TeamViewer AG

–

Geschäftsbericht 2022

Annual Report

TeamViewer SE

– Annual Report 2023

TeamViewer at a glance

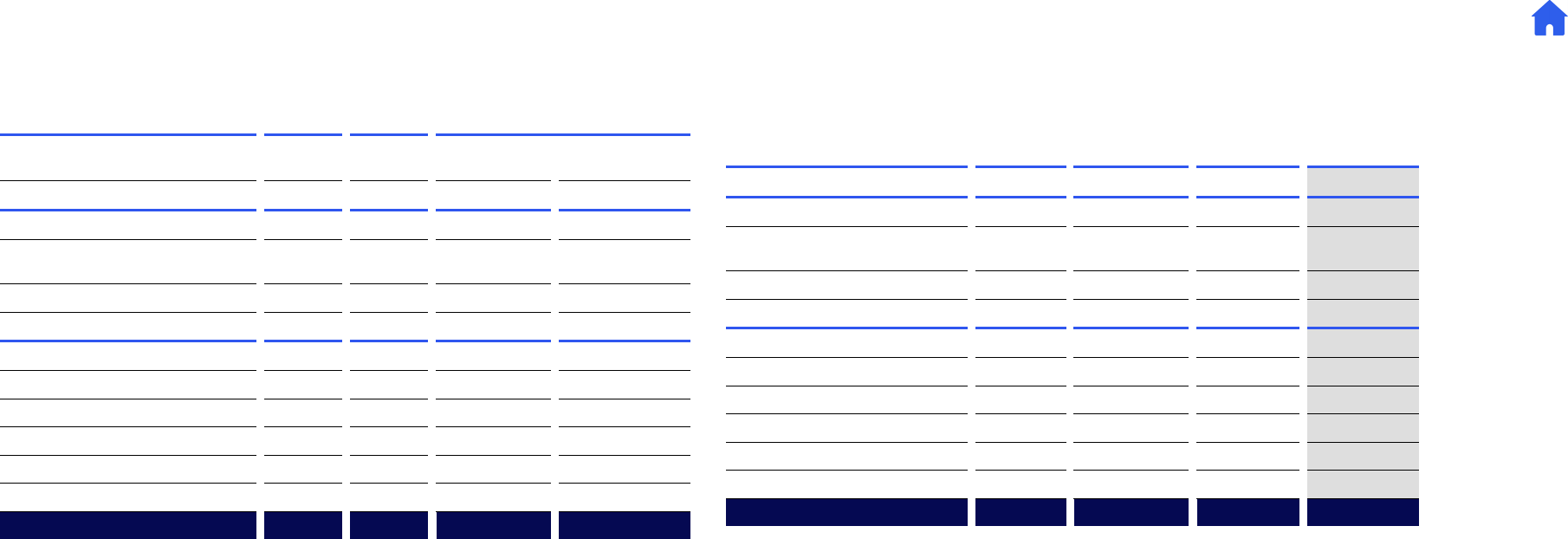

FY 2023 FY 2022 Δ YoY

Sales

Revenue (in EUR m) 626.7 565.9 +11 %

Billings (in EUR m) 678.0 634.8 +7 %/

9 % cc

1

Number of subscribers

2

(reporting date) (in thousands)

632

626 +1 %

Net retention rate (NRR) 104 % 107 % –3 pp

Profits and margins

Adjusted EBITDA

3

(in EUR m) 260.5 229.8 +13 %

Adjusted EBITDA margin

3

42 % 41 % +1 pp

EBITDA (in EUR m) 221.9 197.5 +12 %

EBITDA margin (EBITDA in % of revenue) 35 %

35 % +0 pp

EBIT (in EUR m) 166.6 143.7 +16 %

EBIT margin (EBIT in % of revenue) 27% 25 % +2 pp

Cash flows

Cash flows from operating activities (in EUR m) 229.9 204.3

+12 %

Cash flows from investing activities (in EUR m) (29.6) (10.8) +173 %

Levered free cash flow (FCFE)

198.8

171.8 +16 %

Cash conversion (FCFE/adjusted EBITDA)

76 %

75 % +1 pp

Cash and cash equivalents (in EUR m)

72.8

161.0

–55 %

Other

R&D expenses (in EUR m) (80.1)

(69.5) +15 %

Employees, full-time equivalents (FTEs) (reporting date) 1,461 1,386 +5 %

Earnings per share – basic (in EUR) 0.66 0.37 +81 %

Adjusted earnings per share – basic (in EUR)

0.88

0.67

+31 %

1

cc = constant currency.

2

Adjusted for Russia and Belarus.

3

Since the beginning of the 2023 fiscal year, TeamViewer has been reporting according to a revised system of key performance indicators, in which a greater emphasis is

placed on revenue (IFRS). As a result, the definition of adjusted EBITDA has changed from a billings to a revenue perspective.

IMPORTANT NOTICE

Interactive PDF

This PDF document is optimised for on-screen use.

The table of contents can be accessed via the top

right house icon. The links contained there lead

directly to the respective chapters.

Definition of TeamViewer

TeamViewer refers to the TeamViewer Group, con-

sisting of TeamViewer SE and its consolidated sub-

sidiaries. TeamViewer SE refers to the individual

company or Group parent company.

Rounding

Percentage changes and totals are calculated

based on unrounded figures. Therefore, values may

not add up precisely to the totals given, and

percentage changes may not reflect those based on

rounded figures.

Alternative performance measures

This document contains alternative performance

measures (APMs) that are not defined under IFRS.

The APMs are reconcilable to the measures included

in the IFRS consolidated financial statements and

should not be viewed in isolation. TeamViewer

believes that APMs provide a deeper understand-

ing of the Company’s business performance.

Gender-related references

Care has been taken to use gender-inclusive language

when possible. In cases where this is not possible,

this in no way implies discrimination against other

genders. In the interest of equal treatment, such

terms apply equally to all genders.

TeamViewer SE

– Annual Report 2023

A – To our Shareholders 5

1 Letter from the Management Board .................................................................................................. 6

2 Report of the Supervisory Board .......................................................................................................... 9

3 TeamViewer on the Capital Market ................................................................................................ 14

B – Combined Management Report 18

1 Group Fundamentals ............................................................................................................................... 19

2 Employees .................................................................................................................................................... 30

3 Corporate Responsibility ....................................................................................................................... 31

4 Economic Report........................................................................................................................................ 33

5 Events after the Reporting Date ....................................................................................................... 42

6 Opportunity and Risk Report ...............................................................................................................43

7 Outlook ........................................................................................................................................................... 52

8 Remuneration Report..............................................................................................................................54

9 Takeover-Relevant Information ......................................................................................................... 73

10 Corporate Governance Statement ................................................................................................... 76

11 Non-Financial Reporting ....................................................................................................................... 88

12 Management Report of TeamViewer SE .......................................................................................89

C – Consolidated Financial Statements 92

1 Consolidated Statement of Profit and Loss and Other Comprehensive Income

from 1 January to 31 December .......................................................................................................... 93

2 Consolidated Statement of Financial Position as at 31 December ................................... 94

3 Consolidated Statement of Cash Flows from 1 January to 31 December ....................... 95

4 Consolidated Statement of Changes in Equity ........................................................................... 96

5 Notes to the Consolidated Financial Statements ...................................................................... 97

6 Release Date for Publication ............................................................................................................. 152

7 Responsibility Statement ................................................................................................................... 153

8 Independent Auditor’s Report.......................................................................................................... 154

D – Non-financial Report 162

1 Fundamentals of the Non-financial Report ................................................................................163

2 Sustainability at TeamViewer .......................................................................................................... 164

3 Governance and Integrity .................................................................................................................. 180

4 Employees ................................................................................................................................................. 183

5 Environmental and Climate Protection ....................................................................................... 188

6 Energy, Waste and Water Management ..................................................................................... 192

7 Social Responsibility ............................................................................................................................. 194

E – Further Information 195

1 Index for GRI, SDG, UN Global Compact, WEPs and SASB ................................................... 196

2 List of Abbreviations ............................................................................................................................. 198

3 KPI Glossary ............................................................................................................................................... 201

4 Financial Calendar ................................................................................................................................. 203

5 Imprint ......................................................................................................................................................... 204

6 Disclaimer .................................................................................................................................................. 205

6 A – To our Shareholders – 1 Letter from the Management Board

TeamViewer SE

– Annual Report 2023

1 Letter from the Management Board

Dear Shareholders,

In 2023, TeamViewer evolved significantly in many respects. We enhanced and expanded our

product offering, strengthened our market position, added to our senior leadership team, and

optimised our corporate organisation. All of these measures are aimed at ensuring the

Company continues to be managed successfully and sustainably.

Leading in the remote connectivity market

In the first half of 2023, we made an extensive update to our core remote access and support

product for small and medium-sized companies and non-commercial private use and gave it

a name: TeamViewer Remote. The next generation of this popular solution, used by hundreds

of millions of people across the globe, came with significant new features and increased

security. In the second half of the year, we followed with a new version of TeamViewer

Tensor, our remote connectivity solution for large enterprises and critical infrastructure. The

new version features innovations and enhancements in the areas of security and access

management. The updates to TeamViewer Remote and Tensor underpin our global

leadership in the remote connectivity market. At the end of 2023, our high security and quality

standards were also further validated through successful ISO certifications.

Partner of choice in the global technology ecosystem

In 2023, we continued to demonstrate TeamViewer’s relevance in the global technology

industry. Our partnership with Siemens led to a landmark contract in the aviation industry at

the end of 2023. One of the world’s largest manufacturers of aircraft turbines has chosen the

3D training solution jointly offered by Siemens and TeamViewer to provide training and

education for its technicians at hundreds of locations. This will give the manufacturer a tangible

competitive advantage in times of skilled labour shortages and is extremely important for

quality assurance.

7 A – To our Shareholders – 1 Letter from the Management Board

TeamViewer SE

– Annual Report 2023

TeamViewer also made great progress in its partnership with SAP with the integration of

TeamViewer Frontline into the SAP Digital Manufacturing solution and Tensor into the SAP

Service Cloud and numerous joint customer projects. Our collaboration with Nadro, the

leading wholesaler for Mexico’s healthcare industry, is particularly noteworthy in this context.

Nadro is digitalising its warehouse processes with the help of TeamViewer’s AR-based

logistics solution, which is integrated into SAP’s warehouse management system. After an

initial pilot project at the end of 2022, Nadro decided to widely roll out TeamViewer’s solution

in 2023, making this one of our highest revenue-generating projects in the area of AR

solutions. In addition, we entered into partnerships with Ivanti and Lansweeper and

strengthened our remote monitoring and management solution by integrating their specific

functionalities.

Innovation at the cutting edge

A particular highlight in the reporting year was the development of an app for Apple’s new

Vision Pro spatial computing headset. After the announcement and launch of the headset in

autumn 2023, we began immediately to develop an augmented reality assistance solution

for remote customer service and combined it with the functionalities of Apple’s new smart

glasses. Therefore, we were able to introduce our new app directly at the launch of the new

product in early February 2024, demonstrating how we can quickly and innovatively adapt to

key industry trends.

A

t the end of 2023, we also underscored our commitment to the smart factory space by

investing a low double-digit million euro amount in two pioneering companies working in the

areas of manufacturing analytics and IoT software: Sight Machine from San Francisco and

Cybus from Hamburg. Together, we intend to drive forward the digital transformation of

industrial environments at the interface of information technology (IT) and operational

technology (OT). Our commitment is also reflected by our collaboration with the Hyundai

Motor Group Innovation Center Singapore (HMGICS), a smart factory that opened in Q4

2023, where our Frontline AR solution is used in numerous processes.

Broad product portfolio for all industries

Our continuous development and expansion of our product portfolio with new functionalities

and relevant integrations has enabled us to position ourselves even more firmly as a partner

for industrial companies for their digitalisation projects. Our solutions cover a wide number of

use cases in all industries and along the entire value chain. Examples include remote support

of OT devices, such as industrial equipment, medical devices and coffee machines, and classic

IT support, training and onboarding using 3D models and digitalised logistics processes. In

2023, our solutions enabled us to acquire new major customers worldwide and expand

existing customer relationships. TeamViewer’s customer base has grown to include

renowned car manufacturers such as BMW, Ford, and Toyota. Retail chains such as

Specsavers and Ernsting’s Family, global logistics companies such as DHL and DB Schenker,

and healthcare companies such as Siemens Healthineers also use our software, as do

consumer and B2B brands such as Henkel, Coca-Cola and Dole. Regardless of the industry,

TeamViewer provides solutions that add value.

Global brand with charisma

Our success in winning new customers is also a testament to the significant investments

we have made in marketing and sales in recent years. A new look on and off the website, a

clear brand presence at conferences, numerous events and promotions with our sports

partners in the Premier League and Formula 1, as well as global digital brand campaigns,

have led to a tremendous increase in our brand awareness and a growing interest in our

solutions. Last year, we were able to turn this interest into significant contracts with the

help of our effective online marketing measures, our efficient inside sales and enterprise

sales teams and a new global partner programme.

Expanded Management Board for greater innovation

We also reinforced our management team in 2023 and strengthened our corporate

organisation. Mei Dent, an internationally experienced manager, joined our Management

Board as Chief Product & Technology Officer (CPTO). She is responsible for product

management, solution delivery, and research and development in a centralised function,

and thus also for the Company’s innovation strategy. In addition, the extension of Oliver

Steil’s contract as CEO until 2028 ensures continuity at the Company’s top. At the beginning

of 2023, we transferred the leadership of our Americas business to our former Chief of Staff

& Strategy, Georg Beyschlag, after experiencing a slowdown in growth in this region at the

end of 2022. Three quarters later, we are already seeing the first success of this

reorganisation, with a double-digit increase in billings. Other important additions to the

team were Constanze Backhaus, who took over as CHRO, and Andrew Belger, who joined as

Country Manager for Australia & New Zealand, one of our most important APAC markets.

We continued our international expansion, opening new offices in Guadalajara (Mexico)

and Mumbai (India) and a new representation in Munich. We also completed the conversion

of TeamViewer into a European stock corporation (SE) in March 2023, which included the

voluntary creation of a global works council, consisting of employee representatives, to

further strengthen employees’ engagement in the Company.

8 A – To our Shareholders – 1 Letter from the Management Board

TeamViewer SE

– Annual Report 2023

Double-digit revenue growth and strong margin

Our initiatives led to strong results in the 2023 fiscal year that either met or exceeded our

guidance. We closed the year with revenue of EUR 626.7 million, corresponding to year-on-

year growth of 11 %. At 42 %, the adjusted EBITDA margin exceeded our expectations and

underlined our outstanding profitability. Earnings per share rose 81 % in the past fiscal year.

At the end of the fourth quarter, we had 633,000 paying customers. We completed share

buybacks in 2023 totalling close to EUR 164 million, ensuring that, as our shareholders, you

continued to participate in our high cash generation.

Corporate culture based on shared values

More than 1,400 TeamViewer employees worldwide played a significant role in achieving this

strong performance. We would like to thank them for their unwavering dedication,

commitment to our growth initiatives, and embodying our company values. We have a unique

company culture, which was on display at our global company gathering in late 2023. We were

able to bring colleagues together from around the world for this unforgettable experience.

We reward our employees’ exceptional performance with our extensive employee share

participation programme, a one-off special bonus, flexible working conditions, numerous

internal events and progressive HR approach. Our latest employee survey confirmed the

success of these measures, showing a seven percentage point increase in our employees’

willingness to recommend us to others.

Focus in the year 2024: Future technologies, partnerships and industrial digital

transformation

We have resolved to focus even more strongly on future technologies in 2024. This includes

expanding our use of the capabilities of artificial intelligence, data analytics and self-learning

algorithms across our entire product portfolio. These technologies are useful in maintaining

and repairing devices and technical equipment, as well as in production planning and

minimising errors in industrial processes. Next to augmented and mixed reality, spatial

computing is increasingly used in training and onboarding scenarios. This includes the use

of 3D models and digital twins of complex machines provided with interactive annotations.

To make us an even stronger technology partner for digital transformation in the

manufacturing industry, we plan to expand our existing tech partnerships and further join

forces with industry leaders and start-ups to develop joint solutions.

Outlook for 2024: Steady revenue growth, higher EBITDA margin

and further share buybacks

In terms of financial targets, we are aiming for revenue of EUR 660-685 million

1

in 2024, which

is equal to a growth rate of 7–11 % on constant currency. We expect to further improve our

adjusted EBITDA margin to at least 43 %. This improvement will be supported by a positive

impact from a large portion of the roughly EUR 17.5 million in savings resulting from the

revised scope of our partnership with Manchester United at the beginning of the 2024/2025

season. We will reinvest the remaining savings in other strategic growth initiatives. We are

committed as a company to providing attractive shareholder returns. In keeping with this

commitment, we launched a new 2023/2024 share buyback programme in December with a

maximum volume of EUR 150 million to enable you, our shareholders, to continue to benefit

from our strong business performance and high cash flow.

I

n 2024, we will continue to work with great commitment and engage in constructive dialogue

with you to further develop our strategy, achieve our goals, create value for our customers

and remain a reliable partner. To ensure we continue to recruit and retain global talent at our

German locations as an attractive employer, we will do our part to make our colleagues from

over 70 nations who work for us in Germany feel welcome and safe here so we can benefit

from diversity and dialogue in the future as well.

H

ere’s to a positive and successful 2024!

Sincerely,

O

liver Steil Michael Wilkens Mei Dent Peter Turner

CEO CFO CPTO CCO

1

Based on prior-year average exchange rates.

9 A – To our Shareholders – 2 Report of the Supervisory Board

TeamViewer SE

– Annual Report 2023

2 Report of the Supervisory Board

Dear Shareholders,

We look back on an eventful 2023, in which TeamViewer made important progress in many

areas. The Company proved resilient and well positioned to help its customers navigate the

major issues of our time. Hybrid working, increasing automation, industrial digitalisation and

the impact of the ongoing skills shortage are global challenges that continue to gain

importance – all of which can be addressed using technology such as TeamViewer’s. In 2023,

TeamViewer’s product portfolio underwent extensive further development to address these

issues. In spring 2023, for example, the Company strengthened its leading position in the field

of remote access and support with the market launch of TeamViewer Remote, the next

generation of the successful remote connectivity product for small and medium-sized

companies and private users. The Enterprise offers were also enhanced with additional

functionalities and bolstered through integrations and partnerships with other global

technology companies.

I

n terms of governing bodies and organisation, TeamViewer set the course for a successful

future in key areas during the past fiscal year. We extended Oliver Steil’s contract as CEO early

until 2028 to ensure continuity, strategic leadership, and operational excellence at the

Company’s helm. Thus, he can now, in his third term, fully focus on driving and executing

TeamViewer’s growth strategy. This includes the Company’s continued transformation into a

leading provider of enterprise software at the interface between information technology (IT)

and operational technology (OT) in industrial environments. Alongside CEO Oliver Steil, CFO

Michael Wilkens and CCO Peter Turner, we have appointed Mei Dent as Chief Product and

Technology Officer (CPTO) to the Management Board with central responsibility for

product management and software development. This new role underscores the strategic

importance of innovation to TeamViewer’s position as a global software champion.

We also made some changes to our Supervisory Board last year and welcomed a new Chair,

Ralf W. Dieter, with Abraham (Abe) Peled as the Deputy Chair. We have also added two very

experienced members, Swantje Conrad and Christina Stercken, whose expertise in areas

such as corporate development, capital markets, ESG and compliance will be of great value

to us. Stefan Dziarski recently stepped down from the Supervisory Board after major

shareholder Permira further reduced its stake in the Company to approximately 14 per cent

in November 2023.

T

eamViewer strives to balance short and long-term value creation for shareholders through

continued share buyback programmes, strategic growth investments and ongoing debt

reduction. In this context, the Company successfully completed a EUR 150 million share

buyback programme in the 2023 fiscal year. This was followed by a further share buyback

programme with a total volume of up to EUR 150 million launched in December 2023. The

Company cancelled some of the repurchased shares by reducing the share capital. Through

share buybacks, TeamViewer gives its shareholders a greater stake in the Company’s success.

At the same time, the Management Board and Supervisory Board underscore their

confidence in TeamViewer’s strategic direction. Strengthening the trust of the capital

market remains one of the most important goals that we, as the Supervisory Board, will

continue to pursue together with TeamViewer’s Management Board. Also important in this

context is the amendment to TeamViewer’s sponsorship agreement with Manchester United,

which will take effect for the 2024/2025 season. The revised terms will enable the Company

to improve its margin in 2024 and make investments in other areas. In our capacity as the

Supervisory Board, we also closely monitored and supported this process.

We are confident that TeamViewer has set the right course for sustainable long-term success

with its strategic orientation and definitive progress made during the past year. As the

Supervisory Board, we stand behind the path taken.

I

n the following report, we would like to inform you about the work undertaken by the

Supervisory Board and its committees during the 2023 fiscal year.

10 A – To our Shareholders – 2 Report of the Supervisory Board

TeamViewer SE

– Annual Report 2023

Collaboration between the Management Board and

Supervisory Board

The Company’s Supervisory Board fulfilled the tasks and responsibilities assigned to it in the

2023 fiscal year and placed a special focus on the position and performance of TeamViewer

SE and the Group.

D

uring the year, the Supervisory Board always had a constructive, open and trust-based

working relationship with the Management Board. As part of regular and in-depth dialogue,

the Supervisory Board advised the Management Board on the management of the

Company and monitored how it conducted business. The Supervisory Board was always

involved in decisions of fundamental importance for the Company. The monitoring and

advising activities addressed sustainability issues in particular. The Supervisory Board

made sure that it was always satisfied that the work of the Management Board was legal,

appropriate and orderly. The Management Board also always fulfilled its duty to provide

information.

B

oth in and outside of meetings, the Management Board informed the Supervisory Board

regularly, promptly, and comprehensively about strategy development and implemen-

tation, planning and business development, the risk situation and risk management,

compliance, human resources planning, the sustainability strategy and communication

with investors, as well as about current events. All transactions requiring the approval of

the Supervisory Board due to legal or statutory provisions were submitted to the

Supervisory Board for discussion and resolution. In addition to the two aforementioned

share buyback programmes of up to EUR 150 million each, particularly noteworthy in the

2023 fiscal year were the decisions and actions taken in connection with the capital

market and corporate strategy, the new elections to the Supervisory Board proposed to

the Annual General Meeting and the appointment of Mei Dent as a new member of the

Management Board.

T

he members of the Management Board and Supervisory Board did not have any conflicts of

interest during the reporting year that were required to be promptly disclosed to the

Supervisory Board or brought to the attention of the Annual General Meeting.

T

hroughout the fiscal year, the Chairman of the Supervisory Board was appropriately

prepared to hold discussions with investors on topics specific to the Supervisory Board.

Supervisory Board meetings and priorities

The Supervisory Board convened ten times during the reporting period. Regular topics at

Board meetings included the business performance, strategic direction and financial

performance of TeamViewer SE and the Group. The Management Board discussed the

relevant detailed reports in-depth with the Supervisory Board. It complied with the legal

requirements and principles of good corporate governance as well as with the Super-

visory Board’s guidelines in terms of the topics addressed and their scope. The Super-

visory Board also ensured that regular meetings were held without the Management

Board.

D

uring the 2023 fiscal year, the Supervisory Board discussed the following main topics:

A

t its meeting on 31 January 2023, the Supervisory Board approved, among others, the

Company’s 2023 share buyback programme of up to EUR 150 million and the proposals of

the Nomination and Remuneration Committee concerning the Management Board’s

remuneration. The meeting also included an external training session on capital market

strategy and reporting, which led to a comprehensive discussion on aspects of the capital

market and investor relations and the planning of related measures.

A

t the meeting on 8 March 2023, the Supervisory Board focused on issues relating to product

and IT security, the Company’s financing structure and the publication of the upcoming

annual report.

A

t the meeting on 25 April 2023, the general business development and the Group’s medium-

term planning were discussed. Also on the agenda was an intragroup profit and loss transfer

agreement (PTA) between TeamViewer SE and Regit Eins GmbH, which is set to be proposed

to the 2024 Annual General Meeting.

A

t the meeting on 24 May 2023, Ralf W. Dieter was elected as Chair of the Supervisory Board

and Dr Abraham (Abe) Peled as Deputy Chair of the Supervisory Board, directly following the

new elections to the Supervisory Board by the Annual General Meeting. The Supervisory

Board also elected the members of the committees.

11 A – To our Shareholders – 2 Report of the Supervisory Board

TeamViewer SE

– Annual Report 2023

On 26 June 2023, the Supervisory Board resolved to expand the Management Board to four

members and to appoint Mei Dent as a new member of the Management Board with

responsibility for the areas of product and development (Chief Product and Technology

Officer, CPTO). The Rules of Procedure for the Management Board and the schedule of

responsibilities were amended accordingly.

T

he main topics of the meeting on 25 July 2023 were the strategic development and topics

related to sales and products, after which the Supervisory Board dealt in detail with IT and

product security issues following comprehensive training on IT and product security.

On 13 September 2023, the discussion again focused on the product and sales strategy,

the market environment and various product and market-related aspects of the

corporate strategy.

A

t its meeting on 25 October 2023, the Supervisory Board resolved to prematurely extend the

appointment of CEO Oliver Steil for a further five (5) years until October 2028.

O

n 6 December 2023, the Supervisory Board approved a new share buyback programme of up

to EUR 150 million in a conference call convened for this purpose.

At its meeting on 13 December 2023, the Supervisory Board dealt with budget planning and

the subsequent approval of the 2024 budget, as well as with succession planning for Stefan

Dziarski, who stepped down from the Supervisory Board effective 11 December 2023. Various

corporate governance issues were also discussed and resolved.

In addition to the ten meetings, various resolutions were also passed by way of circular

procedure. In the 2023 fiscal year, these were primarily technical measures and

implementation resolutions on the topics previously discussed at the Supervisory Board

meetings and described above.

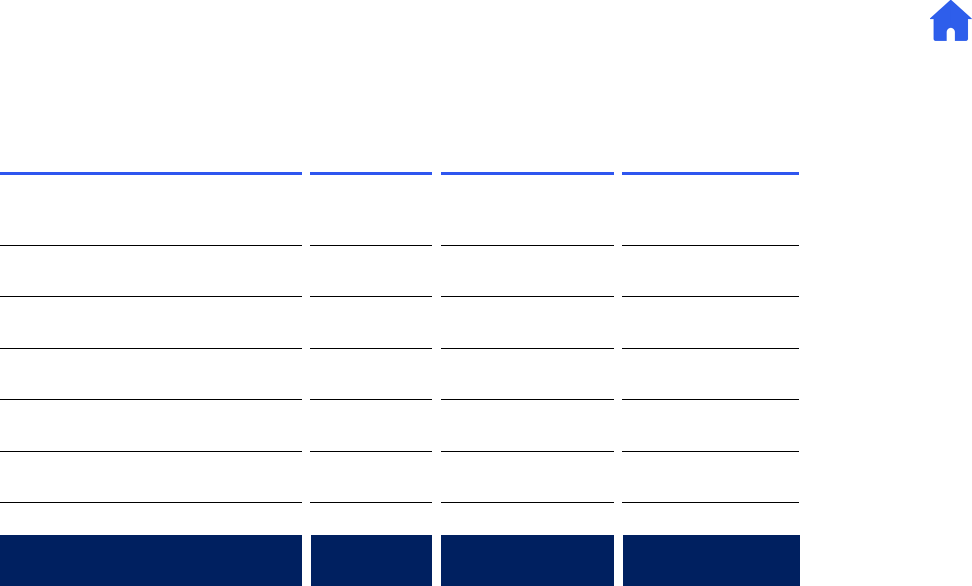

Attendance at Supervisory Board meetings in 2023

Full Supervisory

Board

(

Virtual meetings via

video/teleconference:

31 Jan, 8 Mar, 25 Oct, 6 Dec)

(In-

person meetings:

25 Apr, 24 May, 26 Jun,

25 Jul, 13 Sep, 13 Dec)

Audit Committee

(Virtual

meetings via

video/teleconference:

31 Jan, 8 Mar, 25 Oct)

(In-

person meetings:

25 Apr, 24 May,

26 Jun, 25 Jul)

Nomination and

Remuneration

Committee

(

Virtual meetings via

video/teleconference:

31 Jan, 8 Mar, 25 Oct)

(In-

person meetings:

25 Apr, 24 May, 26 Jun,

25 Jul, 13 Sep, 13 Dec

)

Ralf W. Dieter

10 (10)

3 (3)

9 (9)

Dr Abraham Peled

10 (10)

3 (3)

9 (9)

Stefan Dziarski

8 (9)

5 (7)

–

Dr Jörg Rockenhäuser

9 (10)

–

8 (9)

Axel Salzmann

10 (10)

7 (7)

9 (9)

Hera Kitwan Siu

9 (10)

7 (7)

–

Swantje Conrad

7 (7)

4 (4)

–

Christina Stercken

7 (7)

4 (4)

–

Meeting attendance of Supervisory Board members in 2023 (in brackets: the number of meetings in the respective term

of office of the member).

W

ith the exception of Dr Jörg Rockenhäuser, Stefan Dziarski and Hera Kitwan Sui, who were

each unable to attend one meeting, all members of the Supervisory Board participated in all

meetings of the Supervisory Board in person or virtually via video or telephone conference.

Further details on the attendance at meetings of the Supervisory Board and its committees

can be found in the table above.

Committees

To enable the efficient performance of its tasks, the Supervisory Board has formed the

following committees:

T

he Audit Committee, which also serves as the Sustainability Committee, monitors account-

ting processes, risk management, the effectiveness of the internal control system and the

internal audit system. It also deals with compliance issues as well as environmental, social and

governance (ESG) topics. Furthermore, it verifies the independence of the external auditor

and deals with any other services to be provided by the external auditor, awarding the audit

12 A – To our Shareholders – 2 Report of the Supervisory Board

TeamViewer SE

– Annual Report 2023

engagement, specifying audit priorities, and agreeing on the auditor’s fees. The Audit

Committee discusses the half-year financial reports and quarterly statements with the

Management Board. It also drafts the resolutions for the full Supervisory Board and prepares

the preceding discussion regarding the adoption of the financial statements, profit

appropriation and appointing the external auditor. In the reporting year, the Audit

Committee discussed the assessment of the audit risk, the audit strategy and audit planning

as well as the audit results with the auditor. The Chair of the Audit Committee regularly

discussed the progress of the audit with the auditor and reported to the Committee. The

Audit Committee regularly consults with the auditor without the Management Board.

During the reporting period, the Audit Committee convened seven meetings and dealt,

among others, with the following main issues:

• Discussion of business performance and results, including the annual reporting, interim

reporting and the preliminary results

• Discussion and preparations for adopting the financial statements and profit appropriation

• Verification of the independence of the external auditor and other services provided by

them

• Determination and discussion of the audit priorities and the result of the audit with the

auditor, discussion and agreement of the auditor’s fees, issue of the audit mandate

• Discussion and monitoring of accounting processes

• Discussion and monitoring of risk management, the internal control system, the internal

audit system and compliance, including a regular focus on compliance with data protection

regulations

• Corporate governance issues

• Determining the audit areas for the Internal Audit department

• Assisting in the preparation of CSRD reporting

The Nomination and Remuneration Committee is tasked with proposing suitable candidates

to the Supervisory Board for the Supervisory Board’s election proposals to the Annual

General Meeting, if required. It also examines all aspects of remuneration and terms of

employment for the Management Board and makes relevant recommendations to the

Supervisory Board. Furthermore, it submits an assessment of how the Management Board

has performed.

The Nomination and Remuneration Committee held nine meetings during the reporting year.

The focus was on the expansion of the Supervisory Board from six to eight members, the

addition of a new member to the Management Board and the extension of Oliver Steil’s

mandate as CEO until October 2028. In its recommendations, the Nomination and

Remuneration Committee takes into account the statutory minimum gender representation

and the targets set by the Company for the proportion of women on the Management Board

and Supervisory Board, all of which were met or even exceeded. In the fiscal year, the

Committee also dealt with the Management Board’s remuneration, the setting of targets for

the variable remuneration components and the short and long-term succession planning for

the Management Board and Supervisory Board.

Training and further education

The members of the Supervisory Board are responsible for obtaining the training and

development required for their duties and were again adequately supported by the

Company in the 2023 fiscal year. The training and development measures offered by the

Company in the 2023 fiscal year centred on capital market-related topics as well as product

and IT security issues. Other focal points of the ongoing training and development

measures in 2023 were in the areas of corporate governance, compliance, and products.

The new members of the Supervisory Board, Swantje Conrad and Christina Stercken,

received a comprehensive introduction to familiarise themselves with the Company’s

business model and structures, as well as strategy and risk aspects that are particularly

important.

Audit of the annual and consolidated financial statements

TeamViewer SE’s annual financial statements, which were compiled by the Management

Board in accordance with German accounting regulations (German Commercial Code,

Handelsgesetzbuch, HGB); the consolidated financial statements, prepared in accordance

with § 315e (1) HGB on the basis of the International Financial Reporting Standards (IFRSs);

and the combined management report of TeamViewer SE and the Group for the 2023 fiscal

year were audited and each given an unqualified audit opinion by PricewaterhouseCoopers

GmbH Wirtschaftsprüfungsgesellschaft (PwC), Stuttgart.

13 A – To our Shareholders – 2 Report of the Supervisory Board

TeamViewer SE

– Annual Report 2023

PwC has been the Company’s auditor since 2022, replacing Ernst & Young GmbH Wirtschafts-

prüfungsgesellschaft, Stuttgart. The PwC audit partner responsible as defined by § 319 a (1)

sentence 4 HGB was Jürgen Schwehr.

T

he audit reports, the aforementioned financial statement documents, and the Management

Board’s profit appropriation proposal were submitted to the Supervisory Board sufficiently in

advance of the meeting to approve the financial statements on 8 March 2024, thus providing

sufficient opportunity for scrutiny. The audit reports were explained in person by the auditor

in charge of the audit to both the Audit Committee and the Management Board. In this

process, the auditor reported the key findings of the audit and provided the Audit Committee

and the full Supervisory Board with additional information. Following its own examination,

the Supervisory Board concluded that no objections needed to be raised and concurred with

the auditor’s audit findings. Accordingly, at its meeting on 8 March 2024, the Supervisory

Board adopted the TeamViewer SE annual financial statements and approved the

consolidated financial statements along with the combined management report.

F

urthermore, the Supervisory Board examined the contents of the Non-Financial Report in

accordance with § 171 (1) AktG. No objections needed to be raised following the outcome of

this scrutiny.

Corporate governance

The Supervisory Board attaches foremost importance to ensuring good corporate gover-

nance and is guided by the recommendations detailed in the German Corporate Governance

Code (GCGC). In December 2023, the Supervisory Board, together with the Management

Board, issued a Declaration of Compliance for the reporting period in accordance with § 161

AktG. The Declaration is permanently available under the Investors Relations/Governance

& ESG section of the Company’s website. TeamViewer SE complies with the recommen-

dations of the GCGC Commission without exception. Further information, including the

Declaration of Compliance, can be found in the Corporate Governance Statement.

T

he Supervisory Board would like to thank the Management Board and all employees of

TeamViewer Group for their strong personal commitment during the 2023 fiscal year.

G

öppingen, 8 March 2024

O

n behalf of the Supervisory Board

R

alf W. Dieter

14 A – To our Shareholders – 3 TeamViewer on the Capital Market

TeamViewer SE

– Annual Report 2023

3 TeamViewer on the Capital Market

Since its IPO in 2019, TeamViewer has maintained an open and transparent dialogue with the

capital markets. We continued this policy in the 2023 fiscal year. The Company’s management

and the Investor Relations (IR) department continued building on the development in the

second half of 2022 and increasingly participated in face-to-face events to strengthen

and expand its personal dialogue with capital market participants. TeamViewer also again

held a number of virtual meetings and conferences.

On

TeamViewer’s IR website, shareholders can find extensive information on the TeamViewer

share and all published capital market documents and legal disclosures, as well as recordings

of past capital market events. The IR team can be contacted by email at ir@teamviewer.com

for any enquiries.

Communication with the capital markets

As at 31 December 2023, the TeamViewer share was covered by a total of 16 German and

international financial analysts who regularly publish reports and analyses on the Company.

Based on analyst publications, TeamViewer comprised an analyst consensus consisting of the

average estimates of revenue, billings and adjusted EBITDA figures. A current overview of the

estimates is available on TeamViewer’s IR website.

To coincide with the publication of the financial results, TeamViewer held an analyst and

investor conference call each quarter in which the CEO and CFO reported on the past quarter

and were available to answer questions.

Analyst events 2023

Date Event

7 February 2023 Q4/Fiscal Year 2022 Preliminary Results

3 May 2023 Q1 2023 Results

1 August 2023 Q2/H1 2023 Results

31 October 2023 Q3 2023 Results

I

n addition to regular exchanges with financial analysts, TeamViewer also maintained an

active dialogue with investors in the 2023 fiscal year. At roadshows, conferences and

individual meetings, numerous domestic and international investors were met in one-on-one

meetings and at group events. The subjects of discussion included the Company’s strategic

direction, operational development in the SMB and Enterprise areas and future growth

prospects, particularly in the Enterprise area. The progress made in achieving the annual

targets was also discussed. Next to exchanges with existing investors, a special emphasis was

placed on communicating with potential new investors.

15 A – To our Shareholders – 3 TeamViewer on the Capital Market

TeamViewer SE

– Annual Report 2023

TeamViewer share

The TeamViewer share is listed in the Prime Standard market segment of the Frankfurt Stock

Exchange.

Reference data and key figures for TeamViewer shares as at 31 December 2023

ISIN/WKN DE000A2YN900/A2YN90

Ticker symbol/Stock exchange listing: TMV/Frankfurt Stock Exchange

Stock market segment: Regulated market (Prime Standard)

Index membership: MDAX, TecDAX

Designated sponsor: ODDO BHF

Number of shares/Share capital in EUR

1

: 174,000,000/174,000,000.00

Share class: No-par ordinary bearer shares

Year high on Xetra in EUR: 17.40 (23 August 2023)

Year low on Xetra in EUR: 12.05 (2 January 2023)

Year-end closing price on Xetra in EUR: 14.06 (29 December 2023)

Average daily turnover (Xetra): 584,806 shares/8,635,814 euros

Market capitalisation in EUR million: 2,446 (29 December 2023)

Free float in %: 81.5 %

1

Based on the authorisation of 24 May 2023, the Company cancelled 6,515,856 acquired treasury shares effective

28 August 2023. This resulted in a corresponding reduction in the share capital from EUR 186,515,856.00 to EUR

180,000,000.00. A further 6,000,000 acquired treasury shares were cancelled effective 20 December 2023, with

a corresponding reduction in the share capital from EUR 180,000,000.00 to EUR 174,000,000.00.

Share buyback programme in 2023

In February 2023, with the publication of the preliminary results for the 2022 fiscal year,

TeamViewer announced a new share buyback programme with a volume of EUR 150 million.

The programme was successfully completed in November 2023. A further buyback

programme with a volume of up to EUR 150 million was announced in December 2023. Both

programmes were in line with the previously communicated target leverage ratio of 1.5x

adjusted EBITDA on a billings basis. In the share buyback programme completed in

November, the Company acquired a total of 9,993,893 shares. In the buyback programme

launched in December, a total of 987,760 shares were acquired as at 31 December 2023.

Based on the authorisation of 24 May 2023, the Company cancelled 6,515,856 acquired

treasury shares effective 28 August 2023, with a corresponding reduction in the share

capital from EUR 186,515,856.00 to EUR 180,000,000.00. A further 6,000,000 acquired

treasury shares were cancelled effective 20 December 2023, with a corresponding

reduction in the share capital from EUR 180,000,000.00 to EUR 174,000,000.00.

16 A – To our Shareholders – 3 TeamViewer on the Capital Market

TeamViewer SE

– Annual Report 2023

Shareholder structure

As a result of the aforementioned share buyback programme and capital reduction,

TeamViewer’s shareholder structure as at 31 December 2023 was as follows:

Shareholder No. of shares held Shareholding in %

Permira/TigerLuxOne S.à r.l. 24,498,502 14.1

Treasury shares 7,650,576 4.4

Free float 141,850,922 81.5

Total 174,000,000 100.0

I

n November 2023, as part of a share sale, TigerLuxOne S.à r.l. (TLO), a subsidiary controlled

by Permira, sold a total of 13 million shares in TeamViewer SE to institutional investors.

Following the sale, TLO continued to be TeamViewer’s largest shareholder with a remaining

shareholding of around 24.5 million shares, amounting to 14.1 % of the share capital as at

31 December 2023. The free float as at 31 December 2023 based on the total shares

outstanding, including treasury shares, amounted to 81.5 %.

I

n an analysis of the share register, TeamViewer determined the ownership of around 98.7 %

of the outstanding shares. Based on the shares outstanding as at 31 December 2023, the

proportion of shares held by private shareholders was 18.8 %. The remaining free float of

around 67.1 % was principally held by institutional shareholders. The breakdown of the

shareholder structure is as follows:

Share performance in the 2023 fiscal year

The global capital market environment was politically dominated by Russia’s war of

aggression against Ukraine and the violent conflict in the Middle East. The decline in inflation

over the course of the year allowed central banks to ease their tightening stance in the second

half of the year and keep interest rates stable.

Inflation initially remained high in many parts of the world in the 2023 fiscal year but eased as

the year progressed, particularly due to the decline in energy prices. In Germany, inflation was

still around 6.1 % in August 2023 but had fallen to 3.2 % by November 2023. At the end of 2023,

the US recorded inflation of around 3 %.

17 A – To our Shareholders – 3 TeamViewer on the Capital Market

TeamViewer SE

– Annual Report 2023

The European Central Bank (ECB) continued to raise interest rates in the 2023 fiscal year to

combat inflation. The ECB raised interest rates by 25 basis points each in the months of

February, May and September. The interest rate decisions of the US Federal Reserve also

had a significant impact on international financial markets. Both the Fed and the ECB

decided against further interest rate hikes, leaving the benchmark rates in December

unchanged.

Th

e EUR/USD exchange rate generally held steady during the year. The high of EUR/USD 1.13

was reached in July 2023, while the lowest rate of EUR/USD 1.05 occurred at the beginning of

October 2023. The average EUR/USD exchange rate for the year was approximately 1.08.

A

fter a challenging 2022, the German stock market got off to a very positive start in 2023.

Following an initial record high in June, the German DAX index closed at a new high in August

at around 16,528 points. As of October 2023, global stock markets were initially dominated by

the violent conflict in the Middle East, causing a slump in stock markets around the world and

a drop in the DAX index of almost 500 points within a few short weeks. By the end of the year,

however, prices had fully recovered and, thanks to easing signals from central banks, the DAX

reached a new record high of 17,003 points in December.

T

he TeamViewer share started the 2023 trading year at an opening price of EUR 12.07. The

share initially recorded strong performance, in line with the market as a whole, driven in part

by the publication of the preliminary results for the fourth quarter and the 2022 fiscal year.

After the publication of the 2023 first quarter results, the share price declined into July. The

shares recovered later in the month and went on to reach the year’s high of EUR 17.40 on

23 August 2023.

T

he share price declined again in the months that followed in line with the market as a whole,

although it outperformed the market overall until November. Following the placement of the

share package by major shareholder Permira at a significant discount to the stock market

price, TeamViewer shares recovered again with the start of the new buyback programme in

December and rose significantly again at the end of the year.

T

he share closed the year at EUR 14.06, for a year-on-year increase of around 16.7 %. The

share significantly outperformed the German MDAX benchmark index (+8.0 %) despite the

sale of shares by Permira/TigerLuxOne S.à r.l. In the final months of the year however, the

TeamViewer share was unable to catch up with the performance of the European STOXX 600

Technology Index (+31.7 %).

19 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

1 Group Fundamentals

1.1 Business model

TeamViewer is a global technology company headquartered in Germany. TeamViewer’s

software solutions (TeamViewer Remote and TeamViewer Tensor) provide remote access

and support for information technology (IT) devices such as computers, mobile phones and

tablets, as well as for non-standardised operation technology (OT) devices such as industrial

equipment, robots, medical, and other devices.

2

SMB customers are customers with an annual contract value (ACV) within the last twelve months of less than EUR 10,000

across all products and services. When this threshold is exceeded, the customer is reclassified. Enterprise customers are

TeamViewer also offers solutions based on augmented reality (AR) and mixed reality (MR) to

increase the productivity of manual processes in logistics, manufacturing, and aftersales

(TeamViewer Frontline). Through its products, TeamViewer aims to increase user efficiency

and productivity.

Customers and products

In addition to a large number of private users who can use the free version of the software

(free user community), TeamViewer’s global customer base ranges from small and medium-

sized businesses (SMB) to large corporations (Enterprise)

2

from a wide range of industries.

These customers primarily use the product portfolio listed opposite as part of a subscription

model.

TeamViewer Remote

TeamViewer Remote offers solutions to private users and small business customers via fast,

secure and device-independent connectivity. Remote access to another IT device is the most

common use case for the software. After the launch of the latest generation in April 2023,

TeamViewer Remote offers a revised user interface, a new web client, and higher security.

TeamViewer Tensor

TeamViewer Tensor is especially tailored to corporate customers and provides a compre-

hensive overview of companies’ IT and OT device landscapes and simplifies monitoring,

maintenance, and support. A particular feature of this product is the customised security

functions and granular control options for companies. These features were further expanded

and revised with the update of TeamViewer Tensor in October 2023, when the entire user

interface was redesigned.

customers with an ACV within the last twelve months of at least EUR 10,000 across all products and services. If the ACV

falls below this threshold, the customer is reclassified.

20 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

TeamViewer Frontline

TeamViewer Frontline makes it possible to optimise business processes at companies using

AR and MR workflows. Step-by-step training or workflow instructions in the areas of logistics,

quality assurance, or industrial production are displayed to the user on smart glasses or a

mobile device. A variety of IT systems can also be connected, making it easy to integrate

TeamViewer Frontline into existing company processes. The application also offers complete

direct and automatic digital end-to-end process documentation of all work steps during the

entire work process.

Strategy

TeamViewer’s product portfolio caters to the following global megatrends in the modern

workplace:

• Mo

ve towards hybrid working models, especially remote work

• Increasing number and complexity of internet-enabled endpoints and devices

• Progressive automation of work processes (increasing use of robots and AI)

• Growing acceptance of AR and MR in the industrial environment

• Shift from conventional manufacturing towards smart factories

• Necessity for sustainable management, CO₂ and energy savings

TeamViewer is strategically focused on achieving its overarching goal of sustainable growth

and permanent increases in enterprise value. TeamViewer’s short- and medium-term

strategy focuses on the following three growth dimensions:

1.

Expansion in use cases

Remote access to IT devices such as computers, mobile phones and tablets using TeamViewer

Remote for SMB customers and TeamViewer Tensor for enterprise customers form the core

of TeamViewer and still account for a large proportion of TeamViewer’s revenue today. In

addition, the digital transformation in the industrial sector harbours considerable additional

usage potential for TeamViewer technology. In addition to traditional IT support use cases in

large companies, Enterprise sales in the 2023 fiscal year focused predominately on industrial

use cases for the Tensor and Frontline solutions. The aim is to increase the efficiency of

logistics work processes using vision picking and to digitally support skilled workers and

service technicians on-site in the aftersales area.

2.

Coverage of customer segments

TeamViewer’s product portfolio covers a broad customer spectrum. Private individuals can

use the software free of charge for non-commercial purposes, while SMB and Enterprise

customers use the software for commercial use. Historically, TeamViewer has had a strong

customer base in the SME sector, but in recent years the Company has increasingly invested

in its key account business, developing solutions for the entire value chain and a wide range

of industries.

3.

Geographic expansion

TeamViewer is a global company operating in three regions: EMEA (Europe, Middle East and

Africa), AMERICAS (North, Central and South America) and APAC (Asia, Australia and Oceania).

In strengthening the Company’s geographic footprint in the 2023 fiscal year, the focus was

on reorganising the management and sales organisation of the AMERICAS region, with local

teams concentrating on the ongoing customer base expansion and extending the

corresponding use cases.

Wit

hin the three strategic growth dimensions, TeamViewer’s underlying focus is on organic

growth. In specific cases, growth can be supported by expanding the solutions portfolio

and/or technological expertise through smaller, strategic acquisitions or participations.

1.2 Group structure and

organisation

The Group’s parent company is TeamViewer SE, headquartered in Göppingen, Germany. As at

31 December 2023, the Group had a total of 1,461 employees worldwide (31 December 2022:

1,386 FTEs). TeamViewer SE (TeamViewer AG prior to the entry of the change in legal form in

the commercial register in March 2023) has been listed on the Frankfurt Stock Exchange since

September 2019 and has been a member of the German MDAX index since December 2019.

Legal structure

The TeamViewer Group consists of TeamViewer SE, based in Göppingen, and its total of

fifteen fully consolidated subsidiaries. TeamViewer SE acts solely as a holding company for

the TeamViewer Group and is responsible for the Group’s management and control. The

21 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

operating business is managed by TeamViewer Germany GmbH, an indirect wholly owned

subsidiary of TeamViewer SE and its subsidiaries.

T

he diagram on the following page provides an overview of TeamViewer SE’s group structure

as at 31 December 2023.

Locations

TeamViewer has locations in fourteen countries. The Group’s headquarters are in Göppingen,

Germany, which is also the central development location and the sales centre for the EMEA

region. Other central sales hubs are located in Largo, Florida (USA) for the AMERICAS region

and Singapore and Adelaide (Australia) for the APAC region. TeamViewer also maintains local

sales offices in Tokyo (Japan), Shanghai (China), and Toronto (Canada), as well as further

research and development sites in Bremen (Germany), Ioannina (Greece), Porto (Portugal),

and Linz (Austria). In Mumbai (India), there is a local sales location and shared services centre,

while Yerevan (Armenia) is also home to a shared services centre.

Management and reporting

TeamViewer Group is managed as a single segment. Reporting on the platform is based on

the geographic regions EMEA, AMERICAS and APAC as the reporting units, as well as on the

level of billings and revenue of the SMB and Enterprise customers.

23 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

1.3 Management system

To control and monitor the Group’s development, TeamViewer uses financial and non-

financial performance indicators (KPIs), which are divided into “primary” and “secondary”

KPIs. In the 2023 fiscal year, TeamViewer used two primary and five secondary performance

indicators. In some cases, the indicators were chosen based on the specific customer or

region. The target levels for management KPIs are defined during the annual planning

process and monitored on a monthly basis throughout the year. The actual values are then

compared with the planned and previous year’s values, and corrective measures are initiated

when necessary. Since the beginning of the 2023 fiscal year, TeamViewer has been using

revenue as the primary performance indicator instead of billings, as revenue is a more

common, less volatile planning indicator. Billings is now categorised as a secondary perfor-

mance indicator.

Primary performance indicators

• Revenue (IFRS) represents the value of goods and services transferred to customers and

recognised in profit or loss in accordance with IFRS 15. Revenue is derived from billings

by adjusting the change in deferred revenue recognised in profit or loss.

• Adjusted EBITDA (non-IFRS) is defined as the operating result (EBIT) in accordance with

IFRS, plus depreciation and amortisation of tangible and intangible assets (EBITDA),

adjusted for certain business transactions (income and expenses) defined by the

Management Board in consultation with the Supervisory Board. Business transactions to

be adjusted include expenses from share-based payment models and other material

non-recurring effects. Adjusted EBITDA (non-IFRS) is intended to show the Company’s

underlying operating performance.

Secondary performance indicators

• Billings represent the (net) value of goods and services invoiced to customers within a

specific period and which constitute a contract as defined by IFRS 15. Billings arise

directly from invoices to customers and are not affected by deferred revenue

recognition.

• Annual recurring revenue (ARR) describes the annual recurring revenue for all active

subscribers as at the respective reporting date.

• Net retention rate (NRR) is a key indicator used to assess customer loyalty and is

calculated as the retained billings for the previous twelve months (LTM) divided by the

total recurring billings (retained billings + new billings) for the previous twelve months

(LTM-1). The total recurring billings of the LTM-1 period are adjusted for multi-year

contracts (MYD). The sub-categories of billings used to calculate the NRR are defined as

follows:

• Retained billings: Recurring billings (subscription renewals, up- and cross-selling

activities) with existing subscribers who were already subscribers in the previous

twelve months (LTM-1).

• New billings: Recurring billings attributable to new subscribers.

• Non-recurring billings: Non-recurring billings, such as services and hardware sales.

• Number of paying subscribers and customers.

• Number of employees (full-time equivalents, FTEs).

1.4 Markets and sales

Markets

TeamViewer distributes its products in almost every country worldwide. The Company’s

products and solutions can essentially be used in all economic sectors as well as for non-

commercial purposes.

G

eographically, TeamViewer divides its sales markets into the regions EMEA (Europe, Middle

East and Africa), AMERICAS (North, Central and South America) and APAC (Asia, Australia and

Oceania). In the 2023 fiscal year as in prior years, the EMEA region represented the largest

regional sales market, followed by the AMERICAS and APAC regions. At a country level,

TeamViewer’s highest billings were recorded in the USA, followed by its home market of

Germany. More information on regional business development in the 2023 fiscal year can be

found in the economic report and in the notes to the consolidated financial statements.

24 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

Sales

TeamViewer’s sales model is regionally organised. Sales channels differ according to product

range, customer group and use case.

Web shop: TeamViewer Remote for non-commercial and smaller SMB customers

TeamViewer offers a free, functionally limited software version for remote access to IT

devices for non-commercial product use. The software, which is available free of charge via

the TeamViewer website, is a core element of the sales strategy and ensures a high level of

awareness of the TeamViewer Remote brand and product. We believe that in taking this

approach, users who have familiarised themselves with the free, non-commercial product will

more likely switch to TeamViewer for commercial use. The additional functionalities of the

commercial versus the non-commercial version include comprehensive remote device

management and professional IT support. The commercial solution is offered as part of a

subscription model via TeamViewer’s own web shop. The web shop was thoroughly revamped

in the 2023 fiscal year and should now offer an improved and more intuitive purchasing

experience as well as simpler, more harmonised price scale for the SMB product range.

Inside Sales: TeamViewer Remote and Tensor for SMB customers

The Inside Sales department and its teams organised by language region focus on new

customer acquisitions as well as on existing TeamViewer Remote and Tensor customers who

need extended functionality.

Enterprise Sales: TeamViewer Tensor and Frontline for corporate customers

For sales of customised solutions to corporate customers, TeamViewer has a dedicated sales

organisation, Enterprise Sales, focused on the Tensor and Frontline solutions. In the Tensor

area, the sales team cares for larger corporate customers and offers product solutions

specifically tailored to customers’ needs for the IT and OT device landscape. A special focus is

placed on the holistic management of the devices in use and on various security functions. In

the Frontline area, the sales team works closely with in-house product engineers (Solution

Engineers) responsible for product design and downstream implementation, particularly for

AR and MR solutions. Close cooperation with Customer Success Managers ensures that

products are successfully adapted to the customer’s needs and enhances the value of

TeamViewer solutions for corporate customers.

Channel sales: All products for all customers

TeamViewer’s sales model is supported by various sales partners, including resellers,

distributors, referral partners, managed service providers (MSPs) and system integrators,

who provide their support in selling standardised products in the SMB segment and in

developing and implementing complex solutions for the Enterprise business. In the 2023

fiscal year, the Company launched “TeamViewer TeamUP”, a new global sales partner channel

programme. Participating partners receive benefits, including exclusive discounts, special

support, and comprehensive sales training, as well as a wide range of certifications.

Technology partners: All products for all customers

In addition to the sales channels already mentioned, TeamViewer software is also distributed

by integrating it into the applications and shops of various strategic technology partners,

which include Realwear, EPSON, dynabook and Zebra. In the 2023 fiscal year, TeamViewer

expanded its product portfolio to include mobile device management solutions from partners

Ivanti (management of IT devices and operating systems) and Lansweeper (device detection

in networks). TeamViewer intends to continuously expand its circle of technology partners,

not only to strengthen its sales but also to further expand its product range.

Strategic sales partners

TeamViewer pursues a co-selling approach with strategic partners such as Microsoft, SAP,

Google, and Siemens. Through the SAP partnership, TeamViewer solutions are presented

with SAP at industry events and installed for demonstration at SAP innovation centres

worldwide, making them accessible to potential customers. As part of the cooperation with

Google, TeamViewer’s AR platform and TeamViewer Tensor are available on Google Cloud

Marketplace. The partnership with Microsoft includes making TeamViewer Tensor available

in the Microsoft Azure Marketplace. The partnership with Siemens focuses on TeamViewer’s

AR solutions, which are offered in combination with Siemens’ product lifecycle management

solution. The success of TeamViewer’s sales efforts is measured not only by revenue and

billings but also by customer loyalty and satisfaction.

25 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

1.5 Research and development

The ability of software providers to develop new products and quickly bring them to market

while continuously adapting existing products and services is a key factor for success. This

makes research and development (R&D) work of central importance for the future success of

TeamViewer.

R&D organisation

At the end of the 2023 fiscal year, 399 FTEs (full-time equivalents) were employed in R&D

across the Group (previous year: 404), which was largely unchanged compared to the prior

year. In 2023, TeamViewer also made greater use of external resources to maintain flexibility

and rapidly respond to changing requirements. Most R&D employees work in Germany at the

Group’s headquarters in Göppingen, as well as in Stuttgart, Karlsruhe, and Bremen. TeamViewer

also maintains R&D locations in Greece, Austria, and Portugal. These national and inter-

national locations provide the Group additional access to skilled employees in the area of R&D.

R&D expenses

Research and development expenses amounted to EUR 80.1 million in the 2023 fiscal year

(2022: EUR 69.5 million). They include personnel costs, costs for work and services rendered by

service providers and cooperation partners, and depreciation and amortisation. TeamViewer’s

R&D expenses, excluding depreciation and amortisation and including adjustments made

according to the definition of adjusted EBITDA, amounted to EUR 64.2 million in the 2023

fiscal year (2022: EUR 54.4 million), corresponding to a share of revenues of 10.2 % (2022:

9.6 %).

Continued evolution of core software

In the 2023 fiscal year, TeamViewer successfully repositioned its best-known software under

the name “TeamViewer Remote”. Through a fundamental redesign, TeamViewer Remote

brings significant enhancements to usability and fraud prevention, as well as to the

underlying technology, including the switch to Microsoft’s WebView2 technology. The revised

design and new way of launching remote access sessions not only reflects a contemporary

user experience, but also lays the foundation for future innovations and product

development. Next to improving performance, stability and security, a special focus was

placed on introducing a fully functional web application to maintain the software’s standing

as one of the leading device-independent solutions for remote connectivity.

TeamViewer Tensor enterprise connectivity software

TeamViewer Tensor enterprise solution received major enhancements in the fiscal year, with

a particular focus on expanding security features and tailoring them to the needs of

enterprises. Specifically, the “Bring-Your-Own-Certificate” functionality was introduced,

which enables companies to use their own certificates for TeamViewer connections. The user

interface was also redesigned to ensure a consistent and modern user experience, similar to

what was accomplished with TeamViewer Remote. These improvements increase the

security and usability of TeamViewer Tensor in mission-critical environments.

Focus on integration

Research and development also focused in the 2023 fiscal year on integrating third-party

technologies to provide a comprehensive solution for small, medium, and enterprise

customers. This specifically included advancing the integration with leading mobile device

management and asset discovery products such as Ivanti’s Neurons and Lansweeper

platforms, making TeamViewer’s remote monitoring and management solution even more

effective. All IT devices can now be managed and monitored, regardless of the manufacturer

and operating system.

Augmented and mixed reality

In the 2023 fiscal year, TeamViewer also further advanced its applications in the areas of AR

and MR. TeamViewer Frontline Spatial, for example, can now integrate 3D models directly

from the Siemens Product Lifecycle Management Teamcenter. This enables customers to

seamlessly integrate interactive 3D models from existing CAD data into their training and

maintenance processes. TeamViewer also redesigned the data analysis options for its vision

picking solution. Customers can now prepare and display data on a dashboard and provide a

more detailed record and analysis of the individual work steps and the time required. This is

intended to make processes more efficient and enable data-based decisions for better

processes. TeamViewer intentionally relies on practical data analytics solutions to

continuously optimise workflows.

26 B – Combined Management Report – 1 Group Fundamentals

TeamViewer SE

– Annual Report 2023

Developments in the area of artificial intelligence

TeamViewer also forged ahead with development in the area of artificial intelligence (AI)

during the past year. A key component of this development was the optimisation of AI image

recognition for TeamViewer Frontline. This enhancement is essential for Frontline AI Studio

training and intended to help structure advanced AR workflows more effectively.

In addition, TeamViewer implemented the first version of an AI-powered co-pilot called AI

Script Assistant, which is used in remote monitoring and management (RMM). The aim is to

reduce complexity in the RMM environment. Remote monitoring and management tasks can

be automated using the co-pilot through simple commands. The implementation of the co-

pilot is part of TeamViewer’s conscious focus on practical AI solutions with the aim of offering

customers functional, efficient remote management tools.

1.6 Security and data protection

Centrally important to TeamViewer’s business is its ability to ensure the best possible data, IT

and product security at all times. To meet these demands, the Group continually invests in

developing preventive measures and internal guidelines, expanding its security applications,

and ensuring it complies with legal regulations.

Security

TeamViewer has a Group-wide IT and product security strategy that protects its own

infrastructure as well as the software products it offers. IT and product security are organised

as two departments operating under the uniform leadership of the Chief Information

Security Officer (CISO). In 2023, the departments continued to be supported by external

consultants and providers of recognised security solutions.

Raising employee awareness

To ensure the highest possible level of IT security and cyber hygiene, TeamViewer places

particular importance on ensuring the ongoing sensitisation of all employees. Periodic

queries on the contents of internal guidelines and frameworks give employees practical

experience and ensure a strong security culture. Mandatory training provides sophisticated

knowledge of the patterns of possible attack attempts and the appropriate defensive

measures. Targeted campaigns regularly assess the organisation to identify possible threat

patterns. In 2023, a knowledge database of safety-related aspects dedicated to the safety