Copyright 2020 Impact Institute. All rights reserved.

1

COCOA FARMER INCOME

strategies for improvement

s

Final report

June 2021

Copyright 2020 Impact Institute. All rights reserved.

2

Contact

For inquiries about this report please reach out to:

Fairtrade International, Ricardo Guimaraes, [email protected]

ABOUT

Authors

Impact Institute

Andrea Rusman

Anne Mesguich

Romeo Kaptijn

Anne Barendregt

Jules van de Meulengraaf

Fairtrade International

Ricardo Guimarães

Sandra Yañez-Quintero

Jon Walker

Anne Marie Yao (Fairtrade Africa)

Fairtrade Additional Support

Carla Veldhuyzen

Emily de Riel

Suggested reference:

Impact Institute (2021). ‘Cocoa farmer income. The household income of cocoa farmers in Côte d’Ivoire and

strategies for improvement.’ Amsterdam, the Netherlands.

Copyright 2020 Impact Institute. All rights reserved.

3

About Impact Institute

Impact Institute – spin-off of True Price - is recognised as a global leader in impact measurement and valuation. It has contributed to international frameworks

such as the NCP and the TEEB framework. It developed the first methods worldwide for true pricing, the integrated profit loss, and impact statement.

impactinstitute.com

About Fairtrade International

Fairtrade International is the non-governmental organization that has commissioned this study on the cocoa farmer income. Fairtrade changes the way trade

works through better prices, decent working conditions and a fairer deal for farmers and workers in developing countries. A non-profit organization

representing more than 1.7 million farmers and workers, Fairtrade International owns the Fairtrade label, the most recognized ethical label and backed by

rigorous social, economic and environmental standards and certification. Fairtrade International and its member organizations empower producers, partner with

businesses, engage consumers and advocate for a fair and sustainable future.

fairtrade.net

About EMC

EMC is an Ivorian organisation that is specialised in market research, opinion polls and socio-economics studies. EMC has a special focus on Francophone

countries of West Africa, especialy the 8 countries of the Economic Union of West African States. Data collection in Côte d’Ivoire was performed by EMC.

ABOUT

Photo Credits:

Cover Slide Photo © Lisa Casado Bolivar

Slide 2 Photo © Jason Sanches

Slide 4 Photo © Flora Hackett

Chapter slide Photo © Lara Di Mauro

Slide 26 Photo © Jason Sanches

Slide 28 Photo © Michaela Nová

Final Slide Photo © Kate Fishpool

Copyright 2020 Impact Institute. All rights reserved.

4

CONTENTS

Introduction

01

Methodology

02

Comparison study

03

Fairtrade price mechanisms

04

Conclusions & recommendations

05

05

07

12

18

24

06

Appendix

27

Copyright 2020 Impact Institute. All rights reserved.

5

5

01

INTRODUCTION

Copyright 2020 Impact Institute. All rights reserved.

6

Côte d’Ivoire, located in Western Africa, is home to

approximately 28 million people and over the past 5

years has seen one of the world’s highest growth

rates in terms of GDP. Côte d’Ivoire is the world’s

largest producer and exporter of cocoa beans. The

Ivorian economy is largely dependent on the

agricultural sector and about two-thirds of the

population is engaged in this area. However, this

dependency causes the Ivorian economy to be

highly sensitive to changes in the international

prices of these products. To counter this

dependency, policy measures have prioritised a shift

to higher value-adding activities such as the

processing of cocoa, cashews and other

commodities

1

.

One of Fairtrade’s most prominent products is

cocoa. Fairtrade is pushing the sector to address the

many challenges that endanger the long-term

sustainability of cocoa and the people behind it.

Fairtrade certifies 272 producer organisations in Côte

d’Ivoire, with 293,237 farmer members including

28,031 female producers. A central element of

Fairtrade International’s strategic vision 2021-2025 is

the ambition to see small-scale farmers earning a

living income. This study touches upon different

initiatives and investigates the progress that

Fairtrade farmers have booked over the last years.

The first goal of this study is to assess the situation

of these cocoa farmers in 2020, in terms of individual

farmer household incomes and the income

distribution of cocoa farmers in 2020 as compared to

2018

2

.

The second goal is to evaluate the effectiveness of

the Fairtrade Minimum Price (FMP) mechanism, a

safety net for producers, which came into effect in

the 2019/2020 harvest period.

CONTEXT

Côte d’Ivoire is highly dependent on its cocoa sector, which faces many challenges that threaten long-term sustainability

1

CIA World Factbook (2021)

2

True Price (2018) Cocoa farmer income - trieved from: https://trueprice.org/consumer/cocoa fairtrade/

The research conducted for Fairtrade

uses four different research

questions related to the two

different goals:

1.1. What is the current household income of

the

1.2. How do these results compare to the

previous study?

2.1. What is the current household income of

2.2. What is the effect of FT price mechanisms

on farmer income, in particular for the FMP

differential payments performed between

October 2019-March 2020?

Copyright 2020 Impact Institute. All rights reserved.

7

7

02

METHODOLOGY

Copyright 2020 Impact Institute. All rights reserved.

8

METHODOLOGY | HOUSEHOLD INCOME MODEL

The farmer household income model is based on farmer wealth

The model on the right presents a breakdown

of how the household income of cocoa farmers

is calculated. The perspective of the model is

farmer wealth (current and future income), not

economic profit; therefore, opportunity costs

are excluded. Net farm income, based on the

sales of cocoa beans, was extended with in-

kind farm and off-farm income.

The majority of the data points is derived from

primary data collected from the conducted

field study. Relevant data that could not be

collected during the field study, including

interest costs, subsidies and in-kind

contributions from cooperatives, is based on

secondary literature and previous studies.

Fixed costs include items like ropes, axes,

tarpaulins, and other production equipment.

The costs are used on an expense basis and not

depreciation basis.

Figure 1: Overview of farmer household income model. Source adapted from LICOP (2020)

Revenues

• Revenue from sale of produce

crops and/or livestock

Costs

• Input costs: Planting and

taking care of crops (e.g. seeds,

tools, fertilisers, and pesticides)

• Land costs: Rental/purchasing

of farm land

• Labour costs: Payment of

wages of additional labour

(outside household labour)

• Unexpected costs: Unforeseen

costs, for example to cover

crop damage from drought or

bad weather

• Other

Net off-farm income

Other sources of

income

Produce consumed at

home

Secondary crop income

Primary cash crop

income

Net farm income

Net off farm income

Other income

Actual

income

Copyright 2020 Impact Institute. All rights reserved.

9

The two research questions use different samples to address the different purposes of each research question

METHODOLOGY | SAMPLING & DATA COLLECTION

Data collection

The fieldwork for this study was conducted between

October 1

st

, 2020 and January 7

th

, 2021. Data collection

was performed by EMC, in Côte . Data collection

was twofold: farmer data was collected through farmer

interviews and additional information was collected

through a survey amongst the management staff of the

farmer cooperatives.

Due to the COVID-19 situation and the risk that on-

location interviews carried, the interviews were

conducted with the help of computer assisted telephone

interviewing (CATI) technology.

The interview process was followed by a quality control

by the statistics department of EMC and at a later stage

upon receival by Impact Institute. All data processing

steps and assumptions made can be found in Appendix

A4.

Sampling approach

The sampling approaches enable random, but balanced samples where all cooperatives are

represented. The selection of cooperatives to be included in the sample was made in consultation

with Fairtrade. This means purposive sampling was used. Different samples were used for each

research question. However, stratified random sampling ensured that a sufficient number of farmers

contributing to the sales of the cooperatives were included in the samples. This leads to a 95%

confidence level and 5% error margin approximately.

Research question 2.

Fairtrade price mechanisms

Research question 1.

Comparison study

The cooperatives included in the sample have

minimum sales on Fairtrade terms of 20%. The

average sales on Fairtrade terms per cooperative

is 45%. The cooperatives were selected using

purposive sampling: only cooperatives with sales

above 20% on Fairtrade terms were considered.

The cooperatives included in the sample are

cooperatives that participated in the study

conducted in 2018 and that were still certified.

Some differences in sampling with the previous

study could hinder comparability. A total of 7

cooperatives were no longer certified at the time

of this study.

482

20 cooperatives

farmers, sampled from

384

16 cooperatives

farmers, sampled from

Copyright 2020 Impact Institute. All rights reserved.

10

Data collection

Farmers were asked whether they had received the FMP differential payment

from their cooperative. All cooperatives reported to have distributed the

FMP, yet only 57% of farmers reported to have received the payment. No

pattern in the results could be identified. Some cooperatives performed

better than others in the distribution of the FMP differential (ranging from

100% of farmers who reported to have received the FMP differential payment

for the highest performing cooperative, to 12% for the lowest performing

cooperative).

On notification of the issue FLOCERT, auditor of Fairtrade, carried out a rapid

assessment at all cooperatives in the study with low awareness rates of the

FMP differential payment amongst the interviewed farmers and found no

evidence of fraud at the cooperatives. FLOCERT did find some evidence of

delayed payments. Additionally, farmers get a variety of different payments

from their cooperatives, and it might be difficult for them to disentangle

which payment is coming from which organisation.

Fairtrade will take action to ensure that future payments are made in a timely

manner and farmers are more clearly informed by their cooperative on the

reason for payment.

Analysis

Because of the uncertainty in the collected data, three scenarios are created,

and farmer household income and household income distribution are

calculated under these 3 scenarios. The three scenarios are as follows:

▪ Conservative. Farmer household income is calculated assuming no FMP was

received for any of the farmers in the sample.

▪ As collected. Farmer household income is calculated with the data as reported

by the farmers.

▪ Ideal scenario. Farmer household income is calculated with an ‘ideal FMP

distribution’ which is defined as follows: all farmers receive the FMP differential

payment equal to the value of 141.5 CFA per kg of cocoa sold to the cooperative.

Finally, the FMP differential payment is examined in light of the Fairtrade

Living Income Reference Price

1.

Based on studies by the Living Income

Community of Practice, a formula for the LI Reference Price was set up. This is

dependent on certain parameters, such as yield and cocoa area. The payment

of the LI Reference Price is analysed under different conditions: calculating

farmer household income using yield as collected in the sample and yield as

implied by the LI Reference Price formula.

METHODOLOGY | PRICE MECHANISMS

Three different scenarios shed light on how the Fairtrade Minimum Price (FMP) can influence the farmer household income

1

Veldhuyzen, C. (2019). Fairtrade Living Income Reference Prices for Cocoa. Retrieved from

https://www.fairtrade.net/issue/living-income

Copyright 2020 Impact Institute. All rights reserved.

11

METHODOLOGY | LIVING INCOME

Table 1: Living income results, based on median household size of full sample

Variable Unit Value Variable Unit Value

Costs per adult Costs per child

Food $ 553 Food $ 369

Housing $ 104 Housing $ 104

Clothing $ 67 Clothing $ 67

Healthcare $ 35 Healthcare $ 35

ICT $ 68 Education $ 188

Transport $ 91 Transport $ 91

Savings/unforeseen expenses $ 329

Total per adult $ 1,245 Total per child $ 852

Total household living income $ 7,468

Total household living income

(incl. social security)

$ 8,094

1

CIRES is the Ivorian Centre for Economic and Social Research. CIRES has calculated a living

income benchmark for Ivorian cocoa farmers in 2018.

The living income is 7,468 USD per year for the median household

This slide presents the living income results based on the median

household size of the full sample.

The living income value has been calculated using CIRES

1

data. It is

then scaled up to match the median household size of the sample,

which is 5 adults and 3 children (compared to 2 adults and 4

children in the CIRES study).

Values are also adjusted to the inflation rate of the period of the

analysis.

The living income figure does not include social security and

taxes, in order to align with the Fairtrade and the Living Income

Community of Practice setting standard.

However, social security are expenses that farmers should be able

to make and therefore could be included in the living income

figure.

For this reason, two separate household living income are

estimated: one without social security and one including social

security.

8

5

2.7 3

Household size

Adults

FTEs Children

Median household composition

Copyright 2020 Impact Institute. All rights reserved.

12

12

Results for the following research questions:

1.2. How do these results compare to the previous study conducted in 2018?

03

COMPARISON STUDY

Copyright 2020 Impact Institute. All rights reserved.

13

COMPARISON STUDY | DESCRIPTIVE STATISTICS

In comparison to the 2018 study, the most notable change is an increase in the yield of cocoa farmers

Indicator Unit Average (2020) Average (2018)

Total farm area ha 7.3 6.7

Area of cocoa production ha 4.63 4.9

Amount of cocoa trees # 7,732 6,352

Trees per hectare #/ha 1,881 1,348

Kilos of cocoa produced kg 2,743 1,999

Farm-gate price USD/kg 1.48 1.53

Profit per kilo cocoa USD/kg 1.01 0.9

Yield kg/ha 625 437

Hired FTE #FTE 1.04 0.8

Household FTE #FTE 3.55 3

Wages (of hired labour) USD/FTE 508.1 530.2

Quality of life scale of 1-5 3.8 4.1

Household size # people 9 9

Model household # adults & children 5.8 adults & 3.6 children 4.9 adults, 4.1 children

Percentage of trees below 5 years % 18% 13%

Percentage of trees between 5

and 25 years % 53% 51%

Percentage of trees over 25 years % 28% 35%

Number of farmers # 364 3202

The table on the right contains average descriptive statistics for

both the current sample and the sample from the study

conducted in 2018. Findings should be interpreted with caution

given the differences in sampling.

The most notable change is the increase in yield. It can be

explained as follows:

Both the absolute number of trees and the number of trees per

hectare have increased. A change in the distribution of trees

per tree age can also be observed. The percentage of trees

below 5 years and between 5 and 25 years old has increased,

while the percentage of trees over 25 years has decreased. This

partly explains the significant increase in production, and

therefore the increase in yield since younger trees are more

productive than older ones.

The profit per kilogram of cocoa has remained relatively similar.

This can be explained by the decrease in farm-gate cocoa prices

between the previous and current study. Yield has increased,

potentially driven by higher fertilizer and pesticide costs, which

are also decreasing profit.

Table 4: Development of average descriptive statistics

Copyright 2020 Impact Institute. All rights reserved.

14

The household income is not sufficient to make the living income. The average

farmer earns 66% of a living income. Cocoa is the main source of income:

almost 58% of farmer income stems from the profit on cocoa. The average

household makes 13% of their income from selling other goods, whereas in-

kind income and off-farm income account respectively for 10% and 20% of

total household income.

Average household income has increased largely compared to 2018.

Revenue from cocoa has increased significantly, while the costs of cocoa

production have increased at a slightly lower rate. As a consequence, the

average profit from cocoa has increased at a significant rate.

The increase in revenue from cocoa can be explained by the large increase in

yield, which is due to higher tree productivity and therefore higher

production of cocoa. In addition, some farmers received a Fairtrade Minimum

Price (FMP) differential on top of their regular revenue. The FMP serves as a

safety net: when the market price drops below the FMP level, farmers receive

the FMP.

The increase cannot be explained by an increase in price, since the farm-gate

price that farmers have received has decreased from an average of 850

CFA/kg to 825 CFA/kg. This is excluding the FMP differential payment.

A key difference is that the average farmer is more diversified in the current

study than in the previous results. Where in the previous study, the average

farmer earned 74% of his/her household income from cocoa, the average

farmer currently earns 58% of his/her household income from cocoa.

COMPARISON STUDY | FARMER HOUSEHOLD INCOME

The average yearly household income is 4,937 USD per household, compared to 2,670 USD per household in the 2018 study

Figure 9: Average farmer household income 2018 vs. 2020 (USD/year)

Revenue

Costscocoa Net profit Net profit Financial In-kind Off-farm

Household

cocoa production cocoa other

goods

farm

income income income income

$2,861

-$1,089

$3,493

$1,958

$2,114

$4,937

$2,670

2020 results

2018 results

Copyright 2020 Impact Institute. All rights reserved.

15

COMPARISON STUDY | FARMER HOUSEHOLD INCOME

Higher farmer household income is driven by diversification through in-kind income and off-farm income

Diversification

Farmers are diversifying their production. About 70% of the farmers have diversified their

production to some degree and produce other goods next to cocoa, compared to 55% of

farmers in the previous study. Other goods serve both as a form of in-kind income (30% produce

other goods only for in-kind purposes), as a form of financial revenue (19% produce other goods

only for sales purposes) or both (51%). Rubber, cassava, palm, and chicken are among the most

popular and profitable crops/herds next to cocoa. The average farmer earns most from rubber.

Farmer household income is partially driven by both in-kind income and off-farm income. In-kind

income comes from the consumption of agricultural goods., such as cows, sheep and yam. Off-

farm income stems from wage income primarily.

Costs of production

The profit margin of cocoa production is high. In

comparison to the previous study, both the revenue and

profit have increased. In 2018, the revenue per ha was

$648 compared to $896 in the current study and the

profit per cocoa area was $443 compared to $695

currently. The biggest driver of costs is labour costs,

accounting for 60% of the total cost of cocoa

production.

400

Orange bars represent the average income per

crop/animal over all farmers (not all of them

grow this crop/herd this animal)

Grey dots represent the average income for

farmers that do grow a certain crop/herd a

certain animal

400

Figure 10: Average income per crop/animal for all farmers vs. for farmers that grow the crop/herd the animal

Revenue Interest Land Fixed Input Labour Profit

cocoa costs costs

1

costs

2

costs

(external)

cocoa

Figure 11: Breakdown of cost of production per cocoa area

Cost of production/cocoa area = $201

$695

1

Fixed costs include machete, machete file, tarpaulins, pick, basket, rope, axe, mechanic

pruner, bag, boots, bucket, fuel and other fixed costs

2

Input costs include fertilizer, pesticides, transport and seedlings costs

Copyright 2020 Impact Institute. All rights reserved.

16

Less than

zero

Zero to

extreme

poverty line

Extreme

poverty to

poverty line

Poverty line to living

income

Above living income

2% 36% 18% 28% 15%

Zero

line

Extreme

poverty

line

Poverty line

Living

income

1

line

Median

Average

$0 $2,276 $3,713 $7,468$4,937$3,186

RESULTS | HOUSEHOLD INCOME DISTRIBUTION: COMPARISON

85% of farmers earn below the living income

1

Estimated using median household size, excluding social security

Figure 12: Farmer household income distribution (USD/year)

Number of farmers

Key insights:

▪ The distribution of income per household per year is peaked towards low incomes.

This means that most farmers earn below the average. Main drivers of farmer income

below the median are farm area, yield, diversification and cocoa price. 15% of farmers

earn above the living income.

▪ The extreme poverty line and poverty line are calculated based on World Bank

guidelines. The extreme poverty, corrected for the purchasing power in Côte d’Ivoire,

is USD 0.76. The poverty line for Côte d’Ivoire, is USD 1.24.

Indicator Unit 2020 results 2018 results

Less than 0 USD/household % 2.2% 5.5%

0 to extreme poverty line % 35.7% 52.3%

Extreme poverty line to poverty line % 18.4% 19.4%

Poverty line to living income % 28.3% 16.2%

Above living income % 15.4% 6.6%

Table 5: Development of farmer household income distribution

The median farmers lies in the green cells, while the average farmer lies in the yellow cells.

Copyright 2020 Impact Institute. All rights reserved.

17

Significant positive correlations are found between the variable

household income and the variables cocoa area, product

diversification and yield.

The correlation between household income and cocoa area is the

strongest and almost identical to the result of the previous study.

As for profit per hectare, there is a strong correlation with the yield.

The positive correlation seems to indicate that the higher a

yield is, the higher his profits are. Remarkably enough, a weak,

negative correlation is found between profit per hectare and cocoa

area.

As for the drivers of the yield, there is a positive correlation between

yield and fertilizer plus pest management costs and tree productivity

and the yield.

Literature states that younger and older trees are generally less

productive and that trees between 5-25 years are most productive.

This also shows in the positive correlation that was found between

trees with the age between 5-25 years and yield.

RESULTS | POTENTIAL HOUSEHOLD INCOME DRIVERS

Yield, cocoa area and product diversification positively correlate with household income

About the Fairtrade premium:

The Fairtrade Premium, which is paid on top of the Fairtrade Minimum Price, is a

sum of money that farmers and workers invest in projects they choose. Based on

external Fairtrade data, 75% of the premium is used for services for workers and

their families, 16% for services for communities, 6% for training and

empowerment of workers and 3% for other purposes (Fairtrade, n.d.)

Key insights from this study:

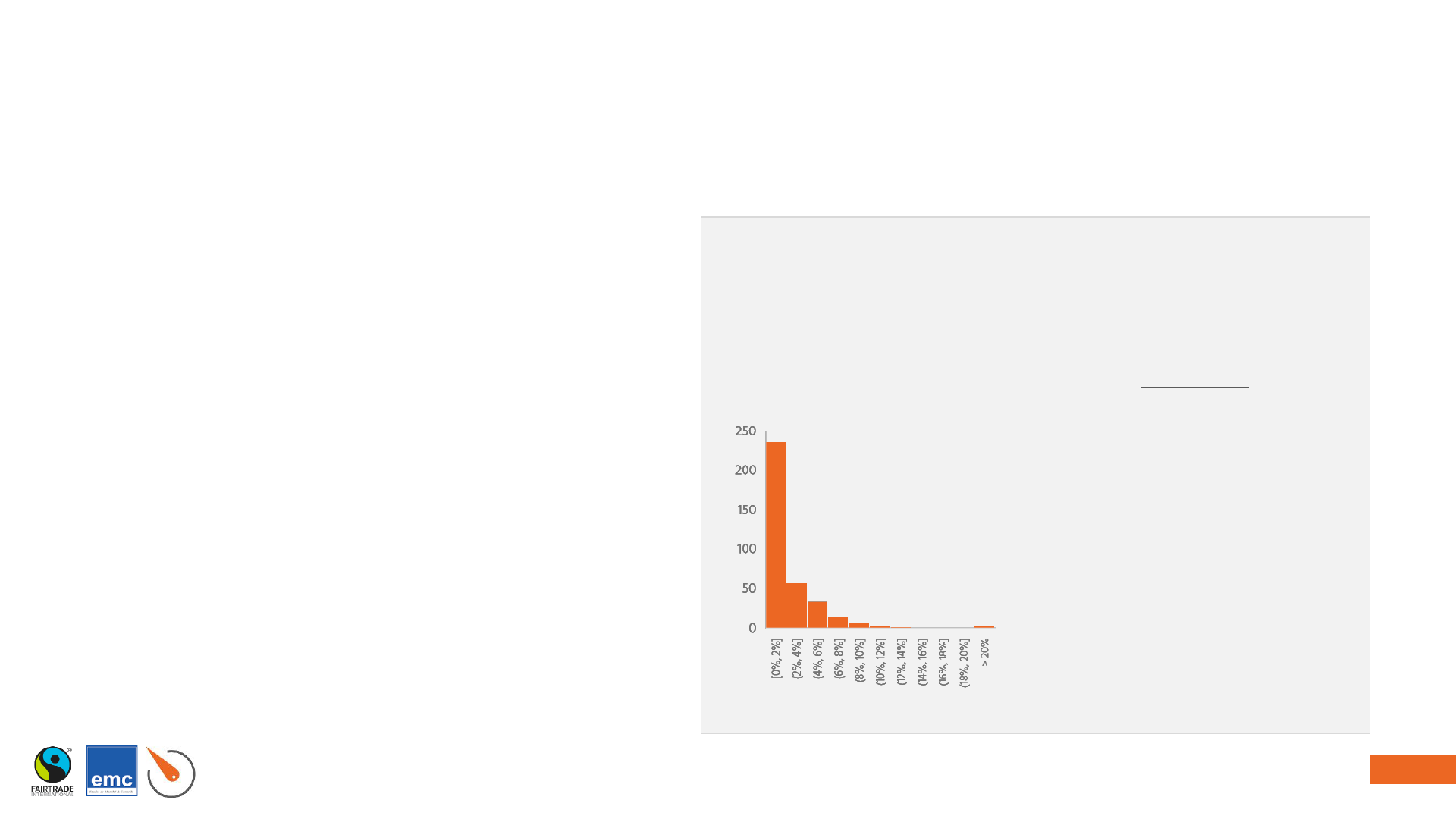

The results show that for the majority of

the farmers (64.3%) the FT premium

makes up less than 2% of their income. In

comparison to the previous study, it

seems that farmers have become less

reliant on the premium, given that the

average household income has increased.

It can also be the case that farmers have

received more support from the Fairtrade

premium in the form of services and

trainings instead of monetary payments.

Number of farmers

% of total household income consisting of Fairtrade premium

Figure 13: Distribution of Fairtrade premiums

Copyright 2020 Impact Institute. All rights reserved.

18

18

Results for the following research questions:

2.2. What is the effect of the FT price mechanisms on farmer income, in particular

for the FMP differential payments performed between October 2019-March 2020?

04

FAIRTRADE PRICE MECHANISMS

Copyright 2020 Impact Institute. All rights reserved.

19

FAIRTRADE PRICE MECHANISMS | DESCRIPTIVES & HOUSEHOLD INCOME

The average household income is 4,080 USD per household, or 55% of a living income

Living income =

$7,468

1

$4,080

Revenue Costscocoa Net profit Net profit Financial In-kind Off-farm Household

cocoa production cocoa other goods farm income income income income

$2,224

$2,744

1

Estimated using median household size, excluding social security

Figure 2: Average farmer household income (USD/year)

Descriptive statistics

Household income

▪ The average household income is 4,080 USD per household.

This is around 55% of a living income, and therefore the

household income is not sufficient to make the living

income.

▪ Cocoa is the main source of income for the average household (54%), supplemented by

selling other goods (13%), in-kind income (11%), and off-farm income (22%).

Variable Unit Average Median

Total farm area ha 6.52 5.00

Area for cocoa production ha 4.11 3.14

Amount of cocoa trees # 4,128 3,300

Profit per kg cocoa USD/kg 0.91 1.10

Yield kg/ha 597 500

Hired FTE # FTE 1.07 0.17

Household FTE # FTE 0.94 0.96

Household size # people 9 8

Number of farmers # farmers 482 482

Table 2: Key descriptive statistics

Copyright 2020 Impact Institute. All rights reserved.

20

Diversification

Farmers are diversifying their production. About 70% of the farmers have diversified their

production to some degree and produce other goods next to cocoa. Other goods serve both as a

form of in-kind income (23% produce other goods only for in-kind purposes), as a form of

financial revenue (18% produce other goods only for sales purposes) or both (59%). Rubber,

cassava, palm, and chicken are among the most popular and profitable crops/herds next to

cocoa. The average farmer earns most from rubber.

Farmer household income is partially driven by both in-kind income and off-farm income. In-kind

income comes from the consumption of agricultural goods., such as cows, sheep and yam. Off-

farm income stems from wage income primarily.

FAIRTRADE PRICE MECHANISMS | FARMER HOUSEHOLD INCOME

Farmer household income is driven by diversification of income and costs of production

Revenue

Interest

Land Fixed Input Labour Profit

cocoa costs costs

1

costs

2

costs cocoa

Cost of production/cocoa area = $234

Figure 4: Breakdown of cost of production per cocoa area

$640

300

Figure 3: Average income per crop farmed / animal herd

300

Costs of production

The profit margin of cocoa production is quite high since

the cost of production per cocoa area is only 234 USD/ha,

making up 27% of the revenue. The revenue per cocoa area

is $873 and the profit per cocoa area is $640. The biggest

driver of costs is labour costs, which is responsible for 66%

of the total cost of cocoa production.

$640

1

Fixed costs include machete, machete file, tarpaulins, pick, basket, rope, axe, mechanic

pruner, bag, boots, bucket, fuel and other fixed costs

2

Input costs include fertilizer, pesticides, transport and seedlings costs

Copyright 2020 Impact Institute. All rights reserved.

21

4%

Less than

zero

Zero to

extreme

poverty line

Extreme

poverty to

poverty line

Poverty line to living

income

Above living income

39%

20% 25%

12%

Zero

line

Extreme

poverty

line

Poverty line

Living

income

1

line

Median Average

$0 $2,276 $3,713 $7,468

$4,080

$2,740

FAIRTRADE PRICE MECHANISMS | HOUSEHOLD INCOME DISTRIBUTION

88% of farmers earn below the living income

Key insights:

▪ The distribution of income per household per year is peaked towards low incomes.

This means that most farmers earn below the average.

▪ 12% of farmers earn above the living income.

▪ The extreme poverty line and poverty line are calculated based on World Bank

guidelines:

▪ The extreme poverty line is USD 1.90 per person per day at the 2011 price level of the

USA. This is corrected for the purchasing power in Côte d’Ivoire, giving an extreme

poverty line at USD 0.76

▪ The poverty line is USD 3.10 per person per day at the 2011 price level of the USA, or

USD 1.24 in Côte d’Ivoire .

1

Estimated using median household size, excluding social security

Figure 5: Farmer household income distribution (USD/year)

Number of farmers

Copyright 2020 Impact Institute. All rights reserved.

22

Farmer household income

Scenario 1 is the scenario where farmers have received no FMP differential

payment. Farmer household income is the lowest in this scenario, standing at

3,957 USD/household.

In scenario 2, farmers receive the FMP differential payment they claim to have

received in the questionnaire. Revenue from cocoa increases to 3,368

USD/household from scenario 1, an increase of 4%. Farmer household income

increases to 4,079 USD/household, representing a 3% increase from scenario 1.

In the ideal distribution scenario, all Fairtrade farmers receive the FMP

differential payment for cocoa sold to their cooperative on a pro-rata basis, i.e.

the same amount per kg sold. In scenario 3, average farmer household income

stands at 4,332, an increase of 9% from scenario 1.

FAIRTRADE PRICE MECHANISMS|EFFECT FMP DIFFERENTIAL ON INCOME

An improvement in average farmer household income is observed as the number of farmers who receive the FMP increases

Household income distribution

When moving from scenario 1 to scenario 2, the bottom two categories

(farmers earning below 0 and farmers living in extreme poverty) become less

populated. Around 1.8% of farmers have moved from these bottom two

categories to the top three categories: farmers living in poverty, farmers

earning below the living income and farmers earning above the living income.

Similar observations can be drawn for moving from scenario 2 to scenario 3.

The bottom three categories become less populated, 3.6% of farmers have

shifted to the top two categories.

Figure 6: Average farmer household income under different scenarios

Figure 7: Farmer household income distribution under the different scenarios

Copyright 2020 Impact Institute. All rights reserved.

23

1

Fairtrade Living Income Reference Price indicates the price needed for an average farmer household with a viable farm size and an adequate productivity level to make a living income from the sales of their crop.

2

The productivity benchmark is a long-term achievable goal to help reaching living incomes. This study is used to get insights about current farmers’ situation and how (potential) improvements can be made to achieve the goal.

Household income distribution

Assuming farmers received the Living Income Reference Price at their current

yield improves the household income distribution. The median farmer shifts

from earning income below the poverty line to earning income above the

poverty line. Assuming farmers received the Living Income Reference Price at

the benchmark yield improves the household income distribution even further.

There are now less than 10% of farmers living in extreme poverty, while 33% of

farmers earn above the living income.

Fairtrade Living Income Reference Price parameters against study results

Revised in 2019, the Fairtrade Living Income Reference Pirce

1

for cocoa at

farm gate is estimated to be $2.20 (CFA 1289) per kg for Côte d’Ivoire. The

median price received by farmers in the sample is $1.40 (CFA 825) per kg. The

reference price is calculated based on some benchmark parameters, such as a

productivity benchmark of 800kg/ha and a cocoa area benchmark of 4.4 ha

amongst others. The median yield in the sample is 500 kg/ha. Only 22% of

farmers in the sample meet the productivity benchmark of 800 kg/ha

2

.

Similarly, the median cocoa area of farmers in the sample is 3.1 ha. 31% of

farmers have cocoa area of 4.4 hectare or larger.

FAIRTRADE PRICE MECHANISMS | LIVING INCOME REFERENCE PRICE

22% of farmers in the sample meet the productivity benchmark used to calculate the Fairtrade Living Income Reference Price

Figure 8: Share of farmers in each income bucket under the different scenarios

Table 3: LI Reference Price parameters against results in the current sample

Variable Unit

LI

reference

price

Current

sample

1

% farmers at LI

reference price

benchmark

Farm-gate price CFA/kg 1,289 825

N/A

Farm-gate price (incl. FMP) CFA/kg 1,289 965

Yield kg/ha 800 500 22%

Cocoa area ha 4.4 3.11 31%

Copyright 2020 Impact Institute. All rights reserved.

24

24

05

CONCLUSION & RECOMMENDATIONS

Copyright 2020 Impact Institute. All rights reserved.

25

Research question 1.

Comparison study

How do these results compare to the previous study?

CONCLUSION

Farmer income remains low, however positive developments can be observed notably due to the FMP as well as compared to

the 2018 study

Research question 2.

Fairtrade price mechanisms

What is the effect of FT price mechanisms on farmer income, and in particular

of the FMP differential payments performed in the 2019/2020 harvest?

Based on this study, the average annual household income of Ivorian

cocoa farmers is $4,080. The median annual household income is

$2,740 per household. This implies that the majority of farmers earn

less than the average income. 88% of farmers earn below the living

income.

The data collection regarding the FMP differential payment was

complicated by the fact that some farmers did not report correctly

whether they had received it. Nevertheless, farmer household income

was assessed under three different scenarios. An improvement in

average farmer household income was noted as the number of

farmers who receive the FMP increased.

The Fairtrade price mechanisms in place are compared to the Fairtrade

Living Income Reference Price. While some farmers do not meet the

productivity benchmarks used to calculate the Living Income

Reference Price, implementing this as farm-gate price will alleviate

farmers out of poverty. When adjusting the revenue and costs from

cocoa using the benchmark yield for the Living Income Reference

Price, significant improvement can be seen.

Based on this study, the average annual household income of Ivorian

cocoa farmers is $4,937. The median annual household income is $3,186

per household. The average (and median) annual household income of

cocoa farmers in Côte has increased when comparing results

from this study with the results of the previous study.

This appears to be driven by an increase in the cocoa yield of the

sampled farmers, and therefore an increase in cocoa production, an

increase in the diversification of income sources through higher in-

kind income and production of other goods. Off-farm income has also

increased. Costs have remained relatively similar, with labour costs

accounting for the majority of the production costs.

85% of farmers earn below the living income. In the previous study,

only 7% of the sampled farmers were earning a living income. While

positive developments can be noted, it is important not to draw too

optimistic conclusions since sampling differences could be a key driver

of the differences.

Copyright 2020 Impact Institute. All rights reserved.

26

▪ Diversification. Farmer income diversification

strategies seem to contribute to farmer household

income. Farmer household income has increased

significantly partly due to increased sales and

consumption of other goods. Continue, and improve

where possible, the initiatives that stimulate product

diversification.

▪ Rehabilitation. It appears farmers have benefited from

rehabilitating their farms and rejuvenating their cocoa

trees. This should be encouraged as younger trees enable

higher yields.

▪ Cocoa prices. The Fairtrade Minimum Price has acted

as a safety net during the cocoa season at hand in this

study. Moving towards a living income reference price

can further improve the cocoa revenue of farmers.

Additionally, supporting financial literacy can improve

understanding of the various payments they

receive and how they can use these payments in

productive ways. Clarity on what the payments are and

why they are being paid would improve

understanding of the benefits of Fairtrade.

RECOMMENDATIONS

Diversification strategies, premiums and trainings can drive further improvements in farmer household income

▪ Fairtrade premiums. The results of this study

hint that Ivorian cocoa farmers are not directly

reliant on the payment of Fairtrade premiums for

their financial farm income. It would be interesting to

understand how the premium does impact farmers

and what form is perceived to be most effective.

▪ Training. Obtain more knowledge on trainings

and how effective they are at conveying information

to farmers. This results show weak but

positive correlation between the various trainings

provided by Fairtrade and the cocoa yield of farmers.

▪ Distribution policies. Depending on the goal of

the FMP differential payments, Fairtrade can steer its

cooperatives towards distribution policies that are

more or less incentivizing, or more or less poverty

alleviating.

▪ Create a roadmap. Towards a successful living

income strategy, it can be useful to create a

roadmap of the steps required to achieve the goal,

whether it is about lifting farmers out of poverty or

setting the price to a living income reference price.

Copyright 2020 Impact Institute. All rights reserved.

27

27

06

APPENDIX

Copyright 2020 Impact Institute. All rights reserved.

28

APPENDIX | CONTENTS

Additional analyses RQ1

A1

Additional analyses RQ2

A2

Explanatory list of variables and concepts

A3

Methodology & key assumptions

A4

Page 29

Page 32

Page 37

Page 40

List of references

A5

Page 50

Copyright 2020 Impact Institute. All rights reserved.

29

29

Additional analyses were performed for research question 1. These include the

calculation of median household income and the distribution of farmer household

income per person per day.

A1

ADDITIONAL ANALYSES RQ1

Copyright 2020 Impact Institute. All rights reserved.

30

RESULTS | FARMER HOUSEHOLD INCOME

The median household income is 3,186 USD per household

▪ The household income is not

sufficient to make the living

income. The median farmer earns

43% of a living income.

▪ Cocoa is the main source of

income: 63% of farmer income

stems from the profit on cocoa

▪ The median household makes 1%

of their income from selling other

goods, whereas in-kind income

and off-farm income account

respectively for 3% and 0% of

total household income

Revenue Costs cocoa Net profit Net profit Financial In-kind Off-farm Household

cocoa production cocoa other goods farm income income income income

$1,920

1

Estimated using median household size, excluding social security

$2,377

$3,186

Figure 3: Median farmer household income (USD/year)

Living income =

$7,468

1

Copyright 2020 Impact Institute. All rights reserved.

31

RESULTS | INCOME DISTRIBUTION PER PERSON

87% of farmers earns less than the daily amount needed for a living income

Key insights:

▪ The distribution of income is peaked towards low

incomes. This means that most farmers earn below

the average.

▪ Based on the calculated living income and the

median household size, the living income is set at

USD 2.56 per person per day

▪ The extreme poverty line and poverty line are

calculated based on World Bank guidelines:

▪ The extreme poverty line is USD 1.90 per person

per day at the 2011 price level of the USA. This is

corrected for the purchasing power in Côte

d’Ivoire, giving an extreme poverty line at USD

0.76

▪ The poverty line is USD 3.10 per person per day at

the 2011 price level of the USA, or USD 1.24 in

Côte d’Ivoire.

1

Estimated using median household size, excluding social security

Figure 7: Farmer household income distribution (USD/per person per day)

Number of farmers

Less than

zero

Zero to

extreme

poverty line

Extreme

poverty

to

poverty

line

Poverty line

to living

income

Above living income

2% 36% 18% 28% 15%

Zero

line

Extreme

poverty

line

Poverty line

Living

income

1

line

Median - $1.09

Average -

$1.70

$0 $0.76

$1.24

$2.56

Copyright 2020 Impact Institute. All rights reserved.

32

32

Additional analyses were performed for research question 2. These include the

calculation of median household income and the distribution of farmer household

income per person per day.

Further, regression analysis was performed to assess the effect of FMP differential

payments. The distribution polices of cooperatives are also assessed under

different scenarios.

A2

ADDITIONAL ANALYSES RQ2

Copyright 2020 Impact Institute. All rights reserved.

33

RESULTS | FARMER HOUSEHOLD INCOME

The median household income is 2,740 USD per household

▪ The household income is not

sufficient to make the living

income. The median farmer

earns 37% of a living income.

▪ Cocoa is the main source of

income: 60% of farmer income

stems from the profit on

cocoa

▪ The median household makes

1.5% of their income from

selling other goods, whereas

in-kind income and off-farm

income account respectively

for 3.5% and 0% of total

household income

Revenue Costs cocoa Net profit Net profit Financial In-kind Off-farm Household

cocoa production cocoa other goods farm income income income income

$1,624

$1,900

$2,740

Living income =

$7,468

1

1

Estimated using median household size, excluding social security

Figure 3: Median farmer household income (USD/year)

Copyright 2020 Impact Institute. All rights reserved.

34

RESULTS | INCOME DISTRIBUTION PER PERSON

95% of farmers earns less than the daily amount needed for a living income

Key insights:

▪ The distribution of income per person per day is

peaked towards low incomes. This means that

most farmers earn below the average.

▪ Based on the calculated living income and the

median household size, the living income is set at

USD 2.56 per person per day

▪ The extreme poverty line and poverty line are

calculated based on World Bank guidelines:

▪ The extreme poverty line is USD 1.90 per person

per day at the 2011 price level of the USA. This is

corrected for the purchasing power in Côte

d’Ivoire, giving an extreme poverty line at USD

0.76

▪ The poverty line is USD 3.10 per person per day at

the 2011 price level of the USA, or USD 1.24 in

Côte d’Ivoire.

1

Estimated using median household size, excluding social security

Figure 7: Farmer household income distribution (USD/per person per day)

Number of farmers

Less than

zero

Zero to

extreme

poverty line

Extreme

poverty

to

poverty

line

Poverty line

to living

income

Above living income

4% 60% 20% 12% 5%

Zero

line

Extreme

poverty

line

Poverty line

Living

income

1

line

Median - $0.58

Average - $0.86

$0 $0.76

$1.24

$2.56

Copyright 2020 Impact Institute. All rights reserved.

35

RESULTS | FAIRTRADE PRICE MECHANISMS

FMP received potentially contributes to closing the living income gap

Variable

Coefficient

(Standard error)

P-value

(Constant)

5763.530

(1969.251) 0.004

Farmer age

19.342

(34..159) 0.572

Yield (kg/ha)

0.975

(1.017) 0.338

mid season)

-1.380

(0.167) 0.000

Costs per kg

1.504

(0.962) 0.119

FT Sales volume

100.37

(1616.834) 0.951

FMP Received (1 = Yes, 0 =

No)

-1198.64

(733.591) 0.103

FMP Distribution dummy

1

(1 =

Yes, 0 = No)

628.955

(785.075) 0.423

FMP Distribution dummy

2

(1 = Yes, 0 = No)

-240.302

(1661.817) 0.885

R-squared

3

0,202

▪ The table on the right presents the results of a regression to get better

insight into what variables have an effect, either positive or negative, on the

living income gap. The variable living income gap is therefore the dependent

variable.

▪ The results show that only the relationship between production in kgs and

the living income gap is found to be significant. The regression coefficient of -

1.380 indicates that the more a farmer produces, the smaller the living income

gap becomes.

▪ The relationship between the receipt of the FMP and the living income gap

was also found to be negative, yet just insignificant (at p <0.10)

1

. This means

that the living income gap of farmers who have received the FMP is smaller

than the ones who did not receive this. Even though it cannot be said with

certainty, the payment of the FMP seems to have a direct positive effect on

farmer income, moving it closer to a living income.

▪ For the rest of the variables, there is insufficient evidence to conclude that

there is effect at the population level since all p-values are insignificant.

Table 6: Regression results with living income gap as dependent variable

1

Represents the distribution policy in which all Fairtrade farmers receive an equal FMP

2

Represents the distribution policy in which all farmers receive an equal FMP

3

R-squared is a statistical measure of how well the data fits the model

1

It should be noted that cocoa, on average, only makes up 58% of the income. There are many intervening variables of

other income sources and their potential shifts during the past years for which this model does not control

Copyright 2020 Impact Institute. All rights reserved.

36

▪ In the scenario definitions, the pro-rata distribution policy is used as the ideal distribution policy for

feasibility purposes. However, there is a possibility that the ideal distribution policy is different

depending on the goal of the FMP.

▪ In the graphs on the right, the different household income distributions under each FMP

distribution policy are presented.

▪ The baseline graph uses the farmer income distribution assuming there had been no FMP differential

payment. The other graphs are overlayed on top of the baseline graph to show the impact of each

distribution policy when compared to the baseline.

▪ Pro-rata distribution of the FMP has the lowest effect on the farmers earning negative income and

the biggest improvement can be observed for farmers earning above the living income.

▪ A pro-rata distribution policy is expected to be incentivizing for low earners and will pull the higher

income earners who already produce a lot of cocoa up.

▪ The share of farmers earning the living income below decreases slightly, while the share of farmers

earning above the living income increases significantly.

▪ Distributing the FMP equally to all farmers and to all Fairtrade farmers have similar effects on

poverty alleviation. The share of farmers in extreme poverty decreases while the share of farmers

earning above the poverty line increases.

▪ Equal distribution to all farmers will alleviate farmers with lower sales and farmers who cannot afford to

be certified from poverty.

▪ The share of farmers earning above the living income increases slightly, but the biggest differences can

be observed for relatively poorer farmers. The decrease in the share of farmers earning below 0 is more

important. A similar observation can be drawn for farmers earning below the extreme poverty line.

RESULTS | FAIRTRADE PRICE MECHANISMS

A pro-rata distribution policy is incentivizing, while an equal distribution policy helps to alleviate more farmers from poverty

No FMP (baseline)

Pro-rata distribution

Equally to FT farmers

Equally to all farmers

0

Extreme

poverty line

Poverty

line

Living

income

Copyright 2020 Impact Institute. All rights reserved.

37

37

This section outlines the list of variables used in the calculation of farmer

household income, along with their definitions.

A3

EXPLANATORY LIST OF VARIABLES

Copyright 2020 Impact Institute. All rights reserved.

38

Variable Definition

Financial farm income Financial income from the farm(s)

Net profit othergoods Revenues of goodsbesides cocoa that are sold for cash minusthe extra costs of these other products (including costs of goods sold, overhead costs, non-

operating costs, and netinvestment outlays)

Net investmentoutlays Investment costs on capital assets, spread out over the useful life years. This includes costs of structures, facilities, tools, materials, machinery and

equipment, and establishment costs of newcocoa trees

Overhead costs Overhead costs include book keeping costs, memberships fees to the SPO and other member organizations,insurance, pre-studies and analysis, and

possible other overheadcosts

Interest Interest costs on outstandingloans

Taxes Governmenttaxes

Subsidies Subsidies in cash received from the SPO or otherparties

Revenue cocoa Financial revenues of cocoa soldfor cash

COGS (costs of goodssold)cocoa Operationalcosts of cocoa includinginput costs and hired labour costs; all costs from cocoa crop management,cocoa processing,cocoa packing, and

storage and cocoatransport

In-kind farm income In-kind income from the farm(s)

Exchanged goodsreceived Monetary value of goods and services received from SPO or others in exchange for farm goods

In-kind contributionassociation Monetary value of goodsand services received from SPO or others not in exchange for farm goods

Farm goods consumed by household Monetary value of farm goods that are consumed by thehousehold

In-kind income from otherfarms Monetary value of in-kind goods that are received from other farms

Off-farm income Income from sources other than the farm(s)

Wage income Income from off-farm wages earned by thehousehold members

Rental income Income from rental of land, house, vehicle or other property owned by the household

Other income andremittances Money or checks received from non-household members, either family or not family (usually internationally), or any other not farm related income source

that was not earned from a job or rent

3. EXPLANATORY LIST OF VARIABLES AND CONCEPTS

Copyright 2020 Impact Institute. All rights reserved.

39

Concept Definition

LI Reference Price Fairtrade Living Income Reference Price

The LI Reference Price indicates the price needed for an average farmer household with a viable farm size and an adequate productivity level to make a living

income from the sales of their crop.

FMP Fairtrade Minimum Price

The FMP is the minimum price that must be paid by buyers to producers for a product to become certified against the Fairtrade Standards. The FMP is a

esents a formal safety net

that protects producers from being forced to sell their products at a too low price when the market price is below the FMP. It is therefore the lowest

possible price that the Fairtrade payer may pay to the producer.

FMP Differential payment Fairtrade Minimum Price Differential Payment

The Fairtrade Standard for Cocoa requires traders to pay a price differential for Fairtrade cocoa beans if the reference price in Ivory Coast falls below the

Fairtrade Minimum Price.

Fairtrade Premium Fairtrade Premium

The Fairtrade Premium is an extra sum of money paid on top of the selling price that farmers or workers invest in projects of their choice. They decide

together and democratically how to spend the Fairtrade Premium to reach their goals, such as improving their farming, businesses, or health and education

in their community.

3. EXPLANATORY LIST OF VARIABLES AND CONCEPTS

Copyright 2020 Impact Institute. All rights reserved.

40

40

Limitations to the model are outlined in this section. This includes missing variables,

relevant ambiguities and issues revolving household size.

Key assumptions used to calculate farmer income are also outlined.

A4

METHODOLOGY & KEY ASSUMPTIONS

Copyright 2020 Impact Institute. All rights reserved.

41

3. METHODOLOGY & KEY ASSUMPTIONS | MISSING VARIABLES

The elaborate questionnaire enabled detailed calculation, but some variables are missing and there are some ambiguities

Potentially relevant missing variables

1. Water costs

2. Taxes

3. (In

-kind) contribution SPOs

4. In

-kind payment of hired labour

5. Duration of the harvest season (this is asked per SPO, but

individual farmers might a different harvest season duration).

Relevant ambiguities

1. Land costs are not specified to refer to purchase or rent. For some

farmers these can be very high. Do they represent one

-off costs?

2. Farmers indicate how many months a year they worked (for the

other activities next to farming). However, when a

on how many days or weeks were actually worked.

3. Field interviews were not possible. It was not possible to check

the number of cocoa trees or the size of the farm as reported by the

farmers.

4. Regarding off

-farm labour for other family members, it is unclear

how the farmers have answered the questions on how many days

they have worked off

-farm and how much money they have

received for that work.

Copyright 2020 Impact Institute. All rights reserved.

42

▪

values up to 36 have been recorded

(see figure). This might correspond to genuinely large households, but alternatively, this number might

include relatives not living in the household.

▪

in comparisons. The median family size with 8 people ~11% lower than the average. These very large

-off, as all choices (16?,

20?, 25?) are arbitrary.

▪ The main effect of the very large households, is that they drive up the average family size. The average

family in the sample consists of 9 people.

▪ Note that the family size does not directly affect the farmer household income. However, the household

income needs to be compared to the (extreme) poverty line and living income based on larger families.

3. METHODOLOGY & KEY ASSUMPTIONS | HOUSEHOLD SIZE

Some farmers report household sizes up to 36 people

Copyright 2020 Impact Institute. All rights reserved.

43

3. METHODOLOGY & KEY ASSUMPTIONS | FARMER INCOME

Key assumptions were made in order to calculate farmer income

Building block Calculation

Revenue cocoa

Calculated as the sum of sales to different buyers plus FMP differential plus bonus.

Cocoa sales are calculated for each buyer (cooperative, other cooperative, exporter/trader, private company or individual,

other) by multiplying the volume sold.

Constituent of building block Assumption

Volume of cocoa sold (for each

buyer)

We test on the sum of all volumes sold versus the total volume produced: for most farmers, these are (almost equal). Farmers

for which the sum of all sales is much smaller than the cocoa produced (less than 50%), we use the following assumptions: 1)

the amount sold is assumed to be the full amount produced. 2) all cocoa is assumed to be sold to the cooperative.

Note also that we have omitted a number of farmers that have given strongly incoherent answers. See data processing

protocol for more on omitted entries.

Fairtrade minimum price

differential received

Some farmers have replied they have not received a FMP differential. As discussed with Fairtrade, farmers should have received

the differential but have not reported it for a variety of possible reasons. Because of the different distribution policies of

cooperatives, it is difficult to make an accurate estimate of how much each farmer should have received. The data is therefore

treated as reported by the farmers.

Copyright 2020 Impact Institute. All rights reserved.

44

3. METHODOLOGY & KEY ASSUMPTIONS | FARMER INCOME

Key assumptions were made in order to calculate farmer income

Building block Calculation

Cost of goods sold (COGS)

cocoa

Calculated as the sum over hired labour, land costs, input costs, fixed costs and other costs.

It is calculated by multiplying the number of people hired in each category (permanent vs. temporary), with the days worked

by

them, with their daily pay rate and then summing over all categories.

Input costs are calculated as the sum over 'fertilizer costs', 'pest management costs', 'transport costs' and the product of

Fixed costs consist of 'machete', 'machete file', 'tarpaulin', 'pick', 'basket', 'rope', 'axe', 'pruner', 'bag', 'boots', 'bucke

'other'. It is calculated by taking the sum over the amount of these items times their respective costs. Expenses on these items

are treated as a cost in the year that they occur, not depreciated over the lifetime.

Other costs consists only of training costs.

Constituent of building block Assumption

Hired labour people hired,

days worked and pay rate

The normal rules for overwriting empty cells and cells containing "Non-applicable", can be overruled. This happens when one or

two out of the three factors (people hired, days worked and daily pay rate) have a positive value, while the other(s) are not

filled in (or are 0 or "Not Applicable"). In that case, the missing elements are replaced by their respective medians. For example:

a farmer does not fill in the number of people hired but gives values for days worked and the daily pay rate. The number of

people hired is replaced by the median, instead of by 0 (as would happen under the regular replacement rules). We have

checked that this procedure does not have a large influence on the results.

Hired labour days worked

(seasonal)

Responses above 7 days per week were replaced with the median of the responses below or equal to 7 days per week.

Input costs If seedling costs are bigger than thousand, it is likely to refer to the total costs of all seedlings, not the average costs per

seedling. Seedling costs smaller than 10 XOF per seedling are unrealistic and are replaced by the median.

Water costs are not included in the questionnaire and are assumed to have a negligible effect on the input costs. This

hypothesis needs further research.

Copyright 2020 Impact Institute. All rights reserved.

45

3. METHODOLOGY & KEY ASSUMPTIONS | FARMER INCOME

Key assumptions were made in order to calculate farmer income

Building block Calculation

Interest

Calculated as a percentage of revenue.

Constituent of building block Assumption

Interest

Assumed to be 2.4% of the cocoa revenue (based on two other studies, previously done by True Price).

Building block Calculation

Taxes

Calculated as a percentage of revenue.

Constituent of building block Assumption

Taxes

Our understanding is that the farmers are theoretically obliged to pay this but are not doing so in practice.

Tax burden is not included in the questionnaire and is assumed to be zero.

Building block Calculation

Subsidies

Calculated as a percentage of revenue.

Constituent of building block Assumption

Subsidies

Assumed to be 1% of the cocoa revenue (based on the coffee project, previously done together by Fairtrade & True Price).

Building block Calculation

Net investment outlays

Out-of-scope

Copyright 2020 Impact Institute. All rights reserved.

46

3. METHODOLOGY & KEY ASSUMPTIONS | FARMER INCOME

Key assumptions were made in order to calculate farmer income

Building block Calculation

Net profit other goods

Calculated as the sum over profits from each crop and each form of cattle. The crops consist of cassave, maize, plantain, yam,

fruits, vegetables, rubber, cashew and palm. The cattle consists of chicken, sheep, cow, pig and goat.

The profit of each category is calculated by taking the value (revenue) in that category and substracting some of the costs

made to grow that crop or breed that type of cattle. The questionnaire reports the total costs per type. Some of these can be

attributed to the commercial activities, the remainder to the own consumption (see below). We calculate the share of costs

relevant to commercial activities by multiplying total costs by portion that is sold (instead of consumed in the household).

When that portion could not be properly calculated from the given data, the full costs of production are assigned to the

commercial activities.

As a formula: profit = value - (total cost of production)*(volume sold/volume produced)

Constituent of building block Assumption

Crops total volume sold It is assumed that all volume not sold is consumed by the household.

Crops total volume produced No additional assumptions.

Crops cost of production No additional assumptions.

Crops value No additional assumptions.

Cattle number sold It is assumed that all volume not sold is consumed by the household.

Cattle number raised One farmer had reported to raise 30,000 chickens, far above the median of the sample. The value is replaced with the median.

Cattle cost of production No additional assumptions.

Cattle value No additional assumptions.

Copyright 2020 Impact Institute. All rights reserved.

47

3. METHODOLOGY & KEY ASSUMPTIONS | FARMER INCOME

Key assumptions were made in order to calculate farmer income

Building block Calculation

In-kind contributions cooperatives

Calculated as a percentage of revenue.

Constituents of building block Assumption

In-kind contributions cooperatives

Assumed to be 1.1% of the cocoa revenue (based on the coffee project, done together by Fairtrade and True

Price).

Building block Calculation

Exchanged goods received

Consists of produce exchanged for land.

Constituents of building block Assumption

Produce exchanged for land

No additional assumptions.

Building block Calculation

Other income & remittances

Consists of remittances from friends or relatives, gift money to pay for health or education, or any other money not earned

from a job or rent.

Constituents of building block Assumption

Other sources of income

No additional assumptions.

Building block Calculation

Rental income

Summation over house, vehicle and other sources of rental income.

Constituents of building block Assumption

Land, house, vehicle and other

rental income

No additional assumptions.

Copyright 2020 Impact Institute. All rights reserved.

48

3. METHODOLOGY & KEY ASSUMPTIONS | FARMER INCOME

Key assumptions were made in order to calculate farmer income

Building block Calculation

Wage income

Calculated as the summation over the incomes of the different types of work. For each type of work, the

income is calculated as the income per unit time, multiplied, when relevant, by the number of months

worked.

The other sources of work consist of other agricultural work, construction work, domestic labour, public service,

wood charcoal, palm wine and other work.

Constituents of building block Assumption

Other sources of work months worked

No additional assumptions.

Other sources of work income No additional assumptions.

Other sources of work rate basis

If the rate basis is "Annually", then the 'income' is directly used.

If the rate basis is "Monthly", then the income per month is multiplied by the number of months worked.

If the rate basis is "Daily" or "Weekly", the income is still multiplied by the number of months worked. This is because

the weeks or days worked per month are not known. In addition, this approach gives roughly equal contributions for

the different rate bases. Multiplying with the number of days or weeks in a month, gives results that are out of line

with the other entries.

When the rate basis is "Does not know", "Refuse to answer" or "Not Applicable", but the income has a positive value,

the rate base is either changed to "Annually", or to "Monthly". When the income is larger than ten times the average of

all the incomes that have a pay rate category of "Monthly", the rate basis is changed to "Annually", otherwise

"Monthly" is used.

Copyright 2020 Impact Institute. All rights reserved.

49

3. METHODOLOGY & KEY ASSUMPTIONS | OTHER

Key assumptions were made in order to calculate farmer income

Element Assumption

Poverty line & extreme

poverty line

Extreme poverty line and poverty line are taken from the World Bank to be $1.90 and $3.10 respectively. This needs to be

the

extreme poverty line and the poverty line become $0.78 and $1.27 respectively.

FTE calculation Data about days entitled to paid leave, official public holidays, working days per week and hours per working week of Côte

were found at the database of the International Labour Organization (ILO). For full-time employment expressed in

days, the year was corrected for the holidays, the weekends and the paid leaves. For full-time employement expressed in

hours, this number was multiplied by the number of working hours per day.

From the data, the amount of hours or days worked by the farmers, the household and the hired labour could be calculated,

followed. For this calculation, the duration of the harvest season of the relevant

cooperative per farmer was taken from the questionnaire of the cooperatives.

Household size The sum of adults, children and babies is taken as the household size, rather than the answer provided by the farmer to the

question: what is your household size?

Cocoa trees

of trees per hectare multiplied by the cocoa area of that farmer.

Copyright 2020 Impact Institute. All rights reserved.

50

50

List of sources used in the report and modelling of farmer

household income.

LIST OF REFERENCES

A5

Copyright 2020 Impact Institute. All rights reserved.

51

Author (Year) Title

CIA World Factbook (2021) https://www.cia.gov/the-world-factbook/countries/cote-divoire/#people-and-society

LICOP (n.d.) Measuring actual income

Retrieved from: https://www.living-income.com/measurement-actual-income

True Price (2018) Cocoa farmer income

Retrieved from: https://trueprice.org/consumer/cocoa-fairtrade/

True Price (2017) Assessing coffee farmer household income

Retrieved from: https://www.impactinstitute.com/wp-

content/uploads/2018/05/Assessing_Coffee_Farmer_Household_Income_Report_2017_updated.pdf

World Bank (n.d.) Poverty.

Retrieved from:

https://www.worldbank.org/en/topic/poverty#:~:text=Based%20on%20information%20about%20basic,less%20tha

n%20%241.90%20a%20day.&text=These%20lines%20are%20%243.20%20and,thresholds%20for%20middle%2Dinco

me%20countries

Veldhuyzen, C (2019) Fairtrade Living Income Reference Prices for Cocoa. Retrieved from https://www.fairtrade.net/issue/living-income

4. LIST OF REFERENCES

Copyright 2020 Impact Institute. All rights reserved.

52

52

Address: Haarlemmerplein 2, 1013 HS, Amsterdam

Site: www.impactinstitute.com

Facebook: /impactinstitutecom

Twitter: impact_inst

Tel.: +31 202 403 440

Mail: info@impactinstitute.com

CONFIDENTIALITY REQUEST AND DISCLAIMER

Information, data, and drawings embodied in this document should not be reproduced without the prior

written consent of Impact Institute.