ANNUAL

REPORT &

ACCOUNTS

2022.

FRASERS GROUP PLC

ABOUT

FRASERS GROUP

Founded as a single store in

1982, Frasers Group Plc (Frasers

Group, the Group, the business

or the Company) is today the

UK’s largest sporting goods

retailer by revenue.

The Group operates a diversified portfolio of sports,

fitness, premium lifestyle and luxury fascias in over 20

countries. We have more than 30,000 colleagues across

five business segments: UK Sports Retail, Premium

Lifestyle, European Retail, Rest of World Retail and

Wholesale & Licensing.

Our strategy is to provide consumers with access to

the World’s best sports, premium and luxury brands by

providing a World-leading retail ecosystem. Aligned with

this vision, we have defined the Group’s purpose:

To elevate the lives of the many by giving them access to the

World’s best brands and experiences.

OUR IMPACT

SINCE 2007

We became a listed public company in 2007. In

the years since we floated, the Group has greatly

contributed to the British economy. This includes:

£250m

Approx. £250m paid in staff share bonuses

30,000

Have a workforce of approx. 30,000 people

Worldwide, approx. 22,000 of which are in the UK

£2,300m

Contributed approx. £2,300m in VAT and Duty

£200m

Approx. £200m paid in sales commission

to retail bonuses

£700m

Contributed approx. £700m in UK Corporation Tax

£200m

Contributed approx. £200m in NI

employer contributions

GROUP

OUTLOOK

We are delighted to report a record-breaking

year for Frasers Group with an adjusted profit

before tax of £339.8m (FY21: loss £39.9m),

despite the significant economic headwinds and

well-chronicled challenges across the sector.

Our Elevation strategy has remained laser focused,

and we have re-structured our team to execute

it with conviction. It is underpinned by our core

strengths and rock-solid foundations. Although the

backdrop remains challenging, this momentum

gives us the confidence of achieving an adjusted

profit before tax of between £450m and £500m for

the next financial year.

MISSION STATEMENT

TO SERVE OUR CONSUMERS WITH

THE WORLD’S BEST SPORTS,

PREMIUM AND LUXURY BRANDS.

BUSINESS ETHOS

We do not run the business for the short-term

but work to ensure we deliver shareholder value

over the medium to long-term, whilst adopting

accounting principles that are conservative,

consistent and simple.

FRASERS GROUP PLC ANNUAL REPORT 2022

2

CONTENTS

01. HIGHLIGHTS AND

OVERVIEW

002 About Frasers Group

004 Group at a Glance

006 Financial Highlights

008 Strategic & Operational Highlights

02. STRATEGIC REPORT

010 Chair’s Statement

012 Our Business

014 Our Strategy

016 Key Performance Indicators

018 CEO Report and Business Review

028 Financial Review

031 Non-Financial Information

032 Workers Representative Report

033 ESG Report (Including TCFD)

048 S172 Statement

050 Principal Risks and Uncertainties

063 Viability Statement

03. GOVERNANCE

065 Corporate Governance Report

072 The Board

075 Nomination Committee Report

077 Directors’ Remuneration Report

089 Audit Committee Report

095 Directors’ Report

101 Directors’ Responsibility Statement

04. GROUP FINANCIAL

STATEMENTS

102 Independent Auditor’s Report

to the Members of Frasers Group Plc.

113 Consolidated Income Statement

114 Consolidated Statement of

Comprehensive Income

115 Consolidated Balance Sheet

116 Consolidated Cash Flow Statement

117 Consolidated Statement of

Changes in Equity

118 Notes to the Financial Statements

05. COMPANY FINANCIAL

STATEMENTS

198 Company Balance Sheet

199 Company Statement of Changes in Equity

200 Notes to the Company

Financial Statements

06. GLOSSARY

208 Consolidated Five Year Record and

Alternative Performance Measures

210 Company Directory

211 Shareholder Information

GROUP AT

A GLANCE

UK SPORTS RETAIL EUROPEAN RETAIL

55.0%

Total Group Revenue

16.4%

Total Group Revenue

£2,640.1m £790.2m

0.7% 0.5%

UK Sports Retail includes core sports retail store

operations in the UK, plus all the Group’s sports

retail online business (excluding Bob’s Stores, Eastern

Mountain Sports and Sports Direct Malaysia), the gyms,

SRL, the Group’s Shirebrook campus operations, retail

store operations in Northern Ireland, Evans Cycles and

GAME UK.

Our store footprint is significant, with 808 stores across

the UK, totalling approximately 6.7m sq.ft. of retail

space. The majority of stores are operated under the

Sports Direct, USC, Evans Cycles and GAME fascias.

European Retail includes all the Group’s sports

retail stores, management and operations in

Europe including the Group’s European distribution

centres in Belgium and Austria as well as GAME

Spain. The total European store count is 489 stores

and approximately 3.7m sq.ft. of retail space.

During FY22, management continued to elevate

the Group’s European stores and work to further

tailor the Group’s consumer value propositions to

our local markets.

FRASERS GROUP PLC ANNUAL REPORT 2022

4

PREMIUM LIFESTYLE

WHOLESALE & LICENSING

The Group’s Premium Lifestyle division offers a broad range of clothing,

footwear and accessories from leading global contemporary and luxury

retail brands through our fascias in the UK: FLANNELS, Cruise, van mildert,

House of Fraser, Sofa.com and Jack Wills along with their related websites.

The majority of these fascias operate as multi-brand premium retail

destinations and are focused on providing fashion conscious consumers

with high-end and on trend products.

The segment is supported by our Group-wide centralised commercial and

support functions, giving the benefits of scale and operating efficiencies

to each fascia. The segment is a significant part of the Group’s new

generation retail concept and as such, in certain locations, Premium and

Lifestyle stores are co-located alongside our Sports retail stores to benefit

from increased customer footfall and operating synergies.

The total Premium Lifestyle store count is 179 stores and approximately

4.0m sq.ft. of retail space.

The Wholesale & Licensing segment operates our globally renowned

heritage Group brands (such as Everlast, Lonsdale, Karrimor and

Slazenger) and our wholesale, licensing and distribution relationships

across the World, as well as our partnerships with third party brands that

we license-in to sell certain products.

The Group’s own brands are managed both individually and centrally within

this segment. This unique, integrated approach to brand management

leverages the expertise of our people, encourages innovation, and

ensures consistency.

REST OF THE WORLD RETAIL

Rest of World Retail includes sports and outdoor retail stores in the US

under the Bob’s Stores and Eastern Mountain Sports fascias and their

corresponding e-commerce offerings. It also includes the Group’s retail

stores in Malaysia, under the Sports Direct fascia, and its corresponding

e-commerce offering. Subsequent to the period end the Bob’s Stores and

Eastern Mountain Sports fascias and their corresponding e-commerce

offerings were disposed of.

As at the period end, the total Rest of World store count is 76 stores and

approximately 1.3m sq.ft. of retail space.

£1,056.6m

1.7%

22.0%

Total

Group Revenue

£150.3m

1.1%

3.1%

Total

Group Revenue

£168.1m

0.7%

3.5%

Total

Group Revenue

FRASERS GROUP PLC ANNUAL REPORT 2022

5

£335.6m

FINANCIAL HIGHLIGHTS

32.5%

Strong financial performance as we

recover from Covid-19, with Group revenue

up by 32.5%

Excluding acquisitions and on a currency neutral basis,

revenue increased by 31.2%

(1)

Reported profit before

tax was £335.6m, up

3,848.2% from a profit

of £8.5m driven by the

strong reopening of

stores after lockdown,

new FLANNELS stores,

continued growth in online

in the Premium Lifestyle

segment, continued

operating efficiencies, FY21

including Covid-19 related

lockdowns and current

period property related

impairments of £227.0m

compared to £317.0m

in FY21.

Premium Lifestyle revenue increased by

43.6%, largely due to new FLANNELS

stores, continued growth in online, and the

strong reopening of stores after the last

lockdown in March 2021

Excluding acquisitions, revenue increased by 43.3%

(1)

Cash inflow from operating activities

increased to £628.9m compared to

£578.3m in the prior period

43.6%

£628.9m£578.3m

3,848.2%

FRASERS GROUP PLC ANNUAL REPORT 2022

6

£335.6m

£339.8m

Group adjusted PBT

(2)

increased to £339.8m

compared to a loss of £(39.9m) in the

prior period

Excluding acquisitions and on a currency neutral basis,

Adjusted PBT

(2)

increased by £394.0m

(1)

UK Sports Retail revenue

increased by 34.1%,

largely due to the strong

reopening of stores after

the last lockdown in March

2021 and the comparative

period being impacted by

lockdowns as a result of

Covid-19

Excluding acquisitions, revenue

increased by 30.1%

(1)

European Retail revenue increased by

28.4%, largely due to strong growth in

Ireland and the lockdowns experienced in

the prior year

Excluding acquisitions and on a currency neutral basis,

revenue increased by 33.4%

(1)

As at 24 April 2022 net assets increased to

£1,308.6m from £1,211.0m at 25 April 2021

(1) A reconciliation excluding acquisitions and currency neutral performance

measures can be found in the Glossary.

(2) Adjusted PBT (PBT) is profit before tax less the effects of exceptional items,

realised foreign exchange, fair value adjustments to derivative financial

instruments included within Finance income/costs, fair value gains/losses and

profit on disposal of equity derivatives, and share schemes. Further detail on this

calculation can be found in the Glossary.

28.4%

£1,308.6m

34.1%

£(39.9m)

FRASERS GROUP PLC ANNUAL REPORT 2022

7

STRATEGIC AND

OPERATIONAL HIGHLIGHTS

FURTHER GROWTH

Further growth of our key brand partner relationships, alongside establishing new and innovative brand partners

OUR

ELEVATION

STRATEGY

HAS COME

TO LIFE

SPORTS DIRECT BIRMINGHAM

Our Elevation strategy has come to life through the new

store developments, including the creation of flagship

stores, leading to recent openings including Sports Direct

Birmingham and FLANNELS Liverpool

FRASERS GROUP PLC ANNUAL REPORT 2022

8

Supported our strategic brand partner Hugo Boss AG, with an increased

investment reflecting our growing relationship and confidence in the brand’s future

£193.2m

Returned £193.2m to shareholders through a

significant share buy back program

£980m

Successfully refinanced our Group facility,

which now stands at £980m

UNLOCK

NEW ECOMMERCE

CAPABILITIES

Strategic acquisitions, including Missguided (post period end) and Studio Retail (‘SRL’), enable the

Group to unlock new e-commerce capabilities and access a wider customer base

IMPROVED

THE DIGITAL

CONSUMER

EXPERIENCE

Significantly improved the digital consumer experience across

all touchpoints within the Group

FRASERS GROUP PLC ANNUAL REPORT 2022

9

CHAIR’S STATEMENT

CEO Appointment

Earlier this year, Michael Murray transitioned into

the role of Chief Executive of Frasers Group and was

formally appointed on 1 May 2022. With Michael’s

leadership, we remain laser focused on the growth of

the business, through keeping up the momentum of our

Elevation strategy, investing in our people and building

out the proposition for brands.

Michael has set out a clear vision for the business -

to provide consumers with access to the World’s best

sports, premium and luxury brands by providing a

World-leading retail ecosystem, and through that, he

has significantly improved our relationships with our key

brand partners and grown our presence across the UK

and Europe, through the development of our

store portfolio.

With the Group’s new leadership, and a clear direction,

Michael continues to redefine the culture, employee

value proposition and strategy of Frasers Group, which

all contribute to the efficiency of the business and our

strong performance.

Business Performance and

Financial Highlights

We are pleased that our business has performed

above expectations since stores reopened in March

2021, following the final period of closure due to the

Covid-19 pandemic. We are a cash generative business

which enables us to continue to invest in our strategies

and withstand some of the pressures and impact of

the pandemic, Brexit, global supply chain challenges

and political and economic uncertainty at home and

abroad. Notwithstanding our business resilience, these

macro-economic factors have contributed to our

conservative judgements and estimates, leading to some

significant non-cash accounting impairments of £232.7m

(FY21: £326.1m) to our asset base, further details can be

found in notes 2, 17, 18 and 19.

• Revenue increased to £4,805.3m (FY21: £3,625.3m)

• Profit Before Tax increased to £335.6m (FY21: £8.5m)

• Adjusted PBT increased to a profit of £339.8m

(FY21: loss £39.9m)

• Net assets at FY22 £1,308.6m (FY21: £1,211.0m)

Looking forward, we will continue to invest in the high

street alongside our online and digital capabilities.

Following the success of the business’s first Sports Direct

flagship on London’s Oxford Street, which opened to

great acclaim last June, we recently opened our second

Sports Direct flagship store in Birmingham – further

demonstrating the strength of our elevated consumer

experience, and the direction of the Sports Direct brand.

The FLANNELS business continues to perform

exceptionally well and we are excited about the recent

opening of our 120,000 sq. ft. FLANNELS flagship store

in Liverpool. The store is our largest store opening to

date and saw an impressive investment of approx. £30m

from the business. Our expansion plans for FLANNELS

are crucial to the on-going success of the luxury side

of the business and through our new brand vision to

become the leading destination for new luxury, we are

delighted to be expanding into new markets and new

locations throughout the UK and Europe, including the

expansion into Ireland with openings planned for Dublin,

Blanchardstown and Cork.

Acquisitions

We continue to see opportunities that strengthen Frasers

Group’s brand proposition and our recent acquisitions of

Studio Retail Limited (with its significant knowledge and

experience in consumer credit) during FY22. Missguided

and I Saw It First (with their focus on womenswear and

its digital platforms) subsequent to the period end are

examples of our drive to expand and acquire businesses

and brands that can strengthen the Group, and our

connection to our consumers.

Operations

We are continually developing our automation

capabilities in our Shirebrook distribution facility,

including the launch of a Dematic Shuttle machine

which covers a floor plate of 200,000 sq. ft and

increasing the size of our AutoStore facility, which was

already the biggest in Europe. In the second half of the

financial year, we completed the purchase of land in

Bitburg, Germany, where we have plans for a significant

distribution centre which will service mainland Europe

from both a store and digital perspective.

Our People

Our people are the key asset to the business.

Under Michael Murray’s leadership, the management

team has been strengthened. The business has created

several new roles including the additions of a Managing

Director of Sports, Ger Wright (formerly a Nike Executive),

and a Managing Director of Luxury and Premium, David

Epstein. Alongside the management team, we will look

to support the business by adding relevant talent and

expertise to the Board when appropriate.

FRASERS GROUP PLC ANNUAL REPORT 2022

10

This year the Group will receive its third annual intake of

highly talented individuals into the Elevation Programme.

The programme is aimed at high potential graduates

seeking a career in commercial management, and

we have twenty-six (FY20: twenty-seven and FY21:

twenty-five) young, ambitious new joiners who started

in September 2022. Over the past three years, we

have been monitoring the success and benefits of the

Elevation Programme and are pleased to confirm that

we will be rolling out the scheme across our finance

department, which has seen five graduates start in

August 2022.

Sustainability

Sustainability and Elevation go hand in hand and

both are important priorities for the Group and its

stakeholders. We have built a Sustainability Team

structure within the organisation with our CFO

Chris Wootton as the executive sponsor. There are

Sustainability Champions across the business and

hundreds of dedicated people across our stores who

are responsible for helping deliver against our priorities.

We have set ourselves targets to reduce emissions and

single use plastic, and improve our waste management

and recycling. We now offer a carbon neutral delivery

option on the web.

We have outperformed our target of a 10% reduction

in our UK stores energy usage, achieving a reduction

of 15%. More detail of our various achievements and

targets can be found in the ESG Report on page 33.

This is the first year of Taskforce on Climate-related

Financial Disclosures (TCFD). During the year we have

worked closely with expert external advisors to enhance

our understanding of the potential impact of climate

change on Frasers Group and to inform our future

strategy risk management approach and the metric and

targets we will use to monitor our progress. The TCFD

section can be found in the ESG report

on page 40.

Refinancing

In our Half Year reporting we noted the successful

refinance of our Group facility whereby we have access

to a combined term loan and revolving credit facility

(RCF) of £930.0m for a period of three years, with the

possibility to extend this by a further 2 years. This facility

has increased in size to £980.0m since then. We believe

this is a great endorsement for the business and our

Elevation strategy and I want to say thank you to our

banking partners for their support.

Disposals

Subsequent to the period end the Bob’s Stores and

Eastern Mountain Sports fascias and their corresponding

e-commerce offerings were disposed of for

consideration of $70m. The Bobs and EMS store estate

does not include any of the new elevated stores which

are core to the FG Elevation strategy. The disposal of

these non-core businesses allows Frasers Group to have

an even greater focus on delivering its Elevation strategy

by focusing on store experience, digital and product. The

board of Frasers Group is grateful to staff in Bobs and

EMS for their loyal service and wishes these businesses

every success for the future.

The Group disposed of a number of freehold and

long leasehold retail parks held by its wholly owned

subsidiaries post period end for a total of £205m.

Frasers Group fascias will operate from leases within

these properties where appropriate. Frasers Group in

the ordinary course of business purchases and sells

properties from time to time.

Outlook

Under Michael Murray’s direction and leadership, we are

confident the Group is well positioned for a successful

year ahead.

Relationships with our key brand partners are better

than they have ever been, and we will continue to invest

in supporting and growing these relationships.

The business cannot overlook the many significant

economic factors which are headwinds on the business,

including challenges with supply chain, increased energy

costs and cost of living – these factors could have an

impact on business potential.

However, we look forward to growing the business both

organically and through acquisitions, to ensure we

remain a market leader globally. We believe the growth

factors will mitigate these headwinds and we will be

looking to grow our Adjusted PBT to between £450m

and £500m in FY23.

Dividend and Share Buybacks

The Board has decided not to pay a final dividend in

relation to FY22 (FY21 £nil). The Board remains of the

opinion that it is in the best interests of the Group and its

shareholders to preserve financial flexibility and facilitate

future investments and other growth opportunities. The

payment of dividends remains under review.

Our share buyback programme during the year has

continued which is a demonstration of our commitment

to shareholder returns, our confidence in the Company

and the strategy for future growth.

David Daly

Non-Executive Chair of the Board

20 September 2022

FRASERS GROUP PLC ANNUAL REPORT 2022

11

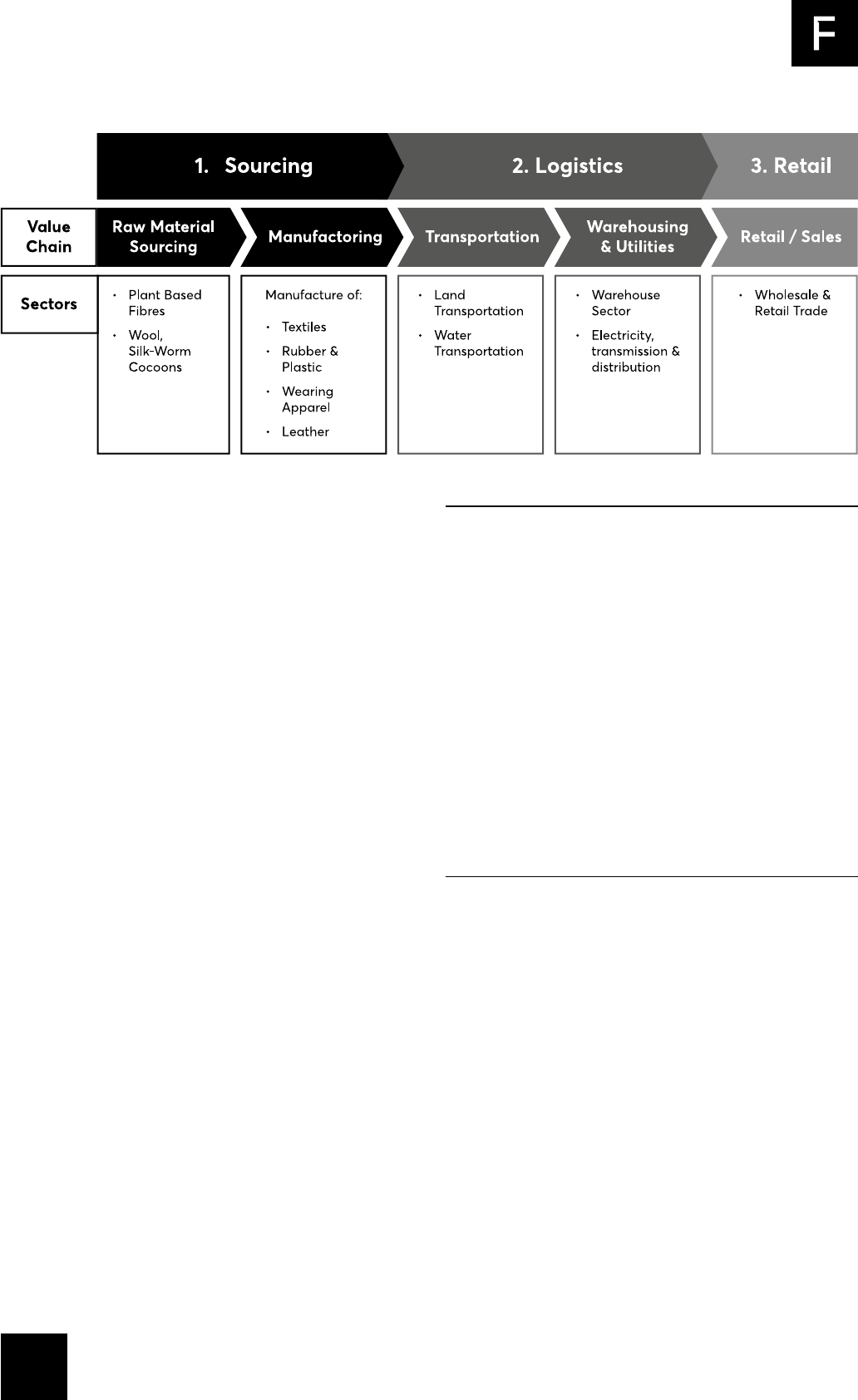

OUR BUSINESS

Business Model

Founded as a single Store in Maidenhead in 1982,

Frasers Group Plc today operates a diversified portfolio

of sports, fitness, premium lifestyle and luxury store

fascias. The Group’s colleagues work together with our

suppliers and our third-party brand partners to serve

customers in over 20 countries. The Group aspires to

be an international leader in sports, lifestyle and luxury

retail. The Board is committed to treating all people with

dignity and respect. We value our people, our customers

and our shareholders and we strive to adopt good

practices in our corporate dealings. We aim to deliver

shareholder value over the medium to long term, whilst

adopting accounting principles that are conservative,

consistent and simple. Our strategy is set out in the ‘Our

Strategy – To build the World’s most compelling brand

ecosystem’ section of this report.

Our business model remains consistent in providing

customers with the World’s best brands. This requires

us to have the right product, in the right place, at the

right time and at the right price. Our vision is to become

the elevated, multi-channel platform for our Sports

Retail and Premium Lifestyle fascias. To this end, we are

elevating across all channels to enhance the customer

journey every step of the way.

The Group’s business model is explained in greater

detail below. This includes an outline of our fascias and

retail channels, management of our property portfolio,

our people, our third-party brand partners, our Group

brands and our centralised support functions.

Business Structure

The Group is structured across five business segments:

UK Sports Retail, Premium Lifestyle, European Retail,

Rest of World Retail and Wholesale & Licensing.

In UK Sports Retail, we offer a complete range of

sporting apparel, footwear and equipment through our

predominant fascia, Sports Direct. This segment also

includes our lifestyle fascia USC. Our current forward-

looking view is that the majority of our offering to

customers must include leading third-party brands.

The elevation of our sports retail proposition is key to

ensuring we are fully aligned with the future direction

and ambitions of these brand partners. UK Sports

Retail includes core sports retail store operations in the

UK, plus all the Group’s sports retail online business

(excluding Bob’s Stores, Eastern Mountain Sports and

Sports Direct Malaysia), the gyms, SRL, the Group’s

Shirebrook campus operations, retail store operations in

Northern Ireland, Evans Cycles and the GAME UK stores

and online business.

In Premium Lifestyle, we are developing the Group’s

premium and luxury offering, which consists of the

FLANNELS, Frasers, House of Fraser, Jack Wills and

Sofa.com fascias, along with Cruise and van mildert. We

aim to offer fashion-conscious consumers a luxurious,

multi-brand retail destination with high-end and

on-trend products.

In European Retail, we are evolving our customer

proposition in line with the Elevation strategy, while also

seeking to increasingly tailor our proposition to the local

markets in which we operate. These include the Republic

of Ireland and continental Europe.

In Rest of World Retail, we operate stores trading as

Bob’s Stores and Eastern Mountain Sports and we

also have stores trading as Sports Direct in Malaysia.

Subsequent to the period end the Bob’s Stores and

Eastern Mountain Sports fascias and their corresponding

e-commerce offerings were disposed of, further detail

can be found in note 16.

In Wholesale & Licensing, the Group retains a portfolio

of World-famous heritage brands, which we offer via

our fascias, and also wholesale and license to partners

internationally. Our own brands include Everlast,

Lonsdale, Karrimor and Slazenger. The Group is also

proud to have a number of sporting and entertainment

personalities as ambassadors, as well as supporting

sporting events.

Multi-Channel Elevation strategy

Our Elevation strategy continues to work towards

improving our offering to customers across all our

channels, including marketing, social media, product,

digital and in-store. This aims to enable the Company,

along with our third-party brand partners, to connect

with customers via a consistent voice across multiple

platforms, including online, mobile and on the high

street. This strategy enables our stores and our online

operations to complement each other.

The websites for each of our core fascias in the UK,

including SPORTSDIRECT.com, USC.co.uk, FLANNELS.

com, Houseoffraser.co.uk and GAME.co.uk, have

undergone significant enhancements to facilitate

optimum appeal to consumers. Our product offering

across these core fascias, both in-store and online,

aims to create a compelling shopping experience in

key categories that include, amongst others, football,

women’s, kids, running, cycling, lifestyle, fashion, luxury

and gaming.

FRASERS GROUP PLC ANNUAL REPORT 2022

12

We offer product across a range of price points,

including good, better and best. This enables us to

offer more premium products, which is net-new to

the business. This gives consumers a greater range

of choices for those who wish to shop for premium

products, whilst still retaining our original entry-level and

continuity product offerings.

Progression of the Elevated Store Model

The Group remains firmly committed to the Elevation

strategy across fascias and territories building on the

momentum gained over recent years.

For Sports Direct, the beginning of the financial period

welcomed the opening of the Oxford Street, London

flagship store following a significant refurbishment.

This store showcases the elevated flagship concept in

one of Europe’s most iconic retailing destinations. A

further flagship Sports Direct store was opened after

the financial period end in Birmingham city centre,

and additional markets are being explored to deliver

equivalent flagship stores.

To complement the elevated Sports Direct concept,

store-in-store models continue to be refined for our

Evans Cycles and GAME fascia’s providing a more

diverse offer in-store.

A significant milestone over the period was the first

FLANNELS flagship store opening in Sheffield, with

this large format incorporating new categories such as

beauty and food & beverage. After the period end, the

FLANNELS flagship concept reached new heights with

the opening of the largest FLANNELS store to date

in Liverpool, covering 120,000 sq ft over seven floors.

The new store introduces new experiences such as the

boutique fitness brand Barry’s Bootcamp.

Post period end a new Jack Wills concept store was

launched in Derby. To complement this new concept a

store-in-store model has also been developed, having

been launched in selected USC locations.

Finally, a new Everlast Gym concept was delivered in

Denton, Manchester. This elevated concept sets the

new standard for the division, with more sites to follow.

Our People

The Group’s policy is to treat all our people with dignity

and respect. Frasers Group colleagues work together

across all areas of the business and we are proud that

Frasers Group Plc is one of the first public companies

in the UK to make an elected Workers’ Representative

a Board member. We welcome all new colleagues into

the Group following the acquisitions in the year and post

period end and those who joined us through the Frasers

Group Elevation Programme as well as all other

new recruits.

Remuneration and Rewards

Our policy is to foster a reward-based culture that

enables our colleagues to share in the success of the

Group. It is Company policy to pay above the statutory

National Minimum Wage, including rates that are

above the statutory National Living Wage for those

over 23 years of age in the UK. In addition to this, in the

current period the Group paid awards and incentives of

approximately £15.0m, from which both permanent and

casual colleagues benefitted.

Our Fearless 1000 share scheme will result in 1,000 of our

Fearless colleagues, who live and breathe our values -

thinking without limits and take the team with you, don’t

hesitate and act with purpose and own it and back

yourself - being eligible to receive share bonuses ranging

from £50k right up to £1m, if the share price is at £10 at

the vesting dates. See note 25 for further details.

Workers’ Representative

The Frasers Group Workers’ Representative is Cally

Price, a Manager at our Cardiff Bay store. The Workers’

Representative has a unique insight into the Group

and will speak on behalf of the Group’s workforce at all

scheduled meetings of the Board, in order to facilitate a

healthy and constructive dialogue.

Colleague Engagement

In addition to the Workers Representative, the Company

has an ongoing dialogue with colleagues via an

initiative called ‘Your Company, Your Voice.’ This is a

system whereby colleagues are able to raise any issues

of their choosing via a number of different routes, both

physical and digital. This feedback is passed to senior

management and the Workers’ Representative for

review and appropriate action.

Our Global Third-Party Brand Partners

We work with our leading third-party global brand

partners and provide significant prominence for them

with our customers across all our platforms.

Our third-party and Group brands are managed by

central brand and marketing teams. This centralised

structure significantly benefits the Group by enabling

the individual brands to participate in Group buying

and sourcing; aggregated supplier relationships and

enhanced supply chain disciplines; Group inventory

monitoring and replenishment; and more inspired and

harmonious visual merchandising in-store.

FRASERS GROUP PLC ANNUAL REPORT 2022

13

OUR STRATEGY

Frasers Group believes in the power of brands. We serve

them, nurture them, and invent them. Today more than

ever, the World looks to Brands for ideas, inspiration

and meaningful change, crexating value for people and

elevating the everyday.

Our strategy is aligned to this purpose and is based on

three interconnected focus pillars – the brands we sell,

our digital offering and our physical stores. These are

supported by a set of enablers, focused on our people,

systems, automation and data. By continuing to elevate

our performance across all areas of our strategy, we will

achieve our vision: to build the World’s most compelling

brand ecosystem.

TO

BUILD

THE

WORLD’S

MOST

COMPELLING

BRAND

ECOSYSTEM

FRASERS GROUP PLC ANNUAL REPORT 2022

14

Strategy Key Achievements In FY22 Priorities for FY23

Brands

Our customers look to brands to elevate their

everyday. They want to have the choice of the

World’s best brands, whether in sports, lifestyle or

luxury. Accessibility is essential for our success. To

achieve our vision, we focus on building excellent

relationships with our brand partners, unlocking

the best talent and product.

This powerful brand offering is supported by our

complementary range of own brands, where we

aim to offer unrivalled choice and value, and

drive growth through meaningful partnerships

and brand collaborations. We will continue

to consider strategic acquisitions that bring

attractive brands into the Group.

During FY22, our achievements included:

• Further growing our relationships with key

brand partners, such as Nike, adidas, Gucci,

Balenciaga, Mulberry and Hugo Boss, and

establishing new, innovative brand partners

such as Hermes Beauty, On Running

and Jacquemus.

• Supporting our key strategic brand partner,

Hugo Boss AG, with an increased Strategic

Investment, reflecting our growing relationship,

our confidence in its future and the potential

for synergies between our businesses.

During FY23, our priorities are to:

• Continue to nurture and strengthen our brand

partner relationships and further improve our

access to their best product and talent.

• Invest in and grow our own-brand portfolio, to

ensure they remain relevant to consumers and

pioneer the market.

• Invest in the best talent for our businesses, so

that our partners continue to have consistent

and effective communication, to ensure that

they have clear insight into the businesses’

strategic goals.

Digital

We aim to elevate our digital experience to meet

the demands of consumers and brands and offer

an outstanding experience.

Through our digital Elevation strategy, we

are continuing to invest more than £100m to

elevate our proposition across our channels. This

investment has and will further build on our core

digital foundations, to support future growth

and agility.

A key focus remains our online customer

experience, which includes investment into

platforms that will reinvent engagement, data,

marketing and customer service.

During FY22, our achievements included:

• Significantly improving the digital consumer

experience across all touchpoints within the

Group.

• Investing and working alongside industry

leaders, ensuring our web business has

remained relevant with strong performance.

• Integrated 360 marketing initiatives to

demonstrate a cohesive and better reflecting

brand image for our fascia’s.

During FY23, our priorities are to:

• Continue to invest in our online retail

capabilities, particularly on the luxury

side of the business, which will focus on

merchandising, brand adjacencies and visual

representation.

• Pioneer our approach to digital marketing

through the latest trends and consumer

insights, to ensure we are industry leaders

within this market.

• Invest in our payment platform strategy.

Physical

The elevation and concept innovation of our

physical store portfolio is a fundamental part of

our Group-wide strategy.

Across our three pillars of Sports, Premium and

Luxury, we will continue to:

• Invest in new strategic locations and

acquisitions.

• Elevate and improve our current estate,

particularly for Sports Direct.

• Give consumers access to unrivalled luxury

destinations across the UK.

• Invest in retail efficiencies which will improve

our operating, technology, and stock

capabilities.

During FY22, our achievements included:

• Opening a series of our new-concept flagship

stores, including:

• FLANNELS Sheffield and FLANNELS

Leicester, which also saw the delivery of

our first ever food & beverage concepts

and the launch of

FLANNELS Beauty.

• Sports Direct Birmingham New Street

• Continuing to open new location stores

across UK and Europe, including Brighton,

Southampton, and Hertfordshire.

• Significantly investing in our flagship

FLANNELS Liverpool on Parker Street, which

opened to great acclaim in

June 2022.

• Committing to over 500,000 sq. ft of vacant

retail space in the Irish market with recent

store openings in Derry, Cork,

and Galway.

• Acquiring Boucher Retail Park in

Northern Ireland.

During FY23, our priorities are to:

• Roll out new elevated stores across

the Group.

• Invest in new concepts and retail partner

collaborations across key categories which

will focus on fitness, home, and beauty.

• Develop and improve operational excellence

across our retail portfolio.

• Progress the ongoing elevation and

improvement of our existing store portfolio.

• Strategise and select key destinations across

Europe for expansion.

Enablers

We need to have talented people who will

enable us to succeed, supported by training that

empowers them to achieve.

To attract new talent, we will continue to develop

our employer brand, while further improving

internal communication to drive engagement

with existing colleagues.

We will also continue to invest in our systems and

automation to enhance efficiency, and in our data

capabilities, so we can make data-driven decisions.

During FY22, our achievements included:

• Doubling down on our investment in people,

launching a new careers website, introducing

new roles and programmes focused on

learning and development, reinvigorating our

retail pay rates and incentives and recruiting

over 60 new high-potential people into our

early careers programmes.

• Connecting through regular communication

and videos, to create transparency with our

Leadership team.

• Further investing in automation, now claiming

one of the largest auto stores in the World.

• Enhancing data sharing with suppliers

through electronic data interchange (EDI),

improving management of stock and

streamlining supplier payment processes.

During FY23, our priorities are to:

• Build out clear career pathways in our

Commercial function, to enable the growth

we need in this area over the coming years.

• Continue to drive a high-performance culture,

with the introduction of more regular updates

and support around colleague performance.

• Significantly expand our Retail development

offering.

• Launch a new internal comms and

engagement platform to better connect

people across our business and share key

updates and successes.

• Continue onboarding products and suppliers

onto EDI.

• Capture customer data and insights through

growth in our digital business, digital

marketing and the roll-out of our loyalty

programme.

KEY PERFORMANCE INDICATORS

The Board manages the Group’s performance by reviewing a number of key performance indicators (KPIs).

The KPIs are discussed in this Chief Executive’s Report and Business Review, the Financial Review, the Environment

section and the ‘Our People’ section.

The table below summarises the Group’s KPIs.

52 weeks ended

24 April 2022

52 weeks ended

25 April 2021

52 weeks ended

26 April 2020

Group revenue

£4,805.3m £3,625.3m £3,957.4m

Reported PBT

£335.6m £8.5m £143.5m

Adjusted PBT

(1)

£339.8m (£39.9m) £115.1m

Cash flow from operating activities

£628.9m £578.3m £425.2m

Net assets

£1,308.6m £1,211.0m £1,280.3m

Non-Financial KPIs

Number of retail stores

(2)

1,552 1,547 1,534

Workforce turnover

38.3% 28.9% 28.6%

Packaging recycling

(3)

14,405 tonnes 11,164 tonnes 12,358 tonnes

The Directors have adopted Alternative Performance

Measures (APM’s). APMs should be considered in

addition to IFRS measures. The Directors believe

that Adjusted profit before tax (PBT) provide further

useful information for shareholders on the underlying

performance of the Group in addition to the reported

numbers, and are consistent with how business

performance is measured internally. They are not

recognised profit measures under IFRS and may not be

directly comparable with ‘adjusted’ or ‘alternative’ profit

measures used by other companies.

From FY22 management changed the main reporting

KPI from Underlying EBITDA to Adjusted PBT. Adjusted

PBT is profit before tax less the effects of exceptional

items, realised foreign exchange, fair value adjustments

to derivative financial instruments included within

Finance income/costs, fair value gains/losses and profit

on disposal of equity derivatives, and share schemes.

This change has been reviewed by the Audit Committee

which has appropriately challenged management on

the presentation and the adjusting items included in

this APM.

(1) The method for calculating adjusted PBT is set out in note 4 and the Glossary.

(2) Excluding associates and stores in the Baltic states that trade under fascias other

than SPORTLAnd or SPORTSDIRECT.com. and other niche fascias. Includes GAME

and Sofa.com concessions.

(3) Cardboard and plastic recycling.

Management has taken this decision for the following

reasons:

• with the continued significant investment in and roll

out of our Elevation strategy, on both the physical

and digital fronts, the importance of depreciation

and amortisation to both the Board and our

stakeholders in terms of assessing performance has

grown;

• our understanding from a number of financial

sectors including the banking sector is that

accounting for IFRS 16 Leases is becoming an

increasingly important consideration; and

• with this new measure being introduced we are

trying to align with the Financial Reporting Council’s

thematic standpoint with regard to ‘alternative

performance measures’ as far as possible whilst

retaining a degree of interpretation given factors

outside of our control, such as FX and fair value

movements in our Strategic Investments which

are exceptionally difficult to forecast, particularly

months in advance.

FRASERS GROUP PLC ANNUAL REPORT 2022

16

Group Revenue

The Board considers that this measurement is a key

indicator of the Group’s growth.

Reported Profit Before Tax

Reported PBT shows both the Group’s trading and

operational efficiency, as well as the effects on the

Group of external factors as shown in the fair value

movements in Strategic investments and FX.

Adjusted Profit Before Tax

Adjusted PBT shows how well the Group is managing

its ongoing trading performance and controllable costs

and therefore the overall performance of the Group.

Cash Inflow from Operating Activities

Cash inflow from operating activities is considered

an important indicator for the Business of the cash

available for investment in the Elevation strategy.

Net Assets

The Board considers that this measurement is a key

indicator of the Group’s health.

Number of Retail Stores

The Board considers that this measure is an indicator

of the Group’s growth. The Group’s Elevation strategy

is replacing older stores and often this can result in the

closure of two or three stores, to be replaced by one

larger new generation store.

Workforce Turnover

The Board considers that this measure is a key indicator

of the contentment of our people. for more details refer

to the retention section of the ‘Our People’ section of this

report.

Packaging Recycling

The Board considers that this measurement is a key

indicator of our impact and commitment to the best

environmental practices. for more details refer to the

environment section of this report.

FRASERS GROUP PLC ANNUAL REPORT 2022

17

CHIEF EXECUTIVE’S REPORT AND

BUSINESS REVIEW

Clear Vision

We are accelerating our strategy to provide consumers

with access to the World’s best sports, premium and

luxury brands by providing a World-leading retail

ecosystem. Aligned with this vision, we have defined the

Group’s purpose:

To elevate the lives of the many by giving them access to the

World’s best brands and experiences.

To deliver on this mission and purpose, and to maintain

the momentum created by the Elevation strategy, we

will continue to work closely with our key brand partners

such as Nike, Hugo Boss and Stone Island, to align

plans. Our brand partnerships are deeper and stronger

than they have ever been in the Group’s history. These

relationships will allow us to continue improving our

product offering and customer experience, by creating

the best platforms to enable our brands to succeed.

We are also redeveloping our sustainability strategy to

ensure we set ambitious targets and meet them in

the coming years.

Strategic Delivery

Our focus has been on executing our Elevation

strategy, with investments across our store portfolio,

brand partnerships and further innovations across our

operations. The strategic investments we made during

the year offer exciting new opportunities for Frasers

Group, whilst also supporting the long-term future of the

existing retail businesses, saving the jobs and

livelihoods of many.

Our recent acquisition of Studio Retail Limited provides

expertise and synergies which will enable us to deliver

flexible payment models in the future. Our post period

end acquisitions of the digital-first fashion brands

Missguided and I Saw It First allows us to unlock the

latest trends in women’s fashion and e-commerce.

To strengthen our European expansion strategy,

subsequent to the period end we acquired the leading

Danish sport retailer SportMaster.

We will also continue to divest non-core assets that fall

outside our vison and key focus segments, such as our

post period end disposal of Bob’s Stores and Eastern

Mountain Sports in America. Further details can be

found within note 16.

Increased PBT Guidance

We are alive to the challenging economic conditions at

present, with inflationary pressures and supply chain

disruption causing challenges for many businesses

operating in the retail sector. As well as the significant

increase in general running costs, we are fighting

against a fundamentally flawed business rates system

which is yet to be addressed. Linked to these are the

cost-of-living pressures facing many of our consumers.

As a result, we have been conservative in our forecasting

for the next financial year. However, with our proven

strategy and strong operational backbone, we are

confident of achieving a healthy growth to between

£450m and £500m of Adjusted PBT.

Store Openings

Our Elevation strategy keeps exceeding our

expectations. Its strength is demonstrated by our recent

store openings of FLANNELS Liverpool and Sports

Direct Birmingham.

FLANNELS Liverpool is one of the largest luxury retail

investments in the UK to date. This revolutionary

seven floor, 120,000 sq. ft store in a historic building

brings a ground-breaking fashion, beauty, wellness

and restaurant experience to the North of England. It

boasts a leading collection of experiences including

boutique fitness phenomenon Barry’s Bootcamp, the

first ever of its kind in a retail environment. Our regional

flagships do not only benefit the physical environment,

but also allow us to bring in new categories and brands

that our consumers can access online through our

omnichannel platforms.

Sports Direct Birmingham follows our Oxford Street,

London, opening last summer. Both stores demonstrate

the pinnacle of our journey and showcase the strength

of our Elevation strategy. The consumer experience

has been enhanced at every stage including digital

touchpoints, activations and integrations of other

group brands such as Evans, USC and GAME, giving

access to a wider variety of products and experiences.

FRASERS GROUP PLC ANNUAL REPORT 2022

18

Big Believers in Physical Retail

We have consistently criticised the archaic business rates

regime and the need for reform. Unfortunately, these

issues remain unaddressed and are now coupled with

soaring construction and store fit out costs, making

for an extremely challenging environment to open and

operate physical stores. While others have shied away

from committing to physical retail in these difficult times,

we are convinced that consumers will still flock to stores

for great brands and experiences. This belief has allowed

us to build remarkable momentum, bucking market

trends. We will continue to invest in new store openings,

refurbishments and flagship opportunities, to bring

the World’s best brands and experiences to untapped

markets.

Digital and Operational Transformation

As part of our growth strategy, we are continually

innovating across our supply chain and logistics to

drive further efficiencies. At our Shirebrook site, home

to our distribution centre, we have invested over £200m

in automation. This makes us the biggest AutoStore in

Europe and vastly improves our digital capabilities.

This has provided us with significant operational

efficiencies and supported the smooth integration of

acquisitions into the Frasers Group platform, enabling

both our own brands and brand partners to benefit from

our World-leading operations and logistics capabilities.

At Shirebrook, we now have approximately 2 million sq.

ft of warehousing, which enables us to process up to 4

million units per week. This still leaves us with capacity

for further growth.

We have continued to iterate and improve across the

entirety of our Frasers Group platform. Most notably

we have trialled a new headless e-commerce platform

on our Malaysian site, with a view to roll-out across

the Group. This will be a transformative step for the

Group, allowing us to be more agile when entering new

territories or deploying changes to our technology stack.

Global Growth

We also have extensive ambitions to grow the business

outside of the UK and will be exploring the potential

for further international expansion through acquisitions,

joint ventures and organic openings. We have already

begun to expand our operational capabilities in Europe,

with a new development site in Bitburg, Germany set to

open in the coming years. This will have up to 2.4million

sq. ft of warehouse and distribution space, handling

approximately 300 million units annually. This will

support our growth across continental Europe.

Talent and Partners

To support the Group in executing our ambitious strategy,

I am proud to have built an excellent senior team made

up of outstanding talent. They are the driving force

behind the Group’s ambitious culture, bringing together

dynamic, talented and motivated teams to drive

growth across the business. I have made it a priority

to strengthen Frasers Group’s management team by

creating several new roles. Alongside the management

team, we will look to support the business by adding

relevant talent and expertise to the Board

when appropriate.

Finally, thank you to our people and partners for your

continued support. I am proud of the steps we have

taken this year in transforming the trajectory of Frasers

Group and look forward to another exciting year of

innovation, impact and growth.

Michael Murray

Chief Executive Officer

20 September 2022

FRASERS GROUP PLC ANNUAL REPORT 2022

19

Performance Overview

Group revenue increased by 32.5% to £4,805.3m in

the year. UK Sports Retail revenue increased by 34.1%

to £2,640.1m, Premium Lifestyle revenue increased by

43.6% to £1,056.6m, European Retail revenue increased

by 28.4% to £790.2m, Rest of World Retail revenue

decreased by 1.6% to £150.3m and Wholesale &

Licensing revenue increased by 9.7% to £168.1m.

Group gross margin in the year has improved compared

with the prior year with a small increase of 130 basis

points from 42.2% to 43.5%. UK Sports Retail margin

increased 100 basis points to 43.1% (FY21: 42.1%),

largely due to the continually improving product

mix. Premium Lifestyle’s gross margin was 44.9%

(FY21:44.9%), consistent with the prior year as product

margins were maintained over the period. European

Retail gross margin increased to 42.7% (FY21: 39.0%),

largely due to continually improving product mix in

the core business. Rest of World Retail gross margin

increased to 51.0% (FY21: 41.9%), largely due to

decreased inventory provisions within the US businesses

as inventory management was significantly improved.

Wholesale & Licensing gross margin decreased to 37.5%

(FY21: 44.1%), largely due to product mix within the US

wholesale division.

Group Selling, distribution and administrative expenses

increased by 20.5% largely driven by increased store

costs due to the reopening of stores after lockdowns

due to the Covid-19 pandemic, no repeat of the prior

year Government support schemes such as CJRS

(Coronavirus Job Retention Scheme), business rates

relief in the prior year particularly in House of Fraser and

increased investment in marketing.

There were property related impairments in the period

totaling £227.0m (FY21: £317.0m), including £76.8m in

relation to right-of-use assets (FY21: £168.2m), £106.5m

in relation to freehold land and buildings (FY21: £84.4m),

£2.0m in relation to long-term leasehold (FY21: £3.9m),

£40.7m of other property, plant and equipment (FY21:

£59.9m) and £1.0m of investment properties (FY21:

£0.6m). Property related impairments have been

recognised following a reassessment of future expected

cash flows largely driven by supply chain issues, the

increased cost of living, the change in consumer

behaviour in moving from physical to online shopping,

the impact of direct-to-consumer and increasing costs

as a result of Brexit. Further details including sensitivity

analysis are included within note 2.

Depreciation and amortisation charges have decreased

by 15.4% to £260.0m (FY21: £307.5m) largely due to prior

period impairment and a decrease in freehold land and

buildings depreciation, following the change in useful

economic life estimate in the period. See accounting

policies for further details.

As a result, Adjusted PBT for the year was £339.8m (FY21:

loss £39.9m). Excluding acquisitions and on a currency

neutral basis, Adjusted PBT increased to £371.9m from

a loss of £22.1m. UK Sports Retail Adjusted PBT was

£196.9m up from a loss of £12.8m in FY21, while Premium

Lifestyle Adusted PBT was £10.5m, up from a loss of

£7.8m in FY21. European Retail Adjusted PBT was £88.6m,

up from a loss of £51.3m in FY21. Rest of World Retail

Adjusted PBT was £32.7m, up from £12.2m in FY21 and

Wholesale & Licensing Adjusted PBT decreased to £11.1m

from £19.8m.

Group profit before tax increased to £335.6m (FY21:

£8.5m), driven by the strong reopening of stores after

lockdown, new FLANNELS stores, continued growth

in online in the premium lifestyle segment, continued

operating efficiencies, and the FY21 comparative

including Covid-19 related lockdowns, mitigated to some

extent by property related impairments of £227.0m.

Basic EPS for the year increased to 52.9p

(FY21: loss of 16.5p).

Within other comprehensive income, the Group’s

hedging contracts increased by £43.8m (FY21: decreased

by £16.5m) as a result of the fair value movements in the

period. With regard to the Group’s long-term financial

assets, fair value movements have resulted in a loss of

£8.1m (FY21: gain of £77.3m) in the period.

The Group generated cash inflows from operating

activities during the year of £628.9m, up from £578.3m in

the prior period, largely due to the increase in operating

profit year on year, offset by the increase in inventory.

Total Net assets as at the period end totalled £1,308.6m

compared to £1,211.0m in the prior period, largely due to

the profitability of the business mitigated by significant

share buybacks.

FRASERS GROUP PLC ANNUAL REPORT 2022

20

REVIEW BY BUSINESS SEGMENT

UK Sports Retail

The UK Sports Retail segment includes all of the

Group’s sports retail and USC store operations in the

UK (including Northern Ireland), all of the Group’s online

businesses (excluding Bob’s Stores, Eastern Mountain

Sports, Baltics and Malaysia), the Group’s gyms, Evans

Cycles, GAME UK stores and the Group’s Shirebrook

campus operations. UK Sports Retail is the main driver of

the Group and accounts for 54.9% (FY21: 54.3%)

of Group revenue.

52 weeks ended

24 April 2022

52 weeks ended

25 April 2021

(£m) (£m)

UK Sports Retail Revenue

2,640.1 1,968.5

Cost of Sales

(1,503.3) (1,139.2)

Gross Profit

1,136.8 829.3

Gross Margin %

43.1 42.1

Revenue increased 34.1% to £2,640.1m. Excluding

acquisitions, revenue increased 30.1%, largely due to

the strong reopening of stores after the last lockdown in

March 2021 and the comparative period being impacted

by lockdowns as a result of Covid-19.

UK Sports Retail gross margin increased to 43.1%

(FY21: 42.1%), largely due to the continually improving

product mix.

Adjusted PBT for UK Sports Retail was £196.9m (FY21:

loss of £12.8m), largely due to the strong reopening of

stores after the last lockdown in March 2021 and the

comparative period being impacted by lockdowns as

a result of Covid-19 and a reduction in property related

impairments in the current period (FY22: £103.4m

compared to FY21: £201.9m).

UK Sports Retail Store Portfolio

(3)

24 April 2022 25 April 2021

England

387 394

Scotland

37 39

Wales

30 31

Northern Ireland

19 21

Isle of Man

1 1

GAME UK (1)

259 247

Evans Cycles (2)

57 48

USC

18 25

Total

808 806

Opened

90 93

Closed

(88) (98)

Acquired

- 42

Area (sq.ft.)

approx. 6.7m approx. 6.5m

(1) The GAME UK store numbers include 125 concessions operating within

Sports Direct fascia stores (FY21: 71) and does not include BELONG arenas.

(2) The Evans Cycles store numbers include 2 concessions operating within

House of Fraser fascia stores (FY21: 1).

(3) Table excludes the Group’s standalone gyms.

FRASERS GROUP PLC ANNUAL REPORT 2022

21

Premium Lifestyle

Premium Lifestyle consists of FLANNELS, Cruise, van

mildert, House of Fraser, Jack Wills and Sofa.com fascia

stores and corresponding web sales.

52 weeks ended

24 April 2022

52 weeks ended

25 April 2021

(£m) (£m)

Gross Transaction Value (GTV)

(1)

1,133.8 788.1

Revenue

1,056.6 735.6

Cost of Sales

(581.8) (405.3)

Gross Profit

474.8 330.3

Gross Margin %

44.9 44.9

Adjusted PBT

10.5 (7.8)

(1) GTV being gross sales net of VAT, discounts and returns, and gross sales where the

Group acts as agent.

Revenue grew 43.6% to £1,056.6m. This was largely due

to new FLANNELS stores, continued growth in online,

growth in House of Fraser, and the impact of Covid-19

related lockdowns on the prior period comparative.

Gross margin was 44.9%, consistent with the prior year

as product margins were maintained over the period.

It should be noted that despite year-on-year trading

improvements in the House of Fraser business, business

rates in their current form continue to be a significant

and disproportionate cost to House of Fraser.

Adjusted PBT for Premium Lifestyle increased from a

loss of £7.8m in FY21 to a profit of £10.5m for the period,

largely due to new FLANNELS stores, continued growth

in online, the strong reopening of stores after the last

lockdown in March 2021, offset by more significant

property related impairments in the current period (FY22:

£103.5m compared to FY21: £40.9m).

Premium Lifestyle Store Portfolio

24 April 2022 25 April 2021

FLANNELS

53 41

Jack Wills

(2)

52 60

House of Fraser / Frasers

(2)

39 43

Sofa.com

(1)

23 24

Cruise

5 5

18 Montrose

4 3

van mildert

1 1

Garment Quarter

1 1

Psyche

1 1

Total

179 179

Opened

21 12

Closed

(21) (17)

Acquired

- 5

Area (sq.ft.)

approx. 4.0m approx. 4.2m

(1) Sofa.com store numbers include 17 concessions operating within House of Fraser

fascia stores (FY21: 17).

(2) Jack Wills and Frasers stores in Republic of Ireland are shown in the European

store numbers as opposed to the Premium Lifestyle store numbers.

FRASERS GROUP PLC ANNUAL REPORT 2022

22

European Retail

The European Retail division includes the Group’s sports

retail store management and operations in Europe,

including the Group’s European distribution centres in

Belgium and Austria, stores and corresponding web

business in the Baltic regions and GAME Spain stores

and corresponding web business.

52 weeks ended

24 April 2022

52 weeks ended

25 April 2021

(£m) (£m)

Revenue

790.2 615.2

Cost of Sales

(452.9) (375.5)

Gross Profit

337.3 239.7

Gross Margin %

42.7 39.0

Adjusted PBT

88.6 (51.3)

Revenue increased 28.4% to £790.2m. On a currency

neutral basis and excluding acquisitions, European Retail

revenue increased by 33.4%, largely due to temporary

store closures as a result of Covid-19 in the prior period

comparative.

Gross margin increased to 42.7%, largely due to

continually improving product mix in the core business.

Adjusted PBT for European Retail improved from a loss of

£51.3m in FY21 to a profit of £88.6m for the period, largely

due to the strong reopening of stores after lockdown, the

comparative period being impacted by lockdowns as a

result of Covid-19, especially in Ireland and significant

property related impairments in the prior period of

£71.6m compared to £17.9m in the current period.

All of the following stores are operated by companies

wholly owned by the Group, except Estonia and Latvia

where the Group owns 60.0% and Lithuania where the

Group owns 51%.

European Retail Store Portfolio

(1)

24 April 2022 25 April 2021

GAME Spain

235 236

Republic of Ireland

(1)

43 39

Belgium

34 34

Portugal

21 20

Estonia

(2)

20 21

Austria

19 20

Lithuania

(2)

19 18

Latvia

(2)

18 17

Poland

13 14

Slovenia

13 13

Czech Republic

12 12

Spain

10 9

Hungary

8 8

Cyprus

6 6

Holland

5 5

Slovakia

5 5

France

4 4

Luxembourg

2 2

Germany

1 2

Iceland

1 1

Total

489 486

Opened

12 13

Closed

(9) (38)

Acquired

- -

Area (sq.ft.)

approx. 3.7m approx. 3.6m

(1) Excluding Heatons fascia stores

(2) Includes only stores with SPORTSDIRECT.com and SPORTLAnd fascias.

FRASERS GROUP PLC ANNUAL REPORT 2022

23

Rest of World Retail

Rest of World Retail includes sports stores in Malaysia

trading under the Sports Direct fascia, retail stores in the

US trading under Bob’s Stores and Eastern Mountain

Sports and their online businesses. In Malaysia the stores

are 51.0% owned by the Group.

52 weeks ended

24 April 2022

52 weeks ended

25 April 2021

(£m) (£m)

Revenue

150.3 152.7

Cost of Sales

(73.6) (88.7)

Gross Profit

76.7 64.0

Gross Margin %

51.0 41.9

Adjusted PBT

32.7 12.2

(1) GTV being gross sales net of VAT, discounts and returns, and gross sales where the

Group acts as agent.

Revenue decreased 1.6% to £150.3m, mostly due to the

US businesses offset by an increase in Malaysia. Gross

margin increased to 51.0% from 41.9%, largely due to

decreased inventory provisions within the US businesses,

as inventory management was significantly improved.

Adjusted PBT was £32.7m, compared to £12.2m in FY21,

largely due to overall operating efficiencies in the US

businesses.

Subsequent to the period end the Bob’s Stores and

Eastern Mountain Sports fascias and their corresponding

e-commerce offerings were disposed of.

Rest of World Retail Store Portfolio

24 April 2022 25 April 2021

Malaysia

34 33

Bob’s Stores

21 22

Eastern Mountain Sports

21 21

Total

76 76

Area (sq.ft.)

approx. 1.3m approx. 1.3m

Wholesale & Licensing

The portfolio of Group brands includes a wide variety of

World-famous sport and lifestyle brands. The Group’s

Sports Retail division sells products under these brands

in its stores, and the Wholesale & Licensing division

sells the brands through its wholesale and licensing

activities. The Wholesale & Licensing division continues

to sponsor a variety of prestigious events and retains a

variety of globally recognised celebrities and sporting

professionals as brand ambassadors.

52 weeks ended

24 April 2022

52 weeks ended

25 April 2021

(£m) (£m)

Wholesale

145.3 131.5

Licensing

22.8 21.8

Total Revenue

168.1 153.3

Cost of Sales

(105.0) (85.8)

Gross Profit

63.1 67.5

Gross Margin %

37.5 44.1

Adjusted PBT

11.1 19.8

Revenue increased by 9.7% to £168.1m. Wholesale

revenues were up 10.5% to £145.3m and Licensing

revenues increased 4.6% to £22.8m, largely due to the

prior period comparative being impacted by Covid-19.

Total gross margin decreased to 37.5% (FY21: 44.0%),

largely due to product mix within the US wholesale

division. Adjusted PBT decreased 43.9% to £11.1m (FY21:

£19.8m), largely due to impairment of goodwill in

the period.

FRASERS GROUP PLC ANNUAL REPORT 2022

24

PROPERTY REVIEW

The beginning of the financial year welcomed the

opening of the refurbished Sports Direct on Oxford

Street, London, showcasing the elevated store model

in one of Europe’s most iconic retailing destinations.

Further Sports Direct flagship locations in the pipeline

include Birmingham, which opened shortly after the

financial period end and Manchester, due to open late

FY23. Opportunities to deliver this flagship concept are

also being considered in various European capital cities.

In addition, a refurbishment model has been trialled

and is under development, to elevate appropriate stores

which are currently trading.

FLANNELS experienced significant new store activity

over the period with 15 new openings. The most notable

opening was delivering the first FLANNELS flagship store

in Sheffield incorporating beauty and food & beverage

elements across 55k sq ft. The outcome is a World-class

luxury offering receiving industry recognition. A second

FLANNELS Flagship store was also opened in Fosse Park,

Leicester, in the period. Further flagship sites have been

secured in Liverpool which is now trading, along with

Cardiff and Leeds which are both due to open during

FY24. FLANNELS will also be expanding its store network

into Ireland over the coming financial period. These will

be the first store openings outside of the U.K. for the

brand having secured sites in Dublin, Blanchardstown

and Cork.

The Group continues to identify large sites, which

working with collaborative landlords can be configured

to provide a multi fascia offering. Over the period sites

have been secured at Derby, Cork and Newbridge in

Ireland, to develop into Frasers and Sports Direct stores.

The main objective for the Group’s estate remains the

move to turnover-based rents. There has been significant

investment into new store concepts across all the

Group’s brands, including more recently the new Everlast

Gym concept as well as enhancements to existing brand

concepts such as the Sports Direct and FLANNELS

Flagship concepts. Where landlords are prepared to

co-invest in new stores the Group is prepared to enter

into long leases.

The Group remains acquisitive across fascias and

territories, with an exciting pipeline of new stores due to

open in the coming financial year; the number of new

store openings is expected to be comparable to FY22.

However, caution is being applied over shop fit costs,

which are being monitored closely and could influence

the store opening pipeline. In the usual manner, freehold

investment activity will continue to be used as an option

to secure space for the Group.

The business rates regime continues to be a challenging

landscape to navigate, particularly on large stores

and former department stores. With further clarity

required on the new regime effective April 2023 and the

uncertainty around transitional relief arrangements, the

Group is taking a cautious view on future rates liabilities.

Store Portfolio – UK Retail

Sports Stores in the UK (including Northern Ireland):

• Sports Direct is currently operating 387 stores in

England, 37 in Scotland, 30 in Wales and 19 in

Northern Ireland. There were 18 openings and 30

closures over the period. The majority of closures

were linked to new larger store openings and

closures, following the acquisition of the DW Sports

estate in FY21.

• Noteworthy openings include the Oxford Street

flagship (55k sq ft), Leicester Fosse Park (35k sq ft)

and Cheshunt (25k sq ft), a new market opening

following the successful asset management plan of

the retail park that the Group acquired in FY20.

• Store-in-store GAME/BELONG and Evans Cycles

concepts have been developed to complement

Sports Direct formats in selected locations. All new

store openings include a USC zone providing a

lifestyle offering, as part of the elevated store model

across all size formats.

Store Portfolio – Evans Cycles:

• There are currently 57 Evans Cycle stores trading, an

increase of nine stores over the period as a result

of ten openings and one closure. The Evans Cycles

store-in-store concept continues to be refined and

will be rolled out into selected future store openings.

Store Portfolio – GAME UK:

• The relocation program transitioning GAME stores

into selected Sports Direct stores continued over

the period and will continue throughout FY23. With

GAME now forming part of a significant number of

new Sports Direct store openings, the overall number

of GAME stores for the UK estate increased to 259,

having closed 50 and opened 62.

• The BELONG gaming arenas form part of GAME

stores in selected viable locations and have been

introduced to a number of elevated Sports Direct

stores. Note the GAME store numbers do not

include BELONG.

FRASERS GROUP PLC ANNUAL REPORT 2022

25

Store Portfolio – Premium Lifestyle

FLANNELS, Cruise and van mildert:

• Across the FLANNELS, Cruise and van mildert

fascias there was significant store activity with

16 openings and four closures resulting in a net

increase of 12 stores. Combining these fascias,

the total estate at the end of the financial period

amounted to 59 stores.

• Key openings for FLANNELS include the

Meadowhall flagship being the first FLANNELS store

to incorporate a beauty offering and F&B along

with the Leicester Fosse Park Flagship opening

shortly after. FLANNELS was also introduced on the

South Coast of England for the first time opening at

Southampton, Brighton and Portsmouth.

• After the financial period, the largest FLANNELS

flagship store to date was opened in Liverpool

covering seven floors over 120,000 sq ft and

introducing new experiences such as the boutique

fitness brand Barry’s Bootcamp.

• A refit programme refreshing older stores to the

new standard continued over the period and

will continue throughout the upcoming financial

period. There will be a focus on securing further

new stores in key incremental markets as well as

flagship locations.

• Finally, FLANNELS is due to launch in the Republic

of Ireland over FY23 having secured three new store

locations over the period. The secured locations are

in Dublin, Blanchardstown and Cork.

House of Fraser (HoF):

• At the end of FY22 there were 39 House of Frasers

stores trading, a net decrease of four stores after five

closures and one opening.

• Having come back into effect following relief over

the pandemic, the current business rates regime

remains a significant burden on the Hof estate

particularly given the large store sizes. Clarity

around the new regime effective April 2023 is

eagerly awaited and will be an influential factor on