This report does not constitute a rating action

Middle-Market CLO And Private

Credit Quarterly:

Harbor In The Tempest?

Q1 2023

Stephen Anderberg

Daniel Hu

Ramki Muthukrishnan

Evangelos Savaides

Jan. 27, 2023

Middle-Market Lending Key Takeaways

2

Takeaways

• 2022 saw more credit estimate upgrades than downgrades. However, this trend reversed in the fourth quarter. The slowdown in economic growth, coupled

with inflationary pressures and rising interest rates--and the consequent pressure on margins--weighed heavily on companies with high leverage and low

interest coverage ratios.

• Credit estimate upgrades continued to outpace downgrades by a ratio of 1.35 to 1 in 2022 compared to 1.31 to 1 for all of 2021. Improved earnings and better

balance sheets have seen many middle-market companies become candidates for upgrade.

• Among rated loan issuers, we expect the trailing-12-month Morningstar LSTA Leveraged Loan Index default rate to more than double to 2.5% by September

2023 under our base case, which is in line with the long-term historical average rate of 2.5%. Under our pessimistic case, we think defaults could increase to

4.5% over the same period.

• Selective defaults have seen a slight uptick as companies restructured terms of payment given macro-economic headwinds. We expect selective defaults to

continue to rise as more companies will look to restructure outside of the bankruptcy process. From 2020 through third-quarter 2021, conventional defaults

among credit estimated obligors were significantly lower than conventional defaults among rated broadly syndicated loan (BSL) loan issuers, partly due to

many amendments and other actions taken on middle-market loans that averted payment defaults.

Key Risks

• S&P Global Ratings forecasts a mild recession for the U.S. in 2023. We have lowered our GDP forecasts to 1.6% for 2022 and -0.1% for 2023.

• Cost inflation, supply issues, and labor constraints leading to margin compression could result in a pickup in credit estimate downgrades.

Middle-Market CLO Key Takeaways

3

Takeaways

• One middle-market CLO transaction saw two obligor defaults in fourth-quarter 2022, dropping the cushion on its junior-most overcollateralization (O/C) ratio

test to 2.06% from 4.73%. This was enough to (very slightly) reduce the average junior O/C cushion in our index of middle-market CLO performance metrics,

to 7.08% from 7.13% at the start of December 2022. Given the size of the average cushion, though, most middle-market CLOs are a long way off from

triggering an O/C test (see slide 11).

• The typical middle-market U.S. collateralized loan obligation (CLO) has much lower obligor diversity within its portfolio than a typical BSL CLO transaction.

But given that many middle-market CLO managers originate some of the assets in their CLO portfolios, there is much lower asset overlap and greater asset

diversity

between

CLOs from different middle-market CLO managers. See slide 16 for a full matrix of asset overlap between different middle-market CLO

managers.

• We provide other metrics at the CLO manager level on slide 17 and the largest obligors held by two or more middle-market CLO managers on slide 18.

• The level of asset purchases/new assets being added to middle-market CLO portfolios dropped during the year, to 5.33% of target par in fourth-quarter

2022 from 11.70% of target par in first-quarter 2022 (see slide 15). We attribute this to lower asset amortization and fewer loan refinancings in a less

accommodating market.

• Middle-market CLO par build was relatively strong in 2022, with the average CLO in our index (see slide 11) ending the year at 101.23% of target par, up from

100.76% of target par in January 2022. This is at least partly due to new loans being added to the portfolios at less than par (often 97.5% or 98%). However,

the rate of par growth slowed during the year, especially in Q4 2022, as the rate of new assets being added to CLO portfolios dropped.

• Middle-market CLOs saw few downgrades during the pandemic, with only seven ratings lowered during 2020, which is about 1.3% of the outstanding middle-

market CLO ratings, versus 13.0% of BSL CLO ratings lowered during 2020. On slide 12, we discuss some of the reasons why.

4

Industry Median of debt/EBITDA (x)

Internet software and services

8.46

Software

7.92

Road and rail

7.85

Real estate management and development

7.54

Insurance

7.38

Food products

7.33

Aerospace and defense

7.26

Wireless telecommunication services

7.15

Distributors

6.96

Life sciences tools and services

6.90

Top 10 Industries With The Highest S&P Global Ratings

Calculated Leverage Ratios In 2022

Top 10 Industries With The Lowest S&P Global Ratings

Calculated Interest Coverage Ratios In 2022

Credit Estimates | Median Leverage And Interest Coverage By Sector

Source: S&P Global Ratings. Source: S&P Global Ratings.

Industry Median interest coverage (x)

Software

1.42

Real estate management and development

1.53

Wireless telecommunication services

1.59

Aerospace and defense

1.66

Textiles, apparel, and luxury goods

1.80

Household products

1.86

Internet software and services

1.89

Road and rail

1.89

Capital markets

1.89

Health care technology

1.93

5

Number Of Outstanding S&P Global Ratings Credit Estimates (2012 – Q4 2022)(i)

Middle-Market CLOs | Growth In Outstanding Credit Estimates

(i)Covers all outstanding S&P Global Ratings U.S. credit estimates, including estimates for obligors not currently held within a CLO transaction.

CLO--Collateralized loan obligation. Source: S&P Global Ratings.

0

500

1,000

1,500

2,000

2,500

Jan. 2007 Jan. 2008 Jan. 2009 Jan. 2010 Jan. 2011 Jan. 2012 Jan. 2013 Jan. 2014 Jan. 2015 Jan. 2016 Jan. 2017 Jan. 2018 Jan. 2019 Jan. 2020 Jan. 2021 Jan. 2022

Outstanding credit estimates (no.)

6

Middle-Market CLOs | Credit Estimate Score Distribution

• Before the pandemic, about 75% of our

outstanding credit estimates were ‘b-’.

• This dropped to about 69% after the

pandemic induced downgrades of ‘b-’ credit

estimates into the ‘ccc’ category.

• By 2022, over 75% of outstanding credit

estimates were back at ‘b-’ as performance

of companies rebounded, and many obligors

saw their credit estimates raised back to ‘b-’

from the ‘ccc’ range.

Overall Credit Estimate Distribution By Issuer Count(i)

(i)Covers all outstanding S&P Global Ratings U.S. credit estimates, including estimates for obligors not currently held within a CLO transaction.

CLO--Collateralized loan obligation. Source: S&P Global Ratings.

2

7

69

16

6

3

9

76

9

3

0

10

20

30

40

50

60

70

80

b+ and above b b- ccc+ ccc and below

(% of issuers)

Issuer credit estimate

Outstanding as of Q4 2020 Outstanding as of Q4 2022

7

Middle-Market CLOs | Credit Estimates Raised And Lowered

• Downgrades peaked in the second quarter of

2020 due to the pandemic as we lowered

credit estimate scores to ‘ccc’/’sd’/’d’ on

over 85 entities.

• From second-quarter 2021 forward,

upgrades have continued to outpace

downgrades, until the fourth quarter of 2022.

• We can expect to see downgrades to rise

from margin compression due to increased

borrowing costs, inflation, and labor

constraints.

Credit Estimates Raised And Lowered By Quarter (2020 – Q4 2022)

Source: S&P Global Ratings.

20

5

16

18

25

32

40

45

55

35

39

25

41

110

40 40

44

22

28

14

22

26

34

32

0

20

40

60

80

100

120

Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022

Credit estimate (no.)

Raised Lowered

8

Credit Estimates

Raised And Lowered By Sector

As Of Q4 2022

Drivers of raised credit estimates:

• Growth in EBITDA

• Decrease in leverage

• Rebound from COVID-19

• Improved interest coverage

• Better operational performance

Drivers of lowered credit estimates:

• High leverage

• Weak liquidity

• Inflationary pressure

• Supply chain disruptions

• Acquisitive growth strategy

Source: S&P Global Ratings.

Top five sectors upgraded (overall percentage of upgrades) (%)

Sector exposure of total

credit estimates (%)

1

Healthcare Providers and Services

11.0 12.4

2

Hotels, Restaurants and Leisure

9.7 3.0

3

Software

9.7 13.9

4

Commercial Services and Supplies

7.8 5.8

5

Diversified Consumer Services

5.2 3.9

Top five sectors downgraded (overall percentage of

downgrades) (%)

Sector exposure of total

credit estimates (%)

1

Software

16.7 13.9

2

Healthcare providers and services

9.6 12.4

3

Food products

7.0 1.9

4

Commercial services and supplies

6.1 5.8

5

Professional services

5.3 5.1

154 Upgrades In 2022

114 Downgrades In 2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22

b+ and above

b

b-

ccc+

ccc

ccc-

cc/sd/d

9

Outstanding Credit Estimate Distribution By Issuer Count, (2007–Q4 2022)(i)

Credit Estimates | Credit Quality Over The Years

(i)Covers all outstanding S&P Global Ratings U.S. credit estimates, including estimates for obligors not currently held within a CLO transaction. CLO--Collateralized loan obligation. Source: S&P Global Ratings.

• Many of the companies we

assign credit estimates to are

financial sponsor-owned and

generally highly levered.

• The median EBITDA of these

companies was $24 million,

and the median adjusted debt

was about $175 million.

• Due to their weaker business

and financial risk profiles, a

large majority of these

companies tend to have credit

estimate scores at the lower

end of the credit spectrum,

especially ‘b-’.

March 2020:

Arrival of COVID-19

pandemic

10

Middle-Market Loan Performance | Default Rate Comparison

• After dipping to 0.26% in April, the Morningstar

LSTA Leveraged Loan Index default rate (yellow line)

among rated issuers increased to 0.69% in

December.

• The dashed blue line, which includes both selective

and conventional defaults among credit estimated

issuers, declined sharply to below 2.0% in August

2022 after peaking at nearly 8% in 2020.

• If we exclude selective defaults and focus only on

conventional defaults among credit estimated

issuers (solid blue line), the default rate was much

lower, increasing to about 2.5% in July 2020 before

declining below 0.25% by November 2022.

• From 2020 through third-quarter 2021, conventional

defaults among credit estimated obligors were

significantly lower than conventional defaults

among rated BSL loan issuers, partly due to many

amendments and other actions on middle-market

loans that averted payment defaults. This had the

effect of raising the level of selective defaults

among credit estimated issuers while decreasing

the level of payment defaults.

One-Year Lagging Default Rate: Credit Estimates Vs. LSTA Index

Source: S&P Global Ratings.

0

1

2

3

4

5

6

7

8

9

Jul. 2017 Jul. 2018 Jul. 2019 Jul. 2020 Jul. 2021 Jul. 2022

(%)

Credit estimate

default rate -

including

selective defaults

Morningstar/LSTA

Leverated Loan

Index - LTM # of

defaults / total

defaults

Credit estimate

default rate -

excluding

selective defaults

• The metrics below are averaged across an index of about 60 reinvesting S&P Global Ratings-rated U.S. middle-market (MM) CLOs issued across 21 different managers.

• The various credit metrics have held steady year to date, with the S&P Global Ratings' weighted average rating factor (SPWARF) remaining stable in 2022.

• Par balance has continued to gradually increase, along with junior overcollateralization (O/C) test cushions.

• Defaults reported within trustee reports led to notable declines in O/C ratios for one transaction in December, which affected the overall average O/C test cushion.

Middle-Market CLOs | Par Build Slows But Credit Metrics Hold Steady

Credit Metrics For Collateral In Reinvesting S&P Global Ratings

-Rated Middle-Market CLOs

Date ‘B-’ exposure (%)(i) ‘CCC’ exposure (%)(i) No rating/CE (%)(i) Non-performing (%)(i) SPWARF

Jr. O/C

test cushion (%)

Current par

(% target par)

Jan. 1, 2022 71.75 10.15

8.86

0.30 3858

6.63

100.76

Feb. 1, 2022 70.54 9.54

10.05

0.23 3870 6.71 100.81

Mar. 1, 2022 71.75 9.06

8.97

0.27 3842

6.90

100.86

Apr. 1, 2022 70.66 9.10

9.80

0.26 3856

6.93

100.90

May 1, 2022 73.04 8.92

7.45

0.35 3812

6.83

100.97

Jun. 1, 2022 73.09 9.22

7.12

0.31 3805

6.96

101.00

Jul. 1, 2022 74.19 9.12 7.16 0.37 3819 7.01 101.05

Aug. 1, 2022 73.61 8.80

8.27

0.32 3840 7.03 101.08

Sep. 1, 2022 73.02 9.06

8.10

0.26 3829

7.02

101.12

Oct. 1, 2022 73.59 9.00 7.74 0.24 3824

7.06

101.16

Nov. 1, 2022 73.72 9.54

7.30

0.22 3827 7.14 101.18

Dec. 1, 2022 73.51 9.82 7.13 0.22 3822 7.13 101.18

Jan. 1, 2023 73.71 10.28

6.40

0.21 3813 7.08 101.23

11

(i)By par amount as proportion of total CLO collateral. CLO--Collateral loan obligation. CE--Credit enhancement. O/C--Overcollateralization. SPWARF-S&P Global Ratings' weighted average rating factor.-Source: S&P Global Ratings.

Middle-Market CLOs | Few Downgrades In 2020 (And None Since)

Middle-market CLO transactions performed well during the pandemic, with only seven ratings lowered during 2020--about 1.3% of the outstanding ratings at the time, versus

13.0% of BSL CLO ratings lowered during the year. Why?

1) CLO structural reasons: Middle-market CLOs tend to have more par subordination and rating cushion at a given tranche level than a typical BSL CLO, with this being

positively correlated with the proportion of credit estimates in a CLO collateral pool. Middle-market CLOs also sometimes don’t issue lower rated (‘BBB’ and ‘BB’)

tranches, which would be more likely to see downgrades.

2) Fewer loan payment defaults: In 2020, parties to middle-market loan agreements were able to amend loan terms in ways that avoided payment defaults and

bankruptcy. This took different forms: rolling scheduled amort into the final bullet, allowing a company to payment-in-kind (PIK) upcoming interest payments, pushing

out loan maturities, etc. S&P Global Ratings treated some of these as selective defaults, but they reduced the level of conventional (payment) defaults on these loans

(see slide 10).

3) Some sponsors injected cash into their companies: This was done because, in some cases, sponsors saw value in infusing equity rather than losing control of the

company in a payment default/bankruptcy scenario. In a more protracted downturn, however, the economic incentives to do this might be less appealing.

4) CLO manager asset swaps: Under their CLO indenture provisions, middle-market CLO managers can swap out distressed assets from the portfolio and replace them

with loans from better performing companies. Because middle-market CLO managers often (although not always) hold the CLO equity in their transactions, and because

they often manage assets across different types of accounts, in some cases, they may be incentivized to move distressed assets outside of their CLO(s) and replace

them. It’s also often easier for a manager to work out a distressed loan outside the CLO.

12

BSL--Broadly syndicated loan. CLO--Collateralized loan obligation. Source: S&P Global Ratings.

U.S. BSL CLO And Middle-Market CLO Rating Changes (2020-2022)

CLO type

Total ratings

(mid-2020) Rating action Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Total

BSL CLOs 3,786

Downgrades 19 464 10 4 7 2 4 5 1 3 3 522

Upgrades 5 5 17 23 200 4 70 2 3 329

MM CLOs 553

Downgrades 7 7

Upgrades 2 13 2 5 2 2 26

13

BSL CLO Vs. MM CLO Loan Maturity Wall

BSL CLO Vs. MM CLO Loan Spreads

Comparing BSL CLOs

and MM CLOs:

• The maturity wall for loans

within BSL CLOs is pushed

out considerably further

than for the loans within

MM CLO transactions.

• Spreads above LIBOR/SOFR

are higher for loans in MM

CLOs by an average of

about 1.9% compared to

loans in BSL CLO

transactions.

• Credit spreads widened for

both middle-market and

BSL new issue loans

starting in late first-quarter

2022 for BSL loans and

third-quarter 2022 for MM

loans.

Middle-Market CLOs | Maturity Wall And Loans Spreads Vs. BSL CLO Assets

MM--Middle market. BSL--Broadly syndicated loan. CLO--Collateralized loan obligation. Source: S&P Global Ratings.

0

5

10

15

20

25

30

35

2023 2024 2025 2026 2027 2028 2029 2030 and later

(%)

BSL CLO exposures MM CLO exposures

0

5

10

15

20

25

30

0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 >8

(%)

BSL CLO exposures MM CLO exposures

MM--Middle market. BSL--Broadly syndicated loan. CLO--Collateralized loan obligation. Source: S&P Global Ratings.

14

Top 30 Industries (GICS categories) In MM CLO and BSL CLO Collateral Pools

Middle-Market CLOs | Software And Healthcare Are Largest Industries

MM--Middle market. BSL--Broadly syndicated loan. CLO--Collateralized loan obligation. Source: S&P Global Ratings.

0

2

4

6

8

10

12

14

16

Software

Healthcare Providers and Services

Commercial Services and Supplies

Insurance

Professional Services

IT Services

Hotels, Restaurants and Leisure

Health Care Technology

Diversified Consumer Services

Capital Markets

Trading Companies and Distributors

Chemicals

Food Products

Construction and Engineering

Healthcare Equipment and Supplies

Media

Distributors

Machinery

Aerospace and Defense

Specialty Retail

Electronic Equipment, Instruments and

Components

Food and Staples Retailing

Containers and Packaging

Auto Components

Textiles, Apparel and Luxury Goods

Household Durables

Air Freight and Logistics

Pharmaceuticals

Life Sciences Tools and Services

Personal Products

(%)

BSL CLO assets MM CLO assets

15

• Volume of purchases has declined

throughout 2022, as prepayments have

slowed.

• Average price of purchases and sales (as

reported within trustee reports) were

similar, resulting in steady portfolio par

balance across MM CLOs in 2022.

• Sales of asset from ‘ccc’ obligors, as a

proportion of fourth-quarter 2022 sales, is

notably larger than that of purchases; we

think this is evidence of manger de-risking.

• Sale prices of assets from ‘ccc’ obligors were

also slightly lower than average.

Middle-Market CLOs | Purchases And Sales In 2022

MM--Middle market. CLO--Collateralized loan obligation. Source: S&P Global Ratings.

S&P Global Ratings MM CLO Asset Trades By Issuer Rating

Or Credit Estimate In Fourth-Quarter 2022

Rating category

Purchase

(% of trades) Avg purchase price

Sales

(% of trades) Avg sale price

bb category 0.01 97.50 1.21 96.87

b+ 0.03 97.50 0.84 97.78

b 9.00 96.87 10.50 98.19

b- 63.61 97.87 63.72 98.49

ccc category 9.51 98.56 21.13 95.06

No CE at time of purchase 17.84 98.23 2.60 98.65

Quarter

Average

purchase price

Purchases as %

of target par

Average

sale price

Sales as %

of target par

Q1 2022

98.68 11.70 98.81

3.20

Q2 2022

98.81 8.02 99.13

2.26

Q3 2022

98.20 6.63 98.09

1.77

Q4 2022

97.91 5.33 97.71

2.92

Source: S&P Global Ratings.

Middle-Market CLOs | The Matrix: Q4 2022 Asset Overlap By Manager

16

Alliance Bernstein

Angelo Gordon/

Twin Brook

Antares

Apollo

Ares

Audax

Bain

Barings

BMO

Brightwood

Carlyle

Churchill

Deerpath

First Eagle/

NewStar

Fortress

Golub

GSO/

Blackstone

Guggenheim

KCAP/

Garrison

KKR

Maranon

MCF/Madison

Midcap

Monroe

NXT Capital

Owl Rock

Pennantpark

Silver Rock

Tennenbaum/

Blackrock

Alliance Bernstein 0.0% 2.6% 0.0% 5.6% 0.9% 1.9% 1.4% 1.6% 0.9% 3.8% 2.1% 1.2% 0.0% 2.3% 5.9% 0.3% 1.3% 4.9% 2.4% 1.6% 3.5% 5.1% 1.3% 2.8% 3.1% 1.6% 2.3% 4.2%

Angelo Gordon/Twin Brook 0.0% 0.2% 0.0% 0.3% 0.0% 0.0% 0.1% 2.2% 0.0% 0.0% 0.6% 0.0% 1.2% 0.0% 0.0% 0.7% 0.0% 1.8% 0.0% 1.3% 0.3% 3.1% 0.0% 0.3% 0.0% 0.2% 0.0% 0.0%

Antares 2.6% 0.2% 0.0% 7.9% 4.9% 5.9% 10.1% 7.7% 1.0% 2.8% 13.0% 1.4% 7.0% 1.6% 7.4% 0.3% 2.5% 4.2% 3.3% 5.1% 7.7% 4.5% 3.0% 9.4% 8.2% 5.0% 0.8% 6.9%

Apollo 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.1% 0.0% 0.0% 0.0% 0.0%

0.0% 2.3% 0.0% 0.0% 2.4% 0.0% 0.7% 0.0% 0.0% 0.9% 8.7% 0.5% 0.0% 0.0% 2.6% 0.0% 0.0%

Ares 5.6% 0.3% 7.9% 0.0% 11.9% 2.0% 5.1% 2.2% 0.6% 1.0% 6.0% 0.3% 3.1% 3.1% 6.9% 2.1% 6.5% 8.6% 5.4% 2.2% 7.6% 4.1% 9.4% 1.6% 5.0% 1.3% 0.0% 8.2%

Audax 0.9% 0.0% 4.9% 0.0% 11.9% 1.5% 1.9% 0.6% 0.5% 2.3% 8.5% 3.9% 4.2% 2.6% 0.9% 0.8% 4.2% 7.6% 0.2% 2.8% 3.4% 0.5% 14.3% 0.4% 3.7% 3.6% 0.0% 3.2%

Bain 1.9% 0.0% 5.9% 0.0% 2.0% 1.5% 2.2% 0.0% 0.0% 0.0% 2.7% 0.0% 4.0% 1.6% 3.1% 0.0% 0.0% 0.9% 0.0% 0.0% 0.5% 0.3% 0.6% 2.9% 3.4% 1.6% 0.0% 3.6%

Barings 1.4% 0.1% 10.1% 0.1% 5.1% 1.9% 2.2% 5.7% 1.5% 2.9% 10.8% 0.4% 5.7% 1.1% 0.7% 1.8% 1.9% 2.3% 1.8% 3.0% 2.5% 5.5% 4.7% 6.8% 1.5% 2.9% 1.5% 2.4%

BMO

1.6% 2.2% 7.7% 0.0% 2.2% 0.6% 0.0% 5.7% 1.1% 0.0% 1.8% 4.8% 1.8% 0.0% 0.5% 0.4% 1.3% 6.3% 0.0% 5.4% 3.3% 4.0% 0.8% 5.8% 0.9% 0.8% 1.2% 0.0%

Brightwood 0.9% 0.0% 1.0% 0.0% 0.6% 0.5% 0.0% 1.5% 1.1% 0.5% 1.1% 0.0% 1.1% 1.4% 1.0% 0.0% 0.0% 4.2% 0.8% 0.0% 0.5% 1.4% 1.0% 0.0% 0.4% 1.8% 3.0% 3.1%

Carlyle 3.8% 0.0% 2.8% 0.0% 1.0% 2.3% 0.0% 2.9% 0.0% 0.5% 1.6% 0.0% 3.4% 0.6% 0.6% 1.5% 2.6% 1.5% 5.5% 0.0% 2.2% 3.0% 1.7% 0.0% 4.7% 2.3% 4.6% 1.8%

Churchill 2.1% 0.6% 13.0% 0.0% 6.0% 8.5% 2.7% 10.8% 1.8% 1.1% 1.6% 1.4% 6.0% 0.5% 4.5% 1.9% 2.3% 6.1% 0.6% 5.3% 6.8% 4.7% 8.5% 3.1% 3.5% 2.4% 0.0% 6.1%

Deerpath 1.2% 0.0% 1.4% 0.0% 0.3% 3.9% 0.0% 0.4% 4.8% 0.0% 0.0% 1.4% 1.0% 0.4% 0.1% 0.5% 0.0% 2.5%

0.0% 0.0% 1.0% 0.0% 1.5% 1.2% 0.8% 1.8% 0.0% 0.0%

First Eagle/NewStar 0.0% 1.2% 7.0% 2.3% 3.1% 4.2% 4.0% 5.7% 1.8% 1.1% 3.4% 6.0% 1.0% 3.5% 1.3% 4.5% 4.7% 6.3% 0.5% 3.0% 6.4% 5.9% 5.1% 4.4% 0.7% 7.0% 0.0% 5.3%

Fortress 2.3% 0.0% 1.6% 0.0% 3.1% 2.6% 1.6% 1.1% 0.0% 1.4% 0.6% 0.5% 0.4% 3.5% 1.2% 0.1% 2.1% 3.8% 0.4% 0.0% 0.0% 1.7% 1.0% 1.4% 3.7% 1.1% 6.9% 3.5%

Golub 5.9% 0.0% 7.4% 0.0% 6.9% 0.9% 3.1% 0.7% 0.5% 1.0% 0.6% 4.5% 0.1% 1.3% 1.2% 0.1% 1.7% 3.6% 5.8% 0.7% 4.2% 1.2% 0.3% 2.3% 5.8% 0.6% 0.1% 6.5%

GSO/Blackstone 0.3% 0.7% 0.3% 2.4% 2.1% 0.8% 0.0% 1.8% 0.4% 0.0% 1.5% 1.9% 0.5% 4.5% 0.1% 0.1% 0.3% 2.2% 0.0% 1.8% 0.6% 2.0% 0.6% 0.5% 0.0% 1.6% 0.0% 0.0%

Guggenheim 1.3% 0.0% 2.5% 0.0% 6.5% 4.2% 0.0%

1.9% 1.3% 0.0% 2.6% 2.3% 0.0% 4.7% 2.1% 1.7% 0.3% 4.0% 2.5% 2.5% 0.0% 1.7% 6.2% 0.0% 4.9% 1.9% 1.9% 7.3%

KCAP/Garrison 4.9% 1.8% 4.2% 0.7% 8.6% 7.6% 0.9% 2.3% 6.3% 4.2% 1.5% 6.1% 2.5% 6.3% 3.8% 3.6% 2.2% 4.0% 0.0% 1.6% 0.8% 5.5% 5.7% 1.6% 0.7% 6.2% 1.0% 4.2%

KKR 2.4% 0.0% 3.3% 0.0% 5.4% 0.2% 0.0% 1.8% 0.0% 0.8% 5.5% 0.6% 0.0% 0.5% 0.4% 5.8% 0.0% 2.5% 0.0% 0.6% 1.1% 2.8% 2.2% 1.4% 3.6% 0.0% 0.0% 6.4%

Maranon 1.6% 1.3% 5.1% 0.0% 2.2% 2.8% 0.0% 3.0% 5.4% 0.0% 0.0% 5.3% 0.0% 3.0% 0.0% 0.7% 1.8% 2.5% 1.6% 0.6% 4.9% 3.2% 0.4% 4.7% 0.8% 1.8% 1.3% 5.2%

MCF/Madison 3.5% 0.3% 7.7% 0.9% 7.6% 3.4% 0.5% 2.5% 3.3% 0.5% 2.2% 6.8% 1.0% 6.4% 0.0% 4.2% 0.6% 0.0% 0.8% 1.1% 4.9% 7.4% 1.5% 7.4% 2.1%

3.1% 0.6% 3.0%

Midcap 5.1% 3.1% 4.5% 8.7% 4.1% 0.5% 0.3% 5.5% 4.0% 1.4% 3.0% 4.7% 0.0% 5.9% 1.7% 1.2% 2.0% 1.7% 5.5% 2.8% 3.2% 7.4% 3.3% 3.4% 0.1% 2.8% 0.0% 3.4%

Monroe 1.3% 0.0% 3.0% 0.5% 9.4% 14.3% 0.6% 4.7% 0.8% 1.0% 1.7% 8.5% 1.5% 5.1% 1.0% 0.3% 0.6% 6.2% 5.7% 2.2% 0.4% 1.5% 3.3% 1.1% 1.7% 2.2% 1.1% 7.3%

NXT Capital 2.8% 0.3% 9.4% 0.0% 1.6% 0.4% 2.9% 6.8% 5.8% 0.0% 0.0% 3.1% 1.2% 4.4% 1.4% 2.3% 0.5% 0.0% 1.6% 1.4% 4.7% 7.4% 3.4% 1.1% 3.3% 5.0% 0.0% 2.5%

Owl Rock 3.1% 0.0% 8.2% 0.0% 5.0% 3.7% 3.4% 1.5% 0.9% 0.4% 4.7% 3.5% 0.8% 0.7% 3.7% 5.8% 0.0% 4.9% 0.7% 3.6% 0.8% 2.1% 0.1% 1.7% 3.3% 3.7% 0.0% 6.0%

Pennantpark 1.6% 0.2% 5.0% 2.6% 1.3% 3.6% 1.6% 2.9% 0.8% 1.8% 2.3% 2.4% 1.8% 7.0%

1.1% 0.6% 1.6% 1.9% 6.2% 0.0% 1.8% 3.1% 2.8% 2.2% 5.0% 3.7% 1.9% 4.9%

Silver Rock 2.3% 0.0% 0.8% 0.0% 0.0% 0.0% 0.0% 1.5% 1.2% 3.0% 4.6% 0.0% 0.0% 0.0% 6.9% 0.1% 0.0% 1.9% 1.0% 0.0% 1.3% 0.6% 0.0% 1.1% 0.0% 0.0% 1.9% 6.3%

Tennenbaum/Blackrock 4.2% 0.0% 6.9% 0.0% 8.2% 3.2% 3.6% 2.4% 0.0% 3.1% 1.8% 6.1% 0.0% 5.3% 3.5% 6.5% 0.0% 7.3% 4.2% 6.4% 5.2% 3.0% 3.4% 7.3% 2.5% 6.0% 4.9% 6.3%

Source: S&P Global Ratings.

Middle-Market CLOs | Q4 2022 Middle-Market Manager Metrics

17

(i)Based on third-quarter 2022 exposure to companies with ratings/credit estimates raised & lowered in Q4 2022. Includes both rated obligors and credit estimated obligors. (ii)Assets without credit estimate (or other derived S&P Global Ratings’

rating) treated as ‘ccc-’ for purposes of SPWARF calculation. Includes both rated and credit estimated obligors. MM--Middle-market. CLO--Collateralized loan obligation. DG--Downgrade. UG--Upgrade. SPWARF--S&P Global Ratings weighted average

rating factor. WAS--Weighted average spread. WAM--Weighted average maturity. Source: S&P Global Ratings.

Manager

Largest GIC Industry

Largest GICS

industry (%)

No. of GICS

Industries

Largest issuer

exposure (%)

No. of

issuers

DG:UG ratio in

Q4 2022(i)

Credit

estimated

issuers (%)

SPWARF(ii)

WAS (%)

WAM

% of MM CLO

assets unique

to manager

Manager with largest

overlap

Proportion overlap (%)

Alliance Bernstein

Software

31.04

26

1.95

134 5:1 86.62

3897

5.65 3.96 48.01%

Golub

5.90

Angelo Gordon/Twin Brook

Healthcare providers and services

18.53

28

2.13

75 4:0 91.69

3848

5.78 2.62 79.29%

Midcap

3.09

Antares

Healthcare providers and services

11.27

44

0.86

283 8:6 88.28

3734

5.14 3.47 30.71%

Churchill

12.98

Apollo

Professional Services

13.18

15

5.50

25 0:0 85.73

3874

5.49 4.46 18.12%

Midcap

8.73

Ares

Software

15.41

39

2.04

210 5:2 58.02

3660

5.19 3.76 21.68%

Audax

11.92

Audax

Software

17.68

40

1.09

246 3:3 13.23

3543

4.40 4.39 2.80%

Monroe

14.28

Bain

Professional Services

12.78

25

3.29

42 0:0 91.91

3855

6.09 3.89 38.70%

Antares

5.86

Barings

Software

17.09

39

2.46

137 3:2 81.78

3665

5.24 3.86 33.40%

Churchill

10.82

BMO

Healthcare providers and services

16.20

40

1.71

160 1:1 85.74

3917

5.07 3.32 50.43%

Antares

7.68

Brightwood

Commercial services and supplies

21.77

26

5.26

61 0:1 81.96

3572

6.37 3.41 63.23%

KCAP/Garrison

4.20

Carlyle

Commercial services and supplies

9.72

24

5.05

60 0:0 80.15

3965

6.17 3.95 30.21%

KKR

5.48

Churchill

Healthcare providers and services

8.70

42

1.49

186 2:1 76.18

3744

5.11 3.99 22.61%

Antares

12.98

Deerpath

Healthcare providers and services

23.14

40

2.21

145 3:1 82.47

3771

5.59 3.29 69.86%

BMO

4.81

First Eagle/NewStar

Healthcare providers and services

14.43

48

2.34

172 10:6 68.09

3762

5.58 3.64 25.57%

Pennantpark

7.02

Fortress

Hotels, restaurants, and leisure

14.11

41

4.03

134 3:3 67.86

3698

6.59 3.72 53.93%

Silver Rock

6.92

Golub

Software

24.00

45

1.59

258 6:4 89.54

3856

5.60 3.80 53.82%

Antares

7.39

GSO/Blackstone

Hotels, restaurants, and leisure

16.91

21

9.03

33 2:0

49.41

3763

5.24 2.57 5.61%

First Eagle/

NewStar 4.54

Guggenheim

Software

12.51

41

3.32

126 5:3 50.10

3910

5.13 4.16 20.31%

Tennenbaum/Blackrock

7.34

KCAP/Garrison

Software

17.91

43

2.50

131 6:4 49.56

3810

5.57 3.77 15.22%

Ares

8.62

KKR

Healthcare providers and services

12.56

23

3.26

52 1:0 74.55

4063

6.16 4.31 43.50%

Tennenbaum

/Blackrock 6.36

Maranon

Commercial services and supplies

8.53

32

2.29

107 6:1 91.42

3791

5.52 3.39 52.17%

BMO

5.37

MCF/Madison

Healthcare providers and services

10.91

42

1.71

196 3:1 87.37

3800

5.55 3.61 35.85%

Antares

7.67

Midcap

Healthcare providers and services

9.04

46

1.71

207 6:6 90.24

3830

5.66 3.64 39.80%

Apollo

8.73

Monroe

Software

15.71

37

1.25

128 9:0 35.32

3518

4.84 4.56 17.01%

Audax

14.28

NXT Capital

Healthcare providers and services

14.12

31

2.15

104 1:0 91.68

3869

5.23 3.33 35.33%

Antares

9.42

Owl Rock

Software

22.85

37

3.88

141 5:1 81.55

3770

5.81 4.05 19.67%

Antares

8.19

Pennantpark

Media

10.86

35

2.13

109 2:1 82.00

3783

5.81 3.43 45.04%

First Eagle/

NewStar 7.02

Silver Rock

Commercial Services and supplies

10.97

32

3.14

45 3:1 51.66

3873

6.82 3.85 31.47%

Fortress

6.92

Tennenbaum/Blackrock

Software

25.64

43

1.63

167 5:1

75.56

3744

5.68 4.22 26.77%

Ares

8.22

• There are about 1,600 issuers with loans in

our rated middle-market CLO transactions,

about the same number of obligors

contained in our rated BSL CLOs.

• Compared to the obligors in BSL CLOs, there

is far less overlap in middle-market CLOs; for

example, the most widely held obligor in BSL

CLOs is held by nearly every CLO manager,

while the top obligor in middle-market CLOs

is held by just nine managers.

• The list of obligors on this slide is based off

the most recent trustee reports we have

received for middle-market CLOs and

represents the top 30 obligors held by

multiple managers.

• The par amount given in the table is the total

exposure across S&P Global Ratings-rated

middle-market CLOs.

• Several of the most widely names have

changed since the end of third-quarter 2022.

18

Middle-Market CLOs | Top 30 Obligors Held By More Than Two Managers

Source: S&P Global Ratings.

# Company Manager count Total par ($) GICS Industry

1 DRILLING INFO, INC. 9 316,652,699.90 Software

2 ImageFirst Holdings LLC 8 65,995,338.35 Commercial Services and Supplies

3 RSC INSURANCE BROKERAGE, INC 7 435,033,198.97 Insurance

4 Edgewood Partners Holdings, LLC 7 339,407,752.64 Insurance

5 ALERA GROUP HOLDINGS, INC. 7 287,934,890.68 Insurance

6 Jensen Hughes Inc. 7 84,623,213.80 Construction and Engineering

7 INTEGRITY MARKETING ACQUISITION, LLC 6 288,985,614.37 Insurance

8 ALPINE ACQUISITION CORP. II 6 158,156,174.90 Commercial Services and Supplies

9 WEG HOLDINGS, LLC 6 155,289,830.56 Capital Markets

10 CM GROUP LTD. 6 138,500,639.94 IT Services

11 ARCH GLOBAL PRECISION, LLC 6 129,772,565.84 Machinery

12 HIG Holdings, Inc. 6 119,130,301.80 Insurance

13 KNEL Acquisition LLC 6 114,157,433.07 Personal Products

14 OMNI PARENT, LLC 6 112,227,847.56 Transportation Infrastructure

15 Symplr Software Intermediate Holdings Inc. 6 75,796,703.90 Health Care Technology

16 AMS Intermediate Holdings LLC 6 74,396,442.24 Diversified Consumer Services

17 Output Services Group Inc. 6 63,390,511.76 IT Services

18 Ta TT Buyer LLC 6 52,585,837.59 Technology Hardware, Storage and Peripherals

19 PEACH STATE LABS, LLC 6 31,346,516.70 Chemicals

20 DILIGENT CORPORATION 5 307,415,898.68 Software

21 OHIO TRANSMISSION CORPORATION 5 191,395,038.67 Trading Companies and Distributors

22 MRI Intermediate Holdings LLC 5 191,384,425.10 Software

23 AWP HOLDING COMPANY 5 146,246,222.69 Commercial Services and Supplies

24 RHODE HOLDINGS INC. 5 146,143,843.24 Software

25 PC FOY HOLDINGS, LLC 5 154,202,391.69 Insurance

26 TL LIGHTING HOLDINGS, LLC 5 135,157,030.51

Auto Components

27 ECMI HOLDINGS, LLC 5 126,673,423.66 Construction Materials

28 PROCARE SOFTWARE HOLDINGS, LLC 5 119,969,977.59 Software

29 IG Investments Holdings LLC 5 157,007,655.15 IT Services

30 LONG'S DRUGS INCORPORATED 5 117,984,937.29 Food and Staples Retailing

19

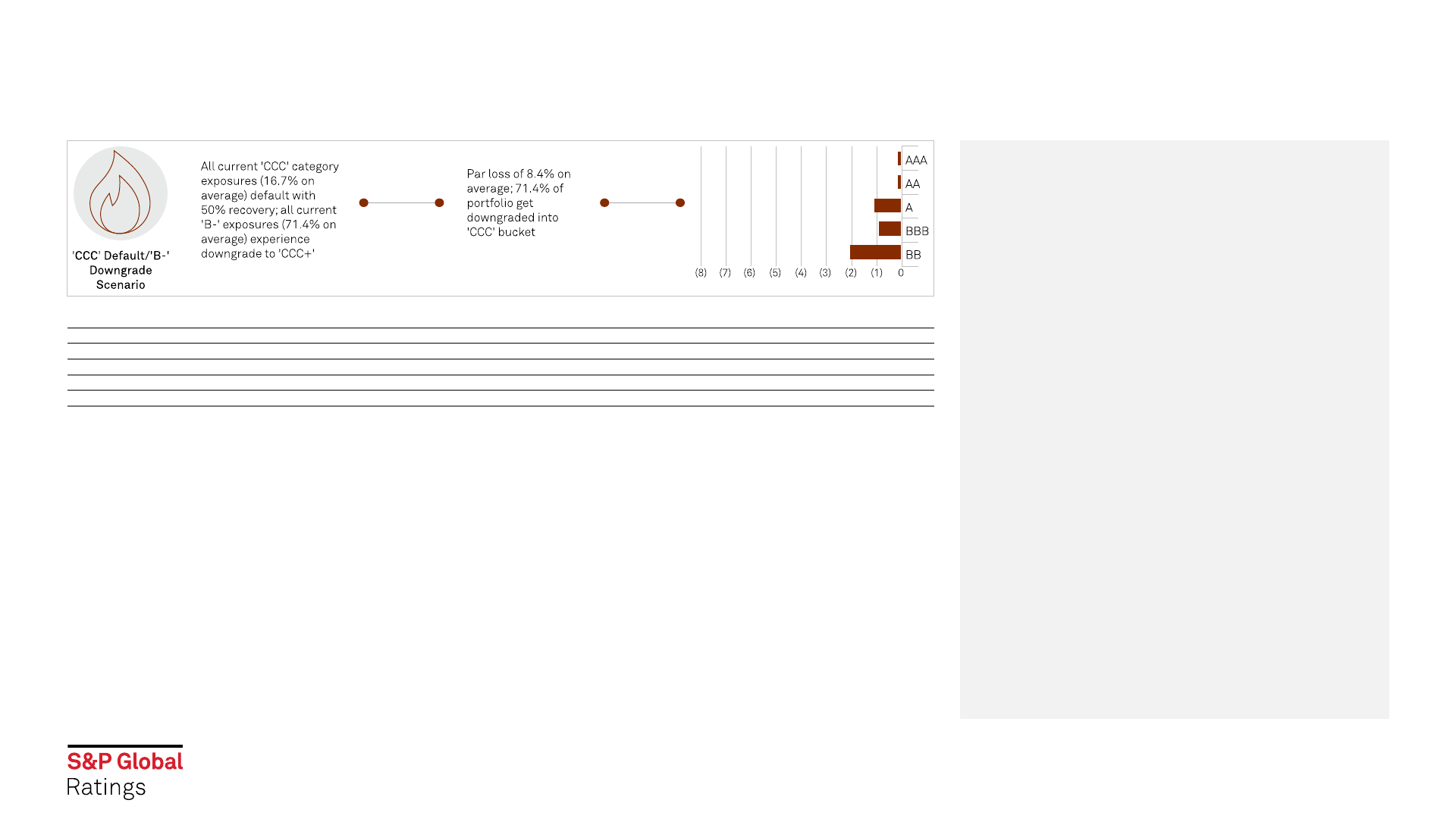

• We applied a series of five hypothetical

stress scenarios to a sample of 65 of our

rated middle-market CLO transactions

still within their reinvestment periods,

generating quantitative analysis for each

one using our CLO rating models (CDO

Evaluator and S&P Cash Flow Evaluator).

• The first four scenarios feature

increasing levels of collateral default

stress, while the fifth scenario assumes

that all ‘ccc’ category obligors default

with a 50% recovery and all ‘b-‘ obligors

are lowered to a rating of ‘ccc+’.

• The stress scenarios shows the

fundamentals of the CLO structure

protecting the noteholders, especially

for the senior CLO tranches, and that

middle-market CLOs can withstand

comparable asset defaults with less

rating impact than BSL CLOs.

Rating Stress Scenarios | How Resilient Are Middle-Market CLO Ratings?

WA--Weighted average. Source: S&P Global Ratings.

CLO tranche rating 0 -1 -2 -3 -4 -5 -6 -7 or more WA notches Spec.-grade

‘CCC’

category

Below

'CCC-'

AAA 98.1% 1.9%

0.02

AA 100.0%

0.00

A 95.1% 4.9%

0.05

BBB 95.6% 4.4%

0.04

4.4%

BB 88.9% 2.8% 2.8% 5.6%

0.50

100.0% 5.6%

CLO tranche rating 0 -1 -2 -3 -4 -5 -6 -7 or more WA notches Spec.-grade

‘CCC’

category

Below

'CCC-'

AAA 95.0% 5.0%

0.05

AA 98.0% 2.0%

0.02

A 88.9% 6.2% 4.9%

0.16

BBB 91.2% 7.4% 1.5%

0.12

5.9%

BB 66.7% 16.7% 5.6% 2.8% 8.3%

0.97

100.0% 2.8% 8.3%

20

• Even under the most punitive of our

scenarios, with 30% of the collateral in

the CLOs defaulting with a 50% recovery,

more than 98% of the CLO ‘AAA’ ratings

either remain ‘AAA’ or are downgraded

one notch to ‘AA+’ and none are lowered

by more than two notches (i.e., below

‘AA’).

• As expected, ratings further down the

MM CLO capital stack were affected

more significantly in the hypothetical

stress scenarios.

• For example, under our most stressful

scenario (the above-referenced 30%

default case), the average MM CLO ‘BBB’

tranche rating was lowered by slightly

more than two notches, 1.5% of the CLO

ratings were lowered into the ‘CCC’

range, and 2.9% of the CLO tranches

defaulted.

Rating Stress Scenarios | How Resilient Are Middle-Market CLO Ratings?

WA--Weighted average. Source: S&P Global Ratings.

CLO tranche rating 0 (%) -1 (%) -2 (%) -3 (%) -4 (%) -5 (%) -6 (%)

-7 or more

(%) WA notches

Spec.-grade

(%)

‘CCC’

category (%)

Below

'CCC-’ (%)

AAA 90.6 9.4

0.09

AA 89.1 6.9 4.0

0.15

A 53.1 27.2 16.0 1.2 2.5

0.73

1.2

BBB 36.8 54.4 5.9 2.9

0.78

57.4

BB 16.7 27.8 19.4 8.3 11.1 5.6 11.1

2.42

100.0 11.1 11.1

CLO tranche rating 0 (%) -1 (%) -2 (%) -3 (%) -4 (%) -5 (%) -6 (%)

-7 or more

(%) WA notches

Spec.-grade

(%)

‘CCC’

category (%)

Below

'CCC-’ (%)

AAA 57.5 40.6 1.9 0.44

AA 41.6 28.7 23.8 1.0 5.0 0.99

A 2.5 6.2 25.9 27.2 25.9 12.3 3.05 17.3

BBB 2.9 51.5 20.6 11.8 7.4 1.5 4.4 2.06 97.1 1.5 2.9

BB 8.3 2.8 2.8 86.1 6.56 100.0 5.6 86.1

21

• In contrast to the four previous

scenarios, each of which envisioned a

set proportion of CLO collateral

defaulting, our fifth scenario starts with

the credit estimates.

• In this scenario, we assume that every

company with a credit estimate in the

‘ccc’ range experiences a default, and

every company with a credit estimate of

‘b-’ is lowered to ‘ccc+’.

• This led to an assumed 16.7% of MM CLO

collateral defaulting, and another 71.4%

being lowered to a credit estimate of

‘ccc+’ from ‘b-’.

• As with the other scenarios, the senior

CLO tranche ratings showed only modest

movement under this stress, with the

impact increasing on lower-rated CLO

tranches.

Rating Stress Scenarios | How Resilient Are Middle-Market CLO Ratings?

WA--Weighted average. Source: S&P Global Ratings.

CLO tranche rating 0 (%) -1 (%) -2 (%) -3 (%) -4 (%) -5 (%) -6 (%)

-7 or more

(%) WA notches

Spec.-grade

(%)

‘CCC’

category (%)

Below

'CCC-’ (%)

AAA 88.8 11.3 0.11

AA 92.1 4.0 4.0 0.12

A 43.2 19.8 29.6 3.7 2.5 1.2 1.06 1.2

BBB 30.9 55.9 7.4 4.4 1.5 0.90 69.1

BB 36.1 22.2 13.9 5.6 5.6 16.7 2.06 100.0 5.6 16.7

24

Copyright © 2023 by Standard & Poor’s Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form

by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized

purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P

Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is

provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE,

FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall

S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and

opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions

(described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following

publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other

business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no

duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such

acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been

suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not

available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are

made available on its Web sites,

www.spglobal.com/ratings (free of charge) and www.ratingsdirect.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional

information about our ratings fees is available at

www.spglobal.com/ratings/usratingsfees.

Australia: S&P Global Ratings Australia Pty Ltd holds Australian financial services license number 337565 under the Corporations Act 2001. S&P Global Ratings' credit ratings and related research are not intended for and must not be

distributed to any person in Australia other than a wholesale client (as defined in Chapter 7 of the Corporations Act).

STANDARD & POOR'S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor's Financial Services LLC.

spglobal.com/ratings