1

RBS – Annual Results 2015

The Royal Bank of Scotland plc

Results for the year ended 31 December 2015

Contents

Page

Financial review 2

Consolidated income statement 7

Consolidated statement of comprehensive income 8

Consolidated balance sheet 9

Consolidated statement of changes in equity 11

Consolidated cash flow statement 13

Notes 14

Statement of directors’ responsibilities 50

Additional information 51

Forward-looking statements 52

Presentation of Information

The Royal Bank of Scotland plc (the ‘Bank’ or ‘RBS plc’) is a wholly-owned subsidiary of The Royal Bank of

Scotland Group plc (the ‘holding company’ or ‘RBSG’). The ‘Group’ comprises RBS plc and its subsidiary

and associated undertakings. ‘RBS Group’ comprises the holding company and its subsidiary and

associated undertakings.

Restatements

Pension accounting policy

As set out in Note 3, the Group has revised its accounting policy for determining whether or not it has an

unconditional right to a refund of surpluses in its employee pension funds. The change has been applied

retrospectively and comparatives restated.

2

RBS – Annual Results 2015

Financial review

Highlights and key developments

●

The loss attributable to ordinary shareholders for the year of £2.0 billion was p

rimarily driven by

litigation and conduct costs of £3.5 billion, principally relating to provisions for mortgage-

backed

securities litigation in the US (£2.1 billion), additional PPI provisions (£0.6 billion) and other conduct

redress charges of £0.8 billi

on. The loss also included £0.5 billion write down of goodwill in Private

Banking and write-off of other intangible assets (£0.8 billion), primarily in

Corporate & Institutional

Banking (CIB) and Capital Resolution. These charges overshadowed positive perf

ormance in the core

businesses. Despite a loss of £1.1 billion in RBS plc for the year, its CET1 ratio improved from 13.1%

to 16.0% driven by significant RWA reduction.

●

Segment performance:

o UK Personal & Business Banking (UK PBB) operating profit was

broadly stable compared with

2014. There was a good performance in mortgages with net new lending totalling £9.3 billion, the

strongest performance since 2009; albeit at lower overall margins as customers shift from

standard variable rate to fixed rate pro

ducts. Credit quality remained good, with modest net

impairment releases.

o Ulster Bank RoI recorded lower operating profit

as net impairment releases, though still

substantial, were lower than in 2014. The low yielding tracker mortgage portfolio reduced

from

£10.6 billion to £9.2 billion.

o Commercial Banking

operating profit was broadly in line with the prior year

reflecting margin

pressure and included a Q4 2015 loss of £34 million on the sale of non-

strategic asset portfolios,

partially offset by lower impairment losses. Deposit and lendin

g volumes (net new lending of

£3.6 billion excluding businesses transfers, run-off and disposals) contributed to a

rise in net

interest income.

o Private Banking and RBS International (RBSI) both recorded lower operating profit

primarily

reflecting lower income. Private Banking included a charge for goodwill impairment of £498

million.

o CIB

lower total income was

in line with the business’s reduced scale and risk appetite. CIB

continues to move towards a more sustainable cost base.

o Capital Resolution operating loss included increased disposal losses as it accelerated the run-

down of its portfolios.

●

On 27 January 2016, RBS Group announced a change to its pensions accounting policy; in particular

the policy for determining whether or not it has an unconditional right to a refund of surplus in its

employee pension funds. As a result of this accounting

policy change, a minimum funding requirement

of £3.3 billion in respect of The Royal Bank of Scotland Group Pension Fund (the Main scheme) within

the Group was recorded as a liability at 31 December 2015 representing the present value of deficit

reduction contributions for 2016 to 2023 (£3.7 billion) less an asset ceiling of £400 million.

●

Separately, RBS Group signed a memorandum of understanding with the Main scheme trustee to

make a payment of £4.2 billion into the scheme, relating to which a statement of funding principles was

signed and the £4.2 billion payment was made in March 2016.

The accelerated payment improves

capital planning and resilience and provides increased certainty on contribution commitments and the

pension balance sheet position of the Group.

3

RBS – Annual Results 2015

Financial review

Progress was made in de-risking the balance sheet as the Group continued the run-down or sale of certain

businesses and higher risk or capital intensive assets. Funded assets (total assets excluding derivatives)

decreased from £690.8 billion at 31 December 2014 to £549.1 billion at 31 December 2015. In 2015 the

Group:

●

Completed the exit from Citizens a year ahead of schedule, underlining the

commitment to a UK

market focus.

●

Delivered strong progress in the first year of CIB Capital Resolution.

The business substantially exited

the North American and Asia-

Pacific (APAC) portfolios, and a partnership for international customers

was agreed with BNP Paribas as an alternative to the Global Transaction Services business.

Agreed

the sale of the Russian subsidiary which is due to complete in Q2 2016.

●

The RBS Group achieved the run-down target of RBS Capital Resolution (RCR)

a year ahead of

schedule, reducing funded assets by 88% since the original pool of assets was identified, exceeding

the targeted 85%, to £4.6 billion at 31 December 2015.

●

Completed the

first tranche of the international private banking business sale, with the final tranche

due to complete in the first half of 2016.

●

Improved the quality of the

core loan books, primarily through the sale of commercial real estate and

infrastructure portfolios in Commercial Banking and a buy-to-let portfolio in Ulster Bank RoI.

●

Continued to progress the Williams & Glyn (W&G) divestment, submitting a banking licence application

to UK regulatory authorities in September 2015 and work continues on separat

ion (although this will

not now be achieved until after the previously announced Q1 2017). The Group remains committed to

full divestment by the end of 2017.

●

Credit quality remained stable, with risk elements in lending (REIL) decreasing to £12.0 billion (3.9

% of

gross customer loans) at 31 December 2015, from £26.7 billion (7.7%) at 31 December 2014.

This

reduction was primarily driven by disposals in RCR in Capital Resolution coupled with the recovering

Irish economy.

●

In line with the progress to de-

risk the balance sheet, committed exposures to the natural resources

sectors have more than halved, with oil and gas in particular substantially reducing by 70% during

2015 to £6.6 billion.

●

Funding and liquidity position remains strong, aided by the

accelerated reduction of the Capital

Resolution balance sheet. The liquidity portfolio of £153 billion covered short-

term wholesale funding

excluding derivative collateral by more than nine times and the loan:deposit ratio was 89% compared

with 95% at the

end of 2014 reflecting the strategic run down of Capital Resolution loans and higher

retail and commercial deposits, being partially offset by UK PBB loan mortgage growth.

Performance review

The Group reports a loss for the year of £1,586 million compared with a loss of £3,116 million in 2014. This

included profit from discontinued operations of £1,538 million, compared with a loss of £3,486 million in

2014. Operating expenses increased by £2,589 million to £16,141 million compared with £13,552 million in

2014, primarily due to increased litigation and conduct costs and restructuring costs and a charge for

goodwill impairment of £498 million attributed to Private Banking. Loss on redemption of own debt was £263

million compared with a gain of £6 million in 2014.

4

RBS – Annual Results 2015

Financial review

Operating (loss)/profit

Operating loss before tax was £3,153 million compared with a profit of £2,403 million in 2014. The decrease

reflects lower income of £12,151 million, compared with £14,618 million in 2014, primarily due to income

attrition and disposal losses in the Capital Resolution business. Net impairment releases were lower at £837

million, compared with £1,337 million in 2014. Operating expenses were £16,141 million (2014 - £13,552

million) and included higher litigation and conduct costs of £3,507 million (2014 - £2,202 million) primarily

relating to additional provisions for mortgage backed securities litigation in the US (£2.1 billion) and PPI

costs of £600 million. Restructuring costs were £2,903 million (2014 - £1,154 million) as the transformation of

the Group accelerated, particularly in CIB.

Net interest income

Net interest income decreased by £458 million, or 5%, to £8,408 million, driven principally by a 52%

reduction in Capital Resolution, down £468 million to £440 million, in line with the planned shrinkage of the

balance sheet. UK PBB net interest income was £4,263 million compared with £4,277 million in 2014 as

competitive front book margin pressures impacted. Ulster Bank RoI net interest income fell by £102 million,

22%, to £365 million primarily due to the weakening of the euro relative to sterling and reduced income on

free funds.

Non-interest income

Non-interest income decreased by £2,009 million, 35%, to £3,743 million compared with £5,752 million in

2014. Own credit adjustments represented a gain of £329 million compared with a charge of £128 million in

2014. Net fees and commissions decreased by £591 million, 17%, to £2,887 million mainly due the reduced

scale of activity in CIB, run down of Capital Resolution and lower card interchange fees in UK PBB. Income

from trading activities was down £236 million to £954 million, compared with £1,190 million in 2014 due to

the reduced scale and resources in CIB and the continued planned reduction of the Capital Resolution

business.

A loss of £263 million was recognised on the redemption of own debt, from a liability management exercise

to repurchase certain US dollar, sterling and euro senior debt securities, compared with a gain of £6 million

in 2014. Other operating income reduced by £913 million, or 85%, to £165 million, principally due to the

reduced scale of CIB together with the run down of Capital Resolution and the impact of disposal losses.

Operating expenses

Operating expenses increased by £2,589 million, or 19%, to £16,141 million from £13,552 million in 2014

and included a charge for goodwill impairment of £498 million attributed to Private Banking (2014 - £130

million in Capital Resolution). Operating expenses, excluding restructuring costs and litigation and conduct

costs, decreased by £465 million, or 5%, to £9,731 million (2014 - £10,196 million) mainly reflecting the

benefits of cost savings initiatives.

Litigation and conduct costs were £3,507 million compared with £2,202 million in 2014, primarily relating to

mortgage backed securities litigation in the US of £2.1 billion. Other charges in 2015 include: provisions for

foreign exchange investigations in the US, £334 million, customer redress provisions primarily relating to PPI

of £600 million, Interest Rate Hedging Products redress of £81 million and other litigation and conduct

provisions of £392 million including provisions relating to packaged accounts and investment products.

Restructuring costs increased by £1,749 million to £2,903 million, compared with £1,154 million in 2014, as

the transformation of the Group accelerated, particularly re-engineering the CIB business.

5

RBS – Annual Results 2015

Financial review

Impairment releases/(losses)

Net impairment releases were £837 million in 2015 compared with net impairment releases of £1,337 million

in the prior year. Capital Resolution recorded net releases of £781 million, compared with £1,293 million in

2014, with disposal activity continuing. Ulster Bank RoI recorded net impairment releases of £141 million,

down from £306 million in 2014, as economic conditions in Ireland continue to improve. UK PBB recorded a

release of £7 million compared with a loss of £154 million, due to lower debt flows and increased releases

and recoveries. Net impairment releases were also reported in CIB, although at more modest levels.

Discontinued operations

Profit from discontinued operations was £1,538 million reflecting a gain on disposal in relation to Citizens of

£249 million and in respect of reserves of £1,001 million recycled to the income statement, together with a

gain of £318 million attributable to non-controlling interests. In 2014, the loss from discontinued operations

was £3,486 million, which reflected an accounting write down of £3,994 million in relation to Citizens.

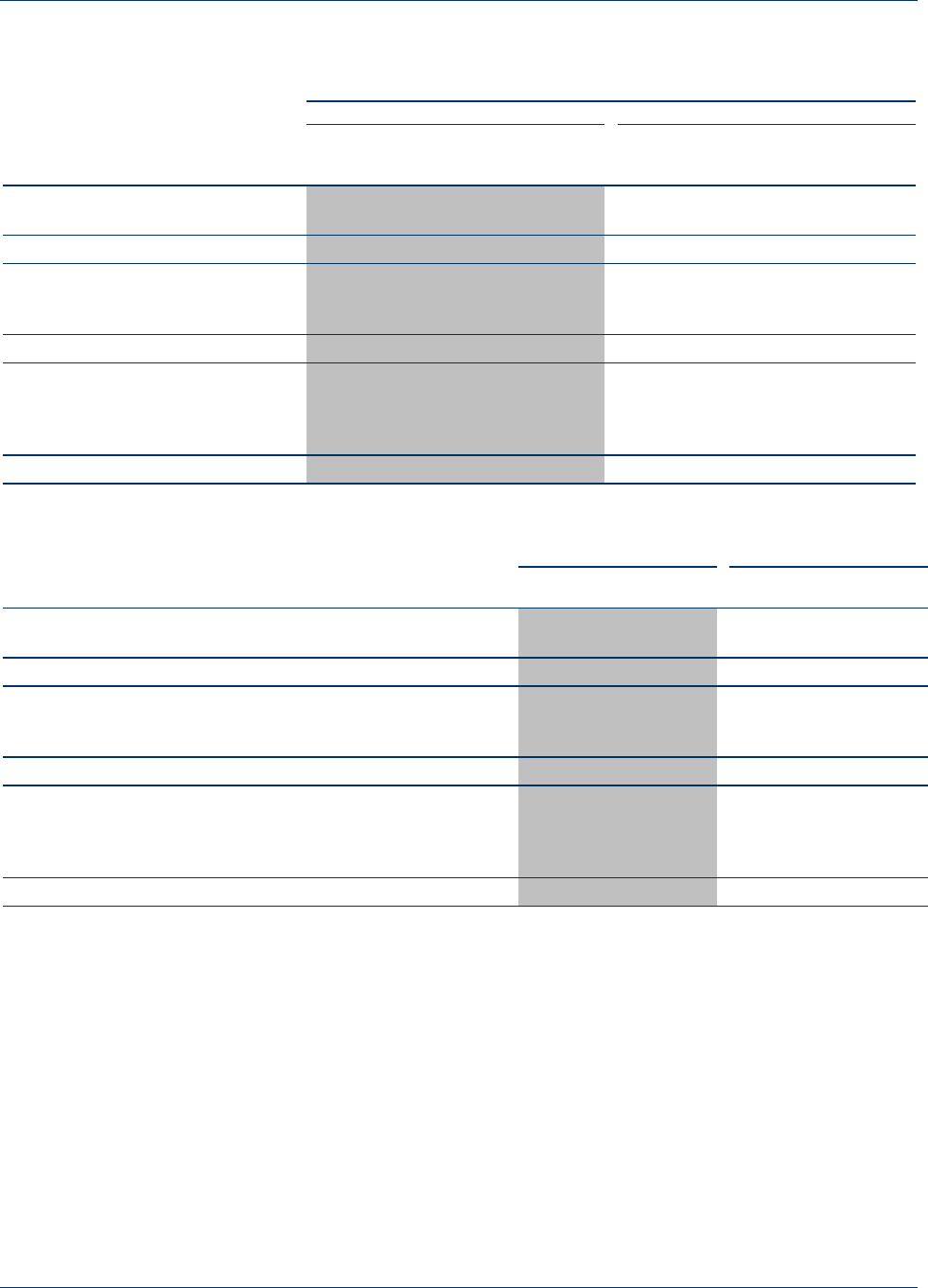

Capital and leverage ratios

Capital resources, leverage and RWAs based on the relevant local regulatory capital transitional

arrangements for the significant legal entities within the Group are set out below.

2015 2014

RBS plc

NatWest

UBIL

RBS plc NatWest UBIL

Capital

£bn

£bn

£bn

£bn £bn £bn

CET 1

32.4

7.

2

5.7

34.5 9.5 4.2

Tier 1

34.7

7.2

5.7

36.7 9.6 4.2

Total

51.3 12.1 6.2

55.3 14.8 4.7

2015 2014

RBS plc

NatWest

UBIL

RBS plc NatWest UBIL

Risk

-

weight

ed a

ssets

£bn

£bn

£bn

£bn £bn £bn

Credit risk

- non-counterparty

146.4

54.4

17.8

200.1 61.7 22.5

- counterparty

21.8 0.4 0.3

27.7 0.6 0.4

Market risk

19.1 0.6 -

19.0 0.5 -

Operational risk

15.6 6.4 1.1

17.1 5.5 1.3

202.9 61.8 19.2

263.9 68.3 24.2

2015 2014

RBS plc

NatWest

UBIL

RBS plc NatWest UBIL

Risk asset ratios

%

%

%

% % %

CET 1

16.0

11.6

29.6

13.1 13.9 17.3

Tier 1

17.1

11.6

29.6

13.9 14.0 17.3

Total

25.3 19.6 32.1

20.9 21.7 19.5

2015

Leverage

RBS plc

NatWest

UBIL

Tier 1 capital (£bn)

34.7

7.

2

5.7

Exposure (£bn)

502.6

153.1 23.7

Leverage ratio (%)

6.9

4.7

24.0

Note:

(1) UBIL 2014 profit (unverified for regulatory reporting purposes in 2014) is excluded from 2014 but included in 2015.

6

RBS – Annual Results 2015

Financial review

RBS plc: The CET1 ratio improved from 13.1% to 16.0%. CET1 capital fell due to the loss of £1.1 billion in

2015. RWAs decreased by £61.0 billion, primarily reflecting Capital Resolution risk reduction strategy as well

as a move from risk weighting to capital deduction of significant investments in financial institutions, as part

of phased in move to end-point Capital Requirements Regulation (CRR). The 2015 CET1 ratio also reflected

the impairment of significant investments, mainly relating to Citizens.

National Westminster Bank Plc (NatWest): The CET1 ratio decreased from 13.9% to 11.6%, reflecting the

current year loss of £1.4 billion, which included PPI provisions (£0.4 billion) and the impairment of

investments in US subsidiaries (£1.6 billion), principally RBS Securities Inc. The loss on remeasurement of

the Main pension scheme resulted in a CET1 capital reduction of £1.4 billion. This was partially offset by a

capital injection of £0.8 billion from RBS plc. RWAs decreased by £6.5 billion, primarily reflecting a move

from risk weighting to capital deduction of significant investments in financial institutions, as part of phased in

implementation of end point CRR.

Ulster Bank Ireland Limited (UBIL): The CET1 ratio improved from 17.3% to 29.6% with the 2015 CET1 ratio

benefitting from the inclusion of £0.9 billion of 2014 profit. RWAs were £5.0 billion lower primarily reflecting

reductions in the tracker mortgage portfolio, lower Central Bank of Ireland add-on for corporate exposures

and exchange rate movements.

7

RBS – Annual Results 2015

Consolidated income statement for the year ended 31 December 2015

Year ended

31 December

31 December

2015

2014

£m

£m

Interest receivable

11,746

12,805

Interest payable

(3,338)

(3,939)

Net interest income 8,408

8,866

Fees and commissions receivable

3,692

4,320

Fees and commissions payable

(805)

(842)

Income from trading activities

954

1,190

(Loss)/gain on redemption of own debt

(263)

6

Other operating income

165

1,078

Non-interest income 3,743

5,752

Total income 12,151

14,618

Operating expenses

(16,141)

(13,552)

(Loss)/profit before impairment releases (3,990)

1,066

Impairment releases

837

1,337

Operating (loss)/profit before tax (3,153)

2,403

Tax credit/(charge)

29

(2,033)

(Loss)/profit from continuing operations (3,124)

370

Profit/(loss) from discontinued operations, net of tax

1,538

(3,486)

Loss for the year (1,586)

(3,116)

Non-controlling interests

(320)

(57)

Preference shareholders

(44)

(61)

Loss attributable to ordinary shareholders (1,950)

(3,234)

8

RBS – Annual Results 2015

Consolidated statement of comprehensive income for year ended 31 December 2015

Year ended

31 December

31 December

2015

2014*

£m

£m

Loss for the year (1,586)

(3,116)

Items that do not qualify for reclassification

Loss on remeasurement of retirement benefit schemes

(73)

(1,849)

Tax

306

314

233

(1,535)

Items that do qualify for reclassification

Available

-for-sale financial assets

13

132

Cash flow hedges

(740)

1,412

Currency translation

(1,123)

434

Tax

136

(401)

(1,714)

1,577

Other comprehensive (loss)/income after tax (1,481)

42

Total comprehensive loss for the year (3,067)

(3,074)

Attributable to:

Non-controlling interests

315

194

Preference shareholders

44

61

Ordinary shareholders

(3,426)

(3,329)

(3,067)

(3,074)

*Restated - refer to page 14 for further details

Note:

(1) A profit of £1,220 million (2014 – loss £3,538 million) from discontinued operations was attributable to ordinary shareholders.

Key points

● The loss on remeasurement of retirement benefit schemes reflects the chang

e of accounting policy for

pensions. For further details, refer to Note 3 on page 14.

● Cash flow hedging losses in the year

principally result from transfers from equity as hedged

transactions occurred; this is partially offset by cash flow hedging gains deferred in equity.

● Currency translation losses in the year predominantly relate

to the recycling of foreign exchange

reserves upon ceding control of Citizens and the strengthening of sterling against the euro, partially

offset by the weakening of sterling against the US dollar.

● The movement in available-for-sale financial assets in the year

reflects significant unrealised gains on

a holding of euro equity securities; this is partially offset by unrealised losses on available-for-

sale debt

securities.

9

RBS – Annual Results 2015

Consolidated balance sheet at 31 December 2015

31 December

31 December

2015

2014*

£m

£m

Assets

Cash and balances at central banks

78,999

73,983

Amounts due from fellow subsidiaries

1,557

2,333

Other loans and advances to banks

28,285

42,259

Loans and advances to banks

29,842

44,592

Amounts due from holding company and fellow subsidiaries

1,258

1,323

Other loans and advances to customers

333,699

375,615

Loans and advances to customers

334,957

376,938

Debt securities subject to repurchase agreements

20,224

22,923

Other debt securities

59,803

61,351

Debt securities

80,027

84,274

Equity shares

1,069

5,203

Settlement balances

4,108

4,710

Amounts due from holding company and fellow subsid

iaries

1,275

2,738

Other derivatives

261,808

351,844

Derivatives

263,083

354,582

Intangible assets

6,526

7,765

Property, plant and equipment

4,453

6,123

Deferred tax

2,622

1,881

Prepayments, accrued income and other assets

3,019

4,298

Assets of disposal groups

3,486

81,033

Total assets 812,191

1,045,382

Liabilities

Amounts due to fellow subsidiaries

3,999

4,208

Other deposits by banks

38,095

59,642

Deposits by banks

42,094

63,850

Amounts due to holding

company and fellow subsidiaries

5,021

5,843

Other customers accounts

369,053

389,156

Customer accounts

374,074

394,999

Debt securities in issue

25,804

41,996

Settlement balances

3,383

4,498

Short positions

20,808

23,028

Amounts due to ho

lding company and fellow subsidiaries

1,283

2,005

Other derivatives

254,265

348,778

Derivatives

255,548

350,783

Provisions, accruals, and other liabilities

14,070

12,262

Retirement benefit liabilities

3,764

4,289

Deferred tax

729

236

Amo

unts due to holding company

18,502

19,639

Other subordinated liabilities

8,528

10,830

Subordinated liabilities

27,030

30,469

Liabilities of disposal groups

2,980

71,284

Total liabilities 770,284

997,694

Equity

Non-controlling interests

54

2,385

Owners’ equity

41,853

45,303

Total equity

41,907

47,688

Total liabilities and equity 812,191

1,045,382

*Restated - refer to page 14 for further details

10

RBS – Annual Results 2015

Consolidated balance sheet at 31 December 2015

Total assets of £812.2 billion as at 31 December 2015 were down £233.2 billion, 22%, compared with 31

December 2014. This was driven by the disposal of Citizens, decreases in loans and advances to customers

and derivatives assets, reflecting the reshaping of CIB and Capital Resolution run-down.

Loans and advances to banks decreased by £14.8 billion, 33%, to £29.8 billion. Excluding reverse

repurchase agreements and stock borrowing (‘reverse repos’), down £9.6 billion, 46%, to £11.1 billion, bank

placings declined by £5.1 billion, 22%, to £18.7 billion.

Loans and advances to customers declined £42.0 billion, 11%, to £335.0 billion. Within this, reverse repos

were down £15.3 billion, 35%, to £28.7 billion. Customer lending decreased by £26.7 billion, 8%, to £306.2

billion, or £37.0 billion to £313.3 billion before impairments. This reflected reductions in CIB together with the

run down and disposals in Capital Resolution, partially offset by increases in UK PBB reflecting growth in

mortgages and in Commercial Banking which recorded strong new business volumes.

Debt securities were down £4.2 billion, 5%, to £80.0 billion driven mainly by reductions within CIB partially

offset by increases in Treasury in the liquidity portfolio.

Equity shares decreased by £4.1 billion, 79%, to £1.1 billion primarily due to the continuing risk reduction

and run-down in Capital Resolution.

Movements in the fair value of derivative assets, down £91.5 billion, 26%, to £263.1 billion, and liabilities

down, £95.2 billion, 27%, to £255.5 billion, were primarily driven by a reduction in interest rate swap

notionals as well as yield curve moves.

Intangible assets decreased by £1.2 billion, 16%, to £6.5 billion mainly due to the write down of £0.5 billion

goodwill in Private Banking and the write down of other intangible assets of £0.8 billion, mainly in relation to

the reorganisation of CIB.

Property, plant and equipment decreased by £1.7 billion, 27%, to £4.5 billion mainly reflecting disposals and

write downs.

The decrease in assets and liabilities of disposal groups down from £81.0 billion to £3.5 billion and £71.3

billion to £3.0 billion respectively, primarily reflects the disposal of Citizens, partially offset by the transfer of

the international private banking business to disposal groups.

Deposits by banks decreased by £21.8 billion, 34%, to £42.1 billion, with decreases in repos, down £14.5

billion, 59%, to £10.3 billion and decreases in bank deposits of £7.2 billion, 19%, to £31.8 billion, reflecting

the reshaping of CIB and Capital Resolution run-down.

Customer accounts decreased by £20.9 billion, 5%, to £374.1 billion. Within this, repos decreased by £10.2

billion, 27%, to £27.1 billion. Customer deposits were down £10.7 billion, 3%, at £347.0 billion, primarily

reflecting the reduction of corporate deposits in CIB and run-down in Capital Resolution offset by growth in

UK PBB and in Commercial Banking.

Debt securities in issue decreased by £16.2 billion, 39%, to £25.8 billion, due to decreases in CIB and in

Treasury given the lower funding requirements of a reduced balance sheet.

Subordinated liabilities decreased by £3.4 billion, 11% to £27.0 billion, primarily as a result of the net

decrease in dated loan capital with redemptions of £3.6 billion.

Non-controlling interests decreased £2.3 billion to £54 million, due to the disposal of Citizens.

Owner’s equity decreased by £3.5 billion, 8%, to £41.9 billion, primarily driven by the £2.0 billion attributable

loss for the year and movements in other reserves.

11

RBS – Annual Results 2015

Consolidated statement of changes in equity

for the year ended 31 December 2015

Year ended

31 December

31 December

2015

2014*

£m

£m

Called-up share capital

At beginning and end of year

6,609

6,609

Share premium account

At

beginning of year

26,807

26,290

Redemption of preference shares classified as debt (1)

-

517

At end of year

26,807

26,807

Merger reserve

At beginning of year

10,834

10,800

Unwind of merger reserve

31

34

At end of y

ear

10,865

10,834

Available-for-sale reserve

At beginning of year

400

359

Unrealised gains

88

504

Realised gains

(70)

(409)

Tax

(18)

(45)

Recycled to profit or loss on ceding control of Citizens (2)

9

-

Transfer to retained earnings

(43)

(9)

At end of year

366

400

Cash flow hedging reserve

At beginning of year

1,026

(86)

Amount recognised in equity

668

2,869

Amount transferred from equity to earnings

(1,350)

(1,457)

Tax

106

(334)

Recycled to profit or loss on ceding control of Citizens (3)

(36)

-

Transfer to retained earnings

9

34

At end of year

423

1,026

Foreign exchange reserve

At beginning of year

1,762

1,842

Retranslation of net assets

(79)

403

Foreign currency losses on hedges of net assets

(74)

(82)

Tax

11

(9)

Recycled to profit or loss on disposal of business

4

-

Recycled to profit or loss on ceding control of Citizens

(974)

-

Transfer to retained earnings

(642)

(392)

At end of year

8

1,762

Retained earnings

At beginning of year

(2,135)

2,888

(Loss)/profit attributable to ordinary and equity preference shareholders

- continuing operations

(3,126)

365

- discontinued operations

1,220

(3,538)

Equity preference dividends paid

(44)

(61)

Transfer from available-for-sale reserve

43

9

Transfer from cash flow hedging reserve

(9)

(34)

Transfer from foreign exchange reserve

642

392

Costs of placing Citizens equity

(29)

(45)

Loss on remeasurement of retirement benefit schemes (4)

- gross

(67)

(1,849)

- tax

306

314

Redemption of preference shares classified as debt (1)

-

(517)

Shares issued under employee share schemes

(58)

(91)

Share-based payments

- gross

36

29

- tax

(4)

3

At end of yea

r

(3,225)

(2,135)

Owners’ equity at end of year 41,853

45,303

For the notes to this table refer to the following page.

*Restated - refer to page 14 for further details

12

RBS – Annual Results 2015

Consolidated statement of changes in equity

for the year ended 31 December 2015

Year ended

31 December

31 December

2015

2014*

£m

£m

Non-controlling interests

At beginning of year

2,385

79

Currency translation adjustments and other movements

28

113

Profit attributable to non-controlling interests

- continuing operations

2

5

- discontinued operations

318

52

Dividends paid

(31)

(4)

Movements in available-for-sale securities

- unrealised gains

25

37

- tax

(5)

(13)

Movements in cash flow hedging reserve

- amount recognised in equity

32

18

- recycled to profit or loss on disposal of discontinued operations

-

(18)

- tax

(4)

-

Actuarial losses recognised in retirement benefit schemes

(6)

-

Equity raised (5)

2,491

2,117

Equity withdrawn and disposals

(24)

(1)

Loss of control of Citizens

(5,157)

-

At end of year

54

2,385

Total equity at end of year 41,907

47,688

Total equity is attributable to:

Non controlling interests

54

2,385

Preference shareholders

1,421

1,421

Ordinary shareholders

40,432

43,882

41,907

47,688

*Restated - refer to page 14 for further details

Notes:

(1) Issued by RBS plc to the holding company which was redeemed in June 2014.

(2) Net of tax - £6 million charge

(3) Net of tax - £16 million credit

(4) See Note 3 on page 14

(5) Includes £2,491 million relating to the secondary offering of Citizens in March 2015 (2014 - £2,117 million relating to IPO of Citizens).

13

RBS – Annual Results 2015

Consolidated cash flow statement for the year ended 31 December 2015

Year ended

31 December

31 December

2015

2014*

£m

£m

Operating activities

Operating (loss)/profit before tax on continuing operations

(3,153)

2,403

Operating profit/(loss) before tax on discontinued operations

1,750

(3,258)

Adjustments for non

-cash items

(8,031)

(1,346)

Net cash outflow from trading activities

(9,434)

(2,201)

Changes in operating assets and liabilities

10,787

(11,917)

Net cash flows from operating activities before tax 1,353

(14,118)

Income taxes paid

(231)

(302)

Net cash flows from operating activities 1,122

(14,420)

Net cash flows from investing activities (5,704)

(4,910)

Net cash flows from financing activities (1,176)

(2,000)

Effects of exchange rate changes on cash and cash equivalents

525

682

Net decrease in cash and cash equivalents (5,233)

(20,648)

Cash and cash equivalents at beginning of year

107,308

127,956

Cash and cash equivalents at end of year 102,075

107,308

*Restated - refer to page 14 for further details

14

RBS – Annual Results 2015

Notes

1. Basis of preparation

The Group’s consolidated financial statements should be read in conjunction with the 2015 Annual Report

and Accounts which were prepared in accordance with International Financial Reporting Standards issued

by the International Accounting Standards Board (IASB) and interpretations issued by the IFRS

Interpretations Committee of the IASB as adopted by the European Union (EU) (together IFRS).

Going concern

Having reviewed the Group’s forecasts, projections and other relevant evidence, the directors have a

reasonable expectation that the Group will continue in operational existence for the foreseeable future.

Accordingly, the results for the year ended 31 December 2015 have been prepared on a going concern

basis.

Business structure

The Group continues to deliver on its plan to build a strong, simple and fair bank for both customers and

shareholders. To support this and reflect the progress made the previously reported operating segments

have been realigned.

For further information on these changes see Note 9.

2. Citizens

On 31 December 2014, Citizens Financial Group Inc. was classified as a discontinued operation and a

disposal group: its aggregate assets were presented in Assets of disposal groups and its aggregate liabilities

in Liabilities of disposal groups. Prior period results were re-presented.

From 3 August 2015, when the Group’s interest in Citizens fell to 20.9%, Citizens was accounted for as an

associate classified as held for sale. The Group subsequently completed its divestment of Citizens when it

sold its final tranche on 30 October 2015. Citizens is no longer a reportable segment, therefore segment

disclosures for all periods have been restated.

3. Accounting policies

The Group’s principal accounting policies are set out on pages 176 to 184 of the 2014 Annual Report and

Accounts. Amendments to IFRSs effective for 2015 have not had a material effect on the Group’s 2015

results.

Pensions

The Group changed its accounting policy for the recognition of surpluses in its defined benefit pension

schemes: in particular, the policy for determining whether or not it has an unconditional right to a refund of

surpluses in its employee pension funds. Where the Group has a right to a refund, this is not deemed

unconditional if pension fund trustees can enhance benefits for plan members. The amended policy has

been applied retrospectively and prior periods restated.

15

RBS – Annual Results 2015

Notes

3. Accounting policies (continued)

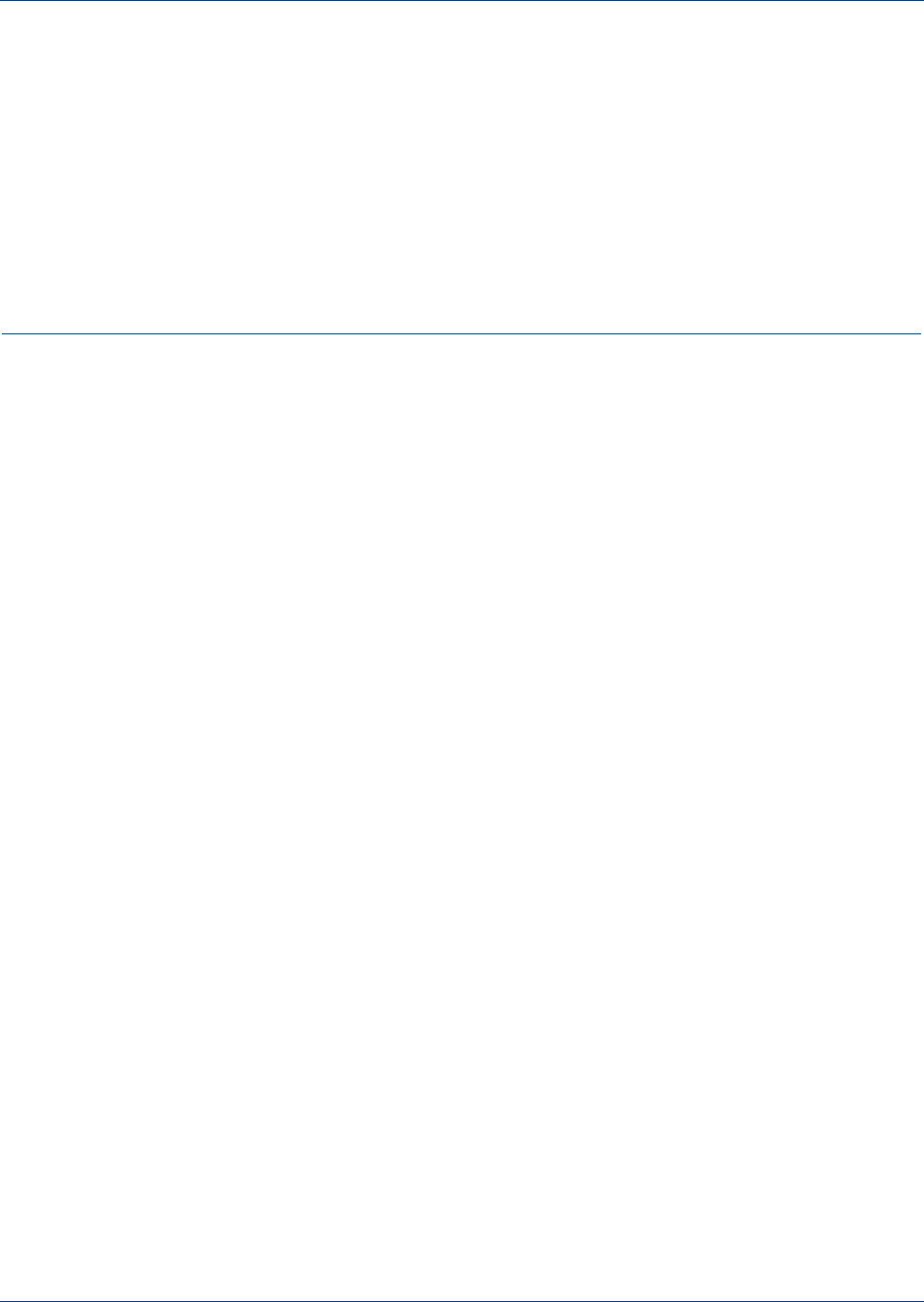

The impact of the change in policy set out below

Consolidated income statement 2015

Under

previous policy

Adjustment

As published

£m

£m

£m

Staff costs

(5,604)

(64)

(5,668)

Operating expenses

(16,077)

(64)

(16,141)

Loss before impairment losses

(3,926)

(64)

(3,990)

Operating loss before tax

(3,089)

(64)

(3,153)

Tax charge

17

12 29

Loss from continuing operations

(3,072)

(52)

(3,124)

Loss for the year

(1,534)

(52)

(1,586)

Loss attributable to ordinary shareholders

(1,898)

(52)

(1,950)

Consolidated statement of comprehensive income

2015

2014

Under

As previously

previous policy

Adjustment As published

reported

Adjustment

Restated

£m

£m £m

£m

£m

£m

Loss for year

(1

,534)

(52) (1,586)

(3,116) -

(3,116)

Gain/(loss) on remeasurement

of retirement benefit schemes

1,139

(1,212) (73)

(100)

(1,749)

(1,849)

Tax

(147)

453 306

(36) 350

314

Total comprehensive loss after tax

(2,256)

(811) (3,067)

(1,675)

(1,399)

(3,074)

Consolidated balance sheet

2015

2014

Under

As previously

previous policy

Adjustment As published

reported Adjustment Restated

£m £m £m

£m £m £m

Deferred tax assets

1,786 836 2,622

1,510 371 1,881

Prepayments, accrued income

and other assets

3,168 (149) 3,019

4,413 (115) 4,298

Retirement benefit liabilities

783 2,981 3,764

2,550 1,739 4,289

Owners' equity

44,147 (2,294) 41,853

46,786 (1,483) 45,303

Consolidated statement of changes in equity

2015

2014

Under

As previously

previous policy

Adjustment

As published

reported

Adjustment

Restated

£m

£m

£m

£m

£m

£m

Retained earnings

At beginning of the year

(652)

(1,483)

(2,135)

2,972

(84)

2,888

(Loss)/profit attributable to ordinary

shareholders and other equity

owners - continuing operations

(3,074)

(52)

(3,126)

365 -

365

Gain/(loss) on remeasurement

of retirement benefit schemes

- gross

1,145

(1,212)

(67)

(100)

(1,749)

(1,849)

- tax

(147) 453

306

(36) 350

314

At end of the year

(931)

(2,294)

(3,225)

(652)

(1,483)

(2,135)

16

RBS – Annual Results 2015

Notes

3. Accounting policies (continued)

Critical accounting policies and key sources of estimation uncertainty

The judgements and assumptions that are considered to be the most important to the portrayal of the

Group’s financial condition are those relating to pensions, goodwill, provisions for liabilities, deferred tax,

loan impairment provisions and fair value of financial instruments. These critical accounting policies and

judgements are described on pages 184 to 186 of the 2014 Annual Report and Accounts.

Accounting developments - International Financial Reporting standards

A number of IFRSs and amendments to IFRS were in issue at 31 December 2015 that would affect the

Group from 1 January 2016 or later.

Effective for 2016

‘Accounting for Acquisitions of Interests in Joint Operations’ issued in May 2014 amends IFRS 11 ‘Joint

Arrangements. An acquirer of an interest in a joint operation that is a business applies the relevant principles

for business combinations in IFRS 3 and other standards and makes the relevant disclosures accordingly.

The effective date is 1 January 2016.

‘Clarification of Acceptable Methods of Depreciation and Amortisation’ issued in May 2014 amends IAS 16

‘Property, Plant and Equipment’ and IAS 38 ‘Intangible Assets’ requiring amortisation to be based on the

consumption of an asset, introducing a rebuttable presumption that this is not achieved by an amortisation

profile aligned to revenue. The effective date is 1 January 2016.

Annual Improvements to IFRS 2012 - 2014 cycle was issued in September 2014 making a number of minor

amendments to IFRS. Its effective date is 1 January 2016.

Amendments to IFRS 10 ‘Consolidated Financial Statements’, IFRS 12 ‘Disclosure of Interests in Other

Entities’ and IAS 28 ‘Investments in Associates and Joint Ventures’ were issued in September 2014 to clarify

the accounting for sales between an investor, its associate or joint ventures, and in December 2014 to clarify

the application of the investment entity consolidation exception. The September 2014 amendments will be

effective from a date to be determined by the IASB and the December 2014 amendments from 1 January

2016.

An amendment to IAS 1 ‘Presentation of Financial Statements’ was issued in December 2014 to clarify the

application of materiality to financial statements. Its effective date is 1 January 2016.

None of these amendments is expected to have a material effect on the Group’s financial statements.

Effective after 2016 - IFRS 9

In July 2014, the IASB published IFRS 9 ‘Financial Instruments’ with an effective date of 1 January 2018.

IFRS 9 replaces the current financial instruments standard IAS 39, setting out new accounting requirements

in a number of areas. The Group is continuing its assessment of the standard’s effect on its financial

statements.

The principle features of IFRS 9 are as follows:

Recognition and derecognition

The material in IAS 39 setting out the criteria for the recognition and derecognition of financial instruments

has been included unamended in IFRS 9.

17

RBS – Annual Results 2015

Notes

3. Accounting policies (continued)

Classification and measurement

Financial assets - There are three classifications for financial assets in IFRS 9: fair value through profit or

loss; fair value through other comprehensive income; and amortised cost.

• Financial assets with terms that give rise to interest and principal cash flows only and which are held in a

business model whose objective is to hold financial assets to collect their cash flow are measured at

amortised cost.

• Financial assets with terms that give rise to interest and principal cash flows only and which are held in a

business model whose objective is achieved by holding financial assets to collect their cash flow and

selling them are measured at fair value through other comprehensive income.

• Other financial assets are measured at fair value through profit and loss.

However, at initial recognition, any financial asset may be irrevocably designated as measured at fair value

through profit or loss if such designation eliminates a measurement or recognition inconsistency.

The Group continues to evaluate the overall effect, but expects that the measurement basis of the majority of

the Group’s financial assets will be unchanged on application of IFRS 9.

Financial liabilities - IFRS 9’s requirements on the classification and measurement of financial liabilities are

largely unchanged from those in IAS 39. However, there is a change to the treatment of changes in the fair

value attributable to own credit risk of financial liabilities designated as at fair value through profit or loss

which are recognised in other comprehensive income and not in profit or loss as required by IAS 39.

Hedge accounting

Hedge accounting requirements are designed to align accounting more closely to the risk management

framework; permit a greater variety of hedging instruments; and remove or simplify some of the rule-based

requirements in IAS 39. The basic mechanics of hedge accounting: fair value, cash flow and net investment

hedges are retained. There is an option in IFRS 9 for an accounting policy choice to continue with the IAS 39

hedge accounting framework. The Group is actively considering its implementation approach.

Credit impairment

IFRS 9’s credit impairment requirements apply to financial assets measured at amortised cost, to those

measured at fair value through other comprehensive income, to lease receivables and to certain loan

commitments and financial guarantee contracts. On initial recognition a loss allowance is established at an

amount equal to 12-month expected credit losses (‘ECL’) that is the portion of life-time expected losses

resulting from default events that are possible within the next 12 months. Where a significant increase in

credit risk since initial recognition is identified, the loss allowance increases so as to recognise all expected

default events over the expected life of the asset. The Group expects that financial assets where there is

objective evidence of impairment under IAS 39 will be credit impaired under IFRS 9, and carry loss

allowances based on all expected default events.

18

RBS – Annual Results 2015

Notes

3. Accounting policies (continued)

The assessment of credit risk and the estimation of ECL are required to be unbiased and probability-

weighted: determined by evaluating at the reporting date for each customer or loan portfolio a range of

possible outcomes using reasonable and supportable information about past events, current conditions and

forecasts of future events and economic conditions. The estimation of ECL also takes into account the time

value of money. Recognition and measurement of credit impairments under IFRS 9 are more forward-looking

than under IAS 39.

A single bank-wide programme has been established to implement the necessary changes in the modelling

of credit loss parameters, and the underlying credit management and financial processes; this programme is

led jointly by Risk and Finance. The inclusion of loss allowances on all financial assets will tend to result in

an increase in overall impairment balances when compared with the existing basis of measurement under

IAS 39.

Transition

The classification and measurement and impairment requirements are applied retrospectively by adjusting

the opening balance sheet at the date of initial application, with no requirement to restate comparative

periods. Hedge accounting is generally applied prospectively from that date.

Effective after 2016 – other standards

In January 2016, the IASB amended IAS 7 ‘Cash Flow Statements’ to require disclosure of the movements

in financing liabilities. The amendment is effective from 1 January 2017.

In January 2016, the IASB amended IAS 12 ‘Income taxes’ to clarify the recognition of deferred tax assets in

respect of unrealised losses. The amendment is effective from 1 January 2017.

IFRS 15 ‘Revenue from Contracts with Customers’ was issued in May 2014. It will replace IAS 11

‘Construction Contracts’, IAS 18 ‘Revenue’ and several Interpretations. Contracts are bundled or unbundled

into distinct performance obligations with revenue recognised as the obligations are met. It is effective from 1

January 2018.

IFRS 16 ‘Leases’ was issued in January 2016 to replace IAS 17 ‘Leases’. Accounting for finance leases will

remain substantially the same. Operating leases will be brought on balance sheet through the recognition of

assets representing the contractual rights of use and liabilities will be recognised for the contractual

payments. The effective date is 1 January 2019.

The Group is assessing the effect of adopting these standards on its financial statements.

19

RBS – Annual Results 2015

Notes

4. Operating expenses

31 December

31 December

2015

2014

£m

£m

Staff costs

5,668

5,683

Premises and equipment

1,809

2,059

Other administrative expenses (1)

6,160

4,361

Depreciation and amortisation

1,173

926

Write down of goodwill and other intangible assets

1,331

523

16,141

13,552

Note:

(1) Other administrative expenses include Payment Protection Insurance costs, Interest Rate Hedging Products redress and related costs, mortgage-

backed securities

litigation and related costs, other litigation and conduct costs (see note 5) and UK Bank levy.

5. Provisions for liabilities and charges

Regulatory and legal actions

Other

FX

Other

customer

investigations/

regulatory

Property

PPI IRHP

redress (1)

litigation

provisions

Litigation

and other

Total

2015 £m £m

£m

£m

£m

£m £m £m

At beginning of year

799 424

568

320

183

1,772 696 4,762

Transfer

- -

-

(15)

(71)

86 - -

Currency translation and other movements

- -

-

16

2

105 24 147

Charge to income statement (2)

600 81

368

334

27

2,170 1,380 4,960

Releases to income statement (2)

(1) (13)

(34)

-

(7)

(18) (417) (490)

Provisions utilised

(402) (343)

(292)

(349)

(82)

(203) (488) (2,159)

At end of year 996 149

610

306

52

3,912 1,195 7,220

Notes:

(1) Closing provision primarily relates to investment advice and packaged accounts.

(2) Relates to continuing operations.

Payment Protection Insurance (PPI)

A charge for PPI of £600 million has been recognised in 2015 as a result of the developments detailed in

Note 12. The cumulative charge in respect of PPI is £4.3 billion, of which £3.3 billion (77%) in redress and

expenses had been utilised by 31 December 2015. Of the £4.3 billion cumulative charge, £3.9 billion relates

to redress and £0.4 billion to administrative expenses.

The table below shows the sensitivity of the provision to changes in the principal assumptions (all other

assumptions remaining the same).

Sensitivity

Actual to

date

Current

assumption

Change in

assumption

Consequential

change in

provision

Assumption

%

£m

Single premium book past business review take up rate

55%

56%

+/

-

5

+/

-

55

Uphold rate (1)

91%

89

%

+/

-

5

+/

-

35

Average redress

£1,677

£1,638

+/

-

5

+/

-

36

Note:

(1) Uphold rate excludes claims where no PPI policy was held.

20

RBS – Annual Results 2015

Notes

5. Provisions for liabilities and charges (continued)

Interest that will be payable on successful complaints has been included in the provision as has the

estimated cost of administration. There are uncertainties as to the eventual cost of redress which will depend

on actual complaint volumes, take up and uphold rates and average redress costs. Assumptions relating to

these are inherently uncertain and the ultimate financial impact may be different from the amount provided.

We continue to monitor the position closely and refresh the underlying assumptions. Background information

in relation to PPI claims is given in Note 12.

Interest Rate Hedging Products (IRHP) redress and related costs

Following an industry-wide review conducted in conjunction with the Financial Services Authority (now being

dealt with by the Financial Conduct Authority (FCA)), the Group agreed to provide redress to customers in

relation to certain interest rate hedging products sold to small and medium-sized businesses classified as

retail clients under FSA rules. A net charge of £68 million for 2015, principally reflects a marginal increase in

our redress experience compared to expectations and the cost of a small number of consequential loss

claims over and above interest offered as part of basic redress. We have now agreed outcomes with the

independent reviewer on all cases. A cumulative charge of £1.5 billion has been recognised, of which £1.1

billion relates to redress and £0.4 billion relates to administrative expenses. We continue to monitor the level

of provision given the remaining uncertainties over the eventual cost of redress, including the cost of

consequential loss claims.

Regulatory and legal actions

The Group is party to certain legal proceedings and regulatory and governmental investigations and

continues to co-operate with a number of regulators. All such matters are periodically reassessed with the

assistance of external professional advisers, where appropriate, to determine the likelihood of the Group

incurring a liability and to evaluate the extent to which a reliable estimate of any liability can be made.

Additional charges of £2.9 billion in 2015 include anticipated costs following investigations into the foreign

exchange market (£334 million), provisions in respect of mortgage-backed securities related litigation (£2.1

billion), provisions relating to packaged accounts (£157 million) and other litigation and conduct provisions

(£249 million).

21

RBS – Annual Results 2015

Notes

6. Pensions

The Group sponsors a number of pension schemes in the UK and overseas whose assets are independent

of the Group’s finances.

The Royal Bank of Scotland Group Pension Fund (the Main scheme), accounting for 88% (2014 – 87%) of

the Group’s retirement benefit obligations, was closed to new entrants in 2006. Since 2009, pensionable

salary increases in the Main scheme and certain other UK and Irish schemes have been limited to 2% per

annum or CPI inflation if lower. Also, with effect from 1 October 2012, the normal pension age for future

benefits was increased to 65 unless members elected to contribute to maintain a normal pension age of 60.

2015

2014

Pension costs £m

£m

Defined benefit schemes

521

459

Curtailment and settlement gains

(65)

-

Defined contribution schemes

71

83

Pension costs - continuing operations

527

542

All schemes

2015

2014*

Net pension deficit £m

£m

At begi

nning of the year

4,109

2,974

Change in accounting policy

-

105

Currency translation and other adjustments

(32)

(23)

Income statement

456

463

Return on plan assets above recognised interest income

457

(5,171)

Experience gains and losses

(258)

(18)

Effect of changes in actuarial financial assumptions

(1,386)

4,799

Effect of changes in actuarial demographic assumptions

48

490

Asset ceiling/minimum funding adjustments

1,212

1,749

Contributions by employer

(1,059)

(1,063)

Transfer to disposal groups

2

(196)

At end of year

3,549

4,109

Net assets of schemes in surplus

(215)

(180)

Net liabilities of schemes in deficit

3,764

4,289

*Restated - refer to page 14 for further details

Main scheme

2015

2014*

Fund assets at fair value

30,703

30,077

Present value of fund liabilities

30,966

31,776

Funded status

263

1,699

Asset ceiling/minimum funding

2,981

1,739

Retirement benefit liability

3,244

3,438

Minimum funding requirement

3,657

4,190

Ass

et ceiling

(413)

(752)

Retirement benefit liability

3,244

3,438

*Restated - refer to page 14 for further details

22

RBS – Annual Results 2015

Notes

6. Pensions (continued)

Interim valuations of the Main scheme under IAS 19 ‘Employee Benefits’ were prepared at 31 December

with the support of independent actuaries, using the following assumptions.

Principal IAS 19 actuarial assumptions

Main scheme

2015

2014

%

%

Discount rate

3.9

3.7

Expected return on plan assets

3.9

3.7

Rate of increase in salaries

1.8

1.8

Rate of increase in pensions in payment

2.8

2.8

Inflation assumption (RPI)

3.0

3.0

Main scheme

IAS 19 post-retirement mortality assumptions 2015

2014

Longevity at age 60 for current pensioners (years)

Males

27.8

28.0

Females

29.8

30.0

Longevity at age 60 for future pensioners currently aged 40 (years)

Males

29.1

29.3

Females

31.4

31.6

The Group discounts its defined benefit pension obligations at discount rates determined by reference to the

yield on high quality corporate bonds.

The sterling yield curve (applied to 93% of the Group’s defined benefit obligations) is constructed by

reference to yields on ‘AA’ corporate bonds. Significant judgement is required when setting the criteria for

bonds to be included in the population from which the yield curve is derived. The criteria include issue size,

quality of pricing and the exclusion of outliers.

The assets of the Main scheme which represent 88% of plan assets at 31 December 2015 (2014 - 88%), are

invested in a diversified portfolio of quoted and private equity, government and corporate fixed-interest and

index-linked bonds, and other assets including property and hedge funds.

The Main scheme employs derivative instruments, to achieve a desired asset class exposure or to match

assets more closely to liabilities.

The table below sets out the sensitivities of the present value of the defined benefit obligations at 31

December to a change in the principal actuarial assumptions:

Main scheme

(decrease)/increase in obligation

at 31 December

2015

2014

£m

£m

0.25% increase in the discount rate

(1,392)

(1,466)

0.25% increase in inflation

1,106

1,159

0.25% additional rate of increase pensions in payment

945

982

Longevity increase of one year

853

988

23

RBS – Annual Results 2015

Notes

6. Pensions (continued)

In 2015 the Group paid £1.1 billion (2014 - £1.1 billion) in employer contributions to the various pension

schemes. These cash contributions reflect the regular ongoing accrual of benefits and running costs of the

schemes based on the IAS 19 accounting valuations, and also reflect additional contributions agreed with

the trustees of those schemes which are in deficit, as part of the triennial actuarial funding valuation. £0.5

billion (2014 - £0.5 billion) of the employer contributions represented the P&L cost of the pension plans; the

remainder of the contribution served to reduce the net liabilities of the schemes which on an IAS 19 basis fell

from £4.3 billion in 2014 to £3.8 billion this year end (2014 - increased from £3.2 billion to £4.3 billion) as a

result of the employer contributions and £0.1 billion net actuarial and experience losses (2014 - £1.8 billion

net gain) which are not reflected in the income statement.

In May 2014, the triennial funding valuation of The Main scheme was agreed which showed that the value of

the liabilities exceeded the value of assets by £5.6 billion at 31 March 2013, a ratio of 82%. To eliminate this

deficit, the Group will pay annual contributions of £650 million from 2014 to 2016 and £450 million (indexed

in line with inflation) from 2017 to 2023. These contributions are in addition to regular annual contributions of

approximately £270 million in respect of the ongoing accrual of benefits as well as contributions to meet the

expenses of running the scheme.

In January 2016, RBS Group sought regulatory approval to accelerate the settlement of the outstanding

additional contributions of £4.2 billion and it entered into a Memorandum of Understanding with the trustee of

the Main scheme which, among other things, will bring forward the date of the next triennial funding valuation

to no later than 31 December 2015.

The trustee of the Main scheme is responsible for setting the actuarial assumptions used in the triennial

funding valuation having taken advice from the Scheme Actuary. These represent the trustee’s prudent

estimate of the future experience of the Main scheme taking into account the covenant provided by RBS

Group and investment strategy of the scheme. They are agreed with RBS Group and documented in the

Statement of Funding Principles.

24

RBS – Annual Results 2015

Notes

7. Loan impairment provisions and risk elements in lending

Loan impairments

Operating (loss)/profit is stated after net loan impairment releases from continuing operations of £834 million

(2014 - £1,326 million). The balance sheet loan impairment provisions decreased in the year ended 31

December 2015 from £17,404 million to £7,052 million and the movements thereon were:

Year ended

31 December

31 December

2015

2014

£m

£m

At beginning of year

17,404

25,045

Transfer to disposal groups

(20)

(553)

Currency translation and other adjustments

(576)

(657)

Amounts written

-off

(8,950)

(5,253)

Recoveries of amounts previously written-off

172

201

(Releases)/charges to income statement

- continuing operations

(834)

(1,326)

- discontinued operations

-

194

Unwind of discount (recognised in interest income)

(144)

(247)

At end of year

7,052

17,404

Provisions at 31 December 2015 include £1 million in respect of loans and advances to banks (2014 - £40

million).

Risk elements in lending

Risk elements in lending (REIL) comprises impaired loans and accruing loans past due 90 days or more as

to principal or interest. Impaired loans are all loans (including loans subject to forbearance) for which an

impairment provision has been established; for collectively assessed loans, impairment loss provisions are

not allocated to individual loans and the entire portfolio is included in impaired loans. Accruing loans past

due 90 days or more comprise loans past due 90 days where no impairment loss is expected.

REIL decreased from £26,722 million to £12,035 million in the year ended 31 December 2015 and the

movements thereon were:

Year ended

31 December

31 December

2015

2014

£m

£m

At beginning of year

26,722

39,126

Transfer to disposal groups

(20)

(1,347)

Currency translation and other adjustments

(865)

(1,092)

Additions

4,075

6,594

Transfers (1)

(222)

(256)

Transfer to performing book and repayments

(8,705)

(11,350)

Amounts written

-off

(8,950)

(4,953)

At end of year

12,035

26,722

Note:

(1) Represents transfers between REIL and potential problem loans.

Provision coverage of REIL was 59% at 31 December 2015 (2014 - 65%).

25

RBS – Annual Results 2015

Notes

8. Tax

The actual tax credit/(charge) differs from the expected tax credit/(charge) computed by applying the

standard rate of UK corporation tax of 20.25% (2014 - 21.50%) as analysed below:

Year ended

31 December

31 December

2015

2014

£m

£m

(Loss)/profit before tax

(3,153)

2,403

Expected tax credit/(charge)

638

(517)

Losses and temporary differences in period where no deferred tax asset recognised

(968)

(14)

Foreign profits taxed at other rates

486

100

UK tax rate change impact

94

-

Non-deductible goodwill impairment

(124)

(28)

Items not allowed for tax

- losses on disposals and write-downs

(15)

(19)

- UK bank levy

(50)

(54)

- regulatory and legal actions

(226)

(182)

- other disallowable items

(215)

(148)

Non-taxable items

90

37

Taxable foreign exchange movements

(22)

(23)

Losses brought forward and utilised

102

218

(Reduction)/increase in carrying value of deferred tax asset in respect of:

- UK losses

-

(850)

- US losses and temporary differences

-

(775)

- Ireland losses

-

153

Adjustments in respect of prior periods

239

69

Actual tax credit/(charge)

29

(2,033)

At 31 December 2015, the Group has recognised a deferred tax asset of £2,622 million (2014 - £1,881

million) and a deferred tax liability of £729 million (2014 - £236 million). These include amounts recognised in

respect of UK trading losses of £1,121 million (2014 - £1,257 million). Under UK tax legislation, these UK

losses can be carried forward indefinitely to be utilised against profits arising in the future. The Group has

considered the carrying value of this asset as at 31 December 2015 and concluded that it is recoverable

based on future profit projections.

In recent years, the UK government has steadily reduced the rate of UK corporation tax, with the latest

enacted rates standing at 20% with effect from 1 April 2015, 19% from 1 April 2017 and 18% from 1 April

2020. The Finance (No 2) Act 2015 restricts the rate at which tax losses are given credit in future periods to

the main rate of UK corporation tax, excluding the Banking Surcharge 8% rate introduced by this Act.

Deferred tax assets and liabilities at 31 December 2015 take into account the reduced rates in respect of tax

losses and non-banking temporary differences and where appropriate, the banking surcharge inclusive rate

in respect of other banking temporary differences.

Prior year tax adjustments include releases of tax provisions that reflect the reduction of exposures in

countries where RBS is ceasing operations in line with the strategy to become a smaller, simpler UK focused

bank. The prior year tax adjustment also reflects adjustments to reflect submitted tax computations in the UK

and overseas and a further prior year tax credit in respect of tax losses arising in the Belfast Branch of Ulster

Bank Ireland Limited reflecting UK tax law changes and European Court of Justice decisions on the

surrender of tax losses.

26

RBS – Annual Results 2015

Notes

9. Segmental analysis

In 2015, the reported operating segments were realigned as follows:

●

Personal & Business Banking (PBB), comprises two reportable segments, UK Personal & Business

Banking, (UK PBB) and Ulster Bank RoI. UK PBB includes Ulster Bank customers in Northern Ireland.

Ulster Bank RoI serves individuals and businesses in the Republic of Ireland (RoI).

●

Commercial & Private Banking (CPB), comprises three reportable segments Commercial Banking,

Private Banking and RBS International (RBSI).

● Corporate & Institutional Banking (CIB), a single reportable segment.

Capital Resolution includes CIB Capital Resolution and the remainder of RCR.

Williams & Glyn (W&G) comprises the RBS England and Wales branch-based businesses, along with certain

small and medium enterprises (SME) and corporate activities across the UK. During the period presented

W&G has not operated as a separate legal entity. The perimeter of the segment currently reported does not

include certain portfolios that are ultimately intended to be divested as part of W&G, for example, certain

NatWest branches in Scotland.

Reporting changes

A number of items (own credit adjustments, gain/(loss) on redemption of own debt, write-down of goodwill

and strategic disposals) previously reported separately after operating profit are now being reported within

operating profit.

Comparatives have been restated accordingly.

Year ended

31 December

31 December

Analysis of operating profit/(loss)

2015

2014*

£m

£m

UK Personal & Business Banking

1,628

1,663

Ulster Bank RoI

308

542

Personal & Business Banking

1,936

2,205

Commercial Banking

1,847

1,769

Private Banking

(413)

188

RBS International

247

281

Commercial & Private Banking

1,681

2,238

Corporate & Institutional Banking

(504)

(193)

Capital Resolution

(3,426)

1,466

Williams & Glyn

431

467

Central items & other

(3,271)

(3,780)

Total

(3,153)

2,403

*Re-presented to reflect the segmental reorganisation

27

RBS – Annual Results 2015

Notes

9. Segmental analysis (continued)

Year ended

31 December 2015

31 December 2014*

External

Inter

Total

External

Inter

Total

segment

segment

Total revenue £m

£m £m

£m

£m £m

UK Personal & Business Banking

6,195

50 6,245

6,351

39 6,390

Ulster Bank RoI

640

15 655

672

50 722

Personal & Business Banking

6,835

65 6,900

7,023

89 7,112

Commercial Banking

3,482

42 3,524

3,554

51 3,605

Private Banking

577

191 768

624

240 864

RBS International

275

177 452

287

208 495

Commercial & Private Banking

4,334

410 4,744

4,465

499 4,964

Corporate & Institutional Banking

1,872

1,199 3,071

2,541

1,212 3,753

Capital Resolution

746

1,455 2,201

2,597

2,611 5,208

Williams & Glyn

920

- 920

954

- 954

Central items & other

1,587

(3,129)

(1,542)

1,819

(4,411)

(2,592)

Total

16,294

- 16,294

19,399

- 19,399

*Re-presented to reflect the segmental reorganisation

31 December 2015

31 December 2014*

Assets

Liabilities

Assets

Liabilities

Total assets and liabilities £m

£m

£m

£m

UK Personal & Business Banking

127,067 140,585

119,763 136,823

Ulster Bank RoI

21,264 15,837

22,479 17,962

Personal & Business Banking

148,331 156,422

142,242 154,785

Commercial Banking

96,983 94,849

90,677 89,772

Private Banking

11,596 23,256

12,241 22,660

RBS International

7,854 21,399

7,779 20,995

Commercial & Private Banking

116,433 139,504

110,697 133,427

Corporate & Institutional Banking

213,790 194,238

281,910 261,472

Capital Resolution

187,833 186,458

314,449 277,858

Williams & Glyn

20,117 24,171

19,563 22,065

Central items & other

125,687 69,491

176,521 148,087

Total

812,191 770,284

1,045,382 997,694

*Restated - refer to page 14 for further details. Re-presented to reflect the segmental reorganisation.

28

RBS – Annual Results 2015

Notes

10. Discontinued operations and assets and liabilities of disposal groups

In accordance with a commitment to the European Commission to divest Citizens Financial Group, Inc.

(Citizens) by 31 December 2016, the Group disposed of 30% of its interest in Citizens during the second half

of 2014 primarily through an initial public offering in the USA and disposed of a further 28% in March 2015,

21% in August 2015 and the remaining 21% in October 2015 to complete the divestment. Consequently,

Citizens is classified as a disposal group and treated as a discontinued operation until October 2015. From 3

August 2015, Citizens was an associated undertaking.

(a) Profit from discontinued operat

ions, net of tax

31 December

31 December

2015

2014

£m

£m

Citizens

Interest receivable

1,433

2,204

Interest payable

(144)

(191)

Net interest income

1,289

2,013

Non-interest income

615

1,043

Total income

1,904

3,056

Operating expenses

(1,181)

(2,123)

Profit before impairment losses

723

933

Impairment losses

(103)

(197)

Operating profit before tax

620

736

Tax charge

(212)

(228)

Profit after tax

408

508

Provision for gain/(loss) on disposal of subsidiary

10

(3,994)

Gain on disposal of subsidiary

1,159

-

Provision for loss on disposal of interest in associate

(130)

-

Gain on disposal of interest in associate

91

-

Profit/(loss) from Citizens discontinued operations, net of tax

1,538

(3,486)

(b) Assets and liabilities of disposal groups

31 December

31 December

2015

2014

£m

£m

Assets of disposal groups

Cash and balances at central banks

535

622

Loans and advances to banks

709

1,745

Loans and advances to customers

1,639

59,606

Debt securities and equity shares

443

15,865

Derivatives

30

402

Intangible assets

-

555

Property, plant and equipment

19

549

Other assets

111

1,689

Discontinued operations and other disposal groups

3,486

81,033

Liabilities of disposal groups

Deposits by banks

32

6,794

Customer accounts

2,805

61,256

Debt securities in issue

-

1,625

Derivatives

28

144

Settlement balances

7

-

Subordinated liabilities

-

226

Other liabilities

108

1,239

Discontinued operations and other disposal groups

2,980

71,284

29

RBS – Annual Results 2015

Notes

10. Discontinued operations and assets and liabilities of disposal groups (continued)

Disposal groups at 31 December 2015 is primarily International Private Banking (fair value less costs to sell

reflects the agreed sale to Union Bancaire Priveé: fair value hierarchy level 3) (£3,344 million assets; £2,724

million liabilities).

Disposal groups at 31 December 2014 is predominantly Citizens.

11. Contingent liabilities and commitments

31 December

31 December

2015

2014

£m

£m

Guarantees and assets pledged as collateral security

5,894

11,694

Other contingent liabilities

6,789

9,221

Standby facilities, credit lines and other commitments

137,364

213,952

Contingent liabilities and commitments

150,047

234,867

Additional contingent liabilities arise in the normal course of the Group’s business. It is not anticipated that

any material loss will arise from these transactions.

12. Litigation, investigations and reviews

RBS plc and other members of the RBS Group are party to legal proceedings and the subject of

investigation and other regulatory and governmental action (“Matters”) in the United Kingdom (UK), the

United States (US), the European Union (EU) and other jurisdictions.

The RBS Group recognises a provision for a liability in relation to these Matters when it is probable that an

outflow of economic benefits will be required to settle an obligation resulting from past events, and a reliable

estimate can be made of the amount of the obligation. While the outcome of these Matters is inherently

uncertain, the directors believe that, based on the information available to them, appropriate provisions have