Replacement

Models

11.1

Introduction

The

replacement

problems

are concerned with the situations that

arise

when

some

items

such

as

men,

machines.

electric

light

bulbs

ctc

need

replacement

due

to

their

decreased

efficiency,

failure

or

brcakdown.

Srch decreased efficiency

or

complete breakdown may either be graduai

or

all

of

a

sudden.

The

replacement

problem

arises

because

of

the

following

factors

i)

The

old

item

has

become

worse

or

requires

expensive

maintenance.

ii)

The

old

item

has

failed

due

to

accident.

ii)

A

more

efficient

design

of

equipment

has

become

available

in

market.

Thus

the

provlem

of

replacement

is

to

decide

the

best

policy

to

dctermine

the

age

at

which

the

replacement

is

most

economical

instcad

of

continuing

at

increased

cost

due

to

factor

like

maintenance.

The

objective

is

to

find

the

optimum

period

of

replacement.

We

shall

discuss

the

following

main

type

of

replacement

situations:

i)

Replacement

of

items

that

deterioráte

with

time.

Replacement

of

items

which

do

not

deteriorate

but

fail

after

ii)

certain

amount

of

use.

For

items

which

do

not

deteriorate

but

fail

all

of

a

sudden,

following

are

the

two

types

of

replacement

policies

i)

Individual

replacement

policy

:

Under

this

policy,

an

item

is

replaced

immediately

afier

its

failure.

iiGroup

replacement

policy:

Under

this

policy,

we

take

decisions

as

to

when

all

the

items

must

be

replaced,

irrespective

of

the

fact

that

items

have

failed

or

have

not

failed,

with

the

provision

that,

if

any

item

fails

before

the

replacement

time

it

may

be

individually

replaced.

11.4

KEsource

tvlaliagol

Remarks

In

numerical

problems

we

consider

the

minimum

valte

of

determine

the

Plc

the

average

annual

cost

(i.e.,)

minimum

of

gptimum

replacement

period.

Example

1:

A

machine

owner

finds

fron

s

past

records

that

the

costs

per

year

of

maintaining

a

machine

whae

purchase

price

is

Rs.

6000

are

as

given

below:

Year

1

2

3

4

5

Maintenance

Cost (Rs)

Resale

1000

1200.

1400

2300

2800

1500

750

375

200

200

S

3000

Value

(Rs)

Determine

at

what

age

is

replacement

due

?

IMU.

MBA

Apr

97,

MU.

BE.

80

S

scrap

value.

Solution :

See

Table below. Here C

Rs.

6000,

Year Main. cost

Totat

(R)

C-S

Total

Cost

Ave.

cost

(n)

Main.

cost

(Rs)

=

(3)

+(4)

Pn)

(Rs)

2R,

(Rs)

(1)

=

P(n)

n

(1)

(2)

(4)

5)

(6)

1000

1000

3000

4000

4000

2

1200

2200

4500

6700

3350

1400

3600

5250

8850

2950

5400

5625

2756

2700

4

1800

11,025

5 2300

7700

5800

13,500

6

2800

10,500

5800

2717

Minimum

cost is in

5th

year

optimum

replacement

plan

:

16,300

replace

the

machine

at

the

end

of

5th

year

Example

2:

The

cost

of

a machine

is

Rs

6100

and its serap value

Rs.100.

The

maintenance

costs

found

from

experience

are

as

follows:

Year

2

3

5

6

Main.

Cost (Rs)

100

250

400

600

900

1200

1600

2000

When

should

the

machine

be

replaced?

[MU.

BE.

Mech

Oct

96

Solution:

Since

the

scrap

value

of

the

machine

is

Rs.100

resale

value

of

the

machine

alter

a

year

remains

constant

throughout.

The

costs

required

can

now be calculated as follows

Ave. cost

Year Main.

costumulative

C-S

Total

Cost

Mai.

cost

)

T-(3)+(4)

TA

(5).

(1)

(2)

(3)

(4)

(5)

say

(6)

100

100

6000

6100

6100

2

250

350

6000

6350

3175

3

400

08750

6000

6750

2250

4

600

1350

6000

7350

1837

5

900

2250

G000

8250

1650

1200

3450

6000

9450

1575*

6

7

1600

5050

6000

11,050

1579

8

2000

7050

6000

13,050

1631

Here

Ta

is

minimum

during

6th

year.

Hence

the

machine

should

be

replaced at the end

of

6th

year.

Example

3:

A

taxi

owner

estimates

from

his

past

records

that

the

costs

per

year

for

operating

a

taxi

whose

purchase

price

when

new

is

Rs.

60,000

are

as

given

below:

3

5

Age

1

2

Operting

Cost

(Rs)

15,000

18,000

20,000

10,000

12,000

After

5

years,

the

operating

cost

is

Rs.

6000

k

where

k6,

7,

8,

9,

10

(k

denoting

age

in

years).

If

the

resale

value

decreases

by

10%

of

purchase

price

each

year,

what

is

the

best

IMU.

BE.

Apr

91/

replacement

policy

?

Cost

of

the

money

is

zero.

10

Rs.

60,000

x

100

Solution:

10%

of

purchase

price

Rs.

6000

Thus

the

resale

value

decreases

by

Rs.

6000

every

year,

which

nneans

(C-S)

increases

by

Rs.

6000

every

year.

Average

annual

cost

of

the

taxi

is

computed

as

below.

(i1)

In

a

similar

fashion

we

prepare

a

table

for

B.

(3)

(4)

(5)

2)

Running

cost R

(6)

()

()

(1)

Commutative

year

running

costC-S

(5)

(3)+(4)

(

400

400

10,000

10,400

10,400

2

1200

1600

10,000

11,600

5800

2000

3600

10,000

13,600

4533

4

2800

6400

10,000

16,400

4100

3600

10,000

10,000

20,000

4000*

b

4400

14,400

10,000

24,400

4066

The above Table indicates that machine 'B° should be replaced at

the

end

of

5"

year.

Since the lowest average cost

of

Rs.4000 for machine B is less

than

the lowest average cost

of

Rs.5200 for

machine

A, machine A can

be

replaced

by

machine

B.

Now

we

have to determine as to when A

should

be replaced. Machine

A should

be

replaced when the cost for next

year

of

running

this

machine

becomes

more

than

the

average

yearly

cost

for

machine

B

Now

total

cost

for

machine

A

in

the

first

year

=

Rs.

9200

Total cost for machine A

in

the

II

year

Rs. 11,400 Rs.

9200

Rs.2200

III

year

Rs.

4200

150

4

IV

year

=

Rs.

6200(

1-

Sb)

As

the

cost

of

running

machine

A

in

lIl

year

(Rs.4200)

is

mo

thar

e

the

average

yearly

cost for machine B

(Rs

4000)

;

machine

A should

replaced

at the end of two years (i.e.,)

one

year

after

it

is

one year oid

Replacement

Models

11.9

Example

nle

6:

A

machine

shop

has

a

press

which

is

to

be

replaced

wears

out.

A

new

press

is

to

be

installed

now.

Further

an

optimum

a

m

replacement

is

to

be

found

for

next

7

years

after

which

the

press

is

no

longer

required.

The following

data

is

given

after

Installation

cost

at

Salvage

Value

Operating

cost

Year

beginning

of

year

(Rs)

at

end

of

year

during

the

year

(Rs)

(Rs)

1

200

100

60

2

210

50

80

3

220

30

100

240

20

120

5

260

15

150

290

10

180

320

0

230

Find

the

optimum

replacement

plan

and

the

corresponding

minimum

cost.

Solution:

Using

the

given

information,

the

minimum

average

annual

cost

of

the

press

is

computed

in

the

following

table.

C-S

T

TA

Year

(n)

60

200-

100

100

160

160

60

140

210-50

160

300

150

2

80

190

430

143*

3

100

240

120

360

220

580

145

4

245

755

151

5

150

510

280

970

162

6

180

690

1240

177

920

320

7

230

Since

T^

is

minimum

for

n

=

3,

the

machine

should

be

replaced

every

third

year.

Ans

ne

Value,

Present

worth

factor

(pwf)

and

Repla

cement

Models

113

1

Discount

Rate

11.3

honCy

Value

:

Since

money

has

a

value

over

time,

we

often

speak:

)In

one

way,

spending

Rs.100

today

would

be

equivalent

to

h10%

per

year.

This

can

be

explained

in

the

following

2

money

1s

worth

Ways.

equivalent

to

spending

Rs.110

in

a

year's

time

lconsequently

one

rupee

after

a

year

from

now

is

equivalent

to

now

is

equivalent

to

(1:1rupee

today.

Present

worih

factor

(pw)

IMU.

MBA

Nov.96

to

(1

1)

have

just

seen

abOve,

one

rupee

a

year

from

now

is

equivalent

nee

today

at

the

interest

rate

10%

per

year.

one

rupee

spent

Pars

from

now

1s

equivaient

to

(l:1)

today.

Similarly

we

can

sav

Ine

spent

'n

years

from

noW

Is

equivalent

to(1

1)-n

today

The

on

quantity

(1

1)

is

called

present

worth

factor

(pwf)

or

present

value

of

one

rupee

spent

n

years

from

now.

Discount

rate

(Depreciation

Value)

The

present

worth

factor

of

unit

amount

to

be

spent

after

one

year

is

oiven

by

V

=

(1

+r)

were

r

is

the

interest

rate.

Then

V

is

called

discount

IMU.

MBA

Nov.96]

rate

(technically

known

as

depreciation

value)

Example

7:

Let

the

value

of

the

money

be

10%

per

year

and

Suppose

that

machine

A

is

replaced

after

every

3

years

whereasS

machine B is

replaced

after

every

six

years.

1ne

yearly

cost

of

both

machines

are

given

as

under

5

6

1

2

3

4

Age

Machine

A:

1000

200

400

1000

200

400

Machine

B:

1700

100

200

300

400

500

Determine

which

machine

should

be

purchased

?

IMU.

BE

Nov

93

100

10

Solution:

Present

worth

factor

V =

100+

10IT

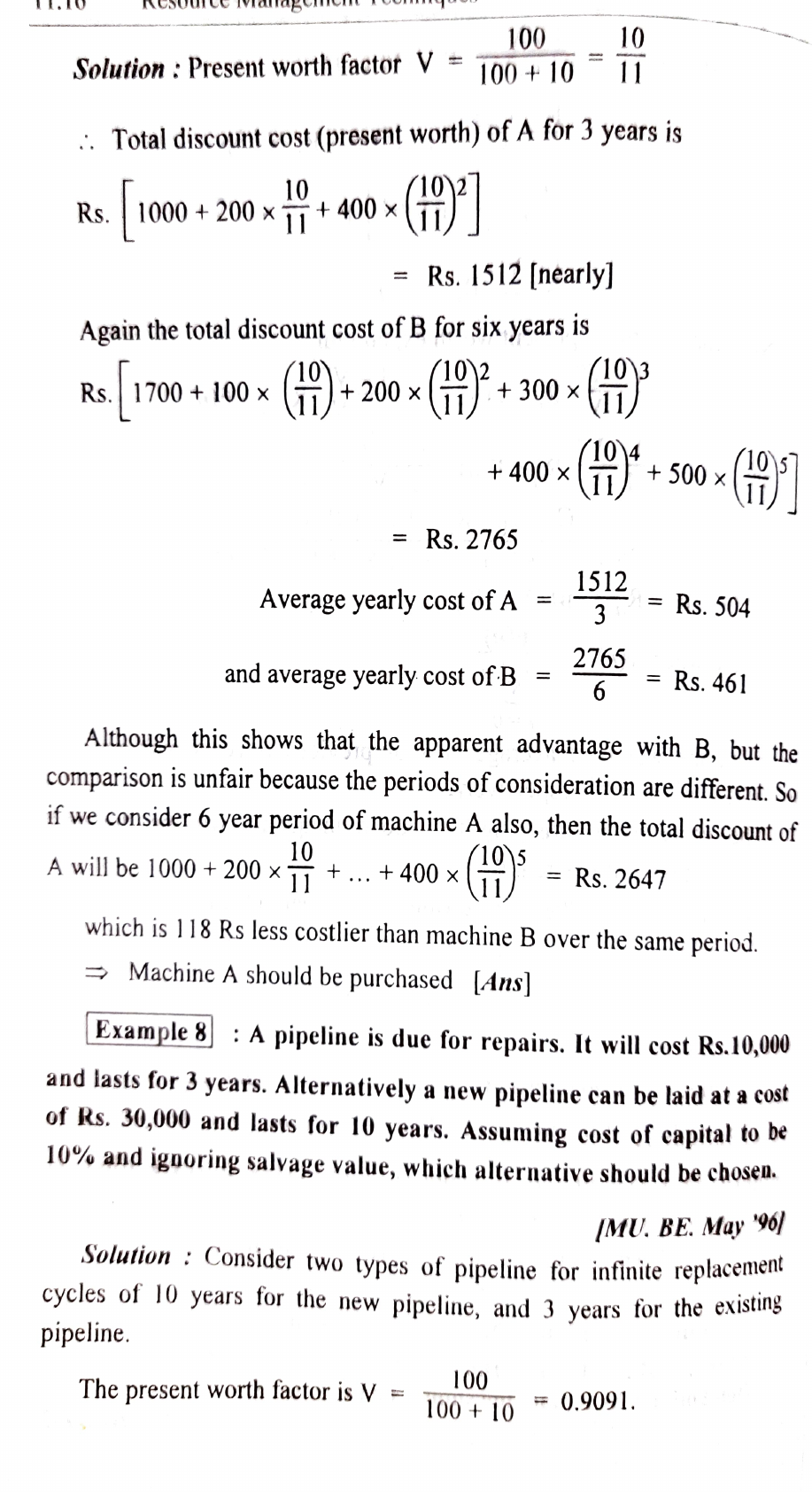

Total discount cost (present worth)

of

A

for

3 years

is

10

Rs.

1000+

200

x+400

xT

=

Rs.

1512

[nearly]

Again

the

total

discount

cost

of

B

for

six

years

is

Rs.

1700

100

x

(+200x

300-

+400xi

Rs. 2765

Average

yearly

cost

of

A = = Rs. 504

1512

3

-22

Rs.

461

and

average

yearly

cost

of

B

=

6

Although

this

shows

that

the

apparent

advantage

with

B,

but

the

comparison

is

unfair

because

the

periods

of

consideration

are

different.

So

if

we

consider 6

year

period

of

machine

A

also,

then

the

total

discount

of

A

will

be

1000+

200x..

+

400

x

=

Rs.

2647

which

is

118

Rs

less

costlier

than

machine

B

over

the

same

period.

Machine

A

should

be

purchased

[Ans]

Example 8 A

pipeline

is

due

for

repairs.

It

will

cost

Rs.10,000

and

lasts

for 3

years.

Alternatively

a

new

pipeline

can

be

laid

at

a

cost

of

Rs.

30,000

and

lasts

for

10

years.

Assuming

cost of

capital

to

De

10%

and

iguoring

salvage

value,

which

alternative

should

be

chosen.

IMU.

BE.

May

96

Solution

:

Consider

two

types

of

pipeline

for

infinite

replacenct

cycles

of

10

years

for

the

new

pipeline, and 3 years

for

the

existmg

pipeline

100

The

present

worth

factor is V =

T00+

10

=

0.9091.

Replacement

Models

11.17

1et

D,

denote

the

discounted

value

of

all

future

costs

associated

with

a

nolicy

of

replacing

they

equipment

after

'n'

years.

Then

if

we

designate

olicy

of

replac

the

initial

outlay

by

C,

D

D

C+V

C+

y2n

C

+.

C[l+Vn

+V2

+

...

...]

C

1-V

Now

substituting

the

values ofC,

V,

n

for

two

types

of pipelines ;

the

discounted

value

for

the

existing

pipeline

is given by

10,000

D3

1-(0.9091)3

Rs.

40,258

and for the new pipeline

30,000

1-

(0.909110

Rs,

48820

Since

D

D10.

the existing pipeline

should

be

continued.

[Ans]

D1o

Alternatively,

the

comparison

may

be

made

over

3 x

10

30

years.

Example

9

The

cost

patterns

of

2

machines

A

and

B,

when

money

value

is

not

considered

is

given

beloww

Year

Machine

A

Machine

B

1

900

1400

2

600

100

700

700

3

Find

the

cost

patterns

for

each

machines

when

money

is

worth

10%

per

year,

and

hence

find

which

machine

is

less

costly.

IMU.

BE.

Nov 91)

Solution:

The

total

outlay

for

three

years

for

Machine

A

=

900

+600

+

700

Rs.

2200

and

also

for

=

Rs.

2200

Machine

B

=

1400+100+

700

Here

we

observe

that

the

total

outlay

for

either

maçhine

is

same

for

Unree

years

when

money

value

is

not

taken

into

account,

Hence

both

the

machines appear equally good.

11.18

Resource

Managoll

ear

and

from

Now

consider

the

money

value

at

the

rate

of

10%

per

the

following

table

we

get

the

discounted

costs

for

A,

B.

2

3

Total

cost

Ycar

Machine

A

|900

600x

110

700x

S

2023.93

Machine

B1400

600x

10

100

02

Rs.

2023.93

700

11

(100)

2

2069.43

100

Machine

A

is

preferred

Ans

be

Example

10:

Assume

that

the

present

value

of

one

runee

t

spent

in

a

year's

time

is

Re

0.9

and

C =

Rs.

3000,

capital

enet

of

cquipment

and

the

running

costs

are

given in

the

table

below. Wh

should the machine be

repaced?

[BRU. BE.

Apr

97, MSU. BE.

4pr

97

4

en

Year

1

2

3

5

6

ung.

cost

(Rs):

500 600 800 1000 1300 1600 2000

Solution:

Consider

the

following

table:

Year

n R

V-R,V=|ER,V-C+R,V-y-

Wn

(1)

(2)

(3)

(4)

(5)

(6)

(7)

1

500

500

500

3500

3500

600

0.90

1040

4040

1.90

2126.32

2

540

800 0.81

648

1688

4688

2.71

1729.88

3

1000

0.73

730

2418

5418

3.44

1575

4

1300

0.66

858

3276

6276

4.10

1530.73

6

1600

0.59

944.784

4220.78

7220.78

4.69

1539.61

Since

W(n)

is

minimum

at

6th

year

optimum

replacement

plan

is

end

of

sixth

year

Example

11:

The

cost

of

a

new

machine

is

Rs.5000.

The

maintenance

cost

of

n"

year

is

given

by

C,

=

500

(n-1);

n

=

1,2

.

suppose

that

money

is

worth

5%

per

year,

after

how

many

years

WI

it be

economical

to

replace

the

machine

by

a

New

one?

IMU.

BE.

Apr

961

Solution:

The

present

worth

of

the

money

to

be

spent

a

year

ro

V

=

(1+0.05)l

=

0.9523

now

is

Replacement

Models

11.19

The

optimum

replacement

time

is

determined

in

the

following

table.

Year

n R

Vn-1R.Vn-1|

C+ER,V-1

5

Zv-

Wn

2

3

6 7

1.0000

0

5000

1.000

5000

1.9523

2805

500

0.9523

1000

0.9073

1500

0.8638

1296

2

476

6476

3

907

6383

2.8593 2232

4

7679

3.7231 2063

4.5458 2061

5.3293

2117

Since

W(n)

is

mininum

for

n = 5

and

R =

1500

< w

(5)

as

well

as

20000

0.8227

1645

-

9324

6

2500

0.7835

1959

11,283

w5)>

R6

2500,

it

is

economical to replace

the

machine

by

a new one at

the

end

of

5 years.

[Ans)

Example

12:

A production machine installed has initial

investment

of

Rs.

30,000

and

its

salvage

value

at

the

end

of

i

years

of

30,000

its

use

is

estimated

as Rs.

The

annual

operating and

maintenance

cost

in

the

first

year

is Rs. 15,000

and

increases

by

Rs.

1000

in

each

subsequent

years

for

first

five

years

and

increases

by Rs.

5000 in

each

year

thereafter.

Replacement

policy is

to

be

planned

over

a

period

of

seven

years.

During

this

period

cost

of

capital

may

be

taken

as

10%

per year.

Solve

the

problem

for

optimal

replacement.

Ans:

Here

C

=

30,000,

V=

O

IC-S,V

Year

R

V-lR,

V2R,V"S

S,"+R,

y-

S

(n)

2V

1.000

15000

1.0000

15000

15000

I5000

13635

31365

8260

26864

1.909

16000

0.909

14544

29544

10000

2

2.735

3

17000

|

0.826

14042

43586

7500

5633

24846

3.486

4

18000

0.751

13518

57104

6000

4098

23811

5000

3105

23261*

4.169

19000

0.683

12977

70081

23500

4.790

24000

0.621

14904

84985

4286

2422

6

1926

24173

5.355

29000

0.565

16385

101370

3750

Optimum

replacement

plan

is

after

5

years.

11.4

Group

Replacement

Policy

Lrample

15:

The

following

failure

rates

have

been

observed

for

certain items.

2

3

End

of

month

0.85

1.00

Probability

of

failure

todate

0.10

0.30

0.55

The

cost

of

replacing

an

individual

item

is

Rs.1.25.

The

decision

is

a0e

to

replace

all

items

simultaneously

at

fixed

intervals

and

also

place

individual

items

as

they

fail.

If

the

cost

of

group

replacement

is

50

paise,

what

is

the

best

interval

for

group

replacement.

A

group

replacement

per

item,

would

a

policy

of

strictly

indiast

a

replacement

become

preferable

to

the

adopted

policy.

11.26

Resource

Management

T

echniqucs

t

what

ndividual

IMU.

BE.

Nov

941

at

Solution:

Assume

that

items

failing

during

a

month

are

renlan

.

the end

of

the month.

that

Suppose

that

there

are

1000

items

in

use.

Let

pj

be

the

probability

that

rin

h

an

item,

which

was

new

when

placed

in

position for use, fails durino

dh

month

of

its

life. Thus,

we

have

P1

0.10

P2

0.30

-

0.10

0.20

P30.55-0.30

=

0.25

P40.85

-0.55

=

0.30

Ps1.00-0.85

=

0.15

Since

the

sum

of

probabilities

is

one,

all

the

probabilities

beyond

p

will

be

taken

as

zero.

Let

N,

denote

the

number

of

replacements

at

the

end

of

the

month.

Then

we

have

No=

Number

of

items

in

the

beginning

=

1000

N

NP=

100

N

NoP2

+

NiP-

200+

10

210

Ng

NoP3

+

NP2

+Nop

=

250

+20

+21

=

291

N4

NoP4

+

N\P3

+Nop

+NaP

396

Ns

NPs

+

NIP4

t+

NoP

+NP2

tNaP

=

331

The

expected

life

of

each

item

=2ip,

1xp+2

x

p2t

3

xpt

4

x

pat

5

x

Ps

=

Ix0.10

+2

x0.20

+3

x

0.25+4x0.30

+5

x

0.15

=

3.20

Replacement

odels,e11.27

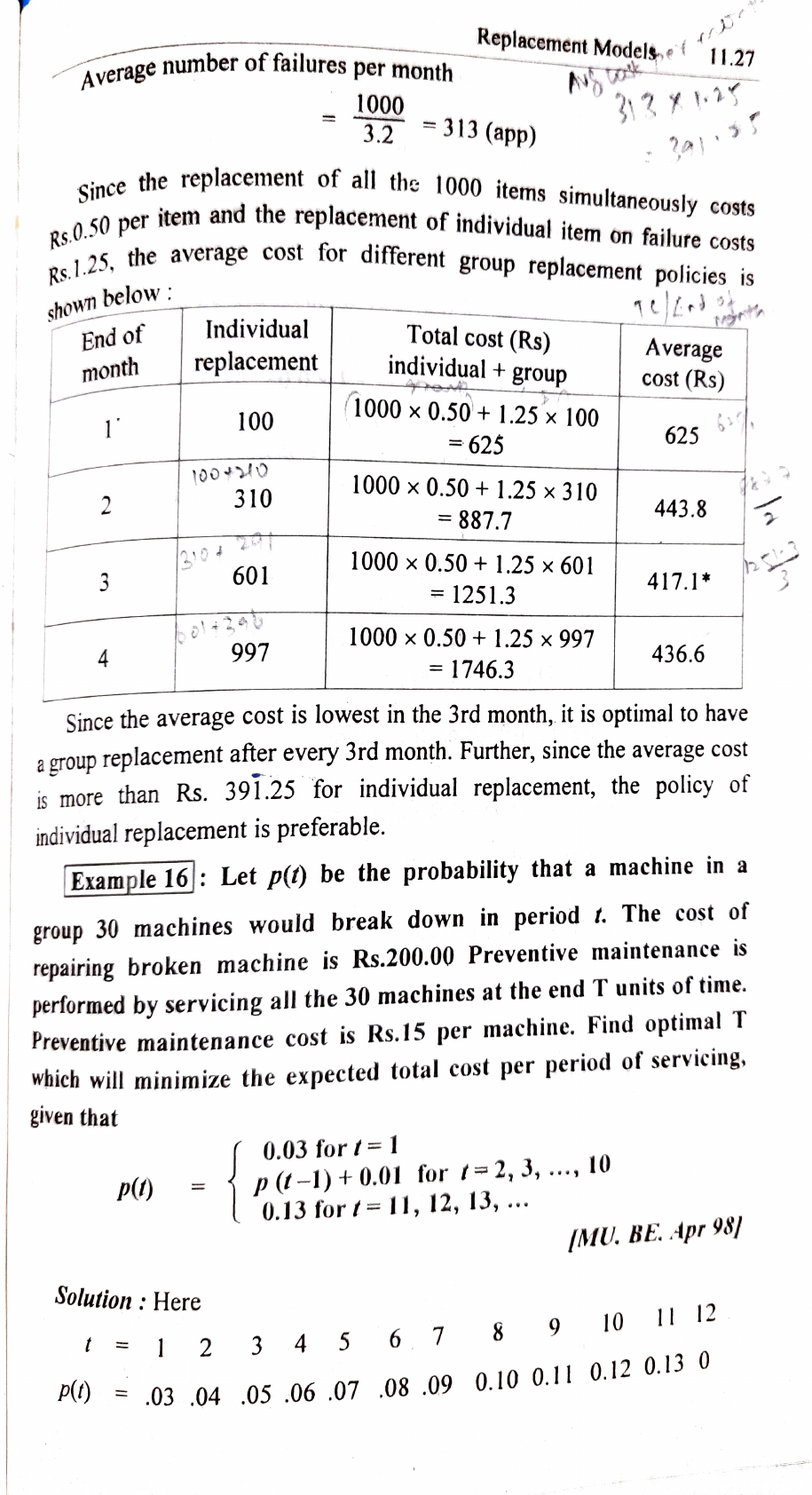

Average number

of

failures per month

1000

3.2

313

(app)

replacement

of

all

the

1000

items

simultaneously

costs

O

ner

item

and

the

replacement

of

individual

item

on

failure

costs

2

Since

the

Rs

0

s.0.50

per

item

and

the

average

cost

for

different

group

replacement

policies

is

s.1.25,

shown

below:

End

of

1tL

Individual

Total

cost

(Rs)

individual+

group

replacement

Average

month

cost (Rs)

1000x

0.50+1.25

x

100

100

625

625

1000

x

0.50

+

1.25

x

310

310

=

887.7

443.8

210

601

1000x

0.50

+

1.25

x

601

417.1*

=

1251.3

1000 x

0.50+1.25

x 997

4

997

436.6

=

1746.3

Since

the

average

cost

is

lowest

in the

3rd

month,

it

is

optimal

to

have

a

group

replacement

after

every

3rd

month.

Further,

since

the

average

cost

is

more

than

Rs.

391.25

for

individual

replacement,

the

policy

of

individual

replacement

is

preferable.

Example

16:

Let

p()

be

the

probability

that

a

machine

in a

group

30

machines

would

break

down

in

period

t.

The

cost

of

repairing

broken

machine

is

Rs.200.00

Preventive

maintenance

is

performed

by

servicing

all

the

30

machines

at

the

end

T

units

of

time.

Preventive

maintenance

cost

is

Rs.15

per

machine.

Find

optimal

T

which

will

minimize

the

expected

total

cost

per

period

of

servicing,

given

that

0.03

for

t=1

P1-1)+

0.01

for

t=2,

3,.,

10

0.13

for

t=

l1,

12,

13,

...

p)

IMU.

BE.

Apr

98

Solution:

Here

2

3

4

56

7

8

9

10

11

12

P)

03

.04

.05

.06

.0708

.09

0.

10

0.11

0.

12

0.15

0

.28

Resource

Managemen

one

this

Since

the

sum

of

all

probabilities

can

never

be

greater

than

means

P120,

P130

etc.

A

machine

which

has

lasted

upto

Iperiod

is

sure

to

fail

in

10th

Let

N,

be

the

number

of

machines

at

the

end

of

fth

period

30

period.

No

N

NoP

30

x

0.03

=

0.9

1

N

N2

NP2

+

NP1

30

x

0.041x

0.03

1.23 1

N

NP+NIP2+

NP2

=

30

x

0.05+

1 x

0.04

+ 1 x

0.03

1.57

2

N

NoP4+

NIP3+

NP2+

NPI

N4

=

1.95

2

Ns=

2,

Ng

=3,

N7

=3,

Ng4,

Ns

N9

4,

N10

5,

N1

=6.

Similarly

11

Since

the

expected

life

of

each

machine,

2

ip

=

6.41

time

units

we

30

have

average

number

of machines

failed

per

period

is

641

5

(app)

Cost

of

individual replacement

Rs.

5 x

200

Rs.

1000

Group maintenance cost

is

computed below:

Average cost

of

Maintenance

per

period

End of

Cost

of

Maintenance

Period

in

groupP

Rs

(30x

15)

+

1

x

200

650

Rs.

650

2

Rs

(30x

15)

+ 2 x

200

850

Rs.

425

3

Rs

(30x

15)

+

4x

200

1250

Rs.

417

4

Rs

(30x

15)

+

6

x

200

1650

Rs.

412

5

Rs

(30x

15)

+8

x

200

2050

Rs.

410*

6

Rs

(30x

15)

+

I1

x

200

2650

Rs. 442

Replacement

Models

1.29

Since

the

minimum

cost

occurs

in

the

5th

period

it

is

optimal

to

maintain

all the machines upto

5th

period.

Example

17:

There

is

a

large

number

of

light

bulbs,

all

of

which

LAns

ct

be

kept

in

working

order.

If

a

bulb

fails

in

service,

it

costs

Re.1

te replace it,

but

if

all

the

bulbs

are

replaced

in

the

same

operation,

it

cOsts

only 35 paise a bulb.

If

the proportion of bulbs failing

in

successive

time

intervals

is

known,

decide

on

the

best

replacement

policy

and give reason. The following mortality rates for light bulbs

have

been

observed.

Proportion

failing

during

first

week

=0.09

Proportion

failing

during

second

week

=

0.165

Proportion

failing

during

third

week

=0.24

Proportion

failing

during

fourth

week

=

0.36

Proportion

failing

during

fifth

week=

0.12

Proportion

failing

during

sixth

week

=

0.03

Solution:

Let

number

of

bulbs

initially

be

No=

10000

(say)

Ifp, denote the probability

of

failure during i

week

then

p = 0.09,

P20.16,

p3

=

0.24,

P4=0.36,

ps=0.12,

P =

0.03,

Now

N,

denote

the

number

of

replacement

at

the

end

of

fh

week.

Then

No

10000

N

Nop

=

1000

x

0.09

900

Na

NP2+NIP

=

1681

Ng

NoP3

+

NP2

t

Nap=2695

Similarly

N4=4324,

Ns

=2747,

N4

N

2599

The

expected

life

of

each

bulbs

2

ip,

=

3.35

10,000

3.35

2985

app.

Average

number

of

failures

per

week

he

cost

of

individual

replacement

2985

x

1=

Rs.

2985

1.30

Resource

Managenment

Techniques

Now

the

average

cost

of

different

group

replacement

is

as

follows:

End

of

Individual

Average

Total cost (Rs)

individual

t

group

week

replacement

cost

(Rs)

10,000 x

0.35

+900x

900 4400

-4400

10,000

x

0.35+

(2581

x

)-

6081

2581

3041

10,000

x

0.35+

(5276

x

1)-

8776

5276

923

10,000x

0,35

+

(9550x

)

13,050

9550

10,000

(),35

(2,207)

12,297

9s

optimul

to

bave

Hroup

eplavement every

Jd

week

A

Is

avernge

00sl

Jean

than

N.

2983

o

lnulivldual

replavenment,

the

adiuy

ul

Hp

veplauemet

in

preleed

4