REPORT

Evaluation of the Impact of the No

Surprises Act on Health Care Market

Outcomes:

Baseline Trends and Framework for

Analysis

First Annual Report

The First of Five Reports Required

by the Consolidated Appropriations Act, 2021

July 6, 2023

U.S. Department of Health and Human Services

Office of the Assistant Secretary for Planning and Evaluation

July 2023

REPORT TO CONGRESS

2

Office of the Assistant Secretary for Planning and Evaluation

The Assistant Secretary for Planning and Evaluation (ASPE) advises the Secretary of the U.S. Department

of Health and Human Services (HHS) on policy development in health, disability, human services, data,

and science; and provides advice and analysis on economic policy. ASPE leads special initiatives;

coordinates the Department's evaluation, research, and demonstration activities; and manages cross-

Department planning activities such as strategic planning, legislative planning, and review of regulations.

Integral to this role, ASPE conducts research and evaluation studies; develops policy analyses; and

estimates the cost and benefits of policy alternatives under consideration by the Department or Congress.

Office of Health Policy

The Office of Health Policy (HP) provides a cross-cutting policy perspective that bridges Departmental

programs, public and private sector activities, and the research community, in order to develop, analyze,

coordinate and provide leadership on health policy issues for the Secretary. HP carries out this mission by

conducting policy, economic and budget analyses, assisting in the development and review of regulations,

assisting in the development and formulation of budgets and legislation, and assisting in survey design

efforts, as well as conducting and coordinating research, evaluation, and information dissemination on

issues relating to health policy.

Suggested Citation

Office of the Assistant Secretary for Planning and Evaluation, U.S. Department of Health & Human

Services. Evaluation of the Impact of the No Surprises Act on Health Care Market Outcomes: Baseline

Trends and Framework for Analysis – First Annual Report. July 2023.

Acknowledgements

Many people at ASPE contributed to this project. The lead authors are Joel Ruhter and Steve Sheingold.

Other contributors include Nancy De Lew, Ken Finegold, and Benjamin D. Sommers. ASPE also

acknowledges support from RAND staff. The statements expressed in this report do not necessarily reflect

the views of RAND.

July 2023

REPORT TO CONGRESS

3

Contents

Chapter 1. Introduction and Overview .........................................................................................8

Chapter 2. State Actions on Surprise Billing ................................................................................ 11

Chapter 3. Consolidation and Competition – Trends and Evidence of Effects in Healthcare ................ 15

Chapter 4. Descriptive Analysis of Trends in OON Billing – Baseline Before NSA Implementation......... 26

Chapter 5. A Conceptual Framework and Potential Methods ........................................................ 32

Chapter 6. Conclusion............................................................................................................. 36

References ........................................................................................................................... 37

Appendix A. Section 109 of the No Surprises Act ......................................................................... 41

Appendix B. Recent State Balance Billing Protections .................................................................. 42

Appendix C. Condensed Summary of Consolidation Effects on Health Care Prices, Spending, Quality,

Access, and Wages ................................................................................................................ 44

July 2023

REPORT TO CONGRESS

4

Executive Summary

The No Surprises Act (NSA)

1

was enacted on December 27, 2020, to address certain instances of surprise

billing – circumstances where individuals with private health plans and coverage

2

receive unexpectedly

high medical bills when they are unknowingly or unavoidably treated by an out-of-network (OON)

provider, facility, or provider of air ambulance services. Under the law, an OON provider

3

subject to

balance billing requirements generally may not charge more than the patient’s in-network cost sharing

requirement based on the Recognized Amount for non-air ambulance items and services.

4

The law also

creates a process for resolving disputes over payment rates between providers and plans and issuers

under certain circumstances. The enactment of NSA, as well as several previous state surprise billing laws,

was motivated by consumer concerns about the adverse financial impacts of surprise medical bills.

Section 109 of NSA requires the Secretary, in consultation with the Federal Trade Commission and

Attorney General, to produce five annual reports on the impact of NSA on patterns of vertical or horizontal

integration, overall health care costs, and access to health care items and services. This is the first of those

reports.

For several reasons, estimates of these impacts of NSA have some limitations. The surprise billing

provisions in the law went into effect on January 1, 2022, and it may take time to see the full impact of

the law on these outcomes. In addition, surprise bills are likely to be a relatively small proportion of total

health care claims for items and services. Furthermore, existing data suggest these bills, and therefore the

law’s impact, may be concentrated in a few services areas, such as emergency departments (EDs) and air

ambulance services. These service areas may see significant impacts, while the majority of items and

services in the health care sector may be less directly impacted by the law. Finally, the trends in NSA

impacts that are the subject of these reports are influenced by many factors over time including but not

limited to demographic changes, technology changes that affect health care delivery, economic

conditions, the COVID-19 pandemic, and health care policies that alter financial incentives. Distinguishing

NSA impacts from these other influences will be challenging methodologically.

This first report focuses largely on establishing a baseline and a framework for further evaluation. The

report details key trends in factors that will be important to evaluate NSA effects including: the

implementation and impacts of state surprise billing laws already in effect; trends in market consolidation

and concentration; the impact of market consolidation and concentration on prices, quality, and spending;

1

The No Surprises Act was included as part of the Consolidated Appropriations Act, 2021 (P.L. 116-260, 134 Stat.

1182, Division BB, Title I).

2

This report will use the term “private health plan and coverage” to refer to the products and “plans and issuers” to

refer to the entities offering the private health plans and coverage regulated by NSA. See page 8 for additional detail

on the private health plans and coverage regulated by NSA.

3

In this report, “provider” refers to providers, facilities, and providers of air ambulance services that are subject to

NSA requirements.

4

The Recognized Amount is the lesser of the amount billed by the provider or facility or the Qualifying Payment

Amount (QPA),if an applicable state law or All-Payer Model Agreement does not provide for a different out-of-

network rate. For air ambulance services provided by a nonparticipating provider, the cost-sharing requirement must

be based on the lesser of the QPA or the billed amount.

July 2023

REPORT TO CONGRESS

5

and trends in OON billing. This report also describes a conceptual framework for considering the health

care market effects of NSA, as well as describing potential methodologic approaches (and their limitations)

for estimating these effects. Subsequent reports will implement these approaches.

Estimating NSA Impacts: Baseline Factors

Estimating the effects of NSA requires distinguishing them from other factors already influencing trends

in health care market outcomes of interest and pre-existing trends in these outcomes. Three of these key

factors are: the effect of state surprise billing laws, existing trends in market consolidation, and pre-NSA

trends in OON billing.

State Surprise Billing Laws - Prior to the enactment of NSA on December 27, 2020, 33 states had enacted

surprise billing protections which vary in level of protection and scope. NSA fills a major gap in these state

laws by covering self-insured plans that are subject the Employee Retirement Income Security Act of 1974

(ERISA) rather than state regulation. Existing studies suggest that these preexisting state surprise billing

protections affect both in-network and OON prices as well as providers’ decisions to join networks. These

effects will need to be accounted for in evaluating NSA.

Market Consolidation and Concentration - There are two concepts relevant for describing and measuring

the degree of competition or market power: consolidation and concentration. Consolidation refers to

actions by participants – such as a merger, purchase, or acquisition – that ultimately modify market

structure and potentially increase their market power. Concentration refers to the relative size and

number of competitors in a market at any given time; concentration is “high” when sales (or purchases)

are made by a few competitors.

The number of hospital consolidations increased in 2010 relative to the previous decade and has followed

a fairly consistent pattern through 2020. As a result, by one measure, the number of hospital markets that

were of moderate or low concentration declined by nearly half during these years, from 23 percent of

markets in 2008 to 12 percent of markets in 2020 (see Chapter 3 for more detail on how these measures

were constructed). On the other hand, about one-third of commercial health insurance markets were of

moderate or low concentration in both 2008 and 2020. Physicians have been involved in a considerable

amount of consolidation activity during these years, both in terms of mergers between physician groups

and mergers with hospitals (vertical consolidation) as well as private equity acquisition of physician

practices.

Health care market consolidation and concentration may have independent impacts on outcomes of

interest such as price and quality. It will be important to account for these impacts in evaluating the effects

of NSA. An environmental scan conducted for this report examined evidence on impacts of consolidation

on price, quality, and access to health care in health care provider and health insurance markets. It found

strong evidence that horizontal consolidation of hospitals is associated with higher prices paid to providers

and some evidence that vertical consolidation of hospitals and physician practices leads to higher prices

paid to providers. It also found that horizontal consolidation of commercial insurers is associated with

lower prices paid to providers as insurers gain market power in negotiations with providers. However, the

lower prices paid to providers do not appear to be passed onto consumers, who face higher premiums

July 2023

REPORT TO CONGRESS

6

following insurer consolidation. Finally, the scan also assessed the evidence of the effects of consolidation

on quality of care and found that evidence on these effects was generally weak and mixed as to the

direction of the impact on quality measures.

In addition to the broader trends in health care consolidation described above, the health care system has

undergone dramatic changes since 2020 due to the COVID-19 pandemic, and researchers are still

examining the full scope of those changes – as well as what their long-term impacts will be on health care

markets. This creates additional challenges and uncertainty in identifying the effects of NSA surprise billing

protections that took effect in 2022.

OON Billing – In order to estimate the impacts of NSA, it is important to establish the overall trend in OON

billing and drill down to the items and services most likely to be affected. Providers, items and services,

and patients most commonly associated with surprise OON bills prior to NSA are likely to be those most

affected by the law. Overall, there was a downward trend in OON claims prior to NSA implementation –

the prevalence of professional claims that were OON decreased from 6.0 percent to 4.7 percent from

2012 to 2020. In addition, the share of total payments that were OON declined over this period from 9.2

percent in 2012 to 6.8 percent in 2020.

Most physicians have a very low prevalence of OON bills. Approximately 70 percent of physicians bill 2

percent or fewer of their claims OON. A small share of physicians account for a disproportionate share of

OON bills, with just over 5 percent of physicians who bill the majority of their claims OON. The specialties

with the highest rates of OON billing are psychiatry, emergency medicine, pathology, anesthesiology, and

pain medicine, each of which, on average, bill over 4 percent of their claims OON. Another factor in the

rate of OON bills is the place of service. Claims from EDs (13 percent) and ambulatory surgery centers

(ASCs) (8 percent) are more likely to be billed OON than claims from office visits (4 percent).

A Conceptual Framework for Estimating NSA Impacts

NSA requires the Secretary, in consultation with the Federal Trade Commission and Attorney General, to

provide an assessment of the impact of NSA on market consolidation, health care spending, and access to

health care. It is therefore useful to develop a conceptual framework that considers all of the pathways

by which NSA might affect health care market outcomes. A primary goal of NSA is to reduce the number

of surprise bills and the out-of-pocket spending associated with them. A potential downstream effect of

the reduced out-of-pocket liability is that medical debt may be reduced. However, there may be other

effects as well. Negotiations between providers and plans and insurers affect both in-network and OON

prices, as well as network participation by providers. To the extent that these dynamics, impacted by NSA,

lead to more market power for insurers, insurers may be able to negotiate lower in-network prices, reduce

premiums, or limit overall health spending. One possible response to the increase in insurer market power

is providers seeking to consolidate to increase their own market power and strengthen their bargaining

positions, which could lead to higher relative prices and increased spending.

Methods for Estimating Potential NSA Impacts

July 2023

REPORT TO CONGRESS

7

As described above, estimating the independent impacts of NSA on key outcomes such as prices,

spending, quality, access to health care, and market consolidation will be challenging. For future reports,

we will identify the most promising study designs and statistical methods to explore these questions as

data become available. In addition, we will hold discussions with interested parties and use qualitative

methods as appropriate to provide the most comprehensive picture of NSA impacts as possible.

July 2023

REPORT TO CONGRESS

8

Chapter 1. Introduction and Overview

NSA was enacted to help protect participants, beneficiaries, and enrollees in group health plans and group

and individual health insurance coverage from surprise medical bills in certain situations where surprise

billing commonly occurs. The law’s provisions providing protections against surprise billing took effect on

January 1, 2022.

These NSA requirements apply to items and services provided to most individuals enrolled in private

health plans and coverage, including:

• Employment-based group health plans, including both self-insured and fully insured plans, and

plans sponsored by private employers, unions, or state and local government employers

• Individual or group health insurance coverage on or outside the Federal or State-based Exchanges

• Federal Employee Health Benefit (FEHB) plans

• Certain church plans within IRS jurisdiction

• Student health insurance coverage

Surprise billing refers to situations where an individual unexpectedly receives an OON bill for the

difference between what the provider charges for an item or service and what the individual’s plan or

issuer will pay. Surprise medical bills from OON providers are often for emergency or ancillary services

when patients do not have a choice of provider. Typical examples include emergency care, anesthesiology,

or diagnostic testing. These situations occur at both OON facilities and in-network facilities where a

treating physician or other provider is OON. Often surprise medical bills are much higher than patients

had anticipated before receiving health care items and services. Patients may have had no way of knowing

that these providers were not in their health plan’s or issuer’s network and might receive bills from these

providers for items or services not fully covered by their plan or issuer. The NSA, as well as several

previously enacted state surprise billing laws, was designed to address these kinds of surprise medical bills

(ASPE, 2021).

Prior to the enactment of NSA, studies found OON bills were a common occurrence for patients treated

in emergency departments or who were admitted to the hospital, many of which would be considered

surprise bills. In 2016, patient OON responsibility for ED surprise bills averaged $628 and was $2,040 for

inpatient admissions (Sun et al., 2019). These unexpected costs represent significant financial distress for

many Americans, 63 percent of whom report not being able to cover a hypothetical $400 emergency

expense exclusively using cash or its equivalent (Board of Governors of the Federal Reserve System, 2023)

In a 2016 survey, 69 percent of those who had problems paying for medical care received from an OON

provider said they did not know that the provider was not in their plan’s network (Hamel et al., 2016). In

2018, among those reporting problems affording health care, the second most frequently cited reason for

those problems was unexpected medical bills, some of which may be surprise bills (Hamel, Muñana, and

Brodie, 2019). In 2020, nearly 20 percent of insured adults in the two years prior received a surprise bill

because the provider was OON and two-thirds of adults are worried about being able to afford unexpected

medical bills (Pollitz et al., 2020). While the precise contribution of surprise billing to medical debt cannot

July 2023

REPORT TO CONGRESS

9

be determined from available data sources, surprise bills likely play a role in medical debt and financial

stress for American families (ASPE, 2020).

Prior to NSA, patients frequently received OON items and services which may have resulted in a surprise

bill. For large employer plans, 18 percent of ED visits and 16 percent of in-network inpatient stays had at

least one OON charge in 2017 (Pollitz et al., 2020). Other studies have found that 22 percent of ED visits

at in-network facilities included care by OON physicians from 2014 to 2015 (Cooper and Scott Morton,

2016), and 20 percent of inpatient admissions from the ED, 14 percent of outpatient visits to the ED, and

9 percent of elective inpatient admissions involved an OON provider in 2014 (Garmon and Chartock,

2017).

NSA provisions require plans and issuers to cover certain OON bills with patient cost-sharing requirements

not greater than the requirements that would apply if the bill were in-network. Plans and issuers and

providers that are unable to agree on the OON rate payable to the provider after a 30-day open

negotiation period may enter the Federal independent dispute resolution (IDR) process

5

to arbitrate the

OON rate. The most common medical procedure codes initially reported among disputes in the Federal

IDR

6

system from April 15 to September 30, 2022 involving emergency or non-emergency items and

services were ED services (66 percent), radiology (9 percent), and anesthesia (7 percent) (The

Departments, 2022).

Section 109 of NSA directs the Secretary, in consultation with the Federal Trade Commission and Attorney

General, to conduct a study on the effects of certain provisions of NSA on market consolidation, overall

health care costs, and access to health care services (see Appendix A for details). Section 109 also directs

the Secretary, in consultation with the Secretary of Labor and the Secretary of the Treasury, to make

recommendations with respect to potential challenges to addressing anti-competitive consolidation of

health care providers, plans and issuers. The effects of NSA on prices paid to OON providers will likely

depend on how the Federal IDR process unfolds and expectations among disputing parties about how

arbitrators may adjudicate cases. If OON rates decrease in general, then providers’ alternative to being in

a plan’s or issuer’s network would become less favorable and their bargaining power relative to health

plans and issuers would decrease, which could in turn lead to changes in in-network prices. If OON rates

increase, then the opposite could happen. Any price changes may have impacts on total health care

spending, consumer spending, and health care market decisions that could affect health care

consolidation, patient access to health care, and quality of care. The price effects of NSA may extend

beyond OON items and services, as negotiations between providers and plans and issuers over in-network

rates likely consider anticipated OON prices as the alternative to entering a contract. Given NSA’s potential

5

Disputes are eligible for the Federal IDR process only if there is no All-Payer Model Agreement or specified state

law that applies to the item or service, provider, and plan and issuer involved.

6

If a provider and plan or issuer cannot reach an agreement on an OON payment dispute, then either party may

initiate the Federal IDR process. The IDR process is a baseball-style arbitration process under which the provider and

the plan or issuer each submit to a third-party arbitrator (i.e., certified IDR entity) their best and final offers. The

certified IDR entity must review both offers and make a determination. Some states have their own separate IDR

process.

July 2023

REPORT TO CONGRESS

10

effects on OON and in-network prices, the law may also affect provider decisions about contracting with

plans and issuers, resulting in changes to network structures and the prevalence of OON billing.

Changes in prices and other aspects of the law may in turn lead to changes in OON spending, medical

debt, total spending, and premiums. Financial protections and changes in prices would affect financial

barriers to care. Changes in prices may affect provider decisions regarding consolidation, provider supply

(e.g., staffing), and investments in quality improvement over the long term. Changes in the supply of

providers would in turn have implications for access to health care, and changes in consolidation could

influence prices, access to health care, and quality of care.

Section 109 of NSA requires this report and four additional annual reports continuing from 2024 through

2027. This first report presents broad context and baseline trends for assessing potential impacts in the

future reports. The report also summarizes NSA, with a particular focus on the patient financial

protections and dispute resolution process that are likely to affect outcomes in the health care sector.

Because the surprise billing protections in NSA went into effect on January 1, 2022, robust data needed

to estimate the effects of NSA on consolidation, overall health care costs, and access to health care items

and services are not yet available. As data become available, future reports will contain empirical analysis

of these outcomes.

Trends in consolidation, as well as trends in health care costs and access to health care, are also influenced

by numerous factors such as local health care market characteristics, technology changes, and other

policies of the federal and state governments. Estimating the independent effects of NSA requires data

and methods that can distinguish them from these other influences. The report provides a description of

the baseline factors needed to establish the existing trends in the outcomes of interest. It discusses state

actions on surprise billing and literature on the impacts of those actions with a discussion of how those

may be relevant to evaluating NSA (Chapter 2). Next, the report discusses the landscape and trends in

health care market consolidation and how consolidation – a potential response by providers and health

insurance issuers to NSA – has been found to impact health care costs, access to health care, and market

concentration (Chapter 3). The report describes the recent trends in OON and surprise billing to better

understand on which patients and providers NSA might have the most impact (Chapter 4). In Chapter 5,

we present a conceptual model that will guide how we estimate NSA impacts relative to these baseline

trends. Finally, in Chapter 6, the report concludes with the analyses that we aim to include in future

reports. Future reports will continue to follow trends in OON and surprise billing, noting the types of

patients, providers, and items and services where these trends appear to change following the

implementation of NSA. Future reports will also track other primary effects of NSA on prices for items and

services as found in analysis of claims data. We expect that future reports will include more thorough

analysis of air ambulance services as well.

We intend to gather feedback from discussions with interested parties on initial impacts of NSA and

anticipated impacts on consolidation, health care costs, and access to health care. These discussions may

also form the basis for recommendations for effective enforcement of provisions of NSA required by

section 109.

July 2023

REPORT TO CONGRESS

11

Chapter 2. State Actions on Surprise Billing

Prior to the enactment of NSA, some states had implemented their own laws limiting surprise billing.

According to an analysis from the Commonwealth Fund, 33 states (see Appendix B) had enacted surprise

billing protections as of February 2021 (Kona, 2021). This includes 18 states with comprehensive

protections that apply to both ED and in-network hospital settings; cover both health maintenance

organization (HMO) and preferred provider organization (PPO) plans; prohibit balance billing; restrict

patient cost sharing to in-network amounts; and establish a formula for determining how much an insurer

will pay a provider in surprise billing scenarios, provide a dispute resolution process for settling

disagreements over payments, or both (Kona, 2021). The structure of surprise billing protections varies

by state, but there are two broad exemptions from state laws. First, pursuant to the Employee Retirement

Income Security Act (ERISA), state surprise billing laws generally do not apply to self-insured employer

plans sponsored by private employers (representing about 64 percent of commercial health coverage

enrollment) (Rosso, Isserman, and Shen, 2021), though in certain states ERISA plans can opt in to state

surprising billing laws. Second, federal law prohibits states from regulating prices of air ambulance

services (Turrini et al., 2021). NSA addresses these gaps in protections for patients by creating federal

protections for certain situations in which the state cannot or chooses not to regulate.

NSA does not supplant state surprise billing laws. If a state has an All-Payer Model Agreement or another

state law that determines payment amounts to OON providers for a service, the All-Payer Model

Agreement or other state law will generally determine the cost-sharing amount and the OON payment

rate. However, if there is a dispute in cases when the state's process does not apply, but NSA does, the

parties can use the Federal IDR process to resolve the dispute.

One complication for evaluating the impacts of NSA is that state methods for addressing surprise bills vary

substantially by state, both in terms of the general approach (i.e., whether the state relies on an IDR

process, directly sets payment standards, or uses a hybrid approach) and in terms of the benchmark rates

that state arbitrators must take into account during the state’s arbitration process or the specified price

levels, as applicable (Kona, 2021) (Table 2-1 ). For example, California sets payment benchmark rates for

nonemergency services at the greater of 125 percent of Medicare rates or the average in-network rate

for a given plan and region, while New York has established an IDR process where the arbitrator is required

to consider the 80

th

percentile of charges in a given region as a benchmark. Some states with surprise

billing laws have modified prior policies to align more closely with NSA standards—which apply to self-

insured plans pursuant to NSA—in order to create a uniform approach and therefore simplify the

regulations for providers and health insurance issuers (Hoadley, O’Brien, and Lucia, 2022; Adler et al.,

2021). Other states may also consider aligning with NSA or addressing perceived gaps in the NSA

protections.

July 2023

REPORT TO CONGRESS

12

Table 2-1 Examples of Payment Determination Methods Under Surprise Billing Laws

Source

Payment Determination

Method

Details

California

Payment standard

• Emergency services: reasonable and customary amounts

• Nonemergency services: greater of 125% of Medicare or average in-

network rate for plan and region

Connecticut

Payment standard and IDR

hybrid

• Emergency services: greater of 80th percentile of charges in region,

in-network rate for plan, amount Medicare would reimburse for such

services

• Nonemergency services: in-network rate for plan unless another

amount is agreed on

New York

IDR

• Arbitrator is required to consider the 80th percentile of charges

Federal –

NSA

Federal IDR

•

Arbitrator is required to consider the Qualified Payment Amount,

generally the median in-network rate for region

•

IDR = independent dispute resolution

SOURCES: AHA, 2021; Corlette and Hoppe, 2019; Keith, Hoadley, and Lucia, 2021; and Kona, 2021.

These state laws represent important factors affecting baseline trends in OON billing and are therefore

important to estimating the independent impact of NSA. Because states generally do not regulate ERISA

plans with respect to surprise billing, many patients even in states that enacted surprise billing restrictions

were not protected by them prior to the implementation of NSA. Figure 2-1 provides an overview of

payment determination methods in NSA and a sample of states with various surprise billing laws enacted

prior to the passage of NSA.

Figure 2-1 – State Surprise Billing Protections Prior to NSA, 2021

Source: Kona, M. (2021) State Balance-Billing Protections. https://www.commonwealthfund.org/node/27021

Additional detail on author’s criteria for comprehensive versus partial protections available:

https://www.commonwealthfund.org/sites/default/files/2019-01/Criteria_for_Meeting_Standards_v2.pdf

July 2023

REPORT TO CONGRESS

13

The Impact of State Surprise Billing Actions: Existing Evidence

Several studies have evaluated the effect of state surprise billing laws on the prevalence of care provided

OON, and in-network and OON rates for health care item and services. This section provides a summary

of these studies. While state surprise billing laws were designed to decrease occurrences of surprise

billing, the potential impacts on in-network and OON prices are less clear. The emerging research suggests

the impacts can be influenced by the regulatory approach taken by the state.

The benchmark rate for payment can be an anchor for prices determined through an arbitration

process.

States varied in their approach to addressing surprise medical bills. In particular, states vary in whether

disputes are resolved through arbitration and what arbitrators should consider as “benchmark” rates for

the arbitration process. In New Jersey and in New York, where arbitrators are required to consider the

80th percentile of charges, average arbitration decisions have been 7–8 percent above the 80th percentile

of charges (Adler, 2019; Chartock et al., 2021). Further, the choice of a payment standard benchmark has

been associated with different trajectories in nonemergency charges after the enactment of surprise

billing protections as compared to states without surprise billing laws. In California, where the arbitration

standard was tied to in-network prices, nonemergency OON charges decreased by 25 percent. In New

York, where the arbitration standard is tied to billed charges, nonemergency OON charges increased by

24 percent (Gordon et al., 2022).

The evidence of the effects of state surprise billing laws on both in-network and OON prices appears

mixed. This may reflect varying state approaches for determining OON prices in scenarios generating

surprise bills. One study found that a state surprise billing law was associated with lower OON prices for

anesthesiologists in California—which stipulates relatively low rates for those services—while another

study found that a state surprise billing law was associated with higher OON prices for emergency services

in Connecticut, which sets relatively high rates for that care (Adler, Duffy, Ly, et al., 2021; La Forgia et al.,

2021). Two studies evaluating the same state (New York) and outcome (in-network prices for emergency

physician services) yielded conflicting results, which suggests the potential difficulty of evaluating these

laws (Adler, Duffy, Fiedler, et al., unpublished; Cooper, Scott Morton, and Shekita, 2020).

Researchers generally found that state surprise billing laws affect in-network prices for covered

services. While state laws regulating or restricting surprise bills most directly impact OON prices, there is

evidence that these laws can also impact in-network prices for health care items and services. In this way,

surprise billing laws can influence health care prices more generally. Among studies finding an association

between state surprise billing laws and in-network prices, two studies also evaluated OON prices and

found that the estimates for in-network and OON prices both decreased (Adler, Duffy, Fiedler, et al.,

unpublished; La Forgia et al., 2021). These results suggest that surprise billing laws can impact OON prices

and in-network prices as well.

Some studies show that state surprise billing laws were associated with an increase in the share of

medical bills that are for in-network care, while others show no significant change. The limited impact

found on in-network rates suggests that state surprise billing laws either increase or do not influence the

July 2023

REPORT TO CONGRESS

14

willingness of providers to join insurer networks. (Adler, 2019; Adler, Duffy, Fiedler, et al., unpublished;

Cooper, Scott Morton, and Shekita, 2020; Maryland Health Care Commission, 2015).

Numerous gaps remain in the understanding of the effects of state surprise billing laws. Evaluations of

state surprise billing laws have yielded varying results. Some of this variation likely stems from variation

in how states determine OON prices in surprise billing scenarios as well as other differences in state

regulation, state health care markets, and other state level variation. Additionally, many of these laws

were recently implemented and understanding the full impact may take some time. Further research is

needed to better understand the impacts of these laws.

To date, evaluations of state surprise billing laws have focused on primary outcomes like prices and rates

of OON claims and have not assessed the effect of these laws on out-of-pocket spending by consumers.

None of these state studies have evaluated downstream effects of the law, such as on total spending,

premiums, health care consolidation, access to health care, or the quality of care.

NSA is in the early stage of implementation and evaluations will evolve as data become available over the

coming years. As NSA is evaluated, it will be important to be cautious in making comparisons with

evaluations of state surprise billing laws which vary in their approach from the federal law. Furthermore,

because NSA was written to defer to some existing state surprise billing laws and limited the degree to

which NSA preempts state laws, many state surprise billing prohibitions continue. The fact that existing

trends likely differ depending on each state’s laws, and that some of these state law provisions will

continue along with NSA provisions, presents both opportunities and challenges as we develop methods

to estimate NSA’s impacts.

July 2023

REPORT TO CONGRESS

15

Chapter 3. Consolidation and Competition – Trends and Evidence of Effects in

Health Care Markets

NSA protections for consumers against surprise medical bills may have other effects on health care

markets. To the extent that NSA results in lower OON prices, providers may choose to move in-network

to increase patient volume if they no longer receive a significant price advantage by staying out of provider

networks. This may cause providers to lose some of their bargaining power with plans and issuers and

result in lower in-network prices (Cooper, Scott Morton, and Shekita, 2020). If these price changes do lead

to decreased bargaining power for providers at their existing levels of market power, they might, in turn,

look to consolidate to increase their market power to recoup some of their lost leverage in bargaining

with plans and issuers.

To the extent NSA creates further incentives for health care providers to increase their market power by

consolidating into larger groups, it is useful to review the literature on consolidation in health care to

anticipate potential impacts if consolidation were to continue, or accelerate, post-NSA.

Terminology – Competition, Concentration, Consolidation

In well-functioning markets, competition provides strong financial incentives for efficiency and value.

Informed consumers shop for the best value in products or services, and sellers compete on the price and

quality of those products or services. The financial incentives in this environment motivate sellers to

innovate to reduce costs and improve their products by adopting new technologies or new business

models. The consequences of not being innovative are that less efficient producers are driven from the

market by more aggressive and creative competitors. In theory, markets that function well to assure lower

prices and higher quality have several characteristics. In general, competition requires that there be a

sufficient number of buyers and sellers, that the buyers are well informed, and that there are relatively

low costs for market entry and exit. In general, competition and its favorable effects on price and quality

decreases with fewer providers offering products or services in a given market. When there are fewer

providers, participants gain market power which insulates them from the competitive forces that assure

the lowest prices and high-quality products.

There are two concepts relevant to describing and measuring the degree of competition or market power

that we focus on in this report: consolidation and concentration. Consolidation refers to actions by

participants that ultimately modify market structure and potentially increase their market power.

Concentration describes market structure as measured by the number and size of the competitors within

that market.

A consolidation event often refers to a merger, purchase, or acquisition of an entity. An entity exiting a

market can also increase the concentration of the remaining market. However, consolidation also

encompasses less formal joint arrangements between organizations. For example, there has been growth

in non-ownership arrangements and affiliations between organizations that allow for joint negotiations,

such as clinically integrated networks (CINs) and accountable care organizations (ACOs) in a form of “soft

consolidation” (Ridgely, Timbie, et al., 2020; Lyu, Chernew, and McWilliams, 2021). Consolidation that

July 2023

REPORT TO CONGRESS

16

eliminates or weakens competition often results in greater market power for the organization and the

potential for less competitive prices and quality. Conversely, a purported benefit of consolidation is that

greater integration will lead to increased efficiencies, coordination of care, and patient outcomes.

However, the achievement of these benefits is most closely tied to the ability of the consolidating

organizations to clinically integrate, which is not guaranteed simply because entities structurally integrate.

Concentration refers to the relative size and number of competitors in a market defined by product and

geography. Market concentration is typically represented by measures such as the Herfindahl-Hirschman

Index (HHI), which is described below. It is important to note that depending on existing market structure

and the size of a merger or acquisition, a given consolidation event may or may not have an appreciable

impact on concentration and market power.

Recent Trends in Health Care Consolidation

In this section, we summarize recent consolidation trends in both provider and insurance markets. More

detailed descriptions can be found in a recent study conducted by the RAND Corporation for ASPE to help

set the baseline for this series of reports to Congress (Liu et al., 2022). In future Reports to Congress, we

will assess how these trends change after the implementation of NSA. Hospital markets are becoming

more concentrated as a result of a steady stream of hospital consolidations. Physician practices have

grown more consolidated in the past decade, with more physicians belonging to larger practices and fewer

physicians in single or small practices (Capps, Dranove, and Ody, 2017; Muhlestein and Smith, 2016; Kane,

2021). Vertical consolidation between hospitals or health systems and physicians is increasing.

Trends in hospital consolidation began to increase in 2010 relative to prior years, though the number of

deals and the number of hospitals involved in the mergers are no higher than in the late 1990s (AHA,

2016; NICHM, 2020). Between 2010 and 2020, there were more than 1,000 announced hospital mergers

and acquisitions (Liu et al., 2022). As displayed in Figure 3-1, since 2017, the number of changes in hospital

ownership have fluctuated on a quarterly basis but do not seem to be subject to an increasing overall

trend. While many of these changes in ownership represent consolidation, some could be health care

systems divesting a hospital or a sale from a larger parent company to a smaller one; the latter two

changes of ownership could plausibly increase competition in a market.

July 2023

REPORT TO CONGRESS

17

30

25

20

15

10

5

0

Figure 3-1 - Changes of Ownership, by Hospital per 1000, by Quarter (Annualized), 2016-2021

Source: W. Pete Welch et al. “Changes of Ownership of Hospital and Skilled Nursing Facilities: An Analysis of Newly Released CMS

Data.”. ASPE Data Point. April 20, 2022.

Physician Markets

Physician group mergers saw a major increase in 2021 (Figure 3-2). This increase occurred after a decline

in 2020 that was presumably related to uncertainty surrounding the COVID-19 pandemic. Whether this

increase is largely a function of mergers that might have otherwise happened in 2020 and were deferred

or whether it represents an accelerating pace of physician group mergers is still unclear.

Changes

in Ownership

(CHOWs)

by Hospital

per

1,000,

by Quarter,

Annualized

July 2023

REPORT TO CONGRESS

18

Figure 3-2 – Physician Medical Groups Mergers and Acquisitions, 2017 - 2021

Source: LevinPro HC, Levin Associates, December 2022 levinassociates.com

Over a longer timeframe, the period since 2017 has had a higher number of physician group mergers than

the years prior to 2017, other than the early partof 2020 when the COVID-19 pandemic initially developed

(Figure 3-3).

Figure 3-3 – Physician Group Mergers and Acquisitions by Month, 2012-2020

Source: LevinPro HC, Levin Associates, December 2022 levinassociates.com

The high number of mergers and acquisitions in 2021 was not focused in practice areas most associated

with surprise billing (i.e. ED, radiology, anesthesiology), though radiology was 11

th

highest among

July 2023

REPORT TO CONGRESS

19

physician specialties by deal volume (Figure 3-4). Again, however, we cannot distinguish here between

acquisitions that represent consolidation versus those that would be neutral or increase competition in a

given market.

Figure 3-4 – Physician Specialties by Merger and Acquisition Deal Volume, 2021

Source: LevinPro HC, Levin Associates, December 2022 levinassociates.com

Again, monitoring the composition of physician specialty mergers will be instructive for whether NSA is

having a major impact on provider consolidation.

Consolidation and Vertical Integration

In general, vertical consolidation or integration refers to a company acquiring or developing one or more

important parts of their production process or supply chain. In recent years, there has been an

acceleration of acquisitions combining traditionally independent elements of the health care supply chain.

Most prominent among these consolidations has been hospitals purchasing or contracting with

physicians’ practices. A recent report estimated that in 2021, nearly 50 percent of physicians were

employed by hospitals (Figure 3-5) (Avalere Health, 2021). Simultaneously, insurers and other corporate

entities also appear to be acquiring physicians’ practices and other health care providers. While the

number of practices employed by hospitals, insurers, and other corporate entities has been rising over

time, the uncertain revenue impacts of the COVID–19 pandemic during 2020 may have accelerated the

trend into 2021.

July 2023

REPORT TO CONGRESS

20

Figure 3-5 – Percent of Physicians Employed by Hospitals and Health Systems, 2019-2021

Source: COVID-19’s Impact On Acquisitions of Physician Practices and Physician Employment 2019-2020. June

2021. Physicians Advocacy Institute, prepared by Avalere Health.

http://www.physiciansadvocacyinstitute.org/Portals/0/assets/docs/Revised-6-8-21_PAI-Physician-Employment-Study-

2021-FINAL.pdf?ver=K6dyoekRSC_c59U8QD1V-A%3d%3d

The acquisition of physician practices by private equity firms has increased in recent years (Tan et al.,

2019; Patel et al., 2019). Private equity investment in anesthesia practices is associated with increased

prices paid to anesthesia practitioners (La Forgia et al., 2022). What role NSA may play in the ongoing

attractiveness of certain specialties to private equity investment is unclear.

Trends in Health Care Market Concentration

Health insurance, hospital, and physician organization markets have been characterized as highly

concentrated for years (Fulton, 2017). This section displays maps of a commonly-used measure of market

concentration in the academic literature and by antitrust agencies, the HHI,

7

for several health care

product markets at several levels of geography.

8

The HHI measures the relative sizes of firms in a market.

7

The Herfindahl–Hirschman Index (HHI) is calculated as the sum of the squared market shares of firms in a given

market and is scaled from 0 to 10,000.

8

Throughout this document, market definitions are not necessarily antitrust product markets nor was a full analysis

conducted in accordance with the U.S. Department of Justice and Federal Trade Commission Horizontal Merger

Guidelines § 5.3 (revised Aug. 19, 2010) that would establish any of these as an antitrust product or geographic

market.

There are multiple potential markets for health insurance and health care items and services. For example, in the

context of commercial health insurance, the DOJ has defined markets for individual, small group, large group, and

July 2023

REPORT TO CONGRESS

21

The measure approaches zero when a market has a large number of firms of equal size (i.e., “perfect

competition”) and reaches its maximum of 10,000 when the market is a monopoly. The Department of

Justice and Federal Trade Commission’s 2010 horizontal merger guidelines generally classify markets into

three types based on their HHI:

• Unconcentrated Markets: HHI below 1500

• Moderately Concentrated Markets: HHI between 1500 and 2500

• Highly Concentrated Markets: HHI above 2500.

9

HHI scores for hospital markets are calculated based on data from the American Hospital Association

Annual Survey. Adjusted hospital admissions

10

were used to measure the market share of each hospital

or hospital system. For these analyses, hospital markets are defined as the hospital referral region (HRR).

HRRs are regional health care markets designated by the Dartmouth Atlas Project (Wennberg and Cooper,

1999). HRRs reflect patterns in inpatient tertiary care referrals while core-based statistical areas (CBSAs)

11

reflect urban commuting patterns.

12

Federal antitrust agencies conduct relevant market analyses on a

case-by-case basis, meaning the relevant markets in antitrust enforcement actions may differ from the

methodology described here.

For at least the past three decades, hospital markets have become increasingly concentrated (Gaynor,

2020). The percentage of HRRs with an HHI <1,500 – meaning unconcentrated – decreased from 23

percent (71 of 306) in 2008 to 12 percent (36 of 306) in 2020 (Figure 3-6).

national accounts. With respect to national accounts, it is not necessarily clear that concentration in a single

geography is informative of overall competition for a given national account.

9

U.S. Department of Justice and Federal Trade Commission, Horizontal Merger Guidelines § 5.3 (2010).

https://www.justice.gov/atr/horizontal-merger-guidelines-08192010#5c

10

AHA’s adjusted admissions measure attempts to capture both inpatient admissions and outpatient volume by

scaling based on relative revenue. Adjusted Admissions = Admissions + (Admissions * (Outpatient Revenue/Inpatient

Revenue))

11

A core based statistical area (CBSA) is that of an area containing a large population center, or urban area, and

adjacent communities that have a high degree of integration with that population center.

12

The increase in remote work and telehealth due to the COVID-19 pandemic may also influence the construction

of relevant markets.

July 2023

REPORT TO CONGRESS

22

Figure 3-6 – Hospital Referral Region (HRR) Level Herfindahl-Hirschman Index (HHI) Scores For

Adjusted Admissions, 2008 and 2020

2008

2020

Source: ASPE Anaylsis of AHA Data

Below, in Figure 3-7, health insurance HHI scores are calculated using Clarivate Managed Market

Surveyor

13

data and are presented at the CBSA level. Markets for health insurance are also frequently

concentrated, but the distribution has not changed substantially in recent years. In 2008, 31 percent of

13

Clarivate Managed Market Surveyor captures enrollment of health lives and affiliations by payer and geography.

July 2023

REPORT TO CONGRESS

23

CBSAs had commercial health insurance HHI scores below 1,500 (120 of 384). In 2020, a similar 35 percent

of CBSAs had commercial health insurance HHI scores below 1,500 (134 of 384).

Figure 3-7 – Core-based Statistical Area (CBSA) Level Herfindahl-Hirschman Index (HHI) Scores for

Commercial Health Insurance Membership, 2008 and 2020

2008

2020

Source: ASPE Anaylsis of Clarivate|Clarivate Managed Market Surveyor

July 2023

REPORT TO CONGRESS

24

Impact of Consolidation and Concentration on Health Care Outcomes: Current Evidence

As part of an environmental scan of evidence on consolidation trends and the impacts of consolidation on

price, quality, and access to health care in health care provider and insurance markets conducted by the

RAND Corporation for ASPE, researchers reviewed 172 articles for evidence of the effects of consolidation

on these outcomes (Liu et al., 2022). They found strong evidence that hospital horizontal consolidation is

associated with higher prices paid to providers and some evidence of the same for vertical consolidation

of hospitals and physician practices. Few studies have directly examined total spending rather than prices

for items and services.

The report found that horizontal consolidation of commercial insurers is associated with lower prices paid

to providers as insurers gain market power in negotiations with providers. However, the lower prices paid

to providers do not appear to be passed onto consumers, who face higher premiums following insurer

consolidation.

The report also assessed the evidence of the effects of consolidation on quality of care. These assessments

of quality can be challenging to generalize as quality performance is complex and multifaced.

Furthermore, studies often examine a small number of quality measures that may not overlap with those

used in other studies. Studies often examine a specific instance of a merger rather than examine effects

nationally. These studies show mixed findings depending on the quality measures studied, setting, and

degree of integration. Several studies show no change in most quality measures following horizontal and

vertical consolidation. Other studies find mixed effects that vary with the degree of vertical integration.

There was insufficient evidence of the effects of horizontal or vertical consolidation on patient access to

health care, and low or insufficient evidence on the effects of consolidation on health care wages.

Despite increasing interest in the effects of consolidation in other care settings such as pharmacy and

telehealth provider markets as well as growing attention to private equity ownership and investment, the

report found insufficient or weak evidence on the effects of these changes in health care markets. Most

of the empirical studies included in the report on private equity investments focused on nursing homes,

and findings were either mixed or too limited to draw clear conclusions.

The report found moderate evidence that an expanding scope of practice is associated with, if anything,

a decrease in health care spending and increase in access to health care and quality of care, but the report

found insufficient evidence on the effects on health care prices and wages. The report also found

moderate evidence that certificate of need laws

14

are associated with no change or a decrease in health

care quality, but the evidence was low or insufficient for other outcomes.

The report found limited mixed evidence on the effects of hospital and physician consolidation on the

provision of charity care and insufficient evidence on its effects on medical debt burden and collection

14

Certificate of need (CON) laws requirehealthcare providers to obtain permission from a state (or state-authorized)

agency to construct new healthcare facilities, expand existing ones, or offer certain healthcare services.

July 2023

REPORT TO CONGRESS

25

(not shown in Appendix C). The report found no studies examining the effects of insurer consolidation on

charity care and medical debt.

State surprise billing protections are relatively new. The report noted, that, to date, the effects of these

protections on prices have been heterogeneous depending on the various approaches taken and their

implementation. Few studies have examined outcomes other than prices.

The report also identified areas where there are gaps in evidence. Non-ownership forms of consolidation

that involve contractual arrangements or memorandum of understanding agreements between hospitals

or health systems and physicians are understudied and often difficult for researchers to measure. The

report noted that in addition to the limited evidence of the average effects of consolidation on quality of

care, there is very little evidence on the heterogeneity of these effects on quality for different care

settings, subpopulations, and extent of integration.

Table 3-1 Condensed Summary of Consolidation Effects on Health Care Prices, Spending, Quality,

Access, and Wages

Domain

Health Care

Prices

Health Care

Spending

Quality of

Care

Patient

Access

Health Care

Wages

Horizontal

Hospital

Increase

a

Increase

a

Mixed

depending

on measure

and setting

b

Possible

decrease

d

Decrease

a

Physician

Increase

a

Mixed

d

Mixed

d

No

evidence

d

No

evidence

d

Commercial

insurers

Decrease

c

Increase in

premiums

a

Possible

increase in

patient

experience

d

No direct

evidence,

might

decrease

with

premium

increase

d

Possible

decrease

d

Vertical

Hospitals and

physicians

Mixed:

increase or

no change

a

Increase

a

Mixed: small

increase or

no change

b

Possible

increase

d

Mixed

d

a

Cells shaded in red indicate effects that have sufficient SOE and are detrimental to consumers.

b

Cells shaded in yellow indicate effects that have sufficient SOE and are unclear for consumers.

c

Cells shaded in green indicate effects that have sufficient SOE and are beneficial to consumers.

d

Cells shaded in gray indicate effects that have insufficient SOE.

Appendix C summarizes the report’s assessment based on its environmental scan.

July 2023

REPORT TO CONGRESS

26

Chapter 4. Descriptive Analysis of Trends in OON Billing – Baseline Before

NSA Implementation

Recent Trends in OON and Surprise Bills

To anticipate potential impacts of NSA on the health care system, it is important to understand where its

provisions are most likely to have an impact. The providers, items and services, and patients most

associated with OON and surprise bills prior to NSA are likely to be the parties most affected by the law.

In addition, items and services with the largest differences between in-network and OON rates will be

most impacted by restrictions on balance billing and cost-sharing as well as the Federal IDR process which

change the dynamics of negotiation between payers and providers.

This section presents an analysis of Health Care Cost Institute (HCCI) data presenting descriptive statistics

of the trends and variation in OON billing in the United States in the period before NSA was enacted. The

HCCI 2.0 data contain claim and enrollment information for 55 million commercially insured individuals

per year between 2012 and 2020. The data are from three national insurers – Aetna, Humana, Kaiser

Permanente – and Blue Health Intelligence

15

. Together, the data constitute roughly one-third of enrollees

with employer-sponsored insurance in the United States, covering all 50 states. Below, in Figure 4-1, the

time trend of OON prevalence from 2012 to 2020 is shown. When presenting a snapshot of OON

prevalence by patient or provider characteristics for a given year, we show 2019 rather than 2020 data

due to possible effects from the COVID-19 pandemic

There are limitations to this analysis. It examines all types of OON billing, including OON bills incurred at

in-network and OON facilities, not surprise billing specifically. A recent study found the share of total

spending that occurred OON ranged from 6 to 8 percent in 2014 to 2017, which is similar to the results

presented here (Song et al., 2020). In contrast, studies focused on OON bills incurred at in-network

inpatient facilities from 2014 to 2016 found that about 15 percent of admissions had at least one

associated OON professional claim (Garmon and Chartock, 2017; Kennedy, Johnson, and Fuglesten Biniek,

2019). Additionally, while data on all states are included, the data may be less representative in states

where the largest commercial insurers are not included in the HCCI data.

OON prevalence is defined as the share of claims that were OON out of all professional claims. The HCCI

2.0 data include a network status flag that indicates whether the claim was paid in-network or OON. This

analysis focuses on professional claims since surprise billing often occurs for physician or other

professional services furnished by an OON provider at an in-network facility. While inpatient and

outpatient facility claims can be OON, the network status of facilities may be known for non-emergency

services, and therefore bills from OON inpatient and outpatient facilities may be less commonly

unexpected to the patient than professional claims. The network status for both facility and professional

claims for emergency services can be unknown to the patient at the time of care, but an OON facility claim

for an emergency service would typically be accompanied by OON professional claims as well.

15

Blue Health Intelligence is a data and analytics company that is a licensee of the Blue Cross Blue Shield Association

and that collects and maintains claims data from the 36 independent Blue Cross Blue Shield licensee insurance

companies.

July 2023

REPORT TO CONGRESS

27

Additionally, in some circumstances, a patient may affirmatively choose to receive services from an OON

provider, a decision that would not be captured by claims data if the patient chooses to finance the service

out-of-pocket.

Overall Trends in OON Billing

The overall prevalence of professional claims that were OON decreased from 6.0 percent to 4.7 percent

from 2012 to 2020 (Figure 4-1). Similarly, the share of payments that were OON out of total payments

also declined over this period from 9.2 percent in 2012 to 6.8 percent in 2020 (data not shown). These

declines seem to have been robust across insurance type, geography (urban vs. rural), age, and sex.

Figure 4-1 - OON Prevalence, 2012-2020

7%

6%

5%

4%

3%

2%

1%

0%

2012 2013 2014 2015 2016 2017 2018 2019 2020

Source: RAND analysis of OON trends using Health Care Cost Institute 2.0 data

Geographic Variation in OON prevalence

In 2019, 4.6 percent of professional claims were OON. However, there was substantial variation in the

rates of OON claims by state. Rates of OON claims were generally higher in the southwest and east than

in other regions of the country. Alaska (20.2 percent) had the highest rate of OON claims, and Nebraska

(1.8 percent) had the lowest.

OON Prevalence

July 2023

REPORT TO CONGRESS

28

Figure 4-2 - OON Prevalence by State, 2019

Source: Analysis of OON trends using Health Care Cost Institute 2.0 data

Figure 4-3 below shows rates of OON prevalence by urban vs. rural residence based on patient ZIP code.

Overall, among all professional claims, OON prevalence was slightly higher in urban areas than in rural

areas though the decline in OON prevalence has been similar for both in the period 2012 to 2020.

Figure 4-3 - OON Prevalence by Urban versus Rural Zip code of Residence

7%

6%

5%

4%

3%

2%

1%

0%

2012 2013 2014 2015 2016 2017 2018 2019 2020

Source: Analysis of OON trends using Health Care Cost Institute 2.0 data

Insurance Plan Type

The share of claims that are OON was highest among those with point of service (POS) insurance, with

health maintenance organizations (HMO) next, and preferred provider organizations ( PPO) the lowest.

The rate of OON claims jumped for HMO and PPO plans in 2020, but declined from 2012-2019 for all plan

Urban

Rural

OON Prevalence

July 2023

REPORT TO CONGRESS

29

types; the gap between the rates of OON claims in POS/HMO plans and PPO plans also shrank over this

time period.

Figure 4-4 - OON Prevalence by Insurance Plan Type

14%

12%

10%

8%

6%

4%

2%

0%

2012 2013 2014 2015 2016 2017 2018 2019 2020

Source: Analysis of OON trends using Health Care Cost Institute 2.0 data

Age

OON claims were most common among those aged 18-24 and least common for those aged 55-64. The

share of claims that are OON for all age groups has declined from 2012-2020.

Figure 4.5 - OON Prevalence by Patient Age

10%

8%

6%

4%

2%

0%

2012 2013 2014

2015 2016 2017 2018 2019 2020

Source: Analysis of OON trends using Health Care Cost Institute 2.0 data

Sex

The percentages of claims that are OON were consistently higher for men than for women, though both

have seen similar declines in the percentage of OON claims from 2012- 2020.

HMO

PPO

POS

0-17

25-34

45-54

18-24

35-44

55-64

OON Prevalence

OON Prevalence

July 2023

REPORT TO CONGRESS

30

Figure 4-6 - OON Prevalence by Gender

7%

6%

5%

4%

3%

2%

1%

0%

2012 2013 2014 2015 2016 2017 2018 2019 2020

Source: Analysis of OON trends using Health Care Cost Institute 2.0 data

OON Prevalence by Provider Characteristics

In Figure 4-7, physicians are grouped by the share of their total claims that were billed OON. The majority

of physicians had a very low prevalence of OON bills. Approximately 56 percent of physicians billed one

percent or less of their claims as OON and 70 percent of physicians billed 2 percent or fewer OON claims

(0-1 percent and 1-2 percent bars combined). Just over 5 percent of physicians billed the majority of their

claims OON.

Figure 4-7 - Share of Physician National Provider Identifiers (NPIs) by OON Billing Prevalence, 2019

60%

50%

40%

30%

20%

10%

0%

0-1% 1-2% 2-3% 3-4% 4-5% 5-10% 10-50% 50-100% 100%

OON Prevalence

Source: Analysis of 2019 OON prevalence using Health Care Cost Institute 2.0 data

The prevalence of physician OON billing varied by physician specialty. Some specialties show much higher

rates of OON billing than others. Psychiatry, emergency medicine, pathology, pain medicine, and

anesthesiology all billed greater than 4 percent of their claims OON on average.

Female

Male

Share

of Billing NPIs

OON Prevalence

July 2023

REPORT TO CONGRESS

31

Figure 4-8 - OON Prevalence for Selected Specialties, 2019

12%

10%

8%

6%

4%

2%

0%

Source: Analysis of 2019 OON prevalence using Health Care Cost Institute 2.0 data

Another factor in the rate of OON bills is the place of service. Claims from EDs (13 percent) and ASCs (8

percent) were more likely to be OON than office visits (4 percent).

Figure 4-9 - OON Prevalence by Place of Service, 2019

14%

12%

10%

8%

6%

4%

2%

0%

ED ASC Inpatient

Hospital

Independent

Laboratory

Office Outpatient

Hospital

Pharmacy

Source: Analysis of 2019 OON prevalence using Health Care Cost Institute 2.0 data

OON Prevalence

OON Prevalence

July 2023

REPORT TO CONGRESS

32

Chapter 5. A Conceptual Framework and Potential Methods

NSA requires the Secretary, in consultation with the Federal Trade Commission and Attorney General, to

study the effects of certain NSA provisions on consolidation, overall health care costs, and access to health

care items and services. The provisions of NSA may have several other potential effects on health care

markets and their outcomes including out-of-pocket spending, prices, and quality. In this chapter, we

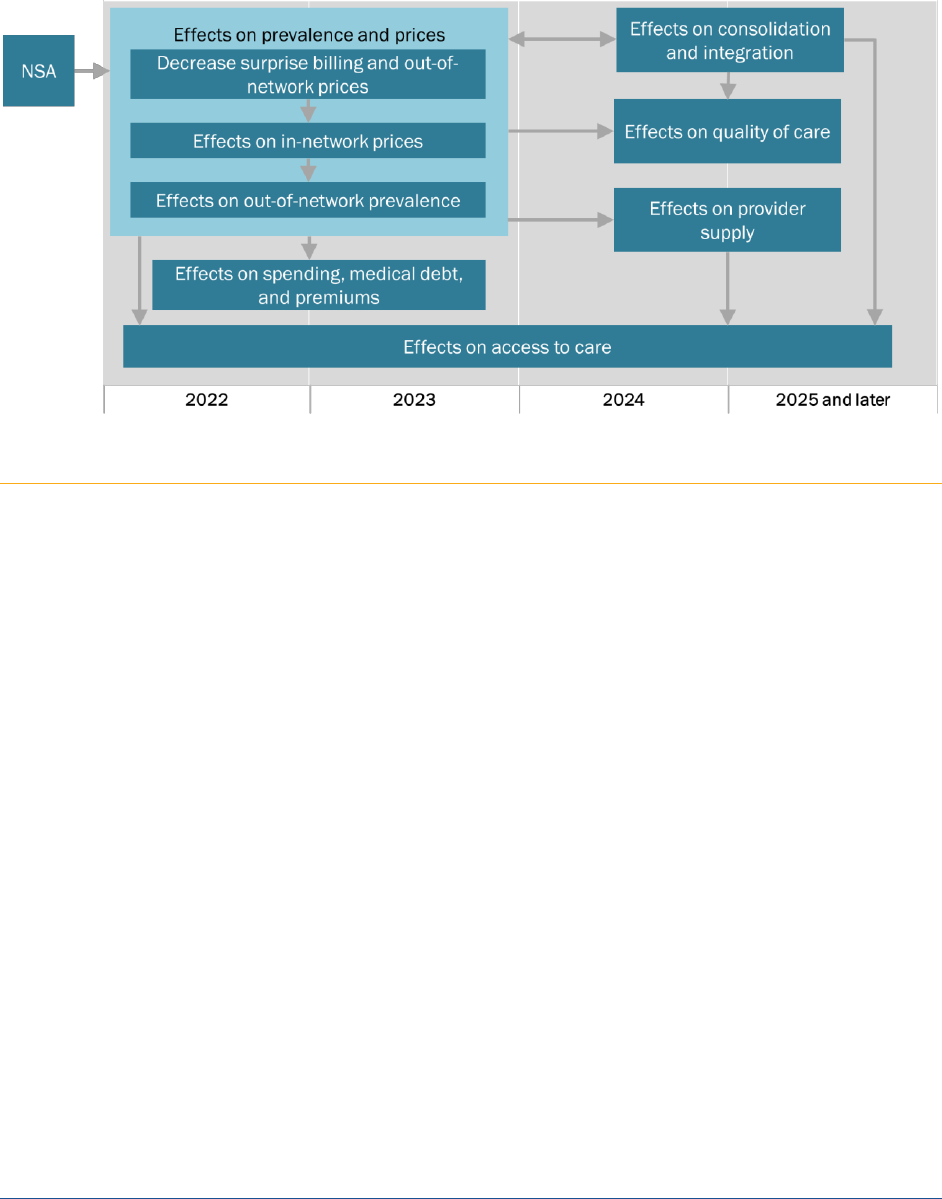

present a framework for understanding these effects and their interrelationships. Figure 5.1 summarizes

the potential effects NSA may have on health care market outcomes.

NSA creates financial protections for certain patients and establishes a process for determining OON

payment rates for certain surprise billing scenarios. Thus, a primary effect of NSA should be to reduce the

number of surprise bills and the out-of-pocket spending associated with them. A potential downstream

effect of the reduced out-of-pocket liability is that medical debt may be reduced.

These effects may extend beyond the financial protections afforded to patients for certain OON items and

services. To the extent that negotiations between providers and plans and issuers regarding payment

rates consider the rates providers would receive if they remain OON, there could be impacts on both in-

network rates and network participation by the providers. For example, in some areas, providers may see

attractive OON billing opportunities as an alternative to joining an issuer’s or plan’s network. By modifying

expectations about OON payments, the NSA may change the bargaining dynamic between plans and

issuers and providers and place more pressure on providers to join plan and issuer networks. The resulting

changes to network structures could further reduce the incidence of OON billing. Alternatively, providers

may believe that IDR process provides them with higher reimbursement than they would be able to

negotiate themselves, and making providers more willing to go out-of-network.

To the extent that these pressures provide more market power for issuers, they may be able to negotiate

lower in-network prices. Lower in-network prices could reduce growth in premiums and overall health

care spending, though as noted above, the evidence is not clear that such savings are consistently passed

on to consumers – particularly in the insurer market itself is highly concentrated.

Changes in prices may affect provider decisions regarding consolidation, provider supply (e.g., staffing),

and investments in quality improvement over the long term. Changes in the supply of providers would in

turn have implications for access to health care, and changes in consolidation could influence prices,

access to health care, and quality of care.

One possible response to this dynamic is providers seeking to strengthen their bargaining positions by

increasing their market power through consolidation. In turn, changes in market consolidation can

adversely affect prices and quality of care (see Chapter 3). Thus, as indicated in Figure 5-1, NSA may have

direct effects on these outcomes of interest as well as indirect effects on them through changes in market

consolidation.

July 2023

REPORT TO CONGRESS

33

Figure 5-1 - Potential Effects of NSA

Looking Forward: Planning for Future Research and Methods for Evaluating the Impact of NSA

Estimating the independent effects of NSA on the key outcomes in Figure 5-1 will be very challenging and

may require a variety of statistical methods and data sources. In this report, we include baseline

information on important trends – such as the prevalence of OON bills – that will be critical to conducting

these analyses. In this section, we describe the potential methodologies that could be applied in future

reports to analyze the impact of NSA on the key outcomes of interest. These methods include both

quantitative and qualitative analyses.

Interested-Party Discussions

Discussions with interested parties can generate information about the impact of NSA where there is a

lack of quantitative data or when evaluating NSA empirically would be difficult. These discussions can also

lead to uncovering important areas of impact not previously considered and suggesting other qualitative

(e.g., provider surveys) or quantitative analyses.

Interested-party discussions may be especially informative early in the implementation of NSA while key

sources of quantitative data are unavailable. Interested-party discussions and other qualitative methods

will continue to play an important role in later years, especially given the limitations of quantitative

approaches for assessing the nationwide implementation of NSA.

July 2023

REPORT TO CONGRESS

34

Descriptive Analysis

A descriptive analysis of quantitative data can show changes in outcomes following implementation of

NSA. In addition to evaluating changes in outcomes and trends, descriptive analysis can include outcomes

that would only be available after implementation of NSA (e.g., consumer complaints submitted via the

federal surprise billing complaints process). This report establishes some baseline trends in OON and

surprise billing (see Chapter 4) that we anticipate tracking in future reports.

In some instances, only descriptive analyses will be possible with the available data.

Quantitative Analyses

Estimating the independent impacts of NSA on key outcomes such as prices, spending, quality, access to

health care, and market consolidation will require the use of statistical modeling and leveraging multiple

research designs. Below we describe the potential methods that may be applied as the appropriate data

become available.

Interrupted Time Series (ITS) Methods

Interrupted Time Series (ITS) is a statistical analysis in which a period of time before an intervention is

compared to a period of time after an intervention, controlling for certain observable influences. The

difference between those trends – in rate and level – is one way to measure the effect of the interruption

or intervention. An ITS approach can evaluate a given outcome over time to assess whether the change

(e.g., an increase or decrease in prices for emergency services) occurred immediately following the

implementation of NSA.

As described above, many factors other than the implementation of NSA have likely affected trends in the

outcomes of interest. Therefore, ITS is not a strong method for attributing observed changes in these

trends fully or even partially to NSA. A stronger method is known as comparative interrupted time series

(CITS) in which changes in trends are analyzed and compared between a group subject to NSA and a similar

group not subject to NSA. One advantage of this approach is that it allows for the possibility that other

factors, such as the COVID-19 pandemic, may affect outcomes as long as that factor has the same effect

on both the treatment and comparator groups. While NSA will be implemented nationally, one approach