Form 4890 (Revised August 2024)

Local Government

Tax Guide

OVERVIEW ...........................................................................1

NOTIFICATION REQUIREMENTS OF RECENTLY ENACTED TAXES

SALES TAX CITIES/COUNTIES .........................................................2

LOCAL OPTION USE TAX .............................................................2

DISTRICT TAX ......................................................................3

ADULT USE MARIJUANA TAX .........................................................4

ANNEXATION – SALES TAX ...........................................................6

TAX DISTRIBUTION

IMPACT ............................................................................7

FLOW CHART .......................................................................8

DISTRIBUTION TERMS ...............................................................9

DISTRIBUTION DETAILED REPORTS ...................................................11

HOW TO READ A BUSINESS LIST REPORT . .............................................12

HOW TO READ A FINANCIAL DETAIL REPORT ...........................................13

HOW TO READ A POLITICAL SUBDIVISION SALES AND USE TAX REPORT ...................14

STATE TAX AND FEE DISTRIBUTION ...................................................15

ST. LOUIS COUNTY CIGARETTE TAX ...................................................15

ANNEXATION – MOTOR VEHICLE SALES TAX, MOTOR FUEL TAX, MOTOR VEHICLE

FEE INCREASE .....................................................................16

FINANCIAL INSTITUTION TAX ..........................................................16

ENSURING TAX COMPLIANCE

..........................................................17

FREQUENTLY ASKED QUESTIONS

.......................................................19

APPENDIX

LOCAL SALES/USE TAX STATUTES .....................................................A-1

MOTOR FUEL TAX, MOTOR VEHICLE SALES TAX, MOTOR VEHICLE FEE INCREASE,

ST. LOUIS COUNTY CIGARETTE TAX STATUTES, RULES, STATE CONSTITUTION ..............A-2

TABLE OF CONTENTS

OVERVIEW

SALES TAX

Sales tax is imposed pursuant to Chapter 144, RSMo, on the purchase price of tangible personal property and

certain taxable services sold at retail. All sales of tangible personal property and taxable services are generally

presumed taxable unless specically exempted by law. Each business is assigned a jurisdiction code to be a

unique code encompassing a city (if business is within city limits), county, and any applicable districts to

identify the correct sales tax rate. Persons/Businesses making retail sales collect the sales tax from the

purchaser and remit the tax to the Department of Revenue. The state sales tax rate is 4.225%, which is

distributed into four funds:

• General Revenue (3%);

• Conservation (0.125%);

• Education (1%); and

• Parks/Soils (0.10%).

Cities, counties, and certain districts may also impose local sales tax; therefore, the amount of tax businesses

collect from the purchaser depends on the combined state and local rate and the location of the seller. Special

taxing districts (such as re districts) may also impose additional sales tax. Generally, the Department of

Revenue collects and distributes only state and local (city, county, and district) sales tax.

The seller remits state and local sales tax together to the Department of Revenue, who in turn, distributes the

local sales tax to the cities, counties, and districts.

USE TAX

Use tax is imposed on the storage, use or consumption of tangible personal property in this state. The state

use tax rate is 4.225%. Cities and counties may impose an additional local use tax. The amount of use tax due

on a transaction depends on the combined (local and state) use tax rate in eect at the Missouri location where

the tangible personal property is stored, used or consumed. Local use taxes are distributed in the same

manner as sales taxes.

Unlike sales tax, which requires a sale at retail in Missouri, use tax is imposed directly upon the person that

stores, uses, or consumes tangible personal property in Missouri. Use tax does not apply if the purchase is

from a Missouri retailer and subject to Missouri sales tax.

If an out-of-state seller does not have nexus in Missouri and is not required to collect use tax from the

purchaser, the purchaser is responsible for remitting the use tax to Missouri. A purchaser is required to le a

use tax return if the cumulative purchases subject to use tax exceed two thousand dollars in a calendar year.

Cities, counties, and certain types of districts may also impose local use tax. However, the rate of local use

tax may equal the local sales tax rate currently in eect and imposed by that city, county

, or district, if

applicable by statute.

If you have questions or concerns regarding city, county, or district tax issues contact:

Email:

localgov@dor.mo.gov

Mail:

Taxation Division

P.O. Box 3380

Jeerson City, MO 65105-3380

Telephone: (573) 751-4876

Fax: (573) 522-1160

1

RECENTLY ENACTED TAXES

Cities, counties, and districts must notify the Department of Revenue within ten days of adoption or ordinance/

order (by certied mail) of recently enacted local sales/use tax at: Taxation Division, Local Tax Unit, P.O.

Box 3380, Jeerson City, Missouri 65105-3380 as follows. For inquiries contact: (573) 751-4876

.

CITY AND COUNTY SALES TAX

REQUIRED

STEPS/

DOCUMENTS:

Submit the following by certied mail to the Department of Revenue:

• Original signed ordinance/order that must include:

- City/County name imposing the tax;

- Missouri statute authorizing tax;

- Percent of increase or extension;

- Usage of the revenue;

- Eective date and expiration date of ordinance/tax; and

- Clearly state if the new tax applies to Domestic Utilities (if applicable).

• Certied copy of election results;

• Copy of the ocial ballot given to the voters when voting; see example below

• Provide the name, title and address to where all future correspondence, and distribution

payments concerning this tax should be sent.

DEPARTMENT

OF REVENUE

STEPS:

• Verify the information provided by the city or county;

• Send a conrmation letter documenting the eective date of the tax;

• Request an Automated Clearing House (ACH) Agreement, which must be completed and

returned for distribution purposes; and

- The city/county must return the new/revised completed agreement on or before the

15th day of the month prior to the eective date of any new tax imposed.

EFFECTIVE

DATE:

• New Local Sales Tax:

Eective on the rst day of the second calendar quarter following Department of

Revenue notication.

• Extension of Existing Local Sales Tax:

Eective on the rst day of the rst calendar quarter following Department of Revenue

notication.

LOCAL OPTION USE TAX

REQUIRED

STEPS/

DOCUMENTS:

• Submit the following by certied mail to the Department of Revenue:

- Original signed ordinance/order that must include:

- City/County* name imposing the tax; and

- Eective date and expiration date of ordinance/tax.

• Certied copy of election results; and

• Copy of the ocial ballot given to the voters when voting; see example below

*A city or county may impose the local option use tax if a local sales tax is imposed.

Local option use tax:

• Must be imposed at a rate equal to the rate of the local sales tax in eect;

• Will automatically be reduced or raised according to the changes in the sales tax rate; and

• Information must be received 45 days prior to the start of a new quarter.

DEPARTMENT

OF REVENUE

STEPS:

• Update the tax rate records for each business with a location within the city or county;

• Request an Automated Clearing House (ACH) Agreement, which must be completed and

returned for distribution purposes;

- The city/county must return the new/revised completed agreement on or before the 15th

day of the month prior to the eective date of any new tax imposed; and

- Send a conrmation letter documenting the eective date of the tax.

EFFECTIVE

DATE:

• New Local Option Use Tax:

Eective on the rst day of the calendar quarter that begins forty-ve (45) days following

Department of Revenue notication.

• Extension of Existing Local Use Tax:

Eective on the rst day of the rst calendar quarter following Department of Revenue

notication.

2

DISTRICT TAX

REQUIRED

STEPS/

DOCUMENTS:

• Submit the following by certied mail to the Department of Revenue:

- Original signed ordinance/order that must include:

Name of district imposing the tax;

Missouri statute number under which the tax is imposed;

Percentage of increase;

Usage of the revenue; and

Eective date and expiration date of tax;

• Certied copy of election results;

• Copy of the ocial ballot given to the voters when voting; see example below.

• A map of the State of Missouri, district showing street names and district boundaries;

- GIS File to be submitted to Department of Revenue

NOTE: The electronic le format PDF, JPEG and other commonly used to transmit

documents are not a valid equivalent to a GIS le.

- For GIS, the state of Missouri is standardized on the ESRI software platform.

RECENTLY ENACTED TAXES

Preferred le formats: Acceptable le format alternatives:

ESRI Shape le Geo-referenced AutoCad DWG/DWF

ESRI le geodatabase Microstation Design le

GeoJSON

KML

Preferred map projections: Acceptable map projection alternative:

UTM NAD83 Zone 15 WGS 1984

NAD 1983 State Plane Missouri (any zone) feet

Preferred attributes:

Name

District Name

County

Filing Date

Expiration Date

Sample County Fire Protection District

Sample

3-1-2019

3-1-2029

Example

• Maps must be of professional quality and accurately drawn.

• All text must be legible and line work clear.

• Scaled version of an original is acceptable, as long as it is legible.

• Rough sketches or pictorial drawings will not be accepted.

• A map of the district must include:

- District boundary line distinctly visible against the map background

- Within and adjacent to the district: label all names of existing street names, roads and

highways

- Preferred within and adjacent to the district:

Parcel IDs of the properties involved

Parcel boundaries

- If a street is located along the district borders, indicate if the district is on both sides of the

street.

• Legal description of the district boundaries (if available).

• List of all cities and counties located in the district;

- Specify if the city/county is entirely or only partially in the district.

• List of business names, addresses, and Missouri sales tax identication numbers of

businesses located in cities and counties that are partially in the district;

- For districts that are partially located within a city or county be sure to include all

possible addresses within the district.

3

REQUIRED

STEPS/

DOCUMENTS:

(Continued)

- If a district covers an entire city or county all businesses located within that city or county

will be automatically registered in the district.

• Indicate if your district overlaps any other districts. Specify any businesses in overlapping

areas.

• List of district ocials (name/ title/telephone number) to be used as a reference.

• Provide the name, title, phone number and address to where all future correspondence,

phone calls, and distribution payments concerning this tax should be sent.

• Notify the Department of Revenue with updates as changes occur.

The district must notify the Department of Revenue of new businesses in the district.

DEPARTMENT

OF REVENUE

STEPS:

• Verify the information provided by the district;

• Send a conrmation letter documenting the eective date of the tax;

• Request an Automated Clearing House (ACH) Agreement, which must be completed and

returned for distribution purposes; and

- The district must return the new/revised completed agreement on or before the 15th day

of the month prior to the eective date of any new tax imposed.

EFFECTIVE

DATE:

• New Local District Tax:

Eective on the rst day of the second calendar quarter following Department of Revenue

notication.

• Extension of Existing Local District Tax:

Eective on the rst day of the rst calendar quarter following Department of Revenue

notication.

4

REQUIRED

STEPS/

DOCUMENTS:

• Submit the following by certied mail to the Department of Revenue:

- Original signed ordinance/order that must include:

City/County name imposing the tax; and tax rate

Eective date and expiration date of ordinance/tax.

• Certied copy of election results; and

• Copy of the ocial ballot given to the voters when voting; see example below.

DEPARTMENT

OF REVENUE

STEPS:

• Update the tax rate records for each business with a location within the city or county;

• Request an Automated Clearing House (ACH) Agreement, which must be completed and

returned for distribution purposes;

- The city/county must return the new/revised completed agreement on or before the 15th

day of the month prior to the eective date of any new tax imposed; and

- Send a conrmation letter documenting the eective date of the tax.

EFFECTIVE

DATE:

• New Adult Use Marijuana Tax:

Eective on the rst day of the second calendar quarter following Department of Revenue

notication.

ADULT USE MARIJUANA TAX

5

Example Ballot:

ANNEXATION – SALES TAX

REQUIRED

STEPS/

DOCUMENTS:

• Submit the following by certied mail to the Department of Revenue:

- Original signed ordinance/order that must include:

Name of City that is annexing the property;

Missouri statute authorizing the annexation;

Legal description of the annexed area; and

The proposed eective date of the annexation.

* Allow at least one month for the Department of Revenue to implement the change.

• A map of the State of Missouri detailing the new boundaries of the city or county;

- GIS File to be submitted to Department of Revenue

NOTE: The electronic le format PDF, JPEG and other commonly used to transmit

documents are not a valid equivalent to a GIS le.

- For GIS, the state of Missouri is standardized on the ESRI software platform.

Preferred le formats: Acceptable le format alternatives:

ESRI Shape le Geo-referenced AutoCad DWG/DWF

ESRI le geodatabase Microstation Design le

GeoJSON

KML

Preferred map projections: Acceptable map projection alternative:

UTM NAD83 Zone 15 WGS 1984

NAD 1983 State Plane Missouri (any zone) feet

Preferred attributes:

Name

City Name

County

Filing Date

Expiration Date

Sample

Sample

3-1-2019

3-1-2029

Example

• Maps must be of professional quality and accurately drawn.

• All text must be legible and line work clear.

• Scaled version of an original is acceptable, as long as it is legible.

• Rough sketches or pictorial drawings will not be accepted.

• A map of the district must include:

- District boundary line distinctly visible against the map background

- Within and adjacent to the district: label all names of existing street names, roads and

highways

- Preferred within and adjacent to the city:

Parcel IDs of the properties involved

Parcel boundaries

• List of businesses located within the newly annexed area, including addresses and Missouri

sales tax identication numbers;

• Notication of annexations for cities in St. Louis County must also include a population

count.

DEPARTMENT

OF REVENUE

STEPS:

EFFECTIVE

DATE:

• Send written conrmation of the eective date of the change to the person who notied the

Department.

• Issue a new sales tax license to each annexed business reecting that it is now within the

city limits.

• Notify annexed businesses of any rate change as a result of the annexation.

• New Tax Rates for Annexed Businesses:

Per Statute 32.310.7 RSMo. the tax will be eective on the rst day of a calendar quarter

after one hundred twenty days’ notice to sellers.

6

TAX DISTRIBUTION

IMPACT

Each business location is assigned a city code (if the business is inside city limits), a county code to identify the correct

sales tax rate, and a code that represents all applicable districts.

• One percent of all local tax money is deposited to the State’s General Revenue Fund for collection costs.

• All local sales/use or district tax collected by the Department of Revenue is distributed by the 10th day of the month

following the month in which the tax return is processed.

• Various factors such as a business’ ling frequency and due dates will aect the size of each distribution.

Providing better service with less expense to cities and counties, the Department of Revenue sends sales, use, and

district tax distribution monies via Automated Clearing House (ACH) transfer. In the event a bank is a nonparticipating

bank (cannot accept the ACH transfer), a letter must be provided from the non-participating bank indicating such. Under

these circumstances, the Department of Revenue will wire transfer sales, use, and district tax distribution monies.

Each month, transactions occur which will impact local distribution. These transactions may positively or negatively eect

distribution, as illustrated in the chart below:

TRANSACTIONS:

POSITIVE

DISTRIBUTION

• Original or amended sales/use tax return(s) from taxpayer;

• Payment of balance due submitted from a return or delinquent account;

• Bond applied to a return or delinquent account;

• Amended return led to correct an invalid location (Example: Location moved from outside to

inside city limits);

• Tax returns processed as a result of audit ndings, resulting in an additional amount due; or

• Amended return led to change previously reported use tax to sales tax.

NEGATIVE

DISTRIBUTION

RESULTS IN:

• Amended return led:

- With valid exemption claims (i.e. farmers, resale, manufacturer);

- For sales to non-prot organizations;

- Correcting an invalid location (location inside city moved to outside or another city); or

- To change sales tax to use tax.

• Return processed as a result of audit ndings, resulting in a refund.

• Statutorily imposed nes against a political subdivision.

ANNUAL POLITICAL SUBDIVISION FINANCIAL REPORTS

Section 105.145, RSMo, requires certain political subdivisions to le a nancial report with the State Auditor’s oce in

compliance with 15 CSR 40-3.030. Eective August 28, 2017, the State Auditor’s Oce must notify the Missouri

Department of Revenue if a political subdivision fails to le a timely nancial statement. Failure to timely le a nancial

statement may subject the political subdivision to a ne of $500 per day. The Department may collect the ne authorized

under this statute by osetting any sales or use tax distributions due to the political subdivision.

7

MONTHLY

REPORTING

(TAXABLE

SALES

OVER $12,500)

QUARTERLY

REPORTING

ANNUAL

REPORTING

(TAXABLE

SALES $375 TO

$12,500)

(TAXABLE

SALES

UNDER $375)

JAN

FEB

MAR

APR

MAY

JUNE

JULY

AUG

SEPT

OCT

NOV

DEC

TAX COLLECTED BY RETAILERS

TAX DISTRIBUTION

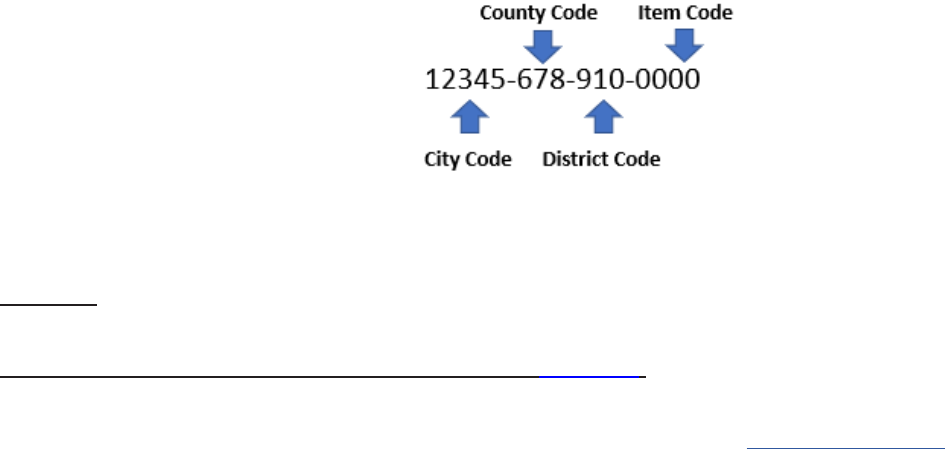

DISTRIBUTION FLOW CHART

• Retailers/businesses are required to le sales/use tax returns monthly, quarterly, or on an annual basis, depending on

the amount of tax collected and remitted.

• Eective January 1, 2022 all returns are due on or by the last day of the following month. When the due date falls on a

Saturday, Sunday or state of Missouri holiday, the return is due the next business day.

The following example demonstrates how due date’s impact distribution:

• December returns are due from taxpayers by January 31st with the majority of returns received and processed by the

Department of Revenue in February for March distribution.

The following chart illustrates the distribution process:

DUE DATE

TO DOR

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

ANNUAL

FILER

MONEY RECEIVED

AND

PROCESSED

BY DOR

DISTRIBUTION TO

CITIES AND

COUNTIES

FEB 28

MAR 31

APR 30

MAY 31

JUN 30

JUL 31

AUG 31

SEP 30

OCT 31

NOV 30

DEC 31

JAN 31

MAR

APR

MAY

JUNE

JULY

AUG

SEPT

OCT

NOV

DEC

JAN

FEB

APR

MAY

JUNE

JULY

AUG

SEPT

OCT

NOV

DEC

JAN

FEB

MAR

8

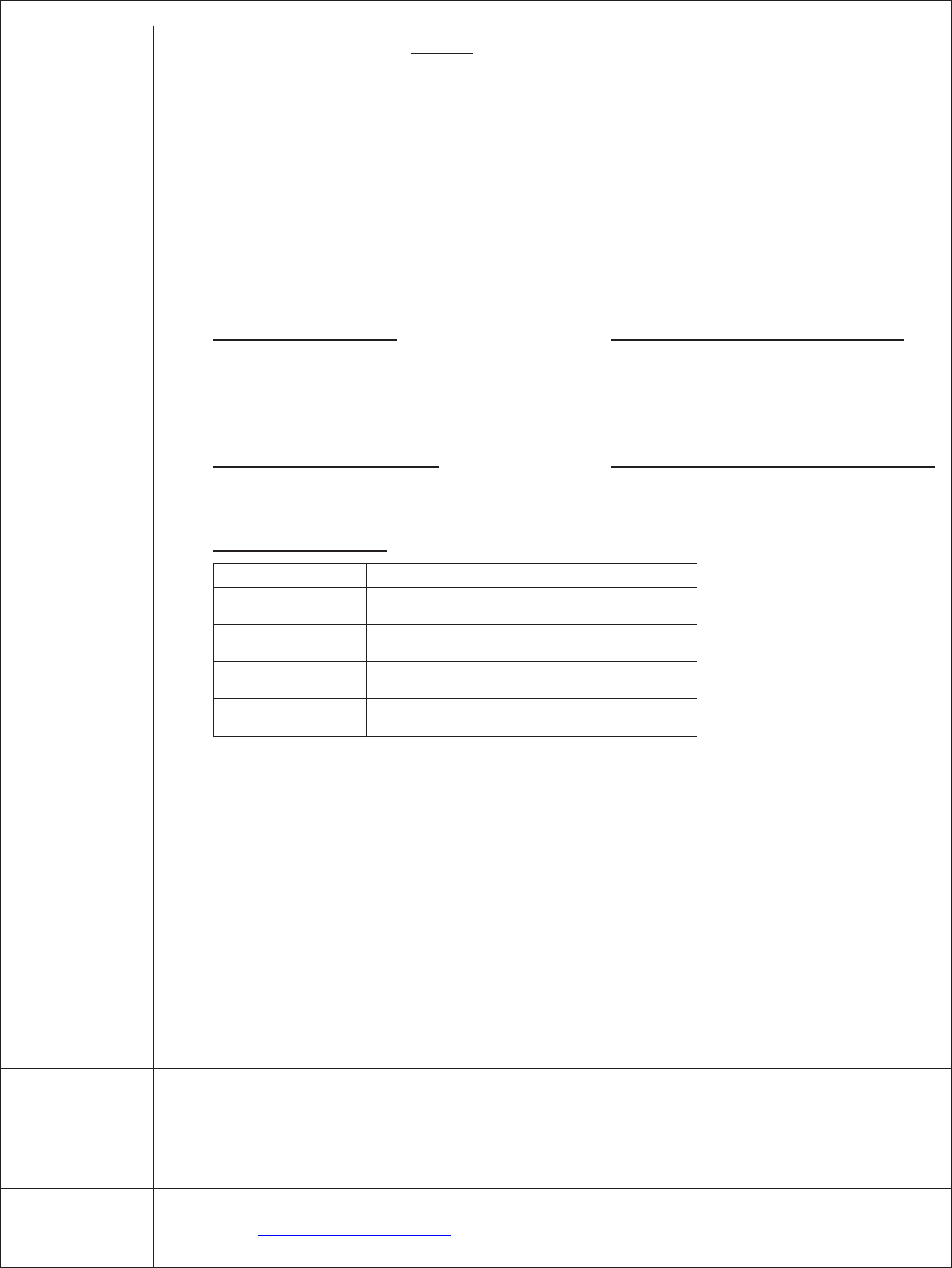

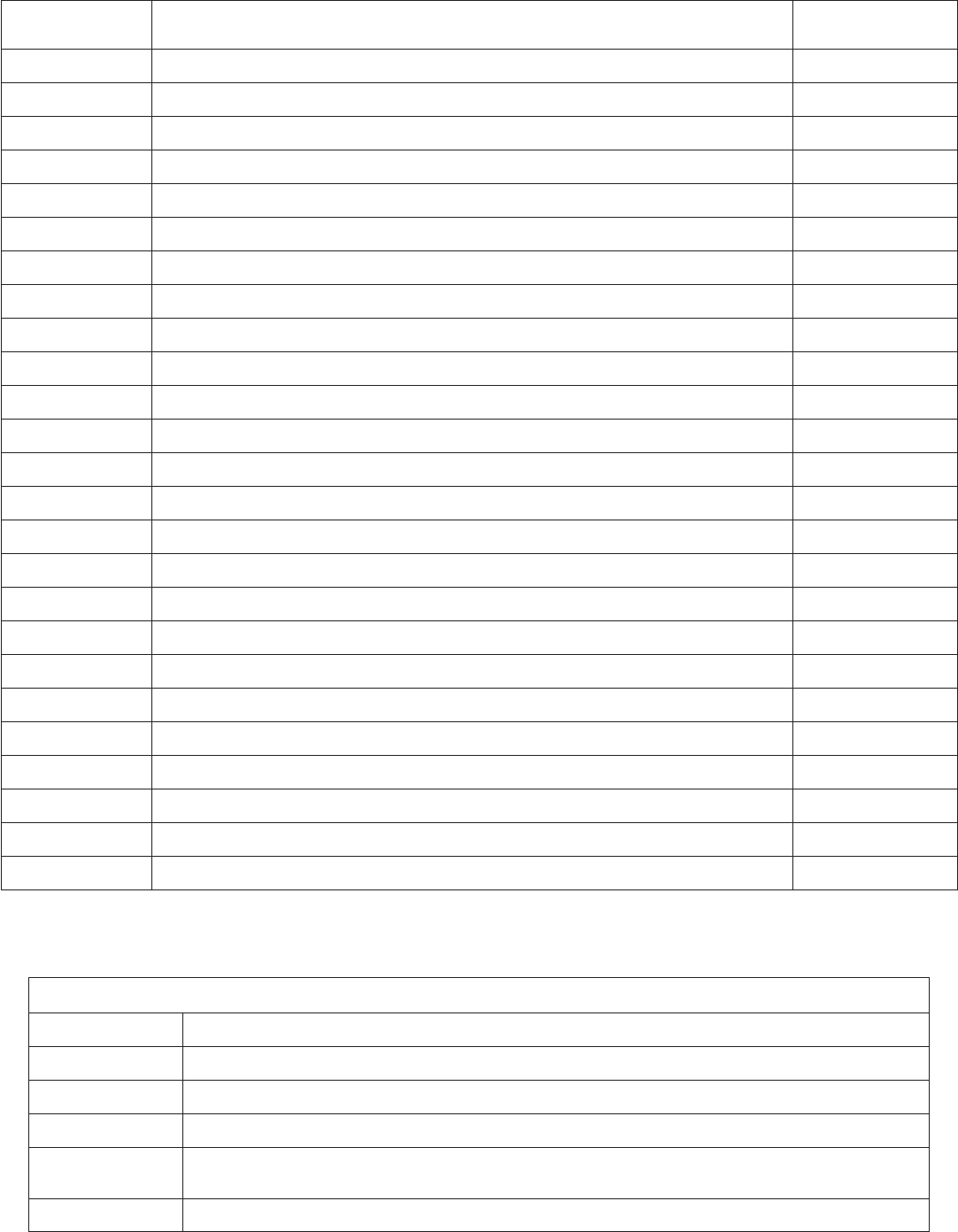

Item Taxes Codes

• Political Subdivision: a city, county, or district with a unique taxing jurisdiction.

• Political Subdivision Number/Code: Each political subdivision that has had a tax imposed will have a unique 8-digit

code assigned for their distribution account. This account is separate from any account with a MOID. The political

subdivision numbers for districts will include letters.

• MOID: The 8-digit Missouri tax identication number issued by the Missouri Department of Revenue. A business uses

their unique MOID when ling sale and use tax returns.

• Sales Tax: A tax imposed on the purchase price of tangible personal property and certain taxable services sold at

retail in the State of Missouri.

• Use Tax:

o Vendor’s Use Tax: Tax on sales made by out-of-state vendors where goods are shipped into Missouri and

vendor has no physical presence within the state of Missouri.

o Consumer’s Use Tax: Tax on the storage, use, or consumption of tangible personal property in the State of

Missouri where tax was not paid on the purchase of the items. A purchaser is required to le a use tax return if

the cumulative purchases subject to tax exceed $2,000 in a calendar year.

• Distribution: Money received by a county/city/district that reects the local sales and use tax collections by businesses

on behalf of the pollical subdivision for the month.

• Distribution Period: A distribution period reects all posted and adjusted sales and use tax returns during that

month. At the rst of each month the Department will distribute local taxes collected back to the applicable political

subdivision for the prior month’s distribution period.

o Example: January 2024 Distribution period includes returns posted with payment and any return adjustments

made during the period of January 1 through January 31, 2024. Distribution of local taxes collected during this

period would be completed by February 7, 2024.

• Jurisdiction Code: The 15-digit code that identies the county, city, district, and item code for a location. The rst

ve digits designate the city, the next three digits represent the county, then the next three will indicate applicable

districts, and the last four are the item code. If the city code is 00000, this indicates the location is not in an incorporated

city limit. You may access the Department’s website to nd a full list of political subdivisions and their corresponding

jurisdiction codes, Sales/Use Tax Rate Tables. Below is a full list of applicable item tax codes.

DISTRIBUTION TERMS

9

Sales/Use Tax 0000

Item Taxes Codes

Marketplace Facilitator (MPF) 0010

Food Tax 1001

Food Tax - (MPF) 1011

Lamar Heights Food 1501

Branson Food/Drink 1502

Textbook 2001

Textbook - (MPF) 2011

Instate MV Leasing 2100

Out of State MV Leasing 2101

Motor Vehicle Sales 2102

Motor Vehicle Non-Missouri Dealer Sales 2103

Out of State MV Leasing - (MPF) 2111

Battery Manufacturing 3001

Jet Fuel 3100

Jet Fuel - (MPF) 3110

Domestic Utility 3200

Branson Tourism Hotel Exemption 7001

Branson Tourism Utility Exemption 7002

Adult Use Marijuana - STACKING 7003

ADULT Use Marijuana - NON-STACKING 7004

10

Jurisdiction Code Example

• Site Code: The number associated with a location of a business when it is registered. Every location that a business

registers will have its own site code. This is a 4-digit number.

• ACH Transfer Agreement for Local Political Subdivisions, Form 5507: This form will need to be completed each

time a new tax type is imposed in order for distribution payments to be sent to a political subdivision via ACH transfer

instead of by check in the mail. Each tax type will need to have its own form sent into the Department of Revenue along

with a voided check or letter from the bank. PDF of document can be sent via email to LocalGov@dor.mo.gov.

DISTRIBUTION DETAILED REPORTS

• Distribution Reports: There are three free secure reports available to those who create a Government User account

with the Department for distribution. The reports can be viewed on the Secure Reports tab within MyTax Missouri.

o Political Subdivision Sales and Use Tax History Detail: Displays a political subdivisions distribution for a

specic date range.

o Sales and Use Financial Details: Displays all active sales and use tax accounts for a specic political subdivision

and the amount of local tax distributed from that business to the political subdivision.

o Sales and Use Tax Business Listing for a Political Subdivision: Displays all active sales and use location

accounts for a specic political subdivision. List will be for accounts that were active any time during a specic

date range.

• Request For Information or Audit of Local Sales and Use Tax Records, Form 4379: This form will need to be

completed to designate individuals authorized to access/change secure information for the political subdivision. Only

individuals submitted on this form will be able to speak to the Department regarding secure information. This form

must be submitted annually and will expire on the last day of the year. The form is only valid with an authorized

signature. PDF of document can be sent via email to LocalGov@dor.mo.gov.

o Forms can be obtained at the Department Website: dor.mo.gov/forms

• Authorized Signature: Individuals who can sign documents to authorize others and communicate with the Department on

condential information. Election results or recent meeting minutes can be submitted to show current authorized signatures.

o County: Presiding Commissioner

o City: Mayor, Chairperson, or City Administrator

o District: Board of Director Member

• MyTax Portal Distribution Account: Authorized individuals can create a ‘Government User’ account type at

MyTax.mo.gov to receive access to online secure distribution reports. The User ID, which is created when registering

at MyTax.mo.gov, should be included on the submitted Form 4379. A ‘Government User’ account type can only be used

for a single political subdivision. The account must have the name of the individual on the Form 4379. A distribution

account is separate from the account(s) in which political subdivisions report their withholding tax, sales, or use tax.

• Authorized Access: A person must be authorized for the political subdivision to perform the following actions:

o Request changes to mailing address on the distribution account.

o Request emailed copies of distribution notices.

o Request emailed secure reports.

o Request removal of authorization for an individual on the account.

o Request audit conrmation for political subdivisions with only 6 businesses or less.

o Requests to have business’ registration corrected or returns retroactively amended.

Condentiality

The reports, attachments, e-mails, or written correspondence you will receive contains condential information. All

persons are subject to the provisions of Section 32.057, RSMo. Authorized individuals can only access the information in

performing their ocial duties related to the administration of the tax and cannot disclose this information to the public,

any media source, or any other ocial who is not authorized to receive.

11

12

13

**

14

TAX DISTRIBUTION

STATE TAX AND FEE DISTRIBUTION

The Department of Revenue distributes a portion of three state taxes or fees to cities and counties, on a monthly basis,

generally by the 20th of each month. County mileage and land valuation gures are updated on a yearly basis.

• The Department of Revenue’s actual costs of collection, not to exceed three (3) percent of the particular tax or fee

collected, is deducted prior to making distributions to the state road fund, cities, and counties.

• 50% of all proceeds from the 3%

state sales tax on motor vehicles,

trailers, motorcycles, mopeds,

and motor-tricycles is dedicated

to highway and transportation use

and is apportioned between cities,

counties, and the state as follows:

- 10% to counties with allocation

based 50% on road mileage

and 50% on rural land

valuation;

- 15% to cities with allocation

based on population from the

last federal decennial census;

- 2% to the state transportation

fund; and

- 73% to the state road fund.

• The remaining 50% of the 3%

state sales tax on motor vehicles

is distributed to the state road

bond fund.

MOTOR VEHICLE SALES TAX MOTOR FUEL TAX MOTOR VEHICLE FEE INCREASE

• Each city and county receives a

distribution of the state fuel tax.

Net proceeds of the tax are ap-

portioned between counties, cities

and the state as follows:

- 10% to counties;

- 15% to cities; and

- 75% to the state road fund.

• Eective July 1, 1994, an

additional 5% of any increased tax

rate is deposited to the County Aid

Road Trust (CART) Fund, with 5%

of the additional 5% distributed to

St. Louis City.

• Cities receive their distribution of

the state fuel tax based on

population from the last federal

decennial census.

• Counties receive their distribution

of the state fuel tax based 50% on

county road mileage and 50% on

rural land valuation.

• Each city and county receives a

distribution from the increased

state motor vehicle fees. These

fees are state license fees and

taxes on motor vehicles, trailers,

motorcycles, mopeds, and motor

tricycles that have been increased

by law since 1979. The amount

distributed is:

- 10% to counties;

- 15% to cities; and

- 75% to the state road fund.

• Cities receive their distribution

of the increased fees based on

population from the last federal

decennial census.

• Counties receive their distribution

of the increased fees based 50%

on county road mileage and 50%

on rural land valuation.

ST. LOUIS COUNTY CIGARETTE TAX

The Department of Revenue distributes the cigarette tax collected on sales of St. Louis County cigarette stamps on a

monthly basis, generally by the 15th of each month.

The Department of Revenue receives a collection fee of one (1) percent of the amount collected which is deducted prior to

making the distribution to St. Louis County and the cities in St. Louis County.

ST. LOUIS COUNTY CIGARETTE TAX

Each city in St. Louis County and St. Louis County receives a distribution of the St. Louis County Cigarette Tax.

• St. Louis County receives its distribution based upon the percentage ratio that the population of the unincorporated

area of the county bears to the total population of the county as shown on the latest federal decennial census.

• Each city, town or village in St. Louis County receives their distribution based upon the percentage ratio their

population bears to the total population of the incorporated area of the county, as shown on the latest federal

decennial census.

15

TAX DISTRIBUTION

ANNEXATION OR CENSUS – MOTOR VEHICLE SALES TAX, MOTOR FUEL TAX,

MOTOR VEHICLE FEE INCREASE, AND ST. LOUIS COUNTY CIGARETTE TAX

Submit the following to the Department of Revenue:

• A certied copy of the annexation or consolidation election results or a certied copy of the

ordinance approving the annexation or consolidation; and

• Ocial written notication from the United States Census Bureau of the amount of

population in the area annexed or consolidated and which political subdivision(s) lost

population through annexation or consolidation.

When changes take eect due to annexations:

• If Department of Revenue receives notication before the fteenth of the month, the new

population will be used in the next distribution.

• If notication is received after the fteenth of the month, the new population will be used

beginning with the second distribution following receipt of notication by the Department.

When changes take eect due to decennial census:

• If initial certication is received by the director prior to the rst day of July, the census results

shall be used for distributions made on or after January rst of the next year.

• If initial certication is received on or after the rst day of July, the census results

shall be used for distributions made on or after July rst of the next year.

REQUIRED

STEPS/

DOCUMENTS:

EFFECTIVE

DATE:

For questions regarding the distribution of motor vehicle sales tax, motor fuel tax, and motor vehicle fee increase contact:

Telephone: (573) 751-5158 E-mail: excise@dor.mo.gov

16

FINANCIAL INSTITUTION TAX

Annually, banks and other nancial institutions pay a 4.48% tax on net income to the Department of Revenue.

Pursuant to Sections 148.080 and 148.670, RSMo, the total amount of tax collected, less a two percent collection fee, is

returned to the county treasurer of the county in which the nancial institution is located. A statement of the exact amount

due each political subdivision of the county is submitted with this payment. Political subdivision includes any sewer, re,

library, or ambulance district etc. that had a property tax rate levy.

A “group combo” is the specic combination of political subdivisions in which each nancial institution is located. The

amount due each political subdivision is determined by applying the local property tax levy to the total property tax levy for

the “combo” area.

This distribution occurs annually, in December, with interest earned in the fund over the year distributed in January.

For questions concerning this tax, contact:

Financial Institution Taxes

P.O. Box 898

Jeerson City, MO 65105-0898

Telephone: (573) 751-2326

E-mail: t@dor.mo.gov

ENSURING TAX COMPLIANCE

LOCAL LICENSE RENEWAL

It is in local government or district’s best interest to properly identify the businesses in their area. If the business is not

registered inside the jurisdiction, the city or county will not receive the proper amount of sales tax revenue.

• Verify the information on the Department of Revenue issued sales tax license is correct prior to issuing a merchant’s

or occupational license.

- A city or county may require a new business to provide a copy of its retail sales tax license to verify the correct

tax identication number and location.

- Requiring the business to provide a tax number is not sucient because the business may have a valid tax

number, but not have a location registered in the political subdivision. See the sample Missouri Retail Sales

License.

• Notify both the business and the Department of Revenue if a city or county discovers a business is not registered

within their political subdivision.

- When notifying the Department of Revenue, include the name of the business, Missouri Tax ID number, street

address, mailing address, and correct taxing jurisdiction of the business.

- Send this information to:

Taxation Division

Business Tax Registration

P.O. Box 3300

Jeerson City, MO 65105-3300

Fax (573) 522-1722

• State law, Section 144.083, RSMo, requires businesses to demonstrate they are compliant with state sales and

withholding tax laws before they can receive or obtain certain licenses that are required to conduct business in the

state. In other words, a business must show that it has “No Tax Due”. Cities or counties can verify whether a business

is tax compliant, before issuing or renewing a business license. A No Tax Due may be obtained at

https://mytax.mo.gov or call (573) 751-9268.

Note: A business that makes NO retail sales is NOT required by Section 144.083, RSMo, to present a Certicate of

No Tax Due in order to obtain or renew its license.

The Department is committed to making this requirement as easy as possible for political subdivisions. Obtaining a

statement of No Tax Due is simple and quick, and it’s a free service. The Department has made access to the online

No Tax Due System through a secure portal, MyTax Missouri. You may log onto the My Tax Missouri portal at

https://mytax.mo.gov and sign up for access as a Government User. Once online access has been requested you

must complete Form 4379A and submit to the Department. We will validate the information provided on the form and

grant access requested to the No Tax Due System.

17

SAMPLE NO TAX DUE CERTIFICATE AND RETAIL SALES TAX LICENSE:

18

FREQUENTLY ASKED QUESTIONS

When I receive my tax distributions, why is there a dierence between two taxes with the same tax rate?

Wouldn’t the distributions be the same because the rates are the same?

• Dierent eective dates aect the distribution amount.

• Refunds, delinquencies, and audits impact each tax dierently (Refer to Impact Chart).

• Taxes applied to domestic utilities could aect the distribution amount.

The voters passed a new sales tax – when will we start receiving monies?

• Eective date is rst day of the 2nd calendar quarter after the Department of Revenue receives notication of the

new tax.

• First sales tax return is due (must be postmarked) by the last day of the second month in the quarter.

• First distribution begins the third month in the quarter.

Example:

1. Election held and Department of Revenue notied in August.

2. New sales tax eective date is January 1.

3. Sales tax returns begin to be led with the January return (due February 28th).

4. Distribution will be issued by March 10th.

How do I contact the Department of Revenue if I have questions?

1. E-mail: localgov@dor.mo.gov

2. Telephone: (573) 751-4876

3. Mail: Taxation Division

P.O. Box 3380

Jeerson City, MO 65105-3380

4. Fax: (573) 522-1160

19

APPENDIX A

STATUTE

RATE

66.600 – 66.630

67.391 – 67.395

67.500 – 67.545

67.547

67.547

67.547

67.547

67.578

67.581

67.582

67.584

67.587

67.700 – 67.727

67.729

67.799

67.799

67.997

67.1305

67.1545

67.1700 – 67.1713

67.1715

67.1775

67.1950 – 67.1979

67.2030

68.245

ST LOUIS COUNTY TAX

COUNTY ANTI-DRUG

COUNTY SALES TAX (ALL EXCEPT ST LOUIS COUNTY)

ST LOUIS COUNTY PUBLIC SAFETY SALES TAX

ST LOUIS COUNTY ZOOGICAL SALES TAX

COUNTY SALES TAX (ALL)

ST LOUIS PUBLIC CITY SAFETY SALES TAX

MUSEUM SALES TAX ANDREW COUNTY

ST LOUIS COUNTY ADDITIONAL SALES TAX

JEFFERSON COUNTY LAW ENFORCEMENT SALES TAX

COUNTY TRANSPORTATION INFRASTRUCTURE (NEW MADRID)

COUNTY CAPITAL IMPROVEMENTS TAX (ALL)

STORM WATER TAX (ALL EXCEPT ST LOUIS COUNTY)

REGIONAL RECREATION DISTRICT

COUNTY REGIONAL RECREATION DISTRICT

PERRY CO SENIOR SERVICES AND YOUTH PROGRAMS SALES TAX

LOCAL OPTION ECONOMIC DEVELOPMENT SALES TAX IN-LIEU OF 67.1300 AND 67.1303

COMMUNITY DEVELOPMENT DISTRICTS

COUNTY METROPOLITAN PARKS & RECREATION SALES TAX

METRO PARKS TAX – ARCH GROUNDS

COMMUNITY SERVICES FOR CHILDREN SALES TAX

TOURISM COMMUNITY ENHANCEMENT DISTRICT

CITY TOURISM TAX (CITY OF WESTON)

PORT AUTHORITY SALES AND USE TAX

COUNTY LAW ENFORCEMENT (ALL EXCEPT ST LOUIS & JACKSON COUNTIES)

1%

1/4%

1/4, 3/8, 1/2%

1/8, 1/4, 3/8, 1/2%

(cannot be in excess

of 1% combined)

1/8, 1/4, 3/8, 1/2%

(Cannot exceed 1/8%

beginning 8/28/17)

(Cannot be in excess of

1% combined)

1/8, 1/4, 3/8, 1/2%

(Cannot be in excess of

1% combined)

UP TO 1/2%

1/8, 1/4, 3/8, 1/2%

(Cannot be in excess

of 1% combined)

Not to exceed 1%

(Cannot be in excess

of 2% combined)

UP TO 1/5%

275/1000%

UP TO 1/2%

UP TO 1/2%

1/2%

1/8%, 1/5, 1/4, 3/8, 1/2%

1/10%

UP TO 1/2%

UP TO 1/2%

UP TO 1/4%

UP TO 1/2%

Increments of 1/8%

up to 1%

1/10%

UP TO 3/16%

UP TO 1/4%

TAX TYPE

70.500 – 70.510

92.400 – 92.421

92.500

94.500 – 94.550

94.577

KANSAS – MISSOURI METROPOLITAN CULTURE DISTRICT

KANSAS CITY PUBLIC MASS TRANSPORTATION SALES TAX

ST. LOUIS CITY PUBLIC SAFETY SALES TAX

CITY SALES TAX

CAPITAL IMPROVEMENTS TAX (ALL EXCEPT ST LOUIS COUNTY CITIES)

(SEE 94.577.10 BELOW – EFFECTIVE 2010)

UP TO 1/2%

Increments of 1/8%

up to 1%

1/4%

1/2%

UP TO 1%

LOCAL TAX STATUTES LAST UPDATE: 05/2020

1/8, 1/4, 3/8, 1/2%

A-1

STATUTE

RATE

94.579

94.585

94.600 – 94.655

94.660

94.660 – 94.655

94.660

94.700 – 94.755

94.805

94.838

94.850 – 94.857

94.890

94.900

94.902

94.903

94.1008

94.1012

162.1100

182.802

184.500 – 184.503

190.035 – 190.041

190.335 – 190.337

190.335 – 190.337

205.202

205.205

221.407

SPRINGFIELD PUBLIC SAFETY, PENSION & HEALTH CARE SALES TAX

EXCELSIOR SPRINGS COMMUNITY CENTER SALES TAX

TRANSPORTATION TAX (ST LOUIS COUNTY)

ST LOUIS METRO LINK TRANSPORTATION TAX (ST LOUIS COUNTY)

TRANSPORTATION TAX (KANSAS CITY AND ST LOUIS CITY)

ST LOUIS METRO LINK TRANSPORTATION TAX (ST LOUIS CITY)

TRANSPORTATION TAX (ALL EXCEPT KANSAS CITY, ST LOUIS CITY & COUNTY)

BRANSON FOOD TAX

LAMAR HEIGHTS FOOD TAX

ST LOUIS COUNTY CITIES CAPITAL IMPROVEMENT SALES TAX

CENTRALIA, EXCELSIOR SPRINGS , HARRISONVILLE, LEBANON, PECULIAR,

BLUE SPRINGS, ST JOSEPH, & PORTAGEVILLE PUBLIC SAFETY SALES TAX

GLADSTONE, NORTH KANSAS CITY, RAYTOWN, GRANDVIEW, LIBERTY,

RIVERSIDE, & FAYETTE PUBLIC SAFETY SALES TAX

BRANSON PUBLIC SAFETY SALES TAX (CERTAIN 4TH CLASS CITIES)

KIRKSVILLE ECONONIC DEVELOPMENT SALES TAX

ECONOMIC DEVELOPMENT SALES TAX (POPLAR BLUFF)

ST LOUIS CITY DESEGREGATION

PUBLIC LIBRARY DISTRICT TAX (BUTLER, RIPLEY, WAYNE, STODDARD,

NEW MADRID, DUNKLIN, & CEDAR COUNTIES)

KANSAS CITY ZOOLOGICAL DISTRICT (JACKSON, PLATTE, CASS, CLAY COUNTY)

AMBULANCE DISTRICT SALES TAX

(Established after August 28,2011, except in St. Louis County)

EMERGENCY SERVICES DISTRICT

COUNTY EMERGENCY SERVICES TAX

HOSPITAL DISTRICT (COUNTY TAX)

HOSPITAL DISTRICT SALES TAX (IRON AND MADISON COUNTY)

REGIONAL JAIL DISTRICT *7/2016 – Governor signs that extends date for the ability for

others to impose a jail district under this statute to 9/30/2028 from 9/30/2015.

SPECIAL MUNICIPAL SALES TAX (ST LOUIS COUNTY CITIES) No ACH Sent

UP TO 1%

Not to Exceed 1%

UP TO 1/2%

UP TO 1%

UP TO 1/2%

UP TO 1%

UP TO 1/2%

UP TO 2%

UP TO 4%

1/8, 1/4%

1/2%

UP TO 1/2%

UP TO 1/2%

UP TO 1/2%

1/4, 1/2 , 3/4 ,1%

1/2%

2/3%

Not to Exceed 1/2%

UP TO 1/4%

Not to Exceed 1/2%

UP TO 1%

UP TO 1%

UP TO 1%

Not to Exceed 1%

1/8, 1/4, 3/8, 1/2%

TAX TYPE

238.235

238.236

321.242

321.242

321.246

321.552 – 321.556

321.552 – 321.556

573.505

644.032 – 644.033

644.032 – 644.033

650.390 – 650.411

ECONOMIC DEVELOPMENT SALES TAX (POPLAR BLUFF)

ST LOUIS CITY DESEGREGATION

FIRE PROTECTION DISTRICT (One city, has same boundaries)

CITY FIRE PROTECTION DISTRICT – Can Apply to Use Tax

FIRE PROTECTION DISTRICTS

FIRE PROTECTION DISTRICT

AMBULANCE DISTRICT

CABARET TAX

STORM WATER/LOCAL PARKS (ANY COUNTY)

STORM WATER/LOCAL PARKS (ANY CITY)

EMERGENCY COMMUNICATION SERVICES (ST LOUIS COUNTY ONLY)

Increments of 1/8%

up to 1%

UP TO 1/2%

UP TO 1/4%

UP TO 1/2%

UP TO 1/2%

UP TO 1/2%

UP TO 10%

UP TO 1/2%

UP TO 1/2%

Not to exceed 1/10%

Increments of 1/8%

up to 1%

A-1

ADDITIONAL SALES/USE STATUTES

32.085 – 32.087 PROCEDURES FOR LOCAL SALES TAX

STATE SALES TAX

STATE USE TAX

OLD LOCAL USE TAX (144.748 FOUND UNCONSTITUTIONAL AND 144.749 REPEALED)

LOCAL OPTION USE TAX 144.757.2(1) Cities & Counties 144.757.2(2)(a); St Louis Co

144.757.2(2)(b); St Louis Co 144.757.2(3) St Louis City

LOCAL OPTION USE TAX FOR DISTRICTS

144.010 – 144.525

144.600 – 144.745

144.748 – 144.749

144.757 – 144.761

67.1545

N/A = NOT YET ADOPTED, CODES ARE NOT ASSIGNED UNTIL ADOPTED

*Tax code will have to be built

STATUTE RATE

67.548

67.571

67.583

67.585

67.671 – 67.685

67.730 – 67.739

67.782

67.1015

67.1300

67.1303

67.1922 – 67.1940

67.2000

67.2040

67.2500 – 67.2530

67.5012

70.515 – 70.545

82.875

94.413

94.577.10

94.578

94.581

94.950

94.1000

238.410

644.034

USE OF 67.547 IN CLAY & PLATTE COUNTIES

MUSEUM/FESTIVAL SALES TAX (BUSHANAN COUNTY)

COUNTY EMPLOYMENT BENEFIT SALES TAX (ST FRANCOIS COUNTY)

RECREATIONAL AND COMMUNITY CENTER DISTRICT (LIBERTY SCHOOL DISTRICT)

COUNTY TOURISM SALES TAX

JACKSON COUNTY CAPITAL IMPROVEMENTS TAX

BOLLINGER & CAPE GIRARDEAU COUNTIES RECREATION TAX

MARSHALL HOTEL/MOTEL TAX

ECONOMIC DEVELOPMENT SALES TAX (CERTAIN CITIES/COUNTIES)

COUNTY WATER QUALITY SALES TAX

COUNTY EXHIBITION & RECREATION FACILITY DISTRICT

PULASKI CO SHELTER FOR WOMEN & CHILDREN SALES TAX

(EXPIRES 3 YRS AFTER EFF DATE)

THEATRE, CULTURAL ART, ENTERTAINMENT DISTRICT SALES TAX

PARKS, TRAILS AND GREENWAY DISTRICT TAX

KANSAS/MISOURI REGIONAL INVESTMENT DISTRICT

(CLAY, PLATTE, JACKSON, CASS, RAY, BUCHANAN)

INDEPENDENCE POLICE SERVICE SALES TAX

STORM WATER (CITIES WITH POPULATION OF MORE THAN 100,000)

KANSAS CITY PUBLIC SAFETY, INCLUDING CAPITAL IMPROVEMENTS

SPRINGFIELD COMMUNITY IMPROVEMENT SALES TAX

COLUMBIA PUBLIC SAFETY CAPITAL IMPROVEMENTS SALES TAX

JOPLIN HISTORICAL LOCATIONS & MUSEUM SALES TAX

ST LOUIS MEDICAL INDIGENCE SALES TAX

ST CHARLES COUNTY TRANSIT AUTHORITY SALES TAX

WASTE WATER & SOIL POLLUTION ABATEMENT

ECONOMIC DEVELOPMENT SALES TAX (CERTAIN CITIES/COUNTIES)

1/8 , 1/4, 3/8, 1/2%

UP TO 2/10%

UP TO 1/8%

Not to Exceed 1/2%

UP TO 7/8%

1/4, 3/8, 1/2, 1%

1%

UP TO 5%

COUNTY – 1/2%,

CITY – 1%

UP TO 1/2%

UP TO 1 1/2%

UP TO 1/4%

1/8%

UP TO 1/2%

1/10%

UP TO 1 1/2%

Increments of 1/8%

up to 1%

1/10%

1/8 , 1/4, 3/8, 1/2%

1/8 , 1/4, 3/8, 1/2%

UP TO 1%

UP TO 1/2%

1/8 , 1/4, 3/8, 1/2, 5.8,

3/4, 7.8/, 1%

UP TO 1%

UP TO 1/4%

LOCAL TAX STATUTES

Statutes Not Yet Adopted by at Least One City/County/District

A-2