IRIS Plus

Investing in European works:

the obligations on VOD providers

IRIS Plus

IRIS Plus 2022-2

Investing in European works: the obligations on VOD providers

European Audiovisual Observatory, Strasbourg, 2022

ISSN 2079-1062

Director of publication – Susanne Nikoltchev, Executive Director

Editorial supervision – Maja Cappello, Head of Department for Legal Information

Editorial team – Francisco Javier Cabrera Blázquez, Julio Talavera Milla, Sophie Valais

Research assistants - Amélie Lacourt, Justine Radel

European Audiovisual Observatory

Authors (in alphabetical order)

Francisco Javier Cabrera Blázquez, Maja Cappello, Julio Talavera Milla, Sophie Valais

Proofreading

Anthony Mills

Editorial assistant – Sabine Bouajaja

Press and Public Relations – Alison Hindhaugh, [email protected]

European Audiovisual Observatory

Publisher

European Audiovisual Observatory

76, allée de la Robertsau, 67000 Strasbourg, France

Tel.: +33 (0)3 90 21 60 00

Fax: +33 (0)3 90 21 60 19

www.obs.coe.int

Cover layout – ALTRAN, France

Please quote this publication as

Cabrera Blázquez F.J., Cappello M., Talavera Milla J., Valais S., Investing in European works: the obligations on

VOD providers, IRIS Plus, European Audiovisual Observatory, Strasbourg, September 2022

© European Audiovisual Observatory (Council of Europe), Strasbourg, 2022

Opinions expressed in this publication are personal and do not necessarily represent the views of the

Observatory, its members or the Council of Europe.

Investing in European

works:

the obligations on VOD

providers

Francisco Javier Cabrera Blázquez, Maja Cappello, Julio Talavera Milla,

Sophie Valais

Foreword

Online services are cross-border per nature, at least from a technical standpoint. As such,

VOD services can reach virtually any country on the planet, with no natural barriers or

frequency shortage to prevent this. That is, if the law of the land allows it.

The regulation of VOD in Europe, although based on an EU Directive (the

Audiovisual Media Services Directive - AVMSD), is done at national level. An example of

this is the possibility for member states to introduce financial obligations to promote the

production of European works. Article 13(2) AVMSD leaves plenty of leeway for member

states to introduce (or not!) such obligations on VOD services, and accordingly, there are

important regulatory differences from country to country. In theory, this could mean that

big SVOD services established in one EU country would have to abide by the financial

obligations of that country alone. But the AVMSD clarifies that, “given the direct link

between financial obligations and Member States' different cultural policies, a Member

State is also allowed to impose such financial obligations on media service providers

established in another Member State that target its territory”.

This new report by the European Audiovisual Observatory describes the rules

concerning financial obligations for VOD services in the EU. We ask the following

questions:

◼ What is the current legal framework for promoting the production of European

works in the EU?

◼ What are the resulting obligations on VOD services operating at national and

cross-border level?

◼ What form do these financial obligations take (investment in production,

acquisition of rights, levies etc.)?

Our report includes a country-by-country analysis of the 14 countries that have decided so

far to introduce this kind of obligation and a chapter on the work of ERGA (the European

Regulators Group for Audiovisual Media Services), and dives into recent case law. As a

bonus, we are also publishing a detailed overview table with information about the

national transposition in the EU27, EFTA countries and the UK of the obligations to

promote European works included in Articles 13, 16 and 17 of the AVMSD.

This extensive kind of analysis would not have been possible without the precious

collaboration of the national members of the European Film Agency Directors association

(EFAD) and of the European Platform of Regulatory Authorities (EPRA): my warmest thanks

go to each and every one of them for their very valuable feedback.

Strasbourg, September 2022

Maja Cappello

IRIS Coordinator

Head of the Department for Legal Information

European Audiovisual Observatory

Table of contents

1. Setting the scene ..................................................................................................... 1

1.1. Audiovisual production in Europe: Film, TV series and TV films ................................................................................... 1

1.1.1. Production volume, episodes and length ........................................................................................................ 1

1.1.2. Origin of audiovisual fiction works .................................................................................................................... 4

1.1.3. Co-production ............................................................................................................................................................ 5

1.1.4. Producers and commissioners of European fiction ...................................................................................... 6

1.2. Audiovisual media services in Europe ..................................................................................................................................... 7

1.2.1. Localised audiovisual media services in Europe ........................................................................................... 9

1.2.2. Revenues and subscribers of VOD services in Europe ............................................................................. 11

2. European legal framework .................................................................................... 13

2.1. The AVMSD rules .......................................................................................................................................................................... 13

2.2. Financial obligations and the country-of-origin principle............................................................................................ 16

2.3. Definitional issues ....................................................................................................................................................................... 19

2.3.1. Low audience and low turnover ....................................................................................................................... 19

2.3.2. Targeting services ................................................................................................................................................. 23

3. National................................................................................................................... 24

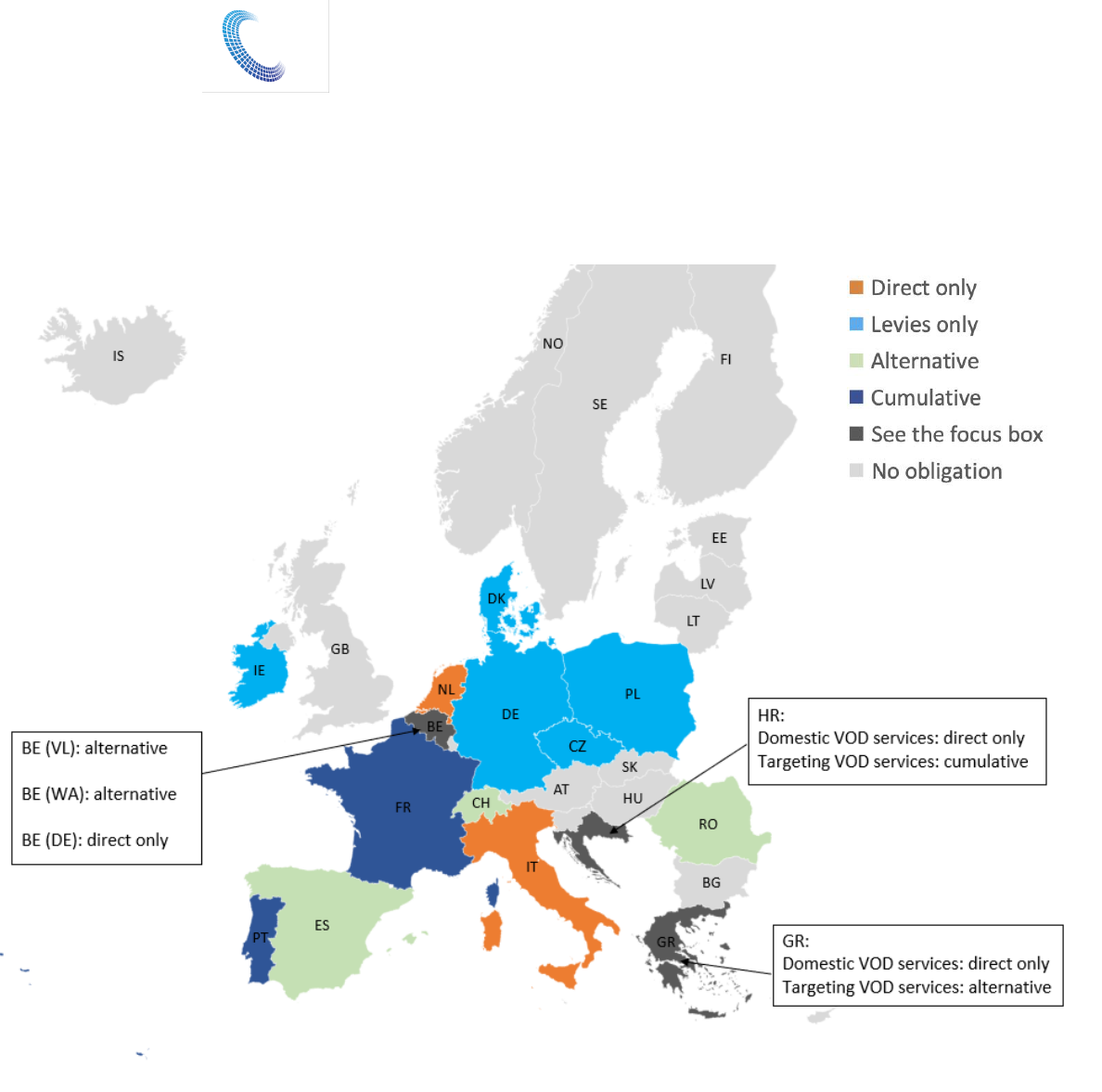

3.1. Types of financial obligations ................................................................................................................................................. 24

3.2. National transposition................................................................................................................................................................ 24

3.2.1. BE - Belgium ............................................................................................................................................................ 30

3.2.2. CH - Switzerland .................................................................................................................................................... 35

3.2.3. CZ - Czech Republic .............................................................................................................................................. 36

3.2.4. DE - Germany .......................................................................................................................................................... 37

3.2.5. DK - Denmark .......................................................................................................................................................... 38

3.2.6. ES - Spain .................................................................................................................................................................. 39

3.2.7. FR - France ............................................................................................................................................................... 41

3.2.8. GR - Greece .............................................................................................................................................................. 43

3.2.9. HR - Croatia.............................................................................................................................................................. 44

3.2.10. IE - Ireland ................................................................................................................................................................ 45

3.2.11. IT - Italy ..................................................................................................................................................................... 46

3.2.12. NL – Netherlands .................................................................................................................................................. 47

3.2.13. PL - Poland ............................................................................................................................................................... 48

3.2.14. PT - Portugal............................................................................................................................................................ 48

3.2.15. RO - Romania .......................................................................................................................................................... 51

4. Cooperation mechanisms ...................................................................................... 53

4.1. Main challenges for national regulatory authorities ...................................................................................................... 53

4.2. The role of ERGA .......................................................................................................................................................................... 55

4.2.1. Cooperation between national regulatory authorities ............................................................................. 55

4.2.2. The formal recognition and reinforcement of the role of ERGA .......................................................... 56

4.2.3. Memorandum of Understanding between NRAs that are members of ERGA .................................. 57

4.2.4. Next steps ................................................................................................................................................................. 61

4.3. Case study: France ....................................................................................................................................................................... 62

4.3.1. Agreements between the CSA and the main foreign-based on-demand AVMS providers ......... 62

4.3.2. Agreement between film organisations and Netflix................................................................................. 63

5. Case law: From an absolute to a relative country-of-origin principle .............. 64

5.1. The European Commission’s decision on Germany’s aid scheme for films ............................................................ 64

5.2. The Netflix v. European Commission case ......................................................................................................................... 66

5.3. Freedom to provide service, and quotas for “national works” .................................................................................... 67

5.4. Freedom to provide services, and access to national film funds funded by levies ............................................. 68

6. State of play ........................................................................................................... 70

7. Annex ...................................................................................................................... 74

Figures

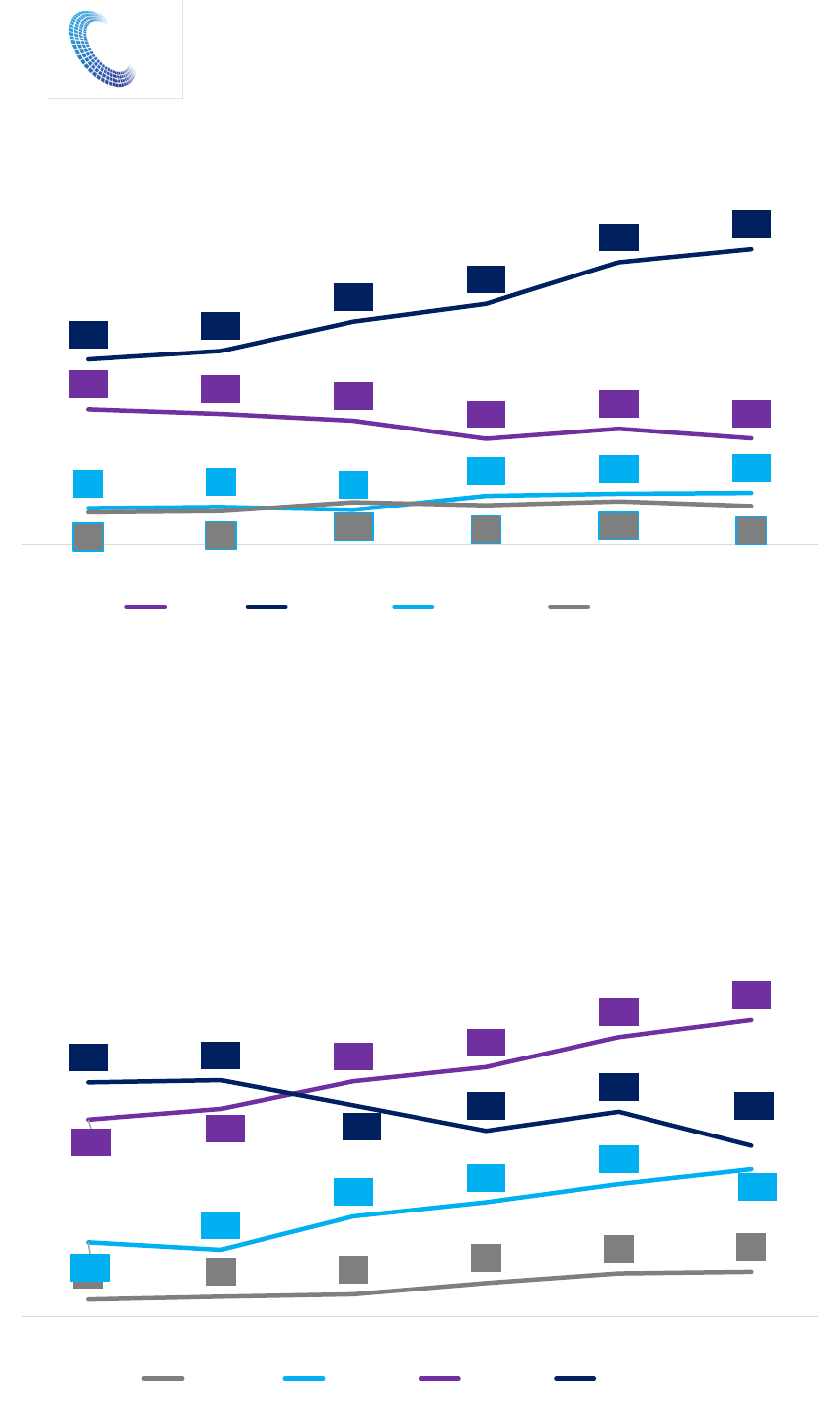

Figure 1. Volume of AV fiction produced in Europe (2015-2020) ....................................................................................................... 2

Figure 2. Number of AV fiction titles produced by format (2015-2020) .......................................................................................... 3

Figure 3. Number of fiction titles by duration of episodes (2015-2020) ......................................................................................... 3

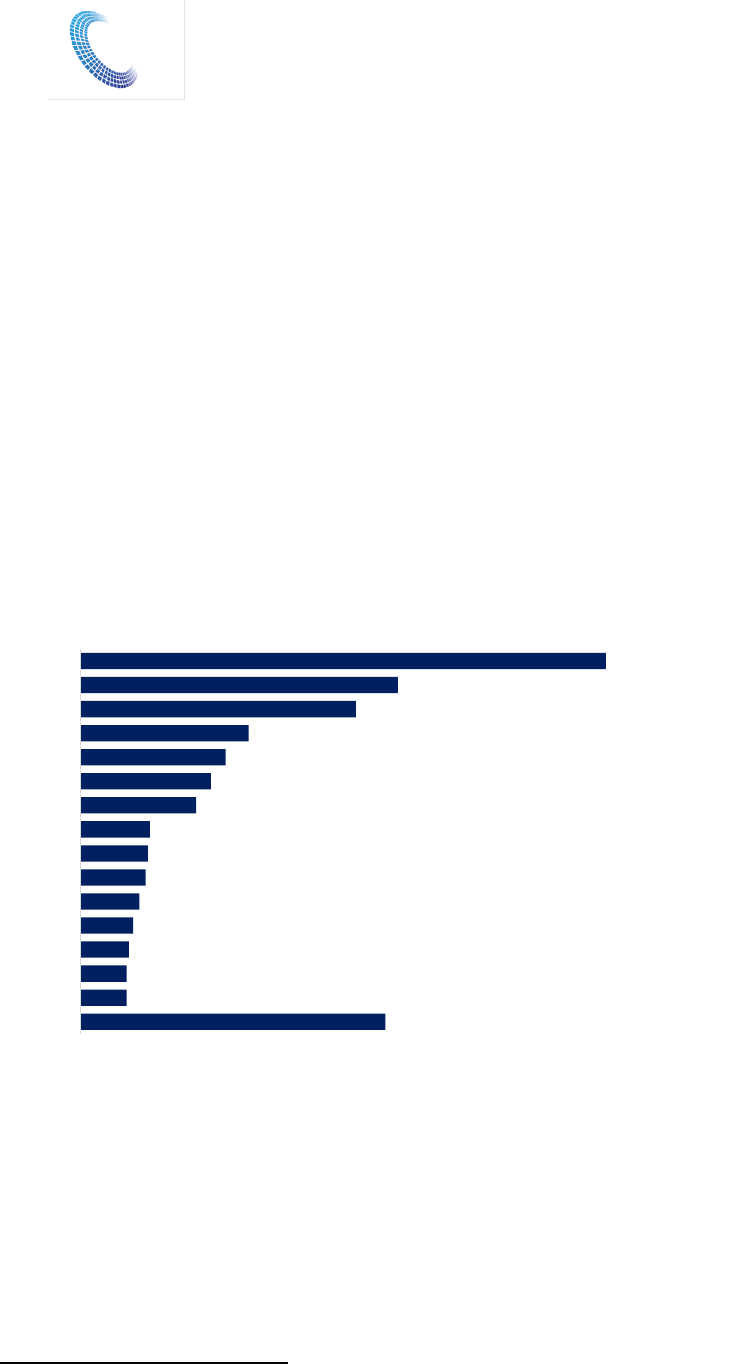

Figure 4. Top fiction-producing countries in number of seasons (2020) ......................................................................................... 4

Figure 5. Top fiction-producing countries in number of hours (2020) ............................................................................................. 5

Figure 6. Number and share of co-productions by format (total 2015-2020) ............................................................................... 6

Figure 7. Breakdown of TV channels available in Europe by type of access and transmissions in 2020 – in % ............ 7

Figure 8. Breakdown of pay on-demand services available in Europe by business model in 2020 – in number

of services and % ................................................................................................................................................................................. 8

Figure 9. Countries with 8 to 388 TV services aimed at non-domestic markets in 2020 – in number of

services .................................................................................................................................................................................................... 9

Figure 10. Countries with pay on-demand services aimed at non-domestic markets in 2020 – in number of

services ................................................................................................................................................................................................. 10

Figure 11. TV channels aimed at non-domestic markets before and after Brexit, 2018 and 2020 – in number

of services ........................................................................................................................................................................................... 10

Figure 12. EU28 Audiovisual market revenues by segment 2019 – in EUR billion and as a % ............................................. 11

Figure 13. EU28 Subscriptions to OTT SVOD 2010-2020 – in subscription million and % of subscriptions, y-o-

y growth ............................................................................................................................................................................................... 12

Figure 14. States with financial obligations ............................................................................................................................................... 71

Figure 15. Type of financial obligations ....................................................................................................................................................... 72

Tables

Table 1. Direct investment obligations – rates and bases................................................................................................................ 25

Table 2. Indirect investment (levies) – rates and bases .................................................................................................................... 28

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 1

1. Setting the scene

1

1.1. Audiovisual production in Europe: Film, TV series and TV

films

1.1.1. Production volume, episodes and length

Over the period 2015-2020, a yearly average of 1 032 titles

2

(including TV films and TV

series commissioned by television channels or on-demand audiovisual services) were

produced in the European Union, accounting for an average of 20 846 episodes and 13

409 hours.

3

With the exception of the year 2020, figures for the three indicators grew over

time.

1

This chapter is mainly based on the most recent reports on market trends in audiovisual production,

audiovisual media services in Europe and, particularly, on the VOD sector, by the Department for Market

Information of the European Audiovisual Observatory. Special thanks to two of their authors, Christian Grece

and Agnes Schneeberger, for peer-reading it before publication.

2

The term “title” refers to either a TV film or a TV season. Each different season of a series is counted as one

title. See European Commission’s Guidelines on the revised Audiovisual Media Services Directive,

https://ec.europa.eu/commission/presscorner/api/files/document/print/en/qanda_20_1208/QANDA_20_1208_E

N.pdf.

3

Fontaine, G., 2022, “Audiovisual fiction production in Europe. 2020 figures”, European Audiovisual

Observatory, https://rm.coe.int/audiovisual-fiction-production-in-europe-2020-figures/1680a5d715.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 2

Figure 1. Volume of AV fiction produced in Europe (2015-2020)

Source: European Audiovisual Observatory analysis of The European Metadata Group data.

This increase does not appear to have been at the expense of the production of theatrical

films. Just before the COVID pandemic, the production of feature theatrical films in the

European Union surpassed the landmark figure of 2 000 films in 2019 (2 007 films

produced, split into 1 225 fiction films and 782 documentaries), up from 1 827 films in

2016. Even in 2020, in spite of the impact of COVID, 1 400 feature films were produced in

the European Union. Over that same period, the number of admissions remained stable

within the EU, at around 1 000 million admissions (growing from 992 million in 2016 to

1 007 million in 2019).

4

The most remarkable trend, when it comes to TV and on-demand production, is a

clear shift towards short TV series (those with between 2 and 13 episodes, which can be

used as a proxy for high-end, premium TV series) at the expense of TV films, the

production of which decreased by 21.6% (down to 250 in 2020) while short TV series grew

by 59.6% over the same period from 2015 to 2020. In turn, TV series with more episodes

(between 14 and 52 episodes, as well as those with more than 52 episodes – mostly soap

operas) saw very mild growth over this period. The most common works produced were

TV series with between 2 and 13 episodes per season, accounting for 54% of the titles

and 24% of the hours produced over the five-year period analysed.

5

4

Kanzler, M., Simone, P., 2020, “Film Market Trends”, European Audiovisual Observatory,

https://rm.coe.int/focus2020/1680a32252.

5

Fontaine, G., 2022, “Audiovisual fiction production in Europe. 2020 figures.”, European Audiovisual

Observatory, https://rm.coe.int/audiovisual-fiction-production-in-europe-2020-figures/1680a5d715.

917

932

999

1024

1160

1159

1 032

18634

19083

21177

22224

22300

21655

20 846

12281

12609

13271

14187

14363

13745

13 409

2015 2016 2017 2018 2019 2020 Average 2015-

2020

Titles Episodes Hours

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 3

Figure 2. Number of AV fiction titles produced by format (2015-2020)

Source: European Audiovisual Observatory analysis of The European Metadata Group data.

In turn, this shift has had an impact on the length of TV works, with very long works –

mainly TV films (those with a duration longer than 65 minutes) – going down, while all

other categories saw an increase over the period 2015-2020. Although the category which

experienced the highest increase was that of 2-to-13-episode titles, those with a length

of between 36 and 65 minutes ranked at the top by number of titles produced in 2020.

Figure 3. Number of fiction titles by duration of episodes (2015-2020)

Source: European Audiovisual Observatory analysis of The European Metadata Group data.

319

308

292

249

273

250

436

456

525

567

665

696

86

89

82

115

120

122

76

79

100

93

102

91

2015 2016 2017 2018 2019 2020

TV film 2 to 13 ep. 14 to 52 ep. More than 52 ep.

30

35

39

59

76

79

130

117

176

201

233

259

346

365

413

438

491

521

411

415

371

326

360

300

2015 2016 2017 2018 2019 2020

15' or less 16' to 35' 36' to 65' More than 65'

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 4

Furthermore, first seasons (45% of the TV series) and subsequent seasons (55% of the TV

series) were approximately evenly split over the covered period, with the share of first

seasons even higher (54%) for solely 2-to-13-episode series.

6

1.1.2. Origin of audiovisual fiction works

Germany (250 titles produced in 2020) is the leading producer of TV series in Europe,

followed at a distance by the UK, France and Spain, with most titles produced by public

service media (PSM). When it comes to hours produced, Greece (1 770 hours produced in

2020) is at the top of the list, followed by Spain, Germany, Poland and Portugal. The high

production figures in Spain, Greece, Portugal, Poland, Hungary and the Czech Republic,

are mostly due to prolific production of soap operas.

7

Figure 4. Top fiction-producing countries in number of seasons (2020)

Source: European Audiovisual Observatory analysis of The European Metadata Group data.

6

Idem.

7

Idem.

145

22

22

23

25

28

31

32

33

55

62

69

80

131

151

250

Others

GR

PT

AT

CZ

DK

NO

FI

NL

IT

SE

PL

ES

FR

GB

DE

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 5

Figure 5. Top fiction-producing countries in number of hours (2020)

Source: European Audiovisual Observatory analysis of The European Metadata Group data.

Nevertheless, when it comes to the production of 2-to-13-episode series – the most

frequent number of episodes –it is the UK at the top of the ranking, both in terms of titles

and hours, with 124 titles and 550 hours produced in 2020. In fact, the UK, as most other

European countries, concentrates most of its production of series on this category of

series (88% of its overall audiovisual fiction production for TV and on-demand services).

Italy, France and the United Kingdom have a specific interest in 2-to-13-episode series,

while Germany and France place a higher-than-average emphasis on TV films.

8

1.1.3. Co-production

Co-production represents only a meagre 10% of all the production of fiction series in the

EU over the period 2015-2020; even less (5%) if we exclude co-productions between

countries with a shared language. In either case, co-productions mainly took place for 2-

to-13-episode series and TV films. France, Belgium and Germany account for the majority

of co-productions in Europe, followed at a distance by the UK and Austria. However, when

excluding cooperation between countries sharing the same language, the leaders are the

United Kingdom, Germany, the United States (as minority co-producer), France and

Sweden.

8

Idem.

1464

209

239

260

326

412

423

519

584

983

1144

1197

1311

1433

1471

1770

Others

LT

SE

FI

BE

NL

HU

CZ

IT

GB

FR

PT

PL

DE

ES

GR

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 6

Figure 6. Number and share of co-productions by format (total 2015-2020)

Source: European Audiovisual Observatory analysis of The European Metadata Group data.

The main minority co-producing countries outside the EU were the United States

and Canada.

9

The co-production levels in fiction series are significantly lower than those

for the co-production of theatrical films, accounting for 22% of overall production in the

European Union over the period 2007-2016.

10

1.1.4. Producers and commissioners of European fiction

Most of the commissioning of European fiction series by audiovisual media services is by

public services, accounting for most of the titles (57% of the total), but private services, in

turn, represent 64% of the hours produced.

The top 20 producers accounted for 38% of overall production of European fiction

and 57% of all hours produced in 2020. When it comes to 2-to-13-episode series, the BBC

9

Idem.

10

Talavera, J., 2017, “Film production in Europe – Production volume, co-production and worldwide

circulation”, European Audiovisual Observatory (Council of Europe),

https://rm.coe.int/filmproductionineurope-2017-j-talavera-pdf/1680788952.

189

417

22

3

631

39

232

13

0

284

11%

12%

4%

1%

10%

2%

7%

2%

0%

5%

0%

2%

4%

6%

8%

10%

12%

14%

0

100

200

300

400

500

600

700

TV Film 2 to 13 ep. 14 to 52 ep. More than 52 ep. All

Co-productions (all) Co-productions (non-linguistic)

% Co-productions (All) % -Co-productions (Non-linguistic)

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 7

led by number of titles (61 titles produced in 2020) followed at a distance by Netflix (49),

ARD (34), ZDF (32) and France Télévisions (30).

11

When it comes to independent productions, these account for the lion’s share of

audiovisual fiction production in general (66% of the titles and 58% of the hours in 2020),

as well as of the production of 2-to-13-episode fiction series (67% of the titles and 65% of

the hours in 2020).

12

1.2. Audiovisual media services in Europe

At the end of 2020, there were 13 638 audiovisual media services available in Europe (11

823 of them established in Europe), 10 839 TV channels (with circa half of the services

offered against payment), and 2 799 on-demand services (42% of them pay on-demand

services, out of which two thirds were subscription services).

13

By 2020, the supply of pay

on-demand services was more concentrated than that of TV channels – 10 countries were

home to 80% of all pay on-demand services and 65% of TV services. The UK was the

market with the greatest supply of national and international TV channels, closely

followed by the Russian Federation and the Netherlands – all three had more than 500

services each. With over 100 services originating from their territories, the main countries

supplying pay on-demand services were Ireland, France, the UK and Spain.

14

Figure 7. Breakdown of TV channels available in Europe

15

by type of access and transmissions

in 2020 – in %

Source: European Audiovisual Observatory’s MAVISE database.

11

Fontaine, G., 2022, “Audiovisual fiction production in Europe. 2020 figures.“, European Audiovisual

Observatory, https://rm.coe.int/audiovisual-fiction-production-in-europe-2020-figures/1680a5d715.

12

Idem.

13

Schneeberger, A., 2021, “Audiovisual media services in Europe”, European Audiovisual Observatory,

https://rm.coe.int/audiovisual-media-services-in-europe-2020/1680a2fc29.

14

Fontaine, G. (Ed.), 2022. Yearbook 2021/2022 Key Trends, European Audiovisual Observatory.

https://rm.coe.int/yearbook-key-trends-2021-2022-en/1680a5d46b.

15

Europe includes the 41 countries covered by MAVISE (https://mavise.obs.coe.int/) and Morocco.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 8

Figure 8. Breakdown of pay on-demand services available in Europe

16

by business model in

2020 – in number of services and %

Source: European Audiovisual Observatory’s MAVISE database

If we exclude local channels, most TV channels (90%) are private; the figure is even

higher if we look at VOD, with 97% of the services privately owned. In addition, most TV

channel suppliers (excluding local channels) in Europe are based in the UK (586 channels

in 2020), Russia (524), the Netherlands (515), Turkey (385), Spain (380) and Germany

(362). As for pay video-on-demand services, 80% of the services were concentrated in only

11 countries, with most services established in Ireland (188 services in 2020), France

(141), UK (140), Spain (104) and Germany (96).

17

Between 2016 and 2020, the revenues of the traditional players more or less

stagnated, while the growth of the top 100 players was largely driven by the new SVOD

players. Pure SVOD players – namely Netflix, Amazon and DAZN – accounted

cumulatively for more than 75% of the revenue growth registered during this period, at

the top 100 level. Furthermore, the top 20 European audiovisual groups by revenue in

2020 accounted for 69% of the market. American Sky topped the list (13.5%), followed by

the German public service media ARD (5.3%) and Netflix (Europe) (5%). SVOD and pay TV

stand out as the most concentrated audiovisual market segments in Europe. A total of

94% of SVOD subscriptions are cumulatively accounted for by top 20 OTT platforms,

while 72% of pay TV subscriptions are attributable to top 20 pay TV operators.

18

16

“Europe” includes the 41 countries covered by MAVISE (https://mavise.obs.coe.int/) and Morocco.

17

Schneeberger, A., 2021, “Audiovisual media services in Europe”, European Audiovisual Observatory,

https://rm.coe.int/audiovisual-media-services-in-europe-2020/1680a2fc29.

18

Idem.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 9

1.2.1. Localised audiovisual media services in Europe

There is a trend within the European Union whereby an increasing number of audiovisual

media services are adapted to the different national markets, either as broadcasters in

different linguistic versions or on-demand services with local-language user interfaces.

These services aimed at non-domestic markets (or localised services) tend to be

predominantly owned by large US media corporations. In addition, the business model is

built on the maximisation of scale in terms of catalogues and geographical coverage.

19

By

the end of 2020, 24% of all TV channels broadcasting from Europe were aimed at non-

domestic markets; the share is even higher when it comes to pay on-demand services

(53%).

20

A total of 91% of TV channels aimed at non-domestic markets were based in just

10 countries, with the Netherlands (388 channels in 2020), the UK (235) and Spain (212)

topping the list. The concentration level is even higher when it comes to VOD, with

services aimed at non-national markets accounting for 96% of the total. In this case, the

ranking is topped by Ireland (180 services in 2020), the UK (106) and Spain (81).

21

Figure 9. Countries with 7 to 388 TV services aimed at non-domestic markets in 2020 – in

number of services

Source: European Audiovisual Observatory’s MAVISE database.

19

Schneeberger, A., 2021, “Audiovisual media services in Europe”, European Audiovisual Observatory,

https://rm.coe.int/audiovisual-media-services-in-europe-2020/1680a2fc29.

20

Idem.

21

Idem.

1 359

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 10

Figure 10. Countries with pay on-demand services aimed at non-domestic markets in 2020 – in

number of services

Source: European Audiovisual Observatory’s MAVISE database.

Moreover, around 60% of the localised audiovisual media services were established in just

three countries: the Netherlands, UK and Spain. After Brexit, a flight of localised TV

channels from the UK has taken place, with most of them relocating to the Netherlands

and Spain. In turn, 61% of localised pay on-demand services were based in Ireland, the UK

and Spain over the same period.

22

Figure 11. TV channels aimed at non-domestic markets before and after Brexit, 2018 and 2020

– in number of services

Source: European Audiovisual Observatory’s MAVISE database.

22

Idem.

600

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 11

1.2.2. Revenues and subscribers of VOD services in Europe

The VOD market has experienced a gigantic leap over the last decade with EU28 revenues

going from EUR 388.9 million in 2010 to EUR 11.6 billion in 2020, mainly thanks to the

hike of SVOD, which in 2020 accounted for 84% of the VOD market revenues. In spite of

this, VOD still represents a meagre slice of the audiovisual pie in Europe, which amounts

to EUR 114,5 billion – with SVOD accounting for 6% of the market revenues, and an

additional 1% from TVOD revenues in 2019.

23

Figure 12. EU28 Audiovisual market revenues by segment 2019 – in EUR billion and as a %

Source: European Audiovisual Observatory, Ampere Analysis, Warc, EBU/MIS, company/public reports

It is true that confinement due to the COVID pandemic has increased the number of

subscriptions to SVOD services. However, the trend was already quite remarkable. In

2020, the figure of 140.7 million subscriptions in the EU28 (36% year-on-year growth, up

from 103.2 million subscriptions in 2019) was reached. The launch of Netflix and other

services during 2011 and 2012 in many European countries accelerated subscription

figures, which went from 3 million subscriptions in 2012 to 7 million subscriptions in

2013; the launch of direct-to-consumer streaming services by some pay TV, commercial

TV, and telecom companies, as well as tech players, has boosted these figures. The

current y-o-y growth figures appear to confirm that, as SVOD becomes mainstream, the

market will continue to grow in the years to come.

23

Grece, C. 2021. VOD Trends in Europe. European Audiovisual Observatory. https://rm.coe.int/grece-trends-

on-the-eu-vod-market-9-12-2021-kipa-summit-warsaw/1680a4d1c7.

Cinema gross box-office 7,2

6%

TVOD revenues 1,6 1%

SVOD revenues 7,1 6%

Pay-TV revenues 34,5 30%

Advertising TV 31,2 27%

Advertising Radio 5,3 5%

Physical Video 1,8 2%

Public funding 25,8 23%

EUR 114,5 billion

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 12

Figure 13. EU28 Subscriptions to OTT SVOD 2010-2020 – in subscription million and % of

subscriptions, y-o-y growth

Source: Ampere Analysis

0,3

0,7

3,0

7,0

16,5

28,7

42,0

54,4

73,6

103,2

140,7

151%

334%

135%

136%

74%

46%

30%

35%

40%

36%

0%

50%

100%

150%

200%

250%

300%

350%

400%

0

20

40

60

80

100

120

140

160

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

OTT SVOD subscriptions OTT SVOD Subscriptions year-on-year growth rate

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 13

2. European legal framework

2.1. The AVMSD rules

The EU's Audiovisual Media Services Directive (AVMSD)

24

governs EU-wide coordination of

national legislation with regard to all audiovisual media. These include all kinds of

services, from TV broadcasts to on-demand services and, since revision of the Directive in

2018, also video-sharing platforms. The AVMSD regulates a wide array of issues, such as

incitement to hatred, accessibility for people with disabilities, jurisdiction, major events,

advertising, protection of minors, and the promotion and distribution of European works.

The directive is of EEA relevance, which implies its transposition also in Norway, Iceland

and Liechtenstein. These countries are therefore covered in this report. Moreover, since

Switzerland has chosen to introduce rules inspired by the AVMSD in the field of financial

obligations, the report covers this country as well. On the other hand, the UK has chosen

to transpose the AVMSD, but without introducing financial obligations, and is therefore

included in the maps for the sake of completeness.

The EU promotes European works on TV and VOD through the quota and financing

provisions of the AVMSD, notably through its articles 13, 16 and 17. For TV broadcasting,

they envisage the following:

◼ At least 50% of the broadcasting time must be dedicated to European works

(Article 16 AVMSD).

◼ A minimum of 10% of broadcasting time, or, alternatively, at least 10% of the

broadcaster’s programming budget has to be dedicated to works of independent

European producers (Article 17 AVMSD).

These rules are in force since they were originally introduced by the predecessor to the

AVMSD, the Television without Frontiers Directive (TwFD) of 1989.

25

At the time, no

obligations were introduced for on-demand AVMS for the simple reason that these

services did not exist at the time. Such rules were introduced in the revision of the TwFD

24

Consolidated text (as modified by Directive (EU) 2018/1808): Directive 2010/13/EU of the European

Parliament and of the Council of 10 March 2010 on the coordination of certain provisions laid down by law,

regulation or administrative action in Member States concerning the provision of audiovisual media services

(Audiovisual Media Services Directive) (codified version) (Text with EEA relevance),

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A02010L0013-20181218.

25

Council Directive 89/552/EEC of 3 October 1989 on the coordination of certain provisions laid down by

Law, Regulation or Administrative Action in Member States concerning the pursuit of television broadcasting

activities, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A31989L0552.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 14

in 2007

26

(later codified into the 2010 version of the AVMSD),

27

but were of a rather

general nature: EU member states had to ensure that on-demand AVMS promoted, “where

practicable and by appropriate means”, the production of and access to European works.

Such promotion “could relate, inter alia, to the financial contribution made by such

services to the production and rights acquisition of European works or to the share and/or

prominence of European works in the catalogue of programmes offered by the on-demand

audiovisual media service”.

At the time, it was considered that the early stage of development of on-demand

AVMS required a light legislative touch, hence the relatively flexible rules introduced in

2007. Ten years later, the growing importance of VOD services led the EU to introduce a

more stringent set of rules:

28

◼ Article 13(1) AVMSD sets a 30% share of European works and a prominence

obligation with regard to those works (Article 13(1) AVMSD).

◼ Article 13(2) provides that member states may also require AVMS providers (both

broadcasters and on-demand AVMS) under their jurisdiction to contribute

financially to the production of European works, including via direct investment in

content and contribution to national funds. If member states decide to introduce

financing obligations, they may also require AVMS providers targeting audiences

in their territories, but established in other member states, to make such financial

contributions, which shall be proportionate and non-discriminatory. When

targeting audiences are included in the scope, the financial contribution shall be

based only on the revenues earned in the targeted member states. If the member

state where the provider is established imposes such a financial contribution, it

shall take into account and deduct any financial contributions imposed by

targeted member states.

The purpose of the AVMSD in this regard is to “promote the production and distribution of

European works and thus contribute actively to the promotion of cultural diversity.”

(Recital 69 AVMSD 2010). The final objective is cultural diversity, and this is achieved

through promotion AND distribution.

The quota obligations of Article 13(1) AVMSD (a 30% share of European works,

and sufficient prominence) concern distribution, or access to content. Concerning the

promotion of production, it can be argued that promoting the distribution of European

works indirectly helps their production. Increased demand (from broadcasters) will

26

The rules were originally introduced by Directive 2007/65/EC, which amended the TwFD, see https://eur-

lex.europa.eu/legal-

content/EN/TXT/?uri=uriserv%3AOJ.L_.2007.332.01.0027.01.ENG&toc=OJ%3AL%3A2007%3A332%3ATOC.

27

Directive 2010/13/EU of the European Parliament and of the Council of 10 March 2010 on the coordination

of certain provisions laid down by law, regulation or administrative action in Member States concerning the

provision of audiovisual media services (Audiovisual Media Services Directive) (Text with EEA relevance),

https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32010L0013.

28

The obligations contained in Article 13(1) and (2) AVMSD do not apply to media service providers with a low

turnover or a low audience. Member States may also waive such obligations or requirements where they

would be impracticable or unjustified by reason of the nature or theme of the audiovisual media services in

question (Article 13(6) AVMSD). See section 2.3.1. of this publication.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 15

promote supply (from producers). And yet, the EU legislator seems to think that promoting

demand via quota obligations is not enough, since it does not impose but nevertheless

allows the promotion of the supply side via the introduction of financial obligations.

Recital 36 AVMSD 2018 states: “In order to ensure adequate levels of investment in

European works, Member States should be able to impose financial obligations on media

service providers established on their territory.” Actually, the Directive goes as far as

listing the ways in which this promotion may be achieved: According to the same Recital,

“Those obligations can take the form of direct contributions to the production of and

acquisition of rights in European works. The Member States can also impose levies

payable to a fund, on the basis of the revenues generated by audiovisual media services

that are provided in and targeted towards their territory.” Moreover, the Directive clarifies

that, “given the direct link between financial obligations and Member States' different

cultural policies, a Member State is also allowed to impose such financial obligations on

media service providers established in another Member State that target its territory”. It

adds: “In that case, financial obligations should only be charged on the revenues

generated through the audience in the targeted Member State.” This is a clear departure

from the country-of-origin (COO) principle, which is the basis upon which the whole

architecture of the AVMSD is built.

29

Why has the EU allowed the introduction of financial obligations for broadcasters

and on-demand AVMS? Is promoting demand not enough? Actually, European states

already promote the production of cinema films and other audiovisual works through

state aid, that is, direct funding or tax incentives. According to the European Commission’s

cinema communication of 2013,

30

“state aid is important to sustain European audiovisual

production”. The communication adds: “It is difficult for film producers to obtain a

sufficient level of upfront commercial backing to put together a financial package so that

production projects can proceed. The high risk associated with their businesses and

projects, together with the perceived lack of profitability of the sector, make it dependent

on state aid.”

Having said this, it is necessary to highlight here that financial obligations are not

state aid. And this is important, since this means that imposing financing obligations on

broadcasters and on-demand AVMS becomes an additional way of facilitating the

financing of European works without the corset of the EU state aid rules that are included

in the treaties. Said otherwise, financial obligations are added to state aid to increase the

funding possibilities of film and audiovisual producers.

29

See section 2.2. of this publication.

30

Communication from the Commission on State aid for films and other audiovisual works; Text with EEA

relevance, OJ C 332, 15.11.2013, p. 1–11,

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52013XC1115%2801%29.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 16

2.2. Financial obligations and the country-of-origin principle

The country-of-origin principle has been a cornerstone of the AVMSD since the inception

in 1989 of the TwFD.

31

In its Recitals 33 and 34, the 2010 version of the AVMSD

32

explained the rationale for the introduction of this principle (emphasis added):

(33) The country of origin principle should be regarded as the core of this Directive, as it is

essential for the creation of an internal market. This principle should be applied to all

audiovisual media services in order to ensure legal certainty for media service providers as

the necessary basis for new business models and the deployment of such services. It is also

essential in order to ensure the free flow of information and audiovisual programmes in

the internal market.

(34) In order to promote a strong, competitive and integrated European audiovisual

industry and enhance media pluralism throughout the Union, only one Member State

should have jurisdiction over an audiovisual media service provider and pluralism of

information should be a fundamental principle of the Union.

The AVMSD was revised in 2018

33

and, while it maintained the country-of-origin principle

intact, it introduced a derogation thereto regarding the promotion of EU works on on-

demand services.

Article 13(1) AVMSD requires that providers of on-demand audiovisual media

services should promote the production and distribution of European works by ensuring

that their catalogues contain a 30% share of European works and that they are given

sufficient prominence.

34

With regard to the principle of the country of origin, the European

Commission has clarified

35

that “it is for the country of origin to ensure that on-demand

providers under its jurisdiction comply with the obligation to ensure the share of

European works in their catalogues”. And further: “If a VOD provider falling under the

jurisdiction of a Member State offers different national catalogues in other Member

31

For more information on the Television without Frontiers Directive see: https://eur-lex.europa.eu/legal-

content/EN/TXT/?uri=LEGISSUM%3Al24101.

32

Directive 2010/13/EU of the European Parliament and of the Council of 10 March 2010 on the coordination

of certain provisions laid down by law, regulation or administrative action in Member States concerning the

provision of audiovisual media services (Audiovisual Media Services Directive) (Text with EEA relevance),

https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32010L0013.

33

Directive (EU) 2018/1808 of the European Parliament and of the Council of 14 November 2018 amending

Directive 2010/13/EU on the coordination of certain provisions laid down by law, regulation or administrative

action in Member States concerning the provision of audiovisual media services (Audiovisual Media Services

Directive) in view of changing market realities, https://eur-lex.europa.eu/eli/dir/2018/1808/oj.

34

This obligation does not apply, however, to media service providers with a low turnover or a low audience.

Member States may also waive such obligations or requirements where they would be impracticable or

unjustified by reason of the nature or theme of the audiovisual media services in question (Article 13(6)

AVMSD).

35

Communication from the Commission Guidelines pursuant to Article 13(7) of the Audiovisual Media Services

Directive on the calculation of the share of European works in on-demand catalogues and on the definition of

low audience and low turnover 2020/C 223/03 C/2020/4291,

https://eur-lex.europa.eu/legal-

content/EN/TXT/?uri=uriserv:OJ.C_.2020.223.01.0010.01.ENG&toc=OJ:C:2020:223:TOC.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 17

States, it is the responsibility of the Member State of jurisdiction (i.e. the country of origin)

to enforce the obligation related to the share of European works with regard to all the

various national catalogues.”

As mentioned above, the AVMSD allows a member state to impose financial

obligations not only on media service providers (linear and non-linear) established on

their territory but also (and here comes the exception to the country-of-origin principle)

on media service providers established in another member state that target its territory.

Such financial obligations must be proportionate and non-discriminatory, and according

to Article 13(3) AVMSD they must be based only on the revenues earned in the targeted

member states. Moreover, if the member state where the provider is established imposes

such a financial contribution, it must take into account any financial contributions

imposed by targeted member states. Any financial contribution must also comply with

Union law, in particular with state aid rules.

36

The rationale for this exception is explained in Recital 36 of the revised AVMSD

(emphasis added):

(36) In order to ensure adequate levels of investment in European works, Member States

should be able to impose financial obligations on media service providers established on

their territory. Those obligations can take the form of direct contributions to the

production of and acquisition of rights in European works. The Member States could also

impose levies payable to a fund, on the basis of the revenues generated by audiovisual

media services that are provided in and targeted towards their territory. This Directive

clarifies that, given the direct link between financial obligations and Member States'

different cultural policies, a Member State is also allowed to impose such financial

obligations on media service providers established in another Member State that target its

territory. In that case, financial obligations should only be charged on the revenues

generated through the audience in the targeted Member State. Media service providers

that are required to contribute to film funding schemes in a targeted Member State should

be able to benefit in a non-discriminatory way, even in the absence of an establishment in

that Member State, from the aid available under respective film funding schemes to media

service providers.

Despite the letter of the AVMSD and the clarification introduced by the Commission in its

Guidelines,

37

there was some political wrangling about the application of the country-of-

origin principle regarding Article 13(1) AVMSD. In Spain, a regional party wanted the

future law implementing the revised AVMSD to include reference to a quota of films made

in the Catalan language that would apply to SVOD services not under Spanish jurisdiction,

which in the view of the government was not possible since Netflix does not fall under

Spanish jurisdiction. The regional party in question mentioned France and Italy as

36

The obligations contained in Article 13(1) and (2) AVMSD do not apply to media service providers with a low

turnover or a low audience. Member States may also waive such obligations or requirements where they

would be impracticable or unjustified by reason of the nature or theme of the audiovisual media services in

question (Article 13(6) AVMSD).

37

See section 2.3.1.2. of this publication.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 18

examples of the contrary situation.

38

However, France does not apply any catalogue quota

to services outside its jurisdiction.

39

In the case of Italy, the draft Decree originally

presented by the government set a quota of at least 30% European works, of which at

least 50% must be original Italian works produced by independent producers, which

applied to targeting services as well.

40

However, both the Italian media regulator Agcom

41

and the Consiglio di Stato

42

requested that this provision be modified, as the possible

derogation from the country-of-origin principle is allowed by the Directive only with

respect to the obligation to make a financial contribution as per Article 13(2). Moreover,

the Camera dei Deputati (lower house of the Italian Parliament) made the same request.

43

Accordingly, the adopted Decreto legislativo,

44

in its Article 55(3), clarifies that only the

financing obligations apply to targeting services that are not under Italian jurisdiction

(see infra), while the quota and prominence obligations apply only to services under

Italian jurisdiction.

38

See e.g. https://www.elmundo.es/cataluna/2021/12/02/61a899a8fc6c83cf5b8b45af.html.

39

See Article 27 of the AVMS Decree. See also Le Roy M., “Tout ce que vous avez toujours voulu savoir sur le

nouveau dcret SMAD... sans jamais oser le demander” , Lgipresse #396, October 2021.

40

See Article 55(3) of the. Atto di Governo n. 288 - Schema di decreto legislativo recante attuazione della direttiva

(UE) 2018/ 1808 recante modifica della direttiva 2010/13/UE, relativa al coordinamento di determinate disposizioni

legislative, regolamentari e amministrative degli Stati membri concernenti la fornitura di servizi di media

audiovisivi, in considerazione dell'evoluzione delle realtà del mercato,

http://documenti.camera.it/apps/nuovosito/attigoverno/Schedalavori/getTesto.ashx?file=0288.pdf&leg=XVIII#

pagemode=none.

41

Agcom, Parere relativo allo schema di decreto legislativo recante attuazione della Direttiva (UE) 2018/1808 del

Parlamento europeo e del Consiglio, del 14 novembre 2018, recante modifica della direttiva 2010/13/UE, relativa al

coordinamento di determinate disposizioni legislative, regolamentari e amministrative degli Stati membri

concernenti la fornitura di servizi di media audiovisivi (direttiva sui servizi di media audiovisivi), in considerazione

dell'evoluzione delle realtà del mercato,

https://www.agcom.it/documents/10179/24308804/Comunicazione+14-09-2021/18da7ce0-d6a6-4d1d-ba00-

07b8edd30307?version=1.0.

42

Consiglio di Stato, Sezione Consultiva per gli Atti Normativi, Adunanza di Sezione del 21 settembre 2021, numero

affare 00944/2021,

http://www.dirittodeiservizipubblici.it/sentenze/sentenza.asp?sezione=dettsentenza&id=7004.

43

Camera dei Deputati, Parere delle Commissioni riunite VII (Cultura, scienza e istruzione) e IX (Trasporti, poste e

telecomunicazioni), 21 October 2021,

https://www.camera.it/leg18/824?tipo=A&anno=2021&mese=10&giorno=21&view=&commissione=0709#dat

a.20211021.com0709.allegati.all00010.

44

Decreto Legislativo 8 novembre 2021, n. 208 Attuazione della direttiva (UE) 2018/1808 del Parlamento europeo e

del Consiglio, del 14 novembre 2018, recante modifica della direttiva 2010/13/UE, relativa al coordinamento di

determinate disposizioni legislative, regolamentari e amministrative degli Stati membri, concernente il testo unico

per la fornitura di servizi di media audiovisivi in considerazione dell'evoluzione delle realta' del mercato.

(21G00231) (GU Serie Generale n.293 del 10-12-2021 - Suppl. Ordinario n. 44),

https://www.gazzettaufficiale.it/atto/serie_generale/caricaDettaglioAtto/originario?atto.dataPubblicazioneGaz

zetta=2021-12-10&atto.codiceRedazionale=21G00231&elenco30giorni=true.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 19

2.3. Definitional issues

2.3.1. Low audience and low turnover

2.3.1.1. The rationale for the exemption

Article 13(6) AVMSD excludes media service providers with a low turnover or a low

audience from the quota and prominence obligations under Article 13(1) AVMSD, as well

as from financial obligations imposed under Article 13(2) AVMSD. Recital 40 of the revised

AVMSD provides an explanation for this exemption (emphasis added):

In order to ensure that obligations relating to the promotion of European works do not

undermine market development and in order to allow for the entry of new players in the

market, providers with no significant presence on the market should not be subject to such

requirements. This is particularly the case for providers with a low turnover or low

audience.

Recital 40 further provides ways in which a low audience or a low turnover can be

determined (emphasis added):

A low audience can be determined, for example, on the basis of a viewing time or sales,

depending on the nature of the service, while the determination of low turnover should

take into account the different sizes of audiovisual markets in Member States. It might

also be inappropriate to impose such requirements in cases where, given the nature or

theme of the audiovisual media services, they would be impracticable or unjustified.

2.3.1.2. The Commission’s Guidelines

Pursuant to Article 13(7) of the AVMSD, the European Commission has provided

Guidelines

45

regarding the calculation of the share of European works in the catalogues of

on-demand providers and the definition of low audience and low turnover.

46

45

Communication from the Commission Guidelines pursuant to Article 13(7) of the Audiovisual Media Services

Directive on the calculation of the share of European works in on-demand catalogues and on the definition of

low audience and low turnover 2020/C 223/03 C/2020/4291,

https://eur-lex.europa.eu/legal-

content/EN/TXT/?uri=uriserv:OJ.C_.2020.223.01.0010.01.ENG&toc=OJ:C:2020:223:TOC.

46

See Chapter 4 of this publication for more information about co-operation between NRAs for the

application of these guidelines.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 20

2.3.1.2.1. Distinction between exemptions established by Union and national law

The aim of the exemptions provided for in Article 13(6) AVMSD is not to replace the

exemptions established at the national level, which define the scope of the contribution

obligations, but to provide safeguards for cross-border providers. If a member state has in

place or introduces obligations for media service providers to contribute financially to the

production of European works and these obligations are limited to providers established

in that member state, the guidelines do not apply.

Member states applying the financial contribution obligations to providers

established in other member states need to respect the principle of non-discrimination.

Therefore, if they have exemptions in place or introduce exemptions at national level

applicable to providers established in their territory, these exemptions also need to be

applied in a non-discriminatory manner to cross-border providers, even if the thresholds

are higher than the ones indicated in these guidelines.

2.3.1.2.2. Low turnover

The threshold for low turnover could be identified by reference to the concept of micro

enterprise developed in the Recommendation 2003/361/EC concerning the definition of

micro, small and medium-sized enterprises,

47

specifically based on the turnover threshold

used in the definition of micro enterprise (i.e. enterprises with a total annual turnover not

exceeding EUR 2 million). The annual turnover of the enterprise should be determined in

accordance with the provisions of the Recommendation 2003/361/EC, thus taking into

account also the turnover of partner and linked enterprises.

48

47

Commission Recommendation of 6 May 2003 concerning the definition of micro, small and medium-sized

enterprises (Text with EEA relevance) (notified under document number C(2003) 1422),

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32003H0361.

48

According to Article 3(3) of the Recommendation, "Linked enterprises" are “enterprises which have any of

the following relationships with each other:

(a) an enterprise has a majority of the shareholders' or members' voting rights in another enterprise;

(b) an enterprise has the right to appoint or remove a majority of the members of the administrative,

management or supervisory body of another enterprise;

(c) an enterprise has the right to exercise a dominant influence over another enterprise pursuant to a contract

entered into with that enterprise or to a provision in its memorandum or articles of association;

(d) an enterprise, which is a shareholder in or member of another enterprise, controls alone, pursuant to an

agreement with other shareholders in or members of that enterprise, a majority of shareholders' or members'

voting rights in that enterprise.”

According to Article 3(2), 2. "Partner enterprises" are “all enterprises which are not classified as linked

enterprises within the meaning of paragraph 3 and between which there is the following relationship: an

enterprise (upstream enterprise) holds, either solely or jointly with one or more linked enterprises within the

meaning of paragraph 3, 25 % or more of the capital or voting rights of another enterprise (downstream

enterprise).

However, an enterprise may be ranked as autonomous, and thus as not having any partner enterprises, even if

this 25 % threshold is reached or exceeded by the following investors, provided that those investors are not

linked, within the meaning of paragraph 3, either individually or jointly to the enterprise in question:

(a) public investment corporations, venture capital companies, individuals or groups of individuals with a

regular venture capital investment activity who invest equity capital in unquoted businesses ("business

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 21

At the same time, Recital 40 of the AVMSD provides that “the determination of low

turnover should take into account the different sizes of audiovisual markets in Member

States”. Therefore, the Commission considers that member states with smaller national

audiovisual markets should be able to determine lower turnover thresholds. Based on the

overall market characteristics, such lower thresholds could be justified and proportionate,

provided they exempt enterprises that have a share of less than 1% of the overall

revenues in the national audiovisual markets concerned.

2.3.1.2.3. Low audience

The concept of audience for VOD services is not an established one and no standardised

industry measurements are available across member states. Therefore, the Commission

considers that the most appropriate method for measuring audience in the VOD sector is

the sales of the services, which will be determined depending on the type of VOD

service:

49

◼ Subscription Video on Demand (SVOD): number of active users of a particular

service, e.g. the number of paying subscribers. In case of subscribers that pay for

bundled services which include also a VOD account, the audience of the VOD

services might not be accurately represented by the number of paying subscribers

of those bundled services as a whole, as some might not be VOD users. In such

cases, national authorities may apply a measurement based on users who have in

fact accessed the video content of the service within a defined time period. In all

these cases, the period taken into consideration should be appropriate and

meaningful (i.e. not too short), set in advance, and not burdensome in terms of

implementation.

◼ Transactional Video on Demand (TVOD): number of unique customers/unique

accounts used for acquisition of works. Active users could refer, for example, to

users that have acquired at least one title in the catalogue over a defined time

period.

◼ Advertising Video on Demand (AVOD): number of unique visitors. The audience

could be determined as an average of active users for a defined time period.

In practice, the audience should be determined in terms of the share of active users

attained by a particular service: The audience of a VOD service would be the number of its

users divided by the total number of users of (similar) VOD services available on the

national market and multiplied by 100 to obtain a percentage. Providers with a low

angels"), provided the total investment of those business angels in the same enterprise is less than EUR

1250000;

(b) universities or non-profit research centres;

(c) institutional investors, including regional development funds;

(d) autonomous local authorities with an annual budget of less than EUR 10 million and fewer than 5000

inhabitants.”

49

See also Recital 40 AVMSD 2018. Member States may, however, use alternative criteria.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 22

number of active users would have no significant presence in the market, thus justifying

the application of the Article 13(6) AVMSD exemption.

The main SVOD providers in Europe tend to have a share that goes well beyond

1% in the national markets where they are present.

50

The Commission considers it

appropriate, in principle, to exempt from the obligations under Article 13 AVMSD those

providers that have an audience share of less than 1% in the member state concerned.

With regard to Article 13(2), this means that these providers are exempted by the targeted

member state from the obligation to contribute financially to the production of European

works.

2.3.1.2.4. Adjustments to take account of the specific nature of financial contributions

When determining the appropriate thresholds, the different impacts of the two possible

types of obligations on cross-border providers should be considered. Direct contributions

to production and acquisition of rights imply a higher entrepreneurial effort than the

payment of a levy to a fund, and depend on the availability of European works, including

production projects in which a provider may invest with the available resources.

In some member states, depending in particular on the size and structure of the

audiovisual market, it may be considered important to apply financial contribution

obligations also to on-demand services with a turnover lower than EUR 2 million or with

an audience share of less than 1% as well as cross-border linear services with an audience

share below 2%, in particular pay TV services, as their presence on the national markets

may still be deemed important. In such cases, member states may decide to apply lower

thresholds, in duly justified cases and in line with their cultural policy objectives,

including the objective to ensure the sustainability of national audiovisual and film

funding systems. These thresholds and the financial contributions imposed should

consider the financial capacity of the service, should respect the principles of non-

discrimination and proportionality, should not undermine market development, and

should allow for the entry of new players on the market.

As regards cross-border direct investment obligations, the Commission invites

member states, in particular those with larger audiovisual markets, to consider also

exempting enterprises having a total turnover above EUR 2 million, by setting a higher

threshold, or at least making them subject to less onerous investment obligations –

taking account, in particular, of the possible difficulties associated with finding

audiovisual productions to invest in with the available resources in the member states

concerned.

50

The Commission quotes here “Main OTT SVOD groups in Europe by estimated number of subscribers”

(December 2018), published as part of the European Audiovisual Observatory Yearbook 2019,

https://yearbook.obs.coe.int.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 23

2.3.2. Targeting services

Article 13 AVMSD does not provide a definition of what “targeting audiences in the

territory of a member state” are. The only helping tool available is Recital 38 AVMSD 2018

(emphasis added):

A Member State, when assessing, on a case-by-case basis, whether an on-demand

audiovisual media service established in another Member State is targeting audiences in

its territory, should refer to indicators such as advertisement or other promotions

specifically aiming at customers in its territory, the main language of the service or the

existence of content or commercial communications aiming specifically at the audience in

the Member State of reception.

Similar indicators can be found in Recital 42 of the 2010 version of the AVMSD

concerning broadcasts directed at the territory of a member state by a media service

provider established in another member state (emphasis added):

A Member State, when assessing on a case-by-case basis whether a broadcast by a media

service provider established in another Member State is wholly or mostly directed towards

its territory, may refer to indicators such as the origin of the television advertising and/or

subscription revenues, the main language of the service or the existence of programmes or

commercial communications targeted specifically at the public in the Member State where

they are received.

In both cases, the main criterion is commercial gain at the target destination. Accordingly,

the rationale of the obligation is that providers should invest back some of the income

obtained in that territory into production or into payment to a fund.

51

51

See e.g. Cole M.D., “Guiding Principles in establishing the Guidelines for Implementation of Article 13 (6)

AVMSD – Criteria for exempting certain providers from obligations concerning European Works”, pp. 17-18,

https://emr-sb.de/wp-content/uploads/2019/05/Study-AVMSD-guidelines-Art-13.pdf.

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 24

3. National

3.1. Types of financial obligations

According to Recital 36 AVMSD 2018, financial obligations can take the form of direct

contributions to the production of, and acquisition of rights in, European works. The

member states could also impose levies payable to a fund, based on the revenues

generated by audiovisual media services that are provided in or targeted towards their

territory.

One important difference between the two types is that whereas direct investment

obligations can be recouped by exploiting the relevant economic rights, levies payable to

national funds do not provide any direct benefit in return, even if the services may benefit

from public funding provided by the beneficiaries of the levies. In that sense, levies may

have a parafiscal character,

52

and given that Article 13(2) introduces an exception to the

country-of-origin principle, the levy has a cross-border element.

Another important issue is that since the AVMSD is a minimum harmonisation

directive, member states remain free to require media service providers under their

jurisdiction to comply with more detailed or stricter rules, provided that such rules comply

with EU law (Article 4 AVMSD).

3.2. National transposition

Article 13(2) AVMSD leaves much room for member states to introduce financial

obligations on VOD services. And the different choices made by individual member states

regarding transposition of the AVMSD are associated with policy choices made by each

state. The first choice to be made is whether to introduce financial obligations or not.

52

For an in-depth discussion of tax-related issues regarding financial obligations see Buriak S. and Weber D.,

“Financial obligations on media service providers to promote European film culture - an analysis from an EU

law and international tax law perspective” (forthcoming). The authors refer to Advocate General Tizzano’s

Opinion in Joined Cases C-393/04 and C-41/05, https://eur-lex.europa.eu/legal-

content/EN/TXT/?uri=CELEX%3A62004CC0393, in particular paragraph 66: “[…] in the case of aid funded by

means of so-called parafiscal taxes, that is to say where the State aid consists in the grant, in the form of

subsidies which benefit certain persons, of resources acquired on the basis of a tax introduced specifically for

that purpose (that is to say, a parafiscal tax).

INVESTING IN EUROPEAN WORKS: THE OBLIGATIONS ON VOD PROVIDERS

© European Audiovisual Observatory (Council of Europe) 2022

Page 25