AUDIT REPORT

OF THE

NEBRASKA LOTTERY

FOR THE FISCAL YEAR ENDED JUNE 30, 2022

This document is an official public record of the State of Nebraska, issued by

the Auditor of Public Accounts.

Modification of this document may change the accuracy of the original

document and may be prohibited by law.

Issued on October 4, 2022

NEBRASKA LOTTERY

TABLE OF CONTENTS

Page

Background Information Section

Background 1 - 2

Mission Statement 2

Organizational Chart 3

Key Officials and Agency Contact Information 4

Financial Section

Independent Auditor’s Report 5 - 7

Management’s Discussion and Analysis 8 - 11

Basic Financial Statements:

Statement of Net Position 12

Statement of Revenues, Expenses, and Changes in Net Position 13

Statement of Cash Flows 14

Notes to the Financial Statements 15 - 23

Government Auditing Standards Section

Independent Auditor’s Report on Internal Control over Financial Reporting and

on Compliance and Other Matters Based on an Audit of Financial Statements

Performed in Accordance with Government Auditing Standards 24 - 25

Statistical Section

Lottery Ticket Sales 26

Total Operating Transfers to Beneficiary Funds 27

Cumulative Operating Transfers to Beneficiary Funds 28

Operating Transfers to Beneficiary Funds 29

Operating Expenses 30

Current Ratio 31

Quick Ratio 31

Percentage of Operating Expenses to Revenues 32

Net Income Before Transfers Compared to Operating Revenue 32

Prize Percentage of Sales 33

NEBRASKA LOTTERY

- 1 -

BACKGROUND

The Legislature created the Lottery Division of the Nebraska Department of Revenue (Nebraska Lottery) in 1991.

Nebraska voters passed a constitutional amendment allowing the creation of a State lottery in November 1992, and

the Legislature established the State lottery in 1993. As the 37

th

lottery in the nation, the Nebraska Lottery began

scratch ticket sales on September 11, 1993. Sales of on-line products began on July 21, 1994.

The Nebraska Lottery is responsible for contracting for scratch ticket production, on-line equipment, advertising,

security, and related services. In addition, the Nebraska Lottery recruits and screens Nebraska Lottery retailers,

develops Nebraska Lottery products, and collects Nebraska Lottery revenues.

Currently, the Nebraska Lottery offers Powerball®, Nebraska Pick 5®, Nebraska Pick 3®, 2by2®, MyDaY®, Mega

Millions®, Lucky for Life®, and instant games.

Article III, § 24, of the Nebraska Constitution sets out the basic requirements for the transfer of lottery proceeds to

certain beneficiary funds, specifying that a portion of those revenues are to “be used for education as the Legislature

may direct[.]”

Neb. Rev. Stat. § 9-812(2) (Supp. 2021) offers the following legislative directive for the transfer of lottery proceeds:

A portion of the dollar amount of the lottery tickets which have been sold on an annualized basis shall be transferred

from the State Lottery Operation Trust Fund to the Education Innovation Fund, the Nebraska Opportunity Grant

Fund, the Nebraska Education Improvement Fund, the Nebraska Environmental Trust Fund, the Nebraska State Fair

Board, and the Compulsive Gamblers Assistance Fund as provided in subsection (3) of this section. The dollar amount

transferred pursuant to this subsection shall equal the greater of (a) the dollar amount transferred to the funds in

fiscal year 2002-03 or (b) any amount which constitutes at least twenty-two percent and no more than twenty-five

percent of the dollar amount of the lottery tickets which have been sold on an annualized basis. To the extent that

funds are available, the Tax Commissioner and director may authorize a transfer exceeding twenty-five percent of the

dollar amount of the lottery tickets sold on an annualized basis.

Additionally, § 9-812(3) provides these further instructions:

Of the money available to be transferred to the Education Innovation Fund, the Nebraska Opportunity Grant Fund,

the Nebraska Education Improvement Fund, the Nebraska Environmental Trust Fund, the Nebraska State Fair Board,

and the Compulsive Gamblers Assistance Fund:

(a) The first five hundred thousand dollars shall be transferred to the Compulsive Gamblers Assistance Fund to

be used as provided in section 9-1006;

(b) Beginning July 1, 2016, forty-four and one-half percent of the money remaining after the payment of prizes

and operating expenses and the initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred

to the Nebraska Education Improvement Fund;

(c) Forty-four and one-half percent of the money remaining after the payment of prizes and operating expenses

and the initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred to the Nebraska

Environmental Trust Fund to be used as provided in the Nebraska Environmental Trust Act;

(d) Ten percent of the money remaining after the payment of prizes and operating expenses and the initial transfer

to the Compulsive Gamblers Assistance Fund shall be transferred to the Nebraska State Fair Board if the most

populous city within the county in which the fair is located provides matching funds equivalent to ten percent of

the funds available for transfer. Such matching funds may be obtained from the city and any other private or

public entity, except that no portion of such matching funds shall be provided by the state. If the Nebraska State

Fair ceases operations, ten percent of the money remaining after the payment of prizes and operating expenses

and the initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred to the General Fund;

and

NEBRASKA LOTTERY

- 2 -

BACKGROUND

(Concluded)

(e) One percent of the money remaining after the payment of prizes and operating expenses and the initial transfer

to the Compulsive Gamblers Assistance Fund shall be transferred to the Compulsive Gamblers Assistance Fund

to be used as provided in section 9-1006.

MISSION STATEMENT

The Nebraska Lottery’s webpage (https://nelottery.com/homeapp/about/main) contains the following mission

statement:

The mission of the Nebraska Lottery is to generate proceeds for good causes as determined by the voters and the

Legislature, while providing quality entertainment options to Nebraskans.

FINANCE

FINANCE MANAGER

G19750

LINCOLN

01630100 Dennis Nelson

LOTTERY & CHARITABLE GAMING DIRECTOR

N00260

01630000 Brian Rockey

MARKETING

MARKETING MANAGER

G33790

LINCOLN

01630200 Jill Marshall

ADMINISTRATION

ADMINISTRATIVE PROGRAMS OFFICER I

V09011

LINCOLN

01601002 Bonnie Amgwert

BUDGET OFFICER III

V19313

LINCOLN

01630101 Kim Vu

INVESTIGATIONS, SECURITY

& INSPECTIONS

REV INVEST & SECURITY SUPV

V62724

LINCOLN

01601800 Steve Anderson

LICENSING

Senior Gaming Analyst

X29223

LINCOLN

01613223 Carri Fitzgerald

ACCOUNTANT II

A19012

LINCOLN

01630102 Victoria Brininstool

ACCOUNTANT I

A19011

LINCOLN

01630107 Ginger Lippold

01630105 Rebecca Davis

INFRASTRUCTURE SUPPORT

ANALYST SR

A07073

LINCOLN

01630152 Barry Jelinek

IT APPLICATIONS DEVELOPER/SR

A07012

LINCOLN

60002640 Eric McHargue

PRODUCTS MANAGER

A33740

LINCOLN

01630203 Brian Griesenbrock

KEY ACCOUNTS MANAGER*

A33760

LINCOLN

60002642 Eric Souders

MARKETING & COMMUNICATIONS

SPECIALIST III

A33013

LINCOLN

01630195 Tom Bash

01630202 Neil Watson

MARKETING & COMMUNICATIONS

SPECIALIST II

A33012

LINCOLN

01630201 Tate Schneider

REVENUE OPERATIONS CLERK II

S29112

LINCOLN

01605005 Katherine Clinch

01630003 Teresa Schuttler

60002562 VACANT

INFORMATION TECHNOLOGY

IT SUPERVISOR

V07091

LINCOLN

01630150 Shawn Fotinos

NEBRASKA DEPARTMENT OF REVENUE

LOTTERY & CHARITABLE GAMING DIVISIONS

January 2022

*Working Title

Updated 1/5/2022

ADMINISTRATION, LICENSING, &

FINANCIAL COMPLIANCE/REVIEW

ADMINISTRATION & COMPLIANCE

MANAGER*, G29330

LINCOLN

01613002 Gail Ross

LOTTERY PROCESSING MONITOR*

S01011

LINCOLN

01630156 Chad Shoemaker

60000821 Susan McKee-Neil

LEGAL

ATTORNEY III

G31113

LINCOLN

01613211 Jordan Mruz

MARKETING & COMMUNICATIONS

SPECIALIST I

A33011

LINCOLN

60005381 Sam Craig

27 Total Positions

26 Filled

1 Vacant

Revenue Tax Specialist

S29621

Lincoln

60002909 Brett Long

Revenue Operations Clerk II

S29112

Lincoln

60005219 Jenny Grop

ACCOUNTANT III

A19013

LINCOLN

60013026 Andrew Littrell

ORGANIZATIONAL CHART

NEBRASKA LOTTERY

- 3 -

NEBRASKA LOTTERY

- 4 -

KEY OFFICIALS AND AGENCY CONTACT INFORMATION

Nebraska Lottery Executive Management

Name Title

Tony Fulton

Tax Commissioner

Brian Rockey

Lottery Director

Dennis Nelson

Lottery Finance Manager

The Nebraska Lottery

137 N.W. 17

th

Street

Lincoln, NE 68528-1204

402-471-6100

- 5 -

NEBRASKA AUDITOR OF PUBLIC ACCOUNTS

State Auditor PO Box 98917

State Capitol, Suite 2303

Lincoln, Nebraska 68509

402-471-2111, FAX 402-471-3301

auditors.nebraska.gov

NEBRASKA LOTTERY

INDEPENDENT AUDITOR’S REPORT

State Tax Commissioner

Nebraska Department of Revenue, Lottery Division

Lincoln, Nebraska

Report on the Audit of the Financial Statements

Opinion

We have audited the financial statements of the business-type activities of the Nebraska Department of Revenue,

Lottery Division (Nebraska Lottery), as of and for the year ended June 30, 2022, and the related notes to the financial

statements, which collectively comprise the Nebraska Lottery’s basic financial statements as listed in the Table of

Contents.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects, the

respective financial position of the business-type activities of the Nebraska Lottery, as of June 30, 2022, and the

respective changes in financial position, and cash flows thereof for the year then ended in accordance with

accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America

(GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by

the Comptroller General of the United States. Our responsibilities under those standards are further described in

the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to

be independent of the Nebraska Lottery and to meet our other ethical responsibilities, in accordance with the relevant

ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our audit opinions.

Emphasis of Matter

As discussed in Note 1, the financial statements of the Nebraska Lottery are intended to present the financial position

and the changes in financial position of only that portion of the business activities of the State that is attributable to

the transactions of the Nebraska Lottery. They do not purport to, and do not, present fairly the financial position of

the State of Nebraska as of June 30, 2022, and the changes in its financial position, or its cash flows thereof, for the

year then ended in conformity with accounting principles generally accepted in the United States of America. Our

opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with

accounting principles generally accepted in the United States of America, and for the design, implementation, and

maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free

from material misstatement, whether due to fraud or error.

- 6 -

In preparing the financial statements, management is required to evaluate whether there are conditions or events,

considered in the aggregate, that raise substantial doubt about the Nebraska Lottery’s ability to continue as a going

concern for 12 months beyond the financial statement date, including any currently known information that may

raise substantial doubt shortly thereafter.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion.

Reasonable assurance is a high level of assurance but is not absolute assurance and, therefore, is not a guarantee

that an audit conducted in accordance with GAAS and Government Auditing Standards will always detect a material

misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than

for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or

the override of internal control. Misstatements are considered material if there is a substantial likelihood that,

individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial

statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or

error, and design and perform audit procedures responsive to those risks. Such procedures include

examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Nebraska Lottery’s internal control. Accordingly, no such opinion is expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluate the overall presentation of the financial statements.

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise

substantial doubt about the Nebraska Lottery’s ability to continue as a going concern for a reasonable period

of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned

scope and timing of the audit, significant audit findings, and certain internal control-related matters that we

identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the Management’s Discussion

and Analysis, on pages 8-11 herein, be presented to supplement the basic financial statements. Such information is

the responsibility of management and, although not a part of the basic financial statements, is required by the

Governmental Accounting Standards Board who considers it to be an essential part of financial reporting for placing

the basic financial statements in an appropriate operational, economic, or historical context. We have applied

certain limited procedures to the required supplementary information in accordance with auditing standards

generally accepted in the United States of America, which consisted of inquiries of management about the methods

of preparing the information and comparing the information for consistency with management’s responses to our

inquiries, the basic financial statements, and other knowledge we obtained during our audit of the basic financial

statements. We do not express an opinion or provide any assurance on the information because the limited

procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

- 7 -

Other Information

Management is responsible for the other information included in the annual report. The other information comprises

the statistical section but does not include the basic financial statements and our auditor’s report thereon. Our

opinion on the basic financial statements does not cover the other information, and we do not express an opinion or

any form of assurance thereon.

In connection with our audit of the basic financial statements, our responsibility is to read the other information and

consider whether a material inconsistency exists between the other information and the basic financial statements,

or the other information otherwise appears to be materially misstated. If, based on the work performed, we conclude

that an uncorrected material misstatement of the other information exists, we are required to describe it in our report.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated September 29, 2022 on

our consideration of the Nebraska Lottery’s internal control over financial reporting and on our tests of its

compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The

purpose of that report is solely to describe the scope of our testing of internal control over financial reporting and

compliance and the results of that testing, and not to provide an opinion on the effectiveness of the Nebraska

Lottery’s internal control over financial reporting or on compliance. That report is an integral part of an audit

performed in accordance with Government Auditing Standards in considering the Nebraska Lottery’s internal

control over financial reporting and compliance.

September 29, 2022 Matt Schochenmaier, CPA

Audit Manager

Lincoln, Nebraska

NEBRASKA LOTTERY

MANAGEMENT’S DISCUSSION AND ANALYSIS

- 8 -

This section of the Nebraska Lottery annual audit presents management’s discussion and analysis of the financial

performance of the Nebraska Lottery for the fiscal period ended June 30, 2022. This discussion should be read in

conjunction with the accompanying financial statements and related notes. The financial statements, notes, and this

discussion are the responsibility of the Nebraska Lottery’s management.

OVERVIEW OF THE FINANCIAL STATEMENTS

The Nebraska Legislature established the Nebraska Lottery (Lottery) on February 24, 1993. The Lottery is to

provide instant win games and on-line random number selection games. The Lottery began selling instant (scratch)

tickets on September 11, 1993, and began selling on-line (lotto) tickets on July 21, 1994. The Lottery is a division

of the Nebraska Department of Revenue and as such, the financial summaries presented here and the related

comments are for the Lottery’s activities only and do not include the Department of Revenue’s activities or

statements.

The Lottery accounts for its financial transactions as an enterprise fund. Enterprise funds are used to account for

governmental operations that are financed and operated in a manner similar to private business. The Lottery uses

the accrual basis of accounting. In the annual report issued by the Lottery, there are three financial reports.

1) Statement of Net Position

This report will show the assets, liabilities, and net position (“equity”) of the Lottery as of June 30, 2022.

This report is basically the balance sheet for a private business.

2) Statement of Revenues, Expenses, and Changes in Net Position

This report will show the revenue, expenses, transfers to other funds, and changes in net position for the

Lottery for the fiscal year. This report would be similar to an income statement or a profit-loss statement

for a private business.

3) Statement of Cash Flows

This report is an analysis of the sources of cash flows into the Lottery and out of the Lottery for the fiscal

year.

DISCUSSION OF NET POSITION

While reviewing the Summary of Net Position, it must be compared to the prior year’s Summary to see the changes

in the various classifications (see Table A). The largest asset change was Cash and Cash Equivalents which

increased about $800,000. In May 2022, there was a Lucky for Life second-tier winner. The Multi-State Lottery

Association (MUSL) sent the Lottery the cash option amount of $390,000 prior to the winner claiming the prize in

late June. The Lottery had to make an electronic payment to the player and so at year-end, the cash was still in the

account. The actual transfer took place in July. The remainder of the difference can be attributed to the increase in

Accounts Payable, which was about $380,000, that allowed for more cash to be held at the end of the year.

On the Liability side, the Prizes Payable increased about $600,000. A majority of the increase is related to the lotto

game Lucky for Life. As noted earlier, the Lottery still had $390,000 of cash that had not been transferred to the

winner at year-end. This caused the Prizes Payable to be higher.

In the Net Position section, the Restricted for Future Prizes decreased about $150,000, while the Unrestricted Assets

increased about $180,000. As the Restricted amount went down due to the rebalancing of prize reserves by MUSL,

the effect of the rebalancing appears in the Unrestricted.

NEBRASKA LOTTERY

MANAGEMENT’S DISCUSSION AND ANALYSIS

(Continued)

- 9 -

Table A

Summary of Net Position

FY

2022

FY 2021

Change

CURRENT ASSETS

Cash and Cash Equivalents

$

8,941,960

$

8,131,659

$

810,301

Accounts Receivable and Reserves

on Deposit

6,863,617

6,497,450

366,167

Prepaid Prizes and Costs

162,628

-

162,628

TOTAL CURRENT ASSETS

15,968,205

14,629,109

1,339,096

NONCURRENT ASSETS

Reserves on Deposit

2,540,702

2,689,721

(149,019)

Furniture, Fixtures, Equipment (Net)

114,246

148,491

(34,245)

TOTAL NONCURRENT ASSETS

2,654,948

2,838,212

(183,264)

TOTAL ASSETS

$

18,623,153

$

17,467,321

$

1,155,832

CURRENT LIABILITIES

Accounts Payable

$

1,957,871

$

1,576,958

$

380,913

Compensated Absences and

Accrued Payroll Payable

92,095

80,399

11,696

Prizes Payable

7,908,466

7,293,102

615,364

Other Accrued Liabilities

514,367

372,234

142,133

TOTAL CURRENT LIABILITIES

10,472,799

9,322,693

1,150,106

NONCURRENT LIABILITIES

Compensated Absences Payable

273,852

265,915

7,937

TOTAL NONCURRENT LIABILITIES

273,852

265,915

7,937

TOTAL LIABILITIES

$

10,746,651

$

9,588,608

$

1,158,043

NET POSITION

Net Investment in Capital Assets

$

114,246

$

148,491

$

(34,245)

Restricted for Future Prizes

2,540,702

2,689,721

(149,019)

Unrestricted Assets

5,221,554

5,040,501

181,053

TOTAL NET POSITION

$

7,876,502

$

7,878,713

$

(2,211)

DISCUSSION OF REVENUES, EXPENSES, AND CHANGES IN NET POSITION

After experiencing record sales for fiscal year 2021, the sales for this year showed a slight decrease of $3.0 million

(see Table B). The Lottery saw scratch sales decrease by $6.1 million (-5.0%) and lotto sales increase by $3.1

million (+3.8%). The overall decrease was 1.5%.

On the scratch side, the only price point with an increase was in the $20 price point ($1.6 million). All the other

price points saw a decrease with the $3 price point suffering the largest decrease ($2.9 million). At this time, we

do not know the specific reason for the sales decrease but suspect that alterations in consumer behavior previously

caused by COVID-19 restrictions may have led to the sales change.

NEBRASKA LOTTERY

MANAGEMENT’S DISCUSSION AND ANALYSIS

(Continued)

- 10 -

On the lotto side, $3.8 million of the increase was due to Lucky for Life and $5.7 million was from Powerball.

During this fiscal year, Lucky for Life went to seven draws a week which led to the increase. For Powerball, the

increase was attributed to higher jackpots. The size and run of jackpots materially affect weekly lotto sales for

jackpot games and during fiscal year 2022, there were four Powerball jackpot runs that went over $300 million

whereas fiscal year 2021 had only one. All the other lotto games had decreased sales with Mega Millions having

the largest decrease ($5.7 million). For Mega Millions, there were two jackpot runs for both fiscal year 2021 and

fiscal year 2022, but the fiscal year 2021 runs went longer and for higher jackpots.

The Prize Expense went down about $2.8 million. This can be attributed to both sales products. The lower scratch

sales produced lower prize expense, and even though the lotto sales went up, the prize payout for those games are

typically lower than scratch games. Contractual Services (costs related to our lottery services provider which are

based on a percentage of sales) went down about $2.4 million due to the lower sales and due to lower contract rates.

The Lottery previously issued and evaluated an RFP that resulted in a contract that had lower rates which became

effective at the beginning of fiscal year 2022. The Marketing Expense went up about $1.3 million. This is the

result of substantially reduced advertising and promotional spending in fiscal year 2021 (due to COVID-19). The

expenses for fiscal year 2022 returned to a more regular pattern for the year.

The Transfers to Other Funds had an increase of almost $1.2 million. With the better contract rates and reduced

prize expense, the Lottery had more profits and was able to transfer more to the beneficiary trust funds this year.

(Continued on Next Page)

NEBRASKA LOTTERY

MANAGEMENT’S DISCUSSION AND ANALYSIS

(Concluded)

- 11 -

Table B

Summary of Revenues, Expenses, and Changes in Net Position

FY 2022

FY 2021

Change

REVENUES

Sales

$

205,336,790

$

208,146,715

$

(

2,809,925)

Sales Returns

(3,

071,602)

(2,864,025)

(207,577)

OPERATING REVENUE

202,265,188

205,282,690

(3,017,502)

Interest Income

217,641

238,229

(20,588)

Other Income

6,780

11,163

(4,383)

Multi

-

State Lottery Assoc. Income

1,659

2,381

(722)

NON-OPERATING REVENUE

226,080

251,773

(25,693)

TOTAL REVENUES

$

202,491,268

$

205,534,463

$

(

3,043,195)

EXPENSES

Prize Expense

$

119,566,977

$

122,341,140

$

(

2,774,163)

Retailer Commissions

13,177,840

13,509,332

(331,492)

Contractual Services

11,864,922

14,266,599

(2,401,677)

Marketing Expense

6,141,963

4,816,529

1,325,434

Lottery Operating Expense

2,311,839

2,212,728

99,111

TOTAL EXPENSES

$

153,063,541

$

157,146,328

$

(

4,082,787)

NET INCOME BEFORE

TRANSFERS

$

49,427,727

$

48,388,135

$

1,039,592

TRANSFERS TO OTHER FUNDS

$

49,429,938

$

48,178,938

$

1,251,000

CHANGE IN NET POSITION

$

(

2,211)

$

209,197

$

(

211,408)

BEGINNING NET POSITION

$

7,878,713

$

7,669,516

$

209,197

ENDING NET POSITION

$

7,876,502

$

7,878,713

$

(

2,211)

OTHER ITEMS OF NOTE

The unpredictability of Powerball, Mega Millions, and Pick 5 jackpots along with external forces that affect player

purchases of both scratch and lotto products (fuel prices, economic situations, international tensions, other

entertainment options, casino gaming, pandemics, etc.) could have a material effect on future sales and future

transfers to the beneficiary trust funds.

CONTACTING LOTTERY MANAGEMENT

This financial report is required as part of Governmental Accounting Standards Board (GASB) Statement 34 and is

prepared to provide the readers such as the Legislature, the public, and other interested parties with an overview of

the financial results of the Nebraska Lottery’s activities. If you have any questions about this report, please contact

the Nebraska Lottery at P.O. Box 98901, Lincoln, NE 68509-8901.

NEBRASKA LOTTERY

STATEMENT OF NET POSITION

As of June 30, 2022

ASSETS

CURRENT ASSETS:

Cash and Cash Equivalents 8,941,960$

Accounts Receivable, Net of Allowance (Note 5) 6,458,660

Prepaid Prizes 162,628

Reserves on Deposit (Note 7) 404,957

TOTAL CURRENT ASSETS 15,968,205

NONCURRENT ASSETS:

Reserves on Deposit (Note 7) 2,540,702

Capital Assets:

Furniture, Fixtures, and Equipment (Note 6) 660,573

Less: Accumulated Depreciation 546,327

Total Capital Assets, Net 114,246

TOTAL NONCURRENT ASSETS 2,654,948

TOTAL ASSETS

18,623,153

$

LIABILITIES

CURRENT LIABILITIES:

Accounts Payable 746,663$

Vendors Payable 1,211,208

Compensated Absences Payable (Note 8) 37,344

Accrued Payroll Payable 54,751

Withheld Taxes on Prizes Paid 42,034

Prizes Payable 7,908,466

Due to Other Funds 26,342

Other Accrued Liabilities 445,991

TOTAL CURRENT LIABILITIES 10,472,799

NONCURRENT LIABILITIES:

Compensated Absences Payable (Note 8) 273,852

TOTAL NONCURRENT LIABILITIES 273,852

TOTAL LIABILITIES 10,746,651

NET POSITION

Net Investment in Capital Assets 114,246

Restricted for Future Prizes (Note 7) 2,540,702

Unrestricted (Note 10) 5,221,554

TOTAL NET POSITION 7,876,502

TOTAL LIABILITIES AND NET POSITION

18,623,153

$

The accompanying Notes to the Financial Statements are an integral part of this statement.

- 12 -

NEBRASKA LOTTERY

STATEMENT OF REVENUES, EXPENSES, AND CHANGES IN NET POSITION

For the Year Ended June 30, 2022

OPERATING REVENUE:

Sales 205,336,790$

Less: Sales Returns 3,071,602

TOTAL OPERATING REVENUE 202,265,188

OPERATING EXPENSES:

Prize Expense, Net of Unclaimed Prizes (Note 1c) 119,566,977

Retailer Commissions 13,177,840

Contractual Services Expense 11,864,922

Marketing 6,141,963

Lottery Operating 2,311,839

TOTAL OPERATING EXPENSES 153,063,541

OPERATING INCOME 49,201,647

NONOPERATING REVENUE:

Interest Income 217,641

Other Income 6,780

Multi-State Lottery Association Income 1,659

TOTAL NONOPERATING REVENUE 226,080

INCOME BEFORE OPERATING TRANSFERS 49,427,727

TRANSFERS TO OTHER FUNDS (Note 9) (49,429,938)

CHANGE IN NET POSITION (2,211)

TOTAL NET POSITION, BEGINNING OF YEAR 7,878,713

TOTAL NET POSITION, END OF YEAR

7,876,502

$

The accompaning Notes to the Financial Statements are an integral part of this statement.

- 13 -

NEBRASKA LOTTERY

STATEMENT OF CASH FLOWS

For the Year Ended June 30, 2022

CASH FLOWS FROM OPERATING ACTIVITIES:

Ticket Sales 202,163,785$

Prizes Paid to Winners (118,753,677)

Commissions Paid to Retailers (13,186,987)

Paid to Contractors for Goods and Services (17,855,353)

Paid to Employees (1,772,297)

Other Operating Expenses (498,608)

Net Cash Provided by Operating Activities 50,096,863

CASH FLOWS FROM NONCAPITAL FINANCING ACTIVITIES:

Paid to Compulsive Gamblers Assistance Fund (989,300)

Paid to Nebraska Environmental Trust Fund (21,773,822)

Paid to Nebraska Education Improvement Fund (21,773,822)

Paid to Nebraska State Fair Support and Improvement Cash Fund (4,892,994)

Net Cash Used in NonCapital Financing Activities (49,429,938)

CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES:

Purchase of Property and Equipment (75,924)

CASH FLOWS FROM INVESTING ACTIVITIES:

Interest on Cash 217,641

Multi-State Lottery Association Income 1,659

Net Cash Provided by Investing Activities 219,300

NET INCREASE IN CASH AND CASH EQUIVALENTS 810,301

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 8,131,659

CASH AND CASH EQUIVALENTS AT END OF YEAR

8,941,960

$

RECONCILIATION OF OPERATING INCOME TO

NET CASH PROVIDED BY OPERATING ACTIVITIES:

Operating Income 49,201,647$

Adjustments to Reconcile Operating Income

to Net Cash Provided by Operating Activities:

Depreciation Expense 116,949

Changes in Assets (Increase) Decrease in:

Reserves on Deposit 53,371

Prepaid Prizes (162,628)

Accounts Receivable - Net (270,519)

Changes in Liabilities Increase (Decrease) in:

Other Accrued Liabilities 157,165

Accounts Payable and Due to Other Funds 280,531

Prizes Payable 615,364

Compensated Absences and Accrued Payroll Payable 19,633

Withheld Taxes on Prizes Paid (15,515)

Vendors Payable 100,865

Total Adjustments 895,216

Net Cash Provided by Operating Activities

50,096,863

$

The accompanying Notes to the Financial Statements are an integral part of this statement.

- 14 -

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

- 15 -

For the Fiscal Year Ended June 30, 2022

1. Summary of Significant Accounting Policies

A. Basis of Presentation

The accompanying basic financial statements of the Nebraska Department of Revenue, Lottery Division,

(Nebraska Lottery) have been prepared in conformity with accounting principles generally accepted in the

United States of America (GAAP), as applied to governmental units. As the Nebraska Lottery is a business-

type activity, the financial statements presented are the financial statements required by Governmental

Accounting Standards Board (GASB) Statement Number 34 for an enterprise fund. GASB is the accepted

standard-setting body for establishing governmental accounting and financial reporting principles.

The basic financial statements have been prepared primarily from data maintained by the Nebraska Lottery

on computer systems provided by the lottery-services vendor and from accounts maintained by the State

Accounting Administrator of the Department of Administrative Services.

B. Reporting Entity

The Nebraska Lottery was created on February 24, 1993, by the Nebraska Legislature as a division of the

Nebraska Department of Revenue (Department), established under and governed by the laws of the State

of Nebraska. As such, the Nebraska Lottery is exempt from State and Federal income taxes. The financial

statements include all funds of the Nebraska Lottery. The Nebraska Lottery is to provide an instant win

and a random number selection on-line lottery. The net proceeds, as outlined in Neb. Rev. Stat. § 9-812

(Supp. 2021), are to be transferred to the Compulsive Gamblers Assistance Fund, the Nebraska Education

Improvement Fund, the Nebraska Environmental Trust Fund, and the Nebraska State Fair Support and

Improvement Cash Fund, a fund of the State Fair Board. The financial statements include only the Nebraska

Lottery and are not intended to present the financial position of the Department or the results of operations

and changes in net positions of the Department as a whole. The Department is part of the primary

government for the State of Nebraska’s reporting entity.

The Nebraska Lottery has also considered all potential component units for which it is financially

accountable, including other organizations that are fiscally dependent on the Nebraska Lottery or whose

relationship with the Nebraska Lottery is so significant that exclusion would be misleading or incomplete.

GASB has set forth criteria to be considered in determining financial accountability. These criteria include

appointing a voting majority of an organization’s governing body, and (1) the ability of the Nebraska

Lottery to impose its will on that organization, or (2) the potential for the organization to provide specific

financial benefits to, or impose specific financial burdens on, the Nebraska Lottery. The Nebraska Lottery

is also considered financially accountable if an organization is fiscally dependent on it, and there is potential

for the organization to provide specific financial benefits to, or impose specific financial burdens on, the

Nebraska Lottery, regardless of whether the organization has (1) a separately elected governing board, (2)

a governing board appointed by a higher level of government, or (3) a jointly appointed board.

These financial statements present the Nebraska Lottery. No component units were identified. The

Nebraska Lottery is part of the primary government for the State of Nebraska’s reporting entity.

C. Measurement Focus, Basis of Accounting

The accounting and financial reporting treatment applied to a fund is determined by its measurement focus

and basis of accounting. Basis of accounting refers to when revenues and expenses are recognized in the

accounts and reported in the financial statements. Basis of accounting relates to the timing of the

measurements made, regardless of the measurement focus applied.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 16 -

1. Summary of Significant Accounting Policies (Continued)

The Nebraska Lottery’s financial statements were reported using the economic resources measurement

focus and the accrual basis of accounting. With the economic resources measurement focus, all assets and

all liabilities associated with the operations are included on the Statement of Net Position. Revenues are

recorded when earned, and expenses are recorded when a liability is incurred, regardless of the timing of

related cash flows. Net Position is segregated into restricted and unrestricted. The Nebraska Lottery’s

operating statements present increases (e.g., revenues) and decreases (e.g., expenses) in net position.

It is the policy of the State to spend restricted resources only when unrestricted resources are insufficient

or unavailable. When both restricted and unrestricted resources are available for use, it is the Nebraska

Lottery’s policy to use unrestricted resources first, then restricted resources, as they are needed.

Revenues generated from the sale of lottery tickets are reported as operating revenues. Transactions that

are capital financing, non-capital financing, or investing related are reported as non-operating revenues.

All expenses related to operating the Nebraska Lottery are reported as operating expenses. All other

expenses are reported as non-operating expenses.

Instant ticket revenue is recognized when tickets are sold to the retailer, and on-line revenue is recognized

after the drawing is completed for the respective wagers. A 5.0% - 6.0% retailer commission and a prize

expense are recognized at the same time. Revenues from the sale of on-line tickets for future drawings and

the related agent commission and prize expense are deferred until the drawings are held.

Prize expense is recognized in the same period ticket revenue is recognized based on the predetermined

prize structure for each game. Because the instant prize-winning tickets are randomly distributed

throughout the tickets, and some winning tickets will be lost, destroyed, or unredeemed for other reasons,

there will be differences between amounts accrued and the amounts actually paid. These differences,

denoted as unclaimed prizes, are recognized as a reduction of prize expense 181 days after the close of each

instant game and 181 days after each draw for on-line games, as prizes unclaimed for 180 days expire.

Unclaimed prizes for the fiscal year ended June 30, 2022, totaled $3,766,397.

The activities of the Nebraska Lottery are accounted for as an enterprise fund. Enterprise funds are used to

account for governmental operations that are financed and operated in a manner similar to private business

enterprises and where the governing body has decided that periodic determination of revenues earned,

expenses incurred, and net position is appropriate.

D. Cash and Cash Equivalents

In addition to bank accounts and petty cash, this classification includes all short-term investments, such as

certificates of deposit, repurchase agreements, and U.S. treasury bills. These short-term investments may

have original maturities (remaining time to maturity at acquisition) greater than three months; however,

cash is available and is considered cash and cash equivalents for reporting purposes. These investments

are stated at cost, which at June 30, 2022, approximates market. Banks pledge collateral, as required by

law, to guarantee State funds held in time and demand deposits.

Cash and cash equivalents are under the control of the State Treasurer or other administrative bodies, as

determined by law. All cash deposited with the State Treasurer is initially maintained in a pooled cash

account. On a daily basis, the State Treasurer invests cash not needed for current operations with the State’s

Investment Council, which maintains an operating investment pool for such investments. Interest earned

on these investments is allocated to funds based on their percentage of the investment pool.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 17 -

1. Summary of Significant Accounting Policies (Continued)

E. Budgetary Process

The State’s biennial budget cycle ends on June 30 of the odd-numbered years. By September 15, prior to

a biennium, the Nebraska Lottery and all other State agencies must submit their budget requests for the

biennium beginning the following July 1. The requests are submitted on forms that show estimated funding

requirements by programs, sub-programs, and activities. The Executive Branch reviews the requests,

establishes priorities, and balances the budget within the estimated resources available during the upcoming

biennium.

The Governor’s budget bill is submitted to the Legislature in January. The Legislature considers revisions

to the bill and presents the appropriations bill to the Governor for signature. The Governor may: a) approve

the appropriations bill in its entirety; b) veto the bill; or c) line item veto certain sections of the bill. Any

vetoed bill or line item can be overridden by a three-fifths vote of the Legislature.

The approved appropriations will generally set spending limits for a particular program within the agency.

Within the agency or program, the Legislature may provide funding from one to five budgetary fund types.

Thus, the control is by fund type, within a program, within an agency.

Appropriations are usually made for each year of the biennium, with unexpended balances being

reappropriated at the end of the first year of the biennium. For most appropriations, balances lapse at the

end of the biennium.

All State budgetary expenditures for the enterprise fund type are made pursuant to the appropriations, which

may be amended by the Legislature, upon approval by the Governor. State agencies may reallocate the

appropriations between major objects of expenditure accounts, except that the Legislature’s approval is

required to exceed the personal service limitations contained in the appropriations bill. Increases in total

appropriations must also be approved by the Legislature as a deficit appropriations bill.

Revenues are not budgeted.

F. Receivables

Receivables are reported net of estimated allowances for uncollectible amounts, which are estimated based

upon past collection experience and current economic conditions.

G. Capital Assets

Capital assets include equipment that is valued at cost when historical records are available and at estimated

historical cost when no historical records exist. Donated capital assets are valued at their estimated fair

market value on the date received. Generally, equipment that has a cost in excess of $5,000 at the date of

acquisition and has an expected useful life of more than one year is capitalized. Computers are an exception

to this policy and are capitalized if they have a cost in excess of $1,500 and a useful life of more than one

year.

Equipment is depreciated using the straight-line method over the estimated useful life of three to seven

years.

H. Compensated Absences

All permanent employees working for the Nebraska Lottery earn sick and annual leave and are allowed to

accumulate compensatory leave rather than being paid overtime. Temporary and intermittent employees

are not eligible for paid leave. The liability has been calculated using the vesting method, in which leave

amounts, for both employees currently eligible to receive termination payments and other employees

expected to become eligible in the future to receive such payments upon termination, are included.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 18 -

1. Summary of Significant Accounting Policies (Concluded)

Nebraska Lottery employees accrue vested annual leave at a variable rate based on years of service.

Generally, accrued annual leave cannot exceed 35 days at the end of a calendar year.

Employees accrue sick leave at a variable rate based on years of service. In general, accrued sick leave

cannot exceed 180 days. There is no maximum limit on the accumulation of sick leave days for employees

under certain labor contracts. Sick leave is not vested except upon either death or reaching the retirement

eligibility age of 55, at which time the State is liable for 25 percent of the employee’s accumulated sick

leave. Employees under certain labor contracts can only be paid a maximum of 50 or 60 days.

The Nebraska Lottery’s financial statements recognize the expense and accrued liability when vacation and

compensatory leave is earned or when sick leave is expected to be paid as termination payments.

I. Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities at June 30, 2022, and revenues and expenditures during the reporting

period. Actual results could differ from those estimates.

2. Deposits and Investments

Investment of all available cash is made by the State Investment Officer on a daily basis, based on total

bank balances. These funds are held in the State of Nebraska Operating Investment Pool (OIP), an internal

investment pool. Additional information on the deposits and investments portfolio, including investment

policies, risks, and types of investments, can be found in the State of Nebraska’s Annual Comprehensive

Financial Report (ACFR).

3. Contingencies and Commitments

Risk Management. The Nebraska Lottery is exposed to various risks of loss related to torts, theft of,

damage to, or destruction of assets, errors or omissions, injuries to employees, and natural disasters. The

Nebraska Lottery, as part of the primary government for the State, participates in the State’s risk

management program. The Nebraska Department of Administrative Services is responsible for maintaining

the insurance and self-insurance programs for the State. The State generally self-insures for general

liability, employee health care, employee indemnification, and workers’ compensation. The State has

chosen to purchase insurance for:

A. Motor vehicle liability, which includes $4,700,000 with a self-insured retention of $300,000

(coverage includes hot pursuit). There is an additional one-time corridor retention of $300,000.

Insurance is also purchased, with various limits and deductibles, for physical damage and uninsured

and underinsured motorists. State agencies have the option to purchase coverage for physical

damage to vehicles. There is a $1,000 deductible for this coverage.

B. Life insurance for eligible employees.

C. Crime coverage, with a limit of $10,975,000 for each loss and a $25,000 self-insured retention per

incident subject to specific conditions, limits, and exclusions.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 19 -

3. Contingencies and Commitments (Concluded)

D. Real and personal property on a blanket basis for losses up to $200,700,000, with a self-insured

retention of $300,000 per loss occurrence. Newly acquired properties are covered up to $5 million

for 30 days and $1 million for 90 days, if the property has not been reported. If not reported after

90 days, the property is not covered. The perils of flood, earthquake, and acts of terrorism have

various coverage, sub-limits, and self-insurance. State agencies have the option to purchase

building contents and inland marine coverage.

Details of the various insurance coverages are available from the Nebraska Department of Administrative

Services – Risk Management Division.

No settlements exceeded commercial insurance coverage in any of the past three fiscal years. Workers’

compensation is funded in the Workers’ Compensation Internal Service Fund through assessments on each

agency based on total agency payroll and past experience. Tort claims, theft of, damage to, or destruction

of assets, errors or omissions, and natural disasters would be funded through the State General Fund or by

individual agency assessments, as directed by the Legislature, unless covered by purchased insurance. No

amounts for estimated claims have been reported in the Nebraska Lottery’s financial statements. Health

care insurance is funded in the Insurance Trust Funds through a combination of employee and State

contributions.

Litigation. The potential amount of liability involved in litigation pending against the Nebraska Lottery,

if any, could not be determined at this time. However, it is the Nebraska Lottery’s opinion that final

settlement of those matters should not have an adverse effect on the Nebraska Lottery’s ability to administer

current programs. Any judgment against the Nebraska Lottery would have to be processed through the

State Claims Board and be approved by the Legislature.

4. State Employees Retirement Plan (Plan)

The single-employer Plan became effective by statute on January 1, 1964. The Plan consists of a defined

contribution option and a cash balance benefit and is administered by the Nebraska Public Employees

Retirement Systems. The cash balance benefit is a type of defined benefit plan. Each member employed

and participating in the retirement system prior to January 1, 2003, elected either to continue participation

in the defined contribution option or to begin participation in the cash balance benefit. The defined

contribution option is closed to new entrants. All new members of the Plan on and after January 1, 2003,

become members of the cash balance benefit. The benefits and funding policy of the Plan is established

and can only be amended by the Nebraska Legislature.

All permanent full-time employees are required to begin participation in the retirement system upon

employment. All permanent part-time employees, who have attained the age of 18 years, may exercise the

option to begin participation in the retirement system.

Contribution. Per statute, each member contributes 4.8% of his or her monthly compensation. The

Nebraska Lottery matches the member’s contribution at a rate of 156%. The employee’s and employer’s

contributions are kept in separate accounts.

The employee’s account is fully vested. The employer’s account is fully vested after a total of three years

of participation in the system, including credit for participation in another Nebraska governmental plan

prior to actual contribution to the Plan.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 20 -

4. State Employees Retirement Plan (Plan) (Concluded)

Defined Contribution Option. Upon attainment of age 55, regardless of service, the retirement allowance

is to be equal to the sum of the employee and employer accounts. Members have several forms of payment

available, including withdrawals, deferrals, annuities, or a combination of these.

Cash Balance Benefit. Upon attainment of age 55, regardless of service, the retirement allowance shall be

equal to the accumulated employee and employer cash balance accounts, including interest credits,

annuitized for payment in the normal form. The normal form of payment is single life annuity with five-

year certain, payable monthly. Members have the option to convert their member cash balance account to

a monthly annuity with built in cost-of-living adjustments of 2.5% annually. Also available are additional

forms of payment allowed under the State Plan that are actuarially equivalent to the normal form, including

the option of lump-sum or partial lump-sum.

For the fiscal year ended June 30, 2022, employees contributed $63,585, and the Nebraska Lottery

contributed $99,193. A separate plan report is issued by and can be obtained from the Nebraska Public

Employees Retirement System. This report contains full pension-related disclosures.

The State of Nebraska Annual Comprehensive Financial Report (ACFR) also includes pension-related

disclosures. The ACFR report is available from the Nebraska Department of Administrative Services –

Accounting Division or on the Nebraska Auditor of Public Accounts’ website at auditors.nebraska.gov.

5. Receivables

Retailers comprised principally of grocery stores, convenience stores, and off-sale liquor stores serve as the

primary distribution channel for lottery sales to the general public. Retailers must pay for instant lottery

tickets 45 days after activation or when the pack is 70% validated, whichever comes first. Retailers pay for

on-line tickets each Wednesday for balances due through the previous Saturday. The retailers’ accounts

receivable is net of allowance for uncollectible in the amount of $43,493.

Accounts Receivable

Retailers (net) $ 6,454,532

Other

4,128

Total

$ 6,458,660

6. Capital Assets

Capital asset activity for the year ended June 30, 2022, was as follows:

Beginning

Balance

Increases

Decreases

Ending

Balance

Capital Assets: Furniture,

Fixtures, and Equipment

$

577,869

$

82,70

4

$

-

$

660,57

3

Less: Accumulated

Depreciation

429,378

116,949 - 546,327

Total Capital Assets, Net

$ 148,491

$ (34,245)

$ - $ 114,246

Depreciation expense for the fiscal year ended June 30, 2022, was $116,949.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 21 -

7. On-Line Games

During the fiscal year ended June 30, 2022, the Nebraska Lottery offered a variety of on-line games, as

described below.

Game Name

Administered by

Nebraska’s Share

of Prize Reserves

Powerball®

MUSL

$

1,518,169

Nebraska Pick 5®

Nebraska Lottery

N/A

Nebraska Pick 3®

Nebraska Lottery

N/A

MyDaY®

Nebraska Lottery

N/A

Mega Millions®

MUSL

911,261

2by2®

MUSL

111,272

Lucky for

Life®

MUSL

N/A

Total

$

2,540,702

The Nebraska Lottery is a member of the Multi-State Lottery Association (MUSL), which operates games

on behalf of participating state lotteries. Each MUSL member sells on-line game tickets through its agents

and makes weekly payments to MUSL in an amount equal to each game’s prize structure, less amounts

retained for prizes paid directly to the winners by each member lottery. MUSL maintains prize reserve

funds on some of the games to serve as a contingency reserve to protect from unforeseen prize liabilities.

The money in these reserve funds is to be used at the discretion of the MUSL Board of Directors. The prize

reserve funds are refundable to MUSL members if MUSL disbands or if a member leaves MUSL. Members

leaving MUSL must wait at least one year before receiving their remaining share of the prize reserve funds.

In addition, the Nebraska Lottery has $404,957 held by MUSL, reported on the Statement of Net Position

as Reserves on Deposit (Current), which can be used to pay the Nebraska Lottery’s portion of MUSL’s

operating budget, any MUSL legal expenses, and other expenses incurred by MUSL. These funds are not

tied directly to any MUSL game.

The Powerball® and Mega Millions® grand prizes can be paid either as annual installments or as a lump

sum cash payment, depending on the selection of the winner when claiming the prize. If the winner selects

annual installments, MUSL purchases bonds, which are held in trust to fund the future installments.

Maturities are staggered in order to provide adequate cash flow for each installment. MUSL is responsible

for paying amounts owed to the grand prize winners. The assets and related liabilities are reflected in

MUSL’s financial statements and, therefore, are not reflected in the Nebraska Lottery’s financial

statements.

The Lucky for Life® top two prize levels can be paid either through annuity payments for the life of the

winner or as a lump sum cash payment, depending on the selection of the winner when claiming the prize.

If a Nebraska winner selects the annuity, the Nebraska Lottery has a contract with MUSL so that MUSL

will secure bids from financial services companies to provide the annual payments directly to the winner.

Each participating jurisdiction contributes a proportionate share to fund the annuity or lump sum payment.

During this fiscal year, there were three second-tier winners. One winner took the annuity option, and the

other two winners took the cash option. For the winner who chose the annuity, per the noted contract,

MUSL requested, evaluated, and arranged the purchase of the annuity.

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Continued)

- 22 -

8. Noncurrent Liabilities

Changes in noncurrent liabilities for the year ended June 30, 2022, are summarized as follows:

Beginning

Balance

Increases

Decreases

Ending Balance

Amounts

Due Within

One Year

Compensated

Absences

$ 302,176 $ 45,281 $ 36,261 $ 311,196 $ 37,344

9. Significant Compliance Requirements

Article III, § 24, of the Nebraska Constitution sets out the basic requirements for the transfer of lottery

proceeds to certain beneficiary funds, specifying that a portion of those revenues are to “be used for

education as the Legislature may direct[.]”

Neb. Rev. Stat. § 9-812(2) (Supp. 2021) offers the following legislative directive for the transfer of lottery

proceeds:

A portion of the dollar amount of the lottery tickets which have been sold on an annualized basis shall be

transferred from the State Lottery Operation Trust Fund to the Education Innovation Fund, the Nebraska

Opportunity Grant Fund, the Nebraska Education Improvement Fund, the Nebraska Environmental Trust

Fund, the Nebraska State Fair Board, and the Compulsive Gamblers Assistance Fund as provided in

subsection (3) of this section. The dollar amount transferred pursuant to this subsection shall equal the

greater of (a) the dollar amount transferred to the funds in fiscal year 2002-03 or (b) any amount which

constitutes at least twenty-two percent and no more than twenty-five percent of the dollar amount of the

lottery tickets which have been sold on an annualized basis. To the extent that funds are available, the Tax

Commissioner and director may authorize a transfer exceeding twenty-five percent of the dollar amount of

the lottery tickets sold on an annualized basis.

Additionally, § 9-812(3) provides these further instructions:

Of the money available to be transferred to the Education Innovation Fund, the Nebraska Opportunity Grant

Fund, the Nebraska Education Improvement Fund, the Nebraska Environmental Trust Fund, the Nebraska

State Fair Board, and the Compulsive Gamblers Assistance Fund:

(a) The first five hundred thousand dollars shall be transferred to the Compulsive Gamblers Assistance

Fund to be used as provided in section 9-1006;

(b) Beginning July 1, 2016, forty-four and one-half percent of the money remaining after the payment of

prizes and operating expenses and the initial transfer to the Compulsive Gamblers Assistance Fund shall

be transferred to the Nebraska Education Improvement Fund;

(c) Forty-four and one-half percent of the money remaining after the payment of prizes and operating

expenses and the initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred to

the Nebraska Environmental Trust Fund to be used as provided in the Nebraska Environmental Trust

Act;

(d) Ten percent of the money remaining after the payment of prizes and operating expenses and the

initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred to the Nebraska State

Fair Board if the most populous city within the county in which the fair is located provides matching

funds equivalent to ten percent of the funds available for transfer. Such matching funds may be obtained

from the city and any other private or public entity, except that no portion of such matching funds shall

be provided by the state. If the Nebraska State Fair ceases operations, ten percent of the money

remaining after the payment of prizes and operating expenses and the initial transfer to the Compulsive

Gamblers Assistance Fund shall be transferred to the General Fund; and

NEBRASKA LOTTERY

NOTES TO THE FINANCIAL STATEMENTS

(Concluded)

- 23 -

9. Significant Compliance Requirements (Concluded)

(e) One percent of the money remaining after the payment of prizes and operating expenses and the

initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred to the Compulsive

Gamblers Assistance Fund to be used as provided in section 9-1006.

As required under its enabling legislation, transfers of $49,429,938 were made to other funds during the

fiscal year.

The Nebraska Lottery develops game structures to comply with the minimum prize provision of its enabling

legislation, which requires a minimum of 40 percent to be paid in prizes.

The Nebraska Lottery compares the social security number of each winner who has a per-wager prize in

excess of $500 against a list of social security numbers having an outstanding State tax liability or

delinquent child support payments. Any delinquent payments are withheld from winnings and forwarded

to the appropriate State agency. During the fiscal year, the Nebraska Lottery collected $18,411 in

delinquent State taxes and $18,275 in delinquent child support payments.

Operating Transfers In/Out will not balance, and Due To/From Other Funds will not balance, within the

Nebraska Lottery’s financial statements, as the Nebraska Lottery represents only part of the State’s primary

government.

10. Net Position

The Nebraska Lottery’s unrestricted net position represents funds not legally restricted for any specific

purpose; however, the funds may be used only to fund additional prize pay-outs, transfers to the beneficiary

funds, or additional operating expenses of the Nebraska Lottery. Management’s intention is to use the

unrestricted net position to fund additional prize pay-outs, retailer incentives, and other game

enhancements.

- 24 -

NEBRASKA AUDITOR OF PUBLIC ACCOUNTS

State Auditor PO Box 98917

State Capitol, Suite 2303

Lincoln, Nebraska 68509

402-471-2111, FAX 402-471-3301

auditors.nebraska.gov

NEBRASKA LOTTERY

REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AND

ON COMPLIANCE AND OTHER MATTERS BASED ON AN AUDIT OF

FINANCIAL STATEMENTS PERFORMED IN ACCORDANCE

WITH GOVERNMENT AUDITING STANDARDS

INDEPENDENT AUDITOR’S REPORT

State Tax Commissioner

Nebraska Department of Revenue, Lottery Division

Lincoln, Nebraska

We have audited, in accordance with auditing standards generally accepted in the United States of America and the

standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller

General of the United States, the financial statements of the business-type activities of the Nebraska Department of

Revenue, Lottery Division, (Nebraska Lottery) as of and for the year ended June 30, 2022, and the related notes to

the financial statements, which collectively comprise the Nebraska Lottery’s basic financial statements, and have

issued our report thereon dated September 29, 2022. The report was modified to emphasize that the financial

statements present only the funds of the Nebraska Lottery.

Report on Internal Control Over Financial Reporting

In planning and performing our audit of the financial statements, we considered the Nebraska Lottery’s internal

control over financial reporting (internal control) to determine the audit procedures that are appropriate in the

circumstances for the purpose of expressing our opinion on the financial statements, but not for the purpose of

expressing an opinion on the effectiveness of the Nebraska Lottery’s internal control. Accordingly, we do not

express an opinion on the effectiveness of the Nebraska Lottery’s internal control.

A deficiency in internal control exists when the design or operation of a control does not allow management or

employees, in the normal course of performing their assigned functions, to prevent, or detect and correct,

misstatements on a timely basis. A material weakness is a deficiency, or combination of deficiencies, in internal

control, such that there is a reasonable possibility that a material misstatement of the Nebraska Lottery’s financial

statements will not be prevented, or detected and corrected, on a timely basis. A significant deficiency is a

deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet

important enough to merit attention by those charged with governance.

Our consideration of internal control was for the limited purpose described in the first paragraph of this section and

was not designed to identify all deficiencies in internal control that might be material weaknesses or significant

deficiencies. Given these limitations, during our audit we did not identify any deficiencies in internal control that

we consider to be material weaknesses. However, material weaknesses may exist that have not been identified.

- 25 -

Report on Compliance and Other Matters

As part of obtaining reasonable assurance about whether the Nebraska Lottery’s financial statements are free of

material misstatement, we performed tests of its compliance with certain provisions of laws, regulations, contracts,

and grant agreements, noncompliance with which could have a direct and material effect on the determination of

financial statement amounts. However, providing an opinion on compliance with those provisions was not an

objective of our audit and, accordingly, we do not express such an opinion. The results of our tests disclosed no

instances of noncompliance or other matters that are required to be reported under Government Auditing Standards.

Purpose of this Report

The purpose of this report is solely to describe the scope of our testing of internal control and compliance and the

result of that testing, not to provide an opinion on the effectiveness of the Nebraska Lottery’s internal control or on

compliance. This report is an integral part of an audit performed in accordance with Government Auditing

Standards in considering the Nebraska Lottery’s internal control and compliance. Accordingly, this communication

is not suitable for any other purpose.

September 29, 2022 Matt Schochenmaier, CPA

Audit Manager

Lincoln, Nebraska

NEBRASKA LOTTERY

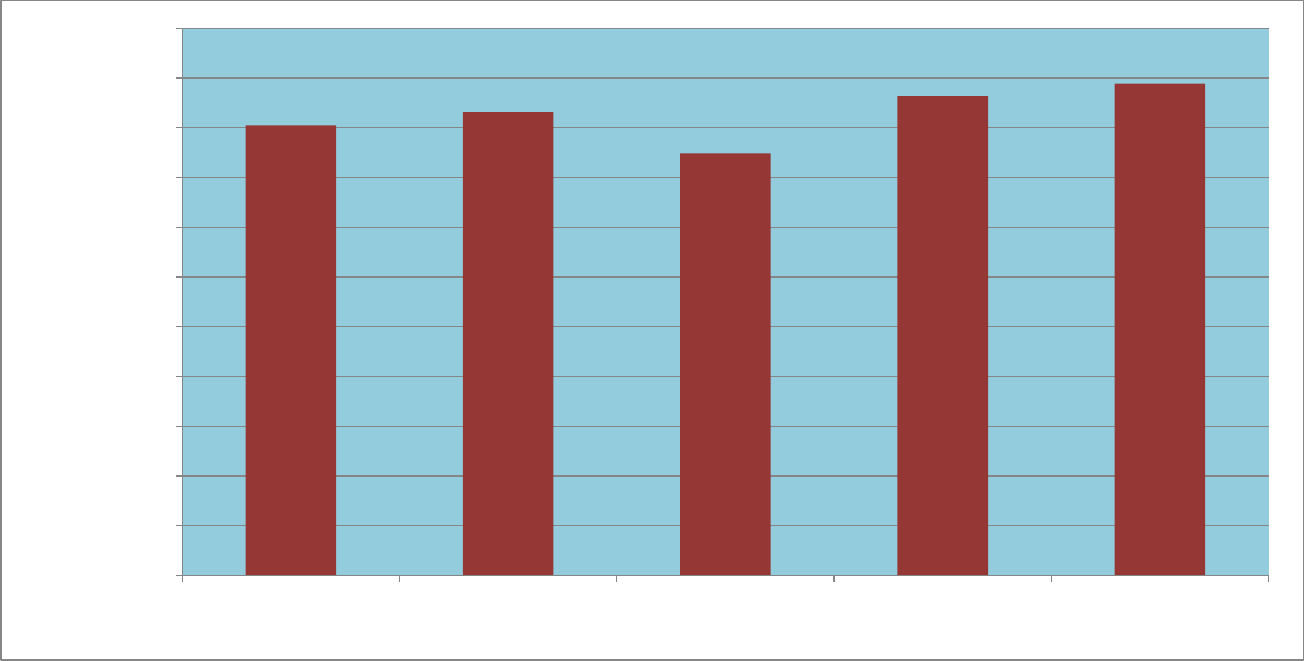

LOTTERY TICKET SALES

For the Fiscal Years 2018 through 2022

Note: These sales are shown on an accrual basis.

$183,368,092

$192,181,990

$183,075,525

$205,282,690

$202,265,188

$150,000,000

$160,000,000

$170,000,000

$180,000,000

$190,000,000

$200,000,000

$210,000,000

Fiscal Year 2018 Fiscal Year 2019 Fiscal Year 2020 Fiscal Year 2021 Fiscal Year 2022

- 26 -

NEBRASKA LOTTERY

TOTAL OPERATING TRANSFERS TO BENEFICIARY FUNDS

For the Fiscal Years 2018 through 2022

$45,250,114

$46,567,592

$42,405,635

$48,178,938

$49,429,938

$-

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

$30,000,000

$35,000,000

$40,000,000

$45,000,000

$50,000,000

$55,000,000

Fiscal Year 2018 Fiscal Year 2019 Fiscal Year 2020 Fiscal Year 2021 Fiscal Year 2022

Note: The Total Operating Transfers include transfers to the Nebraska Environmental Trust Fund, the Compulsive Gamblers Assistance Fund,

Nebraska Education Improvement Fund, and the Nebraska State Fair Support and Improvement Cash Fund. These transfers are shown on a cash basis.

- 27 -

NEBRASKA LOTTERY

CUMULATIVE OPERATING TRANSFERS

TO BENEFICIARY FUNDS

For the Fiscal Years 1994 through 2022

Fiscal Year Transfer Amount

1994 10,931,811

1995 19,308,170

1996 20,486,304

1997 23,363,387

1998 18,740,463

1999 17,581,026

2000 17,887,538

2001 16,596,397

2002 18,235,952

2003 20,098,664

2004 20,807,945

2005 27,195,478

2006 27,601,895

2007 29,266,219

2008 31,008,281

2009 30,245,118

2010 32,000,274

2011 32,055,328

2012 36,075,064

2013 40,014,701

2014 38,000,092

2015 37,106,983

2016 42,782,923

2017 41,277,657

2018 45,250,114

2019 46,567,592

2020 42,405,635

2021 48,178,938

2022 49,429,938

Total Cumulative Transfers 880,499,887$

Note: Total Cumulative Transfers includes transfers to the Solid Waste Landfill Closure Fund (final

allocation made in July 1997), the Nebraska Environmental Trust Fund, the Education Innovation

Fund, the Nebraska Opportunity Grant Fund (beginning October 1, 2003) (LB 956 (2010) changed

the Nebraska Scholarship Fund to the Nebraska Opportunity Grant Fund as of July 1, 2010),

the

Compulsive Gamblers Assistance Fund, and the Nebraska State Fair Support and Improvement

Cash Fund (beginning January 1, 2005). These transfers are shown on a cash basis except for an

adjustment of $2,342,407 increasing the Fiscal Year 2000 transfer amount and decreasing the

Fiscal Year 2001 transfer amount to better reflect the transfer in the year it relates to. The 2005

transfer amount includes a $5,000,000 transfer from the State Lottery Operation Trust Fund to the

General Fund in July 2004, as required by LB 1091 (2004). Effective July 1, 2016, the Nebraska

Lottery no longer transferred funds to the Education Innovation Fund and the Nebraska Opportunity

Grant Fund. Instead, the Nebraska Lottery was to transfer 44.5% of funds available to be

transferred to the Nebraska Education Improvement Fund (LB 497 (2013)).

- 28 -

NEBRASKA LOTTERY

OPERATING TRANSFERS TO BENEFICIARY FUNDS

For the Fiscal Years 2018 through 2022

Fiscal Year 2018 Fiscal Year 2019 Fiscal Year 2020 Fiscal Year 2021 Fiscal Year 2022

Nebraska Environmental Trust Fund

$19,913,801 $20,500,078 $18,648,007 $21,217,127 $21,773,822

Nebraska State Fair Support and Improvement

Cash Fund

$4,475,011 $4,606,759 $4,190,564 $4,767,895 $4,892,994

Compulsive Gamblers Assistance Fund

$947,501 $960,677 $919,057 $976,789 $989,300

Nebraska Education Improvement Fund

$19,913,801 $20,500,078 $18,648,007 $21,217,127 $21,773,822

$-

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

Note: Article III, § 24, of the Nebraska Constitution sets out the basic requirements for the transfer of lottery proceeds to certain beneficiary funds, specifying that a portion

of those revenues are to “be used for education as the Legislature may direct.” Neb. Rev. Stat. § 9-812(2) Supp. 2021) provides the following legislative directive for the

transfer of lottery proceeds: “A portion of the dollar amount of the lottery tickets which have been sold on an annualized basis shall be transferred from the State Lottery

Operation Trust Fund to the Education Innovation Fund, the Nebraska Opportunity Grant Fund, the Nebraska Education Improvement Fund, the Nebraska Environmental

Trust Fund, the Nebraska State Fair Board, and the Compulsive Gamblers Assistance Fund as provided in subsection (3) of this section. The dollar amount transferred

pursuant to this subsection shall equal the greater of (a) the dollar amount transferred to the funds in fiscal year 2002-03 or (b) any amount which constitutes at least twenty-

two percent and no more than twenty-five percent of the dollar amount of the lottery tickets which have been sold on an annualized basis. To the extent that funds are

available, the Tax Commissioner and director may authorize a transfer exceeding twenty-five percent of the dollar amount of the lottery tickets sold on an annualized

basis.” Additionally, § 9-812(3) sets out these further instructions: “Of the money available to be transferred to the Education Innovation Fund, the Nebraska Opportunity

Grant Fund, the Nebraska Education Improvement Fund, the Nebraska Environmental Trust Fund, the Nebraska State Fair Board, and the Compulsive Gamblers Assistance

Fund: (a) The first five hundred thousand dollars shall be transferred to the Compulsive Gamblers Assistance Fund to be used as provided in section 9-1006; (b) Beginning

July 1, 2016, forty-four and one-half percent of the money remaining after the payment of prizes and operating expenses and the initial transfer to the Compulsive Gamblers

Assistance Fund shall be transferred to the Nebraska Education Improvement Fund; (c) Forty-four and one-half percent of the money remaining after the payment of prizes

and operating expenses and the initial transfer to the Compulsive Gamblers Assistance Fund shall be transferred to the Nebraska Environmental Trust Fund to be used as

provided in the Nebraska Environmental Trust Act; (d) Ten percent of the money remaining after the payment of prizes and operating expenses and the initial transfer to the