Property tax is the most stable, complex and local tax

Kem C. Gardner Policy Institute

I

411 East South Temple Street, Salt Lake City, Utah 84111

I

801-585-5618

I

gardner.utah.edu

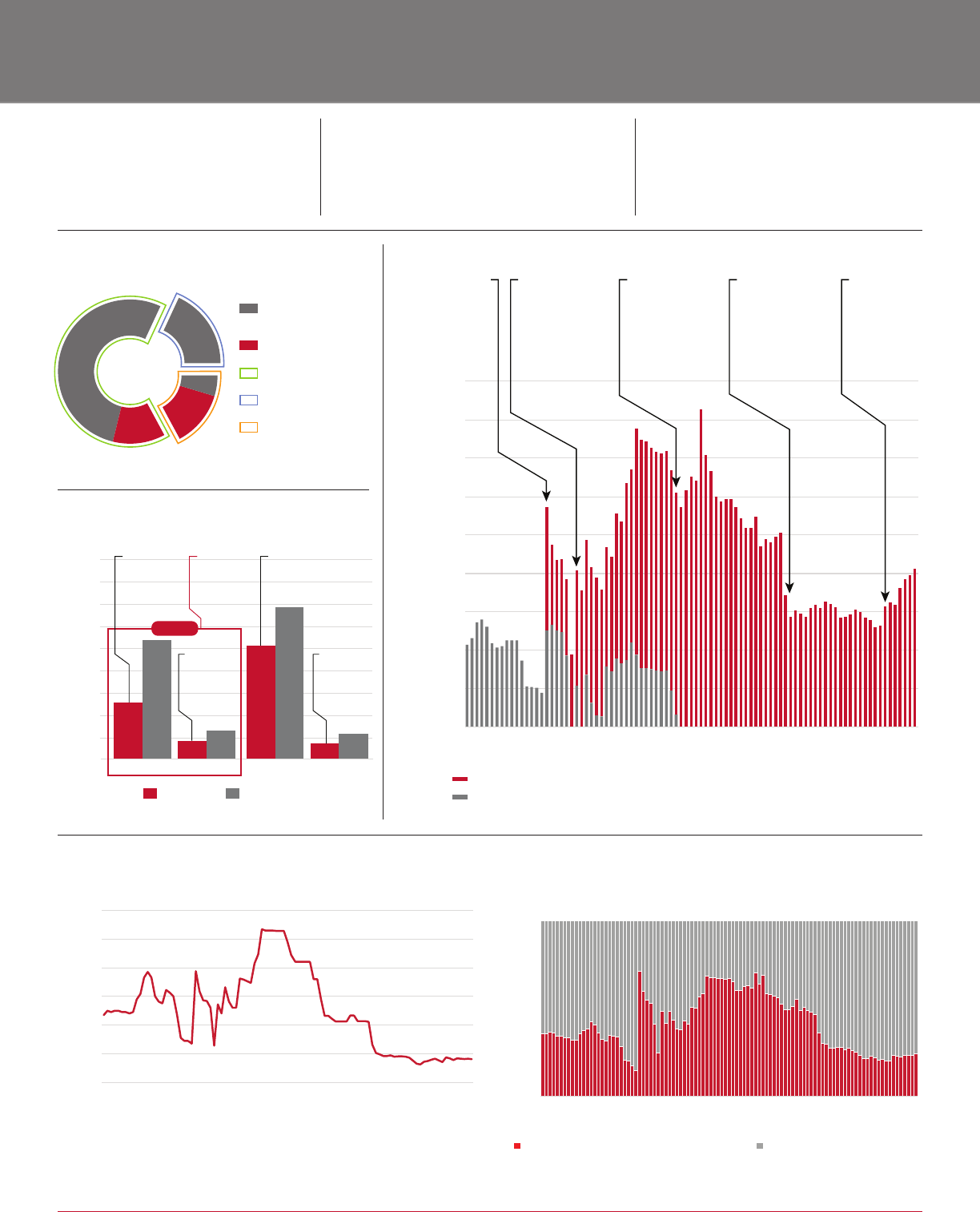

Figure 1: Year-Over Change in Real (Ination-Adjusted) Tax Revenue per

Capita for Major Utah Taxes, FY 1982-2022

-20%

-10%

-30%

-40%

0%

10%

20%

30%

40%

50%

1982 1987 1992 1997 2002 2007 2012 2017 2022

Property Tax State and Local Sales

and Use Tax

Individual and Corporate

Income Tax

Sales Tax Rate Increase

Pandemic and Due Date Timing Shift

Statewide School

Property Tax Cut

Tax Cuts and Dot-com Recession

Tax Cuts and

Great Recession

-20%

-10%

-30%

0%

10%

20%

30%

40%

50%

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Property Tax State and Local Sales and Use Tax Individual and Corporate Income Tax

Sales Tax Rate Increase

Pandemic and Due Date Timing Shift

Statewide School Property Tax Cut

Tax Cuts and Dot-com Recession

Tax Cuts and Great Recession

Source: Utah State Tax Commission and Kem C. Gardner Policy Institute

STABLE – The property tax is Utah’s most

stable tax. This stability comes from both

the less volatile nature of property and

the design of Utah’s property tax system.

COMPLEX – Utah’s property tax system

involves many moving parts, which often

take place behind the scenes. Taxpayers

often have little to no interaction with the

property tax system until the property tax

valuation estimate and bill arrives.

LOCAL – Local entities impose all Utah

property taxes. However, property taxes

interact with state funding, particularly for

schools. Local property tax decisions also

inuence other local scal decisions for

other taxes, such as sales taxes and fees.

Property Tax Insights

December 2022

Q: Where does

the money go?

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

FederalStateOtherProperty

Utah National Average

47% of

national

average

64% of

national

average

50% of

national

average

State Funds

(Mostly Income Tax)

$3.03

$0.68

$1.19

$0.77

$0.26

Local Property Tax

School

57% ($2.5 Billion)

County

18% ($0.8 Billion)

Limited-purpose

12% ($0.5 Billion)

City & Town

13% ($0.6 Billion)

$4.5

Billion

$5.9

Billion

Basic

Related-to-Basic

Levy Guarantee

75% of national

average

60% of

national

average

Local

Note: Includes ad valorem and fee-in-lieu

property tax revenue

Source: Utah State Tax Commission

Figure 3: Property Tax Recipients, 2021

Q: How have property taxes shifted

among taxpayers?

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1921

1931

1941

1951

1961

1971

1981

1991

2001

2011

2021

Statewide School Property Tax Revenue Other Property Tax Revenue

0

0.002

0.004

0.006

0.008

0.010

0.012

1922

1932

1942

1952

1962

1972

1982

1992

2002

2012

2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

7%

1955

7%

1960

7%

1965

7%

1970

6%

1975

6%

1980

6%

1985

9%

1990

11%

1995

11%

2000

10%

2005

6%

2010

6%

2015

5%

2020

5%

16%

12%

11%

10%

8%

3%

4%

3%

4%

8%

9%

11%

10%

10%

10%

26%

5%

14%

32%

32%

6%

15%

29%

34%

5%

16%

27%

35%

5%

15%

28%

37%

5%

17%

28%

48%

7%

17%

18%

45%

8%

18%

19%

41%

8%

17%

21%

45%

7%

18%

15%

44%

7%

20%

11%

46%

6%

20%

9%

46%

5%

22%

10%

47%

6%

21%

10%

50%

6%

21%

8%

52%

6%

20%

7%

2021

Motor Vehicle

Other, including Vacant LandResidential

Business Personal PropertyBusiness Real Property

Centrally Assessed Business

0

20

40

60

80

100

120

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Source: Utah State Tax Commission, Property Tax Division, Annual Statistical Reports

Figure 2: Property Tax Base Composition, 1955-2021

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

FederalStateOtherProperty

Utah National Average

47% of

national

average

64% of

national

average

50% of

national

average

State Funds

(Mostly Income Tax)

$3.03

$0.68

$1.19

$0.77

$0.26

Local Property Tax

School

57% ($2.5 Billion)

County

18% ($0.8 Billion)

Limited-purpose

12% ($0.5 Billion)

City & Town

13% ($0.6 Billion)

$4.5

Billion

$5.9

Billion

Basic

Related-to-Basic

Levy Guarantee

75% of national

average

60% of

national

average

Local

Figure 5: Total Per Pupil Revenues by

Funding Source, 2018

Source: National Center for Education Statistics

Source: Utah Foundation, Utah State Tax Commission, and Utah Superintendent’s

annual reports

Figure 8: Statewide and Discretionary Local Property Tax

Revenue as a Share of Total School Property Tax Revenue,

1921–2021

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1921

1931

1941

1951

1961

1971

1981

1991

2001

2011

2021

Statewide School Property Tax Revenue Other Property Tax Revenue

0

0.002

0.004

0.006

0.008

0.010

0.012

1922

1932

1942

1952

1962

1972

1982

1992

2002

2012

2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

7%

1955

7%

1960

7%

1965

7%

1970

6%

1975

6%

1980

6%

1985

9%

1990

11%

1995

11%

2000

10%

2005

6%

2010

6%

2015

5%

2020

5%

16%

12%

11%

10%

8%

3%

4%

3%

4%

8%

9%

11%

10%

10%

10%

26%

5%

14%

32%

32%

6%

15%

29%

34%

5%

16%

27%

35%

5%

15%

28%

37%

5%

17%

28%

48%

7%

17%

18%

45%

8%

18%

19%

41%

8%

17%

21%

45%

7%

18%

15%

44%

7%

20%

11%

46%

6%

20%

9%

46%

5%

22%

10%

47%

6%

21%

10%

50%

6%

21%

8%

52%

6%

20%

7%

2021

Motor Vehicle

Other, including Vacant LandResidential

Business Personal PropertyBusiness Real Property

Centrally Assessed Business

0

20

40

60

80

100

120

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1921

1931

1941

1951

1961

1971

1981

1991

2001

2011

2021

Statewide School Property Tax Revenue Other Property Tax Revenue

0

0.002

0.004

0.006

0.008

0.010

0.012

1922

1932

1942

1952

1962

1972

1982

1992

2002

2012

2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

7%

1955

7%

1960

7%

1965

7%

1970

6%

1975

6%

1980

6%

1985

9%

1990

11%

1995

11%

2000

10%

2005

6%

2010

6%

2015

5%

2020

5%

16%

12%

11%

10%

8%

3%

4%

3%

4%

8%

9%

11%

10%

10%

10%

26%

5%

14%

32%

32%

6%

15%

29%

34%

5%

16%

27%

35%

5%

15%

28%

37%

5%

17%

28%

48%

7%

17%

18%

45%

8%

18%

19%

41%

8%

17%

21%

45%

7%

18%

15%

44%

7%

20%

11%

46%

6%

20%

9%

46%

5%

22%

10%

47%

6%

21%

10%

50%

6%

21%

8%

52%

6%

20%

7%

2021

Motor Vehicle

Other, including Vacant LandResidential

Business Personal PropertyBusiness Real Property

Centrally Assessed Business

0

20

40

60

80

100

120

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Figure 7: School Property Tax Statewide Basic Levy Rate,

1922–2022

Rate adjusted for changes in statutory assessment levels, which were below 100% from

1947 to 1986.

Source: Utah Superintendent’s annual reports

Nearly 60%

of property taxes

fund schools

School property

tax resources are

uneven

State school funding

closely interacts with

property taxes

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

FederalStateOtherProperty

Utah National Average

47% of

national

average

64% of

national

average

50% of

national

average

State Funds

(Mostly Income Tax)

$3.03

$0.68

$1.19

$0.77

$0.26

Local Property Tax

School

57% ($2.5 Billion)

County

18% ($0.8 Billion)

Limited-purpose

12% ($0.5 Billion)

City & Town

13% ($0.6 Billion)

$4.5

Billion

$5.9

Billion

Basic

Related-to-Basic

Levy Guarantee

75% of national

average

60% of

national

average

Local

Figure 4: Minimum School Program

Funding, FY 2022 ($ in billions)

Source: Oce of the Legislative Fiscal Analyst

Figure 6: Real Per Pupil Basic Levy School Property Tax Revenue, 1931–2021

Minimum

School Program

created, 1947

Basic levy cut

and residential

exemption

expanded,

1995 and 1996

Increased

emphasis

on statewide

property tax

equalization

begins, 2015

State-imposed

school levy

eliminated,

1973

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

1931

1941

1951

1961

1971

1981

1991

2001

2011

2021

Real Revenue per Pupil

Real Locally-Imposed Statewide Property Tax (Basic Levy) Revenue per Pupil

Real State-Imposed Statewide Property Tax (Basic Levy) Revenue per Pupil

State-imposed

school levy

eliminated

in1952 and

reinstated

in 1954

Source: Utah Superintendent’s annual reports and Utah Foundation

December 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

2

Q: How Do Property Taxes Impact School Funding?

Q: How does property tax rate setting work?

Source: Kem C. Gardner Policy Institute

Figure 10: Example of Truth in Taxation Certied Tax Rate Process

Entity-wide Taxable Value

Certied

Tax Rate*

Imposed

Tax Rate

Tax Revenue

($ millions)

Year

1

Previously Existing Property $200 Million

1.00% 1.00%

$2.0

New Growth $0 $0

Total: $2.0 Million

Year

2

Previously Existing Property $400 Million

0.50% 0.50%

$2.0

New Growth $40 Million

$0.2

Total: $2.2 Million

Year

3

Previously Existing Property $660 Million

0.33% 0.40%

$2.2

New Growth $90 Million

$0.3

$0.5

(Revenue Increase)

Total: $3.0 Million

Individual property owner's taxes may shift

even with no overall total revenue increase

on previously existing property

n

Target Tax Revenue from Previously Existing Property

n

Tax Revenue from “New Growth” (Newly-created Property)

Example Taxpayers

A B C D E

Taxable Value $350,000 $1,500,000 $400,000 $250,000 $800,000

Taxes Paid $3,500 $15,000 $4,000 $2,500 $8,000

Taxable Value $400,000 $1,500,000 $800,000 $600,000 $750,000

Taxes Paid $2,000 $7,500 $4,000 $3,000 $3,750

Truth in Taxation Notice and Hearing Required

Value

increases,

tax

decreases

Value the

same,

tax

decreases

Value

increases,

tax

constant

Value

increases,

tax

increases

Value

decreases,

tax

decreases

* Adjusts yearly to meet target tax revenue

Taxing entity boards establish tax

revenue amounts. Assessed

property values allocate those tax

amounts among taxpayers.

Rate Cut

in Half

1

Local Tax – Property tax is a local tax, imposed by taxing

entities including school districts, cities and towns,

counties, and limited-purpose local entities (such as

water districts).

2

No Automatic Revenue Increase on Existing

Properties – When property values increase, the

certied tax rate automatically adjusts down to oset

that valuation increase on existing properties, so taxing

entities receive a at revenue amount.

3

Truth in Taxation Requires Public Notice of Revenue

Increase – Under Utah’s “Truth in Taxation” system, to

increase the revenue dollar amount, taxing entities must

follow specied public notice and hearing processes.

4

No Automatic Ination Adjustment – Utah’s Truth in

Taxation system does not provide for any automatic

inationary adjustment. That is, the certied tax rate is set

to generate the identical revenue amount as the prior year.

5

Newly Created Property Can Generate New Revenue –

New property, such as a new house or commercial building,

is subject to the same tax rate as all other property and can

generate new revenue for a taxing entity.

6

Taxing Entities Set Property Tax Levels – Taxing entities

impose tax rates, within any applicable statutory caps.

7

Property Values Distribute Tax Burden – When taxing

entities set tax rates, assessed property values allocate

those taxes among property owners.

Source: Utah State Tax Commission

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1921

1931

1941

1951

1961

1971

1981

1991

2001

2011

2021

Statewide School Property Tax Revenue Other Property Tax Revenue

0

0.002

0.004

0.006

0.008

0.010

0.012

1922

1932

1942

1952

1962

1972

1982

1992

2002

2012

2022

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

7%

1955

7%

1960

7%

1965

7%

1970

6%

1975

6%

1980

6%

1985

9%

1990

11%

1995

11%

2000

10%

2005

6%

2010

6%

2015

5%

2020

5%

16%

12%

11%

10%

8%

3%

4%

3%

4%

8%

9%

11%

10%

10%

10%

26%

5%

14%

32%

32%

6%

15%

29%

34%

5%

16%

27%

35%

5%

15%

28%

37%

5%

17%

28%

48%

7%

17%

18%

45%

8%

18%

19%

41%

8%

17%

21%

45%

7%

18%

15%

44%

7%

20%

11%

46%

6%

20%

9%

46%

5%

22%

10%

47%

6%

21%

10%

50%

6%

21%

8%

52%

6%

20%

7%

2021

Motor Vehicle

Other, including Vacant LandResidential

Business Personal PropertyBusiness Real Property

Centrally Assessed Business

0

20

40

60

80

100

120

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Figure 9: Statewide Count of Entities Holding Truth in

Taxation Hearing, 2010–2022

Q: How Does Utah's Truth in Taxation System Work?

Value

Doubles

gardner.utah.edu

I

December 2022

INFORMED DECISIONS

TM

3

Q: What happened in 2022?

n School property tax increased

– Statewide school property tax basic levy rate remained

frozen (nal year of 2018-2022 freeze)

– Some school districts held truth in taxation hearings to

increase tax rates

n Cities, counties, and other districts (like water districts) also held truth

in taxation hearings to increase tax rates

n Taxes shifted from businesses to households

- High home price increases

- Changing business property markets

- Assessment practices

n High ination put pressure on government,

household, and business costs

n The Legislature passed SB 25 providing

property tax relief for qualifying individuals

Figure 11: Existing tax relief programs

are underutilized

Source: U.S. Census Bureau and Utah State Tax Commission

If your policy objective is to… Then consider options to…

Minimize regressivity

n Ensure circuit breaker for low-income seniors is appropriately sized and easy for eligible taxpayers to access

n Review alternatives to abate property taxes of the poor who are not seniors

n Cap primary residential exemption for high-value properties

n Adjust fee-in-lieu values to reduce regressivity

n Create income tax credit for low-income households

Ensure market-driven factors

drive distribution of property tax

burden

n Disclose property sale prices (could do so as private record or public record)

n Ensure assessors have sucient stang, training, data, and up-to-date assessment tools

n Cap, reduce, or eliminate various types of preferential tax treatment (such as exemptions and special valuation

approaches)

n Review statute, administrative rules, and assessment practices to determine if any laws, rules, or approaches

inhibit fair market value assessment

Adjust local government revenues

(up or down) to match core service

needs funded with property tax

n Determine appropriate service levels and change tax rates to generate desired revenue

n Review tax rate caps to ensure they are designed appropriately in context of Utah’s Truth in Taxation system

n Allocate more income taxes to schools via equalization programs such as voted/board levy guarantee program,

and oset increases with local property tax certied tax rate adjustments

Equalize school property taxes

statewide

(or further localize school property taxes)

n Re-emphasize the statewide basic levy over local school taxes:

• Increase, keep constant, or adjust basic levy rate for CPI ination

• If overall revenue neutrality is desired, oset increased allocations from statewide property taxes with local

certied tax rate reductions

n Equalize revenues (all or growth) from second homes, centrally assessed businesses, commercial property, or

other non-residential property

n Focus state income tax funds more on school districts with low property tax base making higher local tax eort

(or do the opposite to further localize school property taxes)

Encourage economic eciency,

including more ecient land use

n Place greater emphasis on user fees tied to usage levels and property taxes to fund services, especially property

taxes on land (note that some approaches to an increased emphasis on land value taxes may require a

constitutional change)

n Cap, reduce, or eliminate various types of preferential tax treatment for real property (such as exemptions and

special valuation approaches)

Q: What tax policy options exist?

December 2022

I

gardner.utah.edu INFORMED DECISIONS

TM

4

Receiving Benet

(About 12,500)

Eligible but Not

Receiving Benet

20%

80%