1

Krause Fund Research

Spring 2023

Crown Castle Inc. (NYSE:CCI)

Real Estate

Current Price: $129.81

Target Price: $142 - 148

Investment Thesis

HOLD

Company Description

We recommend a HOLD rating as Crown Castle Inc. will experience predicable growth in the near-

term fueled by long-term lease contracts and the expanding need for 5G technology. However, long-

term performance will remain modest due to the firm’s concentrated revenue and limited expansion

of communications infrastructure.

Drivers of Thesis

Revenue & Expense Predictability: Relative to non-communications infrastructure

REITs, CCI has a large portion of revenue and expenses that originate from long-term

leases on land and towers.

1

These leases offer consistent cash in- and out-flows for the

firm, which allows CCI to operate more efficiently and without large income statement or

cash flow statement fluctuations.

Growth in 5G & C-Band Technology: Within three years, 5G is expected to overtake its

predecessor by reaching five billion subscriptions.

2

This growth and further maturity of

US wireless networks will allow CCI to maintain steady revenues. Our model has reflected

this forecast by maintaining a strong 8.53% growth of site rental revenues until 2025.

Demand for Fiber Optics: As the US continues to become more densely populated, the

implementation of fiber optic cables is expected to grow steadily.

3

Assumptions in our

revenue decomposition reflect this growth by a 2% increase in miles of fiber and a 5.04%

increase in fiber rental revenues.

Risks of Thesis

Concentrated Revenue: CCI is heavily dependent on a small number of tenants, most

notably AT&T, Verizon Wireless, and T-Mobile.

1

While these are established firms, any

loss of a tenant due to a change in financial performance or business model could

dramatically impact CCI.

Slow Expansion of Towers: While CCI’s portfolio is growing, the firm’s increase in the

number of towers has remained minimal; 40,000 total towers have been reported since

first publicized in 2014. Forecasted years’ revenue have suffered as a result of this stagnant

growth.

Significant Near-Term Debt Maturity: CCI’s capital structure consists of 33% debt, two

billion dollars of which is maturing in 2023.

1

If a recession causes reduced income growth,

CCI risks default.

Analysts

Elliott Martin | elliott-mart[email protected]

Luke Navarrete | luke

-

navarrete@uiowa.edu

At a Glance

CCI is a REIT that owns, operates, and

leases communications infrastructure to

telecommunication companies. The firm

focuses on two primary income-generating

areas, towers and fiber (including small cells

and fiber optic services). In total, CCI’s

communications infrastructure portfolio

consists of 40,000 towers (including rooftop

solutions) and 80,000 miles of fiber optic

cables.

1

CCI vs. S&P500

Valuation Methods

DCF, EP: $146

DDM $143

Historical Performance

52-Week Low: $121.71

52-Week High: $199.97

YTD Return -9.29%

TTM Return -31.66%

Firm Overview

Market Capitalization: 57.062B

2022 Revenue: 6.986B

2023E Revenue: 7.741B

2022 FFO: 3.379B

2023E FFO: $3.663B

Dividend Yield: 4.76%

Key Ratios

Current Ratio: 0.45

Dividend Payout Ratio: 1.55

ROE: 0.20

4/18/2023

2

Company Description

Crown Castle Inc. is a well-established REIT headquartered in

Houston, TX. Its offices located throughout the United States

employ approximately 5,000 employees. CCI specializes in

wireless solutions including towers & small cells and fiber

solutions for private networks and metro area coverage.

5

The firm operates its portfolio of towers, small cells, and fiber

optics almost exclusively in the United States, with the

exception of Puerto Rico, a US territory. Its infrastructure is

dispersed throughout the US but is focused on highly populated

areas such as New York and Los Angeles.

5

At the corporate level, CCI’s executives focus on maximizing

profits from existing infrastructure, expanding their portfolio

through construction and acquisitions, and generating

shareholder value through dividends.

1

Revenue Analysis and Decomposition

Crown Castle Inc.’s revenue is generated within two major

segments: site rental revenue and services & other revenues.

Site rental revenue, which has comprised between 60% and

75% of total revenues, involves two components, towers, and

fiber.

1, 4

CCI owns and leases land, constructs a tower, and then

leases space to wireless network providers like AT&T, T-

Mobile, and Verizon Wireless via long-term contracts. Fiber

site rental revenues are generated in a similar way but are used

to transmit data through densely populated areas.

4

Fiber

revenues have historically comprised between 5% and 31% of

revenues.

5

Between 2014 and 2018, the proportion that fiber

site rental revenues made up of total revenue increased

exponentially and have come to a steady state of about 28%, a

trend we continued through all ten forecasted years.

5

Furthermore, total site rental revenues have made up between

81% and 91% of total revenues since 2014. To reflect this

growth, total site rental revenues comprise between 90% and

93% of total revenues in forecasted years.

The amount of revenue generated from site rentals depends on

the amount of infrastructure CCI has access to, the revenue per

tower, and revenue per mile of fiber the firm can generate. Even

though CCI’s number of towers has remained at 40,000 since

2014, CCI has been able to extract more revenue per tower in

prior years. Between 2020 and 2022, revenue per tower

increased an average of 8.53% per year. While an increase in

revenue per tower is likely to continue, we do not believe CCI

can sustain the 13.62% increase in revenue per tower they

generated last fiscal year and instead forecasted the average.

We also believe CCI will reach a ceiling in which they cannot

extract any more revenue out of each tower. Our model reflects

these assumptions by maintaining an 8.53% growth in revenue

per tower until 2025E. Subsequently, this growth steadily

decreases to its steady state value in 2032E of a more

sustainable 2.03%.

5

Fiber is another component to site rental revenues. Unlike the

number of towers, the miles of fiber CCI has access to has

grown substantially since it was first reported in 2015.

5

While

2016-2019 growth in the miles of fiber was significant, the past

three years have only had some growth at an average of 2% per

year.

5

While the use of fiber is continuing to increase, we

anticipate CCI’s growth in miles of fiber will more closely

match recent years. Therefore, we have applied an annual

growth rate of 2% per year to the miles of fiber in CCI’s

portfolio. Unlike total miles of fiber, the revenue CCI has

generated per mile of fiber has been highly volatile, sometimes

decreasing by 16% and increasing by 92%. Between 2020 and

2022, CCI has been able to maintain a relatively steady growth

in revenue per fiber at an average of 3%. To reflect this, our

model’s revenue per mile of fiber increases at the same 3% until

CCI reaches its steady state in 2032E.

Services and other revenues are generated by providing site

development services and installation services to new and

existing customers.

4

Historically, services & other revenues

have consisted between 9% and 19% of total revenues, a

proportion which has been declining steadily since 2014.

5

Services & other revenues’ tower segment comprises almost all

the total services & other revenues that CCI generates, with the

fiber segment making up less than 1% at times. Our model

reflects both of these trends by continuing to decline the portion

of services and other revenues that makes up total revenue from

9% in 2023E to 7% in 2032E.

Given the nature of the industry and its barriers to entry,

revenue is concentrated to few tenants. Last fiscal year, CCI’s

revenue was primarily earned from T-Mobile, AT&T, and

Verizon, which made up 34%, 21%, and 18% of total site rental

revenues, respectively.

5

The remaining 27% was comprised of

other tenants.

Company Analysis

Source: 2022 Form 10-k, Microsoft Excel

3

If any tenant was to change their business model or decide to

end a significant portion of the leases with CCI, overall revenue

would drop substantially. While this is a material risk, CCI’s

geographically-diversified portfolio will help maintain long-

term partners. Therefore, we have not included any expected

decrease in revenue due to the loss of a major tenant for our

model.

Cost of Operations

Crown Castle Inc.’s cost of operations consists of the same two

components of revenue: site rental costs and services & other

costs. Site rental costs consist of expenses associated with

ground leases, access to fiber, property taxes, maintenance,

wages, and utilities.

5

Approximately 50% of site rental costs are

related to ground leases. Given that ground leases are highly

predictable, overall site rental costs have not increased

dramatically since 2013. These costs also make up about 25%

of total site rental revenues, a figure we maintained in all

forecasted years.

Services & other costs are related to expenses incurred while

performing site development services and installation services

and are largely compromised of payments to contractors and

other third-party service providers.

5

Due to the limited growth

in services & other revenues, services & other expenses have

remained steady. In the prior 10 years, services & other

expenses have been between 56% and 86% of total services &

other revenues. Our model reflects this by forecasting services

& other expenses as 65.64% of total services and other

revenues.

Profit Margin

The firm’s overall operating profit margin has been between

65% and 76% since 2012. In 2021 and 2022, operating profit

margin fell 6% and 3%, respectively.

We expect profit margin to continue to decline, though not

dramatically. Our forecasts reflect this in that our expected

profit margin begins at 65% and gradually declines to a steady

state of 57% in 2032E.

Capital Expenditures

Firm-wide capital expenditures increased in 2022 due to the

expansion of CCI’s fiber network. In 2022, CCI had $1.2 billion

in discretionary capital expenditures and spent a total of $1.3

billion including sustaining capital expenditures. This was

primarily used for building new communications infrastructure

and advancing current infrastructure.

5

By developing current

towers in their portfolio, CCI is able to increase the average

number of tenants each tower can occupy, a key initiative to

improving the amount of revenue generated per tower.

Management has indicated that the firm’s capital expenditures

are based on a percentage of net revenues. In the prior three

years, capital expenditures have comprised an average of 22%

of net revenues. Management also believes that capital

expenditures will remain high as the firm expands on the

network of nation-wide small cells.

5

As a result, our model’s

yearly capital expenditures were on average 22% of net

revenues.

Capital Structure

CCI attempts to achieve a capital structure that promotes value

for stockholders and a strong WACC. Management targets a

leverage ratio equal to five times adjusted EBITDA. Currently,

CCI consists of 33% debt and 67% equity. In this estimate,

market value of equity is equal to the firm’s market

capitalization. The market value of debt was approximated by

aggregating the book values of short-term and long-term debt

including current portions and the present value of operating

leases.

A significant portion of CCI’s debt is maturing this fiscal year.

Current maturities of debt & other obligations for 2023E are

$2.06 billion, the highest number the firm has seen in its

history.

5

Furthermore, large amounts of debt will also reach

maturity in 2025E and 2026E.

5

Our model reflects this maturity

schedule and evenly distributes the “thereafter” amount equally

to subsequent years.

Source: 2022 Form 10-

k

c

Source: 2022 Form 10-k

4

While CCI has a substantial amount of debt, principal and

interest payments are relatively predictable given most of the

firm’s debt is fixed rate. Floating rate debt can make firms

vulnerable, especially given the current interest rate

environment. Even though CCI has floating rate debt, their

limited exposure is a strong advantage. Furthermore, CCI has

no variable rate debt that matures after 2026.

Infrastructure REITS as an Industry

A real estate investment trust (REIT) is a publicly or privately

traded company that owns, operates, and/or finances income-

generating real assets and follows strict procedures to maintain

REIT status. The income produced by a REIT is not taxed until

it is passed to its shareholders as dividends—at least 90% of

taxable income must be distributed to shareholders each year.

6

REITs must also have a minimum of 75% of their assets in real

estate, cash, or treasuries and generate a minimum of 75% of

gross income from rental income, mortgage interest, or real

asset dispositions. Most REITs specialize in a specific class of

real estate.

1

Infrastructure REITs, or Real Estate Investment Trusts, are a

type of investment vehicle that allows individuals to invest in

infrastructure assets through the stock market. REITs pool

together capital from multiple investors and use it to purchase

and manage income-generating infrastructure assets, such as

toll roads, airports, ports, communication towers, and

pipelines.

6

Infrastructure REITs typically generate revenue by leasing their

infrastructure assets to tenants, such as transportation

companies, energy providers, and telecommunications firms.

They may also generate revenue through tolls, fees, and other

usage-based charges.

6

Investing in infrastructure REITs can provide investors with

exposure to the growing demand for infrastructure assets, which

is driven by population growth, urbanization, and the need for

upgraded and modernized infrastructure. Infrastructure REITs

can also offer attractive dividend yields, as they are required to

distribute at least 90% of their taxable income to shareholders

in the form of dividends.

Regulations

Real Estate Investment Trusts, or REITs, are regulated by the

Securities and Exchange Commission (SEC) in the United

States. REITs are required to comply with certain regulations to

maintain their status as a REIT, which allows them to avoid

paying federal income tax on their taxable income if they

distribute at least 90% of their taxable income to shareholders

as dividends.

6

The following are the key regulations that REITs must comply

with:

Income Requirements: At least 75% of a REIT's gross

income must be derived from real estate rents,

mortgage interest, or other real estate related activities,

such as the sale of properties. Additionally, at least

95% of a REIT's gross income must come from these

sources, as well as dividends, interest, and gains from

the sale of securities.

Ownership Requirements: A REIT must be owned by

at least 100 shareholders and no more than 50% of the

shares can be owned by five or fewer individuals or

entities.

Diversification Requirements: No more than 50% of a

REIT's assets can be invested in a single property or

real estate project. Additionally, a REIT must invest at

least 75% of its assets in real estate or real estate-

related assets.

Distribution Requirements: A REIT must distribute at

least 90% of its taxable income to shareholders

annually in the form of dividends.

Organizational Structure: A REIT must be structured

as a corporation, trust, or association.

These regulations are designed to ensure that REITs are

primarily invested in real estate and are distributing income to

shareholders, while also promoting diversification and

preventing concentrated ownership. By complying with these

regulations, REITs can maintain their tax benefits and provide

Industry Analysis

5

investors with a way to invest in real estate without directly

owning property.

Tenants

REITs own and operate income-generating real estate assets,

such as office buildings, shopping centers, apartment buildings

and industrial facilities. As a result, the tenants of REITs can

vary widely depending on the type of real estate owned by the

REIT.

For infrastructure REITS, tenants typically sign long-term

leases ranging from 5 to 15 years or more to use a firm’s

wireless communications infrastructure. These leases provide

infrastructure REITS with a stable source of rental income,

which is a key driver of financial performance.

9

In addition to

wireless carriers, infrastructure REITS also lease space on its

towers to other customers, such as government agencies, utility

companies, and Internet of Things (IoT) providers.

The tenants of infrastructure REITs can vary depending on the

type of infrastructure asset owned by the REIT. For cell tower

REITs, the primary tenants are wireless carriers who lease

space on the towers to transmit wireless signals to their

customers. In addition to wireless carriers, cell tower REITs

may also lease space to other companies that provide wireless

services, such as cable providers or internet service providers.

Data center REITs lease space to a wide range of tenants,

including technology companies, financial institutions,

healthcare organizations, and government agencies. These

tenants use data centers for secure storage and processing of

digital data.

9

Infrastructure REITs like CCI tend to have long-term leases

with their tenants, providing a stable source of rental income

and reducing the risk of vacancy or turnover.

Barriers to Entry

The infrastructure REIT industry can be challenging to enter

due to significant barriers that exist. One of the primary barriers

is the high capital requirements needed to acquire, develop, and

operate infrastructure assets such as toll roads, airports, and data

centers.

These assets require large financial investments, which can

limit the number of new players entering the market.

Additionally, infrastructure assets are often heavily regulated

by federal, state, and local governments, which can create

complex and time-consuming regulatory hurdles for new

entrants. Another potential barrier is the limited availability of

suitable infrastructure assets for acquisition or development,

which can further restrict new players' entry into the market.

9

These barriers make it challenging for new entrants to establish

a foothold in the infrastructure REIT industry. The high capital

requirements, regulatory hurdles, and a limited supply of

infrastructure assets can create significant obstacles for new

players looking to enter the market. As a result, established

infrastructure REITs like CCI have a competitive advantage

over new entrants due to their financial resources, regulatory

expertise, and access to a broader range of infrastructure

assets.

10

Growth in 5G

The development and rollout of 5G technology is transforming

the telecommunications industry, offering faster and more

reliable connectivity that can support a wide range of emerging

technologies. This expansion is driving significant growth

opportunities for infrastructure REITs that own cell towers and

other wireless infrastructure assets.

2

The deployment of 5G networks requires a denser network of

small cell sites to provide faster and more reliable connectivity.

As a result, wireless carriers are expanding their infrastructure

to include more small cell sites to support their 5G networks.

This trend is creating an opportunity for infrastructure REITs

that own cell towers and other wireless infrastructure assets to

lease their assets to wireless carriers, providing a stable source

of rental income.

9

Furthermore, some infrastructure REITs such as CCI are

investing in small cell sites themselves to capture a higher

return on investment compared to traditional cell towers. By

investing in small cell sites, these REITs can generate higher

revenue per square foot compared to traditional cell towers,

while also positioning themselves to benefit from the growth of

5G networks.

9

Additionally, the growth of 5G technology is not limited to

wireless infrastructure. The increase in data usage and demand

for faster processing speeds is also driving growth in data center

infrastructure, which can support the processing and storage

needs of 5G networks. This presents an opportunity for data

center REITs to expand their offerings and attract new tenants.

2

Overall, the growth potential for CCI in the 5G market is

significant, and many REITs are actively pursuing these

opportunities to grow their businesses. By investing in and

expanding their wireless and data center infrastructure assets,

the firm can position themselves to benefit from the ongoing

development and expansion of 5G technology.

C-Band Technology

C-Band technology is a type of wireless spectrum that is used

for satellite communication and has recently gained attention in

the telecommunications industry due to its potential for 5G

deployment. In February 2021, the Federal Communications

Commission (FCC) held an auction for C-Band spectrum,

which generated over $80 billion in revenue from wireless

carriers. This auction has created new opportunities for

infrastructure REITs that own wireless infrastructure assets,

such as cell towers and fiber optic networks.

11

Wireless carriers require wireless infrastructure assets to deploy

C-Band technology for 5G networks, which are expected to

6

provide faster and more reliable connectivity. As a result,

infrastructure REITs that own cell towers and fiber optic

networks are well-positioned to benefit from the deployment of

C-Band technology. These REITs can lease their assets to

wireless carriers, providing a stable source of rental income.

3

Additionally, the deployment of C-Band technology is expected

to increase demand for fiber optic networks, which can provide

the necessary connectivity for the transmission of data between

cell towers and data centers. This presents an opportunity for

data center REITs to expand their offerings and attract new

tenants. By investing in and expanding their wireless and fiber

optic infrastructure assets, infrastructure REITs can position

themselves to benefit from the ongoing deployment of C-Band

technology.

11

The deployment of C-Band technology is expected to drive

significant growth opportunities for CCI. By leasing their assets

to wireless carriers and investing in the expansion of their

infrastructure assets, the firm can position itself to benefit from

the ongoing development and deployment of C-Band

technology.

Overview

Crown Castle operates in the highly competitive wireless tower

industry and faces competition from companies such as

American Tower (AMT), SBA Communications (SBAC) and

Uniti Group Inc. (UNIT). Despite the competition, these four

companies dominate the infrastructure REIT industry, which

includes wireless towers and other communication

infrastructure. The industry is subject to regulatory constraints

that could impact growth and profitability. Crown Castle

differentiates itself from its competitors through a strong focus

on customer service, strategic investments in small cell

technology, and diversified revenue streams.

American Tower Corporation (AMT)

American Tower, one of the largest global REITs, is a leading

independent owner, operator, and developer of multitenant

communications real estate, with a portfolio of approximately

225,000 communications sites, including more than 43,000

properties in the United States and Canada and more than

181,000 properties internationally. The company's focus on

providing reliable wireless infrastructure solutions has made it

an essential partner to wireless carriers, broadcasters, and

government agencies. AMT has a diversified customer base that

includes leading wireless carriers in various countries,

providing the company with steady revenue streams.

Additionally, the company has been expanding into new

markets, making strategic acquisitions, and investing in new

technologies to meet the evolving needs of its customers.

SBA Communication (SBAC)

SBA Communications Corporation (SBAC) is a wireless

infrastructure company that owns and operates a portfolio of

cell towers and small cells primarily in the US. The company

has been expanding its operations internationally, with a

growing presence in Central and South America, Europe, and

Africa. SBAC's focus on owning and operating wireless

infrastructure and investing in new technologies, such as fiber

assets, has positioned it as a leader in the wireless infrastructure

industry. The company's strong relationships with its customers

and its focus on providing reliable connectivity solutions have

helped it maintain a competitive edge in the market.

Uniti Group, Inc. (UNIT)

Uniti Group Inc. (UNIT) is a diversified communication

infrastructure company that owns and operates a portfolio of

fiber and copper-based networks, cell towers, and small cells.

The company's focus on providing connectivity solutions to

wireless carriers, cable companies, and data center operators

has helped it establish a diversified customer base. In recent

years, the company has been undergoing a strategic

transformation, focusing on deleveraging and simplifying its

business. This has included divesting some non-core assets and

streamlining its operations. The company's focus on

deleveraging and strengthening its balance sheet has been a key

priority, allowing it to pursue growth opportunities in the future.

Crown Castle’s Competitive Advantage

Crown Castle International Inc. has a competitive advantage in

the infrastructure REIT industry, with the second highest

revenue and the second largest portfolio of towers among the

four companies, indicating its strong market position.

Additionally, the company has the second highest operating

margin, which suggests it is effectively managing costs and

generating profits. CCI also has the highest dividend yield

among the four companies, which may attract income investors

and contribute to shareholder returns. However, the company

may need to address its lower ROA compared to Uniti Group,

Inc., indicating that UNIT is more efficient in generating profits

from its assets. Moreover, American Tower Corporation has a

higher market cap than Crown Castle International Inc., which

means that American Tower Corporation is valued more highly

by the market. Uniti Group Inc. has the highest forward

dividend and yield, indicating that Uniti Group Inc. is

prioritizing shareholder returns through dividend payments.

However, it is important to note that Uniti Group Inc. has a

Competitive Analysis

7

much lower market cap and a smaller portfolio of towers than

Crown Castle International Inc., which may indicate a lower

overall strength and value of the company.

In summary, Crown Castle has a large market share in

comparison to AMT, SBAC, and UNIT because of the number

of cell towers and small cell sites that it owns and operates.

Crown Castle has a more established and extensive network,

which can make it a more attractive partner for wireless carriers

and other companies that need access to telecommunications

infrastructure. Crown Castle has a stable business model with

long-term contracts that provide predictable cash flows. This

can make it a more appealing investment for investors who are

looking for steady, reliable returns over the long term.

Additionally, Crown Castle has a reputation for being a well-

run company with a strong management team and a focus on

growth and innovation. This can inspire confidence in investors

and contribute to a positive perception of the company.

Capitalization Rates

The capitalization rate (cap rate) is a fundamental measure of

risk in real estate.

12

Cap rates tend to rise with interest rates and

borrowing costs, although not as dramatically. Higher cap rates

are associated with a greater return but also indicate greater risk

due to falling market values of properties. A forecasted

decrease or stability in cap rates typically indicates a steady

economy and property market values, while rising cap rates

reduce confidence in commercial real estate markets.

Cap rates are also driven by demand for a specific sector, and

historical data shows that they tend to trend downward over

time as the value of properties increase. However, cap rates

have expanded slightly during the first half of 2022 due to rising

bond yields. The 6–12-month outlook suggests that cap rates

will increase moderately across all sectors, with office

investments predicted to be especially poor due to the work-

from-home trend creating high vacancy rates among office

properties. Industrial investments are expected to remain strong

with only a minimal increase in cap rates.

13

In general, cap rates are important to infrastructure REITs like

Crown Castle International because they provide a measure of

risk and return associated with the underlying real estate assets.

A rising cap rate may indicate a decrease in the value of the

company's assets, which could negatively impact on its

financial performance. Conversely, a stable or decreasing cap

rate may indicate a steady or growing market for Crown Castle's

assets. Therefore, monitoring cap rates is an important part of

assessing the performance and potential of Crown Castle's

investments.

14

Inflation

Inflation can be beneficial for real estate investors since it tends

to drive up rents, but the key to its effectiveness lies in

landlords' ability to raise rents in markets with low vacancy

rates. Historical data shows that real estate has been a strong

inflation hedge, with US REITs' aggregate dividend growth

outpacing inflation in all but one year between 2004 and 2018.

15

In June 2022, the CPI grew by 9.1% year over year, which was

the largest increase in 40 years.

16

If REIT dividend growth

continues to outpace inflation as it has historically, dividend

yields should continue to grow by significant amounts

15

.

However, it's worth noting that rising inflation can also lead to

higher interest rates, which could increase borrowing costs for

infrastructure REITs like Crown Castle International and

reduce their profitability.

Looking ahead, inflation is expected to decrease substantially

in 2023 to around the 3% level, driven by the Fed's

determination to raise rates until "the job is done". While this

may reduce the benefits of inflation for real estate investors, it

could also indicate a more stable economic environment, which

could be positive for infrastructure REITs like Crown Castle

International. It's important for investors to monitor inflation

Economic Analysis

8

trends and their potential impact on the real estate market when

evaluating infrastructure REITs.

15

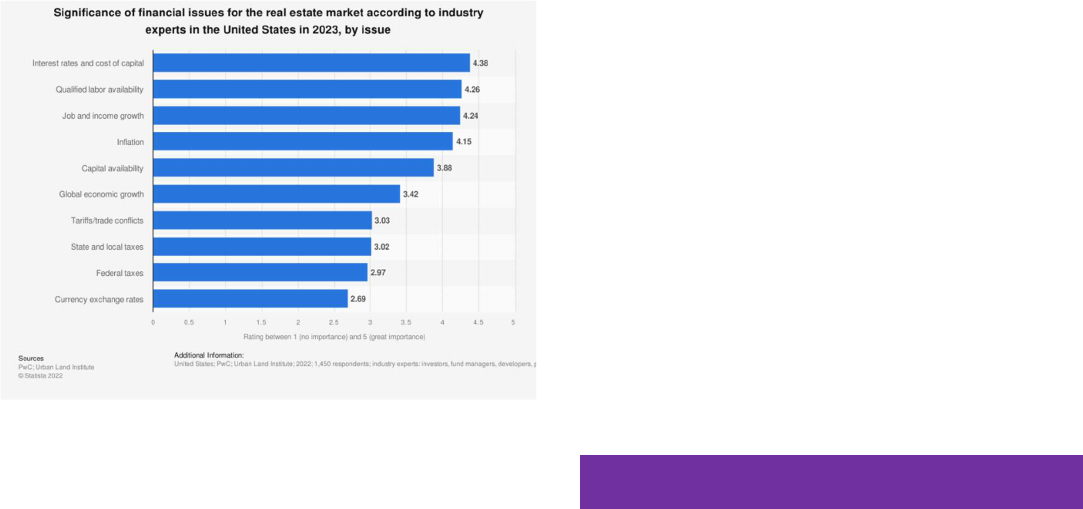

Interest Rates

This year is expected to be challenging for commercial real

estate due to high interest rates and a possible recession.

17

Even

though inflation has decreased slightly, it remains at over 7%,

prompting the Federal Reserve to continue raising interest rates

until inflation is closer to its target of 2%.

18

While real estate is

generally attractive during times of high inflation, rising interest

rates can lead to a decline in property values as tighter financial

conditions dampen economic activity and demand for real

estate.

10

The impact of rising interest rates on real estate prices is mainly

because of buyers who use leverage. As interest rates increase,

so do monthly payments, leading to a decrease in property

valuations.

17

However, historical data indicates that even during

periods of high interest rates, real estate prices tend to continue

growing, although at a slightly slower pace.

18

Infrastructure REITs like Crown Castle International may be

affected by rising interest rates, as it could lead to a decrease in

the value of their real estate assets. As such, closely monitoring

interest rates is crucial in assessing the performance and

potential of infrastructure REIT investments.

10

Vacancy Rates

Vacancy rates are a crucial metric in the real estate market as

they indicate the availability of rental properties and the level

of demand for them. High vacancy rates suggest an oversupply

of rental properties with low demand, resulting in lower rental

prices and difficulties for landlords to find tenants. Conversely,

low vacancy rates signal a tight market with high demand and

rising rental prices.

20

Vacancy rates can be influenced by various factors such as

economic conditions, population growth, job market, and

housing supply.

21

They vary across asset classes, locations, and

price ranges. For instance, most real estate investors in

metropolitan areas aim for a vacancy rate of 2-4%, while those

in rural areas can expect higher average rates.

Historical data shows that vacancy rates tend to decrease during

a strong economy with low unemployment rates and increasing

demand for rental properties. However, during economic

downturns, vacancy rates tend to increase as people lose their

jobs and can no longer afford rent.

22

Looking ahead, vacancy rates are predicted to increase as the

US economy moves towards a recession. Despite signs of

economic recovery from the COVID-19 pandemic, rising

inflation and expected interest rate hikes by the Federal Reserve

are expected to drive vacancy rates higher.

20

Using

unemployment rates as a main indicator, we predict that

unemployment rates will rise from 3.5% to 5% in the next 6

months, causing the national vacancy rate to increase from

6.0% to 8%. In the long term, as the economy stabilizes,

inflation lowers, and interest rates settle, vacancy rates are

expected to lower to around 5%.

22

Capital Markets Outlook

The real estate investment trust (REIT) industry has historically

outperformed the broader market over various time horizons,

including in 2021. However, the potential recession looming

over the market has resulted in REIT values dropping more than

the S&P, with equity REITs losing 27.46% in value compared

to the S&P's 19.44% loss in 2022.

23

Despite the current market downturn, it may be a fair time to

invest in REITs. Historically, REITs have performed well

following the easing of the Federal Reserve's interest rate hikes,

and with the consensus among economists being that the

interest rate hike stoppage will occur in 2023, the REIT market

could see an increase in demand and outperform the broader

market.

24

Additionally, REITs often offer appealing dividend

yields, averaging around 4.3%, which could provide positive

cash flow for investors during a recessionary environment.

In addition, infrastructure REITs may offer some inflation

protection, as the value of the underlying assets and cash flows

may increase with inflation. This can be particularly appealing

for long-term investors who are looking for investments that

can help them maintain purchasing power over time.

12

Weighted Average Cost of Capital (WACC)

To estimate CCI’s weighted average cost of capital (WACC),

we began with determining the firm’s cost of equity by utilizing

the capital asset pricing model (CAPM). Given that the current

yield curve is inverted, and 10 years provides a time horizon

identical to the cash flows our model is discounting, we used a

risk-free rate equal to the 10Y treasury note.

7

For our beta,

Valuation Analysis

9

which scales the equity market risk premium to appropriately

reflect the return needed for to the stock’s level of risk, we

calculated the average of the two-, three-, four-, and five-year

weekly beta using the S&P 500 as the relative index.

7

We

believe that multiple time lengths and weekly returns capture

performance better because our average considered a high

number of data points. Lastly, to estimate the equity risk

premium, we utilized the S&P 500’s geometric average return

from 1928-2020. This substantial time horizon is important

because it includes many economic cycles. Furthermore, a

geometric average was chosen because its counterpart, an

arithmetic average, tends to overstate return. After scaling the

equity market risk premium by CCI’s risk relative to the S&P

500 and adding the risk-free rate, we calculated a cost of equity

of 6.79%.

While the cost of debt is the risk-free rate plus a premium for

default risk, the latter is difficult to determine. Instead, to

estimate overall cost of debt, we began by determining a pre-

tax cost of debt by using the yield-to-maturity on a 30Y

corporate bond. This yield, which was 5.20%, encompasses the

risk-free rate and an implied default risk premium of 1.73%.

Then, to capture the tax implications of the interest associated

with debt, we multiplied the pre-tax cost of debt by our average

marginal tax rate from the prior five years, 1.68%. We chose

these particular years because they had the steadiest marginal

tax rates, which we believe will accurately represent CCI’s

future marginal rates. After applying the tax savings, our after-

tax cost of debt was 5.11%.

The market value of equity was estimated by CCI’s current

market capitalization, total shares outstanding multiplied by its

current stock price. Due to the difficulty of calculating the true

market value of debt, we approximated the value by totaling the

book value of CCI’s debt including short-term debt (accounts

payable), current portion of long-term debt, long-term debt, and

the present value of operating leases. Our model estimated a

$56.2 billion market value of equity and a $28.2 billion dollar

value of debt. The subsequent weights for equity and debt were

66.59% and 33.41%, respectively. After multiplying the cost of

debt and cost of equity by their respective weights, we

determined WACC to be 6.23%.

Discount Cash Flow (DCF) & Economic Profit (EP) Models

Our DCF and EP models both yielded a price of $146.70 per

share by discounting ten years of free cash flow and economic

profit, respectively. A ten-year time horizon will achieve the

best results because we believe it will take nine to ten years for

CCI to reach its steady state. Although the firm is well-

established, we believe growth will continue until 2032E with

new technologies like 5G and C-Band.

Our DCF model estimated a continuing value (CV) of $122.4

billion. A key metric in estimating this value is the CV growth

of NOPLAT. Since 2017, CCI has experienced actual NOPLAT

growth between 4% and 20%. However, our estimated

NOPLAT between 2023E and 2032E ranges from 2.91% to

11%, with growth in NOPLAT declining to its minimum value

in 2032E. We believe this lower growth is more sustainable and

offers a conservative stock price. With our estimated NOPLAT

growth in 2032E of 2.91%, we believe CCI can sustain a

slightly lower 2.75% CV growth in subsequent years. Our

economic profit utilized the same CV growth of NOPLAT and

estimated CCI’s CV to be $86.7 billion.

After discounting each year’s free cash flow & economic profit

and each model’s respective continuing value with enterprise-

wide discount rates, we determined that current CCI shares are

worth an estimated $146 after taking into account the time

passed since December 31, 2022.

Dividend Discount Model (DDM)

Dividends are a key reason many investors hold stock but are

even more valuable to REIT investors due to payout

regulations. Our model utilized a 2.75% growth in EPS. We

believe this amount is sustainable because our income

statement forecasts yield a 3.32% growth in EPS in its final

year. To remain conservative, we reduced this number by 57

basis points. After discounting each year’s estimated dividend

per share and our future stock price estimation by the cost of

equity, we determined an intrinsic value of $143 after

considering the time passed since last FYE.

Relative Valuation Models

While we conducted a relative valuation analysis, we do not

believe this accurately represents CCI’s stock price. After

taking an average of competitors’ average P/E and P/AFFO and

applying it to CCI’s estimated EPS and AFFO, we determined

implied relative values between $161 and $222. While relative

valuation is a strong method in some cases, infrastructure

REITS are each highly unique and, as a result, have

significantly different ratios. SBA Communications

Corporation (SBAC), American Tower Corporation (AMT),

and Uniti Group Inc. (UNIT) are CCI’s closest competitors.

While AMT and CCI and the two largest firms, AMT’s market

capitalization is almost two times that of CCI’s because AMT’s

strategy is worldwide. Similarly, the next smallest, SBAC, is

about half the size of CCI. Given that each firm implements

different strategies, provides different services, and has

substantial differences in market capitalizations, their ratios are

different and cannot be applied to CCI with accuracy.

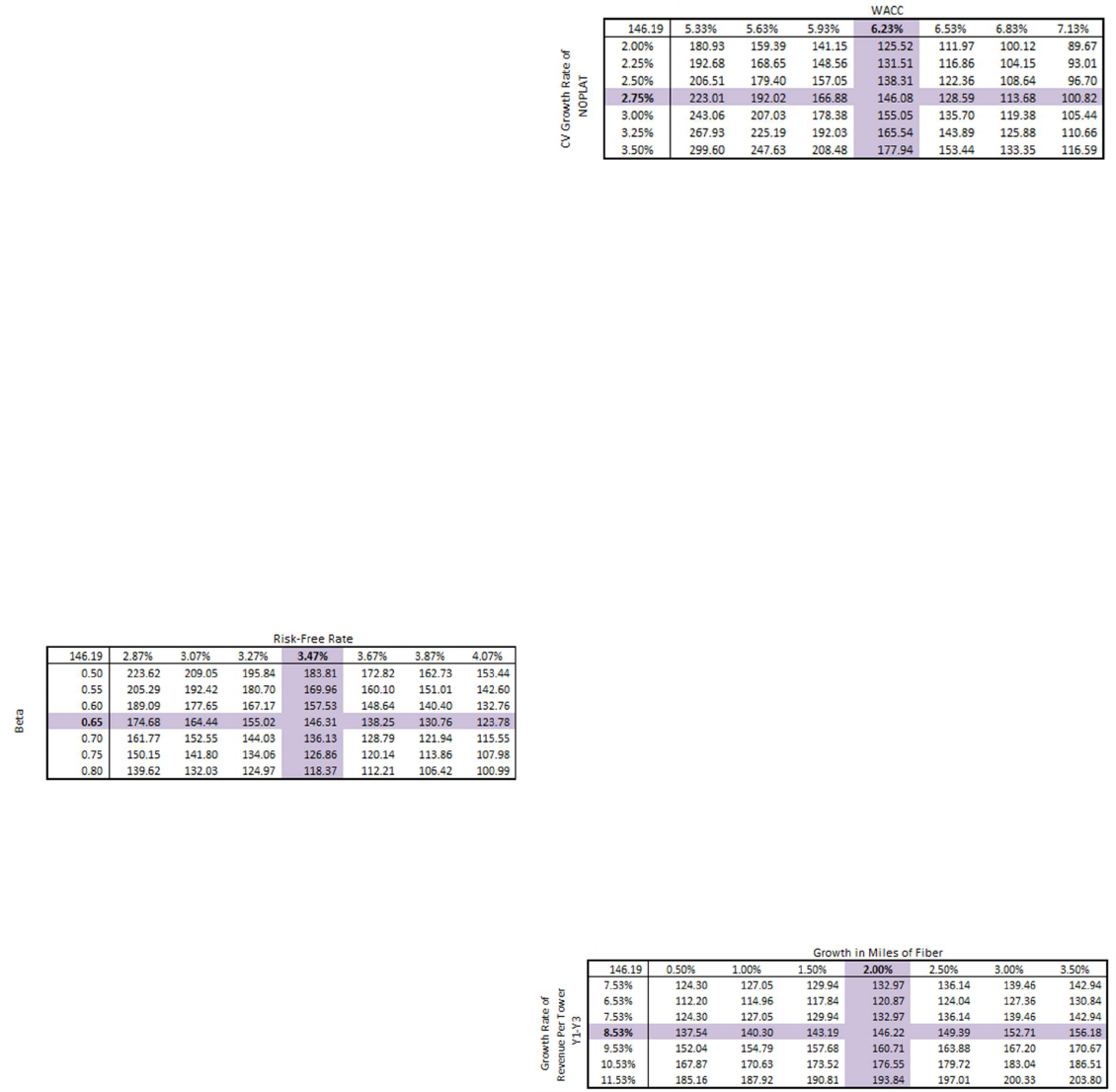

Overview

To better understand how changes in our model’s assumptions

would impact stock price estimation, we created sensitivity

tables. In particular, we focused on changes in both structural

assumptions and operating assumptions.

Sensitivity Analysis

10

Risk-Free Rate vs. Beta

Given that beta can be measured in many different ways, the

number of years, time period of returns such as weekly or

monthly, and the relative index used can all materially impact

the final result. Our beta was 0.65 and any increase or decrease

of .05 would change our DCF and EP implied intrinsic value by

$9-14. In particular, a beta of .60 and .70 would result in a price

of $158 and $136, respectively. Therefore, any small increase

in volatility relative to the market as a whole would drastically

impact the stock price.

Risk-free rates are consistently changing, which impacts the

premium investors demand for equity market risk and the value

added when determining cost of equity. The ten-year treasury

is at an all-time high and is up over 60bps since April of 2022.

If the ten-year treasury continues to remain high the cost of

equity for CCI will increase, too. Our data tables showed that a

mere 20bps increase in the risk-free rate would decrease our

DCF and EP value by almost $9.

Combined, a 20bps increase in the risk-free rate and 0.05

increase in CCI’s beta would yield a final estimated price of

$129. While our beta and risk-free rate are representative of

our forecasts and current market conditions, any small increase

in either variance could reduce the stock’s value.

WACC vs. CV Growth Rate of NOPLAT

In this scenario, we have tested how a change in the weighted

average cost of capital (WACC) and growth of NOPLAT would

impact the stock price. While we believe CCI’s WACC is

currently 6.23%, changes in variables such as the risk-free rate

described above will affect the overall result. Most notably, if

CCI cannot pay their upcoming debt, their credit rating will

most likely fall. This reduction in credit rating will increase

future cost of debt and therefore the firm’s overall WACC. If

CCI’s WACC were to increase 30bps, we estimate their stock

to be worth $129. Conversely, a decrease of 30bps to a WACC

of 5.93% would cause a more significant change and increase

our estimation to $167 per share.

The CV growth in NOPLAT is also important to understand

because it affects all years after 2032E. If CCI is not able to

maintain a profitable business model by failing to progress with

wireless technology, NOPLAT may increase by less than our

estimated 2.75%. However, even if their NOPLAT growth after

2023E fell 50bps, we estimate a value of $132 per share. Given

that this number is above the firm’s current trading price, the

CV growth in NOPLAT is not as significant as a change in

WACC.

Growth in Miles of Fiber vs. Growth Rate of Revenue Per

Tower Y1-Y3

While we predict revenue to grow 8.53% from 2023E to 2025E,

if we enter a recession in 2023, short-term revenue growth may

not be as strong. If growth were to fall one percentage point to

7.53%, we estimate the stock to be worth $132. While this is

still above its current trading price, a growth of 6.53% each year

yields a substantially lower price of $120. If we have a severe

recession, CCI’s response will dramatically impact the overall

share price. Conversely, if CCI continues to benefit from the

growth in 5G and C-Band technology or our economy is

stimulated again, overall share price will be much higher. If the

firm performs better than expected and instead earns 9.53% per

year, we estimate an overall price of $160.

One of CCI’s growing streams of site rental revenues is through

their deployment of fiber optics. While the firm has not focused

heavily on expanding their miles of fiber, the firm added an

additional 5,000 miles last year. We expect an average of 2%

per year until 2032E. If this estimate proves too conservative

and management focuses heavily on expanding their fiber optic

network or if fiber optics become even more mainstream, CCI’s

stock price will be heavily impacted. An increase of only one

percentage point to 3.00% each year yields a price of $152. This

is a significant change even though miles of fiber only increased

by such a small amount. Conversely, if CCI expands their

network even slower, we estimate only a small decrease in stock

price; a decrease from 2.00% to 0.50% per year yields an

overall price per share of $137. While this is a large decrease

from our target price, it is still more than what the firm currently

trades for in the market.

Site Rental Costs % of Site Rental Revenue vs. Services &

Other Costs % of Services & Other Revenues

Historically, site rental costs and services & other costs as a

percentage of their respective revenues have remained

relatively steady. However, if inflation is not continually

managed and costs increase, CCI’s stock price will be affected.

Currently, we estimate that site rental costs will be 25.47% of

site rental revenue. However, if this increases to 27.47%,

overall estimated stock price becomes $137 and still remains

above its current market value. Site rental costs could increase

11

to approximately 29.00% of total site rental revenues before our

estimated price becomes less than what it currently trades at.

CCI’s other main operating cost, services & other costs, show a

different story. These costs, which we estimate to be 65.64% its

revenue counterpart, could increase to 80.64% of services &

other revenues and still yield an estimated value of $140.

Therefore, site rental costs are much more impactful than

services & other costs.

12

Important Disclaimer

This report was created by students enrolled in the Applied

Equity Valuation class at the University of Iowa. The report was

originally created to offer an internal investment

recommendation for the University of Iowa Krause Fund and

its advisory board. The report also provides potential employers

and other interested parties with an example of the students’

skills, knowledge and abilities. Members of the Krause Fund

are not registered investment advisors, brokers or officially

licensed financial professionals. The investment advice

contained in this report does not represent an offer or

solicitation to buy or sell any of the securities mentioned.

Unless otherwise noted, the facts and figures included in this

report are from publicly available sources. This report is not a

complete compilation of data, and its accuracy is not

guaranteed. From time to time, the University of Iowa, its

faculty, staff, students, or the Krause Fund may hold a financial

interest in the companies mentioned in this report.

13

1. Crown Castle International Inc. (2021). 10-K for year

ending 12/31/2021. Inline XBRL Viewer. Retrieved

April 10, 2023, from

https://www.sec.gov/ix?doc=%2FArchives%2Fedgar

%2Fdata%2F1051470%2F000105147022000019%2

Fcci-20211231.htm.

2. Taylor, P. (2023). Topic: 5G. Statista. Retrieved

April 12, 2023, from

https://www.statista.com/topics/3447/5g/#topicOverv

iew.

3. Modor Intelligence. (n.d.). Fiber optic cable market

size & share analysis - industry research report -

growth trends. Fiber Optic Cable Market Size &

Share Analysis - Industry Research Report - Growth

Trends. Retrieved April 10, 2023, from

https://www.mordorintelligence.com/industry-

reports/fiber-optic-cable-market.

4. Cell towers, small cells, fiber: Crown Castle. Cell

Towers, Small Cells, Fiber | Crown Castle. (n.d.).

Retrieved April 12, 2023, from

https://www.crowncastle.com/infrastructure-

solutions/?level=3¢er=-105.61502%2C41.00679

5. Inc. (2022). 10k Fiscal Year Ending 2022. Inline

XBRL Viewer. Retrieved April 9, 2023, from

https://www.sec.gov/ix?doc=%2FArchives%2Fedgar

%2Fdata%2F1051470%2F000105147023000041%2

Fcci-20221231.htm.

6. SEC. (n.d.). Reits.pdf. SEC Emblem. Retrieved April

13, 2023, from https://www.sec.gov/file/reitspdf.

7. US Treasury yield curve. US Treasury Yield Curve.

(n.d.). Retrieved April 14, 2023, from

https://www.ustreasuryyieldcurve.com/.

8. Bloomberg. (n.d.). Bloomberg.com. Retrieved April

9, 2023, from https://www.bloomberg.com/.

9. Infrastructure reits. Infrastructure REITs | Investing

Tips, Data & Information | Nareit. (2023, April 10).

Retrieved April 14, 2023, from

https://www.reit.com/what-reit/reit-

sectors/infrastructure-reits.

10. 2021 outlook for reits and Commercial Real Estate:

Risk and Resilience. 2021 REIT Outlook |

Commercial Real Estate & the Economy | Nareit.

(n.d.). Retrieved April 13, 2023, from

https://www.reit.com/data-research/research/nareit-

research/2021-reit-outlook-economy-commercial-

real-estate.

11. Segan, S. (2022, May 16). What is C-band, and what

does it mean for the future of 5G? PCMAG.

Retrieved April 12, 2023, from

https://www.pcmag.com/news/what-is-c-band.

12. JP Morgan. (n.d.). Guide to the markets. Welcome.

Retrieved April 14, 2023, from

https://am.jpmorgan.com/us/en/asset-

management/adv/insights/market-insights/guide-to-

the-markets/.

13. CBRE. (n.d.). U.S. Cap Rate Survey H1 2022.

CBRE. Retrieved April 10, 2023, from

https://www.cbre.com/insights/reports/us-cap-rate-

survey-h1-2022.

14. JPMorgan Chase. (n.d.). Cap rates, explained:

JPMorgan Chase. Cap Rates, Explained | JPMorgan

Chase. Retrieved April 14, 2023, from

https://www.jpmorgan.com/commercial-

banking/insights/cap-rates-explained.

15. Greaves, B. (2022, August 29). Make the most of

global property in an environment of rising inflation.

STANLIB. Retrieved April 15, 2023, from

https://stanlib.com/2021/05/05/make-the-most-of-

global-property-in-an-environment-of-rising-

inflation/.

16. CBRE. (2023). U.S. real estate market outlook 2023 -

capital markets. CBRE. Retrieved April 13, 2023,

from https://www.cbre.com/insights/books/us-real-

estate-market-outlook-2023/capital-markets.

17. Market yield on U.S. Treasury securities at 10-year

constant maturity, quoted on an investment basis.

FRED. (2023, April 17). Retrieved April 17, 2023,

from https://fred.stlouisfed.org/series/DGS10.

18. U.S. real estate market outlook 2023 - capital

markets. CBRE. (2023). Retrieved April 11, 2023,

from https://www.cbre.com/insights/books/us-real-

estate-market-outlook-2023/capital-markets.

19. Spader, J. (2022, May 25). Homeowner and rental

vacancy rates declined during COVID-19 pandemic.

Census.gov. Retrieved April 14, 2023, from

https://www.census.gov/library/stories/2022/05/housi

ng-vacancy-rates-near-historic-lows.html.

20. Definitions and explanations - census.gov. (n.d.).

Retrieved April 13, 2023, from

https://www.census.gov/housing/hvs/definitions.pdf.

21. What explains the revival in job vacancies alongside

rising unemployment? Economics Observatory.

(2021, January 19). Retrieved April 14, 2023, from

https://www.economicsobservatory.com/data-pretty-

vacant-small-revival-job-openings.

22. DiLallo, M. (2022). REITs vs. stocks: What does the

data say? The Motley Fool. Retrieved April 15, 2023,

from https://www.fool.com/research/reits-vs-stocks/.

23. Why we see favorable entry points emerging for reits.

Cohen & Steers. (2023, January 5). Retrieved April

14, 2023, from

https://www.cohenandsteers.com/insights/why-we-

see-favorable-entry-points-emerging-for-reits/.

24. Understanding REIT sectors. S&P Global Homepage.

(n.d.). Retrieved April 11, 2023, from

https://www.spglobal.com/en/research-

insights/articles/understanding-reit-sectors.

References

14

25. Yahoo! (2023, April 18). S&P 500 (^GSPC)

historical data. Yahoo! Finance. Retrieved April 12,

2023, from

https://finance.yahoo.com/quote/%5EGSPC/history?

period1=1672531200&period2=1681776000&interva

l=1d&filter=history&frequency=1d&includeAdjusted

Close=true.

26. Yahoo! (2023, April 18). Crown Castle Inc. (CCI)

stock historical prices & data. Yahoo! Finance.

Retrieved April 13, 2023, from

https://finance.yahoo.com/quote/CCI/history?period1

=1650305980&period2=1681841980&interval=1d&f

ilter=history&frequency=1d&includeAdjustedClose=

true.

27. Investors. Crown Castle. (2023, April 5). Retrieved

April 15, 2023, from

https://investor.crowncastle.com/.

28. Finviz.com - stock screener. FINVIZ.com - Stock

Screener. (n.d.). Retrieved April 18, 2023, from

https://finviz.com/.

Crown Castle International

Revenue Decomposition

Fiscal Years Ending Dec. 31

2020

2021

2022

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

2031E

2032E

Revenue:

Towers - site rental revenues 3,497 3,804 4,322

4,691

5,091

5,525

5,885

6,240

6,585

6,883

7,126

7,306

7,454

Growth rate 3.19% 8.78% 13.62% 8.53% 8.53% 8.53% 6.53% 6.03% 5.53% 4.53% 3.53% 2.53% 2.03%

Number of towers 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000

Growth rate 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

Revenue per tower 0.0874 0.0951 0.1081 0.1173 0.1273 0.1381 0.1471 0.1560 0.1646 0.1721 0.1781 0.1827 0.1864

Growth rate 3.19% 8.78% 13.62% 8.53% 8.53% 8.53% 6.53% 6.03% 5.53% 4.53% 3.53% 2.53% 2.03%

Fiber - site rental revenues 1,823 1,915 1,967

2,065

2,167

2,274

2,387

2,506

2,630

2,760

2,897

3,041

3,192

Growth rate 6.98% 5.05% 2.72% 4.96% 4.96% 4.96% 4.96% 4.96% 4.96% 4.96% 4.96% 4.96% 4.96%

Miles of Fiber 80,000 80,000 85,000

86,700

88,434

90,203

92,007

93,847

95,724

97,638

99,591

101,583

103,615

Growth rate 0% 0% 6% 2% 2% 2% 2% 2% 2% 2% 2% 2% 2%

Revenue per mile of fiber 0.0228 0.0239 0.0231

0.0238

0.0245

0.0252

0.0259

0.0267

0.0275

0.0283

0.0291

0.0299

0.0308

Growth rate 7% 5% -3%

3%

3%

3%

3%

3%

3%

3%

3%

3%

3%

Totalsiterentalrevenues 5,320 5,719 6,289 6,755 7,257 7,799 8,272 8,746 9,215 9,643 10,023 10,347 10,646

Growth rate 4.46% 7.50% 9.97% 7.41% 7.44% 7.46% 6.07% 5.72% 5.36% 4.65% 3.94% 3.23% 2.89%

Towers - services and other reveneus 500 601 685

698 711 724 737 751 765 779 794 809

824

Growth rate -23.43% 20.20% 13.98% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86%

Services and other revenues per tower 0.0125 0.0150 0.0171 0.0174 0.0178 0.0181 0.0184 0.0188 0.0191 0.0195 0.0198 0.0202 0.0206

Growth rate -23.43% 20.20% 13.98% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86% 1.86%

Fiber - services and other revenues 20 20 12 19 19 19 20 20 20 21 21 22 22

Growth rate 17.65% 0.00% -40.00% 54.42% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00% 2.00%

Services and other revenues per mile of fiber 0.0003 0.0003 0.0001 0.0002 0.0002 0.0002 0.0002 0.0002 0.0002 0.0002 0.0002 0.0002 0.0002

Growth rate 17.65% 0.00% -43.53% 51.39% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Totalservicesandotherrevenues 520 621 697 716 730 743 757 771 786 800 815 830 846

Growth rate -22.39% 19.42% 12.24% 2.77% 1.87% 1.87% 1.87% 1.87% 1.87% 1.87% 1.87% 1.87% 1.87%

TotalRevenue 5,840 6,340 6,986 7,471 7,987 8,542 9,030 9,517 10,000 10,444 10,838 11,177 11,492

Growth rate 1.34% 8.56% 10.19% 6.95% 6.90% 6.95% 5.70% 5.40% 5.08% 4.43% 3.78% 3.13% 2.81%

Segment revenue as proportion of total revenue:

Towers-siterentalrevenues 60% 60% 62% 63% 64% 65% 65% 66% 66% 66% 66% 65% 65%

Fiber-siterentalrevenues 31% 30% 28% 28% 27% 27% 26% 26% 26% 26% 27% 27% 28%

Totalsiterentalrevenues 91% 90% 90% 90% 91% 91% 92% 92% 92% 92% 92% 93% 93%

Towers-servicesandotherreveneus 9% 9% 10% 9% 9% 8% 8% 8% 8% 7% 7% 7% 7%

Fiber-servicesandotherrevenues 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

Totalservicesandotherrevenues 9% 10% 10% 10% 9% 9% 8% 8% 8% 8% 8% 7% 7%

TotalRevenue 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

Crown Castle International

Income Statement

Fiscal Years Ending Dec. 31

2020

2021

2022

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

2031E

2032E

Net revenues:

Site rental revenues 5,320 5,719 6,289

6,755 7,257 7,799 8,272 8,746 9,215 9,643 10,023 10,347 10,646

Services & other revenues 520 621 697

716 730 743 757 771 786 800 815 830 846

Net revenues 5,840 6,340 6,986

7,471 7,987 8,542 9,030 9,517 10,000 10,444 10,838 11,177 11,492

Operating expenses:

Cost of operations

Site rental 1,521 1,554 1,602 1,721 1,849 1,987 2,107 2,228 2,347 2,456 2,553 2,636 2,712

Services and other 448 439 466 470 479 488 497 506 516 525 535 545 555

Selling, general & administrative 678 680 750 824 880 942 995 1,049 1,102 1,151 1,195 1,232 1,267

Asset write-down charges 74 21 34 28 28 28 28 28 28 28 28 28 28

Acquisition & integration costs 10 1 2 - - - - - - - - - -

Depreciation, amortization and accretion 1,608 1,644 1,707 1,781 1,765 1,764 1,777 1,801 1,835 1,877 1,925 1,978 2,034

Total operating expenses 4,339 4,339 4,561 4,824 5,001 5,208 5,405 5,612 5,828 6,038 6,236 6,419 6,595

Other operating expense (income) (362) - - - - - - - - - - - -

Operating income (loss) 1,863 2,001 2,425 2,648 2,986 3,334 3,625 3,905 4,172 4,406 4,602 4,759 4,897

Interest expense & amortization of deferred financing costs (689) (657) (699) (734) (690) (670) (640) (541) (1,372) (1,402) (1,433) (1,463) (1,492)

Gains (losses) on retirement of long-term obligations (95) (145) (28) - - - - - - - - - -

Interest income 2 1 3 0 5 1 0 5 10 5 4 4 4

Other income (expense) (5) (21) (10) - - - - - - - - - -

Income (loss) before income taxes 1,076 1,179 1,691 1,914 2,301 2,666 2,985 3,369 2,811 3,008 3,173 3,300 3,408

Provision (benefit) for income taxes 20 21 16 32 39 45 50 57 47 51 53 56 57

Income (loss) from continuing operations 1,056 1,158 1,675 1,882 2,263 2,621 2,935 3,313 2,763 2,958 3,120 3,244 3,350

Discontinued operations:

Income (loss) from discontinued operations, net of taxes - (62) - - - - - - - - - - -

Less: net income (loss) attributable to the noncontrolling interest - - - - - - - - - - - - -

Net income (loss) attributable to Crown Castle International Corp. stockholders 1,056 1,096 1,675 1,882 2,263 2,621 2,935 3,313 2,763 2,958 3,120 3,244 3,350

Dividends or distributions on preferred stock 57 - - - - - - - - - - - -

Net income (loss) attributable to Crown Castle International Corp. common stockholders 999 1,096 1,675 1,882 2,263 2,621 2,935 3,313 2,763 2,958 3,120 3,244 3,350

Net income (loss) 1,056 1,096 1,675 1,882 2,263 2,621 2,935 3,313 2,763 2,958 3,120 3,244 3,350

Other comprehensive income (loss):

Foreign currency translation adjustments 1 - (1) - - - - - - - - - -

Comprehensive income (loss) attributable to CCIC stockholders 1,057 1,096 1,674 1,882 2,263 2,621 2,935 3,313 2,763 2,958 3,120 3,244 3,350

Net income (loss) attributable to CCIC common stockholders, per common share:

Net income (loss) per common share - basic 2.36 2.54 3.87

4.34 5.21 6.03 6.75 7.62 6.36 6.80 7.18 7.46 7.71

Weighted-average common shares outstanding:

Basic 423 432 433 433 434 435 435 435 435 435 435 435 435

Year end shares outstanding:

Basic 431 432 433 434 435 435 435 435 435 435 435 435 435

Dividends/distributions declared per share:

Common stock 4.98 5.49 6.01 5.24 5.74 6.25 6.72 7.29 6.54 6.89 7.19 7.44 7.67

Crown Castle International

Balance Sheet

Fiscal Years Ending Dec. 31

2020

2021

2022

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

2031E

2032E

Assets

Current Assets:

Cash & cash equivalents 232 292 156

2,152 573 113 2,176 3,949 1,822 1,653 1,535 1,419

1,306

Restricted cash 144 169 166

171 176 181 186 191 197 202 208 214

220

Receivables, net 431 543 593

609 651 696 735 775 814 851 883 910

936

Prepaid expenses 95 105 102 118 126 135 143 150 158 165 171 177 182

Deferred income tax assets - - - - - - - - - - - - -

Other current assets 202 145 200 217 232 248 262 277 291 304 315 325 334

Total current assets 1,104 1,254 1,217 3,266 1,757 1,372 3,502 5,342 3,282 3,175 3,112 3,045 2,978

Deferred site rental receivables 1,408 1,588 1,954 1,922 2,064 2,218 2,353 2,488 2,621 2,743 2,851 2,943 3,028

Total gross property & equipment 25,965 27,206 28,478 30,120 31,876 33,754 35,739 37,831 40,029 42,325 44,707 47,164 49,690

Less: accumulated depreciation - property & equipment 10,803 11,937 13,071 14,852 16,618 18,382 20,159 21,961 23,796 25,673 27,598 29,576 31,610

Property & equipment, net 15,162 15,269 15,407 15,268 15,258 15,372 15,579 15,870 16,233 16,652 17,109 17,588 18,080

Operating lease right-of-use assets 6,464 6,682 6,526 6,467 6,463 6,511 6,599 6,722 6,876 7,053 7,247 7,450 7,658

Goodwill 10,078 10,078 10,085 10,085 10,085 10,085 10,085 10,085 10,085 10,085 10,085 10,085 10,085

Site rental contracts & tenant relationships, net 4,365 3,982 3,535 4,681 5,029 5,404 5,732 6,060 6,385 6,682 6,946 7,170 7,377

Other intangible assets, net 68 64 61 57 54 50 46 43 39 35 32 28 24

Deferred income tax assets - - - - - - - - - - - - -

Other assets, net 119 123 136 148 158 170 179 189 198 207 215 222 228

Total assets 38,768 39,040 38,921 41,895 40,869 41,183 44,077 46,799 45,720 46,633 47,596 48,531 49,459

Liabilities and Equity

Current liabilities:

Accounts payable 230 246 236 352 376 402 425 448 471 491 510 526 541

Accrued interest 199 182 183 192 180 175 167 141 358 366 374 382 390

Deferred revenues 704 776 736 759 813 881 939 1,003 1,068 1,117 1,174 1,205 1,226

Other accrued liabilities 378 401 407 458 490 524 554 584 614 641 665 686 705

Current maturities of debt & other obligations 129 72 819 2,060 831 593 2,771 4,548 2,416 2,416 2,416 2,416 2,416

Current portion of operating lease liabilities 329 349 350 332 332 335 339 345 353 362 372 383 393

Total current liabilities 1,969 2,026 2,731 4,153 3,022 2,910 5,195 7,070 5,279 5,394 5,512 5,598 5,671

Debt & other long-term obligations 19,151 20,557 20,910 21,699 22,000 22,421 22,874 23,391 23,963 24,553 25,143 25,715 26,283

Operating lease liabilities 5,808 6,031 5,881 6,135 6,131 6,177 6,260 6,377 6,523 6,691 6,875 7,067 7,265

Deferred income tax liabilities - - - - - - - - - - - - -

Other long-term liabilities 2,379 2,168 1,950 2,849 2,888 2,944 3,003 3,071 3,146 3,223 3,301 3,376 3,451

Total liabilities 29,307 30,782 31,472 34,835 34,041 34,451 37,332 39,908 38,911 39,861 40,830 41,756 42,669

CCIC stockholders' equity:

Common stock & additional paid-in capital 17,937 18,015 18,120 18,247 18,375 18,413 18,413 18,413 18,413 18,413 18,413 18,413 18,413

Accumulated other comprehensive income (loss) (4) (4) (5) (5) (5) (5) (5) (5) (5) (5) (5) (5) (5)

Dividends or distributions in excess of earnings (8,472) (9,753) (10,666) (11,055) (11,286) (11,383) (11,370) (11,225) (11,306) (11,343) (11,349) (11,340) (11,325)

Total CCIC stockholders' equity 9,461 8,258 7,449

7,187 7,083 7,025 7,038 7,183 7,102 7,065 7,059 7,068

7,083

Noncontrolling interest from discontinued operations - -

- - - - - - - - - -

-

Total equity 9,461 8,258 7,449 7,187 7,083 7,025 7,038 7,183 7,102 7,065 7,059 7,068 7,083

Total liabilities and equity 38,768 39,040 38,921 42,022 41,124 41,476 44,370 47,092 46,013 46,926 47,889 48,824 49,752

Crown Castle International

Historical Cash Flow Statement

Fiscal Years Ending Dec. 31

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Cash flows from operating activities:

Income (loss) from continuing operations 201 94 399 525 357 445 671 860 1,056 1,158 1,675

Adjustments to reconcile income (loss) from continuing operations to net cash provided by (used for) operating activities:

Depreciation, amortization & accretion 623 774 1,013 1,036 1,109 1,242 1,528 1,572 1,608 1,644 1,707

Losses (gains) on retirement of long-term obligations 132 37 45 4 52 4 106 2 95 145 28

Losses (gains) on settled swaps - - - (54) 3 0 - - - -

Amortization of deferred financing costs & other non-cash interest, net 109 99 81 37 14 9 7 1 6 13 17

Stock-based compensation expense 42 39 51 61 79 92 103 117 138 129 156

Asset write-down charges 16 15 15 33 34 17 26 19 74 21 34

Deferred income tax provision (benefit) (110) 180 (26) (61) 9 15 2 2 3 4 3

Other non-cash adjustments, net 1 3 (26) (9) 2 (2) 2 (2) 5 21 5

Changes in assets and liabilities, excluding the effect of acquisitions:

Accrued interest (14) 13 1 0 30 35 16 21 31 (17) -

Accounts payable 35 29 10 (5) 11 (34) 37 19 (77) 15 (5)

Deferred revenues, deferred ground lease payables, other accrued liabilities & other liabilities 99 242 401 326 196 176 223 254 (65) (118) (281)

Receivables (99) (60) (77) 13 (59) 61 (105) (96) 166 (113) (49)

Decrease (increase) in prepaid expenses, deferred site rental receivables, long-term prepaid rent & other assets (261) (228) (222) (112) (55) (15) (114) (71) 15 (113) (412)

Net cash flows from operating activities 773 1,238 1,666 1,794 1,782 2,044 2,502 2,698 3,055 2,789 2,878

Cash flows from investing activities:

Capital expenditures (441) (568) (780) (909) (874) (1,228) (1,741) (2,057) (1,624) (1,229) (1,310)

Payments for acquisitions, net of cash acquired (3,759) (4,960) (466) (1,102) (557) (9,260) (42) (17) (107) (111) (35)

Receipts from foreign currency swaps - - - 54 8 (0) - - - - -

Other investing activities, net 1 7 3 (3) 12 (5) (12) (7) (10) 8 (7)

Net cash flows from investing activities (4,200) (5,521) (1,243) (1,960) (1,410) (10,494) (1,795) (2,081) (1,741) (1,332) (1,352)

Cash flow from financing activities:

Proceeds from issuance of long-term debt 5,250 1,618 846 1,000 5,201 3,092 2,742 1,894 3,733 3,985 748

Net proceeds from issuance of preferred stock 951

Principal payments on debt & other long-term obligations (81) (101) (116) (103) (96) (119) (105) (86) (105) (1,076) (74)

Purchases & redemptions of long-term debt (1,979) (763) (837) (1,069) (4,045) - (2,346) (12) (2,490) (2,089) (1,274)

Borrowings under revolving credit facility 1,253 976 1,019 1,790 3,440 2,820 1,820 2,110 2,430 1,245 3,495

Payments under revolving credit facility (251) (1,855) (698) (1,360) (4,565) (1,840) (1,725) (2,660) (2,665) (870) (2,855)

Net issuances (repayments) under commercial paper program - - - - - - - 155 130 (20) 976

Payments for financing costs (79) (30) (16) (20) (42) (29) (31) (24) (38) (42) (14)

Net proceeds from issuance of common stock 0 2,981 - - 1,326 4,221 841 - - - -

Net proceeds from issuance of preferred stock - - - - - 1,608 - - - - -

Purchases of common stock (36) (99) (22) (30) (25) (23) (34) (44) (76) (70) (65)

Dividends & distributions paid on common stock - - (624) (1,116) (1,239) (1,509) (1,782) (1,912) (2,105) (2,373) (2,602)

Dividends & distributions paid on preferred stock (2) - (44) (44) (44) (30) (113) (113) (85) - -

Net (increase) decrease in restricted cash (289) 386 30 16 (8) 4 - - - - -

Net cash flows from (used in) financing activities 3,787 4,063 (463) (935) (96) 8,195 (733) (692) (1,271) (1,310) (1,665)

Net increase (decrease) in cash, cash equivalents, & restricted cash from continuing operations 360 (220) (40) (1,101) 276 (255) (26) (75) 43 147 (139)

Discontinued Operations:

Net cash provided by (used for) operating activities - - - 3 - - - - - (62) -

Net cash provided by (used for) investing activities - - - 1,104 113 - - - - - -

Effect of exchange rate changes on cash 1 2 (8) (2) (0) 1 (1) - - - -

Cash, cash equivalents, & restricted cash at beginning of period 80 441 223 176 179 568 440 413 338 381 466

Cash, cash equivalents, & restricted cash at end of period 441 223 176 179 568 314 413 338 381 466 327

Crown Castle International

Forecasted Cash Flow Statement

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

2031E

2032E

Cash flows from operating activities:

Net Income 1,882 2,263 2,621 2,935 3,313 2,763 2,958 3,120 3,244 3,350

Changes in working capital:

Depreciation, amortization & accretion 1,781 1,765 1,764 1,777 1,801 1,835 1,877 1,925 1,978 2,034

Changes in assets and liabilities, excluding the effect of acquisitions:

Receivables, net (16) (42) (45) (40) (40) (39) (36) (32) (28) (26)

Prepaid Expenses (16) (8) (9) (8) (8) (8) (7) (6) (5) (5)

Other current assets (17) (15) (16) (14) (14) (14) (13) (11) (10) (9)

Deferred site rental receivables 32 (143) (154) (135) (135) (133) (122) (108) (92) (85)

Other intangible assets 4 4 4 4 4 4 4 4 4 4

Other assets (12) (10) (11) (10) (10) (10) (9) (8) (7) (6)

Accounts payable 116 24 26 23 23 23 21 19 16 15

Accrued interest 9 (11) (5) (8) (26) 217 8 8 8 8

Deferred revenues 23 54 69 57 64 65 49 57 31 21

Other accrued liabilities 51 32 34 30 30 30 27 24 21 19

Net cash flows from operating activities 3,837 3,912 4,277 4,613 5,003 4,732 4,757 4,991 5,160 5,319

Cash flows from investing activities:

Capital expenditures (change in gross PPE) (1,642) (1,756) (1,878) (1,985) (2,092) (2,198) (2,296) (2,382) (2,457) (2,526)

Operating lease right-of-use assets 59 4 (48) (88) (123) (154) (177) (194) (203) (209)

Site rental contracts & tenant relationships, net (1,146) (348) (375) (328) (328) (325) (297) (263) (224) (207)

Operating lease liabilities (current & LT) 236 (4) 48 88 123 154 177 194 203 209

Restricted cash (5) (5) (5) (5) (5) (5) (6) (6) (6) (6)

Net cash flows from investing activities (2,498) (2,109) (2,258) (2,318) (2,425) (2,529) (2,598) (2,651) (2,687) (2,739)

Cash flows from financing activities:

Debt and other obligations (current & LT) 2,030 (928) 183 2,631 2,294 (1,561) 590 590 572 568

Other long-term liabilities 899 40 55 59 68 75 77 77 75 75

Dividends distributions (2,271) (2,494) (2,718) (2,922) (3,167) (2,845) (2,995) (3,126) (3,235) (3,336)

Net cash flows from financing activities 657 (3,382) (2,479) (231) (805) (4,330) (2,327) (2,458) (2,588) (2,694)

Net increase (decrease) in cash, cash equivalents, & restricted cash 1,996 (1,579) (460) 2,063 1,773 (2,127) (169) (118) (115) (114)

Cash, cash equivalents, & beginning of period 156 2,152 573 113 2,176 3,949 1,822 1,653 1,535 1,419

Cash, cash equivalents, & end of period 2,152 573 113 2,176 3,949 1,822 1,653 1,535 1,419 1,306

Crown Castle International

Income Statement

Fiscal Years Ending Dec. 31

2020

2021

2022

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

2031E

2032E

Net revenues:

Site rental revenues 91.10% 90.21% 90.02% 90.41% 90.86% 91.30% 91.61% 91.90% 92.14% 92.34% 92.48% 92.57% 92.64%

Services & other revenues 8.90% 9.79% 9.98% 9.59% 9.14% 8.70% 8.39% 8.10% 7.86% 7.66% 7.52% 7.43% 7.36%

Net revenues 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Operating expenses:

Cost of operations

Site rental 26.04% 24.51% 22.93% 23.03% 23.15% 23.26% 23.34% 23.41% 23.47% 23.52% 23.56% 23.58% 23.60%

Services and other 7.67% 6.92% 6.67% 6.29% 6.00% 5.71% 5.50% 5.32% 5.16% 5.03% 4.94% 4.88% 4.83%

Selling, general & administrative 11.61% 10.73% 10.74% 11.02% 11.02% 11.02% 11.02% 11.02% 11.02% 11.02% 11.02% 11.02% 11.02%

Asset write-down charges 1.27% 0.33% 0.49% 0.37% 0.35% 0.32% 0.31% 0.29% 0.28% 0.26% 0.25% 0.25% 0.24%

Acquisition & integration costs 0.17% 0.02% 0.03% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%