2023 ANNUAL REPORT

March 4, 2024

2

A MESSAGE FROM THE CHIEF APPRAISER

It is my pleasure to present the 2023 Annual Report of the Travis Central Appraisal District.

This annual report provides general information regarding Texas property tax appraisals as well

as Travis Central Appraisal District (Travis CAD) statistics highlighting the results of our

appraisal operations, taxpayer assistance, appeals process, financial stewardship, and statistical

comparisons from the Property Tax Assistance Division Property Value Study.

My staff and I are committed to providing timely and accurate appraisal services in a manner

that results in fair and equitable treatment for all of Travis County’s citizens and property

taxpayers. We are very proud to have received Meets All ratings on the Methods and

Assistance Program Review conducted by the State Comptrollers Property Tax Assistance

Division. The Texas Comptroller of Public Accounts also reviewed Travis CAD’s property

market values in 2022 and found that TCAD’s values were within the legally required 5% margin

of error for accuracy. I acknowledge and thank my entire staff for this outstanding

achievement.

Their hard work and dedication resulted in the timely certification of our appraised values to

the taxing units. The property taxes generated from these appraisals provide an essential

source of revenue to support Travis County, school districts, cities, and special districts.

The Travis Central Appraisal District strives to be one of the premier governmental

organizations in the State of Texas. Our goal is to maximize the level of public service we

provide and to serve Travis County taxpayers with professionalism and integrity in all aspects

of our operations.

I thank you for taking the time to review this Annual Report and I hope it provides insight into

the operations of the Travis Central Appraisal District.

Sincerely,

Leana Mann, RPA, CCA, CGFO

Chief Appraiser

3

TABLE OF CONTENTS

FOREWORD 4

UNDERSTANDING THE LOCAL PROPERTY TAX PROCESS 5

PROPERTY TAX CALENDAR 6

ROLE OF THE APPRAISAL DISTRICT 7

TRAVIS CAD MISSION 8

TRAVIS COUNTY DEMOGRAPHICS 9

TRAVIS COUNTY DEMOGRAPHICS 9

TRAVIS COUNTY SCHOOL DISTRICTS 10

TRAVIS COUNTY CITIES 11

PROPERTY TAXES AT WORK 13

DISTRIBUTION OF PROPERTY TAXES 13

20 YEAR HISTORY OF APPRAISAL ROLL VALUES 14

2023 APPRAISAL INFORMATION 15

TRAVIS COUNTY CERTIFIED TOTALS 15

ALL JURISDICTION CERTIFIED VALUES 22

VALUE DISTRIBUTIONS 27

STATE PROPERTY CATEGORIES 28

TOP TEN TAXPAYERS 29

EXEMPTIONS 30

TAXPAYER APPEALS 32

COMPTROLLER PTAD STUDIES 35

2022 PROPERTY VALUE STUDY 35

2023 METHODS AND ASSISTANCE PROGRAM REVIEW 36

APPRAISAL DISTRICT FINANCES 37

CAD STAFFING 40

ORGANIZATIONAL CHART 41

CAD COMPARISON 42

APPRAISAL DISTRICT WORKLOAD

44

VISIT OR CONTACT US 52

4

FOREWORD

Texas local government units rely heavily on property taxes to fund their operations.

Statewide, more than 4,000 separate taxing jurisdictions impose a property tax; these include

counties, school districts, cities, and special-purpose districts that provide junior colleges,

hospitals, water and wastewater utilities, flood control, and emergency services.

In addition to property tax, the Texas Constitution and Legislature empower local governments

to impose, levy, and collect other taxes and fees that supplement their operations.

The Texas Constitution sets out five basic rules for property taxes

(2)

:

• Taxation must be equal and uniform. No single property or type of property should pay

more than its fair share.

• Generally, all property must be taxed on its current market value—the price it would sell

for when both buyer and seller seek the best price and neither is under pressure to buy

or sell. The Texas Constitution provides certain exceptions to this rule, such as the use

of “productivity values” for agricultural and timber land. This means that the land is

taxed based on the value of what it produces, such as crops and livestock, rather than

its sale value. This lowers the tax bill for such land.

• Each property in a county must have a single appraised value. This means that the

various local governments to which you pay property taxes cannot assign different

values to your property; all must use the same value. This is guaranteed by the use of

county appraisal districts.

• All property is taxable unless federal or state law exempts it from the tax. These

exemptions may exclude all or part of your property value.

• Property owners have a right to reasonable notice of increases in their appraised

property value.

Appraisal districts are political subdivisions of the State responsible for appraising property

within county boundaries. Taxing entities use those appraised values to set their ad valorem

tax rates and levy property taxes. The governing bodies of taxing units, such as school boards,

commissioners’ courts, city councils, and special purpose district boards of directors, derive the

tax rate by dividing the proposed tax levy by the taxable value of property, as provided by the

appraisal district. Taxable value is a property’s appraised value minus all applicable exemptions,

deductions, and limitations. The tax rate is the level of taxation imposed by a taxing unit on

taxable property within its boundaries. The local government’s tax assessor applies the tax rate

to the taxable value in its jurisdiction to compute the tax due on each property.

(1)

1 Texas Comptroller of Public Accounts Biennial Property Tax Report-Tax Years 2018 and 2019, Issued December 2020

2 Texas Comptroller of Public Account – Texas Property Tax System

5

UNDERSTANDING THE LOCAL PROPERTY TAX PROCESS

There are three main parts to the property tax system in Texas:

• An appraisal district in each county sets the value of property each year. A chief

appraiser is the chief administrator and operates the appraisal office.

• A citizen board, called the Appraisal Review Board (ARB), hears any disagreements

between a property owner and the appraisal district about a property’s value. The

members of the Appraisal Review Board are appointed by the local administrative judge.

• Local taxing units—city, county, school, and special districts—decide how much money

they will spend by adopting a budget. Next, the units set tax rates that will raise the

revenue necessary to fund their budgets. The adopted budgets and the tax rates set to

fund the budgets determine the total amount of taxes that a person will pay.

The property tax year has four stages: appraising taxable property, protesting the appraised

values, adopting the tax rates, and collecting the taxes. The following represents a summary of

the process.

1. A large part of each appraisal district's job is to estimate what your property is worth on

January 1. What a property is used for on January 1, market conditions at that time, and

who owns the property on that date determine whether the property is taxed, its value,

and who is responsible for paying the tax. Your appraisal district also processes

applications for tax exemptions, agricultural appraisals, and other tax relief.

2. After the May 15 protest deadline, the appraisal review board begins hearing protests

from property owners who believe their property values are incorrect or who did not

get exemptions or agricultural appraisal. When the ARB finishes its work, the appraisal

district gives each taxing unit a list of taxable property.

3. In August or September, the elected officials of each taxing unit adopt tax rates for their

operations and debt payments. Several taxing units tax your property. Every property

is taxed by the county and the local school district. You also may pay taxes to a city and

to special districts such as hospital, junior college, water, fire, and others.

4. Tax collection starts around October 1 as tax bills go out. Taxpayers have until January

31 of the following year to pay their taxes. On February 1, penalty and interest charges

begin accumulating on most unpaid tax bills. Tax collectors may start legal action to

collect unpaid taxes on February 1.

6

PROPERTY TAX CALENDAR

January 1

Appraisal districts are required to appraise property at its

value on this date.

January 1 – April 30

Appraisal districts complete appraisals and process

applications for exemptions.

April – May Appraisal districts send notices of appraised value.

May 15

Appraisal review boards begin hearing protests from property

owners.

July 25

Appraisal districts certify current appraised values to taxing

units.

August – September Local taxing units adopt tax rates.

October 1 Local taxing units begin sending tax bills to property owners.

January 31

Taxes due to local taxing units (or county tax assessor, if

acting on their behalf).

February 1

Local taxing units begin charging penalties and interest for

unpaid tax bills.

7

ROLE OF THE APPRAISAL DISTRICT

Each Texas county is served by an appraisal district that determines the value of all the county’s

taxable property. Generally, a local government that collects property taxes, such as county,

cities, and school districts, is a member of the appraisal district. A board of directors appointed

by the member governments presides over the appraisal district.

The appraisal district is considered a political subdivision and must follow applicable laws such

as the Open Meetings Act and the Public Information Act. Meetings are generally open to the

public and information generated by the appraisal district is, in most cases, also available to the

public.

The appraisal district board of directors hires a chief appraiser, approves contracts, and sets

policies. The chief appraiser is the chief administrator of the appraisal district. The chief

appraiser may employ and compensate professional, clerical, and other personnel as provided

by the appraisal district budget. The chief appraiser’s primary duty is to discover, list, review,

and appraise all taxable property in the appraisal district using generally accepted appraisal

techniques.

BOARD MEMBERS

James Valadez, Chairperson

Travis County

Term Expires 2024

Theresa Bastian, Vice Chairperson

Austin ISD

Term Expires 2023

Nicole Conley, Secretary

City of Austin

Term Expires 2024

Tom Buckle

West Travis County

Term Expires 2024

Deborah Cartwright

Austin ISD

Term Expires 2024

Osezua Ehiyamen

City of Austin/Austin ISD

Term Expires 2024

Elizabeth Montoya

East Travis County

Term Expires 2023

Vivek Kulkarni

Travis County

Term Expires 2023

Blanca Zamora Garcia

City of Austin

Term Expires 2023

Bruce Elfant

Travis County Assessor Collector

CHIEF APPRAISER

Leana Mann

Appointed: January 2024

8

TRAVIS CAD MISSION

The activities of the Travis Central Appraisal District are governed by the Texas Property Tax

Code, the laws passed by the Legislature, and the administrative rules adopted by the

Comptrollers Property Tax Assistance Division.

OUR MISSION

The mission of the Travis Central Appraisal District is to

provide accurate appraisals of all property in Travis County at one

hundred percent market value, equally and uniformly, in a

professional, ethical, economical, and courteous manner, working

to ensure that each taxpayer pays only their fair share of the

property tax burden.

OUR VISION

The Travis Central Appraisal District will act in accordance

with the highest principles of professional conduct, ethics,

accountability, efficiency, openness, skill, and integrity. We approach

our activities with a deep sense of purpose and responsibility.

OUR VALUES

• Appraise- fairly, efficiently, and effectively, balancing the needs of

both taxpayers and the taxing units by adhering to the Texas

Property Tax Code, USPAP, and generally accepted appraisal

standards.

• Educate- taxpayers of their rights, remedies, and responsibilities.

• Communicate- collaboratively with and encourage communication

among the taxing units, taxpayer public, and the agency.

• Service- provide exceptional customer service that is accessible,

responsible and transparent.

• Performance- demand integrity, accountability, and high standards

from all staff and strive continuously for excellence and efficiency.

Strategic Goals

1. Develop appraisals that

reflect market value and

ensure fairness and

uniformity.

2. Be efficient in business

processes and ensure that

mission-critical tasks are

completed in a timely manner

with a high level of accuracy.

3. Collect, create, and maintain

accurate data.

4. Ensure that the district

maintains a highly educated,

motivated, and skilled

workforce.

5. Provide customer service that

is courteous, professional, and

accurate.

9

TRAVIS COUNTY DEMOGRAPHICS

Travis County is located in south central Texas astride the Balcones Fault, the boundary

between the Edwards Plateau to the west and the Blackland Prairies to the east. The county

seat, Austin, is also the capital of Texas.

Entity ID

Entity Cd

Entity Name

M&O Tax Rate

I&S Tax Rate

Total Tax Rate

1003

03

TRAVIS COUNTY

0.26971

0.03495

0.30466

TRAVIS COUNTY DEMOGRAPHICS

Established:

January 25, 1840

County Seat:

Austin

2020 Population:

1,290,188

2023 Est Population:

1,344,328

Square Miles:

1,022

Jurisdictions:

15 Schools

1 Junior College

21 Cities

120 Special Districts

33 Other Entities

10

TRAVIS COUNTY SCHOOL DISTRICTS

Travis County has 6 school districts wholly contained within its boundaries and 9 school

districts which are shared across county lines. Austin ISD is the largest school district in Travis

County and one of the largest school districts in the state.

Entity ID

Entity Cd

Entity Name

M&O Tax Rate

I&S Tax Rate

Total Tax Rate

1001

01

AUSTIN ISD

0.73650

0.12300

0.85950

1005

06

DEL VALLE ISD

0.67280

0.33000

1.00280

1006

07

LAKE TRAVIS ISD

0.74660

0.32750

1.07410

1007

08

EANES ISD

0.76800

0.12000

0.88800

1009

1A

HAYS CONSOLIDATED ISD

0.66920

0.48770

1.15690

1023

16

LAGO VISTA ISD

0.69920

0.32000

1.01920

1026

19

PFLUGERVILLE ISD

0.78920

0.32000

1.10920

1027

2A

ELGIN ISD

0.75750

0.46820

1.22570

1037

22

COUPLAND ISD

0.66920

0.50000

1.16920

1042

3A

MARBLE FALLS ISD

0.67250

0.21530

0.88780

1053

34

MANOR ISD

0.69160

0.39450

1.08610

1057

38

DRIPPING SPRINGS ISD

0.75750

0.35000

1.10750

1059

4A

JOHNSON CITY ISD

0.66920

0.19390

0.86310

1072

5A

ROUND ROCK ISD

0.72100

0.19800

0.91900

1098

69

LEANDER ISD

0.77870

0.33000

1.10870

11

TRAVIS COUNTY CITIES

Travis County has 21 cities within its boundaries, including the state capital of Austin. Austin is

the fourth-largest city in the state and the eleventh-largest city in the United States. Residents

of the area represent a diverse mixture of government employees, college students and staff,

musicians, high-tech workers, and business people.

Entity ID

Entity Cd

Entity Name

M&O Tax Rate

I&S Tax Rate

Total Tax Rate

1002

02

CITY OF AUSTIN

0.35770

0.08810

0.44580

1004

05

CITY OF MANOR

0.48020

0.19870

0.67890

1008

09

CITY OF WEST LAKE HILLS

0.11780

0.06080

0.17860

1018

11

CITY OF ROLLINGWOOD

0.09660

0.09510

0.19170

1019

12

VILLAGE OF SAN LEANNA

0.24980

-

0.24980

1031

2F

CITY OF ROUND ROCK

0.23852

0.10348

0.34200

1035

20

CITY OF PFLUGERVILLE

0.24850

0.28770

0.53620

1036

21

CITY OF LAKEWAY

0.10450

0.03950

0.14400

1046

3F

CITY OF CEDAR PARK

0.19437

0.17563

0.37000

1065

40

CITY OF CREEDMOOR

0.45000

-

0.45000

1071

49

CITY OF LAGO VISTA

0.29890

0.11500

0.41390

1075

5F

CITY OF ELGIN

0.36327

0.13497

0.49824

1076

5G

VILLAGE OF VOLENTE

0.07230

-

0.07230

1077

5H

VILLAGE OF WEBBERVILLE

0.05850

0.11150

0.17000

1078

50

CITY OF JONESTOWN

0.33430

0.05620

0.39050

1083

55

VILLAGE OF BRIARCLIFF

0.04150

0.02650

0.06800

1090

6F

CITY OF LEANDER

0.26286

0.15443

0.41728

1096

61

CITY OF MUSTANG RIDGE

0.25150

0.01370

0.26520

1102

7E

VILLAGE OF THE HILLS

0.07500

0.02500

0.10000

1103

7F

VILLAGE OF POINT VENTURE

0.08583

-

0.08583

1122

83

CITY OF BEE CAVE

-

0.02000

0.02000

12

13

PROPERTY TAXES AT WORK

Property taxes are taxes that are assessed locally, collected locally, and used locally. You pay

your property taxes to the local tax collector. The tax collector distributes the funds to schools,

cities, and other local governments. Local governments spend the funds on schools, roads,

hospitals, police departments, fire departments, and other programs.

In Travis County, property taxes support 137 local government agencies including 21 cities,

18 emergency districts, the county, the hospital district, the junior college, 62 municipal utility

districts, 1 road districts, 15 school districts, and 17 water control improvement districts. For

2022 the projected tax levy for all taxing units in Travis County is $5,966,208,393.

DISTRIBUTION OF PROPERTY TAXES

Cities

19.50%

County

16.61%

Emergency Districts

1.61%

Hospital District

5.49%

Junior College

4.74%

Municipal Utility

Districts

1.87%

Road District

0.02%

School Districts

49.44%

Water Control

Improvement

Districts

0.72%

Budget by Taxing Unit Type

14

20 YEAR HISTORY OF APPRAISAL ROLL VALUES

2023 was the thirteenth consecutive year of appraisal roll growth.

Year

Total Appraisal Roll

Appraisal Roll in

Billions

Change from Prior Year

Percent

Change

2004

$ 77,780,497,021

$ 78

$ 1,312,197,337

1.72%

2005

$ 82,376,017,030

$ 82

$ 4,595,520,009

5.91%

2006

$ 95,938,443,366

$ 96

$ 13,562,426,336

16.46%

2007

$ 108,849,163,598

$ 109

$ 12,910,720,232

13.46%

2008

$ 121,880,175,682

$ 122

$ 13,031,012,084

11.97%

2009

$ 125,920,708,866

$ 126

$ 4,040,533,184

3.32%

2010

$ 120,247,416,959

$ 120

$ (5,673,291,907)

-4.51%

2011

$ 123,196,201,548

$ 123

$ 2,948,784,589

2.45%

2012

$ 128,176,409,480

$ 128

$ 4,980,207,932

4.04%

2013

$ 136,609,794,659

$ 137

$ 8,433,385,179

6.58%

2014

$ 154,513,882,900

$ 155

$ 17,904,088,241

13.11%

2015

$ 179,776,622,324

$ 180

$ 25,262,739,424

16.35%

2016

$ 203,900,582,596

$ 204

$ 24,123,960,272

13.42%

2017

$ 223,147,520,227

$ 223

$ 19,246,937,631

9.44%

2018

$ 245,338,206,315

$ 245

$ 22,190,686,088

9.94%

2019

$ 266,184,989,892

$ 266

$ 20,846,783,577

8.50%

2020

$ 281,851,353,216

$ 282

$ 15,666,363,324

5.89%

2021

$ 314,594,449,350

$ 315

$ 32,743,096,134

11.62%

2022

$ 428,452,895,722

$ 428

$ 113,858,446,372

36.19%

2023

$ 463,332,450,474

$ 463

$ 34,879,554,752

8.14%

$78

$82

$96

$109

$122

$126

$120

$123

$128

$137

$155

$180

$204

$223

$245

$266

$282

$315

$428

$463

$-

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Value in Billions

15

2023 APPRAISAL INFORMATION

TRAVIS COUNTY CERTIFIED TOTALS

16

17

18

19

20

21

22

ALL JURISDICTION CERTIFIED VALUES

EntityID

Entity_Name Entity_Type Market NetTaxable

1138

ACC DIST - WMSN CO J 537,257$ 520,255$

1864723

ALTESSA MUD M 8,899,554$ 8,757,882$

1439214

ANDERSON MILL LIMITED DISTRICT M 35,330,892$ 24,271,220$

1097

AUSTIN COMM COLL DIST

J 377,649,661,467$ 289,223,027,459$

1895742

AUSTIN DOWNTOWN PUBLIC IMPROVE P 22,016,105,647$ 17,035,126,873$

1001

AUSTIN ISD

S 274,130,079,463$ 197,384,085,678$

1124

AUSTIN MUD NO 1 M 22,801$ 22,801$

1125

AUSTIN MUD NO 2 M 202$ 202$

1126

AUSTIN MUD NO 3 M 40,318$ 40,318$

1895743

BACKYARD PID P 7,032,889$ 7,032,889$

1364190

BASTROP-TRAVIS COUNTIES ESD NO 1

E 755,024,225$ 560,660,969$

1890601

BELLA FORTUNA PID

P 64,931,914$ 62,552,976$

1329420

BELVEDERE MUD

M 486,767,738$ 379,428,982$

1895751

BRIARWOOD MUD

M 7,234,395$ 56,606$

1002

CITY OF AUSTIN C 320,042,984,815$ 224,788,575,368$

1122

CITY OF BEE CAVE C 4,349,162,180$ 3,248,318,249$

1046

CITY OF CEDAR PARK C 2,222,889,819$ 1,647,759,015$

1065

CITY OF CREEDMOOR

C 282,931,873$ 179,086,357$

1075

CITY OF ELGIN C 436,247,402$ 310,384,241$

1078

CITY OF JONESTOWN C 1,558,117,146$ 1,093,304,798$

1071

CITY OF LAGO VISTA C 3,307,869,802$ 2,404,921,642$

1036

CITY OF LAKEWAY C 9,840,119,523$ 7,920,380,976$

1090

CITY OF LEANDER C 3,968,079,852$ 2,970,150,293$

1004

CITY OF MANOR C 2,694,149,348$ 2,181,809,435$

1096

CITY OF MUSTANG RIDGE C 322,632,060$ 208,823,366$

1035

CITY OF PFLUGERVILLE C 14,745,239,353$ 11,236,739,477$

1018

CITY OF ROLLINGWOOD C 2,181,108,723$ 1,576,451,807$

1031

CITY OF ROUND ROCK C 860,380,435$ 725,026,418$

1020

CITY OF SUNSET VALLEY

C 697,237,228$ 514,577,660$

1008

CITY OF WEST LAKE HILLS C 4,309,510,422$ 3,273,685,321$

1895752

COLONY PARK SUSTAINABLE

COMMUNITY

T 2,736,983$ -$

1876898

COLORADO RIVER PROJECT

REINVESTMENT ZONE

T 1,695,655,493$ 1,695,655,493$

1015

COTTONWD CREEK MUD NO 1 M 569,292,889$ 497,564,642$

1037

COUPLAND ISD

S 33,346,102$ 8,600,847$

1016

CYPRESS RANCH WCID NO 1

W 335,771,399$ 275,435,155$

1005

DEL VALLE ISD S 22,550,354,103$ 16,467,153,172$

1028

DOWNTOWN PUB IMP DIST P 43,061$ 40,807$

1057

DRIPPING SPRINGS ISD S 255,465,518$ 27,589,211$

1049

E SIXTH ST PUB IMP DIST P 685,681,929$ 683,232,180$

1007

EANES ISD S 31,473,161,681$ 23,006,799,774$

1027

ELGIN ISD S 1,447,405,623$ 821,180,069$

1559173

ELGIN TIRZ #1

T 8,107,052$ 8,000,453$

1671480

ESTANCIA HILL COUNTRY PID P 535,805,340$ 483,680,871$

1009

HAYS CONSOLIDATED ISD S 446,481,824$ 211,469,206$

23

EntityID

Entity_Name Entity_Type Market NetTaxable

1675215

HOMESTEAD PRESERVATION

REINVESTMENT ZONE 1

T

12,463,863,293$ 9,071,284,959$

1039

HURST CREEK MUD

M 1,217,336,970$ 752,494,936$

1607165

INDIAN HILLS PID P 7,237,992$ 6,274,306$

1059

JOHNSON CITY ISD

S 169,180,996$ 24,046,422$

1306817

KELLY LANE WCID NO 1 W 476,234,813$ 357,058,812$

1306818

KELLY LANE WCID NO 2

W 389,833,720$ 298,744,187$

1023

LAGO VISTA ISD

S 6,055,783,145$ 3,801,506,898$

1814277

LAGOS PID

P 126,554,634$ 113,552,201$

1895746

LAGOS PID IMPROVEMENT AREA #1 P 41,723,755$ 40,486,756$

1761821

LAKE POINTE MUD

M 1,047,940,782$ 786,015,930$

1089

LAKE POINTE MUD NO 3 (DA) M 487,272,169$ 379,060,352$

1101

LAKE POINTE MUD NO 5 (DA)

M 561,031,519$ 407,072,268$

1006

LAKE TRAVIS ISD S 31,599,131,399$ 19,737,414,811$

1332603

LAKESIDE MUD NO 3 M 444,687,761$ 337,701,678$

1875672

LAKESIDE MUD NO 5

M 28,897,476$ 15,512,652$

1131

LAKESIDE WCID NO 1

W 286,506,906$ 230,310,645$

1134

LAKESIDE WCID NO 2A

M 394,736,113$ 322,261,365$

1135

LAKESIDE WCID NO 2B

W 256,016,048$ 201,557,592$

1136

LAKESIDE WCID NO 2C W 663,015,164$ 505,331,444$

1137

LAKESIDE WCID NO 2D W 510,429,823$ 414,426,526$

1040

LAKEWAY MUD M 2,405,819,535$ 1,966,365,739$

1397701

LAZY NINE MUD NO 1A M 154,477,942$ 141,658,135$

1397702

LAZY NINE MUD NO 1B M 1,125,764,154$ 957,036,380$

1397703

LAZY NINE MUD NO 1C M 208,935$ 1,323$

1397704

LAZY NINE MUD NO 1D

M 557,893$ 1,037$

1397705

LAZY NINE MUD NO 1E M 18,596,374$ 74,156$

1098

LEANDER ISD S 23,162,504,102$ 15,387,881,051$

1599645

LONE STAR RAIL DISTRICT T 8,831,536,335$ 8,457,127,392$

1685385

LOST CREEK LIMITED DISTRICT M 1,776,875,742$ 1,462,435,032$

1890621

MANOR HEIGHTS PID (IMP AREA #1 P 102,415,033$ 101,342,976$

1890633

MANOR HEIGHTS PID (IMP AREA #2 P 36,382,218$ 34,991,046$

1895754

MANOR HEIGHTS PID (IMP AREA #3) P 8,873,419$ 8,806,395$

1890652

MANOR HEIGHTS PID (MIA) P 13,637,500$ 12,112,392$

1838707

MANOR HEIGHTS TIRZ T 149,510,945$ 145,092,702$

1053

MANOR ISD S 16,782,112,544$ 11,214,597,166$

1042

MARBLE FALLS ISD S 1,921,718,290$ 1,078,042,568$

1895747

MARTIN TRACT PID P 2,038,700$ 2,038,700$

1099

MOORES CROSSING MUD M 377,439,136$ 283,195,907$

1127

NE TCRD DIST NO 4 (WELLS PT)

RO 638,143,978$ 555,735,991$

1111

NE TRAVIS CO ROAD DIST NO 2 RO 2,197,339,849$ 1,924,248,816$

1033

NE TRAVIS CO UTILITY DIST M 615,104,236$ 488,057,041$

1879798

NEW SWEDEN MUD NO 1 M 12,062,467$ 1,470,222$

1396104

NORTH AUSTIN MUD NO 1 M 211,378,326$ 182,002,645$

1123

NORTHTOWN MUD M 1,797,946,684$ 1,293,109,846$

1636256

ONION CREEK METRO PARK DIST M 462,079,853$ 282,155,049$

24

EntityID

Entity_Name

Entity_Type Market NetTaxable

1026

PFLUGERVILLE ISD

S 37,318,320,827$ 25,703,024,555$

1672423

PILOT KNOB MUD NO 1 M 3,582,864$ 1,636,420$

1604242

PILOT KNOB MUD NO 2 M 246,144,103$ 222,184,500$

1597862

PILOT KNOB MUD NO 3 M 863,461,413$ 742,481,382$

1597864

PILOT KNOB MUD NO 4 M 5,798,867$ 5,020,844$

1636020

PILOT KNOB MUD NO 5

M 6,586,118$ 4,900,196$

1332144

PRESIDENTIAL GLEN MUD

M 529,500,638$ 454,182,196$

1506857

REINVESTMENT ZONE # 1 CITY OF PFLUG T 1,342,029,600$ 894,407,071$

1761831

RIVER PLACE LIMITED DISTRICT M 1,372,214,702$ 971,914,406$

1318757

RMMA REUSE & REDEVELOPMENT T 3,547,475,497$ 2,766,301,017$

1116

RNCH @ CYPRSS CRK MUD 1 M 193,214,353$ 154,108,000$

1857921

ROSE HILL PID P 419,406,113$ 351,138,645$

1072

ROUND ROCK ISD

S 16,168,507,547$ 12,636,061,378$

1607163

SEAHOLM TIF

T 464,254,240$ 440,290,765$

1074

SENNA HILLS MUD

M 610,948,539$ 434,563,501$

1052

SHADY HOLLOW MUD

M 695,971,752$ 568,815,683$

1895750

SOUTH CENTRAL WATERFRONT OVERL

P 1,291,143,255$ 1,147,043,177$

1676767

SOUTH CONGRESS PID P 182,307,650$ 144,686,758$

1558193

SOUTHEAST TRAVIS CO MUD NO 1

M 121,426,073$ 113,203,028$

1558195

SOUTHEAST TRAVIS CO MUD NO 2

M 3,893,024$ 3,893,024$

1636027

SOUTHEAST TRAVIS CO MUD NO 3

M 4,613,084$ 4,613,084$

1636028

SOUTHEAST TRAVIS CO MUD NO 4

M 3,030,119$ 3,030,119$

1895744

SPANISH OAKS PID

P 12,939,050$ 9,201,299$

1373279

SUNFIELD MUD NO 1 M 19,769,475$ 19,543,289$

1373280

SUNFIELD MUD NO 2 M 6,889,905$ 3,388,897$

1373281

SUNFIELD MUD NO 3 M 1,563,579$ 180,184$

1082

SW TRAVIS CO RD DIST NO 1 RO 140,676,576$ 140,676,573$

1013

TANGLEWD FOREST LTD DIST

M 773,195,793$ 637,049,001$

1772331

TESSERA ON LAKE TRAVIS PID (IMP AREA

#1)

P 166,393,837$ 137,540,022$

1772333

TESSERA ON LAKE TRAVIS PID (IMP AREA

#2)

P

134,921,860$ 119,846,697$

1698761

TESSERA ON LAKE TRAVIS PID (MIA) P 9,133,019$ 9,133,019$

1014

TRAVIS CO BCCP M 22,571,903,001$ 15,421,267,512$

1389381

TRAVIS CO BEE CAVE ROAD DIST NO 1 RO 467,346,855$ 455,367,613$

1066

TRAVIS CO ESD NO 1 E 9,199,399,231$ 6,551,492,002$

1086

TRAVIS CO ESD NO 10 E 4,618,247,152$ 3,350,495,110$

1079

TRAVIS CO ESD NO 11 E 5,916,356,212$ 4,161,937,965$

1108

TRAVIS CO ESD NO 12 E 7,776,853,801$ 5,827,458,471$

1332608

TRAVIS CO ESD NO 13

E 501,697,062$ 275,426,238$

1107

TRAVIS CO ESD NO 14 E 1,271,572,185$ 923,704,701$

1727173

TRAVIS CO ESD NO 15 E 5,923,842,507$ 4,159,841,537$

1807956

TRAVIS CO ESD NO 16 E 5,704,151,213$ 3,949,806,160$

1891104

TRAVIS CO ESD NO 17 E 7,868,245,793$ 6,813,381,364$

1129

TRAVIS CO ESD NO 2 E 29,374,707,185$ 23,049,013,175$

1011

TRAVIS CO ESD NO 3 E 7,677,327,002$ 5,547,274,000$

1085

TRAVIS CO ESD NO 4 E 8,869,142,490$ 6,717,250,924$

25

EntityID

Entity_Name

Entity_Type Market NetTaxable

1084

TRAVIS CO ESD NO 5 E 3,873,606,703$ 3,020,950,456$

1080

TRAVIS CO ESD NO 6 E 33,381,000,549$ 25,828,859,172$

1010

TRAVIS CO ESD NO 7

E 9,191,424,488$ 6,544,805,364$

1112

TRAVIS CO ESD NO 8

E 6,578,865,904$ 4,761,196,356$

1058

TRAVIS CO ESD NO 9

E 15,636,677,542$ 11,764,128,232$

1635977

TRAVIS CO IMPROVEMENT DIST NO 1

P 60,683,725$ 4,971,833$

1062

TRAVIS CO MUD NO 10 M 283,581,378$ 223,075,751$

1274977

TRAVIS CO MUD NO 11 M 657,105,207$ 510,056,576$

1274978

TRAVIS CO MUD NO 12

M 663,464,978$ 541,214,464$

1274981

TRAVIS CO MUD NO 13 M 802,227,277$ 701,274,399$

1047

TRAVIS CO MUD NO 14

M 328,246,132$ 280,787,954$

1091

TRAVIS CO MUD NO 15

M 1,160,389,561$ 816,724,993$

1396736

TRAVIS CO MUD NO 16 M 424,369,644$ 321,478,549$

1574082

TRAVIS CO MUD NO 17 M 591,816,977$ 519,165,561$

1574543

TRAVIS CO MUD NO 18 M 424,799,836$ 348,671,304$

1727347

TRAVIS CO MUD NO 19

M 181,511,393$ 153,337,514$

1106

TRAVIS CO MUD NO 2

M 593,639,596$ 474,863,782$

1727348

TRAVIS CO MUD NO 20 M 373,502,244$ 330,078,518$

1574074

TRAVIS CO MUD NO 21

M 1,011,944,357$ 790,115,183$

1729857

TRAVIS CO MUD NO 22

M 292,938,573$ 251,659,736$

1720114

TRAVIS CO MUD NO 23 M 651,680,247$ 555,149,196$

1720115

TRAVIS CO MUD NO 24 M 14,042,977$ 1,183,729$

1807970

TRAVIS CO MUD NO 25

M 13,689,082$ 11,504,013$

1895741

TRAVIS CO MUD NO 26 M 16,982,165$ 16,981,927$

1115

TRAVIS CO MUD NO 3 M 1,331,297,240$ 1,015,596,098$

1130

TRAVIS CO MUD NO 4

M 262,435,814$ 262,408,814$

1012

TRAVIS CO MUD NO 5 M 847,205,219$ 626,678,925$

1029

TRAVIS CO MUD NO 6

M 261,566,912$ 195,414,060$

1044

TRAVIS CO MUD NO 7 M 4,466,864$ 4,466,864$

1061

TRAVIS CO MUD NO 8 M 300,454,322$ 251,672,549$

1073

TRAVIS CO MUD NO 9 M 4,843,311$ 3,471,308$

1081

TRAVIS CO RFP DIST NO 6

FD 112,735$ 112,735$

1100

TRAVIS CO WCID 17 COMANCHE TRAILS

(DA)

W 437,630,413$ 310,314,193$

1064

TRAVIS CO WCID 17 FLINTROCK (DA)

W 718,026,245$ 535,295,925$

1481361

TRAVIS CO WCID 17 SERENE HILLS (DA) W 601,368,015$ 499,272,136$

1088

TRAVIS CO WCID 17 SOUTHVIEW (DA) W 71,173,611$ 47,659,293$

1043

TRAVIS CO WCID 17 STEINER RANCH (DA) W 4,920,187,932$ 3,525,565,345$

1017

TRAVIS CO WCID NO 10 W 8,552,137,714$ 6,481,849,799$

1024

TRAVIS CO WCID NO 17 W 14,263,631,724$ 10,292,726,415$

1025

TRAVIS CO WCID NO 18 W 1,680,329,869$ 1,241,379,180$

1054

TRAVIS CO WCID NO 19 W 464,772,496$ 331,519,091$

1056

TRAVIS CO WCID NO 20 W 1,084,257,853$ 751,603,272$

1038

TRAVIS CO WCID POINT VENTURE W 581,754,668$ 477,915,675$

1003

TRAVIS COUNTY G 463,332,450,474$ 318,124,990,230$

1034

TRAVIS COUNTY HEALTHCARE DISTRICT H 463,324,646,746$ 318,015,184,626$

26

EntityID

Entity_Name Entity_Type Market NetTaxable

1436544

TRAVIS-CREEDMOOR MUD M 45,668,844$ 45,346,799$

1895748

TURNERS CROSSING PID

P 121,978,797$ 118,263,100$

1083

VILLAGE OF BRIARCLIFF C 741,851,192$ 587,585,561$

1103

VILLAGE OF POINT VENTURE C 588,233,366$ 460,145,344$

1019

VILLAGE OF SAN LEANNA

C 162,771,356$ 110,274,975$

1102

VILLAGE OF THE HILLS C 1,123,958,937$ 674,935,763$

1076

VILLAGE OF VOLENTE C 492,955,760$ 382,895,812$

1077

VILLAGE OF WEBBERVILLE C 71,425,595$ 43,576,995$

1396737

WALLER CREEK TIF T 4,887,790,987$ 3,391,116,865$

1051

WELLS BRANCH MUD M 2,403,932,429$ 1,879,994,560$

1332609

WEST CYPRESS HILLS WCID NO 1

W 17,169,891$ 147,926$

1092

WEST TRAVIS CO MUD NO 6 M 1,239,640,297$ 1,041,916,889$

1093

WEST TRAVIS CO MUD NO 7

M 6,208,204$ 6,208,204$

1094

WEST TRAVIS CO MUD NO 8

M 295,339,066$ 276,259,301$

1607164

WHISPER VALLEY PID P 291,807,619$ 218,235,639$

1104

WILBARGER CRK MUD NO 1

M 416,803,962$ 354,052,551$

1105

WILBARGER CRK MUD NO 2 M 13,320,346$ 13,320,346$

1400491

WILLIAMSON/TRAVIS MUD NO 1

M 246,064,932$ 192,759,367$

1032

WMSN CO WSID DIST 3 W 132,589,035$ 115,812,007$

27

VALUE DISTRIBUTIONS

Property Type

Count

Market Value

BPP

41,417

$ 19,657,792,821

Commercial

24,481

$ 159,446,551,784

Residential

411,775

$ 284,228,105,869

Total

477,673

$ 463,332,450,474

9%

5%

86%

4%

35%

61%

Distribution by General Property Type

BPP Commercial Residential

Outer Ring =

Distribution by

Market Value

Inner Ring =

Distribution by

Number of Parcels

2%

18%

29%

11%

24%

16%

0%

4%

12%

18%

35%

22%

9%

0%

Commercial Distribution by Property Type

Comm_Hotels

Comm_Industrial

Comm_Land

Comm_MultiFamily

Comm_Office

Comm_Retail

Comm_Specialty

Outer Ring =

Distribution by

Market Value

Inner Ring =

Distribution by

Number of Parcels

28

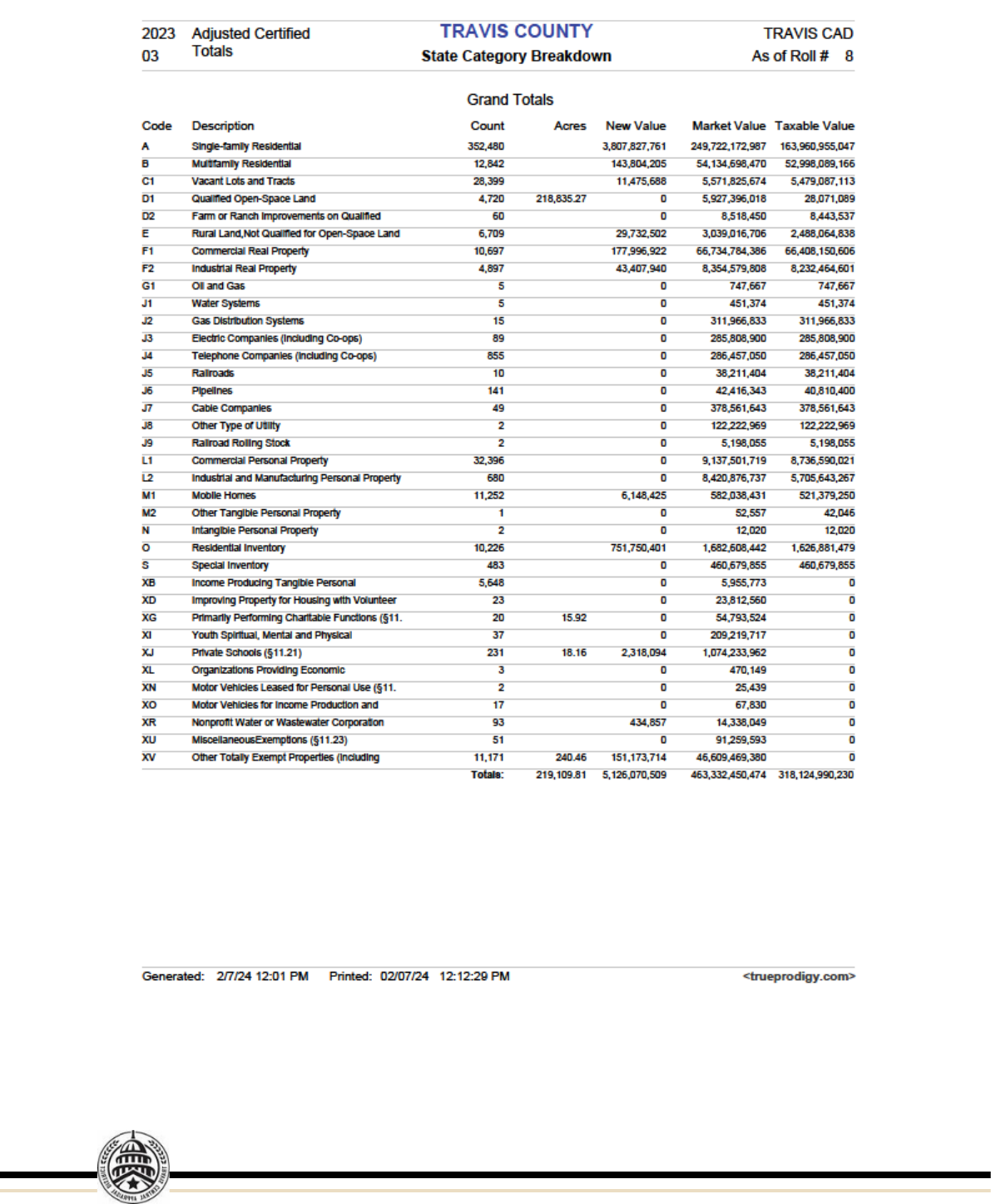

STATE PROPERTY CATEGORIES

State Cd State Cd Desc Prop Count New Market Value Market Val Taxable Val

A

SINGLE FAMILY RESIDENCE

352,480 $ 3,807,827,761 $ 249,722,172,987 $ 163,960,955,047

B

MULTIFAMILY RESIDENCE

12,842 $ 143,804,205 $ 54,134,698,470 $ 52,998,089,166

C1

VACANT LOTS AND LAND TRACTS

28,399 $ 11,475,688 $ 5,571,825,674 $ 5,479,087,113

D1

QUALIFIED OPEN-SPACE LAND

4,720 $ - $ 5,927,396,018 $ 28,071,089

D2

IMPROVEMENTS ON QUALIFIED OPEN

SPACE LAND

60 $ - $ 8,518,450 $ 8,443,537

E

RURAL LAND, NON QUALIFIED OPEN

SPACE LAND, IMPRVS

6,709 $ 29,732,502 $ 3,039,016,706 $ 2,488,064,838

F1

COMMERCIAL REAL PROPERTY

10,697 $ 177,996,922 $ 66,734,784,386 $ 66,408,150,606

F2

INDUSTRIAL AND MANUFACTURING REAL

PROPERTY

4,897

$ 43,407,940 $ 8,354,579,808 $ 8,232,464,601

G1

OIL AND GAS

5 $ - $ 747,667 $ 747,667

J1

WATER SYSTEMS

5 $ - $ 451,374 $ 451,374

J2

GAS DISTRIBUTION SYSTEM

15 $ - $ 311,966,833 $ 311,966,833

J3

ELECTRIC COMPANY (INCLUDING CO-OP)

89 $ - $ 285,808,900 $ 285,808,900

J4

TELEPHONE COMPANY (INCLUDING CO-

OP)

855 $ - $ 286,457,050 $ 286,457,050

J5

RAILROAD

10 $ - $ 38,211,404 $ 38,211,404

J6

PIPELINE COMPANY

141 $ - $ 42,416,343 $ 40,810,400

J7

CABLE TELEVISION COMPANY

49 $ - $ 378,561,643 $ 378,561,643

J8

OTHER TYPE OF UTILITY

2 $ - $ 122,222,969 $ 122,222,969

J9

RAILROAD ROLLING STOCK

2 $ - $ 5,198,055 $ 5,198,055

L1

COMMERCIAL PERSONAL PROPERTY

32,396 $ - $ 9,137,501,719 $ 8,736,590,021

L2

INDUSTRIAL AND MANUFACTURING

PERSONAL PROPERTY

680 $ - $ 8,420,876,737 $ 5,705,643,267

M1

TANGIBLE OTHER PERSONAL, MOBILE

HOMES

11,252 $ 6,148,425 $ 582,038,431 $ 521,379,250

M2

OTHER TANGIBLE PERSONAL PROPERTY

1 $ - $ 52,557 $ 42,046

N

INTANGIBLE PROPERTY AND/OR

UNCERTIFIED PROPERTY

2 $ - $ 12,020 $ 12,020

O

RESIDENTIAL INVENTORY

10,226 $ 751,750,401 $ 1,682,608,442 $ 1,626,881,479

S

SPECIAL INVENTORY TAX

483 $ - $ 460,679,855 $ 460,679,855

X

TOTALLY EXEMPT PROPERTY

17296 $ 153,926,665 $ 48,083,645,976 $ -

494,313 5,126,070,509 463,332,450,474 318,124,990,230

29

TOP TEN TAXPAYERS

Taxpayer Name Market Value

% of Total

County

Market Value

Taxable Value

% of Total

County

Taxable Value

1

Tesla Inc. 1,863,429,868$ 0.40% 1,799,678,062$ 0.57%

2

Colorado River Project LLC 1,698,280,414$ 0.37% 1,698,280,414$ 0.53%

3

Samsung Austin Semiconductor 1,366,564,090$ 0.29% 1,309,249,952$ 0.41%

4

Columbia/St Davids Healthcare 743,133,774$ 0.16% 743,133,774$ 0.23%

5

Icon IPC TX Property Owner 498,694,754$ 0.11% 498,694,754$ 0.16%

6

Amazon.com Services LLC 590,887,033$ 0.13% 460,451,973$ 0.14%

7

BPP Alphabet MF Riata LP 460,000,500$ 0.10% 460,000,500$ 0.14%

8

Oracle America Inc. 457,797,487$ 0.10% 457,797,487$ 0.14%

9

University of Texas 456,036,800$ 0.10% 456,036,800$ 0.14%

10

Green Water Block 185 LLC 427,000,000$ 0.09% 427,000,000$ 0.13%

TRAVIS COUNTY TOTAL 463,332,450,474$ 100.00% 318,124,990,230$ 100.00%

Top Ten 2023 Ad Valorem Taxpayers in Travis County

* Sum of all properties/accounts for the principal taxpayer

30

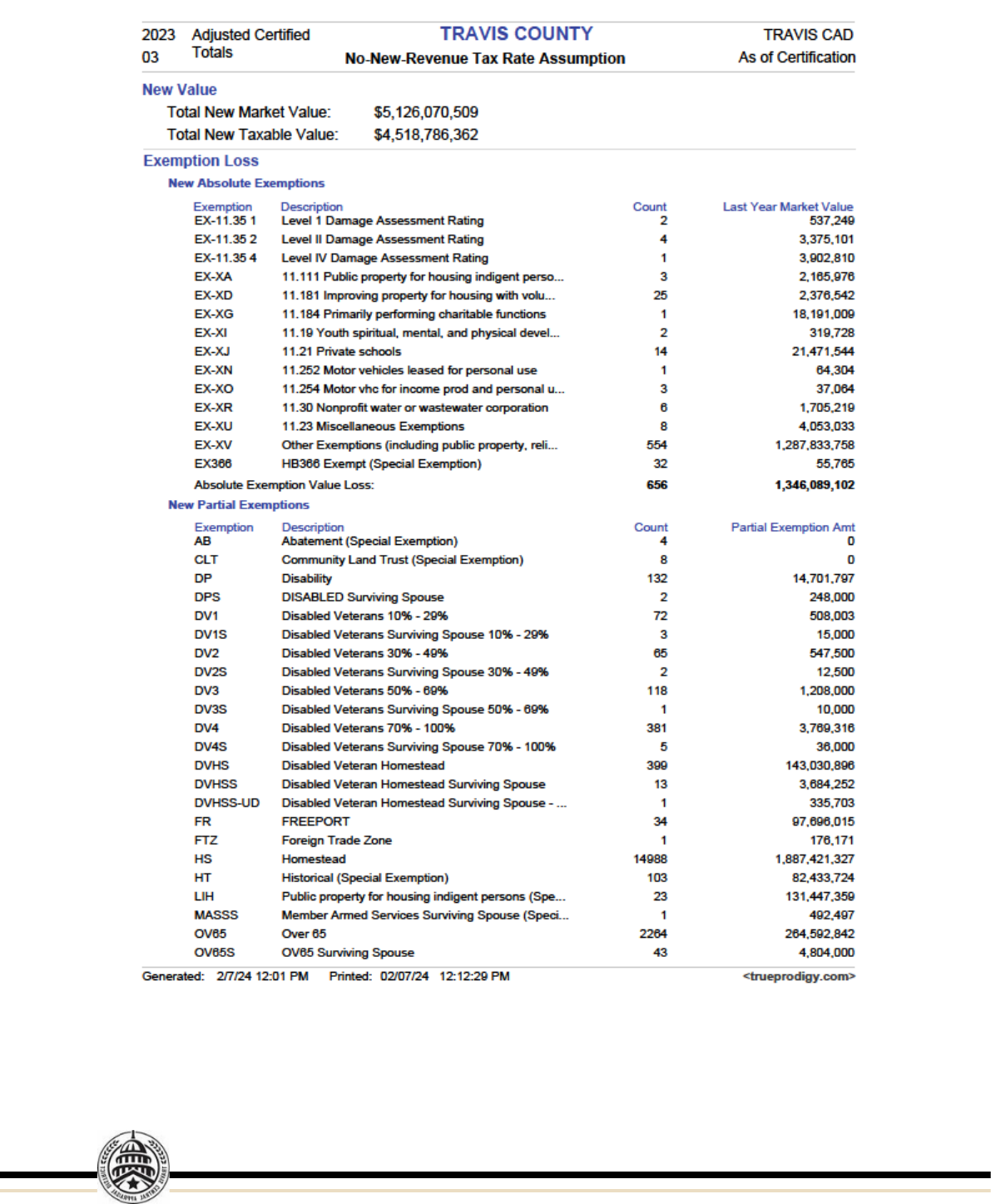

EXEMPTIONS

The general homestead exemption is for owner-occupied residential properties. The

exemption removes a portion of your value from taxation, providing a lower tax amount for the

homestead property.

If you qualify for the Over 65 exemption, there is a property tax “ceiling” that automatically

limits school taxes to the amount you paid in the year that you first qualified for the exemption.

100% disabled veterans are eligible for 100% exemptions for their residence homestead.

Documentation from the Department of Veterans Affairs must be submitted indicating 100

percent disability compensation due to a service-connected disability AND a rating of 100

percent disabled or a determination of individual unemployability from the VA.

Entity Name

State

Mandated

Homestead

Local Option

Homestead

State

Mandated

Over 65

Local Option

Over 65

State

Mandated

Disability

Local Option

Disability

ACC DIST - WMSN CO 1% 75,000$ 75,000$

ANDERSON MILL LIMITED DISTRICT 20% 10,000$ 10,000$

AUSTIN COMM COLL DIST 1% 75,000$ 75,000$

AUSTIN ISD 100,000$ 10,000$ 25,000$ 10,000$ 15,000$

CITY OF AUSTIN 20% 124,000$ 124,000$

CITY OF AUSTIN/HAYS CO 51,000$ 51,000$

CITY OF AUSTIN/WMSN CO 51,000$ 51,000$

CITY OF BEE CAVE 20% 65,000$ 65,000$

CITY OF CEDAR PARK 1% 30,000$ 20,000$

CITY OF ELGIN 15,000$ 15,000$

CITY OF JONESTOWN 20% 8,000$ 8,000$

CITY OF LAGO VISTA 20%

CITY OF LAKEWAY 25,000$

CITY OF LEANDER 1% 10,000$ 10,000$

CITY OF MANOR 10,000$

CITY OF MUSTANG RIDGE 5,000$

CITY OF PFLUGERVILLE 50,000$ 50,000$

CITY OF ROLLINGWOOD 3,000$

CITY OF ROUND ROCK 22,000$ 3,000$

CITY OF SUNSET VALLEY 10% 3,000$ 3,000$

CITY OF WEST LAKE HILLS 4,000$

COTTONWD CREEK MUD NO 1 5,000$ 5,000$

COUPLAND ISD 100,000$ 10,000$ 10,000$

DEL VALLE ISD 100,000$ 10,000$ 10,000$

DOWNTOWN PUB IMP DIST 70,000$ 70,000$

DRIPPING SPRINGS ISD 100,000$ 10,000$ 10,000$

E SIXTH ST PUB IMP DIST 70,000$ 70,000$

EANES ISD 100,000$ 10,000$ 20,000$ 10,000$ 20,000$

ELGIN ISD 100,000$ 10,000$ 10,000$

HAYS CONSOLIDATED ISD 100,000$ 10,000$ 10,000$

HURST CREEK MUD 20% 10,000$ 10,000$

JOHNSON CITY ISD 100,000$ 10,000$ 10,000$

LAGO VISTA ISD 100,000$ 10,000$ 10,000$

31

Non-profit organizations that are eligible for property tax exemptions include, but are not limited

to, certain charitable organizations, youth development organizations, religious organizations, non-

profit private schools, charitable hospitals, cemeteries, and veterans’ organizations.

Property owners with mineral property worth less than $500 or business personal property worth

less than $2,500 are exempt from property taxes. No exemption application is required.

Entity Name

State

Mandated

Homestead

Local Option

Homestead

State

Mandated

Over 65

Local Option

Over 65

State

Mandated

Disability

Local Option

Disability

LAGO VISTA ISD 20% 10,000$ 10,000$

LAKE TRAVIS ISD 100,000$ 10,000$ 10,000$

LAKE TRAVIS ISD 20% 10,000$ 10,000$

LAKESIDE WCID NO 2B 100,000$

LAKEWAY MUD 5,000$

LAZY NINE MUD NO 1B 5,000$ 5,000$

LEANDER ISD 100,000$ 10,000$ 3,000$ 10,000$ 3,000$

LOST CREEK LIMITED DISTRICT 4,000$

LOST CREEK MUD 4,000$

MANOR ISD 100,000$ 10,000$ 25,000$ 10,000$ 15,000$

MARBLE FALLS ISD 100,000$ 10,000$ 3,000$ 10,000$

NORTH AUSTIN MUD NO 1 15,000$ 15,000$

NORTHTOWN MUD 5% 25,000$ 25,000$

PFLUGERVILLE ISD 100,000$ 10,000$ 9,100$ 10,000$

RIVER PLACE LIMITED DISTRICT 10% 25,000$ 25,000$

RIVER PLACE MUD 10% 25,000$

RNCH @ CYPRSS CRK MUD 1 15,000$ 15,000$

ROUND ROCK ISD 100,000$ 10,000$ 10,000$ 3,000$

TANGLEWD FOREST LTD DIST 10% 50,000$ 15,000$

TRAVIS CO BCCP 20% 65,000$ 65,000$

TRAVIS CO BEE CAVE ROAD DIST NO 1 20% 124,000$ 124,000$

TRAVIS CO ESD NO 4 20% 60,000$

TRAVIS CO ESD NO 9 4,000$

TRAVIS CO MUD NO 10 15% 10,000$ 10,000$

TRAVIS CO MUD NO 15 10,000$ 10,000$

TRAVIS CO MUD NO 18 21,000$ 21,000$

TRAVIS CO MUD NO 2 5,000$ 5,000$

TRAVIS CO MUD NO 8 15,000$

TRAVIS CO RFP DIST NO 6 $5,000 3,000$ 3,000$

TRAVIS CO WCID NO 10 4,000$

TRAVIS CO WCID NO 15 20% 15,000$

TRAVIS CO WCID NO 17 10% 15,000$ 15,000$

TRAVIS CO WCID NO 18 30,000$

TRAVIS COUNTY 20% 124,000$ 124,000$

TRAVIS COUNTY HEALTHCARE DISTRICT 20% 124,000$ 124,000$

VILLAGE OF POINT VENTURE 10%

VILLAGE OF SAN LEANNA 25,000$

VILLAGE OF THE HILLS 20% 25,000$ 25,000$

VILLAGE OF VOLENTE 45,000$ 45,000$

VILLAGE OF WEBBERVILLE 5%

WELLS BRANCH MUD 20% 125,000$ 125,000$

WEST TRAVIS CO MUD NO 8 20% 15,000$

WILLIAMSON/TRAVIS MUD NO 1 15,000$ 15,000$

WMSN-TR CO WCID NO 1F 15,000$ 15,000$

WMSN-TR CO WCID NO 1G 15,000$

32

TAXPAYER APPEALS

Taxpayers have the right to appeal their property’s valuation. The Appraisal Review Board

considers all evidence presented by the property owner and the Appraisal District Office at

formal hearings. They then rule on the value of the property in question.

Taxpayer protests can be filed by the property owner or an authorized agent for the property

owner. Protests can be filed electronically through the public portal or using the paper protest

form.

95,916

107,858

115,870

126,151

143,047

147,368

123,948

141,367

172,367

180,956

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

200,000

10 Year History of

Property Appeals

149,891

83%

31,065

17%

Distribution of 2023 Appeals

by Filing Method

Electronically Filed

Paper Filed

145,108

80%

35,385

20%

463

0%

Distribution of 2023 Appeals

by Filing Type

Agent Protests

Owner Protests

Other Protests

33

$7,684,764,129

3%

$133,469,072,609

48%

$136,498,681,471

49%

$99,360,365

0%

Distribution of 2023 Appeals

by Market Value

Business Personal Property

Commercial

Residential

Other

5,258

3%

15,251

8%

160,372

89%

75

0%

Distribution of 2023 Appeals

By Number of Appeals Filed

Business Personal Property

Commercial

Residential

Other

34

Taxpayers that file an appeal are first given an opportunity to meet informally with an appraiser.

If the property owner is unable to reach a value agreement with the appraiser, they are then

able to carry their protest to the Appraisal Review Board for a formal hearing.

Taxpayers dissatisfied with the Appraisal Review Board formal hearing determination may

appeal the decision to arbitration, State Office of Administrative Hearings, or District Court.

Informal

Agreements

14%

Formal Hearings

17%

Topline

Agreements

58%

No

Show/Dismissed

7%

Withdrawn

4%

Other Resolution

0%

322

512

730

905

1,271

1,514

1,488

1,541

1,755

2,451

0

500

1000

1500

2000

2500

3000

10 Year History of

Property Lawsuits

35

COMPTROLLER PTAD STUDIES

Annually, the Comptroller’s Property Tax Assistance Division performs either a Property Value

Study (PVS) or Methods and Assistance Program (MAP) review of each appraisal district.

The purpose of the PVS is to determine the median level of appraisal for the appraisal district

and determine the taxable value for each ISD for school funding purposes. Travis CAD received

its most recent PVS review in 2022 and the results are presented below.

2022 PROPERTY VALUE STUDY

Category

Number of

Ratios **

2022 CAD Rept

Appraised Value

Median

Level of

Appr

Coefficient

of

Dispersion

% Ratios w

/in (+/ -) 10

% of Median

% Ratios

w /in (+/ -

) 25 % of

Median

Price -

Related

Differential

A. SINGLE-FAMILY

RESIDENCES

5,537 245,371,749,069 1.01 10.18 60.72 91.91 1.03

B. MULTI-FAMILY

154 48,240,537,112 1 6.52 75.97 96.1 1.03

C1. VACANT LOTS 494 5,074,051,089 * * * * *

C2. COLONIA LOTS 0 0 * * * * *

D2. FARM/RANCH IMP 0 37,687,184 * * * * *

E. RURAL-NON-QUAL 75 2,562,646,420 0.94 39.1 26.67 49.33 1.18

F1. COMMERCIAL REAL 267 62,993,235,599 0.98 9.82 69.66 88.76 0.99

F2. INDUSTRIAL REAL 0 7,381,752,848 * * * * *

G. OIL, GAS, MINERALS 0 506,437 * * * * *

J. UTILITIES 7 1,155,173,546 * * * * *

L1. COMMERCIAL PERSONAL 211 7,714,261,606 1 7.45 73.46 93.84 1.02

L2. INDUSTRIAL PERSONAL 0 5,643,454,672 * * * * *

M. OTHER PERSONAL 0 547,858,803 * * * * *

O. RESIDENTIAL INVENTORY 0 1,411,566,698 * * * * *

S. SPECIAL INVENTORY 0 418,104,921 * * * * *

OVERALL 6,745 388,552,586,004 1 11.53 58.8 89.1 1.04

36

2023 METHODS AND ASSISTANCE PROGRAM REVIEW

Travis CAD received its most recent MAP review in 2023. The review is designed to determine

whether appraisal districts are meeting minimum requirements for appraisal duties and reviews

specifically for governance, taxpayer assistance, operating procedures, and appraisal standards

and methodology. Travis CAD passed all mandatory requirements and received a meets all

rating in all areas of review.

37

APPRAISAL DISTRICT FINANCES

Local taxing units pay CAD expenses according to their share of the total property tax levy of

all the taxing units in the CAD.

54%

18%

15%

5%

4%

1%

2% 1%

0%

Budget by Taxing Unit Type

School

City

County

Hospital District

Junior College

Emergency District

MUD

Water

Road

34%

18%

17%

6%

5%

5%

4%

4%

4% 3%

Top 10 Contributing Taxing Units

AUSTIN ISD

CITY OF AUSTIN

TRAVIS COUNTY

PFLUGERVILLE ISD

TRAVIS COUNTY HEALTHCARE

DISTRICT

AUSTIN COMM COLL DIST

LAKE TRAVIS ISD

EANES ISD

LEANDER ISD

DEL VALLE ISD

38

The district’s financial statements are audited annually by a CPA in accordance with generally

accepted auditing standards. The results of the audit are presented to the Board.

The appraisal district budget is prepared and presented to the Board of Directors and all taxing

units in preliminary form no later than June 15

th

of the preceding budget year. After a public

hearing is held, the Board formally adopts the district budget no later than September 15

th

. The

budget outlines goals, objectives, programs to be accomplished, operating and maintenance

expenditures, personnel breakdown with staffing levels and salary ranges, and capitalized

equipment to purchased.

Below is a summary of the major revenue sources and major expenditure categories by fiscal

year for FY 2023 and the previous five years’ budget histories.

2023 Adopted 2022 Adopted 2021 Adopted 2020 Adopted 2019 Adopted 2018 Adopted

Appraisal assessments 25,683,866$ 22,786,110$ 20,193,893$ 20,193,893$ 19,486,627$ 18,827,658$

Other revenue 182,500 182,500 365,000 340,000 145,000 145,000

Total budgeted revenues 25,866,366$ 22,968,610$ 20,558,893$ 20,533,893$ 19,631,627$ 18,972,658$

Expenditures by Category:

1

Personnel Cost 12,561,356 11,138,355 9,471,645 9,389,097 8,337,691 7,947,826

2

Benefit Cost 4,493,676 4,143,506 3,315,329 3,180,737 4,145,872 3,812,072

3

Printing & mailing services 665,819 850,950 733,250 454,300 443,395 460,470

4

Operating supplies 195,500 159,285 172,050 181,850 202,750 205,010

5

Subscriptions and data 286,560 415,426 328,460 189,779 199,330 151,513

6

Training and education 120,790 111,115 112,365 126,655 177,730 165,340

7

Travel expenditures 16,950 10,750 11,250 46,250 48,850 46,350

8

Utilities 607,797 624,147 421,779 426,735 263,525 214,260

9

Legal services 1,715,000 983,500 1,293,000 1,335,000 824,250 949,250

10

Professional services 1,821,189 1,350,369 1,565,356 1,880,061 1,876,015 1,153,635

11

Insurance 74,000 77,000 69,000 82,500 82,500 88,000

12

Aerial photography 802,297 442,297 442,297 524,594 442,297 460,000

13

Rentals 150,870 169,370 175,850 134,520 172,220 314,250

14

Building & equipment

maintenance

379,418 405,984 429,486 325,765 189,189 368,636

15

Software maintenance 462,100 515,735 610,347 573,938 557,328 913,284

16

Other services 407,775 373,760 270,970 288,630 235,890 250,815

17

Capital Equipment 173,931 265,723 22,265 304,288 1,287,795 1,326,947

Debt Administration 748,838 748,838 749,194 749,194 - -

Total Expenditures 25,683,866$ 22,786,110$ 20,193,893$ 20,193,893$ 19,486,627$ 18,827,657$

Budget Comparison FY 2023 & Past 5 Years

39

$-

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

$30,000,000

2018 2019 2020 2021 2022 2023

Axis Title

Budget History

17.5%

2.6%

0.8%

1.1%

0.5%

0.1%

2.4%

6.7%

7.1%

0.3%

3.1%

0.6%

1.5%

1.8%

1.6%

0.7%

2.9%

0.0%

Expenditures by Category

Personnel Cost

Benefit Cost

Printing & mailing services

Operating supplies

Subscriptions and data

Training and education

Travel expenditures

Utilities

Legal services

Professional services

Insurance

Aerial photography

Rentals

Building & equipment

maintenance

Software maintenance

Other services

Capital Equipment

Debt Administration

40

CAD STAFFING

Key District Personnel

Chief Appraiser

Leana Mann

Deputy Chief Appraiser

Mike Mills

In-house Counsel

Dustin Banks

Communications Director

Cynthia Martinez

HR & Finance Director

Kat Harvey

Director Residential Appraisal

Russell Ledbetter

Assistant Director Residential Appraisal

Zachary Dye

Director Commercial Appraisal

Desiree Palencia

Assistant Director Commercial Appraisal

Dustin Harshbarger

Director Personal Property Appraisal

Nancy Wiatrek

Manager Customer Service

Catie Lee

Manager Appraisal Support

Tanya Deleon

Manager Geographic Information Systems

Luis Esteban

The appraisal district employs a mixture of professional and clerical staff.

Year 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Budgeted Personnel 130 128 127.5 132 131 132 123 125 129 129 143 153

Actual Personnel 117 116 114 107 108 102 114 123 114 107 123 153

Variance 13 12 13.5 25 23 30 9 2 15 22 20 0

0

20

40

60

80

100

120

140

160

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Personnel Comparison

41

ORGANIZATION CHART

42

CAD COMPARISON

A useful statistic is comparing the CAD budget to the total taxes levied by the taxing entities.

It reflects how much it costs to generate a dollar of property tax revenue which, in turn,

indicates appraisal and operating efficiencies.

Another helpful statistic for weighing appraisal district performance is comparing the appraisal

district budget to total market value. This measures the CAD's operating efficiency based on

how much it costs to produce a market value appraisal roll. Travis CAD has the lowest budget

as a percent of total market value compared to other similar metro CADs.

2022 Total Levy 2022 Budget

Budget as a

% of Levy

Dallas CAD 8,636,775,393$ 31,205,055$ 0.3613%

Travis CAD 5,966,208,393$ 22,786,110$ 0.3819%

Bexar CAD 4,970,768,992$ 20,238,268$ 0.4071%

Williamson CAD 2,229,068,117$ 10,257,900$ 0.4602%

Tarrant CAD 5,806,429,123$ 26,790,117$ 0.4614%

Denton CAD 2,937,313,897$ 15,324,293$ 0.5217%

Montgomery CAD 1,895,820,850$ 12,239,560$ 0.6456%

Colling CAD 3,788,357,387$ 25,394,900$ 0.6703%

Harris CAD 12,972,489,919$ 94,872,473$ 0.7313%

Fort Bend CAD 2,244,551,453$ 18,194,846$ 0.8106%

Budget as a % of Total Levy

2022 Market Value 2022 Budget

Budget as a

% of Market

Value

Travis CAD 428,443,400,804$ 22,786,110$ 0.0053%

Williamson CAD 155,228,489,181$ 10,257,900$ 0.0066%

Dallas CAD 459,957,531,580$ 31,205,055$ 0.0068%

Bexar CAD 269,872,354,900$ 20,238,268$ 0.0075%

Denton CAD 183,201,173,329$ 15,324,293$ 0.0084%

Tarrant CAD 299,465,744,810$ 26,790,117$ 0.0089%

Collin CAD 251,288,442,956$ 25,394,900$ 0.0101%

Montgomery CAD 109,405,527,159$ 12,239,560$ 0.0112%

Harris CAD 788,310,680,998$ 94,872,473$ 0.0120%

Fort Bend CAD 135,549,932,917$ 18,194,846$ 0.0134%

Budget as a % of Market Value

43

As of the most recent Comptroller’s Operations Survey (2022), Travis CAD had the third-

highest market value in the state.

2022 Market Value

Market Value

(Billions)

% of Total

State Market

Value

Harris CAD

788,310,680,998$ 788$ 14.9588%

Dallas CAD 459,957,531,580$ 460$ 8.7280%

Travis CAD 428,443,400,804$ 428$ 8.1300%

Tarrant CAD 299,465,744,810$ 299$ 5.6826%

Bexar CAD 269,872,354,900$ 270$ 5.1210%

Collin CAD 251,288,442,956$ 251$ 4.7684%

Denton CAD 183,201,173,329$ 183$ 3.4764%

Williamson CAD 155,228,489,181$ 155$ 2.9456%

Fort Bend CAD 135,549,932,917$ 136$ 2.5722%

Montgomery CAD 109,405,527,159$ 109$ 2.0760%

State Total 5,269,891,392,975$ 5,270$

Top 10 Texas CADs by Market Value

44

APPRAISAL DISTRICT WORKLOAD

The appraisal functions for the Travis Central Appraisal District are divided into three

departments- Commercial Appraisal, Residential Appraisal, and Business Personal Property

Appraisal. Within these three departments, there are a total of 79 full-time employees. Of

those staff members, 35 are Registered Professional Appraisers (RPA) through the Texas

Department of Licensing and Regulation (TDLR), with an additional 42 staff members registered

with TDLR and working towards their RPA Designation.

Appraisal Phase

During the appraisal phase, appraisers conduct field inspections and aerial reviews of properties

in order to discover any new property and list all characteristics of new and existing properties.

These steps are the foundation of determining a market value for each property within Travis

County. The staff also determine a property’s situs, or where it will be taxable. The appraisal

district then sends a notice of appraised value to each property owner listing their property’s

market value for the tax year, along with other information required by the Texas Property Tax

Code to be included in the Notice of Appraised Value. Travis CAD then compiles a formal list

of all taxable property, known as the appraisal records, and delivers the records to the Appraisal

Review Board before beginning the next phase of the cycle.

Equalization Phase

During the equalization phase, property owners can protest their appraisal on the basis that

their market value is excessive or they were unequally appraised, determination of situs, the

denial of any exemptions, denial of special-use appraisal, determination of a change of use on

previously qualified agricultural or timber land, determination of ownership, failure of the ARB

or appraisal district to send required notices, or any other action that applies to and adversely

affects the property owner. Appraisers will meet informally with property owners and agents

to discuss a protest and try to resolve any concerns. If a property owner and appraiser cannot

reach an agreement, they can have their protest heard by the Appraisal Review Board, an

independent body of citizens tasked with hearing property owner protests and making a

determination on the protest.

Note: The other two phases of the appraisal cycle do not pertain to the appraisal functions and are not reported here.

Appraisal Functions

45

COMMERCIAL APPRAISAL

The Commercial Appraisal Department is responsible for appraising all commercial properties

within Travis County, including all multi-family properties of five units and larger, retail, office,

industrial, and lodging properties. This department must gather data pertaining to the quality,

classification, and value of complex commercial properties. They are responsible for scheduling

that allows for the systematic processing of commercial protests in a timely manner that will

allow the district to certify timely as well as perform appraisals, data collection, sales analysis,

and estimates for construction costs for various types of commercial properties.

Commercial Appraisal

Performance Metric/Task:

2022

2023

% Inc (Dec)

NOAV

Total Noticed Properties

21,361

20,827

-2.5%

Properties noticed by April 15th

20,167

20,013

-0.8%

% Noticed by April 15th

94.4%

96.1%

1.8%

Protest

Total Protests

14,585

15,205

4.3%

Formal Hearings

4,416

5,122

16.0%

Joint Motion Agreements/Toplines

11,360

8,215

-27.7%

% of Protests Toplined

77.9%

62.3%

-20.0%

Number of Permits Processed

3,745

5,200

38.9%

46

RESIDENTIAL APPRAISAL

The Residential Appraisal Department is responsible for the fair and equitable appraisal of all

residential property in Travis County, including houses, mobile homes, duplexes, triplexes,

fourplexes, and residential condominiums. This department is responsible for applying the

generally accepted appraisal methods to estimate the value of all residential property in Travis

County and producing an accurate residential appraisal roll. This department is also responsible

for the scheduling that allows for the systematic processing of residential protests in a timely

manner that will allow the district to certify timely. This department values all land, builder’s

inventory, and places productivity (usually called Ag) values on properties.

Residential Appraisal

Performance Metric/Task:

2022

2023

% Inc (Dec)

Fieldwork

Field Work Inspections

27,223

43,580

60.1%

New Construction

10,001

5,486

-45.1%

Permits Processed

18,175

30,380

-32.4%

Sales Transactions

16,157

14,469

-10.4%

NOAV

Total Noticed Properties

391,673

400,287

2.2%

Properties noticed by April 15th

139,387

218,085

56.5%

% Noticed by April 15th

35.6%

54.5%

53.1%

Protests

Total Protests

152,711

160,197

4.9%

Formal Hearings

32,987

25,418

-22.9%

Informal Agreements Reached

3,308

4,400

33.0%

Informal Meetings Conducted

18,454

64,570

249.9%

Joint Motion Agreements/Toplines

138,849

95,999

-30.9%

Special Valuation Applications

575

1,428

148.3%

47

BUSINESS PERSONAL PROPERTY APPRAISAL

The Business and Personal Property (BPP) Appraisal department is responsible for the fair and

equitable appraisal of all business and personal property in Travis County. This department is

responsible for valuing all personal property accounts, including equipment, inventory,

furniture, fixtures, and vehicles; they are also responsible for administering abatements, special

inventory, and Freeport exemptions. Additionally, they oversee contract appraisals for utilities,

transportation, and minerals.

Business Personal Property

Performance Metric/Task:

2022

2023

% Inc (Dec)

NOAV

Total Noticed Properties

36,965

34,961

-5.4%

Properties noticed by June 1st

7,982

17,924

124.6%

% Noticed by June 1st

21.6%

51.3%

137.4%

Protests

Total Protests

4,965

4,817

-3.0%

Formal Hearings

875

425

-51.4%

Informal Agreements Reached

2,558

1,568

-38.7%

Informal Meetings Conducted

3,993

3,022

-24.3%

Joint Motion Agreements/Toplines

191

339

77.5%

Renditions

Renditions Mailed

36,780

35,875

-2.5%

Renditions Processed

25,385

23,657

-6.8%

Rendition Extension Request Processed

N/A

3,478

N/A

% of Renditions Filed with Extension Request

N/A

14.7%

N/A

Fieldwork: Total Field Checks

9,702

8,906

-8.2%

Special Inventory Tax

729

726

-0.4%

48

The property owner outreach and support functions are comprised of the Communications

Department and the Customer Service department. There are 22 full-time employees

performing property owner outreach and support functions. The public outreach is managed

by the District’s Communication Director and the property owner support functions are

managed by the Customer Service Director.

PROPERTY OWNER OUTREACH

The property owner outreach is designed to provide beneficial information to property

owners on the property tax system and processes and procedures of the Travis Central

Appraisal District. These educational opportunities are provided through public

outreach events and through messaging available on the District’s public website.

Property Owner Outreach

Performance Metric/Task:

2022

2023

% Inc (Dec)

Traditional

Media

Total Coverage

242

187

-22.7%

Positive Coverage

87%

95%

9.2%

On Message

91%

95%

4.4%

Digital Media

Total Website Visits

3,374,650

3,411,066

1.1%

Exemptions Page Visits

251,836

192,988

-23.4%

Protests Page Visits

182,429

165,811

-9.1%

Website Resource Downloads

N/A

41,924

N/A

Outreach

Events

Outreach events attended

7

13

85.7%

Outreach- People Reached (In Person)

N/A

624

N/A

Outreach- People Reached (Replays)

N/A

7,827

N/A

Property Owner Outreach and Support Functions

49

CUSTOMER SERVICE

The Customer Service department is responsible for representing the district in frequent

contact with the public. This department assists property owners, property tax professionals,

attorneys, and the general public with any request. The customer service department

administers homestead, disabled veteran, and over-65 exemptions, and is responsible for

ensuring that exemptions are fairly and consistently granted per the Texas Property Tax Code.

Customer Service

Performance Metric/Task:

2022

2023

% Inc (Dec)

Property Owner

Assistance

Calls Answered

N/A

66,180

N/A

Emails Answered

55,642

34,661

-37.7%

In Person Transactions

8,242

10,381

26.0%

In-Person Wait Time

6.85 minutes

5.22 minutes

-31.2%

Exemptions Processed

42,151

65,443

55.3%

The support services functions for the Travis Central Appraisal District are divided into five

departments- Administration, Legal, Information Technology, Geographic Information Systems,

and Appraisal Support. These five support departments contain 52 full-time employees. Within

these departments, there are an additional 4 Registered Professional Appraisers (RPA) through

the Texas Department of Licensing and Regulation (TDLR).

ADMINISTRATION

The administration department plans, organizes, directs, and controls the business support

functions related to human resources, budget, finance, purchasing, payroll, facilities

maintenance, records management, and mail services. Additional responsibilities include

conducting staff training/CLE, legislative bill tracking and analysis, as well as notarizing and

translating forms and documents.

Finance

Performance Metric/Task:

2022

2023

% Inc

(Dec)

GFOA Certificate of Achievement for Excellence in Financial

Reporting

Yes

Yes

N/A

GFOA Distinguished Budget Award

Yes

Yes

N/A

GFOA Award for Popular Annual Financial Report

Yes

Yes

N/A

GTOT Investment Policy Certificate of Distinction

Yes

Yes

N/A

Vendor Payments Issues (Checks & ACH)

3,343

3,572

6.9%

Support Services

50

LEGAL

The legal department manages post-administrative appeals, including lawsuits, arbitrations,

SOAH hearings, mediations, and settlement conferences (internally and those of outside

counsel); preparation and review of expert reports; filing and answering lawsuits; preparing and

answering discovery, motions, and judgments; and providing legal advice on day-to-day issues

arising out of issues involving the Texas Property Tax Code, exemption application, contracts,

open meetings, and public information requests. The litigation appraisers handle all the

arbitrations and coordinate valuation efforts for use in SOAH hearings, mediations and

settlement conferences involving real property.

Legal

Performance Metric/Task:

2022

2023

% Inc (Dec)

Lawsuits Filed (Cause Number)

1,783

2,451

37.5%

Lawsuits Filed (Property ID)

3,420

4,285

25.3%

Number of Agreed Judgements (by Cause Number)

740

757

2.3%

Number of Agreed Judgements (by Property ID)

1,548

1,356

-12.4%

Settlement Conferences Held (Days)

93

97

4.3%

INFORMATION TECHNOLOGY

The Information Technology department’s function is to manage the activities of the

information technology environment including the network, security, database, and CAMA

software administration. This department is highly technical in all areas for troubleshooting,

evaluating, and recommending changes to current and future network requirements to meet

the district’s needs. The IT department works closely with management and the district’s

software vendor to help design and implement new software features and programming

changes, including changes required by legislative mandate. This department coordinates

supplement processing with entities and district staff, works with various departments of the

taxing units to electronically exchange information and provide data/information for all taxing

units as requested. The IT department also processes record requests requiring computer

generated information.

IT

Performance Metric/Task:

2022

2023

% Inc (Dec)

Help Desk Ticket Count

4,595

1,911

-58.4%

Servers Supported

44

44

0.0%

System Uptime

96.8%

100.0%

3.3%

True Prodigy Tickets Submitted

1,220

823

-32.5%

51

GEOGRAPHIC INFORMATION SYSTEMS (GIS)

The GIS department’s function is to set up new real estate accounts as recorded on

subdivision plats, condominium declarations, and deed records recorded at the Travis County

clerk’s office. It is also the responsibility of the GIS department to maintain current ownership

and mailing addresses on these properties. Ownership records are recorded and received

from the Travis County Clerk and District Clerk offices. Mailing address changes are received

from the property owners and the United States Postal Service. It is also the GIS department’s

responsibility to maintain current taxing entity records. The annexation and de-annexation

information is received from the various taxing entities.

Geographic Information Systems (GIS)

Performance Metric/Task:

2022

2023

% Inc (Dec)

Deed Transactions

42,737

33,827

-20.8%

New Condos

393

396

0.8%

New Lots

6,874

5,575

-18.9%

New Subdivision

302

264

-12.6%

New Units

2,768

3,017

9.0%

Property Merges Processed

139

253

82.0%

Property Splits Processed

588

548

-6.8%

APPRAISAL SUPPORT

The Appraisal Support department is responsible for accurately entering data, ensuring protests

are entered in a timely manner, verifying that all required forms are executed appropriately,

scheduling protest hearings, and ensuring that customers receive prompt attention and

accurate information.

Appraisal Support

Performance Metric/Task:

2022

2023

% Inc (Dec)

Appointment of Agents Processed

67,000

90,200

34.6%

Rendition Data Entry

22,200

23,700

6.8%

Builder Plans Processed

2,300

7,200

213.0%

Solar Exemptions Processed

1,738

3,100

78.4%

Special Inventory Tax Statements Entered

6,000

8,200

36.7%

52

VISIT OR CONTACT US

Office Location

Travis Central Appraisal District

850 E. Anderson Lane

Austin, Texas 78752

Mailing Address

P.0. Box 149012

Austin, TX 78714-9012

Customer Inquiries and Assistance

Phone: (512) 834-9138

Email: CSinfo@tcadcentral.org

Website: www.traviscad.org

Business Hours

M, W, F — 7:45am-4:45pm

Tu, Th — 9:00am – 4:45pm

Directions

From North Austin

From north Austin go south on IH 35. Take the 183/Saint Johns Ave exit which will be exit

number 240A-239. Turn left at the light onto highway 183 South staying on the frontage

road. Make a U turn at the first available intersection onto East Anderson Lane. Our office at

850 East Anderson Lane will be on the right. If you reach the intersection of IH-35 and US-

183, you have gone too far.

From South Austin

From south Austin go north on IH 35. Take the 183/Saint John’s Ave exit which will be exit

number 240A - 239. Turn right on Hwy 183 staying on the frontage road. Make a U turn at

the first available intersection onto East Anderson Lane. Our office at 850 East Anderson

Lane will be on the right. If you reach the intersection of IH-35 and US-183, you have gone

too far.

From East Austin

From east Austin, head west on Hwy 183 and take the I-35/Lamar Blvd/TX-275 Loop exit.

Our office at 850 East Anderson Lane will be on the right. If you reach the intersection of IH-

35 and US-183, you have gone too far.

From West Austin

From west Austin, head east on Hwy 183 and take the US 290/Cameron Road exit. Make a