E20 STADIUM LLP

Business

Plan and 2017-18 Budget

DRAFT Version 6 (Circulated to officer representatives of Members, 27 March

2017)

Version

Date

Main Revisions Made

1

02/03/2017

Alan Skewis draft from 2016 base document

2

10/3/2017

Review of draft financial forecasts by LBN

and LLDC

3

16/03/2017

Martin Gaunt draft

4

16/03/2017

Alan Skewis initial review

5

17/03/2017

Draft to E20 Finance & Audit Committee

6

27/03/2017

Martin Gaunt updated draft based on

Finance & Audit Committee feedback

Final Approvals

Signature

Date

Author

E20 Director Review

External Review (LLDC)

External Review (NLI)

Page 1 of 54

17-030 IR Annex A

Contents

1. Full Financial Summary ................................................................................................................... 4

2017-18 Budget ................................................................................................................................... 4

10 Year Business Plan Income and Expenditure Projections .............................................................. 5

2. Director’s Foreword ........................................................................................................................ 6

Radical options .................................................................................................................................... 7

3.

Bac

kground Information ................................................................................................................. 9

E20 Stadium LLP .................................................................................................................................. 9

Business Plan Structure ..................................................................................................................... 10

4.

Ope

rator ........................................................................................................................................ 12

Introduction ...................................................................................................................................... 12

Operator Agreement Financial Model .............................................................................................. 13

LS185 Business Plan .......................................................................................................................... 14

LS185 Fixed costs .............................................................................................................................. 14

Other payments to LS185 (contract changes) .................................................................................. 16

Net Commercial Revenues ................................................................................................................ 17

Financial Summary ............................................................................................................................ 21

5.

Nam

ing Rights ............................................................................................................................... 22

Approach ........................................................................................................................................... 22

Income .............................................................................................................................................. 22

Costs and financial appraisal ............................................................................................................. 23

Financial Summary ............................................................................................................................ 24

6.

Oth

er Operating Income and Costs .............................................................................................. 25

Fanstallation ...................................................................................................................................... 25

Asset Disposal (“Own the Track”) ..................................................................................................... 25

Wes

t Ham performance payments / relegation ............................................................................... 26

West Ham share of catering revenues .............................................................................................. 26

Minor South Park Events .................................................................................................................. 26

Matchday costs (non LS185) ............................................................................................................. 27

“Clean Stadium” requirements ......................................................................................................... 27

Sale of West Ham United .................................................................................................................. 27

Financial Summary ............................................................................................................................ 28

7.

Staffin

g .......................................................................................................................................... 29

Financial Summary ............................................................................................................................ 30

Page 2 of 54

17-030 IR Annex A

8. Overheads ..................................................................................................................................... 31

Business Rates ................................................................................................................................... 31

Insurance ........................................................................................................................................... 32

Legal Advice ...................................................................................................................................... 33

Other Professional Advice ................................................................................................................. 34

Member Services .............................................................................................................................. 35

Estate Charges................................................................................................................................... 36

Event Tickets ..................................................................................................................................... 36

Financial Summary ............................................................................................................................ 36

9. Relocatable Seats .......................................................................................................................... 38

Financial Summary ............................................................................................................................ 40

10.

Lifec

ycle Investment ................................................................................................................. 41

Financial Summary ............................................................................................................................ 42

11.

Disc

retionary funding for capital works .................................................................................... 43

Discretionary Funding ....................................................................................................................... 43

12. Community and Economic Benefits .......................................................................................... 44

Queen Elizabeth Olympic Park .......................................................................................................... 44

Local Community .............................................................................................................................. 45

Education .......................................................................................................................................... 45

National ............................................................................................................................................. 45

13.

Work

ing Capital Requirement................................................................................................... 46

14. Summary of annual payments to/from West Ham United ....................................................... 47

15.

Gov

ernance ............................................................................................................................... 49

Board ................................................................................................................................................. 49

G

overnance Structure ....................................................................................................................... 50

Map of Stadium site .......................................................................................................................... 51

Appendices ............................................................................................................................................ 52

Page 3 of 54

17-030 IR Annex A

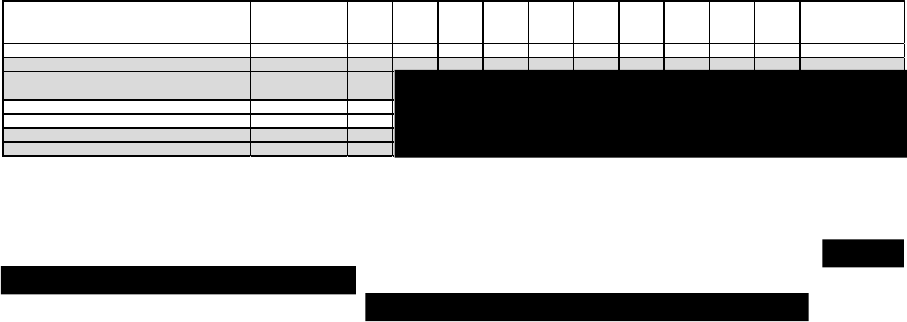

1. Full Financial Summary

2017-18 Budget

The budget indicates that E20 is forecasting a net loss of £19.532m in 2017-18. This is the sum the

E20 Board is asked to consider and approve.

Lifecycle investment remains under consideration, and could require additional funds, subject to a

future Board decision. is shown in the table above, based on E20’s assessment

of LS185’s initial lifecycle review findings. If subsequently approved at that level, that would increase

the net loss to £20.182m.

Risks and opportunities sit outside the £20.182m figure. Risks include (but are not limited to) LS185

underperformance against their business plan, further seat move costs, LS185’s asset survey

resulting in further facility management costs, and potential payment of London Living Wage.

Opportunities include (but are not limited to) , and successful business

rates appeal.

Income and Expenditure Summary: 2017-18 budget

£000s

2016-17 forecast (prior year

comparator)

2017-18 budget

Income

Operator 0 3,574

Naming Rights 0 750

O

ther Ope

rating Income 207 70

Total Income 207 4,394

Expenditure

Operator (7,323) (8,329)

Naming Rights

Other Operating costs (308) (157)

Staffing (343) (339)

Overheads (3,163) (3,798)

Seating (300) (10,000)

Total Expenditure (11,590) (23,926)

E20 net position before lifecycle, risks and

opportunities

(11,383) (19,532)

Lifecycle investment 0 (650)

E20 net position including lifecycle, before risks

and opportunities

(11,383) (20,182)

Risks (450) (6,606)

Opportunities 0 1,

050

E20 ne

t position after opportunities, before risks (11,383) (19,132)

E20 net position, after risks, before opportunities (11,833) (26,788)

Page 4 of 54

17-030 IR Annex A

If opportunities are realised in full, and risks are not realised at all, the forecast would reduce to

£19.132m. If risks are realised in full, but opportunities are not realised at all, the forecast would

increase to £26.788m.

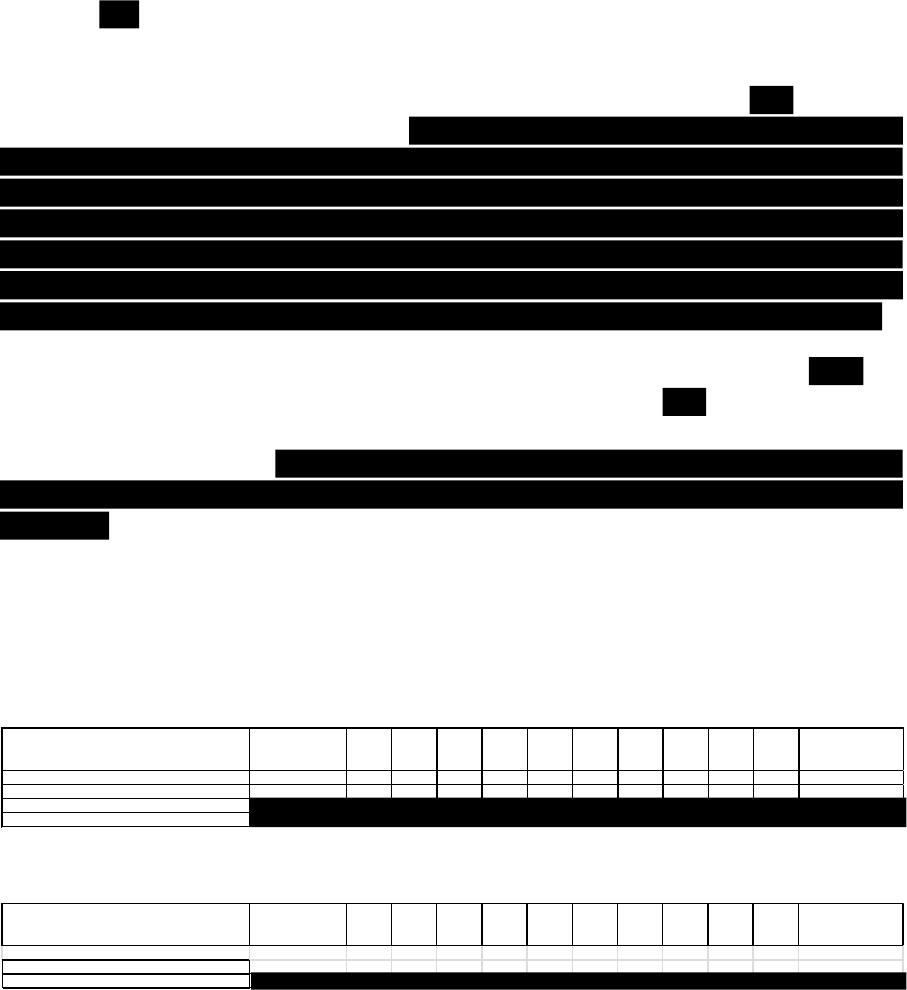

10 Year Business Plan Income and Expenditure Projections

The business plan indicates a base net loss of between £11m and £13m per annum between 2018-

19 and 2026-27. There are potential lifecycle costs beyond this sum, as well as risks and

opportunities. With lifecycle, risks and opportunities factored in, the forecast range is

This fluctuates slightly and gradually grows with inflation in

subsequent years, to a forecast range of

£000s

2016-17 forecast

(prior year

comparat

or)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

E20 net position before lifecycle, risks and opportunities

(11,383) (19,532) (13,443) (10,834) (11,362) (11,512) (11,268) (11,750) (12,028) (12,314) (12,842) (126,887)

E20 net position including lifecycle, before risks and

oppor

tunities

(11,383) (20,182)

Total risks (450) (6,606)

Total opportunities 0 1,050

E20 net position after opportunities, before risks (11,383) (

19,132)

E20 net position, after risks, before opportunities (11,833) (

26,788)

Page 5 of 54

17-030 IR Annex A

2. Director’s Foreword

In the last year the stadium has been handed over in its permanent form. It is now in its long term

configuration, and has started its life as a multi-use venue.

The Stadium has already hosted well over a million spectators since June 2016, and employs over

60% of the workforce from the local population. The first concert has been held; our major tenant

has moved in and played its first domestic and Europa League games. We have installed Europe’s

largest digital screen, and a secondary school that will teach over 1,000 local children has started

construction on site.

The stadium is preparing to stage the 2017 World Athletics Championships and ParaAthletics

Championships this summer.

These successes have required E20 to adopt a pragmatic approach in many of its dealings. While

this has been helpful in securing a safe, licenced venue it has required

The success is also in contrast to the financial performance of the stadium, which has been

unsustainable and failed to meet the forecasts set in March 2016.

This cannot continue.

E20’s primary role is to maximise the financial return for our members, driving our contractors to

deliver income targets, minimise costs and honour (but not over provide) our contractual

commitments.

E20 must make changes in 2017-18 that improve the position, and set us on a path towards an

overriding objective of having a stadium that vastly improves its financial performance.

The business plan reflects six priority areas for our work that support this overriding objective:

1. Making financial efficiencies – Maximum working capital of £19.5m in 2017-18,

2. Holding LS185 accountable for delivery of the stadium operating contract,

3. Securing naming rights gross income of at least for a minimum of ;

4. Closing out stadium transformation issues before August 2017;

5. Moving the relocatable seats in time and within a £10m budget in 2017-18, and securing a

cost of less than for 2018-19;

Page 6 of 54

17-030 IR Annex A

6. Secure contracted local community and economic benefits, including the 75% local

employment target.

In everything we do:

• We will focus on our core business of driving down the working capital needs of the stadium

and providing a platform for a profitable stadium;

• We will not tolerate excuses for under performance in the now transformed stadium;

• We will meet our contractual obligations, but only agree expenditure for what we are legally

obliged to do;

• We will simplify, rather than accept, the interdependencies between different work streams

that have fuelled delays in decision making.

The disadvantage of the 2016-17 pragmatic approach was that it diverted E20 into areas which are

outside its direct responsibility and remit. In 2017-18 we will no longer:

•

•

Radical options

Under the direction of its Members, this Business Plan focuses on driving the best possible

performance for E20 within its existing contractual and physical constraints. It assumes the

following:

• The existing relocatable seating system – which is expensive to operate, and does not

deliver a full transition of the stands within the 7 day target – is retained for the 10 year

business plan period;

• The Concession Agreement with West Ham United is honoured, providing priority use for

the club for a fixed payment of £1.25m-2.5m per annum;

•

• LS185 continue to operate the stadium as per the Operator Agreement;

• E20 continues to own and manage the stadium on behalf of its two Members.

This business plan demonstrates that, within these assumptions, E20 is unlikely to reach a point

where it can meet its objective to deliver a financial return to its Members. As a result, there is

ongoing work on more radical options to address the stadium’s fundamental challenges. This is

largely being led by E20’s Members (with E20 leading or inputting on some items). It includes:

Page 7 of 54

17-030 IR Annex A

• Revi

ewing E20 ownership;

•

•

• The liability for relocatable seating transition costs (which is disputed between LLDC and

NLI);

• An engineering study into whether it is feasible to install a new lower bowl seating system

that would deliver a dramatic improvement in the transition time and cost;

• A Mayoral Review into the stadium, reviewing earlier decisions on the legacy plans, and the

future financial viability of the stadium.

E20 will support work on these more radical workstreams, but not allow them to divert from E20’s

six priorities for 2017-18.

Page 8 of 54

17-030 IR Annex A

3. Background Information

This business plan sets out a summary of the business of E20 Stadium LLP, including financial

projections and key risks and opportunities. The full financial summary provides the detailed income

and expenditure projections for the ten year period from 2017-18 to 2026-27.

This business plan for E20 Stadium LLP is the third full business plan for the stadium in legacy mode.

It draws from the experience of the past year. However, the significant in year changes means that

the 2017-18 plan has been based on a full bottom-up review of all income and expenditure

projections.

E20 Stadium LLP

E20 is a limited liability partnership incorporated on 6 July 2012 under the Limited Liability

Partnerships Act 2000. E20’s Members are the London Legacy Development Corporation (LLDC) and

Newham Legacy Investments Limited (NLI). LLDC is the freeholder of Queen Elizabeth Olympic Park

(QEOP) including the Stadium Island and South Park. NLI is a wholly owned subsidiary of the London

Borough of Newham (LBN). E20 was dormant in 2012-13, with its first year of trading in 2013-14.

E20 was established as the vehicle to deliver the post-Games transformation of the stadium, and

then its ongoing management. The first of these has now been largely been completed by E20’s

nominated agent for the work – the LLDC transformation team.

The E20 Membership Agreement sets out the objectives of the partnership, with the overarching

aim of the LLP being to deliver a programme of sport, community, cultural and commercial events as

well as the following legacy benefits:

• Contributing to the regeneration of the QEOP area, with the Stadium as the centrepiece of a

vibrant Park that delivers growth to East London;

• Local resident access to training and jobs at the Stadium provided by the LLP and the

operator;

• Educational provision within the Stadium; and

• Access to the community track and wider Stadium facilities and events for Newham

residents.

However, most critically, E20 has been set up with the aim of delivering a long-term financial return

to its Members, and ensure that the stadium is not an ongoing burden on taxpayer funding. As set

out in the Director’s Foreword, under current assumptions (i.e. without radical changes), this

business plan demonstrates that E20 will not achieve this objective.

Page 9 of 54

17-030 IR Annex A

Business Plan Structure

The E20 business has not yet reached a mature, steady state, and significant uncertainty and risk

remains. E20’s Members wish to understand the existing financial forecasts for the business, which

will form the budgets to be considered and ultimately approved by the Board.

Members also wish to understand the known risks faced by the business that, if realised, could

create pressures in the business plan and result in a worse financial position.

Finally, Members wish to understand the opportunities potentially open to E20 to exploit, that could

deliver improvements in the financial position.

In order to address these requirements, this business plan presents:

• The “base business plan” forecasts for approval;

• Major (known) risks (quantified) faced by E20 that sit beyond the base forecasts;

• Major opportunities (quantified) open to E20 that sit beyond the base forecasts.

Each of the financial chapters of the business plan consider the primary areas of the business:

• Operator;

• Naming Rights;

• Other Operating Income and Costs;

• Staffing;

• Overheads;

• Relocatable Seats;

• Lifecycle Investment.

Under each chapter, the base business plan is presented, together with the main risks and

opportunities. Commentary is provided primarily to justify the quantifications given, but also to set

out how E20 is managing the risks and driving delivery of the opportunities. Ten year projections are

provided, although typically the figures in latter years simply represent the earlier projections

adjusted for inflation.

1

Other chapters follow at the end of the document, covering management of

E20’s £14.286m discretionary (capital) budget, and the delivery of community benefits.

The business plan does not make any provision or contingency for unknown risks. The Stadium is

now more established, so “unknown unknowns” should no longer emerge on the same level as they

did in the stadium’s opening year. However, the contractual and other challenges faced by E20 do

leave it potentially exposed to other cost pressures emerging that are not currently anticipated or

quantified. Similarly, as the business beds down and LS185 become more established, new and

significant income streams may emerge. Again, by definition these are unknown, so no income is

assumed.

1

Note that inflation is generally assumed across the whole business plan at 3% per annum. This is based on the

average annual RPI experienced in the previous 10 year period, 2007-2016 (Office for National Statistics).

Page 10 of 54

17-030 IR Annex A

E20 updates its business plan annually, so the evolution of the business will be reflected in updated

plans. Members have indicated that, for budgeting purposes, the timetable for E20’s next business

plan should be brought forward, so that it is considered and agreed by the Board in December 2017.

Page 11 of 54

17-030 IR Annex A

4. Operator

The relevant Key E20 Priority is:

Making financial efficiencies – Maximum working capital of £19.5m in 2017-18,

and

Holding LS185 accountable for delivery of the stadium operating contract,

.

The business plan indicates before risks or opportunities, in this area of

the business in 2017-18.

The Board will receive information on:

• Budget vs Actual Forecast LS185 Net return to E20 (Quarterly)

• Match days costs against LS185 business plan and E20 target (monthly)

• Budget vs Actual Fixed Costs (quarterly)

• 2017 Net Concert Revenues (August)

• Health and Safety (Monthly)

• Number of non-event day uses of the stadium (Conferences, banqueting, etc) (Quarterly)

Introduction

The vast majority of the day-to-day operations of the stadium, event sourcing and delivery, and

commercial activity, is contracted by E20 to its operator LS185. The relationship is governed by the

Operator Agreement, established in early 2015.

Managing LS185’s contract forms a major part of E20’s day-to-day business, and is critical to E20’s

financial success. If LS185 fail to deliver it has a very significant impact on:

• The financial performance of E20: is paid to LS185 per annum in fixed costs, with

LS185 expected to deliver significant net commercial revenues in return (see further details

below);

• The stadium’s relationship with primary tenants and other partners, including potential legal

challenge;

• The broader community and economic benefits that the stadium delivers.

Page 12 of 54

17-030 IR Annex A

investment is likely to be required. This is therefore identified as a potential call on the £14.286m

discretionary fund (see chapter 11).

At the time of writing, E20 is in the process of handing over responsibility for utilities to LS185. In

turn, LS185 are establishing contracts with utilities suppliers. The per unit utility rates assumed in

the business plan, in particular for electricity, have been offered but not yet contracted.

Facility management costs

Around of the contracted annual fixed cost payment to LS185 is for facility

management. This is subcontracted by LS185 to VINCI Facilities. The Operator Agreement provides

that LS185 must undertake an asset survey upon taking ownership of the stadium, an exercise now

underway. This survey compares the stadium assets as built, to the specification detailed at the time

of the operator bid.

The annual payment by E20 for facility management is subject to adjustment in accordance with the

outcomes of the asset survey (once challenged and agreed by E20).

Draft high level findings from LS185’s asset survey were presented to E20 and its members on 22

March.

•

•

•

•

E20 has yet to substantiate these (and other) assertions. The draft asset survey report will be

submitted to E20 w/c 27 March, and a detailed period of review and challenge will commence.

5

E20

is already prioritising rapid resolution of any matters relating to statutory records, certification, or

anything that relates to the safety of the stadium.

5

E20 intends to appoint expert consultants to advise and protect E20’s interests. This advice is referenced, and

budgeted for, in the Overheads chapter of the business plan.

Page 15 of 54

17-030 IR Annex A

Notably, LS185’s asset survey is not yet complete. These figures do not yet include the maintenance

of significant items such as the external digital screen, in bowl LEDs, Internet Protocol Television,

some ICT equipment and some furniture, fixtures and equipment (FF&E). E20 has requested a full

assessment of all stadium assets. Once included, these items will increase LS185’s proposal for the

annual cost of facility management.

Other payments to LS185 (contract changes)

E20 and LS185 are working through contract changes that formalise additional scope that the

operator has taken on. This includes the installation and operation of a temporary wifi system (until

the permanent solution is in place), transport modelling to discharge Section 106 Planning

requirements, and the operation of the digital wrap (after contributions from other parties, including

West Ham). The forecast costs associated with these activities are summarised in the table below.

Page 16 of 54

17-030 IR Annex A

Net C

ommercial Revenues

The LS185 business plan forecasts net commercial revenues,

Year LS185 Net Commercial Revenues Forecast

(£m)

2015-16 (part year operation) 0.94 (actual)

2016-17 (part year operation) (0.46)

2017-18 3.57

2018-19 3.66

2019-20 onwards (“steady state”) 5.12

LS185 are projecting future net commercial revenues jumping to positive £3.6m in 2017-18, and

then growing to just over £5m in steady state.

£ 2016-17 2017-18 2018-19 and steady state

Temporary wifi

Transport modelling

Wrap operation

Total

Page 17 of 54

17-030 IR Annex A

Other Operator Risks

The E20 assessment of LS185 underperformance risk does not factor in three further specific risks

(which to a large degree are beyond LS185’s control):

• London Living Wage: A potential adjustment to E20 policy to pay London Living Wage (LLW)

to all event day staff. This is a future decision for the E20 Board, and must be made in the

context of the Mayor of London’s recent public statement that the stadium must now pay

LLW. Current LS185 and E20 forecasts do not assume payment of LLW to all subcontractors –

the majority of event day stewards, catering staff and cleaners are paid below LLW. E20 is

awaiting information requested from LS185 detailing the potential financial impact of paying

LLW.

However, there is likely to be a significant net cost if E20 instructs LS185

(via a change request under the Operator Agreement) to pay LLW. Whilst E20 awaits the

comprehensive information to inform a decision, LS185 have indicated that the net impact

would be in the region of

• “Ipswich ruling” Police costs: There was a recent High Court ruling in respect of policing at

Ipswich Town Football Club. In summary, the High Court found that the football club, not the

Police, is responsible for funding the cost of event-related Policing in the area surrounding

the Portman Road ground. There is the potential for the Metropolitan Police to apply this

ruling to the London Stadium, thereby increasing the extent of the geographic area the

Police can recover costs for.

Net revenues concerts

Net revenues South Park

Net revenues Winter Sports

Net revenues Summer Sports

Net revenues International Sports

Net reveues Special events / filming

Net revenues Partnership

WH Catering

UKA Cate ring

Meeting & events, stadium tours, South Park kiosks

Net revenues WH events

Net revenues Others

Recouped out-of-scope works

Justifications for probability factors and adjustments

Page 19 of 54

17-030 IR Annex A

• Cos

t of capacity increase for West Ham matches: There is an ongoing legal dispute between

E20 and West Ham around responsibility for meeting the costs, and sharing the revenues,

from the increase in the stadium capacity beyond the 53,500 detailed in the Concession

Agreement.

Other Operator Opportunities

There remains the opportunity for a stadium groundshare with another football club. This is

permitted under the terms of the Concession Agreement, although in effect West Ham would be

due a significant slice of the commercial benefit.

Long term, there is undoubtedly scope for vastly improved operator performance, and perhaps net

commercial revenues of the level anticipated during the operator procurement. However,

considerable progress will be necessary over the next three years just to achieve LS185’s business

plan. Therefore, the opportunity beyond that is not currently quantified.

Page 20 of 54

17-030 IR Annex A

Financial Summary

Base business plan section:

Risks:

Opportunities:

£000s

2016-17 forecast

(prior year

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Operator (LS185)

Fixed costs (

base

) (5,080) (

6,

049)

(

1,248)

(1,090)

(250) (1,000)

Other payments to LS185 (contract changes) (284) (

190)

Net Commercial Revenues after Operator share, as

forecast in LS185 business

plan

(461) 3,574

Total LS185 before risks or opportunities (7,323) (4,755)

£000s

2016-17 forecast

(prior year

compar

ator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Risks

(250) (1,000)

(200) (206)

LS185 underperformance against their business plan 0 (2,508)

Payment of London Living Wage 0 (800)

"Ipswich Ruling" Policing costs 0 (525)

0 (500)

£000s

2016-17 forecast

(prior year

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Opportunities

Groundshare with another football club

Utilities savings from improved efficiency

0 200

0 450

Not modelled as highly uncertain, and E20 has limited control

Page 21 of 54

17-030 IR Annex A

5. Naming Rights

The relevant Key E20 Priority is:

Securing naming rights gross income of at least

The business plan indicates a net cost of before risks or opportunities, in this area of the

business in 2017-18.

The Board will receive reports for decision on:

• Naming rights contract (April 2017)

Approach

The potential income from a naming rights partnership would be due directly to E20 – unlike most

other revenues which flow through the operator. The potential value of the naming rights

partnership is such that it is highly significant to E20’s overall financial position. E20 has appointed

an agency (ESP Global) to target, source and deliver a naming rights partner.

E20 is in advanced negotiations with Vodafone as the potential naming rights partner. Vodafone

have indicated in principle that they intend to proceed with a partnership. The precise terms,

notably the inventory rights and responsibility for activation costs, are subject to ongoing

negotiation. The partnership is expected to be successfully secured imminently, in order for it to

commence with the London 2017 Championships in July.

The base business plan

assumes the deal is concluded on the terms under discussion (as circulated to the Board on 16

March). The business plan then makes a risk provision for this deal – or any deal – not proceeding.

This risk is quantified so that it effectively cancels out the net income forecast.

Income

The proposed partnership under discussion with Vodafone

Page 22 of 54

17-030 IR Annex A

Costs and financial appraisal

If the deal is successfully secured, there are a number of costs that may need to be deducted from

the income received, in order to reach the net position. These are not yet finalised and remain

uncertain. At the time of writing, they are assessed as follows:

On current assumptions, the naming rights deal would generate net revenue to E20

Note that

When profiled by financial year, the assessment is potentially slightly different, given the anticipated

1 July 2017 commencement date:

Naming rights financial assessment

By year of deal:

Page 23 of 54

17-030 IR Annex A

Beyond year 5, the business plan assumes that the Vodafone deal (or an equivalent deal with an

alternative partner) continues, with the gross fee and associated costs both growing with inflation.

Financial Summary

Base business plan section:

Risks:

Naming Rights financial assessment

By financial year (assuming 1 July 2017 commencement date):

£000s

2016-17 forecast

(prior year

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Naming Rights

Gross naming rights income 0 750 2,875 4,250 4,500 4,500 4,635 4,774 4,917 5,065 5,217 41,483

Associated costs (excluding capital items) (153) (1,303) (518) (701) (1,205) (1,209) (730) (752) (775) (798) (822) (8,812)

Total Naming Rights before risks or opportunities (153) (553) 2,358 3,549 3,295 3,291 3,905 4,022 4,143 4,267 4,395 32,671

£000s

2016-17 forecast

(prior year

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Risks

No naming rights 0 553 (2,358) (3,549) (3,295) (3,291) (3,905) (4,022) (4,143) (4,267) (4,395) (32,671)

Page 24 of 54

17-030 IR Annex A

6. Other Operating Income and Costs

The relevant Key E20 Priority is:

Making financial efficiencies – Maximum working capital of £19.5m in 2017-18,

The business plan indicates net expenditure of , before risks or opportunities, in this area of

the business in 2017-18.

The Board will receive information on:

• Other Operating Income and Costs (quarterly)

There are various operating income streams or costs that sit outside the Operator Agreement. These

are each described in turn.

Fanstallation

The fanstallation is an area of personalised paving stones in the Champions Place landscaped area to

the north of the stadium. West Ham United have sold, and continue to sell, stones to their fans – to

date they have sold in excess of 17,000, at an average retail price of c£80 (before VAT). A lease was

issued to West Ham in summer 2016, to formalise their use of the site, for a minimum rent of

£20k/annum (more depending on the number of stones sold). Despite already enjoying the access,

and commercial benefits, West Ham are refusing to sign the lease, as they do not accept the

commercial terms. They have refused to engage, citing the need for the bigger issue of “look and

feel” rights to be resolved first. E20 does not accept this position, and is considering its options –

bo

th legally and practically – in response to West Ham’s refusal to sign the lease. The business plan

assumes this issue is resolved and delivers income to E20 of £20k per annum, with the first payment

(backdated) to March 2017.

Asset Disposal (“Own the Track”)

E20’s project to sell sections of the former London 2017 athletics track as commemorative consumer

products has proved successful – to date it has delivered gross sales in excess of £300,000, with

profit to E20 exceeding £60,000, plus significant reputational benefits for E20 and its Members. E20

will continue the project in 2017-18, with its delivery partner Your Tribute (which is responsible for

the bulk of the work). Two priorities are being pursued in order to generate further significant

profits:

o Ongoing partnership with UKA, with the aim to extend to include promotion and sale of

the products at London 2017.

Page 25 of 54

17-030 IR Annex A

o Focus on corporate partnerships, targeting the “top 100” companies associated with

London 2012 and/or the Stadium, with the view to bulk or premium orders.

The base business plan forecasts net profits to E20 of £40k in 2017-18.

West Ham performance payments / relegation

Under the terms of the Concession Agreement, West Ham are due to pay an additional fee to E20 if

the club achieves certain performances (relating to league position, winning cup competitions, or

qualifying for European competitions). These apply from a 10

th

placed Premier League finish (worth

£25k) upwards. At the time of writing, West Ham are outside the top 10. No performance payments

are assumed in the base business plan.

Potential income of £190k, every other year, is shown as an opportunity. This equates to a realistic

upside performance, with West Ham finishing 7

th

in the league every other season, with no cup

wins.

6

The base business plan also does not allow for the corresponding risk that West Ham are relegated,

which triggers a 50% reduction in their £2.5m annual usage fee. This is shown as a risk item,

quantified at £1.25m (indexed), modelled as occurring twice within the 10 year business plan

period.

7

West Ham share of catering revenues

Under the terms of the Concession Agreement, E20 is due to share 30% of the annual catering

revenues from West Ham games above £500k with the club. This is not reflected in the Operator

Agreement and must be paid by E20 rather than LS185. Based on LS185’s business plan, catering

revenues from West Ham’s games are projected at in 2017-18. On this basis, E20 would be

due to pay West Ham

Minor South Park Events

LS185 are responsible for sourcing and delivering large, commercial events on the South Park.

However, the LLDC Events team continue to deliver a steady stream of smaller events to generate

additional revenues for E20. This will drop off in 2017-18 as LLDC take back the land ahead of

development.

6

This was West Ham’s performance in the 2015-16 season (sadly coming too soon for E20 to benefit).

7

This roughly reflects West Ham’s performance in the Premier League era, where they have spent 3 of the

past 23 seasons outside the top flight.

Page 26 of 54

17-030 IR Annex A

Matchday costs (non LS185)

This item comprises costs for E20 on event days that are specifically excluded from the responsibility

of LS185 (and as such are not factored into their net commercial revenues).

New

egress arrangements are expected to be introduced imminently. If successful, this will reduce E20’s

liability to

a

lthough the extent of the impact is not yet agreed.

E20 also made some initial one-off contributions towards and extra staffing at West

Ham station in 2016-17.

A provision of per annum has been made for non-LS185 matchday costs in the base business

plan. This represents a significant saving compared to 2016-17, but still allows for some residual

costs – prudent given that future egress arrangements are not settled, nor funding responsibility

agreed.

“Clean Stadium” requirements

E20 has a contractual obligation to UK Athletics to provide the stadium on a “clean” basis for London

2017 – i.e. with no branding or sponsorship visible. E20 is continuing to work through the practical

implications, and is seeking to minimise any changes to the stadium appearance.

The base business plan makes no provision for clean stadium

costs, but quantifies the risk at (one-off in 2017-18).

Sale of West Ham United

If West Ham United are sold by their current owners in the near future, a proportion of the sale is

payable to E20. The amount payable to E20 is dependent on the timing of the sale, the value of the

sale, and who the club is sold to (E20 do not get a windfall if it is passed on to family members of the

existing owners). Although very significant to E20 in terms of the potential windfall, E20 of course

has no control over this eventuality. As such, it is acknowledged in the business plan as an

opportunity, but is not quantified.

Page 27 of 54

17-030 IR Annex A

7. Staffing

The relevant Key E20 Priority is:

Making financial efficiencies – Maximum working capital of £19.5m in 2017-18,

The business plan indicates net expenditure of before risks or opportunities, in this area of

the business in 2017-18.

The Board will receive information on:

• Appointment of Deputy Director (May 2017)

• E20 Staff recruitment and performance (quarterly)

The current E20 team comprises:

• A Director (Alan Skewis), with overall responsibility for E20 Stadium LLP. This is a permanent

position.

• A Business Manager (Martin Gaunt), who leads on financial strategy, governance, contract

management and certain projects. The role is filled on a secondment from HM Treasury, and is

due to expire at end September 2017.

• An Assistant Business Manager ( ), who supports the Business Manager on

certain projects, with a particular focus on seating transitions, London 2017, “look & feel”

arrangements with West Ham, and residual matters relating to the external wrap. This role is

filled on a fixed term basis, expiring at end August 2017.

• An E20 Capital Adviser ( ), who represents E20’s interests in the transformation

works. This role is filled on a part-time, fixed term basis on a fixed fee through to August 2016.

• A PA and Team Administrator ( ), who provides administrative support plus the

Board secretariat function. This role is filled on a permanent basis.

A number of consultants / project managers are also employed:

• Chris Allison, E20 Security Adviser. Chris’ role should end by May 2017. There is provision for

his costs in the technical advice section (Overheads chapter).

• Mace as Project Managers for the relocatable seating system (covered in seating costs

section).

• on handover issues. There is provision for his costs in the technical advice section

(Overheads chapter).

E20 staffing evolves as required by the task in hand. The theme running through the business plan

of moving from transformation and stadium opening to a focus on contract management is reflected

in proposed changes to the team in 2017-18.

Key changes in the year will be:

Page 29 of 54

17-030 IR Annex A

• App

ointment of a Deputy Director (interviews in May 2017, forecast start date of July 2017);

• Discontinuation of the Business Manager Post (by end September 2017);

• Discontinuation of the fixed term Assistant Business Manager post, currently focused on seat

moves and London 2017 (end August 2017);

• Completion of the secondment of the E20 Capital Adviser (by August 2017).

These changes make the E20 team smaller, and necessitate the withdrawal from non-core activity.

The business plan reflects these staffing structures and the salaries agreed (or, in the case of the

new role, proposed).

“On costs” are allowed for at 20% of salaries. This comprises 13.8% National Insurance and a 6%

employer pension contribution. Subject to satisfactory performance, staff are being awarded a 1%

pay rise in April 2017, below the level of inflation.

Financial Summary

Base business plan section:

£000s

2016-17 forecast

(prior year

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Staffing

Total Staffing before risks or opportunities (343) (339)

Page 30 of 54

17-030 IR Annex A

8. Overheads

The relevant Key E20 Priority is:

Making financial efficiencies – Maximum working capital of £19.5m in 2017-18,

The business plan indicates net expenditure of , before risks or opportunities, in this area of

the business in 2017-18.

The Board will receive information on:

• Business Rates Appeal (July 2017)

• Actual vs Budgeted Legal Advice (Monthly)

• Quarterly Update on achievement of targeted savings (quarterly)

Overheads represent a significant portion of E20’s annual costs (forecast at in 2017-18). It

is worth noting that over £1.5m of these overheads are paid to its two Members and Central

Government. LLDC receive £400k (20% of the business rates), a £300k estate charge and £138k for

services (although with obligations to match). Newham receives £600,000 (30% of business rates).

Business Rates

The business rates payable by E20 are determined by the rateable value of the stadium, as set by the

Valuation Office Agency (VOA). The rates are collected by LB Newham. Government policy dictates

that the actual rates payable are set at c50% of the rateable value.

The rateable value of the stadium is £4m until April 2017, when it will increase to £4.6m as a result

of the na

tionwide revaluation exercise. The increase for the stadium is more modest than many

other properties in London have experienced, but nevertheless still equates to a very significant

rates bill of £2.3m/annum.

The VOA’s assessment of the current and future rateable value is based upon forecast gross

revenues in an earlier version of E20’s business plan, prior to subsequent major revisions in E20’s

forecast profitability. This provides justifiable grounds for an appeal, with the aim of securing a

substantial, backdated, reduction. E20 formally lodged an appeal in November 2016 via its retained

business rates adviser, GeraldEve. The appeal system appears log-jammed (LLDC’s appeal on the

Aquatics Centre took three years’, but has just been successful), but E20 is pushing for priority

consideration. GeraldEve have advised that substantive progress on the appeal can be expected in

the summer, with a likely outcome in late 2017 or early 2018. They are cautious on the prospects of

success. They suggest that any improvement could be a c10% reduction, whereas the Aquatics

Centre appeal achieved over 40%. The base business plan makes no provision for a reduction, but

records a saving opportunity of up to £400k

(equating to a c20% reduction on the current net rates

bill of £

2.1m (after West Ham’s assumed contribution – see below).

Page 31 of 54

17-030 IR Annex A

This represents a major saving against the projections made in the last E20 business plan. The

property insurance is based on a reinstatement valuation of the stadium of (ie. the cost to

rebuild the

stadium from scratch).

E20’s futu

re premiums are likely to increase with inflation. There is a risk – not quantified in this

business plan – that a major safety or other incident could lead to a significant upwards adjustment

in E20’s premiums.

E20 has identified the following potential opportunities to deliver long-term savings of £50k-£100k

per annum on existing insurance costs:

•

•

•

•

Leg

al Advice

The volume of legal issues E20 have dealt with in 2016-17 far exceeded the scale anticipated. This

has been driven by:

• The West Ham Concession Agreement having scope for interpretation on a significant

number of matters;

• West Ham taking a litigious approach;

• A number of LS185-E20 d

isputes generated by the h

andover of the transformation works

and interpretation of the Operator Agreement;

• Challenges relating to the relocatable seating system.

Page 33 of 54

17-030 IR Annex A

The level and scale of disputes are unlikely to quickly abate in 2017-18, with current disputes as

follows:

Dispute

Value of Dispute

Anticipated

Legal Spend

2017-18

Options to Mitigate

A bu

dget of is therefore allocated in the base business plan, to cover both TfL Legal and

Gowlings fees.

Given the volume of legal disputes, and the current reliance on Gowlings to provide advice,

consideration could be given to either:

• Allocating a TfL lawyer dedicated to E20 business. This would allow greater retained

knowledge “in house”, reducing the need to resort to Gowlings so often;

• E20 seconding a lawyer in from outside to be the day-to-day conduit for legal matters, and

able to collate, summarise and minimise external lawyer time.

A decision on this will be made on the basis of saving legal fees, and time spent dealing with legal

issues.

Oth

er Professional Advice

E20 seeks to limit its use of consultancy advice, but makes provision for the following necessary

services.

Page 34 of 54

17-030 IR Annex A

• Acc

ounting advice, assumed at £39k in 2017-18. This covers KPMG’s work to provide 12

monthly VAT returns and Construction Industry Scheme (CIS) returns, tax advice and a

limited number of ad hoc queries as required. These requirements are anticipated to be

taken on by LLDC Finance (via its service into E20) sometime in 2018-19.

• External Audit fees for EY. Their fee estimate for the audit of the 2016-17 accounts is £26k

(incurred during 2017-18). The business plan assumes that this fee is reduced to £21k from

the following year, once the stadium is in more of a steady state and there are very fewer

transactions to audit.

• Technical advice, assumed at £100k in 2017-18, and diminishing thereafter.

The business plan makes

no provision for any feasibility or design costs associated with a potential new seating

system.

Member Services

E20 is a small organisation that relies upon services from its members in order to deliver all its

necessary functions. This approach allows E20 to retain a slim staffing structure, and for its members

to be integrated into its day to day operations. LLDC currently provides services to E20 in accordance

with the Services Agreement. The services include:

• Stadium transformation – residual staff costs are contained within the transformation

budget.

• Finance and procurement – including transaction services, statutory accounts, management

of external audit, FoI management, and procurement advice as required. The cost of these

services in 2017-18 is budgeted at £93,500 (an increase from £80,000 in 2016-17 due to

increased complexity around accounting issues). Procurement management services such as

those provided for the stadium wrap represent an additional capital cost charged to the

project.

• Human Resources and Facilities – including office space, recruitment, payroll management,

and ad hoc personnel issues as they arise. A fee of £5,100 per annum is budgeted for HR

services. Facilities costs, assuming E20’s use of an average of four desks over the course of

2017-18, are £24,100. Total HR and facilities charges for 2016-17 are therefore £29,200 (up

from £28,600 in 2016-17 due to inflation).

• Communications – including strategic communications and press relations. This service is

provided free by LLDC in recognition of the importance of the stadium in the overall

communications strategy for the Park.

• Information Technology – this service is provided for an annual fee of £15,300 (up from

£15,000 in 2016-17 due to inflation). Non-standard equipment or software requirements are

chargeable on a pass through cost basis.

The total budget for LLDC member services for 2017-18 therefore stands at £138k. This is a fixed

liability for E20, unless there happen to be very significant changes in requirements which warrant

Page 35 of 54

17-030 IR Annex A

reconsideration. For future years this figure is subject to inflation, and annual review by the LLDC

Deputy Chief Executive and E20. A small net saving is forecast from 2018-19, due to an expected

reduction in necessary services, partially offset by LLDC potentially bringing accounting advice

(currently provided by KPMG) in house. Over the course of 2017-18, E20 will also review the most

appropriate and cost effective provider of these services. One option could include establishing joint

arrangements with LS185 or other small businesses (e.g. activeNewham)

Estate Charges

E20 is contractually obliged (via its lease with LLDC) to pay an estate charge of £300k/annum, subject

to inflation.

In future this w

ill be partially offset by an estate charge payable to E20 from the Bobby Moore

Academy, commencing when the school opens in September 2018 and growing from c£60k up to

c£14

0k per annum thereafter.

Event Tickets

E20 purchases tickets on behalf of its members. This enables key decision makers and other

sta

keholders to be invited to events, in order to support the strategic objectives of LLDC and

Newham. Approximately £100k was spent on event tickets in 2016-17. The same budget is set for

2017-18. The

majority of the cost is for hospitality tickets for West Ham matches – E20 is tied into

three year commitments for these tickets. There is a small remaining provision for other events. E20

seek

s to minimise costs as far as possible by securing free tickets to stadium events.

Financial Summary

Base business plan section:

£000s

2016-17 forecast

(prior year

comparat

or)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Overheads

LLDC Member Services (124) (138)

E

state charge payable to LLDC (228) (325)

Estate charge payable by school to E20 0 0

Business rates (1,517) (2,100)

Insurance (518) (620)

Brand and marketing (35) 0

Legal advice (392) (350)

Accounting advice (63) (39)

External audit fees (26) (26)

Transport advice (59) 0

Technical advice (102) (100)

Event tickets (100) (100)

Total Overheads before risks or opportunities (3,163) (3,798)

Page 36 of 54

17-030 IR Annex A

Opportunities:

£000s

2016-17 (prior ye ar

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Opportunities

Business rates saving secured via appeal 0 400 412 424 437 450 464 478 492 507 522 4586

Insurance

premium savings 0

Page 37 of 54

17-030 IR Annex A

10. Lifecycle Investment

The relevant Key E20 Priority is:

Making financial efficiencies (although lifecycle investment is not included in E20’s base budget, so

would be subject to further consideration by the Board).

The business plan indicates net expenditure of , before risks or opportunities, in this area of

the business in 2017-18.

The Board will receive reports for decision on:

• E20 Lifecycle Plan (June 2017)

The Board will then receive information on:

• Lifecycle Budget vs Actual Spend (Quarterly)

Under the terms of the Operator Agreement, investment in stadium lifecycle costs is an E20

responsibility for individual assets over in value. LS185 must submit an Annual Lifecycle

Replacement Plan each year. E20 may then instruct LS185 (more specifically, LS185’s subcontractor

VINCI Facilities), or another contractor, to undertake the works of E20’s choosing. Lifecycle

investment clearly creates an upfront cost for E20, whereas choosing not to invest is likely to

increase maintenance costs and/or increase the necessary lifecycle investment in subsequent years.

E20 will need to make a balanced judgement of when and how to invest.

LS185 and VINCI Facilities presented its first draft high level summary of asset lifecycle to E20 and its

members on 22 March 2017. It follows a comprehensive review of stadium assets, all of which is to

be set out in considerable detail in a draft report to E20 w/c 27 March. E20 will then commence a

period of review and challenge. E20 is in the process of procuring specialist consultancy support for

this work (as budgeted in Overheads chapter of business plan). E20 will present a summary to the

Board, with a recommendation on necessary lifecycle investment.

Prior to that period of review and challenge, LS185’s assessment indicates that lifecycle investment

of may be required over the next 25 years (the term of the Operator Agreement). Over the

first five years, LS185’s assessment is as follows:

Year

2017-18

2018-19

2019-20

2020-21

2021-22

Page 41 of 54

17-030 IR Annex A

Pending further details to be issued by LS185, the equivalent figures for the subsequent five years

(i.e. 2022-23 to 2026-27 – the remainder of E20’s business plan period) may be considered to be an

average of per annum (ignoring peaks and troughs).

The above figures presented by LS185 cover all assets regardless of value, but with some notable

exceptions.

11

LS185 can and will present a subset, which only covers assets over in value, in

accordance with the Operator Agreement.

Under the Operator Agreement, E20’s current fixed costs payment to LS185 includes per

annum (subject to inflation) for the maintenance of assets lower than in value. In order to

provide a figure for E20’s base business plan for lifecycle investment, this cost is stripped out of the

figures presented by LS185.

Financial Summary

Base business plan section:

Risks:

11

The external digital screen, in bowl LEDs, IPTV, some ICT equipment and some FF&E items are all currently

excluded. E20 has requested a full assessment of the necessary lifecycle investment for all stadium assets.

£000s

2016-17 forecast

(prior year

comp

arator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Lifecycle 0

Lifecycle investment

Total Lifecycle before risks or opportunities

£000s

2016-17 forecast

(prior year

comparator)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

10 year total (2017-18

to 2025-26)

Risks

Additional lifecycle investment

Page 42 of 54

17-030 IR Annex A

11. Discretionary funding for capital works

Discretionary Funding

E20's members have agreed a provision of £14.286m for additional stadium works, funded 65%

(£9.286m) by LLDC and 35% (£5m) by Newham Legacy Investments. These are finite funds available

for E20 to apply to a number of risks and aspirations.

The fund is all but exhausted by already committed spends and contingent liabilities. A list of up to

£2.8m potential future capital liabilities or “spend to save” proposals was identified to the Board in

January 2017. If a prioritised set of projects cannot be contained within the £14.2m available they

will either need to be rejected or funded from working capital.

An updated summary of commitments, contingent liabilities, and future potential investments will

be circulated to Members shortly.

Page 43 of 54

17-030 IR Annex A

12. Community and Economic Benefits

The relevant Key E20 Priority is:

Secure contracted local community and economic benefits;

and

Holding LS185 accountable for delivery of the stadium operating contract.

The business plan includes no specific net income or expenditure in this area of the business; it is

absorbed into broader E20 and LS185 activity.

The Board will receive information on:

• Local employment (quarterly)

• Use of Stadium by Local Groups

• Education Use: School, Learning Zone

The main focus of this business plan is on managing the opportunities and challenges associated

with financial performance of the Stadium.

However, the venue delivers community and economic benefits beyond the Stadium Island, making

a significant contribution to local, regional and national life.

E20 will hold contactors to employment targets, generate local opportunities to watch elite sport,

and ensure LS185 open the community track with a full programme of local clubs and sports groups.

As a world-class, multi-use venue, the Stadium is the centrepiece of the area’s sporting offer. It

creates jobs, provides local opportunities to watch elite sport, and boosts the economic

regeneration of East London.

Community and economic benefits include:

Queen Elizabeth Olympic Park

• A focus for promoting the Park as the new, dynamic heart of East London. An estimated 4.4

billion people watch the English Premier League worldwide annually; 153 million watched West

Ham United last season on television.

• An estimated 1.5 million event visits to the Park every year, spending time in the Park as well as

injecting money into the local economy.

• A world-class, multi-use entertainment venue for the Park, adding to the vibrancy of the area

through hosting elite sport, concerts and community events.

• A catalyst for development of a mixed use residential development on the nearby Rick Roberts

Way site, providing much needed homes for Londoners.

• Thousands of Stadium spectators will drive footfall to the new education and cultural quarter.

Page 44 of 54

17-030 IR Annex A

Local Community

• Almost 1,000 local people worked on the stadium transformation.

• LS185 have a target for 75% of all stadium employees to come from local Boroughs, in particular

LB Newham. As things stand, 62.8% of employees are from local Boroughs (including 22.6% from

Newham).

• 100,000 Newham residents will be given the opportunity to watch Premier League Football

every year.

• 10 Community Event days available each year for local people to use the Stadium for celebratory

events. For example, the Great Newham London Run gives up to 50,000 people the chance to

run on the Stadium track every year, including more than 10,000 school children from the local

area.

• A Community Track, with a minimum of 250 access days for local people, will be the new home

of the Newham and Essex Beagles AC from September 2017. The Beagles are a club with strong

roots in the local community, as well as a strong record in the British League.

• The redevelopment of West Ham United’s Boleyn ground as “Upton Gardens”, a mixed use

development, contributing housing, jobs and community facilities in the heart of Newham as

well as the wider regeneration of the Upton Park area, estimated to have a regeneration value

worth over £50m.

Education

• A state-of-the-art Learning Zone within the Stadium available to more than 50,000 young people

in Newham and east London each year.

• The location for a new Secondary School on Stadium Island. The Bobby Moore Academy will

open in 2018 and offer places to more than 1,000 local young people, who will also have access

to the Community Track.

National

• The eyes of the world will be on the Stadium again when it hosts the IPC and IAAF World

Athletics Championships in August 2017, creating more great sporting moments.

• For the first time the IPC World Athletics Championships will be held in the same venue as the

IAAF World Athletics Championships, cementing the venue and London as an inclusive city with

an integrated approach to sport. The Stadium will become the national competition centre for

UK Athletics, and the only venue in the country capable of hosting both athletics and football.

Page 45 of 54

17-030 IR Annex A

13. Working Capital Requirement

Based on the 2017-18 base budget of £19.532m, E20 has modelled forecast cash inflows and

outflows, each month. The detailed monthly cashflow projection has been shared with Members. It

takes account of E20’s forecast opening cash balance as at 31 March 2017 (£2.345m), and

outstanding income and expenditure from 2016-17. It models the timing of forecast income and

expenditure over the course of the year on a cash basis. Notably, LS185’s payment of 2017 net

commercial revenues is expected in April 2018, so is not due to be received in cash within the 2017-

18 financial year. This is the primary reason why E20’s working capital requirement, forecast at

£21.762m, is slightly higher than the base budget forecast.

E20’s working capital requirements are summarised in the table below.

£000s

Quarter

1

Quarter

2

Quarter

3

Quarter

4

Total

LLDC

5,479

4,633

1,999

2,034

14,145

NLI

2,950

2,495

1,076

1,095

7,617

Total

8,429

7,128

3,075

3,130

21,762

The working capital requirement is front loaded in the year due to a number of significant outgoings,

most notably seating costs, scheduled for the first half of the year. E20 will continue to manage its

cashflow to secure income in a timely fashion and delay payments where possible.

The working capital requirement is based on the base business plan – it is before any investment in

lifecycle, and before any risks or opportunities. These have the potential to improve or worsen the

working capital requirement.

Subject to Member’s review, E20 will invoice LLDC and NLI for the required funds shortly in advance

of the quarter. As such, E20 intends to invoice LLDC for £5.479m, and NLI for £2.950m, by 31 March

2017. The working capital requirement for quarter 2 will be confirmed in June 2017, in E20’s

quarterly financial update. The working capital requirement for quarter 3 will be confirmed in

September 2017, and quarter 4 in December 2017.

Page 46 of 54

17-030 IR Annex A

14. Summary of annual payments to/from West Ham United

There are several annual transactions with West Ham United contained within this business plan.

These are summarised in the table below, in order to give an approximate (not precise) indication of

the net position. Prices are the base figures largely derived from either the Concession Agreement or

the latest LS185 business plan. Inflation would apply to all annual payments, and precise figures will

vary year on year. The table adopts the base business plan assumptions. Opportunities and risks

have the potential to improve or worsen the position.

E20 income /

(expenditure) from

West Ham tenancy

(£’000s)

Notes

Annual usage fee

2,500

50% reduction applies for any season West Ham

are outside the Premier League.

Annual estimated

catering income from

West Ham matches

LS185 business plan estimate.

Annual estimated West

Ham share of catering

revenues

West Ham are due 30% of the annual catering

revenues from West Ham games above £500k.

Estimate assumes annual catering revenues

as above.

Annual estimated

operating costs for

West Ham games

(5,060),

LS185 business plan estimate, assuming 23

matches per season, with operating costs of

per match in 2017-18, dropping to

per match in 2018-19 (plus other minor costs

spread across the season). This does not include

the cost of moving the seats, as in this context this

is not considered a “West Ham cost”.

Annual estimated West

Ham performance

payments

0

Different levels of performance trigger difference

payments (from 10

th

place Premier League finish

upwards). Not considered in base business plan

assumptions, but opportunity modelled at £190k

income every other year.

Annual share of

revenues from West

Ham fanstallation

20

Commercial arrangements to be agreed between

West Ham and E20.

Annual additional

income or costs from

increase in stadium

capacity

Total

See important caveats below

Page 47 of 54

17-030 IR Annex A

This analysis To note that West Ham also

made a one-off payment to E20 of £15m during 2016-17 as their agreed contribution to the costs of

transforming the stadium.

The table also does not factor in indirect financial benefits for E20 from West Ham’s tenancy.

West Ham’s presence generates vastly increased exposure for the stadium, with indirect financial

benefits as follows:

• Enhanced naming rights income;

• Enhanced income from marketing rights;

• Enhanced ability to secure additional high profile events in the stadium;

• An estimated 1.5m visits to the local area and Queen Elizabeth Olympic Park;

• “Look and Feel” investment.

Naming rights is potentially very significant. E20 benefits from the first £4m in annual naming rights

revenue, with a 50% share with West Ham applying beyond that threshold. Based on the current

forecast of naming rights income reaching annum in steady state, E20 would be liable to pay

to West Ham. However, it would be reasonable to assume that the enormous exposure that

West Ham’s tenancy generates (and more specifically, the global attraction of the Premier League),

forms a major component of E20’s naming rights offer.

Page 48 of 54

17-030 IR Annex A

15. Governance

Board

E20’s Board meets on at least a quarterly basis (currently monthly) and is comprised of no more than

five members and an independent chairperson. LLDC is entitled to nominate up to three and NLI up

to two Board members, with the independent Chairperson being appointed through a unanimous

vote on an initial three-year term. All Board members (including the Chairperson) have a vote. In

addition, the Chief Executives of LLDC and LBN are ex-officio members of the Board with no voting

rights.

During the year David Edmonds resigned as LLDC Chair, and in turn as E20 Chair. The Members have

retained agreement that there is currently not a need for an independent Chairperson, and

nominated Nicky Dunn (LLDC Board Member) to serve as Chairperson.

Resolutions of the Board require a majority of all votes cast. LLDC has three votes, with NLI granted

two votes; this reflects the principle of the current 65:35 shareholding in E20. However, the

Members Agreement sets out a number of reserved matters that require the approval of both

Members.

E20 has also established a Finance & Audit Committee – effectively a slimmed down version of the

Board that meets around three times per year on financial and audit matters.

Page 49 of 54

17-030 IR Annex A

Map of Stadium site

Page 51 of 54

17-030 IR Annex A

Appendices

The pages that follow show:

• Detailed E20 10 year business plan forecast (as circulated to Members 27 March 2017);

• E20 2017-18 cashflow forecast (as tabled at 30 March 2017 Board meeting, based on very

latest cash position – slightly different from business plan);

• LS185 Business Plan. This was considered by the E20 Board at its meeting on 28 February

2017, but not approved.

Page 52 of 54

17-030 IR Annex A

COMMERCIALLY SENSITIVE

£000s Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Total

Operator (LS185)

Fixed costs (base)

(1,512) - - (1,512) - - (1,512) - - (1,512) - - (6,049)

Adjustment to fixed costs for higher utilities costs

(1,721) - - (273) - - (73) - - (273) - - (2,339)

Other payments to LS185 (contract changes)

(332) - - (48) - - (48) - - (48) - - (475)

LS185 Net Commercial Revenues

94 - - - - - - - - 0 - - 94

Matchday costs LS185 Contribution 42 - - - - - - - - 0 - - 42

Net Commercial Revenues after Operator share

- - - - 675 - - - - 0 - - 675

Total LS185

Naming Rights

Gross naming rights income

- - - - - - - - - - -

Associated costs (excluding capital items)

- - - - - - - - - - -

Total Naming Rights - - - - - - - - - - -

Other operating income and costs

Fanstallation - - 20 - - - - - - - - - 20

Asset disposal 1 1 1 1 16 20 - - - - - - 40

South Park Event Income - - 5 - - 5 - - - - - - 10

South Park Event Costs (151) - - - - - - - - - - - (151)

West Ham share of catering revenues - - - (57) - - - - - - - - (57)

Matchday costs (non LS185)

Total Other operating income and costs

Staffing

Total Staffing (84) (27) (27) (27) (27) (27) (27) (27) (27) (27) (27) (46) (396)

Overheads

LLDC Member Services (31) - - (35) - - (35) - - (35) - - (135)

Estate charge payable to LLDC - - - - - - - - - (325) - - (325)

Business rates (230) (230) (230) (230) (230) (230) (230) (230) (230) (230) - - (2,300)

Business Rates (West Ham contributions) - - - 200 19 19 19 19 19 19 19 19 352

Insurance (45) (620) - - - - - - - - - - (665)

Legal advice (112) (29) (29) (29) (29) (29) (29) (29) (29) (29) (29) (29) (433)

Accounting advice (11) - (10) - - (10) - - (10) - - - (40)

External audit fees - - - (26) - - - - - - - - (26)

Technical advice - - (25) - - (25) - - (25) - - - (75)

Event tickets (14) (81) - (80) - - (10) - - (10) - - (195)

Total Overheads (443) (960) (294) (200) (240) (275) (285) (240) (275) (610) (10) (10) (3,842)

Seating (liability not agreed between members)

Retractable seating movement (806) (2,876) (1,583) (213) (3,787) (106) (184) (52) (52) (52) (52) (236) (10,000)

Total Seating before risks or opportunities

(806) (2,876) (1,583) (213) (3,787) (106) (184) (52) (52) (52) (52) (236) (10,000)

Total E20 net cash position

(4,967) (3,925) (1,903) (3,380) (3,362) (408) (2,378) (319) (379) (2,771) (89) (317) (24,198)

Cash Balance at 30 March 2017 2,476 (21,722)

Members Funding Requirement