ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

CUSTOMER INFORMATION SHEET –ICICI Lombard Criti Shield Plus

Description is illustrative and not exhaustive

S.NO

Title

Description

Policy Clause No.

1

Product Name

ICICI Lombard Criti Shield Plus

2

What am I covered for?

Section A : Critical Illness

Benefit 1 : Comprehensive Critical Illness

Part III of Wordings

This cover has been broadly divided into five critical illness buckets.

Name of the bucket

No. of illnesses covered

Bucket 1 - Cancer and blood

disorders

4 Major/1 Minor

Bucket 2 -Heart and Blood Vessel

10 Major/11 Minor

Bucket 3 -Major Organs

14 Major /12 Minor

Bucket 4 -Nervous System

24 Major/8 Minor

Bucket 5 -Other Illness

3 Major/5Minor

In the event of any minor illness the company shall pay 25% of

the Sum Insured subject to a maximum of 12.50lac specified in

the Policy Schedule against that bucket and for any major critical

illness the company shall pay 100 % of the Sum Insured

specified in the Policy Schedule against that bucket. If a major

illness is followed by a minor illness from the same bucket the

company shall only pay the remaining 75% of the sum insured

as specified against that bucket in the Policy Schedule.

The amount payable will be on the First Diagnosis of any one of

the Critical Illnesses listed in the policy wordings.

There is a survival period and waiting period applicable to this

cover as specified on the policy schedule.

Illustration 1

Insured can opt for any of the Critical Illness bucket as per plan

available at inception. The SI payable will be independent for each

bucket if more than one bucket is selected.

1. e.g At policy inception if Mr. XYZ opts for all buckets Cancer

and blood disorders, Heart and Blood Vessel, Major Organs,

Nervous System, Other Illness, he can intimate a claim under all

these buckets independently/simultaneously.

Incase Mr. XYZ is diagnosed with Stroke resulting in permanent

symptoms (Nervous System -Major) in 5

th

month, if the claim is

payable as per policy Terms and conditions we will pay 100% of

SI allocated for Nervous System bucket.

The Nervous System bucket will be exhausted and no renewal

of this bucket will be allowed to the customer.

In the 7

th

month Mr. XYZ is diagnosed with Pulmonary Embolism

(Heart and Blood Vessel-Minor),he can claim for 25% of SI from

Heart and Blood Vessel bucket.

Incase Mr. XYZ consequently suffers from a Myocardial

Infarction (Heart and Blood Vessel -Major) we will pay balance

75% (since we have already paid minor claim of 25% under this

bucket) once this claim has been paid the Heart and Blood

Vessel bucket will be exhausted and no subsequent renewal will

be done for this bucket

Illustration 2:

Mr. PQR a 33yr old has opted for plan which has “Heart and Blood

Vessel” bucket for 1 year Policy Tenure and 3lac SI for a base

premium of 270/- . After the waiting period of the policy is over Mr.

PQR is diagnosed with Other Serious Coronary Artery Diseases in

the 5

th

month. He is eligible to claim for 25% SI which is 75000/-.

Now only 75% of the SI is remaining in “Heart and Blood Vessel

bucket. At the time of renewal, we will be collecting the premium for

100% of SI however our liability will be only towards the balance

Sum Insured which is 75% of SI(in this example 225000).

Under Section A

1.1

Benefit 2: ICU Benefit (Add On)

Part III of Wordings

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

In the event of a hospital admission if an insured is admitted in ICU

on account of any surgery or infection for a minimum of 5 or 7 days

as specified in Policy Schedule, the company shall pay the Sum

Insured as specified in the Policy Schedule against this benefit, in

consideration of payment of additional premium. The surgery or

infection and stay in the ICU must be directly due to the same cause

and confirmed as necessary medical treatment. Add on cover will

not be renewed incase base bucket is exhausted

Under Section A

2.1

Benefit 3: Cancer Restore Benefit (Add On)

Part III of Wordings

In consideration of payment of additional premium this cover pays

the sum insured specified against this Benefit on account of a re

diagnosed or recurred major cancer once a Major cancer (Cancer

of Specified Severity) claim has already been considered and paid

under this policy. A Waiting period of 3 years will be applicable from

the date of diagnosis of the first Major Cancer (Cancer of Specified

Severity) claim admitted under this policy for this Benefit to be

triggered

This Benefit 3 cannot be opted at the time of renewal or during the

policy period.

Illustration 3:

Mr. RST a 40yr old male has opted for plan which has ‘Cancer and

blood disorders’ bucket and add on ‘Cancer Restore Benefit’ for 1

year tenure for 5lac SI with base premium as 970/- & 340/- for

‘Cancer and blood disorders Bucket’ and ‘Cancer Restore Cover’

respectively. After the initial waiting period Mr. RST is diagnosed

with Major Cancer (Cancer of Specified severity),after evaluation of

required documents we pay the major claim with 100% payout of 5

lac sum insured. Since the customer has opted for cancer restore

benefit he will be eligible to claim under this benefit provided the

customer renews this policy subject to having received the premium

for the ‘Cancer and blood disorders’ bucket under benefit 1 and

cancer restore benefit as per the original Sum Insured and age at

the time of renewal. Mr. RST is diagnosed with Cancer relapse after

the 3 years waiting period he will be eligible to claim for ‘Cancer

Restore’ Benefit.

Under Section A

3.1

Section B : Add on Cover

Benefit: 4: Major Surgical Procedures

Part III of Wordings

In the event an Insured Person is Hospitalized on the written advice

of the treating Medical Practitioner due to an Illness contracted or

any Injury sustained during the Period of Cover, and is advised by a

Medical Practitioner qualified as a Surgeon to undergo a Surgical

Procedure specified in Annexure 2 of this Policy and has undergone

the surgery, we will pay the percentage of the Sum Insured as a

lumpsum specified in the Policy Schedule in the manner specified in

the Annexure 2 for each of the listed surgeries. This cover can only

be availed with benefit 1. Add on cover will not be renewed incase

base bucket is exhausted

Illustration 4:

Ms. PQR has opted for plan which has Cancer and blood disorders

bucket and add on Section B: Major Surgical Procedures. After the

initial waiting period she undergoes Pericardectomy. She is eligible

to claim for 50% payout under Major Surgical Procedures(Add on

Cover). Subsequently she has to undergo Amputation of Leg she

will be eligible to claim for 100% payout under Major Surgical

Procedure, however as we have already honoured a 50% claim on

Under Section B

4.1

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

account of Pericardiactomy now she will be eligible to claim for

balance 50% only. Hence we will be honouring 50% payout here

subject to policy terms and conditions

Section C: PERSONAL ACCIDENT(Add on)

Benefit 5: Accidental Death Benefit

Part III of Wordings

We will pay the specified Sum Insured in the manner specified in the

Policy Schedule, if an Insured Person suffers an Injury due to an

Accident that occurs during the Period of Cover and that Injury solely

and directly results in the Insured Person’s death within 365 days

from the date of the Accident. On the acceptance of a claim under

this Benefit and any other applicable Benefit pertaining to the same

event, all Benefit under this Policy shall immediately and

automatically cease in respect of that Insured Person and no

subsequent Renewals of the Policy will be allowed. Add on cover

will not be renewed incase base bucket is exhausted

Under Section C

5.1.1

Benefit 6: Permanent Total Disablement (PTD) Benefit:

Part III of Wordings

We will pay the Sum Insured specified against this Benefit in the

Policy Schedule in the manner specified in the Policy Schedule if an

Insured Person suffers an Injury due to an Accident that occurs

during the Period of Cover and that Injury solely and directly results

in the Permanent Total Disablement of the Insured Person within

365 days from the date of the Accident. Add on cover will not be

renewed incase base bucket is exhausted

Under Section C

5.1.2

Benefit 7 : Permanent Partial Disablement (PPD) Benefit:

Part III of Wordings

We will pay the percentage of the specified Sum Insured in the

manner specified in the policy wordings if an Insured Person suffers

an Injury due to an Accident that occurs during the Period of Cover

and that Injury solely and directly results in the Permanent Partial

Disablement of the Insured Person (which is of the nature specified

in the table below) within 365 days from the date of the Accident.

Add on cover will not be renewed incase base bucket is exhausted

Under Section C

5.1.3

Section D : Value Added Services

1. Tele-consultation:

We will arrange consultations and recommendations for any

listed Critical illnesses under Annexure 1 by a qualified General

Practitioner. For the purpose of this benefit Telephonic/Virtual

consultation shall mean consultation provided by a qualified

General Practitioner through various mode of communication

like audio, chat or mobile app. The services provided under this

Benefit will be made available subject to the terms and

conditions, and in the manner prescribed below:

The General Practitioner may suggest /recommend

/prescribe over the counter medications based on the

information provided, if required on a case to case basis.

However, the services under this Benefit should not be

construed to constitute medical advice and/or substitute the

Insured Person's visit/ consultation to an independent

Medical Practitioner/Healthcare professional*.

This service will be available 24 hours a day, and 365 days

in a year.

Part III of Wordings

Under Section D

6.1

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

The General Practitioner may refer the Insured Person to a

specialist or a general physician, if required**, and the

charges for such specialist or a general physician will have

to be borne by the Insured Person.

We shall not be liable for any discrepancy in the information

provided under this Benefit.

Choosing the services under this Benefit is purely upon the

customer’s own discretion and at own risk.

You will be eligible to avail maximum of 4 tele-consultation

per policy period.

The insured will be able to use this service only with respect

to the listed Critical Illnesses under Annexure 1.

This benefit will lapse incase not used during the policy

tenure

*The proposer should seek assistance from a health care

professional when interpreting and applying them to the Insured

person’s individual circumstances. If the Insured person has any

concerns about His/ her health, He/ She may consult His/ her

general practitioner.

**Consultations charges would be applicable.

2. E-opinion (second opinion)

In the event of your diagnosis with any of the critical illness

covered under your policy and during the policy period, we shall

facilitate in arranging an E-Consultation second opinion from a

super specialty medical practitioner within our Network with

respect to that critical illness only, subject to the following

condition. It will be based on the medical records submitted by

the insured person which should include investigation reports

citing the final diagnosis and relevant consultation papers. We

will not be reimbursing/bearing the cost for E-

opinion/consultation (second opinion).

3. Health and Wellness Offers

Health and Wellness Offers on services/products provided

by our network providers/ Health service providers – We shall

only facilitate the Insured Person in availing offers and

discounts on services/products offered by our network providers/

health service providers. Customer can avail Health and

Wellness Offers on our app on various health, fitness and

wellness products and other services available on the app.

4. Health assistance:

We also provide Health Assistance as a part of Our Value added

services, Our Health Assistance Team (HAT) will assist the

Insured Person in understanding his/her health condition better

by providing answers to any queries related to health and health

care providers on Our dedicated helpline. To avail this service,

the Insured Person may call Our helpline on 040-66274205

(please note that this number is subject to change).

The services provided under this shall include:

Identifying a Physician/ Specialist

Scheduling an appointment with any Medical Practitioner

empanelled with Us

Scheduling appointments for a second opinion

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

Providing suitable options with respect to Hospitals as well

as providing assistance in Cashless facility, wherever

applicable.

Providing preventive information on ailments

Providing guidance on post Hospitalization care, such as

Physiotherapy/ Nursing at home.

Please note that services provided under this Benefit are solely

for assistance, and should not be construed to be a substitute for

a visit/ consultation to an independent Medical Practitioner. This

Benefit does not include the charges for any independent

Medical Practitioner/nutritionist consulted on HAT’s

recommendation, and such charges are to be borne by the

Insured Person. We do not accept any liability towards quality of

the services made available by our network providers/ service

providers and are not liable for any defects or deficiencies on

their part

While deciding to obtain such value-added service, You

expressly note and agree that it is entirely for You to decide

whether to obtain these services and also to decide the use (if

any) to which these services is to be put for

3

What are the major

exclusions in the policy

Please refer to the policy wordings for the complete list.

We shall not be liable under this Policy for payment for any claim in

respect of an Insured person, caused by, arising from or in any way

attributable to any of the following:

Section A:

Benefit 1 : Comprehensive Critical Illness

Part III of Wordings

1. Any Critical Illness where the symptoms indicative of such

Critical Illness have first manifested or first occurred prior to the

Risk Inception Date or arisen within the waiting period of

90/120/150 days as specified in the Policy Schedule at

commencement of the Period of Cover.

2. Insured should survive for 0/3/7/14 days as mentioned in the

Policy Schedule from the date of diagnosis and fulfilment of the

critical illness definition(definitions mentioned in Annexure 1)

before the claim benefit will be paid.

3. Any Critical Illness arising on account of or in connection with

any Pre-Existing Disease(s).

4. Any Critical Illness or Surgery/Surgical Procedure arising out of

any external Congenital Anomaly or internal Congenital

Anomaly known at the commencement of the policy.

5. Any physical, medical or mental condition or treatment or service

that is specifically excluded in the Policy Schedule under the

head “Special Conditions”.

6. Any claim made without a medical certificate from the treating

Medical Practitioner evidencing the diagnosis of such Critical

Illness.

7. Any Critical Illness traceable to pregnancy, childbirth, abortion,

or related consequences.

Under Section A

1.2

Section A:

Benefit 2: ICU Benefit (Add on)

Part III of Wordings

1. Any ICU hospitalization where the appearance of first

(signs/symptom/diagnosis) of the infection or advice for surgery

was done during or prior to the initial waiting period of 90/120/150

days (as specified on the Policy Schedule) shall not be

considered payable under this Benefit.

2. We shall not consider any domiciliary/Home ICU care under this

Benefit.

Under Section A

2.3

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

3. We shall not consider ICU stay in an AYUSH hospital as payable

for this Benefit

4. Any Critical Illness or Surgery/Surgical Procedure arising out of

any external Congenital Anomaly or internal Congenital

Anomaly known at the commencement of the policy.

5. Any physical, medical or mental condition or treatment or service

that is specifically excluded in the Policy Schedule under the

head “Special Conditions”.

6. Any claim made without a medical certificate from the treating

Medical Practitioner mandating the stay in ICU.

7. Any claim traceable to pregnancy, childbirth, abortion, or related

consequences.

8. ICU admissions on account of Sterility/Infertility or any plastic

surgery for cosmetic purpose.

9. ICU admission due to any treatment necessitated due to

participation as a professional in hazardous or adventure sports,

including but not limited to, para-jumping, rock climbing,

mountaineering, rafting, motor racing, horse racing or scuba

diving, hand gliding, sky diving, deep-sea diving.

10. ICU admission directly arising from or consequent upon any

Insured Person committing or attempting to commit a breach of

law with criminal intent.

11. ICU admission on account of Alcoholism, drug or substance

abuse or any addictive condition and consequences thereof.

12. ICU admission on account of Intentional self-injury (whether

arising from an attempt to commit suicide or otherwise)

13. Any ICU admission arising from or attributed to war, invasion,

acts of foreign enemies, hostilities (whether war be declared or

not), civil war, commotion, unrest, rebellion, revolution, military

or usurped power or confiscation or nationalisation or requisition

of or damage by or under the order of any government or public

local authority

14. Any ICU admission caused by or contributed to by nuclear

weapons/materials or contributed to by or arising from ionising

radiation or contamination by radioactivity by any nuclear fuel or

from any nuclear waste or from the combustion of nuclear fuel

Section A:

Benefit 3: Cancer Restore Benefit (Add On)

Part III of Wordings

No claim shall be payable within the waiting period of 3 years

from the date of diagnosis of first Major Cancer.

In the event of death of the insured during the 3 years waiting

period, the claim shall not be payable.

Under Section A

3.2

Section B:

Benefit: 4: Major Surgical Procedures (Add On)

Part III of Wordings

1. Any covered Surgery/Surgical Procedure arising out of an

Illness diagnosed/contracted prior to Risk Inception Date or

arising within the waiting period of 90/120/150 days as specified

in policy schedule. However, no Waiting Period will be

applicable in case of any Surgical Procedure arising out of/due

to an Accident during the Period of Cover.

2. Any Surgery/Surgical Procedure arising out of an Accident

which occurred prior to Risk Inception Date.

3. Any Pre-Existing Disease(s) or any disability arising out of a Pre-

Existing Disease or any complication arising therefrom.

Under Section B

4.2

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

4. Any Critical Illness or Surgery/Surgical Procedure arising out of

any external Congenital Anomaly or internal Congenital

Anomaly known at the commencement of the policy.

5. Any of the covered Surgery/Surgical Procedure performed

which was otherwise deemed unnecessary, or against standard

health practices.

6. Any Unproven/Experimental treatment.

7. Any Surgery/Surgical Procedure performed solely due to

cosmetic or aesthetic reasons.

8. Any claim made without a medical certificate from the treating

Medical Practitioner evidencing the diagnosis of such Illness or

Injury or the undergoing of the medical / Surgical Procedure.

Section C: Personal Accident (Add On)

Benefit 5: Accidental Death Benefit

Part III of Wordings

Benefit 6: Permanent Total Disablement (PTD) Benefit:

Benefit 7 : Permanent Partial Disablement (PPD) Benefit:

1. War, invasion, act of foreign enemy hostilities or warlike

operations (whether war be declared or not) or civil commotion

or rebellion, revolution, insurrection, mutiny, arrests,

detainments of all kinds and political gatherings, engaging in

aviation other than as a passenger (fare paying or otherwise) in

any licensed standard type of aircraft.

2. Any Injury sustained while performing duty in army, navy, air

force, paramilitary force, police or any other such institution,

except to the extent it is expressly covered under any Benefit

3. Any event which occurs whilst the Insured Person is operating

or learning to operate any aircraft or common carrier, or

performing duties as a member of the crew on any aircraft, or

scheduled airlines or is engaging in aviation, or whilst the

Insured Person is mounting into, or dismounting from or

traveling in any balloon or aircraft other than as a passenger

(fare-paying or otherwise) in any scheduled airline anywhere in

the world.

4. Breach of law/ statutory provisions or while being involved in any

unlawful activity.

5. Any Injury / Illness arising from full-time involvement in

professional sports for livelihood and remuneration, except to

the extent it is expressly covered under any Benefit.

6. Any Injury / Illness arising from intentional self- Injury, suicide or

attempted suicide.

7. Any Injury / Illness arising from a failure to take reasonable

precautions to avoid a claim under the Policy.

8. Any Injury / Illness arising whilst under the influence of alcohol

or intoxicating drugs or substance abuse of any kind.

9. Any Injury / Illness occurring whilst working in underground

mines or explosives magazines, or involving electrical

installation with high tension supply, or as jockeys or circus

personnel or any other high risk occupations.

10. Any Injury that has occurred prior to the commencement of

Policy of Benefit whether or not the same has been treated, or

medical advice, diagnosis, care or treatment has been sought.

11. Any Illness, complication or ailment not arising out of or

connected to Injury.

12. Payment of compensation in respect of death, disablement

(whether of a permanent nature or of a temporary nature), Injury,

Illness or Hospitalization of the Insured Person resulting directly

from, or indirectly caused by, or contributed to or aggravated or

prolonged by, childbirth or pregnancy or in consequence thereof.

13. Payment of compensation in respect of death, disablement

(whether of a permanent nature or of a temporary nature), Injury,

Illness or Hospitalization of Insured Person due to an insect or

mosquito bite.

14. Death, disablement (whether of a permanent nature or of a

temporary nature), Injury, Illness or Hospitalization arising from

or caused by ionizing radiation or contamination by radioactivity

Under Section C

5.2

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

from any nuclear fuel (explosive or hazardous form) or resulting

from or from any other cause or event contributing concurrently

or in any other sequence to the loss, claim or expense from any

nuclear waste from the combustion of nuclear fuel, nuclear,

chemical or biological attack.

GENERAL EXCLUSIONS

Part IV of Wordings

1. Any physical, medical or mental condition or treatment or service

that is specifically excluded in the Policy Schedule under the

head “Special Conditions”.

2. Any breach of the law by the Insured Person with a criminal

intent.

3. War, invasion, act of foreign enemy, hostilities (whether war be

declared or not) civil war, rebellion, revolution, insurrection,

mutiny, military or usurped power, seizure, capture, arrests,

restraints and detainment of citizens of whatever nation, riots or

civil commotion.

4. Any Injury sustained while performing duty in army, navy, air

force, paramilitary force, police or any other such institution,

except to the extent it is expressly covered under any Benefit.

5. Ionising radiation or contamination by radioactivity from any

nuclear fuel or from any nuclear waste or from nuclear weapon

materials or from the combustion of nuclear fuel. For the purpose

of this exclusion, combustion shall include any self-sustaining

process of nuclear fission.

6. Use or misuse of intoxicating drugs and/or alcohol.

7. Participation (aggravation) in any kind of strike, processions,

riots etc.

8. Any act of self-destruction or self-inflicted injury, attempted

suicide or suicide and deliberate participation of the Insured in

an illegal or criminal act with criminal intent.

9. Any Injury / Illness occurring whilst working in underground

mines or explosives magazines, or involving electrical

installation with high tension supply, or as jockeys or circus

personnel

10. Any consequential or indirect losses or expenses related to any

Insured Event.

11. Any tests and treatment relating to infertility and in vitro

fertilization.

12. Any Injury / Illness occurring whilst engaging in any Adventure

Sports, either as an instructor/ trainer, or as a participant.

13. Any natural peril (including but not limited to storm, tempest,

avalanche, earthquake, volcanic eruptions, hurricane, or any

other kind of natural hazard).

4

Waiting Period

Following Waiting Periods shall be applicable under the Policy,

unless specified otherwise in the Policy Certificate.

Section A:

Benefit 1 – 90/120/150 Days

Benefit 2 – 90/120/150 Days

Benefit 3 – There is a 3 Year waiting period from the date of first

diagnosis of a major cancer

Section B:

Benefit 4 – 90/120/150 Days

Section C:

Benefit 5,6,7 – No Waiting Period

Part III of Wordings

Section A

Section B

Section C

& Policy Certificate

5

Payment Basis

We shall make payment of an admissible claim to the Insured

Person’s nominee/assignee, as the case may be, or in the

absence of an assignee, to the Insured Person or the Insured

Person’s nominee. If there is no assignee or Nominee and the

Insured Person is incapacitated or deceased, we will pay to the

Insured Person’s heir, executor or validly appointed legal

representative.

Part V of Wordings

“Specific Terms and

Conditions”

Clause No.1 “Payments”

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

Any payment we make in this manner will be a complete and

final discharge of our obligations under this Policy and Our

liability towards the claim.

6

Loss Sharing

NA

7

Renewal Conditions

1. The Policy may be renewed by mutual consent under the then

prevailing (ICICI Lombard Criti Shield Plus) Policy or its nearest

substitute product (in case of product withdrawal) approved by

the IRDAI, and in such event the Renewal premium should be

paid to Us on or before the date of expiry of the Policy and in no

case later than the Grace Period of 30 days from the expiry of

the Policy. We will not be liable to pay for any Claim arising out

of an Insured Event that occurs during the Grace Period.

2. Once the Sum Insured under any of the Benefits opted and

available to the insured is exhausted any future renewal under

that Benefit shall not be allowed.

3. You shall on tendering any premium for the Renewal of this

Policy give notice in writing to Us of any Illness, physical defect

or infirmity with which any of the Insured Person(s) have become

affected since the payment of the expiring Policy start date.

4. Renewals will not be denied except on grounds of

misrepresentation, moral hazard, fraud, non-disclosure of

material facts. We may, revise the Renewal premium payable

under the Policy or the terms of Benefit, provided that all such

changes are approved in accordance with the IRDAI rules and

regulations as applicable from time to time. We will intimate You

of any such changes at least 3 months prior to date of such

revision or modification.

5. We shall not be bound to give any notice to You/ Insured Person

that the premium for the Renewal is due.

6. Policyholder will not be allowed to make any changes in his/her

policy coverage’s, terms and conditions and Sum Insured at the

time of renewal in case a claim has already been settled

7. Policyholder will not be allowed to make any changes in his/her

policy coverage’s, terms and conditions at the time of renewal,

unless decided by Us on exceptional call or case to case basis

8. In the event where the base cover(s) has been exhausted the

insured shall not be allowed to renew the add on cover(s)

9. The above conditions for Renewal are to be read in unison, and

not standalone.

Part V of Wordings

“Specific Terms and

Conditions”

Clause No. 2 “Terms of

Renewal”

8

Renewal Benefits

No Waiting Periods shall be applicable in case of subsequent

Renewals, subject to no Break In Policy.

Part I of Wordings

“General Definitions”

Definition No. 23 “Waiting

Period”

9

Cancellation

1. The policyholder may cancel this policy by giving 15days'written

notice and in such an event, the Company shall refund premium

for the unexpired policy period as detailed below.

2. We shall from the date of receipt of the notice cancel the Policy,

retain the premium for the period this Policy has been in force,

and refund at Our short period scales as per the Refund Grid

provided below, provided that no refund of premium shall be

made if any claim has been made under the Policy by or on

behalf of the Insured Person.

3. Notwithstanding anything contained herein or otherwise, no

refunds of premium shall be made in respect of the Insured

Person where any Claim has been admitted by Us or has been

lodged with Us or any Benefit has been availed by the Insured

Person under the Policy.

4. In case of a cancellation request by You/ Insured Person, the

Policy will be cancelled in its entirety, and any selected Benefits

or Sections under the Policy cannot be cancelled.

5. The Company may cancel the policy at any time on grounds of

misrepresentation non-disclosure of material facts, fraud by the

Part V of Wordings

“General Terms and

Conditions”

Clause No. 6

“Cancellation/

Termination”

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

insured person by giving 15 days' written notice. There would be

no refund of premium on cancellation on grounds of

misrepresentation, non-disclosure of material facts or fraud.

6. For any cancellation initiated by Us, due to any other reason the

company may choose to refund the premium on pro-rata basis.

10

Claims

The Company shall settle or reject a claim, as the case may be,

within 30 days from the date of receipt of last necessary

document.

In the case of delay in the payment of a claim, the Company

shall be liable to pay interest to the policyholder from the date of

receipt of last necessary document to the date of payment of

claim at a rate 2% above the bank rate.

However, where the circumstances of a claim warrant an

investigation in the opinion of the Company, it shall initiate and

complete such investigation at the earliest, in any case not later

than 30 days from the date of receipt of last necessary

document- In such cases, the Company shall settle or reject the

claim within 45 days from the date of receipt of last necessary

document.

In case of delay beyond stipulated 45 days, the Company shall

be liable to pay interest to the policyholder at a rate 2% above

the bank rate from the date of receipt of last necessary

document to the date of payment of claim.

On occurrence of an any event that may give rise to a Claim

under this Policy, You shall-

Notify Us immediately on toll free number 1800 2666 or on our

website www.icicilombard.com or email us at

Along with the completed and signed Claim form, provide all the

relevant documents, specified within the relevant Section of the

Policy for the Benefit being claimed, must be submitted in full

within 30 days.

Wherever details pertaining to happening of Claim are conveyed

by you to Us after reasonable period, You shall provide the

reasons of such delay to Us.

Customer to send documents to Us at :- ICICI Lombard General

Insurance Company Limited ICICI Bank Tower, Plot No. 12,

Financial District, Nanakram Guda, Gachibowli, Hyderabad,

Andhra Pradesh- 500032

If any claim is not made within 30 days of the Insured Event,

then We will condone such delay on merits only where the delay

has been proved to be for reasons beyond the claimant’s control.

All claims will be investigated (as required) and settled in

accordance with the applicable regulatory guidelines, including

the IRDAI (Protection of Policyholders Interests) Regulations,

2017.

The admissible Claim amount will be calculated post

applicability of Deductible, Co-pay, Sub-limits, if any, and as

specifically defined in Policy Schedule.

The role of the TPA (if any) would be limited to facilitate the flow

of information between Us and the Insured Person.

Part V of Wordings

“Standard General Terms

and Clauses”

Clause No. 3 :Claim

Settlement”

&

“Specific Terms and

Conditions”

Clause No. 3 “Claim

Procedure”

11

Policy Servicing/

Grievances/Complaints

Call Us at toll free number: 1800 2666 or email us at

If You are not satisfied with the resolution then You may

successively write to Manager- Service Quality, Corporate

Manager- Service Quality, National Manager- Operations &

finally Director-services and Business development at the

following address:

ICICI Lombard General Insurance Company Limited,

ICICI Lombard House,

414, Veer Savarkar Marg,

Near Siddhi Vinayak Temple,

Prabhadevi, Mumbai 400025

Part V of Wordings

“General Terms and

Conditions”

Clause No. 15

“Redressal of

Grievances”

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

If the issue still remains unresolved, You may, subject to vested

jurisdiction, approach Insurance Ombudsman for the redressal

of the grievance.

Please refer to the policy wordings for the details of Insurance

Ombudsman.

12

Insured’s Rights

The insured person shall be allowed free look period of fifteen days

(30 days when policy is sourced through distance marketing) from

date of receipt of the policy document to review the terms and

conditions of the policy, and to return the same if not acceptable.

lf the insured has not made any claim during the Free Look

Period, the insured shall be entitled to

A refund of the premium paid less any expenses incurred by the

Company on medical examination of the insured person and the

stamp duty charges or

Where the risk has already commenced and the option of return

of the policy is exercised by the insured person, a deduction

towards the proportionate risk premium for period of cover or

Where only a part of the insurance coverage has commenced,

such proportionate premium commensurate with the insurance

coverage during such period

The Policy can be cancelled only if no claims have been made

under the Policy. All Your rights under this Policy will

immediately stand extinguished on the free look cancellation of

the Policy.

In case the request for cancellation comes 15 days after the

receipt of Policy by the Insured Person, We would refund the

premium paid as per the applicable refund grid provided in the

Cancellation clause of the Policy.

The Company shall settle or reject a claim, as the case may be,

within 30 days from the date of receipt of last necessary

document.

In the case of delay in the payment of a claim, the Company

shall be liable to pay interest to the policyholder from the date of

receipt of last necessary document to the date of payment of

claim at a rate 2% above the bank rate.

However, where the circumstances of a claim warrant an

investigation in the opinion of the Company, it shall initiate and

complete such investigation at the earliest, in any case not later

than 30 days from the date of receipt of last necessary

document- In such cases, the Company shall settle or reject the

claim within 45 days from the date of receipt of last necessary

document.

In case of delay beyond stipulated 45 days, the Company shall

be liable to pay interest to the policyholder at a rate 2% above

the bank rate from the date of receipt of last necessary

document to the date of payment of claim.

If any claim is not made within 30 days of the Insured Event,

then We will condone such delay on merits only where the delay

has been proved to be for reasons beyond the claimant’s control.

All claims will be investigated (as required) and settled in

accordance with the applicable regulatory guidelines, including

the IRDAI (Protection of Policyholders Interests) Regulations,

2017.

The admissible Claim amount will be calculated post

applicability of Deductible, Co-pay, Sub-limits, if any, and as

specifically defined in Policy Schedule.

Part V of Wordings

“General Terms and

Conditions”

&

Clause No. 14 “Free look

period”

“Standard General Terms

and Clauses”

Clause No. 3 :Claim

Settlement”

&

“Specific Terms and

Conditions”

Clause No. 3 “Claim

Procedure”

13

Insured’s Obligations

Please disclose all material information (Including Pre-existing

illnesses) before buying the Policy.

The Policy shall be null and void and no Benefit shall be payable

in the event of untrue or incorrect statements,

misrepresentation, mis-description or on non-disclosure in any

material particular in the proposal form, personal statement,

Part V of Wordings

“General Terms and

Conditions”

“Standard General Terms

and Clauses”

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

declaration and connected documents, or any material

information having been withheld.

Cooperation from the Insured/ Person claimant is solicited in

providing all or sufficient documents as per the claims procedure

in support of claim.

Clause No. 1 “Disclosure

of Information”

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

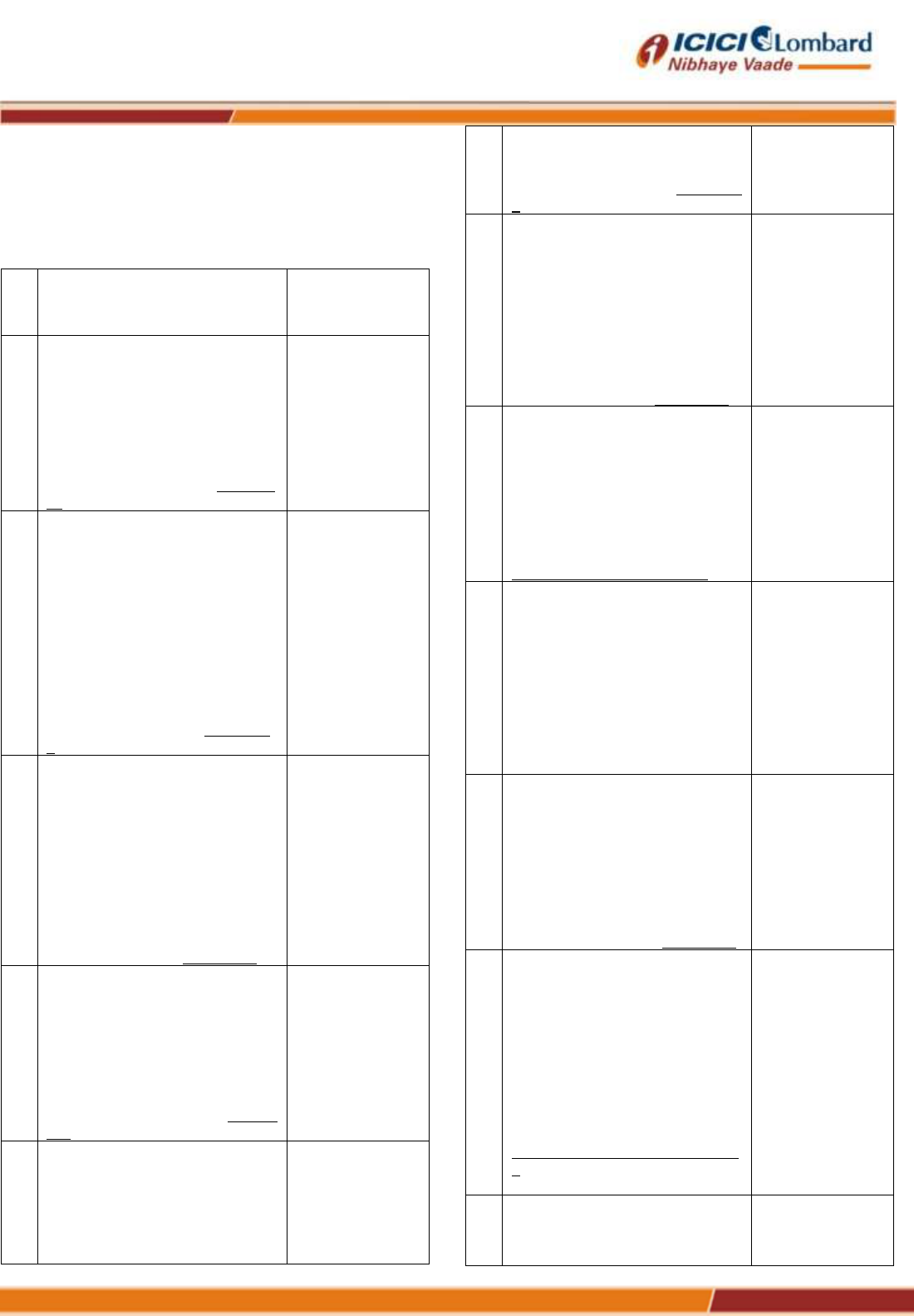

Benefit Illustration in respect of policies offered individual basis or family floater basis

Age of

the

member

s insured

Coverage opted on

individual basis

covering each

member of the family

separately (at a single

point in time)

Coverage opted on individual basis covering

multiple members of the family under a single

policy (Sum insured is available for each member

of the family)

Coverage opted on family floater basis with

overall Sum insured (Only one sum insured

is available for the entire family)

Premium(

Rs)

Sum

Insured(

Rs)

Premium(

Rs)

Discount

if any

Premium(

After

Discount)(

Rs)

Sum

Insured(Rs

)

Premium

or

consolida

ted

premium

for all

members

of

family(Rs

)

Floate

r

disco

unt if

any

Premium

after

discount(

Rs)

Sum

Insured(

Rs)

3mon-

20yrs

214

5,00,000

214

11

204

5,00,000

NA

NA

NA

NA

21 - 25

yrs

254

5,00,000

254

13

241

5,00,000

NA

NA

NA

NA

26 - 30

yrs

299

5,00,000

299

15

284

5,00,000

NA

NA

NA

NA

31 - 35

yrs

452

5,00,000

452

23

429

5,00,000

NA

NA

NA

NA

36 - 40

yrs

1,112

5,00,000

1,112

56

1,056

5,00,000

NA

NA

NA

NA

41 - 45

yrs

2,105

5,00,000

2,105

105

2,000

5,00,000

NA

NA

NA

NA

46 - 50

yrs

3,572

5,00,000

3,572

179

3,394

5,00,000

NA

NA

NA

NA

51 - 55

yrs

6,174

5,00,000

6,174

309

5,866

5,00,000

NA

NA

NA

NA

56 - 60

yrs

9,566

5,00,000

9,566

478

9,088

5,00,000

NA

NA

NA

NA

61 - 65

yrs

12,552

5,00,000

12,552

628

11,924

5,00,000

NA

NA

NA

NA

>65 yrs*

14,431

5,00,000

14,431

722

13,710

5,00,000

NA

NA

NA

NA

Total Premium for all members of

the family is Rs. 965/-, when each

member is covered separately.

Sum Insured available for each

individual is 500000/-**

Total Premium for all members of the family is Rs.

917/-, when each member is covered separately.

Sum Insured available for each individual is

500000/-**

NA

Note: Premium rates specified in the above illustration are standard premium rates without considering any loading. The premium

rates are exclusive of taxes applicable

Plan considered above is Cancer Shield plan without any Add on cover for 1 year policy tenure has been opted. Waiting period

considered here is 90 days and 0 days Survival period

1. The above Illustration is considering primary applicant to be 35yrs of age, spouse 30yrs of age and child 10yrs of age. If they opt

for individual policies the total base premium would be 965/-. Incase Multi Life option is chosen 917/-.

2.**The above illustration is considering an equal Sum Insured for entire family, however the Sum Insured offered to spouse/child will

be as per the company's UW guidelines.

3. *Premium rates are for renewal only.

4. Please refer rate chart for more details

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

ICICI Lombard Criti Shield Plus

PREAMBLE

ICICI Lombard General Insurance Company Limited (“We / Us”),

having received a Proposal and the premium from the Proposer

named in Part I of the Policy (hereinafter referred to as the “Policy

Schedule”) and the said Proposal and Declaration together with

any statement, report or other document leading to the issue of

this Policy and referred to therein having been accepted and

agreed to by Us and the Proposer as the basis of this contract do,

by this Policy agree, in consideration of and subject to the due

receipt of the subsequent premiums, as set out in the Policy

Schedule, and further, subject to the terms and conditions

contained in this Policy that on proof to Our satisfaction of the

compensation having become payable as set out in the Policy

Schedule to the title of the said person or persons claiming

payment or upon the happening of an event upon which one or

more benefits become payable under this Policy, the Annual Sum

Insured / appropriate benefit amount will be paid by Us.

Part II of Schedule: Policy Wordings

I GENERAL DEFINTIONS

Standard Definitions

1. Accident: An accident means sudden, unforeseen and

involuntary event caused by external, visible and violent

means.

2. Any one illness: Any one illness means continuous period

of illness and includes relapse within 45 days from the date

of last consultation with the Hospital/Nursing Home where

treatment was taken.

3. AYUSH Hospital: An AYUSH Hospital is a healthcare

facility wherein medical/surgical/para-surgical treatment

procedures and interventions are carried out by AYUSH

Medical Practitioner(s) comprising of any of the following:

a. Central or State Government AYUSH Hospital; or

b. Teaching hospital attached to AYUSH College

recognized by the Central Government/Central Council

of Indian Medicine/Central Council for Homeopathy; or

c. AYUSH Hospital, standalone or co-located with in-patient

healthcare facility of any recognized system of medicine,

registered with the local authorities, wherever applicable,

and is under the supervision of a qualified registered

AYUSH Medical Practitioner and must comply with all the

following criterion:

i. Having at least 5 in-patient beds;

ii. Having qualified AYUSH Medical Practitioner in

charge round the clock;

iii. Having dedicated AYUSH therapy sections as

required and/or has equipped operation theatre

where surgical procedures are to be carried out;

iv. Maintaining daily records of the patients and making

them accessible to the insurance company’s

authorized representative.

4. Cashless facility: Cashless facility means a facility

extended by the insurer to the insured where the payments,

of the costs of treatment undergone by the insured in

accordance with the policy terms and conditions, are

directly made to the network provider by the insurer to the

extent pre-authorization is approved.

5. Condition Precedent: Condition Precedent means a policy

term or condition upon which the Insurer's liability under the

policy is conditional upon.

6. Congenital Anomaly: Congenital Anomaly means a

condition which is present since birth, and which is

abnormal with reference to form, structure or position.

a) Internal Congenital Anomaly Congenital anomaly which

is not in the visible and accessible parts of the body.

b) External Congenital Anomaly Congenital anomaly which

is in the visible and accessible parts of the body

7. Day Care Centre: A day care centre means any institution

established for day care treatment of illness and/or injuries

or a medical setup with a hospital and which has been

registered with the local authorities, wherever applicable,

and is under supervision of a registered and qualified

medical practitioner AND must comply with all minimum

criterion as under –

i) has qualified nursing staff under its employment;

ii) has qualified medical practitioner/s in charge;

iii) has fully equipped operation theatre of its own

where surgical procedures are carried out;

iv) maintains daily records of patients and will make

these accessible to the insurance company’s

authorized personnel.

8. Day Care Treatment: Day care treatment means medical

treatment, and/or surgical procedure which is:

i. undertaken under General or Local Anesthesia in

a hospital/day care centre in less than 24 hrs

because of technological advancement, and

ii. which would have otherwise required

hospitalization of more than 24 hours. Treatment

normally taken on an out-patient basis is not

included in the scope of this definition.

9. Disclosure to information norm: The policy shall be void and

all premium paid thereon shall be forfeited to the Company

in the event of misrepresentation, mis-description or non-

disclosure of any material fact.

10. Domiciliary Hospitalization: Domiciliary hospitalization

means medical treatment for an illness/disease/injury

which in the normal course would require care and

treatment at a hospital but is actually taken while confined

at home under any of the following circumstances:

i) the condition of the patient is such that he/she is

not in a condition to be removed to a hospital, or

ii) the patient takes treatment at home on account of

non-availability of room in a hospital.

11. Emergency Care: Emergency care means management for

an illness or injury which results in symptoms which occur

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

suddenly and unexpectedly, and requires immediate care

by a medical practitioner to prevent death or serious long

term impairment of the insured person’s health.

12. Grace Period: Grace period means the specified period of

time immediately following the premium due date during

which a payment can be made to renew or continue a policy

in force without loss of continuity Benefits such as waiting

periods and coverage of pre-existing diseases. coverage is

not available for the period for which no premium is

received.

13. Hospital: A hospital means any institution established for

in-patient care and day care treatment of illness and/or

injuries and which has been registered as a hospital with

the local authorities under Clinical Establishments

(Registration and Regulation) Act 2010 or under

enactments specified under the Schedule of Section 56(1)

of the said act Or complies with all minimum criteria as

under: i) has qualified nursing staff under its employment

round the clock; ii) has at least 10 in-patient beds in towns

having a population of less than 10,00,000 and at least 15

in-patient beds in all other places; iii) has qualified medical

practitioner(s) in charge round the clock; iv) has a fully

equipped operation theatre of its own where surgical

procedures are carried out; v) maintains daily records of

patients and makes these accessible to the insurance

company’s authorized personnel;

14. Hospitalization: Hospitalization means admission in a

Hospital for a minimum period of 24 consecutive ‘In-patient

Care’ hours except for specified procedures/ treatments,

where such admission could be for a period of less than 24

consecutive hours.

15. Illness: Illness means a sickness or a disease or

pathological condition leading to the impairment of normal

physiological function and requires medical treatment.

(a) Acute condition - Acute condition is a disease, illness or

injury that is likely to respond quickly to treatment which

aims to return the person to his or her state of health

immediately before suffering the disease/ illness/ injury

which leads to full recovery

(b) Chronic condition - A chronic condition is defined as a

disease, illness, or injury that has one or more of the

following characteristics:

1. it needs ongoing or long-term monitoring through

consultations, examinations, check- ups, and /or tests

2. it needs ongoing or long-term control or relief of

symptoms

3. it requires rehabilitation for the patient or for the patient

to be specially trained to cope with it

4. it continues indefinitely

5. it recurs or is likely to recur

16. Injury: Injury means accidental physical bodily harm

excluding illness or disease solely and directly caused by

external, violent, visible and evident means which is verified

and certified by a Medical Practitioner.

17. Inpatient Care: Inpatient care means treatment for which

the insured person has to stay in a hospital for more than

24 hours for a covered event.

18. Intensive Care Unit: Intensive care unit means an identified

section, ward or wing of a hospital which is under the

constant supervision of a dedicated medical practitioner(s),

and which is specially equipped for the continuous

monitoring and treatment of patients who are in a critical

condition, or require life support facilities and where the

level of care and supervision is considerably more

sophisticated and intensive than in the ordinary and other

wards.

19. ICU Charges: ICU (Intensive Care Unit) Charges means

the amount charged by a Hospital towards ICU expenses

which shall include the expenses for ICU bed, general

medical support services provided to any ICU patient

including monitoring devices, critical care nursing and

intensivist charges.

20. Medical Advice: Medical Advice means any consultation or

advice from a Medical Practitioner including the issuance

of any prescription or follow-up prescription.

21. Medical Expenses: Medical Expenses means those

expenses that an Insured Person has necessarily and

actually incurred for medical treatment on account of Illness

or Accident on the advice of a Medical Practitioner, as long

as these are no more than would have been payable if the

Insured Person had not been insured and no more than

other hospitals or doctors in the same locality would have

charged for the same medical treatment.

22. Medical Practitioner: Medical Practitioner means a person

who holds a valid registration from the Medical Council of

any State or Medical Council of India or Council for Indian

Medicine or for Homeopathy set up by the Government of

India or a State Government and is thereby entitled to

practice medicine within its jurisdiction; and is acting within

its scope and jurisdiction of license. The registered

practitioner should not be the insured or close member of

the family.

23. Medically Necessary Treatment: Medically necessary

treatment means any treatment, tests, medication, or stay

in hospital or part of a stay in hospital which:

i) is required for the medical management of the

illness or injury suffered by the insured;

ii) must not exceed the level of care necessary to

provide safe, adequate and appropriate medical

care in scope, duration, or intensity;

iii) must have been prescribed by a medical

practitioner;

iv) must conform to the professional standards widely

accepted in international medical practice or by

the medical community in India.

24. Migration: Migration means, the right accorded to individual

health insurance policyholders (including all member under

family cover and members of group health insurance

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

policy), to transfer the credit gained for pre-existing

conditions and time bound exclusions, with same insurer.

25. Network Provider: Network Provider means hospitals or

health care providers enlisted by an insurer, TPA or jointly

by an Insurer and TPA to provide medical services to an

insured by a cashless facility.

26. New Born Baby: Newborn baby means baby born during

the Policy Period and is aged upto90 days.

27. Non- Network Provider: Non-Network means any hospital,

day care centre or other provider that is not part of the

network.

28. Notification of Claim: Notification of claim means the

process of intimating a claim to the insurer or TPA through

any of the recognized modes of communication.

29. OPD treatment: OPD treatment means the one in which the

Insured visits a clinic / hospital or associated facility like a

consultation room for diagnosis and treatment based on the

advice of a Medical Practitioner. The Insured is not

admitted as a day care or in-patient.

30. Portability: Portability means, the right accorded to

individual health insurance policyholders (including all

member under family cover), to transfer the credit gained

for pre-existing conditions and time bound exclusions, from

one insurer to another insurer.

31. Post-hospitalization Medical Expenses means medical

expenses incurred during predefined number of days

immediately after the insured person is discharged from the

hospital provided that: i. Such Medical Expenses are for the

same condition for which the insured person’s

hospitalization was required, and ii. The inpatient

hospitalization claim for such hospitalization is admissible

by the insurance company.

32. Pre-Existing Disease: Pre-existing Disease means any

condition, ailment, injury or disease:

a) That is/are diagnosed by a physician within 48 months

prior to the effective date of the policy issued by the insurer

or

b) For which medical advice or treatment was

recommended by, or received from, a physician within 48

months prior to the effective date of the policy or its

reinstatement.

33. Pre-hospitalization Medical Expenses Pre-hospitalization

Medical Expenses means medical expenses incurred

during pre-defined number of days preceding the

hospitalization of the Insured Person, provided that:

i. Such Medical Expenses are incurred for the

same condition for which the Insured Person’s

Hospitalization was required, and

ii. The In-patient Hospitalization claim for such

Hospitalization is admissible by the Insurance

Company.

34. Qualified Nurse: Qualified nurse means a person who holds

a valid registration from the Nursing Council of India or the

Nursing Council of any state in India.

35. Reasonable and Customary Charges: Reasonable and

Customary charges means the charges for services or

supplies, which are the standard charges for the specific

provider and consistent with the prevailing charges in the

geographical area for identical or similar services, taking

into account the nature of the illness / injury involved.

36. Renewal: Renewal means the terms on which the contract

of insurance can be renewed on mutual consent with a

provision of grace period for treating the renewal

continuous for the purpose of gaining credit for pre-existing

diseases, time-bound exclusions and for all waiting periods.

37. Room Rent: Room Rent means the amount charged by a

Hospital towards Room and Boarding expenses and shall

include the associated medical expenses.

38. Surgery or Surgical Procedure: Surgery or Surgical

Procedure means manual and / or operative procedure (s)

required for treatment of an illness or injury, correction of

deformities and defects, diagnosis and cure of diseases,

relief from suffering and prolongation of life, performed in a

hospital or day care centre by a medical practitioner.

39. Unproven/Experimental treatment: Unproven/Experimental

treatment means the treatment including drug experimental

therapy which is not based on established medical practice

in India, is treatment experimental or unproven

Specific Definitions:

1. Admission means admission of the Insured Person in a

Hospital as an in-patient for the purpose of medical

treatment of an Injury and/or Illness, for a minimum duration

of 24 hours.

2. Adventure Sport means sports/activities including but not

limited to Sky Diving, Bungee Jumping, Bungee swoop,

Bungee slingshot, Dune sliding, Hot air ballooning, Bridge

Swinging, Zip Lining, Zip Trekking, Rock Climbing, Bicycle

Polo, Bamboo rafting, Rock Scrambling, Rappelling, Via

Ferrata, Fell Running, Fell Walking, Gorge Walking, Indoor

Rock Climbing, Mountain Biking, Mountaineering, Body

Boarding, Sailing, Ski boarding, Scuba Diving, Snorkeling,

Shark Diving, Sky Diving, Swimming with Dolphins, Banana

boating/donuts/inflatable’s behind power boat Diving with

Whales, Wakeboarding, Surfing, Auto (car) racing, Motor

rallying, Motorcycle racing, Air racing, Kart racing, Boat

racing, Hovercraft racing, Lawn mower racing, Snowmobile

racing, Zorbing, and Truck racing.

3. Age means the completed years of the Insured Person on

his/her last birthday as per the English calendar as on the

Risk Inception Date.

4. Break In Policy means the period that occurs at the end of

the existing policy term, when the premium due for

Renewal on a given Policy is not paid on or before the

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

premium Renewal date, or within 30 days thereof. In case

of Premium collected on Installment basis the grace period

is 7 days.

5. Common Carrier shall mean to include any commercial

public airline, railway, bus, or water borne vessel carrying

fare paying passengers and licensed by the appropriate

authority for transportation of passengers

6. Family means, the Family that consists of the proposer and

any one or more of the family members as mentioned

below:

i. Legally wedded spouse.

ii. Dependent Children (i.e. natural or legally adopted)

between 3months of age to 25 years. If the child above 18

years of age is financially independent, he or she shall be

ineligible for coverage.

7. Financial Institution shall have the same meaning assigned

to the term under Section 45-I of the Reserve Bank of India

Act, 1934, and shall include a Non-Banking Financial

Company as defined under Section 45-I of the Reserve

Bank of India Act, 1934.

8. First Diagnosis shall mean the point in time at which the

requirements of any Critical Illness under this Policy were

first satisfied with respect to the Insured Person, including

the availability of the test reports and medical reports

evidencing such diagnosis and confirmed by a medical

practitioner

9. Infection: means an invasion of human body by pathogenic

microorganisms including bacteria, viruses, parasites and

fungi.

10. Income means and includes the amount that the Insured

Person earns each month from his/her Primary Occupation.

For Salaried Individuals, this would mean salary including

regular bonuses, regular commissions, superannuation

contributions or any other allowances, any Benefits

explicitly mentioned in CTC (Cost to Company) or any

compensation structure provided to the Insured Person by

his/her employer for the financial year, or as declared in the

previous ITR (Income Tax Return) filed by the Insured

Person. For self-employed individuals having an ownership

in a business, or operating as a sole trader or under a

partnership, company or trust, Income will be considered

as the gross annual income (before tax) filed before the

relevant tax authorities in the previous assessment year.

11. Insured Event means any event or occurrence specifically

mentioned as covered under this Policy for which

applicable premium has been received by Us.

12. Insured Person means the individual(s) whose name(s) are

specifically appearing under the heading “Insured name” in

the Policy Schedule to the Policy, and for whom the Insured

Events are covered in lieu of the applicable premium

received by Us under the Policy.

13. Loan means the sum of money lent at interest or otherwise

to the Insured Person by any Financial Institution, as

identified by a Loan Account Number. .

14. Nominee means the person(s) nominated by the Insured

Person to receive the applicable Benefits under this Policy

payable in the event of death of the Insured Person caused

by any Critical Illness or Surgical Procedure defined and

specified under the Policy. For the purpose of avoidance of

doubt it is clarified that if the Nominee is a minor, the legal

guardian appointed by the Insured Person will take care of

any relevant proceedings.

15. Permanent Total Disablement means any of the following:

i. Total and irrevocable loss of sight in both eyes, and

ii. Total and irrevocable physical separation of two entire

hands or two entire feet, or

iii. Total and irrevocable loss of one entire hand and one

entire foot, or

iv. Total and irrevocable loss of sight of one eye and

physical separation of one entire hand or physical

separation of one entire foot, or Total and irrevocable loss

of use of two hands or two feet, or

v. Total and irrevocable loss of use of one hand and one

foot, or

vi. Total and irrevocable of loss of sight of one eye and

loss of use of one hand or one foot. For the purpose of this

definition:

i. Physical separation of a hand or foot means separation

of the hand at or above the wrist, and of the foot at or

above the ankle.

ii. Loss of use or Loss of sight means total paralysis of

one or more limb, or loss of vision respectively, which is

certified in writing by a Medical Practitioner to be

permanent, complete and irreversible and substantiated

by physical examination and investigation to be

permanent, complete and irreversible.

16. Policy Period means the period commencing from the

Policy Start Date and ending at the Policy End Date as

specifically appearing in the Policy Schedule, inclusive of

both dates. It is the duration in which the policy is valid and

the Insured Person is liable to get a claim subject to any

applicable waiting Periods and the terms and conditions

under this Policy.

17. Public Authority means any governmental or quasi-

governmental organization, statutory body, or duly

authorized organization which exercises autonomous

authority in a regulatory or supervisory capacity.

18. Risk Inception Date means the date of commencement of

the Period of cover, as specified in the Policy Schedule for

the Insured Person.

19. Salaried Individuals means those Insured Persons who

work as an employee or a worker, with government or

private organization, whether confirmed or on probation as

on the Risk Inception Date, and earn a fixed amount of

compensation at a fixed frequency as salary.

ICICI Lombard General Insurance Company Limited

IRDA Reg. No. 115 CIN: L67200MH2000PLC129408 UIN : ICIHLIP22131V012122 ICICI Lombard Criti Shield Plus

Mailing Address: Registered Office Address: Toll free no : 1800 2666

601 & 602, 6th Floor, Interface 16, ICICI Lombard House, 414, Veer Savarkar Marg, Alternate no : 86552 22666 (chargeable)

New Linking Road, Malad (West) Near Siddhi Vinayak Temple, Prabhadevi, E-mail : customersupport@icicilombard.com

Mumbai - 400 064 Mumbai 400 025 Website : www.icicilombard.com

20. Sum Insured means the amount specified in the Policy

Schedule against a Benefit or set of Benefits that

represents Our maximum, total and cumulative liability for

any and all claims made in respect of that Insured Person

during the Period of cover under that Benefit/set of

Benefits.

21. Surgeon means a specialist Medical Practitioner who is

fully qualified as per applicable law to practice

Surgery/carry out Surgical Procedures in India.

22. Survival period- refers to the period from the diagnosis and