How to Accept Your Financial Aid Offer

A Step-by-Step Guide

Ofce of Financial Aid and Scholarships

1 Tressel Way, Youngstown, OH 44555

330-941-3505

ysunaid@ysu.edu

www.ysu.edu/naid

Dear Student,

The enclosed Financial Aid document reects your current nancial aid offer from Youngstown State University.

The offer is based on full-time attendance for the academic year. In the event that future aid is subsequently added

(state grants, federal loans, miscellaneous scholarships, etc.), notication of offer adjustments may be viewed online.

Log in to the PENGUIN Portal to access your nancial aid summary.

Sincerely,

Patrick Hoffman

Director, Ofce of Financial Aid and Scholarships

What to do with your offer:

Review the amounts that appear on your nancial aid offer carefully.

Read the explanation of nancial aid offer descriptions.

Refer to the instructions “How to Accept Your Financial Aid Offer in Banner” to accept and authorize

YSU to process the student aid being offered.

Locate the nancial aid offer due date to ensure timely online acceptance of your nancial aid.

Please contact our ofce at 330-941-3505 with

questions, or call 330-941-3506 to make an

appointment with one of our Financial

Aid Counselors.

YOUNGSTOWN

STATE

UNIVERSITY

Table of Contents

I. How to Accept Your Financial Aid Oer 3

II. Federal Student Loan Application Process 9

III. Parent PLUS Application Process 11

IV. Summer Aid Application Process 12

V. Explanation of Financial Aid Oer 13

VI. Eligibility 15

VII. Tuition Refund Policy and

Complete Withdrawal 16

Oce Hours

Walk-in Hours

Counselor

Appointments*

Fall, Spring and Summer Semesters

Monday–Friday 8 am - 4:30 pm

Monday–Friday 10 am - 12 pm

Monday–Friday 2 pm - 4 pm

Monday–Friday 8:30 am - 4 pm

To set up an appointment, call 330-941-3506

Hours for the Office of Financial Aid and Scholarships

The Oce of Financial Aid and Scholarships is open 8 am - 4:30 pm over academic breaks.

* Financial Aid Counselors are available Monday through Friday usually between 8:30 a.m. and 4:00 p.m.

To schedule an appointment, call 330-941-3506. If you are unable to meet at these times, you may ask to

speak with a counselor to make special arrangements that will accommodate your schedule.

112

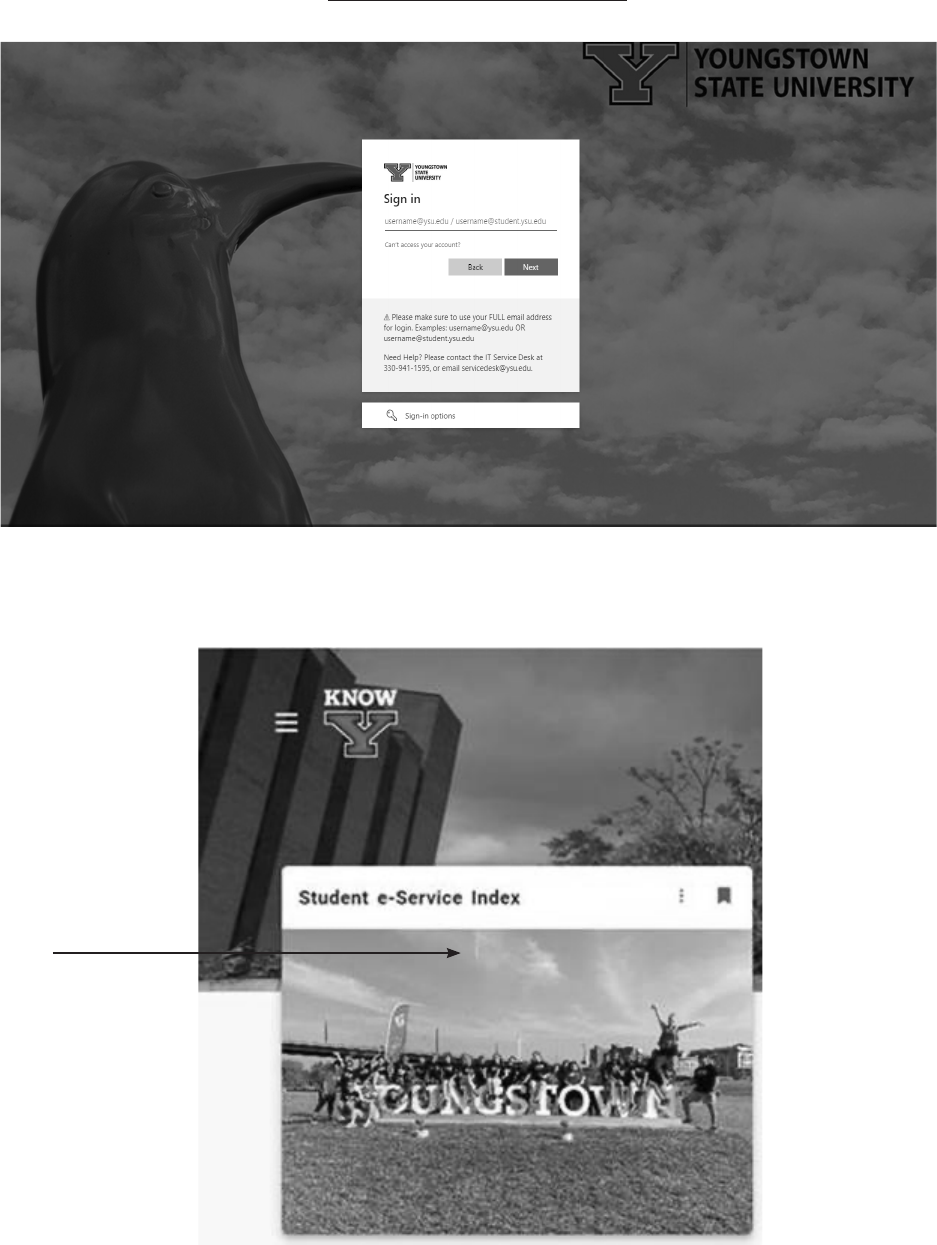

Click on the Student e-Service Index Card to access Financial Aid

How to Accept Your 2024-2025 Financial Aid Oer in Banner

Browse to http://penguinportal.ysu.edu and login

Click on the Student e-Service Index Card to access Financial Aid

3

Click Here

Click on the Student e-Service Index Card to access Financial Aid

Select ‘Financial Aid”

114

Click Here

On the Home Tab, Select 2024-2025 Aid Year and Click “View Questions”

20

Select ‘Financial Aid’

Click Here

Answer the mandatory questions and then click “Submit”

115

Click Here

Select Semester

Accept grants, scholarships, and loans, then click “Submit”

116

On the Aid Oer tab, review and accept aid oers

Click Here

Click Here

Click Here

Click Here

Read the Terms and Conditions and review Loan Balance totals, click the box to

acknowledge the Terms and Conditions and click “Accept Award”

117

Click & Submit

Click Here

On the Notications tab, review messages/additional requirements

118

View upper right-hand corner message to conrm successful submission

Federal Student Loan Application Process for 2024-2025

To secure a Federal Student Loan, three requirements must rst be satised:

1. Student accepts their Federal Student Loan eligibility online via the PENGUIN portal.

2. Student completes Entrance Loan Counseling (one-time requirement).

3. Student signs a Direct Loan Master Promissory Note.

Entrance Loan Counseling is an interactive counseling session designed to help students understand the

responsibilities that come with borrowing student loans. This is a one-time requirement and only required

for rst-time borrowers. Students must complete Entrance Loan Counseling at studentaid.gov.

Student Master Promissory Note (MPN) is a legally binding contract the student must sign. The MPN,

signed with the Department of Education, is an agreement to repay the loan money borrowed. An FSA ID

is required to sign the MPN electronically. Students must sign an MPN at studentaid.gov.

Annual Student Loan Acknowledgment is an optional acknowledgment completed by a borrower of a

subsidized/unsubsidized loan, a PLUS Loan for graduate/professional students, or a PLUS Loan for parents,

and is recommended you complete each year you accept a new Federal Staord Loan at studentaid.gov.

Studentaid.gov

119

Questions & Answers About Federal Direct Student Loans

What is the Master Promissory Note (MPN)?

An MPN is a legally binding contract the student must sign. It is an agreement to repay the Federal Loan

money borrowed. The MPN also describes your rights and responsibilities as a student loan borrower.

How long is the MPN valid?

An MPN will expire 10 years after the date it is signed. However, you must complete a new FAFSA for each

year you wish to receive a loan.

Who is eligible to borrow?

Students enrolled at least half-time in a degree or teacher-certicate program are eligible. Audited classes

are not covered by nancial aid and are not counted when determining enrollment status for nancial aid.

What is the interest rate?

Federal Subsidized Student Loans, with a rst disbursement made on or after July 1, 2023, will have a xed

rate of interest of 5.50%. Federal Unsubsidized Student Loans have a current xed 5.50% rate of interest.

Note: Graduate students are eligible only for unsubsidized loans at a current 7.05% interest rate. The Parent

and Grad PLUS Loan interest rate is currently set at 8.05%.

Are there fees associated with borrowing?

All Direct Federal Loan disbursements are subject to a 1.057% origination fee. The Direct PLUS origination

fee is 4.228%.

Disbursement Regulations

Loan funds accepted will be split evenly between the fall and spring semesters. Students are limited to 50%

of their yearly loan eligibility in any single term. If, for example, a student’s yearly eligibility is $10,000, the

maximum that the student could borrow in a single term would be $5,000, or 50% of the loan. A student

may move money to the summer, but the maximum eligibility for any single term in the aid year will be

50% of the yearly eligibility.

1110

Parent PLUS Application Process

The PLUS Application site combines the YSU PLUS Loan Request and Parent Direct Loan Master

Promissory Note under one process.

Why a separate process?

A Parent PLUS loan application requires parental information and, for that reason, cannot be accepted by the

student via the online nancial aid oer. To apply, parents must log in to studentaid.gov using their FSA ID and

request the loan. Please note the 2024–2025 Parent PLUS loan application will be available in April 2024.

What are the yearly and lifetime maximum federal loan amounts?

Annual and Aggregate Loan Limits for Staord Loans

1

st

year

(Freshman)

2

nd

year

(Sophomore)

Associate degree

borrow as 2

nd

year

students

3

rd

& 4

th

years

(each)

(Junior and Senior)

Aggregate loan limits

for life of student’s

education

$5,500 Max

$3,500 of this

amount may be

subsidized loans

$6,500 Max

$4,500 of this

amount may be in

subsidized loans

$7,500 Max

$5,500 of this

amount may be in

subsidized loans

$31,000 Max

$23,000 of this

amount may be in

subsidized loans

$9,500 Max

$3,500 of this amount

may be subsidized

loans

$10,500 Max

$4,500 of this amount

may be in subsidized

loans

$12,500 Max

$5,500 of this amount

may be in subsidized

loans

$57,500 Max

$23,000 of this

amount may be in

subsidized loans

$20,500 Max

$0 of this amount may be in

subsidized loans

Eective July 1, 2012 grad

students are no longer

eligible for subsidized

student loans

$138,500 Max

$65,500 of this amount may

be in subsidized loans

The graduate debt limit

includes Staord Loans

received for undergraduate

study

Dependent

Undergraduates

Independent

Undergraduates

Graduate Student

may be in subsidized

Studentaid.gov

1111

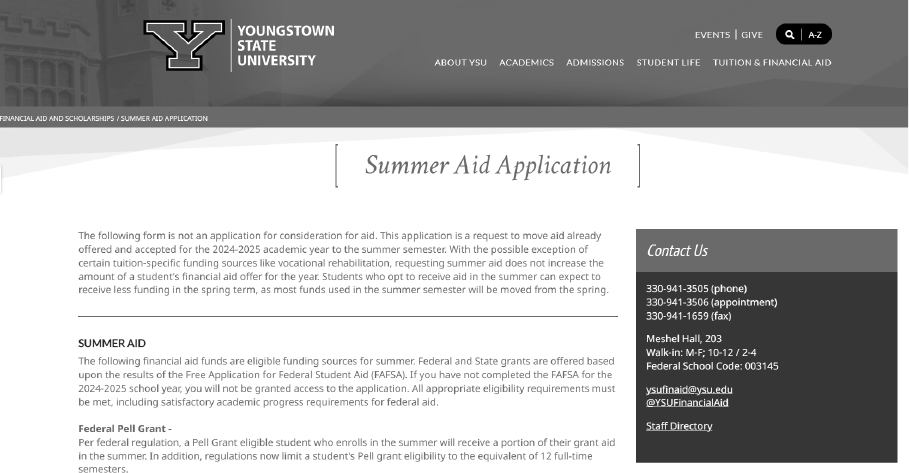

Summer Aid Application Process

With the possible exception of certain tuition-specic funding sources like vocational rehabilitation,

requesting summer aid does not increase the amount of a student’s nancial aid oer for the year.

Students who opt to receive aid in the summer can expect to receive less funding in the fall and spring

semesters. A student may be eligible to receive an additional Federal Pell Grant, however, for the summer

term. To qualify, the student must otherwise be eligible to receive Pell Grant Funds for payment period (Fall

and Spring), and must be enrolled at least half-time in the summer semester. The student may not exceed

150 percent of the Pell Grant funding scheduled for the year.

How do I apply for summer aid?

YSU provides a Summer Aid Application that enables students to request aid that they have accepted

to be moved to the summer. The Summer Aid Application is provided as a means to move previously

accepted aid from the fall/spring to the summer. It is not an application for additional aid.

1. Accept nancial aid online through the process documented in this enclosure.

2. Next, complete the Summer Aid Application on our website.

Note on summer loans:

The Summer Aid Application allows students to move loan funds accepted for the fall/spring to the

summer. It is not an additional loan request. Be sure to accept the loan amount needed for the entire

academic year (summer, fall, spring) when accepting your aid, then complete the Summer Aid Application,

moving needed funds to the summer.

1112

The College Financing Plan – This consumer tool is

utilized by participating institutions to notify students

about their nancial aid package. It is a standardized

form that is designed to simplify the information that

prospective students receive about costs and nancial

aid so that they can easily compare institutions and

make informed decisions about where to attend school.

The College Financing Plan became available for use

beginning in the 2013-2014 aid year.

Federal Pell Grant – This federal grant is oered to

undergraduate students based on nancial need who

are U.S. citizens or eligible non-citizens. Eligible students

must be accepted for enrollment in a degree or certicate

program and pursuing their rst associate or bachelor’s

degree. Students attending less-than-full-time will have

their Pell Grant prorated based on the number of hours

enrolled. Eective July 1, 2012, regulations now limit a

student’s Pell Grant eligibility to the equivalent of 12 full-

time semesters.

Ohio College Opportunity Grant (OCOG) – This State

of Ohio grant is oered to undergraduate students

based on nancial need. Eligible students must be Ohio

residents, enrolled in an eligible program, pursuing their

rst associate or bachelor’s degree and meet the same

satisfactory academic progress (SAP) requirements as

is required to receive federal nancial aid. The deadline

to receive consideration is October 1

st

. Ohio College

Opportunity Grants are oered to eligible students

attending less-than-full-time and are subject to availability

of funds and need eligibility. Eligibility for the Ohio

College Opportunity Grant is derived using the applicant’s

Student Aid Index (SAI).

Federal Work-Study – This federal program provides

part-time campus jobs for undergraduate and graduate

students based on their nancial need. The rate of pay

is regulated by the federal minimum wage law. Job

openings can be viewed online. Returning students are

permitted to work during the summer semester based on

job availability.

Federal Supplemental Educational Opportunity Grant

(FSEOG) – This federal grant is oered to undergraduate

students based on exceptional nancial need. First

consideration will be given to students with maximum Pell

Grant eligibility. Recipients must be enrolled in an eligible

program, registered at least half- time, and pursuing their

rst associate or bachelor’s degree. FSEOG is subject to the

availability of funds.

Martin Luther King Merit Award (Incoming Freshman)

– This merit-based award is available to new high school

graduates from Campbell Memorial, Cardinal Mooney,

Chaney, East, Farrell, John F. Kennedy, Niles McKinley,

New Castle, Sharon, Struthers, Summit Academy, Ursuline,

Warren G. Harding, Valley Christian and Youngstown Early

College. Recipients must have a grade point average of at

least a 3.0, based on a 4.0 scale, and an ACT score of 19 or

SAT score of 990.

Housing Grant – This grant is available to new and

continuing students on a rst-come, rst-served basis.

Need-based awards of up to $2,000 per academic year are

available to students who have nancial need and live in

University Housing or University Courtyard Apartments.

New incoming freshmen must live in YSU housing their

rst year to receive Housing Grant funds. Preference will

be given to students who live at least 30 miles from the

university. Recipients must be admitted to the university

and enroll full-time. Early completion of the FAFSA is

encouraged as funds are limited. A completed FAFSA is

a requirement. The priority ling date for applications

is February 1 for new students, and February 15 for

continuing students, and a separate online application

must be completed.

Federal Direct Subsidized and Unsubsidized Staord

Loans – Youngstown State University students who

complete a FAFSA and have not met their aggregate

loan limit will be oered the Federal Direct Loan based

on grade level upon date of aid packaging. The federally

funded Subsidized Staord Loan has a xed interest

rate, which will be 5.50% beginning July 1, 2023. The

subsidized loan interest is paid by the federal government

while you are enrolled at least half-time. Federal

Unsubsidized Staord Loan interest accrues from the

time the loan is rst disbursed. The current interest rate

for the Unsubsidized Staord Loan is a xed 5.50% for

undergraduate students and 7.05% for graduate students.

Repayment of both types of Staord Loans begins six

months after graduation, separation, or enrollment of less-

than-half-time. Student borrowers cannot exceed their

designated annual loan limits and maximum total debt

allowed by federal law.

Explanation of Financial Aid Offer

Explanation of the information and funding sources found on the Financial Aid Oer

1113

Federal Direct PLUS Loan - This federally funded

loan has a xed interest rate currently set at 8.05%.

Parents of dependent undergraduate students are eligible

to borrow based on their credit-worthiness. Repayment of

the Federal PLUS Loan generally begins 60 days after the

nal loan disbursement for each academic year, but may

be deferred until six months after the student graduates,

separates, or drops below half-time enrollment. A parent

will have the option of requesting a deferment as part of

the loan request process. A parent can also contact loan

servicer to request a deferment.

Federal Direct PLUS Loans for Graduate and

Professional Students - This federally funded loan has

a xed interest rate, currently set at 8.05%. The loan is

available to students who are enrolled in a graduate or

professional program (a program that leads to a master’s

or doctoral degree) and who have reached their annual

Staord Loan limit. Additional requirements include

minimum half-time enrollment and a good credit history;

a credit check is required for approval. Repayment of the

loan will begin six months after graduation, separation, or

enrollment of less-than-half-time.

PA State Grant

The Pennsylvania Higher Education Assistance Agency

Grant provides grants to Pennsylvania residents who

are YSU students. Students may be full-time or half-time

undergraduates enrolled in an approved program of study

requiring at least two years to complete. The deadline to

receive consideration is May 1.

YSU PA State Grant Match

Recognizing the legislative cap on Pennsylvania grants

to Pennsylvania residents attending Ohio universities,

Youngstown State University has initiated a supplemental

grant program funded by the YSU Foundation and

the university. This grant is automatically awarded to

YSU students who are awarded a PA State grant. The

supplemental grant will be awarded in amounts up to

200% of the PHEAA grant, subject to availability of funds.

1114

Satisfactory Academic Progress

Youngstown State University is required to uniformly

measure a student’s progress toward his or her degree.

The citation process is not dependent on the student’s

receiving nancial aid. A student becomes disqualied for

nancial aid when he or she fails to maintain either the

minimum required grade point average, continually fails to

successfully complete enrolled credit hours, or exceeds the

maximum number of credit hours required to complete a

degree. The complete policy is available on the Oce of

Financial Aid and Scholarships’ website, and can also be

found in YSU’s Undergraduate Catalog.

Repeated Classes

Under new regulations, students passing a course with a

grade of D or above can retake the same course only one

more time to receive federal nancial aid for that course.

Courses taken for a third time are no longer eligible for

federal nancial aid. The new regulations impact Federal

Pell Grants, Supplemental Educational Opportunity Grants,

Work Study, Staord Loans and PLUS Loans.

Undergraduate Enrollment Status

Full-time status is achieved by an enrollment of 12

semester hours or more. Three-quarter-time enrollment is

9 to 11 hours. Half-time students are enrolled 6 to 8 hours,

and an enrollment of 1 to 5 hours is deemed less-than-

half-time. Enrollment status for the purposes of oering

nancial aid is determined as of the last day of the 100%

refund policy, or as of the date aid is oered if that aid

is oered after the last day of the 100% refund policy.

Enrollment status for Federal Staord and PLUS Loans

is locked in the date the loan is certied; however, the

student must maintain a minimum half-time enrollment

for the loan to be disbursed.

Graduate Enrollment Status

Full-time status is achieved by a graduate enrollment of 6

semester hours or more. Half-time students are enrolled

3 hours and an enrollment of less than 3 hours is deemed

less-than-half-time.

Adjustment Of Aid When Registered Hours

Are Changed

Financial aid that pays 100% of specic fees are adjusted

as per YSU’s tuition-refund policy. Federal Staord and

PLUS loans already disbursed are not adjusted; however,

dropping below half-time will result in credit balances

being returned to the lender and cancellation of future

disbursements for the respective loans. Federal Pell Grants

are adjusted according to enrollment status through the

end of the refund period. After that date, Pell Grants are

not adjusted unless the federal refund formula is applied in

connection with a complete withdrawal.

Eligibility

Other Adjustments And Corrections

Youngstown State University reserves the right to adjust

nancial aid oer amounts in order to prevent or correct

over-awards, to comply with federal, state and agency

regulations or donor guidelines, and to maintain scal

responsibility.

Transfer Students

All transfer students will be classied as freshmen until

their credit hours have been accepted and documented

by the Oce of Undergraduate Admissions. Transfer

students will need to complete Entrance Loan Counseling

and MPN before loans at YSU can be disbursed.

Exit Counseling

Students who have received Federal Staord Loans while

attending Youngstown State University are required to

complete a federally mandated Exit Counseling online

before graduating or leaving school. This interactive

counseling session is designed to help the student

plan for the repayment of their student loans. Students

can complete Exit Counseling by logging into www.

studentaid.gov with their FSAID. Contact the Oce of

Financial Aid and Scholarships for further information.

1115

Tuition Refund Policy

4.24_3._PS 4.24_3._PS

Youngstown State University does not discriminate on the basis of race, color, national origin, sex, sexual orientation, gender identity and/

or expression, disability, age, religion or veteran/military status in its programs or activities. Please visit www.ysu.edu/ada-accessibility for

contact information for persons designated to handle questions about this policy.

Students who receive Title IV Federal Aid are strongly encouraged to meet with someone in the Oce of Financial Aid and

Scholarships prior to completely withdrawing from all courses to review nancial aid information. Students should meet with

someone in the Oce of University Bursar prior to completely withdrawing from all courses to review account balance.

To withdraw from a single course, or from all courses (complete withdrawal), it is necessary to process a change of registration via

the PENGUIN Portal – Registration. It is the student’s responsibility to conrm that the withdrawal was correctly processed.

Nonattendance of class, or notication to the instructor or department, does not constitute ocial withdrawal.

Title IV Federal Student Aid Refund Policy

Financial aid is earned by attending classes. You may be required to return your entire award or a portion of it, depending on your

class attendance record. Students who receive a refund of Title IV monies and fail to begin attendance in all courses must return

their refund immediately to the University Bursar. Failure to return the money immediately will initiate a 30-day demand letter

to be generated to the student from the Federal Lender Servicer. If monies are then not returned to the Lender Servicer by the

student, the student will be considered to be in default by the Federal Government and will no longer be eligible to borrow any

Title IV funds. In addition, monies not returned by the student to the Lender Servicer may reduce the student’s eligibility of funds

for the same school year.

If a student is permitted to withdraw from the university or if a student reduces his or her academic load, a refund of the tuition

charge, and the nonresident tuition surcharge, where applicable, shall be made in conformity with the following schedule for

regularly scheduled courses:

Length of course 100% refund No reduction of charges

More than 8 weeks through the 14th day of term* 15th day of term and later*

8 weeks or less through the 7th day of term* 8th day of term and later*

* Since access to change of registration is now available online 24/7, every day of the week is counted (including weekends and

holidays) when calculating tuition refunds.

Note: For a complete withdrawal from any term, all applicable fees, nes, and penalties will be deducted from any refunds. If fees

were paid by scholarship, loan, or grant-in-aid, the appropriate credit will be issued to the fund from which the initial payment

was made. Student accounts paid with nancial aid awards may be subject to a nancial aid repayment.

Any withdrawal, or reduction in academic hours, processed after the tuition refund schedule outlined above will not be entitled

to any reduction of charges and/or refund unless an Application for Involuntary Withdrawal is submitted and approved by the Fees

and Charges Appeals Board. The form for this one-time appeal is available at the Penguin Service Center (Meshel Hall). Please be

sure to carefully review all information included on the reverse side of the form. All decisions of the Fees and Charges Appeals

Board are nal and binding.

What is Title IV?

Title IV federal nancial aid includes: Pell, SEOG, Federal Direct Student Loans and PLUS Loans. Title IV nancial aid awards are

awarded to a student under the assumption that the student will attend school for the entire period for which the assistance

was awarded. If a student completely withdraws on or before the 60% point in time of the enrollment period, calculated using

calendar days, a portion of the federal aid awarded (Pell, SEOG, Federal Direct Student and PLUS Loans - but not Federal Work

Study) may need to be returned according to the provisions of the Higher Education Amendments of 1998. This recalculation may

result in the student’s owing a balance to Youngstown State University and/or the federal Department of Education. Contact the

Financial Aid and Scholarships Oce (330-941-3505) for a full explanation of the impact of a complete withdrawal. Students who

receive federal aid funds are encouraged to seek nancial aid advisement before processing a complete withdrawal.

The Board of Trustees reserves the right to change the Tuition Refund Policy without notice if conditions warrant.

1116