Filed Pursuant to Rule 424(b)(5)

Registration Nos. 333-272941 and 333-272941-01

Prospectus dated September 7, 2023

Chase Issuance Trust

Issuing Entity

CIK Number: 0001174821

Chase Card Funding LLC

Depositor and Transferor

CIK Number: 0001658982

JPMorgan Chase Bank, National Association

Sponsor, Originator, Administrator and Servicer

CIK Number: 0000869090

CHASEseries

$1,150,000,000 Class A(2023-1) Notes

The issuing entity will issue and sell: Class A(2023-1) Notes

Principal amount $1,150,000,000

Interest rate 5.16% per annum

Interest payment dates 15th day of each calendar month, beginning October 16, 2023

Scheduled principal payment date

September 15, 2026

Legal maturity date

September 15, 2028

Expected issuance date

September 15, 2023

Price to public $1,149,681,220 (or 99.97228%)

Underwriting discount $2,875,000 (or 0.25000%)

Proceeds to the issuing entity $1,146,806,220 (or 99.72228%)

The Class A(2023-1) notes, or the “offered notes,” are a tranche of the Class A notes of the CHASEseries.

For a description of how the amount of interest payable on the Class A(2023-1) notes is determined see

“Transaction Summary” and “Summary—Interest” in this prospectus.

The assets of the issuing entity include:

• Credit card receivables that arise in certain revolving credit card accounts owned by JPMorgan Chase

Bank, National Association; and

• Funds on deposit in the collection account, the excess funding account, the interest funding account, the

principal funding account and the Class C reserve account.

The assets of the issuing entity may include in the future additional credit card receivables that arise in revolving credit card accounts owned by JPMorgan

Chase Bank, National Association or by one of its affiliates.

Enhancement for the Class A(2023-1) notes is provided in the form of outstanding subordinated notes as described in “Transaction Summary” and “Summary—

Subordination, Credit Enhancement” in this prospectus.

The issuing entity is not now, and immediately following the issuance of the Class A(2023-1) notes pursuant to the indenture will not be, a “covered fund” for purposes of

regulations adopted under Section 13 of the Bank Holding Company Act of 1956, as amended, commonly known as the “Volcker Rule.” In reaching this conclusion,

although other statutory or regulatory exemptions under the Investment Company Act of 1940, as amended, and under the Volcker Rule and its related regulations may be

available, the issuing entity has relied on the exemption from registration set forth in Rule 3a-7 under the Investment Company Act of 1940, as amended. See “Summary

—Certain Investment Company Act Considerations” and “Certain Investment Company Act Considerations” in this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the Class A(2023-1) notes or determined if this prospectus is truthful,

accurate or complete. Any representation to the contrary is a criminal offense.

Underwriters

J.P. Morgan

Barclays

RBC Capital Markets

You should consider the discussion under “Risk Factors” beginning on page 17 of this prospectus before you purchase any Class A(2023-1) notes.

The Class A(2023-1) notes are obligations of the issuing entity only and are not interests in or obligations of JPMorgan Chase Bank, National Association, Chase

Card Funding LLC, any of their affiliates or any other person or entity.

The Class A(2023-1) notes are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality.

TABLE OF CONTENTS

i

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED

IN THIS PROSPECTUS v

EU and UK Securitization Regulations v

Notice to Residents of the European Economic Area vi

Notice to Residents of the United Kingdom vi

TRANSACTION PARTIES AND DOCUMENTS viii

TRANSACTION SUMMARY ix

SUMMARY 1

Risk Factors 1

The Issuing Entity 2

The Depositor and Transferor 3

The Sponsor, Originator, Servicer and Administrator 3

Indenture Trustee and Collateral Agent 3

Asset Representations Reviewer 3

Assets of the Issuing Entity 3

Composition of Issuing Entity Receivables 3

Exceptions to Underwriting Criteria 4

Securities Offered by this Prospectus 4

Use of Proceeds 4

Series, Classes and Tranches of Notes 5

Interest 5

Principal 6

Revolving Period 6

Transferor Amount 6

Required Transferor Amount 7

Minimum Pool Balance 7

Risk Factors 7

Servicing Fee 7

Asset Representations Reviewer Fees 8

Nominal Liquidation Amount 8

Available Finance Charge Collections and Application 8

Application of Available Principal Collections 10

Subordination, Credit Enhancement 12

Limit on Repayment of All Notes 13

Optional Redemption and Early Amortization of Offered

Notes 13

Events of Default 13

Events of Default Remedies 14

Limited Recourse to the Issuing Entity; Security for the

Offered Notes 14

Denominations 15

Record Date 15

Ratings 15

U.S. Federal Income Tax Considerations 15

Certain ERISA and Benefit Plan Considerations 15

Certain Investment Company Act Considerations 15

RISK FACTORS 17

Business Risks Relating to JPMorgan Chase Bank’s Credit

Card Business 17

Insolvency and Security Interest Risks 23

Other Legal and Regulatory Risks 25

Transaction Structure Risks 32

General Risk Factors 39

GLOSSARY 41

THE ISSUING ENTITY 41

General 41

The Trust Agreement 42

Issuing Entity Covenants 43

Owner Trustee 43

Bankruptcy Considerations 44

The Administrator 44

CHASE CARD FUNDING LLC 45

General 45

Transfer of the Transferor Interest 45

JPMORGAN CHASE BANK 45

General 45

General Securitization Experience 46

U.S. Public Securitization Program for Credit Card

Receivables 46

Repurchases of Receivables 47

RETAINED INTERESTS 47

Credit Risk Retention 47

Transferor Amount 48

JPMORGAN CHASE BANK’S CREDIT CARD PORTFOLIO 49

The Credit Card Receivables 49

Origination 50

Underwriting Criteria and Process 51

ii

Compliance with Underwriting Criteria 52

Maintenance of Credit Card Accounts 53

Billing and Payments 53

Collection of Delinquent Accounts 56

Portfolio Information Tables 57

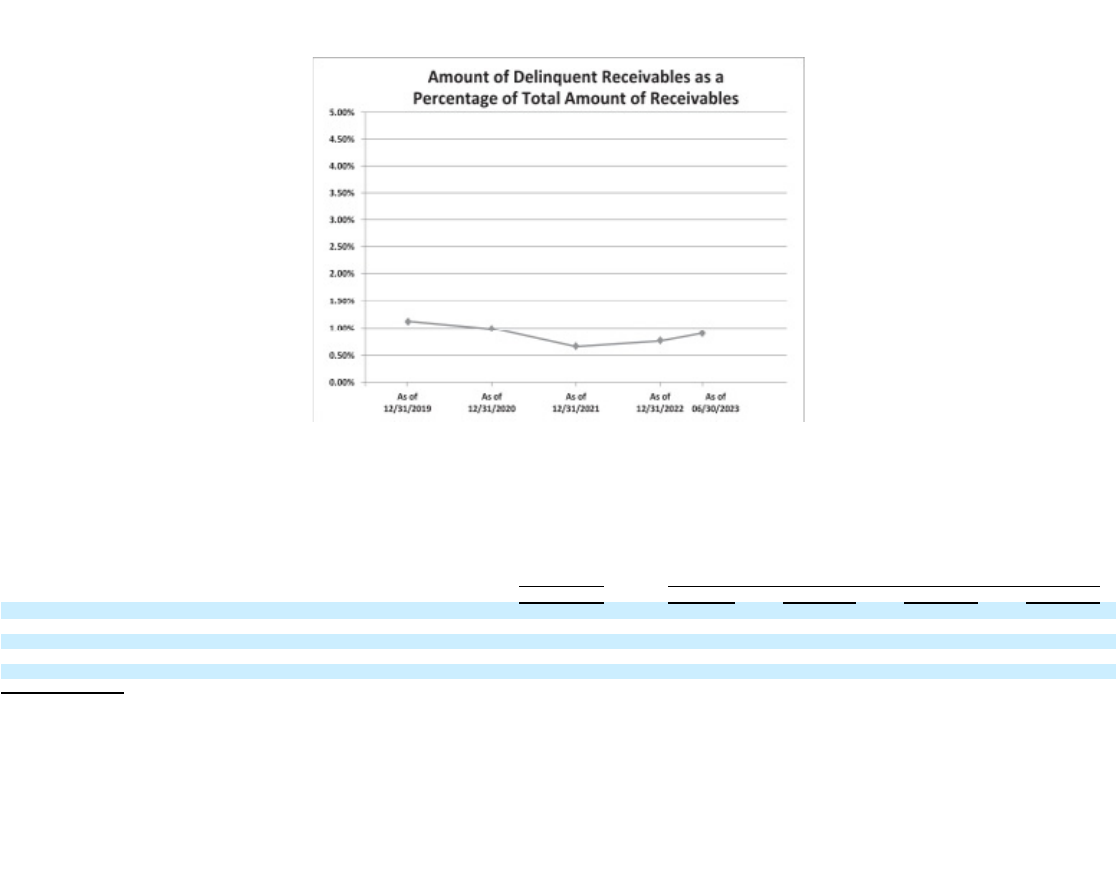

Delinquency and Loss Experience 57

Recoveries 60

Dilution 60

Interchange 61

Revenue Experience 61

Principal Payment Rates 62

Composition of Issuing Entity Receivables 62

Credit Risk Management 64

Rule 193 Review 65

Findings of Rule 193 Review 66

Static Pool Information 66

THE INDENTURE TRUSTEE AND COLLATERAL AGENT 67

General 67

The Indenture Trustee 68

The Collateral Agent 69

ASSET REPRESENTATIONS REVIEWER 70

SERVICING OF THE RECEIVABLES 71

General 71

Servicing Experience 72

Payment of Fees and Expenses; Servicing Compensation 72

Certain Matters Regarding the Servicer 72

Resignation and Removal of the Servicer; Issuing Entity

Servicer Default 73

Outsourcing of Servicing 74

Evidence as to Compliance 75

THE NOTES 76

The Notes Offered by this Prospectus 76

General 76

Stated Principal Amount, Outstanding Dollar Principal

Amount and Nominal Liquidation Amount 77

Interest 79

Principal 80

Subordination of Interest and Principal 80

Required Subordinated Amount 81

Revolving Period 82

Redemption and Early Amortization of Notes; Early

Amortization Events 83

Events of Default 84

Events of Default Remedies 85

Final Payment of the Notes 86

Issuances of New Series, Classes and Tranches of Notes 87

Payments on Notes; Paying Agent 88

Record Date 89

Addresses for Notices 89

List of Noteholders 89

Voting 89

Issuing Entity’s Annual Compliance Statement 89

Indenture Trustee’s Annual Report 89

Reports 90

Governing Law 90

Form, Exchange and Registration and Transfer of Notes 90

Book-Entry Notes 91

The Depository Trust Company 92

Clearstream Banking 93

Euroclear 93

Distributions on Book-Entry Notes 94

Global Clearance and Settlement Procedures 94

Definitive Notes 95

Replacement of Notes 95

Amendments to the Indenture, the Asset Pool One

Supplement and Indenture Supplements 95

Tax Opinions for Amendments 98

Limited Recourse to the Issuing Entity; Security for the

Notes 98

SOURCES OF FUNDS TO PAY THE NOTES 98

General 98

Transferor Amount 99

Required Transferor Amount 99

Minimum Pool Balance 100

Allocations of Amounts to the Excess Funding Account

and Allocations of Amounts on Deposit in the Excess

Funding Account 100

Addition of Assets 101

Removal of Assets 102

Discount Receivables 103

Issuing Entity Bank Accounts 103

JPMorgan Chase Bank and Transferor Representations

and Warranties 104

Sale of Assets 107

iii

DEPOSIT AND APPLICATION OF FUNDS IN THE ISSUING

ENTITY 109

Deposit and Application of Funds 109

Available Finance Charge Collections 110

Application of Available Finance Charge Collections 110

Targeted Deposits of Available Finance Charge

Collections to the Interest Funding Account 111

Allocation to Interest Funding Subaccounts 112

Allocations of Reductions from Charge-Offs 112

Allocations of Reimbursements of Nominal Liquidation

Amount Deficits 113

Application of Available Principal Collections 114

Reductions to the Nominal Liquidation Amount of

Subordinated CHASEseries Notes from

Reallocations of Available Principal Collections 115

Limit on Allocations of Available Principal Collections

and Available Finance Charge Collections to

Tranches of Notes 117

Targeted Deposits of Available Principal Collections to

the Principal Funding Account 117

Allocation to Principal Funding Subaccounts 119

Limit on Deposits to the Principal Funding Subaccount

of Subordinated Notes; Limit on Repayment of all

Tranches 119

Deposits of Withdrawals from the Class C Reserve

Account to the Principal Funding Account 120

Withdrawals from Interest Funding Subaccounts 120

Withdrawals from Principal Funding Account 121

Pro rata Payments Within a Tranche of Notes 121

Shared Excess Available Finance Charge Collections 121

Shared Excess Available Principal Collections 122

Segregated Finance Charge Collections 122

SHELF REGISTRATION ELIGIBILITY REQUIREMENTS 122

Transaction Requirements 122

Registrant Requirements 127

MATERIAL LEGAL ASPECTS OF THE CREDIT CARD

RECEIVABLES 127

Transfer of Credit Card Receivables 127

Certain Matters Relating to Conservatorship or

Receivership 128

Certain Regulatory Matters 130

Consumer Protection Laws 131

LITIGATION AND OTHER PROCEEDINGS 135

Litigation Regarding the Depositor and Issuing Entity 135

Litigation Regarding the Sponsor and Servicer 135

Industry Litigation 135

Indenture Trustee Litigation 136

U.S. FEDERAL INCOME TAX CONSIDERATIONS 136

U.S. Federal Income Tax Characterizations of the Notes

and the Issuing Entity 138

U.S. Holders 139

Non-U.S. Holders 139

Foreign Account Tax Compliance Act 140

CERTAIN ERISA AND BENEFIT PLAN CONSIDERATIONS 141

Plan Asset Issues for an Investment in the Notes 141

Prohibited Transactions between the Plan and a Party in

Interest 142

Investment by Plan Investors 142

General Investment Considerations for Prospective Plan

Investors in the Notes 143

Tax Consequences to Plans 144

CERTAIN INVESTMENT COMPANY ACT

CONSIDERATIONS 144

CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS 144

iv

UNDERWRITING (PLAN OF DISTRIBUTION, PROCEEDS

AND CONFLICTS OF INTEREST) 145

LEGAL MATTERS 147

WHERE YOU CAN FIND MORE INFORMATION 148

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE 148

FORWARD-LOOKING STATEMENTS 148

GLOSSARY OF DEFINED TERMS 150

Annex I Other Outstanding Classes and Tranches A-I-1

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS PROSPECTUS

You should rely only on the information provided in this prospectus including the information incorporated by reference. We have not authorized

anyone to provide you with different information. We are not offering the offered notes in any jurisdiction where the offer is not permitted. We do not

claim the accuracy of the information in this prospectus as of any date other than the date stated on the cover.

Information regarding certain entities that are not affiliates of JPMorgan Chase Bank, National Association, referred to in this prospectus as

“JPMorgan Chase Bank,” or Chase Card Funding LLC, referred to in this prospectus as “Chase Card Funding,” has been provided in this prospectus.

See in particular “The Issuing Entity—Owner Trustee,” “The Indenture Trustee and Collateral Agent—General” and “Asset Representations Reviewer.”

References to “we” in this prospectus refer to Chase Card Funding and, where applicable or the context requires, to JPMorgan Chase Bank or the issuing

entity.

J.P. Morgan Securities LLC, one of the underwriters of the offered notes, is a wholly owned subsidiary of JPMorgan Chase & Co., referred to in

this prospectus as “JPMorgan Chase,” and an affiliate of JPMorgan Chase Bank, Chase Card Funding and Chase Issuance Trust, the issuing entity. See

“Underwriting (Plan of Distribution, Proceeds and Conflicts of Interest).”

On May 18, 2019, referred to in this prospectus as the “Merger Date,” Chase Bank USA, National Association, referred to in this prospectus as

“Chase USA,” was merged with and into JPMorgan Chase Bank with JPMorgan Chase Bank as the surviving entity. Prior to the Merger Date, Chase

USA was the sponsor, originator, administrator and servicer of the issuing entity. As of the Merger Date, JPMorgan Chase Bank assumed and agreed to

perform all covenants and obligations of Chase USA as sponsor, originator, administrator and servicer of the issuing entity. For a description of the

activities of the surviving entity see “JPMorgan Chase Bank.”

Unless the context otherwise requires, all references to JPMorgan Chase Bank are to Chase USA for the period prior to the Merger Date.

We include cross-references in this prospectus to captions in these materials where you can find further related discussions. The Table of Contents

in this prospectus provides the pages on which these captions are located.

EU and UK Securitization Regulations

Prospective noteholders should note that none of JPMorgan Chase Bank, Chase Card Funding, Chase Issuance Trust, Wilmington Trust Company,

Wells Fargo Bank, National Association, the underwriters of the offered notes or any of their respective affiliates makes any representation or agreement

that it is undertaking or will have undertaken to ensure that it will comply with (a) European Union regulation 2017/2402 (as amended, the “EU

Securitization Regulation”) or (b) Regulation (EU) 2017/2402, as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act

2018 as amended (the “EUWA”), and as amended by the Securitization (Amendment) (EU Exit) Regulations 2019 (the “UK Securitization Regulation”).

In particular, no such party will take or refrain from taking any action that may be required by any prospective investor or noteholder for the purposes of

its compliance with any requirement of the EU Securitization Regulation or the UK Securitization Regulation.

Consequently, the notes may not be a suitable investment for any person that is now or may in the future be subject to any requirement of the EU

Securitization Regulation or the UK Securitization Regulation. Prospective noteholders are responsible for analyzing their own regulatory position and

are advised to consult with their own advisors regarding the suitability of the offered notes for investment and compliance with the

v

applicable EU Securitization Regulation or the UK Securitization Regulation. If the regulatory treatment of an investment in the Notes is relevant to any

investor’s decision whether or not to invest, the investor should make its own determination as to such treatment and for this purpose seek professional

advice and consult its regulator.

For additional information regarding the EU Securitization Regulation and the UK Securitization Regulation, see “Risk Factors—Other Legal and

Regulatory Risks—Certain EEA-regulated and UK-regulated investors are subject to due diligence and risk retention requirements relating to the

notes.”

Notice to Residents of the European Economic Area

This prospectus is not a prospectus for the purpose of the EU Prospectus Regulation (as defined below). This prospectus has been prepared on the

basis that any offer of the notes in any member state of the European Economic Area (“EEA”) will be made pursuant to an exemption under the EU

Prospectus Regulation from the requirement to publish a prospectus for offers of the notes. Accordingly, any person making or intending to make an

offer in a EEA member state of the notes may only do so in circumstances in which no obligation arises for any of JPMorgan Chase Bank, Chase Card

Funding, Chase Issuance Trust, Wilmington Trust Company, Wells Fargo Bank, National Association, the underwriters of the offered notes or any of

their respective affiliates to publish a prospectus pursuant to Article 3(1) of the EU Prospectus Regulation or supplement a prospectus pursuant to Article

23 of the EU Prospectus Regulation, in each case, in relation to such offer. None of JPMorgan Chase Bank, Chase Card Funding, Chase Issuance Trust,

Wilmington Trust Company, Wells Fargo Bank, National Association, the underwriters of the offered notes or any of their respective affiliates have

authorized, nor do they authorize, the making of any offer of the notes in circumstances in which an obligation arises for any such person to publish a

prospectus for such offer. The expression “EU Prospectus Regulation” means Regulation (EU) 2017/1129 as amended and includes any relevant

implementing measure in any EEA member state.

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any

EEA Retail Investor. For these purposes, an “EEA Retail Investor” means a person who is one (or more) of: (i) a retail client as defined in point (11) of

Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 on insurance

distribution (as amended) (the “EU Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point

(10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Article 2 of the EU Prospectus Regulation. Consequently no key

information document required by Regulation (EU) No 1286/2014, as amended (the “EU PRIIPs Regulation”) for offering or selling the notes or

otherwise making them available to EEA Retail Investors has been prepared and therefore offering or selling the notes or otherwise making them

available to any EEA Retail Investor may be unlawful under the EU PRIIPs Regulation.

Notice to Residents of the United Kingdom

This prospectus is only being distributed to and is only directed at (i) persons who are outside the United Kingdom (the “UK”) or (ii) have

professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, as amended (the “Order”) or (iii) high net worth companies, and other persons, falling within Article 49(2)(a) to (d) of the

Order or (iv) other persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial

Services and Markets Act 2000 (“FSMA”)) in connection with the offer of the notes may lawfully be communicated (all such persons together being

referred to as “relevant persons”). The notes are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire

such notes will be engaged in only with, relevant persons. Any person who is not a relevant person must not act or rely on this document or any of its

contents.

vi

This prospectus is not a prospectus for the purpose of Regulation (EU) 2017/1129 as it forms part of UK domestic law by virtue of the EUWA (the

“UK Prospectus Regulation”). This prospectus has been prepared on the basis that any offer of the notes in the UK will be made pursuant to an

exemption under the UK Prospectus Regulation from the requirement to publish a prospectus for offers of the notes. Accordingly, any person making or

intending to make an offer of the notes in the UK may only do so in circumstances in which no obligation arises for any of JPMorgan Chase Bank,

Chase Card Funding, Chase Issuance Trust, Wilmington Trust Company, Wells Fargo Bank, National Association, the underwriters of the offered notes

or any of their respective affiliates to publish a prospectus pursuant to Section 85 of the FSMA or to supplement a prospectus pursuant to Article 23 of

the UK Prospectus Regulation in relation to such offer. None of JPMorgan Chase Bank, Chase Card Funding, Chase Issuance Trust, Wilmington Trust

Company, Wells Fargo Bank, National Association, the underwriters of the offered notes or any of their respective affiliates have authorized, nor do they

authorize, the making of any offer of the notes in circumstances in which an obligation arises for any such person to publish a prospectus for such offer.

Prohibition on Sales to UK Retail Investors

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any

UK Retail Investor in the UK. For these purposes, a “UK Retail Investor” means a person who is one (or more) of the following:

(i) a client, as defined in point (7) of Article 2(1) of Regulation (EU) 600/2014 as it forms part of UK domestic law by virtue of the EUWA

subject to amendments made by the Markets in Financial Instruments (Amendments (EU Exit) Regulation 2018 (SI 2018/1403) who is not

a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK domestic law by virtue

of the EUWA subject to amendments made by the Markets in Financial Instruments (Amendment) (EU Exit) Regulations 2018 (SI

2018/1403) (“UK MiFIR”); or

(ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement the

Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of UK

MiFIR; or

(iii) not a qualified investor as defined in Article 2 of the UK Prospectus Regulation.

Consequently, no key information document required by the EU PRIIPs Regulation, as amended, as it forms part of UK domestic law by virtue of

the EUWA subject to amendments made by the Packaged Retail and Insurance-based Investment Products (Amendment) (EU Exit) Regulations 2019

(SI 2019/403) (the “UK PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors has been prepared

and therefore offering or selling the notes or otherwise making them available to any UK Retail Investor may be unlawful under the UK PRIIPs

Regulation.

vii

TRANSACTION PARTIES AND DOCUMENTS

viii

TRANSACTION SUMMARY

This Transaction Summary provides information on the notes offered by this prospectus, which are a tranche of the Class A notes of the

CHASEseries. General descriptions of the CHASEseries and the Class A notes are also included in this prospectus. For a description of other

outstanding classes and tranches of Class A, Class B and Class C CHASEseries notes, see “Annex I: Other Outstanding Classes and Tranches.”

Issuing Entity: Chase Issuance Trust

Depositor and Transferor: Chase Card Funding LLC or “Chase Card Funding”

Sponsor, Originator, Administrator and Servicer:

JPMorgan Chase Bank, National Association, “JPMorgan Chase Bank” or

“sponsor”

Owner Trustee: Wilmington Trust Company

Indenture Trustee and Collateral Agent: Wells Fargo Bank, National Association

Expected Issuance Date: September 15, 2023

Assets of the Issuing Entity:

Receivables originated in Visa and Mastercard accounts owned by JPMorgan

Chase Bank, including recoveries on charged-off receivables and interchange*

Notes Offered by this Prospectus:

Class A(2023-1) notes, or the “offered notes,” which are a tranche of the Class A

notes of the CHASEseries

Principal Amount: $1,150,000,000

Enhancement: Subordination of the Class B notes and the Class C notes

Class A Required Subordinated Amount of Class B Notes:

8.13953% of the adjusted outstanding dollar principal amount of the

Class A(2023-1) notes

Class A Required Subordinated Amount of Class C Notes:

8.13953% of the adjusted outstanding dollar principal amount of the

Class A(2023-1) notes

Interest Rate:

5.16% per annum

Interest Accrual Method: 30/360

Interest Paymant Dates:

Monthly on the 15

th

(unless the 15

th

is not a business day, in which case it will be

the next business day)

First Interest Payment Date: October 16, 2023

Scheduled Commencement of Accumulation Period: September 1, 2025

Scheduled Principal Payment Date: September 15, 2026

Legal Maturity Date: September 15, 2028

Price to Public: $1,149,681,220 (or 99.97228%)

Underwriting Discount: $2,875,000 (or 0.25000%)

Net proceeds from the sale of the Class A(2023-1) notes net of estimated expenses: $1,146,018,114 (or 99.65375%)

CUSIP/ISIN: 161571HT4/US161571HT41

Annual Servicing Fee:

1.5% for so long as JPMorgan Chase Bank is the servicer and 2.00% in the event

JPMorgan Chase Bank is no longer the servicer

Clearance and Settlement: DTC/Clearstream Banking/Euroclear

*Visa

®

is a registered trademark of Visa Inc. and Mastercard

®

is a registered trademark of Mastercard International Incorporated.

ix

SUMMARY

This summary does not contain all the information you may need to make an informed investment decision. You should read this entire

prospectus before you purchase any of the offered notes.

1

Risk Factors

Investment in the Class A(2023-1) notes involves risks, including

business risks, legal and regulatory risks, and transaction structure

risks, most of which could result in accelerated, delayed or reduced

payments on your notes. We have summarized these risks below and

described them more fully under the heading “Risk Factors,”

beginning on page 17 in this prospectus. You should consider these

risks carefully.

Business Risks Relating to JPMorgan Chase Bank’s Credit Card

Business

• A successful cyber attack affecting JPMorgan Chase Bank could

cause significant harm to JPMorgan Chase Bank’s credit card

origination and servicing activities, result in the loss of

information or the disclosure or misuse of confidential or

proprietary information, cause reputational harm and/or reduce

the rate at which new receivables are generated and repaid, and

consequently have an adverse impact on the timing and amount

of payments on your notes.

• JPMorgan Chase Bank’s operational costs and customer

satisfaction could be adversely affected by the failure of an

external operational system.

• The effects of climate change could adversely impact the timing

and amount of payments on your notes.

• Competition in the credit card industry may result in a decline in

JPMorgan Chase Bank’s ability to generate new credit card

receivables and this may result in the payment of principal

earlier or later than the scheduled principal payment date.

• Payment patterns of cardholders may not be consistent over time

and variations in these payment patterns may result in reduced

payment of principal or receipt of payment of principal earlier or

later than expected.

• Cardholder use, payment patterns and the performance of the

credit card receivables may be adversely affected by any lasting

effects of the COVID-19 pandemic, which may impact the timing

and amount of collections and may reduce payments on your

notes.

• JPMorgan Chase Bank may change the terms of the revolving

credit card accounts in a way that reduces, accelerates or slows

collections, and these changes may result in reduced, accelerated

or delayed payments on your notes.

• Yield and payments on the assets in the issuing entity could

decrease, resulting in the receipt of principal payments earlier or

later than the scheduled principal payment date or the occurrence

of an early amortization event.

Insolvency and Security Interest Risks

• If a conservator or receiver is appointed for JPMorgan Chase

Bank, delays or reductions in payment of your notes could occur.

• Some liens may be given priority over your notes which could

cause your receipt of payments to be delayed or reduced.

Other Legal and Regulatory Risks

• Regulatory action could cause delays or reductions in payment of

your notes to occur.

• Changes to consumer protection laws may impede collection

efforts, alter timing and amount of collections and reduce the yield

on the pool of credit card receivables which may result in

acceleration of or reduction in payments on your notes.

• Financial regulatory reforms could have a significant impact on

the issuing entity, Chase Card Funding or JPMorgan Chase Bank.

• The sponsor, servicer, transferor and the issuing entity could be

named as defendants in litigation, resulting in increased expenses

and greater risk of loss on your notes.

2

• Legal proceedings may have a negative impact on JPMorgan

Chase Bank which in turn could have a negative impact on

Chase Card Funding and the issuing entity.

• Certain EEA-regulated and UK-regulated investors are subject to

due diligence and risk retention requirements relating to the

notes.

Transaction Structure Risks

• The note interest rate and the credit card receivables interest rate

may re-set at different times or fluctuate differently, which could

result in a delay or reduction in payments on your notes.

• Allocations of the default amount and reallocation of principal

collections could result in a reduction in payment on the

subordinated notes.

• If JPMorgan Chase Bank or Chase Card Funding breaches

representations and warranties relating to the credit card

receivables, payments on your notes may be reduced.

• Class A notes can lose the benefit of subordination under some

circumstances resulting in delayed or reduced payments to you.

• The composition of the assets in the issuing entity may change,

which may decrease the credit quality of the assets securing the

offered notes, which in turn could cause your receipt of

payments of principal and interest to be reduced, delayed or

accelerated.

• JPMorgan Chase Bank may not be able to generate new credit

card receivables or designate new revolving credit card accounts

when required, which could result in an acceleration of or

reduction in payments on your notes.

• The objective of the asset representations review process is to

independently identify noncompliance with a representation or

warranty concerning the receivables but no assurance can be

given as to its effectiveness.

• The certification provided by the chief executive officer of the

depositor does not guarantee that the securitization will produce

expected cash flows at times and in amounts to service

scheduled payments of interest and the ultimate repayment of

principal on the offered notes in accordance with their terms as

described in this prospectus.

• Issuance of additional notes may affect the timing and amount of

payments to you.

• Some customers may provide information that is inaccurate or

intentionally false during the underwriting process.

• The underwriting, risk management and servicing efforts of

JPMorgan Chase Bank may not be effective.

• The rate of collections on delinquent accounts may not be

consistent over time and variations in this rate may lead to

significant increases in the rate of charge-offs.

• You may have limited or no ability to control actions under the

indenture.

• If an event of default occurs, your remedies may be limited and

you may not receive full payment of principal and accrued

interest.

• JPMorgan Chase Bank’s review of the pool asset disclosure in this

prospectus does not provide absolute certainty that the pool asset

disclosure is accurate in all material respects.

General Risk Factors

• There is no public market for the offered notes. As a result you

may be unable to sell your notes or the price of the offered notes

may suffer.

• If your notes are repaid prior to the scheduled principal payment

date, you may not be able to reinvest your principal in a

comparable security.

• A reduction, withdrawal or qualification of the ratings on your

notes, or the issuance of unsolicited ratings on your notes, could

adversely affect the liquidity or the market value of your notes.

The Issuing Entity

Chase Issuance Trust, a Delaware statutory trust, is the issuing entity for

the offered notes and is also referred to in this prospectus as the “issuing

entity.”

3

The Depositor and Transferor

Chase Card Funding LLC is the depositor into the issuing entity and is

referred to in this prospectus as “Chase Card Funding.” Chase Card

Funding also is the transferor and holds the transferor certificate of the

issuing entity.

The Sponsor, Originator, Servicer and Administrator

JPMorgan Chase Bank, National Association is the sponsor of the

issuing entity and is referred to in this prospectus as “JPMorgan

Chase Bank” or “sponsor.” JPMorgan Chase Bank is also the

originator and the servicer of all credit card receivables transferred to

the issuing entity and will provide all administrative services on behalf

of the issuing entity. JPMorgan Chase Bank is the sole member of

Chase Card Funding.

On May 18, 2019, referred to in this prospectus as the “Merger Date,”

Chase Bank USA, National Association, referred to in this prospectus

as “Chase USA,” was merged with and into JPMorgan Chase Bank

with JPMorgan Chase Bank as the surviving entity. Prior to the Merger

Date, Chase USA was the sponsor, originator, administrator and

servicer of the issuing entity and the sole member of Chase Card

Funding. As of the Merger Date, JPMorgan Chase Bank assumed and

agreed to perform all covenants and obligations of Chase USA as

sponsor, originator, administrator and servicer of the issuing entity. For

a description of the activities of the surviving entity see “JPMorgan

Chase Bank.”

JPMorgan Chase Bank has outsourced certain servicing activities to

unaffiliated third parties. For information about the unaffiliated third

party vendor that provides these services, see “Servicing of the

Receivables—Outsourcing of Servicing.”

Indenture Trustee and Collateral Agent

Wells Fargo Bank, National Association is the indenture trustee under

the indenture and the collateral agent under the asset pool one

supplement and is referred to in this prospectus as “Wells Fargo Bank”

or “indenture trustee.”

Under the terms of the indenture and the asset pool one supplement,

the roles of the indenture trustee and the collateral agent are limited.

As of November 1,

2021, Computershare Trust Company, National Association is acting as

agent for Wells Fargo Bank, National Association, as the Indenture

Trustee and Collateral Agent under the Indenture. See “The Indenture

Trustee and Collateral Agent.”

Asset Representations Reviewer

FTI Consulting, Inc. is the asset representations reviewer under the asset

representations review agreement and is referred to in this prospectus as

the “asset representations reviewer.” See “Asset Representations

Reviewer.”

Assets of the Issuing Entity

The assets of the issuing entity include:

• credit card receivables arising in certain revolving credit card

accounts owned by JPMorgan Chase Bank that meet the eligibility

criteria for, and have been designated for, inclusion in the issuing

entity; and

• funds on deposit in the collection account, the excess funding

account, the interest funding account, the principal funding

account and the Class C reserve account.

For a description of JPMorgan Chase Bank’s revolving credit card

accounts, see “JPMorgan Chase Bank’s Credit Card Portfolio.”

The composition of the issuing entity’s assets will likely change over

time due to:

• the designation of additional revolving credit card accounts to

have their credit card receivables included in the issuing entity;

• the removal of revolving credit card accounts included in the trust

portfolio; and

• changes in the composition of the credit card receivables in the

issuing entity.

See “Sources of Funds to Pay the Notes—Addition of Assets.”

Composition of Issuing Entity Receivables

As of June 30, 2023:

• the Issuing Entity Receivables included $9,152,071,695 in total

receivables;

4

• the accounts in the trust portfolio had an average total

receivables balance of $1,660, including accounts with a zero

balance, and had an average credit limit of $15,167;

• the percentage of the aggregate total receivables balance in the

Issuing Entity Receivables to the aggregate total credit limit was

10.95%;

• the average age of the accounts, the receivables of which are in

the Issuing Entity Receivables, was approximately 262 months;

• for the June 2023 monthly period, 2.72% of the accounts in the

trust portfolio received the minimum payment due and 29.74%

of the accounts in the trust portfolio received a full balance

payment; and

• of the accounts in the trust portfolio, approximately 11.94%

related to cardholders with billing addresses in California, 8.58%

in New York, 7.94% in Texas, 6.49% in Florida and 5.83% in

Illinois; no other single state represented more than 5% of the

accounts in the trust portfolio. Because the largest number of

accountholders (based on billing addresses) whose accounts

were included in the trust portfolio were in California, New

York, Texas, Florida and Illinois, adverse economic, financial,

social or environmental conditions affecting accountholders

residing in these states could affect timely payment by the

related accountholders of amounts due on the accounts and,

accordingly, the actual rates of delinquencies and losses with

respect to the issuing entity.

See “JPMorgan Chase Bank’s Credit Card Portfolio—Composition of

Issuing Entity Receivables” for more detailed portfolio information on

the assets of the issuing entity.

Exceptions to Underwriting Criteria

Unless the context otherwise requires, all references to JPMorgan

Chase Bank are to Chase USA for the period prior to the Merger Date.

JPMorgan Chase Bank uses manual credit decision-making as part of

the underwriting process to supplement its automated underwriting,

primarily

(1) when it believes an experienced lender’s review would enhance the

credit decision-making, (2) when additional information is needed,

and/or (3) under specific circumstances, such as when fraud concerns

are present. Based on a review of the manual credit decisions made

during the three calendar months ended June 30, 2023, the number of

accounts in the trust portfolio identified with exceptions to JPMorgan

Chase Bank’s underwriting process and criteria in effect during that

time period as a percentage of the total number of accounts in the trust

portfolio was less than 0.1%.

See “JPMorgan Chase Bank’s Credit Card Portfolio—Underwriting

Criteria and Process” and “JPMorgan Chase Bank’s Credit Card

Portfolio— Compliance with Underwriting Criteria” for a description

of JPMorgan Chase Bank’s underwriting criteria and the process for

reviewing for any deviations from the disclosed underwriting criteria.

Securities Offered by this Prospectus

The issuing entity is offering by this prospectus the Class A(2023-1)

notes, also referred to in this prospectus as the “offered notes.” The

offered notes will be issued pursuant to the indenture between the

issuing entity and Wells Fargo Bank, as indenture trustee and the asset

pool one supplement, the CHASEseries indenture supplement and the

applicable terms document, each between the issuing entity and Wells

Fargo Bank, as indenture trustee and collateral agent.

So long as there is sufficient credit enhancement and the required

transferor amount and the minimum pool balance requirements have

been satisfied, additional classes and tranches of notes may be issued on

any date without notice to, or the consent of, the holders of any

outstanding notes, including the offered notes.

Use of Proceeds

The proceeds from the sale of the offered notes will be used to make

deposits to the Class C reserve subaccounts for outstanding Class C

notes in an aggregate amount of $17,250,000 and the remaining

proceeds, in the amount of $1,129,556,220 before deduction of issuance

expenses, will be paid by the issuing entity to Chase Card Funding. The

5

estimated expenses are $788,106. Therefore, the proceeds, net of the

deposits to the Class C reserve subaccounts and issuance expenses,

will be approximately $1,128,768,114. Chase Card Funding will use

such proceeds for the general purposes of Chase Card Funding,

including the repayment of amounts owed to JPMorgan Chase Bank.

Expenses incurred in connection with the selection and acquisition of

pool assets that are payable from the offering proceeds will be

approximately $0.

Series, Classes and Tranches of Notes

The offered notes are a tranche of the Class A notes of the

CHASEseries. “CHASEseries” is a designation for a series of notes

issued and to be issued by the issuing entity pursuant to the indenture,

the asset pool one supplement and the CHASEseries indenture

supplement.

The offered notes have, and each other tranche of notes has, a stated

principal amount, an outstanding dollar principal amount and a

nominal liquidation amount. The initial stated principal amount of the

offered notes is the principal amount specified in “Transaction

Summary.” For a description of how to determine, as of any date, the

outstanding dollar principal amount and the nominal liquidation

amount of the offered notes, see “The Notes—Stated Principal

Amount, Outstanding Dollar Principal Amount and Nominal

Liquidation Amount.”

Tranches of notes within a class of CHASEseries notes may be issued

on different dates and have different stated principal amounts, interest

rates, interest payment dates, scheduled principal payment dates, legal

maturity dates and other varying characteristics.

The scheduled principal payment dates and the legal maturity dates of

the tranches of senior and subordinated notes will in most cases be

different. Some tranches of subordinated notes may have scheduled

principal payment dates and legal maturity dates earlier than the

offered notes or all of the tranches of senior notes. However, tranches

of subordinated notes will not be repaid before their legal maturity

dates unless, after payment of those tranches of subordinated notes,

the remaining tranches of subordinated notes provide the required

enhancement for the senior notes. In addition,

tranches of senior notes will not be issued unless after issuance there are

sufficient outstanding subordinated notes to provide the required

subordinated amount for all outstanding tranches of senior notes. See

“The Notes—Issuances of New Series, Classes and Tranches of Notes.”

See “Annex I: Other Outstanding Classes and Tranches” for additional

information on other outstanding notes issued, or expected to be issued,

on or prior to the issuance of the offered notes, by the issuing entity.

Other series of notes secured by the assets in asset pool one may be

issued by the issuing entity in the future.

Interest

Interest on the offered notes will equal the product of:

• the interest rate for the offered notes for the applicable interest

period; times

• (x) the number of days in the applicable interest period based on a

360-day year of twelve 30-day months, divided by (y) 360; times

• the outstanding dollar principal amount of the offered notes as of

the close of business on the last interest payment date or, for the

first interest payment, the outstanding dollar principal amount of

the offered notes as of the issuance date.

Each interest period will begin on and include an interest payment date

and end on but exclude the next interest payment date. However, the

first interest period will begin on and include the issuance date and end

on but exclude the first interest payment date. Each of the expected

issuance date, the interest rate, the first interest payment date and the

interest accrual method for the offered notes is specified in “Transaction

Summary.”

The issuing entity will make interest payments on the offered notes on

the dates specified in “Transaction Summary.” Interest payments due on

a day that is not a business day in New York, New York, Wilmington,

Delaware or Minneapolis, Minnesota will be made on the following

business day.

6

Principal

The issuing entity expects to pay the stated principal amount of the

offered notes in one payment on the scheduled principal payment date,

and is obligated to do so if funds are available on that date for that

purpose. If the stated principal amount of the offered notes is not paid

in full on the scheduled principal payment date due to insufficient

funds, noteholders will generally not have any remedies against the

issuing entity until the legal maturity date of the offered notes. The

timing of payment of the stated principal amount for the offered notes,

including the scheduled principal payment date and the legal maturity

date, is specified in “Transaction Summary.”

If the stated principal amount of the offered notes is not paid in full on

the scheduled principal payment date, then, subject to the principal

payment rules described in “ —Subordination, Credit Enhancement”

and “ —Required Subordinated Amount,” an early amortization event

with respect to the offered notes will occur and principal and interest

payments on the offered notes will be made monthly until they are

paid in full or the legal maturity date occurs, whichever is earlier.

Principal of the offered notes may be paid earlier than the scheduled

principal payment date for the offered notes if an early amortization

event or an event of default and acceleration occurs with respect to the

offered notes. See “The Notes—Redemption and Early Amortization of

Notes; Early Amortization Events” and “The Notes—Events of

Default.”

Revolving Period

The revolving period for the offered notes is the period from the

issuance date through the beginning of the amortization period or

accumulation period. The accumulation period is generally scheduled

to begin twelve whole calendar months before the scheduled principal

payment date. The accumulation period for the offered notes is

scheduled to commence on the date specified in “Transaction

Summary.” Under certain circumstances, the accumulation period

length for the offered notes may be shortened by the servicer so long

as there is at least one targeted deposit. For a description of when and

how the accumulation period may be shortened see “The Notes—

Revolving Period.”

Receivables arising in additional accounts may be added to the issuing

entity at any time or receivables arising in designated accounts may be

removed from the issuing entity at any time. There is no minimum or

maximum amount of additional accounts that may be added during the

revolving period for the offered notes but all accounts must meet the

requirements for addition described in “Sources of Funds to Pay the

Notes—Addition of Assets.”

Chase Card Funding will be permitted to designate for removal from the

issuing entity, require release from the lien in favor of the trust and

require reassignment to it, of credit card receivables arising under

revolving credit card accounts only upon satisfaction of certain

conditions as described in “Sources of Funds to Pay the Notes—

Removal of Assets.”

Transferor Amount

The interest in the issuing entity not securing any series, class or tranche

of notes is the “transferor amount.” The interest representing the

transferor amount will be held by Chase Card Funding or an affiliate.

The transferor amount does not provide credit enhancement to the

offered notes or to any other tranche of notes.

The transferor amount will increase or decrease based on a variety of

factors including:

• increases and decreases in the principal amount of the assets

included in the issuing entity, including the amount of principal

receivables, without a corresponding increase or decrease in the

nominal liquidation amount of any notes;

• the issuance of a new series, class or tranche of notes by the

issuing entity, assuming there is not a corresponding increase in

the principal amount of the assets included in the issuing entity;

• changes in the amount on deposit in the excess funding account;

and

• reductions in the nominal liquidation amount of any series, class

or tranche of notes due to payments of principal on those notes or

a deposit to the principal funding account with respect to those

notes.

7

See “Sources of Funds to Pay the Notes—Transferor Amount.”

Required Transferor Amount

The issuing entity has a minimum transferor amount requirement

called the “required transferor amount.” The required transferor

amount for any month will equal the product of the amount of

principal receivables included in the issuing entity for that month and

the required transferor amount percentage. The required transferor

amount percentage is currently 5%.

If, for any month, the transferor amount is less than the required

transferor amount, Chase Card Funding, as transferor, will be required

to transfer additional credit card receivables to the issuing entity.

When Chase Card Funding’s obligation to the issuing entity is

triggered, JPMorgan Chase Bank will be required to designate

additional credit card accounts from which receivables would be

transferred to Chase Card Funding.

If JPMorgan Chase Bank is unable to either designate additional credit

card accounts from which receivables would be transferred or Chase

Card Funding fails to transfer the credit card receivables in the

additional credit card accounts conveyed to it by JPMorgan Chase

Bank, an early amortization event will occur with respect to the notes.

See “Sources of Funds to Pay the Notes—Required Transferor

Amount” and “The Notes—Redemption and Early Amortization of

Notes; Early Amortization Events.”

Minimum Pool Balance

In addition to the required transferor amount requirement, the issuing

entity has a minimum pool balance requirement. The minimum pool

balance for any month will equal the sum of (1) for all notes in their

revolving period, the sum of the nominal liquidation amounts of those

notes as of the close of business on the last day of that month and

(2) for all notes in their amortization period, the sum of the nominal

liquidation amounts of those notes as of the close of business as of the

last day of the most recent revolving period for each of those notes,

excluding any notes that will be paid in full or that will have a

nominal liquidation amount of zero on their applicable payment date in

the following month.

If, for any month, the pool balance is less than the minimum pool

balance, Chase Card Funding will be required to transfer additional

credit card receivables to the issuing entity as described in “Sources of

Funds to Pay the Notes—Addition of Assets.” When Chase Card

Funding’s obligation to the issuing entity is triggered, JPMorgan Chase

Bank will be required to designate additional credit card accounts from

which receivables would be transferred to Chase Card Funding.

If JPMorgan Chase Bank is unable to either designate additional credit

card accounts from which receivables would be transferred or Chase

Card Funding fails to transfer the credit card receivables in the

additional credit card accounts conveyed to it by JPMorgan Chase

Bank, an early amortization event will occur with respect to the notes.

See “Sources of Funds to Pay the Notes—Minimum Pool Balance” and

“The Notes—Redemption and Early Amortization of Notes; Early

Amortization Events.”

Risk Factors

Investment in the offered notes involves risks. You should consider

carefully the risk factors beginning on page 17 in this prospectus.

Servicing Fee

As compensation for its servicing activities and as reimbursement for

any expenses incurred by it as servicer for the issuing entity, JPMorgan

Chase Bank is entitled to receive a servicing fee each month for the

credit card receivables included in the issuing entity.

The servicing fee for the issuing entity is generally equal to one-twelfth

of the product of 1.50% per annum for so long as JPMorgan Chase

Bank is the servicer and 2.00% per annum in the event JPMorgan Chase

Bank is no longer the servicer, times the principal receivables in the

issuing entity as of the close of business on the last day of the prior

monthly period.

The portion of the servicing fee allocated to the noteholders will be paid

from available finance

8

charge collections after they have been applied to make deposits for

payments of interest on the notes, if any, as described in “Deposit and

Application of Funds in the Issuing Entity—Application of Available

Finance Charge Collections.”

See “Servicing of the Receivables—Payment of Fees and Expenses;

Servicing Compensation.”

Asset Representations Reviewer Fees

The asset representations reviewer will be entitled to a one-time

upfront fee and an annual fee. Payment of the asset representations

reviewer’s fees will be made by JPMorgan Chase Bank, as sponsor.

Nominal Liquidation Amount

If the nominal liquidation amount of the offered notes is less than the

adjusted outstanding dollar principal amount of the offered notes,

principal of and interest on the offered notes may not be paid in full. If

the nominal liquidation amount of the offered notes has been reduced,

the amount of principal collections and finance charge collections

allocated to the notes to pay principal of and interest on the offered

notes will be reduced.

For a more detailed discussion of nominal liquidation amount, see “The

Notes—Stated Principal Amount, Outstanding Dollar Principal Amount

and Nominal Liquidation Amount.”

Available Finance Charge Collections and Application

Available finance charge collections consist of the finance charge

collections allocated to the notes, investment earnings on amounts on

deposit in the collection account, the excess funding account, the

principal funding account and the interest funding account of the notes,

segregated finance charge collections allocated to the notes to cover

earning shortfalls on funds on deposit in the principal funding account,

any shared excess available finance charge collections from other series

in shared excess available finance charge collections group allocated to

the notes, and any amounts to be treated as available finance charge

collections pursuant to any terms document. Each month, the indenture

trustee, at the direction of the servicer, will apply available finance

charge collections for the prior month as described in “Deposit and

Application of Funds in the Issuing Entity—Application of Available

Finance Charge Collections,” and according to the diagram that

follows.

9

10

Application of Available Principal Collections

The available principal collections consist of the sum of the

principal collections allocated to the notes, payments for principal

under any supplemental credit enhancement agreement for tranches of

notes, any amounts of available finance charge collections available to

cover the default amount or any deficits in the nominal liquidation

amount of the notes and

any shared excess available principal collections allocated to the notes.

Each month, the indenture trustee, at the direction of the servicer, will

apply available principal collections for the prior month as described in

“Deposit and Application of Funds in the Issuing Entity—Application of

Available Principal Collections,” and according to the diagram that

follows.

11

12

Subordination, Credit Enhancement

The payment of principal and interest on subordinated notes will be

subordinated to the payment of principal of and interest on senior

notes.

Principal collections allocated to subordinated notes may be

reallocated to pay interest on senior notes or the portion of the

servicing fee allocable to the senior notes. These reallocations will

reduce the nominal liquidation amount of the subordinated notes. In

addition, the nominal liquidation amount of the subordinated notes

will generally be reduced for charge-offs resulting from any uncovered

default amount allocated to the notes prior to any reductions in the

nominal liquidation amount of the offered notes. Charge-offs resulting

from any uncovered default amount allocated to the notes will initially

be allocated to each tranche pro rata based upon each tranche’s

nominal liquidation amount. These charge-offs will then be reallocated

from tranches of senior notes to tranches of subordinated notes to the

extent credit enhancement in the form of subordination is still

available to those tranches of senior notes.

In addition, principal collections allocated to the subordinated notes

will first be used to fund targeted deposits to the principal funding

subaccounts of senior notes before being applied to the principal

funding subaccounts of subordinated notes.

A tranche of subordinated notes that reaches its scheduled principal

payment date, or that has an early amortization event, event of default

and acceleration, or an optional redemption, will not be paid to the

extent that that tranche is necessary to provide the required

subordination for tranches of senior notes. If a tranche of subordinated

notes cannot be paid because of the subordination provisions of the

senior notes, prefunding of the principal funding subaccounts for

tranches of senior notes will begin as described in this prospectus

under “Deposit and Application of Funds in the Issuing Entity—

Targeted Deposits of Available Principal Collections to the Principal

Funding Account—Prefunding of the Principal Funding Account of

Senior Notes” and “Deposit and Application of Funds in the Issuing

Entity—Limit of Deposits to the Principal Funding Subaccount of

Subordinated Notes; Limit on Repayment of all Tranches.” After that

time, that

tranche of subordinated notes will be paid only to the extent that:

• the principal funding subaccounts for the tranches of senior notes

are prefunded to an appropriate level such that none of the

tranches of subordinated notes that have reached their scheduled

principal payment date are necessary to provide the required

subordination; or

• new tranches of subordinated notes are issued so that the tranches

of subordinated notes that have reached their scheduled principal

payment date are no longer necessary to provide the required

subordination; or

• enough tranches of senior notes are repaid so that the tranches of

subordinated notes that have reached their scheduled principal

payment date are no longer necessary to provide the required

subordination; or

• the tranches of subordinated notes reach their legal maturity date.

On the legal maturity date of a tranche of notes, principal collections, if

any, allocated to that tranche and proceeds from any sale of credit card

receivables will be paid to the noteholders of that tranche, even if that

payment would reduce the amount of available subordination below the

required subordination for the senior notes.

Required Subordinated Amount

The Class A required subordinated amount of Class C notes for the

offered notes is the percentage of the adjusted outstanding dollar

principal amount of the offered notes specified in “Transaction

Summary.” The Class A required subordinated amount of Class B notes

for the offered notes is the percentage of the adjusted outstanding dollar

principal amount of the offered notes specified in “Transaction

Summary.”

The percentage and methodology for calculating the required

subordinated amount for the offered notes and other tranches of senior

notes may change without notice to, or the consent of, any noteholders

if each applicable note rating agency confirms that the change will not

cause a reduction, qualification with negative implications or

withdrawal of its

13

then-current rating of any outstanding notes and the issuing entity has

delivered to each applicable note rating agency and the indenture

trustee an opinion that the change will not have certain adverse tax

consequences for holders of outstanding notes.

The required subordinated amount of subordinated notes of other

Class A notes may be different from the percentage specified for the

tranche of Class A notes being offered hereby, as described in

“Transaction Summary.”

Limit on Repayment of All Notes

You, as a holder of the offered notes, may not receive full repayment

of your notes if:

• the nominal liquidation amount of the offered notes has been

reduced by charge-offs due to any uncovered default amount or

as a result of reallocations of principal collections to pay interest

on senior notes or the portion of the servicing fee allocable to

those senior notes, and those amounts have not been reimbursed

from finance charge collections allocated to the offered notes; or

• credit card receivables are sold (1) following an event of default

and acceleration or (2) on the legal maturity date and the

proceeds from the sale of those assets, plus any funds on deposit

in the applicable subaccounts allocated to the offered notes, and

any other amounts available to the offered notes, are insufficient

to provide full repayment of the offered notes.

Optional Redemption and Early Amortization of Offered Notes

JPMorgan Chase Bank, as the servicer for the issuing entity, has the

right, but not the obligation, to redeem the offered notes in whole but

not in part on or after the day on which the aggregate outstanding

principal amount of the offered notes is reduced to less than 10% of

their highest outstanding dollar principal amount. This redemption

option is referred to as a “clean-up” call. JPMorgan Chase Bank, as

servicer for the issuing entity, will not redeem subordinated notes if

those notes are required to provide credit enhancement for the offered

notes or other senior notes.

If JPMorgan Chase Bank, as servicer for the issuing entity, elects to

redeem the offered notes, it will notify the registered holders of the

offered notes at least 30 days prior to the redemption date. The

redemption price of a note will equal 100% of the outstanding dollar

principal amount of that note, plus accrued but unpaid interest and any

additional interest or principal accreted and unpaid on that note to but

excluding the date of redemption.

In addition, the issuing entity is required to repay any note upon the

occurrence of an early amortization event with respect to that note, but

only to the extent funds are available for repayment after giving effect

to all allocations and reallocations and, in the case of tranches of

subordinated notes, only to the extent that payment is permitted by the

subordination provisions of the senior notes.

For a discussion of early amortization events, see “The Notes—

Redemption and Early Amortization of Notes; Early Amortization

Events.”

Events of Default

The occurrence of some events of default can result in an automatic

acceleration of the affected series, class or tranche of notes, and other

events of default result in the right of the noteholders of the affected

series, class or tranche of notes to demand acceleration after an

affirmative vote by holders of more than 66 2/3% of the outstanding

dollar principal amount of the affected series, class or tranche of notes.

For a discussion of events of default see “The Notes—Events of

Default.”

An event of default with respect to one series, class or tranche of notes

will not necessarily be an event of default with respect to any other

series, class or tranche of notes.

It is not an event of default if the issuing entity fails to redeem the

offered notes prior to the legal maturity date for the offered notes

because it does not have sufficient funds available or, in the case of the

offered notes being subordinated notes, if payment of principal of the

offered notes is delayed because the offered notes are necessary to

provide required subordination for senior notes.

14

Events of Default Remedies

After an event of default and acceleration of the offered notes, funds

on deposit in the applicable issuing entity bank accounts for the

offered notes will be applied to pay principal of and interest on the

offered notes. Then, in each following month, available principal

collections and available finance charge collections allocated to the

offered notes will be deposited into the applicable issuing entity bank

accounts and applied to make monthly principal and interest payments

on the offered notes until the earlier of the date the offered notes are

paid in full and the legal maturity date of the offered notes. However,

in the case of offered notes that are subordinated notes, the offered

notes will receive payment of principal prior to their legal maturity

date only if, and to the extent that, funds are available for that payment

and, after giving effect to that payment, the required subordination

will be maintained for senior notes.

If an event of default of the offered notes occurs and the offered notes

are accelerated, the indenture trustee may, and at the direction of the

holders of more than 66 2/3% of the outstanding dollar principal

amount of the offered notes will, direct the collateral agent to sell

assets. However, this sale of assets may occur only if:

• the conditions described in “The Notes—Events of Default” and

“The Notes—Events of Default Remedies” are satisfied and only

to the extent that payments are permitted by the subordination

provisions of the senior notes; or

• the legal maturity date of the offered notes has occurred.

None of the transferor, any affiliate of the transferor, including

JPMorgan Chase Bank, or any agent of the transferor will be permitted

to purchase assets if the sale occurs or to participate in any vote with

respect to that sale.

The holders of the offered notes and any other accelerated tranche of

notes will be paid their allocable share of the proceeds of a sale of

these assets and amounts previously deposited in issuing entity bank

accounts for each series, class or tranche of accelerated notes. Upon

the sale of those assets

and payment of the proceeds from the sale, the nominal liquidation

amount of each accelerated tranche of notes will be reduced to zero. See

“Sources of Funds to Pay the Notes—Sale of Assets.”

Limited Recourse to the Issuing Entity; Security for the Offered

Notes

The offered notes are secured by a security interest in the assets of the

issuing entity that are allocated to them under the indenture, the asset

pool one supplement, the CHASEseries indenture supplement and the

terms document for the offered notes.

The offered notes will be secured by a security interest in:

• credit card receivables in accounts designated for inclusion in the

issuing entity;

• additional credit card receivables that may be included in the

issuing entity;

• the collection account;

• the excess funding account;

• the principal funding subaccount for the offered notes; and

• the interest funding subaccount for the offered notes

The sole source of payment for principal of or interest on the offered

notes is provided by:

• the portion of collections of principal receivables and finance

charge receivables received by the issuing entity for the credit

card receivables and available to the offered notes after giving

effect to any reallocations, payments and deposits; and

• funds in the applicable issuing entity bank accounts for the offered

notes.

A noteholder will generally have no recourse to any other assets of the

issuing entity—other than shared excess available finance charge

collections—or any other person or entity for the payment of principal

of or interest on the offered notes.

However, if there is a sale of assets included in the issuing entity

(1) following an event of default and

15

acceleration, or (2) on the legal maturity date, as described in “Sources

of Funds to Pay the Notes— Sale of Assets,” following that sale the

noteholders generally will have recourse only to their share of the

proceeds of that sale, investment earnings on the proceeds of that sale

and any funds previously deposited in any applicable issuing entity

bank account held for the benefit of and allocated to the noteholders.

See “Sources of Funds to Pay the Notes—General.”

Denominations

The offered notes will be issued in denominations of $100,000 and

multiples of $1,000 in excess of that amount.

Record Date

The record date for payment of the offered notes will be the last day of

the month before the related interest payment date or principal

payment date, as applicable.

Ratings

The offered notes will be rated in one of the four highest rating

categories by at least one nationally recognized rating agency.

A rating addresses the likelihood of the payment of interest on a note

when due and the ultimate payment of principal of that note by its

legal maturity date. A rating does not address the likelihood of

payment of principal of a note on its scheduled principal payment

date. In addition, a rating does not address the possibility of early

payment or acceleration of a note, which could be caused by an early

amortization event or an event of default. A rating is not a

recommendation to buy, sell or hold notes and may be changed or

withdrawn at any time by the assigning rating agency.

See “Risk Factors—General Risk Factors—A reduction, withdrawal

or qualification of the ratings on your notes, or the issuance of

unsolicited ratings on your notes, could adversely affect the liquidity

or the market value of your notes.”

U.S. Federal Income Tax Considerations

At the time the notes are issued, Skadden Arps, Slate, Meagher & Flom

LLP, as special tax counsel to the issuing entity, will deliver an opinion

to the effect that, based on and subject to the facts, assumptions,

representations, and qualifications set forth therein, (1) such notes will

be characterized as debt for U.S. federal income tax purposes and

(2) the issuing entity will not be classified as an association or publicly

traded partnership subject to tax as a corporation for U.S. federal

income tax purposes.

By your acceptance of a note, you agree to treat the note as debt for

U.S. federal, state and local income and franchise tax purposes.

See “U.S. Federal Income Tax Considerations” for additional

information concerning the U.S. federal income tax considerations with

respect to owning and disposing of a note.

Certain ERISA and Benefit Plan Considerations

Subject to important considerations described in “Certain ERISA and

Benefit Plan Considerations,” the offered notes are eligible for purchase

by persons investing assets of employee benefit plans or individual

retirement accounts.

Certain Investment Company Act Considerations

The issuing entity is not, and solely after giving effect to any offering

and sale of the offered notes by the issuing entity and the application of

the proceeds thereof will not be, a “covered fund” for purposes of

regulations adopted under Section 13 of the Bank Holding Company

Act of 1956, as amended, commonly known as the “Volcker Rule.”

In reaching this conclusion, although other statutory or regulatory

exemptions under the Investment Company Act of 1940, as amended

(referred to in this prospectus as the “Investment Company Act”) and

under the Volcker Rule and its related regulations may be available, the

issuing entity has relied on the determinations that:

• the issuing entity may rely on the exemption from registration

under the Investment

16

Company Act provided by Rule 3a-7 thereunder, and

accordingly

• the issuing entity does not rely on Section 3(c)(1) or Section 3(c)

(7) of the Investment Company Act for its exemption from

registration under the Investment Company Act

and may rely on the exemption from the definition of a “covered

fund” under the Volcker Rule made available to entities that do not

rely solely on Section 3(c)(1) or Section 3(c)(7) of the Investment

Company Act for their exemption from registration under the

Investment Company Act.

RISK FACTORS

The risk factors disclosed in this section of the prospectus describe the principal risk factors of an investment in the offered notes. You

should carefully consider the following risks before making an investment decision. If any of the following events or circumstances identified

as risks actually occur or materialize, your investment could be adversely affected. References in this “Risk Factors” section to “your

notes” are to the offered notes.

Business Risks Relating to JPMorgan Chase Bank’s Credit Card Business