JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 1 of 21

Additional Banking Services and Fees for Business Accounts

Deposit Account Agreement

This document is part of the Deposit Account Agreement and has 5 sections that provide additional information

about our products and services. Accounts are subject to approval.

1. Product Information

2. Business Deposit Express

3. Fee Schedule

4. Card Purchase and Withdrawal Limits

5. Chase Business Overdraft Services

Deposit Account Agreement – Business Product Information

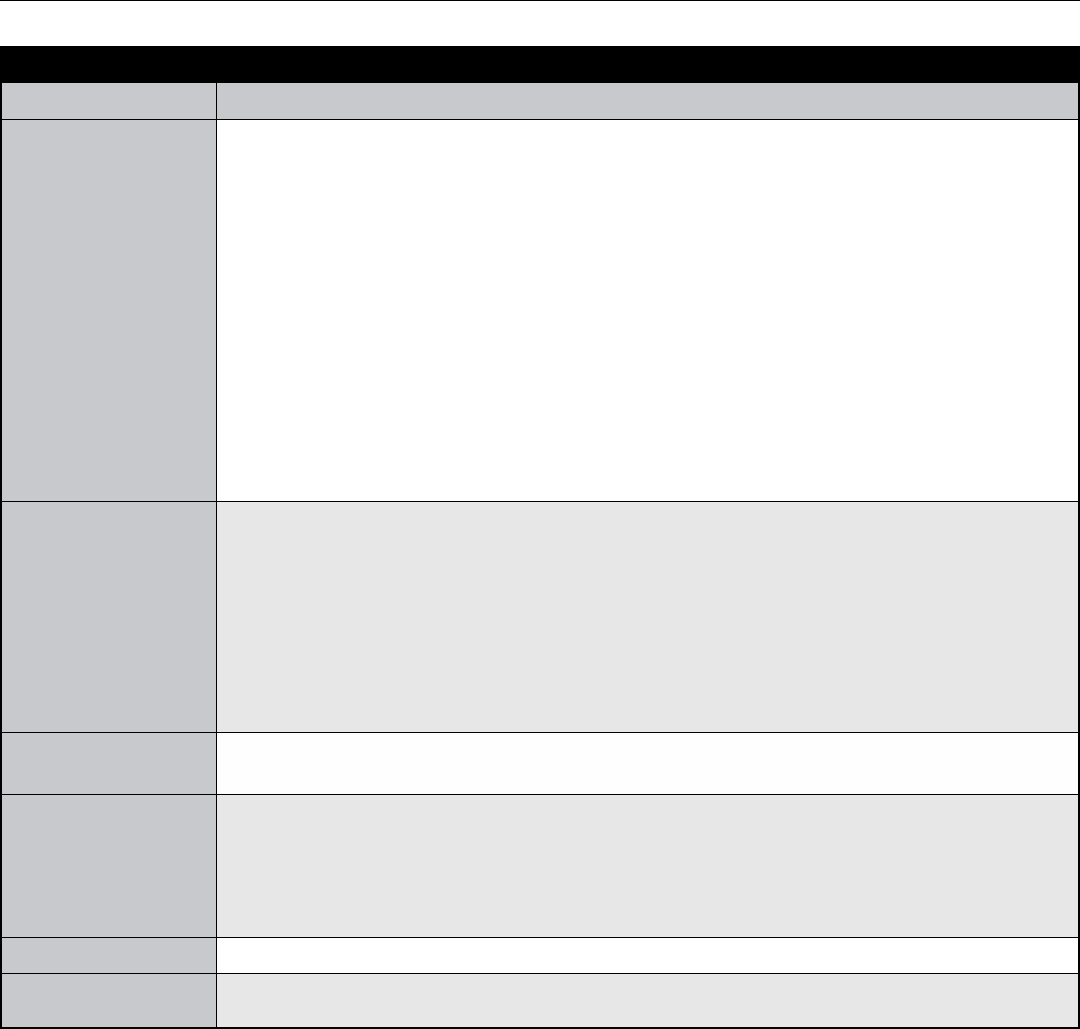

BUSINESS CHECKING ACCOUNTS

Chase Business Complete Checking

SM

How to Avoid the

Monthly Service Fee

If you meet any of the following qualifying activities for each Chase Business Complete

Checking account in a monthly statement period, we will waive the $15 Monthly Service Fee:

•

Maintain a linked Chase Private Client Checking

SM

, JPMorgan Classic Checking, or Private

Client Checking Plus account OR

• Meet Chase Military Banking requirements OR

• Fulll at least one of the following qualifying activities:

•

Minimum Daily Ending Balance: Maintain a minimum daily ending balance of at least

$2,000 in the Chase Business Complete Checking account each business day during the

monthly statement period

1

• Chase Payment Solutions

SM

Activity: Have at least $2,000 of aggregate eligible deposits

2

into the Chase Business Complete Checking account at least one day before the end of

the monthly statement period

3

using one or more of the following:

•

Chase QuickAccept

SM

including Chase Smart Terminal

SM

• InstaMed Patient Payments and InstaMed Patient Portal

• Other eligible Chase Payment Solutions products

4

• Chase Ink

®

Business Card Activity: Spend at least $2,000 on eligible purchases

5

in the

most recent monthly Ink card billing cycle

6

Chase Military Banking

Benets

Chase Military Banking benets are available on Chase Business Complete Checking Accounts

for current servicemembers and veterans of the U.S. Armed Forces

Monthly Service Fee Waiver: This fee can be waived with a valid military ID or proof of military service

Additional benets for Active Duty servicemembers require direct deposit of military pay (does not

include allotments). Benets will end if no direct deposit has been made within the last 180 days:

• No Chase fee on all non-Chase ATM transactions (Surcharge Fees from the ATM

owner/network still apply)

• No Chase fee on incoming or outgoing wire transfers

7, 8

• No Chase fee for Foreign Exchange Rate Adjustments on debit card purchases or ATM

withdrawals using your Debit/ATM card in currencies other than U.S. Dollars

Otherwise, a Monthly Service/

Maintenance Fee will apply

$15

Transaction

9, 10

Fees per month

Electronic deposits and deposited items, ACH and ATM transactions, Chase QuickDeposit

SM

,

debit card purchases, and internal transfers: No Charge

9

Deposits and withdrawals made with a teller and paper checks written on the account

0–20 No Charge

21+ $0.40/each

(These fees will be included in your Monthly Service Fee if applicable)

Interest

Does not earn Interest

No Cash Deposit Processing Fee

For the rst $5,000 per statement period (see Business Deposit Express Fee Schedule for

additional fees)

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 2 of 21

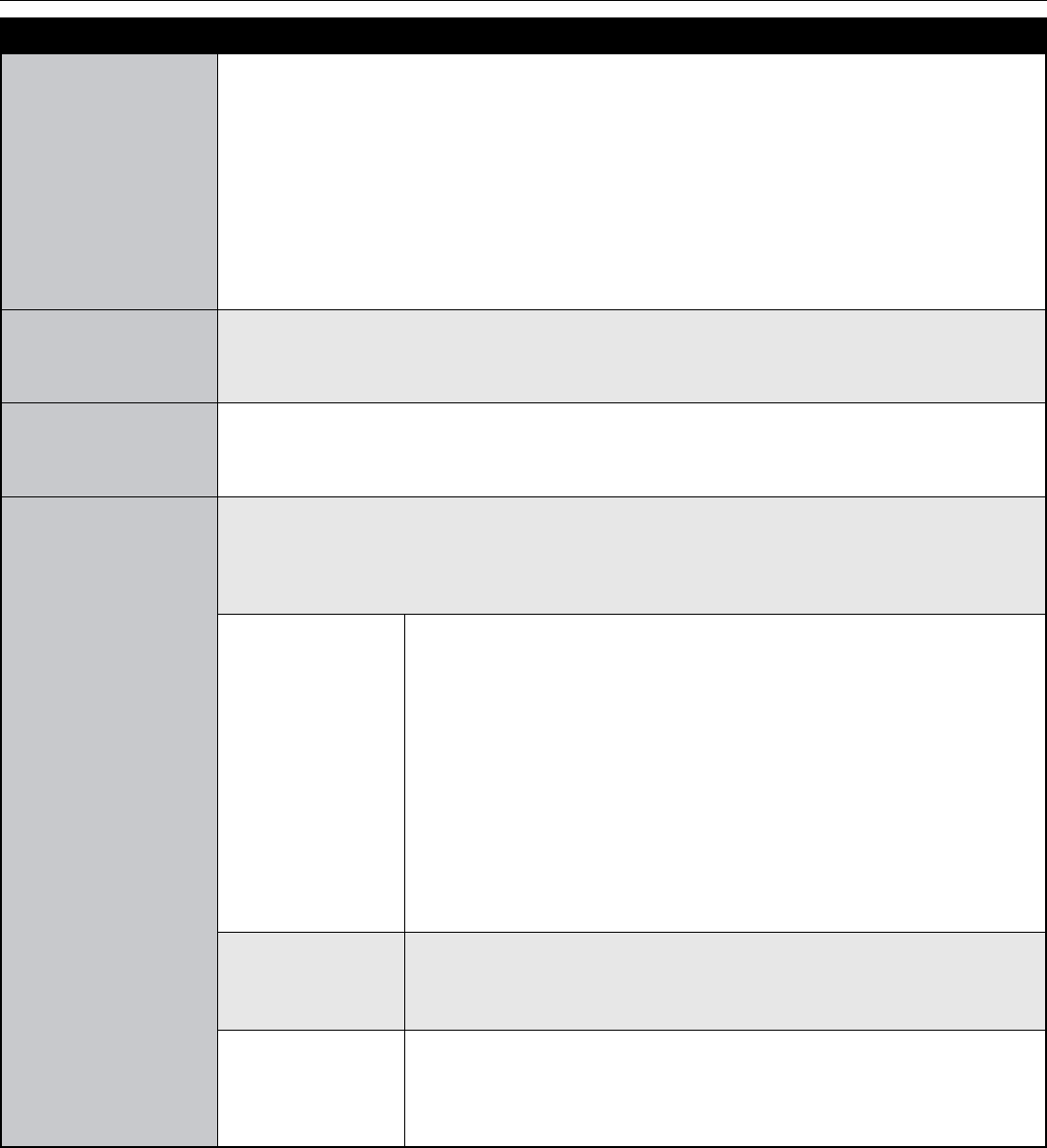

Deposit Account Agreement – Business Product Information

BUSINESS CHECKING ACCOUNTS (CONTINUED)

Wire Transfer Fees

7, 8

Wire Transfers: Incoming

Domestic $15.00/item

International $15.00/item

$0 if transfer was originally sent with

the help of a Chase banker or using

chase.com or Chase Mobile

Wire Transfers: Outgoing

Domestic (chase.com) $25 per transfer

Domestic (branch) $35 per transfer

International U.S. Dollar

(chase.com) $40 per transfer

International FX (chase.com) $5 per transfer or

$0 per transfer

if the amount is

equal to $5,000

USD or more

International U.S. Dollar or FX

(branch) $50 per transfer

Statement Period

All Chase Business Complete Checking accounts have a statement period that ends on the

last business day of the month. Accounts with statement periods that do not end on the

last business day of the month will be automatically updated including, without limitation,

accounts that are converted into Chase Business Complete Checking

Other

Certain cash management services, including, but not limited to, Cash Concentration, Lockbox

and End of the Day Sweeps are not permitted in conjunction with this type of checking

account. Chase reserves the right to convert the account to accommodate such cash

management services. Conversion may result in increased fees

Chase QuickAccept

SM

QuickAccept allows customers with a Chase Business Complete Checking account to

accept card payments directly into their Chase Business Complete Checking account. Most

domestic and international credit, debit, prepaid or gift cards with a Visa

®

, Mastercard

®

,

American Express

®

or Discover

®

logo can be accepted through QuickAccept. Usage of

QuickAccept is subject to eligibility, terms of service, monitoring and further review

Swipe, Dip & Tap

Transactions

2.6% + $0.10 per authorized transaction when:

Accepting card payments using Chase point of sale hardware (card

reader, terminal) by:

• Tapping an NFC-enabled contactless card or device

• Dipping an EMV-enabled card

• Swiping a magnetic strip-enabled card

Accepting card payments using Tap to Pay on iPhone on the Chase

Mobile

®

app and Chase Point of Sale

SM

app (no hardware required) by:

• Tapping an NFC-enabled contactless card or device to an iPhone

Point of sale hardware, and accessories are sold separately and ordered

using the QuickAccept feature on the Chase Mobile

®

app, Chase Business

Online, Chase Point of Sale

SM

app or through a Chase point of sale

terminal

Manual Entry

& Payment Link

Transactions

3.5% + $0.10 per authorized transaction for card payments accepted

when card information is inputted via manual entry or payment link

through the QuickAccept section of the Chase Mobile app, Chase

Business Online, Chase Point of Sale app

SM

or through a Smart Terminal

Other

• If you refund a payment in full, transaction fees will be returned in full

• If you refund a payment in part, transaction fees will not be returned

• You agree to reimburse us for all nes, fees, penalties, liabilities, or

other charges or assessments by a card network or other payment

network relating to your actions or your transactions

NOTE: The cost of processing a payment via other Chase Payment Solutions products may be higher or lower

depending upon the size and method of the payment.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 3 of 21

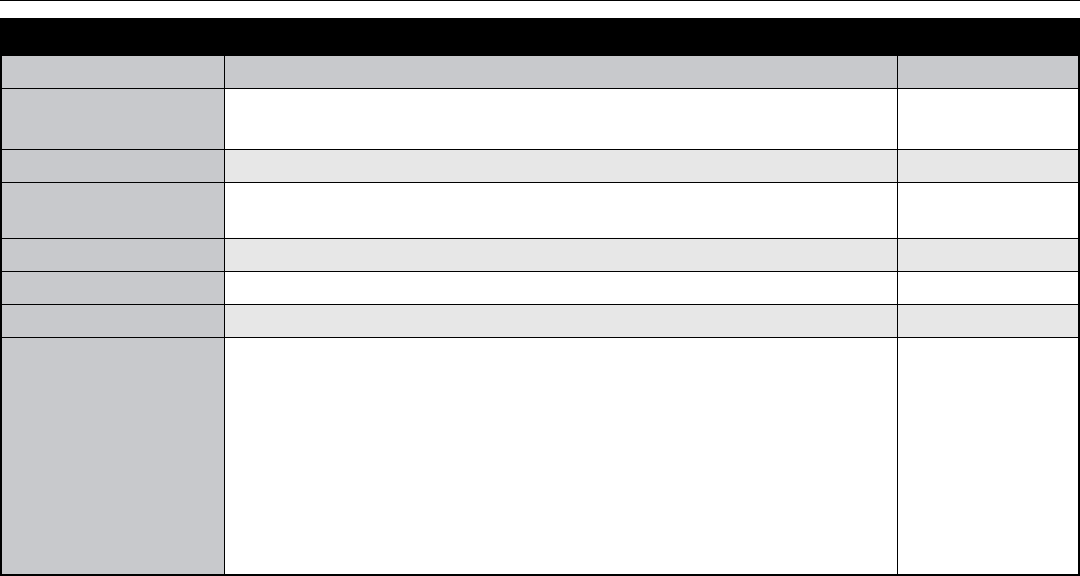

Deposit Account Agreement – Business Product Information

BUSINESS CHECKING ACCOUNTS (CONTINUED)

Chase Performance Business Checking

®

Chase Performance Business

Checking with Interest

®

No Monthly Service/

Maintenance Fee in any

statement period in which you

Maintain an average beginning day balance

11

of $35,000 or more in

any combination of linked business savings (excluding Client Funds

Savings accounts), business CDs and other Chase Performance

Business Checking accounts

Not Applicable

Otherwise, a Monthly

Service/Maintenance Fee will

apply

$30

Transaction

9, 10

Fees per month

Electronic deposits and deposited items made via ATM, ACH, Wire and Chase QuickDeposit: No

Charge

9

(across all linked Chase Performance Business Checking accounts)

Deposits and deposited items made with a teller, and all debits:

0–250 No Charge

251+ $0.40/each

(across all linked Chase Performance Business Checking accounts)

Interest

Does not earn Interest

Earns Interest; Variable;

based on daily collected

balance

No Cash Deposit Processing Fee

For the rst $20,000 per statement period across all linked Chase Performance Business

Checking accounts (see Business Deposit Express Fee Schedule for additional fees)

Wire Transfer Fees

7, 8

Wire Transfers: Incoming

Domestic No Charge

International No Charge

Wire Transfers: Outgoing

2 most expensive outgoing domestic wire transfers

per month included at no charge; otherwise, the

following charges will apply across all linked Chase

Performance Business Checking accounts:

Domestic (chase.com) $25 per transfer

Domestic (branch) $35 per transfer

International U.S. Dollar (chase.com) $40 per transfer

International FX (chase.com) $5 per transfer or

$0 per transfer

if the amount is

equal to $5,000

USD or more

International U.S. Dollar or FX

(branch) $50 per transfer

Other

• Certain cash management services are not permitted, or may be limited, in conjunction

with this type of checking account. Chase reserves the right to convert the account to

accommodate such cash management services. Conversion may result in increased fees

• $4 Check Enclosure Fee charged per statement period

• No non-Chase ATM fees charged by Chase for using another institution’s ATM

12

• No charge for Counter Checks, Money Orders, Cashier’s Checks

• Link up to 99 Chase Performance Business Checking subaccounts

• No Monthly Service Fee on a linked Chase Total Checking

®

account

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 4 of 21

Deposit Account Agreement – Business Product Information

BUSINESS CHECKING ACCOUNTS (CONTINUED)

Chase Platinum Business Checking

SM

No Monthly Service/

Maintenance Fee in any

statement period in which you

Maintain an average beginning day balance

11

of $100,000 ($50,000 when linked to Chase

Private Client Checking, JPMorgan Classic Checking, or Private Client Checking Plus) or more in

any combination of linked business savings (excluding Client Funds Savings accounts), business

CDs, other Chase Platinum Business Checking accounts and qualifying investment accounts

13

Otherwise, a Monthly

Service/Maintenance Fee will

apply

$95

Transaction

9, 10

Fees per month

Electronic deposits and deposited items made via ATM, ACH, Wire and Chase QuickDeposit

SM

:

No Charge

9

(across all linked Chase Platinum Business Checking accounts)

Deposits and deposited items made with a teller, and all debits:

0–500 No Charge

501+ $0.40/each

(across all linked Chase Platinum Business Checking accounts)

Interest

Does not earn Interest

No Cash Deposit Processing Fee

For the rst $25,000 per statement period across all linked Chase Platinum Business Checking

accounts (see Business Deposit Express Fee Schedule for additional fees)

Wire Transfer Fees

7, 8

Wire Transfers: Incoming

Domestic No Charge

International No Charge

Wire Transfers: Outgoing

4 most expensive outgoing wires per month included

at no charge; beyond 4, the following charges will

apply across all linked Chase Platinum Business

Checking accounts:

Domestic (chase.com) $25 per transfer

Domestic (branch) $35 per transfer

International U.S. Dollar (chase.com) $40 per transfer

International FX (chase.com) $5 per transfer or

$0 per transfer

if the amount is

equal to $5,000

USD or more

International U.S. Dollar or FX

(branch) $50 per transfer

No charge when linked to Chase Private Client

Checking, JPMorgan Classic Checking, or Private

Client Checking Plus

Other

• Certain cash management services

are not permitted, or may be

limited, in conjunction with this

type of checking account. Chase

reserves the right to convert the

account to accommodate such cash

management services. Conversion

may result in increased fees

• 1 Overdraft Fee waived per

statement period

• No charge for Stop Payments made

via Chase Online

SM

, branch and Chase

by Phone

®

automated phone system,

or renewals of Stop Payments

• No non-Chase ATM fees charged by

Chase for using another institution’s

ATM

12

• No charge for Counter Checks, Money

Orders, Cashier’s Checks

• Link up to 99 Chase Platinum Business Checking

subaccounts

• No Monthly Service Fee on a linked Chase Premier

Plus Checking

SM

account

• No monthly charge for QuickDeposit Single Feed

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 5 of 21

Deposit Account Agreement – Business Product Information

BUSINESS CHECKING ACCOUNTS (CONTINUED)

Chase Analysis Business Checking

SM

Chase Analysis Business Checking with Interest

SM

Monthly Service/

Maintenance Fee

$25

Transaction

9, 10

Fees per month

Checks Paid/Debits $0.24/each

Branch Credit $2.00/each

Electronic Credit $0.25/each

On-Us Deposited Items $0.20/each

Not-on-Us Deposited Items $0.27/each

Wire Transfer Fees

7, 8

Wire Transfers: Incoming

Domestic $ 15.00/item

International $ 15.00/item

Wire Transfers: Outgoing

Domestic (chase.com) $10 per transfer

Domestic (branch) $35 per transfer

International U.S. Dollar (chase.com) $40 per transfer

International FX (chase.com) $5 per transfer or

$0 per transfer

if the amount is

equal to $5,000

USD or more

International U.S. Dollar or FX

(branch) $50 per transfer

Other

Chase QuickDeposit Deposited Item $0.20/item

Chase QuickDeposit Credit $0.80/day ACH Return Fee: $3/item

Interest

Does not earn Interest

Earns Interest; Variable; based on daily collected

balance

Earnings Credit

Variable; subject to change at Chase’s

discretion. It is applied to the monthly

average collected balance and used to

oset fees for monthly maintenance,

transactions, cash management and

additional banking services

Not Applicable

Negative Collected Balance Fee

Chase Prime +3% charged on daily negative collected balance

Balance-Based Charges

Varies; subject to change at Chase’s discretion

No Cash Deposit Processing Fee

For the rst $10,000 per month (see Business Deposit Express Fee Schedule for additional

fees)

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 6 of 21

Deposit Account Agreement – Business Product Information

BUSINESS CHECKING ACCOUNTS (CONTINUED)

IOLTA/IOTA/IOLA/IBRETA/IOREBTA/IRETA/COLTAF/CARHOF/UARHOF

SM

Client Funds Checking

SM

Monthly Service/Maintenance

Fee will apply

Accounts located in IL, NY: $15

Accounts located in all other states where oered: $0

None

Transaction

9, 10

Fees per month

None None

Interest

Earns Interest; Variable; based on daily collected balance

Does not earn

Interest

Earnings Credit

Not Applicable Not Applicable

No Cash Deposit Processing Fee

Not Applicable Not Applicable

Wire Transfer Fees

7, 8

Not Available Not Available

Other

Monthly Service Fee is deducted from interest earned and remaining

interest is paid to the applicable state association or foundation to fund

public service. Fees for additional banking services may be billed to your

Chase Analysis Business Checking, Chase Platinum Business Checking or

Chase Performance Business Checking (interest counterparts included,

where applicable). Refer to your Pro Forma Analysis provided by your

banker

Check fees: No fee for Chase design checks when ordered through

Chase. Fees may apply for certain other supplies and expedited shipping

options.

Link up to

99 subaccounts

Special purpose

use only

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 7 of 21

Deposit Account Agreement – Business Product Information

BUSINESS SAVINGS ACCOUNTS

Chase Business Total Savings

SM

Chase Business Premier Savings

SM

Client Funds Savings

SM

No Monthly Service/

Maintenance Fee in any

statement period

in which you have

• An average ledger balance

of $1,000 or more in this

account; OR

• A linked Chase Business

Complete Checking account

• An average ledger balance of

$25,000 or more in this account; OR

• A linked Chase Performance

Business Checking, Chase Analysis

Business Checking or Chase

Platinum Business Checking account

(interest counterparts included,

where applicable)

Not Applicable

Otherwise, a Monthly Service/

Maintenance Fee will apply

$10 $20 $0

Transaction

9, 10

Fees per month

0–15 items – No Charge

16+ $0.40/each

0–30 items – No Charge

31+ $0.40/each

None

Interest

Earns Interest; Variable; based

on daily collected balance

Earns Interest; Variable; based on daily

collected balance. Premier relationship

rates available when linked to

an active

14

Chase Performance

Business Checking, Chase Analysis

Business Checking or Chase Platinum

Business Checking account (interest

counterparts included, where

applicable)

Earns Interest;

Variable; based

on daily collected

balance

Interest is paid

to the client’s

account

No Cash Deposit Processing Fee

For the rst $5,000 per

statement period (see Business

Deposit Express Fee Schedule

for additional fees)

For the rst $10,000 per statement

period (see Business Deposit Express

Fee Schedule for additional fees)

Not Applicable

Wire Transfer Fees

7, 8

Wire Transfers: Incoming

Domestic $ 15.00/item

International $ 15.00/item

$0 if transfer was originally sent

with the help of a Chase banker

or using chase.com or Chase

Mobile

Wire Transfers: Outgoing

Not Available

Not Available

Other

Not Applicable Not Applicable

Available only

with Client Funds

Checking

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 8 of 21

Deposit Account Agreement – Business Product Information

BUSINESS CD ACCOUNTS

Chase Certicates of Deposit

SM

Minimum Deposit to Open

$1,000

Interest

Fixed; based on ledger balance

Earn CD relationship rates available when linked to a Chase Business Checking account except

public funds, IOLTA/IOTA/IOLA/IBRETA/IOREBTA/IRETA/COLTAF/CARHOF/UARHOF and Client

Funds Checking

Withdrawal Penalties

There is a penalty for withdrawing principal prior to the maturity date.

– If the term of the CD is less than 12 months, the early withdrawal penalty is equal to $25

plus 1% of the amount withdrawn

– For terms of 12 months or more, the early withdrawal penalty is equal to $25 plus 3% of

the amount withdrawn

– If the withdrawal occurs less than seven days after opening the CD or making another

withdrawal of principal, the early withdrawal penalty will be calculated as we described

above, but it cannot be less than seven days’ interest. We may not permit withdrawals if

funds have not been credited to the account

– The amount of your penalty will be deducted from principal

Statement Period

Summary of linked CDs appears on monthly checking account statement

BUSINESS DEBIT AND ATM CARDS FOR OWNERS AND SIGNERS

Chase Business Debit Card Chase Business ATM Card

Annual Fee

$0

Maximum Number of

Cards Allowed

One (1) per person per account

Zero Liability Protection

15

Yes

Primary Business

Checking Accounts

Available for Chase Business Complete Checking, Chase Performance Business Checking,

Chase Analysis Business Checking or Chase Platinum Business Checking account (interest

counterparts included, where applicable)

Other

The Business Debit Card and Business ATM Card may be issued only to owners/signers of the

business

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 9 of 21

Deposit Account Agreement – Business Product Information

BUSINESS DEBIT AND DEPOSIT CARDS FOR EMPLOYEES

Chase Business Associate Card Chase Business Employee Deposit Card

Annual Fee

$0

Maximum Number of

Cards Allowed

No card limit per employee per account

Zero Liability Protection

15

Yes

Primary Business Checking

Accounts

Available for Chase Business Complete

Checking, Chase Performance Business

Checking, Chase Analysis Business Checking

or Chase Platinum Business Checking account

(interest counterparts included, where

applicable)

Available for Chase Business Complete

Checking, Chase Performance Business

Checking, Chase Analysis Business

Checking, Chase Platinum Business

Checking account and IOLTA (interest-

bearing counterparts and accounts for

municipalities included, where applicable)

Other

The Business Associate Debit Card may be

issued only to an employee of the business,

but not a signer already on the account,

allowing the employee to deposit, withdraw and

purchase, drawing from a primary Business

checking account. An employee is dened as a

full-time or part-time employee of a business

or a contractor for which our client les 1099

reporting and not a client or tenant of the

business. The signer can set limits on the

card in $100 increments, from $100–$1,000

(not including fees) for withdrawals and $100–

$5,000 for spending. However, the business

is responsible for all charges and withdrawals

made by the employee. Associate Cards cannot

be shared by employees and must be closed

once an employee leaves the business or the

contractor relationship is terminated

Card will not reissue at expiration date. For a

new card, the signer will need to supply the

employee’s legal name, residential address

and date of birth for card opening, and the

employee’s legal name and the company name

will emboss on the card

Up to an additional three (3) Business checking

and up to ve (5) Business savings accounts

may be linked to a Business Associate Card.

When the signer performs any additional

linking, beyond the primary Business checking

account, the employee will automatically gain

the additional ability to transfer funds between

any and all accounts their card is linked to, as

well as deposit to and, subject to the limits

you set, withdraw funds from these additional

accounts

The Business Employee Deposit Card

may be issued only to an employee of the

business, but not a signer already on the

account. An employee is dened as a full-

time or part-time employee of a business

or a contractor for which our client les

1099 reporting, and not a client or tenant

of the business. Each card will permit an

employee to make deposits into a Business

checking or savings account via an ATM

or at a Chase branch. The card will not

permit the employee to obtain account

information, make withdrawals or take any

other actions, including performing account

maintenance. Business Employee Deposit

Cards cannot be shared by employees and

must be closed once an employee leaves

the business or the contractor relationship

is terminated

Card will not reissue at expiration date. For

a new card, the signer will need to supply

the employee’s legal name, residential

address and date of birth for card opening

and the employee’s legal name and the

company name will emboss on the card

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co. Eective 6/10/2024

Page 10 of 21

Deposit Account Agreement – Business Product Information

Footnotes: Business Product Information

1 The monthly statement period for Chase Business Complete Checking ends on the last business day of each month.

For the purposes of the Minimum Daily Ending Balance requirement, the last day of the monthly statement period is

excluded.

2

Eligible deposits are net of chargebacks, refunds, or other adjustments. Eligible deposits must be made from Chase

Payment Solutions associated with the same business as your Chase Business Complete Checking account, as

reected in Chase records.

3 The cuto time for eligible deposits from QuickAccept, InstaMed, and other eligible Chase Payment Solutions, is

11:59 p.m. Eastern Time one day prior to the last day of your Chase Business Complete Checking monthly statement

period. For example, if your Chase Business Complete Checking monthly statement period ends on November 30, the

cuto time would be 11:59 p.m. Eastern Time on November 29.

4 An eligible product has a transaction history that is viewable on Chase Business Online, Chase Connect

®

, or

J.P. Morgan Access

®

.

5 Eligible purchases must be made using Chase Ink Business Card(s) associated with the same business as your Chase

Business Complete Checking account, as reected in Chase records, and must earn Chase Ultimate Rewards

®

points.

Certain purchases and transactions are excluded from earning Chase Ultimate Rewards points, as described in your

Rewards Program Agreement available on chase.com/ultimaterewards.

6 The most recent monthly Ink billing cycle will be used if it's dierent from your Chase Business Complete Checking

monthly statement period.

7 For wire transfers, the “No Chase Fee” benet applies to the Wire Transfer Fees section listed on the Fee Schedule

included in this document and does not apply to the spread we include in the foreign currency exchange rate.

Financial institutions may deduct processing fees and/or charges from the amount of the incoming or outgoing wire

transfers, including on returned wire transfers. Any deductions taken by us, and our aliates, may include processing

fees charged by Chase.

8 For wire transfers you send or we receive in a foreign currency, the exchange rate is determined by us in our sole

discretion and includes a spread, which we may make a commission from when completing the foreign currency

exchange. You should expect that these foreign exchange rates will be less favorable than rates quoted online or in

publications. For additional information on these rates, refer to the Deposit Account Agreement and Wire Transfers

Agreements.

9 Transactions are all deposits and withdrawals made from your account, including deposit tickets. This includes: cash

deposited or withdrawn; checks deposited or debited; other ACH items that are deposited or debited; incoming or

outgoing electronic transfers; incoming or outgoing wire transfers; and point-of-sale debits.

10 Products such as Chase QuickDeposit and certain cash management products may have additional service fees.

Contact your banker or cash management specialist for details.

11 Average beginning day balance is based on the average of your ledger balances at the beginning of each day.

12 We will not charge a non-Chase ATM fee. Surcharge Fees from the ATM owner/network still apply. A Foreign Exchange

Rate Adjustment Fee from Chase will apply for ATM withdrawals in a currency other than U.S. dollars.

13 Qualifying investment accounts must be held in the name of the business and include: Securities (including mutual

funds and variable annuities) and investment advisory services. Investment products and services are oered

through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member of FINRA and

SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency,

doing business as Chase Insurance Agency Services, Inc. in Florida. JPMS, CIA and JPMorgan Chase Bank, N.A. are

aliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

INVESTMENT AND INSURANCE PRODUCTS:

• NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• NO BANK GUARANTEE • MAY LOSE VALUE

14 “Active” is dened as an account with 5 customer initiated transactions per statement period.

15 Zero Liability Protection: Chase reimburses you for any unauthorized debit card transactions made at stores, ATMs,

on the phone or online when reported promptly. Certain limitations apply. See Deposit Account Agreement for

details.

Eective 6/10/2024

Page 11 of 21

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co.

Deposit Account Agreement – Business Deposit Express

JPMorgan Chase Business Deposit Express

SM

Fee Schedule

Cash Deposit Processing Fees for all Business Checking and Savings Accounts

Fees will apply per month to all cash deposits in excess of the amount listed in the Business Product Features

Cash Deposited Per Month

Night Drop, Post Verication and Immediate Verication $2.50 (per $1,000)

Cash Deposited at ATMs

No Charge

Coin Roll Order

No Charge

Currency Strap Order

No Charge

Dual Pouch Plastic Bags

Fee depends on bags selected

Terms & Conditions: Business Deposit Express

1 Business Deposit Express services (“Services”) apply to Depository Bags (see paragraph 2) received at the Branches,

including but not limited to, night depositories, bulk deposits made over the counter, delivered by Customer’s armored

car or courier, Bank Commercial Deposit Machines and Commercial Cash Centers. Upon request, the Bank shall issue

Customer a key to certain designated vault facilities (“Facilities”).

2 Customer shall utilize tamper-resistant disposable bags (“Depository Bags”) which conform to such standards as the

Bank may establish from time to time.

3 Customer agrees to the following:

a. The Facilities shall only be used for the delivery to the Bank of Depository Bags which shall contain only currency and/

or negotiable instruments together with a deposit ticket prepared by the Customer.

b. The Bank may, prior to verication of the contents of the Depository Bag, provisionally credit Customer’s account

based on the amount stated on Customer’s deposit ticket.

c. The Bank shall, not in the presence of Customer, count and verify the contents of the Depository Bags. The Bank’s

count shall be controlling and nal and the Bank will notify Customer of any adjustment to the amount of the deposit.

d. No deposit is deemed to be made until the Bank has concluded its verication process and credited Customer’s

account.

4 The use of the Facilities is at Customer’s sole risk and Bank shall not be liable for any loss, destruction or disappearance

of any Depository Bag or any part of the alleged contents prior to verication by Bank.

5 The Bank may terminate any of these Services at any time upon notice to Customer. Customer shall promptly return to

Bank all Depository Bags and keys to any Facility.

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

Eective 6/10/2024

Page 12 of 21

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co.

Deposit Account Agreement – Business Fee Schedule

Unless otherwise indicated or specied in Product Information, fees apply to all checking and savings accounts.

ATM Fees and

Debit Card Fees

Non-Chase ATM

(Avoid these fees by using a Chase

ATM)

$3 per withdrawal at a non-Chase ATM in the U.S. and the

U.S. territories

$5 per withdrawal at a non-Chase ATM outside the U.S. and

the U.S. territories

Surcharge Fees from the ATM owner/network still apply. U.S.

territories include American Samoa, Guam, the Northern

Mariana Islands, Puerto Rico and the U.S. Virgin Islands

Foreign Exchange Rate

Adjustment: You make card

purchases, non-ATM cash

transactions or ATM withdrawals in

a currency other than U.S. dollars

3% of withdrawal amount after conversion to U.S. dollars.

For additional information on foreign exchange rates, refer to

the Deposit Account Agreement

Non-ATM Cash: You use your

Chase Debit Card to withdraw cash

from another nancial institution

(excluding ATMs)

3% of the dollar amount of the transaction OR

$5, whichever is greater

Card Replacement – Rush

Request:

1

You request express

shipping of a replacement debit or

ATM card

(Avoid this fee by requesting

standard shipping)

$5 per card, upon request

Overdraft Fees

Overdraft: Chase pays a

transaction during our nightly

processing on a business day when

your account balance is overdrawn

$34 Overdraft Fee per transaction during our nightly

processing beginning with the rst transaction that

overdraws your account balance by more than $50.

• Maximum of 6 fees per business day (up to $204)

We won’t charge an Overdraft Fee:

• With Chase Overdraft Assist

SM

, if you’re overdrawn by

$50 or less at the end of the business day OR if you’re

overdrawn by more than $50 and you bring your account

balance to overdrawn by $50 or less at the end of the next

business day. See Chase Business Overdraft Services for

eligible accounts and products, and additional details

• If your transaction is $5 or less

• If your debit card transaction was authorized when there

was a sucient available balance in your account

• If your check or ACH is returned unpaid. However, we may

charge an Overdraft Fee if a previously returned check or

ACH is presented again and paid

• If your debit card transaction or ATM cash withdrawal

request is declined

You can avoid overdrawing your account by making a deposit or transferring funds to cover the overdraft before the

business day ends and we start our nightly processing. Here are the cuto times for some ways of making a deposit or

transferring funds from another Chase account:

• At a branch before it closes

• At an ATM before 11 p.m. Eastern Time (8 p.m. Pacic Time)

• When transferring money on chase.com or Chase Mobile

®

or using Zelle

®

before 11 p.m. Eastern Time (8 p.m. Pacic Time)

If you deposit a check, this assumes we do not place a hold and the check is not returned. Additional cuto times

apply to other transfers, including transfer from non-Chase accounts. Please visit chase.com or Chase Mobile for more

information and service agreements.

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

Eective 6/10/2024

Page 13 of 21

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co.

Deposit Account Agreement – Business Fee Schedule

Unless otherwise indicated or specied in Product Information, fees apply to all checking and savings accounts.

Wire Transfer Fees

7, 8

Domestic and International Incoming Wire: A

wire transfer is deposited into your account

$15 per transfer OR

$0 if transfer was originally sent with the

help of a Chase banker or using chase.com or

Chase Mobile

Domestic Wire: A banker helps you send a wire

from your account to a bank account within the U.S.

$35 per transfer

Online Domestic Wire: You use chase.com or

Chase Mobile to send a wire from your checking

account to a bank account within the U.S.

$25 per transfer

International Wire: A banker helps you send a

wire from your account to a bank outside the U.S.

in either U.S. dollars (USD) or foreign currency (FX)

$50 per transfer

Online USD International Wire: You use

chase.com or Chase Mobile to send a wire from

your account to a bank account outside the U.S. in

U.S. dollars (USD)

$40 per transfer

Online FX International Wire: You use

chase.com or Chase Mobile to send a wire from

your account to a bank outside the U.S. in foreign

currency (FX)

$5 per transfer or

$0 per transfer if the amount is equal to

$5,000 USD or more

Other Fees

Order for Checks or Supplies: An order of

business checks, deposit slips or other banking

supplies

Varies (based on items ordered)

Counter Check:

1

A blank page of 3 personal

checks we print upon your request at a branch

$3 per page

Money Order:

1

A check issued by you, purchased

at a branch, for an amount up to $1,000

$5 per check

Cashier’s Check:

1

A check issued by the bank,

purchased at a branch, for any amount and to a

payee you designate

$10 per check

Legal Processing: Processing of any garnishment,

tax levy, or other court or administrative order

against your accounts, whether or not the funds

are actually paid

Up to

$100 per order

Stop Payment: You contact us and a banker

places your stop payment request on a check or

ACH

$30 per request

Online or Automated Phone Stop Payment:

You use chase.com, Chase Mobile or our

automated phone system to place a stop payment

on a check. Only some types of stop payments

are available

$25 per request

Stop Payment Automatic Renewal

$4 per item per year

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

Eective 6/10/2024

Page 14 of 21

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co.

Deposit Account Agreement – Business Fee Schedule

Unless otherwise indicated or specied in Product Information, fees apply to all checking and savings accounts.

Online Banking Services

ACH Payments: Optional service to initiate

electronic (ACH) payments to a checking or

savings account in the U.S. See chase.com for

details

$2.50 per item for the rst 10 items per month

$0.15 per item above 10 per month

$2.50 return fee

ACH Collections: Optional service to initiate

electronic (ACH) collections to a checking or

savings account in the U.S. See chase.com for

details

$25 for the rst 25 items per month

$0.25 per item above 25 per month

$2.50 return fee

ACH Debit Block: Optional service on Chase

Business Online that allows clients to block all or

allow some ACH debits from a checking account.

See chase.com for details

$0 monthly fee

$0 per allowed Company ID per month

Check Protection Services (Positive Pay):

Optional service on Chase Business Online where

customers upload a le or enter information about

checks they have written, and Chase compares

checks presented for payment against that le or

entered information to help prevent fraud

$0 monthly fee per account

$0 per exception item

$0 per check return

Check Monitoring (Reverse Positive Pay):

Optional service on Chase Business Online that

allows customers to monitor checks presented

to Chase for payment against checks they have

written to help prevent fraud

$0 monthly fee

$0 per check return

QuickDeposit – Multiple Feed Check Scanner:

Optional service to remotely scan and deposit

checks using a multiple feed check scanner via

chase.com. See chase.com for details

$50 monthly fee

QuickDeposit – Single Feed Check Scanner:

Optional service to remotely scan and deposit

checks using a single feed check scanner via

chase.com. See chase.com for details

$25 monthly fee

QuickDeposit – Cancellation Fee: Charged if

QuickDeposit service cancelled within rst 2 years

of enrollment. See chase.com for details

$250

QuickDeposit – Additional Multiple Feed Check

Scanner: Charged for additional multiple feed

check scanner ordered. See chase.com for details

$600 per scanner

QuickDeposit – Additional Single Feed Check

Scanner: Charged for additional single feed check

scanner ordered. See chase.com for details

$300 per scanner

Real Time Payments: Optional service to initiate

electronic payments to a checking or savings

account in the U.S. See chase.com for details

1% of transaction amount OR

$25 per transaction, whichever is less

Same Day ACH: Optional service to initiate

electronic payments to a checking or savings

account in the U.S. See chase.com for details

1% of transaction amount OR

$25 per transaction, whichever is less

NOTE: Refer to the Fee Schedule and Product Information for fees and additional benets that may apply to your account.

Footnotes: Business Fee Schedule

1 Does not apply to Chase Platinum Business Checking, Chase Performance Business Checking, Chase Performance

Business Checking with Interest, Chase Analysis Business Checking or Chase Analysis Business Checking with Interest.

Eective 6/10/2024

Page 15 of 21

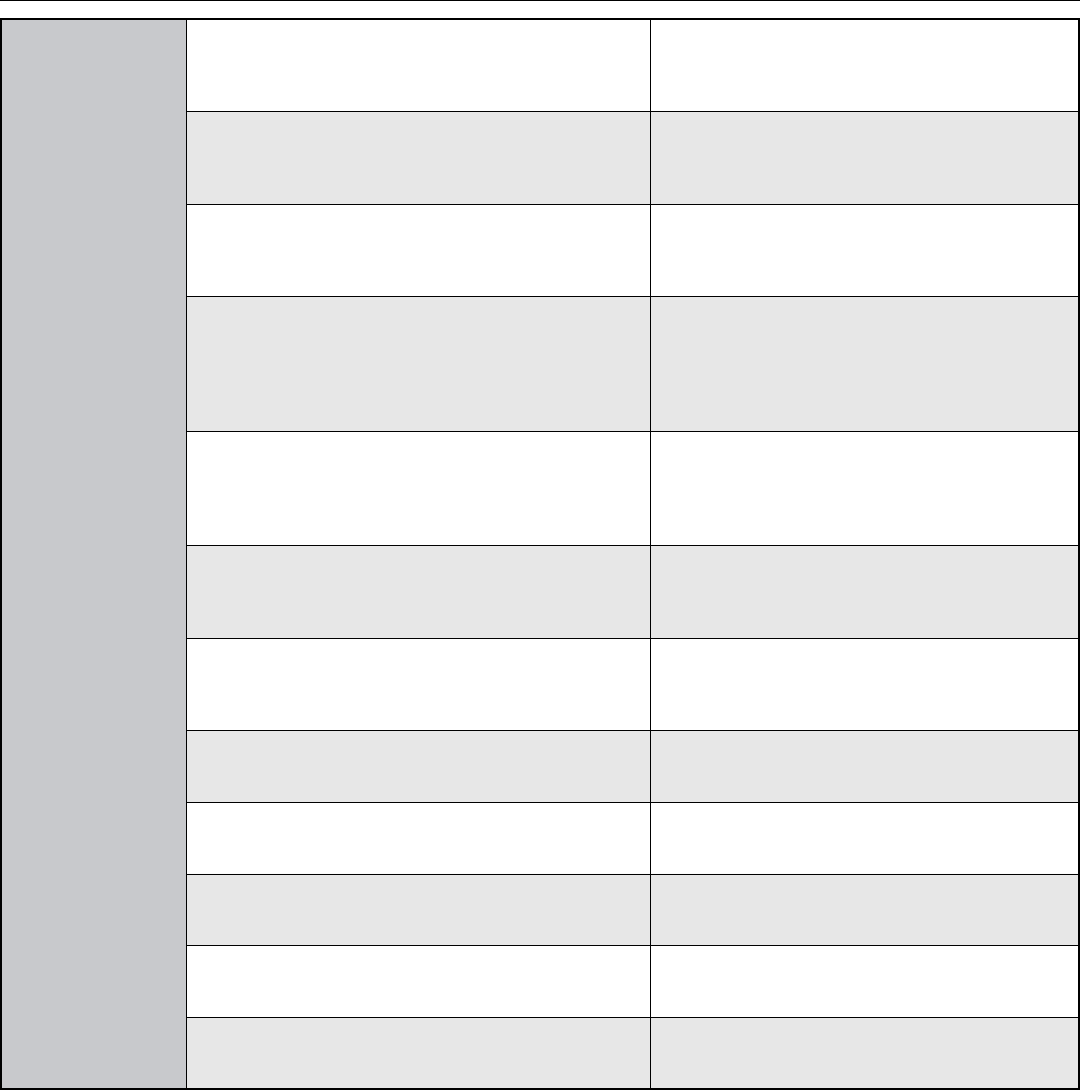

Deposit Account Agreement – Card Purchase and Withdrawal Limits

Limits are based on the card you use and which type of ATM you use.

DAILY LIMITS

Card Type Purchase Limit Chase In-Branch ATM Limit Other Chase ATM Limit Non-Chase ATM Limit

Chase Business Debit Card

$10,000 $3,000 $1,000

$500 ($1,000 for

accounts opened in

CT, NJ, NY, TX)

Chase Platinum Business Debit Card

$15,000 $3,000 $3,000 $1,000

Chase Business ATM Card

$0 $3,000 $1,000

$400 ($1,000 for

accounts opened in

CT, NJ, NY, TX)

These are the limits that come with your card, but you can request a dierent ATM or Purchase Limit (subject to approval).

If your checking account is changed, we may provide you a new debit card that aligns with that account.

When you use a Chase ATM it is either considered an In-Branch ATM or Other Chase ATM.

• Chase In-Branch ATMs are ATMs located inside the main area of a Chase branch that you use during the branch’s

posted business hours.

• Other Chase ATMs include ATMs located inside the main area of a Chase branch that you use outside of the branch’s

posted business hours, ATMs that are separated from the main area of a branch by another set of doors, drive-up

ATMs and other Chase ATMs not located in or near a branch.

The Chase In-Branch ATM Limit is separate from all other limits, which means that withdrawals at a Chase In-Branch ATM

do not count toward a cardholder’s Other Chase ATM or Non-Chase ATM Limits for the same business. When you use a

Chase In-Branch ATM, all withdrawals made with any of a cardholder’s ATM or debit cards for the same business count

toward every card’s Chase In-Branch ATM Limit. Chase ATMs have daily funds transfer limits for your security.

When you use an Other Chase ATM or a Non-Chase ATM, all withdrawals count toward the Other Chase ATM Limits for all

of a cardholder’s ATM or debit cards for the same business and count toward only that card’s Non-Chase ATM Limit.

Non-ATM cash transactions are considered as everyday debit card transactions and count toward your purchase limit.

Special rules for Business Associate Cards:

The Associate Card has daily limits for ATM withdrawals and purchases which are set by the account owner (not to exceed

$1,000 for ATM withdrawals and $5,000 for purchases). Withdrawals at any ATM count toward the daily limit, and Associate

Card withdrawals do not count toward the cardholder’s limit on other cards.

JPMorgan Chase Bank, N.A. Member FDIC

© 2024 JPMorgan Chase & Co.

Eective 6/10/2024

Page 16 of 21

CHASE BUSINESS OVERDRAFT SERVICES

An overdraft occurs when you don’t have enough money available in your checking account to cover a transaction.

Whether your account has enough money to cover a transaction is determined during our nightly processing. During

our nightly processing, we take your previous end of day’s balance and post credits. If there are any deposits not yet

available for use or holds (such as tax levies), these will reduce the account balance used to pay your transactions. Then

we subtract any debit transactions presented during our nightly processing. The available balance shown to you during

the day may not be the same amount used to pay your transactions as some transactions may not be displayed to you

before nightly processing. You must immediately pay the amount of any overdraft along with any fees that apply.

STANDARD OVERDRAFT PRACTICE:

Included with Chase Business Complete Checking, Chase Performance Business Checking, Chase Platinum Business Checking,

Chase Analysis Business Checking and interest-bearing counterparts (where applicable).

We have a Standard Overdraft Practice that comes with Chase business checking accounts. Our Standard Overdraft

Practice does not require enrollment. We also oer Overdraft Protection and Chase Business Debit Card Coverage,

which are optional services that can help pay overdrafts when they occur.

WHAT IT IS:

Our Standard Overdraft Practice may pay, for a fee, overdraft transactions at our discretion based on your account

history, deposits you make and the transaction amount. We do NOT GUARANTEE we will always pay your overdraft

transaction, and if we do not pay your transaction, the transaction will be declined or returned unpaid.

WHAT IT PAYS:

• Checks

• Other transactions made using your checking account number (you set up automatic payments for your recurring

phone bill, utility bill, recurring vendor payments)

• Recurring debit card purchases (e.g. subscriptions)

• NOT covered: Everyday debit card transactions (e.g. oce supplies, everyday expenses)

WHAT IT COSTS:

• We charge a $34 Overdraft Fee per transaction

1

during our nightly processing beginning with the rst

transaction that overdraws your account balance by more than $50 (maximum of 6 fees per business day, up

to $204). For Chase Analysis Business Checking accounts we may charge a $34 Overdraft Fee per transaction

beginning with the rst transaction that overdrafts your account (maximum of 6 fees per business day, up to $204).

WHEN A FEE WON’T BE CHARGED:

With Chase Overdraft Assist

SM

, you can avoid Overdraft Fees when your account balance is overdrawn. Chase

Overdraft Assist is not available with Chase Analysis Business Checking.

Chase Overdraft Assist is available and does not require enrollment. Each business day, we complete our nightly

processing of the transactions for that business day. After we complete our nightly processing, if your account balance

at the end of the business day is overdrawn by more than $50, then you need to make a deposit or transfer to avoid

Overdraft Fees on the transactions that overdrew your account. You will then have until 11 p.m. ET (8 p.m. PT) on the

next business day to make a deposit or transfer that brings your account balance to overdrawn by $50 or less at the

end of that business day. Chase Performance Business Checking and Chase Platinum Business Checking are not eligible

for the next business day feature. To calculate your account balance at the end of the business day, we take your

previous end of day’s balance and post credits. If there are any deposits not yet available for use or holds (such as tax

levies), these will reduce the account balance used to pay your transactions. Then we subtract any debit transactions

presented during our nightly processing. See the Posting Order and Processing section here and in the Deposit Account

Agreement for detailed information about posted and pending transactions.

If after we complete our nightly processing your account balance is overdrawn by $50 or less at the end of the current

business day, then no Overdraft Fees will be charged on the previous and current business day’s transactions.

If your account balance remains overdrawn by more than $50 at the end of the current business day, you may be

charged Overdraft Fees on the previous business day’s transactions. You will have an additional business day to

deposit or transfer funds to avoid Overdraft Fees on the current business day’s transactions.

To help illustrate how Chase Overdraft Assist works, here are some examples:

In these examples, all days are business days and we assume there are no additional transactions other than the ones described.

As a reminder, we pay overdraft transactions at our discretion.

Example 1: No $34 Overdraft Fees – Overdrawn by $50 or less: On Monday, you start the day with $5 in your

Chase Business Complete Checking, Chase Performance Business Checking, or Chase Platinum Business Checking

account. Throughout the day, we receive three $15 checks drawn on your account. During our nightly processing

for Monday, we pay these transactions, leaving your end of day account balance overdrawn by $40.

Result: A $34 Overdraft Fee was not charged because your account balance is overdrawn by $50 or less at the end of the business day.

Example 2: No $34 Overdraft Fee – Chase Business Complete Checking Account Overdrawn by more than

$50 and you make a deposit to bring your account balance to overdrawn by $50 or less at the end of the

next business day: On Monday, you start the day with $5 in your Chase Business Complete Checking account.

If you have questions, please call us at 1-800-242-7338 (we accept operator relay calls).

Eective 6/10/2024

Page 17 of 21

Throughout the day, we receive three $25 checks drawn on your account. During our nightly processing for

Monday, we pay these transactions, leaving your end of day account balance overdrawn by $70. To avoid the $34

Overdraft Fee, you make a cash deposit of $30 by 11 p.m. ET (8 p.m. PT) Tuesday, leaving your end of day

account balance overdrawn by $40.

Result: A $34 Overdraft Fee was not charged because your account balance is overdrawn by $50 or less at the end of

the business day. If you had not made that cash deposit, then your account balance would have remained overdrawn by

more than $50 on Tuesday and you would have been charged a $34 Overdraft Fee on the check.

Example 3: $34 Overdraft Fees are charged on a debit card transaction: (In this example, you have been

automatically enrolled in Chase Business Debit Card Coverage.) On Monday, you start the day with $5 in your

Chase Business Complete Checking account. Later that day you make a $100 debit card transaction on oce

supplies. During our nightly processing for Monday, this transaction posts and we pay it, leaving your end of day

account balance overdrawn by $95.

On Tuesday, you make a $60 debit card transaction for gasoline. During our nightly processing for Tuesday, this

transaction posts and we pay it, leaving your end of day account balance overdrawn by $155 ($100 oce supply

transaction + $60 gasoline transaction).

Result: A $34 Overdraft Fee is charged on the $100 oce supplies that overdrew your account by more than $50 on

Monday. This fee is charged because you didn’t make a deposit or transfer by 11 p.m. ET (8 p.m. PT) on Tuesday to bring

your account balance to overdrawn by $50 or less at the end of the business day.

On Wednesday your account is overdrawn by $189 ($100 oce supply transaction + $60 gasoline transaction + $34

Overdraft Fee). You have until 11 p.m. ET (8 p.m. PT) on Wednesday to avoid a $34 Overdraft Fee on the $60 gasoline

transaction from Tuesday by making a deposit or transfer that brings your account balance to overdrawn by $50 or less

at the end of the business day.

Example 4: $34 Overdraft Fee – Overdrawn by more than $50 and you have a Chase Performance

Business Checking or Chase Platinum Business Checking Account: On Monday, you start the day with $5 in

your account. Throughout the day, we receive three $25 checks drawn on your account. During our nightly

processing for Monday, we pay these transactions, leaving your end of day account balance overdrawn by $70.

Result: A $34 Overdraft Fee is charged because your account balance is overdrawn by more than $50 at the end of the

day and you didn’t make a deposit or transfer by 11 p.m. ET (8 p.m. PT) on Monday and your account type is not eligible

for the next business day feature to make a deposit to bring your account balance to overdrawn by $50 or less.

There are other ways to avoid Overdraft Fees:

• If your transaction is $5 or less

• If your debit card transaction was authorized when there was a sucient available balance in your account

• If your check or ACH is returned unpaid. However, we may charge an Overdraft Fee if a previously returned check

or ACH is presented again and paid

• If your debit card transaction or ATM cash withdrawal request is declined

Knowing your balance may help you avoid fees

Use any of these options to check your balance before you make a purchase.

• Sign up for Account Alerts

Go to chase.com/AccountAlerts

• Use any Chase ATM

• Use Chase Mobile

• Call 1-800-935-9935 (we accept operator relay calls)

• Log on to chase.com

"Pending" transactions

Throughout the day we post debits and credits to your account that may appear as “pending” when we become aware

of the transaction. The following are the most common types of debit transactions that may appear as “pending” and

reduce your available balance by the amount of the transaction:

• ATM and Chase Banker Withdrawals, Transfers and Payments

• Automatic Payments

• Chase.com or Chase Mobile Online Transactions

• Checks Drawn on Your Account

• Debit Card Transactions

• Wire Transfers

ATM and Chase Banker Withdrawals, Transfers and Payments: For payments or cash withdrawals, we will

apply the transactions and update your available balance as soon as the transaction is complete.

Automatic Payments (ACH transactions): We will generally apply debit transactions against your available

balance as pending at the start of the business day of the eective date of the payment. If you initiate ACH

debit transactions on the same day as the eective date, we will apply them in the order we receive them.

1 The Chase Platinum Business Checking account waives one Overdraft Fee per monthly statement period.

If you have questions, please call us at 1-800-242-7338 (we accept operator relay calls).

Eective 6/10/2024

Page 18 of 21

Chase.com or Chase Mobile Online Transactions: For any payment or transfer, once you approve the

transaction, we’ll apply it to your account. For recurring or future dated payments, it is applied on the eective

“send on” date.

Checks Drawn on Your Account: When cashed or deposited at a Chase ATM, branch, or online, the checks

will be pending on your account at the time the item was cashed or deposited. Checks that are deposited at

other banks will show as pending throughout the day as the other banks submit the item to us for payment. If

the amount of the check identied in the notice exceeds your balance at the time we receive the notice, we may

notify the other bank of that fact.

Debit Card Transactions: For more information on debit card transactions refer to the section Important

Information and Agreements About Your Card.

Wire Transfers: Once we’ve begun processing the wire transfer and completed all of our internal reviews, we

will apply the transaction to your account and update your available balance on the transfer’s eective date.

While we make every eort to place transactions in a pending status on your account during the day, transactions may

be unable to be displayed as pending before they are posted to your account. How these items are posted when they

are completed and no longer display as pending is based on the posting order. Fees are applied against the account

based on how items are posted. For details, refer to Posting Order.

Posting Order

Posting order is the order in which we apply deposits and withdrawals to your account. We provide you with visibility

into how transactions are posted and in what order to help you better manage your account.

When we transition from one business day to the next business day we post transactions to and from your account

during our nightly processing. The order in which we generally post items during nightly processing for each business

day is:

• First, we make any previous day adjustments, and add deposits to your account.

• Second, we subtract transactions in chronological order by using the date and time of when the transaction was

authorized or shown as pending. This includes ATM and Chase banker withdrawals, transfers and payments;

automatic payments; chase.com or Chase Mobile online transactions; checks drawn on your account; debit card

transactions; wire transfers; and real time payments. If multiple transactions have the same date and time, then

they are posted in high to low dollar order.

– There are some instances where we do not have the time of the transaction therefore we post at the end of the

day the transaction occurred:

• We are unable to show the transaction as pending; or

• We don’t receive an authorization request from the merchant but the transaction is presented for payment.

• Third, there are some transactions that we cannot process automatically or until we’ve completed posting of your

chronological transactions. This includes Overdraft Protection transfers or transfers to maintain target balances in

other accounts. We subtract these remaining items in high to low dollar order.

• Finally, fees are assessed last.

If you review your account during the day, you will see that we show some transactions as “pending.” For details, refer

to the section “Pending” transactions. These transactions impact your available balance, but have not yet posted to

your account and do not guarantee that we will pay these transactions to your account if you have a negative balance

at that time. We may still return a transaction unpaid if your balance has insucient funds during that business day’s

nightly processing, even if it had been displayed as a “pending” transaction on a positive balance during the day. If a

transaction that you made or authorized does not display as “pending,” you are still responsible for it and it may still be

posted against your account during nightly processing.

OVERDRAFT PROTECTION:

WHAT IT IS:

Allows you to link an Overdraft Protection backup funding account—a Chase business savings account or a Chase

business line of credit—to your checking account to help pay any overdraft transactions that may occur. If your

checking account does not have enough money, we will use the available funds from your backup account to authorize

or pay transactions. The exact amount needed to cover the transaction will be transferred if enough funds are

available.

WHAT IT PAYS:

All transactions, including everyday debit card transactions

WHAT IT COSTS:

• There is not a fee for an Overdraft Protection transfer: Refer to the page How your transactions will work for Overdraft

Fees that may apply if there is NOT enough money available in your linked Overdraft Protection backup account

• Business Line of Credit Transfer: You will pay interest as stated in the Line of Credit Agreement

If you have questions, please call us at 1-800-242-7338 (we accept operator relay calls).

Eective 6/10/2024

Page 19 of 21

Establishing or Canceling Overdraft Protection: Any owner of both a qualifying checking account and the backup

account may enroll in Overdraft Protection without the consent of other owners, and both accounts must share at least

one owner to maintain Overdraft Protection. Any owner of the checking account or the backup account may cancel

Overdraft Protection (by terminating the service or closing the account) without the consent of other owners. A backup

account can provide Overdraft Protection for more than one checking account, but a checking account can have only

one backup account. A personal checking account may be linked to a Chase personal savings account; and a business

checking account may be linked to a Chase business savings account or a business line of credit in good standing.

We may cancel your Overdraft Protection service at any time. Your request to add or cancel Overdraft Protection will

become eective within a reasonable time after approval.

Transfers: We will make one Overdraft Protection transfer per business day that will appear on your statement for

both accounts. If you have enough available funds in your backup account, we will automatically transfer enough to

bring your checking account balance to zero. If you do not have enough available funds in your backup account to bring

your checking account balance to zero, but you have enough available funds to pay one or more transactions and/

or your previous day's negative balance, we will transfer that amount. If the amount transferred does not bring your

checking account balance to zero, your checking account will become overdrawn and you may be charged Overdraft

Fees. If we authorize your transaction, we will leave the funds in your backup account until we pay the transaction,

which may take several days. However, if you use those funds before the transaction is paid there will not be available

funds to make the transfer and your checking account may become overdrawn and charged an Overdraft Fee. The

available balance for a savings account is determined at the time that we authorize a transaction or at the end of

business day processing. The available balance for a business line of credit is determined at the end of the previous

business day processing. We are not required to notify you if funds from the backup account cannot be transferred for

Overdraft Protection (for example if the account is dormant, purged, restricted or not in good standing). Refer to the

section Restricting Your Account; Blocking or Delaying Transactions for additional information.

CHASE BUSINESS DEBIT CARD COVERAGE:

WHAT IT IS:

Allows you to choose how we treat your EVERYDAY DEBIT CARD

1

transactions. If you don’t have Overdraft Protection,

or you don’t have enough funds in your linked Overdraft Protection backup account, and:

• You select YES (default choice), we may authorize overdrafts at our discretion and you understand you will be

charged an Overdraft Fee per transaction if Chase pays your overdraft

• You select NO, the transaction will be declined and you will NOT be charged an Overdraft Fee

Regardless of your Business Debit Card Coverage decision, if you are enrolled in Overdraft Protection and

you have enough money in your linked Overdraft Protection backup account, we will use the available funds

from your backup account to authorize or pay transactions (subject to daily limits—see Card Purchase and

Withdrawal Limits).

WHAT IT PAYS:

Everyday debit card transactions ONLY (e.g., oce supplies or gasoline)

WHAT IT COSTS:

• We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the rst transaction

that overdraws your account balance by more than $50 (maximum of 6 fees per business day, up to $204)

WHEN A FEE WON'T BE CHARGED:

With Chase Overdraft Assist, if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn

by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day.

See Chase Business Overdraft Services for eligible accounts and products, and additional details.

• If your transaction is $5 or less

• If your debit card transaction was authorized when there was a sucient available balance in your account

• If your debit card transaction is declined

IMPORTANT INFORMATION – See your Deposit Account Agreement for full details on all products and services.

1 Everydaydebitcardpurchasesareone-timepurchasesorpayments,suchasocesuppliesoreverydayexpenses.Everydaydebitcardpurchasesaresubjectto

daily point of sale limits.

If you have questions, please call us at 1-800-242-7338 (we accept operator relay calls).

Eective 6/10/2024

Page 20 of 21

Learn how your transactions will work:

EVERYDAY DEBIT CARD PURCHASES

1

(Not recurring)

STEP

1

Is there enough money available in your checking account?

YES

Transaction Authorized and Paid

NO

Proceed to Step 2

STEP

2

OVERDRAFT PROTECTION

Is enough money available in your checking account plus your linked Overdraft Protection backup account

(savings or business line of credit)?

YES

Transaction Authorized and Paid

The exact amount needed to cover the

transaction will be transferred.

NO (or you do NOT have a backup account)

Proceed to Step 3

STEP

3

CHASE BUSINESS DEBIT CARD COVERAGE

By default, you are automatically enrolled in Chase Business Debit Card Coverage.

YES (Default Choice)

Transaction Authorized and Paid or Declined

We may authorize and pay your transaction

at our discretion based on your account

history, deposits you make and the transaction

amount. If authorized, you will be charged a $34

Overdraft Fee per transaction (maximum of 6

Overdraft Fees per business day, up to $204).

If declined, transaction does NOT go through

and you are NOT charged a fee.

NO (you opted out)

Transaction Declined

Transaction does NOT go through and you are NOT

charged an Overdraft Fee.

CHECKS, AUTOMATIC PAYMENTS OR RECURRING DEBIT CARD PURCHASES

2

STEP

1

Is there enough money available in your checking account?

YES

Transaction Authorized and Paid

NO

Proceed to Step 2

STEP

2

OVERDRAFT PROTECTION

Is enough money available in your checking account plus your linked Overdraft Protection backup account

(savings or business line of credit)?

YES

Transaction Authorized and Paid

The exact amount needed to cover the

transaction will be transferred.

NO (or you do NOT have a backup

account) Proceed to Step 3

STEP

3

STANDARD OVERDRAFT PRACTICE NOW APPLIES

Transaction authorized and paid or returned/declined at our discretion based on your account

history, deposits you make and the transaction amount.

AUTHORIZED AND PAID

If authorized and paid, you will be charged a $34

Overdraft Fee per transaction (maximum of 6

Overdraft Fees per business day, up to $204).

RETURNED/DECLINED

If a transaction is returned unpaid or declined, you are

NOT charged a fee.

1 Everydaydebitcardpurchasesareone-timepurchasesorpayments,suchasocesuppliesoreverydayexpenses.Everydaydebitcardpurchasesaresubjectto

daily point of sale limits.

2 Recurringdebitcardpurchasesincludetransactionssuchasphonebills,utilitybillsandrecurringvendorpayments.Recurringdebitcardpurchasesaresubject

to daily point of sale limits.

If you have questions, please call us at 1-800-242-7338 (we accept operator relay calls).

Page 21 of 21

Conrm your choice:

YOU ATTEMPT A TRANSACTION WITHOUT ENOUGH MONEY IN YOUR CHECKING ACCOUNT

YOUR CHOICE

TODAY

TYPE OF

TRANSACTION

IF YOU HAVE ENOUGH

MONEY IN YOUR LINKED

OVERDRAFT PROTECTION

BACKUP ACCOUNT

IF YOU DO NOT HAVE ENOUGH

MONEY IN YOUR LINKED

OVERDRAFT PROTECTION

BACKUP ACCOUNT

STANDARD

OVERDRAFT

PRACTICE

If you decline both Overdraft Protection and Business Debit Card Coverage, our

Standard Overdraft Practice will apply.

Check, Automatic

Payment,

Recurring Debit

Card

Transaction Authorized and Paid or Declined at Chase’s discretion

Overdraft Fee

3

per transaction if authorized and paid (no linked

backup account)

Everyday Debit

Card

Transaction Declined NO OVERDRAFT FEE (no linked backup account)

OVERDRAFT

PROTECTION

Check, Automatic

Payment,

Recurring Debit

Card

Transaction Authorized and

Paid and transfer made—No

Overdraft Fee

Transaction Authorized and Paid

or Declined at Chase’s discretion

Overdraft Fee

3

per transaction if

authorized and paid

Everyday Debit

Card

Transaction Authorized and

Paid and transfer made—No

Overdraft Fee

Transaction Declined NO

OVERDRAFT FEE

BUSINESS

DEBIT CARD

COVERAGE

(Default

Choice)

Check, Automatic

Payment,

Recurring Debit

Card

Not applicable

Everyday Debit

Card

Transaction Authorized and Paid or Declined at Chase’s discretion

Overdraft Fee

3

per transaction if authorized and paid (no linked

backup account)

BUSINESS

OVERDRAFT

PROTECTION

and

BUSINESS

DEBIT CARD

COVERAGE

Check, Automatic

Payment,

Recurring Debit

Card

Transaction Authorized and

Paid and transfer made—No

Overdraft Fee

Transaction Authorized and Paid

or Declined at Chase’s discretion

Overdraft Fee

3

per transaction if

authorized and paid

Everyday Debit

Card

Transaction Authorized and

Paid and transfer made—No

Overdraft Fee

Transaction Authorized and Paid

or Declined at Chase’s discretion

Overdraft Fee

3

per transaction if

authorized and paid

If a recurring debit card transaction is declined, the transaction does not go through and you are not charged a fee.

You can avoid overdrawing your account by making a deposit or transferring funds to cover the

overdraft before the business day ends and we start our nightly processing. Here are the cuto times

for some ways of making a deposit or transferring funds from another Chase account:

• At a branch before it closes

• At an ATM before 11 p.m. Eastern Time (8 p.m. Pacic Time)

• When transferring money on chase.com or Chase Mobile or using Zelle

®

before 11 p.m. Eastern Time

(8 p.m. Pacic Time)

If you deposit a check, this assumes we do not place a hold and the check is not returned. Additional

cuto times apply to other transfers, including transfers from non-Chase accounts. Please visit

chase.com or Chase Mobile for more information and service agreements.

3 The Chase Platinum Business Checking account waives one Overdraft Fee per monthly statement period.

If you have questions, please call us at 1-800-242-7338 (we accept operator relay calls).

Eective 6/10/2024