We’ve included annotations in the gray boxes below to

emphasize certain portions of our notice and help guide

you as you read them. Annotations aren’t part of the terms

and have no legal effect, but they should help you follow the

text.

This page explains our terms for Cash App. By using the

service, you agree to these terms. If you use the service on

behalf of your company, your company agrees to them too.

Using Cash App requires that you open an account. You

need to be a U.S. resident and at least 18 years old. If you

want to use your account balance to send money to another

Cash App customer or use certain Cash App products or

services, then you’ll need to give us some more information

about you that we will use to verify your identity.

This is also the part where you tell us you own the email or

phone number you registered with and that the personal

information you provide to us is correct. You agree to

cooperate with us so that we can verify your identity. We

might use third parties to help us do so.

You may choose a unique username for Cash App, which will

be your “$Cashtag.” If you choose a $Cashtag that is

confusing or deceptive, we may change it.

Here’s where we describe your consent to receive texts

from us and your representations regarding texts we send

to others relating to your payments. You also consent to us

sending messages to your email. You can opt out of

communications in ways that are specific to that

communication method, such as by unsubscribing from

emails, or replying to text messages with ‘STOP’.

You retain all rights to your content when you upload it into

our services, but you do give us broad rights to use, modify,

display your content in our services. You can see specifics

on the rights you grant us below.

Also, anything you provide us or make available to the

public through our services must not contain anything that

we think is objectionable (e.g., illegal, obscene, hateful or

harmful to you, our customers or us). We can remove any

content at any time.

We take security incredibly seriously, but can’t guarantee

that bad actors will not gain access to your personal

information. You need to do your part by keeping your

passwords safe, being smart about who has access to your

account and which of your devices can access our services,

and letting us know if you think an unauthorized person is

using your account.

If there is ever a dispute about who owns your account, we

are the decider.

While we’re happy to let you use our services, you don’t

have any ownership rights in them. We can act on any ideas

you share with us about how we can improve our products

and services free of charge.

There are several ways you can add funds to your Cash App

Balance (“Add Cash”), which are described here.

You can transfer funds from your Cash App balance out to

your bank account (“Cash Out”). These transfers can take

up to three days, or for a fee, be made instantly. We may

limit your ability to transfer funds to your bank account,

based on the circumstances. For example, we may delay

transfers while we screen for fraud or risks. You are

responsible for all amounts owed on your account even

after it is closed.

You will be able to send funds using our P2P service if you

have a linked bank account or linked a credit card. If you

have an Unrestricted Account you will also be able to send

funds using our P2P service from your balance. You

authorize us to move funds on your behalf. We won’t be

responsible for certain incomplete transactions, as

described here.

If you’re sending large amounts of money over certain

thresholds, you will need to provide additional identification

information so that we can make sure you are who you say

you are.

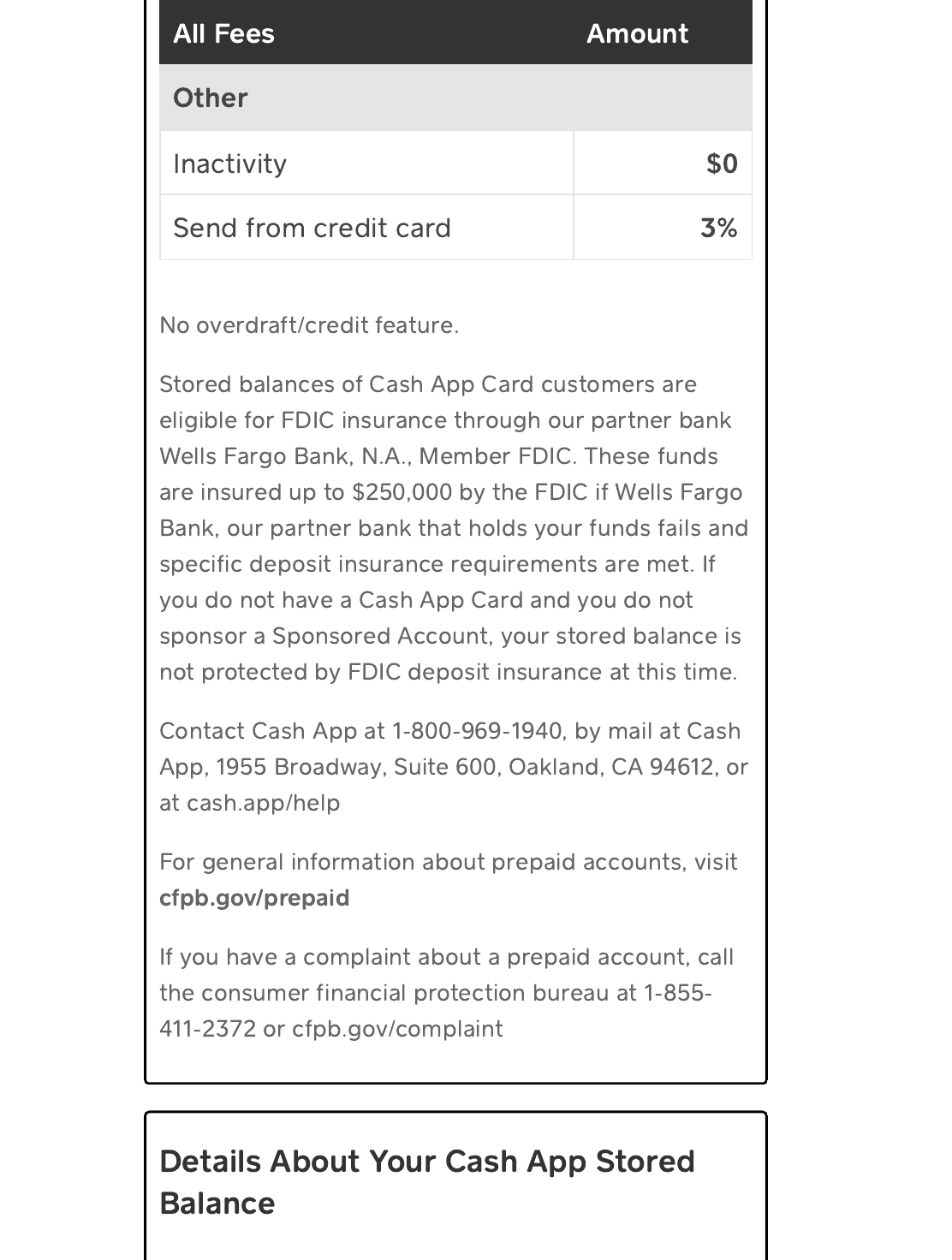

You can send money to others through our P2P service for

free, unless you choose to send funds using a credit card.

We can change these fees in the future.

If we believe you received a payment that should not have

been made for some reason (for example, fraud), you give

us permission to reverse that payment. We are not

responsible for any payments that you receive, even if you

don’t know who sent the payment.

A bank may provide you with a virtual or physical Cash App

Card. By requesting the Cash App Card, you agree to any

additional applicable terms from the issuing bank. We may

cancel, repossess, or revoke your Cash App Card at any

time.

You can use your Cash App Card to make purchases using

any available Cash App balance. You agree we can move

funds from your balance to your Cash App Card for

purchases that you make with your Cash App Card.

You agree that you won’t make a purchase or transaction in

excess of the funds available in your balance and if you do,

you agree that we can recover any negative balance.

You may use the “Disable Card” feature of Cash App to

disable your Cash App Card if you lose your Cash App Card

or think it has been stolen.

If we determine that you are no longer eligible for a Cash

App Card, we will let the issuing bank know and your Cash

App Card may be canceled without notice.

We make no guarantees regarding your Cash App Card and

we are not responsible if it gets stolen, lost, destroyed, or

used without your permission.

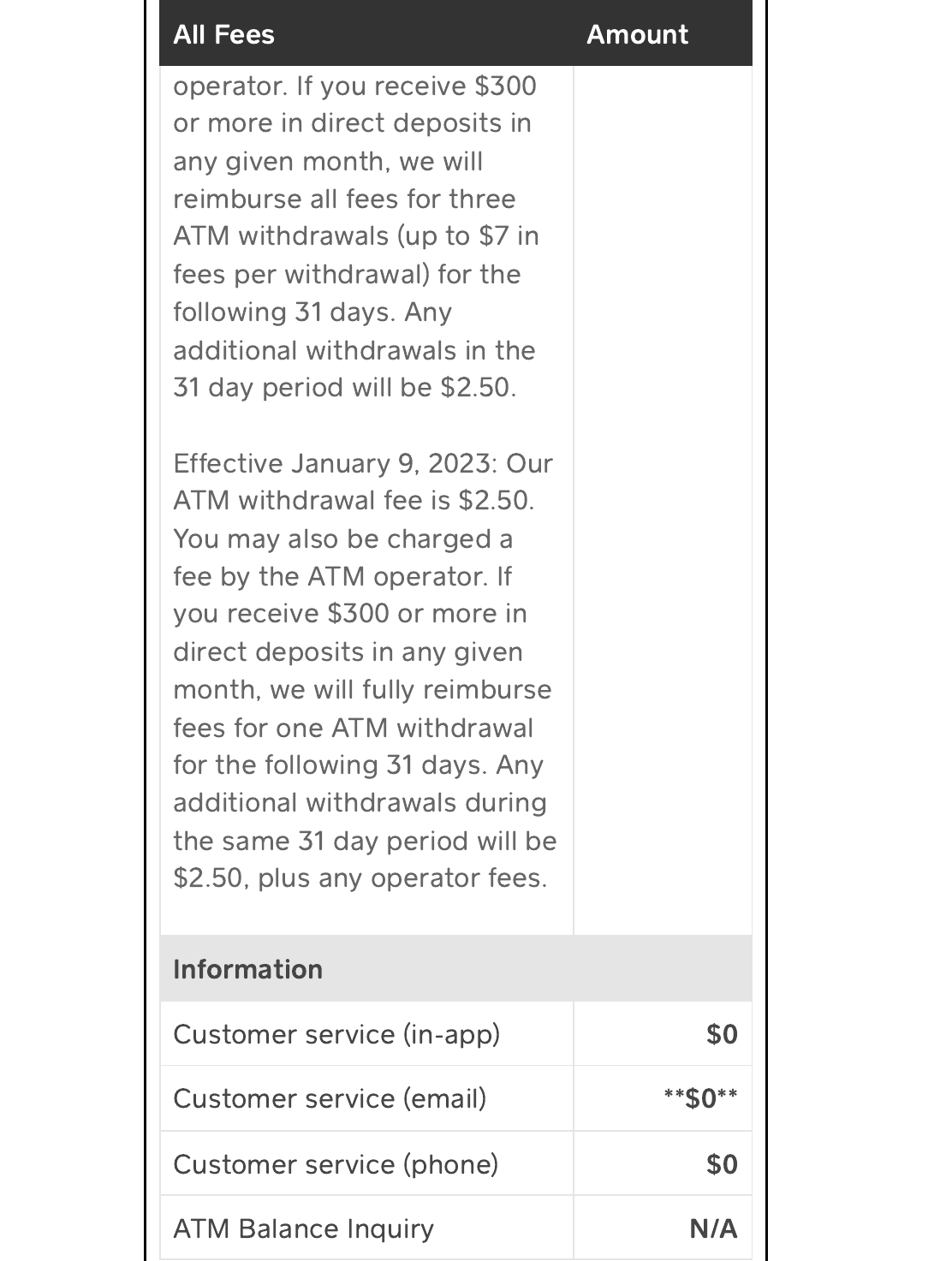

You may be charged certain fees in connection with your

use of the Cash App Card.

This section governs your use as an individual of the Virtual

Currency (as defined below) services offered through Cash

App.

If you want to use Cash App to buy stocks you need to sign

up with our broker-dealer, Cash App Investing LLC.

If you have a Cash for Business Account, we will charge you

a transaction processing fee, depositing the balance of

payments from your customers into your Cash App balance.

You authorize us to process your transactions as an agent

on your behalf. You allow us to void transactions if we

believe that a chargeback for the transactions will occur.

You may use your account or a linked card to purchase

goods and services from Cash for Business Accounts. By

initiating a payment to a Cash for Business Account, you

agree to let that seller debit your account or linked card to

complete the transaction. You can use your Cash App

Balance to purchase goods and services from Cash for

Business Accounts only after we have verified your identity.

You can find your transaction receipts and account

statements in your Cash App account.

Contact us if you see any errors or issues with your account.

Our contact info is below, along with a description of the

process and timeline for us to look into your issue. We’ll

need some basic information from you to begin our

investigation.

Contact us as soon as possible if you think there has been

unauthorized activity on your account. You could lose all the

money in your Account.

When we will cover your losses for certain incomplete or

incorrect transactions, detailed here.

When you contest a transaction with your external funding

source (such as the bank that issued your linked debit

card), your rights when requesting reimbursement for a

completed transaction are determined by the funding

source used to fund the applicable transaction.

You give us permission to recover amounts you owe by

debiting funds available in your Cash App account or any

other account you may have with the Company. This may

involve us making attempts to recover less than the full

amount you owe to us. We might contact you or take other

legal actions to collect amounts due.

We may limit your funding sources to reduce risk. You will

use Cash App legally and in accordance with debit and

credit card network rules. You agree to not abuse the

payment system or the service. We may block or reverse

any transaction, including those that violate our terms or

the law, at your expense.

There are some circumstances where we will not be liable if

transactions do not go through. Those circumstances are

listed here.

We can terminate or deny you access to our services at any

time, for any reason. You can also choose to deactivate your

account at any time.

Once our relationship ends, we are not responsible for any

losses you experience because of the termination of our

services or for removing your data from our servers. Some

terms of our agreement will still apply even after our

relationship ends.

When your Cash App account is closed, we’ll settle any

pending transactions and return remaining funds in your

account to you. We may need to hold your funds if there is

an investigation at the time your Account is closed.

If you do something using our services that gets us sued or

fined, you agree to cover our losses as described below.

While we do our best to bring great products and services

to our customers, we provide them as-is, without

warranties. We are not responsible for any goods and

services that you might buy or sell using Cash for Business.

As described below, if something bad happens because of

your use of our services, our liability is capped.

When you see the word “Dispute” in Section XI.19, here’s

what it means.

This section provides details about how we will resolve

disputes through the arbitration process.

Our relationship is governed by the laws of California,

federal law, or both.

You may not transfer any rights you have under our terms of

service to anyone else.

This page explains the terms for the Mobile Check Capture

service. By using the service, you agree to these terms.

This section defines what an Electronic Check is and details

what data we collect from the Electronic Check. It also

informs you that we may decline to process your check or

reverse our decision to process your check. To protect

yourself, you should retain your paper check for two weeks.

You agree not to use this feature to disrupt Cash App or to

conduct illegal activity.

This section details the requirements your paper check

must meet to be eligible for Mobile Check Capture.

Here is the part where you tell us all the information on the

check you are transmitting through Mobile Check Capture

is true and that the check is eligible for this service.

You must keep your check for two weeks after you use

Mobile Check Capture. We may need to contact you about

your check. Please update your contact information on

Cash App.

The bank that accepts your check from us may have a claim

against us if there are problems with your check. Some

common problems, but not all, are listed here. If we make

the bank that accepts your check whole, then we may

recover funds from you.

We may delay your access to funds while we process your

check.

This is where we tell you the cut off time for a check to be

submitted in order to be counted on a specific day and

potential hold periods.

We may make funds available to you before they clear from

the paying bank. If we do, and the funds do not clear the

paying bank you will be required to pay back the funds we

made available to you. If you present us with a check that

has been paid out by another bank and we also make funds

available to you, you will be required to repay the funds to

us.

The image capture service on Cash App is provided by

Mitek Systems, Inc (“Mitek”). Below are Mitek’s rights to the

intellectual property and your license to use the technology.