block q4 2023 1

Q4 2023 Shareholder Letter

investors.block.xyz

block q4 2023 2

February 22, 2024

Preliminary Draft - Confidential

To Our Shareholders:

We’ve done a lot recently to reduce our costs. Now we’re going to focus on growth.

We’re under our 12,000 people cap. This constraint forces us to prioritize more

impactful work, which we believe will lead to growth. We’re going to operate under

this cap until we feel it’s holding us back, which is likely years out, and continue to look

critically at our organization and priorities.

On the topic of people, we’re reorganizing the people in Square back to a simple

Engineering/Product/Design/Sales structure. The past organizational structure was

holding us back, slowing us down, and weakening our skills. I want Square to be a

leader in engineering and design again. A team people point to as inspiration, and

aspire to join. This reorg will help us do that. Robert Andersen, our first Square, and

then Cash App designer and team lead is rejoining our company to focus on making

design at Square world-class again.

Our last shareholder letter was about how we’re going to grow Square through our 4

priorities of platform, local, AI, and banking. This one will be about growing Cash App.

Cash App aims to become one of the top providers of banking services to

households in the United States which earn up to $150,000 per year, a segment

that represents approximately 80% of consumers and more than 50% of household

income.

How are we going to achieve this? We have a three part strategy: (1) Banking our

Base (2) Move Up Market by Serving Families and (3) Build the Next Generation

Social Bank. The majority of our near term focus and current investments are on the

first, where we see the most direct opportunity to drive meaningful top line growth for

Cash App.

#1: Banking our Base.

As of December there were 2 million actives (3% of our monthly transacting actives)

depositing their paycheck into Cash App each month, relative to 23 million Cash App

Card monthly actives (41% of our monthly transacting actives) and our broader base

of 56 million monthly transacting actives. In the same way that peer-to-peer (P2P)

payments was a gateway to the Cash App Card, we see the Cash App Card as a

gateway to our customers adopting Cash App as a primary banking solution.

We believe the most direct opportunity for Cash App to drive meaningful top line

growth is by converting our existing base of 56 million monthly transacting actives,

who mostly use P2P and Cash App Card, into primary banking actives who deposit

their paycheck into Cash App and generate significantly more inflows per active. We

see a meaningful step up in value and engagement as customers choose to deposit

their paycheck with us: Cash App Card actives who deposit at least $2,000 of

paychecks per month spend nearly 6x more than Cash App Card actives who do not

deposit a paycheck with Cash App.

block q4 2023 3

So how do we capture this opportunity?

It starts with earning our customer’s trust. Our top priority is continuing to improve

upon safety, security, and support for our customers. This means continued focus on

risk and fraud management, including protecting our customers from bad actors who

attempt to abuse our platform through vectors like scams and phishing attacks. It also

means ensuring our systems are highly reliable by improving system observability,

redundancy and resiliency. And to support our customers in the case where they do run

into a problem, we’re improving and scaling customer service through automation and

features like priority phone support for the customers who rely on us the most.

Next, we will round out and differentiate our banking features. Today, we offer a free

customizable Visa debit card, direct deposit which arrives up to 2 days earlier than

most traditional banks, paper money deposits, instant discounts on debit spending,

and a savings account with no minimum balance—all covered by FDIC insurance. We

also offer short-term credit through Borrow, and round-ups/paycheck distribution into

savings, stocks and Bitcoin—not to mention our suite of additional financial services

like tax prep, investing, and of course P2P payments.

We stack up well against the competition, and will continue to build out our offering to

make banking with Cash App an obvious choice. We recently launched free overdraft

coverage and 4.5% yield on savings balances for paycheck direct deposit actives.

We’re excited to push the boundary even further by offering new capabilities like credit

building, spending insights, and subscription management tools. While some features

like wire transfers, check deposits, and bill pay that our customers get from traditional

banks are not yet widely available on Cash App, we’re aiming to close gaps like these

soon to further grow customer adoption.

We’ll create even further differentiation by integrating our commerce payment

tools. Cash App Card and Afterpay are two scaled payment tools that enable our

customers to purchase goods and services from the largest and most frequently

visited merchants in the United States. Afterpay enables customers to buy now and

pay later both in network and out of network (via single use payment cards) as well

as discover merchants through the Afterpay app. Our focuses in 2024 and beyond

will be: 1) further integrating Afterpay into Cash App, 2) continuing to scale merchant

discovery in Cash App, 3) using Afterpay’s distribution to continue growing Cash App

Pay and 4) leveraging Cash App Card to distribute BNPL (e.g. Afterpay powering BNPL

on the Cash App Card).

Finally, we will package all of this functionality together into a simple offering that

makes it straightforward for customers to start banking with us and makes it easy for

Cash App to go-to-market and acquire customers who will choose us as their primary

provider of banking services.

block q4 2023 4

#2: Move Up Market by Serving Families.

Today, Cash App’s base is largely made up of customers with a household income

of less than $100,000 per year, and longer term we see an opportunity to serve

customers with a household income of up to $150,000 per year. Strengthening our

P2P network with families in the U.S.— including with higher-household-income parents

and their dependents—is one lever that we believe will contribute meaningfully to

our ability to move up market over the medium term. Dependents typically have less

complicated financial lives compared to their parents and the families segment more

broadly has historically not been well-served by P2P platforms in the U.S.

Over the last few years, we made Cash App available to individuals 13 and older, first

starting with Cash App Card and P2P and then expanding into additional banking

features. We’ve been focused on growing our feature set for teens and on earning

trust by giving parents transparency into their family’s activity, allowing them to set

permissions, and offering an increasingly robust set of oversight controls to promote

safety.

Through this effort, we’re positioning Cash App for long-term growth by serving

families in the near-term and then growing with our teen customer base as they

mature, their income grows, and they engage more deeply with the full suite of banking

products and financial services that Cash App offers.

#3: Build the Next Generation Social Bank.

Cash App is social. We show up where and when people interact, bringing together

people and money (e.g., splitting the bill, contributing to a group gift, buying art at a

craft fair). Cash App Card, our most successful banking product so far, is inherently

social. Customers get Cash App Card because of its uniqueness and its utility tied

to P2P payments, which they can’t get from traditional banks. We’re continuing to

invest in building our social-driven feature set through areas like expanded profile

functionality, sharing/recommendations, and exploring new ways for our customer

base to transact together through financial services that have historically been

disconnected from the community.

A big part of this vision is linking Square’s local priority with Cash App. In Cash App’s

densest communities people commonly use Cash App to send money to pay for goods

and services, like nails at a salon or fresh eggs at a farmers market—seller use cases

that have historically been served by Square’s Card Reader. And with Cash App Card

we see a considerable amount of Cash App customers buying from Square sellers.

Given this area of natural overlap we are aiming to enable more local commerce by

connecting our two largest ecosystems.

We believe there's an opportunity to offer Square sellers the ability to customize

profiles in Cash App, that allows for better discovery and ordering for customers—

ultimately connecting them to new local businesses through our commerce offerings.

block q4 2023 5

All of this does represent a change in our approach: we are focused on growing within

the U.S., not expanding into new markets, and we’re focused on driving growth through

inflows per active more than actives. This past year we intentionally made decisions

that impacted our actives growth, and that we believe allows us to move faster on

overall profitable growth as we make progress towards Rule of 40. For example, we

deprioritized global expansion, implemented tighter controls to improve risk loss, and

introduced deliberate friction to the onboarding process that slowed actives growth

some, but ultimately allowed customers to adopt banking products earlier and receive

higher limits. Our ability to increase engagement in this way is evidenced by recent

Cash App Card growth: monthly Cash App Card actives grew 20% year over year in

December—more than 2x the growth rate of total monthly actives. We believe this

strategy will enable us to build the largest network in the long run, with a highly engaged

customer base using Cash App as their primary banking solution.

We thank you for your continued trust and belief in our work.

Jack Dorsey

1. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App’s bank partners.

block q4 2023 6

Margins above are all calculated as a percent of gross profit. In the fourth quarter of 2023, total net revenue was $5.77 billion, up 24% year over year, and, excluding bitcoin

revenue, revenue was $3.25 billion, up 15% year over year.

In the fourth quarter of 2023, we began reporting the financial results of our BNPL platform fully within Cash App, rather than allocating 50% of revenue and gross profit to each

of Square and Cash App. The prior period segment financial information in this letter has been revised to conform to the new segment reporting. Please see the reconciliations at

the end of this letter for select financial results related to this segment reorganization.

In the fourth quarter of 2023, operating expenses included a goodwill impairment charge related to TIDAL of $132 million, severance and other related expenses of $70 million,

and lease impairment restructuring expenses of $34 million. Other income, net included a remeasurement gain on our bitcoin investment of $207 million upon adoption of the new

accounting guidance on accounting for crypto assets. Reconciliations of non-GAAP financial measures used in this letter to their nearest GAAP equivalents are provided at the

end of this letter. Please see these reconciliations for a description of certain items that affected operating income (loss) and net income (loss) in the fourth quarter of 2023.

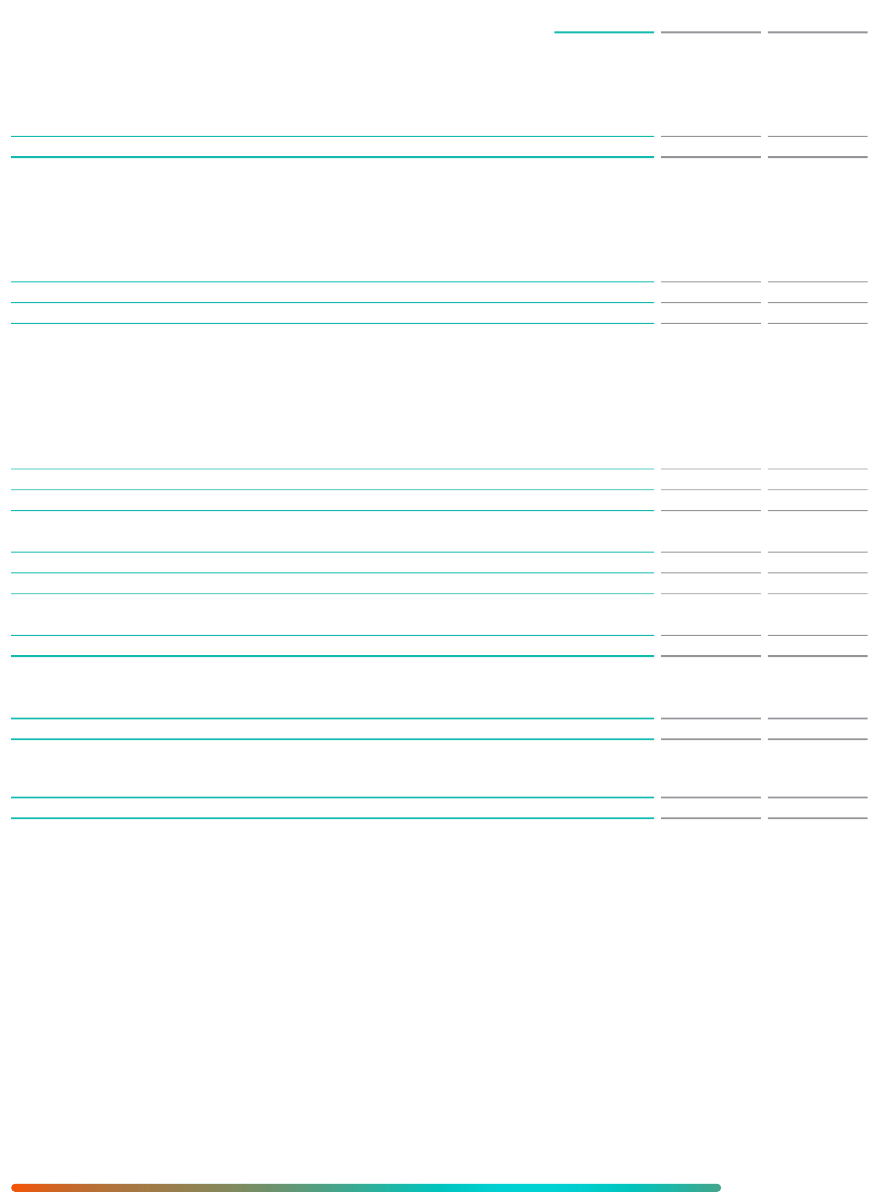

In the fourth quarter of 2023, gross

profit grew 22% year over year to $2.03

billion. Square generated gross profit

of $828 million, up 18% year over year,

and Cash App generated gross profit

of $1.18 billion, up 25% year over year.

Q4'23 Highlights

27% 21%32%

Q2

Gross Profit

$2.03 Billion

+

22% yoy

YoY Growth

40%

22%

Q4

2022

Q1

2023

Q4Q3

$2.03B

$1.90B

$1.87B

$1.71B

$1.66B

Q2Q2 Q1

2023

Q1

2023

Q3Q3 Q4

2022

Q4

2022

Q4Q4

35%

51%

YoY

Growth

83%

12%

YoY

Growth

7%

$1.18B$828M

$805M $804M

$692M

$703M

25%18%

Square Gross Profit

$828 Million

+

18% yoy

14%

18%

Cash App Gross Profit

$1.18 Billion

+

25% yoy

27%

$1.08B

$1.05B

$1.01B

$0.95B

Q2Q2 Q1

2023

Q1

2023

Q3Q3 Q4

2022

Q4

2022

Q4Q4

Operating Income (Loss)

($131 Million)

(6%)

Adjusted Operating Income (Loss)

$185 Million

+

9%

($10M)

($131M)

($6M)

($135M)

($132M)

($32M)

$185M

$90M

$25M

$51M

margin margin

Q2Q2 Q1

2023

Q1

2023

Q3Q3 Q4

2022

Q4

2022

Q4Q4

($29M)

($17M)

($123M)

$562M

$477M

$384M

$368M

$281M

Net Income (Loss)*

$178 Million

+

9%

Adjusted EBITDA

$562 Million

+

28%

*Attributable to common stockholders

($114M)

$178M

margin margin

We saw improvement across all

profitability measures in the fourth

quarter of 2023. Operating loss was

$131 million while Adjusted Operating

Income was $185 million. Net income

attributable to common stockholders

was $178 million and Adjusted EBITDA

was $562 million, up 2x year over year.

block q4 2023 7

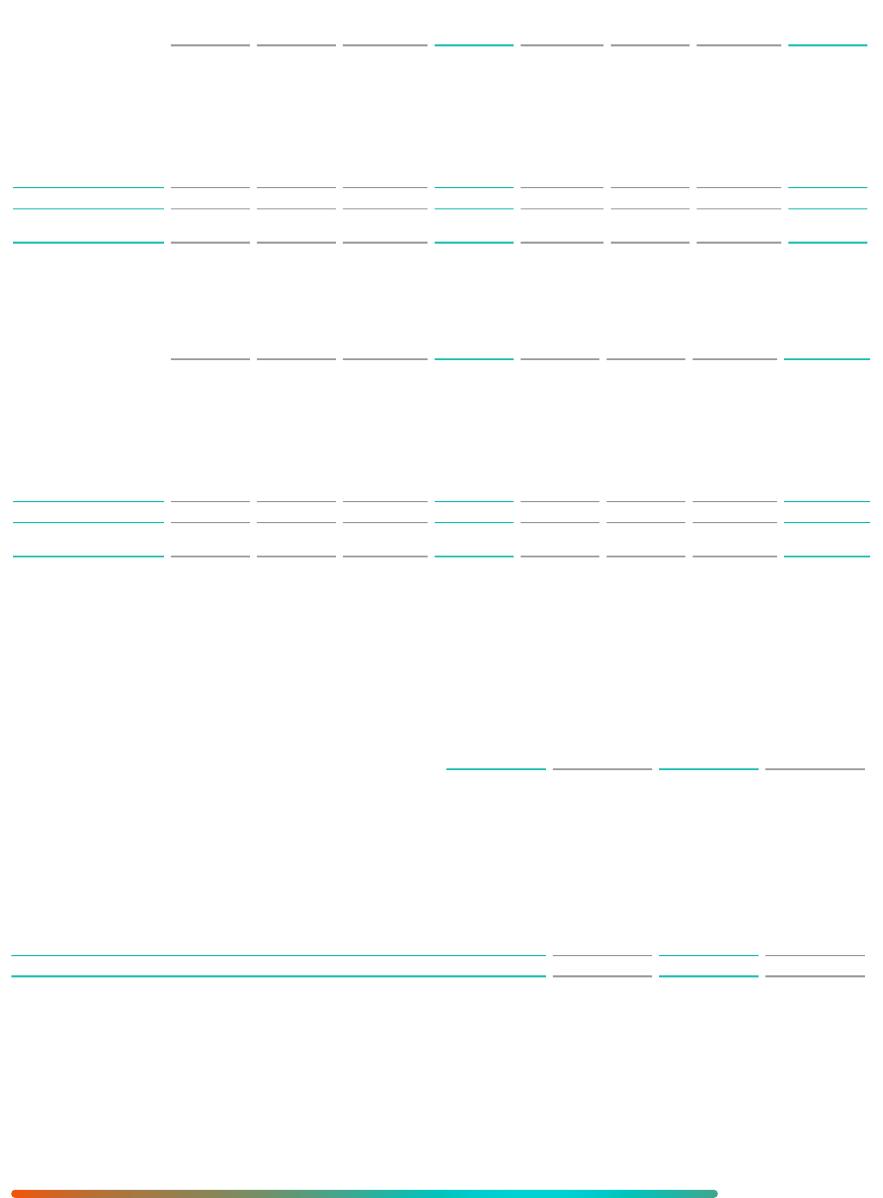

$10M

($541M)

$166M

$213M

$375M

2021

2021

Net Income (Loss)*

$10 Million

0%

Adjusted EBITDA

$1.79 Billion

+

24%

2020

2020

2022

2022

2019

2019

*Attributable to common

stockholders

2023

2023

$1.79B

$0.42B

$0.47B

$1.01B

$0.99B

margin margin

2023 Highlights

69%

168%

20212021 20202020 20222022 20192019

Square Gross Profit

$3.13 Billion

+

16% yoy

Cash App Gross Profit

$4.32 Billion

+

33% yoy

57%17%

54%

8%

20232023

$4.32B$3.13B

$0.46B

$1.23B

$2.07B

$3.25B

$2.71B

$2.32B

$1.51B

$1.39B

33%16%

YoY

Growth

30%

YoY

Growth

135%

62%

36%45%

2021

Gross Profit

$ 7. 5 0 Billion

+

25% yoy

25%

2019 2020 20232022

$7. 50 B

$1.89B

YoY Growth

45%

$2.73B

$4.42B

$5.99B

We experienced strong growth during

2023 with gross profit of $7.50

billion, up 25% year over year.

Our investment framework informed

decisions throughout the year and led

to a heightened focus on efficiency.

Operating loss was $279 million while

Adjusted Operating Income was $351

million. While operating loss margin was

-4%, Adjusted Operating Income margin

was 5%, and each expanded by seven

points year over year. Net income was

$10 million and Adjusted EBITDA was

$1.79 billion, up 81% year over year.

We continue to drive toward our

Rule of 40 target. For the full year

2023, we achieved Rule of 29% on a

combined company basis, with gross

profit growth of 24% and Adjusted

Operating Income margin of 5%.

2023

$351M

($279M)

($145M)($625M)

$306M

$161M

$4M

($19M)

$36M

$27M

20212021

Operating Income (Loss)

($279 Million)

(4%)

Adjusted Operating Income (Loss)

$351 Million

+

5%

20202020 20222022 20192019 2023

marginmargin

Margins above are all calculated as a percent of gross profit. For the full year of 2023, total net revenue was $21.92 billion, up 25% year over year, and, excluding bitcoin revenue,

revenue was $12.42 billion, up 19% year over year.

Reconciliations of non-GAAP financial measures used in this letter to their nearest GAAP equivalents are provided at the end of this letter. Please see these reconciliations for a

description of certain items that affected operating income (loss) and net income (loss) in 2023.

On a combined company basis, gross profit is calculated assuming a $51 million gross profit contribution from our BNPL platform in January 2022, as if our BNPL platform had

been acquired on January 1, 2022.

block q4 2023 8

Square Ecosystem

Square’s ecosystem of software, hardware,

and banking products takes the complexity

out of commerce to save sellers time and

help them grow their businesses.

Experimenting with and investing behind new

marketing channels is essential to improving

acquisition and understanding what is most

aligned with our sellers’ preferences.

• In the fourth quarter, we began to leverage

a Pay-as-You-Go model, offering select

prospective sellers free hardware up

front in exchange for a higher processing

rate. Removing up-front hardware costs

enables more sellers to adopt Square

products and aims to minimize friction in

onboarding, which can drive incremental

sellers and gross profit to our ecosystem.

• In January, we launched a Restaurant

Essentials Bundle, which offers software

products, such as Square for Restaurants,

Square Online, and Payroll, at a flat price.

We see an opportunity to win more

upmarket food and beverage sellers,

and we believe one way to do so is by

cross-selling earlier in their journey and

packaging products that resonate most.

• We revamped our two referral programs

at the beginning of 2024, both aimed

at winning upmarket leads. For our seller

program, we expanded the base available

to make referrals, and increased the

cash reward for successful conversions.

For partner referrals, we are focused on

increasing distribution by broadening the

range of partners we work with, improving

the program's incentive structure, and

establishing presence at local events.

Our Restaurant Essentials Bundle offers access to six popular

software tools at a discounted rate, taking the guesswork out

of deciding which tools sellers need to run their business. With

Square for Restaurants Plus, Square Online Premium, Square

Team Plus, Square Shifts Plus, Square Team Communication,

and Square Payroll, sellers can easily create and customize an

eCommerce website, schedule shifts, manage payroll, keep their

team connected, and more.

block q4 2023 9

Gross profit from banking products in our international markets

has grown with our expanded offerings and represented 20%

of gross profit in our international markets in the fourth quarter

of 2023.

In the fourth quarter, we launched a GenAI

conversational tool for our customer-facing

teams to improve efficiency. This tool auto-

populates answers to frequently asked seller

questions for our sales and customer service

teams and aggregates data in a concise, easy-

to-read format. This reduces the amount of

time these teams spend researching and

retrieving information across databases so

they can focus on serving our sellers.

As our banking product offerings have expanded

internationally, we have seen meaningful adoption,

leading to strong growth. In the fourth quarter

of 2023, 20% of Square gross profit in our

international markets came from banking products.

• In January, we continued to expand

our international banking presence by

enabling access to capital to our sellers

in Japan. We believe our offering makes

it easier and faster for sellers to secure

funds, as it can be difficult for these sellers

to receive funding from traditional banks.

Serving sellers beyond our payment

and software capabilities can lead them

to bring us more of their business.

square inte rn ational bank ing gros s

profit momentum

Q4

2023

Q4

2022

Q4

2021

Banking

Gross Profit

International

Gross Profit

5%

17%

20%

block q4 2023 10

Cash App Ecosystem

Cash App is uniquely positioned to reinvent

banking by seamlessly bringing together

financial services, our network, and commerce

for customers in one easy-to-use platform.

We are focused on winning the primary banking

relationship with our customers, and, as a

part of that, we are prioritizing products and

features that make our offering more robust.

• In the fourth quarter, we launched free

overdraft coverage, a feature that protects

customers who overdraw on their Cash

balance up to a certain amount from being

charged the punitive fees that are an

industry standard at traditional banks. This

was a welcomed feature for customers

who had considered switching their direct

deposit to Cash App, and since launch,

we've seen record direct deposit sign-ups.

• Our Savings product was one of our fastest-

growing products in its first year, so to build

on that success we began rolling out a

Savings Yield feature in January, offering

4.5% annual interest on savings balances to

paycheck deposit monthly actives and 1.5%

annual interest on savings balances to Cash

App Card account holders. We believe this

can drive customer acquisition for those

looking for a robust savings product and

increase inflows from existing customers.

• Cash App Borrow continued to drive

momentum in 2023, originating $3.6

billion in short-term loans, up 74% year

over year, while maintaining historical

loss rates at less than 3% on average.

A transacting active is a

Cash App account that has at

least one financial

transaction using any

product or service within

Cash App during a specified

period. A transacting active

for a specific Cash App

product has at least one

financial transaction using

that product during the

specified period and is

referred to as an active.

Examples of transactions

include sending or receiving a

peer-to-peer payment,

transferring money into or

out of Cash App, making a

purchase using Cash App

Card, earning a dividend on a

stock investment, paying

back a loan, among others.

Certain of these accounts

may share an alias identifier

with one or more other

transacting active accounts.

This could represent, among

other things, one customer

with multiple accounts or

multiple customers sharing

one alias identifier (for

example, families).

A paycheck deposit monthly

active is a Cash App account

that receives $300 or more

through direct deposit into

Cash App during the month.

We rolled out Savings Yield for our Cash App Savings product

in January, building on the success we’ve seen with our Savings

product throughout 2023.

We originated $3.6 billion in short-term loans in 2023 while

maintaining loss rates at less than 3% on average.

Cash App Card monthly

actives, which increased

20% year over year.

23M

cash ap p bor row or iginations ($)

Q1

2022

Q1

2023

Q2 Q2Q3 Q3Q4 Q4

block q4 2023 11

With Commerce, we have the ability to make our

customers’ money go further by allowing them

to have more control over the way they pay.

• Cash App Pay grew significantly during the

year, ending December with 3 million monthly

actives and $2.5 billion in annualized GPV.

• We experienced strength from our BNPL

Platform in the fourth quarter of 2023,

with $8.6 billion in GMV up 25% year over

year, driven by our Pay-in-Four offering as

well as Single Use Payments (SUP). SUP

allows customers across the U.S., U.K.,

and Australia to shop via the Afterpay app

at merchants that do not have a direct

relationship with Afterpay, and pay using

BNPL. This enables us to reach highly

engaged customers through personalized

merchant recommendations in the app, while

also offering a flexible payment option.

cash ap p pay actives grow th and

gpv growth

June

2023

Dec

2023

Sept

2023

$2.5B

Annualized GPV

3M2M1M

Our BNPL platform’s Gross

Merchandise Value or

“GMV” is a measure of the

total order value processed

on our BNPL platform.

block q4 2023 12

revenue and gross profit

Total net revenue was $5.77 billion in the

fourth quarter of 2023, up 24% year over year.

Excluding bitcoin revenue, revenue in the fourth

quarter was $3.25 billion, up 15% year over

year. For the full year of 2023, total net revenue

was $21.92 billion, up 25% year over year.

Excluding bitcoin revenue, revenue for the full

year was $12.42 billion, up 19% year over year.

Gross profit was $2.03 billion in the fourth

quarter of 2023, up 22% year over year.

For the full year of 2023, gross profit was

$7.50 billion, up 25% year over year.

Transaction-based revenue was $1.60 billion in

the fourth quarter of 2023, up 8% year over year,

and transaction-based gross profit was $650

million, up 7% year over year. We processed

$57.49 billion in GPV in the fourth quarter of

2023, up 8% year over year. Transaction-based

gross profit as a percentage of GPV was 1.13% in

the fourth quarter, down 1 basis point year over

year and up 1 basis point quarter over quarter.

For the full year of 2023, transaction-based

revenue was $6.32 billion, up 11% year over

year, and transaction-based gross profit

was $2.61 billion, up 12% year over year. We

processed $227.70 billion in GPV for the

full year of 2023, up 12% year over year.

Transaction-based gross profit as a percentage

of GPV was 1.15%, flat year over year.

Subscription and services-based revenue was

$1.62 billion in the fourth quarter of 2023,

up 24% year over year, and subscription and

services-based gross profit was $1.35 billion,

up 27% year over year. For the full year of

2023, subscription and services-based revenue

was $5.94 billion, up 31% year over year, and

subscription and services-based gross profit

was $4.87 billion, up 32% year over year.

Financial

Discussion

Reconciliations of non-GAAP

metrics used in this letter to

their nearest GAAP

equivalents are provided at

the end of this letter.

Bitcoin gross profit was $66

million in the fourth quarter of

2023. The total sale amount

of bitcoin sold to customers,

which we recognize as bitcoin

revenue, was $2.52 billion.

Bitcoin gross profit was 3% of

bitcoin revenue.

GPV includes Square GPV

and Cash App Business

GPV. Square GPV is defined

as the total dollar amount of

all card payments processed

by sellers using Square, net

of refunds, and ACH

transfers. Cash App

Business GPV comprises

Cash App activity related to

peer-to-peer transactions

received by business

accounts and peer-to-peer

payments sent from a credit

card. GPV does not include

transactions from our BNPL

platform because GPV is

related only to transaction-

based revenue and not to

subscription and services-

based revenue. Revenue

from our BNPL platform

includes fees generated

from consumer receivables,

late fees, and certain

affiliate and advertising fees

from the platform.

gros s profit

Q4

22%

Q1

2023

Q4

2022

32%

40%

YoY G ro w th

Q3

21%

Q2

27%

$2.03B

$1.90B

$1.87B

$1.71B

$1.66B

block q4 2023 13

In the fourth quarter and for the full year of

2023, gross profit included $18 million and $73

million, respectively, of amortization of acquired

technology assets, the majority of which was

from the acquisition of our BNPL platform.

In the fourth quarter of 2023, we began

reporting the financial results of the BNPL

platform fully within Cash App, rather than

allocating 50% of revenue and gross profit to

each of Square and Cash App. The prior period

segment financial information in this letter has

been revised to conform to the new segment

reporting. Please see the reconciliations at the

end of this letter for select financial results

related to this segment reorganization.

block q4 2023 14

square ecosystem revenue

and gross profit

In the fourth quarter of 2023, Square generated

$1.81 billion of revenue and $828 million of gross

profit, up 12% and 18% year over year, respectively.

For the full year of 2023, Square generated $7.03

billion of revenue and $3.13 billion of gross profit,

up 12% and 16% year over year, respectively.

We target positive gross profit retention to

measure our ability to support our sellers and

help them grow over time. In 2023, Square

cohorts in aggregate achieved positive gross

profit retention when compared to 2022, driven

by strength from our software and banking

products. Square cohorts onboarded prior to

2022 have achieved or are pacing toward an

estimated return on investment of approximately

3x or greater over four years. Our 2022 and

2023 cohorts are pacing toward an estimated

payback of approximately six to seven quarters.

Software and banking solutions are a key part

of our strategic priority to help sellers save

time and grow their businesses. Software and

integrated payments gross profit grew 17% year

over year in the fourth quarter of 2023, while

gross profit from our banking products, which

primarily include Square Loans, Instant Transfer,

and Square Debit Card, grew 28% year over

year. For the full year of 2023, gross profit from

software and integrated payments and banking

products each grew 18% year over year.

Square generated $1.49 billion of transaction-

based revenue in the fourth quarter of 2023, up

10% year over year. During the quarter, Square saw

a higher percentage of GPV with custom pricing

on a year-over-year basis, as we intend to drive

incremental growth with larger sellers through our

go-to-market and product strategies. For the full

year of 2023, Square generated $5.82 billion of

transaction-based revenue, up 11% year over year.

Square gross profit retention rate is calculated as the

year-over-year gross profit growth of all existing quarterly seller

cohorts, averaged over the last four quarters (excluding gross

profit from hardware, Caviar, PPP loans, and Weebly prior to the

acquisition). A Square cohort represents new sellers onboarded

to Square during a given period.

For Square, return on investment, or payback, measures the

effectiveness of sales and marketing spend. Return on

investment (ROI) is calculated by dividing the cumulative

cohort gross profit of each cohort of sellers by Square sales

and marketing expenses for the applicable time period,

excluding historical Caviar sales and marketing expenses and

the portion of sales and marketing expenses from the legacy

Weebly business.

gross profit by annual square cohort

2023 Cohort

2020 Cohort

2021 Cohort

2022 Cohort

Pre-2020

Cohorts

2019 2020 2021 2022 2023

square gross profit by product area

2021

Q4

2022

Q4

2020

Q4

2023

Q4

2019

Q4

Sidecar

Payments

Software &

Integrated

Payments

Banking

ex. PPP

per cent of total s quare gross profi t ex ppp

Q4'19 Q4'20 Q4'21 Q4'22 Q4'23

16% 10% 16% 21% 23%

Banking ex.

PPP

54% 62% 62% 60% 59%

Software &

Integrated

Payments

36% 31% 27% 24% 20%

Sidecar

Payments

Hardware gross profit losses are not presented for any period.

Percentages are of Square gross profit excluding contributions

from PPP loan forgiveness for each period.

block q4 2023 15

square gpv mix by s eller size

2021

Q4

2022

Q4

2023

Q4

$16.9B

$15.3B

$21.4B

$14.0B

$15.9B

$18.9B

$15.7B

$12.4B

$14.5B

<$125K

Annualized GPV

$125K–$500K

Annualized GPV

>$500K

Annualized GPV

$53.5B

$48.6B

$42.6B

Percent Mid-market

Sellers

37% 39%

40%

We determine seller size based on annualized GPV during the

applicable quarter. A mid-market seller generates more than

$500,000 in annualized GPV.

$23M

$39M

$62M

$83M

$106M

9%6%

gross profit in markets outside the u.s.

2019

Q4

2022

Q4

12%

2021

Q4

9%

2020

Q4

2023

Q4

13%

% of Square

Gross Profit

Services verticals include

professional services, beauty

and personal care, health

care and fitness, and home

and repair.

Square GPV is defined as the total dollar amount of all card

payments processed by sellers using Square, net of refunds, and

ACH transfers.

square gross payment volu me

Q4

10%

Q1

2023

Q4

2022

Q3

Q2

$53.5B

11%

$55.7B

12%

$54.2B

17%

$46.2B

YoY

Growth

14%

$48.6B

In the fourth quarter of 2023, Square GPV

was $53.54 billion, up 10% year over year on

both a reported and constant currency basis.

For the full year of 2023, Square GPV was

$209.61 billion, up 12% year over year and 13%

year over year on a constant currency basis.

We observed the following trends in Square

GPV during the fourth quarter of 2023:

• Acquisition and Retention: We achieved

positive growth in acquisition of new sellers.

Retention of existing sellers is a function

of churn and GPV per seller. Churn of

existing sellers remained consistent with

prior periods. In the U.S., growth in GPV per

seller continued to be affected by consumer

demand as year-over-year growth in spend

per card and in the number of unique cards

decelerated in the fourth quarter of 2023

compared to the fourth quarter of 2022.

• Geographies: Square GPV in our U.S. market

grew 7% year over year, and in our international

markets grew 26% year over year on both

a reported and constant currency basis.

• Verticals: On a year-over-year basis, food

and drink GPV was up 15%, GPV from

services verticals was up 8%, and retail GPV

was up 4%. Gross profit from our vertical

point-of-sale solutions, including Square

Appointments, Square for Restaurants, and

Square for Retail, was up 27% year over year.

• Channels: Card-present GPV was up 13%

year over year while card-not-present GPV

was up 4% year over year. Within card-not-

present volumes, GPV growth from online

channels was up 11% year over year and was

partially offset by a year-over-year decline in

GPV from manual keyed-entry transactions.

In the fourth quarter of 2023, Square generated

$293 million of subscription and services-based

revenue, up 24% year over year. Square Loans

facilitated approximately 137,000 loans totaling

$1.40 billion in originations, up 22% year over

year. For the full year of 2023, Square generated

$1.06 billion of subscription and services-based

revenue, up 18% year over year. Square Loans

facilitated approximately 489,000 loans totaling

$4.78 billion in originations, up 18% year over year.

Hardware revenue in the fourth quarter of 2023

was $32 million, down 9% year over year, and

gross loss was $24 million as we use hardware

as an acquisition tool. For the full year of 2023,

hardware revenue was $157 million, down 4%

year over year, and gross loss was $110 million.

block q4 2023 16

cash app ecosystem revenue

and gross profit

In the fourth quarter of 2023, Cash App

generated $3.91 billion of revenue and $1.18

billion of gross profit, up 31% and 25% year over

year, respectively. Excluding bitcoin revenue,

Cash App revenue was $1.39 billion, up 20%

year over year. For the full year of 2023, Cash

App generated $14.68 billion of revenue and

$4.32 billion of gross profit, both up 33% year

over year. Excluding bitcoin revenue, Cash App

revenue was $5.18 billion, up 32% year over year.

Our Cash App ecosystem has achieved positive

annual gross profit retention in aggregate and for

each annual cohort, demonstrating that existing

customers have remained on the platform and

increased their engagement with Cash App

over time. We continued to efficiently grow our

customer base and generate strong returns on

customer acquisition for Cash App. Our historical

Cash App cohorts through 2021 have achieved a

return on investment of 6x or greater over three

years, and our 2022 and 2023 Cash App cohorts

are at or pacing toward an estimated payback of

less than one year. In 2023, we onboarded our

largest annual cohort on a gross profit basis.

Cash App annual gross profit retention is calculated as the

year-over-year gross profit growth of all existing quarterly Cash

App cohorts, averaged over the last four quarters, and excluding

BNPL platform gross profit and contra revenue. A Cash App

transacting active’s cohort is determined based on the date they

first became a transacting active on the platform. For example,

retention for our 2019 cohort is the average annual gross

profit growth from transacting actives who completed a first

transaction in 2019. Each of our annual Cash App cohorts since

2013 and the pre-2019 cohort have exhibited positive overall

gross profit retention on aggregate from the date of their first

transaction through December 31, 2023.

For Cash App, return on investment, or payback, is calculated

by taking a given Cash App monthly cohort’s cumulative variable

profit and dividing by acquisition marketing spend for the initial

month when onboarded. Cohort variable profit is calculated as

gross profit across Cash App transaction-based profit, Cash

App Card gross profit, Instant Deposit gross profit for Cash App,

bitcoin gross profit, less certain variable sales and marketing

expenses, including peer-to-peer processing and risk loss. Cohort

variable profit includes estimates for certain risk loss measures.

Cohort variable profit does not include profit from our BNPL

platform.

gross profit by annual cash app

cohort

2023 Cohort

2020 Cohort

2021 Cohort

2022 Cohort

Pre-2020

Cohorts

2019 2020 2021 2022 2023

block q4 2023 17

In December, Cash App had 56 million monthly

transacting actives, up 9% year over year. Inflows

per transacting active in the fourth quarter

were $1,137, up 8% year over year and relatively

stable quarter over quarter. Overall inflows

were $63 billion in the fourth quarter, up 18%

year over year and 2% quarter over quarter, and

monetization rate was 1.48%, up 9 basis points

year over year and 5 basis points quarter over

quarter. Overall inflows for the full year of 2023

were $248 billion, up 22% year over year.

In the fourth quarter of 2023, Cash App Business

GPV was $3.95 billion, down 13% year over year.

Cash App Business GPV comprises Cash App

activity related to peer-to-peer transactions

received by business accounts and peer-to-peer

payments sent from a credit card. Cash App

generated $109 million of transaction-based

revenue during the fourth quarter of 2023, down

11% year over year. For the full year of 2023,

Cash App Business GPV was $18.09 billion, up

6% year over year. Cash App generated $498

million of transaction-based revenue during

the full year of 2023, up 7% year over year.

Inflows per transacting

active refers to total inflows

in the quarter divided by

monthly actives for the last

month of the quarter.

Inflows refers to funds

entering the Cash App

ecosystem. Inflows does not

include the movement of

funds when funds remain in

the Cash App ecosystem or

when funds leave the Cash

App ecosystem, or inflows

related to the Afterpay or

Verse apps. Inflows from

Verse actives were not

material to overall inflows.

cash app inflows framework

56M

Actives

$

1,137

Inflows per Active

1.48%

Monetization Rate

We calculate monetization rate by dividing Cash App gross

profit, excluding contributions from our BNPL platform, by Cash

App inflows.

X

X

Q2

cash ap p inflows

Q4

18%

Q1

2023

Q4

2022

27%

YoY

Growth

20%

Q3

21%

25%

$63B

$62B

$62B

$61B

$54B

block q4 2023 18

Cash App generated $1.28 billion of subscription

and services-based revenue during the fourth

quarter of 2023, up 24% year over year. The

increase was driven by growth in Cash App

Card, our BNPL platform, Instant Deposit,

and other financial services products, as well

as interest earned on customer funds. For

the full year of 2023, Cash App generated

$4.69 billion of subscription and services-

based revenue, up 36% year over year.

Cash App generated $66 million of bitcoin gross

profit in the fourth quarter of 2023, up 90% year

over year. The total sale amount of bitcoin sold

to customers, which we recognize as bitcoin

revenue, was $2.52 billion, up 37% year over year.

The year-over-year increase in bitcoin revenue

and gross profit was driven by an increase in

the average market price of bitcoin as well as a

benefit from the price appreciation of our bitcoin

inventory during the quarter. For the full year of

2023, Cash App generated $205 million of bitcoin

gross profit and $9.50 billion of bitcoin revenue,

up 31% and 34% year over year, respectively.

In the fourth quarter of 2023, our BNPL platform

contributed $325 million of revenue and $242

million of gross profit to Cash App, compared

to $264 million and $196 million in the fourth

quarter of 2022, respectively. For the full year

of 2023, our BNPL platform contributed $1.04

billion of revenue and $755 million of gross profit

to Cash App, compared to $811 million and $588

million for the full year of 2022, respectively.

Bitcoin revenue is the total

sale amount of bitcoin sold

to customers. Bitcoin costs

are the total amount we pay

to purchase bitcoin in order

to facilitate customers’

access to bitcoin. In future

quarters, bitcoin revenue

and gross profit may

fluctuate as a result of

changes in customer

demand or the market price

of bitcoin.

cash app gross profit by p roduct

are a

2021 20222020 20232019

BNPL

Platform

Bitcoin

Financial

Services

Other

Community

Instant

Deposit

per cent of total cash app gross profit

2019 2020 2021 2022 2023

0% 0% 0% 18% 17%

BNPL

Platform

2% 8% 10% 6% 7% Bitcoin

21% 25% 29% 32% 38%

Financial

Services

10% 13% 14% 10% 8%

Other

Community

67% 53% 46% 34% 29%

Instant

Deposit

As presented here, Bitcoin equals gross profit from bitcoin

buying and selling and bitcoin withdrawal fees, as well as

brokerage gross losses. Financial Services equals gross profit

from transaction fees on Cash App Card, interest on customer

funds, cash deposits, Cash App Card Studio, ATM fees, Cash

App Borrow, and Cash App Pay. Other Community equals gross

profit from business accounts and P2P transactions funded with

a credit card.

block q4 2023 19

corporate and other revenue

and gross profit

Corporate and Other generated $50 million in

revenue and $14 million in gross profit in the

fourth quarter of 2023. For the full year of

2023, Corporate and Other generated $201

million in revenue and $53 million in gross

profit. Corporate and Other comprised areas

outside Square and Cash App, which were

primarily TIDAL and intersegment eliminations

between Cash App and Square in 2023.

operating expenses

We implemented a number of initiatives during

2023 targeted at driving operating efficiency

across our business, which had a modest

benefit to 2023 results, and we expect to

contribute more meaningfully to savings in

2024 and beyond. In November 2023, we

announced we would implement an absolute

cap of 12,000 on the number of employees we

have at our company. We plan to operate below

this cap through a combination of performance

management, centralizing teams and functions

to reduce duplication, and prioritization of our

scope. We expect to keep this cap in place

until we believe the growth of the business

has meaningfully outpaced the growth of our

company. We have also explored opportunities

to reduce our corporate overhead spend, which

involved scaling back on real estate facilities

and curbing discretionary spending in 2023.

In the fourth quarter of 2023, operating expenses

were $2.16 billion on a GAAP basis and $1.48

billion on a non-GAAP basis, up 20% and 6% year

over year, respectively. In the fourth quarter,

we recognized a goodwill impairment charge

related to TIDAL of $132 million, severance and

other related expenses of $70 million, and lease

impairment restructuring expenses of $34 million.

For the full year of 2023, operating expenses

were $7.78 billion on a GAAP basis and

$5.79 billion on a non-GAAP basis, up 18%

and 14% year over year, respectively.

Product development expenses were $685

million on a GAAP basis and $411 million on a

non-GAAP basis in the fourth quarter of 2023,

up 13% and 8% year over year, respectively.

The increase was driven primarily by personnel

costs related to our engineering team.

block q4 2023 20

As bitcoin is considered an

indefinite-lived intangible

asset, and upon adoption of

Accounting Standards

Update No. 2023-08,

Accounting for and

Disclosure of Crypto Assets,

we remeasure our bitcoin at

fair value at each reporting

date with changes recognized

in net income.

In the fourth quarter of 2023,

we reclassified interest

expense on our warehouse

funding facility for the full

year of 2023 from “Product

development” expenses to

“General and administrative”

expenses.

We discuss Cash App

marketing expenses because

a large portion is generated

by our peer-to-peer service,

which we offer free to our

Cash App customers, and we

consider it to be a marketing

tool to encourage the use of

Cash App. In the fourth

quarter of 2023, we began

reporting BNPL platform

marketing expenses within

Cash App. The year-over-year

growth rate for Cash App

marketing expenses

presented in this letter reflect

the new reporting

classification for all historical

periods.

Sales and marketing expenses were $506

million on a GAAP basis and $470 million on a

non-GAAP basis in the fourth quarter of 2023,

down 6% and 7% year over year, respectively.

• Cash App marketing expenses were down

11% year over year, driven by decreases

in advertising costs and peer-to-peer

transaction losses, and partially offset

by increases in peer-to-peer processing

costs and card issuance costs.

• Other sales and marketing expenses

were up 3% year over year. Other sales

and marketing expenses primarily include

expenses related to Square and TIDAL.

General and administrative expenses were $746

million on a GAAP basis and $415 million on a

non-GAAP basis in the fourth quarter of 2023,

up 65% and 21% year over year, respectively.

The increase was driven by a reclassification

of certain interest expenses, and, on a GAAP

basis, a goodwill impairment charge related to

TIDAL, lease impairment restructuring expenses,

and severance and other related expenses.

Transaction, loan, and consumer receivables losses

were $176 million in the fourth quarter of 2023, up

13% year over year. The increase was driven primarily

by growth in BNPL consumer receivables and Cash

App Borrow volumes. In the fourth quarter, loss

rates for Square GPV, Square Loans, and Cash

App Borrow remained consistent with historical

ranges, and losses on BNPL consumer receivables

were 1.00% of GMV, also consistent with historical

ranges. We will continue to monitor trends closely.

In the fourth quarter and for the full year of 2023,

operating expenses included $43 million and $174

million, respectively, of amortization of customer

and other acquired intangible assets, the majority of

which was from the acquisition of our BNPL platform.

In the fourth quarter of 2020 and first quarter of

2021, we invested $50 million and $170 million,

respectively, in bitcoin. As of December 31,

2023, we held approximately 8,038 bitcoins for

investment purposes with a fair value of $340

million based on observable market prices, which

is included within “Other non-current assets” on

the consolidated balance sheets. In the fourth

quarter of 2023, other income, net included a

remeasurement gain on our bitcoin investment of

$207 million for the year ended December 31, 2023.

block q4 2023 21

Q4

Q2 Q3

Q1

2023

Q4

2022

earnings

In the fourth quarter of 2023, operating loss was

$131 million, compared to $135 million in the fourth

quarter of 2022. Adjusted Operating Income was

$185 million, compared to Adjusted Operating

Loss of $32 million in the fourth quarter of 2022.

For the full year of 2023, operating loss was $279

million, compared to $625 million in 2022. Adjusted

Operating Income was $351 million, compared to

Adjusted Operating Loss of $145 million in 2022.

For both the fourth quarter and full year of

2023, the year-over-year improvement in

operating loss and Adjusted Operating Income

was driven by gross profit growth across

our Cash App and Square ecosystems.

operating income (loss)

Please see the reconciliations at the end of this letter for a

description of certain items that affected operating income (loss)

in the fourth quarter of 2023.

($131M)

($10M)

($6M)

($135M)

($132M)

$185M

adj usted operating income (loss)

Q4Q1

2023

Q4

2022

Q3

Q2

($32M)

$51M

$25M

$90M

block q4 2023 22

Q4Q2 Q3Q1

2023

Q4

2022

adj usted ebitda

$562M

$477M

$368M

$281M

$384M

Net income attributable to common stockholders

was $178 million in the fourth quarter of 2023.

Net income per share attributable to common

stockholders was $0.29 on a basic and $0.28 on a

diluted basis in the fourth quarter of 2023, based on

615 million weighted-average basic and 629 million

weighted-average diluted shares outstanding during

the fourth quarter of 2023, representing a $0.48

and $0.47 increase year over year, respectively.

For the full year of 2023, net income attributable

to common stockholders was $10 million. Net

income per share was $0.02 on a basic and diluted

basis, based on 609 million weighted-average

basic and 614 million weighted-average diluted

shares outstanding during the full year of 2023.

Adjusted EBITDA was $562 million in the

fourth quarter of 2023, compared to $281

million in the fourth quarter of 2022. For the

full year of 2023, Adjusted EBITDA was $1.79

billion, compared to $991 million in 2022.

For both the fourth quarter and full year of 2023,

the year-over-year improvement in net income

attributable to common stockholders and Adjusted

EBITDA was driven by gross profit growth

across our Cash App and Square ecosystems

and, on a net income basis, a gain from the

remeasurement of our bitcoin investment.

In the fourth quarter of 2023, Adjusted Net Income

Per Share (Adjusted EPS) was $0.45 on a diluted

basis based on 631 million weighted-average diluted

shares outstanding during the fourth quarter of

2023, representing a $0.23 increase year over year.

For the full year of 2023, Adjusted EPS was $1.80

based on 628 million weighted-average diluted

shares, compared to $1.00 for the full year of 2022.

Please see the reconciliations at the end of this letter for a

description of certain items that affected net income (loss) in the

fourth quarter of 2023.

net income (loss) at tributable to

common stockholders

$178M

Q4Q1

2023

Q4

2022

Q3

Q2

($114M)

($17M)

($123M)

($29M)

block q4 2023 23

balance sheet/cash flow

We ended the fourth quarter of 2023 with $7.7

billion in available liquidity, with $6.9 billion in cash,

cash equivalents, restricted cash, and investments

in marketable debt securities, as well as $775 million

available to be withdrawn from our revolving credit

facility subject to compliance with our covenants.

Additionally, we had $99 million available to be

withdrawn under our warehouse funding facilities,

to support funding of growth in our consumer

receivables related to our BNPL platform.

In October 2023, our board of directors authorized

the repurchase of up to $1 billion of our Class A

common stock. In 2023, we repurchased 2.5

million shares of our Class A common stock

for an aggregate amount of $157 million. As

of December 31, 2023, $843 million remained

available and authorized for repurchases.

In the fourth quarter of 2023, Adjusted EBITDA

contributed positively to our overall liquidity.

Net cash provided by operating activities was

$101 million for the twelve months ended

December 31, 2023, compared to $176 million for

the twelve months ended December 31, 2022.

Adjusted Free Cash Flow was $515 million for

the twelve months ended December 31, 2023,

compared to negative $346 million for the

twelve months ended December 31, 2022.

Adjusted Free Cash Flow has historically been

lower in the fourth quarter due to the funding of

seasonally higher BNPL consumer receivables

originations, which are historically collected in the

following quarters. Adjusted Free Cash Flow for

the twelve months ended December 31, 2023 was

negatively impacted by a $350 million deposit held

by a processor to meet requirements related to

processing volumes under an arrangement that

was executed in the fourth quarter of 2023.

Adjusted Free Cash Flow is a

non-GAAP financial measure

that represents our net cash

provided by operating

activities adjusted for

changes in settlements

receivable, changes in

customers payable, changes

in settlements payable, the

purchase of property and

equipment, payments for

originations of consumer

receivables, proceeds from

principal repayments and

sales of consumer

receivables, and sales,

principal payments, and

forgiveness of PPP loans. We

present Adjusted Free Cash

Flow because we use it to

understand the cash

generated by our business

and make strategic decisions

related to our balance sheet,

and because we are focused

on growing our Adjusted Free

Cash Flow generation over

time. It is not intended to

represent amounts available

for discretionary purposes.

block q4 2023 24

Q1 2024

Gross Profit $2.00B to $2.02B

YoY Growth (midpoint) 17%

Adjusted EBITDA $570M to $590M

% Margin (midpoint) 29%

Adjusted Operating Income $225M to $245M

% Margin (midpoint) 12%

Guidance

1. We have not provided the forward-looking GAAP equivalents for certain forward-looking non-GAAP metrics, including Adjusted EBITDA, and Adjusted Operating

Income (Loss), or GAAP reconciliations of any of the aforementioned, as a result of the uncertainty regarding, and the potential variability of, reconciling items such

as share-based compensation expense. Accordingly, the Company has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K to exclude such

reconciliations, as the reconciliations of these non-GAAP guidance metrics to their corresponding GAAP equivalents are not available without unreasonable effort.

However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided reconciliations

of other historical GAAP to non-GAAP metrics in tables at the end of this letter.

Adjusted Operating Income margin is defined by dividing Adjusted Operating Income over a given period by gross profit over the same period.

Q1 2024 OUTLOOK

2024 OUTLOOK

We remain focused on achieving Rule of 40 in 2026, which is gross profit growth plus Adjusted Operating

Income margin. Our primary objective in 2024 is to deliver an improvement from the Rule of 29 we achieved

in 2023, on a combined company basis. To achieve this, we have put forward an initial guidance that we

intend to exceed, by at least one point of outperformance during the year, either on gross profit growth or

Adjusted Operating Income margin, or both. Our initial 2024 guidance calls for gross profit of at least $8.65

billion, up at least 15% year over year. For Adjusted Operating Income we expect at least $1.15 billion, for a

13% margin. For Adjusted EBITDA we expect at least $2.63 billion, for a 30% margin. This outlook does not

assume any additional macroeconomic deterioration, which could impact results.

On a combined company basis, gross profit is calculated assuming a $51 million gross profit contribution

from our BNPL platform in January 2022, as if our BNPL platform had been acquired on January 1, 2022.

On a GAAP basis, we expect to recognize approximately $61 million in expenses related to amortization of

intangible assets in each quarter of 2024, based on the intangible assets as of December 31, 2023. This

quarterly expense includes approximately $18 million recognized in cost of sales and approximately $43

million in operating expenses. These amounts may be affected by fluctuations in foreign exchange rates in

future periods.

In the first quarter of 2024, we expect our share-based compensation expense to decrease slightly quarter

over quarter on a dollar basis.

block q4 2023 25

Block (NYSE:SQ) will host a conference call and

earnings webcast at 2:00 p.m. Pacific time/5:00

p.m. Eastern time, February 22, to discuss these

financial results. To register to participate in

the conference call, or to listen to the live audio

webcast, please visit the Events & Presentations

section of Block’s Investor Relations website

at investors.block.xyz. A replay will be available

on the same website following the call.

We will release financial results for the first

quarter of 2024 on May 2, 2024, after the

market closes, and will also host a conference

call and earnings webcast at 2:00 p.m. Pacific

time/5:00 p.m. Eastern time on the same

day to discuss those financial results.

MEDIA CONTACT

press@block.xyz

INVESTOR RELATIONS

CONTACT

ir@block.xyz

Jack Dorsey

ceo

Amrita Ahuja

cfo

Earnings

Webcast

block q4 2023 26

“

The Epicurean Trader is one of the top retailers of

specialty food and craft spirits in the United States,

featuring cafe and wine bar service on-premises at

their five locations in San Francisco, CA. They use

Square for Retail, Square for Restaurants, Square

Online, Square Marketing and Loyalty, and integrations

from Square’s App Marketplace.

We're sort of a combination of all of them. And so for us, the dierent

product suites that Square oers, along with the amazing customer

support with implementing the dierent solutions, for us it was just a

natural fit. As we've grown in size and complexity, Square has kept up

and matched our needs. As we realized our business needed to evolve,

Square has kept up with the curve.”

Mat Pond

Co-Owner, The Epicurean Trader

When we looked at the solutions,

there were a lot that were very

focused on retail, some very

focused on restaurants…

block q4 2023 27

Love that cash app sound

when the coins hit

@_iRanOutOfIdeas

Via X

I do round ups and it came

in handy for Christmas.

@susanheflin08

Via Instagram

Cash app do a purple

or blue card next

@justchillyay

Via TikTok

Just ordered mine I literally

have pink hair I needed the

pink card

@basswitchmars

Via Instagram

This is really cool. @CashApp is adding

free overdraft coverage for customers.

This would’ve saved me a small fortune

when I was a teenager learning how to

manage my money. I remember getting

nailed for a $27 overdraft fee on a $5

sandwich. Well done Cash App team!

@ryanfinlay

Via Twitter

block q4 2023 28

safe harbor statement

This letter contains “forward-looking statements” within the

meaning of the Safe Harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact could be deemed

forward-looking, including, but not limited to, statements

regarding the future performance of Block, Inc. and its

consolidated subsidiaries (the Company); the Company’s

strategies, including expected impact of such strategies on

our customers, actives, and sellers as well as our business and

financial performance, expected financial results, guidance,

and general business outlook for current and future periods;

the Company’s integration of Afterpay, and its impacts on the

Company’s business and financial results; future profitability

and growth in the Company’s businesses and products and the

Company’s ability to drive such profitability and growth; the

Company’s expectations regarding scale, economics, and the

demand for or benefits from its products, product features, and

services; the Company’s product development plans; the ability

of the Company’s products to attract and retain customers,

particularly in new or different markets or demographics;

trends in the Company’s markets and the continuation of such

trends; the Company’s expectations and intentions regarding

future expenses, including future transaction and loan losses

and the Company’s estimated reserves for such losses; the

Company’s bitcoin investments and strategy as well as the

potential financial impact and volatility; and management’s

statements related to business strategy, plans, investments,

opportunities, and objectives for future operations. In some

cases, forward-looking statements can be identified by

terms such as “may,” “will,” “appears,” “should,” “expects,”

“plans,” “anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential,”

or “continue,” or the negative of these words or other similar

terms or expressions that concern our expectations, strategy,

plans, or intentions.

Such statements are subject to a number of known and

unknown risks, uncertainties, assumptions, and other factors

that may cause the Company’s actual results, performance,

or achievements to differ materially from results expressed or

implied in this letter. Investors are cautioned not to place undue

reliance on these statements, and reported results should not

be considered as an indication of future performance.

Risks tht contribute to the uncertin nture of the forwrd-

looking sttements include, mong others, continued or

prolonged economic downturn in the United Sttes nd in other

countries round the world; the Compny’s investments in its

business nd bility to mintin profitbility; the Compny’s

efforts to expnd its product portfolio nd mrket rech;

the Compny’s bility to develop products nd services to

ddress the rpidly evolving mrket for pyments nd finncil

services; the Compny’s bility to del with the substntil nd

incresingly intense competition in its industry; cquisitions,

strtegic investments, entries into new businesses, joint

ventures, divestitures, nd other trnsctions tht the

Compny my undertke; the integrtion of Afterpy; the

Compny’s bility to ensure the integrtion of its services with

vriety of operting systems nd the interoperbility of its

technology with tht of third prties; the Compny’s bility

to retin existing customers, ttrct new customers, nd

increse sles to ll customers; the Compny’s dependence

on pyment crd networks nd cquiring processors; the

effect of extensive regultion nd oversight relted to the

Compny’s business in vriety of res; risks relted to the

bnking ecosystem, including through our bnk prtnerships,

nd FDIC nd other regultory obligtions; the effect of

mngement chnges nd business inititives; the libilities

nd loss potentil ssocited with new products, product

fetures, nd services; litigtion, including intellectul property

clims, government investigtions or inquiries, nd regultory

mtters or disputes; doption of the Compny’s products

nd services in interntionl mrkets; chnges in politicl,

business, nd economic conditions; s well s other risks listed

or described from time to time in the Compny’s filings with

the Securities nd Exchnge Commission (the SEC), including

the Compny’s Annul Report on Form 10-K for the fiscl yer

ended December 31, 2022, nd its Qurterly Reports on Form

10-Q for the qurters ended Mrch 31, 2023; June 30, 2023;

nd November 30, 2023, which re on file with the SEC nd

vilble on the Investor Reltions pge of the Compny’s

website. Additionl informtion will lso be set forth in the

Compny’s Annul Report on Form 10-K for the yer ended

December 31, 2023. All forwrd-looking sttements represent

mngement's current expecttions nd predictions regrding

trends ffecting the Compny’s business nd industry nd

re bsed on informtion nd estimtes vilble to the

Compny t the time of this letter nd re not gurntees of

future performnce. Except s required by lw, the Compny

ssumes no obligtion to updte ny of the sttements in this

letter.

block q4 2023 29

key operating metrics and

non-gaap financial measures

To supplement our financial information presented in accordance

with generally accepted accounting principles in the United States

(GAAP), from period to period, we consider and present certain

operating and financial measures that we consider key metrics or

are not prepared in accordance with GAAP, including Gross

Payment Volume (GPV), Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted Net Income (Loss), Diluted Adjusted Net Income

(Loss) Per Share (Adjusted EPS), Adjusted Operating Income

(Loss), Adjusted Operating Income (Loss) margin, Adjusted Free

Cash Flow, constant currency, and non-GAAP operating expenses

as well as other measures defined in this letter such as measures

excluding bitcoin revenue, and measures excluding PPP loan

forgiveness gross profit. We believe these metrics and measures

are useful to facilitate period-to-period comparisons of our business

and to facilitate comparisons of our performance to that of other

payments solution providers.

We define GPV as the total dollar amount of all card payments

processed by sellers using Square, net of refunds, and ACH

transfers. Additionally, GPV includes Cash App Business GPV,

which comprises Cash App activity related to peer-to-peer

transactions received by business accounts, and peer-to-peer

payments sent from a credit card. GPV does not include

transactions from our BNPL platform.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income

(Loss), and Diluted Adjusted Net Income (Loss) Per Share (Adjusted

EPS) are non-GAAP financial measures that represent our net

income (loss) and net income (loss) per share, adjusted to eliminate

the effect of share-based compensation expenses; amortization of

intangible assets; gain or loss on revaluation of equity investments;

bitcoin impairment losses; amortization of debt discount and

issuance costs; and the gain or loss on the disposal of property and

equipment, as applicable. Adjusted Operating Income (Loss) is a

non-GAAP financial measure that represents our operating income

(loss), adjusted to eliminate the effect of amortization of acquired

technology assets; acquisition-related and integration cost,;

restructuring and other charges; goodwill impairment; bitcoin

impairment losses; amortization of customer and other acquired

intangible assets; and acquisition-related share-based acceleration

costs. We also exclude from these measures certain acquisition-

related and integration costs associated with business

combinations, and various other costs that are not reflective of our

core operating performance. We exclude amortization of intangible

assets arising from business combinations because the amount of

such expenses in any specific period may not directly correlate to

the underlying performance of our ongoing business operations.

Acquisition-related costs include amounts paid to redeem

acquirees’ unvested stock-based compensation awards, and legal,

accounting, and due diligence costs. Integration costs include

advisory and other professional services or consulting fees

necessary to integrate acquired businesses. Other costs that are

not reflective of our core business operating expenses may include

contingent losses, impairment charges, and certain litigation and

regulatory charges. We also add back the impact of the acquired

deferred revenue and deferred cost adjustment, which was written

down to fair value in purchase accounting. Additionally, for purposes

of calculating diluted Adjusted EPS, we add back cash interest

expense on convertible senior notes, as if converted at the

beginning of the period, if the impact is dilutive. In addition to the

items above, Adjusted EBITDA is a non-GAAP financial measure

that also excludes depreciation and amortization, interest income

and expense, other income and expense, and provision or benefit

from income taxes, as applicable. Adjusted Operating Income

(Loss) margin is calculated as Adjusted Operating Income (Loss)

divided by gross profit.

Adjusted EBITDA margin is calculated as Adjusted EBITDA divided

by gross profit.To calculate the diluted Adjusted EPS, we adjust the

weighted-average number of shares of common stock outstanding

for the dilutive effect of all potential shares of common stock. In

periods when we recorded an Adjusted Net Loss, the diluted

Adjusted EPS is the same as basic Adjusted EPS because the

effects of potentially dilutive items were anti-dilutive given the

Adjusted Net Loss position.

Adjusted Free Cash Flow is a non-GAAP financial measure that

represents our net cash provided by operating activities adjusted for

changes in settlements receivable, changes in customers payable,

changes in settlements payable, the purchase of property and

equipment, payments for originations of consumer receivables,

proceeds from principal repayments and sales of consumer

receivables, and sales, principal payments, and forgiveness of PPP

loans. We present Adjusted Free Cash Flow because we use it to

understand the cash generated by our business and make strategic

decisions related to our balance sheet, and because we are focused

on growing our Adjusted Free Cash Flow generation over time. It is

not intended to represent amounts available for discretionary

purposes.

Constant currency growth is calculated by assuming international

results in a given period and the comparative prior period are

translated from local currencies to the U.S. dollar at rates consistent

with the monthly average rates in the comparative prior period. We

discuss growth on a constant currency basis because a portion of our

business operates in markets outside the U.S. and is subject to

changes in foreign exchange rates.

Non-GAAP operating expenses is a non-GAAP financial measure

that represents operating expenses adjusted to remove the impact

of share-based compensation, depreciation and amortization, bitcoin

impairment losses, loss on disposal of property and equipment, and

acquisition-related integration and other costs.

We have included Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Operating Income (Loss), Adjusted Operating Income

(Loss) margin, Adjusted Net Income, Adjusted EPS, and non-GAAP

operating expenses because they are key measures used by our

management to evaluate our operating performance, generate future

operating plans, and make strategic decisions, including those

relating to operating expenses and the allocation of internal

resources. Accordingly, we believe that Adjusted EBITDA, Adjusted

EBITDA margin, Adjusted Operating Income (Loss), Adjusted

Operating Income (Loss) margin, Adjusted Net Income, Adjusted

EPS, and non-GAAP operating expenses provide useful information

to investors and others in understanding and evaluating our operating

results in the same manner as our management and board of

directors. In addition, they provide useful measures for period-to-

period comparisons of our business, as they remove the effect of

certain non-cash items and certain variable charges that do not vary

with our operations. We have included measures excluding our BNPL

platform because we believe these measures are useful in