Department of Defense | Defense Human Resources Activity

DTS Guide to Establishing LOAs and

Budgets for the New Fiscal Year

August 26, 2024

GUIDE

V23.0

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 1 travel.dod.mil

Table of Contents

Revision History .................................................................................................................... 2

Chapter 1: Overview for Establishing Lines of Accounting and Budgets ........................ 3

1.1 FDTA and BDTA Responsibilities ............................................................................................. 3

1.2 LOA List ..................................................................................................................................... 3

1.3 Reference Materials .................................................................................................................. 3

Chapter 2: Roll Over LOA to New Fiscal Year ..................................................................... 4

2.1 Roll over LOAs Using Default Rules ......................................................................................... 4

2.1.1 Error Correction ................................................................................................................. 7

2.2 Roll Over LOAs Using Custom Rules ........................................................................................ 8

2.2.1 Error Correction ............................................................................................................... 10

2.3 Copy LOA to New Fiscal Year ................................................................................................. 11

2.3.1 Copy to Create a LOA and a Quarterly Budget ............................................................... 11

2.4 Updating the Budget After Creating New Fiscal Year LOAs ................................................... 14

2.5 LOA Placeholder and Budget Item Wild Cards ....................................................................... 18

2.6 No-Year and Multi-Year Funds ................................................................................................ 18

2.6.1 Current Quarter Tracking: Rolls Over LOAs and Updates Labels................................... 18

2.6.2 Fourth Quarter Tracking: Does Not Roll Over LOAs ....................................................... 18

2.7 Account 2 Document FY (DFY) Roll Over ............................................................................... 19

Chapter 3: Updating a Traveler’s Default LOA .................................................................. 21

Chapter 4: Deleting Prior Year Lines of Accounting ........................................................ 24

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 2 travel.dod.mil

Revision History

Revision

Date

Authorization

Change Description

Page,

Section

13.0

08/11/14

DTMO

Reviewed guide for FY15

All

14.0

06/20/16

DTMO

Reviewed guide for FY16.

Replaced screen shots in Chapter 3

& 4 to reflect new budget module

layout

Chapter 3

Chapter 4

15.0

08/28/17

DTMO

Reviewed guide for FY18. Replaced

screen shots in Chapter 3 &4 to

reflect new FY

Chapter 3

Chapter 4

16.0

08/17/18

DTMO

Reviewed guide for FY19. Updated

access to DTA Maintenance Tool.

Section 2.1

17.0

08/26/19

DTMO

Reviewed guide for FY20. Updated

LOA and Budget screen shots.

Throughout

18.0

08/21/20

DTMO

Reviewed guide for FY21. Updated

LOA and Budget screen shots.

Throughout

19.0

07/26/21

DTMO

Reviewed guide for FY22. Updated

LOA and Budget screen shots.

Throughout

19.1

05/18/22

DTMO

Formatting & branding

Updated LOA and Budget screen

shots.

Throughout

20.0

06/24/22

DTMO

Updated Roll Over Custom Rules

screen shots.

Section 2.2

21.0

07/05/23

DTMO

Reviewed guide for FY24. Updated

LOA and Budget screen shots.

Throughout

22.0

08/28/23

DTMO

Removed Navy STARS examples

Section 2.7

23.0

08/26/24

DTMO

Updated slides for FY25.

Throughout

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 3 travel.dod.mil

Chapter 1: Overview for Establishing Lines of Accounting and Budgets

The fiscal year for the Department of Defense (DoD) begins on 01 October and ends on 30 September the

following calendar year. Every fiscal year, elements in the lines of accounting (LOAs) and corresponding budgets

require modification to reflect the new fiscal year. This document assists Finance Defense Travel Administrators

(FDTAs) and Budget DTAs (BDTAs) when setting up the LOAs and budgets in the Defense Travel System (DTS) for

the new fiscal year.

1.1 FDTA and BDTA Responsibilities

The process begins with the FDTA obtaining a list of LOAs (Section 1.2) and then determining the appropriate

method to create the new LOAs for the new fiscal year. Although the FDTA can Create LOAs from scratch, there

is a faster way to establish LOAs from year to year. Listed below are the three preferred methods. A more

detailed explanation of each appears later in this guide.

• Rollover Default rules – Update specific data elements based on the LOA’s format map.

• Rollover Custom rules – Allow the FDTA to customize the default rules to the fiscal year (FY) and

program year (PY).

• Copy – Used for LOAs that require custom changes to fields other than FY or PY.

Upon receipt of the new fiscal year funding, money is loaded into the new fiscal year DTS budgets, so the AO can

approve documents using new fiscal year LOAs.

1.2 LOA List

To assist FDTAs with fiscal year setup, they may access a current list of LOAs with labels and data elements in a

spreadsheet format. This can be found in the DTS DTA Maintenance Tool > Lines of Accounting > View LOA(s)

List. The FDTA should view the LOA listing and determine if any element changes are necessary for the new fiscal

year being sure to make the essential changes when rolling over and then updating or copying the new LOAs.

1.3 Reference Materials

The following documents provide additional supporting information about the fiscal year crossover process:

• Defense Travel Administrator’s (DTA) Manual, Chapter 8 and Chapter 9

• DTS Guide to Processing Authorizations for the New Fiscal Year

These documents are available at https://www.travel.dod.mil/Training/Reference-Materials.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 4 travel.dod.mil

Chapter 2: Roll Over LOA to New Fiscal Year

One method in forming the new FY LOAs is the rollover feature. Rollover allows the FDTA to select one or many

LOAs at the same time. DTS provides two means of rolling over LOAs to the new fiscal year:

• Default rules automatically update fiscal year and program year account elements in each LOA to the

designated fiscal year defined for each LOA format map. Any empty elements in the LOA will remain

empty. All other data elements within the LOA copy into the new LOA. You can modify default rules.

• Custom rules allow users to turn off individual fiscal/program year account element rules from the

default rule set. Custom rules can apply to one or more LOAs when selected in the Rollover feature.

Once the user has turned off the LOA element rules, DTS will not automatically update fiscal/year

account elements in each LOA with a specified fiscal year value.

Note: All other data elements in the LOA move over into the new LOA. If the LOA has the fiscal year designator

embedded in a data element not covered by the custom rules, follow the procedures in Section 2.3 to execute

the roll over. If needed, use Update to modify LOA Data Elements, Accounts 1 – 10.

2.1 Roll over LOAs Using Default Rules

To roll over a LOA:

Select DTA Maintenance Tool (quick link) from the DTS Dashboard, or select Administration and then

DTA Maintenance Tool and page loads.

Select DTA Maintenance Home to open a drop-down menu, then select Lines of Accounting (Figure 2-

1). The Search Lines of Accounting screen (Figure 2-2) opens.

Figure 2-1: DTA Maintenance Tool Home Page

Figure 2-2: Search Lines of Accounting Screen

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 5 travel.dod.mil

Enter the LOA name in the Label field.

-OR-

To expand the search to include all LOAs for the selected organization, leave this field blank.

Select the Format Map drop-down arrow to select a map type. To expand the search to include all map

types, leave this field blank.

Select the Organization Name drop-down arrow to select an organization. To expand the search to

include all sub-orgs, check the Include Sub-Organizations box.

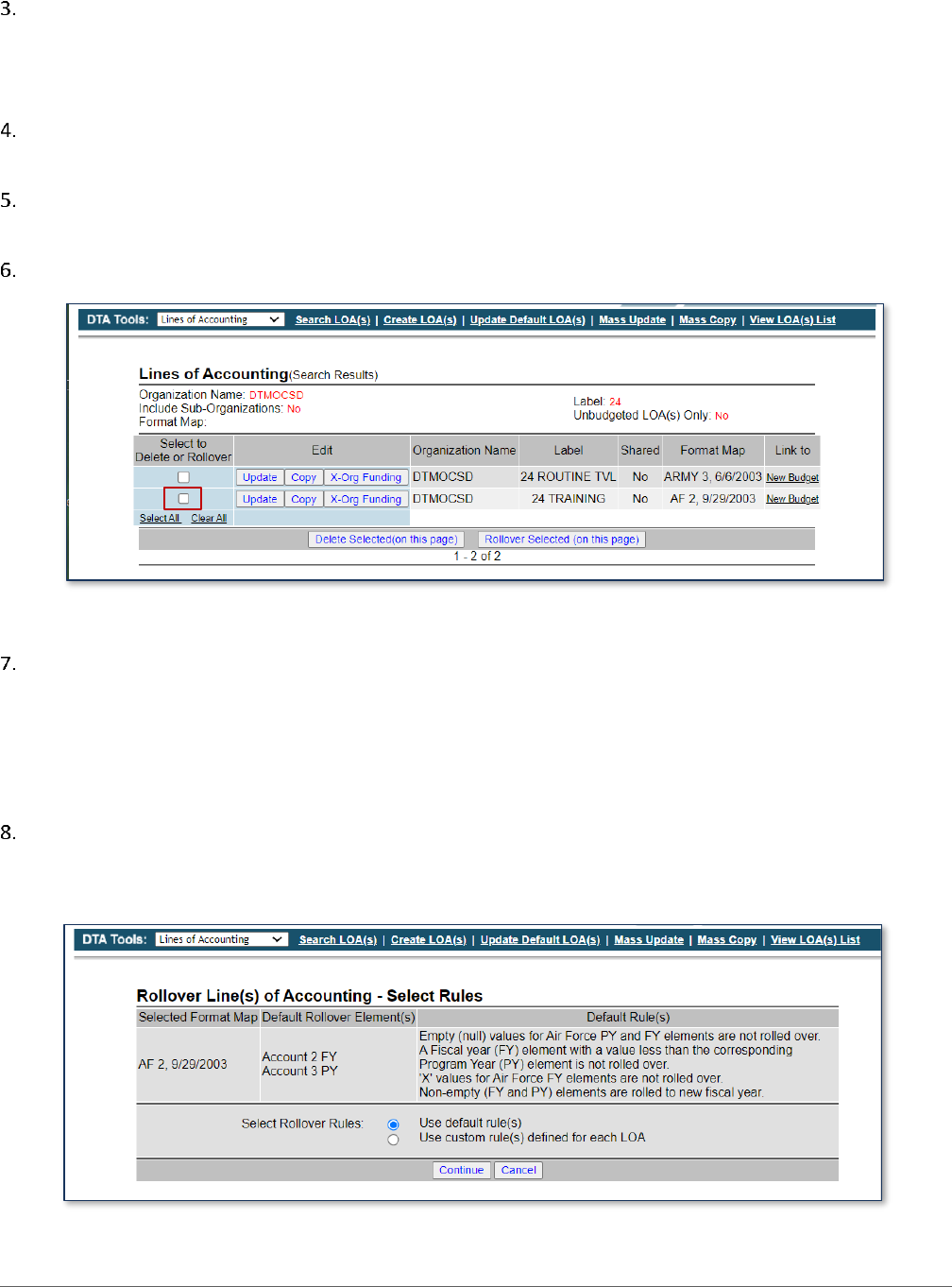

Select Search. The Lines of Accounting (Search Results) screen opens (Figure 2-3).

Figure 2-3: Lines of Accounting (Search Results) Screen

Check the box next to each LOA you want to include in the roll over or use the Select All link to select

all LOAs on the screen.

Note: The LOAs display by Organization Name, LOA Label, and Format Map. You cannot view all data

elements of the LOA once roll over is selected. Use the View LOA(s) List link to view all data elements and

verify the LOA as a candidate for roll over.

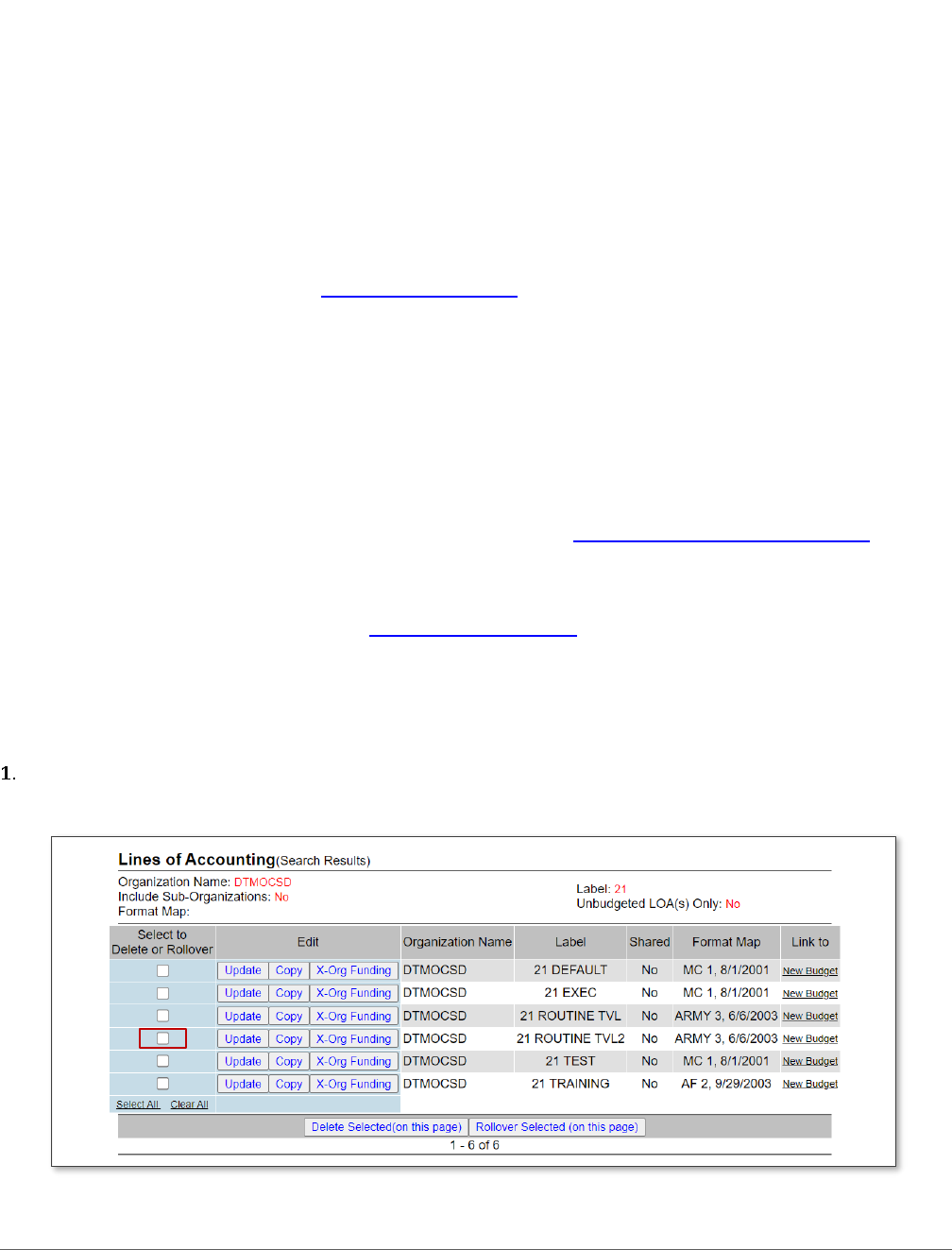

Select Rollover Selected (on this page). The Rollover Line(s) of Accounting – Select Rules screen

(Figure 2-4) opens. It displays the default rules for how DTS will complete the roll over process for the

selected LOAs.

Figure 2-4: Rollover Line(s) of Accounting – Select Rules Screen

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 6 travel.dod.mil

Select the Use default rule(s) radio button.

Select Continue. The Rollover Line(s) of Accounting – Default Rules screen opens. This screen previews

the LOAs requiring roll over. It shows the list of selected LOAs with the Organization Name, LOA Label,

Format Map, and the option to Preview the new fiscal LOA before rollover.

Enter the new fiscal year in the Rollover LOA(s) and Empty Budget Shell(s) fields (Figure 2-5) if there

are no LOA data element changes. Note: If you need to update a LOA field (Accounts 1-10), only add

the new FY in Rollover LOA(s) to Fiscal Year field, uncheck the Create Budget box and don’t create the

Empty Budget Shell at this point. Instead, after LOA rollover, Update the LOA element(s), and then

create the budget shell using the Link to column, New Budget link (Figure 2-3).

Figure 2-5: Rollover Line(s) of Accounting – Default Rules

If the organization uses annual budgets, then uncheck the Create Budget box. You must manually

create the budgets in the Budget module.

If sharing the LOA with the organization’s sub-organizations, check the box in the Shared column. Note:

Sharing LOAs means within “all” the sub-organizations. Once shared the LOA stays shared.

(Optional) If you select Preview (Figure 2-5), the new LOA Data Elements screen opens. This screen

displays the format of the LOA data elements in view only. To return to the prior screen, simply select

Close Window.

Select Rollover Line(s) of Accounting to generate the new fiscal year LOAs and empty budgets. The

Rollover Line(s) of Accounting – Confirm page opens (Figure 2-6).

Figure 2-6: Rollover Line(s) of Accounting – Confirm Screen

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 7 travel.dod.mil

Select Continue to complete the roll over process. The Rollover Lines(s) of Accounting Summary screen

confirms the number of LOAs rolled over and empty budgets created (Figure 2-7).

Figure 2-7: Rollover Lines(s) of Accounting Summary

Select OK. The Lines of Accounting (Search Results) window displays the newly established LOA (Figure

2-8).

Figure 2-8: Lines of Accounting (Search Results)

2.1.1 Error Correction

If you made an error, use one of the following options to fix it:

• Edit the LOA and associated budgets.

o Under Lines of Accounting, search for the LOA label for the organization.

o When the results appear, under the Edit column, select the Update button for the required

LOA.

o The Update Line of Accounting screen opens.

o Make any changes to the 10 by 20 Accounts 1 to Accounts 10.

o Be sure to Save Changes.

-OR-

• Delete the LOA and inactivate or delete any associated budgets. Also, see Figure 4-1 through 4-3.

o To Delete a LOA label.

▪ Under Lines of Accounting, search for the LOA Label for the organization. Once the

search results appear under Select to Delete or Rollover column for the required

LOA, check the box.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 8 travel.dod.mil

▪ Select the Deleted Selections (on this page) button.

▪ Follow the prompts.

▪ The LOA is removed from DTS. Note: Once you remove the LOA from DTS it is

permanent. You must either Create the LOA, use Copy, or Rollover feature and

Update (if needed) to establish the LOA under the organization.

• Delete a Budget item.

o From the DTS Dashboard, select Administration and then choose Budget Tool from the drop-

down (Figure 2-16).

o Within the DTS Budget Administration Tool, you will search for the Budgets under the

organization. Once the screens refreshes locate the Budget item. Select Inactivate/Delete.

▪ The Inactivate/Delete Budget Item screen opens.

• If there are no funds in the budget item, then the option to Delete displays at

the bottom of the page. Enter a comment and then select Delete. An

information message displays (Figure 2-23). Select OK. DTS brings back the

Show Budgets Results page. The deleted entry no longer appears.

• If there are funds, you can only Inactivate the budget and it remains in listing

but not useable.

2.2 Roll Over LOAs Using Custom Rules

Search for the LOAs to roll over by following the steps in Section 2.1. The Rollover Line(s) of Accounting

– Select Rules screen displays the default rules for completing the roll over process for the selected

LOAs.

Be sure to select the Use custom rule(s) defined for each LOA radio button (Figure 2-9).

Figure 2-9: Rollover Line(s) of Accounting – Select Rules Screen

Select Continue. The Rollover Lines(s) of Accounting – Custom Rules screen opens.

Complete the Rollover LOA(s) to Fiscal Year and the Empty budget Shell(s) Fiscal Year fields (Figure 2-

10).

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 9 travel.dod.mil

Figure 2-10: Rollover Lines of Accounting – Custom Rules Screen

Note 1: If a box under the Select Rollover Fields(s) columns is checked when the screen opens, the

value populated for the LOA account element rolls over in the new LOA. Clear the check from a box to

prevent the value from changing.

Note 2: If a box is unchecked under the Select Rollover Field(s) column when the screen opens, there is

no current value for the LOA account element and it will remain empty after the roll over. If you check

one of these boxes, the account element will roll over with the value that you enter in the Rollover

LOA(s) to Fiscal Year field. For example, if you enter 2025 into the Rollover LOA(s) to Fiscal Year field,

then the account element of the new LOA will be 25.

(Optional) Select Preview to view the updates to the new LOA. The new LOA Data Elements Preview

screen opens in view only. Select Close Window to return to the Custom Rules screen.

Select Rollover Line(s) of Accounting. The Rollover Line(s) of Accounting – Confirm screen opens

(Figure 2-11).

Figure 2-11: Rollover Lines of Accounting – Confirm Screen

Select Continue to complete the Roll over process.

-OR-

Select Cancel to end the action.

On the Rollover Lines(s) of Accounting Summary screen, select OK. DTS has successfully rolled over the

designated LOAs and created empty budgets, if selected. The Lines of Accounting (Search Results)

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 10 travel.dod.mil

displays the newly established LOAs (Figure 2-12). See Section 2.4 for instructions on adding funds to

the budget.

Figure 2-12: Lines of Accounting (Search Results)

2.2.1 Error Correction

If you made an error, use one of the following options to fix it:

• Edit the LOA and associated budgets.

o Under Lines of Accounting, search for the LOA label for the organization.

o When the results appear, under the Edit column, select the Update button for the required

LOA.

o The Update Line of Accounting screen opens.

o Make any changes to the 10 by 20 Accounts 1 to Accounts 10.

o Be sure to Save Changes.

-OR-

• Delete the LOA and inactivate or delete any associated budgets.

o To Delete a LOA label.

▪ Under Lines of Accounting, search for the LOA Label for the organization. Once the

search results appear under Select to Delete or Rollover column for the required

LOA, check the box.

▪ Select the Deleted Selections (on this page) button.

▪ Follow the prompts.

▪ The LOA is removed from DTS. Note: Once you remove the LOA from DTS it is

permanent. You must either Create the LOA, use Copy, or Rollover feature and

Update (if needed) to establish the LOA under the organization.

• Delete a Budget item. See Section 2.1.1 for more details and Figure 2-22 and Figure 2-23 screen shots.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 11 travel.dod.mil

2.3 Copy LOA to New Fiscal Year

Copy is another method to establish the new LOAs. Using the Copy LOA feature is much faster than using the

Create LOAs process to form the FY LOAs.

The Copy LOA feature does the following:

• Allows copying all the data elements of an existing LOA to create a new LOA for another fiscal year and

edit the elements. You can copy a LOA from one organization to another based upon organization

access. However, DTS allow allows you to copy one LOA at a time.

• If the Create Budget box is checked, DTS creates an empty quarterly budget with the copied LOA

accounting elements included. The FDTA/BDTA must access the DTS Budget Module to edit the new

budget and add funds as determined by the Resource Management Office.

2.3.1 Copy to Create a LOA and a Quarterly Budget

Use the following steps to use the Copy LOA feature to create a LOA and a quarterly budget:

Access the DTA Maintenance Tool and select Lines of Accounting (Figure 2-1). The Search Lines of

Accounting screen (Figure 2-13) opens.

Figure 2-13: Lines of Accounting (Search Results) Screen

In the Edit column, select Copy for the LOA you want to duplicate. Note: You can only select one LOA to

copy at a time. The Copy Line of Accounting screen opens (Figure 2-14).

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 12 travel.dod.mil

Figure 2-14: Copy Line of Accounting Screen - Partial View

The Format Map displays at the top of the page in view only (Indicator 1).

In the Organization Name field, enter the organization in which you want the LOA to replicate

(Indicator 2).

The Label contains 2 fields. If you copy the LOA within the same org, then you must change the Label

(Figure 3) or if you copy the LOA from one org to another, then you can keep the same Label (Figure 3)

or change it.

The Empty Budget Shell Fiscal Year field can be completed or left blank (Figure 4).

Review Table 2-1 details and determine which fields you will modify.

Table 2-1

COPY LINE OF ACCOUNTING FIELDS SCREEN

FIELD LABEL

COMMENTS

Share LOA

Checking this box shares the LOA to all subordinate

organizations. Note: A shared LOA can be unshared at any

time; however, the corresponding budget cannot be

unshared once it has been shared.

Create Budget

DTS checks this box by default. DTS automatically creates an

empty budget for the new LOA for the corresponding FY.

1

2

Review and add

data in Accounts

1 – 10 and update

the data.

3

4

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 13 travel.dod.mil

Clear this box if the organization uses annual budgets. If

cleared, the budget requires manual creation in the Budget

module.

Empty Budget Shell Fiscal

Year*

Enter the 4-digit year for the new FY. This is only required if

you selected Create Budget.

LABEL

LOA Fiscal Year*

DTS populates this field automatically, based on the selected

LOA. Enter the 2-digit year for the new FY. This becomes part

of the label name.

LOA Name*

DTS populates this field automatically, based on the label

value of the selected LOA. If copying the LOA into the same

organization, you must change the label name. Each LOA

within an organization must have a distinct label name.

LOA DATA ELEMENTS

Fiscal Year Related

Elements

Update the necessary fiscal year related elements (e.g., FY,

PY, DFY, BFY, EFY) in the format map to reflect the new FY.

The copy function does not automatically roll over the values.

Remaining Data Elements

Make other necessary changes to the remaining data

elements in the format map.

*Signifies required field

Select Save Copied Line of Accounting to create the new fiscal year LOA and the empty budget (if

selected) for the corresponding LOA. If you left Create Budget checked, DTS will create an empty

quarterly budget for the copied LOA in the Budget module. The FDTA will have to add funds to the

budgets prior to use. Note: See Section 2.4 for instructions on adding funds to the budget.

The Lines of Accounting (Search Results) screen (Figure 2-15) displays the copied LOA.

Figure 2-15: Lines of Accounting (Search Results)

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 14 travel.dod.mil

2.4 Updating the Budget After Creating New Fiscal Year LOAs

Use the following steps to add funds to a budget in DTS. For additional information on the DTS Budget Tool, see

the DTA Manual, Chapter 9: Budgets.

From the DTS Dashboard, select Administration and then select Budget Tool from the drop-down

(Figure 2-16).

Figure 2-16: DTS Dashboard

The DTS Budget Administration Tool (Welcome) screen (Figure 2-17) opens.

Figure 2-17: DTS Budget Administration Tool Screen

Select Budget Maintenance from the navigation bar (Figure 2-17). The Budget Maintenance Function

screen (Figure 2-18). Opens.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 15 travel.dod.mil

Figure 2-18: Budget Maintenance Function Screen

Select Show Budgets. The Show Budgets screen (Figure 2-19) appears.

Figure 2-19: Show Budgets Screen

Choose the Fiscal Year for the budget(s) that you want to edit. The Organization will populate with

your highest organization access. Place a check in Include Sub Organizations box if you have sub-

organizations you need to see. Change the field and only view a single organization at a time.

You may leave the Budget Label blank if you wish to see all the budgets in your organization or enter a

single item to view.

Select Show Budgets for Selected Organization(s) to display available budgets. The Show Budgets

Results screen (Figure 2-20) opens.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 16 travel.dod.mil

Figure 2-20: Show Budgets Results Screen

Locate the newly created budget label by the roll over or copy process. Select Edit next to the budget

label. The Edit Budget Item screen (Figure 2-21) opens.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 17 travel.dod.mil

Figure 2-21: Edit Budget Item Screen

(Optional) Select the Yes radio button in the Shared field if you want to share the budget.

Update the Funding Target Adjustments fields.

Complete the Remarks field.

Scroll to the bottom of the page and select Save.

DTS returns you to the Show Budget Results screen reflecting the updated funding targets.

Repeat the process of updating funding targets for each newly created empty budget by the roll over or

copy process.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 18 travel.dod.mil

Note: When setting up a new LOA (DTA Maintenance Tool, LOAs) if you don’t check the box to automatically

create the budget, then you must remember go back, create the budget and add funds. For complete details,

see the DTA Manual, Chapter 9: Budgets.

2.5 LOA Placeholder and Budget Item Wild Cards

LOA placeholders roll over with each LOA. If the FDTA elected to create a budget during roll over, the

placeholders must be replaced in the new fiscal year budget with an asterisk (*) to indicate a wild card. You can

add the wild card using the Mass Update feature in the Budget module, or when initially setting up funds.

For organizations using multiple LOAs that roll up to single budget using wild cards, the FDTA should coordinate

and decide whether to create budgets at roll over. If creating budgets, the FDTA/BDTA must ensure the

following:

• The wild card is entered in one new fiscal year budget

• Delete or inactivate the remainder of the budgets not required

2.6 No-Year and Multi-Year Funds

Some organizations travel on funds that are available for multiple-year obligations. These are No-Year or Multi-

Year funds. Users may choose one of the following options for using these fund types:

• Current quarter tracking that rolls over LOAs (this updates the labels only)

• Fourth quarter tracking (does not roll over the LOAs)

Sections 2.6.1 and 2.6.2 explain how to use these types of funds. The FDTA/BDTA must determine the

appropriate option for the site.

Note: Sites using Multi-Year or No-Year funds cannot use a LOA more than once in a document. Users who roll

over the LOAs cannot use a current and next fiscal year LOA on a document if all the data elements in the LOAs

are the same. Use one or the other for the entire trip.

2.6.1 Current Quarter Tracking: Rolls Over LOAs and Updates Labels

Use this option for sites that want to track funds quarterly in the new fiscal year budget. The advantage is that

the BDTA can track funds in the actual quarter in which the documents are stamped APPROVED.

This option uses the default roll over feature in the DTA Maintenance Tool, Lines of Accounting module, as

explained in Section 2.1. When using the roll over feature, any values in the FY or field designated in the default

rules for that format map will not change. This results in a new LOA label with the new fiscal year without

changing any of the LOA elements (e.g., 24 Training rolls over to 25 Training). DTS treats LOAs with the same

LOA details as the same LOA, even if the label is different.

2.6.2 Fourth Quarter Tracking: Does Not Roll Over LOAs

The second option is to continue using LOAs that have the current fiscal year in the label into the next and future

fiscal years. When choosing this option, once the new fiscal year begins, all document approvals using LOAs with

labels containing the previous fiscal year will fund in the previous fiscal year budget item’s fourth quarter only.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 19 travel.dod.mil

2.7 Account 2 Document FY (DFY) Roll Over

Check with your Component on LOA Format rules for Account 2.

Expenses incurred in FY24 allocate to a FY24 LOA that has a document fiscal year (DFY) data element of 24.

Normal LOA roll over creates a new fiscal year LOA with a DFY of 25. Table 2-2 provides the relevant roll over

data elements for the types of fiscal year trips (an all-FY24 trip, a crossover trip starting in FY24 and ending in

FY25, and a new all-FY25 trip).

Table 2-2

ROLLOVER DATA ELEMENTS

Travel FY

LOA Document

FY Acct 2/DFY

FY (Beginning)

Acct 3/BFY

PY (Ending)

Acct 3/EFY

FY 24 Trip

24/24

4

4

FY 24-25 Crossover Trip

(September departure, October return)

24/24

24/25

4

5

4

5

FY 25 Trip

25/25

5

5

If your LOA format accomplishes the roll over for LOAs from the previous fiscal year to the new fiscal year then

Table 2-2 examples accommodates next fiscal year trips created in the current fiscal year.

For the next fiscal year costs in crossover trips, a second custom roll over of the LOA is necessary.

Since duplicate LOA labels are not permissible, when a LOA label already exists (from roll over only), DTS should

display the following prompt:

“A duplicate label already exists. If you want to proceed, DTS will automatically add an X to the end of the label.

If the label is at the maximum length, the last character of the label is replaced with an X (XX Training becomes

XX Training X). Select OK to proceed or Cancel to return.”

This allows the FDTAs to roll over the current fiscal year LOAs into the next fiscal year while keeping the current

fiscal year DFY. Using the custom roll over rules for trips that cross fiscal years, the FDTA essentially rolls over

the LOA twice. This functionality is available for all LOA formats.

Budget Item Removal: If a Budget Label ending in an X (due to a rolled over LOA) or any budget item was

unintentional, just search for the Budget Item, and then select Inactivate/Delete (Figure 2-22).

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 20 travel.dod.mil

Figure 2-22: Show Budgets Results Screen

The Inactivate/Delete Budget Item screen opens. If there are no funds in the budget item, then the option to

Delete displays at the bottom of the page. Enter a comment and then select Delete. An information message

displays (Figure 2-23). Select OK.

Figure 2-23: Information Message

DTS brings back the Show Budgets Results page. The deleted entry no longer appears.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 21 travel.dod.mil

Chapter 3: Updating a Traveler’s Default LOA

The DTA Maintenance Tool allows a DTA to update the default LOA label for multiple travelers’ profiles within

the organization. Making the profile changes using the Default LOA Update features saves time. The default LOA

label appears in the traveler’s profile as soon as the update in the LOA table occurs. When a traveler creates a

trip in DTS, the default LOA automatically appears on the document. Travelers can add additional LOAs to their

document if necessary or switch to different LOA per mission. Note: Some organizations do not apply a default

LOA label in a traveler’s profile. Instead, at document creation based upon the mission the traveler or document

creator selects the appropriate LOA.

Follow your local business rules regarding setting at default LOA in a profile. For more on lines of accounting

(LOAs), see the DTA Manual, Chapter 8: LOAs.

To change most or all personnel in the organization to a new default LOA:

Access the DTA Maintenance Tool and select Lines of Accounting. The Lines of Accounting (Search

Results) screen appears.

From the Navigation Bar, select Update Default LOA(s). The Default LOA Update screen opens (Figure

3-1).

Figure 3-1: Default LOA Update Screen

The Organization Name will default to your highest organization access.

You can leave the Existing Default LOA Label blank or select a specific label.

Select the New Default LOA Label drop-down menu to choose the new default LOA.

Place a check in the Include All Users box to display all personnel in the organization and their current

default LOA.

Select Submit. The Default LOA Update Person (Search Results) screen opens (Figure 3-2).

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 22 travel.dod.mil

Figure 3-2: Default LOA Update Person (Search Results) Screen

In the Select to Include in Update column beside each person’s default LOA, check the box to update

the person’s profile. Then select Submit. DTS updates the profiles based upon your selection.

If you selected every profile row to update, then DTS makes the changes and the Search Results page

updates to reflect No matches found for the specified search criteria (Figure 3-3). If you only updated a

few profiles, then DTS provides the update results (e.g., 2 - 2 of 5 rows updated).

Figure 3-3: Default LOA Update Person (Search Results - After LOA Changes Applied) Screen

Repeat this process for each sub-organization.

To change some of the personnel in the organization to a new default LOA, follow Steps 1 through 3 above then:

Select the Organization Name; then choose the Existing Default LOA Label you want replaced from the

drop-down list (Figure 3-4).

Select the New Default LOA Label from the drop-down list (Figure 3-4).

Figure 3-4: Default LOA Update (Search Results) Screen

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 23 travel.dod.mil

Select Submit. DTS searches for any profiles which match the criteria and displays the results (Figure 3-

5).

Figure 3-5: Default LOA Update Person (Search Results) Screen

In the Select to Include in Update column beside each person’s default LOA, check the box to update

the person’s profile. Then select Submit (Figure 3-4). DTS will replace only the selected existing default

LOA with the new default LOA; all other existing LOAs will remain unchanged.

Repeat this process for each new default LOA and for each sub-organization. Once you make all the LOA label

updates, you can verify the changes by searching the existing LOAs under Update Default (LOAs) or you can

view the Default LOA in the profiles individually or running a view listing under the People module. See the DTA

Manual, Chapter 7 for more on profiles.

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 24 travel.dod.mil

Chapter 4: Deleting Prior Year Lines of Accounting

Based upon local procedures, organizations will provide guidance on using the new LOAs for new FY trips, cease

using of the prior year LOAs, and determine when to remove older LOAs from DTS. The prior year LOAs do not

require removal from DTS as soon as the fiscal year begins. In fact, some organizations wait until midway

through the new fiscal year before deleting prior year LOAs while other organizations keep up to three fiscal

years of LOAs in DTS to support multi-year funding and travel audits. Note: Be sure to follow your local guidance

for maintaining LOAs and FY cross-over procedures.

DTS allows deletion of one or multiple LOAs at a time from the DTA Maintenance Tool, Lines of Accounting

module. Before removing a LOA consider the following: the organization’s funding type (single year vs multi-year

funds), outstanding voucher payments, amended orders pending voucher submission (e.g., long term travel),

and travel compliance audits. See the DTA Manual, Chapter 8 for more on LOAs.

The DTAs should:

• Run the DTS Unsubmitted Voucher report to review the documents at the end of the FY at a minimum.

o If there are vouchers not approved, notify the AOs to act.

o If there are vouchers (for approved authorizations) not processed, notify the travelers file the

vouchers and AOs to act.

o If there are authorizations not cancelled due to non-travel then have the travelers and AOs

follow the cancellation procedures in DTS. See the Trip Cancellation Procedures in DTS info

paper.

• Verify open documents clear, and if your local process allows, remove the LOAs in DTS. To learn about

the DTS Report Scheduler, see the DTA Manual, Chapter 10.

• Consult your local business rules on the travel audit process. If your organization is undergoing a travel

audit, then do not remove any LOAs without first seeking guidance.

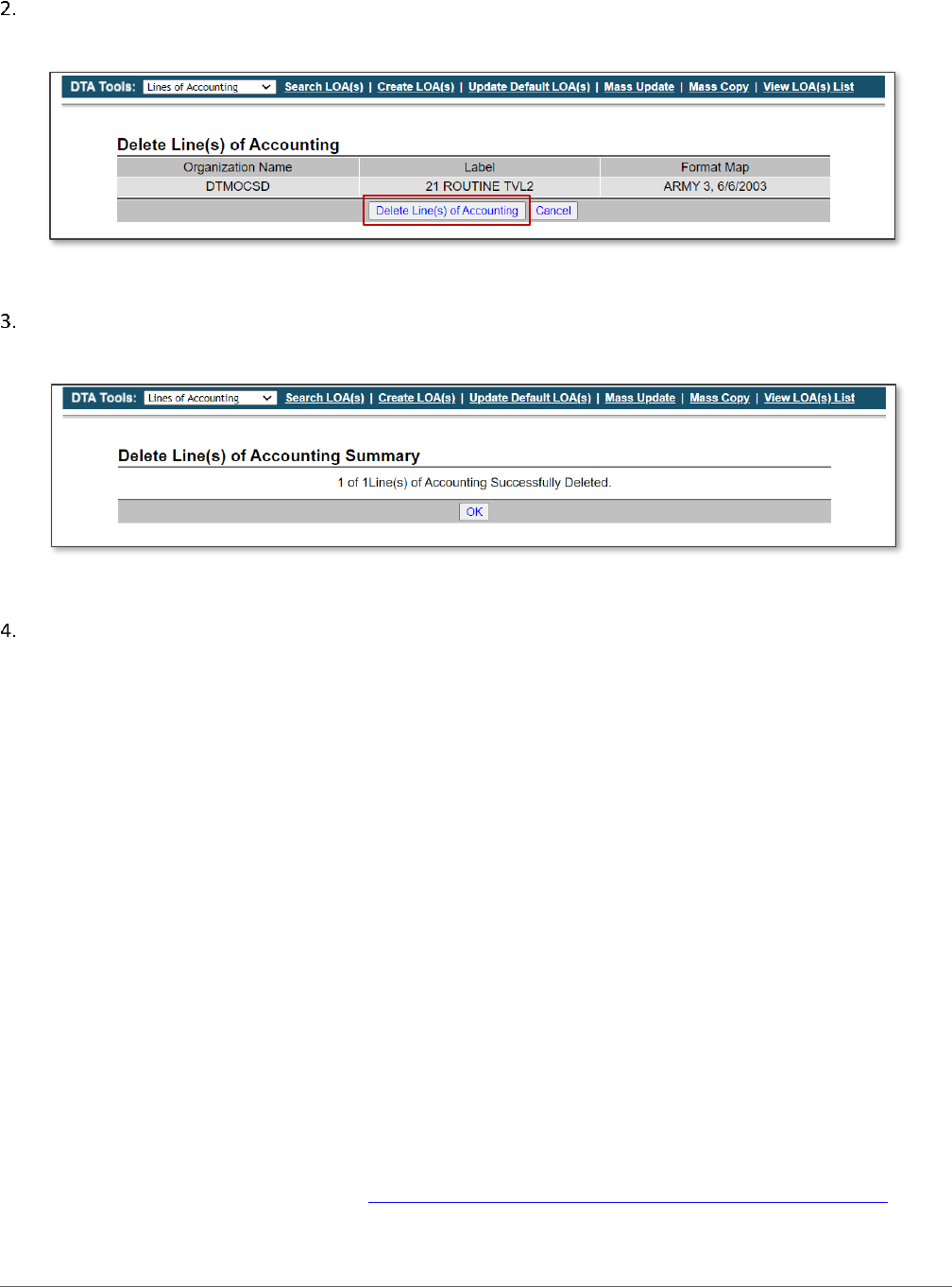

Here is how to delete a LOA:

Access the DTA Maintenance Tool and select Lines of Accounting. The Search Lines of Accounting

screen (Figure 4-1) opens.

Figure 4-1: Lines of Accounting (Search Results) Screen

Guide: Establishing LOAs and Budgets for the New FY August 26, 2024

Defense Travel Management Office 25 travel.dod.mil

In the Select to Delete or Rollover column for each LOA Label, check the box to remove. Then select

Delete Selected (on this page) (Figure 4-1). The Delete Line(s) of Accounting screen opens (Figure 4-2).

Figure 4-2: Delete Line(s) of Accounting Screen

Select Delete Line(s) of Accounting. The Delete Line(s) of Accounting Summary page appears (Figure 4-

3). DTS provides a confirmation of the removed LOA.

Figure 4-3: Delete Line(s) of Accounting Summary Screen

Select OK. The Search Lines of Accounting screen displays. The LOA no longer appears on the LOA list.

Here are a few key document processing and LOA rules:

• When approving a document, DTS checks the trip to verify there is a LOA present, the LOA on the

document matches the LOA (10 by 20) in the LOA (master accounting codes) table, and there is an

active Budget item with ample funds to process the document. If any of the three checks fail, then the

AO can’t approve the document. Contact the FDTA for support.

• Removing a LOA from the DTA Maintenance Tool, Lines of Accounting module, only removes the LOA

from the module and doesn’t remove the LOA from a document. Determine the correct LOA necessary

to process the trip. Then ensure the proper LOA is entered into the document.

• Editing or amending a document that contains a deleted LOA from the DTA Maintenance Tool, triggers

a Pre-Audit flag indicating, “Acct code does not exist in the master table.” To clear the flag:

o If the removed LOA should be available, contact the FDTA to add the LOA back into the LOA

master table. Re-add the LOA to the trip and proceed with document processing.

o If a new LOA is necessary then remove the incorrect LOA from the document, add the new

LOA, and proceed with document processing.

• Processing a trip with a prior year LOA, triggers a Pre-Audit flag. Enter a justification for using the prior

year LOA on the Pre-Audit Trip screen. Then proceed with document processing.

To learn more about FY Cross-over, see the DTS Guide to Processing Authorizations in the New Fiscal Year.