Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scannable, but the online version of it, printed from this website, is not. Do not print and file

copy A downloaded from this website; a penalty may be imposed for filing with the IRS

information return forms that can’t be scanned. See part O in the current General

Instructions for Certain Information Returns, available at IRS.gov/Form1099, for more

information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be

downloaded and printed and used to satisfy the requirement to provide the information to

the recipient.

If you have 10 or more information returns to file, you may be required to file e-file. Go to

IRS.gov/InfoReturn for e-file options.

If you have fewer than 10 information returns to file, we strongly encourage you to e-file. If

you want to file them on paper, you can place an order for the official IRS information

returns, which include a scannable Copy A for filing with the IRS and all other applicable

copies of the form, at IRS.gov/EmployerForms. We’ll mail you the forms you request and

their instructions, as well as any publications you may order.

See Publications 1141, 1167, and 1179 for more information about printing these forms.

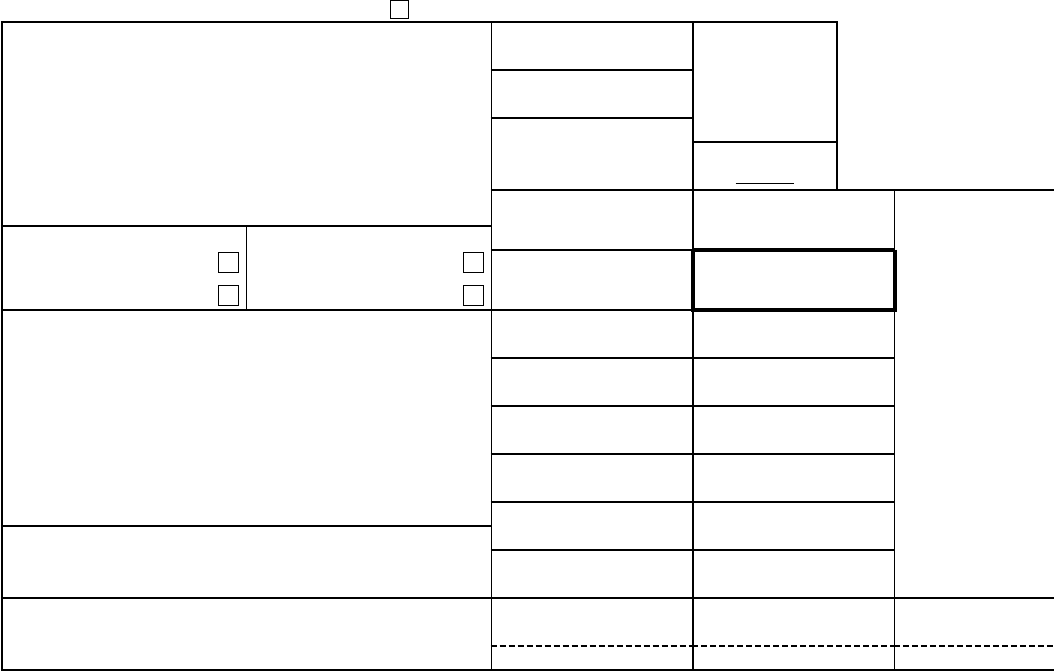

Form 1099-K

(Rev. March 2024)

Cat. No. 54118B

Payment Card and

Third Party

Network

Transactions

Copy A

For

Internal Revenue

Service Center

File with Form 1096.

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2205

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

current General

Instructions for

Certain Information

Returns.

For calendar year

1010

VOID CORRECTED

FILER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

Check to indicate if FILER is a (an):

Payment settlement entity (PSE)

Electronic Payment Facilitator

(EPF)/Other third party

Check to indicate transactions

reported are:

Payment card

Third party network

PAYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

PSE’S name and telephone number

Account number (see instructions) 2nd TIN not.

FILER’S TIN

PAYEE’S TIN

1a Gross amount of payment

card/third party network

transactions

$

1b Card Not Present

transactions

$

2 Merchant category code

3 Number of payment

transactions

4 Federal income tax

withheld

$

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

6 State 7 State identification no. 8

State income tax withheld

$

$

Form 1099-K (Rev. 3-2024)

www.irs.gov/Form1099K

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

Form 1099-K

(Rev. March 2024)

Payment Card and

Third Party

Network

Transactions

Copy 1

For State Tax

Department

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2205

For calendar year

VOID CORRECTED

FILER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

Check to indicate if FILER is a (an):

Payment settlement entity (PSE)

Electronic Payment Facilitator

(EPF)/Other third party

Check to indicate transactions

reported are:

Payment card

Third party network

PAYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

PSE’S name and telephone number

Account number (see instructions)

FILER’S TIN

PAYEE’S TIN

1a Gross amount of payment

card/third party network

transactions

$

1b Card Not Present

transactions

$

2 Merchant category code

3 Number of payment

transactions

4 Federal income tax

withheld

$

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

6 State 7 State identification no. 8

State income tax withheld

$

$

Form 1099-K (Rev. 3-2024)

www.irs.gov/Form1099K

Form 1099-K

(Rev. March 2024)

Payment Card and

Third Party

Network

Transactions

Copy B

For Payee

Department of the Treasury - Internal Revenue Service

This is important tax

information and is

being furnished to

the IRS. If you are

required to file a

return, a negligence

penalty or other

sanction may be

imposed on you if

taxable income

results from this

transaction and the

IRS determines that it

has not been

reported.

OMB No. 1545-2205

For calendar year

CORRECTED (if checked)

FILER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

Check to indicate if FILER is a (an):

Payment settlement entity (PSE)

Electronic Payment Facilitator

(EPF)/Other third party

Check to indicate transactions

reported are:

Payment card

Third party network

PAYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

PSE’S name and telephone number

Account number (see instructions)

FILER’S TIN

PAYEE’S TIN

1a Gross amount of payment

card/third party network

transactions

$

1b Card Not Present

transactions

$

2 Merchant category code

3 Number of payment

transactions

4 Federal income tax

withheld

$

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

6 State 7 State identification no. 8

State income tax withheld

$

$

Form 1099-K (Rev. 3-2024)

(Keep for your records) www.irs.gov/Form1099K

Instructions for Payee

You have received this form because you have either (a) accepted

payment cards for payments, or (b) received payments through a third

party network in the calendar year reported on this form. Merchant

acquirers and third party settlement organizations, as payment

settlement entities (PSEs), must report the proceeds of payment card

and third party network transactions made to you on Form 1099-K

under Internal Revenue Code section 6050W. The PSE may have

contracted with an electronic payment facilitator (EPF) or other third

party payer to make payments to you.

If you have questions about the amounts reported on this form,

contact the FILER whose information is shown in the upper left corner

on the front of this form. If you do not recognize the FILER shown in

the upper left corner of the form, contact the PSE whose name and

phone number are shown in the lower left corner of the form above

your account number.

Note: For more information on why you received your Form 1099-K,

go to www.irs.gov/KnowYour1099K. For information on what to do

with your Form 1099-K, go to www.irs.gov/businesses/what-to-do-

with-form-1099-k.

If the Form 1099-K is related to your business, see Pub. 334 for

more information. If the Form 1099-K is related to your work as part of

the gig economy, go to www.irs.gov/GigEconomy.

See the separate instructions for your income tax return for using

the information reported on this form.

Payee’s taxpayer identification number (TIN). For your protection,

this form may show only the last four digits of your TIN (social security

number (SSN), individual taxpayer identification number (ITIN),

adoption taxpayer identification number (ATIN), or employer

identification number (EIN)). However, the issuer has reported your

complete TIN to the IRS.

Account number. May show an account number or other unique

number the PSE assigned to distinguish your account.

Box 1a. Shows the aggregate gross amount of payment card/third

party network transactions made to you through the PSE during the

calendar year.

Note: The gross amount is the total dollar amount of total reportable

payment transactions without regard to any adjustments for credits,

cash equivalents, discount amounts, fees, refunded amounts,

shipping amounts, or any other amounts. The dollar amount of each

transaction is determined on the date of the transaction.

Box 1b. Shows the aggregate gross amount of all reportable payment

transactions made to you through the PSE during the calendar year

where the card was not present at the time of the transaction or the

card number was keyed into the terminal. Typically, this relates to

online sales, phone sales, or catalogue sales. If the box for third party

network is checked, or if these are third party network transactions,

Card Not Present transactions will not be reported.

Box 2. Shows the merchant category code used for payment card/

third party network transactions (if available) reported on this form.

Box 3. Shows the number of payment transactions (not including

refund transactions) processed through the payment card/third party

network.

Box 4. Shows backup withholding. Generally, a payer must backup

withhold if you did not furnish your TIN or you did not furnish the

correct TIN to the payer. See Form W-9, Request for Taxpayer

Identification Number and Certification, and Pub. 505. Include this

amount on your income tax return as tax withheld.

Boxes 5a–5l. Show the gross amount of payment card/third party

network transactions made to you for each month of the calendar

year.

Boxes 6–8. Show state and local income tax withheld from the

payments.

Future developments. For the latest information about developments

related to Form 1099-K and its instructions, such as legislation

enacted after they were published, go to www.irs.gov/Form1099K.

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify

for no-cost online federal tax preparation, e-filing, and direct deposit

or payment options.

Form 1099-K

(Rev. March 2024)

Payment Card and

Third Party

Network

Transactions

Copy 2

To be filed with the

recipient’s state

income tax return,

when required.

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2205

For calendar year

CORRECTED (if checked)

FILER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

Check to indicate if FILER is a (an):

Payment settlement entity (PSE)

Electronic Payment Facilitator

(EPF)/Other third party

Check to indicate transactions

reported are:

Payment card

Third party network

PAYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

PSE’S name and telephone number

Account number (see instructions)

FILER’S TIN

PAYEE’S TIN

1a Gross amount of payment

card/third party network

transactions

$

1b Card Not Present

transactions

$

2 Merchant category code

3 Number of payment

transactions

4 Federal income tax

withheld

$

5a January

$

5b February

$

5c March

$

5d April

$

5e May

$

5f June

$

5g July

$

5h August

$

5i September

$

5j October

$

5k November

$

5l December

$

6 State 7 State identification no. 8

State income tax withheld

$

$

Form 1099-K (Rev. 3-2024)

www.irs.gov/Form1099K