1

April 22, 2024

Jason Almonte

Director for Large Bank Licensing

7 Times Square

10th Floor Mailroom

New York, New York 10036

Licensing@occ.treas.gov

RE: Application by Capital One, National Association to acquire Discover Bank

Dear Director Almonte,

The National Community Reinvestment Coalition (NCRC) and our undersigned member

organizations and partners request that the Office of the Comptroller of the Currency (OCC) and

the Federal Reserve deny Capital One’s application to acquire Discover Financial Services and

Discover Bank. If approved, this merger would further consolidate the credit card industry, reduce

options for customers with lower credit scores, and give Capital One the ability and incentive to

raise debit interchange fees. Capital One would also become the sixth largest US bank by assets,

greatly increasing risk for the entire financial system in the event of an economic downturn given

their vulnerable and limited business model. Capital One’s business practices and merger history

also call into question how this merger would serve the public’s convenience and needs.

NCRC is a network of organizations and individuals dedicated to creating a nation that not

only promises but delivers opportunities for all Americans to build wealth and live well. We work

with community leaders, policymakers and institutions to advance solutions and build the will to

solve America’s persistent racial and socio-economic wealth, income and opportunity divides, and

to make a Just Economy a national priority and a local reality.

We have organized this comment letter using factors established by the Bank Merger Act, often

referred to as the four prongs of merger review.

1

The following is an outline that shows that none

of these factors supports approval, with more detail provided in the rest of the comment.

1

Licensing Manual: Business Combinations | OCC (treas.gov); cited by Acting Comptroller of the Currency Michael

J. Hsu Remarks at Brookings “Bank Mergers and Industry Resiliency” May 9, 2022. Page 2.

https://www.occ.gov/news-issuances/speeches/2022/pub-speech-2022-49.pdf

2

● The effect of the proposed business combination on competition (“competition

prong”);

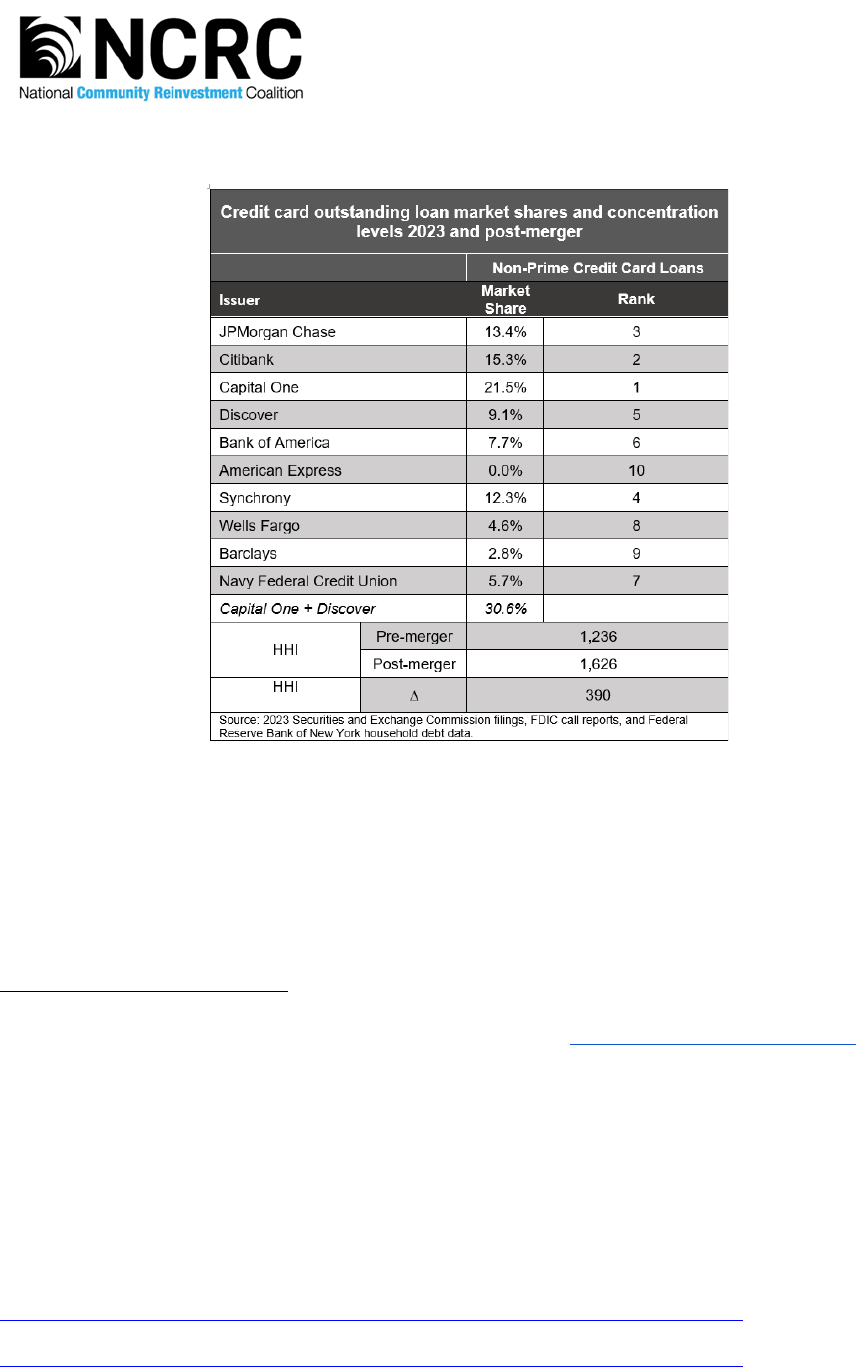

o Credit Cards - The US credit card market is already highly concentrated, with

indicators of a lack of price competition among the largest credit card companies.

Capital One in particular is already one of the most expensive options for customers

of all credit types. Analysis of this merger should also focus on how this will affect

competition in the non-prime credit card market, as these borrowers have fewer

options, and preliminary analysis suggests that Capital One and Discover’s market

share of outstanding non-prime credit card debt results in a presumption that this is

an anti-competitive merger.

o Debit Cards and Interchange Fees - Capital One wants this merger because it would

exempt them from regulatory caps on fees charged to merchants when they use

debit cards to make purchases. If approved, Capital One would have the ability, and

incentive, to raise fees.

o Unlikely to Compete with Visa and Mastercard - Previous credit card mergers have

not resulted in benefits to consumers. In addition, this merger may actually increase

Visa’s dominance of the credit card market and start a wave of payment network

mergers.

● The financial and managerial resources and future prospects of the existing or

proposed institutions (“safety and soundness prong”);

o Financial Resources - Capital One’s concentration in non-prime credit card and

auto lending, combined with rising delinquency rates in both these sectors, raise

serious concerns about Capital One’s ability to withstand an economic downturn.

o Managerial Resources - Capital One’s repeat violations of antitrust, banking,

consumer, and discrimination laws indicate significant compliance deficiencies and

suggest that Capital One is already too-big-to-manage at its current size, and may

even be too-big-to-care about complying with federal and state laws.

● The probable effects of the business combination on the convenience and needs of the

community served (“convenience and needs prong”);

o Capital One claims it will develop a community benefits plan, but they have not

lived up to similar claims in the past. In 2012 Capital One made a $180 billion

commitment related to their merger with ING Direct that included a $28.5 billion

commitment to mortgage lending. However, Capital One did not deliver on this

commitment and exited mortgage lending in 2017. Banks cannot continue to meet

the convenience and needs prong of merger review with empty promises that are

not monitored or enforced after the merger is completed. Commitments must be

part of the merger approval, legally binding, monitored, and enforceable. Capital

One’s predatory business practices also cast doubt on their ability to serve the needs

3

of borrowers with lower credit scores.

● The risk to the stability of the U.S. banking and financial system (“financial stability

prong”)

o Combining Capital One and Discover’s non-prime credit card portfolios would

create a bank with unacceptable credit concentration risk. Adding in Capital One’s

auto lending, the proposed merger would mean the nation’s 6th largest bank has a

concentration of loans to a single group of borrowers, is overexposed and unlikely

to be able to withstand an economic downturn. If Capital One were to fail, only a

few of our largest banks would have the capability of acquiring them, which would

significantly increase consolidation of the US banking system.

COMPETITION

Credit Cards

The US credit card market is already highly concentrated, with indicators of a lack of price

competition among the largest credit card companies. Capital One in particular is already one of

the most expensive options for customers of all credit types. Analysis of this merger should also

focus on how this merger would affect competition in the credit card market for borrowers with

non-prime credit scores, as these borrowers have fewer options, and preliminary analysis suggests

that Capital One and Discover’s market share of outstanding non-prime credit card debt results

in a presumption that this is an anti-competitive merger.

This merger would make Capital One the largest credit card issuer in the US with a 20%

share of outstanding credit card debt, 23% more than JPMorgan Chase the current largest credit

card debt holder.

2

The US credit card market is already highly concentrated. The Consumer

Financial Protection Bureau (CFPB) reports that the top ten issuers in terms of outstanding credit

card debt represent 83% of credit card loans in 2022, and that no single issuer outside the top 15

represented more than 1% of total credit card loans.

3

Outstanding balances is the ideal way to

measure concentration in the credit card industry, not purchasing volume, as interest income on

balances accounts for nearly 80% of credit card profitability.

4

This is well known by Capital One

2

“A Capital One-Discover Merger Could Raise Credit Card Interest Rates.” Forbes. March 16, 2024.

https://www.forbes.com/sites/elenabotella/2024/03/16/a-capital-onediscover-merger-could-raise-card-interest-

rates/?sh=105599af1513 and “Capital One Plots Largest Credit Card Acquisition Ever. Will Regulators Play Ball?”

Investor’s Business Daily. February 20, 2024. https://www.investors.com/news/capital-one-plots-largest-credit-card-

acquisition-ever-will-regulators-play-ball/

3

2023 Consumer Credit Card Market Report. CFPB. Page 18.

https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2023.pdf

4

“Credit Card Profitability.” FEDS Notes. September 9, 2022. https://www.federalreserve.gov/econres/notes/feds-

4

as regulatory filings reveal that interest charged to cardholders on outstanding balances accounts

for more than half of Capital One’s total net revenue.

5

The largest credit card companies continue to set interest rates far above the cost of offering

credit, with an average APR margin of 15.4 percentage points above the prime rate in 2022,

indicative of a lack of price competition among the largest companies.

6

This coincides with US

credit card debt surpassing $1 trillion for the first time in 2022 and with one in ten credit card users

finding themselves trapped in a vicious cycle of “persistent debt” by being charged more in interest

and fees each year than they pay toward the principal debt.

7

Capital One in particular stands out as a higher priced option for all consumers. We

compared Capital One’s median purchase APR by credit tiers on their general purpose credit cards

to the median purchase APR of small credit card issuers identified by the CFPB.

The chart above shows that Capital One’s median APR is 43% higher than small issuers

for customers in the lowest credit tier, as well as 67% higher for customers in the highest credit

tier.

8

If approved, Capital One would be able to raise Discover’s existing customer’s interest rates

to match Capital One’s higher interest rates for all new purchases.

9

notes/credit-card-profitability-20220909.html

5

“Capital One-Discover: A Competition Policy and Regulatory Deep Dive.” American Economic Liberties Project.

March 21, 2024. https://www.economicliberties.us/our-work/capital-one-discover-a-competition-policy-and-

regulatory-deep-dive/ In 2023, Capital One earned $19.7 billion in net interest income from credit cards out of a total

of $36.8 billion in net revenue. See: Capital One Financial Corp, Form 10-K For the Year Ended December 31, 2023,

SEC filing, Feb. 24, 2023, https://ir-capitalone.gcs-web.com/static-files/994c8bec-608e-49d1-8ae2-a039bc43ba54.

6

“CFPB Report Finds Credit Card Companies Charged Consumers Record-High $130 Billion in Interest and Fees in

2022.” https://www.consumerfinance.gov/about-us/newsroom/cfpb-report-finds-credit-card-companies-charged-

consumers-record-high-130-billion-in-interest-and-fees-in-2022/

7

Ibid.

8

NCRC Analysis. https://www.datawrapper.de/_/wKPZ4/ and “Credit card data: Small issuers offer lower rates.”

CFPB. February 16, 2024. https://www.consumerfinance.gov/data-research/research-reports/credit-card-data-small-

issuers-offer-lower-rates/

9

“A Capital One-Discover Merger Could Raise Credit Card Interest Rates.” Forbes. March 16, 2024.

5

A 2021 Executive Order called on the federal banking regulators to revitalize merger

oversight in order to “ensure Americans have choices among financial institutions and to guard

against excessive market power.”

10

Multiple Senators have also requested that regulators update

the bank merger review process to improve analysis of competitive factors as well as impact on

financial stability.

11

Former Federal Reserve Board member Daniel Tarullo recently noted that

competition can vary across forms of lending, and that customers with less access comprise “sub-

markets” that could be negatively impacted by mergers.

12

Tarullo was speaking there about online

access, but customers with non-prime credit scores also have less access to traditional credit cards,

often forcing them into more expensive credit card products that make it harder for them to rebuild

their credit score.

Capital One and Discover both prioritize borrowers with credit scores in the 600s.

13

From

2019 to 2023, Capital One sent more direct mail offers to households with credit scores between

621 and 660 than any other issuer, and Discover was the only other mainstream credit card issuer

to send a significant number of direct mail offers to this same market segment.

14

Capital One is

already the largest non-prime credit card lender in the US, and adding Discover’s $20 billion to

their portfolio would give them more than double the outstanding non-prime credit card balances

of JPMorgan Chase and Citigroup, the next largest non-prime lenders.

15

This raises significant

concerns about how this merger would reduce options for financially vulnerable customers and

reduce the already limited competition on pricing for non-prime credit cards. A preliminary

analysis based on information from regulatory filings suggests that applying the Herfindahl-

Hirschman Index (HHI) to the market share of outstanding non-prime credit card balances results

https://www.forbes.com/sites/elenabotella/2024/03/16/a-capital-onediscover-merger-could-raise-card-interest-

rates/?sh=105599af1513

10

“Executive Order on Promoting Competition in the American Economy.” July 9, 2021.

https://www.whitehouse.gov/briefing-room/presidential-actions/2021/07/09/executive-order-on-promoting-

competition-in-the-american-economy/

11

“In The Wake of Recent Bank Failures, Brown, Colleagues Urge Federal Reserve to Overhaul Big Bank Merger

Policy.” United States Senate Committee on Banking, Housing, and Urban Affairs. August 9, 2023.

https://www.banking.senate.gov/newsroom/majority/wake-recent-bank-failures-brown-colleagues-urge-federal-

reserve-overhaul-big-bank-merger-policy

12

“Regulators should rethink the way they assess bank mergers.” Brookings. March 16, 2022.

https://www.brookings.edu/articles/regulators-should-rethink-the-way-they-assess-bank-mergers/

13

“The Proposed Merger of Capital One and Discover Deserves Rigorous Scrutiny.” The Sling. March 4, 2024.

https://www.thesling.org/the-proposed-merger-of-capital-one-and-discover-deserves-rigorous-scrutiny/

14

“A Capital One-Discover Merger Could Raise Credit Card Interest Rates.” Forbes. March 16, 2024.

https://www.forbes.com/sites/elenabotella/2024/03/16/a-capital-onediscover-merger-could-raise-card-interest-

rates/?sh=105599af1513

15

Capital One-Discover: A Competition Policy and Regulatory Deep Dive.” American Economic Liberties Project.

March 21, 2024. https://www.economicliberties.us/our-work/capital-one-discover-a-competition-policy-and-

regulatory-deep-dive/

6

in a presumption that this is an illegally anti-competitive merger.

16

The Department of Justice (DOJ) and the Federal Trade Commission (FTC) use HHI to

evaluate the competitive effect of transactions. DOJ and FTC guidelines state that deals that result

in a single firm with market share above 30%, combined with an HHI increase of over 100 points,

results in a presumption that the merger would substantially reduce competition or create a

monopoly.

17

The chart above shows that this merger results in Capital One having a market share

of 30.6%, and that the HHI increased by nearly 400 points. This analysis is preliminary but

16

Analysis conducted by Americans for Financial Reform. Total outstanding general purpose credit card loans from

Federal Reserve Bank of New York. Center for Microeconomic Data. Household Debt and Credit Report. Q4 2023.

Issuer loans based on credit card loans carried as assets on Securities and Exchange Commission filings or FDIC call

reports. Non-prime market based on issuers’ disclosure of higher-risk loans (typically reported as under 660 credit

score, although some report under 680 or under 650). Eighteen of the 30 issuers reported non-prime lending breakdown

on their SEC reports and the total reported non-prime lending from these 18 firms was divided into their total lending

to determine an average of 19 percent of credit card loans to consumers with non-prime credit scores; this average

was applied to the total credit card loans of issuers that did not report breakdowns and the FRB NY total loans to get

individual issuer non-prime credit card lending and market size.

“The Department of Justice and the Federal Trade Commission generally measure concentration levels using the

Herfindahl-Hirschman Index (“HHI”). The HHI is defined as the sum of the squares of the market shares; it is small

when there are many small firms and grows larger as the market becomes more concentrated.” Merger Guidelines

U.S. Department of Justice and the Federal Trade Commission. Page 5.

https://www.ftc.gov/system/files/ftc_gov/pdf/2023_merger_guidelines_final_12.18.2023.pdf

17

Merger Guidelines U.S. Department of Justice and the Federal Trade Commission. Pages 5-6.

https://www.ftc.gov/system/files/ftc_gov/pdf/2023_merger_guidelines_final_12.18.2023.pdf

7

includes the 30 largest credit card lenders and national data found in 10-K filings. We encourage

the DOJ to conduct a full HHI analysis of the market share of non-prime credit cards based on

outstanding loan balances, and to complement this with state and MSA level market analyses if

possible.

Capital One claims in their merger application that the credit card issuing market is

“intensely competitive and dynamic - in part due to the ease with which issuers and consumers can

switch among products and services.”

18

This ignores the fact that a significant percentage of

Capital One and Discover’s customers have lower credit scores that limit their options, with

borrowers with credit scores 660 or below comprising 32% of Capital One’s credit card portfolio

in 2023 and 20% of Discover’s.

19

For example, options to transfer credit card balances to less

expensive credit cards are typically only available to borrowers with high credit scores.

20

Furthermore, many large issuers make it difficult for consumers to shop around and compare credit

cards by not clearly providing the interest rate that borrowers will pay.

21

Consumers also often

encounter manipulated results when using online-comparison shopping tools that inappropriately

favor products from lenders that offer kickback payments to the website.

22

Debit Cards and Interchange Fees

This merger is attractive to Capital One because it would exempt them from regulatory caps on

fees charged to merchants when they use debit cards to make purchases. If approved, Capital One

would have the ability and incentive to raise fees on merchants.

Speaking on an investor call after the announcement of Capital One’s intention to buy

Discover, Capital One’s CEO Richard Fairbank commented that “a network is a very, very rare

asset. There are very few of them and it’s just – I don’t think people are going to be building any

of these anytime soon because it’s such a chicken-and-egg problem to ever get one started.”

23

Fairbank went on to describe Discover’s network as a “holy grail” that Capital One has long sought

18

Capital One – Discover OCC Merger Application. Preliminary Statement. Page 3.

19

Capital One 2023 10-K Filing. Page 94. cof-20231231 (sec.gov) and Discover 2023 10-K Filing. Page 102. dfs-

20231231 (sec.gov)

20

2023 Consumer Credit Card Market Report. CFPB. Page 117.

https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2023.pdf

21

“CFPB Enhances Tool to Promote Competition and Comparison Shopping in Credit Card Market.” March 21, 2023.

https://www.consumerfinance.gov/about-us/newsroom/cfpb-enhances-tool-to-promote-competition-comparison-

shopping-credit-card-market/

22

“CFPB Issues Guidance to Rein in Rigged Comparison-Shopping Results for Credit Cards and Other Financial

Products.” February 29, 2024. https://www.consumerfinance.gov/about-us/newsroom/cfpb-issues-guidance-to-rein-

in-rigged-comparison-shopping-results-for-credit-cards-and-other-financial-products/

23

Transcript of Capital One Financial Corporation and Discover Financial Services Investor Call. February 20, 2024.

https://www.sec.gov/Archives/edgar/data/927628/000119312524040125/d797639d425.htm

8

in order to “deal directly with merchants.”

24

Discover’s network is highly coveted because having

their own network would exempt Capital One from the Durbin Amendment that caps interchange

fees on debit cards, the price that merchants pay to banks when customers use debit cards issued

by their bank.

DOJ’s Antitrust Division and the FTC recently released updated guidelines related to their

analysis of whether proposed mergers would result in anti-competitive effects. The American

Economic Liberties Project notes how this merger would draw scrutiny across several of these

updated guidelines, and also that the DOJ and FTC list “a merger that would enable firms to avoid

a regulatory constraint because that constraint was applicable to only one of the merging firms” as

an example of mergers that have weakened competition in the past.

25

This merger obviously falls

into this category. Not only would Capital One have the ability to raise debit card interchange fees,

they would also have a strong incentive to do so. One of the most effective ways for Capital One

to encourage credit card issuing banks to move debit cards to their network would be by offering

a higher share of interchange fees, which encourages Capital One to increase interchange fees

overall.

26

Capital One would also be able to leverage access to its extensive card network to force

businesses to accept higher interchange fees. One financial services analyst estimated that Capital

One’s debit interchange fee increases could cost American businesses and consumers around $800

million a year.

27

Unlikely to Compete with Visa and Mastercard

Previous credit card mergers have not resulted in benefits to consumers. In addition, this merger

may actually increase Visa’s dominance of the credit card market and potentially start a wave of

payment network mergers.

Capital One claims in their merger application that this deal will “facilitate more robust

competition against Visa and Mastercard” and the combination of Capital One and Discover

24

Ibid.

25

Capital One’s acquisition is likely to draw scrutiny across several guidelines. The transaction takes place in

concentrated markets (Guideline 1), which may be “trending towards consolidation” (Guideline 7). The acquisition

may threaten to eliminate substantial competition between firms (Guideline 2), and it involves a multi-sided platform

whose control may entrench the acquiring firm’s market power in an adjacent market position (Guideline 9). “Capital

One-Discover: A Competition Policy and Regulatory Deep Dive.” American Economic Liberties Project. March 21,

2024. https://www.economicliberties.us/our-work/capital-one-discover-a-competition-policy-and-regulatory-deep-

dive/ and “Merger Guidelines U.S. Department of Justice and the Federal Trade Commission.” December 18, 2023.

Page 30. https://www.ftc.gov/system/files/ftc_gov/pdf/2023_merger_guidelines_final_12.18.2023.pdf

26

“Will the Capital One, Discover merger impact the Credit Card Competition Act?” Bankrate. March 1, 2024.

https://www.bankrate.com/finance/credit-cards/capital-one-discover-merger-ccca-impact/

27

“By shifting its debit volume to Discover’s network, Capital One can charge merchants higher fees, which could

lead to around $800 million of pre-tax earnings upside based on estimated debit volumes of $90 billion.” See: Marc

Rubenstein, "The Third Network," Net Interest, Feb 23, 2024, https://www.netinterest.co/p/the-third-network.

9

“presents the most viable chance to deconcentrate and increase competition among payments

networks.”

28

Speaking at a recent event, CFPB Director Rohit Chopra and Assistant Attorney

General for the DOJ’s Antitrust Division Jonathan Kanter expressed skepticism about the counter

intuitive idea that further consolidation will increase competition. Chopra referred to this as the

“three is better than four argument” and that he is not aware of “many examples of this ever really

working.”

29

Instead, Chopra noted that

“The credit card market has seen a small set of players really dominate the market,

and when we look backward, we see there is a big delta between larger and smaller

issuers in terms of rates and fees that they charge, and that suggests that some of

the prior mergers in the industry didn't necessarily translate into benefits.”

30

Kanter also added that, “the remedy for lack of competition in a market isn’t less competition.”

31

There is reason to be skeptical of Capital One’s claims that this merger will help them

compete with Visa and Mastercard. If Capital One were to move all of its cards currently on the

Visa and Mastercard network over to an acquired Discover network, the effect will be far more

pronounced on Mastercard than Visa. Mastercard would lose twice the cards as Visa and is already

the smaller of the two, so instead of Capital One competing against a Visa-Mastercard duopoly,

they could actually further cement Visa’s advantage.

32

Also, there is a possibility that if approved

this merger could spur a wave of payment network mergers as Mastercard and American Express

would likely cite approval as precedent and argue they need to acquire payment networks such as

PayPal or Klarna as well in order to compete with Visa and Capital One/Discover.

33

SAFETY AND SOUNDNESS

Financial Resources

Capital One’s concentration in non-prime credit card and auto lending, combined with rising

delinquency rates in both these sectors, raise serious concerns about Capital One’s ability to

withstand an economic downturn.

As already mentioned, interest charged to cardholders on outstanding balances accounts

for more than half of Capital One’s total net revenue.

34

Adding Discover’s outstanding credit card

28

Capital One – Discover OCC Merger Application. Preliminary Statement. Pages 3 and 83.

29

“CFPB Head Sees Flaws In Capital One-Discover Deal Rationale.” Law360. March 21, 2024.

https://www.law360.com/articles/1816330/cfpb-head-sees-flaws-in-capital-one-discover-deal-rationale

30

Ibid.

31

Ibid.

32

“The Proposed Merger of Capital One and Discover Deserves Rigorous Scrutiny.” The Sling. March 4, 2024.

https://www.thesling.org/the-proposed-merger-of-capital-one-and-discover-deserves-rigorous-scrutiny/

33

Ibid.

34

“Capital One-Discover: A Competition Policy and Regulatory Deep Dive.” American Economic Liberties Project.

10

loans to Capital One’s assets would result in an over 70% increase of Capital One’s outstanding

credit card loans, and leave Capital One with credit card loans accounting for nearly 40% of total

assets.

35

Auto lending also accounts for practically all of Capital One’s consumer banking at 98%

of consumer banking loans held for investment, and with 47% of Capital One’s auto loan

customers having credit scores of 660 or below at origination.

36

Credit card and auto loan delinquency rates continue to rise above pre-pandemic levels.

The share of newly delinquent credit card borrowers in the lowest income areas in the third quarter

of 2023 was nearly double the rate from the first quarter of 2015, and in 2023 subprime auto loan

delinquency rates reached their highest level since 1996.

37

Capital One and Discover’s credit card

delinquency rates at the end of January 2024 are the highest among the six major credit card

issuers, with Capital One also having the highest charge off rate with net charge offs increasing by

77% from 2022 to 2023.

38

Delinquency rates could rise even further as student loan payments

resume, as newly delinquent rates are rising fastest for credit card borrowers that also have student

debt, with the highest newly delinquent rate among credit card borrowers with both student and

auto debt.

39

March 21, 2024. https://www.economicliberties.us/our-work/capital-one-discover-a-competition-policy-and-

regulatory-deep-dive/ In 2023, Capital One earned $19.7 billion in net interest income from credit cards out of a total

of $36.8 billion in net revenue. See: Capital One Financial Corp, Form 10-K For the Year Ended December 31, 2023,

SEC filing, Feb. 24, 2023, https://ir-capitalone.gcs-web.com/static-files/994c8bec-608e-49d1-8ae2-a039bc43ba54.

35

Ibid. and “Analysis: Antitrust and Banking Agencies Must Block Capital One-Discover Merger.” Americans for

Financial Reform. March 14, 2024. https://ourfinancialsecurity.org/2024/03/report-antitrust-and-banking-agencies-

must-block-capital-one-discover-

merger/#:~:text=The%20merger%20would%20increase%20Capital,provisions%20for%20credit%20card%20losses.

36

Capital One 2023 10-K Filing. Pages 68 and 94. cof-20231231 (sec.gov)

37

“Credit Card and Auto Loan Delinquencies Continue Rising; Notably Among Younger Borrowers.” Federal Reserve

Bank of New York. February 6, 2024. https://www.newyorkfed.org/newsevents/news/research/2024/20240206 and

“Credit Card Delinquencies Continue to Rise—Who Is Missing Payments?” Liberty Street Economics. Federal

Reserve Bank of New York. November 7, 2023. https://libertystreeteconomics.newyorkfed.org/2023/11/credit-card-

delinquencies-continue-to-rise-who-is-missing-payments/ and “Delinquency rates at highest level in almost 30

years.” Bankrate. November 29, 2023. https://www.bankrate.com/loans/auto-loans/subprime-auto-loan-

delinquencies-surge/

38

“Credit card delinquency, net loss rates return to pre-pandemic levels.” S&P Global. February 29, 2024.

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/credit-card-delinquency-net-

loss-rates-return-to-pre-pandemic-levels-80618274 and “Capital One Charge-Offs Jump on Auto, Credit Card Write-

Downs.” Bloomberg. January 25, 2024. https://www.bnnbloomberg.ca/capital-one-charge-offs-jump-on-auto-credit-

card-write-downs-1.2026732

39

“Credit Card Delinquencies Continue to Rise—Who Is Missing Payments?” Liberty Street Economics. Federal

Reserve Bank of New York. November 7, 2023. https://libertystreeteconomics.newyorkfed.org/2023/11/credit-card-

delinquencies-continue-to-rise-who-is-missing-payments/

11

Managerial Resources

Capital One’s repeat violations of antitrust, banking, consumer, and discrimination laws indicate

significant compliance deficiencies and suggest that Capital One is already too-big-to-manage at

its current size, and may even be too-big-to-care about following federal and state laws.

Capital One has racked up over $963 million in fines since 2000 for illegal corporate

behavior that runs the gamut from improper anti-money laundering procedures, consumer

protection, privacy, wage and hour violations, to discriminatory job postings.

40

These include

repeat antitrust violations by Capital One CEO Richard Fairbank for failing to disclose his

acquisition of Capital One stock.

41

The Hart-Scott-Rodino Act (HSR) requires companies and

individuals to report large transactions over a certain threshold to the FTC and DOJ so that the

federal agencies can investigate the deals before they close.

42

Fairbank violated the HSR in 1999

and 2004, but the FTC chose not to pursue fines for those violations after Fairbank alleged it was

inadvertent and pledged to implement a system to ensure HSR compliance going forward.

However, this turned out to be an empty promise as Fairbank violated the HSR again in 2018.

43

Other recent fines and enforcement actions against Capital One include:

2022

● $2 million settlement with the Los Angeles County District Attorney for making calls with

unreasonably excessive frequency and persisting in calling wrong numbers in an effort to

collect their debts, both in violation of California’s Rosenthal Act and the Federal Debt

Collection Practices Act.

44

● $49,728 fine from the DOJ for posting job opportunities with unlawful citizenship status

restrictions on college job recruiting platforms in violation of the Immigration and

Nationality Act’s (INA) anti-discrimination provision. DOJ determined that Capital One’s

advertisements deterred qualified students from applying for jobs because of their

citizenship status, and in many cases the citizenship status restrictions also blocked students

40

“Capital One Should Not Rush To Acquire Discover.” Forbes. February 22, 2024.

https://www.forbes.com/sites/mayrarodriguezvalladares/2024/02/22/capital-one-should-not-rush-to-acquire-

discover/?sh=7249a6cb5a91 and “Justice Department Secures Settlements with CarMax, Axis Analytics, Capital One

Bank and Walmart for Posting Discriminatory Job Advertisements on College Recruiting Platforms.” Department of

Justice. Office of Public Affairs. September 21, 2022. https://www.justice.gov/opa/pr/justice-department-secures-

settlements-carmax-axis-analytics-capital-one-bank-and-walmart

41

“FTC Fines Capital One CEO Richard Fairbank for Repeatedly Violating Antitrust Laws.” Federal Trade

Commission. September 2, 2021. https://www.ftc.gov/news-events/news/press-releases/2021/09/ftc-fines-capital-

one-ceo-richard-fairbank-repeatedly-violating-antitrust-laws

42

Ibid.

43

Ibid.

44

“Capital One to Pay $2 Million to Settle Debt Collection Lawsuit.” Los Angeles County District Attorney’s Office.

December 15, 2022. http://da.lacounty.gov/media/news/capital-one-pay-2-million-settle-debt-collection-lawsuit

12

from applying or even meeting with company recruiters.

45

2021

● $390 million civil money penalty assessed by the Financial Crimes Enforcement Network

(FinCEN) for violations of the Bank Secrecy Act. Capital One admitted to willfully failing

to implement and maintain an effective anti-money laundering program that resulted “in

millions of dollars in suspicious transactions to go unreported in a timely and accurate

manner, including proceeds connected to organized crime, tax evasion, fraud, and other

financial crimes laundered through the bank into the U.S. financial system.” FinCEN

Director Kenneth A. Blanco noted that “Capital One’s egregious failures allowed known

criminals to use and abuse our nation’s financial system unchecked, fostering criminal

activity and allowing it to continue and flourish at the expense of victims and other

citizens.”

46

2020

● $80 million civil money penalty assessed by the OCC for failing to establish effective risk

assessment processes prior to migrating its information technology to the cloud operating

environment, including failures to address issues identified by Capital One’s own internal

audits.

47

This followed “one of the biggest data breaches ever” when a hacker in 2019

accessed over 100 million Capital One accounts and credit card applications.

48

Each of the settlements and enforcement actions discussed above occurred after Capital One’s

acquisition of ING Direct in 2012. That merger approval was conditioned on Capital One

improving risk management and compliance functions.

49

Capital One’s history of illegal corporate

behavior since 2012 shows that Capital One has failed to live up to these conditions.

45

“Justice Department Secures Settlements with CarMax, Axis Analytics, Capital One Bank and Walmart for Posting

Discriminatory Job Advertisements on College Recruiting Platforms.” Department of Justice. Office of Public Affairs.

September 21, 2022. https://www.justice.gov/opa/pr/justice-department-secures-settlements-carmax-axis-analytics-

capital-one-bank-and-walmart

46

“FinCEN Announces $390,000,000 Enforcement Action Against Capital One, National Association for Violations

of the Bank Secrecy Act.” Financial Crimes Enforcement Network. January 15, 2021.

https://www.fincen.gov/news/news-releases/fincen-announces-390000000-enforcement-action-against-capital-one-

national

47

OCC Consent Order. Docket Number AA-EC-20-51. August 6, 2020. Page 2.

https://www.occ.gov/static/enforcement-actions/ea2020-036.pdf

48

“A hacker gained access to 100 million Capital One credit card applications and accounts.” CNN Business. July 30 ,

2019. https://www.cnn.com/2019/07/29/business/capital-one-data-breach/index.html

49

Capital One – ING Direct Federal Reserve Merger Approval Order. February 14, 2012. Pages 12-14.

https://www.federalreserve.gov/newsevents/pressreleases/files/order20120214.pdf

13

CONVENIENCE AND NEEDS

Capital One claims it will develop a community benefits plan, but they have not lived up to similar

claims in the past. In 2012 Capital One made a $180 billion commitment related to their merger

with ING Direct that included a $28.5 billion commitment to mortgage lending. However, Capital

One did not deliver on this commitment and exited mortgage lending in 2017. Banks cannot

continue to meet the convenience and needs prong of merger review with empty promises that are

not monitored or enforced after the merger is completed. Commitments must be part of the merger

approval, legally binding, monitored, and enforceable. Capital One’s predatory business practices

also cast doubt on their ability to serve the needs of borrowers with lower credit scores.

Capital One’s merger application is light on specific forward-looking details of how this

merger will serve the public’s convenience and needs. The application notes that Capital One plans

to develop a community benefit plan, but offers little detail on what the plan would include.

50

This

makes the merger application incomplete, but more importantly, Capital One’s previous merger

history casts doubt on Capital One’s intent to actually implement a community benefits plan. In

2011 Capital One announced an “$180 billion community investment commitment over the next

ten years” related to their merger with ING Direct which included a $28.5 billion commitment for

“low and moderate income home mortgages and home equity lending.”

51

Capital One makes no

mention of this $180 billion commitment or its results in their merger application. Instead of

delivering on this commitment, Capital One chose to exit home mortgage lending halfway through

the ten-year commitment in 2017 and only lent $11.3 billion in mortgage lending to borrowers

with LMI or in LMI census tracts from 2012 through 2022, less than half of the total mortgage

commitment.

52

It is difficult to imagine how Capital One could come up with a plan that would make them

a positive contributor to credit needs. Capital One’s business practices are incompatible with

wealth building for lower income borrowers. As discussed above in the section on competition,

Capital One is one of the most expensive credit card lenders in the country, and they specifically

target non-prime borrowers who are more likely to carry outstanding balances over from month to

50

Capital One – Discover OCC Merger Application. Preliminary Statement. Pages 50-51.

51

Transcript of Federal Reserve Board Public Meeting Regarding Notice by Capital One to Acquire ING Direct.

September 20, 2011. Pages 29-30. https://www.federalreserve.gov/foia/files/Capital_One-

ING_Meeting_Transcript_09-20-2011.pdf

52

Capital One – Discover OCC Merger Application. Preliminary Statement. Page 64. And NCRC analysis of Capital

One’s Home Mortgage Disclosure Act Data from 2012-2022 that included income data on the borrower with loans

without income data excluded. Multifamily loans excluded as they appear to be included in a separate commitment

for “affordable housing development and commercial revitalization for 25 billion.” In addition to not being mentioned

in the merger application, unable to find any information from Capital One on the results of this commitment online.

14

month and generate more interest payments to Capital One.

53

There is nothing wrong with

prioritizing borrowers with lower credit scores, but given Capital One’s significantly higher

interest rates than smaller issuers, it appears that Capital One’s customers would be much better

served taking their business elsewhere. Capital One’s practice of raising credit lines on non-prime

borrowers as they approach their limit is certainly a contributing factor to the rise in persistent

credit card debt, with Capital One receiving more than $800 annually in interest payments alone

from many of their customers.

54

It has also been reported that in at least one instance Capital One

used $100 credit card line increases to borrowers living in LMI census tracts that would not have

ordinarily qualified in order to artificially inflate its CRA performance.

55

Capital One is also an industry leader in filing debt collection civil suits, recovering more

from previously charged off card accounts than much larger banks including JPMorgan Chase.

56

Debt collection lawsuits have grown to dominate state civil courts, with data from nine states

indicating that debt collection lawsuits have risen to nearly 1 in 2 civil court cases in 2021,

compared to 1 in 4 in 2013 and 1 in 9 in 1993.

57

Debt collection lawsuits are highly predatory with

customers sued rarely having legal representation, or not even being aware of the lawsuit as more

than 70% of debt collection lawsuits result in default judgments where the defendant does not

show up to court or respond to the suit.

58

These cases often result in heavy fines for defendants as

courts routinely order customers to pay accrued interest as well as court fees that together often

exceed the amount owed, and can also result in garnished wages.

59

Garnished wages are more

common with customers earning less than $40,000 a year as well as predominately black

53

Balance carrying behavior by cardholders is highly correlated with credit score. 2023 Consumer Credit Card Market

Report. CFPB. Page 44. https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-

report_2023.pdf

54

“I Worked at Capital One for Five Years. This Is How We Justified Piling Debt on Poor Customers.” The New

Republic. October 2, 2019. https://newrepublic.com/article/155212/worked-capital-one-five-years-justified-piling-

debt-poor-customers

55

Delinquent: Inside America’s Debt Machine. Elena Botella. October 11, 2022. University of California Press. Pages

34-36.

56

Aggressive debt collection is key to Capital One’s profitability. Last year, the same year the company reported $5.5

billion in net income, it recovered $1.4 billion from its card accounts that had been previously charged-off, or

recognized as losses. It was a haul hundreds of millions of dollars beyond any other card issuer, even much larger

ones like JPMorgan Chase. “Capital One and Other Debt Collectors Are Still Coming for Millions of Americans.”

ProPublica. June 8, 2020. https://www.propublica.org/article/capital-one-and-other-debt-collectors-are-still-coming-

for-millions-of-americans

57

“Debt Collection Cases Continued to Dominate Civil Dockets During Pandemic.” Pew Charitable Trusts. September

18, 2023. https://www.pewtrusts.org/en/research-and-analysis/articles/2023/09/18/debt-collection-cases-continued-

to-dominate-civil-dockets-during-pandemic

58

“How Debt Collectors Are Transforming the Business of State Courts.” Pew Charitable Trusts. May 6, 2020.

https://www.pewtrusts.org/en/research-and-analysis/reports/2020/05/how-debt-collectors-are-transforming-the-

business-of-state-courts

59

Ibid.

15

communities, and they often create financial emergencies where customers are forced to let other

bills go unpaid, further trapping them in a vicious cycle of debt.

60

Capital One’s significant role in

filing debt collection lawsuits, combined with their practice of raising credit limits on non-prime

borrowers as they approach their limit, raises a serious compliance question, as lenders are required

to consider a customer’s ability to meet minimum payments before originating credit lines or

increasing them.

61

Capital One cites increased reward opportunities as an example of how this merger will

improve services for customers.

62

When considering the benefits of increased reward

opportunities, it is important to keep in mind who gains the most from reward programs. A recent

Federal Reserve paper found that credit card rewards are unequally distributed across geographies

and “transfer income from less to more educated, from poorer to richer, and from high- to low

minority areas, thereby widening existing spatial disparities.”

63

Borrowers in the highest credit

score tiers account for about 80% of reward redemptions despite only accounting for 67% of

general purpose rewards cards at mass market issuers, with below-prime customers only

accounting for 6% of reward redemptions.

64

Reward credit cards may also induce consumers with

lower credit scores to over borrow on their credit cards.

65

This could be the result of rewards

obscuring the true cost of borrowing as the cost of revolving debt often outweighs the value of

redeemed rewards, particularly for customers with lower credit scores facing higher interest and

fees.

66

The potential for rewards programs to both transfer wealth away from poorer and more

diverse communities, as well as encourage higher debt levels for those with lower credit scores,

should limit any positive consideration of rewards programs as evidence of how this merger would

serve the public’s convenience and needs.

Lastly, Capital One and Discover both currently employ a significant number of employees

in Delaware, with Capital One accounting for 2,000 and Discover accounting for 1,100.

67

Capital

60

“Capital One and Other Debt Collectors Are Still Coming for Millions of Americans.” ProPublica. June 8, 2020.

https://www.propublica.org/article/capital-one-and-other-debt-collectors-are-still-coming-for-millions-of-americans

61

12 CFR Part 1026 (Regulation Z). § 1026.51 Ability to Pay. CFPB. https://www.consumerfinance.gov/rules-

policy/regulations/1026/51/

62

Capital One – Discover OCC Merger Application. Preliminary Statement. Page 18.

63

Agarwal, Sumit, Andrea Presbitero, Andre F. Silva, and Carlo Wix (2023). “Who Pays For Your Rewards?

Redistribution in the Credit Card Market,” Finance and Economics Discussion Series 2023-007. Washington: Board

of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2023.007.

64

2023 Consumer Credit Card Market Report. CFPB. Page 101.

https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2023.pdf

65

Agarwal, Sumit, Andrea Presbitero, Andre F. Silva, and Carlo Wix (2023). “Who Pays For Your Rewards?

Redistribution in the Credit Card Market,” Finance and Economics Discussion Series 2023-007. Washington: Board

of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2023.007.

66

2023 Consumer Credit Card Market Report. CFPB. Page 101.

https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2023.pdf

67

In news reports from 2019 and 2021, Capital One reported 2,000 employees in Delaware. The News Journal.

16

One makes a vague and noncommittal mention of “maintaining a strong presence” in Delaware,

as well as Chicagoland.

68

In order to accurately review this mergers impact on convenience and

needs, Capital One should make clear their long term employment plans as it relates to Delaware

in light of the significant overlap.

FINANCIAL STABILITY

Combining the Capital One and Discover non-prime credit card portfolios would create a bank

with unacceptable credit concentration risk. Adding in Capital One’s auto lending, the proposed

merger would mean the nation’s 6

th

largest bank has a concentration of loans to a single group of

borrowers, is over-exposed and unlikely to be able to withstand an economic downturn. If Capital

One were to fail, only a few of our largest banks would have the capability of acquiring them,

which would significantly increase consolidation of the US banking system.

If approved, Capital One would hold approximately $640 billion in assets, making them

the sixth largest bank in the United States, and with more assets than the combined assets of the

six US banks that failed in 2023.

69

As discussed above in the section on financial resources, Capital

One’s assets are highly concentrated in the non-prime credit card and auto lending sectors which

both have rising delinquency rates, and acquiring Discover increases this asset concentration

further. In the event of an economic downturn, Capital One would be more vulnerable than similar

sized banks due to this asset concentration in non-prime credit cards and auto loans.

The size of an expanded Capital One also increases the likelihood that only an institution

that has already reached globally systemically important bank status (GSIB), or too-big-to-fail in

other words, would be able to absorb Capital One in the event of a bank failure.

70

We saw examples

Delaware Online. March 25, 2024. and “MBNA veteran Rhodes named new Discover CEO.” Delaware Business

Times. December 12, 2023. https://delawarebusinesstimes.com/news/rhodes-discover-

ceo/#:~:text=Today%2C%20the%20credit%20giant%20currently,at%20its%20sole%20Greenwood%20branch.

68

Capital One – Discover OCC Merger Application. Preliminary Statement. Page 48.

69

Capital One – Discover OCC Merger Application. Preliminary Statement. Page 3. And FDIC BankFind Suite – Top

100 Banks and Thrifts by Assets. Reporting Period 12/31/2023. https://banks.data.fdic.gov/bankfind-

suite/financialreporting?commonSearch=top100&commonSearchesExpand=true&establishedEndRange=4%2F7%2

F2024&establishedStartRange=01%2F01%2F1792&inactiveEndRange=4%2F7%2F2024&inactiveStartRange=01%

2F01%2F1970&incomeBasis=YTD&institutionType=banks&limitEstablishedDate=false&limitInactiveDate=false

&pageNumber=1&reportPeriod=20231231&resultLimit=25&sortField=ASSET&sortOrder=DESC&unitType=%24

. Based on Call Report Data, Silicon Valley Bank ($209 billion), Signature Bank ($110.4 billion), First Republic Bank

($212.6 billion), Silvergate Bank ($11.4 billion), Citizens Bank – Sac City, IA ($59.7 million), and Heartland Tri-

State Bank ($139.1 million) had combined assets of $543.6 billion as of year-end 2022. Federal Financial Institutions

Examination Council Central Data Repository’s Public Data Distribution.

https://cdr.ffiec.gov/public/ManageFacsimiles.aspx#

70

“Financial Stability and Large Bank Resolvability”. Acting Comptroller of the Currency Michael J. Hsu Remarks

Before the Wharton Financial Regulation Conference 2022. April 1, 2022. https://www.occ.gov/news-

issuances/speeches/2022/pub-speech-2022-33.pdf

17

of this in 2023 and 2008 when JPMorgan Chase acquired First Republic and Washington Mutual

Bank respectively despite already being the nation’s largest bank by assets, two banks with less

than half the assets that Capital One would hold.

71

As Acting Comptroller Hsu has pointed out,

these outcomes increase the systemic importance of GSIBs with minimal due diligence and

analysis of integration challenges, and erodes public confidence in the government’s ability to

prevent banks from becoming too-big-to-fail.

72

Conclusion

NCRC and the undersigned member organizations and partners request that the OCC and

the Federal Reserve deny this merger application due to the significant concerns discussed above.

We believe that the myriad of issues associated with this merger are too severe to effectively

address through conditional approvals or the development of a community benefits plan given

Capital One’s business practices and history.

Thank you for considering our views on this important matter. If you have any questions,

please contact Kevin Hill, Senior Policy Advisor, at khi[email protected] or myself at jvantol@ncrc.org.

Sincerely,

Jesse Van Tol

President and CEO

CC

Jonathan Kanter

Assistant Attorney General, Antitrust Division Department of Justice

950 Pennsylvania Avenue, NW

Washington, DC 20530

71

Ibid. and “Late-Night Negotiating Frenzy Left First Republic in JPMorgan’s Control.” New York Times. May 1,

2023. https://www.nytimes.com/2023/05/01/business/first-republic-jpmorgan-fdic.html. First Republic Bank had

$212.6 billion in assets as of year-end 2022. Federal Financial Institutions Examination Council Central Data

Repository’s Public Data Distribution. https://cdr.ffiec.gov/public/ManageFacsimiles.aspx#

72

Ibid. Pages 4 and 6.

18

Undersigned Member Organizations and Partners

20/20 Vision

Accountable.US

AHCOPA

Alabama State Conference of NAACP

American Economic Liberties Project

Americans for Financial Reform Education Fund

Amplify Equity

Atlanta Neighborhood Development Partnership

Birmingham Business Resource Center

Bridging Communities, Inc.

Building Alabama Reinvestment

California Coalition for Rural Housing

CASA of Oregon

CCEDA

Ceiba

Center for Economic and Social Justice

Central Baptist Community Development Corporation

Centre for Homeownership & Economic Development Corporation

Centro Cultural

Chattanooga Neighborhood Enterprise

Chicanos Por La Causa, Inc

Clover New Orleans

CNHED

19

Columbus Compact dba Columbus Empowerment Corp.

Community Alliance of Tenants

Community First Fund

Community Growth Fund

Community Reinvestment Alliance of Florida

Consumer Federation of America

Co-op Dayton

Cornerstone Renter Equity

Data You Can Use

Dundalk Renaissance

Eastside Community Network

Economic Development Connections

Esperanza Community Housing

Fahe

Fair Finance Watch

Fair Housing Center of Northern Alabama

Fair Housing Resource Center, Inc.

Famicos Foundation

Georgia Advancing Communities Together, Inc.

Greater Cincinnati Microenterprise Initiative Inc

Grow America

Habitat for Humanity of the Greater La Crosse Region

Harlingen Community Development Corporation

Home Ownership Center of Greater Cincinnati

20

Housing Opportunities Made Equal of Greater Cincinnati

Housing Oregon

HousingWorksRI

Inner City Health

Johnson Consulting Group

Jovis

JustDane

Latino Leadership Council

Lifted Cares

LK Hynson Consultants

Local Enterprise Assistance Fund (LEAF)

Local First Arizona

Logan Heights Community Development Corporation

Main Street Alliance

Manna, Inc.

Metro North Community Development Inc.

Metropolitan Milwaukee Fair Housing Council

Milwaukee Christian Center

Neighborhood Development Collaborative

New Jersey Citizen Action

New Urban Development, LLC

NEWCAP, Inc.

Northwest Center

Open Markets Institute

21

Ophelia Steen Family and Health Center

Oregon Consumer Justice

Our Casas Resident Council Inc.

PCR Business Finance

Philadelphia Association of Community Development Corporations

Piedmont Business Capital

Prosperity Indiana

R.A.A.! - Ready, Aim, Advocate! Committee

REBOUND, Inc.

Reinvestment Partners

Renaissance Entrepreneurship Center

Revolving Door Project

Rise Economy (formerly the California Reinvestment Coalition)

Rural Housing Coalition of New York

S J Adams Consulting

Santa Fe Habitat for Humanity

SC Uplift Community Outreach

Seniors Success Center

South Bend Heritage Foundation

South Georgia Alliance 85

Southern Dallas Progress CDC

Southwest CDC

Southwest Georgia United

The Center for Public Skills Training

22

The Central Valley Urban Institute

The Freedom BLOC

The Greenlining Institute

The National Appraisal Bias Taskforce

Town of Apex

Tribal Homeownership Coalition of the Southwest

Ubuntu Institute of Learning

United Community Center, Inc.

United South Broadway Corporation

Universal Housing Solutions CDC

Urban Land Conservancy

Vermont Slauson Economic Development Corporation

Veterans Center

WINDS Green Accelerator Inc.

Wisconsin Preservation Fund, Inc

Women's Economic Ventures

Working In Neighborhoods