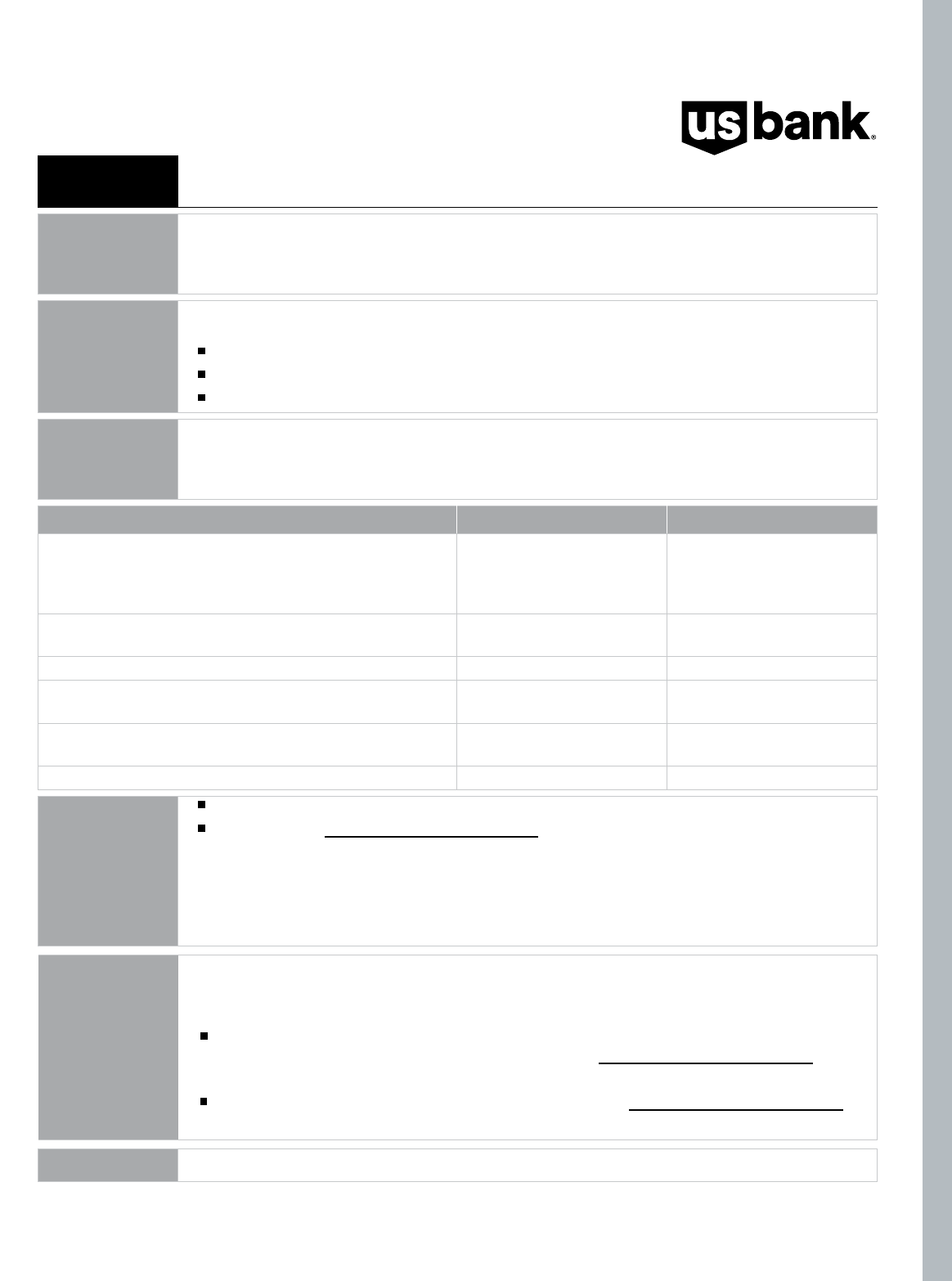

WELCOME

MAY

Union Bank mortgage accounts transition to U.S. Bank.

MAY

Union Bank deposit accounts automatically move to

U.S. Bank.

MAY

Enroll in U.S. Bank mobile and online banking.

MAY/JUNE

New U.S. Bank Credit Cards issued.

JUNE

Credit Card accounts move to U.S. Bank.

JUNE/JULY

New U.S. Bank Debit and/or ATM Cards issued.

LATER IN

Trust and investment accounts transition to U.S. Bank.

What you can do before May 27

•

Make sure your contact information

is up to date with Union Bank.

•

Keep banking as usual and continue

to work directly with your existing

team at Union Bank.

•

Be on the lookout for more important

transition updates from U.S. Bank in

your mailbox, email and online.

After May 30

•

Enroll in U.S. Bank mobile and

online banking through the

U.S. Bank Mobile App or at

usbank.com/unionbank-enroll.

•

Validate your bill pay information and

any scheduled automatic payments,

transfers and bill pay.

•

Explore U.S. Bank Online Banking

and set up additional payments

and transfers.

Key dates

Welcome | 1

We’re here for you.

We are very pleased to welcome you as a new U.S. Bank customer.

At our core, we are dedicated to providing you with best-in-class banking services and to helping you achieve your

nancial goals. You can count on us for our expertise in a wide variety of banking products and services – all

designed to make banking with us easy, convenient and rewarding. What’s more, you will have access to U.S. Bank

branches, ATMs, and mobile and online banking tools so you can bank how you want.

As your Union Bank accounts transition to U.S. Bank, we will partner with you every step of the way to provide

banking products and services that make banking safe, simple and convenient. Our relationships are built on trust,

built every day through every interaction.

For the latest information on your new accounts with U.S. Bank, please visit our dedicated website at

usbank.com/unionbank.

Some materials and services may only be available in English.

•

To view this document in Spanish, visit usbank.com/union-bank-es.

•

To view in Japanese, visit usbank.com/union-bank-ja.

2

Algunos materiales y servicios pueden estar disponibles solamente en inglés.

•

Para ver este documento en español, visite usbank.com/union-bank-es.

一部サービスや資料は英語のみでの対応となるのでご了承ください。

•

この文書の日本語版はusbank.com/union-bank-ja をご 覧ください。

2

Table of Contents

Getting started

Frequently asked questions about my

account changes ........................... 2

Mobile and online banking at U.S.Bank ........ 4

Setting up bill pay and

account-to-account transfers ................. 7

Your new account(s) information

Transitioning your Union Bank

personal account(s) ........................... 10

Checking account ......................... 10

Savings and money market accounts ......... 11

Union Bank Time Deposit Account(s) (CDs)

and IRA account(s) ......................... 14

Overdraft coverage and overdraft fees ......... 16

Overdraft protection information .............. 17

ATM and Debit Card Overdraft

Coverage Notication ........................ 18

Consumer Pricing Information ................. 20

Privacy Pledge ............................... 34

Appendix ................................... 38

Notes ....................................... 40

1. Algunos materiales y servicios pueden estar disponibles solamente en inglés.

2. 一 部サービスや資料は英語のみでの対応となるのでご了承ください。

Contact us

If you have questions, call the U.S. Bank

helpline at 833-398-1533 any time before

May 30, 2023. Representatives are available

Monday through Friday, 8 a.m. to 8 p.m. PT,

except holidays. They are trained and prepared to

eciently help you through the transition from

Union Bank to U.S. Bank.

Beginning May 30, 2023, call us at

800-USBANKS (872-2657). Assistance is

available 24/7. We accept relay calls.

Getting started | 2

Frequently asked questions about my account changes

Below are some of the most frequently asked questions concerning the transition of your accounts to U.S. Bank.

More detail on these changes and other information is contained in this guide.

Please note: You may receive separate, additional notices from U.S. Bank that provide more detailed information on

upcoming account changes. Please take a moment to review this information and, if necessary, act upon these

changes per the instructions provided.

CHECKING, SAVINGS, MONEY MARKET, CDS AND IRAS

Are my deposit account numbers changing?

Yes. It is necessary for U.S. Bank to renumber all deposit accounts when they transition to U.S. Bank. A letter

containing your new checking, savings, money market, certicates of deposit (CDs) or Individual Retirement Account

(IRA) account numbers will be mailed to you in May. You will be able to view your new account numbers in mobile and

online banking beginning in May.

What will happen to my overdraft protection?

If you currently have overdraft protection on your checking account, this protection will continue in most situations

for accounts linked to another deposit account, a Cash Reserve account or your new U.S. Bank Credit Card, as long as

it is activated. Refer to the Overdraft Protection Information section for more information.

Will my Union Bank checks continue to work?

You may continue to use your existing Union Bank checks and deposit slips until your supply runs out, for your deposit

accounts following the transition of your accounts to U.S. Bank. You will be sent a letter in May with your new account

number and instructions on how to order new U.S. Bank checks when you are ready.

If you have a home equity line of credit or personal line of credit, you will receive new checks within 10 days of those

accounts transitioning to U.S. Bank. You should begin using your new checks for these accounts upon receipt.

Important note: If you currently use special signature instructions on your checks, these will no longer be available

after May 30. However, there may be U.S. Bank services that meet your needs for fraud protection, such as Check

Filter, Positive Pay, Reverse Positive Pay, Information Reporting, ACH Block and more. Please call us for details.

Will the Annual Percentage Yield (APY) and interest rate change on my checking, savings or money

market account?

Annual Percentage Yields (APYs) and interest rates have yet to be determined for the date of conversion. Interest rates

on all deposit accounts are determined at the bank’s discretion and may change daily. For tiered rate accounts you

must maintain the minimum daily balance noted for each tier in order to earn the APY disclosed. Fees could reduce

earnings on the account.

For information on current Annual Percentage Yields, call 24-Hour Banking at 800-USBANKS (872-2657), view them

through the U.S. Bank Mobile App and online banking, or visit usbank.com.

Will I be able to access the funds in my checking, savings and money market accounts as they convert over to

U.S. Bank?

Yes. You will have access to your entire Available Balance (as dened in the enclosed Your Deposit Account Agreement)

during the transition to U.S. Bank.

Important changes will take eect on your deposit accounts on May 30. Please read the entire enclosed

U.S. Bank Your Deposit Account Agreement document and the Consumer Pricing Information section of this guide

for a complete list of account terms, policies and pricing.

1. If a Non-U.S. Bank ATM Transaction fee applies, U.S. Bank will assess a fee for each ATM Transaction conducted at the Non-U.S. Bank ATM. Additionally,

Non-U.S. Bank ATM owners may apply a surcharge fee unless they participate in the MoneyPass

®

Network. If you use an ATM that uses the MoneyPass

®

Network and are charged a fee, please contact us at 800-USBANKS (872-2657) for a refund. To find MoneyPass

®

ATM locations, select “Show MoneyPass

®

ATM Network locations” in the ATM locator usbank.com/locations. Non-U.S. Bank ATMs are defined as any ATM that does not display the U.S. Bank logo in any

manner, physically on the ATM or digitally on the screen. Please refer to the Consumer Pricing Information section for miscellaneous checking, savings or

money market fees and a summary of ATM transaction fees.

Getting started | 3

DEBIT AND ATM CARDS

What will happen to my Union Bank Debit and/or ATM Card?

You will be able to use your current Union Bank Debit and/or ATM Card, along with your existing personal

identication number (PIN), through July 31.

Your Union Bank Debit and/or ATM Card will stop working on August 1, or when you activate your new

U.S. Bank Debit and/or ATM Card, whichever comes rst.

If your current Union Bank Debit Card only accesses a savings account, you will be receiving a new U.S. Bank

ATM Card.

When will I receive a new U.S. Bank Debit and/or ATM Card?

You will receive a new U.S. Bank Debit and/or ATM Card by July 15. If you do not receive your card by this date,

please call 24-Hour Banking at 800-USBANKS (872-2657) for assistance.

Will my PIN change?

No, your PIN will not change. You will be able to use your existing PIN with your new U.S. Bank Debit and/or

ATM Card.

Will automatic payments that I set up with my Union Bank Debit Card transfer to my new U.S. Bank

Debit Card?

Most automatic payments that were set up with your Union Bank Debit Card will automatically be updated with your

new card information (card number, expiration date and the three-digit security code displayed on the back of your

card). Common automatic payments include utility companies and cell phone services. You will need to verify that all

of your automatic payments were updated accordingly.

Will ATM fees still be waived?

Yes, for transactions within the U.S. Bank ATM network. ATM transactions made at non-U.S. Bank ATMs may incur a

fee. U.S. Bank has an expansive ATM network. For a full listing of U.S. Bank branches with ATM access, please visit

usbank.com/locations.

Will I still be able to request cash back when I make a purchase with my new U.S. Bank Debit Card?

Yes. You will be able to request cash back when you use your debit card to make a purchase and enter your PIN.

Note: The U.S. Bank Mobile App is available for download from the Apple

®

App Store or Google Play store.

4

Your device must be in the United States to download the U.S. Bank Mobile App. Some services available in the

United States only.

Mobile and online banking at U.S.Bank

With U.S. Bank mobile and online banking, you’ll be able to do your everyday banking securely from your home or

just about anywhere.

•

View your balances and available credit.

•

Review electronic statements (e-statements) and transactions.

•

Manage and pay bills.

•

Send and receive money with Zelle

®

.

•

Deposit checks

2

using the U.S. Bank Mobile App.

3

•

Find the nearest U.S. Bank branch or ATM.

•

And more!

To help make your transition to mobile and online banking at U.S. Bank easier, we’ve provided answers to a few

anticipated questions here and at usbank.com/unionbank.

When can I access my deposit account information in mobile and online banking?

Beginning May 30, you’ll be able to enroll in U.S. Bank mobile and online banking.

1. U.S. Bank checking or savings account required to use Zelle

®

. Transactions between enrolled consumers typically occur in minutes and generally do not

incur transaction fees. Terms and conditions apply. Services available in U.S. only.

2. Eligibility requirements and restrictions apply. Please refer to the Digital Services Agreement at usbank.com/DSA for more information.

3. Standard messaging charges apply through your mobile carrier. Message frequency depends on account settings.

4. Android™ and Google Play are trademarks of Google LLC. Apple and iPhone

®

are registered trademarks, and the App Store is a registered service mark, of

Apple Inc.

How do I enroll in mobile and online banking?

You’ll have three ways to enroll in U.S. Bank mobile and

online banking.

1. From the Union Bank Mobile App or unionbank.com

A simpler enrollment process that grants you

U.S. Bank digital credentials from Union Bank digital

properties. This enrollment process is only available

for personal accounts.

•

Open the Union Bank Mobile App or

visit unionbank.com.

•

Log in to your account using your Union Bank

login credentials.

•

You’ll be prompted to complete verication and create

new U.S. Bank credentials.

2. From the U.S. Bank Mobile App

•

Download the U.S. Bank Mobile App on your

Android

TM

or iPhone

®

.

4

•

Open the app and click Create a username

and password.

•

On the rst screen, use your new U.S. Bank account

number or your Union Bank Debit Card number and

the last 4 digits of your Social Security number (SSN).

•

Follow the step-by-step instructions.

3. At usbank.com

•

Visit usbank.com/unionbank-enroll.

•

On the rst screen, use your new U.S. Bank account

number or your Union Bank Debit Card number and

the last 4 digits of your Social Security number (SSN).

•

Follow the remaining step-by-step instructions.

TIP

Visit exploreusbank.com for simple,

interactive demos that show you how to

do everyday banking tasks in the U.S. Bank

Mobile App or online banking.

Scan the QR code with

your phone’s camera.

Mobile and online banking | 4

Mobile and online banking | 5

Timeline and special notes

May 26 Last day you will have access to Union Bank digital banking and bill pay.

May 26

All Union Bank digital banking bill payments scheduled to be paid after May 26

will be paid on the date requested.

May 27-30 Mobile and online banking will be unavailable while we transition accounts to U.S. Bank.

May 30

Enroll in U.S. Bank mobile and online banking through the U.S. Bank Mobile App or at

usbank.com/unionbank-enroll. If you utilize Union Bank digital bill pay, validate your

biller information and any scheduled bill payments.

Is U.S. Bank mobile and online banking secure?

Yes. Our services and tools enlist advanced encryption and monitoring technologies. Visit usbank.com/guarantee to

learn more about our Digital Security Coverage.

Will my historical electronic statements (e-statements) transfer?

Yes. If you had e-statements at Union Bank for your deposit accounts, they will transfer to U.S. Bank mobile or online

banking. However, we recommend that you print past Union Bank statements, on or before May 27, for your records.

For more information regarding statements, please refer to the Personal Accounts – Statement Update beginning on

page 12.

Will my alerts transfer?

We’ve done our best to match the current alerts set on your Union Bank accounts with alerts that are available at

U.S. Bank. Some alerts may not have transferred because we did not have a match, so we recommend you review the

alerts set on your accounts upon enrollment.

Will my scheduled bill payments transfer?

Yes. Once you enroll in U.S. Bank mobile and online banking, your existing bills and biller information from the

Union Bank bill pay

1

system will automatically transfer. Your Union Bank bill pay history will transfer to your new

U.S. Bank account in mobile and online banking. We recommend that you log in to your U.S. Bank account and

validate that your billers, automatic and scheduled payments were transferred accurately.

1. A phone number and address in the U.S. Is required to use bill pay.

Mobile and online banking | 6

Will my new U.S. Bank Debit Card automatically be added to my mobile wallet?

No. After you receive your new U.S. Bank Debit Card, you will need to add it to your mobile wallet.

A U.S. mobile number is required to add a card to your mobile wallet.

Please note that your old Union Bank Debit Card will no longer work in your mobile wallet either

after you have activated your new U.S. Bank Debit Card or after August 1, whichever comes rst.

Mobile and online banking at U.S.Bank

Setting up bill pay and account-to-account transfers | 7

Setting up bill pay and account-to-account transfers

Whether making a purchase, paying bills or saving for the future, we want to provide accessible money movement

options with the ability to move your money where you need it, when you need it.

Choose what works best for you.

Bill payments – When you pay your bills through U.S. Bank mobile and online banking, you’re in charge. Set up

advance or recurring electronic payments (or checks) to be delivered on the date you choose. You can edit or cancel

any payment up to the time it’s processed. A phone number and address in the U.S. is required to use bill pay.

1. Recurring bill payments are not available for the Safe Debit account.

2. Zelle

®

and the Zelle

®

related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

3. To send money in minutes with Zelle

®

, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking

profile for at least three calendar days. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. Terms

and conditions apply.

4. Services available in U.S. only. Standard messaging charges apply through your mobile carrier. Message frequency depends on account settings. Eligibility

requirements and restrictions apply. Please refer to the Digital Services Agreement for more information.

In addition to one-time payments, bill pay oers the following options:

Recurring

Set up automatic monthly payments to payees. This is a great option for payments that

generally are a xed amount every month, such as your mortgage or car payment.

e-bills

Many companies can deliver e-bills – free electronic versions of your paper bills – directly

to your account in mobile and online banking. Customers like this option for bills that can

vary, such as utility or credit card bills.

Zelle

®2

– Zelle

®

is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S.,

typically within minutes.

3

With just an email address or U.S. mobile phone number, you can send money to people you

trust, regardless of where they bank.

4

You can also use Zelle

®

to set up recurring payments.

Since money is sent directly from your bank account to another person’s bank account within minutes,

3

it’s important

to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile

number. It’s easier to be sure when you select your recipient from the Zelle

®

Ready Contacts list on your Select a

recipient screen within Zelle

®

.

Account-to-account transfers

There are many reasons you may need to move money from account to account:

Overdraft

protection

Protect your checking or money market accounts from overdraft by linking another

deposit or credit account for protection.

Saving money Regular or one-time transfers to accounts like savings or money market.

Funding another

account

You may want to move money from one account to another for something like a major

purchase. Account-to-account transfers can also be done to an account outside of

U.S. Bank, provided the owners named on both accounts match.

Will my payroll direct deposit or my pre-established automatic debits and/or credits continue?

U.S. Bank will automatically notify nancial institutions originating direct deposit and other automatic debit or credit

transactions to your account of the new U.S. Bank routing number and your new account number. However, please

note that based on our notication, the originator of your automatic debit or credit transaction may contact you to

verify the changes and ask you to complete new paperwork to have the automatic transaction continue.

We recommend that you contact the originator once you receive your new routing number and account number and

inform them of the changes eective May 30, to eliminate possible disruption in automated transaction processing.

For additional information on stop payments, please refer to the Transitioning your Union Bank personal

account(s) section.

Setting up bill pay and account-to-account transfers | 8

I already have Zelle

®

, bill pay and transfers set up at Union Bank. Will these stay the same when my accounts

move to U.S. Bank?

If you are making bill payments from a current Union Bank deposit account (checking or money market), there is no

action required. However, we recommend you validate that your payments have transferred properly.

If you are transferring from a current Union Bank deposit account (checking, savings or money market) to another

Union Bank deposit account on which you are an owner, there is no action required.

All of your recurring Zelle

®

payments will automatically carry over. Before you begin sending or receiving money,

you’ll need to verify your enrolled email or mobile number.

Type of transfer From To

Action

required?

Notes

Zelle

®

(person to person

payments)

Union Bank

deposit account

Any payee

Yes

You will need to verify the email and mobile

numbers you previously enrolled. We

recommend you validate that your payees,

scheduled, and recurring payments have

transferred properly.

Internal account-to-

account transfers

(to another person)

Union Bank

deposit account

Union Bank

deposit account

Yes

If you are not an account owner, use Zelle

®

for your transfer.

Internal account-to-

account transfers

Union Bank

deposit account

Union Bank

deposit account

No

If you are an account owner, there is no

action required on your part.

External account-to-

account transfers

Union Bank

deposit account

Non-Union Bank

deposit account

No

If you are an account owner, there is no

action required on your part.

External account-to-

account transfers

(to another person)

Union Bank

deposit account

Non-Union Bank

deposit account

Yes

Use Zelle

®

for your transfer.

Bill payments

2

Union Bank

deposit account

Any payee

No

No action is required; however, we

recommend you validate that your payees

and scheduled payments have transferred

properly.

Overdraft

protection

Union Bank

deposit account

or credit account

Union Bank

deposit account

No

If account owner(s) on the to and from

account match and the account is a

consumer-to-consumer or business-to-

business account, there is no action required

on your part. Refer to the Overdraft

Protection Information section for details on

matching ownership.

IRA distributions or

CD interest

payments

Union Bank IRA

CD or IRA money

market or CD

Union Bank

deposit account

No

There is no action required on

your part.

1. Zelle

®

and the Zelle

®

related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

2. Recurring bill payments are not available for the Safe Debit account.

Setting up bill pay and account-to-account transfers

Setting up bill pay and account-to-account transfers | 9

Type of transfer From To

Action

required?

Notes

Credit card and

loan payments

Union Bank

deposit account

Union Bank

Credit Card or

loan account

Yes

Simply locate the account you wish

to make a payment in online banking

or the U.S. Bank Mobile App and

schedule your payment using the

bill pay feature.

Digital wire

transfers

Any account Any account Yes

Your wire transfer limit may change;

visit your local U.S. Bank branch for

assistance with wire transfers

exceeding your limit.

Wire processing in online banking

and the U.S. Bank Mobile App ends

at 1:30 p.m. PT.

For international wire transfers,

more information will be sent to

you separately.

If you are making payments to credit accounts and loans (e.g., auto, mortgage or credit card accounts) or

wiring funds, there are additional actions required on your part.

Your new account(s) information | 10

Transitioning your Union Bank personal account(s)

CHECKING ACCOUNT

What will happen to my Union Bank checking account?

Beginning May 30, your personal checking account will automatically change to a U.S. Bank checking account that

comes with great features. For additional information and benets for your account, please review the Consumer

Pricing Information section. It is necessary for us to assign a new account number to your checking account. You may

continue to use your existing account deposit slips and checks until your supply runs out.

Please see the following chart for your new checking account name.

Updated account names

If your current Union Bank account is:

Your updated U.S. Bank

account name will be:

In May, you will receive a

separate letter with your new

account number. That letter

will give instructions on how

to order new U.S. Bank checks

when you are ready.

Union Bank Access Account Safe Debit Account

Bank Freely™

U.S. Bank Smartly™

Checking account,

U.S. Bank Smart Rewards™

Primary rewards tier

Employee/Retiree Checking

Teen Access

Ready to Go Checking

Banking by Design

Company Benets Banking

Union Bank Essentials Checking

Priority Banking

Signature Banking Regular Checking

Signature Banking Tiered Interest Checking

Tiered Interest Checking

Pacic Rim Company Benets Checking

Private Capital Advantage Checking

U.S. Bank Smartly™

Checking account,

U.S. Bank Smart Rewards™

Premium rewards tier

Private Advantage

Portfolio Connection

U.S. Bank Smartly™

Checking account,

U.S. Bank Smart Rewards™

Pinnacle rewards tier

As a courtesy to our customers, the monthly maintenance fee on the Safe Debit account will be waived through

February 2024. For customers converting into the U.S. Bank Smartly Checking account (Smart Rewards – Primary,

Plus, Premium or Pinnacle rewards tiers), you will not be charged a monthly maintenance fee until at least

March 2024 as one of your rewards tier benets.

Your new account(s) information | 11

CHECKING ACCOUNT Continued

Please note that if your checking account is being converted into the U.S. Bank Smartly Checking account, you will

be automatically enrolled in the noted rewards tier and it could be up to ve business days after conversion before

your tier benets will be available. Your combined qualifying balances and customer group information is reviewed

daily for additional rewards tier benets, but please note that not all balances may be available for review at the time

of conversion or for monthly reviews until June 2023. The rst annual review is at the end of 2023, per the terms

related to U.S. Bank Smart Rewards™ listed in the Consumer Pricing Information section, and your rewards tier may

change as a result. You will be notied prior to any rewards tier change.

For customers with a Portfolio Connection account, please watch for a separate communication with more

information regarding your new account.

Will I still be able to use my current checks?

Yes. You may continue to use your existing Union Bank checks and deposit slips, until your supply runs out, for your

deposit accounts following the transition of your accounts to U.S. Bank.

SAVINGS AND MONEY MARKET ACCOUNTS

What will happen to my savings and money market accounts at Union Bank?

Beginning May 30, your savings and money market accounts at Union Bank will have an updated name; please refer

to the following chart. Please review the Consumer Pricing Information section for miscellaneous savings or money

market fees and a summary of ATM transaction fees.

It is necessary for us to assign a new account number to your savings or money market account. You may continue

to use your existing account deposit slips and checks until your supply runs out.

Updated account names

If your current Union Bank account is:

Your updated U.S. Bank

account name will be:

In May, you will receive a letter

with your new savings or

money market account number

and instructions as to how you

can order new checks and

deposit slips for your accounts.

Please note that check usage is

only available on the Elite

Money Market account.

MoneyMarket

High Rate MoneyMarket

Money Market Extra

Union Bank Preferred Savings

Elite Money Market

Teen Savings

Standard Savings

BTM Savings

Trustee Savings

Bank Freely™ Savings

Regular Savings

Kidz Savings

55 Plus Savings

Nest Egg Savings

Retirement Money Market Savings Retirement Money Market

As a courtesy to our customers, the monthly maintenance fee on the above converting accounts will be waived

through February 2024.

Your new account(s) information | 12

Transitioning your Union Bank personal account(s)

Personal accounts – statement update

Whether you currently receive electronic statements

(e-statements) or paper statements, you will receive a

nal paper Union Bank account statement for each of

your Union Bank checking, money market or savings

accounts in the mail by early June. This statement will

reect any account activity between your most recent

statement and May 26. Starting with the activity on

May 27, you will receive a U.S. Bank account statement.

If you currently receive both e-statements and paper

statements, you will receive only e-statements once

your account has converted.

Past Union Bank statements will be viewable through

U.S. Bank mobile and online banking; however, there

may be a delay in your ability to view statements online.

We recommend that you retain any online statements

from your Union Bank digital banking that you may need

immediately. Please note that if you do not enroll in

U.S. Bank mobile and online banking within 60 days of

account conversion and you currently receive

e-statements, your e-statements will convert to

paper statements and you may be charged a fee.

For more information, please refer to the Consumer

Pricing Information section on fees for deposit

account statements.

Are there fees for deposit account statements?

e-statements

For customers who currently receive e-statements with

Union Bank, we will continue to provide e-statements

with U.S. Bank at no charge with enrollment in U.S. Bank

mobile or online banking.

You can also easily manage your paperless preferences

anytime within U.S. Bank digital banking services.

Paper statements

The Consumer Pricing Information section provides

additional information applicable to paper statements.

If you choose to continue with paper statements, they

will automatically be combined within one full statement

cycle after May 30.

Customers converting to the U.S. Bank Smartly

Checking account (Smart Rewards – Primary, Plus,

Premium or Pinnacle rewards tiers) will not be charged a

paper statement fee until at least March 2024 as one of

your rewards tier benets.

To avoid a paper statement fee, enroll in electronic or

paperless statements through online banking or the

U.S. Bank Mobile App. For additional instructions on

how to enroll, refer to the Mobile and Online Banking

section. Please refer to the enclosed Your Deposit

Account Agreement for information about statements

and notices.

Will I still be able to use my current Union Bank Debit

and/or ATM Card?

Yes. You may continue to use your existing Union Bank

Debit and/or ATM Card through July 31, or when you

activate your new U.S. Bank Debit and/or ATM Card,

whichever comes rst.

Will my Union Bank Debit and/or ATM Card

withdrawal and purchase limit remain the same?

Yes. Your withdrawal and purchase limits will remain the

same with your new U.S. Bank Debit and/or ATM Card.

What will happen to my Union Bank Credit Card?

Your current Union Bank Credit Card will be replaced

with a new U.S. Bank Credit Card and number beginning

in late May. Please continue to use your Union Bank

Credit Card as usual and watch for future U.S. Bank

communications regarding your credit card account.

What will happen to my safe deposit box?

Your safe deposit box will remain at the same location

unless you have been notied in a separate letter. If you

are currently having your safe deposit box rental fee

debited from your Union Bank checking, savings or

money market account, this will continue only if your

account is being converted to a U.S. Bank checking,

savings or money market account. A notice will be

mailed annually for the amount due. Please read this

notice carefully as your safe deposit box rental fee and

discounts may change as it switches over to the

U.S. Bank standard safe deposit box pricing. If you

receive an invoice to pay your annual safe deposit box

rental fee, that will continue; however, please be aware

that U.S. Bank charges a fee for this service. Please refer

to the Consumer Pricing Information section for

related fees.

You can avoid the invoice fee by having your safe

deposit box rental fee automatically debited from your

U.S. Bank checking, savings or money market account.

Please review the Consumer Pricing Information section

for more information about available safe deposit box

rental fee discounts.

1. Safe deposit boxes and their contents are not covered by FDIC insurance or U.S. Bank’s insurance policy.

Your new account(s) information | 13

1. Services available in U.S. only. Eligibility requirements and restrictions

apply. Contact a U.S. Bank branch to obtain the Digital Services Agreement

for more information.

2. For text alerts, standard messaging charges apply through your mobile

carrier and message frequency depends on account settings.

You can easily make a deposit several ways beginning

on May 30.

•

Mobile check deposit is safe and secure with the

U.S. Bank Mobile App. Your mobile check deposit limits

can be found in your mobile banking.

•

Most U.S. Bank ATMs accept deposits 24 hours a day

and do not require an envelope. To nd an ATM with

deposit capabilities, please visit usbank.com/locations.

•

Any U.S. Bank branch will welcome your deposit at the

teller or drive-up window.

How are my FDIC-insured deposits handled?

The FDIC will insure your Union Bank deposits separately

from any existing U.S. Bank deposits for a period of six

months after the date of the merger of Union Bank

and U.S. Bank.

Certicates of deposit (CDs) previously held at

Union Bank are separately insured until the earliest

maturity date after the end of the six-month period. CDs

that mature during the six-month period and are renewed

for the same term and dollar amount as the original

deposit (either with or without accrued interest added to

the principal amount) will continue to be separately

insured until the rst maturity date after the six-month

period. If a CD matures during the six-month period and is

renewed for any other term or dollar amount, it will be

separately insured only until the end of the six-month

period. Your U.S. Bank deposit accounts are FDIC-insured

to the maximum permitted by law.

When will my deposited funds be available to me?

In most cases, you will have immediate access to the rst

$225 of the total deposits made the business day of the

deposit, including on ATM deposits; generally, the

remaining amount of the deposit will be available to you

on the rst business day after the day the deposit was

made unless you are notied otherwise. Please review the

enclosed Your Deposit Account Agreement for information

about the U.S. Bank Funds Availability Policy, which

applies to checking, savings and money market accounts.

What if a deposit gets returned?

If you make a deposit and the item is returned for

insucient funds on the account, we will return that

deposited item automatically to you. We will not

automatically redeposit the item. A Returned Deposited

Item fee may apply; please see the Consumer Pricing

Information section for more details.

How will I be notied of an overdraft or returned item

on my account?

U.S. Bank has several ways to notify customers of an

overdraft or returned item on an account. We will mail a

notication the day after the occurrence, but there are

other ways to know if your Available Balance falls below a

certain amount or has become negative.

Simply enroll in U.S. Bank mobile and/or online banking so

you can view your account transaction activity at any

time. You can set up multiple alerts to be sent directly to

you via email or text message on your mobile device.

2

All consumer checking accounts (excluding Safe Debit

Accounts) are eligible for U.S. Bank Overdraft Fee

Forgiven, which gives you extra time to bring your

account to a zero or positive Available Balance to waive

Overdraft Paid Fees. Please see the Overdraft Coverage

and Overdraft Fees section for more details on Overdraft

Fee Forgiven.

What will happen to my automatic recurring transfers

between deposit accounts?

If you have an automatic recurring transfer between

your deposit accounts at Union Bank, those transfers

will continue.

What about my existing stop payments?

If you currently have a stop payment on your account for

check and ACH transactions, it will remain in eect as

your accounts convert to U.S. Bank for the duration stated:

•

Expiration date is before May 30, 2025 – stop payment

date will remain the same.

•

Expiration date is after May 30, 2025 – stop payment

will expire on May 30, 2025.

•

No expiration date – stop payment will expire on

May 30, 2024.

To cancel a stop payment, you can log into your account

via the U.S. Bank Mobile App or online banking, at your

local U.S. Bank branch, or by calling 24-Hour Banking at

800-USBANKS (872-2657).

If you have a stop payment on your Union Bank Debit

Card, it will not be converted to U.S. Bank. After receiving

your new U.S. Bank Debit Card, please contact U.S. Bank

to re-establish any stop payments that were set up with

your Union Bank Debit Card.

If I have a personal loan, lease or line of credit, what

will happen to my account?

You will be notied at least 15 days prior to conversion if

your account number changes and of the new mailing

address for payments. If your account is enrolled in ACH,

this service can continue with no action required on your

part at this time.

How can I access my line of credit?

You will be able to access your line(s) of credit as you’re

used to until further notice. New instructions will be

provided at a later date.

Union Bank Time Deposit Account(s) (CDs) and IRA account(s)

What will happen to my Union Bank Time Deposit

account(s) (CDs)?

If you have a Union Bank Time Deposit Account (CD), your

existing terms and conditions, including your interest rate

and maturity date, will remain the same until your

certicate matures. Your CD will receive a new account

number, which will be mailed to you in May.

The form in which your interest is paid – added to the

account, transferred to another deposit account or by

check – will not change. Please note that U.S. Bank will

not send a notice when interest is paid on a CD account.

If you earn interest and move to another state, U.S. Bank

will report the interest earned during the time you lived in

each state.

A note about odd-term CDs: If you opened a CD with a

term other than 12, 24, 36, 48 or 60 months, it will

automatically renew at the same term and will receive the

rate for the CD term that is closest to but not exceeding

the term of your current CD, unless you request a dierent

term (for example, if you have a 27-month odd-term CD,

your CD will renew back into a 27-month term and your

renewal rate will default to the 24-month rate).

A note about CDs greater than 60 months: Note that

any CD with a term greater than 60 months will

automatically renew into a 60-month CD term.

You may request to have your CD summary information

added to your checking account statement beginning

May 30. Please note that U.S. Bank will not send a

renewal notice if a CD is automatically renewed.

What will happen to my Union Bank Foreign Currency

Time Deposit?

For customers with a Foreign Currency Time Deposit

account, please watch for a separate communication with

more information regarding your new account.

Rate information – The interest rate on your account may be adjusted upon renewal. Unless otherwise indicated, you

will earn this adjusted rate for the next term of your certicate. Your CD is automatically renewed for the same term.

The rate is determined based on the published rate for the CD, excluding CD Specials, that is closest to but not

exceeding the term of the CD. Advertised interest rate and Annual Percentage Yield (APY) can be found at usbank.com

or by calling 24-Hour Banking at 800-USBANKS (872-2657). The Annual Percentage Yield assumes interest remains on

deposit until maturity. A withdrawal will reduce earnings.

Balance computation method – Upon the rst renewal of your Union Bank CD we will use the daily balance method to

calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day.

Interest begins to accrue the business day you deposit non-cash items, such as checks.

Compounding and crediting of interest – Interest will be credited annually for certicates with maturities greater than

one year, at maturity for certicates less than one year or, at your option, at the credit frequency listed on your original

Union Bank Time Deposit Account (CD) account terms and conditions. Interest will be compounded daily after the rst

CD renewal after May 30.

Renewal policy – You may withdraw the entire balance of your CD before its rst renewal day without incurring an

early withdrawal penalty and fee between May 30, 2023, and August 30, 2023. Once the CD matures and is renewed,

our standard renewal policy, listed here, will apply to the renewed CD. Unless notied otherwise, CDs will automatically

renew at maturity. A maturity notice is generated and mailed approximately 14 days prior to the maturity. Please note

that if you receive two maturity notices on your converting CD around the time of conversion, refer to the U.S. Bank

interim maturity notice and disregard the Union Bank maturity notice. You will have one opportunity during the grace

period of ten (10) calendar days from the maturity date to make changes, add funds and/or withdraw funds without

penalty. If the amount withdrawn is deposited into another time certicate at U.S. Bank within this ten (10) day period,

interest will be paid during the ten (10) day period at the rate applicable to the new certicate. The bank may, upon not

less than 30 days’ written notice, elect to call a certicate for payment on a maturity date.

The current terms of your Union Bank Time Deposit Account (CD) will remain in eect until maturity. The following are

the new terms and early withdrawal penalties and fees that will apply to any renewed CD. Please read these carefully.

If you do not agree with these terms, you may withdraw the full amount of your CD prior to its rst renewal date

between May 30, 2023, and August 30, 2023, without incurring an early withdrawal penalty and fee.

Your new account(s) information | 14

Your new account(s) information | 15

Transaction limitations – You may not make deposits into your account until the maturity date, with the exception of

the 12-month and 18-month Variable-Rate IRA CDs. The 12-month and 18-month Variable-Rate IRA CDs will continue

to allow additional deposits until maturity, per the terms and conditions of the original certicate. You may make

partial withdrawals from your account prior to maturity; however, we will impose the early withdrawal penalty and fee

on the amount withdrawn. For partial early withdrawals on Union Bank CDs with a term of 7 to 31 days prior to its rst

renewal with U.S. Bank, we will assess a penalty of 7 days interest on the amount withdrawn. Interest that has

accrued or capitalized since the last renewal date may be withdrawn without penalty at any time. The minimum

partial withdrawal amount is $500. If a partial withdrawal is made, your remaining balance must meet minimum

opening balance requirements.

Minimum balance requirement – The minimum amount required to open a standard CD is $500. The minimum

amount required to open a CD Special is $1,000.

General provision – This deposit is not transferable. This certicate may not be paid to any person other than the

named depositor(s). Any person requesting payment of this certicate will be required to establish to the satisfaction

of the bank that s(he) is the depositor.

Early withdrawal penalty – Please note that your existing Union Bank CD early withdrawal penalties and fee

structure may result in a lower charge than the U.S. Bank CD early withdrawal penalties and fee structure. Existing

Union Bank CD early withdrawal penalties and fee will continue to apply until the rst U.S. Bank CD renewal.

Please note that we may not assess the Union Bank CD early withdrawal compensating penalty as dened in your

Union Bank Time Deposit Account (CD) disclosure, but other early withdrawal penalties will still apply. For partial

early withdrawals on Union Bank CDs with a term of seven (7) to 31 days prior to its rst renewal with U.S. Bank, we

will assess a penalty of seven (7) days interest on the amount withdrawn. As previously stated, you may withdraw the

entire balance of your CD before its rst renewal date without incurring an early withdrawal penalty and fee between

May 30, 2023, and August 30, 2023.

A CD is an agreement to keep the funds on deposit with the bank until the current maturity date. Except as required

by law, withdrawal prior to maturity will be permitted only with consent of the bank, which may only be given at the

time of withdrawal. Funds will generally be available no later than the seventh business day after the day of your

deposit. The following fees and penalties charged for early withdrawals and redemptions are eective after the rst

renewal of your converted U.S. Bank CD.

If your account has a term of six

months or less, the penalty will be

the greater of A or B, plus a $25

early withdrawal fee.

A. All interest that would have

been earned on the funds

withdrawn if held for the

entire term

B. 1% of the amount withdrawn

If your account has a term of

greater than six months through

12 months, the penalty will be the

greater of A or B, plus a $25 early

withdrawal fee.

A. One-half of the interest that

would have been earned on the

funds withdrawn if held for the

entire term

B. 1% of the amount withdrawn

If your account has a term greater

than one year, the penalty will be

the greater of either A or B, plus a

$25 early withdrawal fee.

A. One-half of the interest that

would have been earned on the

funds withdrawn if held for the

entire term

B. 3% of the amount withdrawn

The penalty may be waived in the case of death or judicially declared mental incompetence of any owner of the

certicate. The penalty may also be waived on IRA CDs in the case of permanent disability of the owner or for normal

or required distribution of retirement funds at age 72 or beyond.

Please review to the enclosed Your Deposit Account Agreement and the Consumer Pricing Information section for

additional information applicable to CDs.

Your new account(s) information/Overdraft coverage and overdraft fees | 16

What will happen to my IRA?

If your IRA is invested in a Union Bank CD (IRA Time

Deposit), your rate and term will remain the same until

maturity unless your IRA CD is a Variable-Rate IRA CD.

All Variable-Rate IRA CDs will remain at their current

term and rate structure until renewal, when the IRA CD

will renew into a xed rate IRA CD. If your IRA is invested

in a Retirement Money Market Savings account, it will be

called a U.S. Bank Retirement Money Market account.

Beginning May 30, U.S. Bank will become the custodian

of your IRA plan. The terms and conditions of your IRA

plan remain the same. Please review the Consumer

Pricing Information section for IRA plan fee details.

U.S. Bank will waive annual IRA plan fees for converted

Union Bank IRAs in 2023.

Your plan and account number will be updated.

In May, you will receive a separate letter with your new

account number. Quarterly statements with all activity

and interest paid are sent for IRA plans that include a

Retirement Money Market account. IRA plans that only

contain CDs will receive an annual year-end IRA plan

statement that displays activity and interest paid for all

accounts within your IRA plan.

If you had an existing IRA plan at U.S. Bank and one with

Union Bank, you will receive two year-end statements

and two tax documents. This year-end statement also

serves as disclosure for your 5498 information for the

previous tax year. If contributions are made January 1

through April 15 for the previous tax year, an updated

5498 form will be mailed to you each May.

You will continue to receive paper statements for your

IRA. You may choose to add summary information for

your IRA to your checking account statement or combine

your IRA plans by calling us at 800-USBANKS (872-2657)

beginning May 30.

If you are currently making contributions to your

Variable-Rate, Retirement Income or Frontier IRA CD

during the term, you will be able to continue to do so

through the rst maturity beginning May 30. Upon the

rst renewal, the ability to add a deposit during the term

of the IRA CD will no longer be available. Contributions

can only be made during the grace period upon renewal

of your CD.

For customers who make regular deposits to an IRA CD,

a Retirement Money Market account is a more exible

alternative over the long term. Large balances can be

converted to an IRA CD as they accumulate.

Please note that beginning May 30, customers age 72 or

older will be able to withdraw funds on an IRA CD during

the term of the CD without penalties and fees. Automatic

recurring IRA distributions can also be set up penalty-

free from an IRA CD for customers age 59 ½ or older.

For converted IRA CDs, your existing terms and

conditions will remain in eect until the rst maturity

after conversion. These terms and conditions allow

customers age 70 ½ or older to withdraw funds on an IRA

CD during the term of the CD without penalties and fees.

Customers age 59 ½ or older can transfer funds to

another U.S. Bank IRA CD penalty-free. Automatic

recurring IRA distributions can also be set up penalty-

free from an IRA CD for customers age 59 ½ or older.

Union Bank Time Deposit Account(s) (CDs) and IRA account(s)

Overdraft coverage and overdraft fees

Your Union Bank checking and money market accounts

will convert with our standard overdraft coverage.

Information about our standard overdraft coverage,

costs and limits is provided in the ATM and Debit Card

Overdraft Coverage Notication beginning on page 18.

You can also refer to the enclosed Your Deposit Account

Agreement for additional details.

What will happen to my current ATM and debit card

overdraft coverage?

Your current Union Bank ATM and Debit Card overdraft

coverage election will continue with your converted

U.S. Bank account.

If you have said “yes” or opted in previously to ATM and

debit card overdraft coverage, we will authorize the

following types of transactions and you may incur an

overdraft fee:

•

ATM transactions

•

Everyday debit card transactions (purchases made with

your debit card on a day-to-day basis)

If you have said “no” or opted out previously to ATM and

debit card overdraft coverage, we will not authorize and

pay overdrafts for those types of transactions listed

above. Those transactions will be declined and you will

not be charged an Overdraft Paid Fee.

Overdraft protection information

What will happen to my current overdraft protection options?

Your current checking account overdraft protection will continue for accounts linked:

•

To another deposit account (checking, savings and/or money market) where at least one account owner is the

same on both the linked deposit account and the checking account.

•

To a converted and activated U.S. Bank Credit Card, if all of the account owners are also the account owners on

the linked credit card account.

If you currently have a deposit or credit account linked to your checking account with dierent account owner(s)

than your checking account, the account will not be linked to your checking account for overdraft protection

beginning May 30.

To avoid overdraft fees and manage your overdraft protection, you can link another deposit account, credit

product, or active U.S. Bank Credit Card account with the same account owner(s) or open a new deposit account

before May 30. An overdraft protection transfer fee may apply when transfers are made from eligible linked credit

accounts. Please see the Consumer Pricing Information section for more details.

Changes to your overdraft protection

Beginning May 30, there will be some changes to how your overdraft protection service works, such as

the amount transferred, interest rates and fee(s). Refer to the Consumer Pricing Information section for

more information.

Additionally:

•

If you currently have a Cash Reserve account, it will be converted to the U.S. Bank Reserve Line as long as

account owner(s) names are the same on both accounts. Accounts without the same account owner(s) will not

continue to be linked for overdraft protection. You will need to apply for and open a new U.S. Bank Reserve Line

with the same account owner(s) to be eligible to link it as overdraft protection.

•

Personal accounts and business accounts cannot be linked together for overdraft protection. Personal and

business accounts currently linked together for overdraft protection will not continue to be linked.

How overdraft protection works

Once you link your accounts, funds will automatically be transferred from the linked overdraft protection account

as follows:

•

If you have linked eligible accounts, and the negative Available Balance in your checking account is $5.01 or more,

the advance amount will transfer in multiples of $50. If, however, the negative Available Balance is $5.00 or less,

the amount advanced will be $5.00. The Overdraft Protection Transfer Fee is waived if the negative Available

Balance in your checking account is $50.00 or less. Refer to the Consumer Pricing Information section for

Overdraft Protection Transfer fees.

•

Please note, if you have overdraft protection and your account becomes overdrawn, overdraft protection funds

will be accessed before the account is eligible for Overdraft Fee Forgiven. Refer to the Overdraft Coverage and

Overdraft Fees section, and the enclosed Your Deposit Account Agreement for more information about Overdraft

Protection Plans.

Please review the ATM and Debit Card Overdraft Coverage Notication beginning on the next page for

terms related to overdraft practices. This information is also included in Your Deposit Account Agreement.

Overdraft protection information | 17

ATM and Debit Card Overdraft Coverage Notication | 18

What is an overdraft?

An overdraft occurs when you do not have enough of an Available Balance in your account to cover a transaction and

we pay it on your behalf. We can cover your overdraft in two dierent ways:

1. We have standard overdraft coverage that comes with your account.

2. We also oer overdraft protection plans, which may be less expensive than our standard overdraft coverage.

To learn more, ask us about these plans.

– Link to your savings, money market or checking account

– Link to your line of credit

– Link to your credit card account

This notice explains our overdraft coverage options and U.S. Bank Overdraft Fee Forgiven.

What is the standard overdraft coverage that comes with my account?

As part of our standard overdraft coverage, we will authorize and pay overdrafts for these types of transactions at

our discretion:

– Checks and other transactions using your checking account number

– Automatic bill payments

– Recurring debit card transactions, such as setting up your debit card to automatically pay a monthly gym

membership

We will not authorize and pay overdrafts for these types of transactions unless you say “yes” to ATM and Debit Card

Overdraft Coverage:

– ATM transactions

– Everyday debit card transactions (purchases made with your debit card on a day-to-day basis)

We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any

type of transaction. If we do not authorize and pay an overdraft, your transaction will be declined or returned with

no fee.

How much does overdraft coverage cost?

U.S. Bank will charge an Overdraft Paid Fee of $36.00 for each overdraft item we pay on your behalf. Whether we

charge the fee is based upon the dollar amount of the item, meaning:

– There is no Overdraft Paid Fee for each overdraft item we pay on your behalf that is $5.00 or less.

– The Overdraft Paid Fee is $36.00 for each overdraft item we pay on your behalf that is $5.01 or more. If the

Available Balance is negative by $50.00 or less, no Overdraft Paid Fee will be charged.

Are there limits to what I could be charged for overdrafts?

U.S. Bank limits the number of charges to a daily maximum of 4 Overdraft Paid Fees per day, no matter how many

items we pay on your behalf. We know it is sometimes dicult to track every transaction. In the event the Available

Balance at the end of the business day is or would be overdrawn $50.01 or more, an Overdraft Paid Fee(s) may be

assessed for each item paid greater than $5.00. In the event your Available Balance at the end of the business day is

or would be overdrawn by $50.00 or less, we will not charge an Overdraft Paid Fee.

ATM and Debit Card Overdraft Coverage Notication

What you need to know about overdraft and overdraft fees

You have a choice to make about your checking or money market account: Tell us if you want overdraft coverage

for ATM and debit card transactions.

ATM and Debit Card Overdraft Coverage Notication | 19

How does Overdraft Fee Forgiven work?

All consumer checking accounts (excluding Safe Debit Accounts) are eligible for U.S. Bank Overdraft Fee

Forgiven, which gives you extra time to bring your account to a zero or positive balance to waive those fees.

The Overdraft Fee Forgiven period starts the rst day the Available Balance becomes negative and you were

charged an Overdraft Paid Fee(s). U.S. Bank will review your account at the end of the Overdraft Fee Forgiven

period at 11 p.m. ET on the day we charge the Overdraft Paid Fee(s). If there are qualifying deposits and the

Available Balance* is at least $0, we will automatically waive the Overdraft Paid Fee(s).

*Excluding the Overdraft Paid Fee(s) and including immediate and same day deposits

If you have linked eligible Overdraft Protection accounts, and the negative Available Balance in your checking

account is $5.01 or more, the advance amount will transfer in multiples of $50. If however, the negative Available

Balance is $5.00 or less, the amount advanced will be $5.00. The Overdraft Protection Transfer Fee is waived

if the negative Available Balance in your checking account is $50.00 or less. Please note, if you have Overdraft

Protection and your account becomes overdrawn, Overdraft Protection funds will be accessed before the

account is eligible for Overdraft Fee Forgiven. Refer to Your Deposit Account Agreement, section titled “Overdraft

Protection Plans,” for additional information.

How do I say “yes” to ATM and Debit Card Overdraft Coverage?

If you want us to authorize and pay overdrafts on ATM and everyday debit card transactions as part of your

account’s standard overdraft coverage:

– Call 24-Hour Banking at 800-USBANKS (872-2657)

– Visit your local U.S. Bank branch

– Log in to the U.S. Bank online banking and select an account. You can manage your ATM and Debit Card

Overdraft Coverage election under Manage account.

– Log in to the U.S. Bank Mobile App and select an account. Click on Account options to manage your ATM and

Debit Card Overdraft Coverage election.

Change your mind?

You always have the right to change your choice by contacting us in one of the ways described above. A change

from “no” to “yes” may not be immediate.

How else can U.S. Bank help me avoid overdrafts?

To help you manage your account, we can alert you if your balance is low with a text message

2

or email. Please be

advised that these alerts may not be sent immediately. Sign up for this service by logging into your account

at usbank.com.

Additional information

For a comprehensive list of all pricing, ATM and Debit Card Overdraft Coverage terms and policies please see

the Consumer Pricing Information disclosure and Your Deposit Account Agreement. Deposit products oered by

U.S. Bank National Association.

1. Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank

ATM, check deposits in branch and internal transfers from another U.S. Bank account. Deposits that generally will not qualify for Overdraft Fee Forgiven

include: Mobile check deposit, extended hold placed on a deposit and deposits into new accounts opened less than 30 days where funds are generally made

available the fth business day after the day of your deposit. Please see Your Deposit Account Agreement disclosure for more information.

2. For text alerts, standard messaging charges apply through your mobile carrier and message frequency depends on account settings.

Member FDIC. ©2022 U.S. Bank

Rev. 11/22

Consumer Pricing Information | 20

Personal Banking

Effective February 13, 2023

Something for everyone

All U.S. Bank personal checking accounts include:

– Mobile and online banking with free credit score access

2

– Mobile check deposit

3

– Bill pay

4

– Send money with Zelle

®5

– Email and text alerts

6

– U.S. Bank Visa

®

Debit Card

We’re ready to help 24 hours a day, 7 days a week – get in touch.

Branch and self-service

7

ATM locations

– Branches in more than 25 states

– One of the largest ATM networks in America

– Access your accounts at thousands of additional

partner

8

ATMs nationwide

– No surcharges at MoneyPass

®

Network ATMs

9

– Find a branch or ATM near you in the app or at

locations.usbank.com.

usbank.com

800-USBANKS (872-2657)

We accept relay calls.

Outside the U.S. 503-401-9991 (call collect)

Scan here with your mobile

device to download the

U.S. Bank Mobile App.

1. A minimum deposit of $25 is required to open a U.S. Bank personal checking account.

2. Free credit score access, alerts and Score Simulator through TransUnion’s CreditView Dashboard

®

are available to U.S. Bank online and mobile banking customers.

Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for the alert functionality. The free VantageScore

®

credit

score from TransUnion

®

is for educational purposes only and not used by U.S. Bank to make credit decisions.

3. Eligibility requirements and restrictions apply. Contact a U.S. Bank branch to obtain the Digital Services Agreement for more information.

4. Safe Debit accounts are not eligible for automatic payments or expedited delivery and can only pay billers listed in our system who accept electronic payment.

5. Must have a bank account in the U.S. to use Zelle

®

. Terms and conditions apply. Zelle

®

and the Zelle

®

related marks are wholly owned by Early Warning Services, LLC

and are used herein under license.

6. For text alerts, standard messaging charges apply through your mobile carrier and message frequency depends on account settings. Please be advised that the alerts

may not be sent immediately.

7. Self-service devices enable consumers to select and conduct banking services.

8. U.S. Bank has established alliances to expand ATM convenience. These partner ATMs display the U.S. Bank logo and are included in the denition of a U.S. Bank ATM.

9. ATM Transaction Fee. U.S. Bank will assess this fee for each ATM Transaction conducted at the Non-U.S. Bank ATM. Non-U.S. Bank ATMs are dened as any ATM that

does not display the U.S. Bank logo in any manner, physically on the ATM or digitally on the screen.

ATM Surcharge. Non-U.S. Bank ATM owners may apply a surcharge fee on ATM transactions at their ATMs. U.S. Bank participates in MoneyPass

®

, an ATM surcharge

free network. To nd MoneyPass ATM locations, select “Show MoneyPass

®

ATM Network locations” in the ATM locator https:// locations. usbank.com/search.html. If

you use an ATM that uses the MoneyPass

®

Network and are charged a surcharge fee, please contact us at 800-USBANKS (872-2657) for a refund of the surcharge fee.

Deposit products offered by U.S. Bank National Association. Member FDIC. Mortgage, home equity and credit products are offered by U.S. Bank National

Association and subject to credit approval. ©2022 U.S. Bank. The U.S. Bank Visa Debit Card is issued by U.S. Bank National Association pursuant to a license

from Visa U.S.A. Inc.

864204c

41862 02/23

Consumer Pricing Information

Consumer Pricing Information, Eective February 13, 2023 | 21

CHECKING ACCOUNT OPTIONS

– Send money with Zelle

®5

– Email and text alerts

6

– U.S. Bank Visa

®

Debit Card

U.S. BANK SMARTLY

TM

CHECKING SAFE DEBIT ACCOUNT1

Minimum Opening

Deposit

2

$25 $25

Monthly

Maintenance Fee

$6.95 $4.95

Requirement to

Waive Monthly

Maintenance Fee

No Monthly Maintenance Fee with one

of the following:

•

Combined monthly direct deposit

totaling $1,000+, or

•

Average account balance of $1,500

or greater,

3

or

•

Presence of an eligible U.S. Bank

credit card

4

Monthly Maintenance Fee

cannot be waived

Interest Tiers

5

less than $1,500

$1,500 to $9,999.99

$10,000 to $24,999.99

$25,000 to $49,999.99

$50,000 to $99,999.99

$100,000 to $249,999.99

$250,000 to $499,999.99

$500,000 and above

None

1. No checks issued/use of checks is not permitted. Safe Debit account subject to terms and conditions and fees and charges for select services. Please refer to the

U.S. Bank Safe Debit Account Terms and Conditions and Safe Debit Account Pricing and Information guide.

2. Accounts opened through online, mobile or phone banking must have an opening deposit, or the account will close after 30 days. Once the opening deposit has been

made, to keep an account open it must have a positive balance or deposit/withdrawal activity. An account will automatically close if it has a zero balance and no

deposit/withdrawal activity for four consecutive months.

3. The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of

calendar days within the statement period.

4. Qualifying accounts include U.S. Bank activated credit cards. Credit products are subject to eligibility requirements and normal credit approval and may be subject to

additional charges such as annual fees. No limitation on Bank Smartly checking accounts with this benet.

5. Variable rate account. Interest rates are determined at the bank’s discretion and can change at any time. Speak to a banker for current deposit rates, disclosures on

rates, compounding and crediting, and other balance information.

Consumer Pricing Information, Eective February 13, 2023 | 22

CHECKING ACCOUNT OPTIONS

(Continued)

U.S. BANK SMARTLY

TM

CHECKING SAFE DEBIT ACCOUNT1

ATM Transactions

•

No ATM transaction fees at U.S. Bank ATMs

•

Non-U.S. Bank ATM transaction fees apply

2

•

No ATM transaction fees at

U.S. Bank ATMs

•

Non-U.S. Bank ATM transaction

fees apply

2

Paper Statement Fee

•

$2.00 Paper Statement Fee

3

•

No Paper Statement Fee

3

Check Printing Fee

•

50% discount on initial box of personal checks

4

Additional Features

•

U.S. Bank Overdraft Fee Forgiven

5

•

Take 0.25% of your new first mortgage loan

amount and deduct it from the closing costs, up

to a maximum of $1,000

6

•

100 Free Trades

7

per calendar year with

a self-directed brokerage account, exclusively

through our affiliate, U.S. Bancorp Investments*

•

No checks

•

No overdraft fees

•

Discount on money orders

1. No checks issued/use of checks is not permitted. Safe Debit account subject to terms and conditions and fees and charges for select services. Please refer to the

U.S. Bank Safe Debit Account Terms and Conditions and Safe Debit Account Pricing and Information guide.

2. ATM Transaction Fee. U.S. Bank will assess this fee for each ATM Transaction conducted at the Non-U.S. Bank ATM. Non-U.S. Bank ATMs are dened as any ATM that

does not display the U.S. Bank logo in any manner, physically on the ATM or digitally on the screen.

ATM Surcharge. Non-U.S. Bank ATM owners may apply a surcharge fee on ATM transactions at their ATMs. U.S. Bank participates in MoneyPass

®

, an ATM surcharge

free network. To nd MoneyPass ATM locations, select “Show MoneyPass

®

ATM Network locations” in the ATM locator https:// locations. usbank.com/search.html.

If you use an ATM that uses the MoneyPass

®

Network and are charged a surcharge fee, please contact us at 800-USBANKS (872-2657) for a refund of the surcharge fee.

3. Additional fees may apply for statements with check images. For additional fee information see Miscellaneous Checking, Savings or Money Market Fees section. Check

images are available with paper or e-statements.

4. When changing existing checking options or customer group, check order discounts may not be immediately available, but will generally be available within ve business

days. Additional shipping fees may apply if expedited or shipped outside the continental United States.

5. Overdraft Fee Forgiven Program – Consumer checking accounts (excluding Safe Debit accounts) assessed an Overdraft Paid Fee may qualify for a fee waiver. The

Overdraft Fee Forgiven period starts the rst day your Available Balance becomes negative and you were charged an Overdraft Paid Fee(s). U.S. Bank will review your

account at the end of the Overdraft Fee Forgiven period (11 p.m. ET) and if your Available Balance (excluding the Overdraft Paid Fees and including immediate and same

day deposits), is at least $0 we will waive Overdraft Paid Fee(s) charged. Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic

deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATM, check deposits in branch and internal transfers from another U.S. Bank account. Deposits that

generally will not qualify for Overdraft Fee Forgiven include: Mobile check deposit, extended hold placed on a deposit and deposits into new accounts opened less than

30 days where funds are generally made available the fth business day after the day of your deposit. Refer to the Determining the Availability of a Deposit – All

Accounts section of Your Deposit Account Agreement for full funds availability details.

6. For purchase or renance transactions, the maximum credit is $1,000. Certain mortgages may not be eligible for stated credits. Offer may not be combined with any

other mortgage offers and can only be applied once per property within a 12-month period. To receive the U.S. Bank customer credit, a U.S. Bank Smartly™ Checking

account must be established prior to nal loan approval, or must have either an existing U.S. Bank Personal Checking Package or rst mortgage with U.S. Bank.

A minimum of $25 is required to open a U.S. Bank Smartly™ Checking account.

7. Offer is for 100 free trades per calendar year (Jan. 1-Dec. 31). Offer applies to online trades of equities and exchange-traded funds only and requires enrollment in

paperless documents for self-directed brokerage account. Free trades made available up to four business days from conrmation of account funding. This offer is not

designed to support day trading or active trading and may be revoked if there is excessive or unreasonable activity. Additional fees may apply. Please refer to the

Schedule of Commissions and Fees for more information at https://www.usbank.com/investing/online-investing/self-directed-investing/brokerage-fees.html.

Investment and Insurance products and services including annuities are:

NOT A DEPOSIT • NOT FDIC INSURED • MAY LOSE VALUE • NOT BANK GUARANTEED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY