HDFC Bank Limited Integrated Annual Report 2021-22 365

Report on Corporate Governance

[Report on Corporate Governance pursuant to the Companies Act, 2013 and the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015 {“the SEBI Listing Regulations”} and forming a part of the report of the Board of Directors]

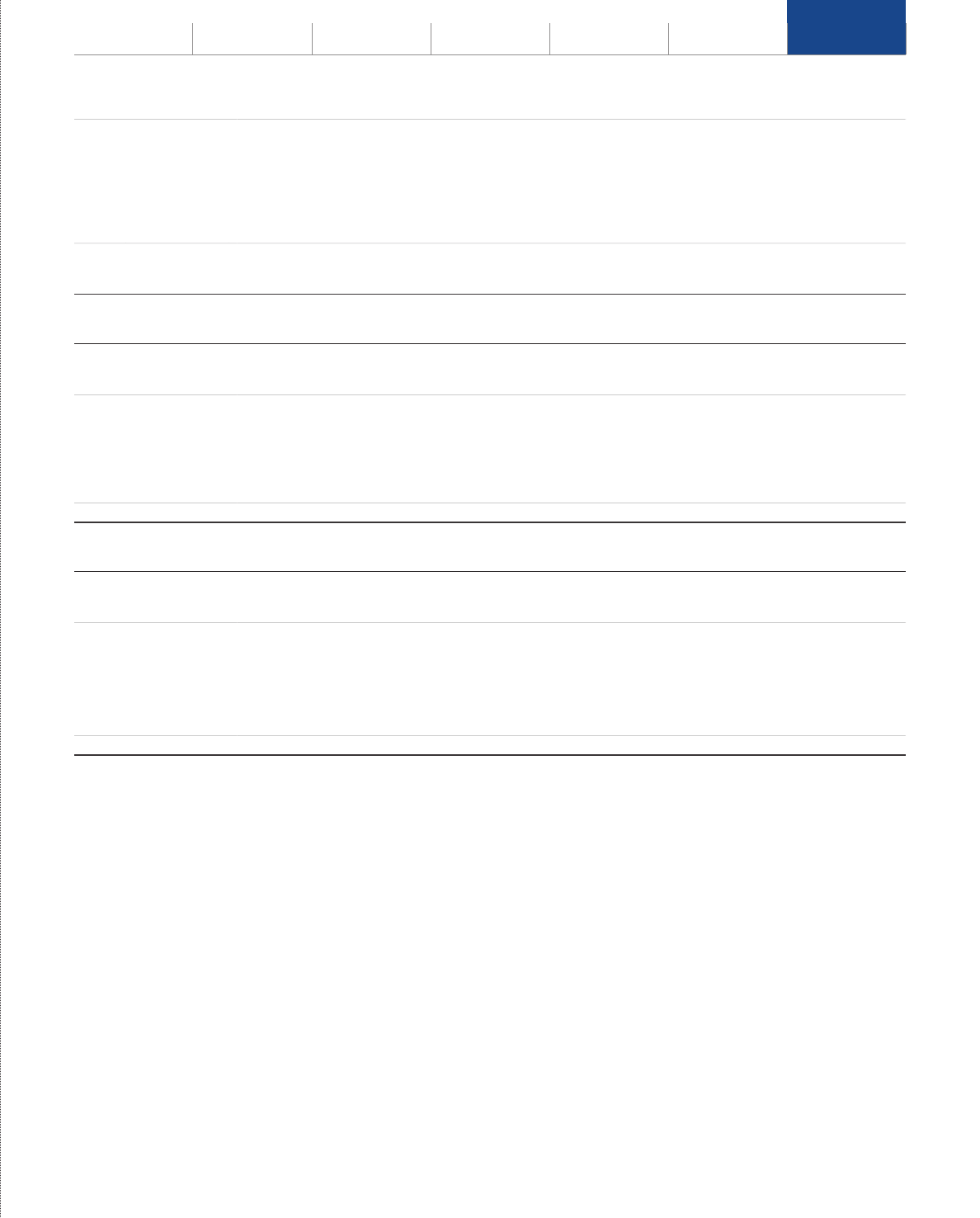

Shareholders Regulators

Board of Directors

Nomination &

Remuneration

Committee

Managing Director

Executive Director

Stakeholders’

Relationship

Committee

Audit

Committee

Risk Policy &

Monitoring

Committee

Other

Committees

Corporate Governance Framework

External and

Internal Auditors

• The Board of Directors of the Bank are the ultimate

custodians of governance.

• The Board of Directors are accountable to various

stakeholders such as shareholders, regulatory authorities

including Reserve Bank of India, Securities and Exchange

Board of India, Ministry of Corporate Affairs, etc.

• The Bankhasanengaged,experienced,diverse and a

well-informed Board. Through the governance framework

in the Bank, the Board along with its Committees, each

with dened roles, undertakes its responsibilities towards

all its stakeholders.

• ThejointStatutoryAuditorshaveareportingresponsibility

to the Audit Committee.

• The Managing Director & Chief Executive Officer is

responsible for the overall affairs of the Bank, under the

superintendence, guidance and control of the Board

of Directors.

• TheExecutiveDirector,undertheguidanceoftheManaging

Director, has over-sight over various business functions.

Philosophy on Code of Corporate Governance

The Bank believes in adopting and adhering to the best

recognized corporate governance practices and continuously

benchmarking itself against each such practice. The Bank

understands and respects its role and responsibility towards its

shareholders and strives hard to meet their expectations.

The Bank believes that best board governance practices,

transparent disclosures and shareholder empowerment are

necessary for creating shareholder value. The Bank has infused

the philosophy of corporate governance into all its activities.

The philosophy on corporate governance is an important tool

for shareholder protection and maximization of their long-

term values. The cardinal principles such as independence,

accountability, responsibility, transparency, fair and timely

disclosures, credibility, sustainability, etc. serve as the means

for implementing the philosophy of corporate governance in

letter and in spirit.

366

Report on Corporate Governance

Board of Directors

The composition of the Board of Directors of the Bank (“Board”)

is governed by the provisions of the Companies Act, 2013, the

Banking Regulation Act, 1949, SEBI Listing Regulations and

other applicable laws.

As on the date of this report, the Board consists of eleven (11)

Directors as follows:

Sr.

No.

Category Name of Director

1 Executive

Directors

i. Mr.SashidharJagdishan(ManagingDirector&

Chief Executive Ofcer)

ii. Mr. Kaizad Bharucha

2 Non-Executive

Directors

Mrs. Renu Karnad (Nominee of Housing

Development Finance Corporation Limited,

Promoter of the Bank)

3 Independent

Directors

i. Mr.AtanuChakraborty(Part-timeChairman&

Independent Director)

ii. Mr. Sanjiv Sachar

iii. Mr. Umesh Chandra Sarangi

iv. Mr. Sandeep Parekh

v. Mr. Malay Patel

vi. Mr. M. D. Ranganath

vii. Dr. (Mrs.) Sunita Maheshwari

viii.Mrs. Lily Vadera

Mr. Atanu Chakraborty, was appointed as the Part-time Chairman

&IndependentDirectoroftheBankwitheffectfromMay5,2021,

pursuant to the approval granted by the Reserve Bank of India,

and by the shareholders of the Bank at the 27

th

Annual General

Meeting held on July 17, 2021.

Mrs. Lily Vadera was appointed as an Independent Director of

the Bank for a period of ve (5) years from November 26, 2021

to November 25, 2026 (both days inclusive), not liable to retire

by rotation and the same was approved by the shareholders of

the Bank through Postal Ballot on March 27, 2022.

Mr. Srikanth Nadhamuni tendered his resignation as Non-

Executive (Non-Independent) Director of Bank with effect from

February 18, 2022.

Further, at the meeting of the Board of Directors held on April

16, 2022, Mrs. Renu Karnad has been re-appointed as the Non-

Executive Director (Nominee of Housing Development Finance

Corporation Limited, Promoter of the Bank) on the Board of the

Bank, for a period of ve (5) years with effect from September 3,

2022, subject to the approval of the shareholders at the ensuing

Annual General Meeting.

All the Directors have made necessary disclosures regarding

their directorship and committee positions occupied by them in

other companies. None of the directors are related to each other.

Details of directorships, memberships and chairpersonships of

the committees of other companies for the current Directors of

the Bank are as follows:

Name of Director

Directorships

on the Board

of other

companies*

Memberships of

committees of other

companies*

Mr. Atanu Chakraborty 2 -

Mr. Kaizad Bharucha - -

Mrs. Lily Vadera - -

Mr. Malay Patel 2 1

Mr. M. D. Ranganath - -

Mrs. Renu Karnad 11 (1)

**

5 (3)

Mr. Sandeep Parekh 1 -

Mr. Sanjiv Sachar 1 -

Mr. Sashidhar Jagdishan - -

Dr. (Mrs.) Sunita Maheshwari 6 -

Mr. Umesh Chandra Sarangi 1 -

* The gures in brackets indicate chairpersonships.

**Mrs. Karnad tendered her resignation from Unitech Limited with effect

from March 24, 2022, and completion of necessary formalities is awaited,

including placing the same before the Hon’ble Supreme Court of India, for

its kind consideration.

Note: For the purpose of considering the limit of the directorships

and limits of committees on which the directors are members /

chairpersons, all public limited companies (whether listed or not),

private limited companies, foreign companies and companies

under Section 8 of the Companies Act, 2013 have been

included. Further, chairpersonships / memberships of only the

Audit Committee and the Stakeholders’ Relationship Committee

in these companies have been considered.

Prole of Board of Directors

The prole of the Directors of the Bank as on the date of this

report are as under:

Mr. Atanu Chakraborty (DIN 01469375)

[Part-time Chairman and Independent Director]

Mr. Atanu Chakraborty, aged sixty-two (62) years, served the

Government of India, for a period of thirty-ve (35) years, as

a member of Indian Administrative Service (IAS) in Gujarat

cadre.HehasmainlyworkedinareasofFinance&Economic

Policy, Infrastructure,Petroleum& NaturalGas. IntheUnion

Government, he held various posts such as Secretary to

Government of India in the Ministry of Finance- Department of

Economic Affairs (DEA) during FY 2019-20. As Secretary (DEA),

he co-ordinated economic policy making for all ministries/

departments and managed entire process of formulation

of budget making for Union of India, including its passage in

Parliament. He was responsible for scal management policies,

policies for public debt management and development &

management of nancial markets.

Mr. Chakraborty also handled nancial stability and currency,

domestic&foreignrelatedissuesaswell.Hemanagedowof

funds with multilateral and bilateral nancial institutions and had

multiple interfaces with them. He also headed a multi-disciplinary

HDFC Bank Limited Integrated Annual Report 2021-22 367

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

task force that produced the National Infrastructure Pipeline

(NIP). He has also served as Secretary to the Union Government

for Disinvestment (Department of Investment and Public Asset

Management) wherein he was responsible for both policy as well

as execution of the process of disinvestment of Government of

India’s stake in state owned enterprises.

During the period 2002-07, Mr. Chakraborty served as Director

and subsequently as Joint Secretary, Ministry of Finance

(Department of Expenditure). During this period, he appraised

projects in the Infrastructure sector as well as looked after

subsidies of Government of India. He had also updated and

modernizedtheGovernment’sFinancial&Procurementrules.

Mr. Chakraborty has also discharged varied roles in the Gujarat

State Government including heading the Finance Department

as its Secretary. He had been responsible for piloting the private

sector investment legislation in the State. In the State Govt.,

he has worked on the ground in both public governance and

development areas.

Mr. Chakraborty has also served on the Board of World Bank as

alternate Governor as well as on the Central Board of Directors of

the Reserve Bank of India. He was also the Chairman of National

Infrastructure Investment Fund (NIIF) as also on the Board of

many listed companies. Mr. Chakraborty was the CEO/MD

of the Gujarat State Petroleum Corporation Limited group of

companies as well as Gujarat State Fertilizers and Chemicals

Limited. Mr. Chakraborty had published articles in reputed

journals in the areas of public nance, risk sharing in Infrastructure

projects and gas infrastructure. Mr. Chakraborty graduated as

aBachelorinEngineering(Electronics&Communication)from

NIT Kurukshetra. He holds a Diploma in Business Finance (ICFAI,

Hyderabad) and a Master’s degree in Business Administration

from the University of Hull, UK.

Mr. Chakraborty is an Independent Director in BAE Systems

India (Services) Private Limited and Association of City Gas

Distribution Entities.

Mr. Chakraborty does not hold any shares in the Bank as on

March 31, 2022.

Mr. Sashidhar Jagdishan (DIN: 08614396)

[Managing Director & CEO]

Mr. Sashidhar Jagdishan, aged fty-seven (57) years, has an

overall experience of thirty (30) years. He has completed his

graduation in Science with specialization in Physics, is a

Chartered Accountant by profession and holds a Master’s

degree inEconomicsofMoney,Banking &Financefromthe

University of Shefeld, United Kingdom.

Mr. Jagdishan joined the Bank in the year 1996 as a Manager

in the Finance function. He became Business Head - Finance

in 1999 and was appointed as Chief Financial Ofcer in the year

2008. He played a critical role in supporting the growth trajectory

of the Bank, and led the nance function with a pivotal role in

aligning the organization in achieving the strategic objectives

over the years.

PriortohisappointmentasManagingDirector&ChiefExecutive

Ofcer of the Bank, he was the Group Head of the Bank in

addition to overseeing the functions of Finance, Human

Resources,Legal&Secretarial,Administration,Infrastructure,

Corporate Communications and Corporate Social Responsibility.

Mr. Jagdishan is not a director in any other company.

Mr. Jagdishan along with his relatives, holds 16,79,943 equity

shares in the Bank as on March 31, 2022.

Mr. Kaizad Bharucha (DIN: 02490648)

[Executive Director]

Mr. Kaizad Bharucha, aged fty-seven (57) years, holds a

Bachelor of Commerce degree from University of Mumbai and

is a career banker with over thirty ve (35) years of experience.

He has been associated with the Bank since 1995. In his current

position as Executive Director, he is responsible for Wholesale

BankingcoveringareasofCorporateBanking,PSUs,Capital&

Commodities Markets, Financial Institutions, Custody, Mutual

Funds,GlobalCapabilityCentre&FinancialSponsorscoverage,

and Banks coverage.

As Executive Director, in his earlier position, he was responsible

for Corporate Banking, Emerging Corporate Group, Business

Banking, Healthcare Finance, Agri Lending, Tractor Financing,

Commercial Vehicle Finance, Commercial Equipment Finance,

Infrastructure Finance, Department for Special operations and

inclusive banking initiatives group.

InhispreviouspositionasGroupHead-Credit&MarketRisk,

he was responsible for the Risk Management activities in the

Bank viz., Credit Risk, Market Risk, Debt Management, Risk

Intelligence and Control functions.

Prior to joining the Bank, he worked in SBI Commercial and

International Bank in various areas including Trade Finance and

Corporate Banking.

He has represented HDFC Bank as a member of the working

group on banking related committees.

Mr. Bharucha is not a director in any other company.

Mr. Bharucha, along with his relatives, holds 26,02,695 equity

shares in the Bank as on March 31, 2022.

Mr. Malay Patel (DIN: 06876386)

[Independent Director]

Mr. Malay Patel, aged forty-five (45) years, is a Major in

Engineering (Mechanical) from Rutgers University, Livingston,

368

Report on Corporate Governance

NJ, USA, and an A.A.B.A. in business from Bergen County

College, Fairlawn, NJ, USA. He is a director on the Board of Eewa

Engineering Company Private Limited, a company in the plastics

/ packaging industry with exports to more than 50 countries.

He has been involved in varied roles such as export / import,

procurement, sales and marketing, etc. in Eewa Engineering

Company Private Limited.

Mr. Malay Patel has special knowledge and practical experience

in matters relating to small scale industries in terms of Section

10-A (2 a) of the Banking Regulation Act, 1949.

Mr. Patel is also on the Board of the following public limited

company(ies):

Listed Public Limited Companies Other Public Limited Companies

- HDFC Securities Limited

(Independent Director)

Mr. Patel does not hold any shares in the Bank as on March

31, 2022.

Mr. Umesh Chandra Sarangi (DIN: 02040436)

[Independent Director]

Mr. Umesh Chandra Sarangi, aged seventy (70) years, holds a

Master’s degree in Science (Botany) from Utkal University (gold

medalist).

Mr. Sarangi has over three decades of experience in Indian

Administrative Service and brought in signicant reforms in

modernizing of agriculture, focus on agro processing and export.

As the erstwhile Chairman of National Bank for Agricultural

and Rural Development (NABARD) from December 2007 to

December 2010, Mr. Sarangi focused on rural infrastructure,

accelerated initiatives such as micronance, nancial inclusion,

watershed development and tribal development.

Mr. Sarangi has specialized knowledge and experience in

agriculture and rural economy pursuant to Section 10-A (2)(a) of

the Banking Regulation Act, 1949.

Mr. Sarangi is not a director in any other listed or public

limited company.

Mr. Sarangi does not hold any shares in the Bank as on March

31, 2022.

Mr. Sanjiv Sachar (DIN: 02013812)

[Independent Director]

Mr. Sanjiv Sachar, aged sixty-four (64) years, is a Fellow Associate

of the Institute of Chartered Accountants of India and former

Senior Partner of Egon Zehnder, the world’s largest privately

held executive search rm.

Mr. Sachar set up the Egon Zehnder practice in India in 1995 and

played a key role in establishing the rm as a market leader in the

executive search space across various country segments. Over

the course of his two decades at Egon Zehnder, Mr. Sachar has

mentored senior executives across industry sectors that today

are either Board members, CEOs or CFOs of large corporates

in India and overseas. Mr. Sachar has also been the co-founder

of the chartered accountancy and management consulting

rm,SacharVasudeva&Associatesandco-foundedexecutive

search rm, Direct Impact.

Mr. Sachar is also on the Board of the following public

company(ies):

Listed Public Limited Companies Other Public Limited Companies

KDDL Limited

(Independent Director)

-

Mr. Sachar does not hold any shares in the Bank as on March

31, 2022.

Mr. Sandeep Parekh (DIN: 03268043)

[Independent Director]

Mr. Sandeep Parekh, aged fty (50) years, holds an LL.M.

(Securities and Financial Regulations) degree from Georgetown

University and an LL.B. degree from Delhi University. He is the

managing partner of Finsec Law Advisors, a nancial sector

law rm based in Mumbai. He was an Executive Director at

the Securities & Exchange Board of India during 2006-08,

heading the Enforcement and Legal Affairs departments. He

is a faculty at the Indian Institute of Management, Ahmedabad.

He has worked for law rms in Delhi, Mumbai and Washington,

D.C. Mr. Parekh focuses on securities regulations, investment

regulations, private equity, corporate governance and nancial

regulations. He is admitted to practice law in New York. He was

recognized by the World Economic Forum as a “Young Global

Leader” in 2008. He was Chairman and member of various SEBI

and RBI Committees and sub-Committees and is presently a

member of SEBI’s Mutual Fund Advisory Committee.

Mr. Parekh is not a director in any other listed or public

limited company.

Mr. Parekh does not hold any shares in the Bank as on

March 31, 2022.

Mr. M. D. Ranganath (DIN: 07565125)

[Independent Director]

Mr. M.D. Ranganath, aged sixty (60) years, holds Master’s

degree in technology from IIT, Madras and a Bachelor’s degree

in Engineering from the University of Mysore. He is a PGDM from

IIM, Ahmedabad and a member of CPA, Australia.

Mr. Ranganath has over twenty eight (28) years of experience

in the Global IT services and nancial services industry. He

is currently President of Catamaran Ventures. He was Chief

Financial Ofcer of Infosys Limited, a globally listed IT services

HDFC Bank Limited Integrated Annual Report 2021-22 369

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

company, till November, 2018. During his tenure of 18 years at

Infosys, he was an integral part of the growth and transformation

of Infosys into a globally respected IT services company and

effectively played leadership roles in a wide spectrum of areas-

Strategy,Finance,Merger&Acquisition(M&A),Consulting,Risk

Management, and Corporate planning- culminating in the role

of Chief Financial Ofcer. Prior to Infosys, he worked at ICICI

Limited for 8 years and executed responsibilities in credit,

treasury, equity portfolio management and corporate planning.

In the years 2017 and 2018, Mr. Ranganath was the recipient of

the Best CFO Asia award in the technology sector, by Institutional

Investor publication, based on poll of buy-side and sell-side

investor community.

Mr. Ranganath is not a director in any other company.

Mr. Ranganath does not hold any shares in the Bank as on

March 31, 2022.

Mrs. Renu Karnad (DIN: 00008064)

[Non-Executive Non-Independent Director]

Mrs. Renu Karnad, aged sixty-nine (69) years, is the Managing

Director of Housing Development Finance Corporation Limited

since 2010. She holds a Master’s degree in Economics from

the University of Delhi and a Bachelor’s degree in Law from

the University of Mumbai. She is also a Parvin Fellow-Woodrow

Wilson School of Public and International Affairs, Princeton

University, USA. Mrs. Karnad brings with her rich experience and

knowledge of the mortgage sector, having been associated with

real estate and mortgage industry in India for over 40 years. Over

the years, she has been the recipient of numerous awards and

accolades, such as the ‘Outstanding Woman Business Leader’

award granted by CBNC-TV18 India Business Leader Awards

2012, induction in the Hall of Fame, Fortune India magazine’s

most powerful women from 2011 to 2019, ‘Top Ten Powerful

Women to watch out for in Asia’ by Wall Street Journal Asia in

2006, etc.

Mrs. Karnad is on the Board of the following public companies:

Listed Public Limited Companies Other Public Limited Companies

Housing Development Finance

Corporation Limited

(Managing Director)

HDFC ERGO General Insurance

Company Limited

(Non-Executive Director)

HDFC Asset Management

Company Limited

(Non-Executive Director)

Bangalore International Airport

Limited

(Independent Director)

HDFC Life Insurance Company

Limited

(Non-Executive Director)

GlaxoSmithKline Pharmaceuticals

Limited

(Non-Executive Director)

Unitech Limited

(Nominee of the Central

Government)*

*(Mrs. Karnad tendered her resignation from Unitech Limited with effect

from March 24, 2022 and completion of necessary formalities is awaited,

including placing the same before the Hon’ble Supreme Court of India, for

its kind consideration.)

Mrs. Karnad, along with her relatives, holds 5,95,320 equity

shares in the Bank as on March 31, 2022.

Dr. (Mrs.) Sunita Maheshwari (DIN 01641411)

[Independent Director]

Dr. (Mrs.) Sunita Maheshwari aged fty-six (56) years is a US

Board certied Pediatric Cardiologist, and completed her MBBS

at Osmania Medical College followed by post-graduation at

AIIMS, Delhi and Yale University in the US. With over thirty (30)

years of experience, she has lived and worked in the US and

India. In addition to being a clinician, Dr. (Mrs.) Maheshwari is a

medical entrepreneur and co-founder at:

(a) Teleradiology Solutions (India’s rst and largest teleradiology

company that has provided over 5 million diagnostic reports

to patients and hospitals globally including for the Tripura

state government),

(b) Telrad Tech which builds AI enabled tele health software and

(c) RXDX healthcare - a chain of multi-specialty neighbourhood

clinics in Bangalore.

She has also incubated other start-up companies in the tele-

health space such as Healtheminds - a tele-counselling

platform. She is active in the social arena in India where she

runs 2 trust funds. ‘People4people’ has put up over 450

playgrounds in government schools and Telrad Foundation

provides teleradiology and telemedicine services to poor areas

in Asia that do not have access to high quality medical care. Her

other interests include teaching - she has been running India’s

e-teaching program for postgraduates in Pediatric Cardiology for

over a decade. In 2019, she helped the Kerala National health

mission Hridayam launch e-classes in pediatric cardiology for

pediatricians in the state.

She has over 200 academic presentations and publications to

her credit and is an inspirational speaker having given over 200

lectures, including several TEDx talks. Dr. (Mrs.) Maheshwari is

the recipient of several prestigious awards and honours including:

WOW (Woman of Worth) 2019 award, Outlook Business; 50

most powerful women of India, March 2016; Amazing Indian

award- Times Now 2014; Top 20 women Health care achievers

in India, Modern Medicare 2009; Yale University- Outstanding

Fellow Teacher of the Year Award, 1995, amongst others.

Dr. (Mrs.) Maheshwari is on the Board of the following public

company(ies):

Listed Public Limited Companies Other Public Limited Companies

Glaxosmithkline Pharmaceuticals

Limited

(Independent Director)

-

370

Report on Corporate Governance

Dr. (Mrs.) Maheshwari does not hold any shares in the Bank as

on March 31, 2022.

Mrs. Lily Vadera (DIN: 09400410)

[Independent Director]

Mrs. Lily Vadera, aged sixty-one (61) years, is a M.A in International

Relations. With over 33 years of experience in Central banking,

she retired as Executive Director from the Reserve Bank of India

(RBI) in October 2020. As the Executive Director of the RBI, she

was in-charge of the Department of Regulation (DoR) where

she dealt with the regulatory framework for various entities

in nancial sector, covering all categories of banks and non-

banking nance companies.

She was instrumental in putting in place a framework for a

regulatory sandbox to provide an enabling environment for

ntech players to foster innovation in nancial services and

played a signicant role in the amalgamation of banks in stress.

She represented the Reserve Bank of India and played an

important role as a member of the Insolvency Law Committee

set up by the Ministry of Corporate Affairs (MCA).

Mrs. Lily Vadera is not a director in any other company.

Mrs. Lily Vadera does not hold any shares in the Bank as on

March 31, 2022.

ATTENDANCE AT BOARD MEETINGS & LAST

ANNUAL GENERAL MEETING (AGM)

The Board / Committee Meetings are convened by giving

appropriate notice well in advance of the meetings. The Directors

/ Committee Members are provided with appropriate information

in the form of agenda items in a timely manner, to enable them

to deliberate on each agenda item and make informed decisions

and provide appropriate directions to the Management. While

the Companies Act, 2013 and other applicable laws do not

prescribe a minimum number of meetings to be attended by

directors, the Board/ Committee Members endeavor to attend

and participate in all Board meetings, unless he/she is unable

to attend the meeting on account of reasonable cause for which

leave of absence is requested, which is considered by the Board

/ respective Committee for approval.

Video-conferencing facility is also provided at the Board /

Committee meetings in case any director is unable to attend the

meeting physically but wishes to participate through electronic

mode in the meetings.

At the Board / Committee meetings, presentations and deep dive

sessions are made covering important areas of the Bank such

as annual plans and strategies, cyber security and information

technology, COVID-19 - impact on the economy, India’s growth

story post 2

nd

wave of COVID-19 pandemic and operational and

business continuity measures of the Bank, customer grievances

and customer services framework, credit portfolio quality, IT

Strategic Initiatives, Board awareness session on cyber security,

Sustainable Livelihood (SLI), Compliance and Risk Management

strategy, rewards strategy, Enterprise-Wide Risk Management

(ERM) Framework, Global Economic Crisis including Russia

Ukraineconict,etc.

Directors are also encouraged to attend relevant programs and

seminars conducted by reputed external organizations. There

have been no instances wherein the Board had not accepted

the recommendations of any Committee.

During the nancial year under review, fourteen (14) Board

meetings were held. The meetings were held on April 17, 2021,

April 29, 2021, May 20, 2021, May 22, 2021, June 18, 2021, July

17, 2021, August 14, 2021, September 17, 2021, October 16,

2021, November 26, 2021, January 15, 2022, February 18, 2022,

March 16, 2022, and March 28, 2022.

Details of attendance at the Board meetings held during the

nancial year under review and attendance at the last virtual

AGM are as follows:

Name of the Director

Board

Meetings

attended

during the year

Attendance

at last virtual

AGM (July 17,

2021)

Independent Directors

Mr. Atanu Chakraborty

#

12 Present

Mr. Sanjiv Sachar 14 Present

Mr. Umesh Chandra Sarangi 14 Present

Mr. Sandeep Parekh 14 Present

Mr. Malay Patel 14 Present

Mr. M. D. Ranganath 14 Present

Dr. (Mrs.) Sunita Maheshwari 13 Present

Mrs. Lily Vadera* 4 NA

Non-executive Directors

Mr. Srikanth Nadhamuni** 12 Present

Mrs. Renu Karnad 14 Present

Executive Directors

Mr. Kaizad Bharucha 14 Present

Mr. Sashidhar Jagdishan 14 Present

#

Mr. Atanu Chakraborty was appointed as Part-time Non-Executive

Chairman and Independent Director of the Bank with effect from

May 5, 2021.

* Mrs. Lily Vadera was appointed as an Independent Director of the Bank for

a period of ve (5) years from November 26, 2021 to November 25, 2026

(both days inclusive), not liable to retire by rotation.

** Mr. Srikanth Nadhamuni tendered his resignation as Non-Executive

(Non-Independent) Director of the Bank with effect from February 18, 2022.

HDFC Bank Limited Integrated Annual Report 2021-22 371

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

REMUNERATION OF DIRECTORS

Managing Director and other Executive Directors

The details of the remuneration paid to Mr. Sashidhar Jagdishan,

Managing Director& Chief Executive Ofcer and Mr. Kaizad

Bharucha, Executive Director, during the nancial year 2021-22

are as under:

(Amount in `)

Particulars

Mr. Sashidhar

Jagdishan

Mr. Kaizad

Bharucha

Basic 2,52,45,000 2,63,55,572

Allowances and Perquisites 3,31,20,966 2,83,16,961

Provident Fund 30,29,400 31,62,666

Superannuation 37,86,756 39,53,328

Performance Bonus - 4,46,25,564

Number of stock options

granted (Number of ESOPs)

- -

Notes:

1. Mr. Aditya Puri retired as the Managing Director of the

Bank at the end of business hours on October 26, 2020.

Mr. Aditya Puri was paid cash variable pay of ` 7,11,00,000

for the performance period April 01, 2020 to October 26,

2020. The same was approved by Reserve Bank of India

(“RBI”) vide its letter dated March 23, 2022. Basis RBI

approval, 40% of the above-mentioned cash variable pay

was paid in the nancial year 2021 – 2022 and the balance

60% of the cash variable pay will be deferred over a period

of three years and will be paid in three equal instalments.

Also Mr. Aditya Puri, was paid cash variable pay of

` 4,33,69,066 for the performance period April 01, 2019

to March 31, 2020. The same was approved by RBI vide

their letter dated April 29, 2021. Since the cash variable

pay approved by RBI was less than 50% of his xed pay

the entire amount was credited to him in the nancial year

2021 – 2022.

Accordingly, the total cash variable pay, paid to Mr. Aditya

Puri in nancial year 2021 - 2022 is as follows.

A. 40% of the cash variable pay for the Performance Year

2020 - 2021 : ` 2,84,40,000

B. 100% of the cash variable pay for the Performance

Year 2019 - 2020 : ` 4,33,69,066

C. Tranche 2 of the deferred cash variable pay for the

Performance Year 2018-19: ` 68,83,979

D. Tranche 3 of the deferred cash variable pay for the

Performance Year 2017-18: ` 57,36,649

Total Payout in the financial year 2021 - 2022

(A+B+C+D): ` 8,44,29,694

2. The Annual remuneration paid to the Executive Director,

Mr. Kaizad Bharucha includes the payment of arrears for

nancial year 2020 - 2021 which was approved by the RBI

vide their letter dated March 23, 2022.

3. Mr. Kaizad Bharucha was paid cash variable pay of

` 3,52,00,000 for the performance period April 01, 2020

to March 31, 2021. The same was approved by RBI vide

its letter dated March 23, 2022. Basis RBI approval, 50%

of the above mentioned cash variable pay was paid in the

nancial year 2021 - 2022 and the balance 50% of the cash

variable pay will be deferred over a period of three years

and will be paid in three equal instalments.

Also, Mr. Kaizad Bharucha was paid cash variable pay of

` 2,08,40,895 for the performance period April 01, 2019

to March 31, 2020. The same was approved by RBI vide

their letter dated April 29, 2021. Since the cash variable

pay approved by RBI was less than 50% of his xed pay

the entire amount was credited to him in the nancial year

2021 - 2022.

Accordingly, the total cash variable payment made to

Mr. Kaizad Bharucha in nancial year 2021 - 2022 is

as follows:

A. 50% of the cash variable pay for the Performance Year

2020 – 2021 : ` 1,76,00,000

B. 100% of the cash variable pay for the Performance

Year 2019 - 2020 : ` 2,08,40,895

C. Tranche 2 of the deferred cash variable pay for the

Performance Year 2018-19 : ` 33,08,079

D. Tranche 3 of the deferred cash variable pay for the

Performance Year 2017-18: ` 28,76,590

Total Payout (A+B+C+D): ` 4,46,25,564

Employee Stock Options:

Mr. Kaizad Bharucha was granted a total quantum of 1,20,730

employee stock options for the performance year 2020-21 on

April 12, 2022 basis approval received from the Reserve Bank

of India vide its letter dated March 23, 2022.

The employee stock options have not been issued at discount

and the same have been granted at the closing market price

prevailing on the day prior to the date of grant on the National

Stock Exchange of India Limited. The vesting schedule for the

stock options is

a. 25% of options after expiry of twelve months from date

of grant,

b. 25% options after expiry of twenty-four months from the

date of grant,

c. 25% of options after expiry of thirty-six months from the

date of grant and

d. the balance options after expiry of forty-eight months from

date of grant.

372

Report on Corporate Governance

The options so vested are to be exercised within 2 years from

the respective dates of vesting.

The criteria for evaluation of performance of Whole-Time

Directors include Business Performance, Stakeholder

Relationship, Audit and Compliance, Digital Transformation and

Organization Excellence.

Pursuant to the Banking Regulation Act, 1949, the appointment

and tenure of Whole-Time Directors is subject to the approval

of RBI.

The Bank provides for gratuity in the form of lump-sum payment

on retirement or on death while in employment or on termination

of employment of an amount equivalent to 15 (fteen) days basic

salary payable for each completed year of service.

The Bank makes annual contributions to funds administered by

trustees and managed by insurance companies for amounts

notied by the said insurance companies. The Bank accounts for

the liability for future gratuity benets based on an independent

external actuarial valuation carried out annually.

Perquisites (evaluated as per Income Tax Rules, 1962 wherever

applicable and at actual cost to the Bank otherwise) such as the

benet of the Bank’s furnished accommodation, gas, electricity,

water and furnishings, club fees, personal accident insurance,

use of car and telephone at residence, medical reimbursement,

leave and leave travel concession and other benets like

Provident Fund, Superannuation and Gratuity are provided in

accordance with the rules of the Bank in this regard.

Service Contracts and the notice period are as per the terms of

agreement entered into by the Bank with Chairman and Whole-

Time Directors. No severance fee is payable by the Bank on

termination of these contracts.

No sitting fees were paid to Mr. Jagdishan and Mr. Bharucha for

attending meetings of the Board and / or its Committees.

DETAILS OF REMUNERATION / SITTING FEES

PAID TO NON-EXECUTIVE DIRECTORS

Criteria for remuneration/sitting fees paid to Non-

Executive Director

All the non-executive directors including the independent directors

and the Chairman receive sitting fees and reimbursement of out

of pocket expenses for attending each meeting of the Board and

its various Committees. No stock options are granted to any of

the non- executive directors.

Pursuant to the provisions of Companies Act, 2013, the Non-

Executive Directors are paid sitting fees of ` 50,000 or ` 100,000

per meeting for attending Committee & Board meetings

respectively. The Board of Directors increased the sitting fees of

certain key Committee meetings to ` 100,000 per meeting with

effectfromApril1,2021,namely,AuditCommittee,RiskPolicy&

MonitoringCommittee,Nomination&RemunerationCommittee,

Credit Approval Committee and IT Strategy Committee.

Subsequently, sitting fees payable for attending Independent

Directors Meeting and Customer Service Committee meeting

was increased to ` 1,00,000 with effect from August 14, 2021

and November 26, 2021 respectively.

The details of sitting fees and remuneration paid to Non-Executive

Directors during the nancial year 2021-22 are as under:

(Amount in `)

Director Sitting Fees

Remuneration to

NEDs

Mr. Atanu Chakraborty

1

36,50,000 31,70,698.96

Mr. Malay Patel 55,50,000 20,00,000

Mr. Umesh Chandra Sarangi 51,00,000 20,00,000

Mrs. Renu Karnad 56,50,000 20,00,000

Mr. Sanjiv Sachar 58,00,000 20,00,000

Mr. Sandeep Parekh 43,50,000 20,00,000

Mr. M. D. Ranganath 64,50,000 20,00,000

Dr. (Mrs.) Sunita Maheshwari 21,00,000 20,00,000

Mrs. Lily Vadera

2

6,00,000 6,90,217

Mr. Srikanth Nadhamuni

3

55,00,000 17,72,222

Total 4,47,50,000 1,96,33,137.96

1 During the year, Mr. Atanu Chakraborty was paid remuneration of

` 31,70,698.96, (i.e. ` 35,00,000 per annum) on proportionate basis for

the period from May 5, 2021 to March 31, 2022 as he was appointed as

the Part-time Chairman and Independent Director of the Bank with effect

from May 5, 2021. The remuneration of the Chairman has been approved

by the Reserve Bank of India.

2 Mrs. Lily Vadera was appointed as an Independent Director of the Bank

with effect from November 26, 2021

3 Mr. Srikanth Nadhamuni tendered his resignation as Non-Executive (Non-

Independent) Director of the Bank with effect from February 18, 2022

Note: Pursuant to the guidelines issued by RBI on Corporate

Governance in Banks - Appointment of Directors and Constitution

of Committees of the Board (“RBI Guidelines”) dated April 26,

2021 and read with the relevant shareholders’ resolution passed

at the 27

th

Annual General Meeting of the Bank held on July 17,

2021, the Non-Executive Directors (NEDs) of the Bank, other

than the Part-time Chairman, were paid compensation in the

form of xed remuneration of ` 20,00,000 (Rupees Twenty Lakhs

Only) each for F.Y. 2021-22. This is in addition to the sitting fees

and reimbursement of out of pocket expenses for given to them

forattendingCommittee&Boardmeetings.

There were no other pecuniary relationships or transactions

of Non-Executive Directors vis-a-vis the Bank (except banking

transactions in the ordinary course of business and on arm’s

length basis) during FY 2021-22.

HDFC Bank Limited Integrated Annual Report 2021-22 373

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

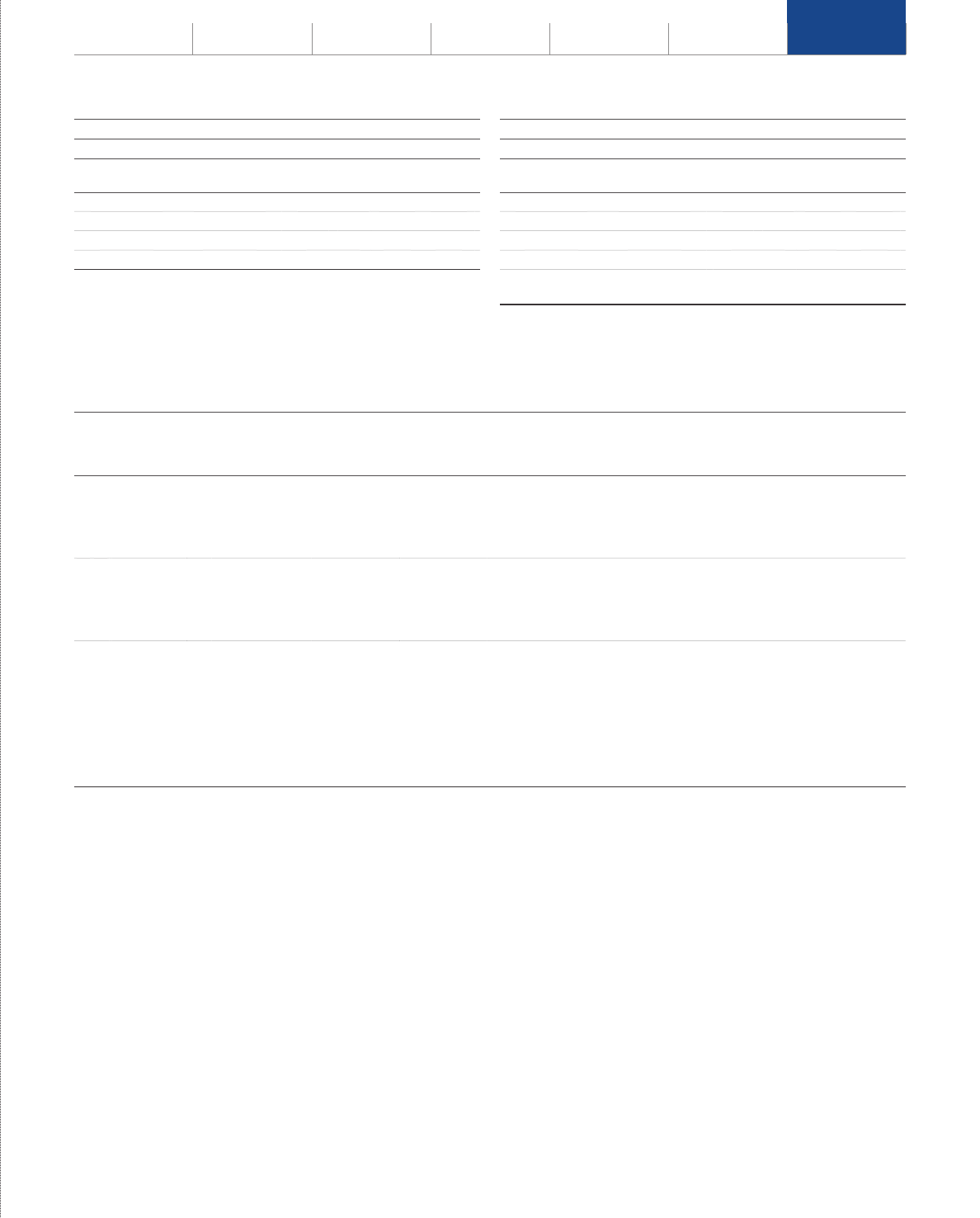

COMPOSITION OF COMMITTEES OF DIRECTORS, TERMS OF REFERENCE AND ATTENDANCE AT

THE MEETINGS

The Board has constituted various Committees of Directors to take informed decisions in the best interest of the Bank. These

Committees monitor the activities as per the scope dened in their Charter and terms of reference.

The Board’s Committees are as follows as on the date of this Report:

Non-Executive Directors Executive Directors

Atanu

Chakraborty

Sanjiv

Sachar

Umesh

Chandra

Sarangi

Sandeep

Parekh

Malay

Patel

M. D.

Ranganath

Sunita

Maheshwari

Lily

Vadera

Renu

Karnad

Sashidhar

Jagdishan

Kaizad

Bharucha

Audit

Nomination and

Remuneration

Stakeholders’

Relationship

Corporate Social

Responsibility&

ESG

Risk Policy and

Monitoring

Fraud Monitoring

Customer Service

Credit Approval

Digital

Transactions

Monitoring

IT Strategy*

Wilful Defaulters’

Identication

Review

Non-Cooperative

Borrowers Review

Premises

* Includes external IT consultant in addition to the above members. Chairperson of the Committee Member of the Committee

374

Report on Corporate Governance

AUDIT COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

a) Overseeing the Bank’s nancial reporting process and disclosure of nancial information to ensure that the nancial

statement is correct, sufcient and credible;

b) Recommending appointment and removal of external auditors and xing of their fees;

c) Reviewing with management the annual nancial statements and auditor’s report before submission to the Board

with special emphasis on accounting policies and practices, compliance with accounting standards, disclosure of

related party transactions and other legal requirements relating to nancial statements;

d) Reviewing the adequacy of the Audit and Compliance functions, including their policies, procedures, techniques and

other regulatory requirements; and

e) Any other terms of reference as may be included from time to time in the Companies Act, 2013, SEBI Listing

Regulations, including any amendments / re-enactments thereof from time to time.

The Charter of the Audit Committee has been formulated in accordance with certain United States regulatory standards

as the Bank’s American Depository Receipts are also listed on the New York Stock Exchange.

Composition: Mr. M. D. Ranganath (Chairman), Mr. Umesh Chandra Sarangi and Mr. Sanjiv Sachar, all of whom are independent

directors. Mr. M. D. Ranganath and Mr. Sanjiv Sachar are the members of Audit Committee having nancial expertise.

Mr. Santosh Haldankar, Company Secretary of the Bank, acts as the Secretary of the Committee.

Meetings: The Committee met sixteen (16) times during the year on:

April 6, 2021, April 16, 2021, May 19, 2021, June 1, 2021, June 17, 2021, June 18, 2021, July 16, 2021, August 12,

2021, September 16, 2021, October 16, 2021, November 25, 2021, December 7, 2021, January 14, 2022, February

17, 2022, March 15, 2022 and March 28, 2022.

NOMINATION & REMUNERATION COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

a) Scrutinizing the nominations of the directors with reference to their qualications and experience, for identifying

‘Fit and Proper’ persons, assessing competency of the persons and reviewing compensation levels of the Bank’s

employees vis-à-vis other banks and the banking industry in general.

The NRC has formulated a Policy for Appointment and Fit and Proper Criteria of Directors, which inter-alia provides

for criteria to assess the competency of the persons nominated, which includes:

•Academicqualications,

•Previousexperience,

•trackrecord,and

•integrityofthecandidates.

For assessing the integrity and suitability, features like criminal records, nancial position, civil actions undertaken

to pursue personal debts, refusal of admission to and expulsion from professional bodies, sanctions applied by

regulators or similar bodies and previous questionable business practices are considered.

b) The Committee also formulates criteria for evaluation of performance of individual directors including independent

directors, the Board of Directors and its Committees.

The criteria for evaluation of performance of directors (including independent directors) include personal attributes

such as attendance at meetings, communication skills, leadership skills and adaptability and professional attributes

such as understanding of the Bank’s core business and strategic objectives, industry knowledge, independent

judgment, adherence to the Bank’s Code of Conduct, Ethics and Values etc.

c) To carry out any other function as is mandated by the Board from time to time and / or enforced by any statutory

notication, amendment or modication, as may be applicable.

Composition: Mr. Sanjiv Sachar (Chairman), Mr. Sandeep Parekh, Mr. M.D. Ranganath, Mr. Umesh Chandra Sarangi and Mr. Atanu

Chakraborty.

All the members of the Committee are independent directors.

Details of re-constitution:

Mr. Atanu Chakraborty was inducted as member on the Committee with effect from June 9, 2021.

Meetings: The Committee met thirteen (13) times during the year on:

April 16, 2021, April 22, 2021, May 19, 2021, June 1, 2021, June 15, 2021, June 28, 2021, July 16, 2021,

July 27, 2021, August 24, 2021, October 20, 2021, November 25, 2021, January 13, 2022 and February 15, 2022.

HDFC Bank Limited Integrated Annual Report 2021-22 375

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

STAKEHOLDERS’ RELATIONSHIP COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

The Committee approves and monitors transfer, transmission, splitting and consolidation of shares and considers

requests for dematerialization of shares. Allotment of shares to the employees on exercise of stock options granted

under the various Employees Stock Option Schemes which are made in terms of the powers delegated by the Board

in this regard, are placed before the Committee for ratication. The Committee also monitors redressal of grievances

from shareholders relating to transfer of shares, non-receipt of Annual Report, dividends, etc.

The Committee shall oversee the various aspects of interests of all stakeholders including shareholders and other

security holders.

The powers to approve share transfers and dematerialization requests have been delegated to executives of the

Bank to avoid delays that may arise due to non-availability of the members of the Committee. Mr. Santosh Haldankar,

Company Secretary of the Bank is the Compliance Ofcer responsible for expediting the share transfer/transmission/

deletion formalities.

During the year ended March 31, 2022, the Bank received 82 complaints from the shareholders. The Bank had

attended to all the complaints except 1 complaint which was pending as was received during the end of quarter. This

complaint was responded and was closed subsequently, all other complaints were closed to the satisfaction of the

shareholder as on March 31, 2022.

Besides, 2,308 letters were received from the shareholders relating to change of address, nomination requests,

updation of email IDs and PAN No(s), updation of complete bank account details viz. Core Banking account no.,

IFSC and / MICR code, Mandate for crediting dividend by National Automated Clearing House (NACH) and National

Electronic Fund Transfer (NEFT), Issuance of Duplicate Share Certicate and claim of shares from Unclaimed Suspense

account queries relating to the annual reports, non-receipt of share certicate upon sub-division of Bank’s shares from

the face value of ` 2/- each to the face value of ` 1/- each, amalgamation, request for re-validation of dividend warrants

and various other investor related matters. These letters have also been responded to.

Composition: Mr. Malay Patel (Chairman), Mr. Umesh Chandra Sarangi, Mr. Sandeep Parekh, Mrs. Renu Karnad, Mr. Kaizad

Bharucha and Mrs. Lily Vadera

Details of re-constitution:

• Mr. MalayPatel was appointedasthe Chairman andMr.Kaizad Bharuchawas inducted as amember of the

Committee with effect from September 17, 2021.

• Mrs.LilyVaderawasinductedasamemberoftheCommitteewitheffectfromJune10,2022.

Meetings: The Committee met four (4) times during the year on:

April 9, 2021, July 13, 2021, October 18, 2021 and January 12, 2022.

RISK POLICY & MONITORING COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

TheRiskPolicy&MonitoringCommittee(RPMC)hasbeenformedaspertheguidelinesofReserveBankofIndiaon

Asset Liability Management / Risk Management Systems. The RPMC is a Board level committee, which supports the

Board by supervising the implementation of the risk strategy. It guides the development of policies, procedures and

systems for managing risk. It ensures that these are adequate and appropriate to changing business conditions, the

structure and needs of the Bank and the risk appetite of the Bank.

The RPMC monitors the compliance of risk parameters/aggregate exposures with the appetite set by the Board. It

ensures that frameworks are established for assessing and managing various risks faced by the Bank, systems are

developed to relate risk to the Bank‘s capital level and methods are in place for monitoring compliance with internal

risk management policies and processes. The Committee ensures that the Bank has a suitable framework for Risk

Management and oversees the implementation of the risk management policy.

Further, the functions of the Committee also include review of the enterprise-wide risk frameworks viz. Risk

Appetite framework (RAF), Internal Capital Adequacy Assessment Process (ICAAP), stress testing framework, etc.

The Committee also reviews the cyber security framework in the Bank from time to time.

Further, as per RBI guidelines, the Chief Risk Ofcer of the Bank regularly interacts with the members of the Committee

without the presence of management at the meetings of the Committee.

Composition: Mrs. Lily Vadera (Chairperson), Mr. Sandeep Parekh, Mr. M.D. Ranganath, Mrs. Renu Karnad, Mr. Sashidhar Jagdishan,

Mr. Sanjiv Sachar and Mr. Atanu Chakraborty.

Details of re-constitution:

• Mr.AtanuChakrabortywasinductedasmemberontheCommitteewitheffectfromJune9,2021.

• Mr.SrikanthNadhamuniceasedtobeaChairmanandmemberoftheCommitteewitheffectfromSeptember17,

2021.

• Mr.SandeepParekhwasinductedasamemberoftheCommitteewitheffectfromSeptember17,2021.

• Mrs.LilyVaderawasinductedasChairpersonandmemberoftheCommitteewitheffectfromJanuary15,2022.

376

Report on Corporate Governance

Meetings: The Committee met nine (9) times during the year on:

April 15, 2021, May 18, 2021, June 17, 2021, July 15, 2021, September 15, 2021, October 18, 2021,

January 13, 2022, February 16, 2022 and March 14, 2022.

CREDIT APPROVAL COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

The Committee considers credit appetite proposals on the customers of the Bank within such authority as delegated to

it by the Board from time to time. This facilitates quick response to the needs of the customers and timely disbursement

of loans.

Composition: Mr. Malay Patel, Mr. Kaizad Bharucha, Mrs. Renu Karnad and Mr. Sandeep Parekh

Details of re-constitution:

• Mr.SrikanthNadhamuniceasedtobeamemberoftheCommitteepursuanttohisresignationasdirectorofthe

Bank with effect from February 18, 2022.

• Mr.SandeepParekhwasinductedasamemberoftheCommitteewitheffectfromJune10,2022.

Meetings: The Committee met thirty (30) times during the year on:

April 26, 2021, April 28, 2021, May 18, 2021, June 7, 2021, June 16, 2021, June 23, 2021, July 6, 2021,

July 15, 2021, August 11, 2021, August 12, 2021, August 31, 2021, September 16, 2021, September 22,

2021, September 27, 2021, October 19, 2021, November 24, 2021, November 27, 2021, December 8, 2021,

December 11, 2021, December 20, 2021, December 28, 2021, January 13, 2022, January 24, 2022,

February 16, 2022, February 19, 2022, February 28, 2022, March 19, 2022, March 23, 2022, March 24, 2022 and

March 29, 2022.

PREMISES COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

TheCommitteeapprovespurchasesandleasingoflandparcelforproposedbuildings&premisesfortheuseofBank’s

branches, back ofces, ATMs, residential training centre(s), currency chests, guest house etc., (including relocation

and renewals) and of residential premises for Bank employees in accordance with the guidelines laid down by the

Board from time to time.

Composition: Mrs. Renu Karnad (Chairperson), Mr. Sandeep Parekh and Dr. (Mrs.) Sunita Maheshwari

Details of re-constitution:

Mrs. Renu Karnad was designated as the Chairperson, Mr. Malay Patel ceased to be the member and Dr. (Mrs.) Sunita

Maheshwari was inducted as the member of the Committee with effect from September 17, 2021

Meetings: The Committee met four (4) times during the year on:

April 9, 2021, July 14, 2021, October 18, 2021, and January 12, 2022.

FRAUD MONITORING COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

Pursuant to the directions of the RBI, the Bank has constituted a Fraud Monitoring Committee, exclusively dedicated

to the monitoring and following up of cases of fraud involving amounts of ` 1 crore and above.

The objectives of this Committee are the effective detection of frauds and immediate reporting of the frauds and

actions taken against the perpetrators of frauds with the concerned regulatory and enforcement agencies. The terms

of reference of the Committee are as under:

a) Identify the systemic lacunae, if any, that facilitated perpetration of the fraud and put in place measures to plug the

same;

b) Identify the reasons for delay in detection, if any and report to top management of the Bank and RBI;

c) Monitor progress of Central Bureau of Investigation / Police Investigation and recovery position;

d) Ensure that staff accountability is examined at all levels in all the cases of frauds and staff side action, if required, is

completed quickly without loss of time;

e) Review the efcacy of the remedial action taken to prevent recurrence of frauds, such as strengthening of internal

controls; and

f) Put in place other measures as may be considered relevant to strengthen preventive measures against frauds.

HDFC Bank Limited Integrated Annual Report 2021-22 377

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

Composition: Mr. Umesh Chandra Sarangi (Chairman), Mrs. Renu Karnad, Mr. Kaizad Bharucha, Mr. Sashidhar Jagdishan and Mr.

Sanjiv Sachar

Details of re-constitution:

Mr. Umesh Chandra Sarangi was designated as the Chairman, Mr. Malay Patel and Mr. Sandeep Parekh ceased to

be the members, Mrs. Renu Karnad and Mr. Kaizad Bharucha were inducted as the members of the Committee with

effect from September 17, 2021.

Meetings: The Committee met four (4) times during the year on:

April 9, 2021, July 13, 2021, October 19, 2021 and January 12, 2022

CUSTOMER SERVICE COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

The Committee has been constituted to monitor and bring about continuous improvements in the quality of services

rendered to the customers and also to ensure implementation of directives received from the Reserve Bank of

India (RBI) in this regard. The terms of reference of the Committee are to formulate comprehensive deposit policy

incorporating the issues arising out of the demise of a depositor for operation of his account, the product approval

process, annual survey of depositor satisfaction and the triennial audit of such services. The Committee is constituted

to bring about continuous improvements in the quality of customer services provided by the Bank. The Committee

would also oversee the functioning of the Standing Committee on Customer Service, and also bring out innovative

measures for enhancing the customer experience and quality of customer service thereby enhancing the customer

satisfaction level across all categories of clientele, at all times.

Composition: Mr Umesh Chandra Sarangi (Chairman), Mr. Sandeep Parekh, Mr. Sashidhar Jagdishan, Dr. (Mrs.) Sunita Maheshwari,

Mr. Kaizad Bharucha and Mr. Atanu Chakraborty.

Details of re-constitution:

• Mr.SrikanthNadhamuniceasedtobeamemberoftheCommitteepursuanttohisresignationasdirectorofthe

Bank with effect from February 18, 2022.

• Mr.MalayPatelceasedtobethememberoftheCommitteeandMr.UmeshChandraSarangiwasdesignatedas

the Chairman, Dr. (Mrs.) Sunita Maheshwari, Mr. Kaizad Bharucha and Mr. Atanu Chakraborty were inducted as

the members of the Committee with effect from September 17, 2021.

Meetings: The Committee met ve (5) times during the year on:

April 9, 2021, June 17, 2021, July 14, 2021, October 19, 2021 and January 12, 2022

CORPORATE SOCIAL RESPONSIBILITY & ESG (CSR & ESG) COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

TheCSR&ESGCommitteeoftheBoardhasbeenconstitutedtoidentify,executeandmonitorCSRprojectsand

assist the Board and the Bank in fullling its corporate social responsibility objectives and achieving the desired results.

The Committee shall also ensure legal and regulatory compliance from a CSR perspective and reporting as well as

communication to all the stakeholders on the Bank’s CSR initiatives.

The terms of reference of the Committee are:

• ToformulatetheBank’sCSRStrategy,PolicyandGoals

• TomonitortheBank’sCSRpolicyandperformance

• ToreviewtheCSRprojects/initiativesfromtimetotime

• ToensurelegalandregulatorycompliancefromaCSRviewpoint

• ToensurereportingandcommunicationtotheBank’sstakeholdersontheBank’sCSR

• TomonitortheBank’sESGFramework,strategy,goalsanddisclosures

Composition: Dr. (Mrs.) Sunita Maheshwari (Chairperson), Mr. Sanjiv Sachar, Mr. Malay Patel, Mrs. Renu Karnad and Mr. Kaizad

Bharucha.

Details of re-constitution:

•Dr.(Mrs.)SunitaMaheshwariwasinductedasamemberoftheCommitteewitheffectfromJune9,2021.

•Mr.UmeshChandraSarangiceasedtobetheChairmanandmemberoftheCommitteeandDr.(Mrs.)Sunita

Maheshwari was elected as the Chairperson of the Committee with effect from September 17, 2021.

378

Report on Corporate Governance

Meetings: The Committee met ve (5) times during the year on:

April 15, 2021, July 15, 2021, October 19, 2021, January 13, 2022 and February 16, 2022

IT STRATEGY COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

The Bank has in place an IT Strategy Committee to look into various technology related aspects. The functions of the

Committee are to formulate IT strategy and related policy documents, ensure that IT strategy is aligned with business

strategy, review IT risks, etc.

The terms of reference of the Committee are:

• ApprovingITstrategyandrelatedpolicydocumentsandreviewingthesamefromtimetotime.

• Ensuringthatthemanagementhasputaneffectivestrategicplanningprocessinplace.

• ApprovingtheBank’sITstrategyandbudgettoensureitalignswiththebusinessneeds.

• Approvingre-allocationofresourceswithinITtofacilitatemeetingprioritiesandbusinessneeds.

• ReviewingandapprovingITimplementationplans.

Composition: This Committee consists of an external IT consultant, Prof. H. Krishmurthy in addition to the Board members viz.

Mr. M.D. Ranganath, Mr. Sashidhar Jagdishan, Mr. Atanu Chakraborty and Dr. (Mrs.) Sunita Maheshwari

Details of re-constitution:

• Mr.AtanuChakrabortyandMr.SashidharJagdishanwereinductedasmembersoftheCommitteewitheffectfrom

June 9, 2021.

• Dr.(Mrs.)SunitaMaheshwariwasinductedasmemberontheCommitteewitheffectfromSeptember17,2021.

• Mr.SrikanthNadhamuniceasedtobeamemberoftheCommitteepursuanttohisresignationasdirectorofthe

Bank with effect from February 18, 2022.

Meetings: The Committee met nine (9) times during the year on:

April 8, 2021, May 7, 2021, May 18, 2021, July 14, 2021, August 11, 2021, October 20, 2021, November 24, 2021,

January 14, 2022 and February 15, 2022.

DIGITAL TRANSACTION MONITORING COMMITTEE

Brief Terms of

Reference / Roles and

Responsibilities:

In order to promote digital transactions of the Bank and to provide directions in terms of strategy and action plans

including monitoring the progress of achievement in the digital transactions space, the Bank has constituted the Digital

Transaction Monitoring Committee.

The terms of reference to the Committee, inter-alia include the following:

a) Framing of the Bank-level strategy and action plans for achieving the target of digital transactions in an organized

manner, as may be set by the Government, regulatory authorities, Indian Banks’ Association, etc. from time to time.

b) Monitoring the progress of achievement in digital transactions in line with the Bank’s strategy and action plans.

c) To review and explore new opportunities for increasing the digital transactions of the Bank from time to time and give

the necessary directions in implementing and improving high level of digitalization in Bank.

d) Reviewing the Digital Banking strategy of the Bank as and when required thereby providing direction on focus areas.

e) Reviewing the progress made on the initiatives relating to Digital Banking covering performance initiatives as

determined by the Board of Directors and Government of India from time to time.

f) To review the customer services rendered on digital platform from time to time.

g) Any other terms of reference as may be specied by the Government, regulatory authorities, Indian Banks’

Association, etc. from time to time.

HDFC Bank Limited Integrated Annual Report 2021-22 379

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

Composition: Mr. Malay Patel, Mr. Sandeep Parekh, Mr. M.D. Ranganath and Mrs. Lily Vadera.

Details of re-constitution:

• Mr.SrikanthNadhamuniceasedtobeamemberoftheCommitteepursuanttohisresignationasdirectorofthe

Bank with effect from February 18, 2022.

• Mrs. Lily Vadera was inducted as member of the Committee with effect from

June 10, 2022.

Meetings: The Committee met four (4) times during the year on:

April 15, 2021, July 14, 2021, October 18, 2021, and January 14, 2022.

REVIEW COMMITTEE FOR WILFUL DEFAULTERS’ IDENTIFICATION

Brief Terms of

Reference / Roles and

Responsibilities:

The Board has constituted a Review Committee for Wilful Defaulters’ Identication to review the orders passed by the

Committee of Executives for Identication of Wilful Defaulters and provide the nal decision with regard to identied

Wilful defaulters and any other matters as may be decided by the Board from time to time.

Composition: Mr. Sashidhar Jagdishan (Chairman), Mr Umesh Chandra Sarangi, Mr. M.D. Ranganath, Mr. Sandeep Parekh,

Mr. Malay Patel and Mr. Kaizad Bharucha

Details of re-constitution:

Mr. Sanjiv Sachar ceased to be a member and Mr. Malay Patel, Mr. Kaizad Bharucha were inducted as the members

of the Committee with effect from September 17, 2021.

Meetings: No meetings of the Committee were held during the year.

REVIEW COMMITTEE FOR NON-COOPERATIVE BORROWERS

Brief Terms of

Reference / Roles and

Responsibilities:

The Board has constituted a Review Committee to review matters related to Non-Co-Operative Borrowers which are

handled by the Internal Committee of Executives appointed for this purpose and any other related matters as may be

decided by the Board from time to time.

Composition: Mr. Sashidhar Jagdishan (Chairman), Mr Umesh Chandra Sarangi, Mr. M.D. Ranganath, Mr. Sandeep Parekh,

Mr. Malay Patel, Mr. Kaizad Bharucha

Details of re-constitution:

Mr. Sanjiv Sachar ceased to be a member and Mr. Malay Patel, Mr. Kaizad Bharucha were inducted as the members

of the Committee with effect from September 17, 2021.

Meetings: No meetings of the Committee were held during the year.

Meeting of the Independent Directors

The Independent Directors of the Bank held two (2) meetings. All Independent Directors as on the date of the meeting were present

at the meeting held on April 29, 2021. In the meeting held on September 9, 2021, leave of absence was granted to Dr. (Mrs.) Sunita

Maheshwari and all other Independent Directors as on the date of the meeting were present.

380

Report on Corporate Governance

ATTENDANCE AT THE COMMITTEE MEETINGS HELD DURING FINANCIAL YEAR 2021-22

Fraud Monitoring Committee

[Total four meetings held]

Name

No. of meetings

attended

Mr. Umesh Chandra Sarangi 4

Mrs. Renu Karnad (from September 17, 2021) 2

Mr. Malay Patel (upto September 17, 2021) 2

Mr. Sandeep Parekh (upto September 17, 2021) 2

Mr. Kaizad Bharucha (from September 17, 2021) 2

Mr. Sashidhar Jagdishan 4

Mr. Sanjiv Sachar 4

Customer Service Committee

[Total ve meetings held]

Name

No. of meetings

attended

Mr Umesh Chandra Sarangi (from September 17, 2021) 2

Mr. Sandeep Parekh 5

Mr. Sashidhar Jagdishan 5

Dr. (Mrs.) Sunita Maheshwari

(from September 17, 2021) 2

Mr. Kaizad Bharucha (from September 17, 2021) 2

Mr. Atanu Chakraborty (from September 17, 2021) 2

Mr. Srikanth Nadhamuni (upto February 18, 2022) 5

Mr. Malay Patel (upto September 17, 2021) 3

Credit Approval Committee

[Total Thirty meetings held]

Name

No. of meetings

attended

Mr. Malay Patel 30

Mrs. Renu Karnad 26

Mr. Kaizad Bharucha 27

Mr. Srikanth Nadhamuni

(upto February 18, 2022) 24

Digital Transactions Monitoring Committee

[Total four Meeting Held]

Name

No. of meetings

attended

Mr. Malay Patel 4

Mr. Sandeep Parekh 4

Mr. M.D. Ranganath 4

Mr. Srikanth Nadhamuni (upto February 18, 2022) 4

Audit Committee

[Total Sixteen meetings held]

Name

No. of meetings

attended

Mr. M.D. Ranganath 16

Mr. Umesh Chandra Sarangi 16

Mr. Sanjiv Sachar 16

Nomination and Remuneration Committee

[Total thirteen meetings held]

Name

No. of meetings

attended

Mr. Sanjiv Sachar 13

Mr. Sandeep Parekh 13

Mr. M.D. Ranganath 13

Mr. Umesh Chandra Sarangi 13

Mr. Atanu Chakraborty

(from June 9, 2021) 9

Stakeholders’ Relationship Committee

[Total Four meetings held]

Name

No. of meetings

attended

Mr. Malay Patel 4

Mr. Umesh Chandra Sarangi 4

Mr. Sandeep Parekh 4

Mrs. Renu Karnad 4

Mr. Kaizad Bharucha

(from September 17, 2021) 2

Corporate Social Responsibility and ESG Committee

[Total ve meetings held]

Name

No. of meetings

attended

Dr. (Mrs.) Sunita Maheshwari (from June 9, 2021) 4

Mr. Umesh Chandra Sarangi (

upto September 17, 2021) 2

Mr. Sanjiv Sachar 5

Mr. Malay Patel 5

Mrs. Renu Karnad 5

Mr. Kaizad Bharucha 5

Risk Policy and Monitoring Committee

[Total nine meetings held]

Name

No. of meetings

attended

Mr. Srikanth Nadhamuni (upto September 17, 2021) 5

Mr. M. D. Ranganath 9

Mrs. Renu Karnad 9

Mr. Sanjiv Sachar 9

Mr. Sashidhar Jagdishan 9

Mrs. Lily Vadera (

from January 15, 2022) 2

Mr. Atanu Chakraborty (

from June 9, 2021) 7

Mr. Sandeep Parekh (

from September 17, 2021) 4

HDFC Bank Limited Integrated Annual Report 2021-22 381

Overview

Our

Performance

Our

Strategy

Introduction to

HDFC Bank

How We

Create Value

Responsible

Business

Statutory Reports and

Financial Statements

Premises Committee

[Total Four meetings held]

Name

No. of meetings

attended

Mrs. Renu Karnad 4

Mr. Sandeep Parekh 4

Dr. (Mrs.) Sunita Maheshwari (from September 17, 2021) 2

Mr. Malay Patel

(upto September 17, 2021) 2

IT Strategy Committee

[Total Nine meetings held]

Name

No. of meetings

attended

Mr. M.D. Ranganath 9

Mr. Srikanth Nadhamuni (upto February 18, 2022) 9

Mr. Atanu Chakraborty (from June 9, 2021) 6

Mr. Sashidhar Jagdishan (from

June 9, 2021) 6

Dr. (Mrs.) Sunita Maheshwari

(from September 17, 2021)

3

GENERAL BODY MEETINGS

Following are the details of general body meetings for the previous three (3) nancial years:

Sr.

No.

Particulars

of meeting

Venue

Day, Date &

Time

Number

of Special

Resolutions

passed, if any

Nature of Special Resolutions

1 25

th

Annual

General

Meeting

Birla Matushri

Sabhagar,

19, New Marine

Lines, Mumbai –

400020

Friday,

July 12, 2019

at 2:30 p.m.

1 (One) Issue of Unsecured Perpetual Debt Instruments (part of Additional

Tier I capital), Tier II Capital Bonds and Long Term Bonds (nancing of

infrastructure and affordable housing) on a private placement basis.*

2 26

th

Annual

General

Meeting

Held through Video-

Conferencing

or Other Audio-

Visual Means

Saturday,

July 18, 2020

at 2:30 p.m.

2 (Two) 1. Re-appointment of Mr. Malay Patel (DIN 06876386) as an Independent

Director.

2. Issue Unsecured Perpetual Debt Instruments (part of Additional Tier

I capital), Tier II Capital Bonds and Long Term Bonds (nancing of

infrastructure and affordable housing) on a private placement basis.*

3 27

th

Annual

General

Meeting

Held through Video-

Conferencing

or Other Audio-

Visual Means

Saturday,

July 17, 2021

at 2:30 p.m.

6 (six) 1. Re-appointment of Mr. Umesh Chandra Sarangi (DIN 02040436) as an

independent Director.

2. Issue Unsecured Perpetual Debt Instruments (part of Additional Tier

I capital), Tier II Capital Bonds and Long Term Bonds (nancing of

infrastructure and affordable housing) on a private placement basis*

3. Amendment to the ESOS-Plan D-2007 as approved by the Members

4. Amendment to the ESOS-Plan E-2010 as approved by the Members

5. Amendment to the ESOS-Plan F-2013 as approved by the Members

6. Amendment to the ESOS-Plan G-2016 as approved by the Members

* The Registrar and Transfer Agent of the Bank, for all such issues, was Datamatics Business Solutions Limited.

POSTAL BALLOT

Pursuant to the provisions of Section 110 and all other applicable

provisions, if any, of the Act read with Rule 22 of the Companies

(Management and Administration) Rules, 2014, Regulation 44 of

the Securities and Exchange Board of India (Listing Obligations

and Disclosure Requirements) Regulations, 2015 (the “SEBI

Listing Regulations”), Secretarial Standard on General Meetings

(“SS-2”) issued by the Institute of Company Secretaries of

India, including any statutory modication(s), clarication(s),

substitution(s) or re-enactment(s) thereof for the time being in

force, guidelines prescribed by the Ministry of Corporate Affairs

(the “MCA”), Government of India, for holding general meetings

/ conducting postal ballot process through electronic voting

(remote e-voting) vide General Circular Nos. 14/2020 dated

April 8, 2020, 17/2020 dated April 13, 2020, 22/2020 dated

June 15, 2020, 33/2020 dated September 28, 2020, 39/2020

dated December 31, 2020, 10/2021 dated June 23, 2021

and 20/2021 dated December 8, 2021 (the “MCA Circulars”)

in view of COVID-19 pandemic and any other applicable laws

and regulations, the approval of the Members of the Bank for

below mentioned resolutions were obtained through Postal

Ballot Notices dated February 18, 2022 and March 28, 2022

via. remote e-voting.

382

Report on Corporate Governance

Particulars

Postal Ballot Notice

Dated February 18,

2022

Postal Ballot Notice

Dated March 28, 2022

Resolution(s) 1. Appointment of Mrs.

Lily Vadera (DIN:

09400410) as an

Independent Director

of the Bank - Special

Resolution

1. Approval and adoption

of Employee Stock

Incentive Plan 2022 -

Special Resolution

2. Approval of Related

Party Transactions with

Housing Development

Finance Corporation

Limited- Ordinary

Resolution

3. Approval of Related

Party Transactions with

HDB Financial Services

Limited - Ordinary

Resolution

4. Approval of Related

Party Transactions

with HDFC Securities

Limited - Ordinary

Resolution

5. Approval of Related

Party Transactions with

HDFC Life Insurance

Company Limited-

Ordinary Resolution

6. Approval of Related

Party Transactions

with HDFC ERGO

General Insurance

Company Limited -

Ordinary Resolution

Remote e-voting Central Depository

Services (India) Limited

National Securities

Depository Limited

Scrutinizer The Board of Directors had appointed Mr. B.

NarasimhanofM/s.B.N.&Associates,Practising

Company Secretaries and in his absence, Mr.

V. V. Chakradeo of M/s. V. V. Chakradeo &

Co., Practicing Company Secretaries, as the

Scrutinizer, for conducting the Postal Ballot

process in a fair and transparent manner.

Cut-off Date Monday, February 21,

2022

Friday, April 08, 2022

Dispatch Date of

Notice

Wednesday, February

23, 2022

Monday, April 11,

2022

Remote e-voting

period

Commenced on

Saturday, February 26,

2022 at 9:00 A.M. IST

and ended on Sunday,

March 27, 2022 at

5:00 P.M. IST.

Commenced on

Friday, April 15, 2022

at 9:00 A.M. IST and

ended on Saturday,

May 14, 2022 at 5:00

P.M. IST.

Accordingly, the Postal Ballots were conducted by the scrutinizer

and a report was submitted to the Authorized Ofcer, Mr. Santosh

Haldankar,Sr.VicePresident(Legal)&CompanySecretaryof

the Bank. The results of the voting conducted through Postal

Ballots are as under:

For all resolutions as specied in the Postal Ballot Notice

dated February 18, 2022:

There were a total of 20,49,142 shareholders of the Bank as on the

record date i.e. February 21, 2022, out of which 78,888 Members

comprising of 3,76,83,99,916 equity shares representing 67.98 %

of the share capital participated in the e-voting process. A

snapshot of the voting results of the postal ballot is as follows:

Resolutions

% of votes

polled on

outstanding

shares

% of votes in

favour on votes

polled

% of votes

against on votes

polled

Resolution No. 1 67.820 99.969 0.031

Resolution No. 2 46.504 99.999 0.001

Resolution No. 3 46.505 99.998 0.002

Resolution No. 4 46.503 99.998 0.002

Resolution No. 5 46.505 99.998 0.002

Resolution No. 6 46.505 99.998 0.002

Note: Invalid votes, inter alia, were caused by Members not

voting on any resolution before submitting their votes, corporate