April 2015 Sales Tools Study Report

Consideration, Acquisition & Performance

B-to-B Sales Tools

SmartSellingTools.com © 6201 Smart Selling Tools, Inc. All Rights Reserved.

Special Issue Courtesy of:

2

-signatureE

T

challenges. unique own your through thinking by start to is choices

technology best themake to you for way effective most The options. of shortage

no is there

Certainly, categories. tool sales 45 into fitting solutions, technology 400 than more are here

There

process:

the

in

yourself

ask

to

questions

two

are

1.

2.

?results quickest the with and—money and time

both

in

—cost

of

amount

least the with fastest, the tackled

be

can

barriers

those

Which of

?faster

them

closing

or deals more closing

from you keep that barriers the areWhat

Think

“survival.” sales to essential most the being level lowest the with importance,their

of

order

in

listed

are these needs, of hierarchy Maslow’s like Just selling. to essential are that technologies

and skills the represents which needs, revenue of hierarchy the of terms in challenges your of

yingfSatis

A

uotation.q fo time romf deal a close to average on month one than

more ktoo it reported %).592( respondents fo kchun large a hilew close, to skeew ourf to one ktoo deals

uotedq that reported %)5(4 respondents fo kulb The uote.q a delivering fo keew one ithinw closed deals

fo 6%25. only that oundf ”process, close to uoteq the ingzptimi“O entitled, Insights OSC yb study recent

time. long inglyzagoni an ekta can hichw line, dotted

ialbprover the on signs uyerb the henw moment golden that untilclosed t’aren they And close.

t’

don

opportunities

those fi matter t’doesn opportunities fo pipeline healthy a having

ever,woH

opportunities.

fo pipeline healthy a tainbo to you lesbena hatw is hierarchy the in levels three irstf the

Impact on Closing Deals

B-to-B

Special

Survey:

Tools

Sales

Pull-Out Section

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Technology

Ranking:

tool the use who those by

beneftPerceived Ranking:

(Very Satisfied) plus Satisfied

SatisfactionOverall

E-signature

1

2

2

.

01

Gamification

3

4

13

Sales Management Contract

5

5

Sales

& Compensation

Performance

4

Time

A

deals illsk

agreement verbal a receiving

after even

.

,

korwpaper

signed

the

orf

aitw salespeople hilew derail

to

deals causing

rong,w

go can lot

To

erhapsP

use. they technologies the fo itsfeneb perceived outba edkas henw types

technology

erentffdi

31 fo out highest the tools signature-e edkran respondents survey our hyw reason

the

is this

hour. eleventh

the

in

lost

deals

fo k

ris

the

reducing

close,

to

uote

q

rom

f

time

the

shorten

can

Sign

ebAdo

occur.

to

events

these orf time enough t’isn there ly,kuicq signed contract the get can

you

fi

simply,

uiteQ

close.

to

uoteq

romf time the shorten to imperative s’it deals, your illingk romf scenarios common these fo any avoid

ot

N

.)iedfsatis very and iedfsatis erew that those up adding( actionfsatis all-over in owt erbnum edkran tools

-se atureign And tool.

sales

other

any

fo

users

erew

than

)actionfsatis

fo

level

highest

the(

”iedf

satis

very“ erew users signature-e more its,feneb perceived in highest kran tools signature-e did only

3

agreement verbal a after lost are deals whyReasons

1

ompaniesC reversers.-decision ithw replaced get erskma-decision means tenfo hichw e,zreorgani

2 udgetsB hold. on put or cut get

3

erskma-ecisionD companies. other at sboj orf leave

4

SatisfactionActual and Benefit eivedcPer

Priorities

.elsewhere budgets focus to issuedare edicts and changed, are top the from

Inside Sales

E-signatures

weeks by often close to quote from time the shorten can

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

An

benefits.

these

realizing

of

short

just

stops

that

stack sales a have companies most benefit, perceived highestthe and users iedsatisf lyhighmost the

drives

that

app

the

is

e-signature

while

that,

means

That

seven.

to six

average

e-signatures

have

who

those

while ;tools sales 5 about use e-signatures without organizations that is research our of finding

important

The

Going

deals.

closed

on

impact

fast

a

to

leading

cost,

implementation

upfront

much

without

quickly,

barrier

the

tackle

you

helps

solution

the

Furthermore,

faster.

themclosing

from

or

,deals

more

closing

from

you

keep

that

rocesses

p close to

quote

lengthy

barrier: significant

aeliminatecan Sign Adobe start, the at posed questions two the to back

benefits.perceived

highest

the

having

as

e-signature rank usersactual while benefits perceived in

thirteen

number

at

e-signature

rank

they

because

out

miss

tools

e-signature

of

non-users

is,

That

benefit.

perceivedin

jumplargest

the

made

tools

e-signature

survey,

the

in

tool

of

type each

for

non-users and

users between benefit perceived the compared

we

When

non-users. by underrated indeed are tools

e-signature

of

benefits

4

benefits." perceived

highest the having as

e-signature rank

users

actual while benefits,

perceived in hirteent

number at e-signature

rank they because out

miss tools e-signature

of"Non-users

If

satisfaction. overall for ranking highest second the and value perceived highest the with -signaturee

selecting by wrong go likely wouldn’t you choose, to technologies sales which of unsure you’re

Adobe

www.adobe.com. visit more, learn To

2006. since

AppExchange Salesforce the in solution e-signature top-rated

the been also has Sign Adobe fact, In use. already you solutions

the inside e-signatures of power the put Dynamics—to

Microsoft and Apttus, Salesforce, as applications—such

enterprise leading with integrates Sign Adobe

Plus,

device. any on agreements e-sign can

recipients and click, single a with signature for out documents

digital send to simple It’s renewal. to close through quote

initial from processes document digital 100% secure, create

organizations sales lets that application only the is Sign

5

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Introduction

Sales Tools

T

he array of sales tools available to the modern B-to-B sales organization is vast. Our denition of sales tools is any

solution intended for use by sales leaders, managers or sales people. The vendors of these tools have delivered

impressive new capabilities in the form of specialized solutions that streamline the sales process, improve sales

performance, or otherwise enhance a company’s ability to drive revenue. With so many cloud-based oerings,

sales tools are no longer the exclusive domain of large enterprises, but are now penetrating medium and small enterprises.

Likewise, they are no longer limited to CRM-like functionality.

Smart Selling Tools conducted research to understand how buyers identify, justify, evaluate and make decisions about

acquiring sales tools. The results of that research is detailed in this report that will help both sales tools vendors and buyers

better understand the journey from need awareness, through discovery, purchase consideration and decision.

This research investigated:

• Who controls the budget

• Who conducts the assessment

• The conditions that trigger an acquisition

•

The diculty of completing the steps in acquiring and using sales tools

• How many sales tools were evaluated and acquired in the past year

• Which kinds of tools are providing the greatest benet

• The impact sales tools are collectively having on revenue attainment

Consideration,

Acquisition &

Performance

B-to-B

Sales T

ools

6

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Executive Summary

A

ll survey respondents were from B-to-B or mixed B-to-B/B-to-C organizations, and almost half of the companies

participating in the survey were from the technology sector. Respondents came from organizations of all sizes,

ranging from 10 or fewer full-time salespeople to companies employing more than 1,000 salespeople.

Here is a summary of some of the study’s key ndings:

• A commercial CRM solution is in use by 88 percent of respondents. A commercial Marketing Automation

solution is in use by 69

percent.

•

Other than CRM and Marketing Automation, the three categories of sales tools currently seeing the most

use are: Prospect Communication & Engagement, Pipeline Management & Deal Flow, and Inside

Sales.

•

The sales tools currently generating the most interest are: Gamication, Sales Intelligence, Prospect

Communication & Engagement, Sales Performance & Compensation and Value Selling &

ROI.

The average number of sales tools in use ranges between 5 and 6, and the maximum number in use

ranges between 10 and

13.

•

The sales organization is the primary sales tool budget holder (39 percent), followed by the C-suite (29

percent) and sales & marketing jointly (20

percent).

•

The lead responsibility to assess which sales tools are needed is tied between the sales organization and

a cross-functional committee (41

percent).

•

Over half of organizations surveyed spend less than 10 percent of their time considering the need for

new, or the eectiveness of current, sales tools.

•

Obtaining budget and gaining user adoption were rated the most dicult phases of the sales tool

acquisition cycle to

complete.

•

•

On average, organizations end up acquiring half of the sales tools they trial or

pilot.

•

84 percent of organizations studied report that their sales tools have a slight or signicantly positive

impact on revenue attainment.

These ndings are further detailed in the report. For information on the survey sample and methodology, please refer to

the Appendix.

7

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Tools Currently in Use

Sales Tools Status

I

ncluding Customer Relationship Management (CRM) and Marketing Automation, the scope of this study spanned 15

separate tool categories, described below:

• E-signature: obtaining signatures electronically.

• Gamication: running sales contests.

• Inside Sales: dialing, routing, call management, etc.

•

iPad or Tablet tools: mobile catalog, visit reporting, etc.

•

Pipeline Management & Deal Flow: sales process, predictive analytics and deal analytics.

•

Prospect Communication & Engagement: information delivery tools that augment email.

•

Quoting & Pricing or Conguration: quote templates and guided quotations.

•

Sales Contract Management: routing, tracking and access to contracts.

•

Sales Enablement:

playbooks, portals and sales asset management.

•

Sales Intelligence: prospecting lists and prospect research.

•

Sales Performance & Compensation: designing and tracking compensation.

•

Territory & Account Planning: territory and quota assignment.

•

Value Selling & ROI: ROI and value quantication.

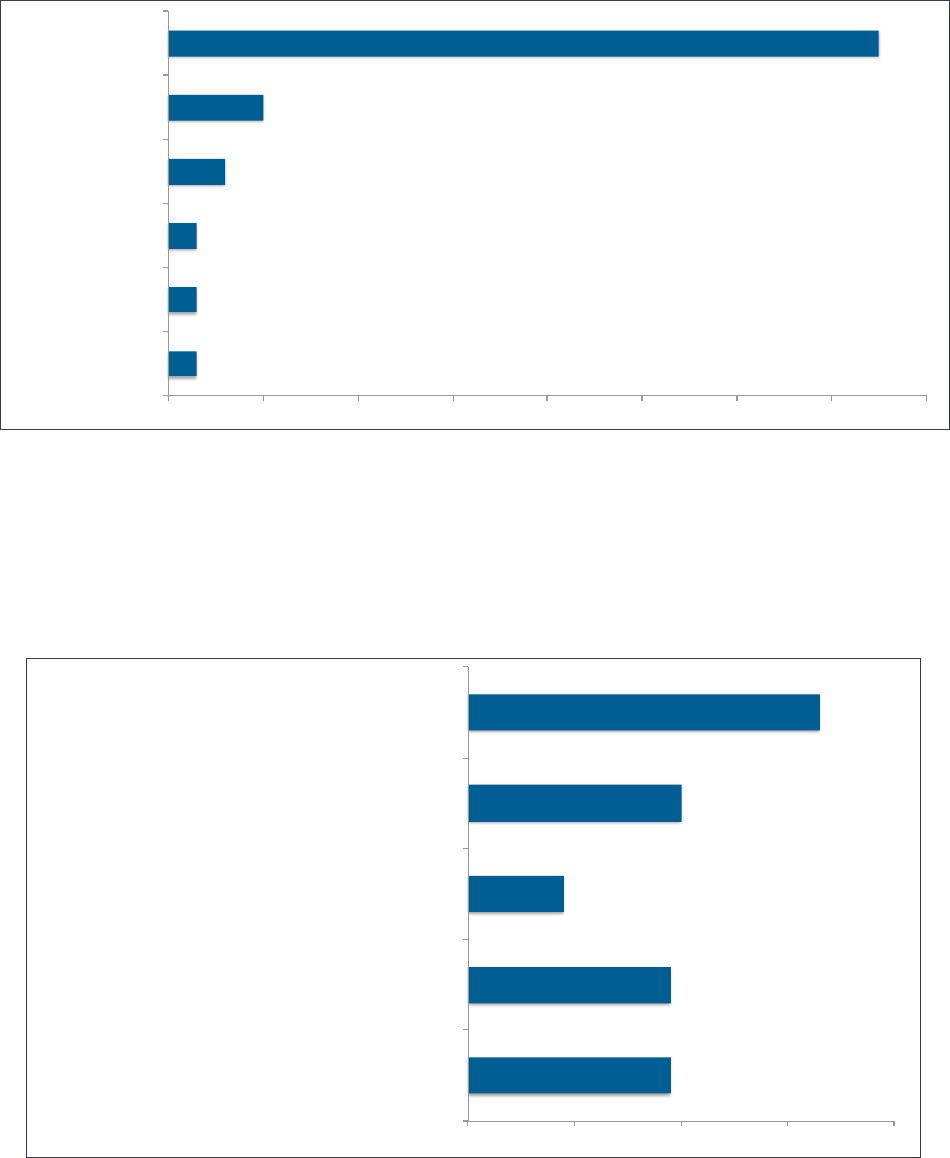

Figure 1 displays the usage status for each of these categories of tools.

26%

11%

32%

37%

37%

41%

42%

42%

45%

47%

48%

55%

55%

57%

0% 10% 20% 30% 40% 50% 60%

Other Tools

Gamification

E-signature

Sales Performance & Compensation

Territory & Account Planning

Sales Contract Management

Sales Enablement

Value Selling & ROI

iPad or Tablet Tools

Quoting & Pricing or Configuration

Sales Intelligence

Inside Sales

Pipeline Management & Deal Flow

Prospect Communication & Engagement

Sales Tools Currently in Use

8

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

O

ther than CRM solutions (covered in a later section of this report) and marketing automation, just three tools in

this survey have crossed the 50 percent adoption threshold.

The “Other Tools” response category was chosen by just over one-fourth of survey respondents, and they were

encouraged to write-in tools not listed in the survey questions. Some of their write-in responses include:

• Predictive analytics

• Phone scripting

• Outside sales route optimization

• Business intelligence data mining

• Sales coaching

• Video communications

For the sales tools listed in Figure 1 that were not in use, participants were asked to identify the current status for each tool,

and this information is summarized in Figure 2.

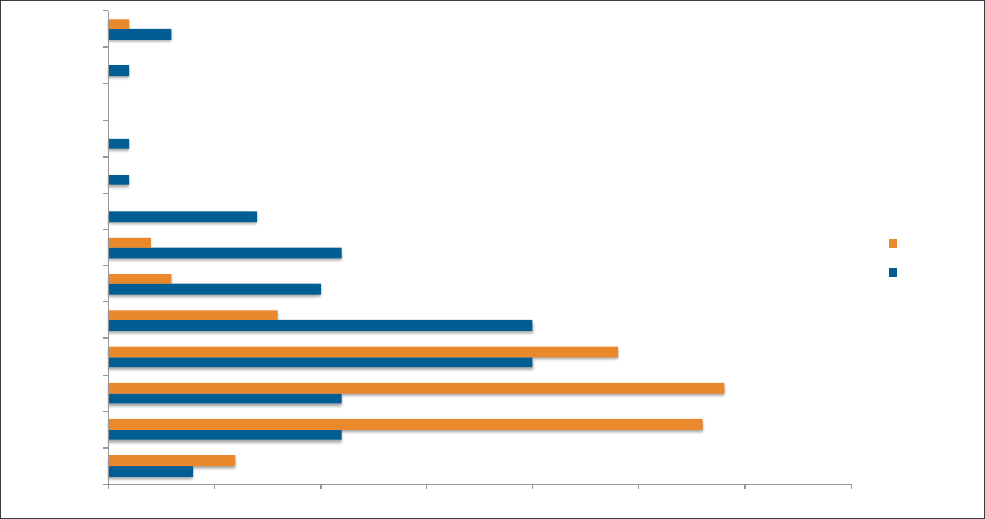

Figure 2: Tools are sorted from top to bottom by highest percentage in implementation status.

3%!

4%!

4%!

5%!

5%!

5%!

6%!

7%!

8%!

8%!

8%!

13%!

13%!

6%!

8%!

6%!

8%!

7%!

6%!

7%!

7%!

8%!

8%!

10%!

8%!

8%!

6%!

5%!

5%!

7%!

4%!

4%!

4%!

7%!

6%!

5%!

4%!

6%!

4%!

34%!

33%!

25%!

57%!

42%!

38%!

29%!

28%!

34%!

26%!

16%!

19%!

15%!

0%! 10%! 20%! 30%! 40%! 50%! 60%! 70%! 80%! 90%!

Sales Contract Mgmt

iPad or Tablet Tools

Inside Sales

Gamification

E-signature

Territory & Acct Planning

Quoting & Pricing or Config.

Value Selling & ROI

Sales Performance & Comp.

Sales Enablement

Prospect Comm. & Engagement

Sales Intel.

Pipeline Mgmt & Deal Flow

Status for Sales Tools not in Current Use

Implementing

Evaluating

Eval'ed-Declined

Interest-No Budget

Not in Use

Status for Sales Tools Not in Current Use

9

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

P

ipeline management and deal ow solutions are experiencing the highest implementation percentage, while

prospect communication and engagement solutions are currently receiving the most consideration. Figure 2 shows

that it is relatively rare that there is no budget for sales tools, or that they have been rejected post-evaluation.

When the “In use” and “Implementing” categories are combined, there are three tools with this hybrid in-use status by

almost two-thirds of survey participants:

1. Pipeline Management & Deal Flow: 68 percent

2. Prospect Communication & Engagement: 65 percent

3. Sales Intelligence: 61 percent

Tool Interest

The top ve sales tools in which survey participants are interested, where “interest” was determined by combining the

responses in Figure 2 in “Evaluating” status with those who expressed interest but have no budget. These tools are:

1. Gamication

2. Sales Intelligence

3. Prospect Communication & Engagement

4. Sales Performance & Compensation

5. Value Selling & ROI

10

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Force Size

& Tool Usage

S

urvey participants were divided into three groups for analysis of tool usage by the size of the sales force. Figure 3

summarizes the distribution of responses by sales force size.

Figure 3: Sales representative headcount categories.

There are some dierences in the way these small, medium and larger sales forces depicted in Figure 3 use sales tools.

Table 1 summarizes the key dierences.

Small

(10 or fewer)

Medium

(11 to 25)

Large

(26 or more)

Average number of tools in

use:

5 5 6.3

Maximum number of tools

in use:

11 10 13

% using just 1 sales tool: 9% 0% 5%

% using 5 or more tools: 64% 59% 69%

% using 10 or more tools: 6% 4% 23%

Most used tool:

Prospect Communication &

Deal Flow

Prospect Communication &

Deal Flow

Quoting, Pricing or

Conguration

Table 1: Metrics by sales force size.

57%

17%

25%

0%

10%

20%

30%

40%

50%

60%

70%

10 or less 11 to 25 26 or more

Number of Full-Time Sales Representatives

Number of Full-Time Sales Representatives

N=155

11

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

T

he dierence in metrics presented in Table 1 isn’t dramatic. Regardless of size, sales forces are all highly likely

to use ve or more sales tools. What is interesting is that small and medium sales forces have a dierent

favored tool than large sales forces. Table 2 provides a more detailed look at the top ve most used tools by

sales force size.

Priority Ranking Small

(10 or fewer Salespeople)

Medium

(11 to 25 Salespeople)

Large

(26 or more Salespeople)

1

Prospect Communication

& Engagement

Prospect Communication

& Engagement

Quoting, Pricing or

Conguration

2

Pipeline Management

& Deal Flow

(Tie) Inside Sales;

Sales Intelligence

iPad or Tablet Tools

3 Inside Sales

Pipeline Management

& Deal Flow

Inside Sales

4 iPad or Tablet Tools

E-signature

(Tie) Pipeline Management &

Deal Flow; Sales Intelligence;

Sales Performance

& Compensation

5

(Tie) Sales Intelligence;

Value Selling & ROI

Sales Enablement

Table 2: Large sales forces have completely dierent sales tool priorities.

W

ith one exception (Sales Intelligence), the lists of top three sales tools in use by small and medium-sized

sales forces contain the same tools, just in a dierent order of use. Not so for large sale forces, which

have an entirely dierent list altogether.

The analysis of the study’s data revealed some statistical relationships between tool usage and sales force size.

Specically, the size of the sales force predicts to some degree that certain sales tool will or will not see use. Figure 4

shows where this relationship exists.

Favored Tools

12

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

The proper way to interpret Figure 4 is:

• Large sales teams are far more likely to use Sales Performance & Compensation tools.

• Small and medium sales teams are slightly more likely to use Prospect Communication &

Engagement tools

• Medium and large sales teams are more likely to use Gamication tools.

For the remaining tools (listed in Figure 1), the size of the sales team is not a predictor of whether a tool is in use or

appropriate. In other words, very few tools are primarily seeing use only by large sales teams. The barriers to using sales

tools have little to do with the size of the sales force and the implied resources that come with larger teams. The sales tool

solutions landscape seems quite accommodating of sales teams of all sizes.

Relationships Between Tool Use & Sales Force Size

2%

62%

26%

22%

63%

19%

13%

49%

54%

0% 10% 20% 30% 40% 50% 60% 70%

Gamification

Prospect Communication & Engagement

Sales Performance & Compensation

Relationships Between Tool Use & Sales Force Size

Large

Medium

Small

13

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Tools

Decision-Making Process

T

he study examined how sales tool decisions are made, starting with which part of the organization controls or owns

the budget for acquiring new sales tools (Figure 5).

Figure 5: Sales has primary control over their budget for tools.

Almost 40 percent of the time, a member of the sales team is the budget holder for sales tools. The C-suite, however, holds

the budget almost 30 percent of the time, and marketing or marketing and sales combined almost one-fourth of the time.

When the budget holder is in sales, over half the time that person is the sales executive or vice-president.

4%

2%

2%

4%

20%

29%

39%

0% 5% 10% 15% 20% 25% 30% 35% 40%

45%

Other

Finance

IT

Marketing

Sales & Marketing

C-Suite

Sales

Primary Budget Holder for Acquiring New Sales Tools

Primary Budget Holder for Acquiring New Sales Tools

14

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Department 25 or fewer sales reps 26 or more sales reps

Sales 20% 39%

Marketing 0% 14%

Sales & Marketing 43% 29%

IT 2% 7%

C-suite/Market President/Owner 24% 7%

Other 11% 4%

Table 3: The Sales department is most likely to hold the sales tool budget for large sales forces.

T

here are dierences in which department holds the sales tool budget based on the size of the sales force (Table 3).

F

or smaller sales forces, it is most likely that sales and marketing combined will control the tool budget, and the C-suite

has signicant involvement as well. The budget ownership picture changes for larger sales forces, with the sales

department almost twice as likely to own this budget, and little involvement from the C-suite. In these larger sales

teams, marketing is involved at the same level, but 14 percent of the time as sole budget holder. IT is not a signicant

sales tool budget holder for any size sales team.

How well does sales tool budget ownership match up with tool assessment responsibility? Figure 6 shows a breakdown of

who has the lead responsibility to assess which sales tools are needed.

Figure 6: Sales has a major role is assessing needed sales tools, either solely or as part of a committee.

Lead Responsibility to Assess Tool Needs

6%

4%

4%

4%

41%

41%

0% 10% 20% 30% 40% 50%

Other

C-Suite

IT

Marketing

Sales

Cross-functional committee

Lead Responsibility to Assess Which Sales Tools are Needed

15

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

T

he responsibility to assess which tools are needed falls within the sales department for almost half the participants

in this study. When that is the case, Figure 7 breaks out who in sales has that responsibility.

Figure 7: The vice-president or top sales executive almost always has the tool assessment responsibility.

I

n addition to examining who holds the budget for sales tools and who has responsibility to assess which ones are

needed, the study also looked at when organizations consider new tools. To determine this, the study survey presented

ve conditions to participants, having them select the one that best represents their trigger for considering new sales

tools. Figure 8 summarizes the results.

Figure 8: One third of study participants are always looking for sales tools that can help.

Lead Responsibility within Sales to Assess Tool Needs

3%

3%

3%

6%

10%

75%

0% 10% 20% 30% 40% 50% 60% 70% 80%

Mid-level manager

First-line manager

Sales enablement

Sales operations

Individual sales rep(s)

VP or top sales exec

Lead Responsibility within Sales to Assess Tool Needs

When Organizations Consider New Sales Tools

19%

19%

9%

20%

33%

0% 10% 20% 30% 40%

After a specific problem/challenge has already impacted sales

performance for a long time

When a specific problem/challenge first begins impacting sales

performance

When a specific problem/challenge is first predicted to impact

sales performance in the future

When we become aware of a new tool that can impact sales

performance

We are always looking for new tools that can improve sales

performance

When Organizations Consider New Sales Tools

We are always looking for new tools that can improve

sales performance

When we become aware of a new tool that can impact

sales performance

When a specific problem/challenge is first predicted to

impact sales performance in the future

When a specific problem/challenge first begins impacting

sales performance

After a specific problem/challenge has already impacted

sales performance for a long time

16

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

T

hose conditions in Figure 8 that trigger consideration of new sales tools for the most part don’t correlate to which

tools sales organizations use, with one notable exception: Value Selling & ROI tools.

The response options in Figure 8 are indicators of an organization’s strategic personality. Those who responded

with “We are always looking for new tools that can improve sales performance” are characteristic of innovators and early

adopters. Those choosing “After a specic problem/challenge has already impacted sales performance for a long time” are

characteristic of laggards. These strategic personalities are at opposite ends of the spectrum, and for Value Selling & ROI

tools, they show dierent usage rates:

• Innovators/early adopters: 49 percent

• Laggards: 32 percent

Sales organizations that are innovators or early adopters are more likely to use sales tools that help demonstrate ROI and

provide value quantication. This higher usage of Value Selling & ROI tools ts the mold of these strategic personalities.

Figure 9 shows how much time survey respondents spend considering the need for new or the eectiveness of current

sales tools.

Figure 9: Well over half of survey respondents spend 10 percent or less of their time in the consideration process.

Percent of Time Spent Considering

Sales Tool Needs or Effectiveness

57%

22%

21%

0% 10% 20% 30% 40% 50% 60%

10% or less

11 to 20%

More than 20%

Percent of Time Spent Considering Sales Tool Needs or Effectiveness

17

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

F

or most individuals with the lead responsibility for assessing which sales tools are needed, it doesn’t take up

much of their time. This study found that there is no relationship between time spent assessing tools and how

many new ones are trialed, but there is a relationship to how many tools are acquired (Table 4).

Table 4: More time spent in consideration results in more sales tools purchased.

Time Spent Considering Sales Tools (Fig. 9) Average number of sales tools

purchased in a year

10% or less 1.7

11 to 20% 2.0

21% or more 2.1

The dierences in Table 4 may seem small, but the statistical relationship between time spent in consideration and the

number of tools acquired is strong. Additional time allows tool evaluators to test longer, rene their requirements,

gain a deeper tool understanding and develop more compelling justications for their acquisitions. Tool vendors that

have a precise understanding of what buyers do in each of these phases of their journey gain a competitive advantage.

18

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Tools Acquisition

T

he preferred outcome of a sales tool decision-making process is the implementation of the right tool that is

accepted by users and delivers the promised benets. This journey from selecting a sales tool to successful use is

still a perilous one, with obtaining budget as the most dicult step. This study identied phases of the sales tool

acquisition cycle, gathering data about the ease of completing each one. Table 5 presents these phases in order,

with the reported diculty of each.

Table 5: Relative diculty associated with various steps in the tools acquisition cycle.

W

hile the steps in Table 5 may not occur in the precise order listed, they generally must all complete to success-

fully implement and use a sales tool. The study shows that the most dicult steps to complete are:

1. Obtaining budget

Gaining user adoption (tie)

2. Getting the desired benets of tool usage

3. Evaluating solutions options

Justifying tool acquisition (tie)

Implementing the tool (tie)

Step in Acquisition Cycle Easy Neutral Dicult

1. Determining the need 60% 32% 8%

2. Identifying potential solutions 30% 47% 23%

3. Evaluating solution options 20% 45% 35%

4. Establishing decision criteria 30% 46% 24%

5. Justifying tool acquisition 21% 44% 35%

6. Obtaining budget 15% 40% 45%

7. Implementing the tool 20% 45% 35%

8. User training for the tool 23% 47% 30%

9. Gaining user adoption 17% 38% 45%

10. Getting the desired benets of tool usage 10% 50% 40%

T

hree of the nal four steps in this acquisition process are on the list of most dicult to complete successfully.

It is a very real possibility that a buyer can prepare a strong justication, obtain budget and still see the tool

implementation fail. Buyers who expect implementation challenges should consider services from vendors or other

outside experts to ensure sales tools are implemented, adopted and deliver the expected benets. Vendors that

don’t already oer such services should consider doing so to improve or accelerate the success rate of implementations.

19

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

G

aining user adoption is one of the most dicult steps in the sales tool buying process. The survey data analysis

shows an interesting relationship between this phase and the consideration time for sales tools (Figure 9). This

relationship is shown in Table 6.

Time Spent Considering Sales Tools (Fig. 9) % Reporting Gaining User Adoption is Easy

10% or less 13%

11 to 20% 13%

21% or more 34%

Table 6: More consideration time makes gaining user adoption easier.

T

he adage “haste makes waste” seems to summarize the conclusion of Table 6. When organizations spend

more time considering sales tool needs and eectiveness, gaining user adoption becomes easier. In fact, for

survey respondents who report spending 21 percent or more of their time considering the need for new, or the

eectiveness of existing sales tools are almost three times more likely to report that gaining user adoption is

easy. This is clearly a case where the upfront investment of time in the consideration process yields benets on a backend

process phase that is critical to achieving success with a sales tool.

Where budget is concerned, the average, annual per user price point at which it becomes dicult to get approval for any

one, new sales tool is $530. This gure varied little based on the size of the sale force (Table 7).

Sales force size Annual per user price point

approval diculty threshold

Small (10 or less) $507

Medium (11 to 25) $596

Large (26 or more) $544

Table 7: Sales teams share similar budget approval levels regardless of sales team size.

20

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

T

he sales tool acquisition process often includes a free trial or pilot of the tool as part of purchase consideration.

Figure 10 displays how many sales tools were tried in the 12 months prior to the survey via free trial or pilot and

then how many of them were subsequently purchased.

Figure 10: Over half of survey respondents purchased none or one sales tool in the past 12 months.

A

nalyzing the data reveals that the approximate average number of new sales tools tried over the course of a

year is four, and about half of those are ultimately purchased. The criteria that respondents report using for

determining the success of new sales tool trials or implementations is ranked below:

1. Impact on sales performance

2. Ease of use

3. User adoption

4. Fast implementation

Other criteria were oered through the write-in comments section of the survey question that collected this data:

• “Not very tech savvy – must be easy to understand.”

• “Perceived positive business outcomes and value received from tool.”

• “Philosophy.”

• “Protability.”

• “Proving potential ROI on spend.”

• “Solves the problem.”

Sales Tool Trial/Pilot & Purchase Activity:

Past 12 Months

4%

11%

11%

20%

20%

10%

11%

7%

1%

1%

0%

1%

3%

6%

28%

29%

24%

8%

3%

2%

0%

0%

0%

0%

0%

1%

0% 5% 10% 15% 20% 25% 30% 35%

I don't know

None

1

2

3

4

5

6

7

8

9

10

More than 10

Sales Tool Trial/Pilot and Purchase Activity in the Past 12 Months

Purchased

Trial/Pilot

21

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Sales Tools Impact,

Satisfaction and Benets

T

he success of any solution is ultimately determined by the results that solution helps produce. The last step of the

buying cycle is the evaluation where buyers assess the impact of their purchase. During this study, participants

rated the collective impact that sales tools are having on revenue attainment, and the results are summarized in

Figure 11.

Figure 11: Just 3 percent in this study report a negative impact on revenue from sales tools.

S

ales tools should, of course, have a favorable impact on revenue, but users don’t always get the benets of solutions

that vendors say they will get. This could, in large part, be due to the diculty of attaining user adoption as pointed

out in Table 5. Most respondents (55%) are seeing the use of tools result in a slight positive impact. While another

29% report a signicant positive impact on revenue attainment.

Impact of Sales Tools on Revenue Attainment

1%

2%

13%

55%

29%

0%

10%

20%

30%

40%

50%

60%

Significant negative Slight negative None Slight positive Significant positive

Impact of Sales Tools on Revenue Attainment

22

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

T

here is an implied relationship between sales tool impact-on-revenue and over-all revenue growth. In other words,

respondents that report a positive impact on revenue from the use of sales tools should also report stronger

revenue growth. Indeed, the relationship between tool impact and revenue growth was statistically quite strong, as

Figure 12 shows.

Figure 12: 88 percent of study participants reporting a positive impact on revenue from sales tools are also experiencing slight to

signicant overall revenue growth.

Sales Tool Impact on Revenue & Revenue Growth

0%

3%

9%

34%

54%

4% 4%

28%

36%

28%

0%

10%

20%

30%

40%

50%

60%

Significant

decrease

Slight decrease Flat Slight increase Significant

increase

Sales Tool Impact on Revenue & Revenue Growth

Positive impact

None or negative impact

23

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

W

hen users say that sales tools are impacting revenue positively, they’re not just making an assumptive state-

ment to justify a tool expense. The tool impact/revenue relationship is very real, as Figure 12 shows. Of the

study participants that said their sales tools positively impact revenue, 88 percent report slight to signicant

revenue growth as well. By contrast, of study participants that said their sales tools are providing no or a

negative impact on revenue, 64 percent report slight to signicant revenue growth – a dierence of 24 percentage points.

In other words when sales tools are working, they are not merely productivity aids for the sales team. They really do drive

revenue growth.

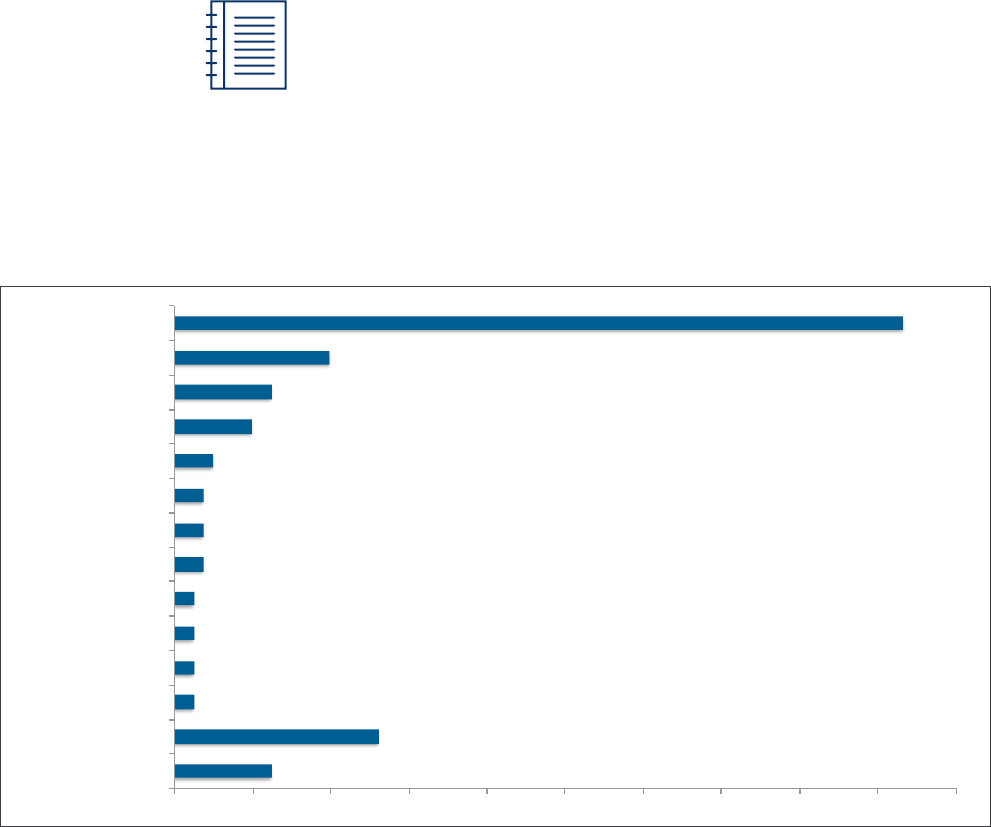

The satisfaction with sales tools listed in Figure 1 was measured, and Figure 13 shows the ranking for tools with which users

were “Satised” or “Very satised.”

Figure 13: A majority of users are satised with every tool listed.

S

ales Performance & Compensation, Gamication and -signatureE are in the top ve for user satisfaction, but in

the bottom ve for usage (Figure 1). These satisfaction ratings are the result of tool usage.

User Satisfaction (% Satised and Very Satised)

26%

58%

63%

64%

64%

66%

67%

67%

67%

68%

71%

72%

80%

83%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Other Tools

Sales Contract Management

Quoting & Pricing or Configuration

Territory & Account Planning

Inside Sales

Prospect Communication & Engagement

Value Selling & ROI

Sales Intelligence

Pipeline Management & Deal Flow

Sales Performance & Compensation

Gamification

Sales Enablement

E-signature

iPad or Tablet Tools

% Satisfied or Very Satisfied

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

24

I

n addition to gathering sales tool satisfaction data, participants also provided a ranking of tools listed

based

on

perceived .benet Table 8 compares perceivedthe op

non-users. by ranking benefit perceived to those compares

and users by ranking benefit on basedtechnologies 5 t

Table 8: Perceived benet non-users. by benefit perceived from differs often usersby

Sales Technology

Rank:

Perceived

sUser byBenefit

Rank: erceivedP

non-users by Benefit

E-signature

1 31

amificationG

2

11

Manageme Contract alesS nt 3 12

Compensation & Performance Sales

4

9

5

Inside Sales 5

W

hen viewing Table 8, it’s important to remember that het erceivedp

benet

of

benefit. of misperception a of because technologies valuable on out missing be ouldc

organizations indicates .non-users hisT

by technology each of beneft perceived

the fromdiffers

users

actualby

technology

each

The benet perception ranking by does respondents all dier slightly based on sales force size, as Table 9 summarizes.

Table 9: Top ve perceived benet ranking by all sales by out broken respondents force size.

Tool Rank

Small Sales Forces

(10 or fewer sales reps)

Medium Sales Forces

(11 to 25 sales reps)

Large Sales Forces

(26 or more sales reps)

1

Prospect Communication &

Engagement

Pipeline Management & Deal

Flow

Sales Intelligence

2

Pipeline Management & Deal

Flow

Prospect Communication &

Engagement

Pipeline Management & Deal

Flow

3

Sales Intelligence

Sales Intelligence Sales Enablement

4 Inside Sales Sales Enablement

Prospect Communication &

Engagement

5 Value Selling & ROI Inside Sales

Quoting, Pricing or

Conguration

25

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

CRM

B

ecause CRM is the “system of record” for sales, this section of the report focuses on the CRM landscape as revealed

through this study. Figure 14 shows the current installed status of CRM systems.

Figure 14: The current CRM solution use landscape.

Only solutions with at least two installations were included as individual bars in Figure 14. Virtually everyone is using some

sort of CRM solution (94 percent), and 88 percent are using a solution from a vendor.

A number of CRM solutions in Figure 14 were only in use by a single study participant. These solutions are accounted for in

the “Other” bar in Figure 14, and listed below for reference:

• Base CRM

• BigContacts

• Buildtopia

• CampaignerCRM

• Divalto

• Focus

• Goldmine

• InfusionSoft

• Membrain

• NimbleCRM

• Sales Task Force

• SalesLogix

• SalesLook

• Streak

• Vtiger

CRM Solution Use

6.2%

13.0%

1.2%

1.2%

1.2%

1.2%

1.9%

1.9%

1.9%

2.5%

5.0%

6.2%

9.9%

46.6%

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0%

None

Other

Oracle

Sugar

VanillaSoft

Hubspot

Act!

SAP

Pipeliner

NetSuite

Zoho

In-house developed

Microsoft

Salesforce

CRM Solution Use

26

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

S

alesforce enjoys the largest market share, and that share diers based on the size of the sales team that uses it

(Table 10).

Table 10: Salesforce CRM market share by sales team size.

The survey questions dealing with CRM generated some insightful write-in comments, shared here:

• “It would be nice to have a CRM system that brings in other systems such as Oracle and Business

Intelligence. A one-stop shop to get a clear picture of past shipments, order history, and general market

information.”

• “New generation of CRM is required. One that addresses the entire organization beyond sales and

marketing.”

• “Most CRMs are the same – and they are used like static repositories of information. The CRM does

nothing for people, people do everything for the CRM. Data/reporting should be intuitive and automatic

– while data is being input.”

Salesforce

Small Sales Teams

(10 or fewer sales reps)

Medium Sales Forces

(11 to 25 sales reps)

Large Sales Forces

(26 or more sales reps)

Share 37% 67% 62%

27

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Summary

I

t isn’t just wishful thinking that sales tools are making a positive impact on revenue attainment: 84 percent of

organizations in this study agree on this impact (Figure 11). Furthermore, those that report a positive revenue impact

from sales tools aren’t just talking: 88 percent of them are also experiencing revenue growth (Figure 12). This benecial

relationship is good news for buyers and vendors, but that doesn’t mean a sales tool has smooth sailing to eective use.

The sales tool acquisition process challenges buyers in several areas, with the two greatest being: obtaining budget

and gaining user adoption. In fact, it’s very possible to navigate the budget approval shoals only to wreck upon the user

adoption rocks. The study does oer advice about one way to mitigate these hazards: spend enough time evaluating tools.

Those who rush the sales tool evaluation process are more likely to have diculty gaining user adoption of those tools

(Table 6). Those who do spend adequate time evaluating tools make better choices and have more realistic expectations

about tool performance.

Vendors can help buyers connect with the right tools more eectively by:

Understanding the customer journey

Most vendors claim intimate knowledge of the buyer’s journey and the customer experience, but few regularly measure,

study and work to improve it. Too many vendors ing random content online hoping to connect with buyers on their

journey. This is a hit and miss proposition at best. Vendors who study what their customers go through know exactly

where the “speed bumps” in the journey are, and they do their best to smooth them out.

Two of the speed bumps the study identies are obtaining budget and gaining user adoption. Vendors can help on the

budget issue by providing case studies and tools that help quantify benets and simplify creating the business justication

for purchasing. Regarding gaining user adoption, improved support, training, self-help resources and optional services may

provide the answer to the adoption barrier.

Know and respect the audience

This study shows that who holds the budget for sales tools and who has lead assessment responsibility often don’t have

“Sales” in their job title. When addressing the budget holder in companies with small or medium-sized sales forces, quite

often that person is in the C-suite. It’s just as likely that tool assessment is the responsibility of a cross-functional committee

as it is a member of the sales team. Vendors should make sure that they know the audience for their communications,

and build those communications specically to address the needs of the audience that is perhaps more diverse than once

thought. This may mean developing multiple sets of messages and marketing assets to support selling to a non-sales

audience.

Vendors that are relentless in the pursuit of a better customer understanding, and who use that understanding to provide

a better customer experience will gain a competitive advantage without making so much as a single feature addition to their

sales tool solutions. Furthermore, those vendors will have more precise insights about which new features and services will

resonate most with their buyers.

28

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

About Smart Selling Tools

N

ancy Nardin is a nationally recognized thought leader and presenter on sales and marketing productivity tools.

She is the Founder and CEO of Smart Selling Tools, Inc., an analyst and consulting rm specializing in sales

productivity and sales performance improvement through the use of smart sales tools.

More than 30,000 sales and marketing professionals rely on Smart Selling Tools’ weekly newsletter to stay current about

software that can help drive revenue. You can also attend any one or more of Smart Selling Tools’ online Demo Day events.

Every Thursday at 11:00 a.m. pacic, Smart Selling Tools introduces a new tool vendor to conduct a 30 minute demo. It’s the

easiest, hassle-free way to learn about tools.

29

Sales Tools Study Report © 2015 Smart Selling Tools, Inc. All Rights Reserved.

Appendix:

Survey Background

T

his Sales Tools Study survey was administered online beginning February 2, 2015 through March 21, 2015. During

the survey period, 421 responses were collected, and from those, 370 contained enough data to be useful in the

analysis. The survey data was analyzed to identify insights and interesting relationships between study variables,

and to ensure the study ndings were statistically valid. The results of this study are most representative for those

organizations whose characteristics resemble the survey sample, which is summarized below.

Type of organization:

• Mostly or entirely B2B 85 percent

• Blend of B2B/B2C 15 percent

Primary role of respondent:

• C-suite 24 percent

• Sales VP/Executive 24 percent

• Sales Management 20 percent

• Sales Representative 11 percent

• Sales Operations 2 percent

• Sales Enablement 4 percent

• Marketing 5 percent

• Other 10 percent

Year-to-year revenue growth:

• Signicant increase 49 percent

• Slight increase 35 percent

• Flat 12 percent

• Slight decrease 3 percent

• Signicant decrease 1 percent

Industry:

• Financial services 5 percent

• Insurance 3 percent

• Manufacturing 4 percent

• Media/Publishing 4 percent

• Professional Services 13 percent

• Technology 49 percent

• All others 22 percent

SmartSellingTools.com

Special Issue Courtesy of: