EUROCONTROL European Aviation Overview / 1

Supporting

European

Aviation

EUROCONTROL

EUROPEAN AVIATION OVERVIEW

12-18 Apr 2023

Thursday 20 April 2023

EUROCONTROL European Aviation Overview / 2

The Network recorded 27,357 average daily flights

(+11% vs 2022), increasing (+4%) vs the previous

week andstanding at90% of 2019levels.

Low-cost and flag carriers have now deployed

their summer capacities (e.g. Ryanair, easyJet,

Wizz Air, KLM, Lufthansa). Some operators are

now deploying (SAS) or continue to expand

(Turkish Airlines).

Over the last 2 weeks, network traffic has been

affected by industrial action in France, already

started earlier this year(reform of pensionlaw).

For this reason, France accounted for 75% of all

en-route ATFMdelays last week.

Arrival and Departure punctuality slightly

improved compared to the previous publication,

mainly due to less en-route ATFM delays, but still

around 7 percentage points below 2019.

EUROCONTROL billed 652M€ of en-route charges

for March flights; 28% above the amount billed for

the March 2022 flights. On a year-to-date basis,

EUROCONTOL billed 1,814M€ in 2023, +34%

compared to 2022, owing to both service units

(flights) andunit rates increases.

On 19 April, the EUROCONTROL website came

under attack by pro-Russian hackers, resulting in

interruptions to the website. There was no impact

on Europeanaviation.

Headlines Traffic Situation

Top 10 Busiest States

On week 12-18 Apr 2023

(all flights incl. overflights compared with previous week)

Average daily flights (including overflights)

Week 12-18 Apr 2023

(Week 12-18 Apr 2023)

EUROCONTROL European Aviation Overview / 3

The latest EUROCONTROL

Traffic scenarios were

published on 16 December

2022.

Since that date, network traffic

has evolved around the base

scenario.

Flights in April 2023 so far

were at 87% of April 2019

levels below our base scenario

(91%).

On a year-to-date basis,

network traffic is at 87% of

2019 and +18%vs 2022.

Overall Situation Compared to the

EUROCONTROL Traffic Scenarios

(base year 2019)

EUROCONTROL European Aviation Overview / 4

Arrival & Departure Punctuality

Week 12-18 Apr 2023

(at top airports for the last week)

Punctuality is still impacted by the long-

term French industrial action which again

influenced network performance

throughout the week. There were traffic

reduction programs at specific French

airports and ATFM delays; however, of

those flights that did operate, they were

still delayed..

Both arrival and departure punctuality

were 7 percentage points below that of

2019levels, over thelast week.

Regarding airports, aerodrome capacity

delays were recorded throughout the

week in Antalya due to runway

maintenance. Copenhagen experienced

delays due to ATC staffing and Athens

airport wasaffected by radar problems.

Looking at weather, this impacted

several airports throughout the week.

High winds affected London Heathrow,

London Gatwick and London City. Low

visibility & low cloud celling affected

Amsterdam Schiphol. Convective

weather affected Frankfurt Main..

EUROCONTROL European Aviation Overview / 5

En-Route ATFM Delays

Delays per cause (EUROCONTROL Area)

Share of en-route

ATFM delays

Week 12-18 Apr 2023

In minutes (7-day average) in 2023

En-routeATFMdelays have beenconstantly higher thanin 2022.

This is mainly due to industrial action in France caused by a reform of pension law which led to

disruption in the network over several days in early 2023 but more severely in March (7

th

to 12

th

and

16

th

to31

st

) and in April (1

st

to16

th

).

Last week, average en-route ATFM delays werearound 40,000 minutes per day, less than half the level

of two weeksago (circa 90,000minutesper day).

Due to strikes, France accounted for 75% of all en-route ATFM delays over the last

week.

Germany comes second with 11% of all en-route ATFM delays, mainly concentrated

in Karlsruhe, Munich and Bremen ACCs.

-

20,000

40,000

60,000

80,000

100, 000

120, 000

140, 000

0

20,000

40,000

60,000

12 Apr 13 Apr 14 Apr 15 Apr 16 Apr 17 Apr 18 Apr

Others

Weather

Disruptions (ATC)

Capacity & Staffing

Total 2022

EUROCONTROL European Aviation Overview / 6

No. Country Average daily flights % prev week % prev year % 2019

1. United Kingdom 5,261

+2%

S +10% W -12%

2. Spain 4,719

-1%

S +4% W -1%

3. Germany 4,648

+6%

S +8% W -22%

4. France 4,018

+4%

S +5% W -12%

5. Italy 3,530

+2%

S +8% W -3%

6. Türkiye 2,687

+7%

S +24% S +8%

7. Netherlands 1,511

+0%

S +5% W -12%

8. Norway 1,375

+26%

S +25% W -2%

9. Portugal 1,246

+2%

S +10% S +6%

10. Switzerland 1,209

-1%

S +7% W -11%

Top 10 Countries States in the EUROCONTROL

Network

Dep/Arr to the equivalent week in 2019

Compared to the equivalent week in 2019

Week 12-18 Apr 2023

Dep/Arr flights for week 12-18 Apr 2023

The top 10 States recorded a slight increase (>3%) on the previous week, mostly due to some operators deploying their

summer capacities to the network. No change in the ranking over the previous week except Norway which moved up two

places while Switzerland moved down two places.

Norway recorded a high growth rate (26%), owing to solid increases for Widerøe, SAS, Norwegian, especially on domestic

flows but also on flows with Denmark. Türkiye posted a 7% increase owing to Turkish Airlines and Pegasus, on domestic

flows. Germany recorded a 6% growth thanks to small aircraft operators and Eurowings on domestic flows.

Only two States have recorded growth above 2019 (Türkiye and Portugal). Spain, Norway and Italy are relatively close to the

pre-covid levels. All other States are still between 22% and 11% below 2019 levels.

EUROCONTROL European Aviation Overview / 7

En-Route ATFM delayed flight per Area Control Centre

Delay per flight

Week 12-18 Apr 2023

Over the last week, en-route ATFM

delays have risen significantly and are

above 2022 levels.

The main reason is related to industrial

action in France, which was mainly

affecting Paris ACC last week. Other

disruptions (e.g. staffing at airport)

were affecting Copenhagen.

Last week, the most affected ACCs

were Paris (9 min/flight), Athens (3.1),

Copenhagen (2), Tel Aviv (1.5),

Marseilles (1.5), Reims (1.3), Lisbon,

Munich andAnkara (1.1 each).

Overall, France was responsible for 75%

of all en-route ATFM delays last week,

followed by Germany (11%) and Greece

(6%)and Spain (3%).

GCCC

GMMM

GMAC

LPPC

LECP

LECS

LECB

LECM

LFMM

LFBB

LFRR

EISN

EGTT

EGPX

LMMM

LIRR

LIMM

LIPP

LSAG

LSAZ

LFFF

LFEE

EDYY

EKDK

ENOSW

ENOSE

ENBD

ESOS

ESMM

EDUU

EFIN

EETT

EVRR

EYVC

EPWW

LKAA

LZBB

LOVV

LJLA

LHCC

LDZO

LIBB

LAAA

LQSB

LYBA

LWSS

KFOR

LBSR

LRBB

LGGG

LGMD

LCCC

LLLL

LTAA

UDDD

UGGG

UKDV

UKBV

UKLV

UKOV

LUUU

EIDW

EGTTTC

EHAA

EDWW

EDMM

EDGG

EBBU

> 3 min

1.0 - 3.0 min

0.5 - 1.0 min

< 0.5 min

Lower Airspace

Lower Airspace

Lower Airspace

LTBB

EUROCONTROL European Aviation Overview / 8

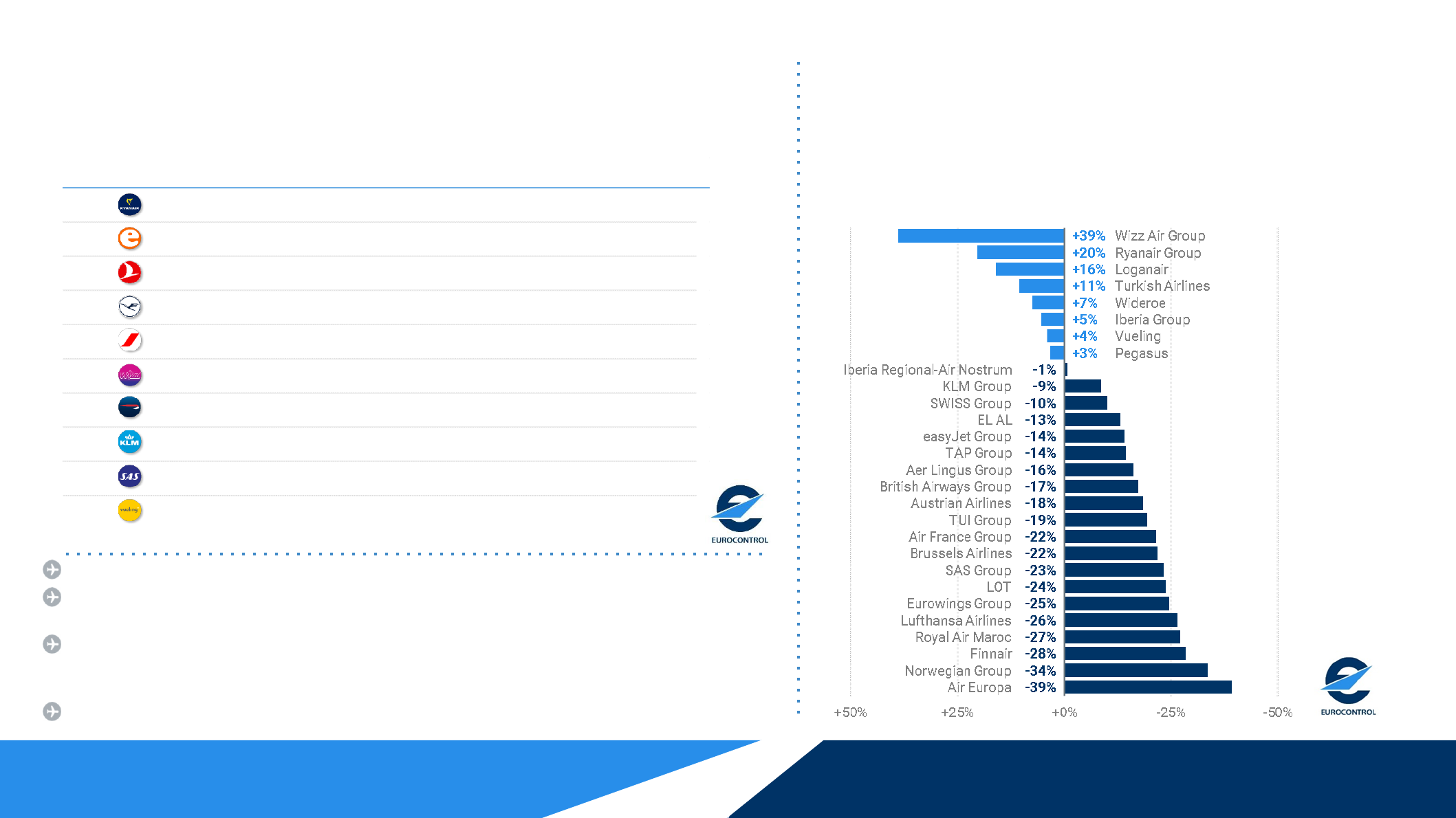

No. Aircraft operator Average daily flights % prev week % prev year % 2019

1. Ryanair Group 3,023

+0%

S

+9%

S

+20%

2. easyJet Group 1,550

-1%

S +1% W -14%

3. Turkish Airlines 1,398

+9%

S +25% S +11%

4. Lufthansa Airlines 1,168

+0%

S +0% W -26%

5. Air France Group 1,004

+3%

S +7% W -22%

6. Wizz Air Group 818

-0%

S +12% S +39%

7. British Airways Group 793

+2%

S +13% W -17%

8. KLM Group 792

-0%

S +13% W -9%

9. SAS Group 646

+23%

S +37% W -23%

10. Vueling 641

-2%

S +1% S +4%

Top 10 Aircraft Operators

Aircraft Operators in the

EUROCONTROL Network

Week 12-18 Apr 2023 (avg daily flights)

Dep/Arr flights for week 12-18 Apr 2023

Compared to the equivalent week in 2019

The top 10 Aircraft operators recorded a growth of 2% on the previous week, ranging from -2% (Vueling) to +23% (SAS).

Last week, five airlines had a stable number of operations compared to the week before (Ryanair, Lufthansa, Wizz Air KLM

and easyJet, to a certain extent).

SAS is the only carrier posting a double digit growth on the week before as the operator deployed its summer capacities

adding more domestic flights (e.g. Oslo to Bergen, Stavanger, Trondheim and Ålesund as well as Copenhagen to Ålesund).

Turkish Airlines has expanded its domestic routes too (Istanbul to Antalya,Diyarbakir, Izmir, Mugla,Rize)

Four airlines within the top 10 surpassed their 2019 flight levels: Wizz Air (+39%), Ryanair (+20%), Turkish Airlines (+11%) and

Vueling (+4%), .

.

EUROCONTROL European Aviation Overview / 9

Market Segments in the EUROCONTROL Network

Compared to 2022, Mainline (+20%), Regional (+18%), All-Cargo (+13%) and Low-Cost (+7%) are recording sustained growth rates compared to last year owing to the continuing recovery and to the relatively low

levels of traffic in 2022.

Business Aviation(-2%) andCharter(-7%)are recordingfewerflights in 2023 comparedto 2022 levels.

EUROCONTROL European Aviation Overview / 10

Top 25 Global Aircraft Operators

(average daily departure flights)

Over the last week:

7 European airlines are ranked in the

Top 25 global aircraft operators (one

missing comparedto2022).

The first European aircraft operator

(3

rd

) is Ryanair (up one place compared

to twoweeks ago).

The other European airlines in the Top

10 are easyJet (8

th

) and Turkish Airlines

(10

th

).

The top 15 is complemented by

Lufthansa (12

th

)and AirFrance (14

th

).

KLM andBritish Airways are ranked 20

th

and21

st

.

Wizz Air is the only European airline

that has slipped out of the top 25 since

2022.

EUROCONTROL European Aviation Overview / 11

No. Airport Avg. daily dep/arr flights vs 2022 vs 2019

1. iGA Istanbul 1,327

S

+28%

S

+21%

2. Paris Charles de Gaulle 1,257

S

+11%

W

-12%

3. London Heathrow 1,254

S

+11%

W

-7%

4. Amsterdam 1,244

S

+8%

W

-12%

5. Frankfurt 1,180

S

+7%

W

-20%

6. Madrid Barajas 1,063

S

+11%

W

-8%

7. Barcelona 895

S

+5%

W

-10%

8. Munich 838

S

+5%

W

-29%

9. Rome Fiumicino 722

S

+19%

W

-18%

10. London Gatwick 702

S

+9%

W

-13%

Top 10 Airports

Airport Ranking

Week 12-18 Apr 2023 (vs 2022)

A few changes in the ranking over

the previous week: increase for

Paris and Rome, decrease for

London Heathrow, Amsterdam and

London Gatwick.

All airports experienced sustained

growth on 2022; ranging from 5%

(Munich, Barcelona) to 28% (iGA

Istanbul).

iGA Istanbul, which became fully

operational on the 6

th

of April 2019,

is the only airport in 2023 amongst

the top 10 surpassing its 2019

levels.

EUROCONTROL European Aviation Overview / 12

Average Arr/Dep Punctuality at Main Airports

(Week 12-18 Apr 2023)

After having deteriorated in early March

because of significant en-route ATFM

delays related to industrial action in

France, both arrival and departure

punctuality are now improving even if

theyare still worse thanin 2022.

At most airports, arrival punctuality is

higher (i.e. better) than departure

punctuality.

However a few airports, notably Oslo,

Stockholm, iGA Istanbul, Athens, Liège,

Copenhagen and Zurich have departure

punctuality which is higher than arrival

punctuality which indicates that these

airports have been able to absorb

delays.

Average Departure Punctuality %

Average Arrival Punctuality %

88%

82%

83%

84%

77%

80%

72%

79%

80%

74%

79%

79%

62%

75%

72%

74%

72%

63%

66%

67%

70%

64%

62%

71%

71%

70%

76%

62%

56%

64%

68%

64%

62%

89%

85%

83%

79%

76%

75%

75%

75%

74%

72%

72%

72%

71%

69%

68%

67%

66%

66%

66%

66%

66%

65%

62%

62%

62%

62%

61%

60%

53%

52%

50%

47%

40%

30%

100%

Oslo

Stockholm Arlanda

Helsinki

Warsaw Chopin

Vienna

Madrid Barajas

iGA Istanbul

Barcelona

Munich

Istanbul Sabiha Gokcen

Dusseldorf

Palma de Mallorca

Athens

Amsterdam

Brussels

Frankfurt

Geneva

Liege

London Stansted

Manchester

London Heathrow

Dublin

Copenhagen

Zurich

Milan Malpensa

Berlin Brandenburg

Rome Fiumicino

London Gatwick

Tel Aviv

Paris Orly

Nice

Lisbon

Paris CDG

EUROCONTROL European Aviation Overview / 13

Top 25 Global Airport Departures

(average daily departure flights)

Over the last week:

Six European airports are ranked in the

Top 25 of global aircraft operators (one

more than in 2022).

The first European airport (9

th

) is iGA

Istanbul.

The other European airports in the Top

25 are London Heathrow (14

th

), CDG

(15

th

), Amsterdam (16

th

), Frankfurt

(17

th

) and Madrid (23

rd

).

EUROCONTROL European Aviation Overview / 14

Traffic Flows

(average daily departure/arrival flights for week 12-18 Apr 2023)

The main traffic flow was intra-European with21,596daily flights last week,+5% vs the previous week.Inter-Continental flowsrecorded 4,980 daily flights on average last week,+2% vs the previous week.

The secondregional flow is between Europe andthe Middle-East with 1,277 average dailyflights lastweek,showing anincrease of +2% vs the previous week.

The third flow is with North America with 1,160 dailyflights,growing by 3% overthe previous week.

Flows withOtherEurope (incl.Russian Federation) are still laggingbehindandwere at-71% compared to2019.

Flows between Europe andAsia/Pacific are alsostill laggingbehind,toa lesserextent,at -16% compared to 2019.

Sudan’s civil aviationauthorityhas suspendedair navigation services withinthe Khartoum FIR.

EUROCONTROL European Aviation Overview / 15

Top 10 Long Haul Country-Pairs

Week 12-18 Apr 2023

(average daily departure/arrival flights for the last week)

No change in the ranking over the previous

week for the top 10 Long-haul Country-

Pairs, except for Ireland ↔ US flow which

moved three ranks up and UAE ↔ UK

which movedtwo ranks down.

The majority of the flows posted an

increase on previous week (ranging from

0% to 6%).

Seven of the top 10 Long Haul Country-

Pairs are with the US, the main three being

between USandUK,Germany andFrance.

The flows between Ireland and the US and

Italy and the US showed the highest

increase (+6% each).

A few flows are now above 2019 levels:

Ireland ↔ US, Russia ↔ UAE and India ↔

UK

To be noted: the increase in the number of

flights in 2023 on the flow Russia ↔ UAE

vs 2022 and2019.

EUROCONTROL European Aviation Overview / 16

Economics

Jet Fuel Price (Europe)

Week 12-18 Apr 2023

The average priceof jet fuel increased to2.47USD/gallon on 14 April, it represents a drop of 5% compared totheend of February 2023and a 14%drop compared tothe beginning of 2023.

Basedon a moving average trend, fuelpricesin Europehavebeen declining since June2022, from$4/gallon down to$2.5/gallonmid April2023.

EUROCONTROL European Aviation Overview / 17

GDP in the European Union

Price Change per Month (EU27)

For year 2022Constant prices and exchange rate, Euro

According to the latest GDP forecast from Oxford Economics, EU27 economies have posted a

positive growth during Q12023 (+0.1% vs Q1 2022, revised up from -0.1% in the previous forecast).

Economies have returned to growth in Q1 2023 (vs Q1 2022) and the quarterly rate should climb

up to +0.5% inQ4 2024(vs Q4 2023).

In terms of indexwith2019 as base 100,2023 should be at 103and 2024 at 105.

The latest information from EUROSTATshowsthe following(no completesampleforMarch 2023):

In 2022, prices of air tickets increasedby16% comparedto 2021 (peakingat +29% in July2022).

In Jan-Feb2023,ticketprices increased by 10% on average,inline with all-prices inflation.

This reflects inte r alia sustaineddemand,reduced flightchoice and higherjet fuel prices.

EUROCONTROL European Aviation Overview / 18

Top 40 European airports passengers

Number of passengers and flights per month

Based on ACI passenger data, the total number

of passengers and corresponding aircraft

movements for the Top 40* ECAC airports

show:

80 million passengers were recorded in

January 2023, corresponding to an 83%

growth (vs January 2022), while

corresponding movements increased by

39% overthe same period.

78 million passengers in February 2023, a

56% increase on February 2022, with

corresponding movements at airports

increasingby 36% overthe same period.

Both January and February 2022 were

affected by omicron, hence the

comparisonis distorted.

In any case, passenger growth per day in

between January and February 2023

(+8%) increased faster than movements

growth per day (+4%), explained by the

higher load factors recorded with the

recoveryfrom COVID-19 crisis.

*

The sample is based on Top 40 ECAC airports for

year 2022.

EUROCONTROL European Aviation Overview / 19

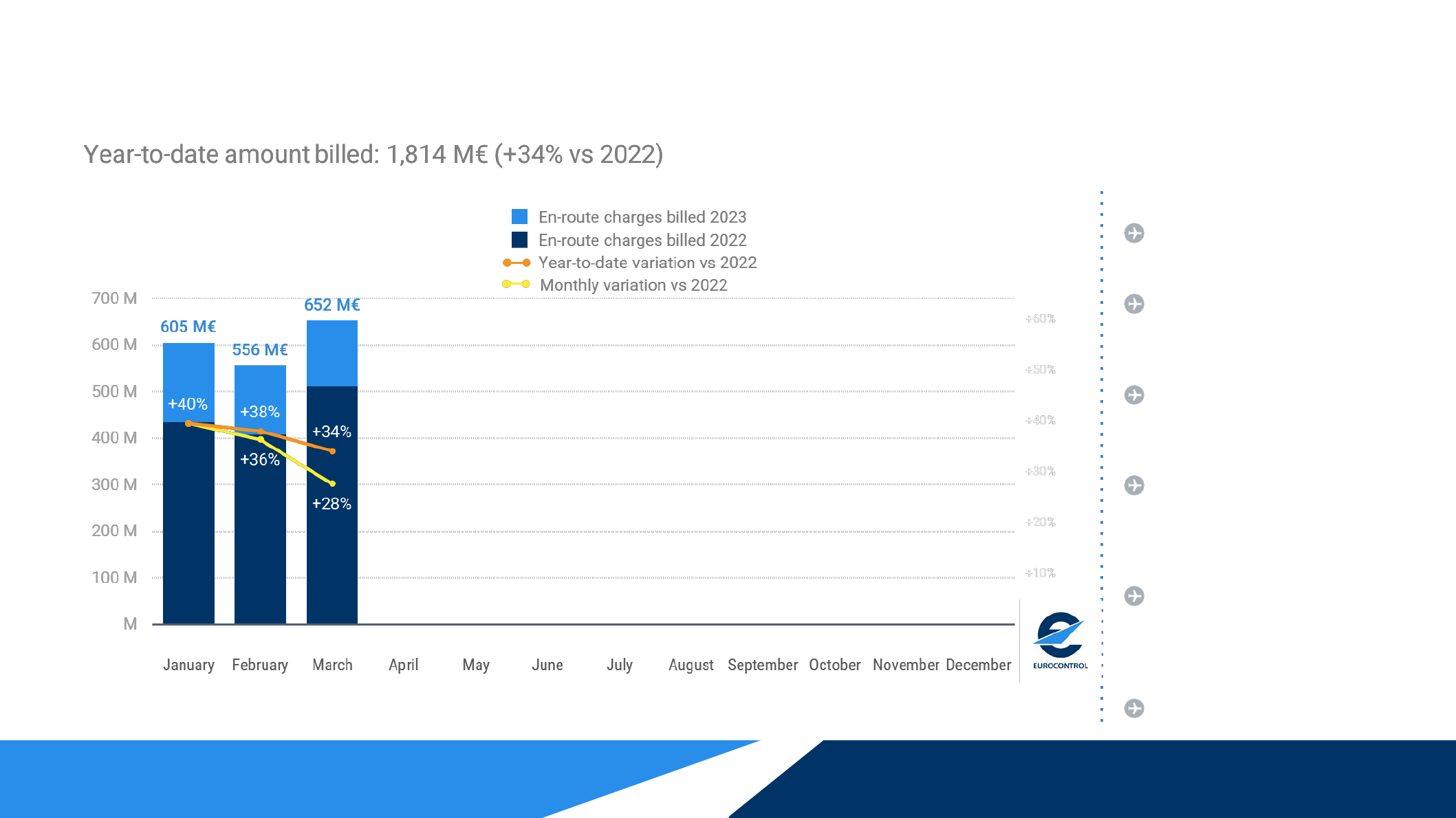

En-route Air Navigation Charges for the EUROCONTROL Area (2023)

At network level, 652M€ were billed in March

which represents +28% vs 2022 and +12% vs

2019.

These changes were driven by the evolution

of unit rates and of traffic characterized by

the distance flown and the weight of each

aircraft (or Service Units).

The March 2023 variation vs March 2022

(+28%) is explained by an increase in Unit

Rates of +7% and an increase in Service

Units of +20%.

Monthly variations in January (+40%) and

February (+36%) were artificially inflated by

COVID-19 variant (omicron) which impacted

growth in service units early 2022. This

artificial effect has diminished inMarch.

The total amount billed in March was higher

than in February: more days and more

seasonal traffic. There is no clear impact of

the industrial action in France on March en-

route charges.

On a year-to-date basis, EUROCONTROL has

billed 1,814 M€ which is +34% vs 2022.

EUROCONTROL European Aviation Overview / 20

© EUROCONTROL- 2023

This document is published by EUROCONTROL for information purposes. It may be copied

in whole or in part, provided that EUROCONTROL is mentioned as the source and it is not

used for commercial purposes (i.e. for financial gain). The information in this document

may not be modified without prior writtenpermission from EUROCONTROL.

www.eurocontrol.int

To further assist you in your analysis, EUROCONTROL provides the following additional

information on a daily basis (daily updates at 7:30 CET for the first item) and every

Friday for the last item:

1. EUROCONTROL Aviation Intelligence Portal:

www.eurocontrol.int/Economics/

This dashboard provides daily traffic data on Day+1 for all European States; for the largest airports;

for each Area Control Centre (ACC) and for the largest aircraft operators.

2. EUROCONTROL “Our Data” Portal:

www.eurocontrol.int/our-data/

This webpage provides an overview of key charts and publications related to European aviation

performance.

3. Rolling Seasonal Plan:

www.eurocontrol.int/publication/european-network-operations-plan-2023-rolling-seasonal-plan

This Rolling Seasonal Plan covers a rolling eight-week period and consolidates data from 350

airlines, 68 area control centres (ACCs), 55 airports and 43 States. It plays a major role in helping

European aviation to recover by providing aviation’s key actors with the global view they need to

plan effectively.

For more information please contact aviation.intelligence@eurocontrol.int

Supporting

European

Aviation