____________

Coast Guard Pay Manual

COMDTINST M7220.29D

November 2019

Commandant

United States Coast Guard

US Coast Guard Stop 7907

2703 Martin Luther King Jr Ave SE

Washington, DC 20593-7907

Staff Symbol: CG-1332

Phone: (202) 475-5376

Email:

COMPENSATION@USCG.MIL

COMDTINST M7220.29D

6 NOV 2019

COMMANDANT INSTRUCTION M7220.29D

Subj:

COAST GUARD PAY MANUAL

1. PURPOSE. This Manual establishes Coast Guard policy concerning the pay and allowances

of Coast Guard personnel.

2. ACTION. Commanding Officer, Coast Guard Pay and Personnel Center (CG PPC) and

Commander, Coast Guard Personnel Service Center (CG PSC), are responsible for

promulgating procedures and guidance necessary to effectively and efficiently implement the

policy included in this Manual. All Coast Guard unit commanders, commanding officers,

officers-in-charge, deputy/assistant commandants, and chiefs of headquarters staff elements

shall comply with the provisions of this Manual. Internet release is authorized.

3. DIRECTIVES AFFECTED. Coast Guard Pay Manual, COMDTINST M7220.29C is hereby

cancelled.

4. DISCUSSION. This revision to the Coast Guard Pay Manual continues the ongoing efforts

to update Coast Guard pay and allowance policy with current statute and regulations.

5. DISCLAIMER. This guidance is not a substitute for applicable legal requirements, nor is it

itself a rule. It is intended to provide guidance for Coast Guard personnel and is not intended

to nor does it impose legally-binding requirements on any party outside the Coast Guard.

6. MAJOR CHANGES. The new name of the Manual is the Coast Guard Pay Manual,

COMDTINST M7220.29D. This Manual has been revised from its previous version,

consolidating and clarifying repetitive or conflicting content, updated references, and

reporting new policy and regulations. A review of the entire Manual is recommended.

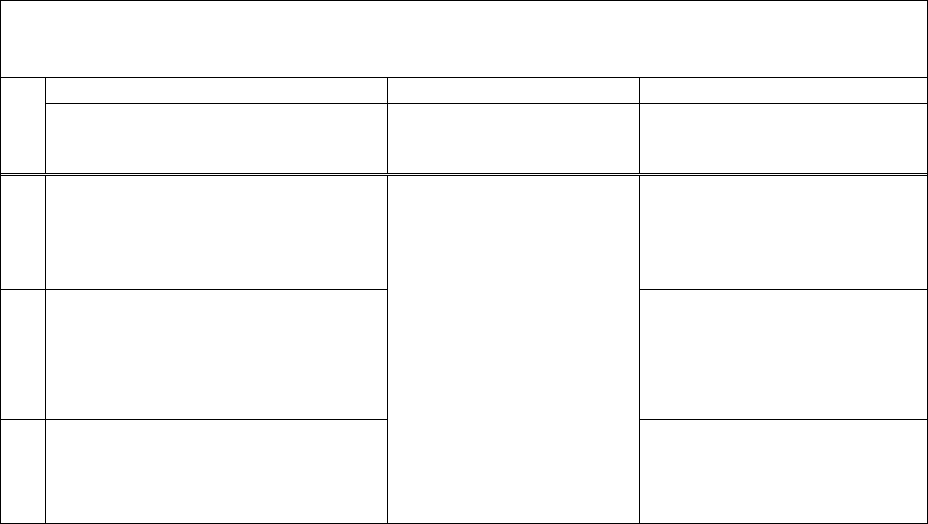

DISTRIBUTION – SDL No. 170

a

b

c

d

e

f

g

h

i

j

k

l

m

n

o

p

q

r

s

t

u

v

w

x

y

z

A

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

B

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

C

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

D

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

E

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

F

X

X

X

G

X

X

X

X

H

X

X

X

X

X

X

NON-STANDARD DISTRIBUTION:

COMDTINST M7220.29D

2

7. ENVIRONMENTAL ASPECT AND IMPACT CONSIDERATIONS.

a. The development of this Manual and the general policies contained within it have been

thoroughly reviewed by the originating office in conjunction with the Office of

Environmental Management, Commandant (CG-47). This Instruction is categorically

excluded under current Department of Homeland Security (DHS) categorical exclusion

DHS (CATEX) A3 from further environmental analysis in accordance with the U.S.

Coast Guard Environmental Planning Policy, COMDTINST 5090.1 and the

Environmental Planning (EP) Implementing Procedures (IP).

b. This Manual will not have any of the following: significant cumulative impacts on the

human environment; substantial controversy or substantial change to existing

environmental conditions; or inconsistencies with any Federal, State, or local laws or

administrative determinations relating to the environment. All future specific actions

resulting from the general policy in this Instruction must be individually evaluated for

compliance with the National Environmental Policy Act (NEPA) and Environmental

Effects Abroad of Major Federal Actions, Executive Order 12114, Department of

Homeland Security (DHS) NEPA policy, Coast Guard Environmental Planning policy,

and compliance with all other applicable environmental mandates.

8. DISTRIBUTION. No paper distribution will be made of this Manual. An electronic version

will be located on the following Commandant (CG-612) web sites.

Internet: http://www.dcms.uscg.mil/directives/, and

CGPortal: https://cgportal2.uscg.mil/library/directives/SitePages/Home.aspx.

9. RECORDS MANAGEMENT CONSIDERATIONS. This Manual has been thoroughly

reviewed during the directives clearance process, and determined there are no further records

scheduling requirements in accordance with Federal Records Act, 44 U.S.C. 3101 et seq.,

National Archives and Records Administration (NARA) requirements, and Information and

Life Cycle Management Manual, COMDTINST M5212.12 (series). This policy does not

have any significant or substantial change to existing records management requirements.

10. FORMS/REPORTS. The forms referenced in this Manual are available in USCG Electronic

Forms on the Standard Workstation or on the Internet at https://dcms.uscg.afpims.mil/Our-

Organization/Assistant-Commandant-for-C4IT-CG-6/The-Office-of-Information-

Management-CG-61/Forms-Management/CG-Forms/ and CG Portal at

https://cgportal2.uscg.mil/library/forms/SitePages/Home.aspx. DoD forms may be found at

https://www.esd.whs.mil/directives/forms/.

11. REQUEST FOR CHANGES. Comments and recommendations pertaining to this Manual

are invited, through your chain of command, and will be addressed to Commandant (CG-

C. J. HULSER /s/

Captain, U.S. Coast Guard

Acting Director of Military Personnel

THIS PAGE HAS BEEN INTENTIONALLY LEFT BLANK

COMDTINST M7220.29D

i

U. S. COAST GUARD PAY MANUAL

TABLE OF CONTENTS

Page

Chapter 1 Introduction to Coast Guard Pay ........................................................................................... 1-1

Chapter 2 Computation of Service and Basic Pay ................................................................................. 2-1

Chapter 3 Allowances ............................................................................................................................ 3-1

Chapter 4 Special Pay ............................................................................................................................ 4-1

Chapter 5 Incentive Pay ......................................................................................................................... 5-1

Chapter 6 Deductions ............................................................................................................................. 6-1

Chapter 7 Allotments From Pay ............................................................................................................ 7-1

Chapter 8 Taxes ..................................................................................................................................... 8-1

Chapter 9 Payment of Military Personnel .............................................................................................. 9-1

Chapter 10 Separation Payments and Claims ...................................................................................... 10-1

Chapter 11 In-Service Debt Collection ................................................................................................ 11-1

Chapter 12 Reserve Pay and Allowances ............................................................................................ 12-1

Chapter 13 Payments to Members of Other Uniformed Services ........................................................ 13-1

Chapter 14 Out of Service Debt Collection ......................................................................................... 14-1

Chapter 15 Cadet Pay and Allowances ................................................................................................ 15-1

Chapter 16 Retired Pay ........................................................................................................................ 16-1

Table of Figures .......................................................................................................................................... ii

COMDTINST M7220.29D

ii

Coast Guard Pay Manual –Table of Figures

Chapter 2 Page

2-1 – When Active Duty Begins ............................................................................................................. 2-9

2-2 – Increase in Pay on Promotion ...................................................................................................... 2-10

2-3 – Authorized Absence – Effect on Pay and Allowances ................................................................. 2-19

2-4 – Unauthorized Absence and other Lost Time - Effect on Pay and Allowances ............................ 2-23

2-5 – Rules for Determining whether Absence is Unavoidable ............................................................ 2-24

2-6 – Allowable Travel Time – Travel between places within the Continental United States ............. 2-28

Chapter 3 Page

3-1 – Officer BAS - Specific Conditions For Entitlement and Non-Entitlement ................................. 3-93

3-2 – Enlisted Members BAS Entitlement – Permanent Duty Station .................................................. 3-94

3-3 – Enlisted Members BAS Entitlement – Travel Status, Leave, Hospitalization, and

Other Special Circumstances ........................................................................................................ 3-96

3-4 – Meal Collection Rates .................................................................................................................. 3-98

3-5 - Date to Start BAH or OHA – Members With Dependents ........................................................... 3-99

3-6 – Date to Stop Housing Allowances – Changes in Dependency Status ........................................ 3-100

3-7 – Date to Stop BAH or OHA – Other Than Dependency Status Changes ................................... 3-101

3-8 – Who Determines Housing Allowance Dependency Relationship ............................................. 3-102

3-9 – BAH or OHA Entitlement at Permanent Duty Stations for Spouses in a Uniformed Service –

Family-Type Quarters Not Assigned (NOTES 1-9 apply for all rules) ..................................... 3-104

3-10 – Member Married to Member; Entitlement to BAH or OHA With-Dependents Based

on Payment of Child Support ................................................................................................... 3-107

3-11 – Member Married to Member; Both in Grade E-5 or Below Assigned to Sea Duty,

Entitlement to BAH or OHA .................................................................................................... 3-108

3-12 – BAH or OHA - Member Without Dependents; Entitled to Basic Pay ..................................... 3-109

3-13 – BAH or OHA - Members With Dependents, Entitled to Basic Pay ........................................ 3-112

3-14 – BAH or OHA With-Dependents Based on Payment of Child Support; Former Spouse

or Other Parent Is Not An Active Duty Uniformed Service Member ...................................... 3-113

3-15 – Divorced Military Member Paying Child Support to a Former Active Duty Spouse;

BAH or OHA Entitlement (Notes 1 and 2)………………………….………………………..3-116

3-16 – Housing Allowance Changes When Member Acquires Dependents (Note 1) ........................ 3-117

3-17 – Housing Allowance Entitlements for Members With-Dependents Serving An

Unaccompanied/Dependent Restricted or Unusually Arduous Sea Duty Tour ....................... 3-119

3-18 – Changes When a Member With a Dependent Serves An Unaccompanied/Dependent

Restricted Tour and Dependents Visit ...................................................................................... 3-123

3-19 – Housing Allowance Entitlement for Members In Transit ........................................................ 3-124

3-20 – Housing Allowance Entitlement Due to Death of Member ..................................................... 3-126

3-21 – Reserve Components; Ordered to Active Duty (AD) or Active Duty For Training (ADT) .... 3-127

3-22 – Housing Allowance Entitlement Incident to Early Return of Dependents (ERD) (NOTE 1) . 3-129

3-23 – Family Separation Housing (FSH); Conditions Affecting Authority ...................................... 3-130

3-24 – FSA Conditions of Entitlement ................................................................................................ 3-131

3-25 – FSA-R, Overseas Assignment .................................................................................................. 3-134

3-26 – FSA Start Date ......................................................................................................................... 3-137

3-27 – FSA Stop Date .......................................................................................................................... 3-139

3-28 – Clothing Maintenance Allowance Entitlement, Basic Maintenance Allowance (BMA),

and Standard Maintenance Allowance (SMA) ......................................................................... 3-140

COMDTINST M7220.29D

iii

3-29 – Reserve Component Clothing Maintenance Allowance Entitlement;

Reserve Basic (RBMA) or Reserve Standard (RSMA) ............................................................ 3-141

Coast Guard Pay Manual –Table of Figures

Chapter 4 Page

4-1 – Hardship Duty For Location Pay; Conditions Of Entitlement For Duty In Designated Areas ..... 4-4

4-2 – Monthly Career Sea Duty Pay Rates (Effective 01 Jan 2017) .................................................... 4-10

4-3 – Career Sea Pay – Conditions of Entitlement – Sea Duty as Permanent Crew Members ............ 4-13

4-4 – Career Sea Pay – Conditions of Entitlement - Mobile Unit Duty ............................................... 4-14

4-5 – Career Sea Pay – Conditions of Entitlement - Permanent Duty Ashore ..................................... 4-15

4-6 – Special Pay for Diving Duty – Conditions of Entitlement .......................................................... 4-20

4-7 – Hostile Fire or Imminent Danger (HF/IDP) – Conditions of Entitlement. .................................. 4-24

4-8 – Date to Start and Stop Foreign Language Proficiency Pay ......................................................... 4-28

Chapter 5 Page

5-1 – Monthly Aviation Career Incentive Pay Rates Effective 17 Oct 1998 for All Officers .............. 5-23

5-2 – Time of Aerial Flight Required for Fractional Part of Month ..................................................... 5-24

5-3 – Flight Examples Involving Basic 3-Month Grace Periods .......................................................... 5-25

5-4 – Flight Examples Involving 3-Month Periods and Excess Time .................................................. 5-26

5-5 – Right to Flying Pay or ACIP Under Certain Conditions ............................................................. 5-27

5-6 – Authorized HDIP-VBSS Board Team Quotas by Activity ......................................................... 5-33

Chapter 6 Page

6-1 – Effective Dates of SGLI Coverage and Deductions ...................................................................... 6-7

Chapter 7 Page

7-1 – Authorized Allotment Purposes and Periods ................................................................................. 7-4

Chapter 8 Page

8-1 – Taxability of Items of Military Pay or Allowances ....................................................................... 8-3

8-2 – Effect of Punishment, Absence, and Non-pay Status on FICA Tax.............................................. 8-6

Chapter 10 Page

10-1 – Payment of Accrued Leave – Officers and Enlisted Members Separation Without Immediate

Reentry on Active Duty ............................................................................................................. 10-5

10-2 – Payment of Accrued Leave – Officers Separation With Immediate Reentry on Active Duty .. 10-6

10-3 – Payment of Accrued Leave – Enlisted Separation With Immediate Reentry on Active Duty .. 10-7

10-4 – Payment of Accrued Leave – Enlisted Members; Extension of Enlistment; Discharge and

Reenlistment Before Extension is Completed ........................................................................... 10-8

10-5 – Entitlement to Discharge Gratuity ........................................................................................... 10-11

10-6 – SEP PAY and Recoupment from Retired Pay ......................................................................... 10-27

COMDTINST M7220.29D

iv

Chapter 11 Page

11-1 – Indebtedness Due to Erroneous Payment – GAO Disallowances and Notices of Exception .. 11-14

11-2 – Indebtedness Due to Loss of Public Funds .............................................................................. 11-15

11-3 – Indebtedness Due to Loss or Damage to Public Property or Supplies ..................................... 11-16

11-4 – Indebtedness to Individuals and Government Instrumentalities and Agents ........................... 11-17

11-5 – Miscellaneous Indebtedness to the United States .................................................................... 11-18

11-6 – Rates of Collection ................................................................................................................... 11-19

11-7 – Priority of Deductions and Collections .................................................................................... 11-20

Chapter 12 Page

12-1 – Disability Entitlements for Reserve Component Members ..................................................... 12-10

Chapter 15 Page

15-1 – Dates to Start and Stop Cadet Pay and Allowances ................................................................... 15-4

COMDTINST M7220.29D

1-i

CHAPTER 1

INTRODUCTION TO COAST GUARD PAY

TABLE OF CONTENTS

Page

Section A – Active Duty Pay Administration……. ........................................................................... 1-1

Section B – Overview of Direct Access (DA) ................................................................................... 1-3

COMDTINST M7220.29D

1-1

CHAPTER 1. INTRODUCTION TO COAST GUARD PAY

A. Active Duty Pay Administration.

1. Direct Access (DA). Direct Access is the centralized personnel and pay system for Coast

Guard active duty, reserve, and retired members.

2. Non-reporting Units. Unit commanding officers are responsible for personnel

management functions. Actions which require the generation of personnel and pay input

must be accurately communicated to the Personnel and Administration (P&A) office. Unit

commanding officers must ensure that appropriate worksheets from the Pay and Personnel

Procedures Manual, PPCINST M1000.2 (series), and supporting documents (copy of

marriage license, divorce decree, birth certificate, course completion certificate, etc.) are

furnished to the P&A Office in a timely manner to facilitate accurate personnel and pay

management. The commanding officer is responsible for notifying the P&A Office when

a member assigned to his/her unit has not received a regular or special payment, or the

payment is in error. These requirements are contained in the Personnel and Pay

Procedures Manual, PPCINST M1000.2 (series).

3. Coast Guard Member Responsibility. Each service member (active duty, reservist, and

retiree) has a responsibility to verify the accuracy and correctness of every pay, allowance,

entitlement, and deduction that is processed or appears on their Semi-Monthly Statement

of Income, commonly referred to as payslip or (in the case of retirees) Retiree &

Annuitant Statement of Monthly Income (RASOMI). These include but are not limited to:

Basic Pay for member's pay entry base date and pay grade, correct housing allowance for

member's dependency status and their duty station location, type of quarters being

assigned, permanent duty station (PDS) zip code, correct meal cost deductions for enlisted

members serving on ships with established Coast Guard Dining Facilities (CGDF - galley)

or shore stations where CGDF use has been designated as mandatory (CG Class A

Schools or certain unaccompanied personnel housing (UPH/barracks) residents), and

special/incentive pays. After review and verification of their Semi-Monthly Statement of

Income, if any discrepancies are noted or suspected, the service member must take prompt

action to notify (in writing or by email) the unit P&A office or the Servicing Personnel

Office (SPO) to have the discrepancies corrected. In the case of a questionable or

suspected overpayment, members must set aside those monies that are in question until

notified in writing by higher authority (PPC or CGHQ) that the amount in question is

correct and the member can retain the funds. If necessary, service members must seek

assistance from their supervisor to ensure discrepancies are properly corrected in a timely

manner.

4. Personnel and Administration (P&A) Office. P&A Offices perform certain personnel

administrative functions for a number of non-reporting units. The P&A Office is a vital

link between the member and their pay and personnel records. P&A Offices provide

administrative support to their subordinate units. They must ensure that appropriate

worksheets and documents are completed timely and accurately and that member’s are

correctly counseled on pay and personnel issues.

COMDTINST M7220.29D

1-2

5. Servicing Personnel Office (SPO). SPOs complete pay & personnel functions for P&A

Offices. Starts and stops of pay entitlements are controlled by the use of Direct Access

(DA) transactions to update the member’s DA pay account. It is essential that these

transactions are accurate and timely. The responsibility for accuracy and timeliness rests

with the member, unit commanding officer, P&A Office, and the SPO. Responsible

officials must ensure that personnel tasked with preparing, reviewing, and approving

documents are thoroughly familiar with applicable directives and procedural guides.

Errors must be carefully investigated and corrected to ensure the personnel data records

are all correct. The SPO contacts PPC on pay problems which cannot be resolved at the

SPO level. SPO personnel who certify/approve payroll transactions are responsible for the

accuracy and legality of those transactions, and have pecuniary liability for illegal,

improper, or incorrect payments as prescribed in the Certifying and Disbursing Manual,

COMDTINST M7210.1 (series). In accordance with sound audit principles outlined in

the GAO “Standards for Internal Control in the Federal Government,” the SPO is required

to, in accordance with procedures established by PPC, conduct audits to validate pay and

allowances on active duty and reserve personnel assigned to that SPO as well as audit all

pay transactions that were approved by that SPO.

6. Special Purpose Reporting Units. The following Coast Guard units also have the ability to

input data into DA:

a. Coast Guard Personnel Service Center (PSC), Washington, DC. Provides data input

for enlisted advancements and officer promotions and various other personnel-related

data.

b. Coast Guard Finance Center, Chesapeake, VA. Provides data input for collection of

travel and transportation indebtedness and tax adjustment transactions associate with

fringe benefits and self-procured HHG moves.

c. Coast Guard Pay and Personnel Center (PPC). The mission of the Coast Guard Pay

and Personnel Center is to provide accurate and timely pay service to all active duty,

reserve, and retired members, and survivors of active duty and retired personnel of the

United States Coast Guard. In order to complete this mission, PPC receives and

accounts for all SPO and HQ data input into DA; administers and records the

disbursement of pay for active duty, reserve, and retired members; administers leave

and retirement point accounting for active and reserve military personnel; arranges for

settlements of claims on behalf of deceased or separated personnel and for collection of

out-of-service debts; process application for allotments and garnishments for certain

support obligations as required by law and regulation; develops written procedures to

support all areas of personnel and pay policy, and provides personnel management and

accounting information to appropriate managers within the Coast Guard. PPC

establishes procedures for conducting key control audits by the SPO.

7. Commandant (CG-6). The program manager for DA has the responsibility for

implementing pay and personnel policy formulated by Commandant (CG-133). No later

than August 2017, Commandant (CG-6) will begin publishing all Variable Data (VD) for

COMDTINST M7220.29D

1-3

all pay and allowances in members’ payslips. Commandant (CG-6) also provides all key

control reports for auditing by PPC and SPO.

B. Overview of Direct Access (DA).

1. Input. Data is entered into DA by multiple entities (P&A office, SPO, supervisor,

member). Regardless of who enters the data, it is essential that the data is accurate. There

are edits in DA that require certain data elements or combinations of data elements to be

completed or prohibit other combinations. If these requirements are not met, DA will not

let the operator finish the transaction. Although DA has edits requiring certain fields on a

transaction, it cannot ensure that a transaction is error-free before it processes. DA is a

real-time system, personnel and pay transactions are updated, in most instances,

immediately and the updated record may be viewed by P&A Offices, SPOs, and PPC.

The payroll finalization process is run at the end of each pay period to finalize a member’s

pay for that pay period, produce a semi-monthly payslip of income to ensure an accurate

record of pay accounts for the member, and to produce fund management and accounting

reports to provide key budgeting and financial information.

2. Update. Automatic updating of the pay accounts are done on the effective date of

entitlement. Pay entitlements affected by longevity of service will occur in the pay period

of the longevity. Automatic update also posts any change in rate caused by policy or

legislation (e.g. a change in COLA or BAH rate for a particular location). Lastly,

automatic updates adjust members’ cumulative sea time for those serving in sea duty

positions.

3. Notice of Overpayment (Indebtedness). When computing a member’s pay, DA

accumulates retroactive credits and debits. The semi-monthly payslip notifies the member

of a planned collection action for debts of less than $1000. A Notice of Overpayment and

Erroneous payment letter will be provided from PPC for debts of $1000 or more. The

letter will provide a full description of the cause and amount of the overpayment, establish

a start date for collection of the overpayment in regular installment amounts via

administrative offset, and provide an opportunity for the unit commanding officer to

propose an alternate repayment schedule within certain parameters. See Chapter 11 of this

Manual for debt collection policy and procedural guidance.

4. Output. The last step in the cycle is the output. DA produces a wide variety of outputs in

support of personnel and pay administration. The following is a brief synopsis:

a. Management Reports. Management reports are developed to provide Commandant and

other Headquarters staff components with a complete summary of financial data for

analytical purposes.

b. Control Reports. Control reports are produced for use by PPC and SPOs to manage

personnel and payroll functions. The reports provide information about pay accounts

requiring action or investigation of a questionable condition, and also detect payments

COMDTINST M7220.29D

1-4

made in error or possible fraud cases.

c. Payrolls. DA issues semi-monthly salary payrolls, monthly allotment, garnishments,

and disbursement files for TSP, SGLI, etc.

d. Accounting Reports. Each month a series of reports provide complete payroll

accounting data. The data is electronically transmitted from the Pay and Personnel

Center to the Finance Center to update the Coast Guard Oracle Financials (CGOF).

e. Wage and Tax Information. Federal, state, and FICA wages and tax withholding data

is generated on a monthly, quarterly, and annual basis to support various tax reporting

requirements of the automated payroll system. This includes W-2’s for the members as

well as summary information for the State and Federal Government agencies involved.

5. Access to File. DA contains HR information on Coast Guard members, a record of

current pay entitlements, and a history showing when members’ pay entitlements were

started/stopped/changed, and the name of the technician who entered and approved the

transactions.

COMDTINST M7220.29D

1-5

THIS PAGE HAS BEEN INTENTIONALLY LEFT BLANK

COMDTINST M7220.29D

2-i

CHAPTER 2

COMPUTATION OF SERVICE AND BASIC PAY

TABLE OF CONTENTS

Page

Section A – Creditable Service ...................................................................................... ……… . 2-1

Section B – Service Not Creditable ........................................................................................... . 2-2

Section C – Effect of Absence from Duty on Creditable Service .............................................. . 2-3

Section D – Computation of Time for Pay ................................................................................ . 2-6

Section E – Commencement of Active Duty Pay ...................................................................... . 2-7

Section F – Termination of Active Duty Pay............................................................................. 2-11

Section G – Continuation of Pay Under Special Circumstances ............................................... 2-13

Section H – Saved Pay ............................................................................................................... 2-14

Section I – Pay Entitlement for Authorized Leave and Authorized Absence ............................ 2-17

Section J – Withholding Pay for Unauthorized Absence and Other Lost Time ........................ 2-20

Section K – Pay and Allowances for Members of the Coast Guard Reserve on

Active Duty (AD) ................................................................................................... 2-25

Section L – Increase in Basic Pay for Retention Beyond Enlistment ........................................ 2-29

COMDTINST M7220.29D

2-1

CHAPTER 2. COMPUTATION OF SERVICE AND BASIC PAY

A. Creditable Service. Under the authority of 37 U.S.C. 205, compute a member’s cumulative

years of service for the purpose of determining the member’s rate of Basic Pay by adding all

periods of active and inactive service as a commissioned officer, warrant officer, or enlisted

member in any Regular or Reserve component of a Uniformed Service. This includes, but is

not limited to the following:

1. Academy Teaching Staff. A military member who is appointed as a professor, associate

professor, assistant professor, or instructor may include any time served as a member of

the civilian teaching staff at the Coast Guard Academy under the provisions of 14 U.S.C.

1946.

2. National Oceanographic and Atmospheric Administration (NOAA) Commissioned

Corps. Include service in the current grades of ensign and above and service as a deck

officer or junior engineer. This includes periods served in the former Environmental

Science Services Administration or Coast and Geodetic Survey. It does not include

service as a ship keeper, seaman, fireman, oiler, etc., under “shipping articles” (24 Comp

Gen 829 and 25 Comp Gen 680).

3. Cadet and Midshipman Service. Cadet or midshipman service at a U.S. Military

Academy (USMA, USNA, USAFA, USCGA), the U.S. Merchant Marine Academy (46

U.S.C. 51311), or Senior ROTC/NROTC Program is only creditable in computing the

pay of enlisted members (29 Comp Gen 331, 31 Comp Gen 528 and 10 U.S.C. 971, 37

U.S.C. 205(6)). Per 10 U.S.C. 971, no cadet or midshipman service is creditable for any

purpose for commissioned officers (including commissioned warrant officers).

4. Service Attained Prior to Statutory Enlistment Age. Any service which is otherwise

creditable may be counted even if the service was performed before a member attained

the statutory age for enlistment. Such service may not be counted if it is determined to be

fraudulent and is voided for that reason.

5. Pay Grades OlE, O2E and O3E. A commissioned officer in pay grade O1, O2, or O3, is

entitled to the special rate of basic pay and allowances for O1E, O2E, or O3E, if the

officer has had over four years of active duty as either a warrant officer or enlisted

member (combination of the two may be used after 30 Sep 1983). Periods of inactive

duty Reserve Component membership are not creditable for the purpose of computing

qualifying service for these special officer pay grades. In computing active enlisted

service, include active duty for training (ADT) as an enlisted member (38 Comp Gen 68).

Do not count active service in a dual status (temporary officer - permanent enlisted) (38

Comp Gen 68). Effective 1 Dec 2001, the special rate of basic pay and allowances for

O1E, O2E, or O3E, is payable to a commissioned officer who is credited with 1,460 or

more retirement points while in an enlisted or warrant officer status.

6. Service on the Retired List. A retired member who is recalled to active duty may count

inactive service on a retired list including a temporary disability retired list, of any of the

Uniformed Services; however, this only applies for longevity pay purposes.

COMDTINST M7220.29D

2-2

7. Retention for Medical Care. Any period on and after 12 Dec 1941 when an enlisted

member of the Armed Forces is retained in service, after expiration of term of service, for

medical treatment or hospitalization for disease or injury incident to service and not due

to the member’s misconduct (10 U.S.C. 507).

8. Delayed Entry Program. Service as an enlisted member in a Reserve Component (RC),

including Ready Reserve service (inactive and active) under the Delayed Entry

(Enlistment) Program (DEP), before beginning active duty or an initial period of active

duty for training, provided the Reserve enlistment was entered into before 1 Jan 1985. As

of 1 Jan 1985, the following restrictions went into effect as and when stated.

a. For enlistments in a RC under 10 U.S.C. 12103(b) or (d), including enlistments under a

DEP, that were entered into between 1 Jan 1985, and 28 Nov 1989, the period served in

the RC before beginning active duty or an initial period of active duty for training is

not creditable.

b. For enlistments entered into on or after 29 Nov 1989:

(1) A period of enlisted service in a RC under 10 U.S.C. 12103(b) or (d), including

inactive service under a DEP, is creditable service only if the member performs

inactive duty training before beginning active duty or an initial period of active

duty for training.

(2) Service performed as an enlisted member in a RC under 10 U.S.C. 513, other than

a period of active duty, is not creditable service.

9. Making Up Lost Time. Effective on returning to full duty, an enlisted member is liable to

make up time lost. The time served to make up lost time is creditable service. However,

if a member is retained beyond normal expiration of enlistment for trial or to serve a

sentence and is not restored to a full duty status, this period does not count as making up

time lost and is not creditable.

10. Creditable Prior Service. A member claiming prior service credit must submit a request

for Statement of Creditable Service (SOCS) to PPC through their unit’s P&A office as

prescribed in Chapter 5, Personnel and Pay Procedures Manual, PPCINST

M1000.2 (series). PPC retains the authority and responsibility to establish the correct Pay

Entry Base Date (PEBD). Upon receipt of proper documentation, PPC is required to

provide a SOCS within 6 weeks. See Section 2.D. of this Manual for policy concerning

adjustment of Pay Entry Base Date (PEBD) and Active Duty Base Date (ADBD) for

members and new accessions who claim prior creditable service.

B. Service Not Creditable. This list of non-creditable service is not all-inclusive, but lists

some types precluded by law.

1. Fraudulent Enlistment. Time spent in an enlistment which is determined to be

fraudulent and is specifically terminated by reason of fraud. (A member is entitled to

credit for time in a fraudulent enlistment when the defect is waived by the

COMDTINST M7220.29D

2-3

Government.) A person whose enlistment is canceled as an illegal enlistment or who is

discharged by reason of a fraudulent enlistment is not entitled to credit for any service

during such enlistment even though the person may later enlist and serve under a legal

enlistment.

2. State, Home, or Territorial Guard. Time spent as a member.

3. Delayed Entry Program.

a. On and after 1 Jan 1985, time served as a member of a Reserve Component

under a delayed entry program, either for Regular or Reserve Component

service prior to entry on active duty or ADT.

b. On and after 29 Nov 1989, any period of time not covered by Section 2.A. of this

Manual.

4. Inactive National Guard. Time served as a member of the inactive National Guard (as

distinguished from the National Guard of the United States). Such service is

creditable if a member held a commission or an enlisted status in the inactive

National Guard and National Guard of the United States at the same time (22 Comp

Gen 907, 23 Comp Gen 755, and 38 Comp Gen 352).

5. Disciplinary Reasons. A person retained in service after the expiration of enlistment

date for disciplinary reasons is not entitled to credit for service during such retention if

they are convicted of the charges for which retained for. (See Chapter 1, Military

Separations Manual, COMDTINST M1000.4 (series)).

6. Medical Reasons. A person detained in service after the expiration of enlistment date

for medical care or hospitalization for an injury, sickness, or disease not incurred in

line of duty, not due to own misconduct, is not entitled to credit for service during such

retention. (See Chapter 1, Military Separations Manual, COMDTINST M1000.4

(series)).

C. Effect of Absence from Duty on Creditable Service.

1. Officer Status. Time spent by commissioned and warrant officers in an absence without

leave, absence due to own misconduct, civil confinement, or military confinement status

is counted as creditable service for pay purposes. However, it is not counted as

creditable service for retirement longevity or leave accrual purposes (Sec. 561, PL 104-

106). See also Chapter 2, Military Assignments and Authorized Absences Manual,

COMDTINST M1000.8 (series).

2. Enlisted Status. Effect on creditable service of enlisted members when absent

from duty. Deductible time denotes periods during which service credit does

not accrue. Absent without leave (AWOL) and desertion include the following:

COMDTINST M7220.29D

2-4

a. All periods of unauthorized absence in excess of 24 hours.

b. An unauthorized delay in excess of 24 hours, in obeying orders or returning

from leave, or a failure to report at a place to which directed is AWOL

unless accounted for to the satisfaction of the commanding officer and

excused as unavoidable and charged as leave.

c. Unauthorized absence of a mentally incompetent person, unless such

absence is excused as unavoidable.

d. Where a person has been tried by a court-martial and acquitted of a charge

of unauthorized absence or desertion or the court-martial is set aside for

some legal reason, this action does not change the status of the

unauthorized absence except where it is clearly shown that the person had

not in fact been in an unauthorized absence status.

3. Absence Due to Own Misconduct. Absence from duty in excess of 24 hours resulting

from own misconduct. Chapter 5, Administrative Investigations Manual,

COMDTINST M5830.1 (series), sets forth the procedures for determining misconduct.

4. Nonperformance of Duty (Civil Arrest). The following applies to civil arrest:

a. Personnel arrested and detained by civil authorities while in an unauthorized

absence status continue in such status even though acquitted of the civil charge.

b. Personnel taken into custody by the civil authorities for an offense alleged to have

been committed prior to enlistment or entry on active duty are not entitled to credit

for the period of the absence irrespective of acquittal or dismissal of the charge (9

Comp Gen 114).

c. Personnel arrested and detained by civil authorities while on authorized leave or

liberty who are released without trial, no reparation having been made, are not

entitled to credit for service from the date and hour of expiration of leave or liberty

to the date of return to their unit if subsequently tried and convicted by a court-

martial for any offense based on the same facts (notwithstanding the fact that the

charges and/or specifications may be different) which necessitated their absence in

the hands of civil authorities.

d. Personnel arrested and detained by civil authorities while on authorized leave or

liberty who fail to return to their units upon expiration of leave or liberty will be

considered to be AWOL from the date and hour of expiration of leave or liberty

unless acquitted of the civil charges on which held, or unless the commanding

officer determines that the person was entirely free from fault in connection with

their arrest and detention. Under no condition will personnel in this category be

granted an extension of leave. See Chapter 2, Military Assignments and

Authorized Absences Manual, COMDTINST M1000.8 (series)

COMDTINST M7220.29D

2-5

e. Personnel arrested and detained by civil authorities while on authorized leave or

liberty that are released and return to their units before expiration of leave or

liberty, do not lose service credit for the period in custody of civil authorities.

Notification of civil arrest is required as described in Chapter 2, Military

Assignments and Authorized Absences Manual, COMDTINST M1000.8 (series).

f. Personnel delivered to civil authorities for trial under the provision of Chapter 8,

Military Justice Manual, COMDTINST M5810.1 (series), are not entitled to credit

for service while in custody of civil authorities.

g. Personnel confined in a brig at their unit due to the commission of some civil

offense, held for trial by civil authorities and found guilty, are not entitled to credit

for service for the period of confinement.

h. Personnel released by civil authorities with a suspended sentence or on promise to

make reparation or restitution are considered not to have been acquitted, and any

absence in excess of 24 hours caused by civil arrest is deductible time.

5. Confinement Awaiting Trial and Disposition of Case (CONF). Confinement awaiting

trial and disposition of a case includes the following:

a. All periods, in excess of 24 hours, in confinement awaiting trial by a summary,

special, or general court-martial when the trial results in conviction. It is not

necessary that a court-martial be ordered before the person can be considered as

“confined awaiting trial.”

b. All periods, in excess of 24 hours, in confinement after trial while awaiting final

action on the court-martial.

c. A person transferred under guard for confinement pending disciplinary action is

considered as “confined awaiting trial” as of the date and hour placed in the custody

of the guard, until the date and hour delivered to the unit for disciplinary action,

provided the person is tried and convicted by a court-martial.

d. An absentee or deserter detained in a nonmilitary facility at the request of a

representative of the Armed forces made pursuant to Chapter 1, Discipline and

Conduct Manual, COMDTINST M1600.2 (series), or similar regulation or instruction

of the other Armed Services, is considered as “confined awaiting trial” as of the date

and hour of the request, until the date and hour returned to Coast Guard jurisdiction,

provided the person is tried and convicted by a court-martial.

e. Prior to 1 Jul 1948, only confinement awaiting trial by a general court-martial which

resulted in conviction and a sentence to imprisonment in a naval prison or at a

receiving ship or station designated as a naval prison was deductible time.

Confinement awaiting trial by a deck or summary court was not deductible time.

COMDTINST M7220.29D

2-6

6. Confinement Under Sentence. Confinement under sentence includes the following:

a. All periods of confinement, in excess of 24 hours, as a result of a sentence of a

summary, special, or general court-martial. The type of confinement adjudged or

how the sentence is served does not affect the determination of deductible time.

The rule is that whenever the approved sentence of a court-martial used the word

“confinement” the person does not receive service credit for the period of

confinement. A sentence using the words “deprivation of liberty” or “restriction”

does not so operate.

b. If confinement adjudged by a court-martial is subsequently set aside by the

reviewing authorities the effect is as though the confinement had never been

adjudged and the person is entitled to service credit for the period involved.

Similarly, if the period of confinement is reduced by the reviewing authorities the

person loses service credit only for the period of the reduced sentence.

c. In accordance with Chapter 1, Discipline and Conduct Manual, COMDTINST

M1600.2 (series), personnel in confinement will have their sentences reduced if

conduct in confinement is satisfactory. In any such case the person loses service

credit for only such part of the approved sentence as they were required to serve.

d. Prior to 1 Jul 1948, only imprisonment in a naval prison or a receiving ship or station

designated as a naval prison under sentence of a general court-martial was deductible

time for pay purposes, completion of enlistment and retirement. Confinement under

sentence of a deck or summary court-martial was, however, deductible time for the

purposes of earning leave.

e. Correctional custody awarded at non-judicial punishment is not considered

confinement and is nondeductible time for any purpose (Ref: Chapter 1, Military

Justice Manual, COMDTINST M5810.1 (series).

D. Computation of Time for Pay.

1. How to Compute Rates of Pay. 5 U.S.C. 5505 establishes the rules for division of time

and computation of pay for services rendered. Appendix C of the Personnel and Pay

Procedures Manual, PPCINST M1000.2 (series), contains procedures for computation of

time for pay.

2. Rates of Pay. To determine a member’s monthly rate of basic pay refer to the web

site: https://www.dfas.mil/militarymembers/payentitlements/Pay-Tables.html.

3. Computation of Creditable Prior Service for Longevity Pay. Effective 30 Jan 2015,

CG PPC is the only Coast Guard activity authorized to grant creditable prior service

for pay longevity (Pay Entry Base Date – PEBD) and active duty (Active Duty Base

Date – ADBD) purposes. All personnel accessed into the Coast Guard or Coast

Guard Reserve regardless of any claimed prior creditable service, will have their

COMDTINST M7220.29D

2-7

PEBD and ADBD established by accession points as the date the authorized travel

began incident to initial active duty or initial active duty for training (IADT). In the

case of Reserve Component personnel accessed into the Ready Reserve for the

purpose of subsequent Selected Reserve service, PEBD may be set on the date the

first inactive duty for training (IDT/Reserve drills) were performed prior to

commencement of IADT after 28 Nov 1989. Per Sections 2.A.8. and 2.B.3. of this

Manual, periods of DEP service time in any uniformed service is not creditable for

PEBD purposes.

4. Statement of Creditable Service requests (SOCS). SOCS requests submitted to PPC

by accession points on behalf of new accessions claiming creditable prior service

will receive priority for processing. Accession points must assist newly accessed

personnel with SOCS requests and submit these requests to PPC within 48 hours of

the newly-accessed personnel’s arrival at the accession point.

5. Pay and Personnel Center (PPC). Must expedite completion of SOCS for all newly-

accessed personnel who claim creditable prior service and adjust these personnel’s

PEBD and (if applicable) ADBD as soon as practicable and issue any back pay and

allowances resulting from the adjusted PEBD credited to the affected member’s pay

account.

6. Recruiter. Must ensure that all prior service accessions are aware that their initial

pay and allowances will be based upon their initial PEBD established at their

accession point, that a SOCS will be expeditiously completed for them by PPC, and

when their PEBD is adjusted, all back pay and allowances will be paid to them,

normally within 8 weeks of accession onto active duty. Recruiters must also brief

all new prior service accessions on the documentation needed to properly complete

a SOCS request at their accession point and ensure copies of the appropriate

documentation for creditable service is in their possession when they depart on

active duty to the accession point. Appropriate documentation includes but is not

limited to:

a. Certificate of Release or Discharge from Active Duty, Form DD-214

b. Semi-Monthly Payslips

c. Discharge paperwork

d. Reserve annual points statements

E. Commencement of Active Duty Pay.

1. When Entitled to Basic Pay. The pay of service members is prescribed by 37 U.S.C.

1009 and implemented by Executive Order. Members are entitled to receive pay

according to their pay grade and years of service when they are on active duty in a pay

status and not prohibited by law from receiving such pay. The pay grade to which a

member is assigned is prescribed by 37 U.S.C. 201. Non-prior service Coast Guard

COMDTINST M7220.29D

2-8

Scholars students at the Naval Academy Preparatory School (NAPS) are entitled to

the same rate of pay as Coast Guard Academy cadets as authorized in Chapter 15 of

this Manual per 37 U.S.C. 203(e)(1). In the case of prior service NAPS students,

their pay is Basic Pay paid at the rate prescribed by 37 U.S.C. 203(e)(1); e.g. the

monthly rate of Basic Pay prescribed for their pay grade and years of service as

enlisted active duty member or Basic Pay at the same rate prescribed for cadets,

whichever is greater. NAPS students are entitled to all other enlisted allowances, if

otherwise eligible.

2. Employment of Members in Another Capacity. Unless otherwise provided by law, a

member may not be employed in another capacity by the Government, and receive pay,

other than the pay and allowances which accrue by reason of the member’s military

status. However, the member may be employed on a voluntary basis during off-duty

hours in connection with non-appropriated fund activities. Refer to 5 U.S.C. 5536 and

46 Comp Gen 400 (1966).

3. Original Appointment of Officers. Pay and allowances accrue from the date of

acceptance of appointment as a permanent or temporary regular officer. The normal

method of acceptance is taking the oath of office. Commencement of travel in

compliance with an order is considered acceptance for pay purposes. Payment is not

authorized until the formal signing of the oath of office. Refer to 60 Comp Gen 143

(1980). Refer to Figure 2-1 for specifics and for Coast Guard Academy graduates.

4. Enlisted Members. Commence pay and allowances of the rate in which an enlisted

member enlists or reenlists in the Regular Coast Guard, upon signature date of the

enlistment or reenlistment.

5. Reserve Members. Instructions governing commencement of pay and allowances of

Reserve members while on active duty are in Section 2.K.2 of this Manual. For reserve

members performing active duty and inactive duty for training (IDT), see Chapter 12 of

this Manual.

6. Recalled Retired Members. Commence active duty pay for a recalled retired member as

prescribed in Section 2.K. of this Manual. Payment restrictions are: A retired member

who is drawing a pension, retired pay, disability compensation, etc., by virtue of the

member’s own service may not receive compensation (including allowances for

subsistence, quarters, and travel) for performance of active duty until the member has

executed a Waiver of Pension/Disability Compensation or Retired Pay.

7. Promotions and Advancements. See Figure 2-2 for the effective date of pay for the

grade to which a member is promoted or advanced.

COMDTINST M7220.29D

2-9

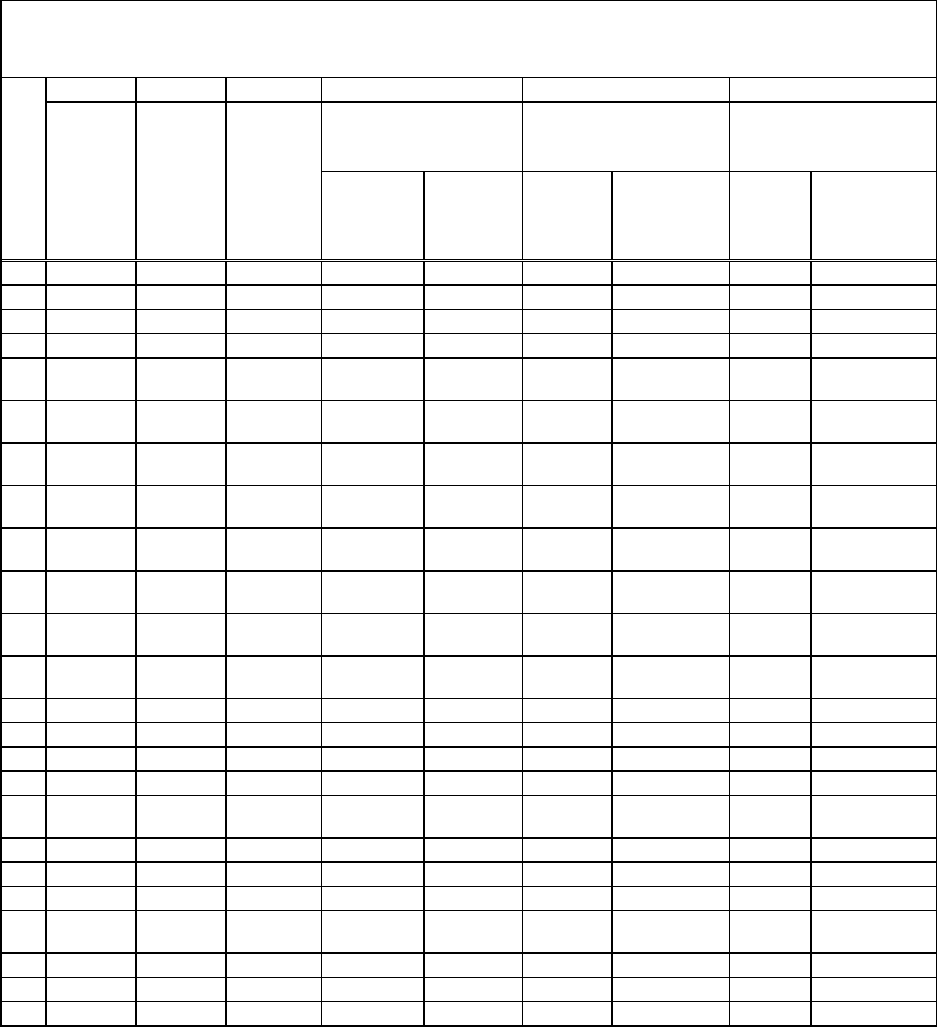

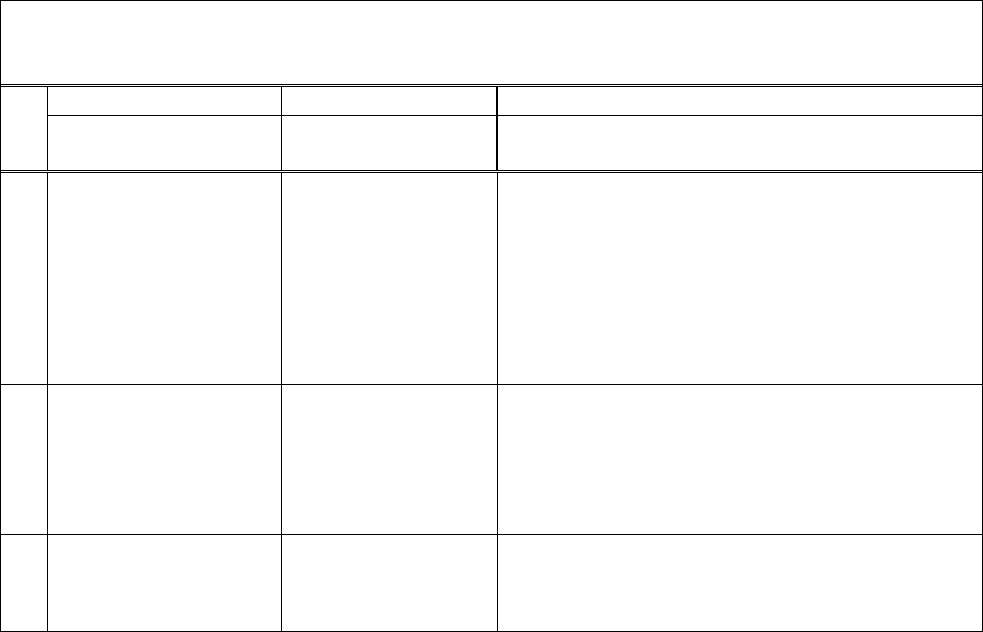

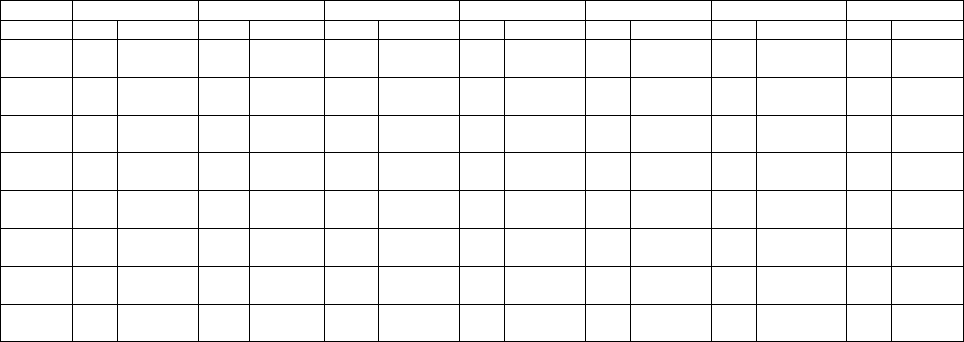

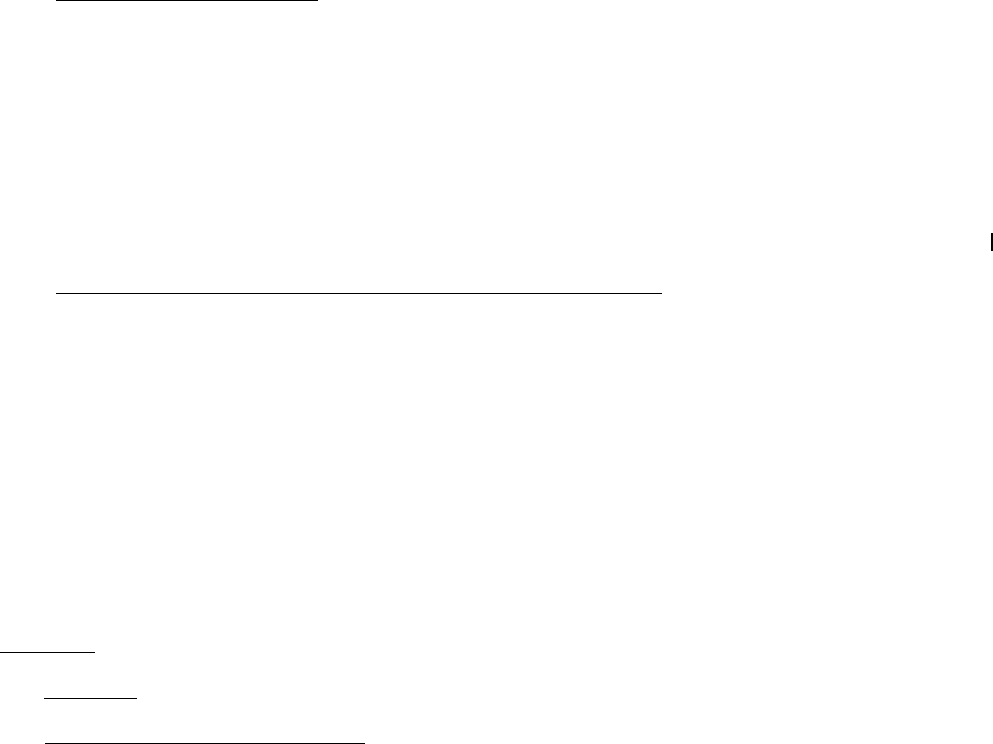

WHEN ACTIVE DUTY BEGINS

R

U

L

E

A

B

C D

When a person is and

then active duty pay and allowances

begin on: are authorized for:

1

originally appointed as a regular

warrant or commissioned officer

appointment is

permanent or

temporary

date of formal

acceptance of

appointment

2

an enlisted member or warrant

officer temporarily appointed to

regular commissioned officer

date of formal

acceptance of

appointment

3

enlisted or reenlisted

date of enlistment or

reenlistment

4

service academy graduate

commissioned as an Ensign

appointment is issued

and accepted within

six months of

graduation

date of rank as stated

in the commission

5

appointment is not

issued or accepted

within six months of

graduation

date of formal

acceptance of

appointment.

(17 Comp Gen 377)

6

reserve or retired member called or

recalled to active duty

date member complies

with active duty

orders. (Note 2)

7

reserve or retired member ordered

to report for physical examination

preparatory to call or recall to

active duty, and continues to

assigned duty station

period of

examination, and

allowable travel

time in connection

therewith (Note 2)

8

separated from the Coast Guard

Academy and required to serve a

period of enlisted active duty

date following

disenrollment from the

Coast Guard Academy

Notes:

1. After acceptance of original temporary appointment and while serving in temporary

rank, a member is not entitled to additional pay, allowances or gratuities because of

change in permanent enlisted or warrant officer grade or status.

2. See Chapter 2 of this Manual and Figure 2-5 for allowable travel time to include in

computation. Pay and allowances do not accrue if the member begins travel or reports earlier

than the travel time necessary to comply with the active duty orders.

FIGURE 2-1

COMDTINST M7220.29D

2-10

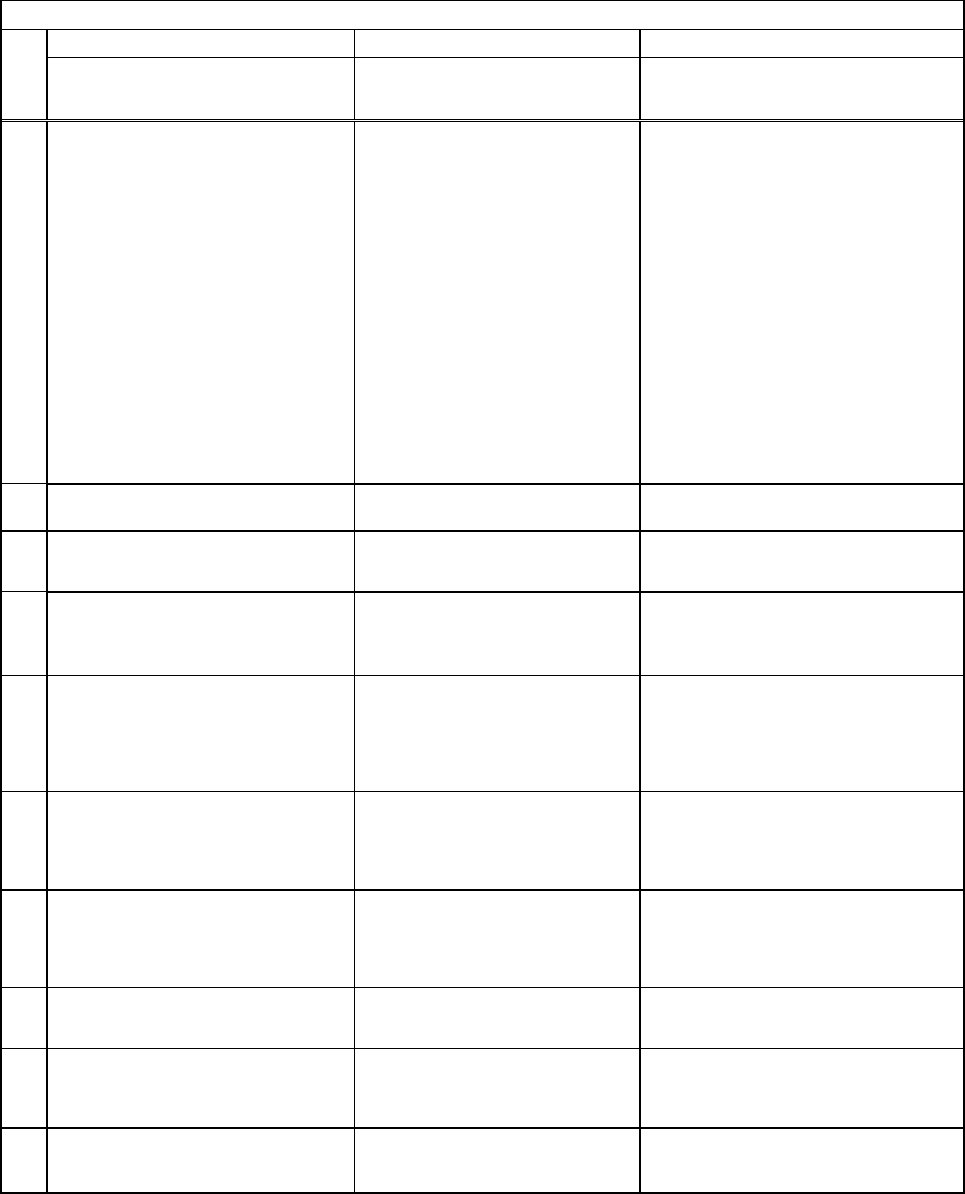

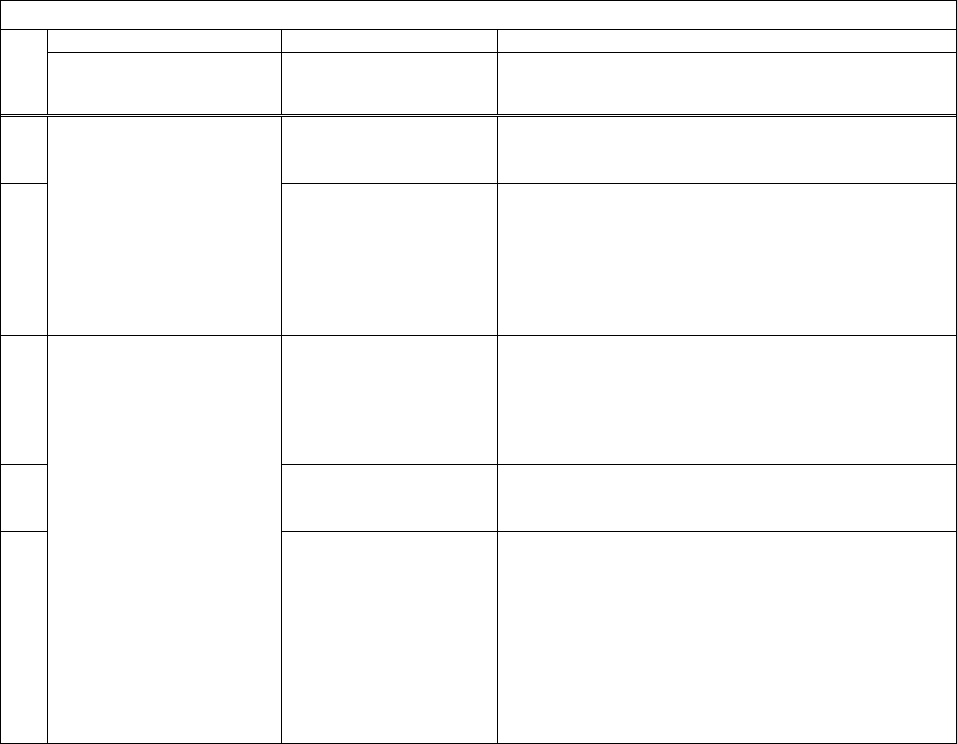

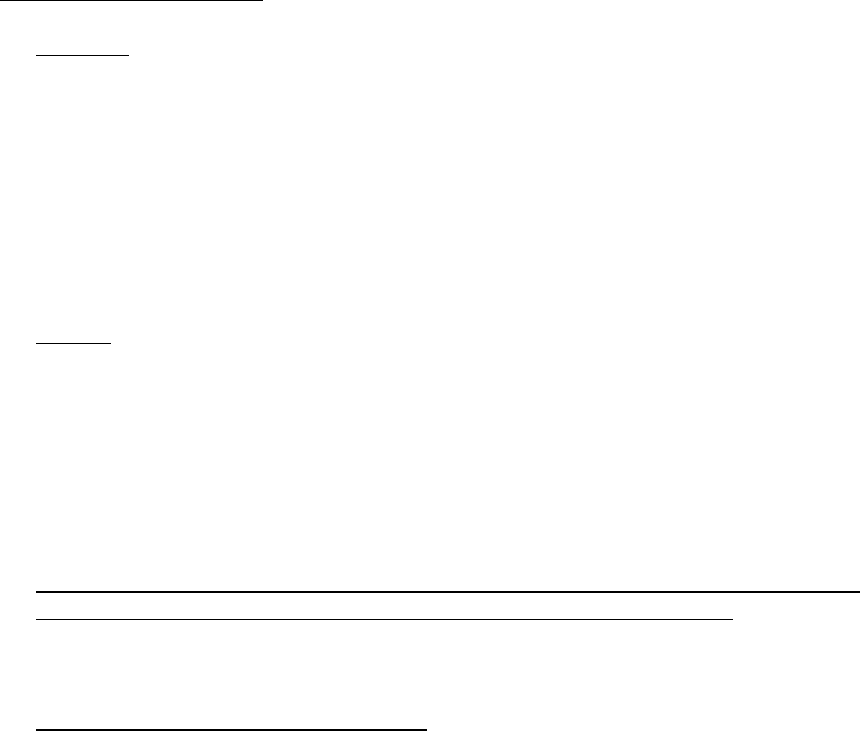

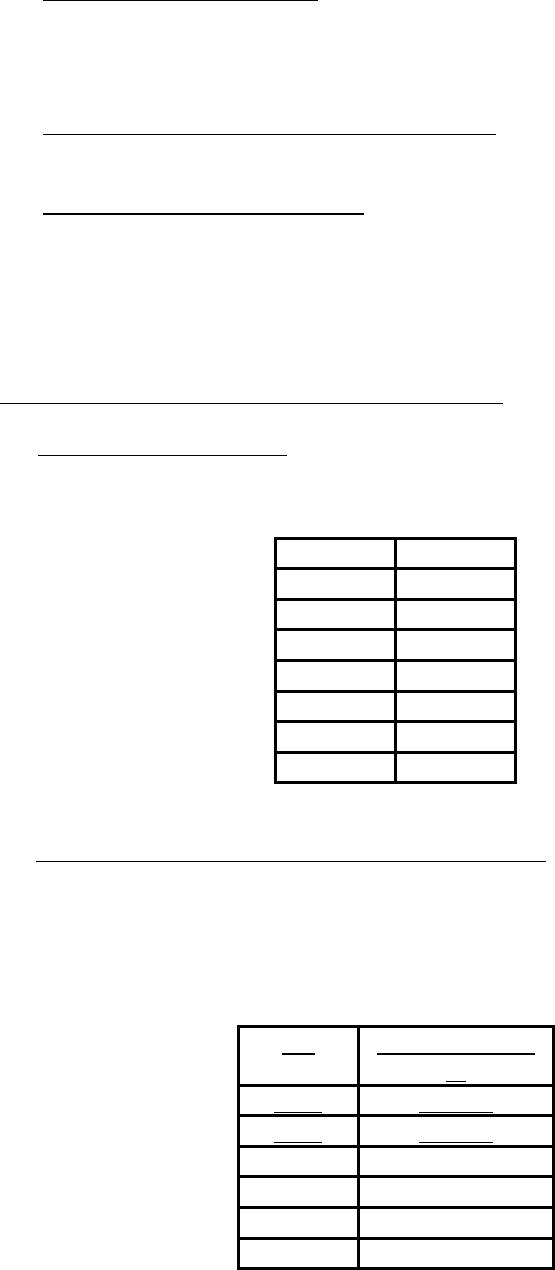

INCREASE IN PAY ON PROMOTION

R

U

L

E

A

B

C

When a member is a(an): and action is

then the effective date of

increase in pay and

allowances is

1

Commandant

Vice-Commandant

appointment to Commandant,

Vice-Commandant, respectively

effective date as stipulated in

Presidential appointment and

terminates on the day of

detachment.

2

Vice Admiral

appointment as Area Commander or

Deputy Commandant (under

authority of 14 U.S.C. 305)

on the date the officer

assumes that duty and

terminates on the date the

officer is detached from that

duty. (Note 1)

3

Commissioned Officer

promotion to pay grade 0-8 or

below under authority of

14 U.S.C. 2121

effective date as stated in the

letter transmitting the

promotion appointment.

4

Commissioned Officer or

Warrant Officer

temporary promotion under

authority of 14 U.S.C. 2125

from the effective date

specified by the Secretary in

5

Enlisted Member

advancement in rate

effective date as indicated in

the advancement

authorization. (Note 2)

Notes:

1. The pay and allowances of a vice admiral must not be interrupted by the termination of an

appointment for the purposes of reappointment to another position as a vice admiral.

(14 U.S.C. 307)

2. A Commanding Officer cannot advance a member retroactively. See Chapter 3,

Enlisted Accessions, Evaluations, and Advancements Manual, COMDTINST

M1000.2(series).

FIGURE 2-2

COMDTINST M7220.29D

2-11

F. Termination of Active Duty Pay. Active duty pay is terminated upon separation or change

in status. Credit active duty pay and allowances through the appropriate date as indicated

below:

1. Retirement. The day before the date placed on the retired list.

2. Recalled Retired Member Released from Active Duty. See the instructions in Section 2.K

of this Manual for reservists being released.

3. Resignation, Discharge, or Dismissal. The date shown as official date of separation in

official notice or date officer receives official notice if no official date of separation is

shown except:

a. Discharge orders do not of themselves relieve the Government of its obligation to an

officer. The officer must have received actual or constructive notice by the effective

date, unless the officer willfully avoids notice of separation. If an officer is kept in

service without fault, in ignorance of an order of dismissal, entitlement to all salaries

and benefits of the office continue.

b. If held in service under orders after the date shown in separation orders, an officer is

entitled to pay if there is nothing in the record showing non-entitlement.

4. Member Transferred to Reserve and Concurrently Released from Active Duty. The date on

which transferred to the Coast Guard Reserve and concurrently released. Travel time is not

allowed in computing entitlement.

5. Termination of Officer Status Under Temporary Appointment. The date prior to the

date of termination of the appointment, except that entitlement accrues for:

a. The date of termination of the appointment if member is discharged or

dismissed from permanent status on the date of termination.

b. The date of termination of appointment if the officer’s resignation becomes

effective on the date of termination.

c. The date the appointment is terminated if the officer is released from AD on

termination date.

d. The date prior to the date the officer is placed on the retired list.

e. The date prior to the date of acceptance of a permanent appointment as an officer

when the temporary appointment is terminated upon acceptance of the permanent

appointment.

6. Reduction in Rate. Pay and allowances of the rate from which reduced accrue up to and

include the date prior to effective date of reduction in rate. When an erroneous promotion is

COMDTINST M7220.29D

2-12

revoked, normally the reduction in pay and allowances is effective on the day prior to the

erroneous promotion. However, if the member served at the higher grade in a “de facto”

status (i.e., the member was promoted by competent authority and performed duties of the

higher grade), the member is entitled to pay and allowances of the higher grade up to the

day before the date of discovery of the erroneous promotion.

7. Fraudulent Enlistment.

a. Void Enlistments. The enlistments of individuals enlisted below the minimum

statutory age who are still below that age when that fact is discovered, and the

enlistments of individuals who are mentally incompetent are voided. Upon a definite

determination of such facts, the individual’s pay and allowances are to be stopped,

and he or she must be released from military control. There is no entitlement to pay

and allowances beyond the date of determination of the fraud, but the individual

retains amounts paid prior to the date of determination, if the payments were

otherwise proper. The individual is not entitled to Lump Sum Leave (LSL) payment.

b. Voidable Enlistments. In these cases the Government may determine to waive the

fraud or release the individual from military control or waive the fraud and

administratively discharge the individual (see (1), (2), or (3) below). Pay and

allowances are to be suspended upon a definite determination that the member’s

enlistment was fraudulent. There is no entitlement to pay and allowances beyond the

date of determination of the fraud, unless the fraud is subsequently waived by the

Government. The decision to waive the fraud or void the enlistment and release the

individual from military control should be contemporaneous, or as contemporaneous as

possible, with the date of determination of the fraud so as to avoid retaining control

over an individual whose status as a military member is void.

(1) If the Government waives the fraud and retains the individual on active

duty, the suspension must be removed and pay and allowances must be

continued.

(2) If the Government decides to release the individual from military control, no

entitlements accrue beyond the date of determination. The individual is not

entitled to LSL payment.

(3) If the Government chooses to waive the fraud and administratively discharge the

individual by reason of misconduct (fraudulent enlistment) under Chapter 2, of the

Military Assignments and Authorized Absences Manual , COMDTINST

M1000.8(series), pay and allowances accrue through the date of discharge and the

individual is entitled to LSL payment.

Note: When a fraudulent enlistment occurs due to the concealment or

misrepresentation of a material fact that would have disqualified the individual for

enlistment, there is no entitlement to pay and allowances for any period served

during the fraudulent enlistment; however, by analogy to the rule applicable in the

COMDTINST M7220.29D

2-13

case of de facto officer, the member is permitted to retain amounts paid prior to

the date of determination or date of discharge, as appropriate, if the payments

were otherwise proper.

c. Authorized Certifying Officer (ACO) Concerns. An ACO is entitled to credit for

proper payments to a member who fraudulently enlisted, if payments were made

without the knowledge of the fraud and before the Government rescinded the contract.

d. Physical Condition. Failure to discover that the physical condition of an enlistee was

such as would warrant rejection for military service does not deprive a member of the

right to pay and allowances or of the status of being entitled to basic pay.

G. Continuation of Pay Under Special Circumstances.

1. Recalled to Active Duty. Officers and enlisted members recalled to AD by orders of

competent authority after retirement are entitled to AD pay until the date of actual

release from AD.

2. Retirement Orders Received Subsequent to Effective Date. Officers and enlisted

members are entitled to active duty pay and allowances to and including the date of actual

receipt or knowledge of retirement orders.

3. Retained for Convenience of the Government. When an enlisted member is retained for

the convenience of the Government beyond the term of their enlistment or beyond the

expiration of obligated service, the member is entitled to pay and allowances for the

period of retention. A member retained under any of the below conditions is considered

to have been retained for the convenience of the Government. See Chapter 1, Military

Separations Manual, COMDTINST M1000.4(series).

a. Hospitalization With Member’s Consent. When an enlisted member is hospitalized

from a disease or injury (excluding misconduct) prior to their date of expiration of

enlistment, the member is entitled to pay and allowances until their recovery period

enables them to meet the physical requirement for reenlistment, or until recovery

from the disease or injury is rendered impossible, whichever is earlier. If

hospitalization was due to the member’s misconduct, pay and allowances terminate

on the date of expiration of enlistment.

b. Services Essential to Public Interest. The member’s services are considered

essential to the public interest. Basic pay and allowances accrue to the member

for the period plus a 25 percent increase in Basic Pay as provided in Section

2.L. of this Manual.

c. Court-Martial Action. The enlisted member is awaiting trial, undergoing trial, or

awaiting the results of a trial, and is acquitted. Pay and allowances accrue until

the member is separated from the Service.

COMDTINST M7220.29D

2-14

d. Detained in Time of War or National Emergency. Under the provisions of 14 U.S.C.

2314, if a member is detained beyond the end of enlistment, pay and allowances

continue without regard to the fact that the member may be in a status such as

awaiting trial by court martial.

H. Saved Pay.

1. Authority. The statutory authority for Saved Pay is 14 U.S.C. 2104 and 37 U.S.C. 907.

The purpose of Saved Pay is to ensure that a member is not unduly penalized with a

reduction in pay for accepting an appointment as either a chief warrant officer or as an

officer.

a. Warrant Officers. A warrant officer who accepts an appointment as a

commissioned officer (temporary or permanent) must be paid the greater of:

(1) The pay and allowances to which the member thereafter becomes

entitled as a commissioned officer; or

(2) The pay and allowances to which such member would be entitled if the

member had remained in the last warrant officer grade held before appointment

as a commissioned officer, and continued to receive increases in pay and

allowances authorized for that grade.

(3) If a warrant officer previously held an enlisted grade, and is entitled to saved

pay for that enlisted grade, the member is entitled to pay and allowances as

prescribed in Section 2.H.1.b. in the Manual.

b. Enlisted Members. An enlisted member who accepts an appointment as an officer

or warrant officer must be paid the greater of:

(1) The pay and allowances to which such member would be entitled if the member

had remained in the last enlisted grade held before appointment as an officer or

warrant officer, and continued to receive increases in pay and allowances

authorized for that grade; or

(2) The pay and allowances to which the member thereafter becomes entitled as

an officer or warrant officer.

c. Licensed Officers of the U. S. Merchant Marine. A licensed officer of the U. S.

Merchant Marine who accepts an appointment as a temporary commissioned officer

in the Regular Coast Guard in a grade not above lieutenant must be paid the greater

of:

(1) The pay and allowances to which such member would have been entitled

had the member remained in the former Uniformed Service grade and

continued to receive the increases in pay and allowances authorized for that

grade; or

COMDTINST M7220.29D

2-15

(2) The pay and allowances to which the member thereafter becomes

entitled as a Regular Coast Guard officer.

d. Prior Service Members. A prior service enlisted member or warrant officer of

another service who is appointed as a commissioned officer in the Coast Guard or

Coast Guard Reserve is entitled to saved pay under the provisions of Chapter 2 of

this Manual. Prior service members who take a reduction in pay grade upon entry

into the Coast Guard are not protected under saved pay provisions.

2. Computation Items. The following pay and allowance items are included in the

computation of saved pay:

a. Basic pay.

b. Basic Allowance for Housing (BAH).

c. Basic Allowance for Subsistence (BAS).

d. Special pay for diving duty.

e. Career Sea Pay (CSEAPAY) and Career Sea Pay Premium

(CSEAPAY PREM)

f. Hardship Duty Pay-location (HDP).

g. Imminent Danger Pay (IDP).

h. Incentive pay (aviation) for the performance of hazardous duty.

i. Family Separation Allowance (FSA)

j. Family Separation Housing (FSH). Refer to 46 Comp Gen 57

(1966).

k. Station allowances.

l. Special duty pay to which entitled had the member not been appointed as an

officer. Refer to 48 Comp Gen 12 (1968). (SDP must only be included if the

officer was appointed prior to 6 Jan 2006. See Section 2.H.3.g. of this

Manual)

m. Cash clothing allowances (initial or maintenance) except when an officer is

eligible for payment of a uniform allowance.

n. Foreign Language Proficiency Pay (FLPP).

COMDTINST M7220.29D

2-16

3. Restrictions. The following restrictions govern Saved Pay. Refer to 45 Comp Gen

763 (1966).

a. A member entitled to Saved Pay is not authorized the Basic Pay for one grade and

the allowances for another grade.

b. The Saved Pay amount must be reduced when a member loses entitlement to

specific items shown in Sections 2.H.2.d. through 2.H.2.g. However, these specific

items must again be included in saved pay if the member later qualifies for such

items. Refer to 46 Comp Gen 57 (1966).

c. A temporary officer is not entitled to an increase in Saved Pay because of

promotion to a higher permanent grade.

d. BAH and quarters-in-kind are regarded as alternatives. BAH may be continued as

an item of Saved Pay and will be paid whenever it is not forfeited because the

member is assigned to Government quarters.

e. Family Separation Housing (FSH) allowance may be continued as an item of

Saved Pay under the same conditions as BAH.

f. Family Separation Allowance (FSA) may be included in the computation of Saved

Pay, until the entitlement ends, if the member was entitled to FSA due to enforced

separation at the time of appointment. FSA may be reinstated as an item of Saved

Pay for future periods during which the member again qualifies. Refer to 46 Comp

Gen 57 (1966). Other items of special or incentive pay may be reinstated if a

member again qualifies for them.

g. Special duty pay, incentive pay for hazardous duty, special pay for diving duty,

imminent danger pay, career sea pay, career sea pay premium and hardship duty

pay location, may be retained as items of saved pay only as long as the member

continues to perform the duty and would be eligible to receive payment by

remaining in the former status (48 Comp Gen 12). SDP must only be included if

the officer was appointed prior to 6 Jan 2006.

h. A break in service (release from active duty or discharge) does not disqualify a

member for the Saved Pay and allowance entitlements of this section.

4. Determination Required. The Pay and Personnel Center (PPC) will determine whether

the pay and allowances of the grade to which appointed equals or exceeds the pay and

allowances of the former grade. In cases where the pay and allowances for the former

grade exceed the pay and allowances of the new grade, the member is placed into a saved

pay status. When the member is transferred to or from sea or overseas duty, completes

an additional period of service, is affected by a statutory pay increase or other change

which affects pay and allowances, pay will be recomputed and, if required, saved pay

changes to the pay for the member’s current grade.

COMDTINST M7220.29D

2-17

I. Pay Entitlement for Authorized Leave and Authorized Absence.

1. Authority. 10 U.S.C. 701-704 contains the authority for granting leave accruing to

members of the Armed Forces. Detailed regulations which contain authority for payment

of unused accrued leave are prescribed in Chapter 2, Military Assignments and

Authorized Absences Manual, COMDTINST M1000.8 (series) and Section 10.A. of

this Manual.

2. Entitlement During Leave Periods. Except as provided in Figure 2-3, a

member is entitled to proper credit of full pay and allowances during periods

of leave.

3. Definition of Full Pay and Allowances. The term “full pay and allowances” for the

purpose of this section means:

a. Basic pay.

b. Special pays. (Except when leave and/or authorized absence is incident to separation

or retirement from active duty)

c. Incentive pay for hazardous duty. (Except when leave and/or authorized absence is

incident to separation or retirement from active duty)

d. Basic Allowances for Housing (BAH) and Subsistence (BAS).

e. Personal money allowance.

f. Clothing maintenance allowances.

g. Family Separation Allowance. (Except when leave and/or authorized absence is

incident to separation or retirement from active duty)

h. Family Separation Housing (FSH) Allowance. (Except when leave and/or authorized

absence is incident to separation or retirement from active duty)

i. Station Allowances

4. Excess Leave and Authorization to Carry-Over Advance Leave. See Chapter 2,

Military Assignments and Authorized Absences Manual, COMDTINST M1000.8

(series).

5. Pay and Allowances During Excess Leave. Members on excess leave are not entitled to

pay and allowances as follows:

a. When the complete period of leave is granted as excess leave, pay and allowance

accrual will be stopped beginning with the first day of leave.

COMDTINST M7220.29D

2-18

b. When a portion of the leave is granted as advance leave and a portion granted as

excess leave, pay and allowance accrual will be stopped beginning with the first day

of excess leave. Members in an excess leave status are considered to have a rate of

pay.

COMDTINST M7220.29D

2-19

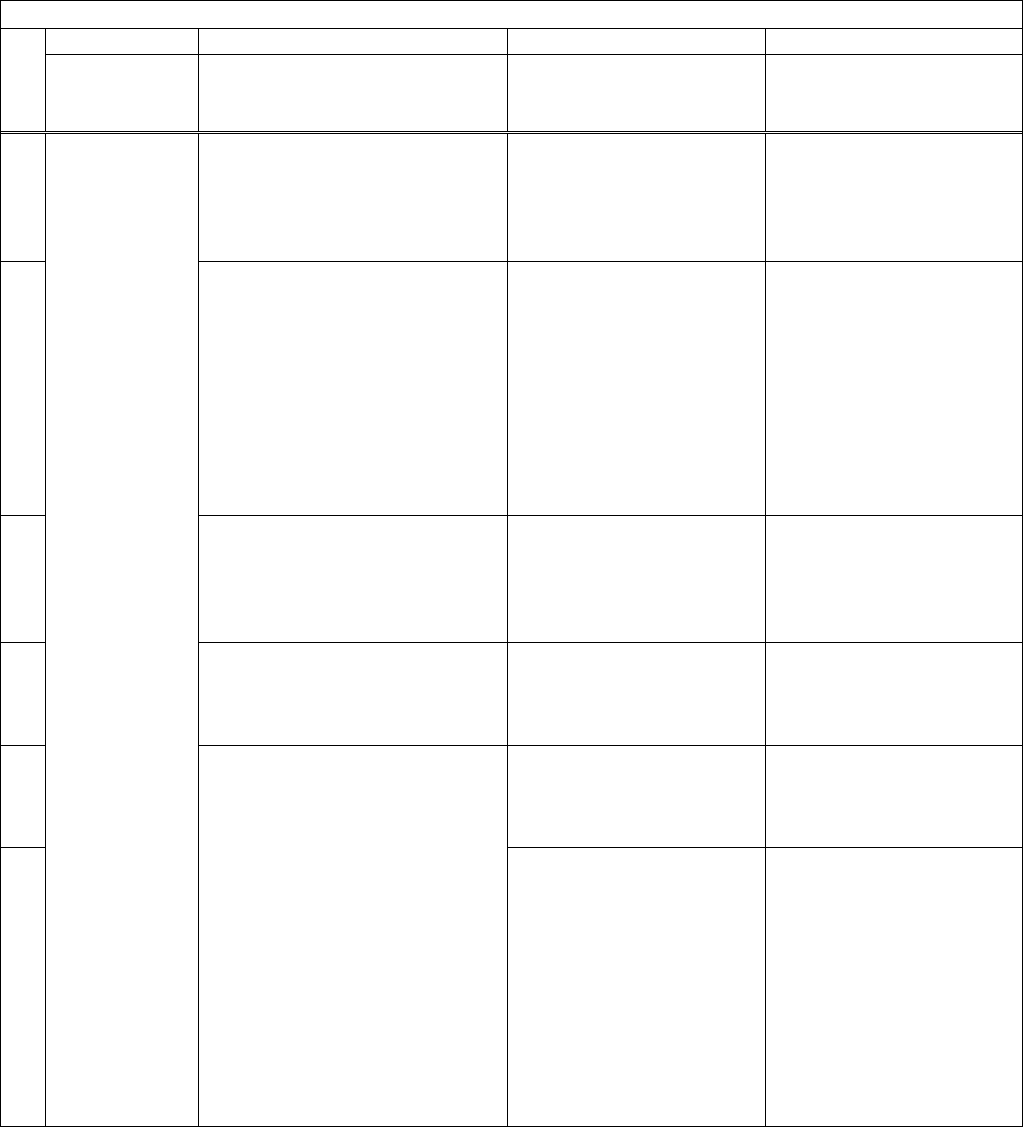

AUTHORIZED ABSENCE – EFFECT ON PAY AND ALLOWANCES

R

U

L

E

A

B

C

D

When a member is

absent from duty

and

then the member

and the period

of absence is

1

on authorized

leave

such leave is:

a. regular accrued leave

b. emergency leave

c. delay en route

is entitled to

otherwise proper

credit of full pay

and allowances

during the period of

absence

charged as leave.

2

Such leave is in advance of that

accrued

charged against

leave as it accrues

(NOTE 1)

3

such leave is:

a. Academy graduation leave

b. sick or convalescent