(2265)

Haryana Government Gazette

EXTRAORDINARY

Published by Authority

© Govt. of Haryana

No. 122–2022/Ext.] CHANDIGARH, FRIDAY, JULY 8, 2022 (ASADHA 17, 1944 SAKA)

HARYANA GOVERNMENT

INDUSTRIES & COMMERCE DEPARTMENT

Notification

The 8th July, 2022

No. 20/01/2022-4IB-I.— The Governor of Haryana is pleased to notify the ‗Haryana Electric Vehicle

Policy-2022‘ which will be effective from 10th of July, 2022 for a period of 5 years. The Haryana Electric Vehicle

Policy-2022 is placed below at Annexure-‗A‘.

The policy has been concurred by the Finance Department vide their U.O. No. 11/02/2022-3FD-

III/2022/14630 dated 24.06.2022 and approved by the Council of Ministers in its meeting held on 27.06.2022.

VIJAYENDRA KUMAR,

Chandigarh: Principal Secretary to Government of Haryana,

The 8th July, 2022. Industries & Commerce Department.

2266 HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA)

HARYANA ELECTRIC VEHICLE POLICY

1. Introduction

The number of vehicles in Haryana has been increasing rapidly over the last decade. However, vehicles driven

on fossil fuels are a major source of environmental pollution and pose serious health hazards and the stocks of fossil-

fuels are fast depleting across the globe. The situation demands that alternative clean, eco-friendly technologies be

explored for running of vehicles.

Haryana Government aims to contribute to improve the environment, reduce carbon footprints and

aggressively motivate the citizens to buy Electric Vehicles through this policy. The Government of India has also

launched ―The Faster Adoption and Manufacturing of Electric Vehicles in India (FAME Scheme I and II)‖ scheme in

2015 which has been extended subsequently in 2019, under National Electric Mobility Mission Plan (NEMMP) with

the aim to promote eco-friendly electric vehicles in the country.

The Haryana Electric Vehicle Policy focuses on following aspects:

Encourage and incentivize Manufacturing of Electric Vehicles, major components of EVs, batteries for

EVs in Haryana and thereby reducing cost of doing business.

Develop charging infrastructure and strengthen e-mobility in the State

Human Capital development

Promote green automotive technology

Promote Research and Development (R&D) on various aspects of electric mobility i.e., manufacturing,

developing prototype vehicles, innovation in the field of battery manufacturing, etc.

This policy places a special emphasis on the creation of end-to-end ecosystem for E-Mobility in the

state and envisages at harnessing Haryana‘s inherent strength in automotive manufacturing sector for supporting

Electric Vehicle manufacturing and adoption within the state.

2. Objectives

i. To promote clean transportation by promotion of use of Electric Vehicles (EVs) in the State.

ii. To make usage of Electric Vehicles affordable and easy, by setting up of a widespread and accessible

charging infrastructure.

iii. To make Haryana a global hub for manufacturing of Electric Vehicles (EVs), major components of

EVs and batteries for EVs.

iv. To generate employment opportunities in the State.

v. To promote Research and Development (R&D) on various aspects of electric mobility.

3. Eligibility

i. This policy shall come into effect on the date of its notification in the Official Gazette of Government

of Haryana.

ii. This policy is applicable to ―new‖ and ―existing‖ units anywhere in B, C, and D blocks and / or in

Govt. approved Industrial Estates / IMTs in Block A.

iii. Existing units desirous of claiming incentives under this policy shall have to comply with the

following:

a. Existing units undertaking expansion / diversification / complete conversion anywhere in B, C,

D category blocks and / or in Govt. approved Industrial Estates / IMTs in Block A

b. Units with an additional investment of at least 50% of FCI (of the already established unit) in

EV sector

c. Units converting completely into EV/EV component/ EV Battery manufacturing

iv. The policy incentives will be available for manufacturers of EV (BEV and FCEV) and Hybrid EV

(PHEV and SHEV); EV components, individual buyers and enterprises setting up charging

infrastructure as defined in clause 4 and detailed in clause 5, 6 and clause 8 of this policy.

v. Large and Mega units shall compulsorily establish a battery disposal/recycling/material recovery

facility at their proposed plant for claiming any incentive under this policy.

HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA) 2267

Note

Units availing a particular incentive under this policy will not be eligible to avail similar incentive under

similar head as given in any other Haryana Government policy. However, such units will be eligible for other

incentives not specified in this policy. All incentives specified in this policy (excluding buyer incentives) may

be availed in addition to incentives available under any Government of India scheme/policy. The maximum

limit of the sum of all fiscal incentives shall not exceed 100% of Fixed Capital Investment (FCI) for

manufacturers and owners of Public Charging Station/Swapping Station or 100% of ex-showroom price of the

vehicle for buyers.

4. Definitions

i. Electric Vehicle: Electric Vehicle (EV) refers to automobiles powered by a battery and an electric

motor, including battery electric vehicles (BEV) and Fuel Cell Electric Vehicle (FCEV).

ii. Battery Electric Vehicle (BEV): A vehicle which is powered exclusively by an electric motor; whose

traction energy is supplied exclusively by traction battery installed in the vehicle; and has an ‗Electric

Regenerative Braking System‘.

iii. Fuel Cell Electric Vehicle: Fuel Cell Electric Vehicle (FCEV) use a propulsion system like that of

electric vehicles, where energy stored as hydrogen is converted to electricity by the fuel cell.

iv. Hybrid Electric Vehicles (HEV): A vehicle that for the purpose of mechanical propulsion draws

energy from both of the following on-vehicle sources of energy/power:

A consumable fuel

Rechargeable Energy Storage System (ReESS)

v. Strong Hybrid Electric Vehicle: Strong Hybrid Electric Vehicle (SHEV) is a HEV which has an

engine ‗Stop-Start‘ arrangement, ‗Electric Regenerative Braking System‘ and a ‗Motor Drive‘ (motor

alone is capable to propel/drive the vehicle from a stationary condition)

vi. Plug-in Hybrid Electric vehicle: PHEV is a type of ‗Strong Hybrid Electric Vehicle‘ which has a

provision for ‗Off Vehicle Charging‘ (OVC) of ‗Rechargeable Energy Storage System (ReESS)‘.

vii. Electric Regenerative Braking System: An integrated vehicle braking system which provides for the

conversion of vehicle kinetic energy into electrical energy during braking.

viii. Engine ‘Stop-Start’ arrangement: A system by which the engine is started or stopped in a hybrid

electric vehicle by vehicle control unit at operating conditions depending upon traction power required

for the propulsion of the vehicle.

ix. Off Vehicle Charging (OVC): Rechargeable Energy Storage System (ReESS) in the vehicle has a

provision for external charging.

x. EV Components: Components of EV will include Motor Controller, Electric Engine (motor) for EV,

Regenerative Braking System, Drive System for EV/FCEV/SHEV, Batteries and Cells (Li-ion, hydrogen

or other hi-tech cells) that can be used in EV/FCEV, Battery Management System (BMS), Electric Power

Control Unit (EPCU), Battery Heating System, On-board Charger (OBC), Electric Traction Motors and

controllers, EV Power Train Components, Components related to transmission mechanism, Traction

battery pack, Low Voltage DC-DC Converter(LDC), Power inverter, Vehicle control unit (VCU), EV

Charge Port, Fuel Cell Control Unit, Anode Recirculation Blower for FCEV, Hydrogen gas injector for

Hydrogen Fuel cells, Humidifier/stack Bypass Valve, Stack-isolation and Control Valve for Hydrogen

fuel cells etc.

xi. Charging/Battery equipment: Equipment that is exclusively used to charge the batteries of

BEV/PHEV/SHEV. This equipment can be installed at existing fuel stations or separate charging or

battery swapping stations.

xii. Privately owned public charging station: A dedicated charging station owned by a private entity that

is used for charging personal EV or EV fleet and can be installed at independent homes, group

residential buildings, offices, public places or dedicated parking land which can be self-operated or

CPO-managed (Charged Point Managed for EV fleet charging). The charging stations shall adhere to

the norms laid by Ministry of Power (MoP)

xiii. Electric Mobility Ecosystem: This policy addresses various components and end products of the

electric mobility ecosystem. Such an ecosystem encompasses the ―Electric Vehicles and components

such as Lithium-Ion Batteries (or other advanced batteries with comparable energy/power densities),

Super capacitors, Fuel cell systems, EV Charging equipment, Hydrogen generation, storage and

refueling equipment, Battery swapping equipment, EV Motors & Controllers and other EV powertrain

components, Battery management systems, EV electronics, electric harness etc. integral to the

functioning of an EV.‖

2268 HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA)

Other Important definitions

i. Fixed Capital Investment (FCI): Fixed Capital Investment refers to Land, Building and Plant &

Machinery, as specified in the policy / the schemes to be notified under the policy.

ii. Ultra-Mega Project: Project having minimum Fixed Capital Investment of INR 6000 crore in A

Blocks, INR 4,500 crore in B Blocks, INR 3,000 crore in C Blocks and INR 1,500 crore in DBlocks.

iii. MegaProject:Project having minimum Fixed Capital Investment(FCI) of INR 200 crore in Govt.

approved Industrial Estates/IMTsin Block Aandallare as under B Blocks, FCI of over INR 100 crore in

C Blocks and FCI of over INR 75 crore in D Blocks. [Mega and Ultra Mega units setting up in the

State shall also be eligible for a special package of incentives as per HEEP 2020 and future Haryana‘s

Flagship Industrial Policy (if and when released)]

iv. Large Enterprise: Investment in Plant and Machinery greater than INR 50 crore and turnover greater

than INR 250 crore (over and above the of limit of Medium units as defined under the MSMED Act,

2020 or amended by GoI from time to time).

v. Medium Enterprise: Investment in Plant and Machinery or Equipment does not exceed INR 50 crore

and turnover does not exceed INR 250 crore as defined under the MSMED Act, 2020 or amended by

GoI from time to time.

vi. Small Enterprise: Investment in Plant and Machinery or Equipment does not exceed INR 10 crore and

turnover does not exceed INR 50 crore as defined under the MSMED Act, 2020 or amended by GoI

from time to time.

vii. Micro Enterprise: Investment in Plant and Machinery or Equipment does not exceed INR 1 crore and

turnover does not exceed INR 5 crore as defined under the MSMED Act, 2020 or amended by GoI

from time to time.

5. Incentives for Manufacturers

Manufacturers of Electric (EV, BEV, FCEV) vehicles, charging infrastructure and EV/Hydrogen/Charging

infrastructure component manufacturers shall be eligible for incentives as mentioned below. Manufacturers

producing components intended to be used exclusively for electric vehicle &EV charging infrastructure shall

only be considered for following incentives under this policy:

a. Capital subsidy of Fixed Capital Investment (FCI)

Capital subsidies will be provided to industries manufacturing Electric Vehicles (BEV/FCEV), major

components of EVs, batteries for EVs, manufacturer of charging infrastructure:

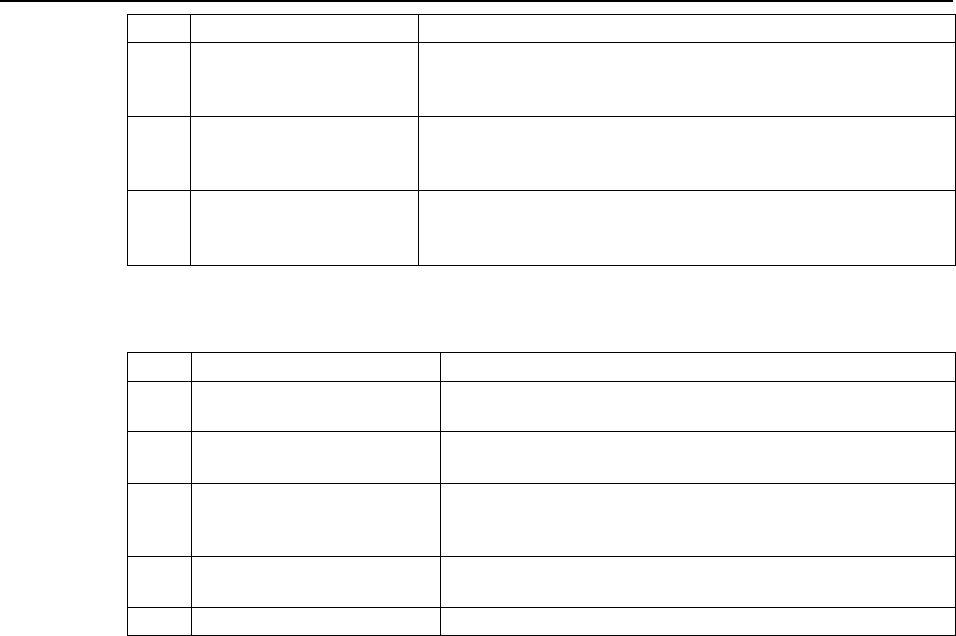

S.No.

Industry

Subsidy

No. of beneficiaries

1.

Micro

Industry

25% of FCI or

INR 15 lakh,

whichever is

lower

First 20 units in each segment of electric vehicles

(2 wheelers, 3 wheelers, 4 wheelers, buses/Heavy Vehicle)

battery and charging equipment

2.

Small

Industry

20% of FCI or

INR 40 lakh,

whichever is

lower

First 10 units in each segment of electric vehicles

(2 wheelers, 3 wheelers, 4 wheelers, buses/Heavy Vehicle)

battery and charging equipment

3.

Medium

Industry

20% of FCI or

INR 50 lakh,

whichever is

lower

First 5 units each in each segment of electric vehicles

(2 wheelers, 3wheelers, 4 wheelers, buses/Heavy Vehicle)

battery and charging equipment

4.

Large

Industry

10% of FCI or

INR 10crores,

whichever is

lower

For first 2 units in each segment of electric vehicles

(EV) (2 wheelers, 3 wheelers, 4 wheelers, buses/Heavy

Vehicle), battery and charging equipment

5.

Mega

Industry

20% of FCI or

INR 20crore

whichever is

lower

For first 3 units in the state

*Mega or Ultra mega units setting up in the State will be

also eligible for a special package of incentives as per

HEEP 2020

In order to promote circular economy and responsible disposable of batteries, first 5 units setting up

their manufacturing facility in the state across Medium, Large or Mega category for battery

disposal/recycling/ material recovery shall be eligible for capital subsidy @ 15% of FCI or INR 1.00

crore whichever is lower.

HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA) 2269

b. Seed and Conversion Fund

One-time support as a seed funding for existing units converting completely into EV manufacturing

(BEV/FCEV), EV component manufacturing or EV Battery manufacturing @ 25% of the book value

of plant and machinery during the year of application for Micro, Small, Medium, and Large units or IN

2 crore whichever is lower. This will be available for early adopter units under each category as below:

S.No.

Type of unit

Maximum Number of Early adopter units

1

Micro units

First 30 units

2

Small units

First 15 units

3

Medium units

First 15 units

4

Large units

First 15 units

c. Net SGST reimbursement

Net SGST reimbursement for micro, small, medium, large, and mega industries manufacturing Electric

Vehicles, major components of EVs, batteries for EVs shall be as below:

i. Allunitswouldbeallowedreimbursementof50%oftheapplicableNetSGST for a period of 10 years

or up to realization of fixed capital investment whichever is earlier.

ii. In case, where Net SGST deposit under cash ledger is less than 5% of FCI in a year or project

having inverted duty, the Investment subsidy up to 5% of FCI may be given for a period of

8 years in equal installments subject to annual ceiling of INR 5 crore for mega units.

Note: Units availing capital subsidy as in the clause 5.a. shall not be eligible for benefits under

clause 5.c.

d. Reimbursement in Stamp Duty

Reimbursement of 100% stamp duty on purchase /lease of land/shed/buildings to be used for

manufacturing Electric Vehicles, major components of EVs, batteries for EVs and charging

infrastructure after commencement of commercial production. Subsequent transactions on same

property will not be eligible for this reimbursement.

e. Power subsidy and incentives:

i. The Government shall provide special tariff to the units manufacturing electric vehicles, major

components of EVs, batteries for EVs and charging infrastructure as announced by Haryana

Electricity Regulatory Commission every year.

ii. 100% exemption on Electricity Duty for a period of 20 years. For units producing captive

power, the exemption shall be limited to the power consumed for its own operation only, but not

sold to other business entities/private companies/PSUs/DISCOMs/etc. In case of the expansion /

diversification of the existing units, a mechanism shall be made to exempt electricity duty in lieu

of incremental consumption of Power.

iii. Power utilities shall provide uninterrupted 24x7 quality power to all units involved in

manufacturing Electric Vehicles, major components of EVs, batteries for EVs and charging

infrastructure.

f. Water treatment plant incentives

In order to promote water recycling for manufacturing plant, the Haryana Government shall reimburse

50% of the cost of water treatment plant up to INR 50 lakh for first 5 units in each category (Medium,

Large, Mega and Ultra-Mega units).

g. Patent Fee

Financial support by reimbursement of 100% of the actual expenses (including filing fees, consultancy

fees, search fees, maintenance fees and Publishing fees) with a maximum of INR 25 lakh for domestic

and international patent registrations for manufacturing units falling under eligibility of this policy.

h. Employment Generation Subsidy

Employment generation subsidy shall be extended to manufacturing units established only in B, C and

D category blocks, for capacity building of persons belonging to Haryana (skilled/semi-skilled/un-

skilled) [having Haryana Resident Certificate], Subsidy @ INR 48,000/- per employee per annum for

10 years for direct employment on pay roll or contract with valid ESI/PF Number. As per the Haryana

State Employment of Local Candidates Act, 2020 amended from time to time, units shall mandatorily

employ at-least 75% of Haryana Domicile workforce, to be able to receive the employment incentive.

2270 HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA)

6. Incentives for Buyers

a. Purchase Incentive

There are individual benefits extended to buyers of EV under Government of India‘s FAME India

scheme Phase II. In the categories covered under FAME Phase II Scheme, individuals would receive

benefits from Government of India. The Haryana Government shall provide benefits to category of

vehicles not covered under FAME-II scheme or any other similar incentive provision announced from

time to time by Government of India within the policy period.

Buyers of Electric Vehicle shall be provided with one-time Purchase Incentive to individuals within

policy period as below:

S.No

.

Vehicle Category

Incentive

1.

Electric Car/Light

EV(BEV/FCEV) ranging from

price of INR15.00 lakh to INR

40.00 lakh

First 1000 units purchased and registered in the state shall

receive purchase incentive of 15% of the ex- showroom

price of vehicle maximum up to INR 6.00 lakh.

2.

Hybrid Electric Car/ Hybrid

Light EV (SHEV/PHEV)

ranging from INR 15.00 lakh to

INR 40.00 lakh

First 200 units purchased and registered in the state shall

receive purchase incentive of 15% of the ex- showroom

price of vehicle maximum up to INR 3.00 lakh.

3.

Electric Car/Light

EV(BEV/FCEV) ranging from

price of INR 40.00 lakh to INR

70.00 lakh

First 1000 units purchased and registered in the state shall

receive purchase incentive of 15% of the ex- showroom

price of vehicle maximum up to INR 10.00 lakh.

4.

Hybrid Electric Car/ Hybrid

Light EV (SHEV/PHEV)

ranging from INR 40.00 lakh to

INR 70.00 lakh

First 200 units purchased and registered in the state shall

receive purchase incentive of 15% of the ex- showroom

price of vehicle maximum up to INR 5.00 lakh.

5.

Hydrogen based vehicle

First 200 units purchased and registered in the state shall

receive purchase incentive of 15% of the ex- showroom

price of vehicle maximum up to INR 10.00 lakh.

6.

Electric Tractors for farmers

First 1000 units purchased and registered in the state shall

receive purchase incentive of 50% of the ex- showroom

price of vehicle up to INR 5.00 lakh.

7.

Hybrid Electric tractor for

farmers

First 100 units purchased and registered in the state shall

receive purchase incentive of 50% of the ex- showroom

price of vehicle up to INR 5.00 lakh.

8.

Electric Bus

First 200 units purchased and registered in the state shall

receive purchase incentive of 10% of the ex- showroom

price of vehicle up to INR 10.00 lakh.

*Incentives of 100 Electric buses shall be reserved for

buses used by government and government owned entities

of Haryana.

Note: Government may revise the Incentive and target number of vehicles from time to time as

required for a response to emerging market and technology landscape.

b. Exemption in Motor Vehicle Tax

Exemption of Motor Vehicle Tax under Haryana Motor Vehicle Tax Act, 2016 for electric vehicles will

be as follows:

S.No.

Vehicle Category

Rate of Tax exemption

1

Electric 2-wheeler

100% exemption on Motor Vehicle Tax for vehicles purchased

and registered in Haryana during policy period for first 30,000

vehicles

2

Electric 3-wheeler

100% exemption on Motor Vehicle Tax for vehicles purchased

and registered in Haryana during policy period for first 15,000

vehicles

HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA) 2271

S.No.

Vehicle Category

Rate of Tax exemption

3

Electric 4-wheeler /

Hydrogen fuel-based

Vehicle (FCEV)

75% exemption on Motor Vehicle Tax for vehicles purchased

and registered in Haryana during policy period for first 10,000

vehicles

4

Hybrid electric 4-wheeler

25% exemption on Motor Vehicle Tax for vehicles purchased

and registered in Haryana during policy period for first 2,500

vehicles

5

Electric buses

75% exemption on Motor Vehicle Tax for vehicles purchased

and registered in Haryana during policy period for first 1,000

vehicles

c. Vehicle Registration Fee

All Electric vehicles, Hybrid Electric vehicles or Hydrogen Electric Vehicles purchased and registered

in Haryana during policy period shall be charged the following discounted registration fee:

S.No.

Vehicle Category

Registration Fee

1

Electric 2-wheeler

INR 200 for all category two wheelers for first 30,000

vehicles

2

Electric 3-wheeler

INR 200 for all category three wheelers for first 15,000

vehicles

3

Electric 4-wheeler /

Hydrogen fuel-based Vehicle

(FCEV)

INR 500 for all category four wheelers for first 10,000

vehicles

4

Hybrid electric 4-wheeler

INR 500 for all category hybrid four wheelers for first 2,500

vehicles

5

Electric buses

INR 500 for all category buses for first 1,000 vehicles

7. Development of EV Charging Infrastructure

Government of Haryana shall ensure availability of adequate charging infrastructure in the State and undertake

the following initiatives:

i. Department of Town and Country Planning (TCP) shall mandatorily include the provisions for

charging stations / charging infrastructure for facilitating charging of electric vehicles in places such as

Group Residential buildings, commercial buildings, institutional buildings, Malls, Metro Station etc.,

and to amend The Haryana Building Code, 2017 accordingly.

ii. Department of Town and Country Planning (TCP) shall also support and motivate existing Group

Residential buildings, commercial buildings, institutional buildings, Malls, Metro Station etc. to have

adequate space reserved for developing charging infrastructure.

iii. Department of Town and Country Planning (TCP) shall also provide provision of setting up charging

infrastructure to promote EV usage and adoption in Green Belts.

iv. Charging infrastructure shall be developed in all existing and new public buildings, public parking

places, all bus depots / sub-depots of State Transport Undertakings

v. Public Sector Undertakings (PSUs) shall be encouraged to set-up charging infrastructure in the State

within their premises and at public areas.

vi. Privately owned public Charging Stations: The State Government shall encourage private players to set

up Electric Vehicle (EV) charging stations and infrastructure in the state.

vii. All new and existing petrol pumps shall be encouraged to have charging stations and battery banks

depending upon demand and viability.

viii. Fast charging stations and battery swapping infrastructure shall be provided on highways and other

prominent roads within every 30 km.

ix. State Government will encourage oil companies (like IOCL, HPCL, IGL, EESL etc.) to invest in

providing a charging network, specially the fast-charging stations at inter-city routes like state and

national highways and in cities.

x. The companies installing Public Charging Station shall also be encouraged to set up battery swapping

stations with due intimation to the Distribution Licensee. The rebate on electricity tariff applicable for

Public Charging Stations shall also be applicable to Battery Swapping Stations.

2272 HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA)

xi. Electricity Distribution companies shall be encouraged to propose capital Investment Plan for

upgrading its network for accommodating charging infrastructure to facilitate smooth and efficient

charging at respective charging stations. The capital investment plan shall be prepared after rigorous

discussions with investor/stakeholders/private players who are keen to set up charging station in the

license area of the Electricity Distribution company.

xii. Solar Power based Charging Stations will be promoted within the State. State Government will provide

applicable incentives for open access charges to the E-Vehicle Charging Stations with rooftop/ground

mounted solar power generation facility.

8. Incentives for Privately owned Public Charging Stations/Privately owned Battery Swapping Station

The following incentives will be for the areas other than FAME II (or FAME III or similar approved cities, if

applicable in future within the policy period):

i. One time subsidy of 20% of Fixed Capital Investment (FCI) up to INR 10 lakh for first 100 Battery

Swapping Stations set up with FCI of more than INR 50 lakh

ii. One time subsidy of 20% of the Fixed Capital Investment (FCI) maximum upto INR 5 lakh for first

200 privately owned public charging stations setup with FCI of more than INR 25 lakh

iii. One time subsidy of 20% of Fixed Capital Investment (FCI) up to INR 50,000 for first 2,000 privately

owned public charging stations to be established in Group Residential buildings, commercial buildings,

institutional buildings, Malls, Metro Station etc. with more than 1,000 inhabitants or that cater to more

than 1,000 people per day. Such residential buildings, office buildings, malls, metro stations, or others,

shall have at least 10 charging units in the designated area. The charging units shall be maintained

appropriately to cater to public demand.

9. Human Capacity Building

Training for various skill developments to the stake holders will be arranged and Industrial Training Institutes

will conduct courses for the repair of electric vehicles. Information Education Communication (IEC) plan will

also be prepared by HAREDA for wide scale public awareness.

In order to provide sufficient skilled employees to the manufacturers of Electric Vehicles in the State, Govt.

organizations / PSU/ private companies shall be encouraged to set up Centres of Excellence (CoE). Five such

CoEs shall be incentivized with a 50% grant of project cost up to INR 5 crore. CoE shall utilize 50% of the

grant in setting up of the CoE and the remaining 50% of the grant shall be used for running operations of the

CoE. The grant shall be released in 5 equal annual installments.

State Government shall also encourage skill development and training programmes for youth as per National

Skill Development Corporation Guidelines released by Government of India from time to time. Incentives

from Government of India can be availed by training institutes and EV manufacturing units providing job

linked trainings.

10. Research and Development

Research and development in the field of e-mobility in co-ordination with State/National or International level

Organizations will be promoted by the State Government. The following incentives shall be provided for

Research & Development:

i. Educational or Research Institutes setting up R&D centers shall be provided subsidy @50% of project

cost up to INR 1 crore for developing new electric charging technology for first 5 units and up to INR 5

crore for developing new electric vehicle technology for first 5 units as per selection of best proposals

by the state government in the policy period.

ii. First 10 Research Institutes / research centers conducting dedicated research on non-fossil-fuel based

mobility solution will be provided with INR 5 crore incentive for developing new technology as per

selection of best proposals by the state government in the policy period.

iii. Additional one-time subsidy of INR 25 lakh will be extended to first 20 college / ITI/ Polytechnic for

setting up of infrastructure related to R&D under EV segment.

11. Demand Creation

The Government Departments/Corporations shall provide leadership in the use of Electric Vehicles to create

the initial demand and to build confidence amongst buyers for buying and using Electric Vehicles. NRE

Department/HAREDA will be the coordinating agency for facilitating the deployment of e-vehicles by

adopting viable business models (lease based/ outright purchase/ any other feasible model) by different

Government Departments/Organizations. The following steps shall be taken by concerned departments:

i. The year of notification of this policy, shall be announced as the ―Year of the Electric Vehicle‖ in

Haryana.

HARYANA GOVT. GAZ. (EXTRA.), JULY 8, 2022 (ASAR. 17, 1944 SAKA) 2273

ii. Due consideration will be given to Electric Vehicles while hire / purchase of new vehicles by the

Government Departments of corresponding class/category as available in the market.

iii. Multiple Government offices and public areas will be chosen for installing public charging equipment

that can be used publicly.

iv. The cities of Gurugram & Faridabad will be declared as model Electric Mobility (EM) cities with

phase-wise goals to adopt Electric Vehicles (EVs), charging infrastructure to achieve 100% e-mobility.

v. Model Electric Mobility cities shall convert 100% of all commercial passenger carrying vehicles to

electric vehicles. These vehicles can belong to any government organization, State Transport

Undertakings, educational institutes, hospitals or corporations and other institutions. Panchkula,

Karnal, Gurugram & Faridabad will be the pilot cities for all new initiatives. Efforts will be taken to

phase out all fossil fuel based commercial passenger carrying vehicles in Gurugram and Faridabad by

2030.

vi. Efforts shall be made to convert 100% of bus fleet owned by Haryana State Transport Undertakings

into electric buses or Fuel Cell Vehicles or other non- fossil-fuel-based technologies by 2030. In this

regard, department shall convert 10% of existing bus fleet within next 2 years of launch of EV policy in

First Phase. Department shall convert 50% of bus fleet in Second Phase by 2026 and eventually, 100%

conversion of bus fleet shall be achieved in Third Phase by 2030.

vii. Efforts shall be made to convert all forms of Government vehicles, including vehicles under

Government Corporations, Boards and Government Ambulances etc., to electric vehicles in two phases

i.e., 50% by 2026 and in rest of the State by 2030.

12. Awareness

Awareness will be created among public to enhance the use of Electric Vehicle (EV). Test rides in

collaboration with various vehicle manufacturers, will be promoted to take the new technology to the common

man. Various state Departments will provide volunteers for the campaigns on demand basis. The state shall

also support the Bureau of Energy Efficiency in the ―Go Electric‖ awareness campaign at the state level for

creating awareness via print media.

Capacity building among local officials will be essential to increase awareness and knowledge of requirements

for EV and the charging infrastructure in the state. Awareness and orientation workshops shall be undertaken

focusing on a target audience.

13. Period of Policy

The policy shall be valid for a period of 5 years from the date of notification of this policy in the official

gazette.

*****************

9739—C.S.—H.G.P. Pkl.