5 July 2022 | ESMA91-372-2060

`

Report

4

th

ESMA Stress Test Exercise for Central Counterparties

1

Table of Contents

1 Executive Summary ......................................................................................................................... 6

2 Introduction ..................................................................................................................................... 10

2.1 Background ............................................................................................................................ 10

2.2 Scope and Objectives ............................................................................................................ 11

3 Methodological Overview ............................................................................................................... 13

3.1 Design and Components ........................................................................................................ 13

3.2 Overview of the Process ........................................................................................................ 13

3.3 Market Stress Scenarios ........................................................................................................ 14

3.4 Methodology – Credit Stress Test .......................................................................................... 19

3.5 Methodology – Concentration Stress Test ............................................................................. 28

3.6 Methodology – Operational risk analysis ............................................................................... 35

4 Results ............................................................................................................................................ 45

4.1 Analysis and Breakdown of Resources.................................................................................. 45

4.2 Credit Stress Test Results...................................................................................................... 54

4.3 Concentration Stress Test Results ......................................................................................... 73

4.4 Operational risk analysis ........................................................................................................ 84

5 Conclusions .................................................................................................................................. 121

6 Annexes ........................................................................................................................................ 124

6.1 List of CCPs included in the scope of the exercise .............................................................. 124

6.2 Concentration Stress Test annex ......................................................................................... 125

6.3 Operational risk analysis annex ........................................................................................... 136

2

List of Figures

Figure 1: Overview of the Process ......................................................................................................... 13

Figure 2: Evolution of 2-day (5-day) moves for benchmark products during the first days ................... 17

Figure 3: Comparison between most severe shocks and Stress Test shocks ...................................... 17

Figure 4: Overview of credit stress test runs .......................................................................................... 24

Figure 5: Illustrative typical Default Waterfall ......................................................................................... 26

Figure 6: Default Waterfall – All CCPs ................................................................................................... 47

Figure 7: Required Margin and Default Fund – per CCP ....................................................................... 48

Figure 8: Required Margin vs Default Fund – All CCPs......................................................................... 48

Figure 9: Default Waterfall – per CCP .................................................................................................... 49

Figure 10: Required vs Excess Margin .................................................................................................. 49

Figure 11: Clearing Members – All CCPs .............................................................................................. 51

Figure 12: Clearing Member Groups – All CCPs ................................................................................... 52

Figure 13: Clearing Member Groups - Distribution of required margin shares ...................................... 53

Figure 14: Cover-2 Groups per CCP – Date: March 2021 – Without Excess Margin ........................... 56

Figure 15: Cover-2 Groups per CCP – Date: March 2021 – With Excess Margin ................................ 57

Figure 16: Cover-2 Groups per CCP – Date: March 2021 – With Concentration impact ...................... 59

Figure 17: Cover-2 Groups per CCP – Date: March 2021 – With Concentration and WWR impact .... 60

Figure 18: Cover-2 Groups per CCP – Date: April 2021 – Without Excess Margin .............................. 62

Figure 19: All CCPs Cover-2 – Date: March 2021 – Without Excess Margin ........................................ 64

Figure 20: All CCPs Cover-2 – March 2021 – Without Excess Margin – With Concentration and Wrong-

way risk Impact ....................................................................................................................................... 65

Figure 21: All CCPs Cover-2 – April 2021 – Without Excess Margin .................................................... 66

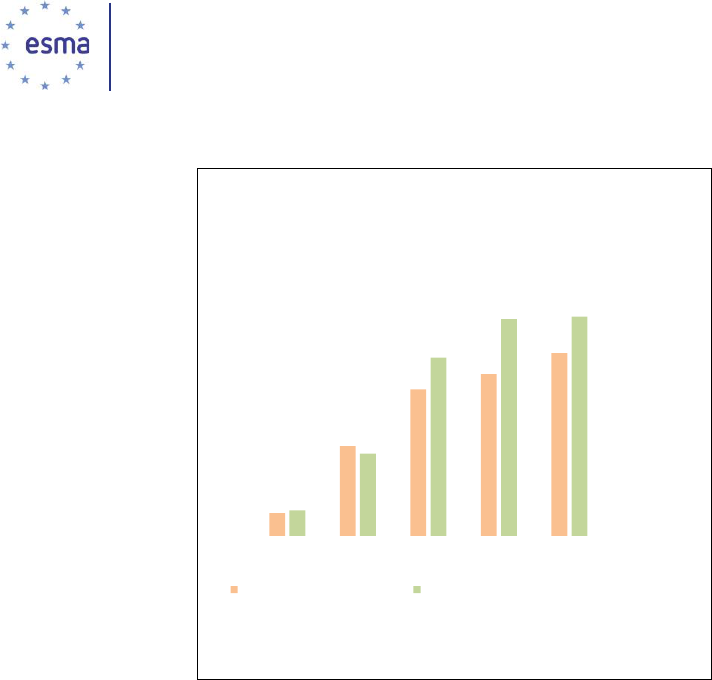

Figure 22: System-wide market impact per asset class......................................................................... 74

Figure 23: Breakdown of concentration risk per asset class ................................................................. 75

Figure 24: System-wide reported concentration add-ons, per asset class ............................................ 75

Figure 25: Concentration risk coverage by addons for individual CCPs ............................................... 76

Figure 26: Comparison of market impact and concentration add-ons, commodity derivatives ............. 77

Figure 27: Comparison of market impact and concentration add-ons, fixed income derivatives .......... 78

Figure 28: Comparison of market impact and concentration add-ons, equity ....................................... 79

Figure 29: Comparison of market impact and concentration add-ons, bonds ....................................... 80

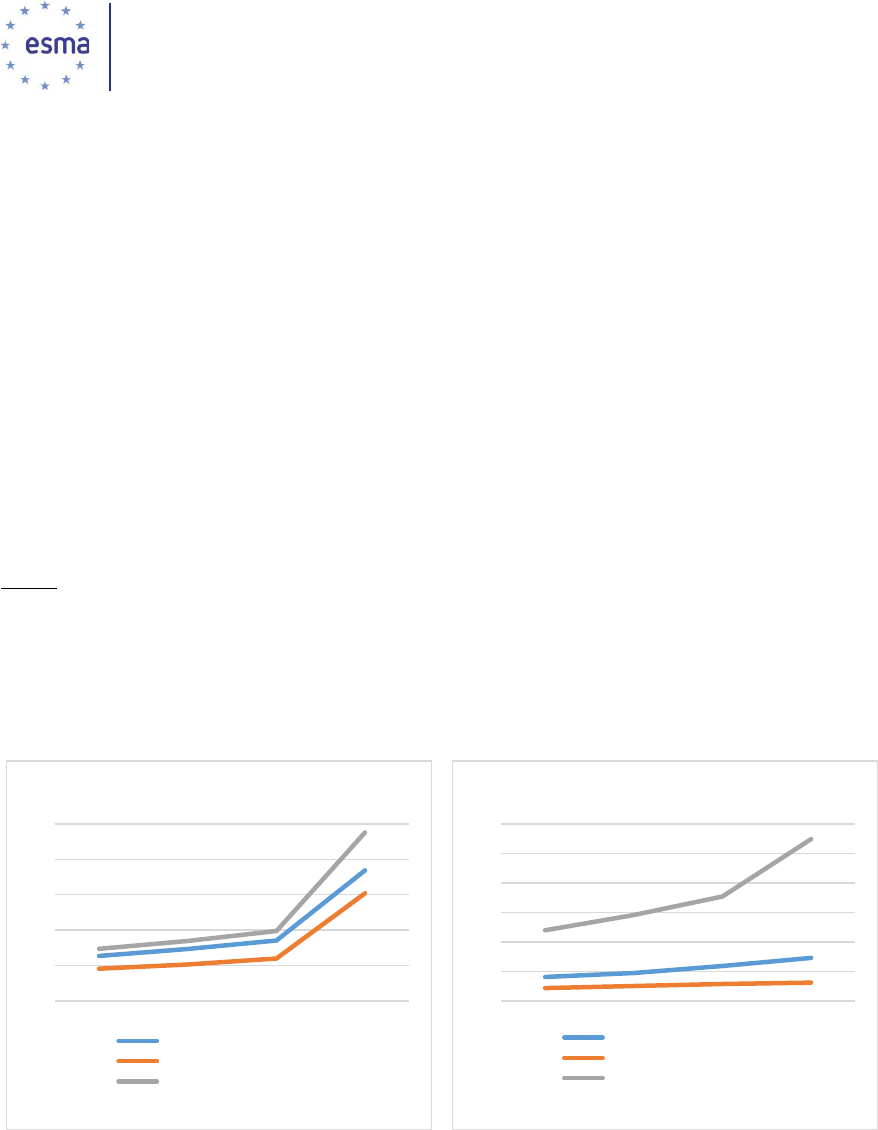

Figure 30: Clearing / settlement unavailable: reliability metrics ............................................................. 89

Figure 31: Critical supporting functions unavailable: reliability metrics ................................................. 90

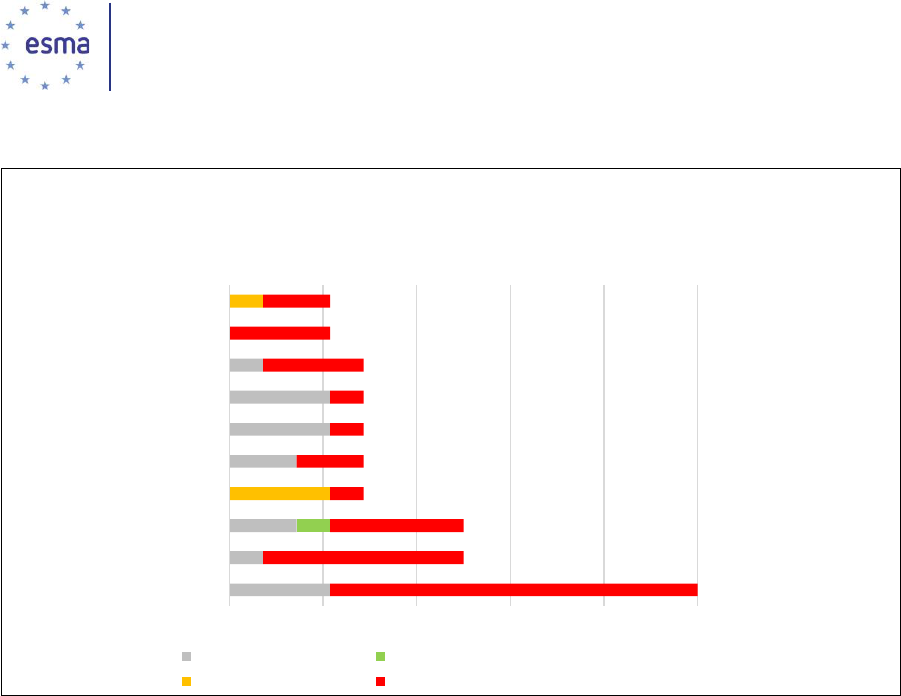

Figure 32: Risk indicators by severity groups- clearing or settlement unavailable ................................ 92

Figure 33: Risk indicators by severity groups- critical supporting functions unavailable ....................... 93

Figure 34: Expected 1y downtime and estimated 95

th

percentile downtime - clearing or settlement

unavailable ............................................................................................................................................. 94

Figure 35: Expected 1y downtime and estimated 95

th

percentile downtime – critical supporting functions

unavailable ............................................................................................................................................. 95

Figure 36: Number of critical third-party service providers per CCP by entity type ............................... 97

Figure 37: Comparison between weighted and not-weighted number of critical third-party service

providers per CCP .................................................................................................................................. 99

Figure 38: Risk reduction for CCPs’ clearing and settlement functions exposure to third-party service

providers using operational risk management tools............................................................................... 99

Figure 39: Risk reduction for critical supporting functions using operational risk management tools . 101

Figure 40: Weighted exposure per CCP after operational risk management tools – critical third-party

service providers .................................................................................................................................. 102

3

Figure 41: Weighted exposure per CCP after operational risk management tools – critical third-party

service providers .................................................................................................................................. 103

Figure 42: Behaviour of operational risk management tools ............................................................... 105

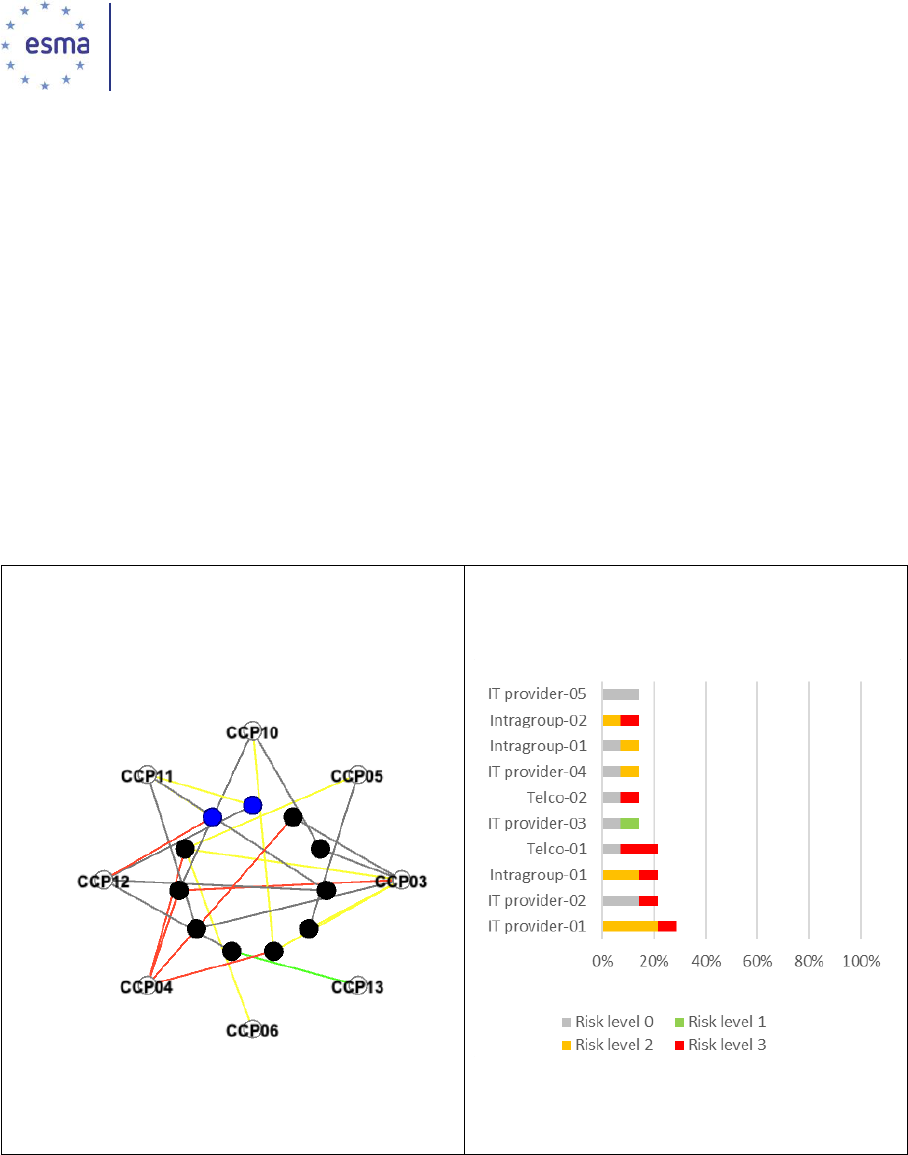

Figure 43: Network of CCPs connected through third-party providers ................................................ 107

Figure 44: Network of third-party providers connected to at least two CCPs ...................................... 109

Figure 45: Box & Whisker plot, Number of CCPs connected by type of entity .................................... 110

Figure 46: Interconnectedness analysis – Financial services .............................................................. 112

Figure 47: Interconnectedness analysis – Software, IT & Telecommunications services ................... 114

Figure 48: Interconnectedness analysis – Data providers ................................................................... 115

Figure 49: Interconnectedness analysis – Other services ................................................................... 117

Figure 50: Telecommunications provider outage ................................................................................. 117

Figure 51: Intragroup entity outage ...................................................................................................... 118

Figure 52: Financial Market Infrastructure outage ............................................................................... 118

Figure 53: Settlement system outage .................................................................................................. 119

Figure 54: Market impact vs. relative position size, Investment grade corporate and sovereign bonds

.............................................................................................................................................................. 127

Figure 55: Market impact vs. relative position size, equities and equity derivatives ........................... 128

Figure 56: Market impact vs. relative position size, energy and commodity derivatives ..................... 129

Figure 57: Market impact vs. relative position size, eur fixed income derivatives ............................... 131

Figure 58: Market impact vs. relative position size, credit derivatives ................................................. 133

Figure 59: Severity distribution – average disruption time and severity distribution estimate by groups of

CCPs .................................................................................................................................................... 138

Figure 60: Probability of event lasting more than 2h by severity groups ............................................. 139

Figure 61: Comparison between Lognormal distribution and Student’s t-distribution ......................... 141

List of Boxes

Box 1: Narrative of the scenario as provided by ESRB ......................................................................... 15

Box 2: The Market Stress Scenarios in the light of the Russia’s invasion of Ukraine ........................... 16

Box 3: Description of the Credit Stress Test Chart ................................................................................ 55

4

List of Tables

Table 1: Reverse Stress Test – Loss above Required Prefunded Resources (No Excess) ................. 68

Table 2: Reverse Stress Test – Loss above Required & Non-Prefunded Resources (No Excess) ...... 69

Table 3: Comparison between baseline and alternative models ........................................................... 82

Table 4: Operational risk events by type, number of events per year, duration of events and events

longer than 2 hours ................................................................................................................................ 85

Table 5: Events resulting in clearing or settlement unavailable – distribution of events, scope, event type

and impact type ...................................................................................................................................... 87

Table 6: Events resulting in critical functions unavailable – distribution of events, scope, event type and

impact type ............................................................................................................................................. 88

Table 7: Market impact on representative large positions, Investment grade bonds .......................... 128

Table 8: Market impact on representative large positions, single name equity derivatives and securities

.............................................................................................................................................................. 129

Table 9: Market impact on representative large positions, other equity derivatives ............................ 129

Table 10: Market impact on representative large positions, energy commodity futures/forwards ...... 130

Table 11: Market impact on representative large positions, agricultural commodity futures/forwards 130

Table 12: Market impact on representative large positions, freight derivatives ................................... 130

Table 13: Market impact on representative large positions, eua ......................................................... 130

Table 14: Market impact on representative large positions, EUR fixed income derivatives ................ 132

Table 15: Market impact on representative large positions, GBP fixed income derivatives ................ 132

Table 16: Market impact on representative large positions, USD fixed income derivatives ................ 132

Table 17: Market impact on representative large positions, credit derivatives .................................... 134

Table 18: Grouping assumptions on total system-wide Market Impact ............................................... 134

Table 19: Impact of the level of aggregation of cm groups positions .................................................. 135

Table 20: Frequency Poisson distribution – estimated parameter λ .................................................... 137

5

Acronyms used

bps Basis points

CCP Central Counterparty

CM Clearing Member

DF Default Fund

EMIR European Market Infrastructure Regulation – Regulation (EU) 648/2012 of the

European Parliament and Council on OTC derivatives, central counterparties and

trade repositories

ESMA European Securities and Markets Authority

ESRB European Systemic Risk Board

EU European Union

ETD Exchange Traded Derivatives

FX Foreign Exchange

GEST Group of Experts on CCP Stress Testing

LEI Legal Entity Identifier

NCA National Competent Authority

OTC Over the counter

P&L Profit and Loss

pp Percentage points

PoA Power of Assessment

RTS Regulatory Technical Standards

SITG/SIG Dedicated CCP Resources (“Skin in the game”)

WWR Wrong-Way Risk

For CCP codes, please refer to Annex 1.

6

1 Executive Summary

Reasons for publication

The European Securities and Markets Authority (ESMA), in accordance with the European Market

Infrastructure Regulation (EMIR), shall initiate and coordinate assessments of the resilience of

Central Counterparties (CCPs) to adverse market developments. This report presents the results of

the fourth ESMA CCP stress test exercise that includes both EU and Tier 2 Third Country CCPs.

Contents

In line with the methodology published in June 2021

1

, the exercise covers both credit and

concentration risks, with targeted improvements in the methodology compared to the previous

exercises. In addition, the exercise includes for the first time an assessment of operational risk.

Given the scope and type of this exercise, a number of limitations and uncertainties remain and have

been highlighted in the report. This is particularly true for the operational risk analysis of the exercise,

the methodology and assumptions of which have been applied for the first time. Results are therefore

presented on an anonymous basis.

As with previous exercises, the objective of the ESMA stress test exercise is to assess the resilience

of CCPs to adverse market developments. This exercise is not aimed at assessing the compliance of

the CCPs with regulatory requirements, nor at identifying any potential deficiency of the stress testing

methodology of individual CCPs. Despite the fact that it is not aimed to do so, it may expose individual

shortcomings in the resilience of CCPs, in which case ESMA will issue the necessary

recommendations.

Analysis of CCP financial resources

Section 4.1 provides an analysis of the financial resources held by the 15 in-scope CCPs, as of 19

March and 21 April 2021. This data gives an overview of the size of the industry and sets the scene

for the presentation of the core stress test results. Overall, the prefunded resources collected by

CCPs have increased compared to the previous exercises. The CCPs reported in total 423 (resp.

409) billion EUR of required margin, default fund contributions and other committed prefunded

resources for March 2021 (resp. April 2021). There was no significant structural change in the overall

share of excess collateral or allocation of resources between margin and default fund contributions.

The analysis shows that, while there was a general increase of provided resources by all clearing

members, at the same time the top clearing members increased their relative share, indicating a

concentration of clearing member activity compared to the previous stress test.

Credit Stress Test

The results of the credit stress test are presented in section 4.2. Two default scenarios have been

run, combined with a common market stress scenario. In addition to the profit and loss balance of

clearing member positions (P&L) stemming from this scenario, concentration costs and costs related

to wrong-way risk were also taken into account for one of the dates. The first scenario is a Cover-2

per CCP, where ESMA assumes the default of two clearing member groups separately at each CCP.

7

The second scenario is the All-CCPs Cover-2 scenario, where ESMA assumes the default of the

same two groups for all CCPs system-wide. The defaulting entities are selected as the groups which

maximize the shortfall of prefunded resources, or alternatively the groups which maximize the overall

consumption of prefunded resources. Both scenarios have been run on two different dates, 19 March

2021 (end of day) and 21 April 2021 (intraday snapshot).

Under the Cover-2 per CCP scenario, ESMA assesses the resilience of each CCP to the default of

its top-2 clearing members groups under common price shocks. The prefunded resources were

sufficient to cover the losses resulting from the core credit stress test scenarios with relatively low or

moderate % consumptions. The sensitivity analysis also indicated that the conclusions seem robust

to small changes in the baseline shocks. The impact due to concentration and specific wrong-way

risk stemming from cleared positions led to higher losses and consumption for almost all CCPs but

under the considered market scenario these were contained within the default waterfalls of the CCPs

and there was no shortfall of prefunded resources.

During the time of finalisation of the exercise, Russia’s invasion of Ukraine led to extreme market

movements for instruments across the commodities and energy markets. A brief analysis of the stress

scenarios in the light of this event is presented in Box 2.

The All-CCPs Cover-2 stress test scenario is designed to assess the resilience of CCPs collectively

to the market stress scenario. Under this scenario, the same two groups of clearing members are

assumed to be in default in all CCPs. The majority of CCPs would experience a default of at least

one of their clearing members. However, these consistent scenarios did not put significant stress to

any CCP with the % consumption of default fund-level prefunded resources being relatively low in all

cases. This indicates that while CCPs are highly interconnected through common clearing

participants, the exercise did not highlight any pairs of groups that are at the same time and under

the common tested scenario highly impactful at multiple CCPs.

Finally, in the reverse stress analysis discussed in section 4.2.3 ESMA intentionally goes beyond

what was considered as plausible for the purpose of this exercise by stepwise increasing the number

of defaulting entities and the severity of the market shocks. Having considered the reverse stress test

scenarios, ESMA has not identified any systemically relevant adverse impact as the result of small

increases in market shocks and number of defaulters. Taking as a starting point the base scenario

and two defaulting groups, the analysis shows that incremental changes in market shock severity are

more harmful than increases in the number of defaulting groups.

Concentration Stress Test

The results of the concentration stress tests are presented in section 4.3. Based on the sensitivity

data provided by CCPs, the market impact (liquidation cost) was computed for all identified

concentrated positions on one reference date (19 March 2021).

The European-wide concentration analysis shows that concentrated positions represent a significant

risk for CCPs. For most asset classes, concentrated position risk is clustered in one or two CCPs, in

line with the findings of the previous exercise.

1

Framework for the 2021 ESMA Stress Test Exercise for Central Counterparties:

https://www.esma.europa.eu/file/119720/download?token=PtWBdAbz

8

System-wide, the largest concentration risk can be found in fixed income derivatives (around 29bn

EUR). Bonds (including bonds from Repo clearing services) come next with a total concentration risk

modelled at 11 bn EUR. Concentration in commodity derivatives and in the equity segment (securities

and derivatives) is very significant as well, with around 7bn EUR each. There is a very large coverage

gap between the system-wide estimated market impact under ESMA methodology and margin add-

ons, for commodity derivatives and to a lesser extent for equity products.

The concentration risk is addressed explicitly by a majority of CCPs through dedicated margin add-

ons. Although all CCPs face market impact, 4 CCPs (KDPW, CCPA, KELER, CCG) did not report

any concentration add-ons. Since the data request date, KDPW and CCG have implemented or are

in the process of introducing concentration add-ons. KELER relies on a monitoring system to require

additional collateral in case of elevated concentration.

Operational Risk

The results of the operational risk analysis are presented in section 4.4. In his analysis, ESMA derived

insights with respect to the level of operational resilience of CCPs for 14 CCPs (one was excluded

due to the absence of historical operational events data) and took an in depth look at third-party risk.

Using information about internal incidents of CCP’s systems and third-party providers ESMA

developed two methodologies to measure operational risk from historical events. With the computed

results, ESMA identified varying degrees of operational reliability for the CCPs included in the

exercise and identified specific CCPs where further work should be conducted to understand the

drivers of these differences, the root causes of the events and the remediation actions taken.

Through the use of a hypothetical scenario, ESMA evaluated the exposures to critical third-party

providers and the ability of CCPs to reduce risk through operational risk management tools. Using

exposure indicators, differences across CCPs in their relative level of third-party risk were identified.

Further work should be conducted to evaluate the individual circumstances of these exposures and

the suitability of taking corrective action to improve operational resilience against operational shocks

affecting critical third-party service providers.

In the analysis of the network of critical third-party providers, ESMA aggregated the information

provided by individual CCPs in order to understand and assess risks from common exposures to

third-party risk. Overall, ESMA identified a number of critical third-party service providers, which have

the potential to affect the critical functions of multiple CCPs in a correlated manner. In addition, ESMA

identified the critical third-party service providers with highest systemic importance for the CCP sector

due to both the criticality of their services and their level of interconnectedness with CCPs.

Overall Results

EU and Tier 2 CCPs proved to be overall resilient under the considered components, scenarios and

assumptions. As with the previous exercise, the adverse scenario did not aim to cover all possible

market movements but was designed to provide an internally consistent narrative to assess the

resilience of CCPs to system-wide market shocks.

The concentration component highlighted once again the need for CCPs to accurately account for

liquidation cost within their risk framework. Finally, the operational risk analysis highlighted a series

9

of areas and entities where further work to assess differences in measured risks between CCPs

should be conducted, and where risk mitigation measures may need to be further enhanced.

During the time of finalisation of the exercise, Russia’s invasion of Ukraine led to extreme market

movements for instruments in the commodity and energy markets. ESMA, in coordination with the

NCAs, closely monitored the impact that the outbreak has had on EU and Tier 2 CCPs. The analysis

performed by ESMA confirmed that the CCPs active in commodities clearing were the most exposed,

in particular the ones with relevant positions in power and to a lesser extent gas products. Moreover,

the CCPs with a more diversified set of cleared products were not significantly affected primarily

because of the lower experienced volatility in prices of other commodity and financial products.

Overall, ESMA notes that CCPs remained resilient through the crisis, despite the increased market

volatility.

Next Steps

In line with the EMIR mandate, where the assessments expose shortcomings in the resilience of one

or more CCPs, ESMA will issue the necessary recommendations.

10

2 Introduction

2.1 Background

1. CCPs are systemically important, and their resilience is critical to the stability of the financial

system in the EU. By their nature, CCPs are counterparties to all their clearing members. Failure

of CCPs to mitigate risks could potentially lead to spill-over effects and may exacerbate systemic

risk. Moreover, as evidenced in previous ESMA stress test exercises, CCPs are highly

interconnected through common stakeholders, which may propagate failures in one CCP

throughout the system. Stress testing CCPs, both individually and at financial system level, is an

important supervisory tool to ensure the sector is safe and resilient to defaults of clearing member

groups and market shocks. The Stress Test is a useful tool to assess the resilience of CCPs also

from other angles, such as the capacity to withstand the costs arising from the liquidation of large

positions or the operational resilience with respect to an outage of critical third-party service

providers.

2. The ESMA stress test is different than the stress tests of individual CCPs. CCPs run daily stress

tests on the basis of stringent prudential requirements that focus on their own environment,

including participants and cleared products. By its nature, the individual CCP’s stress test cannot

consider how the default of one of its clearing members or third-party providers impacts other

CCPs. Therefore, the ESMA stress test is a critical tool in assessing the systemic implications of

system-wide events and thus the resilience of the system of European CCPs.

3. One of the objectives of Regulation (EU) No 648/2012 of the European Parliament and of the

Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (EMIR)

is to promote central clearing and ensure safe and resilient CCPs. Therefore, ESMA shall at least

annually, in cooperation with the ESRB, initiate and coordinate assessments of the resilience of

CCPs to adverse market developments. Following the amendments to Regulation (EU) No

648/2012 in 2019, these assessments should include both EU and third-country Tier 2 CCPs.

Moreover, ESMA shall include both financial and operational risks. ESMA shall develop the

following, for application by the competent authorities:

• Common methodologies for assessing the effect of economic scenarios on the financial

position of a financial market participant,

• Common approaches to communication on the outcomes of these assessments of the

resilience of financial market participants,

• Common methodologies for assessing the effect of particular products or distribution

processes on the financial position of a financial market participant and on investors and

customer information.

4. Where the assessment exposes shortcomings in the resilience of one or more CCPs, ESMA

shall issue the necessary recommendations.

5. The present report sets out the results of the 4th ESMA system-wide stress test exercise in

Section 4, following a description of the employed methodology in Section 3. The objectives,

scope and overview of the different tests performed are presented in the following paragraphs of

this section.

11

2.2 Scope and Objectives

6. The objectives of the ESMA stress test exercise result directly from the legal mandate given to

ESMA under EMIR. The objectives are to:

• Assess the resilience of CCPs to adverse market developments,

• Identify any potential shortcomings in the CCPs’ resilience, and

• Issue recommendations as appropriate.

7. The overall design of the stress test framework was also guided by a number of overarching

principles. ESMA has assessed the resilience of all CCPs in scope, individually and as a system.

This was done on the basis of, as much as possible, common methodologies and criteria. The

ESMA CCP stress testing exercise is not aimed at assessing the compliance of the CCPs with

regulatory requirements nor at identifying any potential deficiency of the stress testing

methodology of the CCPs. It may however expose individual shortcomings, in which case ESMA

will issue the necessary recommendations.

8. The exercise covers 15 CCPs, including all authorised EU CCPs as well as Tier 2 CCPs.

9. The scope of the stress test exercise developed over the years. The first exercise conducted by

ESMA was focused on the counterparty credit risk that CCPs would face as a result of clearing

member defaults and simultaneous market price shocks. The second stress test introduced

several methodological improvements as well as incorporating an assessment of liquidity risk.

The third exercise included a concentration risk component, with the aim of adjusting the losses

arising from the credit stress test to account for the costs of liquidating concentrated positions.

In this fourth exercise, the assessment of liquidity risk was paused, whereas the scope includes

operational risk as a new component. The design of the new component is discussed in detail in

section 3.6 and the results in section 4.4. Also, the integration of concentration with credit is an

important new development in this fourth exercise that has further improved the detections of

vulnerabilities in the European system of CCPs. The details of the methodology are provided in

paragraph 3.4.3.3 and the results in paragraphs 4.2.1.1 and 4.2.2.1.

10. Counterparty credit risk and concentration risk are the core types of risks faced by CCPs. The

methodology has evolved to cover additional risk sources and includes (i) the integration of

concentration with credit on a mutual date, (ii) an intraday test for credit risk only on a second

date.

11. In addition, an analysis of operational risk was performed. This analysis covered a general

assessment of operational resilience of CCPs based on the analysis of past events, as well as

specific analyses on third-party risk through the use of a hypothetical scenario and an analysis

of the network of critical third-party providers.

12. While residual risks from the in-scope risk sources are analysed and highlighted in the

framework, CCPs are also subject to other types of risks that are either not covered or are

partially covered and could in isolation or in combination with assessed risks challenge their

resilience. In particular, legal and any type of business risks are outside the scope of the exercise,

because of their largely idiosyncratic nature. Also, potential shortcomings in policies and

practices of individual CCPs, such as for example in the operationalisation of default handling

procedures, can challenge their resilience but are beyond what was considered in the course of

this exercise. Finally, environmental risk may be covered in a future exercise.

12

13. Furthermore, this exercise does not cover all possible scenarios to which CCPs may be exposed

to. When modelling the scenarios and credit exposures, it is not possible to cover all possible

risk factors and then all possible combinations of risk factor shocks for all CCPs. Indeed, while

the architecture of this stress test is based on internally consistent scenarios, where N securities

or contracts are cleared and possibly in the same portfolio, the number of possible basis risk

movements is 2^N. The value of N is at least thousands in the case of an equity clearing service

and thousands for derivatives. This makes it impossible to apply consistently all the potentially

damaging scenarios consistently across all portfolios of CCPs.

13

3 Methodological Overview

3.1 Design and Components

14. This stress test exercise has the following components:

15. Credit Stress: Assess the sufficiency of CCPs’ resources to absorb losses under a combination

of market price shocks and member default

scenarios.

16. Concentration risk: Assess the impact of

liquidation costs derived from concentrated

positions.

17. Operational risk: Analyse operational

resilience with a focus on external

operational dependencies that are needed

by CCPs to provide their critical services.

18. Reverse Credit Stress: Increase the

number of defaulting entities and level of

market price shocks to identify at which point CCP resources are exhausted.

3.2 Overview of the Process

19. ESMA followed the same approach as during the previous exercises and key steps are further

discussed in the next paragraphs.

FIGURE 1: OVERVIEW OF THE PROCESS

20. ESMA issued on 7 June 2021, the framework for the fourth CCP Stress Test Exercise

2

,

presenting the scope, the methodology and the details of the project. A market stress scenario

for CCPs was built by the ESRB. During the data request, CCPs were provided with templates

as well as detailed instructions on how to calculate and report the required information, including

the calculation of P&L using market stress scenario, concentration metrics or operational risks

and events.

21. A Group of Experts for CCP Stress Testing (GEST) with representatives from all national

competent authorities for CCPs (NCAs) has been setup with the aim of contributing during the

different steps of the project. ESMA and the Bank of England also collaborated during the

different steps of the exercise involving UK Tier 2 CCPs. ESMA finally organised a workshop

with EACH that was consulted on the overall framework and more specifically on the data request

templates and the instructions.

2

https://www.esma.europa.eu/file/119720/download?token=PtWBdAbz

Definition of

the ST

Framework

Data

Request

Data

Validation

Data

Analysis

Reconciliati

on

Final

Publication

14

22. The data request was launched on 8 June 2021 and the CCPs were asked to deliver by 20

August 2021 the completed data templates to the NCAs for EU CCPs or both ESMA and the

Bank of England for UK CCPs.

23. The receipt of the files on 20 August 2021 was followed by the first data validation phase, where

NCAs and the Bank of England validated the submitted data against the instructions and

according to a common set of validation rules. ESMA also coded and offered to run a validation

algorithm to facilitate this task. The first data validation phase lasted until 6 October 2021. Each

Authority appointed one officer that was the single point of contact. Where needed, the appointed

officers were in contact with ESMA staff and fellow officers from other NCAs in order to facilitate

the consistent implementation of the framework across all CCPs. Moreover, in order to facilitate

the convergence of the validation practices across different authorities, ESMA staff compiled and

shared with the authorities a list of frequently asked questions, together with the respective

answers.

24. The first validation phase was concluded with the delivery of the data templates in early October

2021 to ESMA that acted as a second line of defence in terms of data quality assurance. ESMA

checked at least on a sample basis, that the reported data were consistent, reasonable and

conform to the requirements included in the instructions. It finally assessed the overall plausibility

of results, including a comparison between CCP results, to detect any outliers. The second

validation phase was scheduled to last a total of 7 weeks. While the first set of findings were

identified and addressed within this period, there were a significant number of issues that had to

be followed-up multiple times, while in some cases, the correction of issues or the progress of

the analysis raised new issues. Therefore, in practice the validation process continued in parallel

with the analysis of the data that started immediately after resolving the first issues.

25. When sufficient progress was made on data validation and analysis, the GEST set the sensitivity

parameters used in the concentration component in January 2022. ESMA calculated and

analysed the results of the stress test. The preliminary results of the stress test were first

discussed in March 2022 with the GEST (and the Bank of England for UK CCPs) and then at the

CCP Supervisory Committee in April 2022. As a final step, ESMA also reconciled in April 2022

the core stress results with each individual CCP in an effort to reconfirm their robustness. The

reconciliation exercise was focused on CCP specific data. Systemic data could not be reconciled

without revealing confidential information on other CCPs or clearing members. Again, sufficient

time and effort were devoted to the reconciliation process in line with the previous exercise, in

order to ensure that the participants had the time and information needed to confirm the

interpretation of the sourced data and the correctness of the results. To take into account the

constraints of Russia’s invasion of Ukraine, the launch of this reconciliation exercise was delayed

by a few weeks and when launched, two weeks were given to CCPs.

26. To a significant extent, the quality of the data and results still rely on the data submitted by the

CCPs and the primary checks performed by the NCAs as ESMA lacks direct access to the CCPs

and was not in a position to redo all the validation checks that have been performed by the NCAs.

3.3 Market Stress Scenarios

27. Similar to the previous stress test exercises, the ECB, in close collaboration with the ESRB and

ESMA, has developed the narrative and has calibrated the adverse scenario for the 4th stress

test exercise. The shocks were produced using the tool that is employed for the calibration of

financial shocks for adverse scenarios at the ECB and has been in use for the calibration of

financial shocks for the EBA, EIOPA and ESMA scenarios.

28. The scenario that was produced reflects the ESRB’s assessment of prevailing sources of

systemic risk for the EU financial system. It reflects the triggering of one or more of the sources

of systemic risk to the EU financial system identified by the ESRB. These risks could materialise

15

jointly and reinforce each other. The results were derived using a methodology that considers

the joint empirical distribution of historical observations of the risk factors deemed relevant to

CCPs to produce a coherent market risk scenario.

BOX 1: NARRATIVE OF THE SCENARIO AS PROVIDED BY ESRB

The translation of the sources of systemic risk identified by the ESRB into instantaneous shocks

following triggers initiated in various market segments is described below.

In this adverse scenario, ongoing concerns about the evolution of the COVID-19 pandemic and

its economic ramifications trigger adverse confidence effects worldwide and prolong the

unprecedented economic contraction. The worsening of economic prospects is reflected in a

global decline in risk-free rates (from what is already a historically low level). Countries’ fiscal

positions weaken, as do corporate sector balance sheets. Despite the low risk-free interest rates,

concerns about the sustainability of public and private debt resurface, leading to a sharp increase

in credit risk premia and a widening of credit spreads worldwide. Countries with large spreads

are particularly affected, whereas countries with few debt sustainability concerns experience

somewhat more muted increases in sovereign spreads. As a result, the dispersion of sovereign

bond yields across the EU increases. The reassessment of market participants’ expectations

amid declining corporate earnings results in abrupt and sizeable adjustments to financial asset

valuations. Widespread downsizing of firms and rating downgrades trigger large-scale fire sales

in the non-banking sector. Market volatility spikes, the correlation of asset returns increases, and

borrowing costs surge on the back of expectations that non-financial corporations will default.

Similarly, the global fallout in terms of economic activity and the sharp increase in non-financial

corporate bond yields weigh on global investment and global demand for raw materials, causing

an abrupt repricing of commodities. The risk of idiosyncratic failures by financial institutions

intensifies, reflecting the deterioration of the macro-financial environment, with potentially severe

consequences for the financial system as a whole.

The scenario has been obtained by choosing the mean response for each conditioned variable

in an adverse scenario where the triggering variables are stressed over a two or five day horizon

depending on the asset class. The sample chosen for the calibration spans the period from

January 2005 to December 2020.

29. The system-wide stress scenarios should not be bound to only replicate past historical scenarios,

but also use past observations in combination with a narrative that reflects the assessment of

prevailing sources of systemic risk for the EU financial system, including the two Tier 2 CCPs in

the UK, to produce shocks that model potential future market conditions.

30. When modelling the stress scenario, it is not possible to cover all possible movements of different

risk factors and their co-movements within and across asset classes. The scenario constitutes a

severe yet plausible scenario that could arise if a risk environment such as the one explained in

the narrative were to materialise.

31. Overall, it is a very difficult task to produce potential future scenarios for such a wide range of

financial variables covering all major asset classes, which are at the same time sufficiently

severe, internally consistent and plausible. The methodological tool used can combine a large

number of time series and has allowed for the calibration of a more granular scenario, covering

16

more than 800 risk factors. There is no single test that can ensure that all variables are jointly

sufficiently severe and plausible.

32. During the time of finalisation of the exercise, Russia’s invasion of Ukraine led to sharp and

extreme market movements. An analysis of the stress scenarios in the light of these market

moves is presented in Box 2.

BOX 2: THE MARKET STRESS SCENARIOS IN THE LIGHT OF THE RUSSIA’S INVASION OF UKRAINE

Russia’s invasion of Ukraine on the 24

th

of February led to turmoil in the global markets. However,

the severity of the movements was asymmetrical across asset classes with commodities being

the most impacted one.

An overview of the evolution of the market moves for benchmark products in the main asset

classes during the first three weeks of Russia’s invasion is presented in the following figure.

The energy derivatives were the most impacted: a sharp

increase in power and gas prices was observed on the day of

the invasion, which marked the maximum upward movement

over the considered period. Severe upward shocks for power

and gas derivatives were observed also in the following week,

together with a sharp increase in coal prices, while prices

significantly decreased the week after. Oil benchmark

products initially suffered from upward pressure as well, but

the shocks were less severe than in the case of power and gas

products. The role of Russia as the main EU supplier of crude

oil, natural gas and solid fossil fuels led to price increases in

energy products amid fears of reduction in Russian supplies.

The upward shocks on wheat prices, that mainly occurred during the first two weeks of the war,

were also expected because Russia and Ukraine are significant exporters of wheat.

It is worth mentioning that nickel contracts trading was suspended after having reached all-time

highs during the third week of the conflict. However, the CCPs involved in the current stress test

exercise were not directly affected.

More details on the evolution of the market moves for benchmark products during the first days

of the market turmoil are presented in the following figure. An arrow is shown on a date if the 2-

day move (ending on that date) was ‘high’

3

, with the colour and direction of the arrow indicating

the direction of the relevant move.

3

i.e. higher than 50% of the period maximum. Notice that 5-day move was considered for ‘CDS’ and ‘Swap (EUR)’.

17

FIGURE 2: EVOLUTION OF 2-DAY (5-DAY) MOVES FOR BENCHMARK PRODUCTS DURING

THE FIRST DAYS

After having analysed the experienced market movements for a number of benchmark products

across all asset classes, ESMA staff compared them with the shocks used under the baseline

common market stress scenario. For this purpose, ESMA staff used the maximum of 2-day

moves over the period for all benchmark products with the exception of the primarily OTC-traded

instruments (i.e. CDS and Swaps) for which the maximum of 5-day moves was used. This choice

was made to reflect the EMIR requirement in terms of the minimum number of days that the

CCPs need to consider when calculating the margin requirements for the different instruments

and to remain consistent with the methodology used to calibrate the scenario shocks. It should

also be noted that this analysis compares the shocks of the internally consistent stress scenario

with the maximum moves observed during an event that unfolded over multiple weeks. Not all

maximum moves happened on the same day, and these could not have hit a single CCP at the

same time. On the other hand, no second-round effects were considered, that could have

amplified the market moves in case a default would have happened. The figure below

summarises the results of the analysis by comparing the maximum and minimum experienced

market movements during the first days of the Russian invasion with the shocks of the stress

test scenario used for this 4

th

stress test exercise.

FIGURE 3: COMPARISON BETWEEN MOST SEVERE SHOCKS AND STRESS TEST SHOCKS

The comparison of the scenario shocks with the maximum market moves during the first days of

the war showed that the ESRB scenario is overall of greater or comparable severity for most

asset classes

4

, but of a lesser severity for some commodities, mainly in the EU energy space.

Moreover, different directions of shocks were observed in some cases, mostly in the commodities

asset class.

The divergences highlighted can be explained by the scenario design, that was modelled based

on the sources of systemic risk to the EU’s financial system that have been identified by the

4

Only a few outliers were observed.

18

ESRB. More specifically, it was built around ongoing concerns at the time of the design about

the evolution of the COVID-19 pandemic and its economic ramifications. ESRB stress test

scenarios typically model an economic downturn which is very different from shocks driven by

supply concerns experienced during the war. The stress test cannot be used to assess resilience

under specific historic events, but rather aims to assess the resilience of CCPs on a forward-

looking basis and under a specific potential future scenario. Finally, ESMA staff would like to

stress that the extreme market moves were really restricted to a few asset classes that account

for a fraction of the cleared assets overall but could potentially put significant stress to particular

CCPs.

In the context of risks linked to the clearing activity, a combination of clearing member defaults

and simultaneous extreme market moves are needed to put a CCP at risk. In principle, if clearing

members continue to post margin and meet their obligations, periods of extreme market volatility

in isolation will not pose a specific market risk to a CCP. Moreover, the clearing members are

required to collateralise on a daily basis their exposures and thus, the market risk is limited to

the potential price movement from the last collateralisation of a defaulter’s position until the time

needed to hedge or close-out the position. Therefore, in terms of market movements, and always

in combination with simultaneous defaults, it is generally the extreme short-term shocks

spanning over a period of a few days that may put a CCP at risk and not medium or long-term

moves.

The extreme market movements led to a sharp build-up of losses for many market participants,

combined with margin calls from CCPs issued to collateralise the increasing exposures, also on

an intraday basis. Despite the extreme pressure, the impact on CCPs in scope of this exercise

was overall contained: no clearing member defaults were experienced in CCPs (except a small

one) and no inherent weaknesses were found so far, although some CCPs are reviewing margin

models and lists of eligible collateral.

While being cautious about the uncertainties resulting from any attempt to conduct a comparison

of this kind, ESMA staff has analysed the impact of using the shocks that actually occurred during

the first days of the conflict as if they had materialised on the March date in 2021 used for the 4

th

stress test exercise. This analysis cannot lead to accurate and robust conclusions as different

positions and margins were available on the days of the conflict, instrument prices were different,

and a full revaluation of the positions was not performed. The tests that are run daily by CCPs

are better placed to assess the impact of historic market moves on corresponding historic

positions taking fully into account specificities of cleared products. The ESMA Stress Test aims

to assess the resiliency of CCPs to adverse market movements on a forward-looking basis. It

cannot be used to draw conclusions on the resilience of CCPs to specific historic events, as this

would require the exact replication of historic exposures and eventually any conclusions drawn

would be bound to a specific historic event of the past, with limited explanatory power for future

events. However, the analysis performed by ESMA confirmed that indeed the CCPs active in

commodities clearing would have been the most exposed, in particular the ones with relevant

positions in power and to a lesser extent gas products. Moreover, the CCPs with a more

diversified set of cleared products were not significantly affected primarily because of the lower

experienced volatility in prices of other commodity and financial products.

To conclude, the scenarios that were used to run the ESMA CCP stress test are overall of greater

or comparable severity to the overall actual market events in March/April with the commodity

asset class being the only relevant exception. The used scenario remains valid and informative

19

as it stresses all CCPs as opposed to a single historic event that would only stress specific asset

classes and specific CCPs. Nevertheless, this can be further analysed in the context of future

exercises to understand if and how one could tweak the design of this exercise and these

scenarios to also test for stresses to particular assets in a manner that remains internally

consistent.

However, one needs to be very careful when drawing conclusions, as the ESMA stress test is

subject to several limitations and assumptions. Moreover, the unpredictability of the evolution of

the conflict may lead to additional extreme moves and the CCPs need to be prepared to mitigate

the resulting risks, especially if exposed to energy or agricultural products.

3.4 Methodology – Credit Stress Test

3.4.1 Overview

33. The goal of the credit stress test is to assess the

sufficiency of CCPs’ resources to absorb losses under a

combination of market price shocks and member default

scenarios.

34. The CCPs were asked to report, for each one of their

members and for each date separately, the losses the

CCP would face if a member would default following the market shocks dictated by the common

Market Stress Scenario and the resources that would be available to cope with the default.

35. Since it is not feasible to define scenarios for each and every risk factor of all CCP-cleared

contracts, the scenarios were defined for a set of high-level risk factors across different asset

classes and the CCPs needed to translate the risk factor shocks into P&L for their cleared

products and the members’ portfolios. Therefore, the Group of Experts for CCP Stress Testing

(GEST) developed and provided together with the data request and the market stress scenario

a set of detailed instructions that explain how these are expected to be implemented. The

instructions were drafted to provide clarity and address material implementation challenges. The

instructions were shared with EACH

5

for consultation before the finalisation of the design. An

overview of the rules, with a focus on the improvements compared to the previous exercises, is

provided in paragraph 3.4.3.

36. After receiving the exposures of each CCP towards each clearing member, ESMA applied the

conditions and assumptions underlying the Member Default Scenarios to identify the groups of

clearing members that are assumed to be in default. The groups with the top exposures were

identified by aggregating the losses across clearing members and, where relevant across CCPs

(i.e. for the All-CCPs member default scenario). A detailed description of the member default

scenarios is provided in the following paragraph (3.4.2).

37. The results are reported in terms of losses compared to the resources that were available to

cope with the default and are subject to the assumptions and limitations as these are described

in paragraph 3.4.4.

5

European Association of CCP Clearing Houses

20

3.4.2 Member Default Scenarios

38. The member default scenarios define the conditions used to select the entities that are assumed

to be in default. In all cases, the defaulting members were selected for each stress date

individually and considering only the required margin (i.e. excluding excess). Central banks,

governments and CCPs are not included in the list of entities that may be assumed to be in

default for the purpose of this exercise. The following member default scenarios were employed:

Cover-2 groups per CCP: For each CCP, ESMA staff selects as defaulting entities the members

belonging to the top-2 (corporate) groups of clearing members for that particular CCP. The

defaulting clearing member groups are selected per CCP; hence they may be (and in most

cases are) different for each CCP and they are not considered to be in default in other CCPs.

When a group is assumed to be in default in one CCP, all clearing members that belong to the

identified corporate group are assumed to default for the same CCP. ESMA staff first looks for

pairs of groups that lead to the highest aggregate (EUR) loss beyond required margin collateral

of the defaulter and beyond the Default-Fund-level prefunded mutualised resources, including

the Default Fund, the “Skin-in-the-game” and other prefunded Default-Fund-level resources.

Hence, ESMA staff first looks for pairs of groups that could together lead to a depletion of the

prefunded resources. If such pairs of groups are not to be found (i.e. there is no shortfall of

prefunded resources following the default of two groups), ESMA staff selects the two groups

that would lead to the highest consumption of resources, measured by the aggregate (EUR)

loss beyond Required Margin. The consumption can also be measured on a relative basis (i.e.

% of resources consumed). This may lead to different results for CCPs that have more than one

default funds. The selection of defaulting entities on the basis of the relative (%) consumption

could focus on a smaller default fund that may be closer to creating a breach, instead of

selecting pairs of groups that would cause larger (in absolute terms) losses at a larger default

fund or even multiple default funds. Hence, while the core selection is done on the basis of the

absolute (EUR) consumption, we also explore cases where there may be pairs of defaulting

groups that would create a higher % consumption at such default funds. This impact is

discussed when presenting the results as it may highlight a higher sensitivity at a smaller default

fund.

39. All CCPs Cover-2 groups: Across all CCPs (full scope), ESMA staff identifies the two clearing

member groups with the highest aggregate exposure under a particular market stress scenario.

All clearing members that belong to an identified corporate group are assumed to default across

all CCPs. Under this scenario, there may be CCPs with no clearing members defaulting, if none

of the identified defaulters is a member at these particular CCPs. This scenario aims to give an

aggregate view of the impact of the simultaneous default of the same two groups of clearing

members at all CCPs. With regards to the exact condition used to select the clearing member

groups, the first choice would be to select the top-2 groups that would lead to the highest

aggregate shortfall of prefunded resources across all CCPs. However, the results did not indicate

such cases. ESMA staff is therefore reporting the results after selecting the groups that lead to

the highest aggregate (EUR) loss beyond Required Margin across all CCPs.

3.4.3 Calculation of Credit Stress Exposures

3.4.3.1 Stress Dates and modelling of the Default

40. The credit stress test was run for two reference dates, i.e. Friday, 19 March 2021 and

Wednesday, 21 April 2021. For the first date (March), the default was modelled as a weekend

21

default, similar to previous exercises. For the second date (April), the default event was modelled

as an intraday default and the CCPs were asked to report exposures and collateral as of a

specific time window on this date.

41. For the March date (weekend default), all payments/obligations due on Friday prior to the default

were assumed to be met in full. After the default (which occurs during the weekend), no payments

were exchanged between the CCP and the defaulting member. Trading access was revoked in

the weekend, so that no position changes were accepted after the last novation cycle of Friday.

The positions therefore reflected the positions as of Friday end-of-day, including all transactions

that were accepted for novation during Friday. All price movements were supposed to be

happening instantaneously at the time the defaults are announced.

42. For the April date (intraday default), the assumption was that the defaulting clearing members

had met all payments/obligations due before a cut-off time, excluding the settlement of any

securities transactions that were to be settled on this date. After this time, no payments would

have been exchanged between the CCP and the defaulting member. The exposures would have

included any positions assumed by the member as a result of trading/novation during this date

up to the cut-off time and any securities transactions that were due to be settled on or after this

date

6

. The collateral included any collateral required and collected up to this cut-off time on

21/4/2021

7

. The underlying assumption was that the defaulting members met all payments before

the start of the day and were allowed to trade normally until a specific time during the day. The

members would have then stopped honouring any obligations after this time. The CCP would

have stopped accepting new transactions from these members after this time and would have

declared them in default later the same day. Finally, the CCP would have launched its default

management procedures that would have allowed it to start the liquidation of the positions on the

morning of the next day.

43. The intraday member default scenario aimed to test the intraday risk management procedures

of the CCPs, including margining and settlement procedures, considering that clearing members

may have increased their exposures during the day (day trading). This member default scenario

explored for the first time the consequences of the CCP having to face the default of members

carrying these increased positions, while having available only the collateral that was required

and collected up to this time. The implementation of such a supervisory stress test scenario

posed significant implementation challenges. Increased effort was required by all

participants/stakeholders, including CCPs, NCAs and ESMA. As with all assumptions

implemented for the first time, some uncertainties remained on the modelling of the relevant

assumptions. Hence, results should be read with caution. Moreover, in order to manage the

required effort, the cut-off time was not exactly the same for all CCPs and services but was set

by each CCP according to the schedule of its margin calls subject to conditions. For this purpose,

ESMA staff defined a common target time (14:00 CET) and each CCP was asked to identify the

cut-off time to be used for the exercise as the cut-off time of its scheduled intraday margin calls

that was (a) closer to the common target time and (b) in all cases after 12:45 CET and before

15:15 CET. The cut-off time selected reflected the time that was used to take a snapshot of the

positions and collateral in order to execute the intraday margin call and not the time of executing

the margin call or the time reflecting the deadline given to members to provide the collateral.

Moreover, the CCPs were not asked to report the data at account level for this date (21/4/2021)

but only at clearing member level, respecting of course any applicable segregation rules. This

comes at the cost of the stress test results for this date not being able to reflect the additional

stress assumptions (e.g. impact from concentration and wrong-way risk).

6

The assumption is that the defaulting clearing member would not have settled any securities transactions on this date.

7

The CCPs were allowed to adjust the collateral for cases where additional margin would have been required, called and collected

by the CCP according to existing rules and procedures as a direct result of the assumption that no securities transactions were

settled by the defaulting member on 21/4/2021.

22

44. For both dates, it was assumed that no porting of clients occurred, hence clients’ portfolios were

covered along with the proprietary positions of the defaulted clearing members and any losses

resulting from clients’ positions were included in the reported results. In the context of the credit

stress test exercise, this is a conservative assumption as the margin allocated to client accounts

can anyway not be used to cover losses of other client or proprietary accounts of the clearing

member.

3.4.3.2 Calculation of stress P&L from closing the positions at stressed market prices

45. All positions were assumed to be closed, for each individual account, at the prices implied by the

provided market shocks which were modelled as instantaneous shocks. No further price moves

were assumed to occur.

46. The CCPs were instructed on how to identify or adjust when needed the shocks to be applied to

their own products using the provided risk factor shocks and how to calculate the P&L stemming

from those shocks. Specific rules were provided per product type or asset class to set how the

shocks were to be adjusted, e.g. for similar underlyings or different maturities. For a few assets

(e.g. dividend / inflation derivatives) for which no relevant risk factor has been provided, the

shocks were to be modelled by the CCP using the stress scenarios used for their default fund

sizing under the supervision of the NCA.

47. As a general rule, CCPs needed to operate a full repricing on the basis of the risk factor shocks

and using the pricing models they normally use for the daily valuations of positions. Wherever

they are available, the CCP needed to use actual market prices for the base price, i.e. the price

to which the shocks are to be applied. Model-implied prices were only to be accepted where

market prices are not available or not reliable.

48. Beyond the exposures using the common market shocks, the CCPs were asked to report the

exposures as well after applying a number of multipliers on the shocks (i.e. x0.7, x 1.2, x1.5 and

x2.0). Each value of the multiplier corresponds to a Reverse Stress Scenario and all shocks are

to be simultaneously scaled. For each value of the multiplier, the CCPs ran a full repricing of the

portfolios, as opposed to applying a multiplier to the result (P&L) of the scenario.

49. In the determination of losses, no hedging strategy was allowed to be acknowledged or modelled.

In other words, the CCP was assumed to not have performed any risk mitigating transactions in

order to limit the risk of the defaulting member’s positions, but it has liquidated all the defaulting

member’s positions at the stressed price and has not introduced additional transactions such as

an index trade to capture first order risk.

50. The reported losses reflected the full amount that the CCP would have collected / paid in case

of the default, i.e. not only the profit or loss due to the stress shocks (stress P&L), but also any

accumulated profit or loss that has not been settled until the default and would have to be settled

when closing the position (non-stress P&L). This includes for example a loss due to actual market

movements on Friday that should have been settled on Monday when the member would have

been assumed to be in default.

3.4.3.3 Incorporation of impact from concentration and wrong-way risk

51. The methodology of the credit stress test component has now evolved to incorporate the impact

from additional risk sources. In particular, the results for one of the dates (March) were also

calculated to reflect the impact from concentrated positions and from wrong-way risk resulting

from cleared positions.

23

52. The base methodology, parameters and assumptions used to calculate the P&L due to

concentration and wrong-way risk are described in detail in 3.5 and 3.4.3.4 respectively.

However, one of the challenges of including this type of risks in a supervisory stress test exercise

is that the impact is dependent on the selection of defaulting clearing members. For example, a

clearing member may have positions in instruments issued by another clearing member. The

additional loss from wrong-way risk will only impact the CCP if the two members are assumed to

default together. As a further example, the default of two clearing members that hold large same-

direction positions on the same instrument may exacerbate the impact from concentration risk

as the positions would have to be liquidated together. Hence, the impact can only be calculated

in relation to a specific pair of defaulting members, while at the same time the selection of

defaulters needs to consider this additional impact.

53. For ESMA to be able to seamlessly incorporate the additional impact from concentration and

wrong-way risk, the CCPs were asked to report for one of the stress dates (March) the required

data not only at clearing member level but also at account level. In particular, the stress P&L and

corresponding collateral were reported at clearing member and account level and the

concentrated positions only at an account level. The instructions and reporting templates were

redesigned to allow ESMA to have the information required to aggregate results from account

level to clearing member level, while incorporating the effects from these additional stress

assumptions (concentration and wrong-way risk). Beyond allowing the assessment of the impact

from concentration and wrong-way risk, the more granular reports enhanced the visibility in

calculations and together with the detailed instructions helped to further strengthen the data

validation process and the credibility of the exercise.

54. The CCPs were asked to report the data for the accounts that were active (i.e. had open positions

or provided collateral) on this date, specifying also the relationships between different accounts

and priorities in loss absorption reflecting their segregation rules in case of default. CCPs have

in general very diverse account structures that go beyond the minimum set of accounts required

by EMIR. They have different accounts that serve different purposes (e.g. position accounts,

margin accounts, collateral accounts). For the purpose of this exercise, an account was defined

as the level at which collateral can be fully offset against P&L from all positions recorded in the

same account. Hence, CCPs were instructed to report at a level that would allow ESMA to

correctly aggregate all fields from account to clearing member level by implementing the reported

relationships / segregation rules.

55. Hence, for one of the dates (March) ESMA was able to run the stress test with and without these

additional stress assumptions. In fact, three sets of results are presented:

a) Credit stress test results without concentration and wrong-way risk impact

8

.

b) Credit stress test results with concentration impact (but without wrong-way risk impact).

c) Credit stress test results with concentration and wrong-way risk impact.

56. For the second date (April), the data was reported by CCPs only at clearing member level

9

in

order to manage the overall effort. Hence, one cannot reflect the impact from these additional

stress assumptions for the April date or for the reverse stress test scenarios.

8

The stress results without the concentration and wrong-way risk could be calculated both by starting from the account-level

reports or by starting from the clearing member reports as CCPs reported both for the March date. This was used to confirm the

correctness of the aggregation algorithm.

9

In all cases, even where results were reported by CCPs at clearing member level, the reported data reflected all applicable

segregation rules, e.g. that client’s resources cannot be used to cover losses from proprietary positions.

24

57. The following figure provides an overview of the different results obtained.

FIGURE 4: OVERVIEW OF CREDIT STRESS TEST RUNS

58. As explained above, the concentration and wrong-way risk impact stemming from one defaulting

clearing member group may vary depending on the selection of the second defaulting group.

Therefore, results would ideally need to be computed for all possible combinations of pairs of

clearing member groups before selecting the top defaulting pair for each scenario. However, the

number of scenarios, CCPs and Clearing Member Groups implies that there are too many

combinations, that could not be exhaustively computed in a timely manner. In order to address

this issue while reasonably trying to make sure that all relevant pairs of clearing member groups

are analysed, ESMA staff implemented the following heuristic two-step approach. This was

applied when calculating the results with concentration and wrong-way risk.

• First select a subset of clearing member groups to be considered for Cover- 2.

a. Calculate results per single clearing member group taking into account stress

scenario losses and concentration impact and select the top-10 clearing member

groups impacting mutualised prefunded resources.

b. Select the top-10 clearing member groups in terms of potential (aggregate across

all members) wrong-way risk impact.

c. Combine both lists and create a combined list of clearing member groups that are

relevant from a concentration and/or wrong-way risk perspective.

• Then consider all possible pairs between the clearing member groups

10

belonging in the

relevant shortlist and compute results for each pair to identify the top pair based on the

member default scenarios (3.4.2)

11

.

59. It is acknowledged that this approach has some limitations. Not all possible pairs of clearing

member groups are tested. However, it would be extremely difficult, resource- and time-

consuming to calculate the combined concentration impact for each possible pair needed to

exhaustively test all possible cases. Nevertheless, in order to provide some level of comfort that

10

i.e. up to 20 clearing member groups per scenario leading to 190 pairs of groups to compute per scenario

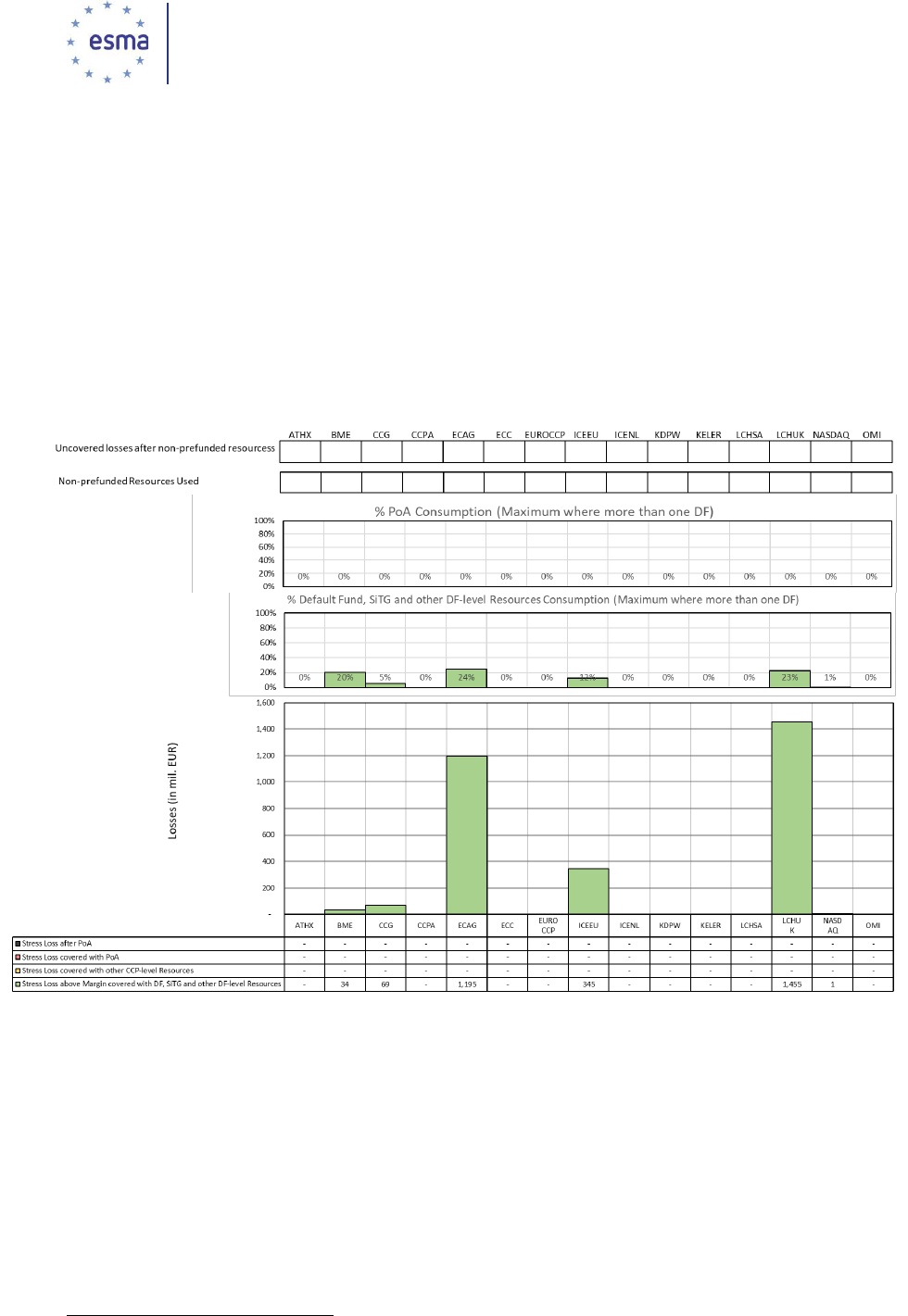

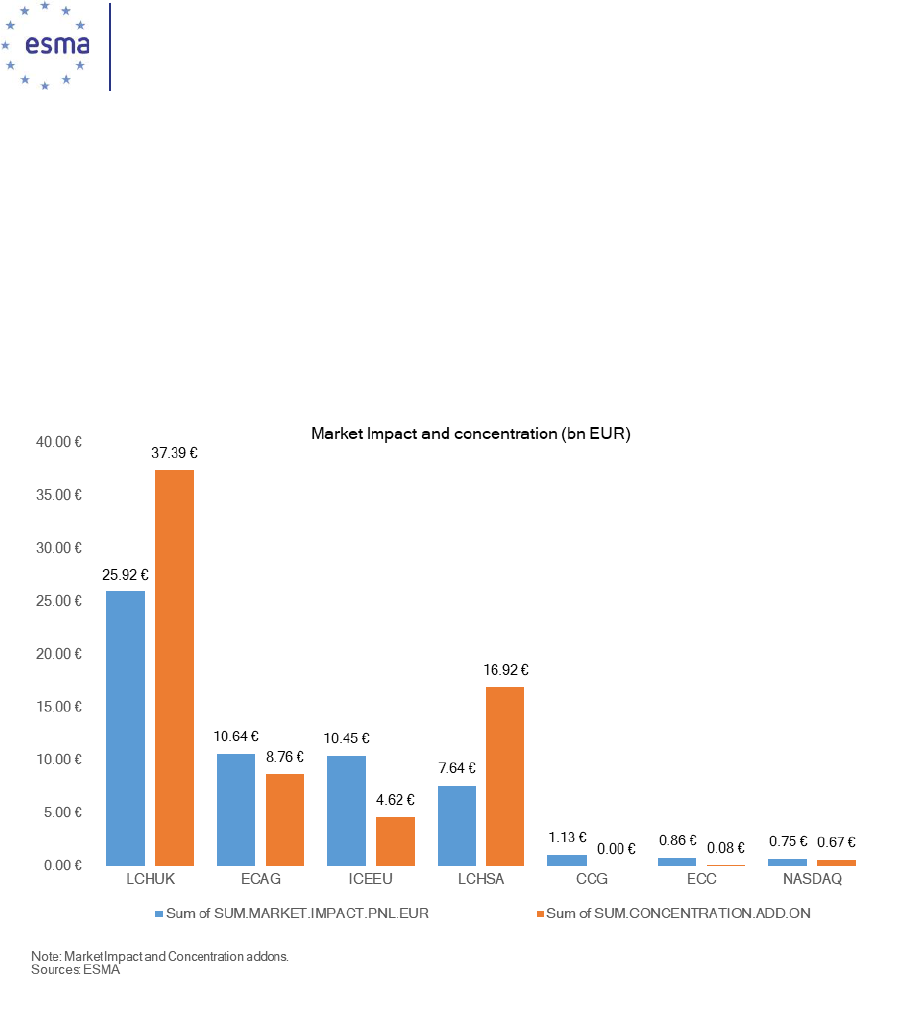

11