You may use MyTax.DC.gov to file and pay online for Form D-30 (unincorporated business franchise tax).

Any payment that exceeds $5,000 per period must be paid electronically.

Make tax payments electronically with ACH Debit, ACH Credit and Credit Card. If electronic payments

are made using ACH Credit, please visit MyTax.DC.gov for instructions in the Electronic Funds Transfer

(EFT) guide.

When making a payment with your D-30 please use the voucher (D-30P) that is provided.

11/202

2023

0

District of Columbia (DC)

Unincorporated Business Franchise

Tax Forms and Instructions

Simpler. Faster. Safer.

What’s New:

• Filing Deadline - For Tax Year 2023, the filing deadline will be April 15, 2024. The filing deadline

for fiscal year filers is the 15th day of the 4th month following the close of your fiscal year.

• International ACH Transaction (IAT)

The District does not support International ACH Transactions ("IAT") for payments or direct deposit

refunds that are remitted to or received from a financial institution outside the territorial jurisdiction

of the United States. (The territorial jurisdiction of the United States includes the District of

Columbia, US territories, US military bases, and US embassies in foreign countries.) A foreign

address is not an indicator of whether the payment or refund is an IAT. Please refer to the IAT

section in the District of Columbia's Electronic Funds Transfer (EFT) Payment Guide for more

information.

Reminders:

• General Instructions - Failure to use the business or trade name that you used when registering

with the DC Office of Tax and Revenue will cause processing delays with

returns and/or payments.

• Modernized e-File (MeF) - Unincorporated business franchise taxpayers that have a

Federal

Employer Identification Number (FEIN) are encouraged to e-file the D-30

Unincorporated

Business Franchise Tax Return through MeF.

• MyTax.DC.gov - Offers the ability to file online the D-30/Schedules to registered taxpayers

provided you are not filing a Combined Report or short-year return.

• D-30N - Affidavit of Gross Income In Lieu of D-30 Unincorporated Business Franchise Tax

Return - For unincorporated businesses not required to file Form D-30 because gross income is

$12,000 or less. The D-30N can be filed online at MyTax.DC.gov.

• **IMPORTANT NOTE REGARDING LINE 33** - If you are claiming the Line 33 Salary

Exemption, the number of days in DC must be entered on Line 33a. EXCEPT FOR A

COMBINED REPORT FILED BY A DESIGNATED AGENT, FAILURE TO COMPLETE LINE

33a WILL RESULT IN DENIAL OF THE SALARY EXEMPTION.

• Small Retailer Property Tax Relief Credit - A refundable credit is available for businesses that

have less than $2.5 million in federal gross receipts or sales. See Schedule SR and instructions

included in this booklet.

• District of Columbia Opportunity Zone Tax Benefits are available to an entity investing in a DC

Qualified Opportunity Fund. See instructions, page 16.

• District of Columbia Low-Income Housing Tax Credit (LIHTC) Instruction Book - Taxpayers

receiving or transferring DC LIHTC must be registered online at MyTax.DC.gov. For more

information, see the Instructions for Low-Income Housing Tax Credit Allocation and

Certification on MyTax.DC.gov. Note: Forms D-8609A and D-8609DS have been discontinued.

Contents

4

5

5

6

6

6

7

9

9

17

23

0 27

29

31

33

49

51

53

55

57

59

2220

0

10

02000201

0201

1

Back Cover

0

0

2020

0

00

25

4

Instructions for the D-30

40

41

Multiple businesses

Taxicab/Limo Drivers

/

0

0

Minimum Tax

20 1

10001

NOTE:

100

DC gross receipts for minimum tax due and only for minimum tax due is computed as follows:

1

Amount from numerator of DC sales apportionment

factor from Schedule F, Line 1, Column 2 of D-20 or

D-30. Financial institutions must use amount on

Schedule F, Line 2, Column 2 of D-20.

1 $

2

Add the adjusted basis of any property sold for

which the gain is included in Line 1.

2 $

3

Add Non-Business income allocated to DC reported

per D-20, Line 33 or D-30, Line 30.

3 $

4

Total DC Gross Receipts

(Add Lines 1, 2 and 3)

4 $

Minimum Tax

The minimum tax is $250.00 if the amount on Line 4 above is $1,000,000 or less.

The minimum tax is $1,000.00 if the amount on Line 4 above is greater than $1,000,000.

Minimum Tax Liability Gross Receipts (MTLGR) Worksheet

Who must file Form D-30?

0

12000

0

even

when such sale or disposition results in the termination of an

unincorporated business.

12000

0

Who is not required to file Form D-30?

11

12000

020

2

10

2

0

40

41

00

12000/

20

Which other DC forms or schedules may unincorporated

businesses need to file?

00

12000

0

0

20

0

2241

10

10

0

1000

0

000

2220

10

2220

22200

100

100

1 2010

1 2010

41002

1

1 1 2 2

1 41 42

2 2

1 1

When are your taxes due?

1

Taxable year

10

NOTE:

200

110

Filing your return

By Modernized e-File (MeF)

/

1

2

MyTax.DC.gov

0

Substitute forms

By mail

0

0

00

1

20001

1

20001

Send in your original DC return with any schedules, not a

copy. Fold your return once. Be sure to keep a copy for your

records.

Payment Options

2

202 0

0

00

1

20001

Dishonored Payments

Penalties and interest

2

20

10

10

0

44212

Special circumstances

1

1

0 0 100

1

200

12002

20244200

Exclusion of Certain Grants From District Gross Income

41002

1

12020

10

20402

21

200

11

1211

1011

1241

12041

1204

1204

1204

1204

1241

1

2021

1204

1204

1204

1204

1204

1204

1204

•

141

141022

1204

1 202

0

10 0

0

10

Getting started

0

100001001

100041000

Taxpayer Identification Number(s) (TIN)

4

/

1001

002

1002121

Preparer Tax Identification Number (PTIN)

Franchise tax rate and minimum tax

2

20

10000001000

Incomplete forms will delay processing

0

Help us identify your forms and attachments

1 1 2 2

1 41 42

0

0

1

Filling out the form

•

✓

✓

•

•

• •

•

204

Do not print outside the boxes.

00

Personal Information

1122

14142

2

2

Assembling your D-30 return

202

2020

202 242

1101 4 2

20024

0

0

Third Party Designee

202

40

/

1202

Signature and verification

/

Email address

202

Explanation of terms

Business income

Commercial domicile

Compensation

Non-business income

Transportation company

Sales

Taxable in another state

Specific Instructions

Negative amounts

Allocation and apportionment of income

100

40

Note: When using the D-30 to file a combined report, do not use

or fill out Schedule F on page 4 to derive the apportionment

factor for the combined group. Leave Schedule F blank. Use

Combined Reporting Schedule 2A instead. Likewise, when

each individual member derives its individual apportionment

factor, do not use Schedule F. Individual members should

use Combined Reporting Schedule 2B instead to derive their

apportionment factor.

Non-business income allocation

/

Gross Income

Note:

Amended returns

0

10

0

10

1

20001

1

20001

Final return

0

D-30, page 1, line-by-line

Line 1 Gross receipts, minus returns and allowances

Line 2 Cost of goods sold and/or operations

0

21

12

Line 3 Gross profit

12

Line 4 Dividends

2

10

NOTE:

20

20

Line 5 Interest

2

Line 6 Gross rental income

NOTE:100

1

2000

0

Line 7 Gross royalties

4 1040

Line 8(a) Net capital gain (loss)

1120

121

NOTE:100

/

Line 8(b) Ordinary gain (loss)

4

4

4

Line 9 Capital gains deferred on federal return due to

investment in a federal Qualified Opportunity Fund

Line 10 Other income

2

10

Line 11 Total gross income

10

Deductions

Line 12 Salaries and wages

/

Line 13 Repairs

/

Line 14 Bad debts

Line 15 (a) Royalty payments

4100

Line 15 (b) Minus nondeductible payments to related entities

Payments to related parties

11

4

Line 16 Rent

11

Line 17 Taxes

0

Line 18 (a) Interest expense

1

4100

Line 18 (b) Minus nondeductible payments to related entities

Line 19 Contributions and/or gifts

0/

12

101

Line 20 Amortization

42

42

42420

Line 21 Depreciation

42

0

42

0

*NOTE:100

12000

0

D-30 page 2, line-by-line

_______________________

Line 22 Capital gains deferred due to DC approved investment

in a DC Qualified Opportunity Fund

22

0

Line 23 Other allowable deductions

40

Line 24 Total deductions

12224

Line 25 Net income

24112

Line 26(a), (b) and (c)

22

2

2

Line 27 Net Income from trade or business subject to apportion-

ment

222

Line 28 DC apportionment factor

240

2

Line 29 Net income from trade or business apportioned to DC

2

22

Line 30 Other Income/deductions attributable to DC

2/

Note:

/

4

10011/

41004

00

11

2

Line 31 Total District net income (loss)

201

Line 32 Salar

y for owner(s)/member(s) services

40

12

01

Line 33 Exemption

000

2

000

000

0

330

33

Line 34 Total taxable income before apportioned NOL

deduction

21

4

Line 35 Apportioned NOL deduction

2000

2010

Line 36 Total DC taxable income

4

Line 37 Tax

02

Line 38 Minus nonrefundable credits

20 101

2010

Note: The credits cannot be shared among combined group

members.

Line 39 Total DC gross receipts

4

Line 40 Net tax

40

1 140

2020

2 140

10001000

Line 41 Payments and refundable credits

0

22

Line 42

202

202

Line 43 Total payments and credits. 41

4142

Line 44 Estimated tax interest

2220

0

442220

Line 45 Total Amount Due

44044

44044

Line 46 Overpayment

44044

40444

Line 47 Amount to be applied to 2024 estimated franchise tax

Line 48 Amount to be refunded

44

4

Other Form D-30 schedules

Schedule F – DC apportionment factor

100

100

Sales factor

Transportation companies

1

Tangible personal property sales

Except for transportation companies – non-tangible personal

property sales are considered as occurring in DC if the income-

producing activity or service is performed:

– in DC; or

– the proportion of the income-producing activity or

service performed in DC is greater than that performed

in any other jurisdiction.

General

If using the income allocation and apportionment rules results in a

tax that does not fairly represent the tax liability arising from your

trade or business in DC or from non-business sources in DC, you may

petition for, or OTR may require, if reasonable:

• a separate accounting, unless the entity is conducting a

unitary business;

• exclusion of one or more of the factors;

• inclusion of one or more additional factors that fairly reflect the

extent of your trade or business in DC; or

• use of any other method to effect a fair allocation and

apportionment of your income.

New Markets Tax Credit

DC taxable income does not include the gross income of a qualified

community development entity as defined in IRC section 45D(c)(1)

that has received an allocation or suballocation of new markets tax

credits from the federal government under IRC section 45D(f). This

exclusion applies to the extent the gross income is derived from one

or more qualified low-income community investments as defined in

IRC section 45D(d)(1). Complete Schedule G and enter on Line 23,

Other allowable deductions.

Schedule G – Other allowable deductions

If you are the recipient of royalty, interest or other intangible payments

from a related entity that has not deducted the payment amounts

on their return and you are filing a return and paying tax on these

payments in the District, enter, on Schedule G, the amount of income

you are reporting on this return to the extent it was included: on Lines

15(b) and 18(b) of the related entity’s District of Columbia D-30

tax return; on Lines 18(b) and 23(b) of the related entity’s District

of Columbia D-20 tax return; or on a related entity’s return filed in

another state where a similar adjustment was made.

Sc

hedule H – Income not reported (claimed as nontaxable) – (page

4 of Form D-30)

List all income of the unincorporated business that you consider

not subject to the DC unincorporated business franchise tax. State

why the income should be considered nontaxable.

Schedule I – Balance sheets (page 5 of Form D-30)

Submit balance sheets for the start and end of the tax year. Conform

them to the unincorporated business’ books and records and your

federal return. Attach to your D-30 an explanation of any variation.

Schedule J – Distribution and reconciliation of net income

(or loss) (page 5 of Form D-30)

Under provisions of DC Code §47-1805.01(a), you must enter the

TIN of each of the owners. The TIN is necessary for the proper

identification of an owner’s tax account with DC and will be used

only for tax administration purposes. Any additional names, TINs,

etc. may be listed on an attachment filed with the return.

Note: If you filed a federal Schedule M-3, net income (loss)

reconciliation with total assets of $10M or more, attach a copy of

it with your DC return.

Schedule K - Disregarded Entities (page 4 of Form D-30)

Use this schedule to report the name and TIN for any single

member limited liability company that is treated as a disregarded

entity for District franchise tax purposes, whose income is included

in the income reported on this return, and which is doing business

in the District.

Supplemental information (page 6 of Form D-30)

Please provide all the information requested in this schedule.

Combined Group Members’ Schedule

If filing a Combined Report, it is necessary to identify each

member the DC Combined Group subject to the franchise tax.

Complete and submit the Combined Group Member’s Schedule.

Fill in Columns A through F for all members of the group and

attach a copy of Federal Forms 851, 5471 and 8975 (including

Schedule A). File this schedule each year that a DC Combined

Report is filed.

Worldwide Combined Reporting Election Form

If the Worldwide Combined Reporting Election Form is completed

and submitted, ensure the “Fill in if Worldwide” oval is shaded.

Submit this form with the initial year of election.

Schedule UB, Business credits

Use this schedule to claim: the Economic Development Zone Incentives

Credits (see instructions); the Organ and Bone Marrow donor credit (see

below); the Job Growth Incentive Act credit (see below); the Alternative Fuel

Infrastructure Installation Credit; the Alternative Fuel Vehicle

Conversion Credit (see below); the Small Retailer Property Tax Relief

Credit (see Schedule SR and instructions); and the DC Low-Income

Housing Tax Credit (see Form D-8609 and instructions).

The Organ and Bone Marrow Donor Act of 2006 provides a credit

to an employer who allows up to 30 days paid leave to an

employee who donates an organ and up to 7 days paid leave

for donating bone marrow.

This is a non-refundable credit equal to 25% of the regular salary

paid to the donor-employee during the leave period. This credit

may not be used to reduce the $250 or $1,000 minimum tax. An

14

employer claiming this credit may not also deduct the salary paid

the donor-employee for the same leave period. This credit is not

available if the employee is eligible for leave under the Family and

Medical Leave Act of 1993.

The 2011 Budget Support Act of 2010 authorized funds for the

Job Growth Incentive Act tax credits. The credit must be approved

by the Mayor in advance of starting the project. The process for

applying for the credit is found in DC Official Code §47-1807.54.

The approval will provide the amount of the allowable credit and the

periods for which the credit can be claimed if the employer continues

to qualify. The allowable approved amount of the credit can be

claimed on Schedule UB, Business Credits, Line 4 for D-20 filers or

Line 15 for D-30 filers.

In order to apply for the credit, the employer must be planning a

project that:

• Will bring a net job growth to DC of at least 10 new jobs with

an average yearly wage of at least 120% of the average yearly

wage of DC residents;

• Will increase income tax and payroll revenue for the DC;

• Will result in a retention of any new positions for at least one

year; and

• Would not have occurred but for the job growth tax credit.

2014

12022

1

2

4101041011

0

10000

2

0

0

1/2

200

12

4100

1201 2

2

00010

000

1

241

41014 41014

1

2

12

1 00

0

10

2

0

1

10

41002

410012

Economic Development Zone Incentives Credit Worksheet

00

100

3

0

20

20

40000

0

1

201

2020

1

2 10

1

202

1202

101204

1

2

44

1

0

22 0

0

410104

410020

2022

2023

0/202

33

.

.

.

.

.

.

.

.

.

.

10

.

.

.

.

.

.

.

.

.

.

.

.

D-30 FORM, PAGE 2

2

2

3

2

32

33 33

34

3 33

3

3 income. 3 3

3 3

3

3

42

43

44

4

3

4 3

4

4

ENTER DOLLAR AMOUNTS ONLY

TAXABLE INCOME

TAX, PAYMENTS AND CREDITS

2 $

.00

2 $

.00

2 $

.00

2

2 $

.00

$

.00

3 $

.00

33 $

.00

34

.

3

.

3

$

.00

2 $

.00

$

.00

.

3

.

3

.

.

3

.

.

4 $

.00

43 $

.00

4 $

.00

.

$ .00

$ .00

$ .00

4 $

.00

$

.00

$ .00

25 $ .00

22 $ .00

23

24 3

2

2

24

.

23 .

33

0/202

202

If this is an amended 202

2024

Schedule A - COST OF GOODS SOLD

1.

2.

3.

.4

.5

6.

7.

8. Cost of goods sold (Line 6 minus Line 7). Enter here and on D-30, Line 2.

Method of inventory valuation used

__________________________________________________________________

Schedule B - CONTRIBUTIONS AND/OR GIFTS

Schedule C - TAXES 1

TOTAL

Schedule E - INTEREST EXPENSE

D-30 FORM, PAGE 3

3

07/2021

D-30 FORM, PAGE 2

2

2

3

2

32

33 33

34

3 33

3

3 income. 3 3

3 3

3

3

42

43

44

4

3

4 3

4

4

ENTER DOLLAR AMOUNTS ONLY

TAXABLE INCOME

TAX, PAYMENTS AND CREDITS

2 $

.00

2 $

.00

2 $

.00

2

2 $

.00

$

.00

3 $

.00

33 $

.00

34

.

3

.

3

$

.00

2 $

.00

$

.00

.

3

.

3

.

.

3

.

.

4 $

.00

43 $

.00

4 $

.00

.

$ .00

$ .00

$ .00

4 $

.00

$

.00

$ .00

25 $ .00

22 $ .00

23

24 3

2

2

24

.

23 .

3

07/2021

2021

If this is an amended 2021

2022

Schedule A - COST OF GOODS SOLD

1.

2.

3.

.4

.5

6.

7.

8. Cost of goods sold (Line 6 minus Line 7). Enter here and on D-30, Line 2.

Method of inventory valuation used

__________________________________________________________________

Schedule B - CONTRIBUTIONS AND/OR GIFTS

Schedule C - TAXES 1

TOTAL

Schedule E - INTEREST EXPENSE

D-30 FORM, PAGE 3

333

0/202

Schedule F - DC apportionment factor (See instructions) Note: If this is a combined report do not use Schedule F to derive the apportionment factor for the group.

Leave Schedule F blank. Use Combined Reporting Schedule 2A, Line 9 instead.

Column 1 TOTAL Column 2 in DC DC Apportionment

Factor

.

.00

.00

Schedule G - Other allowable deductions

TOTAL 2

Schedule H - Income not reported

SALES FACTOR:

DC APPORTIONMENT FACTOR:

D-30 FORM, PAGE 4

Schedule - Disregarded Entities

PLEASE

SIGN

HERE

PAID

PREPARER

ONLY

and enter the name and phone number of that person. See instructions.To authorize another person to discuss this return with OTR, fill in here

0/202

33

D-30 FORM, PAGE 5

Schedule I - BALANCE SHEETS

LIABILITIES AND CAPITAL

ASSETS

2

Schedule J - DISTRIBUTION AND RECONCILIATION OF NET INCOME (OR LOSS)

Col. 4 - See Instructions.

Col. 5 - See Instructions.

Col. 6 - Any loss amount from Line 31 of D-30.

Col. 7 - Enter the difference between Line 25 and Line 31 of D-30.

07/2021

3

Schedule F - DC apportionment factor (See instructions) Note: If this is a combined report do not use Schedule F to derive the apportionment factor for the group.

Leave Schedule F blank. Use Combined Reporting Schedule 2A, Line 9 instead.

Column 1 TOTAL Column 2 in DC DC Apportionment

Factor

.

.00

.00

Schedule G - Other allowable deductions

TOTAL 2

Schedule H - Income not reported

SALES FACTOR:

DC APPORTIONMENT FACTOR:

D-30 FORM, PAGE 4

Schedule - Disregarded Entities

PLEASE

SIGN

HERE

PAID

PREPARER

ONLY

and enter the name and phone number of that person. See instructions.To authorize another person to discuss this return with OTR, fill in here

07/2021

3

D-30 FORM, PAGE 5

Schedule I - BALANCE SHEETS

LIABILITIES AND CAPITAL

ASSETS

2

Schedule J - DISTRIBUTION AND RECONCILIATION OF NET INCOME (OR LOSS)

Col. 4 - See Instructions.

Col. 5 - See Instructions.

Col. 6 - Any loss amount from Line 31 of D-30.

Col. 7 - Enter the difference between Line 25 and Line 31 of D-30.

0/202

33

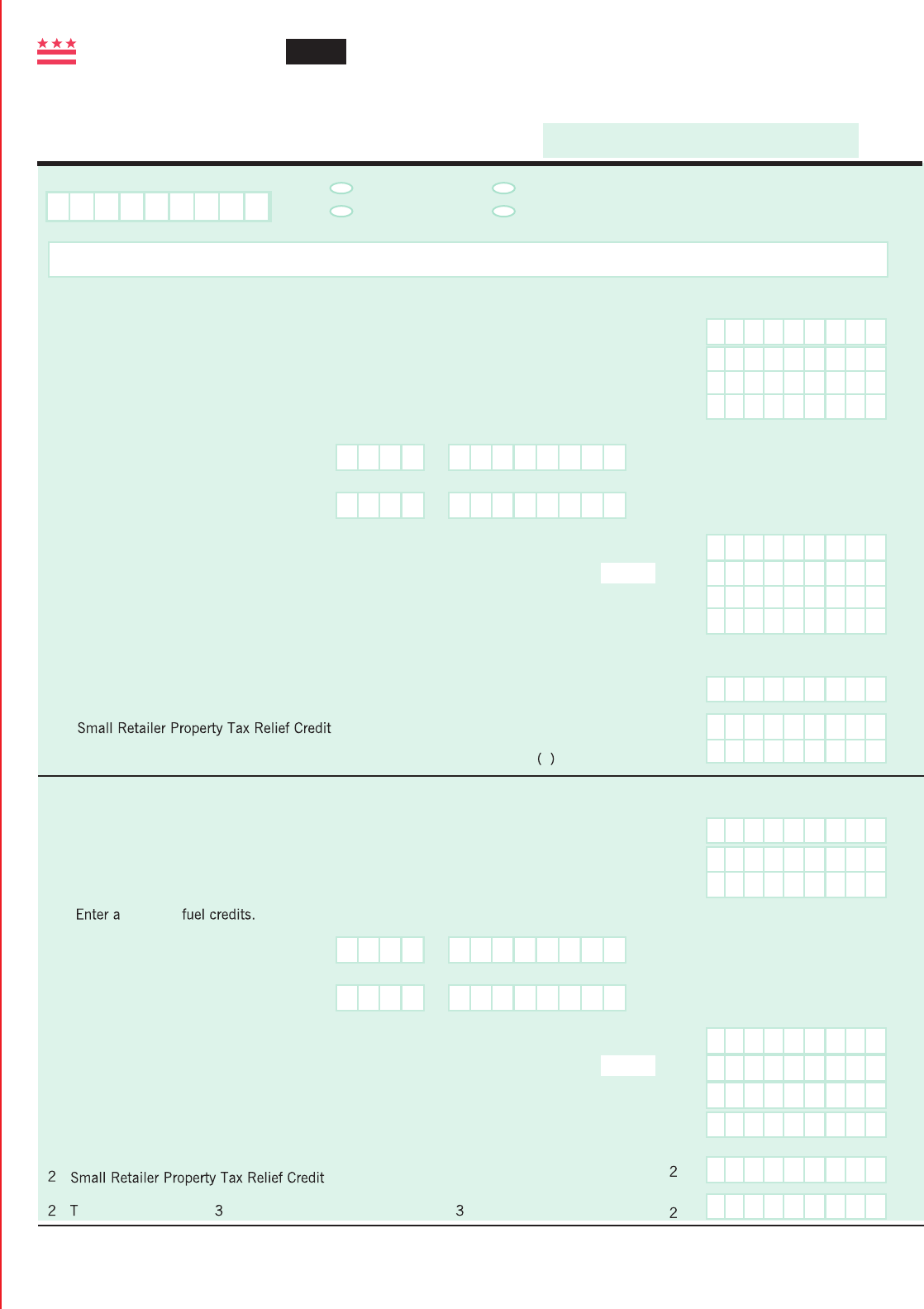

3

Government of the

District of Columbia

Business Credits

Revised 08/2021

Important: Print in CAPITAL letters using black ink.

Attach to your Form D-20 or D-30.

Fill in if filing a D-20 Return

Fill in if filing a D-30 Return

Taxpayer IdentiĐcation Number

Fill in if FEIN

Fill in if SSN

Enter your business name

D-20 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

1 1 $ .00

Economic Development Zone Incentives Credits (see worksheet).

2 QualiĐed High Technology Company Credits

from Part D, Line 4a, DC Form D-20CR. 2 $ .00

3 Organ and Bone Marrow Donor Credit (see computation on reverse side). 3 $ .00

4 Job Growth Incentive Act 4 $ .00

5 Enter alternative fuel credits. See instructions

5a Alternative fuel infrastructure.

5b Alternative fuel vehicle conversion.

6 Total alternative fuel credits. Add Lines 5a and 5b only and enter here. 6

$ .00

7 Employer-assisted Home Purchase Ta x Credit (see computation on reverse side). 7a 7 $ .00

# of employees

8

RESERVED

8 $ .00

9

Total the nonrefundable D-20 credits, enter here and on Form D-20, Line 38. 9 $ .00

Refundable Credits

10

10 $ .00

11 $ .00

11

12 Total the refundable D-20 credits, enter here and on Form D-20, Line 41

d .

12

$ .00

D-30 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

13 Economic Development Zone Incentives Credit (see worksheet).

13 $

.00

14 $

.00

15 $ .00

14

(see computation on reverse side)

15

16

Organ and Bone Marrow Donor Credit

Job Growth Incentive Act

lternative See instructions

16a Alternative fuel infrastructure.

16b Alternative fuel vehicle conversion.

17 Total alternative fuel credits. Add Lines 16a and 16b only and enter here. 17 $ .00

18 Employer-assisted Home Purchase Tax Credit (see computation on reverse side). 18a 18 $ .00

# of employees

19

19

$ .00

20 Total the nonrefundable D-30 credits, enter here and on Form D-30, Line 38.

20

$ .00

Schedule UB Instructions - Qualified High Technology Companies

If you claim credits on Lines 2 above, attach a copy of your DC Form D-20CR to the D-20.

OFFICIAL USE ONLY

Vendor ID# 0000

$ .00

# of stations

$

.00

# of stations

$ .00

# of vehicles

$ .00

# of vehicles

Refundable Credits

1 $

.00

1

2 otal the refundable D- 0 credits, enter here and on Form D- 0, Line 41(d).

2 $

.00

2021

SCHEDULE UB

DC Low-Income Housing Tax Credit (see instructions).

DC Low-Income Housing Tax Credit (see instructions).

D-30 FORM, PAGE 6

SUPPLEMENTAL INFORMATION

202,

202?

202?

2022?

0/202

*232300210000*

Government of the

District of Columbia

Business Credits

Revised 10/202

Important: Print in CAPITAL letters using black ink.

Attach to your Form D-20 or D-30.

Fill in if filing a D-20 Return

Fill in if filing a D-30 Return

Taxpayer Identition Number

Fill in if FEIN

Fill in if SSN

Enter your business name

D-20 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

1 1 $ .00

Economic Development Zone Incentives Credits (see worksheet).

2

Quali High Technology Company Credits

from Part D, Line 4a, DC Form D-20CR.

2 $ .00

3 Organ and Bone Marrow Donor Credit (see computation on reverse side). 3 $ .00

4 Job Growth Incentive Act 4 $ .00

5 Enter alternative fuel credits. See instructions

5a Alternative fuel infrastructure.

5b Alternative fuel vehicle conversion.

6 Total alternative fuel credits. Add Lines 5a and 5b only and enter here. 6

$ .00

7 Employer-assisted Home Purchase Ta x Credit (see computation on reverse side). 7a 7 $ .00

# of employees

8

RESERVED

8 $ .00

9

Total the nonrefundable D-20 credits, enter here and on Form D-20, Line 38. 9 $ .00

Refundable Credits

10

10 $ .00

11 $ .00

11

12 Total the refundable D-20 credits, enter here and on Form D-20, Line 41

d .

12

$ .00

D-30 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

13 Economic Development Zone Incentives Credit (see worksheet).

13 $

.00

14 $

.00

15 $ .00

14

(see computation on reverse side)

15

16

Organ and Bone Marrow Donor Credit

Job Growth Incentive Act

See instructions

16a Alternative fuel infrastructure.

16b Alternative fuel vehicle conversion.

17 Total alternative fuel credits. Add Lines 16a and 16b only and enter here. 17 $ .00

18 Employer-assisted Home Purchase Tax Credit (see computation on reverse side). 18a 18 $ .00

# of employees

19

19

$ .00

20 Total the nonrefundable D-30 credits, enter here and on Form D-30, Line 38.

20

$ .00

Schedule UB Instructions - Qualified High Technology Companies

If you claim credits on Line 2 ab ove, attach a copy of your DC Form D-20CR to the D-20.

OFFICIAL USE ONLY

Vendor ID# 0000

$ .00

# of stations

$

.00

# of stations

$ .00

# of vehicles

$ .00

# of vehicles

Refundable Credits

$

.00

1

$

.00

2023

SCHEDULE UB

DC Low-Income Housing Tax Credit (see instructions).

DC Low-Income Housing Tax Credit (see instructions).

D-30 FORM, PAGE 6

SUPPLEMENTAL INFORMATION

2021,

2021?

2021?

2020?

07/2021

Small Retailer Property Tax Relief Credit

Small Retailer Property Tax Relief Credit

2

22

1

2

22

Total the refundable D-30 credits, entere here and on Form D-30, Line 41( d) .

Enter alternative fuel credits.

Government of the

District of Columbia

2021

SCHEDULE

Property Tax Credit

Important: Read eligibility requirements before completing.

Print in CAPITAL letters using black ink.

Revised 07/2021

elephone number

Landlord’s address (number and street)

City State Zip Code +4

If Owner, enter information from your real property tax bill or assessment. If a section is blank on your property tax bill, leave it blank here.

Square number Suffix number Lot number

Address of DC roperty (number, street and suite number if applicable) for which you are claiming the credit if different from above

Do not claim this credit if your qualified business is exempt from or receives any tax credits towards its real property

tax or the qualified rental retail location or the qualified owned retail location is otherwise exempt from real property

tax.

The credit equals the total Class 2 real property taxes paid by a qualified corporation or qualified unincorporated

business for a qualified retail owned location during the taxable year not to exceed $5,000; or

10% of the total rent

paid by a qualified corporation or qualified unincorporated business for a qualified rental retail location not to exceed

$5,000.

OFFICIAL USE ONLY Vendor ID#0000

Landlord’s name

$ .00

$

.00

$

.00

Fill in

Fill in

if filing a D-20 Return

if filing a D-30 Return

Taxpayer Identification Number

nilli nilliF

nilli nilliF

Enter your business name

Do not make claim if $2.5m or more.

1 $ .00

2021

2021

2021

$ .00

Mailing address (number, street and suite number if applicable)

City State Zip Code +4

if FEIN

if SSN

Sales and Use Tax Account Number

Certificate of Occupancy Permit Number

If member of a Combined Group, Taxpayer Identification Number of Designated Agent

City

State Zip Code +4

*21SR00110000*

Organ and Bone Marrow Donor Credit

An employer who provides an employee with paid leave to donate an organ (up to

30 days leave) or to donate bone marrow (up to 7 days leave) is eligible to claim a

credit against the franchise tax. The credit is equal to 25% of the salary paid to the

employee during the leave period. If you take the credit, you may not also deduct

the salary paid to the donor employee for that period. This credit is not available if

the employee is eligible for leave under the Family and Medical Leave Act of 1993.

Organ and Bone Marrow Donor Credit

— Computation —

Column 1 Column 2 Column 3 Column 4

Credit Category Total Paid Leave Leave Credit Calculation Total Credit

Organ Donor(s) Total Paid Leave Col 2 ______________

Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Bone Marrow Total Paid Leave Col 2 ______________

Donor(s) Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Total of Col. 4.

Enter here and

on Schedule UB.*

$________________

*Line 3 of Schedule UB for D-20 filers

Line 14 of Schedule UB for D-30 filers

1. Number of Eligible Employees

2. Amount of Homeownership Assistance provided

during this period to Eligible Employees ...........................x 50% $

3. Tax Credit .............................................................................. $

(Cannot exceed Line 2 amount and limited to $2,500 per Eligible

Employee)

Enter amount from Line 3 on

Line 7 of Schedule UB for D-20 filers, or

Line 18 of Schedule UB for D-30 filers.

Employer-Assisted Home Purchase Tax Credit

An employer who provides homeownership assistance to eligible employees

through a certified home purchase program may be eligible to claim a credit

against the franchise tax if certain conditions are met. See instructions and

DC Code Section 47-1807.07 for further details.

Employer-Assisted Home Purchase Tax Credit

— Computation —

203

0

01/2024

1

2

4

l

l

l

33

D LPRN

0000

0

•

12000

(The taxpayer must file a Form D-30, District of Columbia Unincorporated Business Franchise Tax

Return instead, even if the business had no net income).

The taxpayer must file Form

D-20, District of Columbia Corporation Franchise Tax Return regardless of the amount of the business's gross income).

1

2

0

12000

0

PLEASE

SIGN

HERE

4

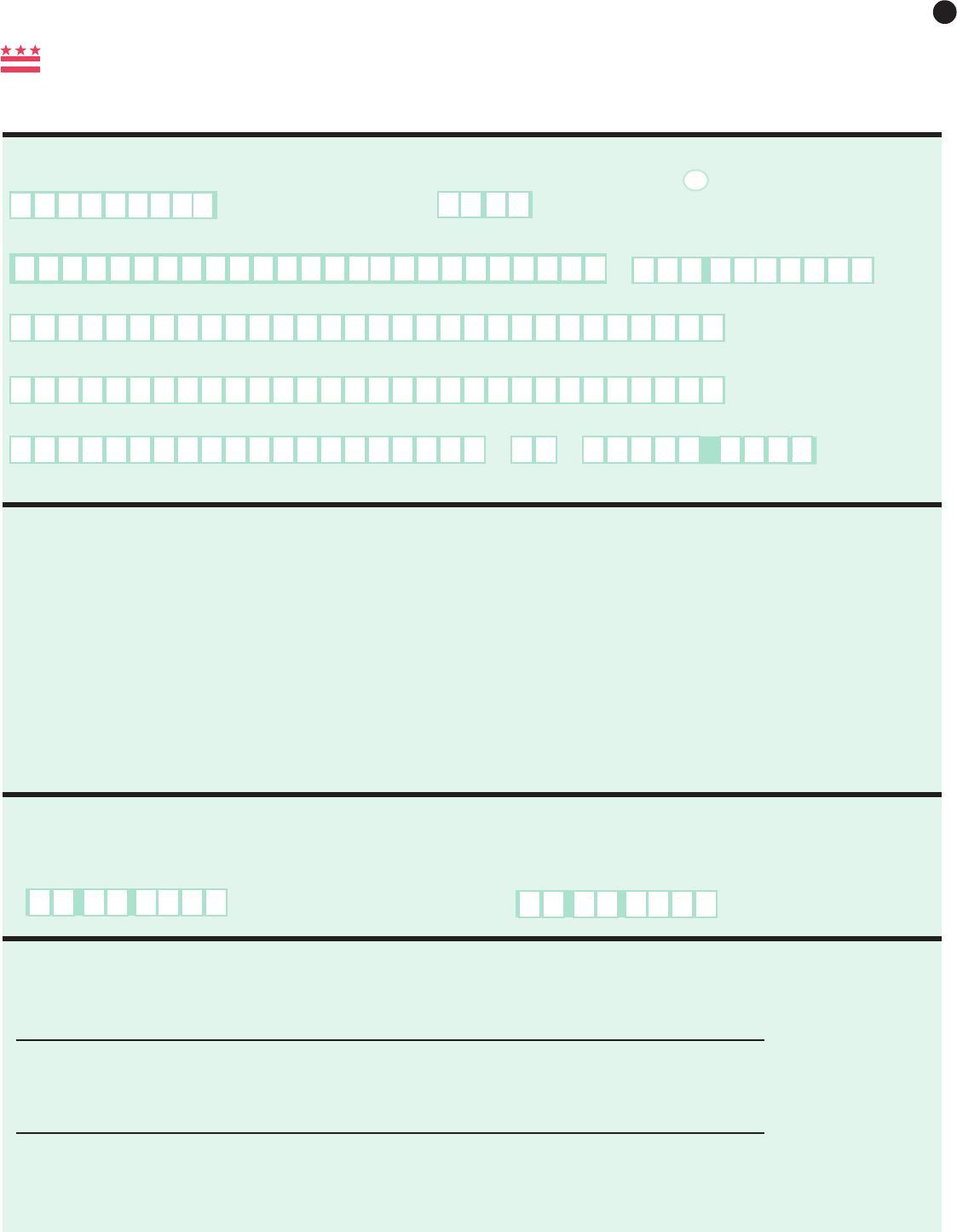

Instructions for D-30N

Affidavit of Gross Income In Lieu of

Unincorporated Business Franchise Tax Return

An unincorporated business having a gross

income of $12,000 or less is not subject to the

unincorporated business franchise tax, including

minimum tax, and does not have to file a D-30

Unincorporated Business Franchise Tax return.

An unincorporated business must demonstrate

that it has filed all required tax returns to be

eligible to receive a Certificate of Clean Hands.

An unincorporated business that has $12,000 or

less in gross receipts for this tax year may be

eligible to satisfy this requirement by filing a

Form D-30N (Affidavit of Gross Income In Lieu

of Unincorporated Business Franchise Tax

Return) instead of filing a D-30 (Unincorporated

Business Franchise Tax Return).

If you have already filed a D-30 (Unincorporated

Business Franchise Tax Return) for this tax year

and you wish to make a change, you must

amend your return by filing an amended D-30

(Unincorporated Business Franchise Tax Return).

You cannot amend your return by filing a D-30N

(Affidavit of Gross Income in Lieu of

Unincorporated Business Franchise Tax Return).

Likewise, if you have already filed a D-30N

(Affidavit of Gross Income in Lieu of

Unincorporated Business Franchise Tax Return),

you cannot amend your affidavit by filing a

superseding D-30N (Affidavit of Gross Income in

Lieu of Unincorporated Business Franchise Tax

Return) and must file an original D-30

(Unincorporated Business Franchise Tax Return).

If you have a credit on your account for the tax

year you are filing for, you must file a full D-30.

D-30N cannot be used to request a refund or

carry forward the credit.

5555

3

ÛiÀiÌÊvÊÌi

ÃÌÀVÌÊvÊÕL>

20Ó3

«ÀÌ>Ì\Ê*ÀÌÊÊ*/ÊiÌÌiÀÃÊÕÃ}ÊL>VÊ°

z

/ÃÊ-iVÌÊÌÊLiÊ

V«iÌi`ÊLÞÊ

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚ

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚ

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚ

*>ÀÌÊ°ÊÊÀi`ÌÊÊ

£°ÊÕ`}Ê``ÀiÃÃ

Ó>°ÊÕ`}Ê"ÜiÀÊ >i

L° Õ`}Ê"ÜiÀÊ``ÀiÃÃ

ΰÊÕ`}Ê"ÜiÀÊ/

{°Êi`iÀ>ÊÕ`}Ê`iÌvV>ÌÊ ÕLiÀÊ

x°Ê>ÝÕÊÜ>LiÊÊ/ÊÕÌIÊ

È°Ê>ÌiÊvÊV>Ì

Ç° >ÌiÊÕ`}Ê*>Vi`ÊÊ-iÀÛVi

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚ

>Ìi

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÊÊ

-}>ÌÕÀiÊvÊÕÌÀâi`ÊÊ"vvV>

*>ÀÌÊ°Ê"ÜiÀÊiÀÌvV>Ì

"ÜiÀëÊÌÌÞ

1`iÀÊ«i>ÌiÃÊvÊ«iÀÕÀÞ]ÊÊ`iV>ÀiÊÌ>Ì\Ê£®ÊÌiÊ>LÛiÊLÕ`}ÊVÌÕiÃÊÌʵÕ>vÞÊ>ÃÊ>Ê«>ÀÌÊvÊ>ʵÕ>vi`ÊÜViÊ

ÕÃ}Ê`iÛi«iÌÊ>`ÊiiÌÃÊÌiÊÀiµÕÀiiÌÃÊvÊÌiÀ>Ê,iÛiÕiÊ`iÊ-iVÌÊ{Ó}®Ê>`ÊÊ`iÊÅ{Ç{nä£Ê>`Ê

Ó® ÌiʵÕ>vi`ÊL>ÃÃÊvÊÌiÊLÕ`}ÊViVÊi®ÊÊÚÚÚ>ÃÊÚÚÚ>ÃÊÌÊ`iVÀi>Ãi`ÊvÀÊÌÃÊÌ>ÝÊÞi>À°ÊÊ>ÛiÊiÝ>i`ÊÌÃÊvÀ]

>`ÊÌÊÌiÊLiÃÌÊvÊÞÊÜi`}iÊ>`ÊLiiv]ÊÌÊÃÊÌÀÕi]ÊVÀÀiVÌÊ>`ÊV«iÌi°

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÊ

-}>ÌÕÀi />Ý«>ÞiÀÊÊ ÕLiÀ >Ìi

ÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÚÊ

>iÊ«i>ÃiÊÌÞ«iÊÀÊ«ÀÌ®

I/iÊ>ÕÌÊvÀÊi>VÊÞi>ÀÊvÊÌiÊ£äÞi>ÀÊVÀi`ÌÊ«iÀ`

"Ê1-Ê" 9

6HQGRU,'

z

z

,iÛÊ

nÈäÊÃÌÀVÌÊvÊÕL>Ê

ÜViÊÕÃ}Ê/>ÝÊÀi`ÌÊ

V>ÌÊ>`ÊiÀÌvV>ÌÊ

n°ÊÊ

vÊiiVÌÊÌÊLi}ÊVÀi`ÌÊ«iÀ`ÊÌiÊvÀÃÌÊÞi>ÀÊ>vÌiÀÊÌiÊLÕ`}ÊÃÊ«>Vi`ÊÊÃiÀÛViÊÜ>ÃÊ

>`iÊÊi`iÀ>ÊÀÊnÈä]ÊiÊ£ä>°Ê

01/2024

-/,/Ê"Ê"1Ê"7 "Ê"1- Ê/8Ê,/Ê

/iÊvi`iÀ>ÊÜViÊÕÃ}Ê/>ÝÊÀi`ÌÊ/®ÊÜ>ÃÊ

iÃÌ>LÃi`ÊLÞÊÌiÊ/>ÝÊ,ivÀÊVÌÊvÊ£nÈÊ>`ÊÃÊ>Ê`>ÀvÀ

`>ÀÊÌ>ÝÊVÀi`ÌÊvÀÊvi`iÀ>ÊÌ>Ý«>ÞiÀÃÊÜÊÛiÃÌÊÊÌiÊ

VÃÌÀÕVÌÊ>`ÊÀi>LÌ>ÌÊvÊÕÃ}ÊvÀÊÜÊ>`Ê`iÀ>Ìi

ViÊ`Û`Õ>ÃÊ>`Êv>iÃÊÊÌiÊ1Ìi`Ê-Ì>ÌiðÊ

*ÕÀÃÕ>ÌÊÌÊÌiÊÃÌÀVÌÊvÊÕL>ÊÜViÊÕÃ}Ê/>ÝÊ

Ài`ÌÊ>ÀvV>ÌÊi`iÌÊVÌÊvÊÓäÓä]Ê°°Ê>ÜÊ

ÓΣ{]ÊÅÊÇÓ䣮]ÊÌiÊÃÌÀVÌÊvÊÕL>Ê>ÃÊ>ÃÊ>VÌi`ÊÌ

iÃÌ>LÃÊ>ÊÜViÊÕÃ}ÊÌ>ÝÊVÀi`ÌÊvÀʵÕ>vi`Ê«ÀiVÌÃ

V>Ìi`ÊÊÌiÊÃÌÀVÌÊvÊÕL>°ÊvviVÌÛiÊ"VÌLiÀÊ£]ÊÓäÓä]Ê>

ºµÕ>vi`Ê«ÀiVÌ»Êi>ÃÊ>ÊÀiÌ>ÊÕÃ}Ê`iÛi«iÌÊÊÌi

ÃÌÀVÌÊÌ>ÌÊÀiViÛiÃÊ>Ê>V>ÌÊvÊvi`iÀ>ÊÜViÊÕÃ}

Ì>ÝÊVÀi`ÌÃÊÕ`iÀÊ,ÊÅ{Ó®£®ÊÀÊ,ÊÅ{Ó®{®Ê>vÌiÀÊ"VÌLiÀÊ£]

ÓäÓ£]Ê>`ÊÀiViÛiÃÊ>ÊiÝiVÕÌi`ÊiÝÌi`i`ÊÜViÊÕÃ}

VÌiÌÊ«ÕÀÃÕ>ÌÊÌÊ,ÊÅ{ӮȮ®ÊvÀÊÌiÊÃÌÀVÌÊv

ÕL>Êi«>ÀÌiÌÊvÊÕÃ}Ê>`ÊÕÌÞÊiÛi«iÌ

®Ê`>Ìi`ÊÊÀÊ>vÌiÀÊ"VÌLiÀÊ£]ÊÓäÓ£°

/iÊÃÌÀVÌÊvÊÕL>ÊÜViÊÕÃ}ÊÌ>ÝÊVÀi`ÌÊÊ

/®ÊV>ÊLiÊÌ

>iÊ>}>ÃÌÊViÊÌ>Ý]ÊvÀ>VÃiÊÌ>Ý]Ê>`Ê

ÃÕÀ>ViÊ«ÀiÕÊÌ>Ý°ÊÊ/iÊVÀi`ÌÊV>ÊLiÊV>i`ÊiµÕ>ÞÊvÀÊ

£äÊÞi>ÀÃÊ>`ÊÃÕLÌÀ>VÌi`ÊvÀÊÌiÊ>ÕÌÊvÊÃÌÀVÌÊÌ>ÝÊ

ÌiÀÜÃiÊ`ÕiÊvÀÊi>VÊÌ>Ý>LiÊ«iÀ`°ÊÊ/iÊVÀi`ÌÊV>ÌÊLiÊ

Ì>iÊ>}>ÃÌÊ>ÞÊÌ>ÝÊÌ>ÌÊÃÊ`i`V>Ìi`ÊÊÜiÊÀÊÊ«>ÀÌÊÌÊÌiÊ

i>ÌÞÊÊ>`Êi>ÌÊ>ÀiÊÝ«>ÃÊÕ`ÊiÃÌ>LÃi`ÊLÞÊÊ

`iÊÅΣÎx£{°äÓ°

/iÊVÀi`ÌÊÃÊÌÊÀivÕ`>Li]ÊLÕÌÊ>ÞÊ>ÕÌÊvÊÌiÊVÀi`ÌÊÌ>ÌÊ

iÝVii`ÃÊÌiÊÌ>ÝÊ`ÕiÊvÀÊ>ÊÌ>Ý>LiÊÞi>ÀÊV>ÊLiÊV>ÀÀi`ÊvÀÜ>À`ÊÌÊ

>ÞÊvÊÌiÊ£äÊÀi>}ÊÃÕLÃiµÕiÌÊÌ>Ý>LiÊÞi>ÀðÊ/iÊÜiÀÊvÊ

>ʵÕ>vi`Ê«ÀiVÌÊi}LiÊvÀÊÌiÊÃÌÀVÌÊÜViÊÕÃ}ÊÌ>ÝÊ

VÀi`ÌÊÕÃÌÊÃÕLÌÊ>ÊV«ÞÊvÊÌiÊi}LÌÞÊÃÌ>ÌiiÌÊÃÃÕi`ÊLÞÊ

ÌiÊi«>ÀÌiÌÊvÊÕÃ}Ê>`ÊÕÌÞÊiÛi«iÌÊÜÌÊ

ÀiëiVÌÊÌÊÌiʵÕ>vi`Ê«ÀiVÌÊ>ÌÊÌiÊÌiÊvÊv}ÊÌiÊ«ÀiVÌÊ

ÜiÀ½ÃÊÊÌ>ÝÊÀiÌÕÀ°ÊÊvÊÌiÊi}LÌÞÊÃÌ>ÌiiÌÊÃÊÌÊ

>ÌÌ>Vi`]ÊÊVÀi`ÌÊÜÊLiÊ>Üi`ÊÜÌÊÀiëiVÌÊÌÊÃÕVʵÕ>vi`Ê

«ÀiVÌÊvÀÊÌ>ÌÊÞi>ÀÊÕÌÊÌiÊV«ÞÊÃÊ«ÀÛ`i`ÊÌÊÌiÊ"vvViÊvÊ/>ÝÊ

>`Ê,iÛiÕi°Ê

ÊÀÊ>ÞÊ«ÀÌÊvÊÃÌÀVÌÊÜViÊÌ>ÝÊVÀi`ÌÃÊ>ÞÊLiÊ

ÌÀ>ÃviÀÀi`]ÊÃ`]Ê>ÃÃ}i`]ÊÀÊ>V>Ìi`ÊÌÊ«>ÀÌiÃÊÜÊ>ÀiÊ

i}LiÊ«ÕÀÃÕ>ÌÊÌÊ>«ÌiÀÊ{nÊvÊ/ÌiÊ{ÇÊvÊÌiÊÃÌÀVÌÊvÊ

ÕL>Ê"vvV>Ê`i°Ê/iÀiÊÃÊÊÌÊÊÌiÊÌÌ>Ê

ÕLiÀÊvÊ

>V>ÌÃÊvÊ>ÊÀÊ«>ÀÌÊvÊÌiÊÌÌ>ÊVÀi`ÌÊ>ÕÌÀâi`°Ê

iVÌÛiÞ]Ê>ÊÌÀ>ÃviÀÃ]ÊÃ>iÃ]Ê>ÃÃ}iÌÃ]Ê>`Ê>V>ÌÃÊ>ÀiÊ

ÃÕLiVÌÊÌÊÌiÊ>ÝÕÊVÀi`ÌÊ>Ü>LiÊÌÊ>Ê«>ÀÌVÕ>ÀʵÕ>vi`Ê

«ÀiVÌ°ÊÊÌ>ÝÊVÀi`ÌÊi>Ài`ÊÀÊ«ÕÀV>Ãi`ÊLÞ]ÊÀÊÌÀ>ÃviÀÀi`ÊÀÊ

>ÃÃ}i`ÊÌ]Ê>Ê«>ÀÌiÀë]ÊÌi`Ê>LÌÞÊV«>Þ]Ê-Ê

VÀ«À>Ì]ÊÀÊÌiÀÊ«>ÃÃÌÀÕ}ÊiÌÌÞÊ>ÞÊLiÊ>V>Ìi`ÊÌÊÌiÊ

«>ÀÌiÀÃ]ÊiLiÀÃ]ÊÀÊÃ>Ài`iÀÃÊÊ>VVÀ`>ViÊÜÌÊÌiÊ

«ÀÛÃÃÊvÊ>ÞÊ>}ÀiiiÌÊ>}ÊÌiÊ«>ÀÌiÀÃ]ÊiLiÀÃ]ÊÀÊ

Ã>Ài`iÀÃÊ>`ÊÜÌÕÌÊÀi}>À`ÊÌÊÌiÊÜiÀëÊÌiÀiÃÌÊvÊÌiÊ

«>ÀÌiÀÃ]ÊiLiÀÃ]ÊÀÊÃ>Ài`iÀÃÊÊÌiʵÕ>vi`Ê«ÀiVÌ°ÊÊÊ

«>ÀÌiÀ]ÊiLiÀ]ÊÀÊÃ>Ài`iÀÊÌÊÜÊ>ÊÌ>ÝÊVÀi`ÌÊÃÊ

>V>Ìi`Ê>ÞÊvÕÀÌiÀÊ>V>ÌiÊ>ÊÀÊ«>ÀÌÊvÊÌiÊ>V>Ìi`ÊVÀi`ÌÊ

ÀÊ>ÞÊÌÀ>ÃviÀ]ÊÃi]ÊÀÊ>ÃÃ}ÊÌiÊ>V>Ìi`ÊVÀi`Ì°ÊiVÌÛiÞÊ

>ÊÌÀ>ÃviÀÃ]ÊÃ>iÃ]Ê>ÃÃ}iÌÃ]Ê>`Ê>V>ÌÃÊ>ÀiÊÃÕLiVÌÊÌÊ

ÌiÊ>ÝÕÊVÀi`ÌÊ>Ü>LiÊÌÊ>Ê«>ÀÌVÕ>ÀʵÕ>vi`Ê«ÀiVÌ°ÊÊ

ÊÜiÀ]ÊÌÀ>ÃviÀii]Ê«ÕÀV>ÃiÀ]Ê>ÃÃ}ii]ÊÀÊÌ>Ý«>ÞiÀÊÌÊÜÊ

>ÊVÀi`ÌÊÃÊ>V>Ìi`Ê`iÃÀ}ÊÌÊ>iÊ>ÊÌÀ>ÃviÀ]ÊÃ>iÊ>ÃÃ}iÌÊ

ÀÊ>V>ÌÊÕÃÌÊÃÕLÌÊÌÊÌiÊ"Ê>`ÊÌiÊÃÃiÀÊvÊ

ÌiÊi«>ÀÌiÌÊvÊÃÕÀ>Vi]Ê-iVÕÀÌiÃ]Ê>`Ê>}Ê

ÃÃiÀ®Ê>ÊÃÌ>ÌiiÌÊÌ>ÌÊ`iÃVÀLiÃÊÌiÊ>ÕÌÊvÊ

ÃÌÀVÌÊÜViÊÕÃ}ÊÌ>ÝÊVÀi`ÌÊvÀÊÜVÊÃÕVÊÌÀ>ÃviÀ]Ê

Ã>i]Ê>ÃÃ}iÌ]ÊÀÊ>V>ÌÊvÊÃÌÀVÌÊVÀi`ÌÊÃÊi}Li°Ê/iÊ

ÜiÀ]ÊÌÀ>ÃviÀÀ]ÊÃiiÀ]Ê>ÃÃ}À]ÊÀÊÌ>Ý«>ÞiÀÊÕÃÌÊ«ÀÛ`iÊÌÊ

ÌiÊ"Ê>`ÊÌiÊÃÃiÀÊ>««À«À>ÌiÊvÀ>ÌÊÃÊÌ>ÌÊ

ÌiÊÜViÊÕÃ}ÊÌ>ÝÊVÀi`ÌÊV>ÊLiÊ«À«iÀÞÊ>V>Ìi`°ÊÊ

/iÊÃÌÀVÌÊÜViÊÕÃ}ÊÌ>ÝÊVÀi`ÌÊV>ÊLiÊÀiV>«ÌÕÀi`ÊvÊ

ÌiÊÜiÀÊv>ÃÊÌÊÃÕLÌÊ>ÊV«ÞÊvÊÌiÊi}LÌÞÊÃÌ>ÌiiÌÊ

ÃÃÕi`ÊLÞÊÌiÊi«>ÀÌiÌÊÜÌÊÀiëiVÌÊÌÊÌiʵÕ>vi`Ê«ÀiVÌÊ>ÌÊ

ÌiÊÌiÊvÊv}ÊÌiÊÀiÌÕÀ]ÊÀ]ÊvÊÕ`iÀÊ,ÊÅ{Ó]Ê>Ê«ÀÌÊvÊ

>ÞÊvi`iÀ>ÊÜViÊÌ>ÝÊVÀi`ÌÃÊÌ>iÊÊ>ÊÜViÊ

µÕ>vi`Ê«ÀiVÌÊÃÊÀiµÕÀi`ÊÌÊLiÊÀiV>«ÌÕÀi`°ÊÊvÊ>ÊÀiV>«ÌÕÀiÊÃÊ

ÀiµÕÀi`]Ê>ÞÊÃÌ>ÌiiÌÊÃÕLÌÌi`ÊÌÊÌiÊ"Ê>ÃÊÀiµÕÀi`ÊLÞÊÊ

`iÊÅ{Ç{näÈL®ÊÕÃÌÊVÕ`iÊÌiÊ«À«ÀÌÊvÊÌiÊVÀi`ÌÊ

ÀiµÕÀi`ÊÌÊLiÊV>«ÌÕÀi`]ÊÌiÊ`iÌÌÞÊvÊi>VÊÌÀ>ÃviÀiiÊÃÕLiVÌÊ

ÌÊÀiV>«ÌÕÀi]Ê>`ÊÌiÊ>ÕÌÊvÊVÀi`ÌÊ«ÀiÛÕÃÞÊÌÀ>ÃviÀÀi`]Ê

Ã`]Ê>ÃÃ}i`]ÊÀÊ>V>Ìi`ÊÌÊÃÕVÊÌÀ>ÃviÀii]Ê«ÕÀV>ÃiÀ]Ê

>ÃÃ}ii]ÊÀÊÌ>Ý«>ÞiÀÊÌÊÜÊ>ÊVÀi`ÌÊÃÊ>V>Ìi`°

ÝVi«ÌÊvÀÊÕÕÃi`ÊVÀi`ÌÃÊV>ÀÀi`ÊvÀÜ>À`Ê>`ÊvÀÊVÀi`ÌÃÊV>i`Ê

Õ`iÀÊÀi}Õ>ÌÃÊ«ÀÕ}>Ìi`ÊLÞÊÌiÊi«>ÀÌiÌÊVÃÃÌiÌÊ

ÜÌÊÌiÊëiV>ÊÀÕiÊÃiÌÊvÀÌÊÊ,ÊÅ{Ó]Ê>ʵÕ>vi`ÊÃÌÀVÌÊvÊ

ÕL>Ê«ÀiVÌÊÃÊÌÊi}LiÊvÀÊ>ÞÊÃÌÀVÌÊÌ>ÝÊVÀi`ÌÃÊvÀÊ

ÀiÊÌ>Ê££ÊÌ>Ý>LiÊÞi>ÀðÊÊ

-}1«ÊvÀÊÞ/>Ý°°}Û

Þ/>Ý°°}ÛÊÃÊÌiÊÜiLÊ«ÀÌ>ÊÜiÀiÊÞÕÊV>ÊÛiÜÊÞÕÀÊ

>Û>>LiÊÊ/Ê>ÕÌÊ>`ÊÀi«ÀÌÊVÀi`ÌÊÌÀ>ÃviÀÃ]ÊÃ>iÃ]Ê

>ÃÃ}iÌÃÊ>`Ê>V>ÌÃÊÌÊÌiÀÊVÀi`ÌÊÀiV«iÌðÊÊÊ

VÀi`ÌÊÜiÀÃ]ÊÌÀ>ÃviÀÀÃÊ>`ÊÀiV«iÌÃÊÕÃÌÊV«iÌiÊ>Êi

ÌiÊÀi}ÃÌÀ>ÌÊÌÊÃ}ÊÕ«ÊvÀÊ>ÊiÊ>VVÕÌ°ÊÊÀi`ÌÊ

ÌÀ>ÃviÀÀÃÊÕÃÌÊÀi«ÀÌÊ>ÞÊVÀi`ÌÊÌÀ>ÃviÀÃ]ÊÃ>iÃ]Ê>ÃÃ}iÌÃÊ

>`Ê>V>ÌÃÊÊÌiÀÊÞ/>Ý°Ê>VVÕÌÊLivÀiÊÌiÊVÀi`ÌÊ

ÀiV«iÌÃÊV>ÊÛiÜÊÌiÀÊ«ÀÌÊvÊ>Û>>LiÊÊ/ÊVÀi`Ì°ÊÊ

ÀÊvÕÀÌiÀÊvÀ>ÌÊÊÜÊÌÊÛiÜÊÞÕÀÊÊ/Ê

vÀ>ÌÊ>`ÊÀi«ÀÌÊÌÀ>Ã>VÌÃ]Ê«i>ÃiÊÃiiÊÃÌÀÕVÌÃÊvÀÊ

ÊÜViÊÕÃ}Ê/>ÝÊÀi`ÌÊV>ÌÊ>`ÊiÀÌvV>Ì°

>}ÊÌiÊÀi`Ì

/iÊÊÜViÊÕÃ}Ê/>ÝÊÀi`ÌÊV>ÊÞÊLiÊV>i`ÊvÀÊ

LÕ`}ÃÊ>V>Ìi`Ê>ÊVÀi`ÌÊ>vÌiÀÊ"VÌLiÀÊ£]ÊÓäÓ£°ÊÊÊÃÌÀVÌÊÌ>ÝÊ

ÀiÌÕÀÊÕÃÌÊLiÊvi`ÊÜÌÊÌiÊVÀi`ÌÊ>ÕÌÊÊÌiÊ>««À«À>ÌiÊ

iÊvÊÌiÊÀiÌÕÀÊÀÊÃVi`ÕiÊÌÊÀiViÛiÊÌiÊVÀi`Ì°ÊÊÊÌÊÃÊ

«ÀÌ>ÌÊÌ>ÌÊÞÕÊ}ÊÌÊÞÕÀÊÞ/>Ý°Ê>VVÕÌÊ>`ÊÛiÀvÞÊ

ÞÕÀÊ>Û>>LiÊÊ/ÊVÀi`ÌÊLivÀiÊv}Ê>ÊÃÌÀVÌÊÌ>ÝÊÀiÌÕÀÊ

V>}ÊÌiÊVÀi`Ì°ÊÊ/iÊiÃÊÌÊV>ÊÌÃÊVÀi`ÌÊ>Ài\

{äÊ-Vi`ÕiÊ1ÊiÊx

{£ÊiÊ£È

ÓäÊ-Vi`ÕiÊ1ÊiÊn

ÎäÊ-Vi`ÕiÊ1ÊiÊ£

/ÃÊÃÊ>ÊÀivÕ`>LiÊVÀi`Ì°ÊÊ/iÊÌÌ>Ê>ÕÌÊvÊÌiÊVÀi`

ÌÊ

Li}ÊV>i`ÊÃÕ`ÊÌÊiÝVii`ÊÌiÊ>ÕÌÊvÊÌ>ÝÊ`Õi°Ê

Government of the

District of Columbia

2023

SCHEDULE

Property Tax Credit

Important: Read eligibility requirements before completing.

Print in CAPITAL letters using black ink.

Revised 0/202

elephone number

Landlord’s address (number and street)

City State Zip Code +4

If Owner, enter information from your real property tax bill or assessment. If a section is blank on your property tax bill, leave it blank here.

Square number Suffix number Lot number

Address of DC roperty (number, street and suite number if applicable) for which you are claiming the credit if different from above

Do not claim this credit if your qualified business is exempt from or receives any tax credits towards its real property

tax or the qualified rental retail location or the qualified owned retail location is otherwise exempt from real property

tax.

The credit equals the total Class 2 real property taxes paid by a qualified corporation or qualified unincorporated

business for a qualified retail owned location during the taxable year not to exceed $5,000; or

10% of the total rent

paid by a qualified corporation or qualified unincorporated business for a qualified rental retail location not to exceed

$5,000.

OFFICIAL USE ONLY Vendor ID#0000

Landlord’s name

$ .00

$

.00

$

.00

Fill in

Fill in

if filing a D-20 Return

if filing a D-30 Return

Taxpayer Identification Number

nilli nilliF

nilli nilliF

Enter your business name

Do not make claim if $2.5m or more.

1 $ .00

202

202

202

$ .00

Mailing address (number, street and suite number if applicable)

City State Zip Code +4

if FEIN

if SSN

Sales and Use Tax Account Number

Certificate of Occupancy Permit Number

If member of a Combined Group, Taxpayer Identification Number of Designated Agent

City

State Zip Code +4

*23SR00110000*

Organ and Bone Marrow Donor Credit

An employer who provides an employee with paid leave to donate an organ (up to

30 days leave) or to donate bone marrow (up to 7 days leave) is eligible to claim a

credit against the franchise tax. The credit is equal to 25% of the salary paid to the

employee during the leave period. If you take the credit, you may not also deduct

the salary paid to the donor employee for that period. This credit is not available if

the employee is eligible for leave under the Family and Medical Leave Act of 1993.

Organ and Bone Marrow Donor Credit

— Computation —

Column 1 Column 2 Column 3 Column 4

Credit Category Total Paid Leave Leave Credit Calculation Total Credit

Organ Donor(s) Total Paid Leave Col 2 ______________

Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Bone Marrow Total Paid Leave Col 2 ______________

Donor(s) Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Total of Col. 4.

Enter here and

on Schedule UB.*

$________________

*Line 3 of Schedule UB for D-20 filers

Line 14 of Schedule UB for D-30 filers

1. Number of Eligible Employees

2. Amount of Homeownership Assistance provided

during this period to Eligible Employees...........................x 50% $

3. Tax Credit .............................................................................. $

(Cannot exceed Line 2 amount and limited to $2,500 per Eligible

Employee)

Enter amount from Line 3 on

Line 7 of Schedule UB for D-20 filers, or

Line 18 of Schedule UB for D-30 filers.

Employer-Assisted Home Purchase Tax Credit

An employer who provides homeownership assistance to eligible employees

through a certified home purchase program may be eligible to claim a credit

against the franchise tax if certain conditions are met. See instructions and

DC Code Section 47-1807.07 for further details.

Employer-Assisted Home Purchase Tax Credit

— Computation —

Instruc�ons for Schedule SR

Small Retailer Property Tax Relief Credit

For taxable years beginning a December 31, 2017,

a quali corporan, or qual unincorporate

business, may claim a creit against corporate or

unincorporate business franchise tax as follows:

a tax cret equal to 10% of the total rent pai by the

corporacorpora business for a qual

rental retail locaon uring the taxable year not to

excee $5,000: or

a tax cret equal to the total Class 2 real property

taxes pai by the qual corporacorpora

qualie business for a quali retail own loon

ring the taxable year not to excee the lesser of the

real property tax pai uring the taxable year or $5,000.

The in any one taxable year may excee the

quali corporai unincorporate

business’s franchise tax liability, incling any minimum

tax ue for that taxable year an is rele to the

quali corporai unincorpora business

claiming the cret.

The cret shall not apply if the qualie

corporaali unincorpora business is

exempt from or receives any tax crets towars its real

property tax or the quali rental retail locan or

quali owne retail loon is otherwise exempt

from real property tax.

Qualified Corpora�on/Qualified Unincorporated

Business Defined

The term corpoon” or “quali

unincorporate business” means a corporaon or

unincorporate business that: is engage in the

business of making sales at retail anles a sales tax

return reecng those sales; has less than $2,500,000 in

feeral gross receipts or sales; ans current on all

District tax lings an payments.

Qualified Retail Rental Loca�on/Qualified Retail

Owned Loca�on Defined

The term “quae retail rental locaon” or “quale

retail own loon” means a builing or part of a

builg in the District that ring the taxable year is: a

in

qualior

the unincorporate

business; in whole or in part, as Class 2

Property as DC §47-813; has

a Ccate of Occupancy for commercial use.

Tax-Exempt and Government Proper�es

i

Line Instruc�ons

Line 1 Enter the total amount of gross receipts

or sales. If you have feeral gross receipts or sales of

$2.5 million or more you are ineligible to claim the

cret.

Line 2 If you are a tenant, enter the amount of rent

pai on the retail rental in

taxable year 2023.

Line 3 If you are an owner, enter the amount of Class 2

real property taxes on the retail

in 2023, or, if you are a tenant, enter the

amount of 10% of the rent the retail

rental in taxable year 2023.

Line 4 The limit is $5,000.

Line 5 Enter the smaller of Line 3 or Line 4 on Line 5.

This is the amount of the that may be

Enter the Line 5 amount on UB, Line 11 if

or Line 21 if unincorporate

Line 6 For the retail enter the

Owner or Laor’s name,

number.

Line 7 If the property is a retail

loon, enter the Square number

Lot number for the property as it appears on your real

property tax bill or assessment.

Note: In ain to other requirements as lis above,

all businesses must have a sales a use tax account

with OTR all returns in to qualify

for this The Schele SR cannot be fileas a

It must be with UB

athe D-20 Corporation Franchise Tax Return, or D-30

UnincorporateFranchise Tax Return, as applicable. A

business with mule loons in the District may

claim the creit for only one property owner lease

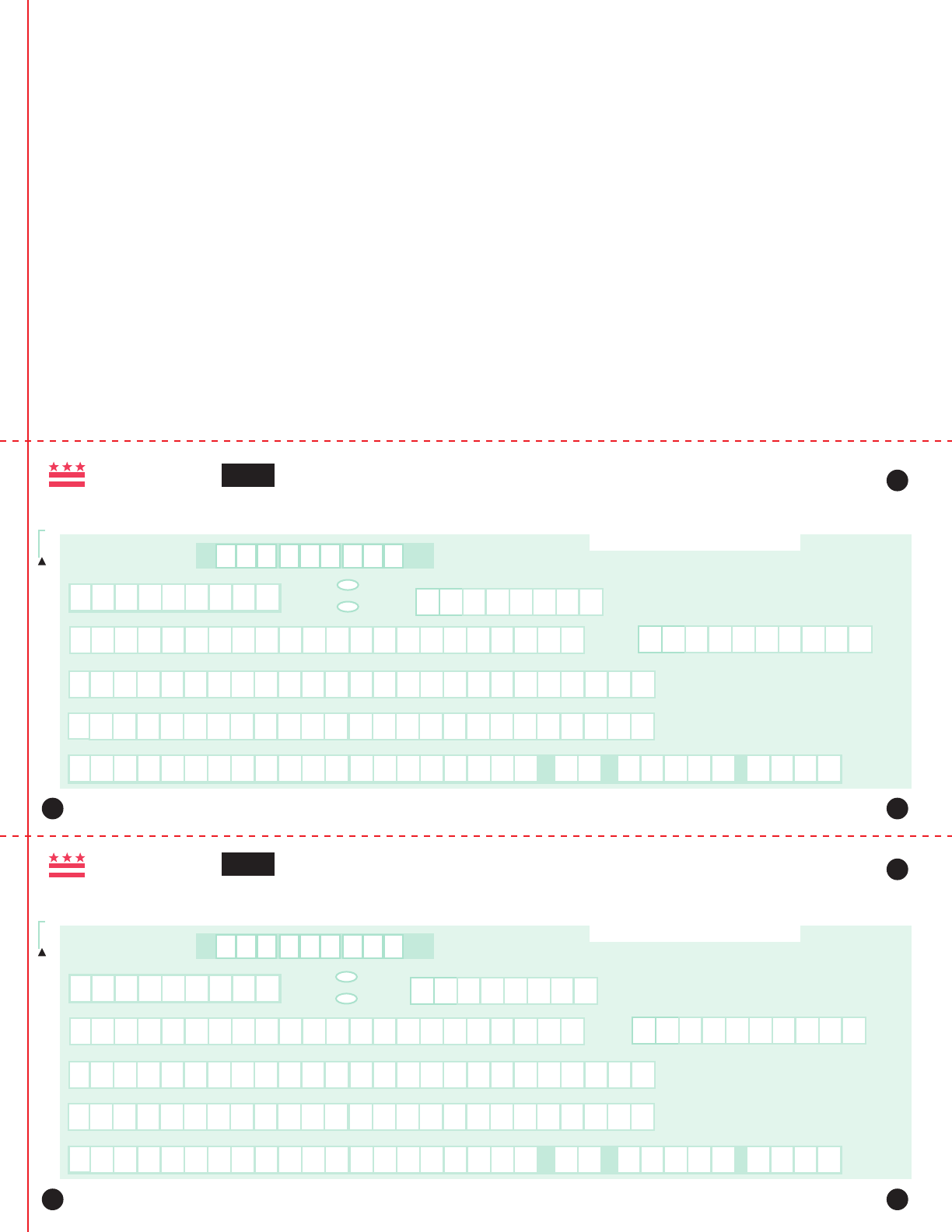

Government of the

District of Columbia

of Designated Agent

Taxable year ending MM

YY

Business mailing address line #2

Business mailing address line #1

Name of Designated Agent

City State Zip Code + 4

Telephone number

A

List the designated agent and all

combined members

D

Is the member new

to the

combined group?

C

Was a separate

DC franchise tax

return filed in the

prior year?

B

Identification Number

E

Was gross income

received from

District sources?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Note: If more than 1 combined members, continue list on a separate sheet of paper.

F

Does the member

have nexus in DC?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Worldwide

2021

NOTE: READ INSTRUCTIONS BEFORE

COMPLETING THIS FORM

*21 1000 *

Important: Print in CAPITAL letters using black ink.

Revised 07/2021

Number of members in the combined group

Government of the

District Columbia

of Designated Agent

Taxable year ending MM

YY

Business mailing address line #2

Business mailing address line #1

Name of Designated Agent

City State Zip Code + 4

Telephone number

A

List the designated agent and all

combined members

D

Is the member new

to the

combined group?

C

Was a separate

DC franchise tax

return filed in the

prior year?

B

Identification Number

E

Was gross income

received from

District sources?

Yes

Note: If more than 1 combined members, continue list on a separate sheet of paper.

F

Does the member

have nexus in DC?

Worldwide

2023

NOTE: READ INSTRUCTIONS BEFORE

COMPLETING THIS FORM

*23

1000 *

Important: Print in CAPITAL letters using black ink.

Revised 0/202

Number of members in the combined group

YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

Yes YesYesYes

of

Combined Group Members’ Schedule

Instructions

Column A - List the designated agent and all combined members included in the DC Combined Report.

Column B - Give the />Ý«>ÞiÀÊIdentification Number (/N) for each member listed.

Column C - Indicate if each member listed filed a separate DC franchise tax return in the prior tax year.

Column D - Indicate if any members are new to the DC Combined Group.

Column E - Indicate if the member received gross income from DC sources.

Column F - Indicate if the member has nexus in DC.

It is necessary to identify each member of the DC Combined Group subject to the franchise tax.

Attach a copy of Federal Forms 851]Ê5471]Ê>`ÊnÇxÊVÕ`}Ê-Vi`ÕiÊ®.

File this schedule each year that a DC Combined Report is filed.

Enter the number of members in the combined group.

Government of the

District of Columbia

Taxpayer Identification Number of Designated Agent Taxable Year YYYY Worldwide

Name of Designated Agent Telephone number

Business address line #1

Business address line #2

City State Zip code +4

• In accordance with the provisions of DC Official Code § 47-1810.07 and the combined reporting regulations, election is

hereby made to report on a worldwide unitary combined basis.

Worldwide Combined Reporting

Election Form

• A worldwide unitary combined reporting election is binding for and applicable to the tax year it is made and all years

thereafter for a period of ten years.

• It may be withdrawn or reinstituted after withdrawal, prior to the expiration of the ten-year period, only upon written

request for reasonable cause based on extraordinary hardship due to unforeseen changes in DC tax statutes, law or

policy and only with the written permission from the Office of Tax and Revenue.

• Upon the expiration of the ten-year period, a taxpayer may withdraw from the worldwide unitary combined reporting

election.

• Withdrawal must be made in writing within one year of the expiration of the election and is binding for a period of ten

years, subject to the same conditions as applied to the original election.

Date Beginning Tax Period: MMDDYYYY Date Ending Tax Period: MMDDYYYY

Authorized Signature

Printed Name Date

Under penalties of law, I declare that the designated agent has authorized me to sign on behalf of all members of the combined group, and that I have examined

this form and the information contained herein is, to the best of my knowledge and belief, correct and complete.

Revised 10/202

33

0/2021

3

10

2023

0/202

33

.

.

.

.

.

.

.

.

.

.

10

.

.

.

.

.

.

.

.

.

.

.

.

D-30 FORM, PAGE 2

2

2

3

2

32

33 33

34

3 33

3

3 income. 3 3

3 3

3

3

42

43

44

4

3

4 3

4

4

ENTER DOLLAR AMOUNTS ONLY

TAXABLE INCOME

TAX, PAYMENTS AND CREDITS

2 $

.00

2 $

.00

2 $

.00

2

2 $

.00

$

.00

3 $

.00

33 $

.00

34

.

3

.

3

$

.00

2 $

.00

$

.00

.

3

.

3

.

.

3

.

.

4 $

.00

43 $

.00

4 $

.00

.

$ .00

$ .00

$ .00

4 $

.00

$

.00

$ .00

25 $ .00

22 $ .00

23

24 3

2

2

24

.

23 .

33

0/202

202

If this is an amended 202

2024

Schedule A - COST OF GOODS SOLD

1.

2.

3.

.4

.5

6.

7.

8. Cost of goods sold (Line 6 minus Line 7). Enter here and on D-30, Line 2.

Method of inventory valuation used

__________________________________________________________________

Schedule B - CONTRIBUTIONS AND/OR GIFTS

Schedule C - TAXES 1

TOTAL

Schedule E - INTEREST EXPENSE

D-30 FORM, PAGE 3

3

07/2021

D-30 FORM, PAGE 2

2

2

3

2

32

33 33

34

3 33

3

3 income. 3 3

3 3

3

3

42

43

44

4

3

4 3

4

4

ENTER DOLLAR AMOUNTS ONLY

TAXABLE INCOME

TAX, PAYMENTS AND CREDITS

2 $

.00

2 $

.00

2 $

.00

2

2 $

.00

$

.00

3 $

.00

33 $

.00

34

.

3

.

3

$

.00

2 $

.00

$

.00

.

3

.

3

.

.

3

.

.

4 $

.00

43 $

.00

4 $

.00

.

$ .00

$ .00

$ .00

4 $

.00

$

.00

$ .00

25 $ .00

22 $ .00

23

24 3

2

2

24

.

23 .

3

07/2021

2021

If this is an amended 2021

2022

Schedule A - COST OF GOODS SOLD

1.

2.

3.

.4

.5

6.

7.

8. Cost of goods sold (Line 6 minus Line 7). Enter here and on D-30, Line 2.

Method of inventory valuation used

__________________________________________________________________

Schedule B - CONTRIBUTIONS AND/OR GIFTS

Schedule C - TAXES 1

TOTAL

Schedule E - INTEREST EXPENSE

D-30 FORM, PAGE 3

333

0/202

Schedule F - DC apportionment factor (See instructions) Note: If this is a combined report do not use Schedule F to derive the apportionment factor for the group.

Leave Schedule F blank. Use Combined Reporting Schedule 2A, Line 9 instead.

Column 1 TOTAL Column 2 in DC DC Apportionment

Factor

.

.00

.00

Schedule G - Other allowable deductions

TOTAL 2

Schedule H - Income not reported

SALES FACTOR:

DC APPORTIONMENT FACTOR:

D-30 FORM, PAGE 4

Schedule - Disregarded Entities

PLEASE

SIGN

HERE

PAID

PREPARER

ONLY

and enter the name and phone number of that person. See instructions.To authorize another person to discuss this return with OTR, fill in here

0/202

33

D-30 FORM, PAGE 5

Schedule I - BALANCE SHEETS

LIABILITIES AND CAPITAL

ASSETS

2

Schedule J - DISTRIBUTION AND RECONCILIATION OF NET INCOME (OR LOSS)

Col. 4 - See Instructions.

Col. 5 - See Instructions.

Col. 6 - Any loss amount from Line 31 of D-30.

Col. 7 - Enter the difference between Line 25 and Line 31 of D-30.

07/2021

3

Schedule F - DC apportionment factor (See instructions) Note: If this is a combined report do not use Schedule F to derive the apportionment factor for the group.

Leave Schedule F blank. Use Combined Reporting Schedule 2A, Line 9 instead.

Column 1 TOTAL Column 2 in DC DC Apportionment

Factor

.

.00

.00

Schedule G - Other allowable deductions

TOTAL 2

Schedule H - Income not reported

SALES FACTOR:

DC APPORTIONMENT FACTOR:

D-30 FORM, PAGE 4

Schedule - Disregarded Entities

PLEASE

SIGN

HERE

PAID

PREPARER

ONLY

and enter the name and phone number of that person. See instructions.To authorize another person to discuss this return with OTR, fill in here

07/2021

3

D-30 FORM, PAGE 5

Schedule I - BALANCE SHEETS

LIABILITIES AND CAPITAL

ASSETS

2

Schedule J - DISTRIBUTION AND RECONCILIATION OF NET INCOME (OR LOSS)

Col. 4 - See Instructions.

Col. 5 - See Instructions.

Col. 6 - Any loss amount from Line 31 of D-30.

Col. 7 - Enter the difference between Line 25 and Line 31 of D-30.

0/202

33

3

Government of the

District of Columbia

Business Credits

Revised 08/2021

Important: Print in CAPITAL letters using black ink.

Attach to your Form D-20 or D-30.

Fill in if filing a D-20 Return

Fill in if filing a D-30 Return

Taxpayer IdentiĐcation Number

Fill in if FEIN

Fill in if SSN

Enter your business name

D-20 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

1 1 $ .00

Economic Development Zone Incentives Credits (see worksheet).

2 QualiĐed High Technology Company Credits

from Part D, Line 4a, DC Form D-20CR. 2 $ .00

3 Organ and Bone Marrow Donor Credit (see computation on reverse side). 3 $ .00

4 Job Growth Incentive Act 4 $ .00

5 Enter alternative fuel credits. See instructions

5a Alternative fuel infrastructure.

5b Alternative fuel vehicle conversion.

6 Total alternative fuel credits. Add Lines 5a and 5b only and enter here. 6

$ .00

7 Employer-assisted Home Purchase Ta x Credit (see computation on reverse side). 7a 7 $ .00

# of employees

8

RESERVED

8 $ .00

9

Total the nonrefundable D-20 credits, enter here and on Form D-20, Line 38. 9 $ .00

Refundable Credits

10

10 $ .00

11 $ .00

11

12 Total the refundable D-20 credits, enter here and on Form D-20, Line 41

d .

12

$ .00

D-30 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

13 Economic Development Zone Incentives Credit (see worksheet).

13 $

.00

14 $

.00

15 $ .00

14

(see computation on reverse side)

15

16

Organ and Bone Marrow Donor Credit

Job Growth Incentive Act

lternative See instructions

16a Alternative fuel infrastructure.

16b Alternative fuel vehicle conversion.

17 Total alternative fuel credits. Add Lines 16a and 16b only and enter here. 17 $ .00

18 Employer-assisted Home Purchase Tax Credit (see computation on reverse side). 18a 18 $ .00

# of employees

19

19

$ .00

20 Total the nonrefundable D-30 credits, enter here and on Form D-30, Line 38.

20

$ .00

Schedule UB Instructions - Qualified High Technology Companies

If you claim credits on Lines 2 above, attach a copy of your DC Form D-20CR to the D-20.

OFFICIAL USE ONLY

Vendor ID# 0000

$ .00

# of stations

$

.00

# of stations

$ .00

# of vehicles

$ .00

# of vehicles

Refundable Credits

1 $

.00

1

2 otal the refundable D- 0 credits, enter here and on Form D- 0, Line 41(d).

2 $

.00

2021

SCHEDULE UB

DC Low-Income Housing Tax Credit (see instructions).

DC Low-Income Housing Tax Credit (see instructions).

D-30 FORM, PAGE 6

SUPPLEMENTAL INFORMATION

202,

202?

202?

2022?

0/202

*232300210000*

Government of the

District of Columbia

Business Credits

Revised 10/202

Important: Print in CAPITAL letters using black ink.

Attach to your Form D-20 or D-30.

Fill in if filing a D-20 Return

Fill in if filing a D-30 Return

Taxpayer Identition Number

Fill in if FEIN

Fill in if SSN

Enter your business name

D-20 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

1 1 $ .00

Economic Development Zone Incentives Credits (see worksheet).

2

Quali High Technology Company Credits

from Part D, Line 4a, DC Form D-20CR.

2 $ .00

3 Organ and Bone Marrow Donor Credit (see computation on reverse side). 3 $ .00

4 Job Growth Incentive Act 4 $ .00

5 Enter alternative fuel credits. See instructions

5a Alternative fuel infrastructure.

5b Alternative fuel vehicle conversion.

6 Total alternative fuel credits. Add Lines 5a and 5b only and enter here. 6

$ .00

7 Employer-assisted Home Purchase Ta x Credit (see computation on reverse side). 7a 7 $ .00

# of employees

8

RESERVED

8 $ .00

9

Total the nonrefundable D-20 credits, enter here and on Form D-20, Line 38. 9 $ .00

Refundable Credits

10

10 $ .00

11 $ .00

11

12 Total the refundable D-20 credits, enter here and on Form D-20, Line 41

d .

12

$ .00

D-30 Return

Nonrefundable Credits (Nonrefundable Credits may not be applied against the required minimum tax)

13 Economic Development Zone Incentives Credit (see worksheet).

13 $

.00

14 $

.00

15 $ .00

14

(see computation on reverse side)

15

16

Organ and Bone Marrow Donor Credit

Job Growth Incentive Act

lternative See instructions

16a Alternative fuel infrastructure.

16b Alternative fuel vehicle conversion.

17 Total alternative fuel credits. Add Lines 16a and 16b only and enter here. 17 $ .00

18 Employer-assisted Home Purchase Tax Credit (see computation on reverse side). 18a 18 $ .00

# of employees

19

19

$ .00

20 Total the nonrefundable D-30 credits, enter here and on Form D-30, Line 38.

20

$ .00

Schedule UB Instructions - Qualified High Technology Companies

If you claim credits on Line 2 ab ove, attach a copy of your DC Form D-20CR to the D-20.

OFFICIAL USE ONLY

Vendor ID# 0000

$ .00

# of stations

$

.00

# of stations

$ .00

# of vehicles

$ .00

# of vehicles

Refundable Credits

1 $

.00

1

2 otal the refundable D- 0 credits, enter here and on Form D- 0, Line 41(d).

2 $

.00

2023

SCHEDULE UB

DC Low-Income Housing Tax Credit (see instructions).

DC Low-Income Housing Tax Credit (see instructions).

D-30 FORM, PAGE 6

SUPPLEMENTAL INFORMATION

2021,

2021?

2021?

2020?

07/2021

Government of the

District of Columbia

2021

SCHEDULE

Property Tax Credit

Important: Read eligibility requirements before completing.

Print in CAPITAL letters using black ink.

Revised 07/2021

elephone number

Landlord’s address (number and street)

City State Zip Code +4

If Owner, enter information from your real property tax bill or assessment. If a section is blank on your property tax bill, leave it blank here.

Square number Suffix number Lot number

Address of DC roperty (number, street and suite number if applicable) for which you are claiming the credit if different from above

Do not claim this credit if your qualified business is exempt from or receives any tax credits towards its real property

tax or the qualified rental retail location or the qualified owned retail location is otherwise exempt from real property

tax.

The credit equals the total Class 2 real property taxes paid by a qualified corporation or qualified unincorporated

business for a qualified retail owned location during the taxable year not to exceed $5,000; or

10% of the total rent

paid by a qualified corporation or qualified unincorporated business for a qualified rental retail location not to exceed

$5,000.

OFFICIAL USE ONLY Vendor ID#0000

Landlord’s name

$ .00

$

.00

$

.00

Fill in

Fill in

if filing a D-20 Return

if filing a D-30 Return

Taxpayer Identification Number

nilli nilliF

nilli nilliF

Enter your business name

Do not make claim if $2.5m or more.

1 $ .00

2021

2021

2021

$ .00

Mailing address (number, street and suite number if applicable)

City State Zip Code +4

if FEIN

if SSN

Sales and Use Tax Account Number

Certificate of Occupancy Permit Number

If member of a Combined Group, Taxpayer Identification Number of Designated Agent

City

State Zip Code +4

*21SR00110000*

Organ and Bone Marrow Donor Credit

An employer who provides an employee with paid leave to donate an organ (up to

30 days leave) or to donate bone marrow (up to 7 days leave) is eligible to claim a

credit against the franchise tax. The credit is equal to 25% of the salary paid to the

employee during the leave period. If you take the credit, you may not also deduct

the salary paid to the donor employee for that period. This credit is not available if

the employee is eligible for leave under the Family and Medical Leave Act of 1993.

Organ and Bone Marrow Donor Credit

— Computation —

Column 1 Column 2 Column 3 Column 4

Credit Category Total Paid Leave Leave Credit Calculation Total Credit

Organ Donor(s) Total Paid Leave Col 2 ______________

Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Bone Marrow Total Paid Leave Col 2 ______________

Donor(s) Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Total of Col. 4.

Enter here and

on Schedule UB.*

$________________

*Line 3 of Schedule UB for D-20 filers

Line 14 of Schedule UB for D-30 filers

1. Number of Eligible Employees

2. Amount of Homeownership Assistance provided

during this period to Eligible Employees ...........................x 50% $

3. Tax Credit .............................................................................. $

(Cannot exceed Line 2 amount and limited to $2,500 per Eligible

Employee)

Enter amount from Line 3 on

Line 7 of Schedule UB for D-20 filers, or

Line 18 of Schedule UB for D-30 filers.

Employer-Assisted Home Purchase Tax Credit

An employer who provides homeownership assistance to eligible employees

through a certified home purchase program may be eligible to claim a credit

against the franchise tax if certain conditions are met. See instructions and

DC Code Section 47-1807.07 for further details.

Employer-Assisted Home Purchase Tax Credit

— Computation —

Government of the

District of Columbia

2023

SCHEDULE

Property Tax Credit

Important: Read eligibility requirements before completing.

Print in CAPITAL letters using black ink.

Revised 0/202

elephone number

Landlord’s address (number and street)

City State Zip Code +4

If Owner, enter information from your real property tax bill or assessment. If a section is blank on your property tax bill, leave it blank here.

Square number Suffix number Lot number

Address of DC roperty (number, street and suite number if applicable) for which you are claiming the credit if different from above

Do not claim this credit if your qualified business is exempt from or receives any tax credits towards its real property

tax or the qualified rental retail location or the qualified owned retail location is otherwise exempt from real property

tax.

The credit equals the total Class 2 real property taxes paid by a qualified corporation or qualified unincorporated

business for a qualified retail owned location during the taxable year not to exceed $5,000; or

10% of the total rent

paid by a qualified corporation or qualified unincorporated business for a qualified rental retail location not to exceed

$5,000.

OFFICIAL USE ONLY Vendor ID#0000

Landlord’s name

$ .00

$

.00

$

.00

Fill in

Fill in

if filing a D-20 Return

if filing a D-30 Return

Taxpayer Identification Number

nilli nilliF

nilli nilliF

Enter your business name

Do not make claim if $2.5m or more.

1 $ .00

202

202

202

$ .00

Mailing address (number, street and suite number if applicable)

City State Zip Code +4

if FEIN

if SSN

Sales and Use Tax Account Number

Certificate of Occupancy Permit Number

If member of a Combined Group, Taxpayer Identification Number of Designated Agent

City

State Zip Code +4

*23SR00110000*

Organ and Bone Marrow Donor Credit

An employer who provides an employee with paid leave to donate an organ (up to

30 days leave) or to donate bone marrow (up to 7 days leave) is eligible to claim a

credit against the franchise tax. The credit is equal to 25% of the salary paid to the

employee during the leave period. If you take the credit, you may not also deduct

the salary paid to the donor employee for that period. This credit is not available if

the employee is eligible for leave under the Family and Medical Leave Act of 1993.

Organ and Bone Marrow Donor Credit

— Computation —

Column 1 Column 2 Column 3 Column 4

Credit Category Total Paid Leave Leave Credit Calculation Total Credit

Organ Donor(s) Total Paid Leave Col 2 ______________

Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Bone Marrow Total Paid Leave Col 2 ______________

Donor(s) Wages amt.

$_______________

x

25% ____________

$__________________ $________________

Total of Col. 4.

Enter here and

on Schedule UB.*

$________________