New York Commercial Fishing

2021 Survey Report

Last Updated: March 11, 2022

The Suolk County Department of Economic Development & Planning in collaboraon with New York Sea Grant,

Cornell Cooperave Extension Marine Program, and the Long Island Commercial Fishing Associaon developed

this survey to create an up-to-date prole of the Long Island commercial shing industry. The prole is meant to

assist with evaluang the needs of local shermen and characterize the harvesng and processing capacity of

the industry, support businesses, and people engaged in this livelihood.

The survey results reported here can be used to beer understand the industry and assist, industry, researchers,

policy makers, State and Federal Agencies in providing the resources and support necessary to promote a viable

and sustainable shing industry.

Contact:

Michael Ciaramella, PhD, MSc.

Seafood Safety and Technology Specialist

New York Sea Grant

Photo Credit : LICFA

Report prepared by: Michael Ciaramella, August Ruckdeschel, Maeo Reiss, Ryan Wolf, Bonnie Brady, Sco

Curatolo-Wagemann, Krisn Gerbino, and Tara McClintock

2

Partner Proles

The Department of Economic

Development and Planning’s mission is

to foster a comprehensive understanding

of how to grow, improve and conserve

Suolk County’s amazing resources

within both the built and natural environments. Our

goal is to implement iniaves and projects to realize

a Suolk County that is modern and sustainable,

where ambion, quality of life and economic growth

thrive. Suolk County has a rich agricultural and

marime heritage. These industries are the backbone

of the Long Island way-of-life. Not only do our farms,

farmstands, vineyards, marinas, sheries, pack houses,

and docks generate the tourism dollars that support

our local restaurants and service industries, but they

also provide the fresh seafood and produce that

feed people both locally and across the globe. The

Department of Economic Development & Planning

produces an Agriculture & Fishing E-Newsleer which

provides updates on important meengs, deadlines,

and economic opportunies for farmers and shermen.

You can subscribe to this valuable e-newsleer here.

New York Sea Grant (NYSG), a

cooperave program of Cornell

University and the State University

of New York (SUNY), is one of 34

university-based programs under the

Naonal Oceanic and Atmospheric Administraon’s

Naonal Sea Grant College Program. Since 1971, NYSG

has represented a statewide network of integrated

research, educaon and extension services promong

coastal community economic vitality, environmental

sustainability and cizen awareness and understanding

about the State’s marine and Great Lakes resources.

Through NYSG’s eorts, the combined talents of

university sciensts and extension specialists help

develop and transfer science-based informaon to

many coastal user groups—businesses and industries,

Federal, State and local government decision-makers

and agency managers, educators, the media and the

interested public.

Suolk County Department of Economic

Development and Planning

New York Sea Grant

Cornell Cooperave Extension Suolk County

Marine Program

Long Island Commercial Fishing Associaon

Cornell Cooperave

Extension (CCE) is a

non-prot community

educaon agency established in 1917. We are aliated

with Cornell University as part of the naonal land

grant university system started in 1862. CCE Suolk is a

subordinate governmental agency with an educaonal

mission that operates under a form of organizaon

and administraon approved by Cornell University as

an agent for the State of New York. The associaon

is part of the naonal cooperave extension system,

an educaonal partnership between County, State,

and Federal governments. As New York’s land grant

university Cornell administers the system in this State.

All associaons work to meet the needs of the counes

in which they are located as well as State and naonal

goals. CCE is one of the only groups on Long Island that

works directly with local commercial sherman. We

help to ensure this unique and historical way of life

is preserved. We work with local, State and Federal

managers to ensure local shing is sustainable.

The Long Island Commercial

Fishing Associaon

represents 11 dierent

gear types of commercial

shermen in 14 ports on

Long Island. It was established in 2001 to educate the

public as to the importance of commercial shing as a

heritage industry, and to work with town, county, State

and Federal lawmakers to promote and support New

York commercial shing and shermen.

3

Partner Proles 2

Execuve Summary 4

Background and Introducon 6

Survey Parcipants 10

Fishing Pracces 12

Fishing Eorts 19

Fishery Challenges 24

Regulatory Challenges 25

Environmental Challenges 29

Infrastructure Challenges 31

Infrastructure Needs 33

Business and Markeng Challenges 34

Other Challenges 37

Impacts of COVID-19 39

COVID-19 Support 42

Fisheries Investments 43

Conclusion 44

Ways to Support 51

Table of Contents

The development of this report was parally funded through A/EEP-52 award NA20OAR4170487 from the Naonal Sea Grant College

Program of the U.S. Department of Commerce's Naonal Oceanic and Atmospheric Administraon, to the Research Foundaon for

State University of New York on behalf of New York Sea Grant. The statements, ndings, conclusions, views and recommendaons are

those of the author(s) and do not necessarily reect the views of any of these organizaons.

Executive Summary

4

Faced with environmental, social and economic

pressures, the NY commercial shing industry has

endured many challenges to maintain its important

posion within the Long Island economy. In light of

these challenges, the Suolk County Department of

Economic Development, New York Sea Grant, Cornell

Cooperave Extension of Suolk County, and the Long

Island Commercial Fishing Associaon conducted a

survey in 2021 to produce data for policy makers to

consider in developing approaches to support an

environmentally and ecologically sustainable shing

industry. The survey garnered 67 responses from

commercial shermen, who rst answered broad

quesons about their businesses and then later oered

insights on the impacts of sheries, regulaons, the

environment, infrastructure, business challenges, and

COVID-19 on the industry. This report will help guide

future eorts to support and grow the commercial

shing industry.

This report idenes many pressing challenges to the

future of shing here on Long Island. Seventy-one

percent of respondents indicated a strong need for

addional support from State and Federal Sources.

Survey results showed a percepon that regulaons

favored compeng interests and compeng water

users. These interests include non-local sheries (out-

of-state and out-of-country) and the recreaonal shing

industry. Current and future oshore wind projects

were called out for parcular concern, as commercial

shermen indicated that oshore wind projects will

occupy and restrict tradional shing grounds, limit

days at sea (parcularly during construcon), and pose

safety hazards. Fishermen in the survey see a need for

increased investment and nancial assistance in order

to build and sustain new and exisng commercial shing

infrastructure, to market and promote local product,

and to oset increases in labor, equipment, materials,

and repair costs. Infrastructure needs were frequently

cited, as shermen experienced challenges related

to a lack of processing facilies for landed species

(80%), lack of ice dockside (66%), lack of direct sales

opportunies (64%), lack of refrigerated storage space

dockside (54%), and lack of facilies to maintain vessels

(54%).

The survey also asked shermen to evaluate

environmental challenges within the region. Habitat

loss (41.1%) and insucient dredging (31.5%) received

the highest percentages of respondents cing these

issues as “extremely challenging.” Fiy-seven percent of

respondents viewed habitat loss as “very” or “extremely

challenging” and only 5% stated that the issue is "not

at all challenging." Sixty-nine percent of respondents

viewed extreme weather events as at least moderately

challenging.

Source: Blue Moon Fish

5

The survey revealed that the COVID-19 pandemic has

presented negave impacts and hardship to almost

every facet of the commercial shing industry. Eighty-

seven percent of respondents experienced a loss of

revenue in 2020 due to the pandemic. A majority of

respondents reported losses in the sale prices of sh

landed, as well as quanty of sh sold, while 47.1%

indicated that COVID-19 reduced the number of dealers

selling landed sh. Addionally, a high proporon of

respondents reported seeing increased costs for both

gear and non-gear expenses. Fortunately, a signicant

percentage, but certainly not all, of the shermen

who responded were able to parally oset lost

revenues with some government nancial support,

including funds from the CARES Act Marine Fisheries

Relief Program, the Small Business Administraon and

Paycheck Protecon Program grants and loans.

Perhaps most importantly, many respondents asserted

that unfavorable condions have led to a widespread

disinterest by and barriers to entry to the next generaon

of shermen. Thus, despite growth in the industry from

$14.1 million in 2005 to $54.1 million in 2018 (NOAA

Fisheries ENOW), survey responses demonstrate how

fragile this industry can be in the absence of wise

planning, targeted government investment, and well-

developed and carefully considered regulaon. This

report concludes with some specic recommendaons

about how to invest in the future of commercial

shing and how we can migate the impacts of some

of the more severe environmental, regulatory, and

infrastructure based constraints on commercial shing

on Long Island.

With responses from only about 10% of licensed

shermen, the survey results are not inclusive and can

only serve as general insight into some of the challenges

and common pracces of New York's shing industry.

Source: Blue Moon Fish

Help increase representaon of the

600+ licensed shermen in New York by

sharing the 2022 survey. The survey is

linked above and open to all New York

Fishermen. Responses will be used to

develop the 2022 survey report.

Click Here to Complete the

2022 Commercial Fishing Survey

Click Here to Complete the

2022 Commercial Fishing Survey

6

Background and Introduction

The 2021 commercial shing survey was distributed to shermen across Long Island online through email and

social media plaorms and in person at the docks. Sixty seven shermen completed the survey and their responses

are recorded in this report. The team plans to connue to distribute this survey annually and publish an annaul

report to track changes in the Long Island commercial shing industry over me.

Overall, the local economic impact of marine living

resources has increased, with several indicators

suggesng that the growth has largely resulted from

investments in establishments that complement

commercial shing. The number of establishments

associated with commercial shing moderately

increased from 87 in 2005 to 110 in 2018, but the

number of employees per establishment increased

from four to six. While the number of self-employed

workers dipped slightly from 757 to 693, the number of

workers employed doubled from 307 to 614.

Meanwhile, wages have signicantly increased from $6

million to over $37 million, and the average wage per

employee increased from $19,400 to $37,300. These

data suggest a growth in higher-end subsectors of the

industry, especially as post-COVID-19 Suolk County

once again experiences record levels of tourism.

Economic Impact

Suolk County’s commercial shing heritage spans

more than 400 years, represenng a patchwork quilt of

inter-related small businesses here on Long Island. Our

wild-caught sheries, ports, shermen, and support

industries all contribute to the producon of sustainable

fresh sh for consumers locally and beyond, supporng

our seafood shops, retail food stores, restaurants, and

tourism industries.

Marine employment on Long Island contributes close

to 34,000 jobs and nearly one billion dollars in wages.

Although commercial shing employment directly on

the water represents only 1.5 percent of that. This is

likely due to the limited access entry regulaons in

place by both the State and the Federal government.

Several economic indicators point to growth in the

overall sector, which can at least parally reect new

posive market trends of local seafood consumpon

(NOAA Snapshots). The gross domesc product (GDP)

increase from $14.1 million in 2005 to $54.1 million in

2018 provides a telling stasc of a growing market for

commercial shing.

In 2018 (ENOW data) nearly 700 small businesses that

depended on living marine resources in Suolk County

brought in over $54 million dollars. That same year

Montauk, the State’s largest shing port, was ranked

the 57th largest commercial shing port in the US in

pounds landed. Together the ports of Montauk and

Shinnecock alone landed over 18 million pounds of sh

in 2018 valued at $23 million dollars. The East End of

Long Island has long dominated the regional commercial

shing industry due to its access to a multude of both

local and Federal water shed species that migrate both

inshore and oshore along the New York Mid-Atlanc

Bight .

Regulatory Overview

Fisheries are regulated by the Department of

Environmental Conservaon (NYSDEC) in New York State

and by the Naonal Marine Fisheries Service (NMFS),

federally. Fishermen must have the appropriate State

and Federal commercial licenses to legally operate.

State and Federal quotas on various sh stocks are

based on biological values determined by both State

and federal sciensts. These quotas, which can vary by

season, determine how many pounds of each individual

species can be landed coastwide, regardles of whether

they were caught in State or Federal waters.

7

In New York State, commercial shermen are required

to have a Marine Commercial Food Fishing License,

which covers mulple species, costs $250 and must

be renewed yearly. Addional State issued permits are

required for certain highly sought-aer species (like

uke and striped bass). The Food Fishing License allows

the license holder to take and land food sh harvested

from State waters and to land food sh taken from

waters outside the State for commercial purposes.

The number of food sh licenses issued each year has

been limited since 1995. New applicants may need to

wait years before an old license is relinquished. Oen

younger shermen work on established boats to get

experience and income, and then once they meet the

income eligibility requirements (averaging $15,000

in commercial shing income over three years), they

can apply for their own personal permits. Species-

specic Federal permits are required for most species

in Federal waters, and many species have a moratorium

on new permits that require the sherman to purchase

an already exisng permit.

Commercial Fishing Methods

Commercial shing methods in Suolk County remain a

mixture of old and relavely new (20th century) shing

and gear types. Baymen may sh using the centuries

old method of pound nets or gill-nets in the bays or

dig for clams and other shellsh. Inshore State-waters

shermen, (0-3 miles from shore,) and/or oshore

Federal-waters-shermen (3-200 miles from shore),

may use gear types which include traps, pots, gill-nets,

longlines, oer-trawl nets, and dredges, depending on

the State and Federal permits they possess.

The species a sherman chooses to target will

determine how big of a boat is needed to work safely

in an ever-changing sheries environment. A boat’s

size will depend on the gear type shed and distance

necessary to travel for permied species, whether

inshore or oshore. In general, a shing boat will need

to be bigger to sh safely farther from shore in deeper

water, in all weather.

Maintenance, upkeep and gear costs, me-of-year

travel distances to sh stocks, (in some cases acquiring

out-of-state permits so as to travel to other States’

ports to land larger quotas of State-by-State regulated

species), seasonal weather changes, market demand

and the cost of fuel will also impact a shermen’s ability

to target, catch, and sell certain species.

In order to understand shing in Suolk County, it is

important to understand sh migraons. Many sh

species that are landed on Long Island migrate inshore

in the spring and then move oshore in the fall and

winter. Excepons to that migraon would include

winter ounder - they come inshore in the winter and

early spring to breed; golden lesh - which live near

the oshore canyons year-round, plus highly migratory

species like swordsh and tunas that swim the eddies of

the Gulf stream and migrate internaonally. New York

commercial shermen catch over 50 species of sh in

State and Federal waters.

Fisheries stocks abundance can uctuate so that shery

management regulaons may vary from year to year.

The top ve species landed by poundage in New York

in 2019 were scup, loligo squid, monksh, lelsh, and

whing. By dollar value, the top ve species were surf

clam, loligo squid, lesh, uke and scup.

8

Impacts of COVID-19

COVID-19 was devastang economically for Suolk

County’s commercial shing communies due to the

loss of sales to sh buyers who ulmately sell to local

restaurants throughout New York City and to points

beyond. Restaurants naonwide were hit hard by

closures or had limited sales during the height of the

pandemic. However a silver lining for the county’s

shermen may be a renewed, and growing, sustainable

consumer interest in both fresh and frozen seafood.

According to a recent 2021 seafood sales research report

by IRI and 210 Analycs, current seafood sales easily

trended ahead of pre-pandemic levels. Frozen seafood

sales spiked more than 40 percent ahead of 2019, while

fresh seafood sales jumped 33.7 percent compared to

2019. Whether it was due to shortages in other protein

sources like beef or chicken, or a newfound interest in

underulized sh species that were reasonably priced,

more Americans started eang more seafood.

Below are 2019 landings (2020 landings were not used

due to COVID-19) ranked by dollar value for Suolk

County’s two most producve ports – Montauk and

Hampton Bays/Shinnecock. Data was provided by the

Atlanc States Marine Fisheries Commission.

9

What You Can Find in This Report

The following report summarizes the demographics,

shing gear, port of landing and other important

aributes gathered from 67 Long Island shermen who

answered our survey. These 67 survey respondents

vary by gear type. The latest DEC records indicate

over 600 food sh licensees in Suolk County, so this

is a small sampling of New York’s overall commercial

shermen. With responses from only about 10% of

licensed shermen, the survey results are not inclusive

and can only serve as general insight into some of the

challenges and common pracces of New York's shing

industry.

The partners on this project intend to issue the

survey annually, so each year we hope to idenfy

beer pracces to increase the number of survey

respondents and obtain a stascally signicant data

set. Addionally, the 67 survey respondents may not

mirror precisely the scope and scale of Suolk County

commercial shing. Certain segments of Long Island’s

commercial shing industry may be underrepresented.

A future determinaon of how many shermen belong

to each gear type and how it relates to full or part me

income may be of interest.

Nevertheless, we believe these inial survey results

will help us beer understand the future needs of Long

Island commercial shing. By design, the survey was

meant to focus on the parcular modern-day needs

and challenges of commercial shing here in New York.

It was also meant to idenfy future opportunies for

Suolk County shermen, and serve the economic

development and quality of life interests of both

shermen and Long Island residents and visitors in

general.

Finally, this 2021 survey, which was in the eld

between April 2021 and November 2021, collected

data that can be compared to survey results collected,

but unpublished, in 2019 (76 respondents). Where

available, the reader will nd survey results compared

to 2019 responses.

This allowed the partners on this report to make

important comparisons to a “pre-COVID-19” industry

and it will allow readers and invested stakeholders to

make recommendaons and draw conclusions about

future industry needs. This report concludes with some

basic recommendaons and an invitaon to the reader

to help us evaluate and explore ways to protect and

preserve the economic, ecological, and sustainable

future of this essenal heritage industry.

Source: Blue Moon Fish

0

5

10

15

20

'21

'19

>5041-5031-4021-3011-206-101-5

Number of Respondents

4.2%

1.8%

10.9%

10.4%

23.6%

22.9%

23.6%

22.9%

14.5%

35.4%

20.0%

29.2%

5.5%

6.3%

10

Q1. How many years have you been a Commercial Fisherman?

Q2. What percentage of your total income (earned, pensions, investments, etc.)

comes from commercial shing?

Survey Participants

The majority of respondents (≥ 70%)

received 75% - 100% of their annual

income from commercial shing. This

remained consistent between the 2019

and 2021 survey. This is an important data

point, as the intent of this survey is to

collect informaon from those individuals

who rely on shing as their primary source

of income and could potenally be used

as an indicator of community reliance

and vulnerability to shocks in the system.

These are the individuals most invested in

the present and future of their industry.

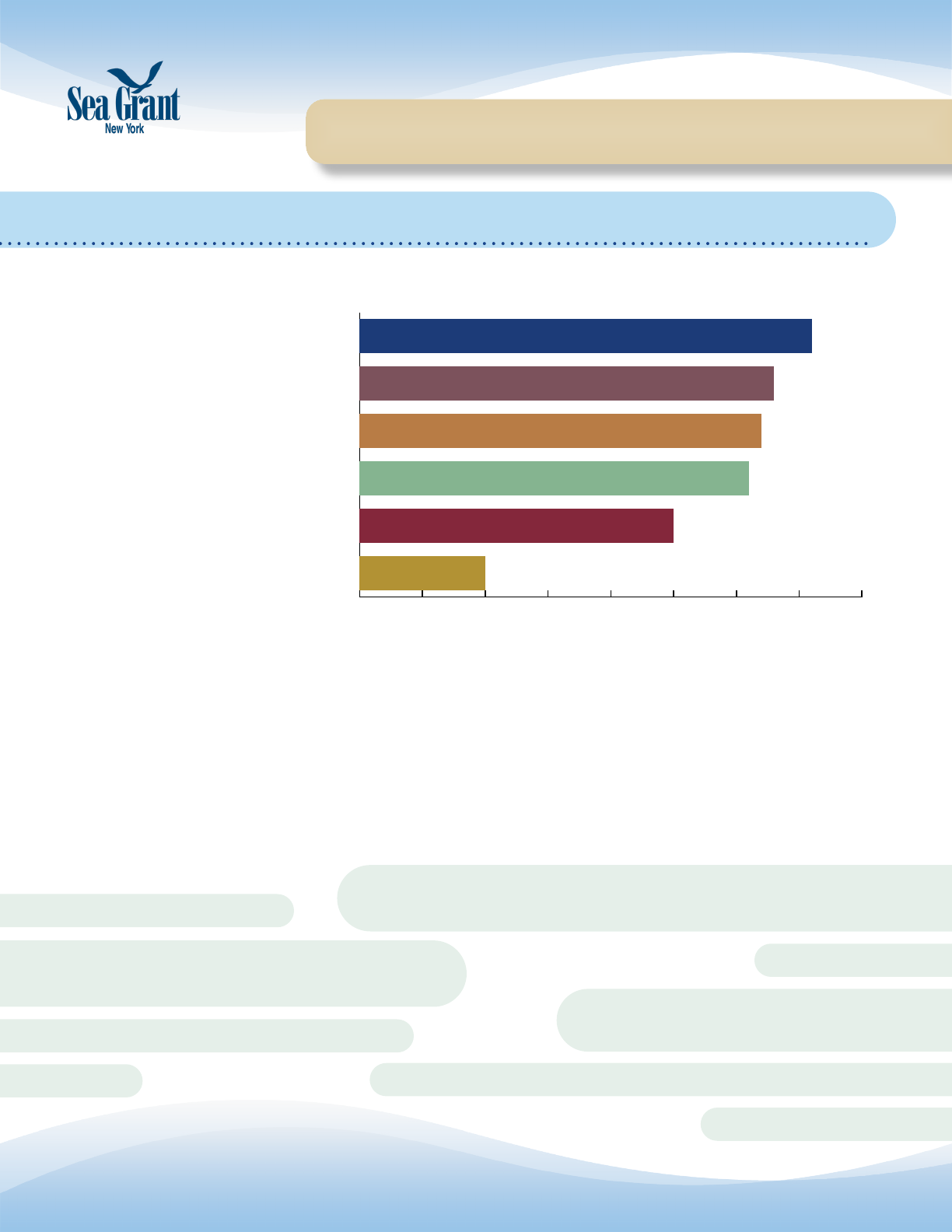

This bar graph represents the length

of me in years that respondents

have been engaged in the

commercial shing industry.

Responses ranged anywhere

from 1-55 years with the majority

between 30-50 years as a

commercial shermen. This is an

increase from the 2019 results

which showed a larger number of

respondents shing between 11-30

years.

Years

Percent Total Income

0

10

20

30

40

50

60

'21

'19

75-100%51-75%26-50%0-25%

Number of Respondents

11.4% 11.4%

11.4%

5.7%

2.9%

7.1%

74.3%

70.0%

0 5 10 15 20 25

'21

'19

75-84

65-74

55-64

45-54

35-44

25-34

18-24

Number of Respondents

2.7%

11.9%

12.0%

13.3%

13.4%

19.4%

25.3%

28.0%

35.8%

10.7%

14.9%

8.0%

4.5%

11

Q3. What is your age?

The majority of respondents were between 45

and 64 years old. In the 2021 survey, there was a

slight increase in respondents in older age ranges

(55+) compared to the 2019 respondents. This

age breakdown mirrors the demographics of the

DEC's food sh licensees who have an average age

of 57, ranging from 18-90. It also speaks to the

aging demographics within the industry and the

need to take steps to idenfy next generaons of

American shermen.

Number of Responses

Age Range

Source: Long Island Commercial Fishing Associaon

12

Q4. How many months a year do you use each of the below gear types?

Fishing Practices

How many months a year do you

use a bull rake?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

How many months a year do you

dive?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

Respondents were asked to indicate how many months each year they ulize dierent shing gear types. Bull

rakes, diving, and hook and line, shown here were used to varying degrees by respondents with hook and line

being used most frequently and by the largest number of respondents. Bull rakes are large metal rakes used to

harvest shellsh from the sea bed from a boat or ski. Diving is tradionally used in New York for shellsh harvest

and hook and line is the tradional rod and reel shing used to catch a variety of nsh species.

How many months a year do you

use hook and line?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

13

How many months a year do you

use an o�er trawl?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

How many months a year do you

use a pelagic longline?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

Oer trawls are a type of midwater trawl that ulize large nets that are pulled behind a shing vessel through the

water column to catch a variety of nsh species commonly found in the water column. This is a common gear

type for New York shermen and are used all year long. Pelagic long lines are used far less frequently in New York

and consist of a series of baited hooks aached to main line that is buoyed at the surface. This type of gear is more

commonly used to catch large game sh like Tunas and Swordsh.

14

How many months a year do you

use pots/traps?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

How many months a year do you

use a pound net?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

Pots and traps are used regularly by New York shermen and are submerged three dimensional devices made of

wood or wire that are baited to ence target species to enter and are designed to be dicult to escape. This gear

type is most commonly used to catch crustaceans and mollusks such as crabs, lobster, and whelk. Pound nets,

while not as common, are also used to varying degrees in New York. Pound nets use mesh fences and tunnels to

interrupt sh movements and funnel the sh into a trap or pound at the end that limits opportunies for escape.

The sh can then be harvested from the trap/pound by net. These can be used for nsh species such as bluesh,

menhaden, and ounder.

15

How many months a year do you

use a dredge?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

How many months a year do you

use a gill net?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

Gill nets are regularly used by New York shermen and consists of a wall of neng that is suspended in the water

column. The mesh size of the neng is designed to specically allow the head but not the body of a target nsh

species to pass through. Once the head passes through the sh's gills, they get caught in the mesh. This method

can be opmized to target a variety of dierent nsh species. Dredging is another method used by New York

shermen. This method relies on a metal frame aached to a collecon bag that is dragged along the sea oor to

collect boom dwelling species of shellsh such as clams, mussels, oysters, scallops, crabs and whelk.

16

How many months a year do you

use a purse seine?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

121110987654321

How many months a year do you

use other types of fishing gear?

0

2

4

6

8

10

12

14

16

Months

Number of Responses

Haul Seine

Not Specified

Beach Seine

Hand Gather

121110987654321

Purse seines are not commonly used in New York but can be used by a couple shermen up to six months a year.

Purse seines are large nets that are deployed around a school of sh in the water column and then closed at

the base before being lied out of the water to trap any sh in the vicinity. This method is commonly used for

schooling nsh species and squid. New York shermen also use haul seines and beach seines to capture near

shore species and hand gather shellsh in the bays across Long Island. More informaon on shing gear and

pracces can be found on the NOAA Fisheries website.

Source: Long Island Commercial Fishing Associaon

17

0 5 10 15 20 25 30 35

Purse Seine

Pelagic Longline

Dive

Other

Pound Net

Bull Rake

Dredge

Gill Net

Hook and Line

O�er Trawl

Pots/Traps

Number of Respondents

Number of Respondents Using

Each Gear Type

35

31

30

27

19

16

9

5

4

3

2

Number of Gear Types Used by

Respondents

0 5 10 15 20 25

12-

11-

10-

9-

8-

7-

6-

5-

4-

3-

2-

1-

Number of Respondents

Number of gear types

21

8

15

7

0

1

3

6

0

1

0

1

Respondents were not limited to choosing

a single gear type. This allowed for mulple

gear types to be idened by a respondent.

The most common gear types employed

were pots/traps (35), oer trawl (31), hook

and line (27), and gill nets (27).

A majority of respondents (44 of 63) indicated

that they used three or fewer dierent gear

types when conducng commercial shing

acvies. One third of all respondents only

used a single gear type.

18

Point

Lookout (1)

Q5. Where is your primary port of landing?

Q6. How many crew work on your vessel?

Of the 67 responses, 45 indicated they

had at least one crew. The majority of

boats have between one and three

crew, with a few reporng as many as

eight crew members.

Montauk - 25

Shinnecock-Hampton Bays - 15

Primary LI Ports:

0

5

10

15

20

25

30

35

40

Women

Men

None7-94-61-3

The largest shing port represented by respondents

was Montauk followed by Shinnecock-Hampton Bays.

Number of Crew

Number of Responses

19

Q7. How have your shing eorts changed over the last year?

Fishing Eorts

0

5

10

15

20

25

30

35

40

Time Spent Fishing

Number of Responses

41.4%

34.5%

24.1%

+=

-

+

=

-

Decrease

No Change

Increase

0

5

10

15

20

25

30

35

40

Crew

30.4%

58.9%

10.7 %

Number of Responses

+=

-

Fiy-six respondents answered the queson of how

their crew size changed over the past year. More than

half (33 responses) of these responses indicated that

respondents' crew levels stayed the same over the past

year. Thirty percent reported that their crew levels have

decreased over the past year and 10% indicated that

crew levels had increased from the year before.

Of the 58 respondents who answered this queson,

41% (24 responses) indicated that the me in which

they spend shing has decreased over the last year.

Thirty-four percent indicated that their me spent

shing had not changed since last year and 24%

indicated that their me spent shing increased from

the year before.

Fiy-eight respondents, in total, provided a response to

the queson of how the me spent on compliance with

regulatory procedures and paperwork has changed

over the past year. A majority – 38 responses (65%) –

indicated that the me spent on regulatory compliance

and paperwork had actually increased over the past

year. Nearly all other respondents (19 responses)

indicated that the me spent on regulatory compliance

had stayed the same, with only one respondent

indicang that me spent on regulatory compliance

had decreased.

Among those 58 respondents indicang how the

amount of gear used has changed over the past year

nearly 70%, or 40 respondents, indicated that the

amount of gear they used had not changed since 2020.

Nearly 14% indicated that the amount of gear they

used had increased (eight responses) and 17% said the

amount of gear decreased from last year.

20

0

5

10

15

20

25

30

35

40

Time Spent on Regulatory

Compliance/Paperwork

+

=

-

Decrease

No Change

Increase

Number of Responses

1.7%

32.8%

65.5%

+=

-

0

5

10

15

20

25

30

35

40

Amount of Gear Used

(Number of pots/traps/etc.)

+=

-

17.2%

69.0%

13.8%

Number of Responses

More than three-quarters (79%) of the 58 respondents

providing a response to this queson indicated that the

type of shing gear that they use had not changed over

the past year. However, a total of twelve respondents

(21%) answered “yes.” Some specic changes to gear

that individual respondents referenced in their survey

responses involved the addion of more traps and

nets, the addion of crab pots, the decision to work

in dierent sheries, and switching from lobstering to

scallop dredging. While the sample size is small, roughly

one out of ve respondents indicang a change in gear

type from year-to-year is noteworthy.

21

Q8. Has the TYPE(s) of shing gear you use changed over the past year?

Q9. If yes, how has the type(s) of gear you use changed over the past year?

"Crab pots."

0

10

20

30

40

50

NoYes

Number of Responses

20.7%

79.3%

"Need to use multiple gear types in the same day."

"Increase in price."

"More eective, less bycatch."

"More types."

"Need to use multiple gear types in the same day."

"Needed to work dierent sheries to make income."

"Same methods, just

more traps/nets."

"Experimenting with gear to maximize catching."

"I had to change some of my shing methods."

"I have made modications to my gear."

"I’ve switched from lobstering to scallop

dredging . I intend to start trawling in 2022."

22

Q10. What species have you landed in the past year?

Species Landed

Percentage of

Respondents

Black Sea Bass 71.6%

Bluesh 67.2%

Striped Bass 65.7%

Scup/Porgy 62.7%

Dogsh 58.2%

Tautog 58.2%

Weaksh 53.7%

Skate 49.3%

Summer Flounder (Fluke) 49.3%

Buersh 44.8%

Goosesh (Monksh) 38.8%

Longn Squid 38.8%

Conch 35.8%

Lobster 29.9%

Atlanc Mackerel 26.9%

Clams (Quahog) 28.4%

Silver Hake (Whing) 28.4%

Winter Flounder 28.4%

Blue Crab 26.9%

Menhaden (Bunker) 26.9%

Red Hake 26.9%

Eel 23.9%

Golden Tilesh 20.9%

Cod 19.4%

Oysters 19.4%

Atlanc Herring 14.9%

Sea Scallops 14.9%

Jonah Crab 13.4%

Tilesh 13.4%

Bluen Tuna 9.0%

Yellown Tuna 9.0%

Surf Clams 1.5%

Horshoe Crabs 0.0%

13.4% of respondents indicated that they

caught other species such as: blowsh

chubb mackerel, kingsh, sanddab,

spot, silversides, croaker, mantis shrimp,

swordsh and welk.

Among the 67 respondents who

completed the survey, over 71%

were landing Black Sea Bass,

over 67% were landing

Bluesh, over 65% were

landing Striped Bass, over

62% were landing Scup/

Porgy, and over 58% were

landing Dogsh and Tautog.

These represent the top

six species landed by

respondents but does not

fully reect NY landings

as a whole, as there are over 600

licensed commercial shermen

in New York. The landings data

reected here is highly dependent

on permits held, geography,

and gear types ulized by the

respondents.

The survey team hopes to increase parcpaon over

me to more accurately represent the New York

commercial shing industry as a whole. For more

complete statewide sheries landing data see: www.

accsp.org

Long Island shermen nd Porgy/Scup to be the most dicult to sell, with een other species idened by at

least one shermen.

Number of Responses

23

Q11. In your opinion, which locally abundant species are most dicult to sell?

Separate le for species landed qs

0 2 4 6 8 10 12 14 16 18 20

Tuna

Summer Flounder

Squid

Skate

Conch

Oysters

Tautog

Lobster

Eel

Crab

Dogfish

Menhaden

Sea Robin

Monkfish

Porgy/Scup

While respondents did identify several

species that were dicult to sell, many

noted that the real challenge was

getting a reasonable price for their

catch, not just selling it.

24

Q12. How concerned are you about the future protability of your business?

Fishery Challenges

89.7%

8.8%

76.3%

20.3%

3.4%1.5%

Not Concerned

Not Very Concerned

Somewhat Concerned

Very Concerned

2019 2021

Fiy-nine of the 67 survey respondents oered their insight into concern over the future protability of the shing

business. Ninety-seven percent of respondents (57 responses) indicated that they are at least “somewhat” or “very

concerned” about the future protability of their business. Specically, 76% of respondents alone reported being

“very concerned” about the future of their business, with an addional 21% being only “somewhat concerned.”

Only two respondents were not very concerned about the future of their business’ protability. Interesngly,

the percentage of shermen who said they were “very concerned” about future protability actually decreased

between 2019 to 2021 from 87% to 76%.

Responses to the queson on the challenge of

the availability of real-me quota tracking were

collected from 54 of the 67 parcipang survey

respondents. Among these responses, 22%

characterized the availability of real-me quota

tracking as “very” challenging. A total of 60%

viewed the availability of real-me quota tracking

either as “very” or “moderately” challenging.

Fiy-ve of the 67 total individuals responding

to the survey answered this queson on Federal

and State regulaons. Nearly 42% of queson

respondents indicated that they felt Federal and

State regulaons were “extremely” challenging.

Nearly half of the 55 queson respondents (27

responses) said that Federal and State regulaons

were either “very” or “moderately” challenging.

Fiy-four respondents to the survey responded

to the queson of the challenge of inappropriate

state-by-state sheries allocaons, with 13

respondents not providing a response. Sixty-ve

percent of these 54 respondents characterized

inappropriate state-by-state sheries allocaons

as “extremely” challenging. An addional 27% of

respondents characterized these allocaons as

“very” or “moderately” challenging.

25

Q13. How challenging are the following regulatory issues are for you as a

commercial shermen?

Regulatory Challenges

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is the availability of real-�me

quota tracking?

22.2%

25.9%

33.3%

14.8%

3.7%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging are Federal and State regula�ons?

41.8%

23.6%

25.5%

5.5%

3.6%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging are innapropriate state-by-state

fisheries alloca�ons?

64.8%

20.4%

7.4%

1.9%

5.6%

Number of Responses

Fiy individual responses from the survey’s 67

total respondents were collected for this queson.

Overall, 36% of these 50 respondents indicated

that insucient regulaon of internaonal sheries

was “extremely” challenging. Forty-two percent of

respondents reported that they felt the insucient

regulaon of internaonal sheries to be either

“very” or “moderately” challenging.

Of the 45 respondents providing responses to this

queson, 71% idened a lack of State support

as extremely challenging. “Very” or “moderately”

challenging were used to describe the lack of State

support by 22% of queson respondents. Few (3

responses) respondents reported nding a lack of

State support as either only slightly challenging or

not at all challenging. Of all challenges idened

under “Regulatory Challenges” sub-category, the

“lack of State support” actually received the greatest

proporon of respondents indicang that this issue

was extremely challenging. Some respondents

provided addional open-ended feedback and cited

issues associated with license transfers, the inability

to transfer permits, and shing quotas.

26

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is insufficient regula�on of

interna�onal fisheries?

36.0%

22.0%

20.0%

8.0%

14.0%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is a lack of State support?

71.1%

8.9%

4.4%

2.2%

Number of Responses

13.3%

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is a lack of Federal support?

48.8%

17.1%

19.5%

0.0%

14.6%

Number of Responses

Nearly half (20 responses) of the 41 total respondents

to this queson stated that the lack of Federal support

was “extremely” challenging. An addional 36% of

these respondents chose “very” or “moderately”

challenging to describe the lack of Federal support.

Six of the 41 respondents (nearly 15%) said that the

lack of Federal support was not at all challenging. No

respondents used “slightly challenging” as a way to

describe the lack of Federal support.

Specify what type of federal

support is lacking:

Specify what type of state support

is lacking:

Respondents indicang that there was a lack in State and Federal support for their industry and/or business

were asked to specify what support was lacking. The quoted text on this page represents the support that

respondents felt was lacking at the State and Federal level.

"Poor promotion of

national industry."

"Unfair shery allocations" & "Too

many permits."

"Federal agencies should not be able

to lease areas directly on or adjacent to

signicant shing grounds."

"If Federal regulations prevent

us from earning a living, we

should be compensated much

like the farm industry."

"If they have a say in waterfront

development they haven’t been

helpful for the Bayman."

"Lack of ability to transfer NYS food

sh permits makes it impossible to shift

sheries."

"Little to no communication."

"Regulations that limit what we sh for are business killers. If we are restricted by

limits and seasonal closures, we should be compensated much like the farm industry."

"They don’t support the sherman in New York. We sh

under the smallest quota on the east coast. We don’t have

processing in the State. Shipping costs are extremely high

to get our sh where they need to go."

"No regulation on homes built along

waterfront negatively impacting water

quality, thus restricting baymen’s

harvesting grounds."

"Too many licenses."

"Limited promotion of local industry."

27

Of the 55 out of 67 survey respondents answering this

queson, 34% said that the cost of compliance with

sheries management regulaons was “extremely

challenging.” More than a quarter of respondents

separately characterized the cost of compliance

as “very challenging” (25% of respondents) and

“moderately challenging” (27% of respondents). The

remaining 13% of respondents indicated that this

cost of compliance was “slightly challenging”, with

no respondents saying that complying with sheries

management regulaons is “not challenging at all.”

Of the 50 survey respondents to this queson, 68%

of respondents found that the perming of oshore

wind turbines was “extremely challenging” to their

livelihood. Twelve (24%) respondents indicated that

this perming was either “very” or “moderately”

challenging. The remaining four respondents to this

queson all indicated that the perming of wind

turbine lease areas in tradionally producve and

viable shing waters was “not challenging at all”.

Responses for this queson on the challenge of

COVID-19 regulatory condions were collected

from 50 of the 67 individuals parcipang in this

survey. Overall, 30% or 15 of these respondents

characterized COVID-19 regulatory condions

as “extremely challenging” to their business. An

addional 44% of respondents indicated that they

found COVID-19 regulatory condions to be “very”

or “moderately” challenging. The remaining 26% of

respondents were nearly evenly divided between

thinking COVID-19 regulatory condions were either

“slightly challenging” (seven responses) or “not at all

challenging” (six responses).

28

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is the cost of compliance with

fisheries management regula�ons?

34.5%

25.5%

27.3%

12.7%

0.0%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

68.0%

12.0%

12.0%

0.0%

8.0%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging are the COVID-19 regulatory

condi�ons?

30.0%

24.0%

20.0%

14.0%

12.0%

Number of Responses

Among the 56 respondents (out of

67 total parcipang individuals) for

this queson, the most commonly

provided answer was that extreme

weather events are moderately

challenging, with 37.5% of these

individuals characterizing extreme

weather in this fashion. 17% of

respondents indicated that extreme

weather events were “extremely

challenging” and 23% reported

that they were “very challenging”

to their livelihood. An addional

16% of the queson’s respondents

found extreme weather events to be

“slightly challenging,” with only three

respondents characterizing this issue

as” not at all challenging.”

29

Q14.Please indicate how challenging the following environmental issues are

for you as a commercial shermen?

Environmental Challenges

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is environmental pollu�on and the

loss of fisheries habitat?

41.1%

16.1%

33.9%

3.6%

5.4%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging are extreme weather events (For

Example, Super Storm Sandy)?

17.9%

23.2%

37.5%

16.1%

5.4%

Number of Responses

Fiy-six of the total 67 survey respondents provided insight on the challenges associated with environmental

polluon and the loss of shery habitat. Forty-one percent of these respondents characterized polluon and

sheries habitat loss as extremely

challenging. Half of the respondents

used “very challenging” or “moderately

challenging” to describe the issue of

environmental polluon and the loss

of sheries habitat. Five respondents

reported that these issues were either

only slightly challenging (2 responses)

or not challenging at all (3 responses).

Among the issues incorporated under

the category of “Environmental

Challenges”, environmental polluon

and the loss of sheries habitat

received the highest proporon of

respondents indicang that they felt

“extremely challenged” by this issue.

Out of the survey’s 67 parcipants, 56 respondents oered insight into the issue and challenges of global climate

change. Among these individuals, nearly 18%, indicated that global climate change is “extremely challenging” to

their profession. Thirty-nine percent of these respondents indicated that global climate change was either “very

or “moderately challenging”. Out of the remaining 24 respondents for this queson, 14% indicated that global

climate change was “slightly challenging” and 29% believed that global climate change was “not at all challenging”

for their livelihoods.

Of the 54 individuals responding to this queson, 17 or 31% thought that the issue of insucient dredging was

“extremely challenging”. More than 38% of respondents indicated that this issue was either “very” or “moderately

challenging” to them and their business. An addional 20% believed that insucient dredging was “not a challenge

at all.”

30

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is insufficient dredging?

31.5%

16.7%

22.2%

9.3%

20.4%

Number of Responses

0 5 10 15 20 25 30 35

Not at all

Slightly

Moderately

Very

Extremely

How challenging is global climate change?

17.9%

16.1%

23.2%

14.3%

28.6%

Number of Responses

Responses to this queson were collected from 55 of

the total 67 parcipang respondents. Of these 55

individuals, the most common characterizaon of the

challenge of conicng water uses and users were

“very challenging” and “moderately challenging,” both

of which were equally selected by 29% of respondents.

Nearly 22% said that conicts with other water users

was “extremely challenging” to them, while 16% said

that this issue was only “slightly challenging.”

Fiy-ve respondents answered this queson, with

the most common characterizaon of the lack of local

infrastructure and support industries being “extremely

challenging.” In total, 49% of respondents said that this

issue was “extremely challenging” to their industry and

profession. An even number of respondents answered

that they believed the lack of local infrastructure

and support industries to be “very” or “moderately

challenging,” with 12 responses received for each. Only

four respondents (7 %) indicated that they felt this issue

was either “slightly” or “not at all challenging.”

Nearly 70% of answering respondents (56 out of 67

total survey respondents) characterized the issue

of rising costs associated with shing as “extremely

challenging.” The remaining 30% of respondents to this

queson either indicated that this issue was “very” or

“moderately challenging” to them. Among the surveyed

infrastructure challenges, rising costs associated with

shing received the greatest proporon of respondents

viewing the issue as an extremely signicant challenge.

31

Infrastructure Challenges

Q15. Please indicate how challenging the following user and infrastructure

issues are for you as a commercial shermen?

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging are conflicts with other water users?

21.8%

29.1%

29.1%

16.4%

3.6%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is the lack of local infrastructure and

support industries?

49.1%

21.8%

21.8%

5.5%

1.8%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging are the rising costs associated

with fishing?

69.6%

21.4%

8.9%

0.0%

0.0%

Number of Responses

A total of 50 survey respondents oered insights into this queson pertaining to specic infrastructure challenges

within the commercial shing industry. The most commonly idened infrastructure challenge was the lack of

processing facilies for landed species, with 80% of respondents (40 out of 50 individuals) nding this to be a

challenge within the industry. The second most common infrastructure challenges were a lack of ice/ice shavings

dockside (66%) and a lack of direct sales locaons and opportunies (64%). Both a lack of refrigerated storage

space dockside and a lack of facilies to repair and upgrade vessels were idened by 54% of the 50 queson

respondents.

"Dock space is available , but costs are challenging."

"No new recruits to industry."

"That I have to truck my sh 30 miles east to have them shipped 100 miles west -

much of which is then shipped back to where they came from. Ludicrous."

32

Q16. What specic infrastructure challenges do you face (Check all that apply)?

0 5 10 15 20 25 30 35 40

Other (Specify)

Dock Infrastructure - Not properly maintained

Lack of Dock Access

Lack of Facili�es to Repair/Upgrade Vessels

Lack of Refrigerated Storage Space Dockside

Lack of Direct Sales Loca�ons and Opportuni�es

Lack of Ice/Ice Shavings Dockside

Lack of Processing Facili�es for Landed Species

Specific infrastructure challenges

Number of Responses

Lorem ipsum

80%

66%

64%

54%

54%

42%

40%

6%

Source: Long Island Commercial Fishing Associaon

In a scenario where new process facilies are constructed, survey respondents most commonly idened

refrigerated storage as being necessary for processing. Of the 48 total respondents, 75% (36 respondents)

indicated refrigerated storage as being needed. Gung/lleng, frozen storage and commercial freezing facility

capabilies were all also idened as being necessary by more than 80% of respondents. Advanced processing

and cooking was the least idened capability, with only 25 respondents viewing this feature as a challenge

to the shing industry. Addional capabilies that individual respondents idened as being necessary for a

potenal new processing facility would be scallop opening and shucking, squid processing, wet storage for sh

and shellsh, ice, and packing and trucking/distribuon.

"Design a Long Island market...keep it local...many dealers

travel daily to Hunts Point and drive back to Long Island."

"Packing & Trucking."

"Needs to be available to shermen - not middlemen."

"Labor!!! Its a huge issue on Long

Island..housing for labor..."

"Scallop openning shop \ sea scallops and

being able to open scallops in the bay."

"Squid processing."

"Ice."

"Shucking."

"Wet storage for sh and shellsh."

33

Infrastructure Needs

0 5 10 15 20 25 30 35 40

75.0%

68.8%

66.7%

64.6%

52.1%

20.8%

Q17. If new processing facilies could be constructed, please indicate which capabilies

would be necessary (Check all that apply).

Fiy-ve of the 67 commercial shermen responded

to the queson of how much of a challenge

imported seafood presents to their businesses. The

majority, 64%, found imported seafood to be either

“very” or “extremely challenging” with “extremely

challenging” being the most common answer. Only

three respondents viewed seafood imports as non-

threatening.

Of the 55 respondents to this queson, 57%

believed the compeon from recreaonal

sheries to be either “very” or “extremely

challenging” with 18 respondents responding

as “extremely challenging’ as the most common

answer (n=18; 32%). Only four shermen found

no compeon from recreaonal sheries.

Out of the 54 survey parcipants who responded to

this queson, a total of 22% found accessing capital

to be “extremely challenging.” Twice as many

respondents (44%) characterized access to capital

as either “very” or “moderately challenging.” The

nal one-third of respondents found this issue to

be only “slightly challenging.”

34

Business and Marketing

Challenges

Q18. Please indicate how challenging the following business and markeng

issues are for you as a commercial shermen?

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is compe��on from recrea�onal

fisheries?

32.1%

25.0%

19.6%

16.1%

7.1%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is compe��on from imported

seafood?

41.8%

21.8%

18.2%

12.7%

5.5%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is access to capital?

22.2%

27.8%

16.7%

18.5%

14.8%

Number of Responses

Of these 56 respondents, 39 (70%) found

it to be “extremely challenging” to nd the

next generaon of Long Island shermen.

An addional 14% cited it as extremely

challenging. Only two respondents did

not believe there would be a problem

nding the next generaon of commercial

shermen.

Fiy-six shermen responded to this queson

and, unlike with most of the other quesons

related to business challenges, the most frequent

response was “moderately challenging” with 34%

of the respondents. Much fewer respondents

viewed lack of demand as “extremely” or “very

challenging,” with each response receiving seven

votes.

The percepon of the challenges associated

with the lack of markeng and promoonal

support for seafood is much more evenly

distributed than other quesons related

to the business challenge sub-category.

The most common answer was ‘extremely

challenging’ with 18 of 54 (33%). The second

most common answer was “moderately

challenging” with 28% of the responses while

15% of respondents found no issue with

markeng.

35

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is a lack of consumer demand?

12.5%

12.5%

33.9%

19.6%

21.4%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is a lack of marke�ng and

promo�onal support for local seafood?

26.9%

13.4%

22.4%

6.0%

11.9%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is finding the next genera�on of Long

Island Fishermen?

69.6%

14.3%

7.1%

5.4%

3.6%

Number of Responses

Fiy-six of 67 commercial shermen assessed

the level of challenge that the COVID-19 market

presented to their businesses. Seventy percent

viewed the market shi as either “very” or

“extremely challenging” with “extremely

challenging” as the most common answer

(45%).

Fiy-six of the 67 total survey respondents

provided feedback on the issue of access to

labor. Slightly over 39% of these respondents

reported nding access to labor to be “extremely

challenging.” An addional 30% found the issue

to be either “very” or “moderately challenging”.

An equal amount (30%) of respondents found

access to labor to either be only “slightly” or

“not at all challenging.”

Fiy-four responses were collected from

among the survey’s 67 total parcipant

respondents on the issue of compeon

from domesc and internaonal aquaculture.

Nearly 30% (equal to 16 respondents) found

this compeon to be “extremely challenging.”

The largest poron of respondents indicated

that this issue was “very” or “moderately

challenging,” with exactly half choosing one

of these two characterizaons. The remaining

20% of responses idened this compeon as

only “slightly challenging” or “not a challenge

at all.”

36

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging are the COVID-19 market condi�ons?

44.6%

25.0%

16.1%

8.9%

5.4%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is compe��on from domes�c and

interna�onal aquaculture?

29.6%

25.9%

24.1%

7.4%

13.0%

Number of Responses

0 5 10 15 20 25 30 35 40

Not at all

Slightly

Moderately

Very

Extremely

How challenging is access to labor?

39.3%

16.1%

14.3%

16.1%

14.3%

Number of Responses

37

0 5 10 15 20 25 30 35 40

Finding the next genera�on of Long Island Fishermen

Rising costs associated with fishing

Environmental pollu�on and loss of fisheries habitat

Inappropriate State-by-State fisheries alloca�ons

Regulatory Challenge

Environmental Challenge

Infrastructure Challenge

Business and Marke�ng Challenge

Number of Respondents

Most Challenging by Category

39

39

23

35

The most challenging by category was idened as the challenge receiving the most respondents selecng

"Extremely Challenging."

Other Challenges

Source: Long Island Commercial Fishing Associaon

38

"Crew."

Other Challenges Idened by

Respondents:

"Able to follow regs and regs are dierent

with each ocer."

"Aordable work space suitable

for processing seafood for

direct marketing purposes."

"Being priced out of area, no aordable

dockage, lack of infrastructure, no new

blood/recruits coming into industry."

"Better opportunity to obtain shing permits."

"Dock space and commercial

shing waterfront protection."

"Dockage and available real estate to rent

is very challenging, too expensive."

"If and when retirement comes, NYS

commercial permits despite the $25,000

maintenance cost cannot be transferred to

new entrants unless they are blood, most

States permits are transferrable."

"Lack of infrastructure. Municipalities allowing

commercial waterfront property to become condos."

"Lack of infrastructure on Long Island. We need

a local sh processing plant to stay competitive

in the market. Rhode Island, New Jersey and

Massachusettes all have processing in their States."

"Lack of promotion of our

local harvesting tradition."

"The extreme bias towards the recreational sector

shown by State and Federal policies. The fact that New

York is the only State that does not allow private held

limited access licenses to be sold by the holders."

"Yes shore side packing facility..."

Respondents were given the opportunity to share

more specically what challenges they faced. These

represent direct quotes with minor grammacal

correcons, when necessary, from survey

respondents.

Overall, most shermen in this survey experienced a decrease in revenue in 2020 as a result of the COVID-19

pandemic. More than half (51%) of these 45 responding shermen reported revenue losses of between 25-

50% in 2020, compared with the year before. 13% of respondents indicated losses of greater than 50% of their

revenue in 2020. Addionally, two shermen indicated a loss of revenue greater than 99%.

39 respondents experienced a

decrease in revenue, 4 experienced

an increase, 2 saw no change and 22

did not respond to the queson.

39

Impacts of COVID-19

Q19. Did your revenues increase or decrease in 2020 as a result of COVID-19?

25 20 15 10 5 0 5 10 15 20 25

- 76-100%

- 51-75%

- 26-50%

- 1-25%

1-25%

26-50%

51-75%

76-100%

Decrease Increase

2020 Revenue Changes Due to COVID-19

Number of Respondents

Out of 51 provided responses, most reported a

negave impact from COVID-19 on the sales price

of sh they landed. Nearly 63% found that the sales

price of sh landed was lower than before COVID-19.

Only 16% experienced higher prices during the

pandemic and 22% saw no change compared with

the period before COVID-19.

Of the 51 survey respondents to this queson, 51%

reported lower sale prices for sh landed during the

COVID-19 pandemic, rather than before COVID-19.

Eleven respondents did not noce any changes in sale

prices. Eight respondents (12%) actually reported

higher prices than during the COVID-19 pandemic

rather than before.

Fiy-one commercial shermen commented on

changes in the number of dealers selling sh.

Twenty-four shermen observed a lower numbers of

dealers, while a dierent 24 shermen did not noce

a change in the number of dealers before and during

the pandemic. Three shermen (6%) believed there

was an increase in the number of dealers during the

on-going pandemic.

40

Q20. How would you compare the following regarding your

commercial shing business to before COVID?

0 5 10 15 20 25 30 35 40

Lower (-)

Same (=)

Higher (+)

How has COVID impacted the sale price of fish landed?

Number of Responses

15.7%

21.6%

62.7%

0 5 10 15 20 25 30 35 40

Lower (-)

Same (=)

Higher (+)

How has COVID impacted the quan�ty of fish sold?

Number of Responses

11.8%

37.3%

51.0%

0 5 10 15 20 25 30 35 40

Lower (-)

Same (=)

Higher (+)

How has COVID impacted the number of dealers

selling fish?

Number of Responses

5.9%

47.1%

47.1%

Fiy-one commercial shermen weighed in on the

cost of shing gear before and during the pandemic.

Exactly three-quarters of the respondents believed

that the price of gear increased. Twenty four

percent of shermen believed that the price has

stayed the same and just one shermen believed

the cost of gear decreased.

Fiy-one commercial shermen provided insight

on the change in cost of non-gear expenses. Similar

to the percepons of gear cost expenses, the

overwhelming majority of respondents (76%) said

that the cost of non-gear expenses increased during

the pandemic. Ten respondents believed that prices

stayed the same while only two thought the price

lowered.

Fiy commercial shermen provided feedback on

the ability to sell direct to consumers during the

COVID-19 pandemic. Sixty percent believed that

direct sales opportunies remained unchanged.

Twenty two percent saw in increase in direct sales

opportunies and 18% felt a decrease in direct

sales opportunies.

41

0 5 10 15 20 25 30 35 40

Lower (-)

Same (=)

Higher (+)

How has COVID impacted the cost of gear (pots,

traps, nets, hoods, etc.)?

Number of Responses

74.5%

23.5%

2.0%

0 5 10 15 20 25 30 35 40

Lower (-)

Same (=)

Higher (+)

How has COVID impacted the the cost of non-gear

expenses (ice, bait, fuel, fishing tackle,

boxes/packaging, etc.)?

Number of Responses

76.5%

19.6%

3.9%

0 5 10 15 20 25 30 35 40

Lower (-)

Same (=)

Higher (+)

How has COVID impacted your ability to sell direct to

consumers?

Number of Responses

22.0%

18.0%

60.0%

Of the total 67 survey parcipants, 47 responded to the queson related to receiving government or private

nancial support made available to commercial shermen. Thirteen respondents indicated they “sought no

nancial assistance” and six indicated they “preferred not to answer.” Of the remaining 28 shermen who received

some form of pandemic nancial assistance, 15 received CARES Act Marine Fisheries Relief Program funding, 11

received Small Business Loans, 10 received assistance through the Paycheck Protecon program, two received

private bank loans or personal lines of credit, and one was turned down for assistance. Three other received

some alternate form of nancial assistance. In many instances, receiving nancial assistance from one nancial

resource (e.g. a PPP grant), would not necessarily preclude a shermen from receiving nancial assistance from

other sources (e.g. CARES Act Marine Fisheries Relief Program funding). In most cases, support is predicated on

ensuring that all combined monies received could not make the harvester “more than whole.”

42

Q21. Has your commercial shing business received funds from any of the following

sources to deal with the eects of the COVID-19 Pandemic (select all received)?

COVID-19 Support

0 4 8 12 16 20

Applied for assistance but was turned down

Private Bank Loan OR Personal Line of Credit

Other (please specify)

Prefer not to answer

Paycheck Protec�on Program (PPP)

Small Business Loan (SBA)

Did not seek financial assistance

CARES ACT Marine Fisheries Relief Program

Financial Assistance Received to Deal with the Effects of

the COVID-19 Pandemic

Number of Respondents

Source: Long Island Commercial Fishing Associaon

“Need for more processing facilities…Other than sending products

to Hunts Point, it’s becoming extremely dicult to get seafood o

Long Island. There are only so many markets to be developed on

the Island. This was a problem long before COVID-19.”

“Processing space for direct marketers. I feel that after our grounds are shifted to use for

wind plants, direct marketing will be the only viable course for small boat shermen.”

43

Fisheries Investments

Q22. In your opinion, what is the best investment that can be made in the

commercial shing industry to sustain the long-term health and economic viability

of this important heritage Long Island industry?

Thirty-seven commercial shermen oered their valuable perspecves on which aspects of the industry are most

in need of investment. To synthesize responses, a word cloud generator extracted the most common words used

by the shermen. The size of each word in the cloud is proporonal to the number of mes it is menoned in the

responses. Each word appeared at least two mes in the responses.

Several opportunies for investment emerged – the need for processing facilies and infrastructure, the need

for dock access, and overall market condions, including dockside prices and consumer demand. Some of the

concerns, such as perming, quota limits, and allocaons, are explored more deeply in the conclusion of this

report.

Conclusion

“I have no packing facilities less than two

hours and have to drive in congested

trac after shing to deliver.”

44

The ming of our surveys provides an important

snapshot of the commercial shing industry before

COVID-19, and during COVID-19. Unsurprisingly,

an industry that was broadly challenged before the

pandemic connues to be challenged two years into

the pandemic. Our survey results mirror real-world

realies. The U.S. Department of Commerce Naonal

Oceanic and Atmospheric Administraon released a

report in December of 2021 tled "U.S. Seafood Industry

and For-Hire Sector Impacts from COVID-19: 2020 in

Perspecve." The report showed an across-the-board

22% decline in commercial landings revenue during

2020 compared to the previous ve-year average.

Northeast sheries suered slightly less, suering 18%

decreases.

However, the same report contains a silver lining.

While shermen were hit hard with loss of business

and landings revenue, seafood retail sales surged

during 2020 as consumers stayed home, stocking their

own freezers and pantries. The report notes another

study, conducted by the Food Industry Associaon

which tracked U.S. seafood retail sales and found they

“increased signicantly in 2020 across all seafood

categories: frozen, up 36 percent; fresh, up 25 percent;

and grocery (canned, pouches, etc.), up 21 percent.”

This aligns with the report’s other notable ndings,

that high-value and export products were hit hardest,

especially in the early months of the pandemic. When

restaurants closed and/or went into lockdown, the

market for restaurant sourced seafood collapsed. The

foodservice sector is our commercial sheries' most

high-value market, both naonally and locally. When

that industry suers, Long Island shermen suer.

Interesngly, according to U.S. Bureau of Labor

Stascs Occupaonal Outlook Handbook, the naonal

employment of shing and hunng workers is actually

projected to grow 11 percent from 2020 to 2030,

faster than the average for all occupaons. On average,

about 5,300 openings for shing and hunng workers

are projected each year over the decade. However,

many of these openings are expected to result from