a

1

We strive to offer a comprehensive benefits package that enhances the health

and wellbeing for you and your family and ensures you have access to the best

healthcare providers and medical services.

As part of your medical plan enrollment, you receive exclusive access to Garner's

Top Provider search tool that identifies high-quality in-network providers who have a

track record of producing excellent patient outcomes and reviews. Garner empowers

you to make an informed decision on who is the best care team for your unique

medical needs. As an added benefit, when you visit Garner approved providers, your

out-of-pocket costs that qualify will be reimbursed, up to $3,000 for family and

$1,500 for individual plans!

Our medical plans are designed to be SIMPLE. You will only pay a copay (flat fee)

for in-network care and services with no deductibles or co-insurance, helping

eliminate surprise medical bills. This will help you plan and budget for out-of-

pocket costs, making it even easier to get the care you need!

To assist those who take medications for chronic conditions, over 100 prescription drugs

are covered at no cost! Review the 2024 free prescription drug list on pages 15 & 16.

to your

BENEFITS

W

E

L

C

O

M

E

W

E

L

C

O

M

E

Clayto

2

glanc

BENEFITS CONTACT INFO: benefits@claytonhomes.com // (865) 380-3000 x7400

MEDICAL

PHARMACY

HEALTH CARE & DEPENDENT FSA

DENTAL

LIFE INSURANCE

SHORT & LONG-TERM DISABILITY PAID PARENTAL LEAVE

TOP PROVIDER DIRECTORY

TELEHEALTH

VISION

DIABETES REVERSAL

VOLUNTARY INSURANCE

benefits at a

Y

O

U

R

Y

O

U

R

IDENTITY THEFT PROTECTION 401(K) ADDITIONAL SUPPORT

3

The 2024 Benefits Guide is not intended to act as a Summary Plan Description and does not change

the terms of the plan. In the event this guide conflicts with the terms of the plan, the plan term

governs. Please email benefits@claytonhomes.com to request a copy of Summary Plan Descriptions.

INCREASED GARNER COPAY

REIMBURSEMENTS

Feel confident you and your family are visiting

top-notch medical providers that are in-network and have

availability to see you. Enjoy more rewards when you choose

Garner! When you visit Garner approved providers, your

out-of-pocket costs that qualify will be reimbursed up to

$3,000 for family and $1,500 for individual plans.

Learn more on pages 9-12.

VIRTA PREDIABETES REVERSAL

Now available for prediabetes! Stop type 2 diabetes in its

tracks with Virta's prediabetes care program. Like Virta's

type 2 diabetes reversal, your personalized treatment plan

includes dedicated health coaching, a physician-led care

team, and personalized nutrition plan to help return blood

glucose and A1C to sub-prediabetes levels.

Learn more on pages 13-14.

WORKDAY

Now you can complete your 2024 benefits enrollment

on Workday!

Learn how to enroll on page 5.

ne

for 2024

4

NEW HIRES:

• You must complete your online enrollment before your effective date.

• Benefits are effective on your 31

st

day of employment.

• Late enrollments are not accepted.

LIFE EVENTS:

• You can make changes mid-year if you have a life event (marriage, divorce,

loss of coverage, birth of child, etc.).

• You must complete your online enrollment within 31 days.

• Supporting documents will be required.

OPEN ENROLLMENT:

• Each year you will be given an opportunity to change, elect or drop coverage.

• Changes are effective January 1

st

and will remain in place for one year.

COVERAGE ENDS:

• If you separate with the company, your insurance coverage ends on your last

day of employment.

• If necessary, COBRA information will be mailed to your home address.

ELIGIBLE DEPENDENTS INCLUDE:

• Your legally married spouse.

• Children under age 26: including biological, step children, legally adopted

children, children placed for adoption, and children who you are legally

appointed as guardian or limited guardian (cannot be temporary guardian).

• Disabled children over age 26: an unmarried child who is mentally or physically

disabled and incapable of engaging in self-sustaining employment.

whe

can I enroll?

6

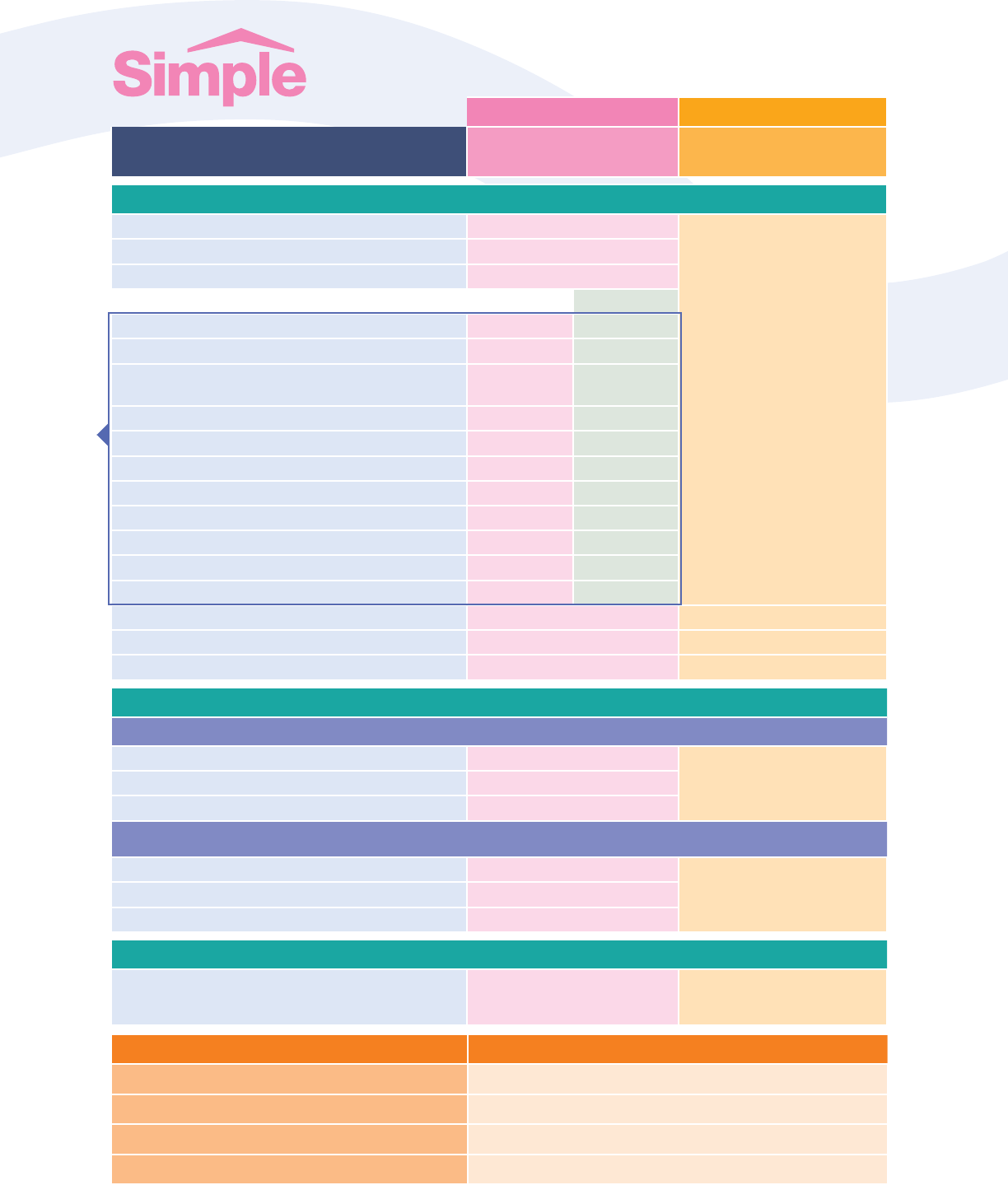

DEDUCTIBLE $0 $0

MEDICAL COPAYS

Preventative Care Free Free

Telehealth Free Free

Lab Free Free

ELIGIBLE FOR $0 COPAY AFTER GARNER REIMBURSEMENT

Primary Care Physician $50 $30

OB/GYN $40 $25

Outpatient Therapy (ex. mental health or substance abuse)

$40 $25

Physical, Speech or Occupational Therapy $60 $40

Chiropractor $60 $40

Urgent Care $75 $50

Standard Radiology (ex. x-ray or ultrasound) $90 $60

Specialist $150 $70

Durable Medical Equipment $150 $100

Advanced Imaging (ex. MRI, CAT or PET scan) $600 $240

Outpatient Procedure / Surgery $850 $425

Ambulance $700 $350

Emergency Room $1,000 $500

Inpatient Stay $1,500 / day $750 / day

PHARMACY COPAYS

30-Day Supply

Generic $20 $10

Preferred Brand Name $120 $60

Non-preferred / Specialty $250 $150

90-Day Supply

Generic $50 $25

Preferred Brand Name $300 $150

Non-preferred / Specialty $625 $375

OUT-OF-POCKET MAXIMUMS

Combined Medical and Pharmacy

Out-of-Pocket Max

$6,000 per individual or

$12,000 combined

family max

$4,000 per individual or

$8,000 combined

family max

WEEKLY PREMIUMS

Team Member Only $23.98 $46.12

Team Member + Spouse $52.78 $99.06

Team Member + Child(ren) $43.17 $80.91

Team Member + Family $71.95 $115.71

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

compariso

medical plan

*WITH

GARNER

Please note: if the service or prescription charge is lower than the copay, you will pay the lesser amount. *Up to $3,000 for family and $1,500

for individual plans. See pages 9 - 12 to learn more about how these copays can qualify for reimbursement through your Garner Benefit.

7

ENROLLMENT GROUP WEEKLY PREMIUM

Team Member Only $23.98

Team Member + Spouse $52.78

Team Member + Child(ren) $43.17

Team Member + Family $71.95

IN-NETWORK OUT-OF-NETWORK

DEDUCTIBLE

$0

$5,000 per individual or

$10,000 combined family max

MEDICAL COPAYS

Preventative Care Free

40% after deductible

Telehealth Free

Lab Free

*WITH GARNER

Primary Care Physician $50 $0

OB/GYN $40 $0

Outpatient Therapy (ex. mental health or

substance abuse)

$40 $0

Physical, Speech or Occupational Therapy $60 $0

Chiropractor $60 $0

Urgent Care $75 $0

Standard Radiology (ex. x-ray or ultrasound) $90 $0

Specialist $150 $0

Durable Medical Equipment $150 $0

Advanced Imaging (ex. MRI, CAT or PET scan) $600 $0

Outpatient Procedure / Surgery $850 $0

Ambulance $700 $700

Emergency Room $1,000 $1,000

Inpatient Stay $1,500 / day 40% after deductible

PHARMACY COPAYS

30-Day Supply

Generic $20

Not CoveredPreferred Brand Name $120

Non-preferred / Specialty $250

90-Day Supply

Generic $50

Not CoveredPreferred Brand Name $300

Non-preferred $625

OUT-OF-POCKET MAXIMUMS

Combined Medical and Pharmacy

Out-of-Pocket Max

$6,000 per individual or

$12,000 combined

family max

$10,000 per individual or

$20,000 combined

family max

ELIGIBLE FOR GARNER

REIMBURSEMENT

*Up to $3,000 for family and $1,500 for individual plans. See pages 9 - 12 to learn more about how these copays can qualify for

reimbursement through your Garner Benefit.

8

IN-NETWORK OUT-OF-NETWORK

DEDUCTIBLE

$0

$3,000 per individual or

$6,000 combined family max

MEDICAL COPAYS

Preventative Care Free

40% after deductible

Telehealth Free

Lab Free

*WITH GARNER

Primary Care Physician $30 $0

OB/GYN $25 $0

Outpatient Therapy (ex. mental health or

substance abuse)

$25 $0

Physical, Speech or Occupational Therapy $40 $0

Chiropractor $40 $0

Urgent Care $50 $0

Standard Radiology (ex. x-ray or ultrasound) $60 $0

Specialist $70 $0

Durable Medical Equipment $100 $0

Advanced Imaging (ex. MRI, CAT or PET scan) $240 $0

Outpatient Procedure / Surgery $425 $0

Ambulance $350 $350

Emergency Room $500 $500

Inpatient Stay $750 / day 40% after deductible

PHARMACY COPAYS

30-Day Supply

Generic $10

Not CoveredPreferred Brand Name $60

Non-preferred / Specialty $150

90-Day Supply

Generic $25

Not CoveredPreferred Brand Name $150

Non-preferred $375

OUT-OF-POCKET MAXIMUMS

Combined Medical and Pharmacy

Out-of-Pocket Max

$4,000 per individual or

$8,000 combined

family max

$4,000 per individual or

$8,000 combined

family max

ENROLLMENT GROUP WEEKLY PREMIUM

Team Member Only $46.12

Team Member + Spouse $99.06

Team Member + Child(ren) $80.91

Team Member + Family $115.71

ELIGIBLE FOR GARNER

REIMBURSEMENT

*Up to $3,000 for family and $1,500 for individual plans. See pages 9 - 12 to learn more about how these copays can qualify for

reimbursement through your Garner Benefit.

9

GARNER

Garner empowers you to make an informed decision on who are the best in-network

providers for your unique medical needs. Access to Garner’s Top Provider search tool is

free for Team Members and family enrolled in the Clayton medical plan.

Garner has compiled and analyzed the largest medical claims database in the United States

to objectively identify the top 20% of all providers.

TOP PROVIDERS HAVE SHOWN TO:

Practice based on latest medical research

Successfully diagnose problems

Get the highest patient satisfaction ratings

Produce the best patient outcomes

GET REWARDED WITH GARNER!

Garner reimburses your out-of-pocket costs that qualify,

up to $3,000 for family and $1,500 for individual plans

when you see Garner approved providers!

for Team Members and family

on the Clayton medical plan!

Fre

GARNER CONTACT INFO

mygarnerguide.com // (866) 761-9586

Message the Concierge in the app!

D

O

W

N

L

O

A

D

the ap!

Increased Garner Benefit for 2024!

10

GARNER

GARNER CONTACT INFO

mygarnerguide.com // (866) 761-9586

Message the Concierge in the app!

TOP PROVIDERS

Top Providers are the best-performing medical professionals that Garner has identified

through an analysis of over 60 billion medical records that represent more than 310 million

unique patients. Top Providers are the top 20% of all providers in the industry. They are

highlighted in the Garner Health app with a green Top Provider badge and represent the

best available doctors near you who are in your network and have appointment availability.

When you choose to visit Garner approved providers, all copays for qualified visits and

services will be reimbursed up to $3,000 for family and $1,500 for individual plans.

Eligible Providers:

Primary Care Provider

Pediatrician

Specialist (ex. Orthopedist, Cardiologist,

or Oncologist)

Imaging or Lab Work

Physical Therapist

Urgent Care Clinic

Advanced Imaging (MRI or CT scan)

Mental Health Therapist

Garner has no financial relationships with doctors. Recommendations are based solely on

independent analysis, not commissions or fees. Garner does not reimburse prescriptions,

emergency room visits, or services covered by your dental or vision insurance.

Always ensure your provider is added to your Garner approved providers

list prior to your medical visit in order to qualify for reimbursement.

D

O

W

N

L

O

A

D

the ap!

11

SEARCH TOP PROVIDERS

You must always ensure your doctor is added to your Garner approved providers list before you

see them to qualify for copay reimbursement. Copays will not be eligible for reimbursement for

any date of service prior to adding your provider to your approved providers list.

How to add Top Providers to your approved providers list on your family account:

• Search providers by symptom, procedure, specialty, condition or provider's name.

• Click a doctor's name with the Top Provider badge

• Look for a green banner that states "Approved for your Garner Benefit".

Now you're all set! All qualified visits for you and your covered family members will be eligible

for your Garner copay reimbursement! To see a list of providers on your family account, go to

Settings and click "Approved Providers".

GET REWARDED!

Up to $1,500 for individuals and $3,000 for families on the Clayton medical plan!

When you visit Garner approved providers, your out-of-pocket copays for qualified

visits are automatically reimbursed. No documentation necessary! Your reimbursement

check will arrive in the mail approximately 6 to 8 weeks after your visit.

Before you seek medical care, connect with Garner! Use Garner when you need a new

provider or to verify your current medical team meets Garner's high-quality metrics.

Follow these instructions to take advantage of your Garner benefit.

SIGN UP

SCAN

TO GET

STARTED

Visit mygarnerguide.com

Download the Garner Health App for the best experience

benefi

your garner

CLICK "CREATE AN ACCOUNT" & ENTER ORGANIZATION NAME:

Cigna Medical Plan: Clayton Homes - Cigna

BCBS Medical Plan: Clayton Homes - BCBS

OR

GARNER CONCIERGE

Garner provides all members with access to a Garner Concierge who is available

to help you find providers, answer questions about your account, and navigate the

healthcare system.

AVAILABLE: Monday – Friday • 8 am – 8 pm Eastern

• Visit mygarnerguide.com

• Email concierge@getgarner.com

• Download the Garner Health mobile app

• Call (866) 761-9586

12

How does Garner identify Top Providers?

Garner has compiled the largest medical claims database in the nation to identify the top

20% of all providers in the United States. These Top Providers have shown to practice latest

medical research, successfully diagnose and treat problems, and get the highest patient

satisfaction ratings.

Are recommended Top Providers in-network with my health plan?

Garner will recommend Top Providers that are in-network. However, since providers change

networks on occasion, we recommend verifying before your visit.

Does everyone on my plan need an account?

Your family only needs one account. However, any dependent over the age of 18 who is on

your health plan is welcome to create their own account.

Will lab work, imaging, and medical equipment be covered?

As long as the service is covered in-network by our medical health insurance plan, Garner will

reimburse your out-of-pocket medical costs for services ordered by an approved provider or

conducted at an eligible facility recommended to you by Garner prior to the visit.

How are medical claims reimbursed?

When you receive care from a Garner approved provider, pay your upfront copays as usual.

After your health insurance company processes the claim, Garner will reimburse your

qualifying out-of-pocket medical costs. You will receive a check in the mail approximately 6

to 8 weeks after your visit.

IMPORTANT: Can I use my Health Care FSA dollars to pay for copays?

You may need to reconsider how much you elect to contribute to your Health Care FSA

account for 2024. Since Garner will reimburse out-of-pocket copays, you may not need to

contribute the same amount to your FSA as you historically have.

Due to IRS regulations, you are not able to use FSA dollars to pay for medical expenses that

will be reimbursed by Garner.

experienc

your garner

GARNER CONTACT INFO

mygarnerguide.com // (866) 761-9586

Message the Concierge in the app!

D

O

W

N

L

O

A

D

the ap!

13

Virta is a virtual clinic that helps members manage or reverse

type 2 diabetes and prediabetes. Virta uses food as medicine

and teaches members how to eat their way to better health

with a nutrition plan made just for them.

VIRTA

Type 2 Diabetes Reversal

VIRTA CONTACT INFO

virtahealth.com/join/clayton // (844) 847-8216

the ap!

D

O

W

N

L

O

A

D

for Team Members and family on

the Clayton medical plan with type

2 diabetes or prediabetes who are

18 to 79 years old.

Fre

14

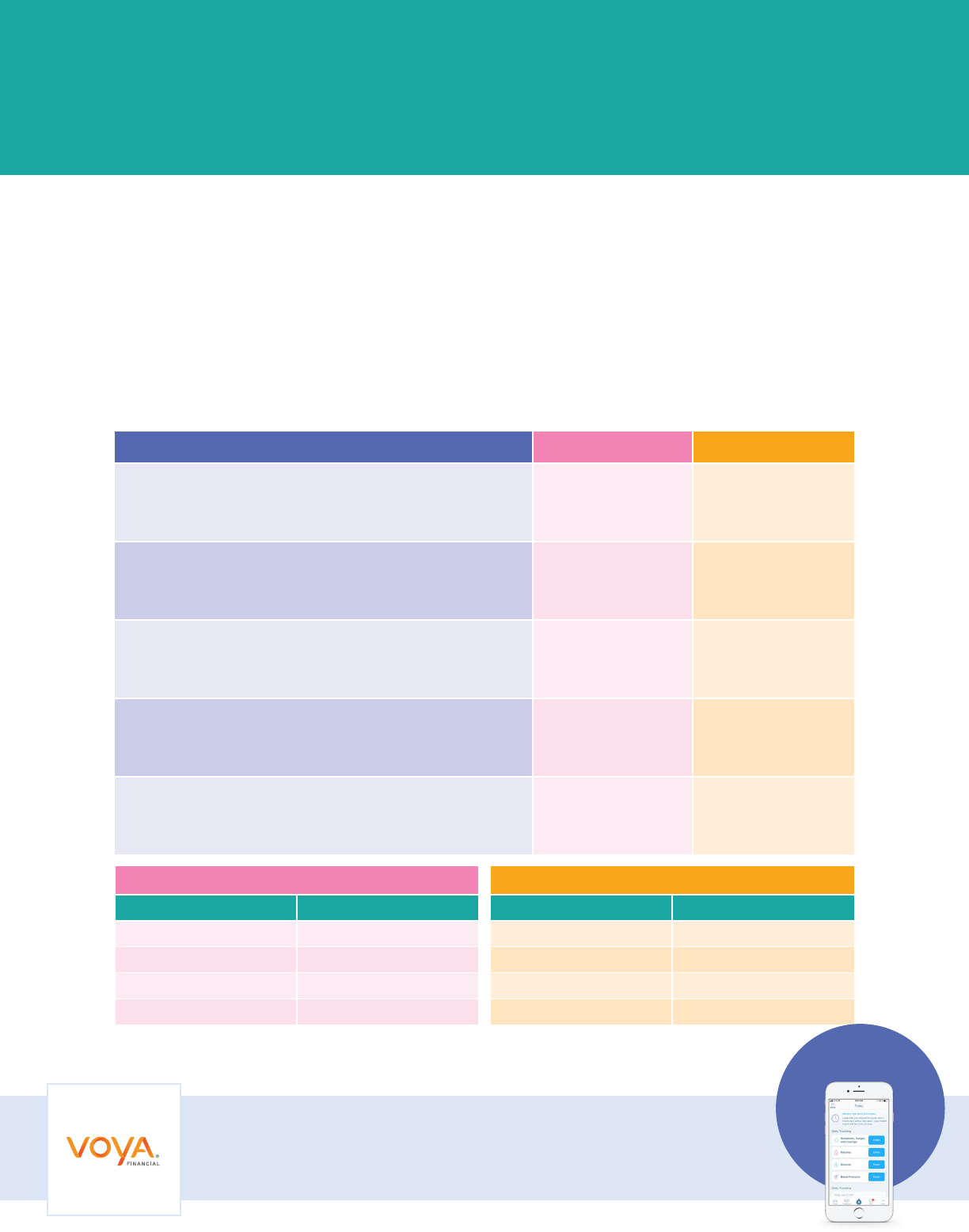

ELIGIBILITY

Team Members, spouses and

dependents who are 18 to 79

years old

Must be enrolled in the Clayton

medical plan

For individuals diagnosed with

type 2 diabetes (A1C of 6.5%

or higher)

NEW FOR 2024! Reverse Prediabetes

For individuals diagnosed with

prediabetes (A1C of 5.7% - 6.4%)

WHAT'S INCLUDED:

• Personalized treatment plan

• Physician-led care team

• Starter kit including meters, strips and connected scale

• Unlimited access to your dedicated health coach

• Patient community to connect with others on the Virta program

• Personalized nutrition program plus meal plans, recipes and grocery guides

VIRTA

Type 2 Diabetes Reversal

the ap!

D

O

W

N

L

O

A

D

VIRTA CONTACT INFO

virtahealth.com/join/clayton // (844) 847-8216

To learn more or enroll, visit

virtahealth.com/join/clayton

15

In an effort to assist Team Members and their families who take essential medications for chronic conditions,

the below list of drugs are completely free to you and any covered dependents as part of your medical plan

in 2024. These drugs are free when you fill a 30 or 90 day supply through a retail or mail order pharmacy.

RESPIRATORY DEPRESSION

CHOLESTEROL

LOWERING

DIABETES

Albuterol (HFA,

nebulizer solution, oral)

Arformoterol

Budesonide Oral

Inhalation

Cromolyn Nebulizer

Solution

Formoterol

Ipratropium/Albuterol

Nebulizer Solution

Ipratropium Nebulizer

Solution

Levabuterol Nebulizer

Solution

Metaproterenol

Montelukast

Terbutaline Oral

Theophylline

Wixela Inhub

Zafirlukast

Zileuton Er

Citalopram

Escitalopram

Fluoxetine

Fluvoxamine

Paroxetine

Paroxetine Er

Sertraline

HMG-COA REDUCTASE

INHIBITORS

______________________

Atorvastatin

Fluvastatin

Lovastatin

Pravastatin

Rosuvastatin

Simvastatin

OTHER CHOLESTEROL

LOWERING AGENTS

_______________________

Amlodipine/Atorvastatin

Cholestyramine

Cholestyramine Light

Colesevelam

Colestipol

Ezetimibe

Ezetimibe/Simvastatin

Fenofibrate

Fenofibric Acid

Gemfibrozil

Niacin

Prevalite

Acarbose

Generic Lancet

Generic Needles

Generic Syringe

Glimepiride

Glipizide Er

Glipizide/Metformin

Glyburide

Glyburide/Metformin

Metformin

Metformin Er

Miglitol

Nateglinide

Pioglitazone

Pioglitazone/Glimepiride

Pioglitazone/Metformin

Repaglinide

Repaglinide/Metformin

BONE DISEASE DENTAL

HEART DISEASE

AND STROKE

COLORECTAL

Alendronate

Ibandronate

Raloxifene

Risedronate

Zoledronic Acid 5mg

Periomed

Sodium Fluoride

(Rinse, Gel, Cream,

Paste, Tabs, Drops)

BLOOD THINNERS

_______________________

Aspirin 325 mg

Aspirin 81mg

Aspirin-Dipyridamole Er

Clopidogrel

Dipyridamole

Prasugrel

Warfarin

COLONOSCOPY PREP

_______________________

Gavilyte-C

Gavilyte-G

Gavilyte-N

Polyethylene Glycol

Trilyte

fre

prescription

drug list

2

0

2

4

2

0

2

4

16

Please note, these are in addition to any prescriptions that are free under the Affordable Care Act (ACA).

This list is subject to change at any time. For the most up to date information, contact Express Scripts at (855) 634-0226.

HIGH BLOOD PRESSURE

TOBACCO

CESSATION

ACE INHIBITORS

Benazepril

Captopril

Enalapril

Fosinopril

Lisinopril

Moexipril

Perindopril

Quinapril

Ramipril

Trandolapril

ACE INHIBITORS/

DIURETIC

COMBINATIONS

Benazepril/Hctz

Captopril/Hctz

Enalapril/Hctz

Fosinopril/Hctz

Lisinopril/Hctz

Moexipril/Hctz

Quinapril/Hctz

ANGIOTENSIN II

RECEPTOR

ANTAGONISTS

Candesartan

Eprosartan

Irbesartan

Losartan

Olmesartan

Telmisartan

Valsartan

ANGIOTENSIN II

RECEPTOR

ANTAGONISTS/

DIURETIC

COMBINATIONS

Candesartan/Hctz

Irbesartan/Hctz

Losartan/Hctz

Olmesartan/Hctz

Telmisartan/Hctz

Valsartan/Hctz

BETA BLOCKERS

Acebutolol

Atenolol

Betaxolol

Bisoprolol

Metoprolol Succinate Er

Metoprolol Tartrate

Nadolol

Pindolol

Propranolol

Propranolol Er

Timolol

BETA BLOCKERS/

DIURETIC

COMBINATIONS

Atenolol/Chlorthalidone

Bisoprolol/Hctz

Metoprolol/Hctz

Nadolol/

Bendroflumethiazide

Propranolol/Hctz

CALCIUM CHANNEL

BLOCKERS

Amlodipine

Cartia Xt

Diltiazem

Diltiazem Cd

Diltiazem Er

Felodipine Er

Isradipine

Matzim La

Nicardipine

Nifedipine Er

Nisoldipine Er

Tiadylt Er

Taztia Xt

Verapamil

Verapamil Er

Verapamil Er PM

Verapamil Sr

OTHER HIGH

BLOOD PRESSURE

COMBINATIONS

Amlodipine/Atorvastatin

Amlodipine/Benazepril

Amlodipine/Olmesartan

Amlodipine/

Olmesartan/Hctz

Amlodipine/Telmisartan

Amlodipine/Valsartan

Amlodipine/Valsartan/

Hctz

Trandolapril/Verapamil

Bupropion Sr 150mg

Nicotine Gum

Nicotine Lozenges

Nicotine Patches

MALARIA

Atovaquione/Proguanil

Chloroquine

Mefloquine

Primaquine

VITAMINS

Generic Pediatric

Multivitamins with

Flouride

Folic Acid

Generic Prenatal

OBESITY

Benzphetamine

Diethylpropion

Phendimetrazine

Phentermine

DIURETICS

Chlorothiazide

Chlorthalidone

Hydrochlorothiazide

Indapamide

Metolazone

the ap!

D

O

W

N

L

O

A

D

EXPRESS SCRIPTS CONTACT INFO

express-scripts.com // (855) 634-0226

17

TELEMEDICINE

GET STARTED!

Register for an account before you need care.

Download the MDLive or Teladoc app.

Register for an account.

(Make sure to have your insurance ID card available.)

24/7 ACCESS to board certified doctors from where it’s most convenient

for you – home, office or on the go! Day or night, weekends and holidays!

COMMON CONDITIONS TREATED:

• Cold & flu symptoms

• Ear infections

• Fevers

• Respiratory & sinus issues

• Behavioral & mental health

Telehealth is not appropriate for every

medical condition and should not be used in

the event of a medical emergency. In case

of a medical emergency, you should dial 911

immediately. State restrictions may apply.

MDLIVE (CIGNA MEDICAL PLANS)

mdliveforcigna.com // (888) 726-3171

TELADOC (BCBS MEDICAL PLANS)

teladoc.com/alabama // (855) 477-4549

the aps!

D

O

W

N

L

O

A

D

for Team Members and family

enrolled in the Clayton

medical plan!

Fre

18

ACCIDENT, HOSPITAL

INDEMNITY & CRITICAL

ILLNESS INSURANCE

Accidents, hospitalizations, and critical illnesses can happen unexpectedly

and be financially challenging. These coverages pay you a benefit determined

by the plan you select and the health event to provide you and your family

financial assistance during unforeseen health matters.

Keep in mind, these plans are not health insurance, but rather a supplement to

your existing medical plan. No underwriting is required.

HERE ARE A FEW EXAMPLES OF HOW ACCIDENT,

HOSPITAL INDEMNITY AND CRITICAL ILLNESS

INSURANCE BENEFITS COULD BE USED:

• Medical expenses, such as

copays or prescriptions

• Home healthcare costs

• Lost income due to missed

time at work

• Everyday expenses like

utilities and groceries

VOYA CONTACT INFO

presents.voya.com/ebrc/claytonhomes // (877) 236-7564

the ap!

D

O

W

N

L

O

A

D

19

By enrolling in any of the VOYA plans, you and any covered dependents can each

get paid $50 annually simply by completing one recommended health exam. To

receive the $50 payment per individual, submit a claim through VOYA within 60 days

of your visit. You can set up direct deposit or elect a check to be mailed to your home

address within 1-2 weeks.

If you have coverage under more than one of these plans benefits, the annual health

screening benefit payment is included on all three plans!

Please note, each covered individual may only receive a $50 payment once annually

per line of coverage, even if you complete multiple health screenings. There is a $200

maximum child payment allowed per line of coverage.

FOR EXAMPLE:

If you, your spouse, and two children are covered under one of these benefits and each

complete a covered health screening, that’s $200 that will be paid to you – regardless if

the actual visit cost anything out-of-pocket!

FOR EXAMPLE:

If you, your spouse, and two children are covered under accident, critical illness, and

hospital that’s $600 of benefit if everyone completes a covered annual health screening!

Get paid for completing your preventative care visits!

EXAMPLES OF COVERED HEALTH SCREENINGS

• Mammography

• Colonoscopy

• Stress test

• Fasting blood glucose

• Prostate cancer screening

• Hearing test

• Routine eye exam

• Routine dental exam

• Well child/preventative exams

through age 18

• Biometric screening

• Adult annual physical

• COVID-19 test or vaccine

PREVENTATIVE CARE

VOYA CONTACT INFO

presents.voya.com/ebrc/claytonhomes // (877) 236-7564

the ap!

D

O

W

N

L

O

A

D

20

LOW PLAN WEEKLY PREMIUMS

Team Member

Only

Team Member

+

Spouse

Team Member

+

Child(ren)

Team Member

+

Family

$1.15 $2.46 $2.94 $4.25

HIGH PLAN WEEKLY PREMIUMS

Team Member

Only

Team Member

+

Spouse

Team Member

+

Child(ren)

Team Member

+

Family

$2.04 $3.98 $4.63 $6.57

ACCIDENT INSURANCE

VOYA CONTACT INFO

presents.voya.com/ebrc/claytonhomes // (877) 236-7564

the ap!

D

O

W

N

L

O

A

D

Accidents can result in unplanned medical expenses. While our medical plans offer

set copays allowing you to know exactly what you will pay, other expenses are still

associated with an accident that you may have not budgeted for such as an ambulance

ride, ER visit, x-ray and follow up treatments. By enrolling in Accident coverage,

you will receive a lump sum payment per covered medical service administered

in connection with a covered accident that occurs on or after the effective date of

coverage. The benefit amount payable depends on the type of injury and care received.

21

Please note, you may be required to seek care for your injury within a set amount of time.

For a list of exclusions and limitations, email benefi[email protected]om or contact VOYA.

To file a claim visit presents.voya.com/ebrc/claytonhomes.

Contact VOYA with any questions at (877) 236-7564.

Sports Accident Benefit: If your accident occurs while participating in an organized sporting activity

as defined by VOYA; the accident hospital care, accident care or common injuries benefit will be

increased by 25%; to a maximum additional benefit of $1,000.

EVENT

LOW PLAN HIGH PLAN

Hospital Care

Surgery open abdominal, thoracic $800 $1,200

Surgery exploratory or without repair $125 $175

Blood, plasma, platelets $400 $600

Hospital admission $1,000 $1,250

Hospital confinement per day, up to 365 days $300 $375

Critical care unit confinement per day, up to 15 days $475 $600

Rehabilitation facility confinement per day, up to 90 days $125 $200

Coma duration of 14 or more days $11,500 $17,000

Transportation per trip, up to three per accident $500 $750

Lodging per day, up to 30 days $120 $180

Accident Care

Initial doctor visit $60 $90

Urgent care facility treatment $250 $250

Emergency room treatment $250 $250

Ground ambulance $350 $700

Air ambulance $1,000 $1,500

Follow-up doctor treatment $60 $90

Chiropractic treatment, up to six per accident $30 $45

Medical equipment $100 $150

Physical or occupational therapy, up to six per accident $30 $45

Speech therapy, up to 6 per accident $30 $45

Prosthetic device (one) $500 $750

Prosthetic device (two or more) $800 $1,200

Major diagnostic exam $200 $400

Outpatient surgery (one per accident) $150 $225

X-ray $60 $90

22

Common Injuries

LOW PLAN HIGH PLAN

Burns second degree, at least 36% of the body $1,000 $1,250

Burns third degree, at least nine but less than 35 square

inches of the body

$4,500 $7,500

Burns third degree, 35 or more square inches of the

body

$10,000 $15,000

Skin grafts 25% of the burn benefit 25% of the burn benefit

Emergency dental work

$250 crown,

$60 extraction

$350 crown,

$90 extraction

Eye injury removal of foreign object $60 $100

Eye injury surgery $225 $350

Torn knee cartilage surgery with no repair or if

cartilage is shaved

$150 $225

Torn knee cartilage surgical repair $500 $800

Laceration

1

treated no sutures $20 $30

Laceration

1

sutures up to 2” $40 $60

Laceration

1

sutures 2” – 6” $160 $240

Laceration

1

sutures over 6” $400 $800

Ruptured disk surgical repair $500 $800

Tendon/ligament/rotator cuff exploratory

arthroscopic surgery with no repair

$275 $425

Tendon/ligament/rotator cuff one, surgical repair $550 $825

Tendon/ligament/rotator cuff two or more, surgical

repair

$800 $1,225

Concussion $600 $500

Paralysis - paraplegia $10,750 $16,000

Paralysis - quadriplegia $16,000 $24,000

Dislocations

Closed/open

reduction

2

Closed/open

reduction

2

Hip joint $2,550/$5,100 $4,000/$8,000

Knee $1,600/$3,200 $3,000/$6,000

Ankle or foot bone(s), other than toes $1,000/$2,000 $1,800/$3,600

Shoulder $1,000/$2,000 $2,200/$4,400

Elbow $750/$1,500 $1,500/$3,000

Wrist $750/$1,500 $1,500/$3,000

Finger/toe $175/$350 $350/$700

Hand bone(s), other than fingers $750/$1,500 $1,500/$3,000

Lower jaw $750/$1,500 $1,500/$3,000

Collarbone $750/$1,500 $1,500/$3,000

Partial dislocations

25% of the closed

reduction amount

25% of the closed

reduction amount

ACCIDENT INSURANCE

COVERAGE CONTINUED

23

LOW PLAN HIGH PLAN

Dislocations

Closed/open

reduction

2

Closed/open

reduction

2

Hip joint $2,550/$5,100 $4,000/$8,000

Knee $1,600/$3,200 $3,000/$6,000

Ankle or foot bone(s), other than toes $1,000/$2,000 $1,800/$3,600

Shoulder $1,000/$2,000 $2,200/$4,400

Elbow $750/$1,500 $1,500/$3,000

Wrist $750/$1,500 $1,500/$3,000

Finger/toe $175/$350 $350/$700

Hand bone(s), other than fingers $750/$1,500 $1,500/$3,000

Lower jaw $750/$1,500 $1,500/$3,000

Collarbone $750/$1,500 $1,500/$3,000

Partial dislocations

25% of the closed

reduction amount

25% of the closed

reduction amount

Fractures

Closed/open

reduction

3

Closed/open

reduction

3

Hip $2,000/$4,000 $5,000/$10,000

Leg $1,500/$3,000 $2,800/$5,600

Ankle $1,200/$2,400 $2,500/$5,000

Kneecap $1,200/$2,400 $2,500/$5,000

Foot, excluding toes & heel $1,200/$2,400 $2,500/$5,000

Upper arm $1,400/$2,800 $2,750/$5,500

Forearm, hand, wrist except fingers $1,200/$2,400 $2,500/$5,000

Finger, toe $160/$320 $400/$800

Vertebral body $2,240/$4,480 $4,200/$8,400

Vertebral processes $960/$1,920 $2,000/$4,000

Pelvis, except coccyx $2,250/$4,500 $4,000/$8,000

Coccyx $200/$400 $500/$1,000

Bones of face, except nose $800/$1,600 $1,400/$2,800

Nose $400/$800 $750/$1,500

Upper jaw $1,000/$2,000 $1,750/$3,500

Lower jaw $960/$1,920 $2,000/$4,000

Collarbone $960/$1,920 $2,000/$4,000

Rib or ribs $300/$600 $600/$1,200

Skull – simple, except bones of face $1,000/$2,000 $1,750/$3,500

Skull – depressed, except bones of face $2,000/$4,000 $5,000/$10,000

Sternum $240/$480 $500/$1,000

Shoulder blade $1,200/$2,400 $2,500/$5,000

Chip fractures

25% of the closed

reduction amount

25% of the closed

reduction amount

1. Laceration benefits are a total of all lacerations per accident.

2. Closed reduction of dislocation = Non-surgical reduction of a completely separated joint.

Open reduction of dislocation = Surgical reduction of a completely separated joint.

3. Closed reduction of fracture = Non-surgical. Open reduction of fracture = Surgical.

ACCIDENT INSURANCE COVERAGE CONTINUED

24

HIGH PLAN

COVERAGE TYPE WEEKLY PREMIUMS

Team Member Only $3.70

Team Member + Spouse $9.05

Team Member + Child(ren) $6.94

Team Member + Family $12.29

COVERED BENEFITS LOW PLAN HIGH PLAN

HOSPITAL ADMISSION

An admission benefit is payable for the first day of hospital

confinement, once per confinement.

$750 $1,500

HOSPITAL CONFINEMENT

A daily confinement benefit is payable for up to 10 days per

confinement, beginning on day 2 of confinement.

$100 $100

CRITICAL CARE UNIT (CCU) CONFINEMENT

A daily confinement benefit is payable for up to 10 days per

confinement, beginning on day 2 of confinement.

$200 $200

REHABILITATION FACILITY CONFINEMENT

A daily confinement benefit is payable for up to 10 days per

confinement, beginning on day 2 of confinement.

$50 $50

OBSERVATION UNIT DAILY BENEFIT

A benefit is payable up to 4 days per calendar year, for

admission to a hospital observation unit for at least 4

consecutive hours other than as an inpatient.

$350 $700

For a list of exclusions and limitations, contact VOYA.

HOSPITAL INDEMNITY

Hospital Indemnity coverage can provide financial protection by paying you an

admission benefit, plus a fixed daily rate, if you have a covered stay in the hospital,

critical care unit, or rehabilitation facility on or after the effective date of coverage.

There are two plan options for you to choose from to best suit your needs.

Expecting a baby in 2024? Consider Hospital Indemnity coverage. You would receive

the hospital admission benefit, a fixed daily confinement rate based on the number of

days you are in the hospital (starting with day 2), plus a $100 newborn benefit.

The below list is a summary of benefits provided under Hospital Indemnity coverage.

VOYA CONTACT INFO

presents.voya.com/ebrc/claytonhomes // (877) 236-7564

the ap!

D

O

W

N

L

O

A

D

LOW PLAN

COVERAGE TYPE WEEKLY PREMIUMS

Team Member Only $2.55

Team Member + Spouse $6.05

Team Member + Child(ren) $4.77

Team Member + Family $8.27

25

The below list is a summary of benefits provided under Critical Illness coverage.

BASE BENEFIT

ENHANCED CANCER BENEFIT

MAJOR ORGAN BENEFIT

• Heart attack* 100%

• Major organ transplant** 100%

• Cancer 100%

• Stroke 100%

• Coronary artery bypass 100%

• Carcinoma in situ (25% of Critical

Illness benefit amount)

• Benign brain tumor 100%

• Bone marrow transplant (25% of

Critical Illness benefit)

• Skin cancer (10% of Critical Illness benefit)

• Stem cell transplant (25% of Critical

Illness benefit)

• Transient ischemic attacks (TIA)

(25% of Critical Illness benefit)

• Ruptured or dissecting aneurysm

(10% of Critical Illness benefit)

• Abdominal aortic aneurysm

(10% of Critical Illness benefit)

• Thoracic aortic aneurysm

(10% of Critical Illness benefit)

• Open heart surgery for valve

replacement or repair

(25% of Critical Illness benefit)

• Severe burns 100%

• Transcatheter heart valve replacement

or repair (10% of Critical Illness benefit)

• Coronary angioplasty (10% of Critical

Illness benefit)

• Implantable/internal cardioverter

defibrillator (ICD) placement (25% of

Critical Illness benefit)

• Pacemaker placement (10% of Critical

Illness benefit)

* A sudden cardiac arrest is not in itself considered a heart attack.

** Major organ transplant means the irreversible failure of your heart, lung, pancreas, entire kidney or liver, or any combination

thereof, determined by a physician specialized in care of the involved organ in addition to being placed on the UNOS list.

COVERAGE OPTIONS

Team Member $10,000, $20,000 or $30,000

Spouse $5,000, $10,000 or $15,000 – not to exceed 50% of Team Member's elected coverage

Child(ren) $5,000, $10,000 or $15,000 – not to exceed 50% of Team Member's elected coverage

CRITICAL ILLNESS

Being diagnosed with a critical illness can be devastating, both personally and financially.

Enrolling in Critical Illness insurance coverage would pay a percentage of your benefit

amount selected if you or a covered family member is diagnosed with a covered illness or

condition on or after the effective date of coverage. The benefit amount payable depends

on the type of illness or condition and the coverage amount you purchase.

You can receive a benefit more than once. Each condition below is payable up to four

times. For instance, if you had a covered heart attack in 2024, then had a second heart

attack more than six months later, both events could be payable.

26

QUALITY OF LIFE

BENEFIT

• Permanent paralysis 100%

• Coma 100%

• Multiple sclerosis 100%

• Amyotrophic lateral sclerosis (ALS)

(50% of Critical Illness benefit)

• Infectious disease (ex. COVID-19, sepsis,

or bacterial pneumonia) if confined to a

hospital for 5+ days or a transitional facility

for 14+ days (10% of Critical Illness benefit)

• Parkinson’s disease 100%

• Advanced dementia, including

Alzheimer’s disease 100%

ADDITIONAL CHILD

DISEASE BENEFIT

• Cerebral palsy 100%

• Niemann-Pick disease 100%

• Congenital birth defects 100%

• Pompe disease 100%

• Cystic fibrosis 100%

• Type IV glycogen storage disease 100%

• Down syndrome 100%

• Infantile Tay-Sachs 100%

• Gaucher disease, type II or III 100%

CHILD(REN) COVERAGE

WEEKLY PREMIUMS

Coverage

Amount

Rate

$5,000 $0.40

$10,000 $0.81

$15,000 $1.21

TEAM MEMBER ONLY COVERAGE

WEEKLY PREMIUMS

SPOUSE COVERAGE

WEEKLY PREMIUMS

Age $10,000 $20,000 $30,000 Age $5,000 $10,000 $15,000

Under 25 $0.44 $0.88 $1.32 Under 25 $0.22 $0.44 $0.66

25-29 $0.53 $1.06 $1.59 25-29 $0.27 $0.53 $0.80

30-34 $0.78 $1.57 $2.35 30-34 $0.39 $0.78 $1.18

35-39 $0.95 $1.89 $2.84 35-39 $0.47 $0.95 $1.42

40-44 $2.03 $4.06 $6.09 40-44 $1.02 $2.03 $3.05

45-49 $4.20 $8.40 $12.60 45-49 $2.10 $4.20 $6.30

50-54 $5.01 $10.02 $15.02 50-54 $2.50 $5.01 $7.51

55-59 $6.12 $12.23 $18.35 55-59 $3.06 $6.12 $9.17

60-64 $7.94 $15.88 $23.82 60-64 $3.97 $7.94 $11.91

65-69 $8.08 $16.15 $24.23 65-69 $4.04 $8.08 $12.12

70+ $10.43 $20.86 $31.29 70+ $5.22 $10.43 $15.65

Cost based on your age

as of 1/1/2024.

Cost based on age of spouse

as of 1/1/2024.

VOYA CONTACT INFO

presents.voya.com/ebrc/claytonhomes // (877) 236-7564

the ap!

D

O

W

N

L

O

A

D

27

What are common examples of

qualifed medical expenses?

A Health Care FSA will usually cover expenses

such as copays, eye glasses or contact

lenses, dental work and orthodontia, medical

equipment, hearing aids or chiropractic care.

Many over the counter drugs*, such as cold and

allergy medicines, pain relievers and antacids,

can also be reimbursed through an FSA.

(*Rx may be required)

How do I access my FSA funds?

You will receive a debit card to access your

FSA funds. Keep in mind, you may need to

submit documentation of the purchase to

Optum Financial. You can also pay for eligible

expenses with any other form of payment and

request reimbursement from your account.

How can I find my account balance

and review transactions?

Account balance and claims status information is

available by using the mobile app or logging on

to your online account. Your mobile and online

accounts are secure and updated in real time.

Can I change my contribution

throughout the year?

Once an election for the FSA has been

made, you cannot change the amount unless

you have a qualifying life event.

(ex. marriage, birth, etc.)

What happens if I do not spend all my

FSA funds by year end?

FSAs are a use it or lose it account. You can

only roll over $610 into the next calendar year.

Therefore, consider your expected medical

and Rx costs before selecting your FSA

annual contribution.

What happens if I leave the company?

You are eligible to be reimbursed only for

services that were incurred before your

termination date, but you can request

reimbursement for these expenses through the

end of the calendar year.

A Health Care Flexible Spending Account (FSA) provides you the ability to set aside pre-tax

dollars to pay for qualified medical expenses. You choose how much money to contribute to

your FSA, within certain limits.

With Garner, you may not need to contribute as

much to your health care FSA.

Due to IRS regulations you are not able to use FSA dollars to pay for medical expenses

that will be reimbursed by Garner. If you are seeing a Garner approved provider, please

pay the out-of-pocket copays with dollars outside of your FSA and wait to be reimbursed

by Garner. You may need to re-evaluate how much you contribute to your FSA plan.

HEALTH CARE

Flexible Spending Account

OPTUM FINANCIAL CONTACT INFO

secure.optumfinancial.com // (833) 229-4432

the ap!

D

O

W

N

L

O

A

D

Please note, you can only use funds in your health care FSA

to pay for qualified medical expenses you incur in 2024.

28

DEPENDENT CARE

Flexible Spending Account

A Dependent Care FSA allows you to save pre-tax dollars to pay for qualified dependent

care expenses, including those for aging parents.

What type of expenses are NOT eligible for

use with a Dependent Care FSA:

• Expenses for non-disabled children 13 or older

• Food, clothing, sports lessons or field trips

• Registration fees

• Late payment fees

• Medical care

Common expenses eligible for use with a Dependent Care FSA:

• Before or after school care

• Qualifying custodial care for dependent adults

• Licensed day care centers

• Nursery or preschools

• Childcare at a day camp or private sitter

• Summer or holiday camps

OPTUM FINANCIAL CONTACT INFO

secure.optumfinancial.com // (833) 229-4432

the ap!

D

O

W

N

L

O

A

D

29

How does a Dependent Care FSA work?

• You elect an annual amount during your new hire or open enrollment. The associated

premium will be deducted each paycheck.

• After paying out-of-pocket for your eligible Dependent Care FSA expense, you can

submit for reimbursement.

• You can only be reimbursed based on how much you have contributed so far in weekly

premiums.

• Use the mobile app or visit secure.optumfinancial.com to submit your request for

reimbursement and the associated receipt

.

What happens if I leave the company?

You are eligible to submit expenses for reimbursement through the end of the calendar

year. This allows you to spend down the account balance you contributed through payroll

deductions while employed.

DEPENDENT CARE

Flexible Spending Account

OPTUM FINANCIAL CONTACT INFO

secure.optumfinancial.com // (833) 229-4432

the ap!

D

O

W

N

L

O

A

D

30

Preventative Major + Ortho

Deductible

Team Member Only $50 $25

Team Member + Spouse

Team Member + Child(ren)

Team Member + Family

$150 $75

Annual Maximum

Note: Preventative, basic, and

major services do count towards

your annual maximum.

$1,000 per individual,

per calendar year

$2,000 per individual,

per calendar year

Preventative Services

Exams

Covered at 100%

no deductible

Covered at 100%

no deductible

Routine cleanings

Fluoride (less than 15 years old)

X-rays

Sealants

Space maintainers

Basic Services

Fillings

Covered at 80%

after deductible

Covered at 80%

after deductible

Extractions

Root canals

Periodontic procedures

Oral surgery

Major Services

Inlays / onlays

Not covered

Covered at 50%

after deductible

Crowns

Dentures

Orthodontic Services

Not covered

Covered at 50% up to $1,500

after plan deductible ($1,500

lifetime max per individual)

Enrollment Group Preventative Weekly Premium Major + Ortho Weekly Premium

Team Member Only $4.81 $9.62

Team Member + Spouse $9.62 $19.24

Team Member + Child(ren) $9.62 $19.24

Team Member + Family $9.62 $19.24

DENTAL

CIGNA CONTACT INFO

mycigna.com // (800) 244-6224

the ap!

D

O

W

N

L

O

A

D

31

AN important note ABOUT HEARING AIDS:

HEARING AID DISCOUNT:

• Free hearing exam

• Discount of up to 40% off premium hearing aids

• superiorvision.yourhearing.com

• (888) 494-1272

LASIK VISION CORRECTION DISCOUNT:

• Up to 50% off the national average price

• lasik.sv.qualsight.com

• (877) 201-3602

Eye Exam (once per calendar year) $10 copay

Frames (once per calendar year) $175 allowance

Standard plastic lens (once per

calendar year)

$20 copay

Single

Bifocal

Trifocal

Lenticular

Adult polycarb, scratch coating and tint

No cost

Contact Lens (in lieu of lenses

and frames)

$175 allowance

Fitting Fee $30 copay

In-Network

Enrollment Group

Team Member Only $1.12

Team Member + Spouse $2.24

Team Member + Child(ren) $2.54

Team Member + Family $3.93

Weekly Premiums

VISION

SUPERIOR VISION CONTACT INFO

superiorvision.com // (844) 549-2603

the ap!

D

O

W

N

L

O

A

D

from

SEE WHAT’S NEXT

(844) 549-2603 | superiorvision.com

Stop by superiorvision.com any time for more information.

SVIPW_SIB_061418

Download our mobile app

Create an online account

• Log in with the username and password

you use to access your Member account

on SuperiorVision.com

• Or, you can create an account in the app.

Locate a provider

• Find a provider in your network

• Get directions

• Call the provider

View your vision benets

• Review your vision benets and the

benets for any dependents

Get your member ID card

• View our ID card full screen

• Print or email your ID card

Hearing aids may be more cost-effective through the medical plan. When using a Garner

approved provider, some copays may be reimbursed. We recommend consulting with the

Benefits team prior to purchasing hearing aids.

32

Spouse Life:

• Purchase up to $250k in increments of $25k.

• Cost is based on amount selected and age as of January 1

st

.

Cost will be shown during your online enrollment.

• Coverage cannot exceed 50% of your life insurance coverage.

• You must be enrolled in additional life to purchase spouse life.

• Underwriting may be required.

Child Life:

• Purchase $10,000 for your children under age 26.

• Cost is $.23 per week for any number of children covered.

Additional Life:

• Purchase up to 10x your covered earnings

(not to exceed $2 million).

• Cost is based on amount selected and age as of January 1

st

.

Cost will be shown during your online enrollment.

• Underwriting may be required.

• Life insurance is based off gross wages from a specified

period of time.

LIFE INSURANCE

PRUDENTIAL CONTACT INFO

contact by phone // (800) 524-0542

life insurance is

provided at no cost to

full-time Team Members!

$30,000

Basic, additional, and spouse life insurance reduces by 35% at age 65 and 50% at age 70.

N

O

T

E

:

N

O

T

E

:

33

Short-term Disability (STD) provides financial support to replace lost income

while disabled due to a short term illness or non-work related injury.

STD is based off your salary or

hourly rate and commissions from a

specified period of time.

There is a 7 day waiting period.

STD will begin on the 8

th

day of

disability.

STD may be offset by any state

disability plans.

SHORT-TERM DISABILITY IS PROVIDED AT NO COST TO YOU!

Pays 50% of

covered earnings up to

$1,500 per week.

Weekly benefit can

continue for up to

26 weeks.

Pays 66.7% of

covered earnings up to

$3,000 per week.

Cost is based

on weekly

benefit amount.

SHORT-TERM DISABILITY

ABSENCEONE (STD) CONTACT INFO

absenceone.com/clayton // (855) 366-2152

Administered by Sedgwick

BUY-UP OPTION:

34

Long-term Disability (LTD) protects your income if you are unable to work for a

long period of time due to an illness or injury. Long-term Disability begins after

Short-Term Disability ends.

LTD is based off your salary

or hourly rate, bonuses, and

commissions from a specified

period of time.

LTD may be offset by other income

such as SSI, Worker’s Comp, etc.

The minimum is $100/month.

LONG-TERM DISABILITY IS PROVIDED AT NO COST TO YOU!

Pays 50% of

covered earnings up to

$6,500 per month.

Monthly benefit can

continue until the

Social Security normal

retirement age.

Pays 66.7% of

covered earnings up to

$25,000 per month.

Cost is based on

amount of your

covered earnings.

BUY-UP OPTION:

LONG-TERM DISABILITY

ABSENCEONE (LTD) CONTACT INFO

absenceone.com/clayton // (800) 842-1718

Administered by Prudential

35

HEALTHY BABIES,

HEALTHY PREGNANCY

STEP 1:

Contact Cigna Healthy Babies, Healthy Pregnancy

at (800) 615-2906 or BCBS Baby Yourself Maternity

Program at (800) 222-4379 as soon as you know

you’re expecting!

STEP 2:

You’ll be transferred to a maternity specialist that

will keep in touch for any maternity related questions

from birthing classes, maintaining a healthy weight,

to choosing a physician.

Expecting?

Enrolled in a

medical plan?

Enroll within your first trimester to

receive $250 or enroll within your

second trimester to receive $125.

wit Cign

STEP 3:

With Cigna, funds will be deposited into a healthy

rewards account. If you enroll in the BCBS Baby Yourself

Maternity Program during your first trimester, you’ll

receive a special gift for you and your baby.

36

We are pleased to offer paid time off to all new parents! It's an incredibly special

time for nurturing and bonding for all parents, as well as needed time off for healing

and recovery for moms after delivery. We hope this offering of paid parental leave

will encourage and empower new parents to take the time they need and give them

financial support while doing so.

FOR MOMS WHO DELIVER ALL PARENTS

• 10 weeks following delivery

• 100% of base pay

• Paid through AbsenceOne administered

by Sedgwick

• May be offset by any state disability plans

• 4 weeks

• 50% of base pay

• Must be used within 6 months of birth,

adoption, or foster placement

• Cannot be used intermittently

• For moms who deliver, the 4 weeks at 50%

pay will begin after the 10 weeks of 100%

pay ends

• Paid through payroll

• Insurance premiums and arrears deducted

PAID PARENTAL LEAVE

37

Every 3 seconds

there was a victim

of identity theft in

2020.

$38+ billion was

lost to cybercrime

in the US in 2020.

3 in 5 U.S. consumers

have been victim to

cybercrime.

Identity theft is when your personal

information is stolen in order to take over

or open new accounts, file fake tax returns,

rent or buy properties, or do other criminal

activities in your name. While no organization

or individual can completely prevent identity

theft, LifeLock alerts you to possible use

of your personal information, which can be

a valuable deterrent to unauthorized use

of your identity. It is important to note that

LifeLock cannot monitor all transactions at

all businesses.

Why do I need protection?

LifeLock monitors fraudulent use of your social,

name, address or date of birth in applications

for credit and services. When activity occurs

involving your information, you are alerted

by email, text or phone. If you are a victim of

identity theft, LifeLock protection includes

reimbursement for stolen funds and coverage

for personal expenses (with limits up to $1

million dollars) and access to lawyers and

experts if needed, to help resolve your case.

Signing up for LifeLock service is an important

step in helping to protect your identity. When

you become a member, you will receive

communications about your membership,

keeping you up-to-date on important

information about your identity.

When you enroll you'll receive:

A welcome to LifeLock

email that explains how

LifeLock service works to

help protect you.

An email that contains your

temporary username and password,

along with instructions on how to log

in to your member portal.

A welcome kit containing

your membership ID card

will arrive within 10 business days

of your benefit effective date.

What is identity theft?

How does LifeLock work?

3

$

38+

IDENTITY THEFT

PROTECTION

38

LifeLock Identity Alert System

Benefit Essential

Identity Lock

Credit, Bank & Utility Account Freezes

Life Lock Identity Alert System

Mobile App

Dark Web Monitoring

Stolen Wallet Protection

Fictitious Identity Monitoring

Bank & Credit Card Activity Alerts

Credit Monitoring (One Bureau)

Online Privacy – Secure VPN, Privacy Monitor

& SafeCam

Social Media Monitoring

Phone Takeover Monitoring

Prior Identity Theft Remediation

Credit Application Alerts and Credit

Monitoring

Norton Device Security

o Secures PCs, Mac & mobile devices (Up

to 3 devices, family gets 6 devices)

o Parental Control

o Cloud Backup 10GB

ALL THE FEATURES OF BENEFIT ESSENTIAL PLUS:

Bank Account Takeover Alerts

Monthly Credit Score Tracking (One Bureau)

Credit Reports & Credit Scores On Demand

Credit Monitoring (3 Bureau)

Checking & Savings Account Application Alerts

Home Title Monitoring

Court Records Scanning

Norton Device Security

o Secures PCs, Mac & mobile devices (Up to

5 devices, family gets 10 devices)

o Parental Control

o Cloud Backup 50GB

No one can prevent all identity theft.

† Lifelock does not monitor all transactions at all businesses.

** Million dollar protection package benefits are provided by a master policy issued by united specialty

insurance company, inc. (State national insurance company, inc. For NY state members). The master

policy provides coverage for stolen funds reimbursement and personal expense compensation, each

with limits of up $1 million. If needed, Lifelock will provide lawyers and experts under the service

guarantee. Please see the policy terms, conditions and exclusions at: lifelock.com/legal.

LIFELOCK BENEFIT ESSENTIAL

TM

LIFELOCK BENEFIT PREMIER

TM

OR

SCAN HERE FOR

A FULL LIST OF

LIFELOCK FEATURES

FOR 2024!

BENEFIT ESSENTIAL WEEKLY PREMIUMS

Team Member Only $1.27

Team Member + Family $2.53

BENEFIT PREMIER WEEKLY PREMIUMS

Team Member Only $2.31

Team Member + Family $4.38

LIFELOCK CONTACT INFO

lifelock.com // (800) 607-9174

the ap!

D

O

W

N

L

O

A

D

39

The Clayton 401(k) plan allows eligible Team Members to save for retirement through payroll deduction.

Team Members are eligible for the 401(k) retirement plan after 90 days of service.

Team Members may contact Fidelity at any time to change their

deferral rate or opt out of the plan.

ENROLLMENT

New hires will receive enrollment materials

directly from Fidelity Investments. If no

action is taken before reaching 90 days of

service, newly eligible Team Members will

be automatically enrolled into the plan at a

4% pre-tax deferral rate.

ANNUAL AUTOMATIC INCREASE

If a Team Member does not actively opt

out of the Annual Increase Program, their

deferral rate will increase 1% each year

until it reaches a 11% deferral rate.

TEAM MEMBER CONTRIBUTIONS

Team Members can contribute up to 75% of

their eligible pay on a pre-tax basis, and Roth

sources, up to the annual IRS dollar limits.

MATCHING CONTRIBUTIONS

Team Members are eligible to receive

company match at the beginning of the

quarter following one year of service. The

company will match dollar for dollar of the

first 4% you contribute to the plan.

ELIGIBILITY REQUIREMENT

Part-time and full-time Team Members 18+

are eligible to participate after 90 days

of employment.

ROTH

We also offer a Roth 401(k) option in the

plan. Roth contributions to your retirement

savings plan allow you to make after-tax

contributions and take any associated

earnings completely tax free at retirement.

401(K) RETIREMENT PLAN

FIDELITY CONTACT INFO

English: (800) 835-5095 // Spanish: (800) 587-5282

netbenefits.com

the ap!

D

O

W

N

L

O

A

D

If you are age 50 or older,

you can contribute an

additional $7,500 annually.

catc up!

40

401(K) RETIREMENT PLAN

the ap!

D

O

W

N

L

O

A

D

IMPORTANT: DESIGNATE YOUR 401(K) BENEFICIARY

Your 401(k) beneficiaries are separate from all other benefits. With Fidelity's Online Beneficiaries

Service, you can designate your beneficiaries, receive instant online confirmation, and check your

beneficiary information virtually anytime.

To elect your 401(k) beneficiaries:

• Visit netbenefits.com

• Select "Beneficiaries"

• Follow the online instructions or contact Fidelity at (800) 835-5095.

FIDELITY CONTACT INFO

English: (800) 835-5095 // Spanish: (800) 587-5282

netbenefits.com

41

additiona

resources

EMPLOYEECONNECT

As a Clayton Team Member, you and your family have access to 24/7 support for a wide

range of personal and work-related issues.

LET'S TALK

Let’s Talk is Clayton’s enterprise-wide commitment to supporting the mental wellbeing of

its Team Members. We all have mental health, just as we have physical health, and we all

benefit from having access to professional resources that help us care for our brains

like we care for our bodies.

CONFIDENTIAL COUNSELING

Up to five* sessions with a counselor per person, per issue, per year.

*In California, up to three sessions in six months, starting with initial contact by

Team Member.

WORK-LIFE SOLUTIONS

Assistance finding child or elder care, moving, college planning, selling a house

and more.

LEGAL SUPPORT

Access to an attorney for legal concerns such as custody, adoption, debt and

bankruptcy.

FINANCIAL INFORMATION, RESOURCES AND TOOLS

Discuss getting out of debt, retirement or estate planning, saving for college

and tax questions.

Call anytime for confidential support!

Call: (800) 311-4327

TDD: (800) 697-0353

Online: guidanceresources.com

Clayton Web ID: GEN311

42

additiona

resources

NEED ADDITIONAL SUPPORT?

Connect with mental health providers with these resources, available at NO COST for Team Members

and family enrolled in the Clayton medical plan.

Garner

Garner can help you find top-rated providers near you with expertise in mental health and

wellbeing. Garner is a free resource available for those on the Clayton medical plan.

Download the Garner Health app or visit garner.guide/account See pages 9-12 for more details.

Telehealth

With MDLive and Teladoc, you can schedule a video or phone call appointment with doctors,

therapists or other trained mental health professionals. Talk to someone same day or schedule

a conversation at a later time. See page 17 for more details.

TELADOC (BCBS)

teladoc.com/alabama // (855) 477-4549

MDLIVE (CIGNA)

mdliveforcigna.com // (888) 726-3171

NATIONAL RESOURCES

SAMHSA Treatment Locator

samhsa.gov // (800) 662-4357 // Call for treatment referrals to mental health care and substance

abuse services.

The National Suicide Prevention Lifeline

Call 9-8-8 for immediate support when experiencing suicidal thoughts. This service is committed

to improving crisis services and advancing suicide prevention by empowering individuals.

National Crisis Text Line

crisistextline.org // Text HOME to 741741 to contact a trained Crisis Counselor for immediate

assistance with anxiety, depression, eating disorders, abuse, gun violence, loneliness, suicide, and

self-harm.

Veterans Crisis Line

Call: (800) 273-8255 // Text: 838255 // Call or text to receive immediate support for all Veterans,

Service Members, National Guard and Reserve and their family members and friends.

Psychology Today

psychologytoday.com/us // Enter your city or zip code to find a therapist close to you.

Contact ClaytonWellbeing@claytonhomes.com to learn more about Let's Talk.

43

TOBACCO CESSATION

PROGRAM

What does the program include?

• 5 one-on-one scheduled calls with your own quit coach

• Call to speak with a quit coach anytime, 24/7

• Direct mail order of 8-week supply of a patch or gum

• $0 copay for 180 day supply of Bupropion or Chantix (prescription required)

• Access to an interactive website that helps you stay on track between calls

• Text2quit, an integrated text messaging service sends games to help during cravings

• Ability to re-enroll and try again if you have not quit for good by last call

The Quit For Life program can help you create an easy-to-follow quit plan that will show you

how to get ready, take action and live the rest of your life tobacco free.

FREE for Team Members, spouses and dependents 18 years and older!

Quit For Life can help!

How do I enroll?

Enroll anytime by calling

(866) 784-8454 or visit

quitnow.net.

Quit for Life offers translation

services for many languages

including Spanish.

Read t quit?

44

vendo

contacts

PROGRAM VENDOR WEBSITE PHONE

401(k) Fidelity netbenefits.com (800) 835-5095

Additional Resources EmployeeConnect guidanceresources.com (800) 835-5095

Disability, Long-term AbsenceOne absenceone.com/clayton (800) 842-1718

Disability, Short-term AbsenceOne absenceone.com/clayton (855) 366-2152

Flexible Spending Optum Financial secure.optumfinancial.com (833) 229-4432

Identity Theft Protection LifeLock by Norton lifelock.com (800) 607-9174

Life Insurance Prudential contact by phone (800) 524-0542

Medical Blue Cross Blue Shield alabamablue.com (888) 578-6772

Medical Cigna mycigna.com (800) 244-6224

Pharmacy Express Scripts express-scripts.com (855) 634-0226

Telehealth (BCBS) Teladoc teladoc.com/alabama (855) 477-4549

Telehealth (Cigna) MDLive mdliveforcigna.com (888) 726-3171

Tobacco Cessation Quit For Life quitnow.net (866) 784-8454

Top Provider Directory Garner mygarnerguide.com (866) 761-9586

Vision Superior Vision superiorvision.com (844) 549-2603

Voluntary Benefits Voya

presents.voya.com/ebrc/claytonhomes

(877) 236-7564

2

0

2

4

2

0

2

4

CLAYTON BENEFITS TEAM

benefits@claytonhomes.com // (865) 380-3000 x7400

45

Health care and benefits can be confusing! Here's a few common terms used throughout the guide

or words that you may hear at your doctor's office defined to help you better understand your

benefits package and navigate your healthcare experience.

Benefits Enrollment

A defined period of time when Team Members may elect or change benefits coverages. Each year,

during open enrollment, all Team Members are given the opportunity to change their benefits

elections for the upcoming year. During qualified life events such as marriage or the birth of a child,

Team Members are given 30 days to change their benefits elections.

Log on to workday.claytonhomes.com to enroll in benefits coverages.

Copay

Also known as a copayment. Copays are a flat or fixed amount that you pay for a covered health

care service such as an appointment, procedure, service or prescription. Helpful tip: See Garner

approved providers to get your copays reimbursed for qualified services.

Copay Reimbursement

When you receive a bill from your medical provider, pay the bill as you normally would. With Garner,

your copays for qualified visits are reimbursed. This means the money you pay will be sent back to

you in the form of a check about 6 to 8 weeks after your visits with Garner approved doctors.

In-network vs. Out-of-network

A provider or facility is considered in-network when they participate in our medical carrier's (BCBS

or Cigna) network of providers. When you visit in-network providers, you will pay a flat copay for

services received, eliminating surprise medical bills. Out-of-network providers do not participate

in our medical carrier network, leading to patients paying a higher cost for medical services. Visit

mygarnerguide.com for a list of in-network Top Providers.

Out-of-pocket Maximum

The maximum amount you will required to pay for covered health care services during a plan year.

Premium

Premium is the amount that is deducted from your paycheck each week for health coverages you

elect during benefits enrollment. With some coverages, such as your medical insurance, a premium

is shared between you and your employer.

Benefits ABCs

Note

47