74 Volume 4, Number 3

Exploring the Business Potential of Chipotle

Mexican Grill's Expansion in China

By Bel Wang

case study

Introduction

Chipotle Mexican Grill, Inc. is an American restaurant chain with

a high reputation for quality good-tasting food. Currently Chipotle

has expanded to other countries such as the United Kingdom, Canada,

and France (Jones et al, 2009). Chipotle’s main products are burritos,

burrito bowls, tacos, and salads. The products are assembled based on

the customer’s preferences using a wide variety of meats, sauces, and

vegetables (University of Oregon Investment Group, 2012). Chipotle

oers naturally raised meat and supports sustainable agriculture. As

one of the rst chains to successfully develop fast casual dining ser-

vice, Chipotle focuses on its mission of oering “Food with Integrity”

(Chipotle Mexican Grill, Inc. 2012). Chipotle supports its mission by

continuing to oer consumers organic and fresh ingredients (Chipotle

Mexican Grill, Inc. 2012).

The success of Chipotle has grown at an amazing rate since Steven

Ells founded the rst Chipotle in 1993. By 2012, Chipotle Mexican Grill

became a household name, gaining popularity at a steady pace. This

year alone, Chipotle has generated approximately $280 million in net

income, and employs roughly 37,000 employees (Chipotle Mexican

Grill, Inc. 2012). Chipotle became a publically traded company in the

beginning of 2006. Soon after, its stock value rose 100% within one day.

Today, the price of Chipotle’s stock remains around $400.00, which is

tenfold compared to the price in 2006 (Chipotle Mexican Grill, Inc. 2012).

Huge Potential in China's Market

Most U.S. restaurant chains are seeking growth in international

markets whose middle class consumers are increasing, based on 2009

Data monitor report. China is proved to be an ideal choice for such as

one of the biggest developing countries. It has 1.3 billion dense popula-

tion, among which the middle working class in enlarging—fast, healthy,

convenient eating experience which Chipotle can provide is also what

Chinese middle class and white-collar workers are seeking for. China’s

market can provide further global expansion opportunities for Chipotle.

Chipotle has gained abundant capital and popular presence in

most states in the U.S. and while it has already expanded so much

within the American domestic market in recent years, there is smaller

development space for Chipotle to grow in this market. To sustain its

continued expansion and development, Chipotle has focused its at-

tention on the global scale and has successfully opened restaurants

in several European countries and Canada. However, Chipotle does

not currently have a plan to develop its business in China’s market yet.

Considering many other U.S. fast service restaurant chains have gained

sizeable prots in China, Chipotle could also further explore its oversea

growth ability in China’s market.

Business Plan

Objectives:

• To establish two to ve company-owned Chipotle Mexican Grill

restaurants in Beijing.

• To advertise Chipotle’s brand and improve customer satisfac-

tion and loyalty in China.

• To expand into at least ten outlets in three years and chose a

model for further expansion: Self-owned or franchising.

Mission

The mission of this plan is to help Chipotle Mexican Grill become

the rst and the most popular Mexican fast and causal restaurant

chain in China, targeting at the younger generation, white-collar work-

ers and the middle class. In the beginning stage, Chipotle shall focus

on enlarging potential customers and establishing a close relationship

with local government. In the growth stage, opening more outlets

and exploring diverse sales channels are crucial. Overall, maintaining a

high reputation and distinguished public relation are the primary mis-

sions of Chipotle China.

Keys to Success

• Location.

To ensure the popularity of CMG’s fast and casual dining style in

China’s market, its target customer should be younger generation,

from students to white-collar middle class workers. Therefore locations

near school and oce building would be spots of interest to get prox-

imity to target customers.

• Sustainable food supply chain and high-quality ingredients.

A huge kitchen backup and several logistics centers are needed

for Chipotle to ensure food freshness and the abundant supply of

ingredients. Locally sourced ingredients can be a wise choice for both

cutting purchasing expenditures and maintaining close local relation-

ship. Chipotle shall also monitor its purchasing process to ensure

obtaining high-quality ingredients.

Bel Wang is aliated with the University of Delaware.

75

Journal of Hospitality & Tourism Cases

• Reasonable pricing and meal strategy.

The target customers of Chipotle China are youth oce workers

who has limited lunch time (0.5-1hr) in regular business days but who

want a fast and healthy lunch at an aordable and appropriate price.

As a result, it is suggested to oer multiple set meals which are quick

to service, varied enough to be chosen from and can signicantly in-

crease customers’ repeat visit rate.

• Comprehensive advertising and promotion strategy.

Chipotle shall eectively advertise and promote Mexican cuisine

to Chinese customers to let them warm up to its dinning style. Instruc-

tions on how to order a meal in store could familiarize them with the

self-selecting fast-casual dining style. It is necessary for Chipotle to

launch eective in-store customer trainings as well as to oer discount

and coupon strategies to stimulate customers’ motivation.

• Measure global and local environment.

Business environments, policies, purchasing power, government

regulation, and customers’ taste are vastly dierent between the U.S.

and China. This dynamic and uncertain environment could be ex-

plored eciently for Chipotle’s advantage if proper methodology are

adopted. Co-alignment model outlines the exact necessary strategy

Figure 1

Olsen, Strategic Management, P 3-7

to make the most eective use of core resources and capabilities that

are durable for CMG to survive and thrive in the long term in Chinese

market. As showed below:

When making strategic choice, CMG can refer co-alignment prin-

ciple to achieve their objectives. According to Olsen et al., the concept

of strategy choice suggests that management is constantly engaged

in making choices about how to compete. It is therefore important to

adopt appropriate environment-measuring strategy—maintain CMG’s

core Mexican ingredients, meanwhile deliver localized meal combos

that both keep the company concept and adapt to Chinese taste; nur-

ture a good public relationship with the government and residents is

also necessary for its market advantage.

Market Analysis and Strategies

1. SWOT analysis of Chipotle China

Strengths:

• High position as a famous and well regarded U.S. chain

brand with highly regarded brand image;

• Mature restaurant chain operation and brand manage-

ment methods;

• The menu variety provides wide choices for customers

with dierent tastes;

• The spicy taste of Chipotle Mexican Grill ts in most Chi-

nese tastes.

• Fast, healthy, low-cost eating experiences ts in the life-

style of modern Chinese, specically:

• Convenient food packaging increases the number of

deliveries;

• Eective order line can serve more customers in

high trac time;

• Aordable price can attract students, blue-and-

white collar workers, and middle class.

Weaknesses:

• Chipotle and China’s market are not familiar with each other;

Figure 2

Blue and Red Ocean Strategy

Blue Ocean Strategy Red Ocean Strategy

- Create uncontested market space - Compete in existing market space

- Make the competition irrelevant - Beat in competition

- Create and capture new demand - Exploit existing demand

- Break the value-cost trade o - Make the value-cost trade o

- Align the whole system of a rm’s activities in pursuit of

dierentiation and low cost

- Align the whole system of a rm’s activities with its strategic choice

of dierentiation or low cost

Source From: Blue Ocean vs. Red Ocean (W. Chan, 2005)

76 Volume 4, Number 3

• Chipotle needs to build brand awareness and local rela-

tionships;

• Further expansion in China can be time-consuming.

Opportunities:

• China’s continued development and ever-expanding

middle class provide a large demand for healthy, reason-

able-priced quick-service food;

• Many potential locations for Chipotle’s outlets in China;

• Increasing purchasing power and dense population in

China’s market lays the foundation for high prots;

• Developed agriculture in China provides abundant high-

quality suppliers with cheaper prices;

• China can act as a platform to support further Asian ex-

pansion, such Japan and South Korea.

Threats:

• A number of competitors, such as foreign and Chinese

fast-food restaurant chains;

• Food safety and public boycott;

• As the rst Mexican fast casual restaurant in China, Chi-

potle can refer to no previous business models or cases,

yielding high unpredictability.

2. Blue Ocean in China’s market

Admittedly Beijing and Shanghai have witnessed Tex-Mex and

Mexican restaurants sprouting in the market including MAYA

and Pistolera. Whilst there has no current Mexican quick-service

fast food chains prevalent. Once Chipotle enters China’s market,

it thus will be the rst U.S. chain restaurant oering Mexican fast-

causal food in China’s market. As a “blue ocean” for such dinning

concept, China oers more opportunities for Chipotle’s growth.

The “Blue Ocean and Red Ocean concept” can be referred below:

3. Distribution Strategy

High quality, responsibly produced but reasonably priced in-

gredients are vital to Chipotle’s revenue and philosophy. Thus

Chipotle China shall pursue direct distribution to customers,

avoiding using a separate distributor channel. Local sourcing is

recommended for the supply chain management because not

only does it foster local economic growth, which in return helps

Chipotle build stable relationships with locals and the govern-

ment, but also deduces transportation costs. Chipotle shall

therefore adopt reputable local suppliers who oer farm-fresh

meat and produce and consider to use supplier rating system

to rate the cost, speed, and quality of the ingredients delivered

by dierent suppliers, and select highest rated ones for long-

term business relationship.

4. Advertising strategies

Eective promotion strategies can help Chipotle China create

and reinforcing customers’ brand awareness, which including

location choice, outbound and inbound advertising. Aside

from above-discussed location selection, outbound methods

such as billboards, posts, and newsletters surrounding its store

can also greatly attract public attention. Meanwhile it is highly

recommended to create Chipotle China website, to build its

social media page, such as Webo, Renren and QQ social media

platform in the case of China, in order to facilitate ordering on-

line and establish presence among netizens.

Performance Metrics for Chipotle China

1. Personnel

It is suggested that Chipotle develop ve restaurants and one

Backup Kitchen Center in Beijing in the rst year, with the goal

to expand to dierent regions in the following years. Figure 3

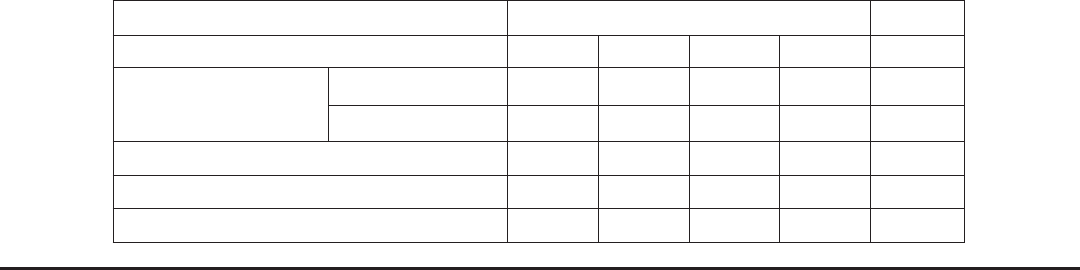

Figure 3

Position Number

Annual Income

(Before tax and include welfare and bonus)

Regional Manager 1 $ 120,000

Store Manager 5 $ 15,000

Salesclerks 50 $ 7,000

Regional Manager Assistant 2 $ 15,000

Kitchen Manager 1 $ 25,000

Cooks 10 $ 7,000

Kitchen Manager Assistant 1 $ 10,000

Market Monitoring Director 1 $ 80,000

Local Product Developer 2 $ 30,000

Total 73 $820,000

77

Journal of Hospitality & Tourism Cases

below is a projected personnel plan of the rst year based on

the general data records of other U.S. restaurant chains and on

the knowledge of Chinese foodservice industry:

2. Financial

Figure 4 and 5 below function as a start-up plan focusing on

the rst year of Chipotle China’s expansion. It gives a nancial

projection to ve stores in Beijing in the rst operational year,

based on the research behind this paper. It serves as a situation

analysis for Chipotle China income estimation.

As Figure 4 and 5 shows, Chipotle will approximately gain

$3,494,000 in the rst operational year. Meanwhile as Chipo-

tle opening ve outlets in Beijing, each restaurant could earn

$2,120,000 annually if based on $5.5 average consumption and

250 customer daily turnovers. The total revenue of the ve out-

lets in Beijing estimated be over 10 million in the rst year. Cost

items ranges from raw food ingredients cost, operational cost,

to marketing expenses. Marketing fees shall be mainly applied

to public relation maintenance and brand advertising. Accord-

ing to Chinese business law, foreign businesses need to turn

over around 8% of the total revenue as business income taxes

annually (Deloitte, 2013). It is showed that Chipotle China will

gain $3,494,000 in net income in the rst year after calculating

each expenditure detail. Therefore exploring the China market

is estimated to be a protable path for Chipotle Mexican Grill.

3. Long term

The long-term plan is to establish at least 50 Chipotle’s res-

taurants in China within ve years. In the rst ve-years of the

expansion plan, all Chipotle restaurants in China shall be com-

pany-owned and a franchising plan may be considered in the

second ve-year plan. Concerning Chipotle’s quick-service din-

ning style caters mostly to high-paced big-city working class

whose majority centered in Beijing, Shanghai and Guangzhou,

most of the 50 outlets should be located in such cities in the

Figure 4

Estimated Restaurant Unit Data

20XX Quarters Ended Total

Mar, 31 Jun, 30 Sep, 30 Dec, 31

The Number of Outlet Beginning of the Year 0 0 0 0

Openings 5 5 5 5

Average Restaurant Sales (in dollars) 530,000 530,000 530,000 530,000 2,120,000

Average Consumption (in dollars) 5.5 5.5 5.5 5.5

Customer Turnover Per Unit (Daily) 250 250 250 250

rst ve-year expansion. Chipotle China shall properly adjust

food prices based on the local economic situation too and its

growth in China needs adequate shareholder investment and

the approval of Chipotle’s managers.

Conclusion

The case study discussed whether the market in China is an ap-

propriate place for CMG’s globalization. With the analysis conducted

above, bringing Mexican quick-service restaurant chain Chipotle into

china is akin to a new product entering into a new market on one

hand, facing high risks and opportunities in the unknown business

environment. On the other hand, its healthy ingredients, well-tailored

Mexican spicy taste and time-sensitive serving manner are in line with

the meal needs of Chinese rising middle class in big, developing cities.

Therefore the paper demonstrated the feasibility of operating CMG in

China through analytics on the company, the environment, marketing

strategies and estimated nancial performances.

The business plan discussed above provided readers with in-

formation about the advantages and comprehensive strategies for

Chipotle’s China expansion. The nancial plan estimated the internal

costs, marketing spending, revenue, and prot per unit. These num-

bers can provide investors a rough nancial budget in execution. The

paper henceforth believes it can yield satisfactory revenue return for

CMG to open chain restaurants in China after the discussion initiated

above. If it performs positively, the prots gained can be deployed to

Chipotle China’s further internal optimization such as innovate new

meals, opening more outlets and strengthen internal management.

Exploring the market of China can also extract Chipotle out of purely

competing in the “Red Ocean” of U.S. fast casual dining market and

bring it into regeneration stage. As such, it is not unsafe to predict Chi-

potle can be a household name in its new “Blue Ocean” of China just

like KFC and McDonald’s when they rst entered.

In the long run after Chipotle enters Chinese market, an inte-

grated supply chain and many logistics centers could subsequently be

78 Volume 4, Number 3

created and these resources can simplify CMG’s further expansion in

other Asian countries, such as India, Japan, South Korea. It concludes

that it is worthwhile for Chipotle Mexican Grill to attempt to explore

the potential market in China.

Due to the limitation of time, length and resources, the case study

is not a complete strategy and knowledge database for Chipotle’s

practical comprehensive expansion plan in China. The ve sections,

from executive summary, huge potential in China’s market to perfor-

mance metrics of this paper, are combined to present the rst stage

scope and analytics of restaurant oversea growth strategies. It helps

Chipotle managers and ambitious investors form a vision of entering

into the market in China and functions as a reference for more compli-

cated practices to be followed.

References

Chipotle Mexican Grill, Inc. SWOT Analysis (2012), Chipotle Mexican Grill, Inc. 1-8.

Company prole: Chipotle Mexican Grill, Inc. (2012), Chipotle Mexican Grill, Inc. 1-8

Chen M & Flannery R (2013). China KFC Supplier Runner Post” 1st-Qrt low, busi-

ness hurt by H7N9, safety concern. From: Forbes.com

Deloitte International Tax Source, (2013). Taxation and Investment in China

2013. Retrieved from http://www2.deloitte.com/content/dam/Deloitte/

global/Documents/Tax/dttl-tax-chinaguide-2013.pdf

Fung M, Lain H, Remais J, Xu L & Sun S (2013). Food supply and Food Safety

Issues in China. Lancet, 381 (9882), 2044-2053.

Kim, W. Chan., and Renée Mauborgne (2005).Blue Ocean Strategy: How to

Figure 5

Income Statement projections

20XX Quarters Ended (dollars in thousands) Total

Mar, 31 Jun, 30 Sep, 30 Dec, 31

Revenue 2,650 2,650 2,650 2,650 10,600

Food, beverage and packaging cost 622.5 622.5 622.5 622.5 2,490

Labor cost 205 205 205 205 820

Occupancy cost 170 170 170 170 680

Other operating cost 266.5 16.5 16.5 16.5 316

General and administrative expenses 150 150 150 150 600

Depreciation and amortization 70 70 70 70 280

Pre-opening cost 100 100 100 100 400

Marketing cost 180 180 180 180 720

Total operating cost 1,764 1,514 1,514 1,514 6,306

Income from operation 886 1,136 1,136 1,136 4,294

Interest and other income (expenses) 100 (150) 200 50 200

Income before taxes 986 986 1,336 1,186 4,494

Provision for income taxes 250 250 250 250 1,000

Net income 736 736 1,086 936 3,494

Create Uncontested Market Space and Make the Competition Irrelevant.

Boston, MA: Harvard Business School.

Miller, P (2004). “Quick service hits China,” China Business Review, 31(4), 18-28.

Olsen, Michael D., Eliza Ching-Yick. Tse, and Joseph J. West (1998).Strategic

Management in the Hospitality Industry. New York: J. Wiley.

Orr, H (2013). CMG-Chipotle Mexican Grill Inc. --- Company Analysis and ASR

Rank Report. Alpha Street Research Reports. 1-9.

Qi M (2012). The analysis of Chinese food safety issues: Legislations and govern-

ment supervision, Chinese Law & Government. 45 (1), 3-9

Sacks, D (2012). Chipotle: For exploring all the rules of fast food. Fast Company.

163, 124-126.