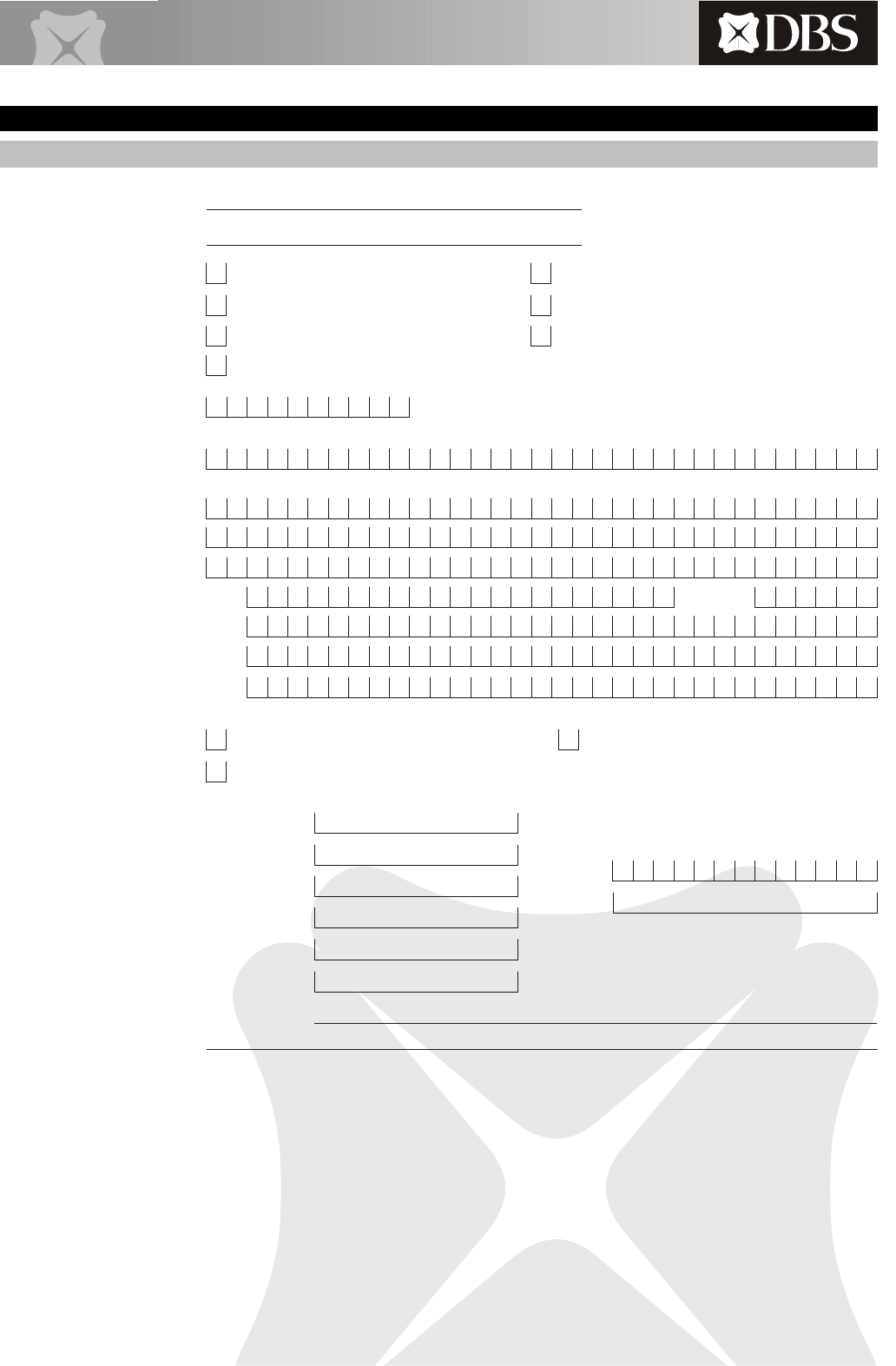

E-payment

Request

Form

22-Aug-2012

Application

for

Online Payments

of Direct

Taxes

T.D.S./

T.C.S.

TAX

CHALLAN

CHALLAN

NO/ITNS

280

Assessment Year

:

Tax

applicable

(Please

Tick

one)

:

(0020) Income Tax On Companies (Corporation Tax)

(0021) Income Tax (Other Than

Companies)

PAN

No.

:

Full

Name

:

Address

:

City

State

Tel.

Email

Pin

co

de

Type of

Payment

(Tick

One)

:

(

100)

Advance Tax

(102) Surtax

(300) Self Assessment Tax

(400) Tax On Regular

Assessment

(106) Tax On Distributed Profit

(107) Tax On Distributed Income

Details

of

Payments

Amount

(in Rs.Only)

:

Income Tax

I/we hereby authorise

DBS

Bank Ltd to Debit

the

Below

Mentioned

Surcharge

Education Cess

Interest

A/c No.

Rs.

and remit the same towards online payment

of

Direct tax as per the details

furnished.

Penalty

Others

Total

Total (in words)

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

2

Application

for

Online Payments

of Direct

Taxes

T.D.S./

T.C.S.

TAX

CHALLAN

CHALLAN

NO/ITNS

281

Assessment Year

:

Tax

applicable

(Please

Tick

one)

:

(0020) Company

Deductees

(0021) Non - Company

Deductees

Tax

Deduction a/c

No. (T.A.N.)

:

Full

Name

:

Address

:

City

State

Tel.

Email

Pin

co

de

Type of

Payment

(Tick

One)

:

(200)

TDS

/

TCS

Payable by Taxpayer

(400)

TDS/TCS

Regular

Assessment

(Raised by

I.T.

Deptt.)

Nature

of

Payment

/Code

NO.

:

Details

of

Payments

Amount

(in Rs.Only)

:

Income Tax

Surcharge

Education Cess

Interest

I/we hereby authorise

DBS

Bank Ltd to Debit

t

he

Below

Men

tione

d

A/c No.

Rs.

and remit the same towards online payment

of

Direct tax as per the details

furnished.

Penalty

Fee Under 234E

Total

Total (in words)

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

3

Application

for

Online Payments

of Direct

Taxes

T.D.S./

T.C.S.

TAX

CHALLAN

CHALLAN

NO/ITNS

282

Financial Year

:

Assessment Year

:

Tax

applicable

(Please

Tick

one)

:

(0034) Securities Transactions Tax

(0024) Interest Tax

(0031) Estate Duty

(0033) Gift Tax

(0023) Hotel Receipts Tax

(0028)

Expenditure/other

Tax

(0032) Wealth Tax

PAN

No.

:

Full

Name

:

Address

:

City

State

Tel.

Email

Pin

co

de

Type of

Payment

(Tick

One)

:

(100) Advance Tax

(300) Self Assessment Tax

(400) Tax on Regular

Assessment

Details

of

Payments

Amount

(in Rs

Only)

:

Income Tax

Surcharge

I/we hereby authorise

DBS

Bank Ltd to Debit

t

he

Below

Men

tione

d

A/c No.

Interest

Penalty

Rs.

and remit the same towards online payment

of

Direct tax as per the details

furnished.

Others

Total

Total (in words)

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

4

Application

for

Online Payments

of Direct

Taxes

T.D.S./

T.C.S.

TAX

CHALLAN

CHALLAN

NO/ITNS

283

Financial Year

:

Assessment Year

:

Tax

applicable

(Please

Tick

one)

:

(0036) Banking Cash

transaction

Tax

(0026) Fringe Benefits Tax

PAN

No.

:

Full

Name

:

Address

:

City

State

Tel.

Email

Pin

co

de

Type of

Payment

(Tick

One)

:

(100) Advance Tax

(300) Self Assessment Tax

(400) Tax on Regular

Assessment

Details

of

Payments

Amount

(in Rs

Only)

:

Income Tax

I/we hereby authorise

DBS

Bank Ltd to Debit

t

he

Below M

entione

d

Surcharge

Education Cess

Interest

A/c No.

Rs.

and remit the same towards online payment

of

Direct tax as per the details

furnished.

Penalty

Others

Total

Total (in words)

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

5

Form TR-6 for

Payment of

Service

Tax

/

Excise

Tax

(Please

tick

whichever applicable)

TR-6

/

GAR

7

Challan

No.

(Treasury

rule

92

/

Receipt

&

Payment

Rules

26)

Assessee

Details

Name*

:

Assessee

Code

No.*

:

Location*

:

Address

:

City

Pin

co

de

Commissionerate

Details

Account

Commissionerate*

Commissionerate

Code

No.*

:

:

Division*

:

Division Code

No.*

:

Range

:

Payment

Details

for

Service

Tax

Account Year*

Accounting

Head*

Accounting

Code*

Amount (Rs)*

For the

month/quarter of

Accounting

Head*

Accounting

Code*

DBS

Bank Ltd to Debit

t

he

6

Full

particulars of

the

Remittance and of

auth

ority

Head of Account and Major Accounting Code

Amount

Head 0038 Union

Excise

Duties

Account Year*

Amount (Rs)*

For the

month/quarter of

I

Total Amount in Words:

I/we confirm and accept that this E-Paym

available at

http://www.dbs.com/in/term

Date of Submission

DBS

Bank Ltd to Debit

t

A/c No.

ent Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

s-and-conditions/terms-and-conditions.aspx

Authorized Signatories Company Seal

Payment Details

for Excise

Tax

Full

particulars of the Head of Account and Major Accounting Code

Amount

Remittance and of authority Head 0044 Union

Excise

Duties

Total

Total

Application

for

Online Payments

of

Maharashtra

Sales

Tax

Form

No.6

TIN*

:

Full

Name*

:

Location*

:

Type of

Tax*

:

MVAT

CST

Tax

Period*

:

From

To

Remarks*

:

Form

I

D

:

Account

Head

Details*

Amount

Amount of Tax

Amount of TDS

Interest

Penalty

Composition

Fine

Fees

Advance

Payment

Amount Forfeited

Deposit

I/we hereby authorise

DBS

Bank Ltd to Debit

t

he

Below M

entione

d

A/c No.

Note: Fields marked with * are

mandatory

Please see overleaf for field details on “Location” and “Remarks/Form ID”

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

7

Total

Amount

D

D

M

M

Y

Y

Y

Y

D

D

M

M

Y

Y

Y

Y

For VAT/CST /PTRC, the TIN should start with 27.

For PTEC, the TIN should start with 99

Application

for

Online Payments

of

Maharashtra

Sales

Tax

05-Thane

Return

III-E

III-E

06-Kalyan

Assessment

Order

Others

07-Palghar

Interest

Order

Others

08-Nalasopara

Penalty

Order

Others

09-Pune

Installment

Order

Others

10-Solapur

Demand Against

Form-213

Others

11-Barshi

Fees For Various Reasons

Others

12-Nashik

Return-231

231

13-Malegaon

Return-232

232

14-Dhule

Return-233

233

15-Jalgaon

Return-234

234

16-Ahmednagar

Return-235

235

17-Kolhapur

TDS-payment

405

18-Satara

Compounding

of

Offence

Others

19-Sangli

20-Ratnagiri

21-Oros

22-Nagpur

23-Akola

24-Amravati

25-Wardha

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

8

Company Seal

42-Washim

41-Raigad

40-Nandurbar

39-Hingoli

38-Bhandara

37-Jalna

36-Osmanabad

35-Nanded

34-Latur

33-Parbhani

32-Beed

31-Aurangabad

30-Gadchiroli

29-Khamgaon

28-Gondia

27-Chandrapur

26-Yavatmal

Form

ID

Remarks

Locations

Application

for

Online Payments

of Delhi VAT/CST

TIN*

:

Name

of

the Dealer*

:

Building Name

/

Number*

:

Area /

Road

:

Locality /

Market

:

PIN

:

Tax

Applicable

:

Tax

Period

:

From

To

Payments

Details*

Amount

Tax

Interest

Penalty

Composition Amt / Tax

Others

Name

of

the Depositor*

:

Designation

/

Status*

:

I/we hereby authorise

DBS

Bank Ltd to Debit

t

he

Below M

entione

d

A/c No.

Note: Fields marked with * are

mandatory

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

9

Depositor's Detail

Total

Amount

D

D

M

M

Y

Y

Y

Y

D

D

M

M

Y

Y

Y

Y

Application

for

Customs

Payments

Port

Code*

:

Bill of Entry

Number*

:

Bill of Entry

Date*

:

Challan Number*

:

Import Export Code*

:

Import

E

xp

or

t

Na

me

*

:

Amount

of Duty

Payable*

:

I/we hereby authorize

DBS

Bank Ltd to Debit

the

Below

Mentioned

Account

Number

A/C

Number:

Please

Note:

If

the customs duty

amount mentioned

above does not match the

outstanding

challan

amount

shown due on the

ICEGATE

customs

duty payment portal, this payment instruction

will

not be

processed.

I

/ We hereby confirm that the details and particulars furnished above are correct and I/we will be responsible for any discrepancy/

incorrect information provided by me/us.

By

signing this E-payment request, I/We accept the Terms and Conditions

mentioned

in

the

E-Payment Request

form.

Note: Fields marked with * are

mandatory

I/we confirm and accept that this E-Payment Request Form

will

be governed by the applicable

„Terms

and Conditions of E-payment

Service‟

which are also

available at

http://www.dbs.com/in/terms-and-conditions/terms-and-conditions.aspx

Date of Submission

Authorized Signatories

Company Seal

10

A

I/

we hereby agree to avail of the E-payment

Services

offered by

DBS

Bank Limited, a banking company

incorporated

in Singapore and having its branch Office in India, at

3rd

floor, Fort House, 221, Dr. D. N. Road, Fort, Mumbai – 400 001 (“Bank”).

I/

we hereby authorize the Bank to remit my/our

Tax

dues to the Relevant Authority by debiting my/

our Account and also to electronically submit the details provided by me to the Relevant Authority. Upon completion of the E-payment of

Tax,

the Bank shall

thereafter

have

no

obligation

whatsoever.

I/

we also

acknowledge

that the E-payment

Services

are being offered by the Bank on a best effort basis and

I/

we

will

not hold the Bank responsible

or

liable for any costs and

consequences

or

damage

or loss caused to

me/us.

Definitions

Unless otherwise specified the following terms shall have the meaning assigned to them

below.

I.

(a)

“Account”

means a current account/saving account of the Customer ordinarily

maintained

with the Bank and

designated

by the Customer for debiting and

thereby

executing the Fund Transfer Request to effect the E-payment and also

designated

by the Customer for debiting any

liability

(including agreed charges and

fees

thereof) incurred by the Customer to the Bank for execution of the E-payment Request issued by the

Customer.

“Authorized Bank” means any bank

authorized

by the Finance Ministry, Central Board of Direct Taxes

(“CBDT”)

for collection of Direct / Indirect

Tax

via electronic

payment and Central Board of

Excise

and Customs (“CBEC”) for collection of

Excise

Duty via electronic payment, with which

DBS

Bank has an

arrangement for

payment of

Tax

or may have such

arrangements

with any such bank in

future.

“Authorized Person” means a person

authorized

by the Customer to give any instructions relating to E-payment

Services

including issuance of E-payment

Request.

Such

authorized

person shall at

all

times be the person who

is

authorized

to

operate

the

Account

“Business Day” means any day on which banks are working in

Mumbai.

“Cut-off Time” means a specified time on a Business

Day,

notified by the Bank to the Customer, by when the Customer shall send the E-payment

Request.

“Customer”

means an individual, sole proprietary concern,

partnership

firm,

HUF

or a company, who has signed and

accepted

these Terms and Conditions

whose

details are

mentioned

in the E-payment

Request.

“DBS

Bank Account” means an account of the Bank

maintained

with an Authorized Bank in which the

Tax

amount

will

be

deposited

for effecting E-payment.

“EEC

Code” means the unique 15 digit means

alphanumeric

Code number allotted to the Customer by the

Excise

Duty authorities in relation to

Excise

Duty

payable

by the Customer to the Government of India.

“E-payment”

means the electronic payment of

Tax

on behalf of the Customer by the Bank

through

the E-payment Gateway as set out in the E-payment

Request.

“E-payment Services” means the

facilities

for E-payment of

Tax

through

E-payment

Gateway.

“E-payment

Gateway”

means the electronic payment gateway of an Authorized Bank, utilized by

DBS

Bank for depositing the

Tax

payable to the Relevant Authority

on behalf of the Customer with the Authorized Bank.

“E-payment Request” means the duly

authorized

instructions received by the Bank from the Customer in the Bank prescribed format

mentioned

overleaf / Bank

prescribed excel sheet format. The E-payment request can be placed either in physical form at the Bank‟s branches or

through

the internet banking portal

of

the Bank

viz.

IDEAL

TM

”.

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m) “Execution Date” means the date

mentioned

in the E-payment Request, being a Business

Day

for payment of

Tax

on behalf of the

Customer.

(n)

“Fund Transfer Request” means instructions forming part of the E-payment Request received from the Customer to transfer funds from the Account to the DBS

Bank Account towards payment of Tax.

“NEFT”

means Electronic Funds Transfer

Facility

through

the Reserve Bank of India

(RBI) NEFT

System.

“PAN/TAN

code” means the unique 10 digit means

alphanumeric

Code number allotted to the Customer by the Income

Tax

authority in relation to the Direct /

Indirect

Tax

payable by the Customer to the Government of India.

“Relevant Authority” means and includes

CBDT, CBEC

and any other such

authority.

"RTGS" means the

Real Time

Gross Settlement offered by Reserve Bank of India

(RBI).

“Tax” means Direct

Tax

or Indirect

Tax

and/or

Excise

Duty or any other such taxes,

levies,

duties for which E-payment

Services

may be offered by the Bank.

(o)

(p)

(q)

(r)

(s)

II.

Specific Terms

and Conditions:

I/

we agree

that:

(a)

The Bank reserves the right to decide which services to offer me/us

pursuant

to these terms and conditions, and it shall be entitled to modify, cancel this service

from

time to time, and shall endeavor to inform me/us of such modifications or

cancellation.

The Bank shall process the E-payment Request application during banking hours on working days and Business Days.

If

the Bank receives the E-payment

Request

after the Cut-off

Time,

the same

will

be processed on the next Business Day.

Any

and

all

changes in the instructions

contained

in this application shall be

communicated

by me/ us to the Bank in the manner stipulated by the Bank, along with all

appropriate authorizations.

I/

we shall not

attempt

to remit the

Tax

without sufficient funds in the

Account.

The Bank

is

entitled to decline processing of the E-payment Request in the event of insufficient funds in the Account for the purpose of

Tax

payment.

I/we agree that the Bank may decline processing of the E-payment Request if I/we do not comply with these Terms and Condition or any of other terms

and

(b)

(c)

(d)

(e)

(f)

conditions stipulated by the Bank from time to

time.

The Bank may deduct from any account held by me/us with the Bank the service charge/ fees, as applicable from time to time for the services offered by the Bank.

The Bank shall not be liable for failure to execute any E-payment Request on behalf of the Customer in the event and to the extent that such failure arises out

of:

i.

breakdown

of the

Bank‟s

and/or Authorized

Bank‟s

systems required to process the E-payment Request, any

interruption, interception,

suspension,

mutilation,

delay, loss, unavailability, withdrawal, error, inaccuracy,

detection

or suspicion of viruses in the

Bank‟s

systems.

ii.

breakdown

of

RTGS/NEFT

or any other fund transfer system required to fund the

DBS

Bank account with the Authorized Bank which

will

be used to process

the

(g)

(h)

E-payment.

(i)

I/We

acknowledge

that the Bank is merely making the payment of Tax based on my/our E-payment Request and the Bank bears no responsibility for any

shortfall/excess in payment due from me/ us on account of our

Tax liabilities

and

all

such

liabilities

are

solely

on my/ our

account.

I/we shall indemnify the Bank and hold the Bank harmless and keep the Bank at all times fully indemnified and held harmless from and against all

actions,

proceedings,

claims,

liabilities

(including statutory

liability),

penalties,

demands

and costs (including without limitation, legal costs of the Bank incurred on solicitors /

attorneys / conveyors /

advocates/counsel),

awards,

damages,

losses and/or expenses however arising directly or indirectly as a result of me/us using the aforesaid E-

(j)

payment Services.

(k)

The Bank may, at its discretion, from time to time impose maximum and minimum

limits

of funds that may be

transferred

by virtue of the E-payment Request given

by me/ us. I/we shall be bound by such

limits

and shall comply with them strictly.

The Customer shall be bound by any payment order executed by the Bank

pursuant

to the E-payment Request,

if

the Bank had executed the same in good faith

and

in compliance with the instructions given by the Customer.

Any

amount entered

in fractions would be

rounded

off upwards to the nearest

rupee.

(l)

III.

Confidentiality and Disclosure

I/We hereby authorize the use of confidential information by Bank and the transfer by Bank

through

the Authorized Bank of any information relating to us to

and

between

the

branches,

subsidiaries,

representative

offices, affiliates,

representatives,

auditors and agents of Bank and Authorized Bank, third parties selected by any

of

them, wherever

situated,

for confidential use in

connection

with the provision of the E-payment Services, or for statistical analysis, credit scoring publicity/promotional

activities and data processing purposes), and further

acknowledges

that any such branch, subsidiary,

representative

office, affiliate, agent or third party shall be

entitled

to transfer any such information as required by any law, court, regulatory or legal

process.

11

Terms

and Conditions

of

E-payment Services

IV.

Validity

of

the

Terms

and Conditions

These Terms and Conditions shall come into force from the date on which the E-payment requests these Terms and Conditions are signed

between

the

Customer

and the Bank.

General Undertaking

of

the Customer

V.

(a)

The Customer hereby agrees,

undertakes

and confirms

that:

i.

ii.

it

fully

understands,

agrees and

is

satisfied with

all

the features of E-payment Services including its usage for completing the desired payment of Tax.

The Customer

is solely

responsible for the accuracy,

completeness

and timeliness of E-payment Request.

In

case of E-payment request placed

via

excel upload

on

IDEAL,

customer confirms that the instructions have been duly

authorized

by the customer‟s

authorized

signatories prior to upload on IDEAL.

the Customer

is solely

responsible for ensuring that the use of E-payment

Services

achieves the

intended

purpose and to adhere to these terms and

conditions.

iii.

(b)

(c)

The Customer hereby agrees and confirms that it

fully

understands

that the Bank

will

be able to provide E-payment

Services

to the

Customer.

The Customer hereby warrants and

represents

that the Customer has executed a fax indemnity in writing in favour of the Bank in the form and manner

acceptable

to

the Bank.

I/

we certify that all information provided and/or which may be provided in the E-payment Request is true, accurate, current and complete and constitutes all

necessary information as required to be set out in the E-payment Request. The Bank does not have any obligation

whatsoever

to

independently

verify any of

the

information provided to the Bank by me/ us in relation to the E-payment Request. The Bank shall not bear any responsibility for any inaccurate

or

incomplete/disclosed information provided by me/ us, which may lead to a payment being wrongly made and there would be no

guarantee

of recovery of the

same

thereafter.

(d)

VI.

Changes

in Terms

and Conditions

The Bank reserves the right to add, alter,

vary

and modify any or

all

of the above terms and conditions at any time at its discretion with prior notice of 30 days

if

so

required

in

accordance

with the regulations or guidelines as may be applicable from time to

time.

VII. Right of Lien

and Set-off

The Bank shall have an absolute and

paramount

right of lien and set-off, irrespective of any other lien or charge, present as well as future on the Accounts and also on any

other accounts, including

amounts

lying

in fixed deposits held in the Customer‟s accounts or balance

lying

in the accounts,

whether

in single name or joint name(s),

and

also over any and all securities of the Customer lying or that may come into the possession of the Bank from time to time for safe keeping or otherwise in any of

the

accounts of the Customer

maintained

with the Bank [joint/single] to the extent of

all

outstanding

dues,

whatsoever,

and howsoever arising. The Bank shall have and shall

continue to have a lien on the Account to recover such costs,

damages

or

liability

that the Bank may incur or be imposed and shall further have the right to claim

and

recover any shortfall from the

Customer.

VIII.

Agency

In providing these E-payment Services, the Bank is acting as an agent of the Customer. Under no circumstances Bank shall be

treated

as or

deemed

to be a

bank

authorized

by Finance

Ministry

or any other regulatory body for collection of tax

through

electronic payments and the Customer‟s obligation towards payment of

Tax

to

concerned

Regulatory Authority(ies) should be

construed

as

completed

only after the Customer receives from the Bank the challan

(TR-6)

or any other applicable

payment receipt

generated

and sent by the Authorized Bank.

IX.

Force

Majeure

The Bank shall not be liable for any failure to perform any of its obligations

pursuant

to these Terms and Conditions

if

the

performance

is

prevented,

hindered or

delayed

by a Force Majeure Event and in such case its obligations shall be

suspended

for so long as the Force Majeure Event continues. The Bank shall inform me/ us of

the

existence of a Force Majeure Event. "Force Majeure Event" means any event due to any cause beyond the reasonable control of the Bank, including, without limitation,

unavailability of any

communication

system, number of frauds, misuse, breach or virus in the processes or the payment and delivery mechanism,

sabotage,

fire,

flood,

explosion, acts of God,

civil

commotion,

strikes or industrial action of any kind, riots, insurrection, war, acts of

government, computer

hacking, malicious, destructive

or

corruption code,

programme

or macro,

unauthorized

access to

computer

data and storage devices, trojan horses, worms, logic software, other bombs or other similar

programs or routines,

computer

crashes, either of the Bank or the Authorized Bank

etc..

Notices

Any written

communication

under these Terms and Conditions, including the E-payment Request, shall be sent by the Customer to the address of the Bank

mentioned

above or by facsimile on the number

communicated

to the Customer by the Bank.

Any

written

communication

to be given to Customer, including the

Tax

challans (TR-6)

shall be sent by post/ courier at the address or by facsimile number of the Customer available with the Bank or

handed

over across the

counter.

Governing Law

These Terms and Conditions shall be governed by the laws of India and each of the parties hereto hereby submit to the jurisdiction of the courts at

Mumbai.

X.

XI.

XII.

Miscellaneous

If

any of the terms and conditions

contained

herein above is held to be invalid or

unenforceable

to any extent, the remainder of the terms and conditions shall not

be

affected and each of such terms and conditions shall be

valid

and

enforceable

to the fullest extent

permitted

by law.

Any invalid

or

unenforceable

term or condition shall

be replaced with a term or condition which

is valid

and

enforceable

and most nearly reflects the original intent of the

unenforceable

term or

condition.

The Bank has made no express or implied warranty with respect to the service provided

pursuant

to this application, including, without limitation, any warranties of

error

free

performance, non-infringement

of third party rights and/ or fitness for any particular

purpose.

For

more

i

n

f

o

r

m

a

t

i

on,

p

l

ea

s

e

c

on

t

a

c

t

:

Bengaluru

DBS

Bank Ltd Salarpuria

Windsor, No.

3,

Ulsoor Road,

Bengaluru

560042, India.

Tel:

+91-80-6632 8888

Kolhapur

Mumbai

DBS

Bank Ltd

Fort House, 3rd Floor,

221, Dr. D.N. Road, Fort,

Mumbai

400001, India.

Tel:

+91-22-6638 8888

Pune

DBS

Bank Ltd

Elbee House, City Survey No.

4/7, Siddarth

Path,

Off. Dhole Patil Road,

Pune

411001, India.

Tel:

+91-20-6621 8888

Salem

DBS

Bank Ltd

No. 24, Yercaud Road,

Opp., Modern

Theatres,

Kannankurichi Po,

Salem

636008, India.

Tel:

+91-427-6641 300

Surat

DBS

Bank Ltd

2nd Floor, Shree Ambica

Auto,

Plot 10,

GIDC

Bhatpore, Hazira,

Surat

394510, India.

Tel:

+91-261-6675 400

DBS

Bank Ltd

Amit Plaza,199/4, 1st floor,

Gandhinagar

Main Road,

Kolhapur

416119, India.

Tel:

+91-231-3050 100

Chennai

DBS

Bank Ltd

806, Anna Salai,

Chennai

600002, India.

Tel:

+91-44-6656 8888

Kolkata

Nashik

DBS

Bank Ltd

41 A,

Jolly

Plaza, Howson Road,

Deolali

Camp,

Nashik

422401, India.

Tel:

+91-253-6632 100

DBS

Bank Ltd

4 A, Nandalal Basu Sarani,

Kolkata

700071, India.

Tel:

+91-33-6621 8888

Moradabad

DBS

Bank Ltd

8th K.M. Stone, Naya

Moradabad,

Delhi Road,

Moradabad 244001, India.

Tel:

+91-591-6601 300

New

Delhi

DBS

Bank Ltd

Birla

Tower,

Upper Ground Floor,

25, Barakhamba Road,

New Delhi

110001, India.

Tel:

+91-11-3041 8888

Cuddalore

DBS

Bank Ltd

Office building No.1

Anugraha Satellite Township,

Periyakattupalayam Village,

East Coast Road,

Cuddalore Taluk

605007, India.

Tel:

+91-4142-305 100

12

22-Aug-2012

www

.db

s

b

a

n

k

.

i

n

Terms

and Conditions

of

E-payment Services