Fiscal Services Orientation

2

Contents

Welcome to Fiscal Services ..................................................................................................................................................... 5

Introduction to Higher Education Finance .............................................................................................................................. 7

Banner Finance and MicroStrategy ......................................................................................................................................... 9

e~Print ............................................................................................................................................................................... 10

Banner Finance Self-Service .............................................................................................................................................. 10

MicroStrategy.................................................................................................................................................................... 12

Reconciliation ........................................................................................................................................................................ 13

MicroStrategy Reconciliation ............................................................................................................................................ 14

Basic eVA Purchasing ............................................................................................................................................................ 17

Exempt Purchases ............................................................................................................................................................. 18

Punch-Out Catalog Order .................................................................................................................................................. 19

Non-Catalog Order ............................................................................................................................................................ 21

Orders to Un-Registered eVA Vendors ............................................................................................................................. 22

Payment Methods ............................................................................................................................................................. 23

Submitted Orders .............................................................................................................................................................. 23

Purchasing Card (P-Card) ...................................................................................................................................................... 24

Unallowable Purchases ..................................................................................................................................................... 24

Monthly Reconciliation and Reporting ............................................................................................................................. 24

Receipt Upload Guidelines ................................................................................................................................................ 25

Bank of America Works Purchase Log Report................................................................................................................... 25

Purchasing Made Easy .......................................................................................................................................................... 26

Procurement Categories ................................................................................................................................................... 27

Prohibited Purchases ........................................................................................................................................................ 27

Sales Tax Exemption.......................................................................................................................................................... 28

Mandatory Sources ........................................................................................................................................................... 28

State Contracts .................................................................................................................................................................. 29

Other Contracts (Non-Mandatory) ................................................................................................................................... 29

Specialized Purchases ....................................................................................................................................................... 29

Sole Source Procurements ............................................................................................................................................ 29

Emergency Procurements ............................................................................................................................................. 29

Professional Services ..................................................................................................................................................... 29

Computer Equipment and Software ............................................................................................................................. 29

Honorarium ................................................................................................................................................................... 30

3

Payment Request Form ................................................................................................................................................. 30

On-Campus Vendors ......................................................................................................................................................... 31

Mason Bookstore & Patriot Tech (Barnes & Noble) ..................................................................................................... 31

Sodexo Catering ............................................................................................................................................................ 31

Student Clubs .................................................................................................................................................................... 31

Amazon.com and Online Purchases .................................................................................................................................. 31

Third Party Processors Such as PayPal .............................................................................................................................. 32

Food and Beverage Purchasing ............................................................................................................................................. 32

Authorized Functions - Policy Limitations and Requirements .......................................................................................... 33

Business Functions ............................................................................................................................................................ 33

The ratio of Mason to Non-Mason Attendees .............................................................................................................. 34

Training Retreats ............................................................................................................................................................... 34

Per Diem Maximums ......................................................................................................................................................... 34

Events Which Include Alcohol, Flowers, and/or Exceed Per Diem ................................................................................... 34

Catering ............................................................................................................................................................................. 35

Food and Beverage Authorization and Payment Form ..................................................................................................... 35

Instructions for Completing the Food and Beverage Form .......................................................................................... 35

List of Attendees ........................................................................................................................................................... 37

Required Approval ........................................................................................................................................................ 37

Purchasing Procedures ...................................................................................................................................................... 37

Process an eVA Order ....................................................................................................................................................... 38

Purchasing Charge Card (VISA/P-Card) ............................................................................................................................. 38

Procedures for Exempt Purchases .................................................................................................................................... 38

Procedures for Using Sodexo Catering ............................................................................................................................. 40

Procedures for Multiple Food Servings ......................................................................................................................... 41

Sales and Use Tax .............................................................................................................................................................. 41

Unallowable Expenditures ................................................................................................................................................ 42

Events Funded by George Mason University Foundation ................................................................................................ 42

Travel Policy .......................................................................................................................................................................... 43

Lodging Limitations ........................................................................................................................................................... 44

Lodging Above Basic Rates ............................................................................................................................................ 44

Exceptions to Maximum Rates ...................................................................................................................................... 44

More Than One Person in a Room ................................................................................................................................ 45

Alternative Lodging ....................................................................................................................................................... 45

Internet charges ............................................................................................................................................................ 45

4

Hotel bills ...................................................................................................................................................................... 45

Meal and Incidental Per Diem Rates ................................................................................................................................. 46

Travel Departure and Return Days ............................................................................................................................... 46

“No-cost” Meals ............................................................................................................................................................ 46

Transportation .................................................................................................................................................................. 47

Commercial Air and Rail Carriers .................................................................................................................................. 47

Motor Pool Vehicles ...................................................................................................................................................... 47

Enterprise Rental Vehicles ............................................................................................................................................ 47

Personal Vehicle ............................................................................................................................................................ 48

Gasoline, Parking, Toll and Taxi Charges ....................................................................................................................... 48

Local Area Travel Expenses ............................................................................................................................................... 48

Local Lodging ................................................................................................................................................................. 48

Local Meals .................................................................................................................................................................... 48

Travel Arrangements......................................................................................................................................................... 49

Payment Methods ............................................................................................................................................................. 49

Reimbursable Expenses ................................................................................................................................................ 49

Non-Reimbursable Expenses ........................................................................................................................................ 49

Receipts ......................................................................................................................................................................... 50

International Travel ........................................................................................................................................................... 50

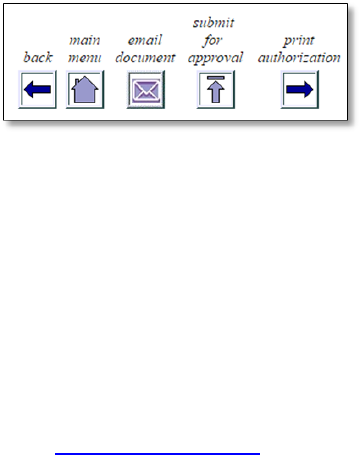

Travel Request System (TRS) User Guide .............................................................................................................................. 51

Delegate Instructions ........................................................................................................................................................ 51

Traveler Instructions ......................................................................................................................................................... 52

Initiate Authorization ........................................................................................................................................................ 52

View Document Status ...................................................................................................................................................... 54

Initiate Reimbursement .................................................................................................................................................... 55

Online Resources .................................................................................................................................................................. 57

http://fiscal.gmu.edu ............................................................................................................................................................ 57

5

Welcome to Fiscal Services

Led by the Associate Vice President and Controller the Fiscal Services Office manages most areas of financial

administration within the university system.

6

Account & Loan Management (ALM): Serves as the main collections entity for Mason. Focus on delinquent accounts, securing

payments, overseeing repayments and providing guidance and support to all university staff.

Accounts Payable: Responsible for processing vendor payments, as well as payments to Mason students and reimbursements to

Mason employees.

Cashier’s Office: Collects money for Mason tuition and fees and accurately updates student accounts. Receives department’s cash

deposits and monitors compliance.

Controller’s Office: Oversees Mason’s financial operations and Fiscal departments. Establishes and monitors the university’s internal

control framework and provides guidance for financial policies and procedures.

Equipment Inventory: Provides for the accountability of equipment from acquisition to final disposition, including the annual

inventory process.

Finance Administrative Systems Team (FAST): Works with fiscal departments to automate processes, improve existing systems and

develop controls that make financial operations at Mason more accurate and efficient.

General Accounting: Ensures the integrity of Mason’s financial records. Maintains the general ledger. Produces the annual financial

statements and files tax returns. Maintains fixed assets database and manages banking transactions and reconciliations.

International Tax Office: Verifies all foreign national employees. Determines tax status for Mason’s foreign visitors and analyzes

payments to foreign visitors or vendors.

Purchasing Office: Oversees all aspects of the procurement of goods and services required by Mason. Manages Mason’s P-Card

program, contract administration, eVA purchasing and contracts.

Student Accounts: Ensures student financial transactions are accurately processed and proper records are maintained.

Training: Assists Mason faculty and staff with fiscal procedures and processes. Provides workshop training, walk-in assistance and

fiscal guides.

Travel Office: Processes travel reimbursements and manages requests for the Travel Credit Card. Provides support for the Travel

Request System (TRS).

Department Directory

Unit

Contact

Mail Stop

Account & Loan Management

703-993-3800

MS 2E3

Accounts Payable

MS 3C1

Cashier’s Office

703-993-2484

MS 2E1

Controller’s Office

703-993-2660 or fiscal@gmu.edu

MS 4B2

Equipment Inventory

703-993-4456 or assests@gmu.edu

MS 4B2

Finance Administrative Systems Team (FAST)

703-993-2574 or fast@gmu.edu

MS 4B2

General Accounting

703-993-2655

MS 4B2

International Tax Office

703-993-2969 or inttax@gmu.edu

MS 4B2

Purchasing Office

MS 3C5

Student Accounts

703-993-2484 or saccount@gmu.edu

MS 2E2

Training Office

MS 4B2

Travel Office

703-993-2580 or travel@gmu.edu

MS 3G6

7

Introduction to Higher Education Finance

George Mason University is a top tier public research university with four campuses in Virginia and one campus

in Songdo, Korea. As the largest university in the Commonwealth, Mason thrives on financial support from many

different sources. These revenue sources include, but are not limited to: state funding, enrollment related fees,

sponsored research and philanthropic activities. Mason allocates this revenue in support of institutional priorities. The

highest priority is “Enrollment Related” activities followed by “All Other Activities” and then “Capital Improvements”.

Enrollment related activities are those that support teaching, research and public service. All other activities are ancillary

and support the Mason mission, such as: research, user services and foundation support. Capital expenditures relate

directly to the building and facilities maintenance on our campuses. Additional information about the university budget

is available on the Office of Budget and Planning

webpage at: http://budget.gmu.edu/.

*The Fiscal Year (FY) begins on July 1 and ends on June 30*

8

Education and General (E&G) Funds

The largest portion of the university budget is Education and General (E&G) expenses which represent 55

percent of Mason’s total operating budget and 50 percent of the overall total budget. These funds support the

university’s mission of teaching, research and public service including: instruction, academic support, libraries,

technology, student services, institutional support and physical plant. Most academic departments and administrative

units are provided yearly budget allocations from the E&G fund.

Auxiliary Enterprise (AE) Funds

The second largest portion of the university budget is Auxiliary Enterprise (AE) revenue which represents 25

percent of the overall total budget. Auxiliary Enterprises are those activities which are: self-supporting through revenue

that they generate; or supported by both revenue that they generate and student fees; or are funded exclusively

through student fees. Examples of units with AE funding are Housing and Residence Life, Student Centers and

Recreation.

Sponsored Research Funds

Sponsored research funding and expenditures are sometimes referred to as grants and contracts. As a funding

source, these sponsorships may come from local, federal or state funding and are usually allocated to a specific focus or

area of research. In general, these awards are highly competitive and bring a great amount of notoriety and prestige to

the university.

Commonly Used Fiscal Terms

Account – An abbreviated term referring to the expenditure account code used in Banner to classify an expense by type

(i.e., service, supply, equipment).

Encumbrance – Budget funds which are reserved for making payments toward certain salaries and purchase orders.

eVA – The electronic procurement system used to purchase goods and services. It is mandated that all purchases are

placed in eVA unless specifically exempt by the Commonwealth of Virginia.

Org – An abbreviated term referring to the organization code used in Banner to represent a department unit. This code

is used to retrieve financial transaction data and is to make payments against purchases for the department.

EP# – A purchase order issued to a vendor for the procurement of goods or services. The number is generated through

eVA.

Recharge – The method in which a department unit may recover costs incurred by providing a service to university

departments (i.e. telecom services).

P-Card – A purchasing charge card issued to an individual on behalf of Mason. The P-Card is the preferred method for

making purchases of goods and services less than $5,000. It may be registered with eVA for ease of use. The credit card

bill is paid by Accounts Payable on a monthly basis.

PR# – a purchase requisition (request) submitted through eVA for the procurement of goods or services.

PCO# – a purchase requisition (request) submitted through eVA and paid for with the P-Card.

Senior Approving Official – These individuals are usually department heads and other administrators who have authority

to authorize purchases of food and beverages expenditures.

9

Banner Finance and MicroStrategy

Banner is a comprehensive and integrated information system comprised of finance, human resources and

student modules. The finance module of this administrative software is used to record financial transactions resulting

from activity at the university. It stores transactional data in an Oracle relational database, and users view information

via a web based self-service system. Admin Applications (Admin Apps) is used by university departments including the

budget office, general accounting, purchasing and accounts payable to input financial transactions.

Chart of Accounts

The Chart of Accounts is the numbering system used by Banner to capture financial transactions and facilitate

retrieval of information and financial reporting. There is only one Chart of Accounts in Banner and it is defined by the

number 1.

The chart of accounts structure in Banner is composed of six elements: Fund, Organization, Account, Program,

Activity, and Location (FOAPAL). Each element of the Chart of Accounts is described below.

Fund: The fund element is used to specify the funding source. Examples of funds include: Educational and General

(E&G), Auxiliary Enterprises (AE), Financial Aid, and Indirect Cost Recovery (Sponsored programs).

Grants are typically identified with a unique fund number. Banner Finance Self Service should not be used to

view financial activity related to grants and contracts. Pooled budget amounts may be reflected incorrectly in Banner

Finance Self Service reports. The PI Reports, located in MicroStrategy

(http://tsd.gmu.edu/services/reporting/), provide

the most accurate record of financial transactions for grants and contracts. The Office of Sponsored Programs

(http://osp.gmu.edu/) provides resources for PI Reports and should be contacted for assistance with these reports.

A listing of all funds in the University’s chart of accounts is available by accessing the Fund Hierarchy report from

the e~Print listing. Fund codes are used to query transactions involving agencies or capital projects. Agency funds begin

with an “8” and capital projects begin with a “9”.

Organization: The organization code is used to identify the organizational unit that is responsible for financial activity

captured within the code. Organization codes are arranged in a hierarchy. The lowest level in the organization hierarchy

in Banner represents the organization code used for data entry purposes, usually six digits. A listing of all organizations

and the hierarchy structure in the University’s chart of accounts is available by accessing the Organizational Hierarchy

Report from the e~Print listing.

The organization code is used to query transactions for most University activities except those transactions

mentioned above including agency funds and capital projects.

Account: The account code is used to classify revenues and expenditures by type. Revenue account codes identify the

type of revenue received, such as tuition or auxiliary sales revenue. Expenditure account codes identify the type of

expenditure, such as salaries or supplies. Revenue account codes typically start with the number 0, personnel

expenditures with the number 6 and direct expenditures with the number 7. There is a searchable database located

here: Expenditure Account Codes

(http://fiscal.gmu.edu/expenditure-account-codes/). A complete listing of account

codes is available by accessing the Account Hierarchy Report (http://fiscal.gmu.edu/generalaccounting/review-account-

hierarchy-report/) or from the e~Print listing.

Program: The program code is used to identify the major purpose of expenditures. Program codes accumulate

expenditure information into major categories such as instruction, research, and academic support. This code is mainly

used for financial reporting purposes.

10

Activity: The activity code is an optional number that may be used to capture information for a specific project or

activity. Activity codes are usually assigned to transactions involving multiple grant projects.

Location: The location code is used to specify the assigned physical location of an asset being purchased or the location

of a transaction that is different from the normal location of the organization. This code is optional and will be used

primarily for fixed asset expenditures.

e~Print

e~Print is a clearing house for standard financial reports. These reports are static and are current as of the run

date listed on the report. To access e~Print from the Patriot Web

Self Service website (https://patriotweb.gmu.edu/),

select Management Reports (e~Print). Using a web browser, you can select reports that you have access to. The

appropriate report pages are retrieved and assembled as a PDF (Adobe Portable Document Format) file, which can be

viewed via Adobe Acrobat Reader (or as a text (TXT) file). Once you have successfully logged into the system, you will be

able to retrieve reports for your unit. e~Print is designed to run on any web browser. The Acrobat Reader application

enables you to view, navigate and print documents in the PDF format. If you do not already have Adobe installed on

your computer, you can get the latest version for free at

www.adobe.com.

Additional information on using e~Print for department reconciliation may be found in the Banner Finance and

Reconciliation Manual (http://fiscal.gmu.edu/training/obtain-training-materials/). An e~Print quick guide is located in

the Reconciliation section of this packet.

Banner Finance Self-Service

Banner finance self-service is used by departmental representatives. It is a web based interface that allows users

to extract information from Admin Applications (Admin Apps) and view it in a user friendly format. The data is posted in

real time. The budget status report allows users to view information on budgets, revenues, and expenditures for an

organization. Increasingly detailed information on transactions may be obtained through a process referred to as

drilling.

Budget Queries

There are three types of queries that can be performed in Banner Finance Self-Service. Each query will extract

data from Admin Applications (Admin Apps) in a slightly different format. These queries may be used to assist with

fund/org monthly reconciliations.

Budget Quick Query: provides a snapshot overview with no drilling capabilities; it’s the easiest Query to set up and

shows the “bottom line” expenses and balances.

Budget Status by Account: provides more detailed information and the ability to drill down to the document level to

view items such as Invoice, Journal Voucher, Purchase Order and Electronic Feed information.

Budget Status by Organizational Hierarchy: provides rollup data (a higher level summary) for each unit. This is good for

department chairs/administrators and others who only need to see the bottom line data for each unit. Drill

down on the related Orgs to get more detailed information.

11

Budget Query Columns

Users will choose which columns to include on the Budget Query reports. An explanation of each column and its

use is listed below.

Adopted Budget

Original budget allocation given at the beginning of the Fiscal Year.

Budget Adjustment

Any additions or reductions made to the budget since the original allocation. This includes

Both Permanent and Temporary adjustments.

Accounted Budget

This is a system-generated column, which does not allow for “drilling” down to details. Mason

does not use this column in any budget reports.

Temporary Budget

Adjustments to budget in the current year that are temporary in nature. (Budget

Adjustments that will not roll over to the next fiscal year.)

Adjusted Budget

Current Budget. Original Budget plus or minus any Budget Adjustments. Total of all budget

transactions. Details on actual transactions may be obtained by “drilling” down on this field.

Year to date

Year-to-date activity. Represents actual revenue and expenditures posted.

Encumbrances

Generated by purchase orders, and salary encumbrances; funds committed for future

payments. Most non-purchase card (P-Card) purchases made through eVA, an electronic

procurement tool that supports the Commonwealth’s decentralized purchasing environment,

integrate with Banner Finance and generate an immediate encumbrance. Purchases made in

eVA with a registered P-Card will be recorded in Banner Finance when the credit card bill is

paid each month. However, all purchases made without a P-Card for which Accounts Payable

will issue a check for payment will immediately appear in Banner Finance as an encumbrance.

Reservation

Setting aside of budget. Generated by purchase requisitions prior to Fiscal Year 2012

Commitment

Equal to the total budget set aside for future obligations.

Commitments are made up of Reservations and Encumbrances. Commitment values may not

be drilled on for additional detail.

Available Balance

Remaining Budget left to spend.

= Adjusted Budget +/- Commitments +/- Year to date

View Document

The View Document Form provides an opportunity to view detailed information about a document (Requisition,

Purchase Order, Invoice, Journal Voucher, or Cash Receipt). If the document number is known, the user may access

View Document to find related information, rather than accessing the document through a Budget Query.

Listed below is an explanation of the document code identifier and examples of direct expenditures associated

with each document code.

Series of number –

1234567

Purchase order integrated from eVA. The eVA generated purchase order will begin with “EP”

(EP1234567); however, once the information feeds to Banner the “EP” is removed.

“I” – I1234567

Invoice generated by Accounts Payable to process payment for a vendor.

“F” – F1234567

Feed document – Identifies a group of transactions that have been fed into Banner finance.

These transactions may include collected revenue and recharge transactions from other

university departments such as print services and postal services.

“J” – J1234567

Journal Voucher – used to transfer non-payroll charges between “State” fund/org or between

“Local” fund/org. A Journal Voucher must be processed to move an incorrectly recorded

expenditure to the correct fund/org or account. *Note – P-card payments will post with a “J”

identifier.

12

Step-by-step instructions on accessing Banner Finance Self-Service reports may be found in the

Banner Finance

and Reconciliation Manual (http://fiscal.gmu.edu/training/obtain-training-materials/). A self-service quick guide is

located in the Reconciliation section of this packet.

MicroStrategy

MicroStrategy is the business intelligence tool used by Mason to analyze Banner financial data. MicroStrategy

reports are developed from Banner data and refreshed daily. These reconciliation reports allow for summary drilling to

examine direct expenditures and provide department users with detailed labor information that is not available in

Banner Finance Self Service. MircoStrategy reports may be exported to Excel for further analysis. MicroStrategy has an

expense application and a revenue and expense application. The reconciliation certification may be accessed through

MicroStrategy and includes a formatted signature and date line for each org. In order to use MicroStrategy you must

have access to Banner Finance. New users should complete the Banner Administrative Systems Account Request

form. A

copy of this form is located in pocket of this packet.

The PI Reports in MicroStrategy provide targeted reporting to reconcile sponsored projects. Additional information

on MicroStrategy may be obtained online through Fiscal Services at: ttp://fiscal.gmu.edu/training/ or MicroStrategy at:

http://tsd.gmu.edu/services/reporting/

.

13

Reconciliation

University Policy 2114 - Reconciling Departmental and Sponsored Fund Accounting Records requires that all

organizations (orgs) and funds are reconciled on a monthly or bi-monthly basis (period). Monthly reconciliation is

strongly encouraged. The purpose of this systematic review is to ensure that all transactions have been properly

recorded, that financial statements accurately reflect the financial position of the fund or org and that any irregularities

are identified and immediately reported to the appropriate authorities.

The following guidelines will assist departments with ensuring that the information recorded in Banner Finance,

the University’s financial accounting system, is consistent with department source documentation. The

reconciliation

procedures document includes a breakdown of terms and timeline guidance.

Source documents may include bills from internal vendors (i.e., Print Services receipts, Telecom Administration

charges, Facilities work orders), eVA purchase orders, travel vouchers, P-Card approval forms, payment requests,

honorarium payment requests, funding change forms, journal vouchers (JVs) and other types of documentation that

result in financial charges to a fund or org. These documents will serve as a reference point when individuals reconcile

department financial information. Departments should maintain a record of any pending charges to an org or fund that

have not yet been recorded in Banner Finance.

Department representatives may use the suggested process OR an alternative reconciliation process provided a

full and systematic verification and reconciliation is completed at least every two months.

Getting Started with Reconciliation

First, there needs to be a process in place for reconciliation. The department and the reconciler should

determine the type of central filing system (electronic of paper) that works best for the unit. The central filing system

should be separated by fund/org number. The central filing system will make it easier for the reconciler to locate source

documents and is convenient for audit purposes. (Note: Source documents must be retained for at least 3 years/10 years

for sponsored research projects.)

Next, determine how the financial reports will be retrieved. It is recommended that MicroStrategy reports be

used for reconciliation, however, departments may also utilize Banner Finance Self Service or e~Print. Then gather

source documents and confirm that charges and/or credits are accurately reflected on the financial reports. For this

process, examine the source document noting the fund/org, account code and amount match the information from the

reconciliation report. If differences are found, make a note of the inconsistency on the reconciliation certification.

Discrepancies must be resolved within 30 days. Some discrepancies (e.g., wrong account code used) can be corrected by

the department through journal voucher submission. Other discrepancies (e.g., error to charge or credit amount) will

require the department to contact the vendor directly. Reconcilers should make a note of all discrepancies for further

investigation.

When comparing source documents to reconciliation reports, there may be items that do not appear on the

report. When a unit has made a purchase or submitted a reimbursement and the transaction has not yet been recorded

in Banner Finance the item is called an expected transaction. A separate file should be maintained for expected

transaction. Examples of expected transactions include: travel reimbursement vouchers that have been submitted but

not yet processed, eVA orders that have been placed but vendor payment has not been remitted, corrections from

previous reconciliations and credits due from a vendor but not yet received. It is important to revisit the expected

transaction file during each reconciliation to ensure items have been/will be recorded in a timely manner.

Once the source documentation has been compared to the reconciliation report and items for correction and/or

pending items have been identified, it is time to certify the reconciliation. The reconciler will sign and date the

document to verify he/she has completed the requirements. Then the approver will sign and date the document to

14

verify he/she has reviewed the work of the reconciler. Once completed and signed, the reconciliation certification,

reports and source documents should be filed and retained for audit and/or review. Electronic certification, including

email certification, is encouraged.

MicroStrategy Reconciliation

MicroStrategy is the recommended tool for completing fund/org reconciliation. Information may be exported to

excel for further examination and review. The reconciliation certification that requires a signature and date from the

preparer and approver is available in MicroStrategy.

Reconciling Labor Accounts

At the beginning of the fiscal year, it is recommended that reconcilers follow the process below. This is only a

suggested process.

1. Login to MicroStrategy here

or http://reporting.gmu.edu

2. Select the “Administrative” file, then “Shared Reports”

3. Select the “Reconciliation” folder

4. Click on “Roster for Reconciliation”

5. Select the applicable roster, “Permanent Roster – Salaried” includes full-time faculty and classified staff

6. Download the roster to Excel

7. Save the roster for future reference when reconciling salary data

8. The same process should be followed for part-time, graduate assistant and wage employees

At the time of reconciliation (required monthy or bi-monthly (period)/recommended monthly)

1. Go to https://reporting.gmu.edu

2. Login with your Net ID and password

3. Select the “Administrative” file, then “Shared Reports”

4. Select “Reconciliation” folder then “Reconciliation Welcome Page”

5. Choose “Reconciliation Expense” application OR choose “Reconciliation Revenue and Expense” if reconciling unit

revenue

6. The page will automatically default to the current fiscal year and last closed month

7. To change the timeframe, click on the “Re-prompt” icon from the document menu bar

8. Click on the Org that you are reconciling. This will bring up a new page titled Labor and DE Drill Document with

internal tabs

9. Choose the “Labor Detail” internal tab to view all Labor for the specified timeframe

10. Confirm that all employees listed with current activity are actively employed by the department

a. Note: If the reconciler does not personally know all individuals on staff, he/she should seek assistance

from a supervisor. If no staffing changes occur and amounts remain constant, charges may be quickly

reviewed.

11. Monitor wage charges ensuring that individuals listed worked for the unit during the appropriate time period.

Confirm that there is sustainable funding for wage employees until the end of the fiscal year

a. Verification of each wage payment is not required since it is confirmed in the payroll approval process,

but any unusual charges should be researched further

12. Document any discrepancies, research and report to Human Resources immediately if error is identified

13. The reconciler should confirm:

a. The amounts posted for faculty special payment (61130) with departmental records

b. That each Funding Change form has been processed as it was submitted

15

c. Verify Annual Leave Balances (613xx)

For example: The reconciler should confirm that an Annual Leave Balance payment was made only to a department/unit

employee who was, but is no longer, employed by Mason.

Reconciling Direct Expenditures

To reconcile department expenditures

1. Go to https://reporting.gmu.edu

2. Login with your Net ID and password

3. Select the “Administrative” file, then “Shared Reports”

4. Select “Reconciliation” folder then “Reconciliation Welcome Page”

5. Choose the “Reconciliation Expense” application OR choose “Reconciliation Revenue and Expense” if reconciling

unit revenue

6. The page will automatically default to the current fiscal year and last closed month

7. To change the timeframe, click on “Re-prompt” icon from the document menu bar

8. Click on the Org that you are reconciling. This will bring up a new page titled Labor and DE Drill Document with

internal tabs

9. Choose the “Direct Exp Detail” tab

10. The shaded column titled Actual Expense Between XXX and XXX can be used to verify source documents for the

selected timeframe

11. The entire report may be download to Excel or PDF and further manipulated

12. Use the source document or other records to verify all charges to a fund or org

13. Document any discrepancies and resolve within 30 days

A list of expenditure account codes may be found at http://fiscal.gmu.edu/expenditure-account-codes/

Reconciling Revenue Accounts (if applicable)

Units collecting revenue will have an existing system to verify revenue transactions before the revenue feed is

entered in Banner Finance. In some cases, the reconciler will match source documents such as cash receipt forms, daily

credit card sales reports and revenue refund forms to Banner Finance activity. The reconciler can use the MicroStrategy,

“Reconciliation Revenue and Expense” application to match source documents and gather additional financial

information on revenue orgs.

Reconciliation Certification

The individual preparing the reconciliation (the reconciler) must certify the reconciliation; the individual

responsible for approving the work of the reconciler, usually the individual responsible for the fund/org (the approver)

must certify his/her review of the reconciliation. In some situations when no reconciler exists, certification means the

approver/PI has completed a systematic review of Banner financial activity. In all situations, the PI must sign and date

the reconciliation to certify that all charges and credits are allowable, allocable and reasonable. The PI may not delegate

this responsibility. Electronic certification is encouraged. These certified records should be retained in the department

or college and be available for auditors’ review. A sample reconciliation certification document using MicroStrategy may

be found on the Fiscal Services Reconciliation webpage

.

MicroStrategy Reconciliation Certification Instructions

Go to https://reporting.gmu.edu

1. Login with your netID and password

16

2. Select the “Administrative” file, then “Shared Reports”

3. Select “Reconciliation” folder then “Reconciliation Welcome Page”

4. Choose the “Reconciliation Expense” application OR choose “Reconciliation Revenue and Expense” if

reconciling unit revenue

5. The page will automatically default to the current fiscal year and last closed month

6. To change the timeframe, click on “Re-prompt” icon from the document menu bar

7. From the Dashboard view in “Reconciliation Expense” select one of the white boxes on the upper right hand

of the page that says “Reconciliation for Program Total” OR for “Reconciliation Revenue and Expense” select

the white box on the upper right hand of the page that says “Reconciliation”, then choose either “Summary

Reconciliation” or “Detail Reconciliation” from the prompt menu

8. This will open either a PDF or Excel document separating each org and providing a signature and date line

for the reconciler and approver

9. The Reconciliation Certification must be retained by the department with the source documentation

17

Basic eVA Purchasing

University Policy 2106 – Purchase of Goods and Services delegates purchasing authority to certain employees at the

department level when the purchase is $5,000 or less. The $5,000 threshold applies to the total cost of the purchase,

regardless of the number of payments made to the vendor or service provider. The Purchasing Office is responsible for

purchasing and leasing all goods and services for Mason that cost more than $5,000.

The primary purchasing tool is eVA – Virginia’s eProcurement Portal. eVA is a web-based procurement system

that supports the Commonwealth’s decentralized purchasing environment. This application allows items to be

purchased through an integrated web-based “punchout” catalog or ordered as “non-catalog items” identified in a

vendor’s independent online or paper catalog. Orders are submitted electronically to a number of registered vendors,

but may also, at the vendor’s option, be submitted by fax or mail.

All procurement transactions are required to be processed through eVA unless specifically exempted by the

Commonwealth of Virginia. Transactions that are not exempt from eVA processing may be exempt from the transaction

fees associated with eVA purchasing. A list of exempt transactions and a list of transactions which are exempt from fees

are provided later in this guide.

eVA Terminology

Direct Order

Direct Orders are billed directly to Accounts Payable by the vendor. A direct

order is issued when the purchaser does not have/use a P-Card or for the

purchase or if the vendor does not accept P-Cards. A direct order is indicated

by the prefix “EP” in eVA.

NIGP Commodity Code

The NIGP commodity code is a numeric code from the numbering system

used by the Commonwealth of Virginia to categorize products and services. A

commodity code for each item is required.

Non-Catalog Order

An order from a vendor that does not have a Punchout Catalog in eVA. These

orders require more information from the user in order to complete the

purchase.

Punch-out Catalog

A Punchout catalog is a vendor catalog embedded in the eVA system. It allows

buyers to “punch-out” items from the vendors’ on-line catalog and adds them

to the eVa cart for purchase.

Purchase Order (PO) Category

This is a reference to the type of eVA order. All routine purchases, where fees

are collected on the transaction, will have PO Category of R01.

An order that is exempt from the eVA fees will have a PO category of X02.

Procurement Transaction Type

The procurement transaction type defines the type of procurement to occur.

The most common selections are 20 – Supplies-non-technology and 30 – Non-

professional services-non-technology.

Requisition

The starting point of an order initiated by the purchaser. It is an internal

document and should not be sent to the vendor or Accounts Payable. It is

defined by the prefix PR.

Self-Registered Vendor

A vendor that has self- registered with eVA and agreed to pay transactional

fees. These vendors may have a Punch-out catalog available.

State-Entered Vendor

A vendor that has not self-registered with eVA and does not agree to pay

transactional fees; however, the vendor has been paid by the State in the past

and is therefore registered with eVA.

Un-Registered Vendor

A vendor who is not self-registered and has never been paid by the state.

SWaM Vendor

A Small, Women, and Minority owned business. Use of SWaM vendors is

encouraged.

18

eVA Access

Users of the eVA system must review and sign the Acceptable Use Policy created by the Commonwealth when

requesting access to the eVA system. Users must also complete the eVA Login Request Form which includes signatures

of the applicant’s supervisor’s, as well as their Banner liaison. These forms are located in the Resources section of the

Fiscal Orientation packet and online at Forms and Instructions

(http://fiscal.gmu.edu/forms-and-instructions/). The

applicant should list a current “deliver to” address that includes the building name, room number, and mail stop

number. Only those fields listed as mandatory and in bold are required to be completed. The forms should be saved with

the title “eVA access for lastname” (with the applicant’s last name in the title) and emailed as an attachment to the

Finance Administrative Systems Team (FAST) at

[email protected]. The signature sheet may be faxed to FAST at 3-2920.

Applicants will receive a notice when access has been granted. New users will login to eVA using their Mason NetID and

password (used for PatriotWeb).

Vendor Status

The eVA homepage provides a vendor search. Users should access the vendor search

(https://logi.epro.cgipdc.com/External/rdPage.aspx?rdReport=Public.Reports.Report9001_Data) prior to logging into the

eVA system. In addition to verifying that the vendor is registered with eVA (self-registered or state-entered) the user

may determine if a vendor is SWAM certified, accepts the P-Card and/or VISA, if the vendor accepts orders electronically

or if the order needs to be faxed/mailed to the vendor once approved. If the vendor is located, the user may continue to

initiate an eVA order. If the vendor is not located, this means that the vendor is not registered in eVA and the user

should follow the instructions listed under “Order to Un-Registered eVA Vendors” found later in this guide.

Exempt Purchases

The items listed below are exempt from the eVA purchasing requirement by the Commonwealth of Virginia. This

means that units do not have to utilize eVa to purchase or record a purchase for the following item(s).

Individual travel and lodging

Registration fees for conferences

Over-the-counter purchases using a P-Card

Reimbursements

Honorarium payments (less than $2,000)

Payments to the U.S. Department of Homeland

Security

Moving and relocation (except contracted

moving van services)

Campus Vendors

Postage

PO Category

All routine purchases made using eVA procurement are assessed a transaction fee by eVA. For routine purchases

the PO Category of the eVA order will by R01. The majority of purchases will have a PO category of R01.

Items which require procurement within eVA but are exempt from the eVA transaction fee are listed below. If you

are purchasing an item listed you must use PO category X02 in order to be exempt from the transaction fee.

Entertainment

Professional Membership Dues

Advertisements

Accreditation Fees

Academic Testing Services

State Agency to State Agency

Honorarium Payments over $2,000

Procurement Transaction Type

The procurement transaction type further details the purchase. The most commonly used are 20-Supplies-non-

technology and 30-Non-professional services-Non-technology. The full list of transaction types that you may use is listed

below.

19

Designator

Procurement Transaction Type

Examples

10

Equipment – Non-technology

Furniture, telescopes, athletic and aquatic equipment, lab

equipment

15

Equipment – Technology

Computer, servers, monitors, laptop

20

Supplies – Non-technology

Books, office items, lab and student event supplies, pizza for

student events

25

Supplies – Technology

Computers, computer components, software

30

Non-Professional Services –

Non-technology

Consultants, guest speakers, entertainers, security guard, dies,

subscriptions, library, banking, hotels, bus transportation,

catering, advertising

35

Non-Professional Services –

Technology

Cable/satellite TV service, cell service

40

Professional Services

PLEASE DO NOT SELECT. Professional services are defined as

the practice of accounting, architecture, land surveying, law,

medicine, pharmacy, etc. (Purchasing Office may provide

additional guidance)

NIGP Commodity Code

The NIGP Commodity Code is a numeric code related to the description of the product or service and must be

selected for each item when completing an eVA order. It is not necessary to locate an exact match for the item. The

purchaser may choose to look-up the commodity codes prior to initiating an eVA purchase requisition by using the

NIGP

Code Lookup (https://logi.epro.cgipdc.com/External/rdPage.aspx?rdReport=Public.Reports.Report9004_Data). The

commodity code may also be found by performing a search within the NIGP commodity code field when completing an

eVA purchase requisition.

Commonly Used Commodity Codes

17500

Chemical Laboratory Equipment & Supplies

20000

Clothing (athletic, casual, uniform)

20700

Computer accessories/supplies

23200

Crafts: general

42500

Furniture: office

48500

Janitorial Supplies

60000

Office machines, equipment and accessories

61500

Office Supplies: general

80500

Sporting goods/athletic equipment

89800

X-Ray/Radiological supplies, equipment

91800

Consulting Services

92400

Educational/Training Services

96286

Shipping/Freight charges

96750

Delivery Fee

Punch-Out Catalog Order

Use this process for vendors, such as The Supply Room Companies, who have a Punch-Out Catalog in eVA. A

Punch-Out catalog is an electronic resource a vendor provides to eVA that integrates the vendor’s online ordering

system with the eVA system. Purchasers are “punched out” of eVA to shop as if they were on the vendor’s independent

web site. eVA will direct the purchaser into the online catalog for the selected vendor. In some cases, such as The Supply

Room Companies, the vendor will have a quick order form as part of the catalog allowing the purchaser to enter item

numbers for the items to purchase. The purchaser may also browse the catalog for items to purchase. Once all items

have been selected and placed into the shopping cart, the purchaser may submit the order to eVA by selecting “Submit

Cart.” This checkout process allows eVA to extract the purchase information detail and enter it into the eVA format.

20

1. Login to eVA and select “eMall/eForms” from the

top left menu.

2. On the Dashboard select “Requisition” from the

top left Create section

3. Enter the title of the order (i.e., vendor’s name,

purchase date and/or fund/org number)

4. If a P-Card has been added to the user profile, this

will become the default payment method. Uncheck

the “Use P-Card” box if the vendor does not accept

P-Card or if a direct bill order is required.

5. Enter “R01” into the PO Category field

6. Select a Procurement Transaction Type

7. Click “Add from Catalog”

8. Select the vendors Punch-Out Catalog from the left

side link “PunchOut Catalogs” or by searching the

“Catalog Home”

9. In the vendors Punch-Out catalog select items to add to the cart. Once all items have been added to the vendors

Punch-Out cart, click on “Submit Cart” to return to the eVA order. All item information will be transmitted onto

the eVA order

10. The system will redirect you back to the “Summary” page

11. On the “Summary” page, scroll down to the Line Items section

12. If all items will be paid using the same fund/org, place a check mark in the box

next to each item. Multiple fund/orgs may be charges by selecting individual line

items and entering the corresponding fund/org information for each item.

13. Once Line Items have been selected click on “Edit”

14. Enter only the org or fund (but not both) and the

account code and click “OK” at the bottom. The activity

code is an optional element used by cost-sharing units.

15. Select “Next” at the bottom of the page

16. Review the order and enter a Need-By Date into the

field (a date one week from the order is appropriate.

17. Enter comments for the vendor or the purchasing office if needed then click “Submit” to complete the order.

The user should receive a message that the order has been submitted.

18. To return to the Dashboard page select the Home.

21

Non-Catalog Order

Many vendors register with eVA but do not provide a Punch-Out catalog. Purchasers may view the item

information on the vendor’s independent website or paper catalog and manually enter each item into eVA. The user

may also request a quote from a company and use the information provided to complete the eVA order.

1. Login to eVA and select “eMall/eForms” from the top left menu.

2. On the Dashboard select “Requisition” from the top left Create section

3. Enter the title of the order (i.e., vendor’s name, purchase date and/or fund/org number)

4. If a P-Card has been added to the user profile,

this will become the default payment method.

Uncheck the “Use P-Card” box if the vendor does

not accept P-Card or if a direct bill order is

required.

5. Enter “R01” into the PO Category field or “X02”

if the purchase is exempt from eVA fees (see list

of exempt items in the beginning of this section)

6. Select a Procurement Transaction Type

7. Click on “Add Non-Catalog Item” to add items to

the cart

8. Enter a full description for the first item

9. Select an NIGP Commodity Code using the down

arrow at the end of the field to search

10. Locate the supplier using the down arrow at the

end of the field to search

11. Enter the Supplier Part Number, Quantity and Price

12. Click “Update Total” to verify information is correct and select “OK”

13. Repeat steps 7-12 for each item that is being ordered

14. Click on “Ok” to return to the “Summary” page

15. On the “Summary” page, scroll down to the Line Items section

16. If all items will be paid using the same fund/org, place a check mark in the box

next to each item. Multiple fund/orgs may be charges by selecting individual line

items and entering the corresponding fund/org information for each item.

17. Once Line Items have been selected click on “Edit”

22

18. Enter only the org or fund (but not both) and the account

code and click “OK” at the bottom. The activity code is an

optional element used by cost-sharing units.

19. Select “Next” at the bottom of the page

20. Review the order and enter a Need-By Date into the field

(a date one week from the order is appropriate.

21. Enter comments for the vendor or the purchasing office if needed then click “Submit” to complete the order.

The user should receive a message that the order has been submitted.

22. To return to the Dashboard page select the Home.

Orders to Un-Registered eVA Vendors

There are situations when the University must purchase from a vendor who is not self-registered or state-

entered in eVA. The purchaser should attempt to identify a comparable vendor in eVA prior to making a purchase from

an un-registered vendor. Purchasing Office buyers (3-2580) are available to assist. The purchaser must document his/her

request to the vendor to join eVA and the vendor’s refusal in a comment on the eVA purchase order. If a vendor does

not wish to self-register with eVA, the department must request a substitute W-9 from the vendor and forward it to the

Purchasing Office with a note that the vendor needs to be added to eVA. Once this process is complete, the vendor will

be listed as a state-entered vendor and the department can then complete the purchase through eVA.

If a vendor chooses to join at the purchaser’s request, he/she may visit the eVA homepage and select

I Sell to

Virginia button for registration information. The Supplier Diversity Manager (3-2580) is available to assist Mason

purchasers with requests for vendors to join eVA or assist a vendor with the eVA registration process. For assistance

with processing an order to a vendor who has agreed to register but has not completed the registration process, users

may call eVA Customer Support at 3-2580

Split Orders

Purchases exceeding the $5,000 limitation must be processed through the Purchasing Office. The $5,000 threshold

specified in University Policy 2106 must not be circumvented by “splitting orders”. A split purchase is the breaking down

of a single purchase into two or more separate purchases that appear to circumvent the single purchase limit and the

resulting requirement to submit the purchase to the Purchasing Department for award. Purchases may be identified as

split purchases when:

• a single cardholder makes multiple purchases from the same vendor in a short period of time

• two or more cardholders in a unit purchase from the same vendor in a short period of time

• the total of those purchases exceed the single purchase limit

An example of a split order would be the purchase of a conference table and matching chairs for a total of $5,600

that is placed in two parts: a $2,800 order for the conference table that is followed by a $2,800 order for the matching

chairs

Shipping Charges

If an eVA order includes a charge for shipping or freight or if there is a delivery fee associated with the order,

each of these items should be entered as an individual line item and not simply combined with the price of the ordered

item. Additionally, shipping/freight and delivery fees have unique commodity codes. The commodity code for shipping

or freight charges is 96286. The commodity code for a delivery fee is 96750.

23

Payment Methods

Purchases in eVA may be paid directly by Mason Accounts Payable (direct bill) or with a Mason Purchasing Card

(P-Card). After you complete the vendor search, you will note if the vendor accepts P-Card (VISA) payments. If the

vendor does accept P-Card payments and you have been issued a P-Card you may use it to complete a purchase of

$5,000 or less. If the vendor does not accept P-Card payments and/or you have not been issued a P-Card, you will

complete the order as a direct bill payment to be paid by Mason Accounts Payable. Any eVA procurement order greater

than $5,000 must be direct billed.

Direct Bill

In addition, invoice payments for dues, subscriptions and services previously provided are processed in eVA. In

these situations, the department may have received an invoice directly from the vendor that is to be processed for

payment. When a check is required, enter the payment in eVA following the process for non-catalog orders. The invoice

may be scanned and attached to the eVA order, and the invoice with the EP number noted should also be sent to

Accounts Payable at acctpay@gmu.edu

. Direct bill orders will immediately appear in Banner Finance as an encumbrance

(funds committed for future payment). These orders also require the purchaser to confirm receipt of the items. Items

under $5,000 may be received electronically in eVA. Instructions for receiving an order may be found online in the

Order

Receiving Guide (https://fiscal.gmu.edu/wp-content/uploads/2014/11/eMALL_Receiving_Guide.pdf).

Purchasing Card (P-Card)

A P-Card may be used to place orders with eVA vendors who accept it as a form of payment. The P-Card is the

preferred payment method since it reduces paperwork and expedites payment to the vendor. Credit card information

must be manually entered in the eVA system at least one day before the card is utilized for eVA purchases. To set the P-

Card as the default payment method, log into eVA, select Preferences on the eVA Knowledge Center page. Select

Manage P-Card Information and create a new P-Card entry. Complete the information requested. A P-Card alias is a

reference name the purchaser uses to identify the card in eVA. Punctuation marks may not be used in this field. The

liability field should remain as “No”. Enter the expiration date in this format: MM/DD/YYYY. Enter the last day of the

expiration month. For example if the expiration date indicated on the credit card is 10/21, enter 10/31/2021.

Once a P-Card payment is processed in eVA, the purchaser must allocate the transaction in the Bank of America

Works system to complete the process. The allocation procedure is detailed in the Purchasing Card section of this guide.

Submitted Orders

Once the order is submitted, it will go electronically to the purchaser's approver if the payment will be made

through Accounts Payable. No eVA approval is required if the order is paid with a P-card. When the order is approved,

and if the vendor accepts orders electronically, the order will be electronically transmitted to the vendor and be located

in the My Documents window on the Dashboard page. The order will be located in the Submitted window until it is

approved. If the order is not approved, it will be returned to the Denied window. If the order fails integration, it will be

returned to the Composing window. The purchaser will receive email communication from Ariba (eVA) related to the

order status.

If the vendor does not accept orders electronically, once approved the order will go back to the purchaser to be

approved, printed, and faxed or mailed to the vendor. To approve the order, select the PR number under the To Do

section of the eVA Dashboard. Select the green approve button. Once approved, the order will be located in the My

Documents window on the Dashboard page.

24

Purchasing Card (P-Card)

Purchase cards (P-Cards) offer State agencies and institutions the opportunity to streamline their procedures for

procuring and paying for small dollar goods and services. The purchase card reduces the volume of accounts payable

transactions by eliminating vendor invoices and consolidating vendor payments into one monthly payment. P-Cards are

only issued to full or part-time Mason employees.

P-Card applicants are required to attend in-person Basic eVA Purchasing and P- Cardholder training workshops

prior to receiving the P-Card. To register for the trainings, please go to attend a Classroom Course

or contact the Fiscal

Training Manager at extension 3-2089.

Additionally, the cardholder and his/her P-Card approver are required to complete annual training offered

through the Commonwealth’s Knowledge Center each spring. Cardholders and approvers will be notified via email when

the annual trainings are available. If the cardholder and/or the P-Card approver fail to complete the training by the

stated deadline, the P-Card will be suspended until the training is complete.

Purchasing Limits

Purchases made using the P-Card are limited to $5,000 or less per transaction. Mason P-Cards are also

restricted to a total dollar amount less than $10,000 per month. Although multiple transactions may be conducted in a

single day, the dollar threshold for each vendor must remain under the $5,000 limitation. Purchases exceeding the

$5,000 limitation must be processed through the Purchasing Department using an eVA purchase order. Monthly limits

up to $25,000 can also be requested by sending a business need justification to the Purchasing Office.

Unallowable Purchases

Common carrier transportation (airline and rail tickets) and conference registration fees are allowable P-Card

purchases. Most travel expenses should not be purchased with the P-Card.

Travel - Unallowable P-Card Purchases

•

Hotel accommodations

•

Meals

•

Rental cars

•

Travel insurance

•

Shuttle service

•

Taxis

•

Hotel business center transactions

•

Gasoline and oil

Other Unallowable P-Card Purchases

•

Food and beverages (unless Exception/Waiver on file)

•

Past Due Invoices

•

Group transportation

•

Gift Cards

Monthly Reconciliation and Reporting

The P-Cardholder is responsible for reconciling his/her records with those of Bank of America Works (BoA

Works). The cardholder will access BoA Works to reconcile, allocate, and signoff on his/her transactions. After the

cardholder reconciliation, the approver will access BoA Works to review and sign off on the cardholder’s transactions.

The approver has the ability to change the allocation and attach documents during the review if required. The following

procedures describe the requirements for all purchases using the P-Card.

Accessing Bank of America – Works

All cardholders and approvers will have a Works account established by the P-Card Administrator. An email is

generated to the email address on file to provide login information. A cardholder may access his/her account

information by going to the BoA Works site, https://payment2.works.com/works/

. There is a “forgot password” link on

the login page.

25

Monthly Allocation

Each time the cardholder makes a purchase with the P-Card, the cardholder will receive an email from Bank of

America stating he/she has “tasks to perform” within the Works system. In BoA Works, the cardholder may allocate and

sign off on transactions as they occur. In all cases, the allocation and sign off must occur before the monthly cycle

deadline. After the cardholder signs off on the transaction the approver will receive a similar email noting “tasks to

perform”. He/she will then login, review, and sign off on each transaction. The transaction will post to Banner Finance

the following business day after all approvals have been recorded in BoA Works.

All transactions must be signed off and approved each month in compliance with the P-Card deadlines. During

the allocation process, you will need to provide the department fund/org number (GL01), account code (GL02) for the

purchase (users may choose from the drop down menu), eVA PO Category (Ro1, X02), or PCO#, or the word “exempt”

and an activity code if applicable. If the department does not utilize an activity code, the cardholder will leave the

“XXXXX” in the activity code field. Please refer to the for the list of required receipts and instructions. If a transaction

contains an item that requires a receipt, the cardholder must upload and attach the receipt to the BoA Works

transaction. A brief comment providing details of the purchase and the business purpose is required for each

transaction.

The statement period is from the 16

th

of each month to the 15

th

of the following month. Deadlines for

cardholders are generally around the 25

th

, with approver signoff by the 27

th

of each month. Campus closure for holidays

or fiscal year end requirements may alter the usual deadlines. Notification to all active cardholders will be send by email

when necessary. Failure to comply with these deadlines may result in the following consequences.

• Transactions will be swept to a PCard Suspended Transactions account code. If this occurs, the department is

responsible for completing a Journal Voucher in order to move the funds from the suspended transaction

account into the correct account code.

• The P-card may be suspended until the P-Card Administrator has received notice that the approver has signed

off on the transaction/s in Works.

Receipt Upload Guidelines

Works provides the functionality for cardholders to upload receipts and supporting documents for ALL

transactions. Cardholders should upload receipts and supporting documents for all of the following transactions. For

each transaction, cardholders may upload up to 5 MB of receipt and documentation data in five 1 MB files.

All P-Card receipts, including those uploaded into Works, must be retained by the cardholder locally. Paper and/or

electronic format is acceptable. When a cardholder leaves the unit, the unit is responsible for obtaining all P-Card

receipts and documentation.

Bank of America Works Purchase Log Report

Departments may wish to generate the Purchase Log Report from Bank of America Works. This report is not

required for audit and does not need to be submitted to the P-Card Office. This report is helpful in identifying

transactions made using the P-Card for reconciliation purposes. The guidelines may also be accessed here:

http://fiscal.gmu.edu/wp-content/uploads/2015/02/Receipts-BoA.pdf

1. Log into Bank of America Works

2. Choose the “Reports” tab and select “Create”

3. Select “Spend” in the “Category” field

4. Select “Choose from available templates” in the “Template” field

26

5. Select “Purchase Log” from the templates menu and click Ok

6. The “Selected” field will show all the categories that will display on the report

7. You may choose additional categories from the “Available” field and add them to the “Selected” field if desired

8. Change the timeframe for the report (Dates will default to the most recently closed period) by clicking on the

calendar icon and making a selection.