Cost and Other Implications of

Electrification Policies on

Residential Construction

Prepared For

National Association of

Home Builders

February 2021

Report No. CR1328-3_02242021

400 Prince George’s Blvd. | Upper Marlboro, MD 20774 | 800.638.8556 | HomeInnovation.com

Disclaimer

Neither Home Innovation Research Labs, Inc., nor any person acting

on its behalf, makes any warranty, expressed or implied, with respect

to the use of any information, apparatus, method, or process disclosed

in this publication or that such use may not infringe privately owned

rights, or assumes any liabilities with respect to the use of, or for

damages resulting from the use of, any information, apparatus,

method, or process disclosed in this publication, or is responsible for

statements made or opinions expressed by individual authors.

Condition/Limitation of Use

Home Innovation Research Labs is accredited by IAS in accordance

with ISO 17020, ISO 17025, and ISO 17065. The evaluations within this

report may or may not be included in the scopes of accreditation.

Accreditation certificates are available at iasonline.org.

This report may be distributed in its entirety, but excerpted portions

shall not be distributed without prior written approval of Home

Innovation Research Labs.

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction i

TABLE OF CONTENTS

Executive summary .......................................................................................................................... ii

Acronyms, Abbreviations, and Definitions ...................................................................................... v

Background ...................................................................................................................................... 1

Methodology .................................................................................................................................... 1

Results .............................................................................................................................................. 7

Construction Costs ....................................................................................................................... 7

Gas Infrastructure Cost ................................................................................................................ 8

Energy Use Costs .......................................................................................................................... 8

Comparative Analysis ................................................................................................................... 9

Comparison of Gas Equipment Options ..................................................................................... 14

Impact of Electric to Gas Price Ratio .......................................................................................... 15

Electrification Retrofit Costs ...................................................................................................... 17

Life Expectancy of Equipment and Appliances .......................................................................... 18

Consumer Perceptions of Electric Appliances ........................................................................... 19

Summary Construction Costs of Electrification ......................................................................... 23

Conclusions .................................................................................................................................... 24

APPENDIX A: Construction Costs ................................................................................................... 27

APPENDIX B: Electrification Retrofit Costs ..................................................................................... 39

APPENDIX C: Location Adjustment Factors .................................................................................... 43

APPENDIX D: Reference House ...................................................................................................... 45

Reference House Characteristics ............................................................................................... 45

Reference House Characteristics – Previous Studies ................................................................. 47

February 2021 Home Innovation Research Labs

ii Cost Impact of Electrification Strategies on Residential Construction

EXECUTIVE SUMMARY

Building electrification is an effort to substitute fuel-burning equipment and appliances with their

electric counterparts including heat pumps, heat pump water heaters, and electric appliances for

cooking and clothes drying. Electrification is often presented as a strategy for reducing carbon emissions

and can be complementary to policies focused on renewable energy generation and storage, electric

vehicles, grid-interactive technologies, etc.

This study evaluated the cost impact of electrification strategies on new and existing single-family

homes. All-electric houses were compared to houses with natural gas equipment and appliances.

Construction costs and energy use costs were estimated for a “Reference House” with multiple

equipment configurations and in multiple locations. These costs provided the basis for the comparisons

presented in this report.

A baseline single-family, new construction reference house using natural gas for heating, water heating,

cooking, and clothes drying was established for four locations selected based on consideration of

climate zone and fuel costs. The baseline reference houses were then re-designed to include all-electric

equipment using several combinations of electrification options for each location. Construction costs

and energy use costs were estimated for the gas and electric houses and used to compare electric

houses to gas houses.

In addition, the retrofit cost of electrification for an existing baseline gas house was developed and

compared to the retrofit cost of installing replacement gas equipment and appliances. Also investigated

were equipment life expectancies and consumer perceptions of electric equipment and appliances.

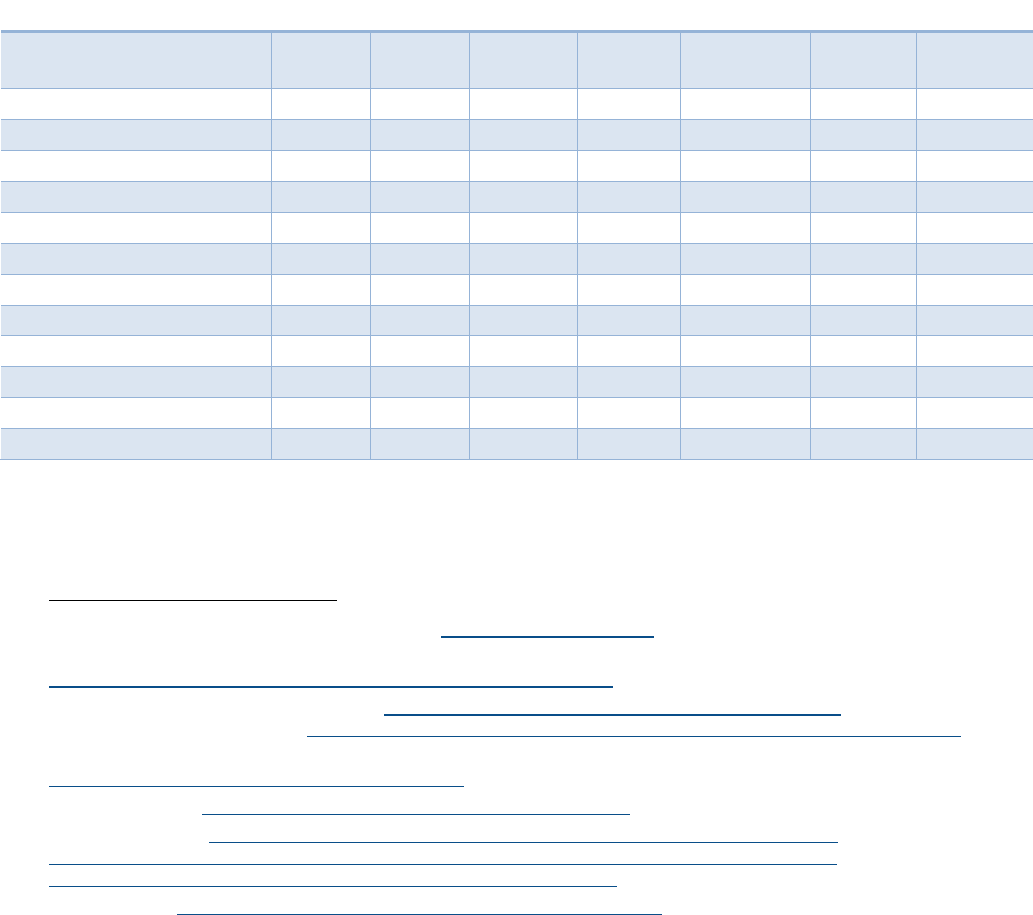

The table below summarizes the range of electrification costs for an electric house with high efficiency

equipment compared to a baseline gas house. The heat pump row takes into account the cost difference

between the baseline gas house and the minimum efficiency electric house. For heat pumps, the low

and high costs are based on systems that are considered appropriate for the climate zone, and the range

includes a ductless heat pump option (heat pump types and efficiencies are discussed further below).

For heat pump water heaters, the low cost is for the 50-gallon, 3.25 UEF model in Houston and

Baltimore and the 80-gallon, 3.25 UEF model in Denver and Minneapolis, and the high cost is for the

80-gallon, 3.75 UEF model. Although an electrical service upgrade was deemed to be not required for

the reference house configurations with a single electric vehicle (EV) charger, the table includes a

placeholder for cost where a service upgrade or additional community electrical infrastructure cost may

be required. For the EV charger circuits, the low cost is for a single circuit, and the high cost is for two

circuits and adding a second electrical panel. Adding EV charging may require upgrading the electrical

service from the street to the house. These costs vary by utility territory and can be substantial but are

not part of this study. There are potential cost savings for not installating gas infrastructure to the

development. These costs also vary by utility and may be typically paid for by the utility or developer.

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction iii

Range of Construction Costs of Electrification relative to a Baseline Gas Reference House, $

Electric Reference House Component

Houston

Baltimore

Denver

Minneapolis

Low

High

Low

High

Low

High

Low

High

Heat Pump

2,114

5,528

1,901

8,655

8,259

9,088

7,866

8,655

Heat Pump Water Heater

1,257

2,632

1,295

2,711

2,516

2,791

2,397

2,658

Electric Vehicle charger circuit(s)

617

2,040

635

2,102

65

2,163

623

2,060

Induction cooktop range

0

997

0

1,027

0

1,057

0

1,007

Total added construction cost, $

3,988

11,196

3,832

14,495

11,430

15,100

10,886

14,381

Electrical service upgrade or community

electrical infrastructure

Varies by Utility Territory

Community gas infrastructure cost savings

Varies by Utility Territory

Key findings based on the estimated construction costs and annual energy costs developed for the

Reference House configurations and selected locations are summarized here:

• The overall range of estimated electrification costs for an electric reference house compared to

a baseline gas reference house is between $3,988 and $11,196 in a warm climate (Houston),

$3,832 and $14,495 in a mixed climate (Baltimore), and $10,866 and $15,100 in a cold climate

(Denver and Minneapolis). On the low end of the range, these costs include a heat pump, heat

pump water heater, and a single EV charger circuit. On the high end of the range, the costs also

include a cold-cimate heat pump upgrade, second EV charger circuit, a second electrical panel

(required for a second EV circuit), and an induction cooktop (induction cookware is not

included). Further costs can include a fee for upgrading electric service and community electric

infrastructure, which can be substantial. There is a potential cost savings for not providing

community gas infrastructure.

• The upfront additional cost of an electric house with a high efficiency 2-stage heat pump (non-

inverter type, 18 SEER/9.3 HSPF) and 80-gallon heat pump water heater (3.75 UEF) compared to

a baseline gas house (minimum efficiency natural gas equipment) is $4,745 in a warm climate

(Houston) and $4,613 in a mixed climate (Baltimore).

• The upfront additional cost of an electric house with a high efficiency inverter heat pump and

80-gallon heat pump water heater (3.75 UEF) compared to a baseline gas house (minimum

efficiency natural gas equipment) is $8,160 in a warm climate (Houston) and $8,131 in a mixed

climate (Baltimore) (warm and mixed climates based on a 19 SEER/10 HSPF inverter heat pump

system rated down to 7°F); for a cold climate, the additional cost ranges from $10,524

(19 SEER/10 HSPF inverter heat pump system rated down to -13°F) to $11,803 (20 SEER/13 HSPF

inverter heat pump system). The higher costs in colder, heating dominated climates are due to

the higher cost of heat pumps rated to operate in colder temperatures.

• In the colder climates (Denver and Minneapolis), the more expensive electric equipment also

results in higher energy use costs by $84 to $404 annually compared to a baseline gas house,

and by $238 to $650 annually compared to a gas house with high efficiency equipment.

Therefore, in colder climates the consumer will be faced with higher upfront construction costs

and higher operating costs throughout the life of the equipment.

February 2021 Home Innovation Research Labs

iv Cost Impact of Electrification Strategies on Residential Construction

• In the cooling dominated climate (Houston), the annual energy use cost for the electric house

with a high efficiency heat pump and 80-gallon heat pump water heater (3.75 UEF) can be

reduced by $154 (18 SEER/9.3 HSPF 2-stage heat pump) to $264 (19 SEER/10 HSPF inverter heat

pump) compared to a baseline gas house, with simple payback of 27 years to 64 years.

Compared to a gas house with high efficiency equipment, the annual energy cost ranges from an

increase of $18 (18 SEER/9.3 HSPF 2-stage heat pump) to a savings of $85 (19 SEER/10 HSPF

inverter heat pump), with simple payback of up to 93 years.

• In the mixed climate (Baltimore), the annual energy use cost for the electric house with a high

efficiency heat pump and 80-gallon heat pump water heater (3.75 UEF) ranges from a savings of

$77 (18 SEER/9.3 HSPF 2-stage heat pump) to $184 (19 SEER/10 HSPF inverter heat pump)

compared to a gas baseline house, with simple payback of 44 years to 60 years; however, when

compared to a gas house with high efficiency gas equipment, the consumer is again faced with

higher upfront construction cost and higher energy use cost.

• The incremental costs for high efficiency gas equipment options relative to a gas baseline are

consistent across climates ranging between $892 and $2,140; the differences are due to house

layout and cost adjustments by location; most payback periods are 10 years or less.

• The retrofit cost of electrification for an exisiting baseline gas house ranges between $24,282

and $28,491, not including the additional cost to substitute an induction cooktop ($1,091-

1,157), install an electric vehicle charger circuit ($1,266-1,343), or install an electrical service

upgrade (a potential substantial additonal cost in some cases). By comparison, the retrofit cost

of gas equipment and applicances for an exisiting baseline gas house ranges between $9,767

and $10,359 using standard efficiency equipment, and between $12,658 and $13,425 using high

efficiency equipment.

• The ratio of electricity price to natural gas price (each converted to $/Btu) is a significant factor

for comparing the impact of electrification between locations with similar climatic

characteristics. The higher the electric-to-gas price ratio, the more expensive it will be to

operate electric equipment versus gas equipment.

• The median life expectancy of most gas equipment tends to be longer than electric

counterparts: gas furnace (20 years) versus heat pump (15 years); tankless gas water heater

(20 years) versus heat pump water heater (12 years); conventional gas and electric storage-type

water heaters have about the same life expectancy (10-13 years).

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction v

ACRONYMS, ABBREVIATIONS, AND DEFINITIONS

AC Air Conditioner

AFUE Annual Fuel Utilization Efficiency

COP Coefficient of Performance

CZ Climate Zone

EA Each

ERI Energy Rating Index

GF Gas Furnace

HP Heat Pump

HPWH Heat Pump Water Heater

HSPF Heating Seasonal Performance Factor

IECC International Energy Conservation Code

IRC International Residential Code

LF Linear Feet

NAHB National Association of Home Builders

O&P Overhead and Profit

SEER Seasonal Energy Efficiency Ratio

SF Square Feet

UEF Uniform Energy Factor

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 1

BACKGROUND

Building electrification is an effort to substitute fuel-burning equipment and appliances with their

electric counterparts including heat pumps, heat pump water heaters

1

, electric clothes dryers, and

electric cooking appliances including induction cooktops. Building electrification is often presented as a

strategy for reducing carbon emissions and can be complementary to policies focusing on electric

vehicles, demand management, grid-interactive technologies, renewable energy generation and

storage, etc.

To evaluate the cost impact of building electrification strategies, Home Innovation Research Labs

determined construction costs and energy use costs using a “Reference House” with multiple equipment

configurations and multiple locations. These costs provided a basis for comparing all-electric houses to

houses with gas equipment and appliances. Additionally, Home Innovation investigated equipment life

expectancies and consumer perceptions regarding electric equipment and appliances.

METHODOLOGY

Project Approach

The primary tasks for this effort were:

• Establish baseline performance levels in accordance with the 2018 IECC and 2021 IECC.

• Establish a baseline single-family Reference House for each performance level using natural gas

equipment and appliances for four locations selected based on considerations of climate zone

and difference in fuel costs.

• Re-design the Reference Houses to all-electric houses using several possible combinations of

features for each house, including optional infrastructure for electric vehicle (EV) charging.

• Evaluate the differences in the cost of construction for gas houses versus electric houses,

including any cost to the builder related to upgrading the electrical service.

• Evaluate the cost of energy to operate gas houses versus electric houses.

• Document, based on available literature, performance considerations and consumer

preferences for electric equipment such as heat pumps, heat pump water heaters,

instantaneous electric water heaters, and electric cooktops.

• Evaluate the cost of retrofitting an existing gas Reference House to add electrification features,

including optional EV charging infrastructure.

Reference House

The characteristics of the Reference House were defined for a representative single-family home. The

features and representative locations of the Reference House are shown below; additional construction

details and basis for selection are provided in Appendix D.

1

Traditional electric-resistance storage water heaters are generally not included in electrification strategies.

February 2021 Home Innovation Research Labs

2 Cost Impact of Electrification Strategies on Residential Construction

Reference House features:

• 2-story, 4-bedroom, vented attic, attached 2-car garage

• Slab-on-grade foundation (Climate Zone 2) or basement foundation (Climate Zones 4-6)

• 2,600 square feet (SF) conditioned floor area above grade:

o First floor: 1,080 SF with 9-foot ceilings

o Second floor: 1,520 SF with 8-foot ceilings

o Basement: 1,080 SF for houses with basements (3,680 SF total)

Reference House locations:

• Houston, TX; Climate Zone 2

• Baltimore, MD; Climate Zone 4

• Denver, CO; Climate Zone 5

• Minneapolis, MN; Climate Zone 6

Reference House configurations:

• There are 8 unique “baseline” configurations (4 locations, 2 performance levels, gas fuel)

• Performance level: each baseline house is constructed to the prescriptive thermal envelope

requirements of the 2018 IECC or the 2021 IECC; thermal envelope measures remain constant

for all analyzed scenarios

• Fuel type: electric houses have all-electric appliances and equipment; gas houses use natural gas

for heating, hot water, cooking, and clothes drying

Equipment and Appliance Selection

The baseline gas houses, and minimum efficiency electric houses, utilize federal minimum efficiency

HVAC systems and water heaters. Electrification equipment choices were identified, based on

manufacturer product data and feedback from builders, to represent options that would be considered

commonly available and suitable for the different climates. A range of high efficiency equipment

combinations was modeled for each location to evaluate the relationship between upfront costs and

annual energy cost savings for various scenarios.

This study evaluated “air source” heat pumps (i.e., not ground source or geothermal heat pumps). Heat

pumps, except ductless heat pumps, utilize electric only backup/supplemental heat (i.e., electric

resistance heating elements installed within the air handler, and not a supplemental gas furnace or

standalone unit heater). Typically, ductless heat pumps are sized to handle the heating load and do not

include supplemental resistance heaters. Houses with ductless heat pumps in colder climates commonly

include a supplemental heat source, such as a gas heater, pellet stove, or electric baseboard convectors;

for this project, the cost of ductless heat pumps did not include any cost for supplemental heat and the

energy model relied only on the capacity of the ductless heat pump to produce heat.

The minimum efficiency heat pump utilizes a single-stage compressor. A system with a two-stage

compressor represents the next higher efficiency level. Systems with variable speed compressors

(“inverter” drive compressors that provide variable refrigerant flow) provide the highest efficiency

ratings; the inverter systems are more suitable for colder climates because these can ramp up to provide

higher heating capacities at lower temperatures compared to typical single-stage or two-stage

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 3

equipment. Climate-appropriate heat pump options were evaluated based on criteria from various cold

climate heat pump programs

2

. Selection of heat pumps in mixed climates will be driven by customer

preferences. To continue to meet performance expectations of those homeowners who are used to gas

furnace heating, the more expensive inverter heat pumps will be needed. In this study, both types of

heat pump equipment are evaluated for Baltimore to provide a range of costs for plausible scenarios

based on consumer preferences.

High efficiency water heating options for electric houses consist of heat pump water heaters: 50-gallon

and 80-gallon capacities were selected for evaluation. Heat pump water heaters operating in heat pump

only mode have a slower recovery than standard electric water heaters, so these are normally operated

in “hybrid mode” that allows supplemental electric resistance heaters to operate as needed to maintain

water temperature within the tank. The Uniform Energy Factor (UEF)

3

efficiency rating for heat pump

water heaters is determined based on the default operational mode as defined by the manufacturer in

its product literature; for the heat pump water heaters in this study, hybrid mode is the default mode,

so using the UEF in the energy software in effect models the heat pump water heaters in hybrid mode.

Even in hybrid mode, with a tank temperature setpoint of 125°F, the modeling software indicated

“unmet showers” for both capacities, indicating the heat pump water heater would run out of hot water

before showering needs were met for a typical demand schedule. When set to 140°F, there were unmet

showers for the 50-gallon model in colder climates, but there were no unmet showers for the 80-gallon

model; the modeling results for unmet showers are provided in Appendix D. To minimize unmet

showers, heat pump water heaters were modeled at a tank temperature of 140°F, and construction

costs include a mixing valve to temper the water temperature leaving the tank. Further, based on

builder feedback that any number of unmet showers may be considered unacceptable, the 80-gallon

model was selected for comparison analysis in the Results section.

Higher efficiency gas equipment options also were analyzed to provide a full picture of equipment

options available to builders for improving energy performance of homes. In those markets where

higher efficiency gas equipment is the prevalent choice, it was also used as a comparative baseline for

evaluation of electrification costs.

The selected equipment options and associated efficiencies that were used to develop construction

costs and annual energy costs are shown in Table 1.

2

E.g., Northeast Energy Efficiency Partnerships (NEEP), Minnesota Center for Energy & Environment (MNCEE)

3

UEF is the current measure of water heater overall efficiency; the higher the UEF value, the more efficient the water heater;

UEF is determined by the Department of Energy’s test method outlined in 10 CFR Part 430, Subpart B, Appendix E.

February 2021 Home Innovation Research Labs

4 Cost Impact of Electrification Strategies on Residential Construction

Table 1. Equipment Options

Reference House

Equipment

Gas Baseline

Gas Furnace (GF): 80 AFUE

Air Conditioner (AC): 13 SEER (14 SEER in CZ2&4)

Water Heater (WH): 50 gal, natural draft, 0.58 UEF

Gas Equipment Options

50 gal, natural draft, 0.64 UEF

Tankless, direct vent, 0.82 UEF

Tankless, condensing direct vent, 0.93 UEF

96 AFUE GF

96 AFUE GF + 16 SEER AC

97 AFUE modulating GF + 16 SEER AC

Electric Minimum Efficiency

Heat Pump (HP): 14 SEER/8.2 HSPF

Water Heater (WH): 50 gal, 0.92 UEF

Electrification Equipment

Options

2-stage HP, 18 SEER/9.3 HSPF

Inverter HP, 19 SEER/10 HSPF rated to 7°F (CZ2&4) or -13°F (CZ5&6)

Inverter HP, 20 SEER/13 HSPF

Ductless inverter HP, 19 SEER/11 HSPF

50 gal Heat Pump Water Heater (HPWH), 3.25 UEF

80 gal HPWH, 3.25 UEF

80 gal HPWH, 3.75 UEF

Construction Costs

Construction costs were developed using RSMeans

4

2020 Residential Cost Data and RSMeans 2020

Residential Repair & Remodeling Cost Data. Costs for mechanical equipment were sourced from

distributor web sites. Construction costs are summarized in the Results section; construction cost details

are provided in Appendix A.

Appendix A costs are reported as both total to the builder and total to consumer. The total cost to

builder includes overhead and profit (designated in the tables as “w/O&P”) applied to individual

component costs (materials and labor) to represent the cost charged by the sub-contractor. The total

cost to consumer is based on applying a builder’s markup of 18.9% to the builder’s total cost

5

. For

remodeling costs, a markup of 30.1% is applied to the remodeler’s total cost to determine the total cost

to consumer

6

. These represent national average costs, which were made specific for each home by

applying a location adjustment; selected location adjustment factors from RSMeans are listed in

Appendix C. For alternative house locations, the Appendix A costs could be modified by applying the

appropriate location adjustment factor. The Results section reports total cost to consumer, adjusted for

location.

4

RSMeans, https://www.rsmeans.com/

5

As reported in the NAHB Cost of Doing Business Study, 2016 Edition.

https://www.builderbooks.com/cost-of-doing-business-study--2016-edition-products-9780867187472.php

6

As reported in the NAHB Remodeler’s Cost of Doing Business Study, 2020 Edition.

http://nahbnow.com/2020/05/how-much-does-it-cost-remodelers-to-do-business

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 5

Construction costs for this study are based on the following:

• Costs include equipment, associated electrical circuits and gas piping, and installation labor;

equipment includes HVAC systems, water heaters, cooking ranges, and clothes dryers.

• Costs for air distribution ducts, water distribution piping, and refrigerant and condensate piping

are not included because these would be the same for gas and electric houses (except for the

ductless heat pump comparison where the cost of the ducts is subtracted from the system costs

and the incremental costs for refrigerant and condensate piping are added to the system costs).

• Costs do not include ducting for heat pump water heaters; for the Reference Houses, water

heaters are installed in the attic or basement and ducting is assumed to be not required. Costs

would be greater where heat pump water heaters installed in closets or mechanical rooms

require ducting.

• Electric houses include a basic electric range with exposed heating elements. Induction cooktop

costs are also evaluated. Gas houses include a gas range; in single family detached houses

started in 2019 that use natural gas as the primary heating fuel, 90% have a natural gas range or

cooktop

7

.

• Gas houses include a gas clothes dryer; in single family detached houses started in 2019 that use

natural gas as the primary heating fuel, 40% have a natural gas dryer

8

.

• For gas houses, the construction cost includes gas piping from the street to the house and

interior gas piping. Costs for gas infrastructure to the development, which may be paid for by

the utility or developer is reported separately as potential cost savings based on estimates

developed by others.

• Reference Houses are assumed to have a 200-amp electrical service and panel. Based on an

electrical load calculation performed in accordance with the National Electrical Code

9

, a

200-amp service is sufficient for an electric Reference House with a finished basement and one

electric vehicle (EV) charger circuit; the electrical load calculation is provided in Appendix D. The

design electrical loads for the reference house are within about 11 percent of the panel

capacity. An electrical service upgrade would be required for a second EV charger circuit and at

some point, for a larger house or a house with additional electric loads such as a well, swimming

pool, or electric baseboard heaters. If the existing electrical service from the street is sufficient,

the electrical upgrade would normally consist of adding a second electrical panel; upgrading the

service from the street, if required, would add significant cost. Any cost to upgrade the electrical

service or panel is not included in this report and should be a subject of a follow-up study.

• The same construction cost is used for the 2018 IECC and 2021 IECC Reference Houses in the

same location using the same fuel.

7

46% of all homes had a natural gas range or cooktop; 51% of all homes used natural gas as the primary heating fuel. Home

Innovation: 2020 Annual Builder Practices Survey

8

20% of all dryers are natural gas dryers, eia.gov and 51% of new homes in 2019 used natural gas as the primary heating fuel

9

National Electrical Code: NFPA 70. https://catalog.nfpa.org/NFPA-70-National-Electrical-Code-NEC-C4022.aspx

February 2021 Home Innovation Research Labs

6 Cost Impact of Electrification Strategies on Residential Construction

• Construction costs are developed based on new construction data except for the retrofit of an

existing gas house for electrification that includes remodeling cost data.

Energy Use Costs

Annual energy use costs were developed using BEopt

10

2.8.0.0 hourly simulation software and energy

prices from the U.S. Energy Information Agency

11

. The natural gas and electricity prices are average

annual 2018 residential prices in the state (2019 prices were not yet available during the analysis period

of this study).

The energy prices used for this study are shown in Table 2. The table also shows prices for other

example locations within the same Climate Zone, and a calculated ratio of electricity price to natural gas

price for each location. This ratio is an important indicator for energy cost comparisons for locations

with similar climate conditions – the higher the ratio, the more expensive it will be to operate electric

equipment versus gas equipment.

Table 2. Energy Prices (source: eia.gov)

CZ 2

CZ 4

CZ 5

CZ 6

Fuel

Houston

Baltimore

Denver

Minneapolis

National Ave

Electricity, $/kWh

0.1120

0.1330

0.1215

0.1314

0.1287

Nat Gas, $/therm

1.142

1.179

0.772

0.869

1.050

Elec to Gas Price Ratio*

3.0

3.4

4.8

4.6

3.7

Examples of energy prices in different locations within the same

climate zone**

Phoenix

New York

Boston

Helena

Electricity, $/kWh

0.1277

0.1852

0.2161

0.1096

Nat Gas, $/therm

1.535

1.237

1.547

0.732

Elec to Gas Price Ratio*

2.5

4.6

4.3

4.6

Tampa

Portland

Chicago

Burlington

Electricity, $/kWh

0.1154

0.1098

0.1277

0.1802

Nat Gas, $/therm

2.134

1.065

0.815

1.365

Elec to Gas Price Ratio*

1.6

3.1

4.8

4.0

*Calculated by converting fuel prices to $/Btu, based on 104 kBtu/therm for gas and 3,414 Btu/kWh for electric

** These additional locations are shown for the purpose of demonstrating the range of price ratios and were not

used for energy modeling or separate cost analysis except on a limited basis to compare New York to Baltimore

to illustrate the impact of different price ratios within the same climate zone.

10

BEopt (Building Energy Optimization Tool) software: https://beopt.nrel.gov/home

11

Energy Information Agency: https://www.eia.gov/

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 7

RESULTS

Construction Costs

Construction costs for various equipment options are summarized in Table 3 for gas houses and Table 4

for electric houses. Cost details are provided in Appendix A. Table 3 shows the baseline cost for gas

houses and the incremental cost of gas equipment options. Table 4 shows the incremental cost of

electrification equipment options relative to electric houses with federal minimum efficiency

equipment.

Table 3. Construction Costs for Gas Houses

Gas Construction Cost, $

Gas Reference House Configuration

Houston

Baltimore

Denver

Minneapolis

Baseline, total cost

11,132

11,746

11,913

11,345

Gas equipment options, incremental cost:

50 gal WH, 0.64 UEF

182

188

193

184

Tankless WH, 0.82 UEF

728

750

772

735

Tankless condensing WH, 0.93 UEF

1,106

1,139

1,173

1,117

96 AFUE GF

1,147

1,106

1,138

1,084

96 AFUE GF + 16 SEER AC

1,317

1,161

1,497

1,426

97 AFUE modulating GF + 16 SEER AC

2,367

2,243

2,611

2,486

Adjust if installing 90+ GF AND tankless WH

(metal chimney vent no longer required)

(283) (1,019) (1,049) (999)

Table 4. Construction Costs for Electric Houses

Electric Construction Cost, $

Electric Reference House Configuration

Houston

Baltimore

Denver

Minneapolis

Electrification equipment options, incremental cost relative to federal minimum efficiency electric systems:

50 gal HPWH*, 3.25 UEF

1,257

1,295

1,333

1,270

80 gal HPWH, 3.25 UEF

2,373

2,445

2,516

2,397

80 gal HPWH, 3.75 UEF

2,632

2,711

2,791

2,658

18 SEER/9.3 HSPF 2-stage HP

2,041

2,102**

N/A

N/A

19 SEER/10 HSPF inverter HP, rated to 7°F

(CZ2&4) or -13°F (CZ5&6)

5,455 5,620 8,288 7,893

20 SEER/13 HSPF inverter HP

8,524

8,782

9,040

8,610

19 SEER/11 HSPF ductless HP***

3,894

8,856

9,117

8,683

Option: Electric Vehicle (EV) charger circuit

617

635

654

623

Option: Substitute induction cooktop range

997

1,027

1,057

1,007

*The 50 gallon HPWH set to 140°F may provide sufficient hot water in Climate Zones 2 & 4 (Houston and Baltimore)

** Standard heat pump may or may not be acceptable to occupants in this climate zone during the heating season.

*** The cost includes savings for not installing ductwork; the Houston system is less expensive due to one less

“head” (wall mounted air handler) because there is no basement, lower overall capacity, and does not include cold

climate technology.

February 2021 Home Innovation Research Labs

8 Cost Impact of Electrification Strategies on Residential Construction

Gas Infrastructure Cost

For gas houses, the construction cost in Table 3 includes gas piping from the street to the house and

interior gas piping, but it does not include gas infrastructure to the development, which may be paid for

by the utility or developer. The cost of community gas infrastructure to the builder can range from zero

to thousands of dollars per house; some reports show an average cost of approximately $1,400

12

.

Energy Use Costs

The modeled annual energy costs are shown in Table 5 for gas houses and Table 6 for electric houses.

Table 5 shows energy costs for baseline houses and for baseline houses with individual gas equipment

options. Table 6 shows energy costs for minimum efficiency electric houses and for individual

electrification equipment options. Both tables show results for houses constructed in accordance with

the prescriptive building thermal envelope requirements for the 2018 IECC and 2021 IECC.

The 2021 IECC also requires selecting an additional energy savings package (options are defined in the

2021 IECC). This requirement is met for the reference houses in Baltimore, Denver, and Minneapolis

because the HVAC ducts are 100% inside conditioned space (one of the prescribed options for 2021). For

Houston, the 2021 houses were modeled with a tighter building enclosure and ERV installed (also a

prescribed option for 2021).

Efficiency ratings for heat pumps are normally based on the system operating in “efficiency mode”

although systems are commonly set up in “comfort mode”. System efficiency is lower than rated when

operating in comfort mode (lower COP ratings by outdoor temperatures). For this analysis, the energy

model is based on the rated efficiencies (in efficiency mode). Energy use would be higher where systems

are set up in comfort mode.

For the 13 HSPF heat pump option (HVAC3), manufacturer product data was used for the software

inputs for variable speed (inverter).

Heat pump water heaters were modeled in “hybrid mode” (supplemental elecric resistance heaters

operate as needed to maintain tank water temperature) and at a set point of 140°F to minimize “unmet

showers” (running out of hot water before showering needs are met for a typical demand schedule, as

indicated by the modeling software).

12

California Building Industry Association (CBIA) survey showed $1,424; Green Builder article from Oct 2020 reported

approximately $1,400 per single family detached house; Energy Logic presentation showed $1,300-$1,500, Green Builder

webinar: https://www.greenbuildermedia.com/impact-series-archive-home/the-electrification-wave-implications-for-builders-

and-others

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 9

Table 5. Annual Energy Costs for Gas Houses

Gas House Annual Energy Cost, $/yr

Houston

Baltimore

Denver

Minneapolis

Gas Reference House Configuration

2018

2021

2018

2021

2018

2021

2018

2021

Baseline

1,501

1,466

1,814

1,756

1,477

1,422

1,893

1,881

w/ 50 gal WH, 0.64 UEF

1,484

1,448

1,797

1,739

1,465

1,410

1,881

1,869

w/ Tankless WH, 0.82 UEF

1,454

1,418

1,769

1,711

1,445

1,390

1,861

1,849

w/ Tankless condensing WH, 0.93 UEF

1,440

1,405

1,750

1,691

1,431

1,376

1,843

1,831

w/ 96 AFUE GF

1,467

1,439

1,727

1,677

1,410

1,362

1,775

1,764

w/ 96 AFUE GF/16 SEER AC

1,392

1,369

1,694

1,647

1,371

1,326

1,730

1,720

w/ 97 AFUE modulating GF/16 SEER AC

1,391

1,367

1,689

1,643

1,368

1,323

1,723

1,713

w/ 96 AFUE GF/16 SEER AC & 0.82 UEF

tankless WH

1,328 1,308 1,627 1,580 1,326 1,281 1,664 1,654

w/ 96 AFUE GF/16 SEER AC & 0.93 UEF

tankless condensing WH

1,315 1,294 1,607 1,560 1,312 1,267 1,647 1,637

Table 6. Annual Energy Costs for Electric Houses

Electric House Annual Energy Cost, $/yr

Houston

Baltimore

Denver

Minneapolis

Electric Reference House Configuration

2018

2021

2018

2021

2018

2021

2018

2021

Minimum efficiency

1,617

1,595

2,118

2,054

NA

NA

NA

NA

w/ 50 gal HPWH set to 140°F, 3.25 UEF

1,468

1,448

1,919

1,854

1,858

1,791

2,628

2,611

w/ 80 gal HPWH set to 140°F, 3.25 UEF

1,454

1,433

1,846

1,781

1,782

1,715

2,536

2,515

w/ 80 gal HPWH set to 140°F, 3.75 UEF

1,444

1,424

1,828

1,763

1,764

1,697

2,518

2,498

w/ 18 SEER/9.3 HSPF 2-stage HP

1,500

1,486

2,025

1,971

NA

NA

NA

NA

w/ 19 SEER/10 HSPF inverter HP, rated

to 7°F (CZ2&4) or -13°F (CZ5&6)

1,413 1,404 1,925 1,880 1,859 1,812 2,614 2,598

w/ 20 SEER/13 HSPF inverter HP

NA

NA

NA

NA

1,825

1,782

2,552

2,536

w/ 19 SEER/11 HSPF ductless HP

1,397

1,408

1,888

1,852

1,852

1,814

2,571

2,559

w/ 18 SEER/9.3 HSPF HP & 80 gal 3.75

UEF HPWH set to 140°F

1,325 1,312 1,734 1,679 NA NA NA NA

w/ 19 SEER/10 HSPF HP & 80 gal 3.75

UEF HPWH set to 140°F

1,237 1,229 1,630 1,585 1,586 1,538 2,297 2,280

w/ 20 SEER/13 HSPF HP & 80 gal 3.75

UEF HPWH set to 140°F

NA NA NA NA 1,550 1,506 2,230 2,215

w/ 19 SEER/11 HSPF ductless HP & 80 gal

3.75 UEF HPWH set to 140°F

1,230 1,242 1,712 1,675 1,720 1,682 2,277 2,266

Comparative Analysis

The estimated construction costs and modeled annual energy use costs provide the basis to compare

electric houses and gas houses. Table 7 compares an electrified house, with selected combinations of

equipment options, to a baseline gas house with minimum federal efficiency equipment, for the 2018

February 2021 Home Innovation Research Labs

10 Cost Impact of Electrification Strategies on Residential Construction

IECC performance level. Table 8 makes the same comparisons for the 2021 IECC performance level. The

tables show the additional construction cost, annual energy savings (shown as a negative value where

there are energy cost increases), and simple payback for the electric house relative to the gas house.

Table 9 and Table 10 make similar comparisons except electric houses are compared to gas houses with

selected higher efficiency equipment.

Note that other combinations of equipment could be compared using the estimated construction costs

and annual energy costs.

Table 7. Electric House Compared to Baseline Gas House, 2018 IECC Performance Level

Electric House relative to Gas Baseline House (80 AFUE GF, 13/14 SEER AC, 0.58 UEF WH) (2018 IECC)

Electric House Configuration

Houston

Baltimore

Denver

Minneapolis

14 SEER/8.2 HSPF HP & 50 gal 0.92 UEF WH

Added construction cost, $

73

(201)

Energy savings, $/yr

(116)

(304)

Simple payback, yrs

NA

NA

14 SEER/8.2 HSPF HP & 80 gal 3.75 UEF HPWH

set to 140°F

Added construction cost, $

2,705

2,510

Energy savings, $/yr

57

(14)

Simple payback, yrs

47

NA

18 SEER/9.3 HSPF 2-stage HP & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

4,745

4,613

Energy savings, $/yr

176

80

Simple payback, yrs

27

58

19 SEER/10 HSPF inverter HP (equipment rated

for 7°F in CZ2&4 or -13°F in CZ5&6) & 80 gal 3.75

UEF HPWH set to 140°F

Added construction cost, $

8,160

8,131

11,050

10,524

Energy savings, $/yr

264

184

(109)

(404)

Simple payback, yrs

31

44

NA

NA

20 SEER/13 HSPF inverter HP & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

11,803

11,241

Energy savings, $/yr

(128)

(337)

Simple payback, yrs

NA

NA

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 11

Table 8. Electric House Compared to Baseline Gas House, 2021 IECC Performance Level

Electric House relative to Gas Baseline House (80 AFUE GF, 13/14 SEER AC, 0.58 UEF WH) (2021 IECC)

Electric House Configuration

Houston

Baltimore

Denver

Minneapolis

14 SEER/8.2 HSPF HP & 50 gal 0.92 UEF WH

Added construction cost, $

73

(201)

Energy savings, $/yr

(129)

(298)

Simple payback, yrs

NA

NA

14 SEER/8.2 HSPF HP & 80 gal 3.75 UEF HPWH

set to 140°F

Added construction cost, $

2,705

2,510

Energy savings, $/yr

42

(7)

Simple payback, yrs

64

NA

18 SEER/9.3 HSPF 2-stage HP & 80 gal 3.75

UEF HPWH set to 140°F

Added construction cost, $

4,745

4,613

Energy savings, $/yr

154

77

Simple payback, yrs

31

60

19 SEER/10 HSPF inverter HP (rated to 7°F in

CZ2&4 or -13°F in CZ5&6) & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

8,160

8,131

11,050

10,524

Energy savings, $/yr

237

171

(116)

(399)

Simple payback, yrs

34

48

NA

NA

20 SEER/13 HSPF inverter HP & 80 gal 3.75

UEF HPWH set to 140°F

Added construction cost, $

11,803

11,241

Energy savings, $/yr

(84)

(334)

Simple payback, yrs

NA

NA

February 2021 Home Innovation Research Labs

12 Cost Impact of Electrification Strategies on Residential Construction

Table 9. Electric House Compared to Higher Efficiency Gas House, 2018 IECC Performance Level

Electric House relative to Gas House with 96 AFUE GF, 16 SEER AC, 0.93 UEF WH (2018 IECC)

Electric House Configuration

Houston

Baltimore

Denver

Minneapolis

18 SEER/9.3 HSPF 2-stage HP & 80 gal 3.75

UEF HPWH set to 140°F

Added construction cost, $

2,605

3,331

Energy savings, $/yr

(10)

(127)

Simple payback, yrs

NA

NA

19 SEER/10 HSPF inverter HP (rated to 7°F in

CZ2&4 or -13°F in CZ5&6) & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

6,020

6,849

9,429

8,980

Energy savings, $/yr

78

(23)

(274)

(650)

Simple payback, yrs

77

NA

NA

NA

20 SEER/13 HSPF inverter HP & 80 gal 3.75

UEF HPWH set to 140°F

Added construction cost, $

10,182

9,697

Energy savings, $/yr

(238)

(583)

Simple payback, yrs

NA

NA

Ductless HP 19 SEER/11 HSPF & 80g 3.75 UEF

HPWH set to 140°F

Added construction cost, $

4,459

10,085

10,258

9,770

Energy savings, $/yr

85

(105)

(408)

(630)

Simple payback, yrs

52

NA

NA

NA

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 13

Table 10. Electric House Compared to Higher Efficiency Gas House, 2021 IECC Performance Level

Electric House relative to Gas House with 96 AFUE GF, 16 SEER AC, 0.93 UEF WH (2021 IECC)

Electric House Configuration

Houston

Baltimore

Denver

Minneapolis

18 SEER/9.3 HSPF 2-stage HP & 80 gal 3.75

UEF HPWH set to 140F

Added construction cost, $

2,605

3,331

Energy savings, $/yr

(18)

(119)

Simple payback, yrs

NA

NA

19 SEER/10 HSPF inverter HP (rated to 7°F in

CZ2&4 or -13°F in CZ5&6) & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

6,020

6,849

9,429

8,980

Energy savings, $/yr

65

(25)

(271)

(643)

Simple payback, yrs

93

NA

NA

NA

20 SEER/13 HSPF inverter HP & 80 gal 3.75

UEF HPWH set to 140°F

Added construction cost, $

10,182

9,697

Energy savings, $/yr

(239)

(578)

Simple payback, yrs

NA

NA

Ductless HP 19 SEER/11 HSPF & 80g 3.75 UEF

HPWH set to 140°F

Added construction cost, $

4,459

10,085

10,258

9,770

Energy savings, $/yr

52

(115)

(415)

(629)

Simple payback, yrs

86

NA

NA

NA

As the results in Tables 7 through 10 indicate, the upfront additional cost of an electric house with high

efficiency electric heat pump and heat pump water heater ranges between $4,613 and $11,803

compared to a baseline gas house (minimum efficiency natural gas equipment). The higher cost is

associated with colder, heating dominated climates due to the higher cost of heat pumps rated to

operate in colder temperatures. In colder climates (Denver and Minneapolis), the more expensive

electric equipment also results in higher energy use costs than gas equipment. Therefore, in colder

climates the consumer will be faced with higher upfront cost and higher operating costs throughout the

life of the equipment.

In the cooling dominated climate (Houston), the energy use cost for the electric house with high

efficiency equipment can be reduced by $154 to $264 annually compared to a baseline gas house

resulting in a simple payback ranging between 27 years and 64 years; compared to a gas house with

higher efficiency gas equipment, the change in energy cost ranges from an increase of $18 to a savings

of $85 annually, with simple payback of 52 years to 93 years. For the electric house with minimum

efficiency equipment compared to the baseline gas house, the energy cost increases by $116 to $129

annually.

February 2021 Home Innovation Research Labs

14 Cost Impact of Electrification Strategies on Residential Construction

In the mixed climate (Baltimore), the energy use cost for the electric house with high efficiency

equipment can be reduced by $77 to $184 annually compared to a baseline gas house, with simple

paybacks ranging between 44 years and 60 years; compared to a gas house with higher efficiency gas

equipment, the consumer is again faced with higher upfront cost and higher annual energy use cost. For

the electric house with minimum efficiency equipment compared to the baseline gas house, the energy

cost increases by $298 to $304 annually.

Comparison of Gas Equipment Options

The estimated construction costs and modeled annual energy use costs also provide the basis for

comparing gas equipment options. Table 11 compares two options for a gas house, with selected

combinations of high efficiency equipment, to a baseline gas house with minimum federal efficiency

equipment, for the 2018 IECC performance level. Table 12 makes the same comparisons for the 2021

IECC performance level. The tables show the additional construction cost, additional energy cost (shown

as a negative value where there are energy savings), and simple payback for the efficient gas house

relative to the baseline gas house.

The incremental costs for high efficiency gas equipment options are consistent across climates; the

differences are due to house layout and cost adjustments by location; most payback periods are

10 years or less.

Table 11. Gas House Equipment Comparison, 2018 IECC Performance Level

Efficient Gas House relative to Baseline Gas House, 2018 IECC

Gas House Configuration

Houston

Baltimore

Denver

Minneapolis

96 AFUE GF/16 SEER AC & 0.82 UEF WH

Added construction cost, $

1,762

892

1,220

1,162

Energy savings, $/yr

173

187

151

229

Simple payback, yrs

10

5

8

5

96 AFUE GF/16 SEER AC & 0.93 UEF WH

Added construction cost, $

2,140

1,282

1,621

1,544

Energy savings, $/yr

186

207

165

246

Simple payback, yrs

12

6

10

6

Table 12. Gas House Equipment Comparison, 2021 IECC Performance Level

Efficient Gas House relative to Baseline Gas House, 2021 IECC

Gas House Configuration

Houston

Baltimore

Denver

Minneapolis

96 AFUE GF/16 SEER AC & 0.82 UEF WH

Added construction cost, $

$1,762

$892

$1,220

$1,162

Energy savings, $/yr

$158

$176

$141

$227

Simple payback, yrs

11

5

9

5

96 AFUE GF/16 SEER AC & 0.93 UEF WH

Added construction cost, $

$2,140

$1,282

$1,621

$1,544

Energy savings, $/yr

$172

$196

$155

$244

Simple payback, yrs

12

7

10

6

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 15

Impact of Electric to Gas Price Ratio

To illustrate the impact of the electric-to-gas price ratio described in the methodology section, Table 13

compares electric houses, with selected high efficiency options, to baseline gas houses, using the 2021

performance level, for two locations within the same climate zone: Baltimore (3.4 price ratio) and New

York (4.6 price ratio). Table 14 compares an electric house to a gas house with selected high efficiency

gas options.

The additional energy costs are higher and payback periods, where there are energy savings, are

significantly longer for New York compared to Baltimore despite being in the same climate zone. These

differences are primarily due to the higher electric-to-gas price ratio.

Table 15 compares a gas house with selected high efficiency equipment options to a baseline gas house.

Paybacks are somewhat shorter for New York compared to Baltimore due to higher energy prices in

New York.

Table 13. Electric House Relative to Gas Baseline House, 2021 IECC Performance Level

Electric House relative to Gas Baseline House

Electric House Configuration

Baltimore

New York

14 SEER/8.2 HSPF HP & 50 gal 0.92 UEF WH

Added construction cost, $

(201)

(201)

Energy savings, $/yr

(298)

(689)

Simple payback, yrs

NA

NA

18 SEER/9.3 HSPF 2-stage HP & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

4,613

4,613

Energy savings, $/yr

77

(93)

Simple payback, yrs

60

NA

19 SEER/10 HSPF inverter HP & 80 gal 3.75 UEF

HPWH set to 140°F

Added construction cost, $

8,131

8,131

Energy savings, $/yr

171

38

Simple payback, yrs

48

214

February 2021 Home Innovation Research Labs

16 Cost Impact of Electrification Strategies on Residential Construction

Table 14. Electric House Relative to Gas House with High Efficiency Equipment,

2021 IECC Performance Level

Electric House relative to Gas House w/96 AFUE GF, 16 SEER AC, 0.93UEF WH

Electric House Configuration

Baltimore

New York

18 SEER/9.30 HSPF HP & 80 gal 3.75 UEF HPWH

Added construction cost, $

3,331

3,331

Energy savings, $/yr

(119)

(337)

Simple payback, yrs

NA

NA

19 SEER/10 HSPF HP & 80 gal 3.75 UEF HPWH

Added construction cost, $

6,849

6,849

Energy savings, $/yr

(25)

(206)

Simple payback, yrs

NA

NA

Table 15. Gas House Equipment Comparison, 2021 IECC

Efficient Gas House relative to Baseline Gas House

Gas House Configuration

Baltimore

New York

96 AFUE GF/16 SEER AC & 0.82 UEF WH

Added construction cost, $

892

892

Energy savings, $/yr

176

224

Simple payback, yrs

5

4

96 AFUE GF/16 SEER AC & 0.93 UEF WH

Added construction cost, $

1,282

1,282

Energy savings, $/yr

196

244

Simple payback, yrs

7

5

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 17

Electrification Retrofit Costs

The estimated cost of electrification to retrofit an existing gas house is summarized in Table 16; details

are provided in Appendix B. The analysis is based on starting with an existing baseline gas house,

removing existing gas appliances, capping gas lines and chimney vents and abandoning those in place,

installing an electric range, dryer, high efficiency heat pump and heat pump water heater, installing

associated electrical wiring, and repairing and painting drywall that was removed to install new wiring.

For comparison purposes, the estimated costs to retrofit an existing gas house with gas equipment is

shown in Table 17.

Table 16. Retrofit Cost of Electrification for an Existing Baseline Gas Reference House

Retrofit Cost of Electrification

Electrification Equipment Options installed in

an Existing Gas Baseline Reference House

Houston Baltimore Denver Minneapolis

Install electric range, clothes dryer, 19 SEER/10

HSPF HP, 80 gal 3.75 UEF HPWH

$24,282 $25,017 $28,491 $27,134

Additional incremental cost to substitute a

range with an induction cooktop

$1,091 $1,124 $1,157 $1,102

Additional cost to install one electric vehicle

(EV) charger circuit

$1,266 $1,305 $1,343 $1,279

Table 17. Retrofit Cost of Gas Equipment and Appliances for an Existing Gas Baseline Reference House

Retrofit Cost of Gas Equipment and Appliances

Gas Equipment Options installed in an Existing

Gas Baseline Reference House

Houston Baltimore Denver Minneapolis

Install gas range, gas dryer, 80 AFUE GF, 14

SEER AC, 50 gal 0.56 UEF WH

$9,767 $10,063 $10,359 $9,866

Install gas range, gas dryer, 96 AFUE GF, 16

SEER AC, tankless condensing 0.93 UEF WH

$12,658 $13,041 $13,425 $12,786

February 2021 Home Innovation Research Labs

18 Cost Impact of Electrification Strategies on Residential Construction

Life Expectancy of Equipment and Appliances

Table 18 shows the approximate life expectancy of HVAC equipment, water heaters, dryers, and ranges

as reported by various organizations. Factors that affect life expectancy of equipment include:

• Proper installation and maintenance

• Proper sizing to minimize on-off cycling

• Climate: air conditioners tend to last longer in colder climates; heat pumps tend to wear out

sooner in colder climates

• Corrosive environments, indoor and outdoor including coastal environments

• Intensity of use

Table 18. Life Expectancy of Equipment and Appliances

Life Expectancy: median or range (years)

Equipment/Appliance DOE

13

NAHB

14

Consumer

Affairs

15

ASHRAE

16

HVAC.COM

17

Consumer

Reports

18

Erie

Insurance

19

Gas Furnace

20

18; 15-20

15

18

15-25

15-20

Air Conditioner

16

15; 10-15

15-20

15

12-15

15

Heat Pump

15

16

10-15

15

16

15

Ductless Heat Pump

15

Gas Storage Water Heater

13

10

8-12

10

Electric Storage Water Heater

13

11

8-15

10

Tankless Water Heater

20

20

20

20

Heat Pump Water Heater

12

13-15

Gas Clothes Dryer

13

10

14

Electric Clothes Dryer

13

10

14

Gas Range

15

19

Electric Range

13

17

13

U.S. Department of Energy: BEopt software values. https://beopt.nrel.gov/home

14

National Association of Home Builders: Study of Life Expectancy of Home Components, 2007.

https://www.interstatebrick.com/sites/default/files/library/nahb20study.pdf

15

Consumer Affairs: Central Air Conditioning. https://www.energy.gov/energysaver/central-air-conditioning

Replacing your home’s heat pump. https://www.consumeraffairs.com/news/replacing-your-homes-heat-pump-031513.html

16

American Society of Heating, Refrigeration, and Air Conditioning Engineers: Equipment Life Expectancy Chart.

https://hvac-eng.com/hvacr-equipment-life-expectancy/

17

HVAC.COM, 2017. https://www.hvac.com/faq/life-expectancy-hvac-systems/

18

Consumer Reports. https://www.consumerreports.org/heat-pumps/most-and-least-reliable-heat-pumps/;

https://www.consumerreports.org/central-air-conditioners/most-reliable-central-air-conditioning-systems/;

https://www.consumerreports.org/cro/gas-furnaces/buying-guide/index.htm

19

Erie Insurance. https://www.erieinsurance.com/blog/when-to-replace-appliances

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 19

Consumer Perceptions of Electric Appliances

Natural gas is the primary heating fuel for the majority of new homes in the United States, as shown in

Table 19

20

. The primary heating fuel varies significantly by region of the country; in colder climates, the

share of natural gas heating is over 80 percent (Figure 1). In some of the warmer climates, heat pumps

approach an 80 percent market share (Figure 2).

Table 19. Primary Heating Fuel for New Homes (source: NAHB)

Primary Heating Fuel for New Single Family Home Starts

Year

Natural Gas

Electricity

2019

51%

44%

2018

54%

40%

2017

56%

39%

2016

55%

40%

2015

55%

40%

Figure 1. Type of Primary Heating Fuel Used in New Homes Started in 2019 (source: NAHB)

20

NAHB Eye on Housing: Air Conditioning and Heating Systems in New Homes, Nov 13, 2020.

http://eyeonhousing.org/2020/11/air-conditioning-and-heating-systems-in-new-homes-5/

February 2021 Home Innovation Research Labs

20 Cost Impact of Electrification Strategies on Residential Construction

Figure 2. Share of New Single-Family Homes Started in 2019

with Air or Ground Source Heat Pump (source: NAHB)

Home Innovation reviewed existing literature regarding consumer perceptions of electric appliances.

The results are presented here [added notes are by Home Innovation to expand on specific items]:

• Heat pumps:

o Do not provide comfort during the heating season; the supply air temperature does not

feel warm

21

[The supply air temperature for heat pump systems is typically below 100°F

(when the electric supplemental heater is not operating) and can feel uncomfortable

particularly compared to a gas furnace with a typical supply air temperature of

105-120°F. Further, the heat pump supply temperature drops as it gets colder outside.

For example, manufacturer product data for a conventional heat pump system (non-

inverter) typically indicates a supply air temperature of approximately 97°F at 47°F

outdoor temperature and 70°F thermostat set point, but supply air temperature drops to

87°F when the outdoor temperature drops to 17°F; inverter heat pump systems designed

for cold climates maintain supply air temperature better because these don’t lose as

much capacity at lower outdoor temperatures, and these also may reduce airflow at the

air handler to maintain a target supply air temperature.]

o High initial installation cost

o High operating cost for heating

o The recovery period, after setting back the thermostat during heating, relies on the

electric supplemental heaters to operate which is expensive, so it is more economical to

“set-and-forget” the thermostat setting in heating mode. [Some heat pump thermostats

21

Trane: https://www.trane.com/residential/en/resources/heat-pump-vs-furnace-what-heating-system-is-right-for-you/

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 21

will increase the set point gradually to minimize electric resistance heating during the

recovery period.]

o Ductless heat pumps may need a supplemental heat source during particularly cold

periods

o Prone to improper installation, e.g., correct air flow and refrigerant charge

22

o There are numerous potential mechanical issues

23

24

o Expensive to repair

o Short life expectancy [Note: see previous section for equipment life expectancies]

• Electric water heaters, conventional electric-resistance storage type:

o Run out of hot water too soon/slow recovery rate [Note: The first hour rating (FHR) of

an electric water heater is lower than a gas water heater with the same size tank; larger

capacity tanks are commonly selected to help offset this]

o Expensive to operate

• Heat pump water heaters

25

26

:

o High potential for energy savings [Note: COP ratings have increased considerably in

recent years; energy modeling for this study confirms significant energy savings

compared to standard electric water heaters; savings will be less during heating season

where the HPWH is installed in conditioned space because it uses heated house air, so

the heating system is also indirectly heating the water, and where the HPWH is installed

in unconditioned space with lower ambient temperature.]

o High initial cost

o Run out of hot water too soon/slow recovery rate. [Note: Heat pump water heaters

have a slower recovery than standard electric water heaters, so are typically set to

“hybrid” mode that allows the electric resistance heating element to operate as needed.

Further, the energy software for this study showed it was necessary to select an

80-gallon capacity and 140F water temperature to avoid “unmet showers”]

o Noise can be an issue, depending on location in the dwelling

o Confusion around best selection of settings: hybrid mode; heat pump only mode;

electric element only; high demand mode; vacation mode [Note: operating in hybrid

mode or electric element only mode reduces efficiency compared to heat pump only

mode]

22

ACHRNEWS: https://www.achrnews.com/articles/135097-addressing-poor-heat-pump-installations

23

Carrier: https://www.carrier.com/residential/en/us/products/heat-pumps/heat-pump-troubleshooting/

24

HVAC.com: https://www.hvac.com/blog/the-most-common-heat-pump-problems-how-to-avoid-them/

25

As reported in Field Performance of Heat Pump Water Heaters in the Northeast. Shapiro and Puttagunta, Consortium for

Advanced Residential Buildings, Feb 2016. https://www.nrel.gov/docs/fy16osti/64904.pdf

26

Building Green blog: https://www.buildinggreen.com/blog/heat-pump-water-heaters-cold-climates-pros-and-cons

February 2021 Home Innovation Research Labs

22 Cost Impact of Electrification Strategies on Residential Construction

o Reliability, e.g., compressor failure

o Additional maintenance: inspecting and clearing the condensate strainer and drain lines;

cleaning the air filter and evaporator

• Cooking

o Historically, many homeowners prefer a gas cooktop: 90% of new homes with natural

gas as the primary heating fuel have a natrual gas range or cooktop

27

o More recently, some homeowners consider induction cooktops as superior to gas and

conventional electric cooktops

28

[ Note: the modeling software for this project predicted

an annual energy savings of $4 for an induction cooktop].

• Clothes Drying

29

o Electric dryers have a lower initial cost

o Gas dryers dry loads in about half the time of electric dryers

o Gas dryers cost less to operate

27

Home Innovation 2019 builder practice survey.

28

Reviewed.com. https://www.reviewed.com/ovens/features/induction-101-better-cooking-through-science

29

Home Depot. https://www.homedepot.com/c/ab/gas-vs-electric-dryers/9ba683603be9fa5395fab902da8afc8

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 23

Summary Construction Costs of Electrification

Table 20 summarizes the range of electrification costs for an electric house with high efficiency

equipment compared to a baseline gas house. The heat pump row takes into account the cost difference

between the baseline gas house and the minimum efficiency electric house. For heat pumps, the low

and high costs are based on systems that are considered appropriate for the climate zone, and the range

includes the ductless heat pump option. For heat pump water heaters, the low cost is for the 50-gallon,

3.25 UEF model in Houston and Baltimore and the 80-gallon, 3.25 UEF model in Denver and

Minneapolis, and the high cost is for the 80-gallon, 3.75 UEF model. Although an electrical service

upgrade was deemed to be not required for the reference house configurations with a single EV charger,

the table includes a placeholder for cost where a service upgrade or additional community electrical

infrastructure cost may be required. For the EV charger circuits, the low cost is for a single circuit, and

the high cost is for two circuits and adding a second electrical panel. Adding EV charging may require

upgrading the electrical service from the street to the house; this cost can be substantial but is not

included in the table. For gas houses, the construction cost includes gas piping from the street to the

house and interior gas piping (these costs are subtracted for electric homes), but it does not account for

gas infrastructure to the development, which may be paid for by the utility or developer. The cost of

community gas instrastructure to the builder can range from zero to thousands of dollars per house;

some reports (developed by others) show an average cost of approximately $1,400.

Table 20. Summary Range of Construction Costs of Electrification

Range of Construction Costs of Electrification relative to a Baseline Gas Reference House, $

Electric Reference House Component

Houston

Baltimore

Denver

Minneapolis

Low

High

Low

High

Low

High

Low

High

Heat Pump

2,114

5,528

1,901

8,655

8,259

9,088

7,866

8,655

Heat Pump Water Heater

1,257

2,632

1,295

2,711

2,516

2,791

2,397

2,658

Electric Vehicle charger circuit(s)

617

2,040

635

2,102

654

2,163

623

2,060

Induction cooktop range

0

997

0

1,027

0

1,057

0

1,007

Total added construction cost, $

3,988

11,196

3,832

14,495

11,430

15,100

10,886

14,381

Electrical service upgrade or community

electrical infrastructure

Varies by Utility Territory

Community gas infrastructure cost savings

Varies by Utility Territory

February 2021 Home Innovation Research Labs

24 Cost Impact of Electrification Strategies on Residential Construction

CONCLUSIONS

Based on the estimated construction costs and annual energy costs developed for the Reference House

configurations and selected locations, key findings are summarized here:

• The overall range of estimated electrification costs for an electric reference house compared to

a baseline gas reference house is between $3,988 and $11,196 in a warm climate (Houston),

$3,832 and $14,495 in a mixed climate (Baltimore), and $10,866 and $15,100 in a cold climate

(Denver and Minneapolis). On the low end of the range, these costs include a heat pump, heat

pump water heater, and a single EV charger circuit. On the high end of the range, the costs also

include a heat pump upgrade, second EV charger circuit, a second electrical panel (required for a

second EV circuit), and an induction cooktop (induction cookware is not included). The low-end

cost for mixed climates depends on the consumer preference for equipment and can be similar

to cold climate costs for those customers who are used to the performance of a gas furnace and

expect a simialr level of comfort. Further costs can include a fee for upgrading electric service

and community electric infrastructure, which can be substantial. There is a potential cost savings

for not providing community gas infrastructure.

• The upfront additional cost of an electric house with a high efficiency 2-stage heat pump (non-

inverter type, 18 SEER/9.3 HSPF) and 80-gallon heat pump water heater (3.75 UEF) compared to

a baseline gas house (minimum efficiency natural gas equipment) is $4,745 in a warm climate

(Houston) and $4,613 in a mixed climate (Baltimore).

• The upfront additional cost of an electric house with a high efficiency inverter heat pump and

80-gallon heat pump water heater (3.75 UEF) compared to a baseline gas house (minimum

efficiency natural gas equipment) is $8,160 in a warm climate (Houston) and $8,131 in a mixed

climate (Baltimore) (warm and mixed climates based on a 19 SEER/10 HSPF inverter heat pump

system rated down to 7°F); for a cold climate, the additional cost ranges from $10,524 (19

SEER/10 HSPF inverter heat pump system rated down to -13°F) to $11,803 (20 SEER/13 HSPF

inverter heat pump system). The higher costs in colder, heating dominated climates are due to

the higher cost of heat pumps rated to operate in colder temperatures.

• In the colder climates (Denver and Minneapolis), the more expensive electric equipment also

results in higher energy use costs by $84 to $404 annually compared to a baseline gas house,

and by $238 to $650 annually compared to a gas house with high efficiency equipment.

Therefore, in colder climates the consumer will be faced with higher upfront construction costs

and higher operating costs throughout the life of the equipment.

• In the cooling dominated climate (Houston), the annual energy use cost for the electric house

with a high efficiency heat pump and 80-gallon heat pump water heater (3.75 UEF) can be

reduced by $154 (18 SEER/9.3 HSPF 2-stage heat pump) to $264 (19 SEER/10 HSPF inverter heat

pump) compared to a baseline gas house, with simple payback of 27 years to 64 years.

Compared to a gas house with high efficiency equipment, the annual energy cost ranges from an

increase of $18 (18 SEER/9.3 HSPF 2-stage heat pump) to a savings of $85 (19 SEER/10 HSPF

inverter heat pump), with simple payback of up to 93 years.

• In the mixed climate (Baltimore), the annual energy use cost for the electric house with a high

efficiency heat pump and 80-gallon heat pump water heater (3.75 UEF) ranges from a savings of

Home Innovation Research Labs February 2021

Cost Impact of Electrification Strategies on Residential Construction 25

$77 (18 SEER/9.3 HSPF 2-stage heat pump) to $184 (19 SEER/10 HSPF inverter heat pump)