New York Smart Thermostat

Market Characterization

Delivered to: New York State Energy Research and

Development Authority

Authors: Northeast Energy Efficiency Partnerships and

SEE Change Institute

October 2016

About NEEP

Mission

Accelerate energy efficiency as an essential part

of demand-side solutions that enable a

sustainable regional energy system

Approach

Overcome barriers and transform markets via

Collaboration, Education and Enterprise

Vision

Region embraces next generation energy

efficiency as a core strategy to meet energy

needs in a carbon-constrained world

One of six regional energy efficiency organizations (REEOs) funded by the US Department of

Energy (US DOE) to link regions to US DOE guidance, products and programs

1

About SEE Change Institute

• See Change Institute blends social science with

innovative design to address global issues through

human solutions.

– We bring together leading academics and practitioners to

work on strategy, implementation, research, and

evaluation of behavior-based energy programs.

– Backed by theory, tested with data, and designed with

care, we develop, implement, and evaluate programs to

solve the issues that matter to us the most.

2

Summary of Contents

• Introduction

• The Smart Thermostat Market

• New York Market: Smart Thermostat Baseline and

Consumer Survey

• Barriers and Opportunities for Wider Smart

Thermostat Adoption in New York

• Interventions, Recommendations, and Potential

Impacts

• Conclusion

3

Introduction

• The goals of this characterization are to:

– Assess customer knowledge, attitudes, and actions toward

smart thermostats

– Analyze various stakeholder perspectives on the industry

and market potential

– Estimate the current baseline of smart thermostat

penetration in New York State

– Determine the size and scope of the opportunity for

NYSERDA to advance this market

4

Introduction Cont.

• The findings are intended to help NYSERDA identify

opportunities and challenges in this market to

determine appropriate interventions and ultimately,

market transformation

• Much of the data presented is specific to New York,

findings have implications for other markets

throughout the United States and world

• This presentation is a companion to the full report

which includes all citations and further explanations

of findings

5

The Smart Thermostat Market

6

Market Confusion in Terminology

“Wi-Fi”

“smart”

“programmable”

“learning”

“connected”

7

Technology overview

Terminology Description

Programmable

Thermostat

A thermostat connected to a home’s HVAC system that can be

programmed by a user or technician to follow a schedule based

on the lifestyle of the user.

Connected or

Wi-Fi

thermostat

A thermostat that is connected to the Internet and typically

includes a user interface, such as a mobile app or online

dashboard, for the user to remotely make changes. Connected

or Wi-Fi thermostats do not necessarily have any advanced

features, though any smart thermostat could also be considered

a connected thermostat.

Smart or

learning

thermostat

A connected thermostat that employs advanced algorithms

and/or sensors to improve user comfort, control, and energy

use. This may include occupancy sensing, geofencing, or

learning behavior.

8

Brands and Products

Navigant's

Smart

Thermostat

Leaders from

Leaderboard

Report, 2016

9

Most Cited Smart Thermostats

ecobee

Est. 2008

Nest

Est. 2011

10

National Smart Thermostat Market Size

Parks

Associates

2015 Smart

Thermostat

Units Sold

and

Projections

11

Size of Thermostat Market

• Smart thermostats are growing in proportion of the

overall thermostat market

– From 40% in 2015 to 50% in 2017 according to Parks

Associates

• Entire thermostats market is growing

– Fueled by early replacement of operational thermostats

with smart thermostats

– From 10 million in 2015 to 12 million in 2017 according to

Parks Associates

12

Product Costs

Manufacturer Model Equipment Cost

Allure EverSense $210.00

ecobee ecobee3 $249.00

ecobee ecobee3 lite* $169.00*

Honeywell Lyric Round $199.00

Honeywell Lyric T5 $149.99

Nest Nest Learning

Thermostat (3rd Gen)

$249.00

RCS 001-01773 $164.29

Schneider Electric Wiser Air $229.98

Venstar Voyager $145.00

*Product not yet available

13

Size of Smart Thermostat Market

• Assuming a weighed average of $210

– Based on presumed popularity of more expensive Nest

and ecobee

• Assuming from Parks Associates 5 million smart

thermostats sold in the U.S. in 2016

$210 x 5M = $1.05Billion

• Calculated $1.05 billion in sales in 2016 in U.S.

14

ENERGY STAR® Connected Thermostat

Specification

• Programmable thermostat program sunset in 2009

• Connected thermostat specification under

development

– expected to be finalized in early 2017

• Provides a common baseline, manufacturers to

report data every 6 months to stay on the list

• Proposed savings thresholds are 8% for heating,

10% for cooling

• Once final, NEEP Recommends NYSERDA only

promote products that earn ENERGY STAR

Certification

15

Potential Energy Savings from Smart

Thermostats

• Fraunhofer Savings Potential of Smart Thermostats

by Climate Zone for Very cold/cold and Mixed-humid

Climate

Zones that

occur in

New York

Heating Savings Cooling Savings

Percentage of

total household

energy use

MMBtu

equivalent per

household

Percentage of

total household

energy use

kWh per

household

Very

cold/cold

15% 9.1 20% 119

Mixed-

humid

15% 5.7 20% 381

16

Ranges of Reported Savings from Smart

Thermostats

17

• Fraunhofer:

– 15% heating, 20% cooling

• NEEP 2015 (compiled from several evaluations):

– 1-15% heating, 1-17% cooling

• ENERGY STAR’s proposed levels in Draft 3

Specification

– 8% heating, 10% cooling

New York Savings Potential from Smart

Thermostats

• From EIA’s 2009 RECS Data:

– 53% of New York households used individual window/wall air

conditioning units

– another 20% have a central air conditioning system

– air conditioning represents 1% of household energy use

– natural gas provides space heating for 57% of New York

households

– fuel oil provides 29% of space heating

– space heating makes up 56% of total energy use

• When all energy sources are combined, the average New

York household consumes the equivalent of 103 mmBtu

per year

18

New York Savings Potential from Smart

Thermostats Cont.

• Potential heating savings:

– Using Fraunhofer’s 15% potential savings from heating,

smart thermostats could offer up to 8.7 MMBtus per

household per year average heating energy savings.

• Potential cooling savings:

– Only 20% have central AC which is best candidate for smart

thermostat control

– Using Fraunhofer’s 20% potential savings from cooling, the

cooling potential savings about 30 kWh/year per

household

19

Market Actors

Market Actor Description Examples

Hardware

Manufacturer

These companies produce smart thermostats. Some are relatively

new companies focused on smart thermostats. Others are traditional

thermostat manufacturers who have expanded their products.

New: Nest, ecobee, tado, Quby

Traditional: Honeywell, Schneider

Electric, Emerson, Carrier, Trane

Software

Vendor

These companies partner with thermostat hardware manufacturers to

provide the advance algorithms that move a product from connected

to smart.

EnergyHub, EcoFactor,

Weatherbug, Energate

E-tail Online retailers and online manufacturer stores on their website for

direct to customer online sales.

Amazon, newegg, manufacturer

online stores

Brick and

Mortar Retail

Retailers with a history of selling thermostats have an extension of

their existing sales. Consumer electronics retailers have also entered

this market

Lowes, Home Depot, Best Buy,

Target, Sears, Apple Store,

independent retailers

HVAC

Distribution

Channels

Manufacturers with a traditional base in HVAC, smart thermostat are

an addition to the suite of offerings through distributors and

installers. Newer manufacturers have also sought out HVAC

distribution and installation.

HVAC distributors, HVAC installers

Security and

Telco Service

Providers

Many security and telecommunications service providers have started

offering smart thermostats as part of their bundle of offerings.

ADT, Alarm.com, Comcast, AT&T

Home

Performance

Contractors

Several manufacturers offer training and tools to aid in the sale and

installation of their products for contractors. Few focus on this

channel for sales

Home Performance Contractors

20

Smart Thermostat Product Journey

From Parks Associates, 2015 and 2016

21

Sales Channels for Smart Thermostats

22

Industry Actor Interviews and Key

Findings

• SEE Change conducted semi-structured interviews with

32 key HEMS players from six stakeholder groups

• An additional 15 HEMS industry stakeholder responded

to an online survey with similar questions

• Findings used to inform analysis

23

Stakeholder Survey Responses on

Important Features for HEMS Adoption

24

New York Contractor Survey and Key

Findings

• Home performance contractors identified as major channel

• Survey: 83 respondents throughout NY

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Energy

Audits

Insulation

Air Sealing

HVAC

Upgrades

Window

replacement

General

home

improveme…

Solar panel

installation

Construction

Consulting

Please indicate what work your company performs in the residential space.

25

Contractor Smart Home Awareness

• Only 1 contractor not aware of “smart home”

0 10 20 30 40 50

Smart appliance

Smart thermostat

Smart lighting

Smart plug

Number of Respondents

How familiar are you with each of the following smart

home technologies?

Very

Somewhat

A little

Not at all

26

Are Customers Asking About it?

• Somewhat…

23%

49%

21%

7%

Do your customers ask you about

smart home technologies?

No, it's never come up

Yes, it's been brought

up once or twice

Yes, it's been

mentioned in a fair

number of jobs

Yes, it comes up

frequently

83%

2%

2%

2%

2%

2%

5%

2%

If yes, which ones

Smart

Thermostat

New custom

contruction

Renewables

Smart appliance

IAQ monitoring

Water Leads

Lighting

Smart switch

27

Contractor Opinions of Smart Thermostats

0 50 100

4. I feel smart thermostats are

helpful to save energy for my

customers

3. I own a smart thermostat

myself (or would like to)

2. I feel smart thermostats are

overrated

1. If a customer wants a smart

thermostat, I try to talk them

out of it

Number of Respondents

Strongly

agree

Somewhat

agree

Neutral

Somewhat

disagree

Strongly

disagree

28

Contractor Survey Conclusion

• Relatively high awareness and some experience with

smart thermostats

• Some skepticism, but not overwhelming

• Value proposition for incorporating smart thermostat

promotion into their work is not yet clear

• Potential for intervention on all components

29

NY Market: Smart Thermostat Baseline

and Consumer Survey*

30

*See survey instruments, available as companion documents to this report, posted on NYSERDA’s website.

NY Smart Thermostat Penetration

Baseline

• Reviewed available national

data

• NY Resident survey of 538

• Long Island subset of 118

• Results of similar survey in CA

• NEEP recommends a 13 to

17% range as the baseline for

New York penetration of

smart thermostats

– with the preponderance of

evidence pointing to the 14%-

15% penetration

Source Rate

Parks Associates

Extrapolated to NY

12.4%

Sylvania Socket Survey 13%

NY Resident Survey

Low

8.9%

NY Resident Survey

High

17%

PSEG-LI Subset of NY

Residential Survey

15.3%

PG&E Survey 14%

31

NY Customer Survey Analysis

• Participants: 538 New Yorkers

– 35% from NYC

– 10% from Buffalo, Rochester, Yonkers, and Syracuse

– 55% from rest of state

Age:

32

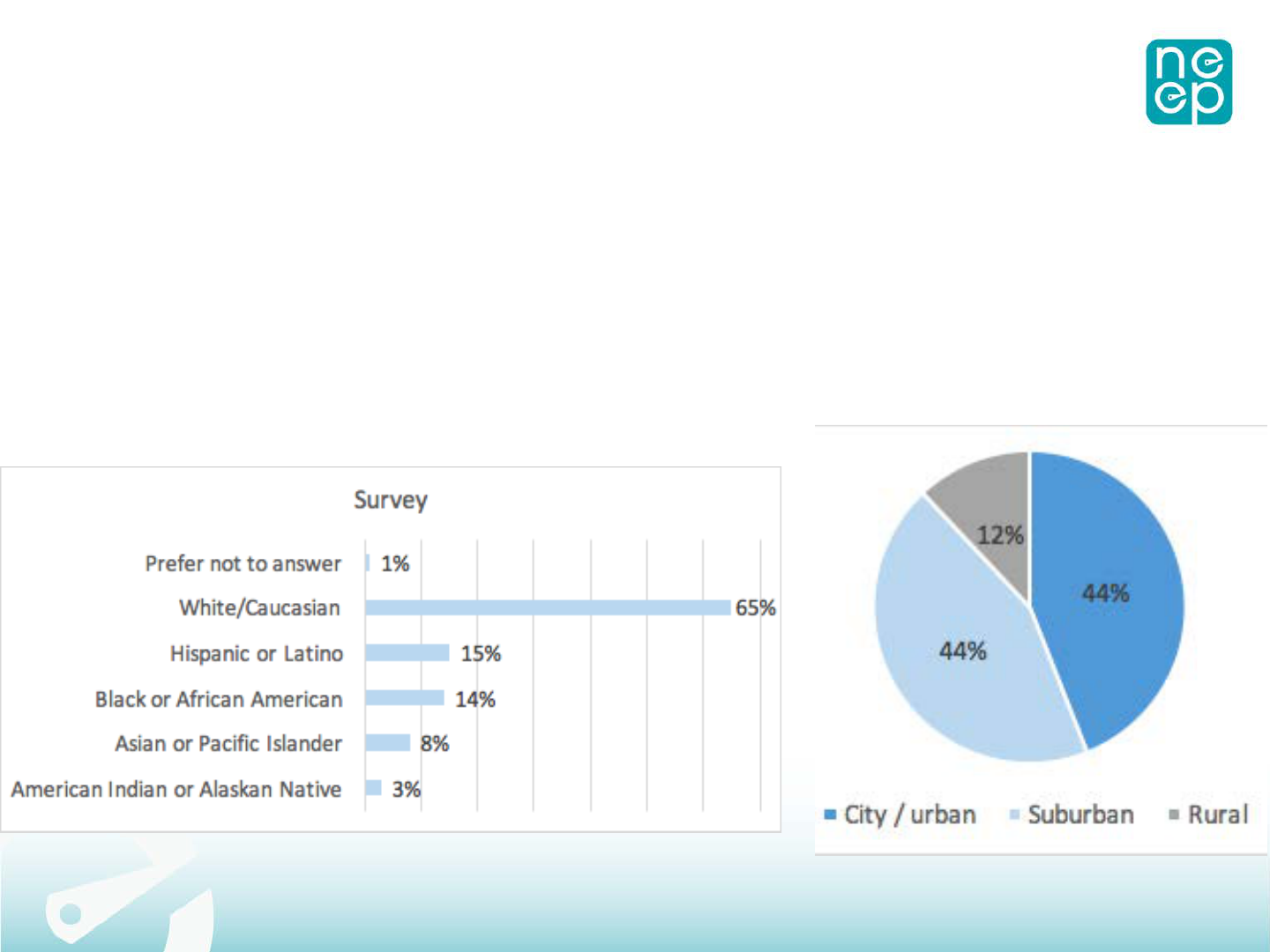

NY Customer Survey Analysis Cont.

• Large range of incomes:

– 30% <$50,000

– 36% $50,000-$100,000

– 19% $100,000-$175,000

– 8% >$175,000

Race/Ethnicity Self-identified community

33

Survey Question Structure and Content

• Smart home technology awareness:

– How aware are survey respondents of smart home

technologies and the smart home market?

• Smart home technology attitudes:

– How do survey respondents feel about smart home

technology, in general and in their own personal use and

ownership?

• Smart home technology actions:

– Do survey respondents own smart technology? How would

(or do) respondents like to interact with and use their

smart technology?

34

Results: Awareness

• Relatively high level of awareness of the notion of a “smart home”

– Nearly 90% of respondents were at least a little familiar with “smart homes”

– 62% of respondents said that they were either “very” or “somewhat” familiar with “smart

homes”

– >50% respondents were either “somewhat” or “very” familiar with smart appliances, smart

lights, and smart thermostats

– 40% of respondents were not at all familiar with smart plugs

– People were significantly more aware of smart thermostats relative to smart plugs and smart

appliances (p < 0.01).

Where did you learn about smart home products?

Media 63%

Store 36%

Word of mouth 36%

Service provider 18%

Not sure 13%

Other 2%

• Work (4)

• Internet (3)

• Advertising (2)

• Engineering magazines (1)

35

Purchase Location for Smart Devices

• For those who owned at least one smart devices, they got them from:

Smart

appliances

Smart

lights

Smart

plugs

Smart thermostat

Store 14% 4% 10% 10%

Online 12% 11% 10% 12%

Gift 5% 14% 4% 3%

Borrowed <1% 2% 2% 1%

Came with my

home

2% 2% 2% 2%

None of these,

not sure

<1% 0% <1% 1%

Other 0% 0% 0% 2%

Installed with HVAC

Installed by ConEd

36

Smart thermostat Owners: Feedback

• Overwhelmingly positive

Control /

Features

0%

General

“positive”

comments

52%

Everything

17%

Ease /

Convenience

/ Comfort

16%

Nothing /

Don’t know

4%

Brand

3%

Money

savings

4%

Other

4%

What (if anything) do you LIKE about your smart

thermostat?

Nothing /

Not sure

61%

General

“good”

comments

21%

Interopera

bility /

Connectivi

ty issues

3%

Features

3%

Size

3%

Other

9%

What (if anything) do you DISLIKE about your

smart thermostat?

37

Smart Thermostats and Demographics

• Smart Thermostat Owners:

– Men were twice as likely as women to own

– Younger people, wealthier people, and Caucasians were all more

likely to own

– People in urban as opposed to rural or suburban locales were

more likely to own

• In stand alone homes:

– renters were disproportionately less likely to own

– home owners disproportionately more likely to own

• Apartment dwellers (renters or homeowners):

– significantly less likely to own smart thermostats

• Smart thermostat owners did not differ from non-owners

in terms of how long they expect to stay in their homes

– counterintuitively, found a marginally significant correlation (p =

0.06) that people who own smart thermostats actually expect to

stay a shorter time in their home.

38

Smart Thermostat Owner Actions and

Attitudes

• Smart thermostat owners did not perceive more smart home benefits

than those without smart thermostats

– No significant difference in the appeal of comfort-related benefits for owners or

non-owners

– Owners found all other smart products more appealing

– Owners were more likely to own other smart devices

– Owners are significantly more likely to also own solar panels and/or electric

vehicles

• 51% of smart thermostat owners also owned solar panels.

• Smart thermostat owners have significantly weaker personal norms, and

significantly stronger social norms about conservation

– Perhaps owners employ “moral licensing,”

• the action of owning one type of “green” technology makes someone think that their neighbors

are trying to conserve and that their community expect them to conserve

– Owner weaker personal norms suggests owners do not personally feel responsible

for conserving energy, as if they feel they have sufficiently “done their part” for

conservation

– This effect was found to be independent of gender, ethnicity, age, and income

39

Miscellaneous Findings and Questions

• A preliminary area for further exploration was the

urban/suburban/rural ownership divide

– Hypothesized that urban households may own more smart thermostats

due to a higher exposure to media, but found urban, suburban, and rural

households do not significantly differ in terms of learning about smart

technology from media

• All reported a high level of learning about smart technology from the media.

• When controlled for personal and social norms:

– Found that most of the urban dominance of owning smart thermostats

over the suburbs disappeared; the difference between urban and rural

homes persisted but was drastically reduced

– Suggests attitudes towards energy use, particularly, personal and social

norms regarding conservation, explain the urban/suburban/rural divide of

smart thermostat ownership.

– People in urban areas were found to hold weaker personal and stronger

social norms for conservation, both of which were associated with greater

smart thermostat ownership.

40

Barriers and Opportunities for Wider

Smart Thermostat Adoption in New York

41

Barriers to Widespread Adoption

“Difficult setup, poor interoperability, difficulty in

support, lack of strong value proposition to consumers,

and lack of ability to control and deploy the systems by

the service provider”

-Stakeholder interview

42

Barriers Ranking for Contractors

0

10

20

30

40

50

60

70

80

90

Customers are not aware

Too expensive

The devices/systems don't

work well together

(interoperability)

Value proposition is

unclear--don't seem worth

it

Security risks

Data sharing

Devices are not easy to use

Number of Responses

Please rate the significance of the following barriers to smart home adoption.

Very

significant

Somewhat

significant

Not

significant

Not sure

43

Analyzed Barriers

• Demonstrated Savings:

– Range of savings demonstrated from pilot efforts

• High Cost:

– Difficult sell to consumers who don’t see full value

– Price prohibitive for a large segment of the population

• Consumer Interest & Engagement in Energy Savings:

– While popular relative to the rest of the HEMS ecosystem, most

consumers are not engaging with smart devices from a primarily

energy savings perspective

– Adoption alone may not be enough to drive energy savings;

consumers need further engagement with their smart thermostats to

yield significant savings

• Data Sharing:

– Utilities and program administrators are concerned about liability and

data validation

– Industry is concerned about reputation and customer protection

44

Analyzed Barriers Cont.

• Interoperability

– customer confusion from multiple platforms, apps, and brands, which

may be challenging for persistence. Some popular platforms are

emerging to work with multiple systems and help improve this.

– For smart thermostats, companies continue to build partnerships with

other platforms; the challenge of interoperability seems to be

diminishing

• Singular Focus on Products not Systems:

– Concerns arose about a “singular focus” on one smart home product

offering, in most cases the smart thermostat, and the potential for this

siloed perspective to affect engagement with the energy management

systems

– Perhaps shifting program administrators role to be “unbiased advisor

and integrator…where customers can shop for a plumber, shop for

solar, get an EV charging station installed, or get a connected home set

up….a holistic solution to needs that customers would have in their

homes”

45

Analyzed Barriers (Cont.)

• Customer awareness:

– While customers are more aware of smart thermostats than they are

of other smart home products, general awareness is quite low

– Results from NY customer survey:

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

The concept of

“smart home”

Smart appliance Smart lights Smart thermostats Smart plugs

How familiar are you with the following?

Not at all

A little

Somewhat

Very

46

Opportunities

• Smart Thermostats can serve as Gateway product to the

smart home

:

– Smart thermostats could act as a gateway product to catalyze

consumer awareness and adoption of products across the larger

smart home ecosystem

• Demand Side Management:

– Because of the control functionalities smart thermostats

provide for both consumers and third parties, there is significant

demand response potential

• New Opportunities for Measurement and Verification:

– Smart thermostats have the potential to provide new ways of

measuring and verifying the actual savings data of households

– Analysis of the data stream is an opportunity to understand the

actual control behavior of the smart thermostat

47

Interventions, Recommendations, and

Potential Impact

48

Interventions and Recommendations

• Consumer Education and awareness:

– This report found gaps in consumer education and awareness of smart

thermostats.

– According to industry stakeholders, the desire to align educational

efforts exists

– Opportunities to capitalize on the various sources of awareness for

smart home technologies, particularly media

• Home Performance Network as Smart Thermostat

Ambassadors:

– Opportunity to partner and push home performance contractors to

bring smart thermostat technology to customers

– Contractor education is necessary first step to ensure that they

understand the benefits of smart thermostats and are willing to

support them

– Through contractor outreach and training, smart thermostat could

become another tool, along with air sealing, insulation, windows, and

more, in the home performance upgrade package

49

Interventions and Recommendations Cont.

• Efficiency Program activity:

– In addition to the other recommendations listed here, rebates and incentives were

the most commonly cited pathway for engaging customers

– Bring-Your-Own-Thermostat programs, were a popular recommendation among

surveyed stakeholders, as it combines customer choice with access to utility

programs

– BYOT minimizes some of the risk of product selection before the ENERGY STAR

Connected Thermostat specification is complete, however once that specification

is final, promoting products that meet the ENERGY STAR recognition is

recommended.

• Bundling and Partnerships:

– Opportunity to bundle products and services together to ease customers into the

market while educating and engaging them in a broader range of energy

management products

– Potential to design behavior based incentives, or “gamification,” to regularly

engage customers with their energy usage as well as drive more sustainable

behavioral changes

– Because many smart home players are new to the efficiency space, there are

opportunities to create unique partnerships to inform and drive the market,

especially with less-traditional stakeholders such as the home security and

telecommunications providers, who are not as focusing on the energy benefits of

smart thermostats, but are a significant player in the market

50

Interventions and Recommendations (Cont.)

• Targeting consumers:

– The customer survey found strong correlations on ownership of

smart thermostats, particularly that urbanites and men were

much more likely to own a smart thermostat than suburbanites

or women

– Armed with that information, smart thermostat education and

promotion should evolve beyond blanket marketing

• Evaluation of Smart Thermostats:

– ENERGY STAR’s work is promising in terms of addressing

measurement, verification, and standardization obstacles

– NYSERDA has the opportunity, through a market transformation

lens, to bring new methods for evaluation of smart thermostat

savings to the fore, as outlined in NEEP’s 2016 Smart Energy

Home Report

– This could have impacts for both how New York claims savings,

as well as implications for the entire country’s evaluation

framework

51

Tracking Success

• Key data sources to track:

– Sales, measured through manufacturer or retailer provided

data when available, (or shipping data through ENERGY

STAR once Connected Thermostats specification is final)

– Penetration, measured through on-site evaluations,

provided from retailers, customer surveys

– Resident awareness, tracked through surveys, media hits,

social media

– Contractor awareness, tracked through surveys, inclusion

in conference agendas, media

52

Conclusion

53

Concluding Thoughts

• Penetration of smart thermostats in New York between

13% and 17%

– over 80% of New York homes do not have a smart thermostat

• Energy savings potential for both heating and

increasingly for cooling in across NY is incredible

– Potential savings of over 217 million kWh for cooling

– 63 Million mmBtus equivalent for heating

• Many opportunity for intervention

– target consumers, partner with contractors, build partnerships,

education, engaging consumers

• Report findings can be extrapolated beyond New York

54