2017 Trade Policy Agenda

and

2016 Annual Report

of the President of the United States

on

the Trade Agreements Program

Office of the United States Trade Representative

FOREWORD

The 2017 Trade Policy Agenda and 2016 Annual Report of the President of the United States on the Trade

Agreements Program are submitted to the Congress pursuant to Section 163 of the Trade Act of 1974, as

amended (19 U.S.C. 2213). Chapter II and Annex II of this document meet the requirements of Sections

122 and 124 of the Uruguay Round Agreements Act with respect to the World Trade Organization. In

addition, the report also includes an annex listing trade agreements entered into by the United States since

1984. Goods trade data are for full year 2016. Services data by country are only available through 2015.

The Office of the United States Trade Representative (USTR) is responsible for the preparation of this

report and gratefully acknowledges the contributions of all USTR staff to the writing and production of this

report and notes, in particular, the contributions of Dorothea E. Cheek, Caper Gooden, Mark C. Jordan, and

Katherine Standbridge. Thanks are extended to partner Executive Branch agencies, including the

Environmental Protection Agency and the Departments of Agriculture, Commerce, Health and Human

Services, Justice, Labor, State, and Treasury.

March 2017

LIST OF FREQUENTLY USED ACRONYMS

AD ................................................................................... Antidumping

AGOA ............................................................................. African Growth and Opportunity Act

APEC .............................................................................. Asia Pacific Economic Cooperation

ASEAN ........................................................................... Association of Southeast Asian Nations

ATC ................................................................................ Agreement on Textiles and Clothing

ATPA .............................................................................. Andean Trade Preferences Act

ATPDEA ......................................................................... Andean Trade Promotion & Drug Eradication

Act

BIA .................................................................................. Built-In Agenda

BIT .................................................................................. Bilateral Investment Treaty

BOP ................................................................................. Balance of Payments

CACM ............................................................................. Central American Common Market

CAFTA ........................................................................... Central American Free Trade Area

CARICOM ...................................................................... Caribbean Common Market

CBERA ........................................................................... Caribbean Basin Economic Recovery Act

CBI .................................................................................. Caribbean Basin Initiative

CFTA .............................................................................. Canada Free Trade Agreement

CITEL ............................................................................. Telecommunications division of the OAS

COMESA ........................................................................ Common Market for Eastern & Southern Africa

CTE ................................................................................. Committee on Trade and the Environment

CTG ................................................................................ Council for Trade in Goods

CVD ................................................................................ Countervailing Duty

DDA ................................................................................ Doha Development Agenda

DOL ................................................................................ Department of Labor

DSB ................................................................................. Dispute Settlement Body

EAI .................................................................................. Enterprise for ASEAN Initiative

DSU ................................................................................ Dispute Settlement Understanding

EU ................................................................................... European Union

EFTA .............................................................................. European Free Trade Association

FTAA .............................................................................. Free Trade Area of the Americas

FOIA .............................................................................. Freedom of Information Act

GATT .............................................................................. General Agreement on Tariffs and Trade

GATS .............................................................................. General Agreements on Trade in Services

GDP ................................................................................ Gross Domestic Product

GEC ................................................................................ Global Electronic Commerce

GSP ................................................................................. Generalized System of Preferences

GPA ................................................................................ Government Procurement Agreement

IFI .................................................................................... International Financial Institution

IPR .................................................................................. Intellectual Property Rights

ITA .................................................................................. Information Technology Agreement

LDBDC ........................................................................... Least-Developed Beneficiary Developing

Country

MAI ................................................................................. Multilateral Agreement on Investment

MEFTA ........................................................................... Middle East Free Trade Area

MERCOSUL/MERCOSUR ............................................ Southern Common Market

MFA ................................................................................ Multifiber Arrangement

MFN ................................................................................ Most Favored Nation

MOSS .............................................................................. Market-Oriented, Sector-Selective

MOU ............................................................................... Memorandum of Understanding

MRA ............................................................................... Mutual Recognition Agreement

NAFTA ........................................................................... North American Free Trade Agreement

NEC ................................................................................ National Economic Council

NIS .................................................................................. Newly Independent States

NSC ................................................................................. National Security Council

NTR ................................................................................ Normal Trade Relations

OAS ................................................................................ Organization of American States

OECD .............................................................................. Organization for Economic Cooperation and

Development

OPIC ............................................................................... Overseas Private Investment Corporation

PNTR .............................................................................. Permanent Normal Trade Relations

ROU ................................................................................ Record of Understanding

SACU .............................................................................. Southern African Customs Union

SADC .............................................................................. Southern African Development Community

SME ................................................................................ Small and Medium Size Enterprise

SPS .................................................................................. Sanitary and Phytosanitary Measures

SRM ............................................................................... Specified Risk Material

TAA ................................................................................ Trade Adjustment Assistance

TABD .............................................................................. Trans-Atlantic Business Dialogue

TACD .............................................................................. Trans-Atlantic Consumer Dialogue

TAEVD ........................................................................... Trans-Atlantic Environment Dialogue

TALD .............................................................................. Trans-Atlantic Labor Dialogue

TBT ................................................................................. Technical Barriers to Trade

TEP ................................................................................. Transatlantic Economic Partnership

TIFA ................................................................................ Trade & Investment Framework Agreement

TPRG .............................................................................. Trade Policy Review Group

TPP .................................................................................. Trans-Pacific Partnership

TPSC ............................................................................... Trade Policy Staff Committee

TRIMS ............................................................................ Trade Related Investment Measures

TRIPS .............................................................................. Trade Related Intellectual Property Rights

T-TIP ............................................................................... Trans-Atlantic Trade and Investment Partnership

UAE ................................................................................ United Arab Emirates

UNCTAD ........................................................................ United Nations Conference on Trade &

Development

UNDP .............................................................................. United Nations Development Program

URAA ............................................................................. Uruguay Round Agreements Act

USDA .............................................................................. U.S. Department of Agriculture

USITC ............................................................................. U.S. International Trade Commission

USTR .............................................................................. United States Trade Representative

VRA ............................................................................... Voluntary Restraint Agreement

WAEMU ........................................................................ West African Economic & Monetary Union

WB ................................................................................. World Bank

WTO .............................................................................. World Trade Organization

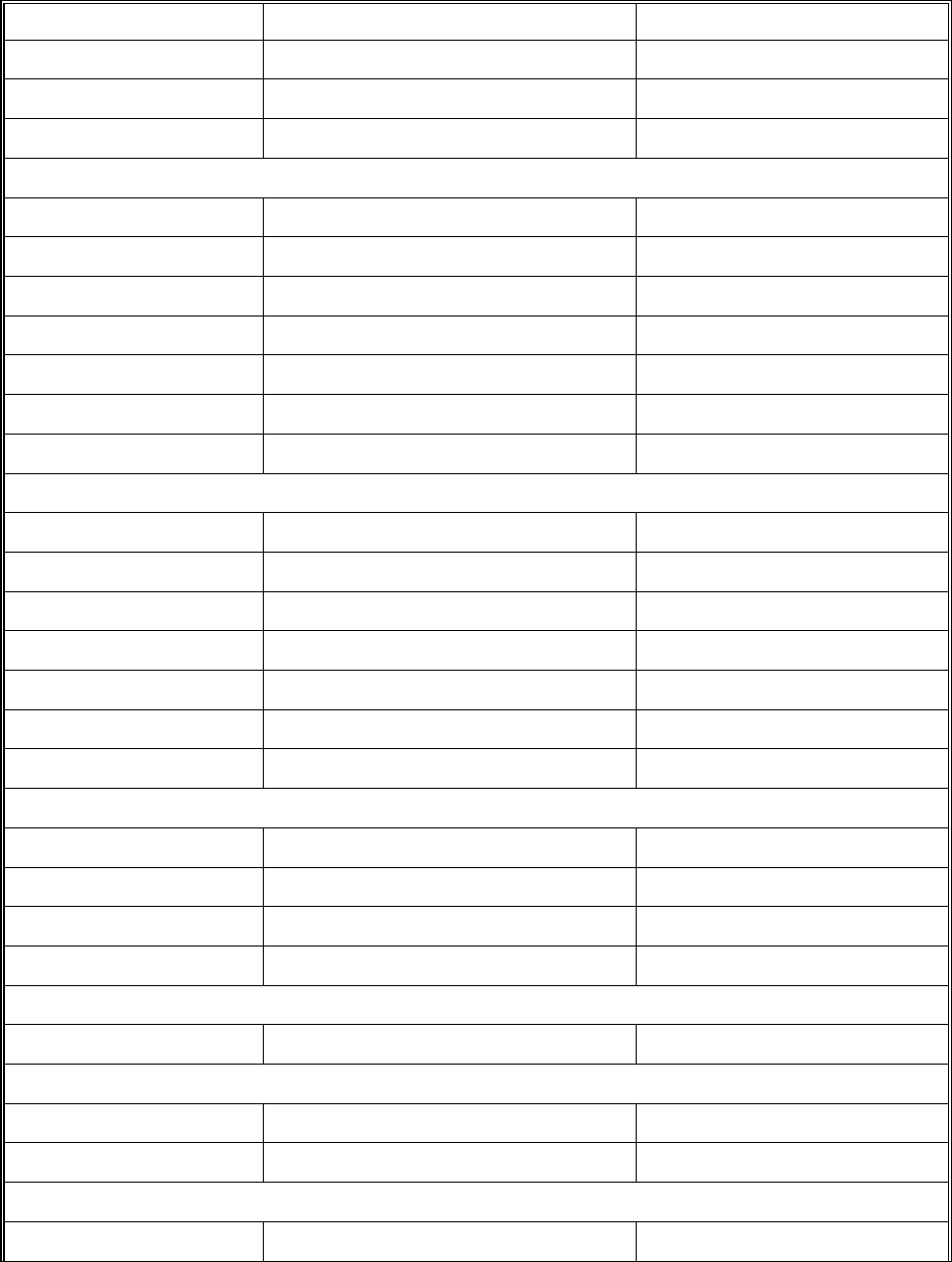

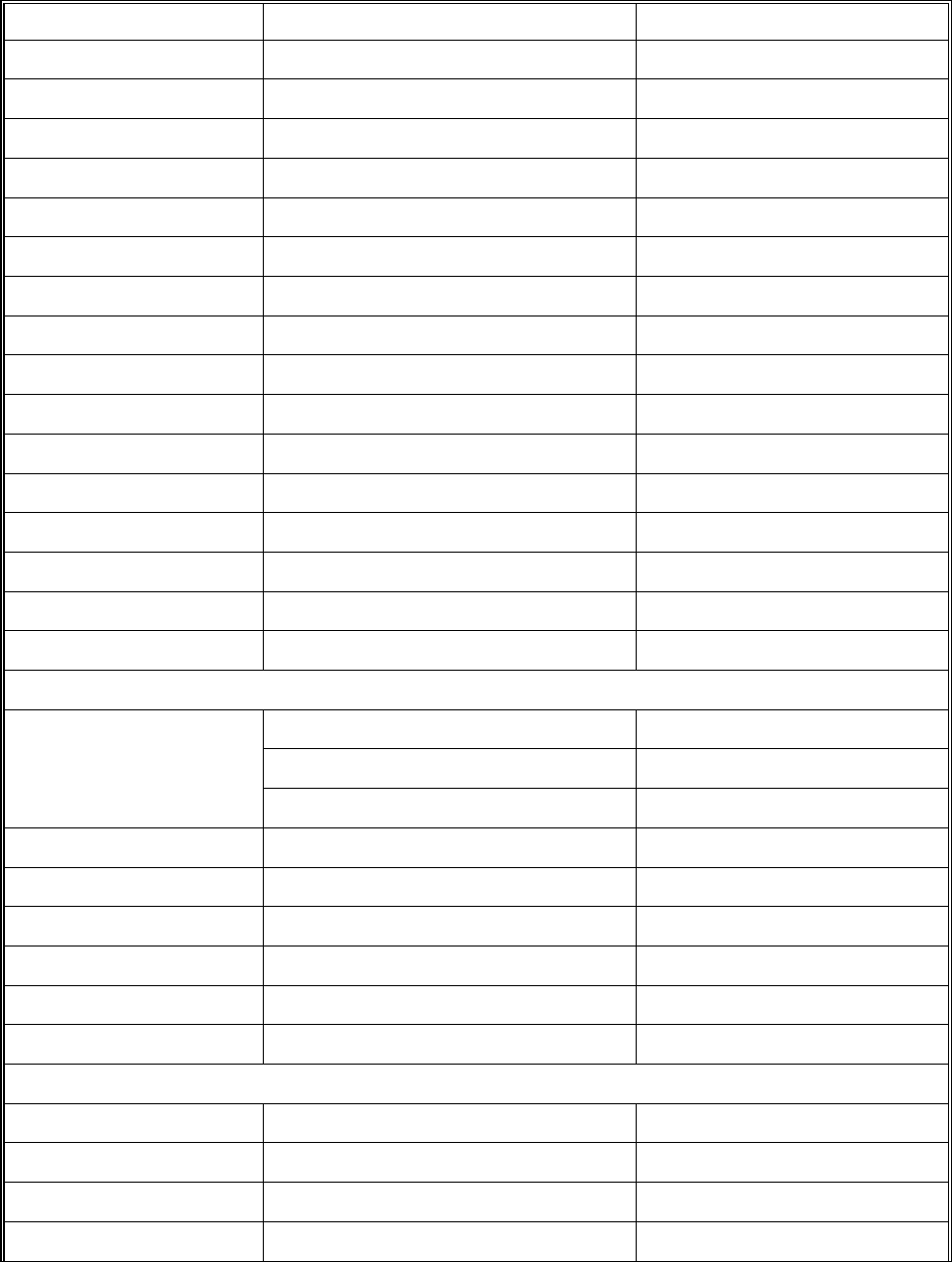

TABLE OF CONTENTS

I. THE PRESIDENT’S TRADE POLICY AGENDA ..................................................................................... 1

II. THE WORLD TRADE ORGANIZATION ............................................................................................... 1

A. INTRODUCTION ................................................................................................................................... 1

B. WTO NEGOTIATING GROUPS ............................................................................................................. 2

1. Committee on Agriculture Special Session .............................................................................................. 2

2. Council for Trade in Services Special Session......................................................................................... 3

3. Negotiating Group on Non-Agricultural Market Access........................................................................... 4

4. Negotiating Group on Rules .................................................................................................................. 4

5. Preparatory Committee on Trade Facilitation ........................................................................................ 6

6. Dispute Settlement Body Special Session ............................................................................................... 7

7. Council for Trade-Related Aspects of Intellectual Property Rights Special Session ................................... 8

8. Committee on Trade and Development Special Session .......................................................................... 9

C. WORK PROGRAMS ESTABLISHED IN THE DOHA DEVELOPMENT AGENDA ............................... 11

1. Working Group on Trade, Debt, and Finance ....................................................................................... 11

2. Working Group on Trade and Transfer of Technology........................................................................... 11

3. Work Program on Electronic Commerce .............................................................................................. 12

D. GENERAL COUNCIL ACTIVITIES ..................................................................................................... 13

E. COUNCIL FOR TRADE IN GOODS ..................................................................................................... 14

1. Committee on Agriculture ................................................................................................................... 15

2. Committee on Market Access .............................................................................................................. 16

3. Committee on the Application of Sanitary and Phytosanitary Measures .................................................. 18

4. Committee on Trade-Related Investment Measures ............................................................................... 20

5. Committee on Subsidies and Countervailing Measures .......................................................................... 21

6. Committee on Customs Valuation ........................................................................................................ 26

7. Committee on Rules of Origin ............................................................................................................. 28

8. Committee on Technical Barriers to Trade ........................................................................................... 29

9. Committee on Antidumping Practices .................................................................................................. 33

10. Committee on Import Licensing ......................................................................................................... 36

11. Committee on Safeguards ................................................................................................................. 37

12. Working Party on State Trading Enterprises ....................................................................................... 40

F. COUNCIL ON TRADE-RELATED ASPECTS OF INTELLECTUAL PROPERTY RIGHTS .................... 41

G. COUNCIL FOR TRADE IN SERVICES ................................................................................................ 45

1. Committee on Trade in Financial Services ........................................................................................... 45

2. Working Party on Domestic Regulation ............................................................................................... 46

3. Working Party on GATS Rules ............................................................................................................ 47

4. Committee on Specific Commitments ................................................................................................... 47

H. DISPUTE SETTLEMENT UNDERSTANDING ..................................................................................... 47

I. TRADE POLICY REVIEW BODY ......................................................................................................... 95

J. OTHER GENERAL COUNCIL BODIES/ACTIVITIES ........................................................................... 97

1. Committee on Trade and Environment ................................................................................................. 97

2. Committee on Trade and Development ................................................................................................. 98

4. Committee on Budget, Finance and Administration ............................................................................. 101

5. Committee on Regional Trade Agreements ......................................................................................... 102

6. Accessions to the World Trade Organization ...................................................................................... 103

K. PLURILATERAL AGREEMENTS ...................................................................................................... 106

1. Committee on Trade in Civil Aircraft ................................................................................................. 106

2. Committee on Government Procurement ............................................................................................ 108

3. The Information Technology Agreement and the Expansion of Trade in Information Technology Products

.......................................................................................................................................................... 111

III. BILATERAL AND REGIONAL NEGOTIATIONS AND AGREEMENTS ......................................... 115

A. FREE TRADE AGREEMENTS ........................................................................................................... 115

1. Australia ......................................................................................................................................... 115

2. Bahrain ........................................................................................................................................... 115

3. Central America and the Dominican Republic .................................................................................... 116

4. Chile ............................................................................................................................................... 120

5. Colombia ........................................................................................................................................ 121

6. Israel .............................................................................................................................................. 123

7. Jordan ............................................................................................................................................ 124

8. Republic of Korea ............................................................................................................................ 125

9. Morocco .......................................................................................................................................... 127

10. North American Free Trade Agreement ............................................................................................ 128

11. Oman ............................................................................................................................................ 129

12. Panama ......................................................................................................................................... 130

13. Peru .............................................................................................................................................. 131

14. Singapore ..................................................................................................................................... 133

B. OTHER BILATERAL AND REGIONAL INITIATIVES ....................................................................... 133

1. The Americas ................................................................................................................................... 133

2. Europe and the Middle East .............................................................................................................. 136

3. Japan, Republic of Korea, and the Asia-Pacific Economic Cooperation Forum ..................................... 138

4. China, Hong Kong, Taiwan, and Mongolia ........................................................................................ 141

5. Southeast Asia and the Pacific .......................................................................................................... 142

6. Sub-Saharan Africa .......................................................................................................................... 144

7. South and Central Asia ..................................................................................................................... 145

IV. OTHER TRADE ACTIVITIES ............................................................................................................ 149

A. TRADE AND THE ENVIRONMENT .................................................................................................. 149

1. Multilateral and Regional Fora ......................................................................................................... 149

2. Bilateral and Regional Activities ....................................................................................................... 151

B. TRADE AND LABOR ........................................................................................................................ 156

1. Bilateral Agreements and Preference Programs ................................................................................. 157

2. Multilateral and Regional Fora ......................................................................................................... 161

C. SMALL AND MEDIUM SIZE BUSINESS INITIATIVE ...................................................................... 161

1. USTR SME-Related Trade Policy Activities ........................................................................................ 161

2. USTR Interagency SME Activities...................................................................................................... 162

3. USTR’s SME Outreach and Consultations.......................................................................................... 163

D. ORGANIZATION FOR ECONOMIC COOPERATION AND DEVELOPMENT ................................... 163

1. Trade Committee Work Program ....................................................................................................... 164

2. Trade Committee Dialogue with Non-OECD Members........................................................................ 164

3. Other OECD Work Related to Trade ................................................................................................. 165

E. LOCALIZATION BARRIERS TO TRADE .......................................................................................... 165

F. TRADE IN SERVICES AGREEMENT ................................................................................................. 166

V. TRADE ENFORCEMENT ACTIVITIES .............................................................................................. 167

A. ENFORCING U.S. TRADE AGREEMENTS ........................................................................................ 167

1. Overview ......................................................................................................................................... 167

2. WTO Dispute Settlement ................................................................................................................... 170

3. Other Monitoring and Enforcement Activities ..................................................................................... 171

4. Monitoring Foreign Standards-related Measures and SPS Barriers ..................................................... 173

B. U.S. TRADE LAWS ............................................................................................................................ 174

1. Section 301 ...................................................................................................................................... 174

2. Special 301 ...................................................................................................................................... 176

3. Section 1377 Review of Telecommunications Agreements .................................................................... 179

4. Antidumping Actions ........................................................................................................................ 179

5. Countervailing Duty Actions ............................................................................................................. 180

6. Other Import Practices ..................................................................................................................... 180

7. Trade Adjustment Assistance ............................................................................................................. 182

8. United States Preference Programs ................................................................................................... 183

VI. TRADE POLICY DEVELOPMENT .................................................................................................... 191

A. TRADE CAPACITY BUILDING ......................................................................................................... 191

1. The Enhanced Integrated Framework ................................................................................................ 191

2. U.S. Trade-Related Assistance under the World Trade Organization Framework .................................. 191

3. TCB Initiatives for Africa .................................................................................................................. 192

4. Free Trade Agreements .................................................................................................................... 193

5. Standards Alliance ........................................................................................................................... 194

B. PUBLIC INPUT AND TRANSPARENCY ........................................................................................... 195

1. Transparency Guidelines and Chief Transparency Officer .................................................................. 195

2. Public Outreach ............................................................................................................................... 196

3. The Trade Advisory Committee System .............................................................................................. 197

3. State and Local Government Relations ............................................................................................... 200

C. POLICY COORDINATION AND FREEDOM OF INFORMATION ACT .............................................. 201

ANNEX I

ANNEX II

ANNEX III

THE PRESIDENT’S 2017 TRADE POLICY

AGENDA

I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA | 1

I. THE PRESIDENT’S TRADE POLICY AGENDA

I. INTRODUCTION

Pursuant to 19 U.S.C. § 2213(a)(1)(B), we hereby submit the President’s National Trade Policy Agenda

for 2017. This submission is normally prepared under the direction of the United States Trade

Representative (USTR). In fact, U.S. law provides that the USTR shall have “primary responsibility for

developing” United States international trade policy. 19 U.S.C. § 2171(c)(1)(A). U.S. law also provides

that the USTR shall “act as the principal spokesman of the President on international trade.” 19 U.S.C. §

2171(c)(1)(E). Accordingly, we intend to submit a more detailed report on the President’s Trade Policy

Agenda after the Senate has confirmed a USTR, and that USTR has had a full opportunity to participate in

developing such a report. In the meantime, and in order to comply with the statutory deadline of March 1,

see 19 U.S.C. § 2213(a), we hereby submit this statement of the trade policy agenda for 2017.

1

II. THE TRADE POLICY OBJECTIVES AND PRIORITIES OF THE UNITED STATES

FOR 2017, AND REASONS THEREFOR

A. Key Principles and Objectives of the Trump Administration’s Trade Policy

In 2016, voters in both major parties called for a fundamental change in direction of U.S. trade

policy. The American people grew frustrated with our prior trade policy not because they have ceased to

believe in free trade and open markets, but because they did not all see clear benefits from international

trade agreements. President Trump has called for a new approach, and the Trump Administration will

deliver on that promise.

The overarching purpose of our trade policy – the guiding principle behind all of our actions in this

key area – will be to expand trade in a way that is freer and fairer for all Americans. Every action we take

with respect to trade will be designed to increase our economic growth, promote job creation in the United

States, promote reciprocity with our trading partners, strengthen our manufacturing base and our ability to

defend ourselves, and expand our agricultural and services industry exports. As a general matter, we believe

that these goals can be best accomplished by focusing on bilateral negotiations rather than multilateral

negotiations – and by renegotiating and revising trade agreements when our goals are not being met.

Finally, we reject the notion that the United States should, for putative geopolitical advantage, turn a blind

eye to unfair trade practices that disadvantage American workers, farmers, ranchers, and businesses in

global markets.

In addition to these basic principles, we will focus on the following key objectives:

Ensuring that U.S. workers and businesses have a fair opportunity to compete for business – both

in the domestic U.S. market and in other key markets around the world.

Breaking down unfair trade barriers in other markets that block U.S. exports, including exports of

agricultural goods.

Maintaining a balanced policy that looks out for the interests of all segments of the U.S. economy,

including manufacturing, agriculture, and services, as well as small businesses and entrepreneurs.

1

At this time, the Trump Administration is not proposing legislation with respect to the objectives or

priorities outlined in this statement. See 19 U.S.C. § 2213(a)(3)(A)(iii).

2 | I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA

Ensuring that U.S. owners of intellectual property (IP) have a full and fair opportunity to use and

profit from their IP.

Strictly enforcing U.S. trade laws to prevent the U.S. market from being distorted by dumped and/or

subsidized imports that harm domestic industries and workers.

Enforcing labor provisions in existing agreements and enforcing the prohibition against the

importation and sale of goods made with forced labor.

Resisting efforts by other countries – or Members of international bodies like the World Trade

Organization (WTO) – to advance interpretations that would weaken the rights and benefits of, or

increase the obligations under, the various trade agreements to which the United States is a party.

Updating current trade agreements as necessary to reflect changing times and market conditions.

Ensuring that United States trade policy contributes to the economic strength and manufacturing

base necessary to maintain – and improve – our national security.

Strongly advocating for all U.S. workers, farmers, ranchers, services providers, and businesses,

large and small – to assure the fairest possible treatment of American interests in the U.S. market

and in other markets around the world.

B. Top Priorities and Reasons Therefor

To achieve the objectives described above, the Trump Administration has identified four major

priorities: (1) defend U.S. national sovereignty over trade policy; (2) strictly enforce U.S. trade laws; (3)

use all possible sources of leverage to encourage other countries to open their markets to U.S. exports of

goods and services, and provide adequate and effective protection and enforcement of U.S. intellectual

property rights; and (4) negotiate new and better trade deals with countries in key markets around the world.

Each of these priorities – and the reasons they are so important – are discussed in greater detail below.

1. Defending Our National Sovereignty Over Trade Policy

In late 1994, Congress approved the Uruguay Round Agreements Act, thereby paving the way for

the United States’ entry into the WTO. WTO members agreed to provisions to ensure that, if a country lost

a dispute at the WTO and failed to bring its measure into compliance with WTO rules, to provide

compensation, or otherwise to reach a mutually satisfactory solution, the complaining countries would have

the right to be authorized to retaliate by imposing trade sanctions on the losing country.

The anchor for this new dispute settlement system was an agreement known as the Understanding

on Rules and Procedures Governing the Settlement of Disputes, often called the Dispute Settlement

Understanding (DSU). The core provision of the DSU was the express legal requirement that the WTO,

through its dispute settlement findings and recommendations, could not “add to or diminish the rights or

obligations” of the United States, or other countries under the WTO agreements. This requirement was so

critical that it was included not once, but twice in the text of the DSU, once in Article 3 as a specific

direction to the WTO’s Dispute Settlement Body in adopting its recommendations, and once in Article 19

as a specific direction to WTO panels and the Appellate Body in setting out their findings and

recommendations to be adopted by the DSB. The Clinton Administration and Congress both made clear

that this language was essential to winning American support for the DSU.

At the time, the American people were assured that, by the express terms of the DSU itself, this

dispute settlement process would not alter the terms of what the United States had agreed to in the WTO

I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA | 3

Agreements, and what Congress thereafter expressly approved when it passed the Uruguay Round

Agreements Act. In other words, the United States entered into written agreements that contained rules on

a range of matter such as trade-related aspects of intellectual property rights, import licensing, sanitary and

phytosanitary standards, antidumping, technical standards, subsidies and countervailing duties, investment

measures, and safeguards. The United States also entered into the DSU, which contained a clear and express

legal limitation that the WTO dispute settlement process could not add to U.S. obligations or diminish U.S.

rights under those agreements. By insisting on and negotiating the express terms of these agreements, the

United States established clear and firm parameters for the role of the WTO in regulating trade.

Given this history, it is important to recall also that Congress had made clear that Americans are

not directly subject to WTO decisions. The Uruguay Round Agreements Act states that, if a WTO dispute

settlement report “is adverse to the United States, [the U.S. Trade Representative shall] consult with the

appropriate congressional committees concerning whether to implement the report’s recommendation and,

if so, the manner of such implementation and the period of time needed for such implementation,”

confirming that these WTO reports are not binding or self-executing. 19 U.S.C. § 3533(f). The Uruguay

Round Agreements Act also specifically provides that “No provision of any of the Uruguay Round

Agreements, nor the application of any such provision to any person or circumstance, that is inconsistent

with any law of the United States shall have effect.” 19 U.S.C. § 3512(a)(1). In other words, even if a

WTO dispute settlement panel – or the WTO Appellate Body – rules against the United States, such a ruling

does not automatically lead to a change in U.S. law or practice. Consistent with these important protections

and applicable U.S. law, the Trump Administration will aggressively defend American sovereignty over

matters of trade policy.

2. Strictly Enforcing U.S. Trade Laws

For decades, Congress has maintained a series of laws designed to prevent the U.S. market from

being distorted by unfair practices such as injuriously dumped or subsidized imports, or by harmful surges

of imports. These laws have been a critical aspect of the bargain between the U.S. government and

American workers, farmers, ranchers, and businesses (large and small) that has long supported the free and

fair trade system in this country. These laws have also reflected the core principles and legal rights of the

multilateral trading system since its founding in 1947 with the General Agreement on Tariffs and Trade

(GATT). It is notable that Article VI of the GATT in the strongest language possible, states that injurious

dumping “is to be condemned.” Trade remedies are a foundation to the implementation of the WTO

agreements, and to avoid market distortions, and it is critical that WTO members fully recognize their

centrality to the international trading system.

Consistent with the strong textual foundation in the GATT and WTO Agreement, Title VII of the

Tariff Act of 1930 provides the United States with the authority to impose antidumping (AD) and

countervailing duties (CVD) on imports that are either “dumped” (sold at less than their fair value) or

subsidized – if such imports cause or threaten material injury to a domestic industry. The AD/CVD laws

are fully consistent with our WTO obligations – and, indeed, the WTO agreements specifically provide for

such laws. For decades, domestic producers have had the right to file cases seeking AD and/or CVD relief.

The U.S. Department of Commerce also has the right to self-initiate such cases if circumstances warrant.

Other long-standing laws address other situations in which government action may be appropriate.

Under Section 201 of the Trade Act of 1974, the President may impose relief if increasing imports are a

substantial cause of serious injury to a domestic industry. This “safeguard” provision, used most recently

by President George W. Bush in response to a harmful surge of steel imports, can be a vital tool for

industries needing temporary relief from imports to become more competitive. USTR has the authority to

ask for a safeguard investigation in the appropriate circumstances.

Section 301 of the Trade Act of 1974 authorizes the USTR to take appropriate action in response

to foreign actions that violate an international trade agreement or are unjustifiable, or unreasonable or

discriminatory, and burdens or restricts United States commerce. Investigations leading to these important

actions may be initiated pursuant to requests by private U.S. workers and businesses or a determination by

4 | I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA

the USTR. Properly used, section 301 can be a powerful lever to encourage foreign countries to adopt more

market-friendly policies.

The Trump Administration believes that it is essential to both the United States and the world

trading system that all U.S. trade laws be strictly and effectively enforced. We strongly support true market-

based competition – and we welcome the partnership of any country that agrees with us. Unfortunately,

however, large portions of the global economy do not reflect market forces. Important sectors of the global

economy, and significant markets around the world, have been at times distorted by foreign government

subsidies, theft of intellectual property, currency manipulation, unfair competitive behavior by state-owned

enterprises, violations of labor laws, use of forced labor, and numerous other unfair practices.

The Trump Administration will not tolerate unfair trade practices that harm American workers,

farmers, ranchers, services providers, and other businesses large and small. These practices lower living

standards for all Americans by distorting U.S. and global markets and preventing resources from being

allocated in the most efficient manner. These practices distort global efficiencies by preventing developing

or emerging economies from competing against non-market based rivals that drive them from markets

before they can even get a foothold. And, when the WTO adopts interpretations of WTO agreements that

undermine the ability of the United States and other WTO Members to respond effectively to these real-

world unfair trade practices with remedies expressly allowed under WTO rules, those interpretations

undermine confidence in the trading system. None of these outcomes is in the interest of the United States

or a healthy global economy. Accordingly, the Trump Administration will act aggressively as needed to

discourage this type of behavior – and encourage true market competition.

3. Using Leverage to Open Foreign Markets

The Trump Administration believes that U.S. workers, farmers, ranchers, services providers, and

businesses large and small should have a free and fair chance to compete around the world. Such access

benefits the U.S. economy, as Americans would have larger and more competitive markets in which to sell

their goods and services. Indeed, exports – of manufactured goods, agricultural products, and services –

are an important and essential aspect of the U.S. economy. Exports already support millions of high-paying

jobs for American citizens, and the Administration wants to see them grow. At the same time, increased

market access for American goods and services will also help the global economy, as everyone benefits

from a system that rewards hard work and innovation.

Unfortunately, U.S. exports face significant barriers in many markets. The causes of market

obstruction and closure are numerous. In some instances, trading partners maintain high tariffs and other

non-tariff barriers, which block market access to U.S. goods and agricultural exports. In others, foreign

producers can benefit from subsidies that give them an unfair advantage over their U.S. competitors. Other

countries have looked to harm U.S. companies by blocking or unreasonably restricting the flow of digital

data and services, or through theft of trade secrets. In still others, foreign countries can use technical barriers

– such as unnecessary regulations on particular items – to limit competition, including in the services sector.

Concerns have also been raised over currency practices and their impact on the competitiveness of U.S.

goods and services. These are only a few examples of the tactics that can be used to block or impede the

competitiveness of U.S. exporters.

For decades, the U.S. government has engaged in efforts to break down such barriers and open

foreign markets to U.S. competition. The Trump Administration recognizes that such efforts are inherently

difficult, as foreign governments often have strong political reasons to protect certain industries in their

home markets. However, the status quo is unsustainable – for too long Americans have lost business to

other countries, in part because our businesses and workers are not being given a fair opportunity to compete

abroad.

There are at least two fundamental challenges that we must finally address. The first challenge is

that the WTO rules, and those of some bilateral and plurilateral trade agreements, are often written with the

implicit understanding that countries implementing those rules are pursuing free-market principles. In a

world in which there are several important players in the global economy that do not fully adhere to the

I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA | 5

free-market principles in the organization of their economic systems, systematic analysis of such economies

relative to economic principles must become more acute. Furthermore, the drafting, implementation, and

application of trading rules must find ways to adjust.

The second challenge is that WTO rules, and those of bilateral and plurilateral trade agreements,

are often written with the implicit understanding that countries implementing those rules have functional

legal and regulatory systems that are transparent. In practice, transparent systems are critical to the

functioning of trade rules because transparency enables stakeholders and governments to understand the

rules of the road, and prepare effective diplomatic or legal challenges to those rules when they are not in

conformity with international obligations. Once again, the world in which we find ourselves is one in which

there are a number of important players whose legal and regulatory systems are not sufficiently transparent.

These countries make it difficult for the global trading system to hold them accountable. The inability of

the system to hold those countries accountable in turn leads to a loss of confidence in the system.

It is time for a more aggressive approach. The Trump Administration will use all possible leverage

to encourage other countries to give U.S. producers fair, reciprocal access to their markets. The purpose of

this effort is to ensure that more markets are truly open to American goods and services and to enhance,

rather than restrict, global trade and competition. Such a policy will help grow the global economy by

breaking down long-standing trade barriers and promoting increased competition.

4. Negotiating New and Better Trade Deals

Since the late 1980’s, the United States has entered into a wide variety of trade deals, including the

North American Free Trade Agreement, the Uruguay Round Agreements that created the WTO, China’s

2001 Protocol of Accession to the WTO, and a series of trade agreements. Together, these and other

agreements have created a framework for globalization that establishes the rules and conditions that govern

U.S. trade and investment. For years, Americans have been promised that this system would lead to

stronger economic growth and greater opportunities for U.S. workers and businesses. And, in fact, this

system has generated substantial benefits to some American workers, farmers, ranchers, services providers,

and other businesses – particularly in the form of increased export opportunities.

Unfortunately, a review of what has happened since 2000 – the last full year before China joined

the WTO – shows a period of slowed GDP growth, weak employment growth, and sharp net loss of

manufacturing employment in the United States. Many factors contribute to this, notably the financial crisis

of 2008-2009 and the broad impact of automation. But the trade data are striking. Rather than showing

that the results of this system have lived up to expectations, they portray a very different reality:

In 2000, the U.S. trade deficit in manufactured goods was $317 billion. Last year, it was $648

billion – an increase of 100 percent.

Our trade deficit in goods and services with China soared from $81.9 billion in 2000 to almost $334

billion in 2015 (the last year for which such data are available), an increase of more than 300

percent.

Of course, a rising trade deficit may be consistent with a stronger economy. However, that has not

been the experience of the typical American household. In 2000, U.S. real median household

income (in 2015 dollars) was $57,790. In 2015 (the most recent year for which data are available),

it was $56,516. In fact, despite the recovery since the financial crisis, real median household

income in the United States remains lower today than it was 16 years ago.

In January 2000, there were 17,284,000 manufacturing jobs in the United States – a figure roughly

in line with the total number of U.S. manufacturing jobs going back to the early 1980s. In January

6 | I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA

2017, there were only 12,341,000 manufacturing jobs in the United States – a loss of almost 5

million jobs.

In the 16 years before China joined the WTO – from 1984 to 2000 – U.S. industrial production

grew by almost 71 percent. In the period from 2000 to 2016, U.S. industrial production grew by

less than 9 percent.

These are alarming results. They reflect numerous challenges facing U.S. policy other than trade

– and the Trump Administration is committed to taking all possible steps to create a more vibrant, and more

competitive, economy. We intend to work with the Congress to lower taxes, reduce regulations, increase

funding for infrastructure, and take other steps to stimulate U.S. economic growth. At the same time, these

figures indicate that while the current global trading system has been great for China, since the turn of the

century it has not generated the same results for the United States.

There are significant reasons to be concerned with other major agreements as well. For years now,

the United States has run trade deficits in goods with our trading partners in the North American Free Trade

Agreement (NAFTA). In 2016, for example, our combined trade deficit in goods with Canada and Mexico

was more than $74 billion. As long ago as 2008, both Barack Obama and Hillary Clinton called for the

United States to renegotiate NAFTA – and to withdraw from NAFTA if such renegotiations were

unsuccessful.

Further, the largest trade deal implemented during the Obama Administration – our free trade

agreement with South Korea – has coincided with a dramatic increase in our trade deficit with that country.

From 2011 (the last full year before the U.S.-Korea FTA went into effect) to 2016, the total value of U.S.

goods exported to South Korea fell by $1.2 billion. Meanwhile, U.S. imports of goods from South Korea

grew by more than $13 billion. As a result, our trade deficit in goods with South Korea more than doubled.

Needless to say, this is not the outcome the American people expected from that agreement.

Plainly, the time has come for a major review of how we approach trade agreements. For decades

now, the United States has signed one major trade deal after another – and, as shown above, the results have

often not lived up to expectations. The Trump Administration believes in free and fair trade, and we are

looking forward to developing deeper trading relationships with international partners who share that belief.

But, going forward, we will tend to focus on bilateral negotiations, we will hold our trading partners to

higher standards of fairness, and we will not hesitate to use all possible legal measures in response to trading

partners that continue to engage in unfair activities.

III. NEXT STEPS

The Trump Administration has already begun making progress on the objectives and priorities

described above.

2

By withdrawing from the Trans-Pacific Partnership (TPP), the President sent a clear

signal that the United States would take a new approach to trade issues, and paved the way for potential

bilateral talks with the remaining TPP countries. The President has begun his consultations with Congress

on the ways in which future trade agreements can work for all Americans more effectively than they have

in the past. The President has also put together a strong team of officials who are committed to defending

America’s national sovereignty, enforcing U.S. trade laws, and using American leverage to open markets

for our goods and services. We anticipate more activity on all of these fronts in the near future.

2

According to 19 U.S.C. § 2213(a)(3)(A)(iv), the President should report on “the progress that was made

during the preceding year in achieving” the trade policy objectives and priorities discussed above. Since the Trump

Administration did not take office until January 20, 2017, our statement is limited to progress since that date.

I. THE PRESIDENT’S 2017 TRADE POLICY AGENDA | 7

IV. CONCLUSION

For more than 20 years, the United States government has been committed to trade policies that

emphasized multilateral and other agreements designed to promote incremental change in foreign trade

practices, as well as deference to international dispute settlement mechanisms. The hope was that such a

system could obtain better treatment for U.S. workers, farmers, ranchers, and businesses. Instead, we find

that in too many instances, Americans have been put at an unfair disadvantage in global markets. Under

these circumstances, it is time for a new trade policy that defends American sovereignty, enforces U.S.

trade laws, uses American leverage to open markets abroad, and negotiates new trade agreements that are

fairer and more effective both for the United States and for the world trading system, particularly those

countries committed to a market-based economy. The Trump Administration is committed to this policy

to increase the wages of American workers; give our farmers, ranchers, services providers, and agricultural

businesses a better chance to grow their exports; strengthen American competitiveness in both goods and

services; and provide all Americans with a better and fairer chance to improve their standard of living.

2016 ANNUAL REPORT

OF THE

PRESIDENT OF THE UNITED STATES

ON THE

TRADE AGREEMENTS PROGRAM

II. THE WORLD TRADE ORGANIZATION | 1

II. THE WORLD TRADE ORGANIZATION

A. Introduction

This chapter outlines the work of the World Trade Organization (WTO) in 2016 – particularly relating to

implementing the results of the Ninth Ministerial Conference in Bali and Tenth Ministerial Conference in

Nairobi and the work anticipated in 2017. This chapter also details work of WTO Standing Committees

and their subsidiary bodies, provides an overview of the implementation and enforcement of the WTO

Agreement, and discusses accessions of new Members to this rules-based organization. The focus of this

chapter is on actions taken by the Obama Administration during 2016. Going forward, and as discussed in

the President’s Trade Agenda in Chapter I, the Trump Administration will provide more details regarding

its policies with respect to the WTO.

The WTO provides a forum for enforcing U.S. rights under the various WTO agreements to ensure that the

United States receives the full benefits of WTO membership. On a day-to-day basis, the WTO operates

through its more than 20 standing committees (not including numerous additional working groups, working

parties, and negotiating bodies). These groups meet regularly to permit WTO Members to exchange views,

work to resolve questions of Members’ compliance with commitments, and develop initiatives aimed at

systemic improvements.

The Doha Development Agenda (DDA), launched in November 2001, was the ninth round of multilateral

trade negotiations since the end of World War II. At the WTO’s Eighth Ministerial Conference in Geneva,

Switzerland in December 2011, there was a consensus among Ministers that the DDA was at an impasse,

with “significantly different perspectives on possible results.” The agreed summary for the Ministerial

Conference noted that “Members need to more fully explore different negotiating approaches,” and

reiterated previous ministerial guidance that, where progress can be achieved on specific elements of the

DDA, provisional or definitive agreements might be reached before all elements of the negotiating agenda

are fully resolved.

During the course of 2012 and 2013, Members with this guidance worked collectively to complete at the

WTO’s Ninth Ministerial Conference in December 2013 a “Bali Package,” which included, in the form of

the Trade Facilitation Agreement (TFA), the first new multilateral agreement in the nearly 20 year history

of the WTO. The TFA is designed to ensure that all WTO Members apply a variety of trade facilitating

customs and related measures that promise to substantially decrease the costs associated with trading and

increase the value and volume of global trade creating opportunities for U.S. manufacturers, farmers,

workers, and logistics and information firms. The Bali Package also included important results on

agriculture, such as decisions on food security, tariff-rate quota administration, export competition, and

development, including a new Monitoring Mechanism to allow experience based reviews of the

implementation and operation of special and differential treatment provisions in WTO agreements. WTO

Members agreed on November 27, 2014 to three decisions that support the implementation of the Bali

package, one each on the TFA, public stockholding for food security and the post-Bali work program.

At the WTO’s Tenth Ministerial Conference in Nairobi, Kenya, in December 2015, Ministers collectively

acknowledged that there was no consensus to reaffirm the DDA’s mandates. As a result, the WTO initiated

a move away from the DDA architecture, which had proven over time to be imbalanced and unable to keep

up with changing global trading trends, such as the increased role of large emerging economies. Ministers

also agreed in Nairobi to important results on agriculture, particularly a Ministerial Decision to end export

subsidies and discipline other forms of export competition, and on least developed countries. From Nairobi

to the end of 2016, WTO Members exchanged views on how to move ahead with unresolved Doha issues,

2 | II. THE WORLD TRADE ORGANIZATION

even if not under the DDA architecture, and on taking up new issues in the WTO. During the course of

2016, a group of WTO Members announced their intention to advance negotiations on the crucial Doha

issue of fisheries subsidies through efforts to conclude a plurilateral WTO agreement, without prejudice to

continuing initiatives to advance negotiations multilaterally. WTO Members also focused attention on the

new issues of digital trade and the needs of micro-, small-, and medium-sized enterprises (MSMEs).

Members also shared views on how to move forward with pending agriculture issues, and the United States

emphasized the importance of developing updated information on current trade and policies on agricultural

trade before exchanging views on new approaches that might offer prospects for future successful

negotiations.

Beyond WTO negotiations, the United States and other WTO Members in 2016 renewed their focus on the

day-to-day work of the WTO’s standing committees and other bodies. These bodies are supposed to

promote transparency in WTO Members’ trade policies, and they provided a fora for monitoring and

resisting market-distorting pressures. Through discussions in these fora, Members sought detailed

information on individual Members’ trade policy actions and collectively considered them in light of WTO

rules and their impact on individual Members and the trading system as a whole. The discussions enabled

Members to assess their trade-related actions and policies in light of concerns that other Members raised

and to consider and address those concerns in domestic policymaking. The United States also took

advantage of opportunities in standing committees to consider how implementation of existing WTO

provisions can be enhanced and to discuss areas that may hold potential for developing future rules.

B. WTO Negotiating Groups

1. Committee on Agriculture Special Session

Status

WTO Members agreed to initiate negotiations for continuing the agricultural trade reform process one year

before the end of the Uruguay Round implementation period, i.e., by the end of 1999. Talks in the Special

Session of the Committee on Agriculture began in early 2000 under the original mandate of Article 20 of

the Agreement on Agriculture (Agriculture Agreement). At the Fourth WTO Ministerial Conference in

Doha, Qatar in November 2001, the agriculture negotiations became part of the single undertaking, and

negotiations in the Special Session of the Committee on Agriculture were conducted under the mandate

agreed upon at Doha, which called for: “substantial improvements in market access; reductions of, with a

view to phasing out, all forms of export subsidies; and substantial reductions in trade-distorting domestic

support.” This mandate, which called for ambitious results in three areas (so called “pillars), was

augmented with specific provisions for agriculture in the framework agreed by the General Council on

August 1, 2004, and at the Hong Kong Ministerial Conference in December 2005. However, at the WTO’s

Tenth Ministerial Conference in Nairobi, Kenya in December 2015, Members acknowledged in the

Ministerial Declaration that there was no consensus to reaffirm Doha mandates. Since then, Members have

been reflecting on what is next for the agriculture negotiations in the WTO. The Nairobi Ministerial

package included a new decision adopted by WTO Ministers related to export competition, in which

Members agreed to the elimination of all forms of export subsidies, as well as new disciplines on export

financing and international food aid. The package also included decisions on public stockholding for food

security purposes, which Members reaffirmed their commitment to negotiate, and a special safeguard

mechanism, which Members agreed to continue to negotiate as part of a broader market access package.

II. THE WORLD TRADE ORGANIZATION | 3

Major Issues in 2016

In 2016, the United States led the effort to approach the agriculture negotiations with a focus on new

approaches to the three pillars (market access, domestic support, and export competition). There has been

an effort to increase transparency with respect to which trade distortions are the most prevalent in today’s

global agricultural trade, and what approaches countries might realistically use to work together to address

these trade distorting measures. The Chairs of the Agriculture Negotiations held negotiations in formal and

informal settings to assess Members’ views on substantive issues on the agriculture negotiations. The

United States continued to urge Members to approach the overall agriculture negotiations on the basis of a

realistic assessment of possibilities for progress. Throughout 2016, U.S. negotiators undertook discussions

at various levels (technical and political) and in various formats (bilateral and small group) to determine

Members’ views on new approaches and look for ways to move the negotiations forward, in line with U.S.

interests and priorities.

Prospects for 2017

A major focus in 2017 will be discussions about the future direction of multilateral agricultural

liberalization in the lead up to the WTO’s Eleventh Ministerial Conference in Buenos Aires, Argentina at

the end of the year, drawing on lessons learned from the Doha negotiations and new developments in and

approaches to international agricultural trade since the Nairobi Ministerial.

2. Council for Trade in Services Special Session

Status

The Special Session of the Council for Trade in Services (CTS-SS) was formed in 2000 pursuant to the

Uruguay Round mandate of the General Agreement on Trade in Services (GATS) to undertake new multi-

sectoral services negotiations. The Doha Declaration of November 2001 recognized the work already

undertaken in the services negotiations and set deadlines for initial market access requests and offers. The

services negotiations thus became one of the core market access pillars of the Doha Round, along with

agriculture and nonagricultural goods. However, at the WTO’s Tenth Ministerial Conference in Nairobi,

Kenya in December 2015, Members acknowledged in the Ministerial Declaration that there was no

consensus to reaffirm Doha mandates. Since then, Members have been reflecting on what is next for the

services negotiations in the WTO.

Major Issues in 2016

The CTS-SS met on a few occasions during 2016 to consider possibilities for advancing negotiations on

services. No viable options were identified.

Prospects for 2017

The United States will continue to pursue new ideas and approaches to promote free and fair trade in

services.

4 | II. THE WORLD TRADE ORGANIZATION

3. Negotiating Group on Non-Agricultural Market Access

Status

The U.S. Government’s longstanding objective in WTO Non-Agricultural Market Access (NAMA)

negotiations – which cover manufactures, mining, fuels, and fish products – has been to obtain a balanced

market access package that provides new export opportunities for U.S. businesses through the liberalization

of global tariffs and non-tariff barriers. Trade in industrial goods accounts for more than 90 percent of

world merchandise trade

3

and more than 90 percent of total U.S. goods exports. Meanwhile, 52 percent of

developing economies countries' merchandise exports went to other "developing economies" in 2015 - up

from 41 percent in 2005. So at least for merchandise trade as a whole, developing economies now buy the

majority of developing economy exports.

4

Therefore, there is a substantial interest in improving market

access conditions among developing countries, which also results in greater market access for U.S.

business. Yet, many emerging economies still charge very high tariffs on imported industrial goods, with

ceiling tariff rates exceeding 150 percent in some cases.

The NAMA negotiations have remained at an impasse since the WTO’s Eighth Ministerial Conference in

Geneva in 2011. Without significant market-opening commitments from advanced developing economies,

it is clear that there is little prospect for achieving robust trade liberalization for industrial goods on a

multilateral basis. This reality contributed to the result at the WTO’s Tenth Ministerial Conference in

Nairobi, Kenya in December 2015, when Members acknowledged in the Ministerial Declaration that there

was no consensus to reaffirm the Doha mandates.

Major Issues in 2016

There were a few informal meetings of the Negotiating Group on Market Access in 2016 but no new

substantive discussions occurred related to either the tariff or nontariff elements of the NAMA negotiations.

Prospects for 2017

In 2017, the United States intends to work with other WTO Members to pursue fresh and credible

approaches to meaningful multilateral trade liberalization.

4. Negotiating Group on Rules

Status

At the Doha Ministerial Conference in 2001, Ministers agreed to negotiations aimed at clarifying and

improving disciplines under the Agreement on Implementation of Article VI of the GATT 1994 (the

Antidumping Agreement) and the Agreement on Subsidies and Countervailing Measures (the SCM

Agreement), while preserving the basic concepts, principles, and effectiveness of these Agreements and

their instruments and objectives. Ministers directed that the negotiations take into account the needs of

developing and least developed country Members. The Doha Round mandate also called for clarified and

improved WTO disciplines on fisheries subsidies.

The Negotiating Group on Rules (the Rules Group) has based its work primarily on written submissions

from Members, organizing its work in the following categories: (1) the antidumping remedy, often

3

WTO, International Trade Statistics 2016.

4

WTO World Trade Statistical Review 2016

II. THE WORLD TRADE ORGANIZATION | 5

including procedural and domestic industry injury issues potentially applicable to the countervailing duty

remedy; (2) subsidies and the countervailing duty remedy, including fisheries subsidies; and (3) regional

trade agreements (RTAs). Over the past years, Members have considered draft texts for antidumping,

subsidies, including disciplines on fisheries subsidies, and countervailing measures, yet no consensus was

reached. The most recent Chairman’s report was issued in 2011.

5

The Doha Declaration also directed the Rules Group to clarify and improve disciplines and procedures

governing RTAs under the existing WTO provisions. To that end, the General Council in December 2006

adopted a decision for the provisional application of the “Transparency Mechanism for Regional Trade

Agreements” to improve the transparency of RTAs. A total of 238 RTAs have been considered under the

Transparency Mechanism since then. Pursuant to its mandate, in the past, the Rules Group has explored

the establishment of further standards governing the relationship of RTAs to the global trading system.

However, such discussions failed to produce common ground on how to clarify or improve existing RTA

rules and have not been further pursued in the Rules Group.

Major Issues in 2016

The Rules Group met informally in March, May, June, November, and December 2016. The purpose of

the March and May meetings was largely to provide an opportunity for the Chair to provide transparency

reporting regarding his consultations with Members on the way-forward for the Rules Group following the

WTO Ministerial Conference in December 2015 (MC10), where no agreement was reached among

Ministers to continue the Doha mandates. The Chair reported that while delegations expressed diverging

views on whether and how to continue to engage on the various Rules issues in a post-MC10 environment,

a large number of delegations stressed the importance of work on fisheries subsidies and of moving away

from old linkages and stalemates between the Rules pillars. The June meeting was focused on a fisheries

subsidies paper presented by New Zealand and a group of co-sponsors, which posed several question to

Members in an effort to re-engage the negotiating group on the substance of a discipline for fisheries

subsidies. The November meeting was focused on another transparency report by the Chair following a

series of Member consultations, as well as a preliminary review of a fisheries subsidies paper presented by

the European Union. The December meeting consisted of a dedicated session on fisheries subsidies, with

focus on proposals from the ACP group, Peru/Argentina and a group of co-sponsors, and the European

Union.

In September 2016, the United States joined 12 other Members to launch a plurilateral initiative to negotiate

fisheries subsidies disciplines, with the goal of delivering an ambitious, high-standard agreement for MC-

11. Throughout the remainder of 2016, the plurilateral group met four times in order to organize its work

and discuss the scope of the negotiations.

Prospects for 2017

In 2017, the United States will continue to focus on preserving the effectiveness of trade remedy rules,

improving transparency and due process in trade remedy proceedings, and strengthening existing subsidies

rules in a post-Doha environment. The United States will continue to support stronger disciplines and

greater transparency in the WTO with respect to fisheries subsidies.

On RTAs, the United States will continue to advocate for increased transparency and strong substantive

standards. The Transparency Mechanism will continue to be applied in the consideration of additional

RTAs.

5

TN/RL/W/252, TN/RL/253, TN/RL/W/254, all dated April 21, 2011.

6 | II. THE WORLD TRADE ORGANIZATION

5. Preparatory Committee on Trade Facilitation

Status

In 2013, Members concluded negotiations on the WTO TFA on December 6 at the Ninth WTO Ministerial

Conference in Bali. This agreement establishes transparent and predictable multilateral trade rules under

the WTO that should reduce opaque customs and border procedures and unwarranted delays at the border

that can add costs that are the equivalent of significant tariffs and are the types of nontariff barriers that

U.S. and other exporters most frequently cite as barriers to trade.

Members established a Preparatory Committee on Trade Facilitation (PCTF) at the Ninth Ministerial

Conference. The PCTF subsumed the Negotiating Group on Trade Facilitation and was established to

conduct the legal review of the TFA, accept Category A notifications from developing country Members

(that is, commitments that will be implemented upon entry into force of the agreement without a transition

period), and draft a Protocol to amend the WTO Agreement to insert the TFA into Annex 1A of the

Marrakesh Agreement Establishing the World Trade Organization (WTO Agreement). Inserting the TFA

into Annex 1A of the WTO Agreement allows it to enter into force once two-thirds of WTO Members

notify the WTO of their acceptance. The PCTF completed the legal review in July 2014, and Members

reached agreement on the Protocol text, which they adopted on 27 November 2014. In 2015, the PCTF

reviewed Members’ efforts to notify their acceptance and implement the TFA.

For many Members, the TFA will bring improved transparency and an enhanced rules-based approach to

border regimes, and will be an important element of broader ongoing domestic strategies to increase

economic output and attract greater investment. There is also the possibility that the TFA will squarely

address factors holding back increased regional integration and south-south trade. Implementation of the

TFA should also bring particular benefits to small and medium-sized businesses, enabling them to increase

participation in the global trading system.

Major Issues in 2016

In 2016, the PCTF met primarily to receive developing country Members’ notifications of Category A

commitments, as well as review progress made and Members’ experiences with their acceptance of the

Protocol. The PCTF met in March, June, and November 2016. During these meetings, a number of

Members reported on their experiences in carrying out domestic reforms needed to meet the commitments

under the TFA, their efforts to secure ratification under their domestic acceptance processes, and any

challenges they faced. The discussions revealed that Members are actively taking steps to complete their

respective domestic acceptance processes, thereby enabling them to notify their acceptance of the TFA

Protocol to the WTO. Many developing country Members recognize that they and their exporters have an

interest in seeking implementation by their neighbors of the TFA commitments.

The United States submitted its letter of acceptance to the WTO on January 23, 2015. As of December 31,

2016, 103 WTO Members had notified their acceptance of the TFA. In addition to the United States,

acceptances have been submitted by: Afghanistan, Albania, Australia, Bahrain, Bangladesh, Belize,

Botswana, Brazil, Brunei, Cambodia, Canada, Chile, China, Cote d'Ivoire, Dominica, El Salvador, EU (on

behalf of its 28 Member States), Gabon, Georgia, Grenada, Guyana, Honduras, Hong Kong, China, Iceland,

India, Jamaica, Japan, Kazakhstan, Kenya, Korea, Kyrgyz Republic, Lao PDR, Lesotho, Liechtenstein,

Macau, China, Madagascar, Malaysia, Mali, Mauritius, Mexico, Moldova, Mongolia, Montenegro, Burma

(Myanmar), New Zealand, Nicaragua, Niger, Norway, Pakistan, Panama, Paraguay, Peru, Philippines,