PRIVATE HEALTH

INSURANCE

Markets Remained

Concentrated through

2020, with Increases

in the Individual and

Small Group Markets

Report to Congressional Committees

November 2022

GAO-23-105672

United States Government Accountability Office

United States Government Accountability Office

Highlights of GAO-23-105672, a report to

congressional

committees

November 2022

PRIVATE HEALTH INSURANCE

Markets Remained Concentrated through 2020, with

Increases in the Individual and Small Group Market

s

What GAO Found

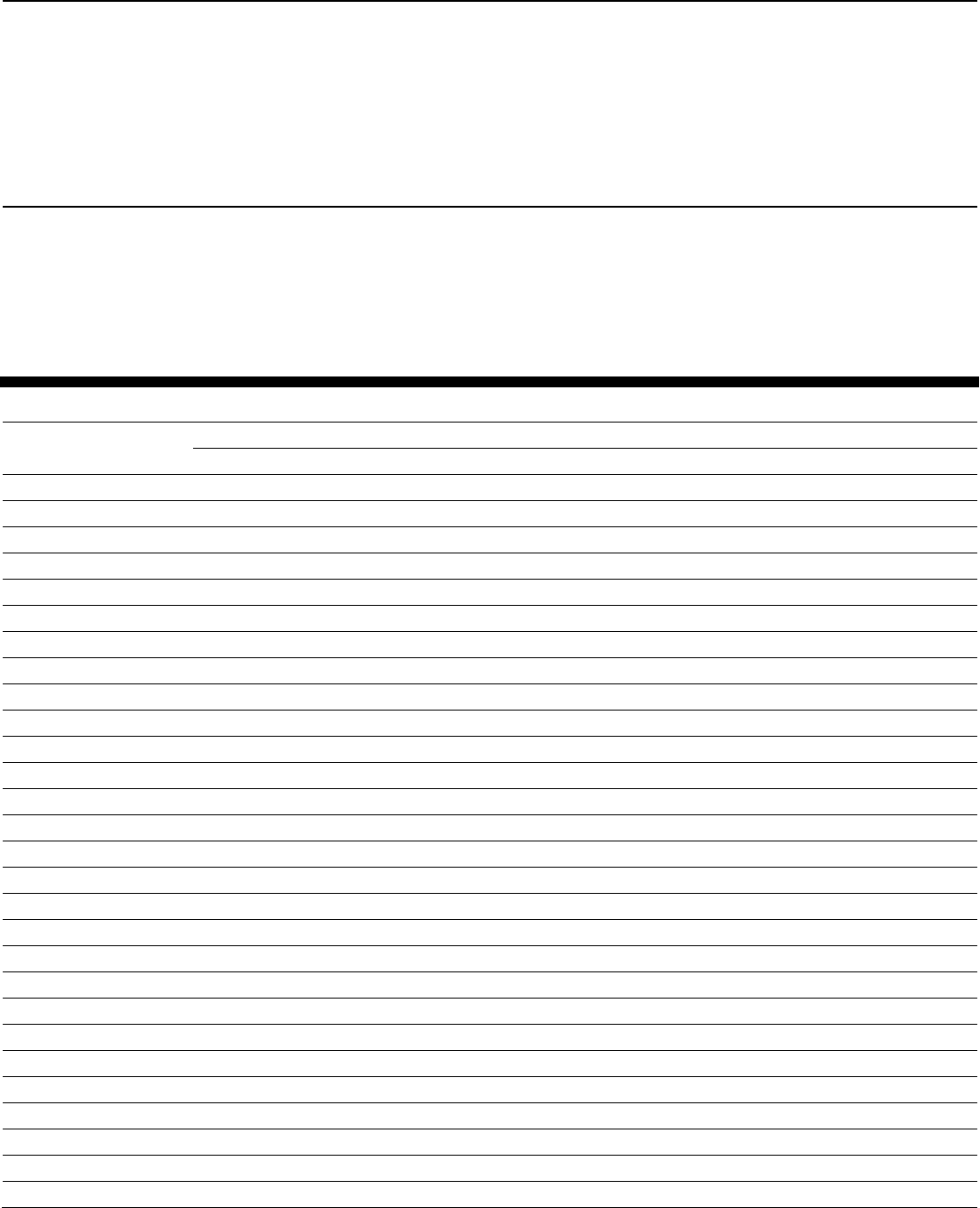

In November 2020, GAO reported that, from 2010 through 2018, enrollment in

private health insurance plans was concentrated, meaning a small number of

issuers of those plans enrolled most of the people in a given market. Specifically,

GAO considered a market concentrated in a state if three or fewer issuers held at

least 80 percent of that market. GAO examined the individual (coverage sold

directly to individuals), small group (coverage offered by small employers), and

large group (coverage offered by large employers) markets and found that this

pattern continued in 2019 and 2020. Specifically:

• Each of the three markets in 2020 was concentrated in at least 42 states

(including the District of Columbia).

• The individual and small group markets generally became more concentrated

in recent years. The median market share of the top three issuers in each

market increased by 12 and 10 percentage points, respectively, from 2011

through 2020. With these increases, their median market share was at least

97 percent in both markets in 2020.

Number of States, including the District of Columbia, Where the Three Largest Issuers Had at

Least 80 Percent of Enrollment, by Market, 2011-2020

GAO found similar patterns of high concentration across individual market

exchanges. Exchanges, which are marketplaces where consumers can compare

and select among insurance plans offered by participating issuers, were

established by the Patient Protection and Affordable Care Act (PPACA). From

2015 through 2020, most states’ exchanges were concentrated and became

more concentrated over time. This was often because the number of issuers

decreased or the existing issuers increased their market share within a state. In

2020, the exchanges were concentrated in all states.

GAO received technical comments on a draft of this report from the Department

of Health and Human Services and incorporated them as appropriate.

View GAO-23-105672. For more information,

contact

John Dicken at (202) 512-7114 or

.

Why GAO Did This Study

Individuals have various options for

obtaining private health insurance,

including through the individual,

small group, and large group

markets. A concentrated health

insurance market may indicate less

issuer competition and could affect

consumers’ choice of issuers and

the premiums they pay for coverage.

PPACA included a provision for

GAO to periodically study health

insurance market concentration.

This report describes changes in the

concentration of enrollment among

issuers in the overall individual,

small group, and large group health

insurance markets and in the

individual market exchanges.

GAO determined market share in

each of the three overall markets

using enrollment data from 2019 and

2020 that issuers are required to

report to the Centers for Medicare &

Medicaid Services (CMS). GAO

determined market share in the

individual market exchanges in

2018, 2019, and 2020 using

enrollment data from CMS. For all

analyses, GAO used the most

recent data available at the time of

its review.

P

age i GAO-23-105672 Health Insurance Market Concentration

Letter 1

Background 5

Concentration in the Individual Health Insurance Market, Including

the Exchanges, Was Higher in Recent Years than in 2011 6

Concentration in Small Group Health Insurance Markets Generally

Increased from 2011 through 2020 14

Large Group Health Insurance Markets Remained Concentrated

from 2011 through 2020 17

Appendix I N

umber and Market Share of Largest Issuers Participating in Each

State’s Individual Market 22

Appendix II States’ Individual Market Exchange Enrollment as a Proportion of

Overall Individual Market Enrollment, 2020 29

Appendix III Number and Market Share of Issuers in Individual Market

Exchanges, 2015-2020 31

Appendix IV Number of Issuers and Market Share of Largest Issuers

Participating in Small Group Health Insurance Market 40

Appendix V Number of Issuers and Market Share of Largest Issuers

Participating in Large Group Health Insurance Market 46

A

ppendix VI GAO Contact and Staff Acknowledgments 52

Tables

Table 1: Trends in Issuer Participation and Concentration in the

Individual Health Insurance Market across States, 2011

through 2020 8

Contents

Page ii GAO-23-105672 Health Insurance Market Concentration

Table 2: Trends in Issuer Participation and Concentration in the

Small Group Health Insurance Market across States,

2011 through 2020 15

Table 3: Trends in Issuer Participation and Concentration in the

Large Group Health Insurance Market across States,

2011 through 2020 18

Table 4: Number of Issuers in Each State’s Individual Health

Insurance Market, 2011 through 2020 22

Table 5: Market Share of the Largest and Three Largest Issuers in

Each State’s Individual Health Insurance Market, 2017

through 2020 23

Table 6: Percentage Change in Market Share for the Three

Largest Issuers’ in Each State’s Individual Health

Insurance Market, 2011 to 2020 and 2019 to 2020 27

Table 7: Covered Life-Years in Each State’s Individual Market

Health Insurance Exchange as a Proportion of Total

Covered Life-Years in the Overall Individual Market, 2020 29

Table 8: Weighted Average Number of Individual Market

Exchange Issuers Participating in Each State’s Rating

Areas, 2015 through 2020 31

Table 9: Market Share of the Largest and Three Largest Issuers in

Each State’s Individual Market Health Insurance

Exchange, 2017 through 2020 33

Table 10: Weighted Average Market Share of the Largest Issuer

across Each State’s Rating Areas, Individual Market

Exchange, 2015 through 2020 35

Table 11: Percentage Change of Largest Issuer’s Market Share

across a State’s Rating Areas in Each Individual Health

Insurance Market Exchange, 2015 to 2020 and 2019 to

2020 37

Table 12: Number of Issuers in Each State’s Small Group Health

Insurance Market, 2011 through 2020 40

Table 13: Market Share of the Largest and Three Largest Issuers

in Each State’s Small Group Health Insurance Market,

2017 through 2020 41

Table 14: Percentage Change of the Three Largest Issuers’

Market Share in Each State’s Small Group Health

Insurance Market, 2011 to 2020 and 2019 to 2020 44

Table 15: Number of Issuers in Each State’s Large Group Health

Insurance Market, 2011 through 2020 46

Page iii GAO-23-105672 Health Insurance Market Concentration

Table 16: Market Share of the Largest and Three Largest Issuers

in Each State’s Large Group Health Insurance Market,

2017 through 2020 47

Table 17: Percentage Change of the Three Largest Issuers’

Market Share in Each State’s Large Group Health

Insurance Market, 2011 to 2020 and 2019 to 2020 50

Figures

Figure 1: Covered Life-Years Reported by Issuers to CMS in the

Individual, Small Group, and Large Group Health

Insurance Markets, 2011 through 2020 5

Figure 2: Number of States Where the Market Share of the

Largest Issuer and Three Largest Issuers Was at Least

80 Percent, Individual Health Insurance Market, 2011

through 2020 7

Figure 3: Percentage Point Change in Market Share Held by the

Three Largest Issuers in the Individual Market from 2011

through 2020, by State 10

Figure 4: Extent to Which the Three Largest Individual Market

Exchange Issuers Were Concentrated, on Average, in 51

States’ Rating Areas, 2015 through 2020 11

Figure 5: Percent Point Change in Average Market Share of the

Largest Individual Market Exchange Issuer across Rating

Areas from 2015 through 2020, by State 13

Figure 6: Number of States Where the Market Share of the

Largest Issuer and Three Largest Issuers Was at Least

80 Percent, Small Group Health Insurance Market, 2011

through 2020 14

Figure 7: Percentage Point Change in Market Share Held by the

Three Largest Issuers in the Small Group Market from

2011 through 2020, by State 16

Figure 8: Number of States Where the Market Share of the

Largest Issuer and Three Largest Issuers Were at Least

80 Percent, Large Group Health Insurance Market, 2011

through 2020 17

Figure 9: Percentage Point Change in Market Share Held by the

Three Largest Issuers in the Large Group Market from

2011 through 2020, by State 19

Page iv GAO-23-105672 Health Insurance Market Concentration

Abbreviations

CMS Centers for Medicare & Medicaid Services

HHS Department of Health and Human Services

PPACA Patient Protection and Affordable Care Act

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-23-105672 Health Insurance Market Concentration

441 G St. N.W.

Washington, DC 20548

November 7, 2022

Congressional Committees

Historically, the market for private health insurance in the United States

has been highly concentrated, meaning a small number of issuers

enrolled most of the people in a given market.

1

In November 2020, we

reported that, from 2010 to 2018, three types of insurance markets—the

large group market (coverage offered by large employers), the small

group market (coverage offered by small employers), and the individual

market (consisting mainly of coverage sold directly to individual

consumers who lack access to group coverage)—were highly

concentrated.

2

We found that the three largest issuers in each of these

markets held at least 80 percent of the market in most states from 2010

through 2018.

3

Within the individual market, we reported similar

concentration patterns for those issuers participating in the individual

insurance exchanges—marketplaces operated by either the state or

federal government (known as federally facilitated exchanges) that were

required to be established in each state by the Patient Protection and

Affordable Care Act (PPACA)—starting in 2015.

4

Highly concentrated

insurance markets may indicate less competition and could affect

consumers’ choices of issuers and the premiums they pay.

1

We use the term “issuer” when referring to the entities that are licensed by a state to

engage in the business of health insurance in that specific state.

2

Federal law defines a small employer as having an average of 1 to 50 employees during

the preceding calendar year; however, states may apply this definition based on an

average of 1 to 100 employees. See 42 U.S.C. §§ 300gg-91(e)(4), 18024(b)(3).

3

See GAO, Private Health Insurance: Markets Remained Concentrated through 2018, with

Increases in the Individual and Small Group Markets, GAO-21-34 (Washington D.C.: Nov.

13, 2020)

4

Pub. L. No. 111-148, § 1321, 124 Stat. 119, 186 (2010) (“PPACA”). Health insurance

exchanges are markets that operate within each state’s overall individual and small group

market where eligible individuals and small employers can compare and select among

qualified insurance plans offered by participating issuers. In this report, the term “state”

includes the District of Columbia. States may choose to operate their own exchanges, or

this responsibility can be carried out by the federal government.

Letter

Page 2 GAO-23-105672 Health Insurance Market Concentration

PPACA included a provision for us to conduct a study on competition and

concentration in health insurance markets.

5

This report describes

changes in the concentration of enrollment among issuers in each state’s

1. individual health insurance market, including the individual market

exchange;

2. small group health insurance market; and

3. large group health insurance market.

To describe changes in concentration in the three health insurance

markets in each state, we analyzed Medical Loss Ratio data that PPACA

requires issuers to report annually to the Department of Health and

Human Services’ (HHS) Centers for Medicare & Medicaid Services

(CMS) for years 2019 and 2020. These were the most recent data

available at the time of our analyses.

6

We previously used this same data

source to analyze concentration from 2011 through 2018. Where

applicable, we present this information alongside our updated analyses in

5

PPACA, § 1322(i), 124 Stat. at 192. PPACA includes a provision for us to report to

Congress biennially beginning in 2014. In addition to GAO-21-34, our prior work in

response to this mandate includes GAO, Private Health Insurance: Concentration of

Enrollees among Individual, Small Group, and Large Group Insurers from 2010 through

2013, GAO-15-101R (Washington, D.C.: Dec. 1, 2014); Private Health Insurance: In Most

States and New Exchanges Enrollees Continued to be Concentrated among Few Issuers

in 2014, GAO-16-724 (Washington, D.C.: Sept. 6, 2016); Private Health Insurance:

Enrollment Remains Concentrated among Few Issuers, including in Exchanges,

GAO-19-306 (Washington, D.C.: Mar. 21, 2019).

6

PPACA required that all issuers report Medical Loss Ratio data to CMS, which include

the percent of premiums the issuers spent on their enrollees’ medical claims and quality

initiatives, known as their medical loss ratio. These data also include enrollment data that

can be used to calculate the market share for fully insured health plans. We did not

examine self-funded health plans, where small and large employers set aside funds to pay

for employee health care rather than pay premiums to an issuer to do so. These data

include state-level enrollment data and are publicly available on the CMS website.

The federal government declared the COVID-19 pandemic a public health emergency in

January 2020. It had far-reaching effects on the U.S. economy, including lower levels of

employment relative to the pre-pandemic period. While we did not examine the effects of

the pandemic in this report, it may have led to disruptions in the health insurance market.

These include employees obtaining coverage through a health insurance exchange upon

losing access to employer-sponsored health insurance. For more information on trends in

the health insurance market during the COVID-19 pandemic, see GAO, COVID-19:

Current and Future Federal Preparedness Requires Fixes to Improve Health Data and

Address Improper Payments, GAO-22-105397 (Washington, D.C.: April 27, 2022).

Page 3 GAO-23-105672 Health Insurance Market Concentration

this report.

7

Within the individual, small group, and large group markets in

each of the 51 states, we determined the state-level market share for

each issuer by calculating the ratio of the total number of covered life-

years for each issuer in a state to the total number of covered life-years in

that state.

8

To analyze changes in concentration in the individual market exchanges,

we obtained data from CMS for 2018, 2019, and 2020, the most recent

data available at the time of our analyses.

9

For states that used a

federally facilitated exchange, CMS provided us with summary-level

enrollment data from its data warehouse, the Multidimensional Insurance

Data Analytics System, for 2019 and 2020.

10

For states that operated

their own exchange, CMS provided us with summary-level enrollment

data from its PPACA Risk Adjustment Program for 2018, 2019, and 2020.

CMS told us its PPACA Risk Adjustment Program collects enrollee-level

data submitted by issuers annually, which CMS can access at the

insurance plan summary level. Where applicable, we present previously

reported information on the exchanges alongside our updated analyses in

this report.

11

For each state’s overall markets and exchange, we counted issuers as

participating in a market if they had enrollment in that market. We did not

count issuers as participating if they offered coverage in a market but did

not have any enrollment. Because there can be multiple issuers within a

7

GAO-16-724, GAO-19-306, and GAO-21-34.

8

We measured beneficiary enrollment by calculating covered life-years, which measure

the average number of lives insured, including dependents, during the reporting year.

Rather than a point-in-time measurement, this measure accounts for changes in

enrollment that occur throughout the year.

9

We did not include an analysis of small group exchanges in this report because officials

from CMS told us that they discontinued collection of enrollment data for the small group

exchanges in 2019. Additionally, we have previously reported that enrollment in the small

group exchanges was low—typically less than 1 percent of the overall small group market.

For more information about concentration in small group exchanges, see GAO-19-306.

10

States that operate their own exchanges can use a federally facilitated exchange for

certain functions, such as enrollment. For this report, states that use federal infrastructure

(i.e., Healthcare.gov) to operate their exchanges, even if the states retain plan

management functions, are classified as “federally facilitated exchanges.”

11

We did not report on state-based exchange data in our most recent report in response to

this mandate, GAO-21-34. In the report prior to that, GAO-19-306, we reported data on

state-based exchanges that we received from the individual states.

Page 4 GAO-23-105672 Health Insurance Market Concentration

market that share a single parent company, we aggregated such issuers

to the parent company level. If there was no parent company, we

analyzed the data by the individual issuers.

12

We did this to more fully

account for the portion of the market held by each parent company. We

calculated the three-firm concentration ratio—the combined shares of

covered life-years for the three largest issuers in that market—and the

market share of the single largest issuer in that market. We considered

states’ overall markets or exchanges to be highly concentrated if three or

fewer issuers held at least 80 percent of the market share. Finally, while

states may have multiple local markets with differing concentrations of

enrollees among health issuers, the data we used to measure

concentration were generally limited to enrollment at the state level, with

the exception of our individual exchange enrollment data—thus

precluding our ability to measure concentration within local markets

except for the individual market exchanges.

13

For all other markets, we

present state-wide issuer market share, although all issuers may not have

participated across the entire state.

We analyzed enrollment data from all of our sources as they were

reported by issuers to CMS. We did not otherwise independently verify

the accuracy or completeness of the information with the issuers. We

assessed the reliability of the data in several ways, including reviewing

relevant data manuals and other documentation and performing

electronic tests of the data to identify any outliers or anomalies. We

determined that the data were sufficiently reliable for the purposes of our

reporting objectives.

We conducted this performance audit from January 2022 through

November 2022 in accordance with generally accepted government

auditing standards. Those standards require that we plan and perform the

12

Specifically, we considered issuers to have the same parent company if in their Medical

Loss Ratio data they reported having the same National Association of Insurance

Commissioners holding group identifier, the same National Association of Insurance

Commissioners company identifier, or the same Health Insurance Oversight System

company identifier.

13

A recent analysis of health issuance concentration found that, in 33 states, the largest

issuer in the state overall was also the largest issuer in at least three-quarters of the local

markets studied in that state. That analysis used 2020 data on enrollment in fully and self-

insured plans by metropolitan statistical areas, which include a county or counties

associated with a city or urbanized area that has a population of at least 50,000. See

American Medical Association, Competition in Health Insurance: A Comprehensive Study

of U.S. Markets, 2021 Update (Chicago, Ill.: 2021).

Page 5 GAO-23-105672 Health Insurance Market Concentration

audit to obtain sufficient, appropriate evidence to provide a reasonable

basis for our findings and conclusions based on our audit objectives. We

believe that the evidence obtained provides a reasonable basis for our

findings and conclusions based on our audit objectives.

Private health insurance is the most common source of health coverage

in the United States—covering approximately two-thirds of the U.S.

population in 2020, according to the U.S. Census Bureau. Small and

large employers may offer fully insured group plans (by purchasing

coverage from an issuer) or self-funded group plans (by setting aside

funds to pay for employee health care).

14

While the majority of private

health insurance is provided through group plans, either small group (for

small employers) or large group (for large employers), people may also

choose to purchase coverage directly from an issuer through the

individual market. Figure 1 shows the total covered life-years reported by

issuers to CMS in the individual and fully insured small and large group

markets.

Figure 1: Covered Life-Years Reported by Issuers to CMS in the Individual, Small

Group, and Large Group Health Insurance Markets, 2011 through 2020

Notes: We calculated the size of each market from 2011 through 2020 using covered life-years, which

measure the average number of lives insured, including dependents, during the reporting year. This is

one of several ways to measure health insurance enrollment, so it may differ from other measures of

market size. Small and large employers may offer fully insured group plans (by purchasing coverage

14

Most small employers purchase fully insured plans, while most large employers self-fund

at least some of their employee health benefits. Approximately 67 percent of covered

workers were in a self-funded plan in 2020, with 84 percent and 23 percent of covered

workers in large employers and small employers, respectively, enrolled in self-funded

plans; see Kaiser Family Foundation, Employer Health Benefits 2020 Annual Survey (San

Francisco, Calif.: October, 2020).

Background

Page 6 GAO-23-105672 Health Insurance Market Concentration

from an issuer) or self-funded group plans (by setting aside funds to pay for employee health care).

Most small employers purchase fully insured plans, while most large employers self-fund at least

some of their employee health benefits. For the small group and large group markets, enrollment data

is from fully insured plans only.

Several factors can affect concentration in health insurance markets.

15

High concentration levels have often been the result of consolidation—

mergers and acquisitions—among existing issuers. However,

concentration can also increase if existing issuers leave the market,

thereby reducing the number of issuers from which enrollees can

purchase coverage. In addition, concentration can persist because it can

be difficult for new issuers to enter the market. For example, issuers that

do not have large numbers of enrollees may have greater challenges

negotiating discounts with health care providers, which may encourage

issuers to consolidate in order to attain enough enrollees to gain

bargaining power.

16

States’ individual health insurance markets were generally concentrated

from 2011 through 2020, and concentration has increased since 2011.

The individual market exchanges, which represented three-fourths of the

overall individual market in 2020, have generally been concentrated since

2015, and all exchanges were concentrated in 2020.

15

In 2009, we conducted a structured literature review that examined the factors that can

influence concentration of private health insurance markets. See GAO, Private Health

Insurance: Research on Competition in the Insurance Industry, GAO-09-864R

(Washington, D.C.: July 31, 2009).

16

PPACA contains provisions that may affect market concentration and competition

among health issuers, both in the overall market and in the health insurance exchanges

initially established in 2014 within each state’s individual and small group markets. For

example, PPACA required that issuers offer coverage to all individuals regardless of

health status, and it limited the ability of issuers to deny coverage or charge higher

premiums to individuals and small groups based on health risks or certain other factors.

For additional discussion about industry consolidation, see Leemore S. Dafny, “Evaluating

the Impact of Health Insurance Industry Consolidation: Learning from Experience,”

Commonwealth Fund Issue Brief (New York, N.Y.: Commonwealth Fund, 2015).

Concentration in the

Individual Health

Insurance Market,

Including the

Exchanges, Was

Higher in Recent

Years than in 2011

Page 7 GAO-23-105672 Health Insurance Market Concentration

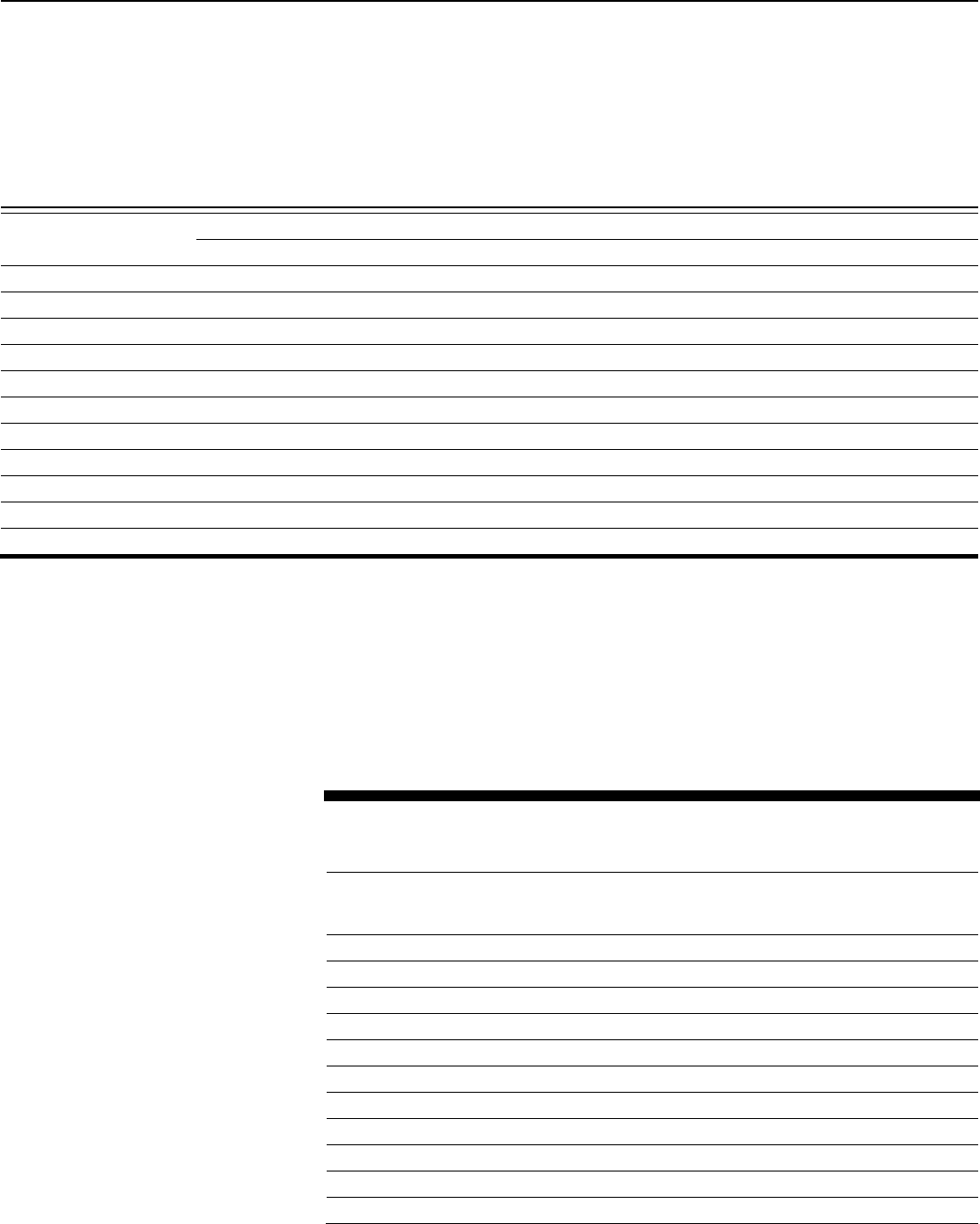

Our analysis of CMS data shows that enrollment in states’ individual

health insurance markets was generally concentrated from 2011 through

2020, and concentration has increased since 2011. The number of states

with three or fewer issuers that held at least 80 percent of the market

increased from 33 states in 2011 to 44 states in 2020, despite brief

declines in 2015, 2016, and 2020 (see fig. 2).

17

Across all states, the

median market share of the three largest issuers increased from 85

percent in 2011 to 97 percent in 2020

In addition, the number of states in which 80 percent of enrollment was

concentrated in a single issuer increased from four in 2011 to 11 in 2020.

Despite this increase, the median market share of all states’ largest issuer

remained relatively consistent during this time period, and some states’

largest issuer lost market share. For instance, Iowa’s largest issuer held

83 percent of the market in 2011 and 50 percent of the market in 2020.

Figure 2: Number of States Where the Market Share of the Largest Issuer and Three

Largest Issuers Was at Least 80 Percent, Individual Health Insurance Market, 2011

through 2020

Notes: This figure includes the 50 states and the District of Columbia. All states had at least three

issuers in their individual markets during this time period. Where multiple issuers in a state shared a

parent company, we aggregated the individual issuers to the parent company level. We calculated

market share using covered life-years, which measure the average number of lives insured, including

dependents, during the reporting year.

17

See appendix I for additional data on the individual market from 2011 through 2020.

The Individual Health

Insurance Market

Generally Has Become

More Concentrated since

2011, and Most States

Markets Remained

Concentrated in 2019 and

2020

Page 8 GAO-23-105672 Health Insurance Market Concentration

As concentration increased, the number of issuers participating in the

individual market decreased from 2011 through 2020. From 2011 through

2020, the median number of issuers per state decreased from 30 to 10. In

2020, New York had the most issuers (23, down from 38 in 2011). Three

states—Alaska, Hawaii, and Vermont—had the fewest issuers (four; all

these states had at least 10 in 2011). Despite these decreases, all states

had multiple issuers participating in the market, including those that had a

single issuer with at least 80 percent market share. For example,

although South Carolina had 11 issuers participating in the individual

market in 2020, Blue Cross Blue Shield of South Carolina held around 92

percent of market. (See table 1 for trends in issuer participation as

concentration increased.)

Table 1: Trends in Issuer Participation and Concentration in the Individual Health

Insurance Market across States, 2011 through 2020

Year

Median number of

issuers per state

Median

market share of three

largest issuers (percent)

Median

market share of the

largest issuer (percent)

2011

30

85

56

2012

26

87

54

2013

25

88

55

2014

21

88

56

2015

19

90

56

2016

15

90

54

2017

14

96

56

2018

12

98

59

2019

10

98

58

2020

10

97

57

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services (CMS). | GAO-23-105672

Notes: This table includes the 50 states and the District of Columbia. All states had at least three

issuers in their individual markets during this time period. Where multiple issuers in a state shared a

parent company, we aggregated the individual issuers to the parent company level. We calculated

market share using covered life-years, which measure the average number of lives insured, including

dependents, during the reporting year.

From 2011 through 2020, 42 states experienced increases in

concentration among the three largest issuers, and nine states

experienced decreases (see fig. 3).

• Of the 42 states with increased concentration, 25 states had an

increase of 10 or more percentage points, with a median increase of

11 percentage points. For example, in Wyoming, which had the

Page 9 GAO-23-105672 Health Insurance Market Concentration

largest percentage point increase (29 percent), 20 issuers exited the

individual market, which may have contributed to more concentration

among remaining issuers.

• Of the nine states with decreased concentration, two states had a

decrease of 10 or more percentage points, with a median decrease of

6 percentage points. For example, Wisconsin, the state with fourth

largest percentage point decrease (8 percent), had no issuer with

more than a 25 percent share of the market, making it the least

concentrated state in 2020.

Page 10 GAO-23-105672 Health Insurance Market Concentration

Figure 3: Percentage Point Change in Market Share Held by the Three Largest Issuers in the Individual Market from 2011

through 2020, by State

Notes: All states had at least three issuers in their individual markets in 2011. Where multiple issuers

in a state shared a parent company, we aggregated the individual issuers to the parent company

level. We calculated market share using covered life-years, which measure the average number of

lives insured, including dependents, during the reporting year.

Page 11 GAO-23-105672 Health Insurance Market Concentration

Our analysis of CMS data also showed that enrollment in the individual

market exchange was concentrated in at least 47 states from 2015

through 2020, with all states’ exchanges concentrated in 2020 (see fig.

4).

18

From 2015 through 2020, states in which the top three issuers

already had at least 80 percent market share became more concentrated.

This was often because the number of issuers decreased or the existing

issuers increased their market share within a state—such that the state

had three or fewer issuers with 100 percent of the market share. The

number of states in which three or fewer issuers held 100 percent of the

market share increased from 16 states in 2015 to 31 states in 2020, with

a peak of 38 states in 2019. In addition, the median number of issuers

participating in each state’s exchange decreased from four in 2015 to

three in 2020.

Figure 4: Extent to Which the Three Largest Individual Market Exchange Issuers

Were Concentrated, on Average, in 51 States’ Rating Areas, 2015 through 2020

Notes: Hawaii and Minnesota are not included in this figure for 2015 because we were unable to

obtain data for that year. The remaining 49 states, including the District of Columbia, are included in

2015, and Hawaii and Minnesota are included for later years.

Rating areas are geographic areas established by states and used, in part, by issuers to set premium

rates.

Where multiple issuers in a state shared a parent company, we aggregated the individual issuers to

the parent company level. The market share is calculated using covered life-years, which measure

the average number of lives insured, including dependents, during the reporting year. Market share in

18

We present statistics by state in appendix II.

Most Individual Market

Exchanges Were

Concentrated in Each Year

since 2015, and All Were

Concentrated in 2020

Exchange Enrollment Increased as a

Proportion of the Overall Individual Market

from 2015 through 2020

Enrollment through the health insurance

exchanges—marketplaces where consumers

can compare and select among insurance

plans sold by participating issuers—became a

larger proportion of overall individual market

enrollment in states, increasing from 52

percent in 2015 to 75 percent in 2020.

Source: GAO analysis of data from the Centers for Medicare

& Medicaid Services (CMS). | GAO-23-105672

Page 12 GAO-23-105672 Health Insurance Market Concentration

this figure refers to the average market share of the three largest issuers across a state’s rating areas

weighted by the number of covered life-years in each rating area. Issuer counts in this figure reflect

the number of issuers, on average, across a state’s rating areas, weighted by the number of covered

life-years in each rating area.

From 2015 through 2020, 35 states experienced increases in

concentration among their largest issuer and 16 states experienced

decreases (see fig. 5).

• Of the 35 states with increased concentration, 21 states had

increases of 10 or more percentage points, with a median increase of

14 percentage points. For example, Louisiana had the largest

percentage point increase (44 percent); the number of issuers

participating in the state’s exchange decreased from four issuers in

2015 to one issuer in 2020.

• Of the 16 states with decreased concentration, 10 states had

decreases of 10 or more percentage points, with a median decrease

of 10 percentage points.

Page 13 GAO-23-105672 Health Insurance Market Concentration

Figure 5: Percent Point Change in Average Market Share of the Largest Individual Market Exchange Issuer across Rating

Areas from 2015 through 2020, by State

Notes: Hawaii and Minnesota’s percent point change is from 2016 through 2020 because we were

unable to obtain data for 2015 for those states.

Rating areas are geographic areas established by states and used, in part, by issuers to set premium

rates.

Where multiple issuers in a state shared a parent company, we aggregated the individual issuers to

the parent company level. We calculated issuers’ market share using covered life-years, which

measure the average number of lives insured, including dependents, during the reporting year.

Market share refers to the average market share of the largest issuer across a state’s rating areas—

geographic areas established by states and used, in part, by issuers to set premium rates—weighted

by the number of covered life-years in each rating area. In some cases, the identity of the largest

issuer varied across rating areas in a state, and changed over time.

Page 14 GAO-23-105672 Health Insurance Market Concentration

Our analysis of CMS data shows that enrollment in states’ small group

health insurance markets generally became more concentrated from

2011 through 2020. During this time, the number of states with three or

fewer issuers that held at least 80 percent of the market share increased

from 36 states to 47 states, with a marked increase since 2015 (see fig.

6). Additionally, from 2011 through 2020, the median market share of the

top three issuers increased by 10 percentage points—from 87 percent to

97 percent.

19

In addition, the number of states in which 80 percent of enrollment was

concentrated in a single issuer increased from three states in 2011 to 13

states in 2020. The median market share of the largest issuer also

increased by 7 percentage points—from 50 percent in 2011 to 57 percent

in 2020. For example, Iowa’s largest issuer, the Wellmark Group,

increased its market share from 61 percent in 2011 to 79 percent in 2020.

Figure 6: Number of States Where the Market Share of the Largest Issuer and Three

Largest Issuers Was at Least 80 Percent, Small Group Health Insurance Market,

2011 through 2020

Notes: This figure includes the 50 states and the District of Columbia. All states, except Vermont and

Wyoming, had at least three issuers in their small group markets during this time period. Small and

large employers may offer fully insured group plans (by purchasing coverage from an issuer) or self-

funded group plans (by setting aside funds to pay for employee health care). Most small employers

purchase fully insured plans, while most large employers self-fund at least some of their employee

health benefits. For the small group and large group markets, enrollment data are from fully insured

plans only. Where multiple issuers in a state shared a parent company, we aggregated the individual

19

See appendix IV for additional data on the small group market from 2011 through 2020.

Concentration in

Small Group Health

Insurance Markets

Generally Increased

from 2011 through

2020

Page 15 GAO-23-105672 Health Insurance Market Concentration

issuers to the parent company level. We calculated market share using covered life-years, which

measure the average number of lives insured, including dependents, during the reporting year.

As concentration increased, the number of issuers per state decreased.

Specifically, the median number of issuers decreased from 13 issuers in

2011 to five issuers in 2020. For example, the number of issuers in

Indiana decreased from 27 issuers in 2011 to nine issuers in 2020. (See

table 2 for trends in issuer participation as concentration increased.)

Table 2: Trends in Issuer Participation and Concentration in the Small Group Health

Insurance Market across States, 2011 through 2020

Year

Median number of

issuers per state

Median market share

of three largest

issuers (percent)

Median market share

of the largest

issuer (percent)

2011

13

87

50

2012

12

88

55

2013

12

88

59

2014

10

88

57

2015

9

89

55

2016

7

92

53

2017

6

92

57

2018

5

94

57

2019

6

96

58

2020

5

97

57

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services (CMS). | GAO-23-105672

Notes: This table includes the 50 states and the District of Columbia. All states, except Vermont and

Wyoming, had at least three issuers in their small group markets during this time period. We

calculated market share using covered life-years, which measure the average number of lives

insured, including dependents, during the reporting year.

From 2011 through 2020, 45 states experienced increases in

concentration among the three largest issuers, and six states experienced

decreases (see fig. 7). Of the 45 states with increased concentration, 23

states had an increase of 10 or more percentage points, with a median

increase of 10 percentage points. The six states with decreased

concentration had a median decrease of 3 percentage points.

Page 16 GAO-23-105672 Health Insurance Market Concentration

Figure 7: Percentage Point Change in Market Share Held by the Three Largest Issuers in the Small Group Market from 2011

through 2020, by State

Notes: All states, except Vermont and Wyoming, had at least three issuers in in their small group

markets during this time period. Small and large employers may offer fully insured group plans (by

purchasing coverage from an issuer) or self-funded group plans (by setting aside funds to pay for

employee health care). Most small employers purchase fully insured plans, while most large

employers self-fund at least some of their employee health benefits. For the small group and large

group markets, enrollment data are from fully insured plans only. Where multiple issuers in a state

shared a parent company, we aggregated the individual issuers to the parent company level. We

calculated market share using covered life-years, which measure the average number of lives

insured, including dependents, during the reporting year.

Page 17 GAO-23-105672 Health Insurance Market Concentration

Our review of CMS data shows that concentration in states’ large group

health insurance markets remained generally steady from 2011 through

2020. The number of states with three or fewer issuers that held at least

80 percent of the market increased from 40 states in 2011 to 42 states in

2020 (see fig. 8).

20

During this time period, the median market share of

the top three issuers increased by 4 percentage points, from 88 percent

to 92 percent.

The number of states in which 80 percent of enrollment was concentrated

in a single issuer also remained relatively unchanged, although the

median market share of states’ largest issuers increased. States with a

single issuer that held at least of 80 percent market share slightly

increased from six in 2011 to eight in 2020, with small fluctuations within

the decade. During the same period, the median market share of the

largest issuer increased by 9 percentage points, from 55 percent to 64

percent.

Figure 8: Number of States Where the Market Share of the Largest Issuer and Three

Largest Issuers Were at Least 80 Percent, Large Group Health Insurance Market,

2011 through 2020

Notes: This figure includes the 50 states and the District of Columbia. All states had at least three

issuers in their large group markets during this time period. Small and large employers may offer fully

insured group plans (by purchasing coverage from an issuer) or self-funded group plans (by setting

aside funds to pay for employee health care). Most small employers purchase fully insured plans,

while most large employers self-fund at least some of their employee health benefits. For the small

group and large group markets, enrollment data are from fully insured plans only. Where multiple

issuers in a state shared a parent company, we aggregated the individual issuers to the parent

20

See appendix V for additional data on the large group market for 2011 through 2020.

Large Group Health

Insurance Markets

Remained

Concentrated from

2011 through 2020

Page 18 GAO-23-105672 Health Insurance Market Concentration

company level. We calculated market share using covered life-years, which measure the average

number of lives insured, including dependents, during the reporting year.

In addition, as concentration remained generally steady, the number of

issuers in each state generally decreased. Specifically, the median

number of issuers per state decreased from 12 issuers in 2011 to eight

issuers in 2020 (see table 3).

Table 3: Trends in Issuer Participation and Concentration in the Large Group Health

Insurance Market across States, 2011 through 2020

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services (CMS). | GAO-23-105672

Notes: This table includes the 50 states and the District of Columbia. All states had at least three

issuers in their large group markets during this time period. We calculated market share using

covered life-years, which measure the average number of lives insured, including dependents, during

the reporting year.

From 2011 through 2020, 31 states experienced increases in

concentration among the three largest issuers, and 20 states experienced

decreases (see fig. 9). Of the 31 states with increased concentration, six

states had an increase of 10 or more percentage points, with a median

increase of approximately 4 percentage points. Similarly, the 20 states

with decreased concentration had a median decrease of 1 percentage

point.

Year

Median number of

issuers per state

Median market share of

three largest

issuers (percent)

Median market share

of the largest

issuer (percent)

2011

12

88

55

2012

11

89

60

2013

11

89

60

2014

10

90

59

2015

10

90

61

2016

9

90

58

2017

9

91

56

2018

9

92

58

2019

8

92

64

2020

8

92

64

Page 19 GAO-23-105672 Health Insurance Market Concentration

Figure 9: Percentage Point Change in Market Share Held by the Three Largest Issuers in the Large Group Market from 2011

through 2020, by State

Notes: All states had at least three issuers in their large group markets during this time period. Small

and large employers may offer fully insured group plans (by purchasing coverage from an issuer) or

self-funded group plans (by setting aside funds to pay for employee health care). Most small

employers purchase fully insured plans, while most large employers self-fund at least some of their

employee health benefits. For the small group and large group markets, enrollment data are from fully

insured plans only. Where multiple issuers in a state shared a parent company, we aggregated the

individual issuers to the parent company level. We calculated market share using covered life-years,

which measure the average number of lives insured, including dependents, during the reporting year.

In some cases, the identity of the largest three issuers changed over time.

Page 20 GAO-23-105672 Health Insurance Market Concentration

We provided a draft of this report to HHS for review and comment. The

department provided technical comments, which we incorporated as

appropriate.

We sent copies of this report to the appropriate Congressional

committees, the Secretary of Health and Human Services, and other

interested parties. In addition, the report is available at no charge on the

GAO website at http://www.gao.gov.

If you or your staff have any questions about this report, please contact

John E. Dicken at (202) 512-7114 or [email protected]. Contact points for

our Offices of Congressional Relations and Public Affairs may be found

on the last page of this report. GAO staff who made key contributions to

this report are listed in appendix VI.

John E. Dicken

Director, Health Care

Page 21 GAO-23-105672 Health Insurance Market Concentration

List of Committees

The Honorable Ron Wyden

Chairman

The Honorable Mike Crapo

Ranking Member

Committee on Finance

United States Senate

The Honorable Patty Murray

Chair

The Honorable Richard Burr

Ranking Member

Committee on Health, Education, Labor, and Pensions

United States Senate

The Honorable Bobby Scott

Chairman

The Honorable Virginia Foxx

Republican Leader

Committee on Education and Labor

House of Representatives

The Honorable Frank Pallone, Jr.

Chair

The Honorable Cathy McMorris Rodgers

Republican Leader

Committee on Energy and Commerce

House of Representatives

The Honorable Richard E. Neal

Chair

The Honorable Kevin Brady

Republican Leader

Committee on Ways and Means

House of Representatives

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 22 GAO-23-105672 Health Insurance Market Concentration

The three tables below present information for each state on a) the

number of participating issuers in the individual health insurance market

from 2011 through 2020, b) the market share of the largest and three

largest issuers from 2017 through 2020, and c) the percentage change in

market share of the three largest issuers from 2011 through 2020 and

2019 through 2020.

Table 4: Number of Issuers in Each State’s Individual Health Insurance Market, 2011 through 2020

Number of issuers

State

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Alabama

27

22

23

17

16

11

10

10

7

8

Alaska

13

13

14

12

10

7

5

5

3

4

Arizona

30

26

24

27

23

17

15

11

12

12

Arkansas

32

26

24

21

19

16

14

14

10

11

California

45

34

30

33

31

27

27

23

22

21

Colorado

35

29

25

26

24

19

17

15

14

15

Connecticut

26

20

19

17

15

11

9

8

7

8

Delaware

20

17

16

14

13

10

8

7

6

6

District of Columbia

18

18

18

16

13

10

8

7

6

6

Florida

40

33

31

28

30

22

20

17

16

17

Georgia

38

32

31

29

25

18

17

15

13

16

Hawaii

14

15

12

10

9

7

6

4

4

4

Idaho

23

22

19

18

17

14

11

10

8

8

Illinois

42

37

34

30

25

21

18

16

15

14

Indiana

37

30

28

23

23

19

14

11

8

8

Iowa

33

27

25

21

19

14

12

9

8

7

Kansas

35

30

28

24

20

15

15

13

11

11

Kentucky

27

22

23

21

21

17

15

14

11

12

Louisiana

34

26

26

24

22

16

15

14

9

10

Maine

20

18

18

15

12

9

8

6

8

7

Maryland

27

24

23

19

18

15

13

10

8

9

Massachusetts

31

29

28

25

25

20

19

16

15

15

Michigan

41

33

33

31

29

22

18

14

12

12

Minnesota

36

29

26

25

25

18

15

13

13

13

Mississippi

30

25

22

21

18

14

14

12

8

10

Missouri

37

31

31

25

23

18

18

15

14

16

Montana

25

22

21

20

16

13

11

8

7

7

Nebraska

31

28

26

25

19

16

13

11

8

8

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 23 GAO-23-105672 Health Insurance Market Concentration

Number of issuers

State

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Nevada

24

20

21

19

19

15

12

10

10

9

New Hampshire

20

17

15

13

14

9

7

6

6

5

New Jersey

24

24

20

19

19

16

14

12

10

10

New Mexico

28

24

22

18

18

14

13

11

10

10

New York

38

32

28

32

33

27

27

23

23

23

North Carolina

31

26

25

22

18

15

14

12

11

11

North Dakota

21

20

19

13

12

10

7

8

7

6

Ohio

43

36

34

32

29

24

20

19

16

15

Oklahoma

30

26

25

23

21

16

15

12

9

12

Oregon

31

28

25

29

25

21

17

13

11

11

Pennsylvania

38

34

36

33

31

24

22

22

21

21

Rhode Island

14

12

13

11

9

7

7

6

5

5

South Carolina

31

24

22

20

17

15

13

10

9

11

South Dakota

30

26

25

17

14

11

9

9

8

8

Tennessee

33

29

26

23

20

15

14

13

13

14

Texas

50

40

36

38

37

32

30

25

19

20

Utah

24

19

19

19

17

14

13

11

9

9

Vermont

16

14

12

10

6

5

5

5

4

4

Virginia

32

29

29

29

26

21

21

16

16

17

Washington

30

27

25

24

23

19

16

14

12

14

West Virginia

27

25

24

19

18

15

12

11

9

9

Wisconsin

42

38

35

35

31

24

23

18

19

19

Wyoming

25

23

21

16

14

11

9

7

5

5

Total

1529

1311

1235

1131

1031

816

725

621

545

563

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services. | GAO-23-105672

Note: Where multiple issuers in a state shared a parent company, we aggregated the individual

issuers to the parent company level.

Table 5: Market Share of the Largest and Three Largest Issuers in Each State’s Individual Health Insurance Market, 2017

through 2020

Market share of the

largest issuer (percent)

Market share of the three

largest issuers (percent)

State

Largest issuer name

2017

2018

2019

2020

2017

2018

2019

2020

Alabama

BCBS OF AL GRP

97.6

97.3

96.7

96.5

99.9

99.7

99.8

99.7

Alaska

PREMERA BLUE CROSS

GROUP

99.3

99.3

99.5

91.1

99.9

100.0

100.0

100.0

Arizona

CENTENE CORP GRP

43.8

49.5

40.6

37.1

95.8

99.0

88.9

85.5

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 24 GAO-23-105672 Health Insurance Market Concentration

Market share of the

largest issuer (percent)

Market share of the three

largest issuers (percent)

State

Largest issuer name

2017

2018

2019

2020

2017

2018

2019

2020

Arkansas

ARKANSAS BCBS

GRP

63.6

63.3

63.9

57.4

93.5

93.5

92.9

89.3

California

BLUE SHIELD OF

CALIFORNIA GROUP

30.0

36.9

36.2

—

81.5

80.1

80.0

79.1

KAISER

FOUNDATION GRP

—

—

—

34.7

Colorado

KAISER

FOUNDATION GRP

41.1

41.0

37.0

—

87.8

83.2

81.6

78.5

WELLPOINT INC GRP

—

—

—

34.1

Connecticut

HIP INS GRP

61.4

67.7

72.9

73.4

98.4

99.3

99.7

99.9

Delaware

HIGHMARK GRP

62.2

99.1

99.0

99.2

99.5

99.9

99.8

99.9

District of

Columbia

CAREFIRST INC GRP

84.6

81.7

83.7

83.8

99.5

99.4

99.9

99.9

Florida

BLUE CROSS AND

BLUE SHIELD OF

FLORIDA, INC.

60.1

68.5

64.4

60.2

88.8

93.0

93.3

92.3

Georgia

CENTENE CORP GRP

—

47.4

55.8

64.1

91.3

88.6

92.8

89.0

WELLPOINT INC GRP

55.5

—

—

—

Hawaii

HAWAII MEDICAL

SERVICE

ASSOCIATION

58.7

58.8

56.6

64.6

99.9

99.9

99.9

99.9

Idaho

BLUE CROSS OF

IDAHO HEALTH

SERVICE, INC.

34.7

50.5

44.2

—

78.6

91.8

93.2

92.7

IHC INC GRP

—

—

—

41.1

Illinois

HCSC GRP

73.0

76.8

79.5

76.1

89.7

91.1

93.1

94.0

Indiana

CENTENE CORP GRP

—

—

57.5

51.3

72.5

96.1

96.6

97.3

CARESOURCE

MANAGEMENT

GROUP

—

46.3

—

—

WELLPOINT INC GRP

28.2

—

—

—

Iowa

WELLMARK GROUP

63.5

58.7

59.9

50.4

95.6

99.7

99.8

99.8

Kansas

BCBS OF KS GRP

61.2

67.2

69.5

60.2

97.0

92.9

94.6

90.8

Kentucky

WELLPOINT INC GRP

77.9

55.7

69.6

58.6

99.3

99.8

100.0

100.0

Louisiana

LOUISIANA HLTH

SERV GRP

76.1

91.8

98.6

98.7

98.4

99.6

100.0

100.0

Maine

MAINE COMMUNITY

HEALTH OPTIONS

40.1

58.6

42.7

—

98.6

99.8

99.8

99.8

WELLPOINT INC GRP

—

—

—

42.8

Maryland

CAREFIRST INC GRP

76.5

66.1

65.2

70.4

99.2

99.4

99.6

99.6

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 25 GAO-23-105672 Health Insurance Market Concentration

Market share of the

largest issuer (percent)

Market share of the three

largest issuers (percent)

State

Largest issuer name

2017

2018

2019

2020

2017

2018

2019

2020

Massachusetts

TUFTS HEALTH PLAN

41.4

44.3

49.7

52.8

78.1

83.2

86.2

86.7

Michigan

BCBS OF MI GRP

49.3

58.5

56.1

52.2

81.4

82.9

86.3

85.3

Minnesota

HEALTHPARTNERS

GRP

38.4

39.2

36.5

31.2

82.9

82.9

78.6

78.5

Mississippi

CENTENE CORP GRP

45.2

55.7

61.6

65.4

94.6

99.4

99.7

97.5

Missouri

CENTENE CORP GRP

—

—

37.2

42.9

82.4

86.2

87.4

85.4

CIGNA HLTH GRP

—

36.7

—

—

WELLPOINT INC GRP

44.7

—

—

—

Montana

HCSC GRP

50.6

—

38.8

39.4

99.7

99.8

99.9

99.9

MONTANA HEALTH

COOPERATIVE

—

42.9

—

—

Nebraska

MEDICA GRP

—

74.5

79.1

86.1

93.7

99.7

99.8

99.8

AETNA GRP

35.6

—

—

—

New Hampshire

WELLPOINT INC GRP

45.7

61.1

68.4

61.3

99.7

99.8

99.6

99.7

New Jersey

BCBS OF NJ GRP

71.6

61.3

55.6

55.9

98.8

97.8

98.3

98.4

New Mexico

MOLINA

HEALTHCARE INC

GRP

40.4

40.6

42.1

45.5

88.8

89.9

91.7

80.5

New York

NEW YORK STATE

CATHOLIC HEALTH

PLAN, INC.

17.4

25.1

26.6

29.4

45.5

52.5

52.5

54.2

Nevada

UNITEDHEALTH GRP

58.4

65.1

60.8

68.5

94.0

94.1

96.9

92.4

North Carolina

BLUE CROSS AND

BLUE SHIELD OF

NORTH CAROLINA

95.6

96.2

97.4

91.8

99.5

99.7

99.4

99.0

North Dakota

BLUE CROSS BLUE

SHIELD OF NORTH

DAKOTA

—

—

80.7

65.7

99.7

99.6

99.7

99.9

NORIDIAN MUTUAL

INSURANCE

COMPANY

82.3

85.7

—

—

Ohio

MEDICAL MUTUAL

OF OHIO

31.4

35.6

38.7

30.8

77.6

70.5

70.0

68.7

Oklahoma

HCSC GRP

93.8

95.5

94.8

87.5

99.7

99.8

99.0

97.4

Oregon

PROVIDENCE

HEALTH PLAN

46.0

45.3

37.7

34.1

76.7

90.1

82.3

80.5

Pennsylvania

INDEPENDENCE

BLUE CROSS GRP

37.9

40.0

39.2

36.7

78.1

81.3

80.8

81.5

Rhode Island

NEIGHBORHOOD HEALTH

PLAN OF RHODE ISLAND

—

52.3

58.1

60.6

99.7

99.7

99.9

99.9

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 26 GAO-23-105672 Health Insurance Market Concentration

Market share of the

largest issuer (percent)

Market share of the three

largest issuers (percent)

State

Largest issuer name

2017

2018

2019

2020

2017

2018

2019

2020

BLUE CROSS & BLUE

SHIELD OF RHODE

ISLAND

61.5

—

—

—

South Carolina

BCBS OF SC GRP

95.7

96.5

97.1

91.5

99.7

99.8

99.8

96.6

South Dakota

AVERA HEALTH

PLANS, INC.

41.2

—

35.7

38.1

98.2

98.4

98.6

98.7

WELLMARK GROUP

—

36.4

—

—

Tennessee

BCBS OF TN INC

26.8

45.0

44.1

41.6

74.5

88.5

82.8

83.7

Texas

HCSC GRP

39.7

37.1

38.3

36.3

73.4

73.4

80.2

78.9

Utah

IHC INC GRP

60.0

85.2

86.9

85.1

97.2

99.8

99.7

95.3

Vermont

BCBS OF VT GRP

80.1

66.8

57.0

52.3

100.0

100.0

100.0

100.0

Virginia

WELLPOINT INC GRP

49.9

—

42.6

48.7

75.6

72.4

84.8

81.8

CIGNA HLTH GRP

—

24.9

—

—

Washington

KAISER

FOUNDATION GRP

29.7

47.6

45.8

38.4

70.9

88.1

88.4

79.6

West Virginia

HIGHMARK GRP

78.2

67.6

67.7

68.2

98.3

98.4

98.3

98.6

Wisconsin

COMMON GROUND

HEALTHCARE

COOPERATIVE

—

23.3

28.3

24.3

50.4

53.5

57.5

51.0

MOLINA

HEALTHCARE INC

GRP

23.8

—

—

—

Wyoming

BLUE CROSS BLUE

SHIELD OF

WYOMING

96.1

96.8

97.7

98.4

99.7

99.7

99.9

99.9

Legend: — This symbol indicates that this issuer was not the largest in that year.

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services. | GAO-23-105672

Notes: Where multiple issuers in a state shared a parent company, we aggregated the individual

issuers to the parent company level. We calculated issuers’ market share using covered life-years,

which measure the average number of lives insured, including dependents, during the reporting year.

We reprinted issuer names as they were reported in the data from the Centers for Medicare &

Medicaid Services.

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 27 GAO-23-105672 Health Insurance Market Concentration

Table 6: Percentage Change in Market Share for the Three Largest Issuers in Each

State’s Individual Health Insurance Market, 2011 to 2020 and 2019 to 2020

State

Percentage change in market

share for the three largest

issuers from 2011 to 2020

Percentage change in market

share for the three largest

issuers from 2019 to 2020

Alabama

2.7

-0.1

Alaska

23.6

0.0

Arizona

8.4

-3.5

Arkansas

-2.2

-3.6

California

1.0

-0.9

Colorado

25.1

-3.2

Connecticut

15.5

0.2

Delaware

15.3

0.1

District of Columbia

12.0

0.0

Florida

19.8

-1.0

Georgia

21.3

-3.8

Hawaii

0.8

0.0

Idaho

0.1

-0.6

Illinois

14.8

0.9

Indiana

15.4

0.7

Iowa

8.1

0.0

Kansas

14.4

-3.8

Kentucky

3.9

0.0

Louisiana

14.9

0.0

Maine

7.6

0.0

Maryland

11.1

0.0

Massachusetts

-1.7

0.5

Michigan

8.5

-1.0

Minnesota

-6.3

-0.1

Mississippi

14.4

-2.2

Missouri

16.4

-2.0

Montana

14.6

0.0

Nebraska

11.8

0.0

Nevada

9.1

-4.5

New Hampshire

6.6

0.0

New Jersey

8.7

0.1

New Mexico

-9.3

-11.2

New York

-1.5

1.7

Appendix I: Number and Market Share of

Largest Issuers Participating in Each State’s

Individual Market

Page 28 GAO-23-105672 Health Insurance Market Concentration

State

Percentage change in market

share for the three largest

issuers from 2011 to 2020

Percentage change in market

share for the three largest

issuers from 2019 to 2020

North Carolina

8.9

-0.4

North Dakota

9.6

0.2

Ohio

-11.6

-1.3

Oklahoma

18.1

-1.6

Oregon

15.9

-1.8

Pennsylvania

9.8

0.7

Rhode Island

0.3

0.0

South Carolina

16.8

-3.2

South Dakota

9.9

0.2

Tennessee

3.8

0.8

Texas

4.7

-1.3

Utah

9.7

-4.4

Vermont

1.2

0.0

Virginia

-4.7

-3.0

Washington

-16.2

-8.8

West Virginia

20.9

0.3

Wisconsin

-7.6

-6.5

Wyoming

28.8

0.0

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services. | GAO-23-105672

Notes: This table includes the 50 states and the District of Columbia. All states had at least three

issuers in their individual markets from 2011 through 2020. Where multiple issuers in a state shared a

parent company, we aggregated the individual issuers to the parent company level. We issuers’

calculated market share using covered life-years, which measure the average number of lives

insured, including dependents, during the reporting year.

Appendix II: States’ Individual Market

Exchange Enrollment as a Proportion of

Overall Individual Market Enrollment, 2020

Page 29 GAO-23-105672 Health Insurance Market Concentration

Table 7 presents a) covered life-years in each state’s individual health

insurance market exchange, b) covered life-years in each state’s overall

individual market, and c) covered life-years in each state’s individual

market exchange as a proportion of covered life-years in the overall

individual market.

Table 7: Covered Life-Years in Each State’s Individual Market Health Insurance

Exchange as a Proportion of Total Covered Life-Years in the Overall Individual

Market, 2020

State

Covered

life-years, individual

market exchange

Covered

life-years, overall

individual market

Individual market

exchange covered

life-years as a

proportion of overall

market (percent)

Alabama

142,035

183,729

77.3

Alaska

15,373

18,255

84.2

Arizona

134,007

184,662

72.6

Arkansas

55,548

339,550

16.4

California

1,508,779

2,248,756

67.1

Colorado

153,679

227,455

67.6

Connecticut

99,874

115,588

86.4

Delaware

22,124

26,396

83.8

District of

Columbia

15,171

17,755

85.4

Florida

1,744,519

2,056,020

84.8

Georgia

409,976

436,326

94.0

Hawaii

18,400

32,813

56.1

Idaho

68,239

93,390

73.1

Illinois

257,165

373,377

68.9

Indiana

124,149

135,645

91.5

Iowa

51,057

99,690

51.2

Kansas

75,969

103,273

73.6

Kentucky

70,626

96,531

73.2

Louisiana

74,801

114,865

65.1

Maine

55,084

62,585

88.0

Maryland

148,438

229,018

64.8

Massachusetts

293,236

363,620

80.6

Michigan

232,966

340,932

68.3

Minnesota

102,984

159,150

64.7

Mississippi

86,086

127,738

67.4

Appendix II: States’ Individual Market

Exchange Enrollment as a Proportion of

Overall Individual Market Enrollment, 2020

Appendix II: States’ Individual Market

Exchange Enrollment as a Proportion of

Overall Individual Market Enrollment, 2020

Page 30 GAO-23-105672 Health Insurance Market Concentration

State

Covered

life-years, individual

market exchange

Covered

life-years, overall

individual market

Individual market

exchange covered

life-years as a

proportion of overall

market (percent)

Missouri

181,558

225,011

80.7

Montana

39,800

49,830

79.9

Nebraska

81,881

90,884

90.1

Nevada

66,282

95,524

69.4

New Hampshire

40,321

51,164

78.8

New Jersey

214,640

315,252

68.1

New Mexico

36,795

44,441

82.8

New York

239,849

359,103

66.8

North Carolina

449,264

537,400

83.6

North Dakota

19,770

42,246

46.8

Ohio

173,251

245,663

70.5

Oklahoma

142,226

162,980

87.3

Oregon

126,256

174,046

72.5

Pennsylvania

288,081

404,484

71.2

Rhode Island

33,003

43,743

75.4

South Carolina

187,372

238,573

78.5

South Dakota

27,351

51,567

53.0

Tennessee

176,649

226,049

78.1

Texas

1,001,733

1,186,029

84.5

Utah

183,835

223,102

82.4

Vermont

26,567

32,427

81.9

Virginia

230,765

277,650

83.1

Washington

189,849

231,703

81.9

West Virginia

17,384

20,859

83.3

Wisconsin

175,219

210,649

83.2

Wyoming

22,517

27,282

82.5

Total

10,332,503

13,754,780

75.1

Source: GAO analysis of data from the Centers for Medicare & Medicaid Services. | GAO-23-105672

Note: We calculated the size of each market using covered life-years, which measure the average

number of lives insured, including dependents, during the reporting year. This is one of several ways

to measure health insurance enrollment, so it may differ from other measures of market size.

Appendix III: Number and Market Share of

Issuers in Individual Market Exchanges, 2015-

2020

Page 31 GAO-23-105672 Health Insurance Market Concentration

The four tables below present information on the number of participating

issuers and the market share of the largest issuers in each state’s

individual market health insurance exchange, from 2015 through 2020.

Specifically: table 8 presents the average number of exchange issuers

across each state’s rating areas; table 9 presents the names and market

shares of the largest exchange issuer and the market share of the three

largest issuers for each state, from 2017 through 2020; table 10 presents

the average market share of the largest issuer across each state’s rating