SUBCHAPTER S11

SPECIAL WAGE RATE SCHEDULES

S11-1 General

a. This subchapter describes special wage schedules and practices applicable to specific

occupations or positions under the Federal Wage System.

b. Except as otherwise specified in the descriptions of each special wage schedule, positions

covered by these special wage schedules are subject to general coverage of the regular

grading and pay plan of the Federal Wage System in this operating manual and to other

applicable rules and regulations of the Office of Personnel Management.

S11-2 Special Wage Schedules for Leader and Supervisory

Wage Positions in Puerto Rico

a. Coverage. This special wage schedule applies to employees in leader and supervisory

positions paid from appropriated funds in the Puerto Rico wage area, except those leader and

supervisory positions subject to other special wage schedules.

b. Computation of leader wage schedules. The second or payline rate for each leader grade

will be set at a rate that is 20 percent above the second rate of the corresponding

nonsupervisory grade. The first, third, fourth, and fifth rates are computed as in paragraph

S5-11f(2)(b).

c. Computation of supervisory wage schedules.

(1) The second or payline rate for supervisory grades 1 through 10 will be set at a rate that is

the second rate of corresponding nonsupervisory grades 1 through 10 plus 60 percent of

the second rate of the nonsupervisory grade WG-10. Rates for supervisory grades 11

through 19 are based on a parabolic curve linking the grade 10 rate to the grade 19 rate,

the second or payline rate of which is set at the third step of the General Schedule GS-14

on the schedule in effect at the time of an area wage schedule adjustment plus the cost-of-

living differential established for Puerto Rico.

(2) The following formulas are used to compute rates for supervisory grades:

WS grade/step 2 WG grade/step 2

WS-1/step 2 = WG-1/step 2 plus 60% of the 2nd rate of WG-10

WS-2/step 2 = WG-2/step 2 plus 60% of the 2nd rate of WG-10

WS-3/step 2 = WG-3/step 2 plus 60% of the 2nd rate of WG-10

WS-4/step 2 = WG-4/step 2 plus 60% of the 2nd rate of WG-10

WS-5/step 2 = WG-5/step 2 plus 60% of the 2nd rate of WG-10

WS-6/step 2 = WG-6/step 2 plus 60% of the 2nd rate of WG-10

WS-7/step 2 = WG-7/step 2 plus 60% of the 2nd rate of WG-10

WS-8/step 2 = WG-8/step 2 plus 60% of the 2nd rate of WG-10

WS-9/step 2 = WG- 9/step 2 plus 60% of the 2nd rate of WG-10

WS-10/step 2 = WG-10/step 2 plus 60% of the 2nd rate of WG-10

WS-11/step 2 = WS-10/step 2 plus 5% of the difference between WS-10/step 2 and

WS-19/step 2

WS-12/step 2 = WS-10/step 2 plus 11.5% of the difference between WS-10/step 2 and

WS-19/step 2

WS-13/step 2 = WS-10/step 2 plus 19.6% of the difference between WS-10/step 2 and

WS-19/step 2

WS-14/step 2 = WS-10/step 2 plus 29.2% of the difference between WS-10/step 2 and

WS-19/step 2

WS-15/step 2 = WS-10/step 2 plus 40.3% of the difference between WS-10/step 2 and

WS-19/step 2

WS-16/step 2 = WS-10/step 2 plus 52.9% of the difference between WS-10/step 2 and

WS-19/step 2

WS-17/step 2 = WS-10/step 2 plus 67.1% of the difference between WS-10/step 2 and

WS-19/step 2

WS-18/step 2 = WS-10/step 2 plus 82.8% of the difference between WS-10/step 2 and

WS-19/step 2

WS-19/step 2 = GS-14/step 3 plus the cost-of-living differential established for

Puerto Rico

(3) The first, third, fourth, and fifth rates are computed as in paragraph S5-11f(3)(c).

S11-3 Special Pay Plan for Production Facilitating Positions

a. Introduction. The following criteria govern the setting of pay for wage employees engaged

in production facilitating operations.

(1) A production facilitating job is considered to be a wage position when responsible

management organizes the work so that the paramount requirement of the position is

trade or craft knowledge and experience, and the employee must utilize this knowledge

and experience in the performance of assigned duties.

(2) A primary consideration in determining when management has organized the work so as

to make trade or craft knowledge the paramount requirement of a position is whether the

career pattern or progression for the production facilitating positions is exclusively from

people with trade or craft experience and background normal to other trade or craft

positions.

(3) The 5-step pay plan for production facilitating wage positions has been designed to

restore and maintain relationships that existed before the Federal Wage System between

certain production facilitating positions and first-line supervisors. Pay for other

production facilitating positions is set so as to maintain pay equity among all production

facilitating positions.

b. Coverage.

(1) Inclusions. Production facilitating positions that require prior experience at the

journeyman level of a recognized skilled trade or craft, or at the full skill level of other

wage occupations, are paid under the special production facilitating wage schedule for

the local wage area. Thus, the production facilitating pay plan is applicable to

supervisory and nonsupervisory wage employees engaged in work operations performed

by the following positions (the appropriate pay schedule identification symbol is shown

in parentheses):

Nonsupervisory Positions (WD)

• Assistant Planner and Estimator

• Assistant Production Shop Planner

• Assistant Progressman

• Shop Planner

• Aircraft Examiner

• Production Shop Planner

• Maintenance Scheduler

• Planner and Estimator

• Progressman

• Ship Progressman

• Ship Scheduler

• Ship Surveyor

Supervisory Positions (WN)

• Supervisory Aircraft Examiner (3 key level definitions)

• Supervisory Planner and Estimator

• Supervisory Production Shop Planner (2 key level definitions)

• Supervisory Progressman

• Supervisory Ship Progressman

• Supervisory Ship Scheduler

• Supervisory Ship Surveyor

• Supervisory Shop Planner (2 key level definitions)

(2) Exclusions.

(a) No wage positions, other than those whose duties and responsibilities meet the key

characteristics described in the key level job definitions in scope and level of skill,

are included in the production facilitating pay plan.

(b) When responsible management organizes the work so that the paramount requirement

of the position is other than trade or craft knowledge and experience the position is

subject to the General Schedule.

c. Pay Plan. The overall pay plan consists of a procedure for aligning the positions, which

involves the use of key level definitions and a procedure for setting pay, involving the use of

a production facilitating pay level structure and wage schedule.

(1) Aligning positions and key level definitions. Key level definitions describe each of the

supervisory and nonsupervisory production facilitating positions and are to be used to

determine the appropriate pay levels of positions covered by these instructions. Each job

is placed in its proper pay level in accordance with the alignment plan and key level

definitions as follows:

• Step 1. Comparison with key level definitions. Compare the duties, responsibilities,

and other work requirements of the position with the supervisory or nonsupervisory

key level definitions, as appropriate, contained in the FWS Job Grading Standards.

Select the key level definition that, overall, best matches the position.

• Step 2. Determination of pay level. Determine the nonsupervisory pay level

(designated WD) or the supervisory pay level (designated WN) by applying the pay

level table on the key level definition selected in step 1. By means of the table, the

nature of the production facilitating work performed, such as Shop Planner or Aircraft

Examiner work, is related to a base grade so as to arrive at the pay level appropriate

for the position involved.

• For the purpose of applying a pay level table, the term based grade is defined as the

nonsupervisory (WG) grade that best represents the nonsupervisory level of work

involved in the industrial or maintenance work processes being planned, controlled,

or facilitated. When only one level of work is involved, the base grade is that level.

When two or more different levels of work are involved, the base grade to be used is

the WG grade which is most representative or most nearly representative of the work

planned for, controlled, or facilitated, and which produces the most equitable pay

relationships. In some cases, only one pay level is to be used for all positions

matched with a particular key level definition. In such cases, rather than a table with

a range of possible base grades and pay levels, only the specific pay level to be used

is shown on the key level definition.

(2) Identification of positions. Production facilitating positions covered by these instructions

will be coded and titled as indicated below:

(a) Coding. The coding system uses a combination of letters and numbers to indicate

whether a position is supervisory or nonsupervisory, the job family and occupation

involved, and the pay level.

• Nonsupervisory and supervisory jobs are identified by the prefix letters:

WD for nonsupervisory jobs

WN for supervisory jobs

• The prefix letters are followed by the numerical code of the job family and

occupation involved. A production facilitating job that primarily involves or

requires experience in a particular trade, is coded to that job family and

occupation. However, when a job cannot be identified with a particular trade or

craft, it is coded to the 01 series of the appropriate job family.

• The code is completed by adding the pay level of the position. For example, a

Planner and Estimator (Pipefitter) at pay level 8 is designated as WD-4204-8.

(b) Titling. The title of a position covered by these instructions is the basic title shown

on the key level definition with which the position is matched, followed,

parenthetically, by a specific or general trade designator as indicated below:

• When a production facilitating position primarily involves or requires experience

in a particular trade, the trade designator is the title of the journeyman mechanic

in that trade, such as Machinist, or Aircraft Engine Mechanic. The complete title

of such a production facilitating position might be, for example, Planner and

Estimator (Machinist), or Aircraft Examiner (Aircraft Engine Mechanic).

• When a production facilitating position involves or requires experience in more

than one trade, and none of these trades are paramount or most important for

qualifications, recruitment, or other personnel purposes, the word “General” is

used as the parenthetical designator. For example, the complete title of such a

production facilitating position might be Progressman (General), or Supervisory

Aircraft Examiner (General).

(3) Pay level structure and schedule. Production facilitating wage schedules have the

following pay level structures:

(a) Pay levels:

WD for nonsupervisory schedule……11 pay levels

WN for supervisory schedule.........…...9 pay levels

(b) Rate range and step rates. Each pay level of the supervisory and nonsupervisory

Production Facilitating Wage Schedule has five rates of pay, with the first, third,

fourth, and fifth rates being set at 96, 104, 108, and 112 percent, respectively, of the

second rate or payline rate. Production facilitating employees usually are hired at the

first rate of the appropriate pay level. With satisfactory work performance a

production facilitating employee advances automatically between step rates as

follows:

From step rate To step rate After

1 2 26 weeks of service in step rate 1

2 3 78 weeks of service in step rate 2

3 4 104 weeks of service in step rate 3

4 5 104 weeks of service in step rate 4

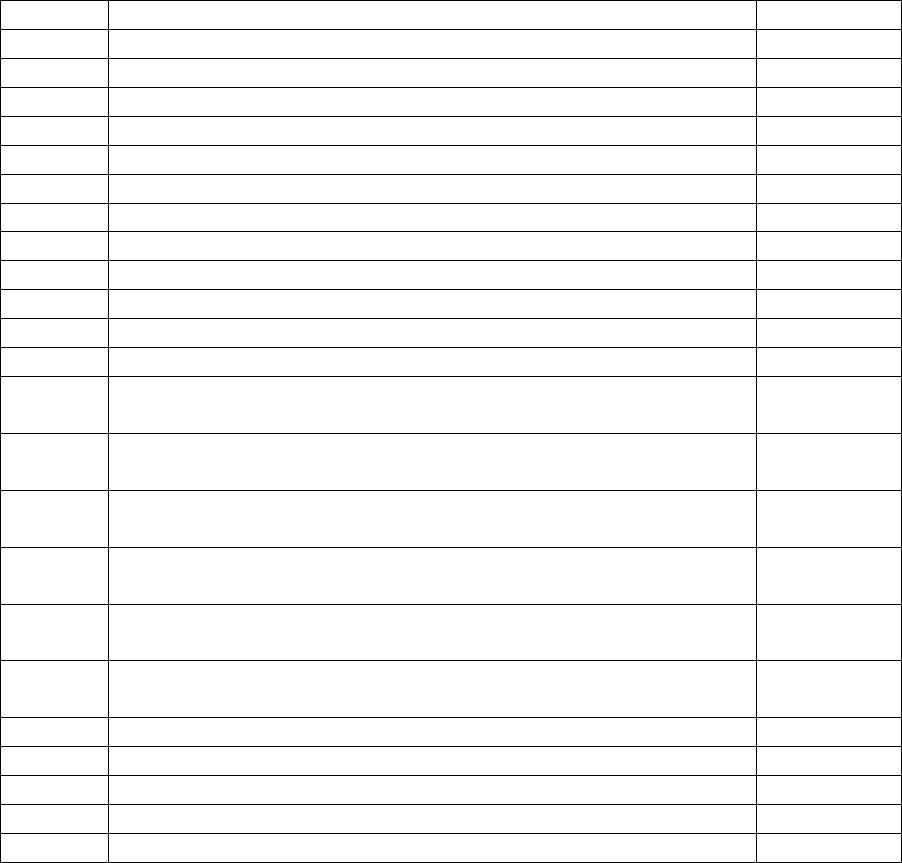

d. Setting rates of pay. Both the supervisory and nonsupervisory production facilitating wage

schedules make use of rates of pay established under section S5-11f(3). The rates of pay for

a nonsupervisory (WD) or a supervisory (WN) employee in a particular production

facilitating pay level are identical to the rates of pay already established for a counterpart

grade on the local Federal Wage System regular supervisory pay schedule. The table below

shows the relationship between production facilitating pay levels and regular supervisory

grades.

WD grade/step 2 WN grade/step 2

WS Grade

1 = 3

2 = 4

3 = 5

4 = 6

5 1 = 7

6 2 = 8

7 3 = 9

8 4 = 10

9 5 = 11

10 6 = 12

11 7 = 13

8 = 14

9 = 15

S11-4 Special Pay Plan for U.S. Citizen Wage Employees in

Foreign Areas

a. Coverage and authority. The regular wage rate schedule for U.S. citizen wage employees

in foreign areas is established and issued by the Department of Defense. This regular wage

schedule for U.S. citizen wage employees in foreign areas provides the rate of pay for

nonsupervisory, leader, supervisory, and production facilitating wage employees

(appropriated fund) for use by all agencies under the Federal Wage System. All pertinent

provisions of this operating manual are applicable to these employees in foreign areas.

b. Basis for schedule. The regular wage schedules in effect for all Federal Wage System areas

are used as the basis for constructing the schedule of wages for U.S. citizen wage employees

in foreign areas.

c. Schedule averaging process. The second step rate of each of the 15 grades of the regular

nonsupervisory schedule for U.S. citizen wage employees in foreign areas is derived by

computing a simple average of the second step rate of each grade of the 15 nonsupervisory

grades of the regular wage schedules in effect as of the cutoff date of December 31 for all

Federal Wage System areas.

d. Computing scheduled pay rates. Through the use of the second step rates derived under

the schedule averaging process, the step rates for each of the 15 grades of the regular

schedule and the pay rates for leader and supervisors are developed on the basis of the

standard formulas in subchapter S5-11, paragraph S5-11f, of this operating manual.

e. Production facilitating rates. The rates of pay for both the supervisory and nonsupervisory

production facilitating wage employees are established in accordance with paragraph S11-3d

of this subchapter.

f. Timing of wage schedule adjustment. The regular wage rate schedule for U.S. citizen

wage employees in foreign areas, issued under this pay plan, is normally adjusted annually to

be effective on the first day of the first pay period which begins on or after January 1 of each

year.

S11-5 Special Pay Plan for Federal Wage Employees in U.S.

Insular Areas

a. Coverage and authority. Designated lead agencies establish and issue special wage

schedules for U.S. civil service wage employees in certain U.S. insular areas. For Guam,

Midway, and the U.S. Virgin Islands, the lead agency is the Department of Defense; for

American Samoa, it is the Department of Transportation; and for the Commonwealth of the

Northern Mariana Islands, it is the Department of the Interior. These wage schedules provide

the rates of pay for Federal Wage System nonsupervisory, leader, supervisory, and

production facilitating employees for use by all agencies in the area.

b. Basis for schedules. Schedules are established at the same time and with rates identical to

the foreign area wage schedules established under paragraph S11-4 of this operating manual.

c. Post differential. Wage employees recruited from outside of the insular area where

employed who meet the same regulatory provisions as those specified for General Schedule

employees are also paid as part of base pay a differential for recruitment and retention

purposes. The differential amount will be that established for General Schedule employees

to be adjusted and effective concurrently with the special schedules for the insular area.

S11-6 Special Pay Plan for Apprentices and Shop Trainees

a. Coverage. This pay plan is used by all Federal agencies conducting formal apprenticeship

and shop trainee programs that are not under the regular grade and pay structure of the FWS.

It covers employees who are receiving training and instruction which is designed to qualify

them to perform all required duties in trade and craft occupations specified in appropriate

approved agency training standards or programs. Wage rates established under provisions of

the pay plan are paid only to those employees who are being trained for trade and craft

occupations authorized to be paid FWS regular schedule wage rates, and who are enrolled in:

(1) Formal apprenticeship programs involving training for journeyman level duties in

occupations which are recognized as apprenticeable by the Bureau of Apprenticeship and

Training.

(2) Formal shop trainee programs involving training for journeyman level duties in

nonapprenticeable occupations which require specialized trade or craft skill and

knowledge.

(3) Other programs established under the regular grade and pay structure of the FWS to

provide trade and craft training for the same and similar occupations, such as helper-to-

journeyman programs, are not included under this pay plan.

b. Special schedule format. Special wage rate schedules for apprentices and shop trainees

developed under provisions of the pay plan show a single wage rate for each training period.

Rate ranges are not authorized.

c. Guides for establishing pay. The pay formula for apprentice and shop trainee wage rates is

keyed to the nonsupervisory (WG) wage rate shown for the targeted journeyman grade level

at step 2, and to the nonsupervisory (WG) wage rate shown for grade 1, step 1, on the FWS

regular schedule authorized for the area where the trainee will be employed.

(1) Wage rates shown on the special schedule are maintained on a current basis. Special

schedule wage rates are adjusted concurrently with each adjustment authorized by lead

agencies for the FWS regular schedule on which they are based.

(2) The targeted journeyman grade level is the grade level authorized by the employer, on

the basis of OPM job grading standards, for performance of the full range of duties

required for the occupation chosen by the trainee.

(3) The total number of wage rates shown on the special schedule is determined by dividing

the training term into separate periods, each consisting of 26 weeks.

d. Pay formula for determining special schedule wage rates. The initial step in making this

determination is to calculate 65 percent of the appropriate FWS regular schedule

nonsupervisory (WG) wage rate shown at step 2 for the targeted journeyman grade level.

The calculated 65 percent rate is then compared with the FWS regular schedule

nonsupervisory (WG) wage rate shown at grade 1, step 1, on the same schedule. If the

calculated rate is higher, the special schedule entrance wage is established at the calculated

rate, rounded to the nearest cent. If the calculated rate is lower, the entrance wage is

established in accordance with wage fixing instructions provided in paragraph e, below.

(1) Increment increases are used to establish all intermediate and final training period wage

rates shown on the special wage rate schedule. The increment increase amount used to

compute special schedule wage rates for these training periods is calculated by

subtracting the established entrance wage from the targeted journeyman level wage rate

and dividing the difference by the total number of wage rates to be shown on the special

wage rate schedule. The quotient, carried five places to the right of the decimal point,

with no rounding, equals the increment increase amount.

(2) After calculation of the increment increase amount, the scheduled intermediate and final

training period wage rates are computed and established as follows: one increment

increase is added to the established entrance wage to obtain the second value or second

wage rate. This rate is rounded to the nearest cent. The increment increase is then added

to the unrounded second value to obtain the third value. This rate is rounded to the

nearest cent, and the procedure is continued to establish all remaining special schedule

wage rates required. An example of special schedule wage rates, determined in

accordance with the pay formula, is shown in Illustration A.

e. Wage fixing instructions. The appropriate FWS regular schedule nonsupervisory (WG)

wage rate shown at grade 1, step 1, is fixed as the entrance wage if it is higher than the

entrance wage derived by the pay formula calculation. When the grade 1, step 1, regular

schedule wage rate is used, special schedule wage rates are fixed so as to provide a minimum

5 cent increase from one intermediate wage rate to the next. The minimum increase

procedure is used to fix each intermediate wage rate as long as it produces a wage rate that

equals or exceeds that derived by the pay formula computation. At the point that the wage

rate derived by the pay formula computation exceeds the amount based on the minimum

increase procedure, the minimum increase procedure is discontinued. The pay formula is

then used to compute and establish all remaining special schedule wage rates required. An

example of a special schedule wage rate, determined in accordance with the wage fixing

instructions, is shown in Illustration B.

f. Administration. Special schedule wage rates for apprentices and shop trainees are

determined and authorized either by the agency or by local activities in accordance with

established practice.

(1) Apprentices and shop trainees are normally hired at the established entrance wage and

are advanced through the scheduled wage rates at 26-week intervals. However, hiring at

advanced rates or accelerated progression through scheduled wage rates is authorized if

prescribed by approved agency training standards or programs. That is, an employee

may be advanced to a higher scheduled rate in less than 26 weeks, if the agency

determines that the employee has fulfilled the training requirements for the period in

which he or she is serving, or the periods or periods through which he or she is being

advanced. A new 26-week period begins on the date an apprentice is advanced to a

higher scheduled wage rate.

(2) Apprentices and shop trainees are employed on an ungraded basis during the training

term.

(3) After graduation, apprentices and shop trainees are promoted, as vacancies permit, to the

second step rate of the targeted journeyman occupation and grade level. Assignment to

the targeted journeyman grade level and wage rate is treated as a Promotion, 702. Pay

determination rules concerning promotion which are included in this operating manual

are not applicable if they conflict with this section. If, after graduation, apprentices and

shop trainees are assigned to an occupation at a grade level which is lower than that of

the target occupation, pay-fixing rules prescribed in this operating manual are followed.

g. Effecting required personnel actions. Pay advancement authorized by paragraph f(1) is

documented as 702, Promotion.

(1) Items 16 and 21 of the SF 50 are used to cite the pay plan (WT), and the appropriate

occupation code. Apprentice and shop trainee jobs are assigned the code of the specific

occupation involved. For example, a carpenter apprentice is coded to the carpentry

occupation. The title of an apprentice or shop trainee job consists of the title of the

occupation followed by the designator apprentice or the designator shop trainee. The

titling and designator information is shown in items 15 and/or 20.

(2) Item 17(a) and/or 22(a) show 00 because apprentices and shop trainees are employed on

an ungraded basis during the training term.

(3) A 1 is placed in the step/rate block of the SF 50 (items 17(b) and/or 22(b) if the employee

is in the first pay level of the program; a 2 is placed in the step/rate block if the employee

is in the second pay level of the program, and so forth.

Illustration A

• Targeted Journeyman Grade Level: WG-10

• Length of Training Term: 4 Years

• WG-1, Step 1, Wage Rate: $7.48

• WG-10, Step 2, Wage Rate: $15.64

Calculations:

• 65% of $15.64 = $10.16600 (Entrance wage). Calculated entrance wage is higher

than grade 1, step 1, nonsupervisory (WG) wage rate—pay formula is used to

calculate all scheduled wage rates.

• 4 x 52 = 208 + 26 = 8 (Total number of wage rates to be shown).

• $15.64 - $10.17 = $5.47 + 8 = .68375 (Increment increase amount).

Computing special schedule

wage rates

Training period Scheduled wage rates

$10.17000

+ .68375

1 $10.17

10.85375

+ .68375

2 $10.85

11.53750

+ .68375

3 $11.54

12.22125

+ .68375

4 $12.22

12.90500

+ .68375

5 $12.91

13.58875

+ .68375

6 $13.59

14.27250

+ .68375

7 $14.27

14.95625 8 $14.96

Illustration B

• Targeted Journeyman Grade Level: WG-10

• Length of Training Term: 4 Years

• WG-1, Step 1, Wage Rate: $11.60

• WG-10, Step 2, Wage Rate: $16.00

Calculations:

• 65% of $16.00 = $10.40000 (Entrance wage). Calculated entrance wage is lower

than grade 1, step 1, nonsupervisory (WG) wage rate—entrance and second training

period wage rates are established under provisions of wage fixing instructions.

• 4 x 52 = 208 + 26 = 8 (Total number of wage rates to be shown).

• $16.00 - $10.40 = $5.60 + 8 = .70000 (Increment increase amount).

Computing special

schedule wage rates

Fixing special

schedule wage rates

Training

period

Scheduled

wage rates

$14.40000

+ .70000

$11.60

+ .05

1 $11.60

11.10000

+ .70000

11.65

+ .05

2 $11.65

11.80000

+ .70000

11.70 3 $11.80

12.50000

+ .70000

4 $12.50

13.20000

+ .70000

5 $13.20

13.90000

+ .70000

6 $13.90

14.60000

+ .70000

7 $14.60

15.30000 8 $15.30

h. Promotions into the apprentice or shop trainee program. In some cases, the rate at which

the apprentice or shop trainee is entering the program may be higher than the representative

rate for the employee’s current grade, but lower than his or her existing scheduled rate of

pay. In such cases, the employee shall be paid the scheduled rate for the apprentice level he

or she is entering or a retained rate, whichever is higher. The retained rate is computed in

accordance with the provisions of subchapter VI of chapter 53 of title 5, United States Code,

and part 536 of title 5, Code of Federal Regulations.

i. Voluntary downgrading into apprentice or shop trainee programs. Apprentice and shop

trainee programs are formal employee development programs. As such, entry into these

programs is not considered a reduction in grade at the employee’s request. Therefore,

employees who are reduced in grade to enter the programs are entitled to retained pay in

accordance with the provisions of subchapter VI of chapter 53 of title 5, United States Code,

and part 536 of title 5, Code of Federal Regulations. (Each level of apprentice training is

treated as a separate grade with a single representative rate.)

S11-7 Special Pay Plan for Aircraft, Electronic, and Optical

Instrument Overhaul and Repair Positions in

Puerto Rico

a. Coverage. Special wage rate schedules established under this plan provide rates of pay

which are appropriate to compensate Federal prevailing rate employees in Puerto Rico whose

primary duties involve the performance of work related to aircraft, electronic equipment, and

optical instrument overhaul and repair.

b. Prevailing rate determination. In order to determine prevailing rates appropriate for the

purpose of this pay plan, the lead agency responsible for planning and conducting the Puerto

Rico regular schedule wage survey also plans and conducts special universe wage surveys of

private establishments in the air transportation and electronic industries located in the survey

area, as provided by section S5-9 of this operating manual. Special universe full-scale and

wage change surveys are conducted separate from, but normally on, the same survey cycle as

are regular schedule wage surveys for Puerto Rico. Insofar as they do not conflict with

instructions provided by this pay plan, applicable procedures described in subchapter S5 of

this operating manual are followed by the lead agency in making prevailing rate

determinations which form the basis for establishing the nonsupervisory special schedule

payline.

(1) Wage area: The wage area definition shown for Puerto Rico in appendix D of this

operating manual is applicable for the purpose of determining the geographic coverage of

special wage rate schedules issued under this pay plan.

(2) Survey area: Special schedule wage surveys include all private establishments in

industries required to be surveyed which are located within the survey area defined for

Puerto Rico in appendix D of this operating manual.

(3) Industries required to be included in special schedule wage surveys:

2002 NAICS Codes 2002 NAICS Industry Titles

3341 Computer and peripheral equipment manufacturing

33422 Radio and television broadcasting and wireless

communications equipment manufacturing

33429 Other communications equipment manufacturing

3343 Audio and video equipment manufacturing

334412 Bare printed circuit board manufacturing

334413 Semiconductor and related device manufacturing

334418 Printed circuit assembly (electronic assembly) manufacturing

334419 Other electronic component manufacturing

334511 Search, detection, navigation, guidance, aeronautical, and

nautical system and instrument manufacturing

334613 Magnetic and optical recording media manufacturing

42342 Office equipment merchant wholesalers

42343 Computer and computer peripheral equipment and software

merchant wholesalers

4811 Scheduled air transportation

4812 Nonscheduled air transportation

4879 Scenic and sightseeing transportation, other

4881 Support activities for air transportation

4921 Couriers

56172 Janitorial services

62191 Ambulance services

81142 Reupholstery and furniture repair

(4) Jobs required to be surveyed:

Job No. Job Title Job Grade

61 Aircraft Cleaner 3

62 Fleet Service Worker 5

26 Aircraft Mechanic 10

35 Electronic Industrial Controls Mechanic 11

63 Aircraft Instrument Mechanic 11

36 Electronic Test Equipment Repairer 11

21 Electronics Mechanic 11

64 Electronic Computer Mechanic 11

65 Television Station Mechanic 11

Description of survey jobs which are authorized to be used in special wage surveys in

Puerto Rico are provided in appendix L.

(5) Wage rate data are collected from all cooperating private industry establishments

approved for the survey for all available matches to the required survey jobs. The

minimum standard of adequacy for special schedule wage surveys conducted under

provisions of this pay plan is that the data used in the nonsupervisory special schedule

payline computation must include as many weighted samples as there are employees

covered by the special wage rate schedules. Each survey job used in computing the

nonsupervisory special schedule payline must include a minimum of three unweighted

samples.

c. Development of special wage rate schedules. Nonsupervisory, leader, and supervisory

special wage rate schedules developed under this pay plan have the same number of grades

as specified in this operating manual for regular wage rate schedules; i.e., 15 nonsupervisory

and leader grades, and 19 supervisory grades. Each grade has three steps with the payline

established at the second step; with the first step at 96 percent of the payline rate, and the

third step at 104 percent of the payline rate. Leader and supervisory payline differentials are

computed in accordance with current provisions of paragraphs S5-11f(2) and (3) of this

operating manual. All wage rates are stated on an hourly basis. The special wage rate

schedule also includes:

(1) Identification as FWS wage rate schedules.

(2) Identification as special schedules which apply to aircraft, electronic equipment, and

optical instrument overhaul and repair positions only.

(3) Identification of the wage area covered by the schedules.

(4) A statement concerning application of the schedules in compliance with appropriate

regulations and instructions.

(5) The name of the issuing agency and the signature of the authorizing official.

(6) The date the special schedules are issued and the date the scheduled wage rates are

effective.

(7) A list of job titles and grades of positions to which the special wage rate schedules apply.

d. Waiting periods for within-grade advancement. Since the waiting periods and other

criteria for within-grade advancement under this pay plan are identical to those appropriate

for prevailing rate employees paid from FWS regular wage rate schedules, all instructions in

section S8-5 of this operating manual apply to employees covered by this pay plan, except

those which refer to a fourth and a fifth step.

e. Administration. Under the FWS, the special wage rate schedule practice is justified

whenever conditions specified in paragraph S4-3b of this operating manual exist in a wage

area. For the purpose of this pay plan, the lead agency is responsible for obtaining and

recording evidence of the existence of the required conditions in Puerto Rico. The Office of

Personnel Management is responsible for finally determining that the special schedule

practice is justified.

f. Identification of positions. Positions covered by this special pay plan will be coded as

indicated below:

(1) Coding. The coding system uses a combination of letter and numbers to indicate whether

the position is nonsupervisory, leader, or supervisory; the job family and occupation

involved; and the grade.

(a) Nonsupervisory, leader, and supervisory jobs are identified by prefix letters as

follows:

WU for nonsupervisory jobs

WR for leader jobs

WQ for supervisory jobs

(b) The above selected prefix letters are followed by the numerical code of the job family

and occupation involved.

(c) The code is completed by adding the grade of the position.

S11-8 Special Pay Plan for Corps of Engineers, U.S. Army

Navigation Lock and Dam Employees

a. Pay policy. Nonsupervisory, leader, and supervisory prevailing rate employees of the Corps

of Engineers, U.S. Army, who are engaged in operating navigation lock and dam equipment,

or who repair and maintain navigation lock and dam operating machinery and equipment, are

subject to one of the following pay provisions:

(1) If all navigation lock and dam installations under a District headquarters office are

located within a single FWS wage area, the operating and repair employees are paid from

special schedules having rates identical to the regular wage schedule applicable to that

FWS wage area.

(2) If navigation lock and dam installations under a District headquarters office are located in

more than one FWS wage area, the operating and repair employees are paid from a

special schedule having rates identical to the regular FWS wage schedule authorized for

the headquarters office.

b. Special wage rate schedules. Special nonsupervisory, leader, and supervisory wage rate

schedules established for navigation lock and dam installation employees have the same

number of grades and steps as do regular wage rate schedules. The special schedules include

wage rates that are identical, by grade and step, to those shown on the regular wage rate

schedules on which they are based. The special schedules also include:

(1) Identification of the Corps of Engineers District headquarters office authorized to apply

the special wage rates and FWS wage areas for which the wage rate schedules have

special application; and

(2) Identification of each lock and dam installation covered, together with the geographic

location of each.

c. Administration. The special schedule lead agency, the Department of Defense, is

responsible for issuing special wage rate schedules under this pay plan. Special wage rate

schedules are issued on a timely basis to reflect new FWS regular schedule rates established

in accordance with wage adjustment authorized for the applicable wage area. Each special

schedule is effective on the same date as the regular schedule on which it is based.

d. Coding. Positions covered by FWS special wage rate schedules issued under this pay plan

are coded as follows:

WY for nonsupervisory jobs

WO for leader jobs

WA for supervisory jobs

The prefix letters are followed by the numerical code of the job family and the occupation

involved, and the grade of the position.

S11-9 Special Pay Plan for U.S. Department of the Interior

Wage Employees in Overlap Areas

a. Coverage. This pay plan is for use in establishing special wage schedules for all agency

prevailing rate employees of the National Park Service, U.S. Department of the Interior,

whose duty station is located in one of the jurisdictions shown below. Each of the three

National Park Service (NPS) jurisdictions involved is located in (overlaps) more than one

FWS wage area. The special wage schedules to be established for each of these NPS

jurisdictions is based on a determination as to which one of the FWS wage area regular

schedules involved provides the most favorable payline for the employees concerned.

NPS Jurisdictions

Blue Ridge Parkway

Natchez Trace Parkway

Great Smoky Mountains National Park

b. Establishment of special wage schedules. For each NPS jurisdiction involved, the

determination as to which is the most favorable payline is made by computing a simple

average of the 15 nonsupervisory second step rates listed on each one of the regular

schedules authorized for each FWS wage area overlapped. The highest average obtained by

this method identifies the regular schedule that produces the most favorable payline. At the

appropriate time all supervisory, leader, and nonsupervisory regular schedule rates shown on

the regular schedule which produced the most favorable payline are issued as the special rate

schedules for the NPS jurisdiction involved.

c. Timing of special schedule determinations and adjustments. Computations and payline

determinations required by paragraph b above are made for each NPS jurisdiction on the

effective date of the next adjustment of the regular area wage schedule which currently

produces the most favorable payline for that NPS jurisdiction. New special schedules issued

as a result of these determinations are effective on the same date as the FWS regular wage

schedules on which they are based. If the identification of the schedule which produces the

most favorable payline in an NPS jurisdiction changes as a result of the computations,

special schedule rates based on the newly obtained highest average are issued on the

determination date. The next special schedule determination and adjustment is then made on

the effective date of the next regular wage schedule for the area which now produces the

most favorable payline for the NPS jurisdiction. In the event the identity of the schedule

which produces the most favorable payline does not change, but an interim regular wage

schedule is issued during the course of the normal adjustment cycle, the special schedule is

also adjusted to reflect the changes in the interim schedules.

d. Administration. The Department of Defense, the lead agency for the regular area wage

surveys, furnishes copies of appropriate regular wage schedules which the Department of the

Interior, as the special schedule lead agency, uses in preparing the special schedules.

e. Coding. Positions covered by special schedules issued under this pay plan are coded as

follows:

XA for nonsupervisory jobs

XB for leader jobs

XC for supervisory jobs

The prefix letters are followed by the numerical code of the family and occupation involved.

The code is completed by adding the grade of the position.

S11-10 Special Pay Plan for U.S. Information Agency Radio

Antenna Rigger Positions

a. Coverage. This pay plan establishes a special wage schedule for Radio Antenna Riggers

employed by the United States Information Agency at transmitting and relay stations in the

United States.

b. Establishment of special wage schedules. The United States Information Agency will issue

a special wage schedule for each transmitting and relay station in the United States. The

wage rate will be the regular wage rate for the appropriate grade for Radio Antenna Rigger

for the wage area in which the station is located, plus 25 percent of that rate.

c. Timing. The special wage schedule will be issued immediately following publication of the

regular wage schedule for each wage area, and the new wage rates will have the same

effective date as the regular wage schedule.

d. Basis for differential. The 25 percent differential is in lieu of any environmental differential

that would otherwise apply by operation of the provisions of Subchapter S8-7 of this

operating manual.

S11-11 Special Pay Plan for U.S. Department of the Navy

Ship Surveyor Positions in Puerto Rico

a. Coverage. This pay plan establishes special schedules of wages for U.S. Department of the

Navy nonsupervisory and supervisory Ship Surveyor positions in Puerto Rico.

b. Establishing of special schedules of wages. The Department of Defense, which issues the

regular Puerto Rico wage area schedule, establishes the special wage schedules to be

effective on the same date as the regular wage area schedule. The special schedule is derived

from the current appropriated fund wage rate schedule for U.S. citizen wage employees in

foreign areas. The second step rate of the special schedule for the nonsupervisory Ship

Surveyor position is initially set at 130 percent of the WG-10 overseas rate. An additional 15

percent is added to the special rate and is included in the rate of basic pay. The second step

rate of the special schedule for the supervisory Ship Surveyor position is initially set at 145

percent of the WG-10 overseas rate. An additional 15 percent is added to the special rate and

is included in the rate of basic pay. The first, third, fourth, and fifth steps of nonsupervisory

and supervisory positions are set at 96, 104, 108, and 112 percent, respectively, of the second

step of the special rates.

S11-12 Special Pay Plan for U.S. Department of the Navy

Positions in Bridgeport, CA

a. Coverage. This pay plan establishes special wage schedules for FWS employees stationed at

the U.S. Marine Corps Mountain Warfare Training Center in Bridgeport, CA.

b. Establishment of special wage schedules. The Department of Defense, which issues the

Reno, Nevada, regular wage schedule, establishes the special wage schedule to be effective

on the same date as the Reno regular wage schedule. The Bridgeport special schedule is

established by adding a 10 percent differential to the rates of the Reno regular wage

schedule.

S11-13 Special Pay Plan for Printing and Lithographic

Positions

a. Coverage. The Office of Personnel Management established FWS special printing and

lithographic wage schedules in areas in which it was anticipated that prevailing industry rates

for comparable printing jobs would be so far above the maximum rates of the regular wage

schedules that agencies would be seriously handicapped in recruiting and retaining qualified

employees at the regular schedule rates. Once an FWS special printing schedule is

established in a wage area, all printing and lithographic wage positions within the area are

paid from the special schedule. For purposes of this pay plan, a printing and lithographic

wage position is defined as one properly allocable to the 4400 Printing Family or the 5330

Printing Equipment Repairing series.

b. Special schedule grade structure and alignment plan. Special printing schedules

established under this pay plan have a 15 grade nonsupervisory and leader schedule structure

and a 19 grade supervisory structure. The FWS job-grading standards for occupations within

the 4400 Printing Family, or the most nearly related FWS standards, and the job-grading

standards for leaders and supervisors, are used to grade positions paid from FWS special

printing schedules.

c. Step rate structure. FWS special printing schedules have three step rates. The second step

is the payline rate, and there are four percent increments between the steps. There is a

waiting period of 26 weeks between steps 1 and 2 and 78 weeks between steps 2 and 3.

d. Special schedule surveys. The lead agency responsible for planning and conducting the

regular schedule survey in an authorized special printing schedule area will also plan and

conduct the special printing survey in the area. Special printing surveys are ordered at the

same time as regular schedule surveys. Insofar as they do not conflict with instructions

provided by this pay plan, applicable procedures described in subchapter S5 of this operating

manual will be followed by the lead agency in making prevailing rate determinations and

computing special printing schedules.

(1) Wage areas: The wage area definitions shown in appendix D of this operating manual

are applicable for the purpose of determining the geographic coverage of special wage

schedules issued under this pay plan.

(2) Survey areas: Special printing schedule surveys are conducted within FWS regular

schedule survey area boundaries.

(3) Industry: The commercial printing, lithographic industry, NAICS 323110 and 323114, is

required to be included in special schedule printing surveys. In the initial special printing

schedule survey for an authorized area, all NAICS’s within Subsector 323 (Printing and

Related Support Activities) are covered. After the initial survey, the lead agency may

revise the industry coverage in light of survey experience.

(4) Establishments: The survey universe consists of all printing establishments in the

surveyed industries which have a total employment of at least 20 employees.

(5) Survey jobs: The jobs to be surveyed in special printing industry surveys are as follows:

Job No. Job Title Job Grade

400 Offset Photographer (Halftone) 10

401 Offset Photographer (Process Color) 11

402 Film Assembler – Stripper (Single Flat-Single Color) 5

403 Film Assembler – Stripper (Partial and Composite Flats) 7

404 Film Assembler – Stripper (Multiple Flat-Multiple Color) 8

405 Opaquer 4

406 Negative Engraver 10

407 Platemaker (Single Color) 5

408 Platemaker (Double Exposure and Multicolor Line) 7

409 Platemaker (Multicolor Halftones and Screen Tints) 8

410 Offset Press Helper 5

411 Offset Press Operator 8

412 Offset Pressman (15" x 18" thru 14" x 20")

38cm x 46cm 36cm x 51cm

9

413 Offset Pressman (17" x 22" thru 19" x 25")

43cm x 56cm 48cm x 64cm

9

414 Offset Pressman (22" x 29" thru 35" x 39")

56cm x74cm 89cm x 99cm

9

415 Offset Pressman (35" x 45" and larger)

89cm x 114cm

10

416 Lithographic Pressman Multicolor (17" x 22" thru 25" x 39")

43cm x 56cm 64cm x 99cm

10

417 Lithographic Pressman Multicolor (34" x 44" and larger)

86cm x 112cm

11

418 Bindery Machine Operator (Helper) 5

419 Bindery Machine Operator (Paper Cutter) 8

420 Bindery Machine Operator (Power Folder) 8

421 Bindery Machine Operator 9

422 Bookbinder 10

(6) Guidelines for determining adequacy of special printing wage survey data: Ordinarily, a

survey is considered to provide wage data which are adequate for computing special

printing schedule survey trend lines when the results include:

(a) 20 unweighted samples in the grade 1 to 5 range, 20 unweighted samples in the grade

6 to 8 range, 40 unweighted samples in the grade 9 and above range; and

(b) At least 6 additional unweighted samples anywhere in the grade 1 to 15 range.

Each survey job used in computing the nonsupervisory special schedule payline must

include a minimum of three unweighted samples.

(7) Adequacy of industry employment: Private printing industry employment is considered

sufficient if the total private printing industry employment in the survey area is at least

twice the FWS printing employment in the area.

(8) Special provision: No special printing schedule third step rate will be less than maximum

rate of the corresponding grade on the regular FWS schedule for the wage area. If an

adjustment is required under this provision, the second step rate of the special schedule

grade in question is reconstructed so as to provide for a third step rate (104 percent of the

second step rate) which is equal to the maximum rate of the corresponding regular

schedule grade. The first step rate is established at 96 percent of the new second step

rate.

e. Identification of positions. Positions covered by the special printing schedules are coded as

follows:

XP for nonsupervisory jobs

XL for leader jobs

XS for supervisory jobs

XD for nonsupervisory production facilitating jobs

XN for supervisory production facilitating jobs

The prefix letters are followed by the numerical code of the job family and the occupation

involved; the code is completed by adding the grade of the position.

f. Special schedule areas. An FWS special printing schedule is currently authorized only in

the Washington, D.C. area.

S11-14 Special Pay Plan for Diver and Tender Positions

a. Coverage. This pay plan establishes special wage schedules for FWS employees who are

performing diving and tending duties.

b. Establishment of special wage schedules. FWS employees who perform diving duties will

be paid 175 percent of the WG-10, step 2, locality rate for all payable hours of the shift.

Employees who perform tending duties will be paid at the WG-10, step 2, locality rate for all

payable hours of the shift. Employees whose regular schedule rate exceeds the

diving/tending rate on the day they perform such duties will retain their regular schedule rate

on that day. An employee’s diving and tending rate, as appropriate, will be used as the basic

rate of pay for computing all premium payments for a shift. Employees who both dive and

tend on the same shift will receive the higher diving rate as the basic rate of pay for all hours

of the shift.

S11-15 Special Wage Schedules for Supervisors of

Negotiated Rate Bureau of Reclamation Employees

a. Coverage. These special wage schedules apply to wage supervisors of negotiated rate wage

employees in the Bureau of Reclamation.

b. Introduction. These schedules are based on annual special wage surveys conducted by the

Bureau of Reclamation in each special wage area. Survey jobs representing Bureau of

Reclamation positions at up to four levels are matched to private industry jobs in each special

wage area. Special schedule rates for each position are based on prevailing rates for that

particular job in private industry. The special survey and wage schedule for a given special

wage area include only those occupations and levels having employees in that area. For each

position on the special schedule, there are three step rates. Step 2 is the prevailing rate as

determined by the survey; step 1 is 96 percent of the prevailing rate; and step 3 is 104 percent

of the prevailing rate.

c. Job classification. Each supervisory job is described at one of four levels corresponding to

the four supervisory situations described in Factor I and four levels of Subfactor IIIA of the

FWS Job Grading Standard for Supervisors. They are titled in accordance with regular FWS

practices, with the added designation of level I, II, III, or IV. FWS occupational codes are

assigned.

d. Basis for schedules. For each special wage area, the Bureau of Reclamation designates and

appoints a special wage survey committee, including a chairperson and two other members

(at least one of whom is a supervisor paid from the special wage schedule), and one or more

two-person data collection teams (each of which includes at least one supervisor paid from

the special wage schedule). The local wage survey committee determines the prevailing rate

for each survey job as a weighted average. Survey specifications are as follows for all

surveys:

(1) Tailored to the Bureau of Reclamation activities and types of supervisory positions in the

special wage area, private industry companies to be surveyed are selected from the

following North American Industry Classification System Subsectors:

2002 NAICS

Codes

2002 NAICS Industry Titles

211 Oil and gas extraction

212 Mining (except oil and gas)

213 Support activities for mining

221 Utilities

333 Machinery manufacturing

334 Computer and electronic product manufacturing

335 Electrical equipment, appliance, and component manufacturing

484 Truck transportation

492 Couriers and messengers

493 Warehousing and storage

515 Broadcasting (except Internet)

517 Telecommunications

562 Waste management and remediation services

811 Repair and maintenance

No minimum employment size is required for surveyed establishments.

(2) Each local wage survey committee compiles lists of all companies in the survey area

known to have potential job matches. For the first survey, all companies on the list are

surveyed. Subsequently, companies are removed from the survey list if they prove not to

have job matches, and new companies are added if they are expected to have job

matches. Survey data is shared with other local wage survey committees when the data

from any one company is applicable to more than one special wage area.

(3) For each area, survey job descriptions are tailored to correspond to the position of each

covered supervisor in that area. They are described at one of four levels (I, II, III, or IV)

corresponding to the definitions of the four supervisory situations described in Factor I

and four levels of Subfactor IIIA of the FWS Job Grading Standard for Supervisors. A

description of the craft, trade, or labor work supervised is included in each supervisory

survey job description.

(4) Special wage area boundaries are identical to the survey areas covered by the special

wage surveys. The areas of application in which the special schedules are paid are

generally smaller than the survey areas, reflecting actual Bureau of Reclamation

worksites and the often scattered location of surveyable private sector jobs.

e. Special wage schedule areas. Special wage schedules are established in the following

areas:

THE GREAT PLAINS REGION

Special Wage Survey Area (Counties):

• Montana: All counties except Lincoln, Sanders, Lake, Flathead, Mineral,

Missoula, Powell, Granite, Ravalli

• Wyoming: All counties except Lincoln, Teton, Sublette, Uinta, Sweetwater

• Colorado: All counties except Moffat, Rio Blanco, Garfield, Mesa, Delta,

Montrose, San Miguel, Ouray, Delores, San Juan, Montezuma, La Plata,

Archuleta

• North Dakota: All counties

• South Dakota: All counties

Special Wage Area of Application (Counties):

• Montana: Broadwater, Jefferson, Lewis and Clark, Yellowstone, Bighorn

• Wyoming: All counties except Lincoln, Teton, Sublette, Uinta, Sweetwater

• Colorado: Boulder, Chaffee, Clear Creek, Eagle, Fremont, Gilpin, Grand, Lake,

Larimer, Park, Pitkin, Pueblo, Summitt

Beginning month of survey: August

THE MID-PACIFIC REGION

Special Wage Survey Area (Counties):

• California: Shasta, Sacramento, Butte, San Francisco, Merced, Stanislaus

Special Wage Area of Application (Counties):

• California: Shasta, Sacramento, Fresno, Alameda, Tehama, Tuolumne, Merced

Beginning month of survey: February

GREEN SPRINGS POWER FIELD STATION

Special Wage Survey Area (Counties):

• Oregon: Jackson

Special Wage Area of Application (Counties):

• Oregon: Jackson

Beginning month of survey: April

PACIFIC NORTHWEST REGION DRILL CREW

Special Wage Survey Area (Counties):

• Montana: Flathead, Missoula

• Oregon: Lane, Bend, Medford, Umatilla, Multnomah

• Utah: Salt Lake

• Idaho: Ada, Canyon, Adams

• Washington: Spokane, Grant, Lincoln, Okanogan

Special Wage Area of Application (Counties):

• Oregon: Deschutes, Jackson, Umatilla

• Montana: Missoula

• Idaho: Ada

• Washington: Grant, Lincoln, Douglas, Okanogan, Yakima

Beginning month of survey: April

SNAKE RIVER AREA OFFICE (CENTRAL SNAKE/MINIDOKA)

Special Wage Survey Area (Counties):

• Idaho: Ada, Caribou, Bingham, Bannock

Special Wage Area of Application (Counties):

• Idaho: Gem, Elmore, Bonneville, Minidoka, Boise, Valley, Power

Beginning month of survey: April

HUNGRY HORSE PROJECT OFFICE

Special Wage Survey Area (Counties):

• Montana: Flathead, Missoula, Cascade, Sanders, Lake

• Idaho: Bonner

• Washington: Pend Oreille

Special Wage Area of Application (Counties):

• Montana: Flathead

Beginning month of survey: March

GRAND COULEE POWER OFFICE (GRAND COULEE PROJECT OFFICE)

Special Wage Survey Area (Counties):

• Oregon: Multnomah

• Washington: Spokane, King

Special Wage Area of Application (Counties):

• Washington: Grant, Douglas, Lincoln, Okanogan

Beginning month of survey: April

UPPER COLUMBIA AREA OFFICE (YAKIMA)

Special Wage Survey Area (Counties):

• Washington: King, Yakima

• Oregon: Multnomah

Special Wage Area of Application (Counties):

• Washington: Yakima

• Oregon: Umatilla

Beginning month of survey: September

COLORADO RIVER STORAGE PROJECT AREA

Special Wage Survey Area (Counties):

• Arizona: Apache, Coconino, Navajo

• Colorado: Moffat, Montrose, Routt, Gunnison, Rio Blanco, Mesa, Garfield,

Eagle, Delta, Pitkin, San Miguel, Delores, Montezuma, La Plata, San Juan,

Ouray, Archuleta, Hindale, Mineral

• Wyoming: Unita, Sweetwater, Carbon, Albany, Laramie, Goshen, Platte,

Niobrara, Converse, Natrona, Fremont, Sublette, Lincoln

• Utah: Beaver, Box Elder, Cache, Carbon, Daggett, Davis, Duchesne, Emery,

Garfield, Grand, Iron, Juab, Kane, Millard, Morgan, Piute, Rich, Salt Lake, San

Juan, Sanpete, Sevier, Summit, Tooele, Uintah, Utah, Wasatch, Washington,

Wayne, Weber

Special Survey Area of Application (Counties):

• Arizona: Coconino

• Colorado: Montrose, Gunnison, Mesa

• Wyoming: Lincoln

• Utah: Daggett

Beginning month of survey: March

ELEPHANT BUTTE AREA

Special Wage Survey Area (Counties):

• New Mexico: Grant, Hidalgo, Luna, Doña Ana, Otero, Eddy, Lea, Roosevelt,

Chaves, Lincoln, Sierra, Socorro, Catron, Cibola, Valencia, Bernalillo, Torrance,

Guadalupe, De Baca, Curry, Quay

• Texas: El Paso, Hudspeth, Culberson, Jeff Davis, Presido, Brewster, Pecos,

Reeves, Loving, Ward, Winkler

• Arizona: Apache, Greenlee, Graham, Cochise

Special Wage Area of Application (Counties):

• New Mexico: Sierra

Beginning month of survey: June

LOWER COLORADO DAMS AREA

Special Wage Survey Area (Counties):

• Nevada: Clark

• California: Los Angeles

• Arizona: Maricopa

Special Wage Area of Application (Counties):

• Nevada: Clark

• California: San Bernadino

• Arizona: Mohave

Beginning month of survey: August

YUMA PROJECTS AREA

Special Wage Survey Area (Counties):

• California: San Diego

• Arizona: Maricopa, Yuma

(Note: Bureau of Reclamation may add other survey counties for dredge operator

supervisors because of the uniqueness of the occupation and difficulty in finding job

matches.)

Special Wage Area of Application (Counties):

• Arizona: Yuma

Beginning month of survey: November (Maintenance) and April (Dredging)

BUREAU OF RECLAMATION, DENVER, CO, AREA

Special Wage Survey Area (Counties):

• Colorado: Jefferson, Denver, Adams, Arapahoe, Boulder, Larimer

Special Wage Survey Area of Application (Counties):

• Colorado: Jefferson

Beginning month of survey: February

f. Coding. These special schedule positions are identified by pay plan code XE, grade 00. The

FWS occupational codes are used.

g. Administration. New employees are hired at step 1 of the position. With satisfactory or

higher performance, advancement between steps is automatic after 52 weeks of service. The

waiting period for within-grade increases begins on the employee’s first day under the new

special schedule.

h. Conversion. Upon establishment of these new special wage schedules, current employees

are placed in step 2 of the new special schedule, or, if their current rate of pay exceeds the

rate for step 2, they are placed in step 3. Pay retention applies to any employee whose rate of

basic pay would otherwise be reduced as a result of placement in these new special wage

schedules.