PRO Program Plan Application: 2025-2027 Program Plan Period Page 1

Oregon Recycling Modernization Act

Producer Responsibility Organization Program

Plan Application Form

2025-2027 Program Plan Period

Prospect

ive PRO contact information

Name of organization: Circular Action Alliance

Address: Phone:

Website: www.circularaction.org

Authorized representative: Charles Schwarze Title: Chair

Address of authorized representative (if different from above): n/a

Prospective PRO qualifications

Is the organization a 501(c)3 nonprofit legally operating in Oregon?

Yes No

Corroborating documents appended (check all that have been provided):

The organization’s articles of incorporation

501(c)3 letter of determination

Proof of registration with the Oregon Department of Justice as a charitable organization

Proof of registration with the Oregon Secretary of State as a foreign corporation operating in Oregon (if

applicable)

Are the organization’s producer members likely to comprise at least 10% of Oregon’s market share?

Yes No

Indicate corroborating information provided:

Has the payment of the program plan review fee been remitted to the department?

Yes No

Program information

Program name: Oregon Program Plan Date of submission: March 31, 2024

20 F Street NW, Suite 700

Washington, D.C. 20001

Executive Summary: The attached Circular Action Alliance (CAA) Oregon Program Plan 2025 – 2027 is submitted in

accordance the requirements for producer responsibility organizations under ORS 459A.875. The plan describes

how CAA will fulfill the obligations of a producer responsibility organizations under Oregon’s Recycling

Modernization Act (RMA) for the period from July 1, 2025 to December 31, 2027 if the submitted plan is approved by

the Department of Environmental Quality. The plan describes CAA’s approach to implementing RMA requirements

including: the provision of funding support for both local governments and recycling participants for recycling

activities and system improvements; the creation of a network for the collection of PRO acceptance list materials;

ensuring collected materials are recycled responsibly and education and outreach activities to communicate

recycling changes and opportunities to Oregonians.

(336) 840-9860

Page 2

Certification and Attestation

I/we hereby declare under penalty of false swearing (Oregon Revised Statute 162.075 and ORS 162.085)

that the above information and all the statements, documents and attachments submitted with this plan are

true and correct.

Signed:

Printed name: Charles Schwarz

e

Date: March 31, 2024

Table of Contents

Table of Contents

Oregon

Program Plan

(2025 – 2027)

Oregon

Program Plan

(2025 – 2027)

2

circularactionalliance.org

Oregon Program Plan

(2025 – 2027)

Table of Contents

Executive Summary ..................................................................................... 5

Goals of the Program ................................................................................................... 5

Operations Plan ......................................................................................................... 6

Financing Strategy ...................................................................................................... 7

Equity ..................................................................................................................... 8

Management and Compliance ......................................................................................... 8

At the Center of the Transformation ................................................................................. 8

Goals of the Program ................................................................................. 10

About Circular Action Alliance...................................................................... 14

Description of the Organization ..................................................................................... 14

CAA’s Qualifications to Serve as a PRO in Oregon ................................................................ 15

Understanding of Oregon’s Recycling Modernization Act ........................................................ 15

Team Expertise and Capabilities .................................................................................... 16

Qualifications to Deliver Interim Coordination Tasks ............................................................ 16

CAA’s Producer Membership ......................................................................................... 17

Operations Plan ....................................................................................... 18

a. Collection and Recycling of USCL Materials .............................................................. 18

i. System Expansions and Improvements ........................................................................... 19

ii. Transportation Reimbursements ................................................................................. 25

iii. Additional Reimbursement and Funding for Local Governments ........................................... 30

iv. Start-Up Approach for Time-Sensitive Tasks .................................................................. 33

b. The PRO Recycling Acceptance List ....................................................................... 35

i. Proposed Approach to Achieving Convenience Standards ..................................................... 36

ii. Proposed Approach to Addressing Performance Standards................................................... 42

iii. Start-Up Approach for Establishing the Depot Collection System ......................................... 48

iv. Proposed Depot Collection Targets ............................................................................. 50

c. Materials Strategy ............................................................................................. 56

i. Proposed Additions to the USCL .................................................................................. 57

ii. Specifically Identified Materials on the USCL .................................................................. 62

iii. Specifically Identified Materials on the PRO Recycling Acceptance List .................................. 64

iv. Proposal to Trial Commingled Collection of Non-USCL Materials ........................................... 66

3

circularactionalliance.org

v. Initial Plastic Recycling Rate Projections ....................................................................... 68

vi. Ensuring Responsible End Markets .............................................................................. 72

vii. Upholding Oregon’s Materials Management Hierarchy ...................................................... 83

d. Education and Outreach ..................................................................................... 84

i. Goals for Education and Outreach ............................................................................... 84

ii. CAA’s Education and Outreach Plan............................................................................. 85

iii. A Description of the Statewide Promotional Campaign ...................................................... 90

iv. A Culturally Responsive Approach .............................................................................. 92

v. Schedule Including Proposed Timings for Start-Up Approach ................................................ 93

vi. Relevant experience .............................................................................................. 97

Financing ............................................................................................... 99

a. Membership Fee Structure and Base Fee Rates ........................................................ 99

i. Product Speciation for the Fee Structure ....................................................................... 99

ii. Development of the Base Fee Algorithm ...................................................................... 100

iii. Preliminary Base Fee Schedule Ranges ....................................................................... 103

iv. Producer Fee Incentives, Other Than Graduated Fee Adjustments ....................................... 104

v. Meeting the Statutory Requirement ............................................................................ 104

b. Graduated Fee Algorithm and Methods ................................................................. 107

i. The Algorithm and Accompanying Descriptive Text for the Proposed Graduated Fee Structure ....... 107

ii. Methods by which the PRO will Accept and Consider Requests for Ecomodulation Credits ............ 110

c. Alternative membership fee structure (if applicable) ............................................... 113

d. Adequacy of Financing ..................................................................................... 114

Equity .................................................................................................. 115

CAA’s Proposed Approach to Equity ............................................................................... 115

CAA Management and Compliance ................................................................ 118

a. Overall Day-to-Day Management ......................................................................... 118

b. Communications ............................................................................................. 119

CAA Plans for Communication and Coordination................................................................. 119

c. Reporting ...................................................................................................... 122

Metrics and Data Collection ........................................................................................ 122

Producer Reporting .................................................................................................. 122

Annual Reporting ..................................................................................................... 122

d. Managing Compliance....................................................................................... 124

e. Dispute Resolution (Local Governments and CRPFs) ................................................ 127

f. General Policies, Procedures, and Practices........................................................... 128

i. Management of Contracts ........................................................................................ 128

ii. Workplace Safety and Conduct ................................................................................. 128

4

circularactionalliance.org

iii. Protection of Confidential Information ....................................................................... 128

iv. Successful and Timely Delivery ................................................................................ 129

v. Retention of Information ........................................................................................ 129

g. Closure Plan .................................................................................................. 130

Certification and Attestation...................................................................... 132

a. Contents ....................................................................................................... 132

i. Contact Information .............................................................................................. 132

ii. The Prospective PRO’s Employer Identification Number .................................................... 132

iii. Proof of the Prospective PRO’s Status as a Nonprofit....................................................... 132

iv. Certifying Statement ............................................................................................ 133

Appendices ............................................................................................ 134

5

circularactionalliance.org

Executive Summary

Oregon’s Plastic Pollution and Recycling Modernization Act (RMA) creates important changes in how materials management

is undertaken and funded within the state. The legislation strives to improve the overall effectiveness of Oregon’s recycling

collection and processing ecosystem through a shared responsibility model.

A key element of this new framework is the concept of a producer responsibility organization (PRO), the entity through

which producers of covered materials will fund recycling services, support innovation and manage collection of certain

materials through a depot system.

To achieve the objectives of the RMA, Circular Action Alliance (CAA) submits this draft program plan to the Oregon

Department of Environmental Quality (DEQ) for consideration.

As a prospective PRO, CAA has developed a detailed approach to managing and administering an extended producer

responsibility (EPR) program to fulfill key obligations pursuant to the RMA. The team behind this program plan includes a

wide range of recycling industry and policy experts with extensive knowledge in program plan development,

implementation, operations, education and outreach, and local government structure. The CAA team has spent a great deal

of time engaging with stakeholders in Oregon and referencing a wide range of applicable studies to formulate strategies and

cost estimates tailored to Oregon’s unique and dynamic materials recovery landscape.

CAA has taken DEQ’s Internal Management Directive (IMD) on the RMA PRO Program Plans as a basis for the structure of

this submission. Some adaptations have been made to the proposed IMD outline to improve narrative flow.

The table of contents, charts, and subheadings in the document will help readers effectively navigate all the plan’s content,

and brief overviews of core sections are provided below.

Goals of the Program

CAA’s overarching objective is to support the successful implementation of the RMA in collaboration with DEQ and all other

key stakeholders. It is the view of CAA that this program plan will result in successful implementation to achieve four high-

level goals:

1. Reduce the negative environmental, social, and health impacts from the end-of-life management of products

and packaging

2. Increase the diversion of recyclable materials from disposal.

3. Improve public participation, understanding and equity in the state’s recycling system.

4. Create a system that fulfills the needs and regulatory requirements of the PRO, its members, and all other

relevant stakeholders.

These top-line objectives are defined in further detail in the Goals of the Program section, along with key metrics and

measures to help chart progress and determine success.

6

circularactionalliance.org

Operations Plan

The operations plan segment delves into the specific steps and strategies that CAA will employ to meet RMA requirements

and help catalyze a range of recycling system expansions and improvements that can lead to a stronger, more efficient

framework of materials management. This includes detailed plans and recommendations for:

Collection and Recycling of UCSL Materials – A plan for the collection, transport, and recycling of all covered materials

on the RMA’s Uniform Statewide Collection List (USCL) and a framework for deploying funding to support these

activities. Highlights include:

o The Oregon Recycling System Optimization Project (ORSOP), a critical project that will offer a more complete

picture of system gaps, opportunities for efficiency, and more. This initiative will provide additional data and

details required to more precisely estimate and schedule the distribution of funding for system

improvements;

o Key tasks to support the distribution of funding and reimbursements to eligible parties that must be

completed in advance of the July 1, 2025 (the RMA implementation date), in addition to the ORSOP:

▪ Negotiating with and then providing associated compensation (with a single accounting point-of-

contact system) to local governments for service expansion;

▪ Setting up a single accounting point-of-contact system for compensation of local governments for

expenses besides service expansion;

▪ Setting up a single accounting point-of-contact system for payment of contamination management

fees and processor commodity risk fees to commingled recycling processing facilities.

The PRO Recycling Acceptance List – This section outlines activities, timelines, and recommendations for increasing

diversion of materials named on the PRO Recycling Acceptance List, including proposed approaches to meeting

service convenience and performance standards and proposed collection targets for each material category.

Highlights include:

o Identification of 173 existing permitted depot sites that meet the state convenience standard, and another

285 to serve as substitutes if any existing facilities choose to not participate as a PRO collection point;

o Key activities to ensure timely provision of depot services that must be completed in advance of the July 1,

2025, RMA implementation date:

▪ Perform additional analysis of needs and further design of PRO depot system in consultation with

DEQ, potential partner depots, local governments, and service providers;

▪ Finalize contracts with local governments, service providers, and end markets and launch reporting

and accounting systems while onboarding key stakeholders;

▪ Open the first phase of PRO acceptance list collection points.

Materials Management – Key materials management considerations including strategies for Specifically Identified

Materials (SIMs) and engagement with and verification of responsible end markets (REMs). Highlights include:

o Proposals to expand the USCL to include PET thermoforms, transparent blue and green PET bottles, and spiral

wound containers;

7

circularactionalliance.org

o A proposal to explore commingled, trial collection of polycoated paper packaging and single-use cups with

the intent to better understand generator behaviors and other system barriers to the inclusion of these

materials on the USCL;

o Insight into the program plan’s anticipated impact on plastic recycling and an estimate of Oregon’s current

plastic recycling rate;

o A strategy to create a materials tracking system that supports REM verification for all system participants and

proposed approach to supporting REM development.

o Key activities to support effective materials management and REMs that must be completed in advance of

the July 1, 2025, RMA implementation date.

Education and Outreach – A vision for delivering effective and harmonized education in a manner that incorporates

feedback from, and supports, local government outreach and is responsive to diverse audiences across this state.

Highlights include:

o Goals to ensure widespread recycling awareness through culturally responsive support and messaging that

has been proven to effectively drive increased participation and capture of recyclables, deployed in a manner

complementary to programmatic efforts to reduce contamination;

o Key activities to support the education and outreach plan that must be completed in advance of the July 1,

2025, RMA implementation date.

Financing Strategy

An essential role of the PRO is developing a comprehensive methodology for determining how much funding obligated

producers of covered materials are required to contribute to the statewide system. Factors such as material type, volume of

product sold into state, environmental impact of materials and commodity revenues must be properly accounted for when

designing and implementing a fair & effective program fee.

The financing section of the program plan lays out the guiding principles CAA has developed and used as the basis of an

interim base fee methodology to set preliminary base fees. This section also describes how the fee outcomes from using

this fee algorithm satisfy the RMA statutory requirements and fulfill the adequacy of financing requirement.

CAA will introduce a graduated fee algorithm to provide producers with practical and measurable criteria upon which to

qualify for fee incentives and disincentives in future program plan amendments.

In advance of the Oregon System Optimization Project being completed, a preliminary estimate of the Year 1 program

budget range is provided in Appendix E. This sum, to be covered by producer fees, accounts for management costs of

materials, service expansion costs, PRO depot system development, as well as costs to develop and sustain viable

responsible end markets and other contributions to advance program improvement initiatives.

CAA expects the program costs to be refined for future Program Plan amendments.

8

circularactionalliance.org

Equity

There is no one-size-fits-all solution to recycling because motivators and barriers vary across age, region, race, ethnicity, and

other factors. For this reason, CAA has embedded principles of equity into the program plan in a manner that upholds and

reinforces the goals set out in the RMA. These principles are integrated into each key component of PRO administration and

program implementation.

This proposal describes how CAA has built equity into the proposed approaches for key activities, including:

The establishment of a PRO depot network

The development of responsible end markets

Development and deployment of recycling education and outreach efforts

PRO administration

CAA consulted with Oregon community-based organizations (CBOs) to develop the equity components of this plan. It

recognizes the importance of fostering relationships with Oregon CBOs to effectively address program equity issues.

In short, the program plan outlines strategies to use this transformational moment in Oregon’s materials management as a

springboard to greater equity in various areas.

Management and Compliance

As an organization helping to introduce a new approach to recycling funding and management in the U.S., CAA recognizes

the critical importance of stakeholder communication as the RMA moves toward implementation.

As such, this program plan offers a detailed explanation on CAA’s structure of day-to-day management, as well as a

communications strategy for maintaining strong connections with government entities and other stakeholders.

Furthermore, CAA has outlined data collection steps and metrics considerations to effectively track program successes and

areas in need of improvement. The elements of an optimized annual report are also explained.

Finally, this section of the plan lays out an in-depth process for tracking and maintaining producer compliance, setting clear

standards and expectations on rules, audits, and action to take place when companies are found to be in noncompliance.

This information is supplemented by important details on contract management, recordkeeping and other best practices

around organizational and program governance.

It is through these clear processes that CAA has confidence in its ability to meet the expectations of regulators, drive overall

program efficiency, and maintain strong coordination both internally as an organization and externally with partners across

the public and private sectors.

At the Center of the Transformation

The ultimate goal of RMA implementation is a transformed system of materials usage and recovery that will be responsive

to the needs of all stakeholders and that will lead to significant environmental and social benefits for Oregonians.

9

circularactionalliance.org

CAA has invested significant resources in developing this program plan and is committed to working with recycling

stakeholders to deliver on the RMA objectives. There is no doubt that effectively and efficiently transitioning to a shared

responsibility model of materials management and delivering on other RMA priorities will be a complicated and challenging

effort and one in which producers and other stakeholders will learn much along the way.

But CAA is confident the transition can and will happen successfully.

Data-driven decision-making, combined with a spirit of collaboration and communication, will be critical in the quest to see

the RMA realize its full potential. CAA has embedded those core principles in all segments of this plan. The group is excited

at the prospect of helping Oregon usher in system shifts that help reduce costs, drive more material into an expanded

recycling marketplace, and open the door to a better materials management future.

10

circularactionalliance.org

Goals of the Program

The overarching goal of Circular Action Alliance (CAA) for this initial program plan period is to support the successful

implementation of the Recycling Modernization Act (RMA) in collaboration with the Oregon Department of Environmental

Quality (DEQ) and all key stakeholders, including local governments, commingled recycling processing facilities (CRPFs),

haulers, and Oregon waste generators. Success will center on four critical high-level objectives:

Objective 1: Reduce the negative environmental, social, and health impacts from the end-of-life

management of products and packaging.

Program Goal

Outcomes/Indicaons of Success

Key Metrics

Ensure that materials

collected and processed

for recycling in Oregon are

consistently delivered to

responsible end markets.

▪ System of idenfying responsible end

markets (REMs) and tracking material ows

established with full cooperaon from

comingled recycling processing facility

(CRPFs) and other key stakeholders.

▪ CRPF and depot material streams directed to

REMs.

▪ System established to address and correct

issues that arise regarding REMs.

▪ Specifically identified materials (SIMs)

directed to REMs, where practicable.

▪ Percentage of recycled material going to

REMs, including SIMs.

▪ Number, kind, and specific REMs used by

CRPFs and CAA for depot material.

▪ Number of instances in which REM material

routing has needed correction and the results

of correction.

▪ Summary of REM verification undertaken

▪ Percentage of chain of custody anomalies

detected during quarterly reporting review

process.

Design and implement

producer fee structures

that provide adequate

financing for RMA

obligations and

incentivize producers to

improve environmental

outcomes associated with

the production and

recycling of printed paper

and packaging supplied to

the Oregon market.

▪ Inial base fee schedule adequately supports

RMA vericaon of REM requirements and

other system improvements.

▪ Eco-modulaon factors integrated into

producer fee following development of

datasets and feedback mechanisms required

to adjust fees for greater impact reducon.

▪ Comparative base fees for covered products

reflecting their individual features as directed

by the RMA.

▪ Data on producer changes to packaging

materials and formats that reflect effects of

base fees (and at a later date, as applicable,

graduated fees).

11

circularactionalliance.org

Objective 2: Increase the diversion of recyclable materials from disposal.

Program Goal

Outcomes/Indicaons of Success

Key Metrics

Create new and expanded

opportunies for more

Oregon residents (waste

generators) to recycle a

wider array of generated

materials, including

supporng enhancement

of local collecon services

and establishing

convenient depots for

addional material

collecon.

▪ PRO-assigned depot system established,

meeng convenience standards and

providing recycling opportunies for

materials assigned for depot collecon and

impact on material recycling rates.

▪ Local government service expansion requests

evaluated and funded according to

priorizaon guidelines resulng in new

collecon opportunies created for waste

generators.

▪ Uniform Statewide Collecon List (USCL)

applied across the state to expand what is

collected in commingled recycling, and steps

taken by CAA to successfully add materials to

the USCL.

▪ SIMs collecon issues successfully addressed.

▪ Progress toward 2028 plasc recycling goals

at the end of each program year.

▪ PRO material collecon and recycling rates in

relaon to plan targets.

▪ Consumer awareness and use of PRO

material depots.

▪ Diversion rates associated with USCL

materials.

▪ Extent of new SIMs collecon eorts

established.

▪ Tons of plasc materials sent to responsible

end markets divided into tons of covered

plasc products generated.

Facilitate the

modernizaon of Oregon’s

commingled material

processing infrastructure,

driving more ecient

capture and delivery of

high-quality materials to

end markets while

reducing loss of materials

to residue.

▪ Processor commodity risk fee (PCRF) and

contaminaon management fee (CMF)

payment system established to provide

necessary funding to CRPFs.

▪ CRPFs meeng DEQ’s performance standards

regarding capture rates and bale quality.

▪ Investments made in new equipment and

sorng processes to accommodate the USCL

and addions to the USCL.

▪ Funding provided to CRPFs through the PCRF

and CMF, with associated tonnage and

funding amounts.

▪ Capture rate and bale quality data from DEQ

and from CAA.

▪ Individual CRPF capacity to accept and

eecvely sort USCL materials.

12

circularactionalliance.org

Objective 3: Improve public participation, understanding and equity in the state’s recycling system.

Program Goal

Outcomes/Indicaons of Success

Key Metrics

Ensure Oregon residents

(waste generators),

reecng the states’ many

diverse communies, are

fully informed about their

recycling opportunies

and how to use those

opportunies opmally,

condently, and correctly.

▪ Increase amount of USCL and depot

materials collected, indexed against

populaon and generaon.

▪ Reducon in the amount of contaminant

materials entering the recycling collecon

stream in commingled recycling and at

depots.

▪ Increase in waste generator understanding

and condence in the recycling system across

all populaons.

▪ Tons of material collected through

commingled, depot, and other applicable

programs, indexed against populaon and

generaon metrics.

▪ Amount and percentage of contaminants in

collected streams and in streams entering

CRPFs.

▪ Measures of waste generator awareness,

knowledge, and condence in recycling (for

example, parcipaon rates) through surveys

or other data collecon.

Incorporate principles of

equity into the

deployment of recycling

opportunies, educaon,

and other elements of the

recycling system.

▪ Provision of equitable recycling opportunies

for populaons that may nd it dicult to

access service at collecon points.

▪ Work with local governments and

community groups to ensure any proposals

for the alternate delivery of recycling

convenience standards address equitable

access for communies and diverse

populaons.

▪ Educaonal materials that are clear and

demonstrably understandable are universally

distributed or made available.

▪ Explore and pursue opportunies with

Cercaon Oce for Business Inclusion and

Diversity (COBID) businesses and depot

collecon partners represenng diverse

communies.

▪ Roll out of recycling services for populaons

with access or mobility issues.

▪ Addional recycling opportunies addressing

gaps idened by local governments and

community groups.

▪ Numbers and kinds of new educaonal

materials created and distributed, and

audiences reached.

▪ Amount of new and eecve system

engagement by groups previously

underserved or unaddressed.

13

circularactionalliance.org

Objective 4: Create a system that fulfills the needs and regulatory requirements of the PRO, its

members, and all other relevant stakeholders.

Program Goal

Outcomes/Indicaons of Success

Key Metrics

Manage organizaonal

operaons to ensure

compliance with all statutory

requirements.

▪ Systems and mechanisms in place to fulll

CAA PRO obligaons under the RMA regarding

day-to-day management, policies and

procedures, communicaon, membership,

melines, and budgets.

▪ Mechanisms in place to address gaps,

shoralls, or other issues regarding CAA’s PRO

obligaons.

▪ Number, kind, and operaonal status

of systems and mechanisms for CAA

management obligaons.

▪ Number and nature of gaps or issues

that needed to be addressed and

resoluon status of those gaps/issues.

▪ Producer compliance acvity reports.

Provide an eecve plaorm of

support and interacon with

local governments, commingled

recycling processing facilies,

and haulers that allow them to

steadily improve their programs

and facilies to meet regulatory

targets and the goals of the

RMA.

▪ Applicaon, reporng, invoicing, and

informaonal plaorms established that are

clear, eecve, and ecient for stakeholders

to use.

▪ Mechanisms in place to use stakeholder

feedback for improving plaorms.

▪ Number and kind of plaorms in

place for stakeholder interacon.

▪ Extent of plaorm use (number of

users, etc.).

▪ Number and kind of issues with

plaorms expressed through

stakeholder feedback and any related

adjustments made to plaorms.

The following program plan details the integrated steps CAA will take to produce results that meet the objectives outlined

above. In putting this plan into action, CAA will prioritize clear and consistent engagement with all stakeholders and will

adopt an approach of continual improvement, recognizing the dynamic and complex nature of the Oregon materials

management system.

14

circularactionalliance.org

About Circular Action Alliance

This section of the plan provides summary information about Circular Action Alliance, including details of its structure,

governance and members, as well as its qualifications to serve as a PRO in Oregon.

Description of the Organization

Circular Action Alliance (CAA) is a U.S., nonprofit producer responsibility organization (PRO) established to support the

implementation of extended producer responsibility (EPR) laws for paper, packaging, and food service ware. The

organization was founded by leading U.S. producers representing retail, food, beverage, and consumer packaged goods

manufacturing.

CAA’s 20 Founding Members are Amazon; The Clorox Company; The Coca-Cola Company; Colgate-Palmolive; Danone North

America; Ferrero US; General Mills; Keurig Dr Pepper; Kraft Heinz; L’Oréal USA; Mars Incorporated; Mondelez International;

Nestlé USA; Niagara Bottling, LLC; PepsiCo, Inc.; Procter & Gamble; SC Johnson; Target; Unilever United States; and

Walmart.

Together, CAA’s membership represents more than 900 brands sold in the U.S., representing a wide variety of covered

product material types.

CAA was incorporated as a nonprofit corporation on December 21, 2022, and is recognized by the Internal Revenue Service

as exempt from taxation under Section 501(c)(3) of the Internal Revenue Code.

The organization’s mission is to provide producers with consistent EPR services across multiple states while developing and

implementing EPR programs that:

Meet state-specific regulatory requirements

Leverage existing recycling systems and infrastructure

Advance the circularity of covered materials on a national scale through collaboration with local governments, service

providers, and recycling system stakeholders

CAA’s National Board of Directors is made up of 20 voting representatives of Founding Member companies, which

represent a diversity of covered material supplied to the Oregon market. Each Founding Member has the right to appoint

one representative to serve as a Director on CAA’s National Board of Directors.

The CAA National Board of Directors has established the following committees and has the ability to create additional

committees or dissolve committees in the future:

Governance Committee – consisting of at least three members appointed by the Board of Directors who have

relevant experience and expertise in governance, membership development, and compliance.

Finance, Audit and Investment Committee – consisting of at least three members appointed by the Board of

Directors who have relevant experience, expertise, and knowledge in accounting, auditing, investments, budgeting,

cash flow management, reserve management, and financial risk management.

15

circularactionalliance.org

Human Resources Committee – consisting of at least three members, appointed by the Board of Directors, who have

relevant experience, expertise, and knowledge in human resources, employment law, organizational development,

and/or diversity, equity, and inclusion.

The CAA National Board of Directors intends to establish a designated governing body known as the Oregon Board, which

will have the delegated authority to act on behalf of the National Board of Directors to approve the producer responsibility

plan and the budget for implementation of the plan, as well as oversee the implementation of the approved producer

responsibility plan under the RMA. The Oregon Board will include Founding Member representatives, other producer

representatives, and non-voting members.

Additionally, CAA has engaged a third-party organization to provide support in the development of the Oregon governance

model. This organization is conducting a comprehensive review of CAA’s governance.

CAA’s Qualifications to Serve as a PRO in Oregon

CAA was established to support the implementation of EPR laws for paper, packaging, and food service ware and is fully

capable of meeting the PRO statutory requirements under the RMA. The organization has the expertise and vision to

collaboratively build a producer responsibility plan that will achieve the objectives of the RMA.

CAA’s progress to date includes the following:

On May 1, 2023, CAA became the first PRO approved to administer an EPR program for paper, packaging and food

service ware in the U.S., being appointed by the Colorado Department of Public Health and Environment (CDPHE) as

the single PRO responsible for implementing Colorado’s Producer Responsibility Program for Statewide Recycling Act.

On October 18, 2023, CAA was approved as the single PRO to represent the interests of producers in Maryland. As the

Maryland PRO, CAA will have a seat on the Producer Responsibility Advisory Council, which will make

recommendations to the Maryland governor on how to effectively establish and implement a producer responsibility

program for packaging materials.

On January 5, 2024, CAA was approved as the single PRO to deliver the objectives of the California Plastic Pollution

Prevention and Packaging Producer Responsibility Act (California Public Resources Code Sections 42040 to 42084).

As they have in these other EPR states, CAA members have invested time and resources to ensure the organization can

fulfill the specific PRO obligations in relation to the RMA in Oregon.

Understanding of Oregon’s Recycling Modernization Act

CAA has a strong and detailed understanding of the RMA. Following its incorporation, CAA was engaged in the Phase I

rulemaking process (and subsequently the Rulemaking Advisory Committee), which included the submission of comments

in July 2023.

CAA has also participated in DEQ Technical Working Groups and has pursued independent and extensive engagement with

Oregon DEQ and other Oregon stakeholders and groups, including: Oregon Refuse & Recycling Association (ORRA), local

governments and service providers, and the Association of Oregon Recyclers (AOR). Full details on CAA’s stakeholder

engagement during the development of this program plan can be found in Appendix D.

16

circularactionalliance.org

As a result of this engagement, CAA understands not only the requirements of the statute and rules, but also the priorities

of key stakeholder groups that are essential to the success of the RMA.

Team Expertise and Capabilities

CAA Founding Members are united in their vision to create a circular economy for paper, packaging, and food service ware

in the United States. CAA’s Founding Members have experience with the implementation of various EPR programs, and

they have assembled a team of independent service providers drawn from across North America with expertise in

developing and operating EPR programs to respond to state-specific regulatory requirements and recycling system needs.

CAA team members have participated in EPR implementation and program operation for many years, playing integral roles

in the creation, operation, and improvement of PROs. The team has expertise in regulatory compliance, project

management, governance, recycling systems and materials management, system improvement, end markets, finance, fee

setting, eco-modulation, packaging design, not-for-profit operation, information technology, reporting, consumer

education, producer and stakeholder relations, and public affairs.

The CAA team also includes Oregon-specific expertise and has plans in place to hire Oregon staff, capable of supporting

implementation. This local team will supplement the organization’s central expertise to enable seamless knowledge

transfer across jurisdictions and consistent producer services. CAA’s organization charts are included in Appendix C.

Qualifications to Deliver Interim Coordination Tasks

CAA is well-qualified to deliver the start-up tasks (previously referred to as interim coordination tasks) required to launch

the program successfully on July 1, 2025, as required by state statute. In particular, the CAA team is preparing to launch the

following workstreams:

Local Government and Service Provider Engagement (Oregon Recycling System Optimization Project)

This workstream is planned for April 2024 onward. The goal is to liaise further with local governments and their service

providers on expansion needs, to finalize plans for expansions to be funded in the first program plan, and to conduct

consultations on other relevant aspects of the plan. CAA has assembled a team of experts to undertake this work, building

from the initial discussions with a selection of local governments outlined in Appendix D that have taken place since

September 2023. The team has experience relevant to Oregon’s regulatory requirements, recycling system design, and

Oregon’s local government ecosystem. More information on plans for this workstream can be found in the Operations Plan

section of this plan, under “Collection and Recycling of USCL Materials.”

PRO Depot Development (Oregon Recycling System Optimization Project)

This workstream is planned for April 2024 onward. The goal is to liaise further with existing drop-off facilities and depot

locations, as well as new potential partners to finalize a network of PRO depot locations (supplemented by events and other

collection services) to meet the necessary collection targets, convenience and performance standards, and Responsible End

Market (REM) requirements under the RMA. CAA has assembled a team of experts to undertake this work, building from

17

circularactionalliance.org

the initial discussions with depot organizations outlined in Appendix D. More information on plans for this workstream can

be found in the Operations Plan section of this plan, under “The PRO Recycling Acceptance List.”

Education and Outreach

This workstream is planned for April 2024 and onward. The goal is to develop education and outreach collateral and a

statewide promotional campaign to communicate the USCL and PRO Recycling Acceptance List to residents and commercial

entities in Oregon. The workstream includes consultations with local stakeholders, including but not limited to DEQ, the

Oregon Recycling System Advisory Council (ORSAC), Oregon residents (in a range of geographies and housing situations),

Oregon businesses, local governments, service providers, and community-based organizations (CBOs). CAA has assembled a

team of experts to undertake this work. The team has experience in the Oregon regulatory requirements, waste generator

behavior trends, education materials development and delivery, Oregon-focused media executions, and Oregon local

government engagement. More information on plans for this workstream can be found in the Operations Plan section of

this plan, under “Education and Outreach.”

CAA’s Producer Membership

CAA membership exceeds the 10% market share threshold for covered products in Oregon required for approved PROs.

Based on available data, CAA estimates that current membership accounts for a minimum of 12% to 15% of the state’s

market share of covered products. (Details of how the market share estimate was calculated can be found in Appendix B.)

CAA is also conducting information sessions with hundreds of non-member producers regarding EPR obligations in Oregon

and other states and will expand membership further through 2024 and into 2025, in advance of the program start date.

CAA is resourced to complete all the tasks necessary to start the program, including all of the interim coordination (start-

up) tasks referenced in the RMA rules. CAA Oregon will be a subsidiary of the national organization that is supported by its

founding members. These members have made significant funding commitments to support the CAA program plan

development in Oregon and other EPR states.

18

circularactionalliance.org

Operations Plan

The operations plan section of this program plan describes activities and recommendations for increasing the diversion of

recyclable materials from disposal to support progress toward targets outlined in the Recycling Modernization Act (RMA).

Important areas of Producer Responsibility Organization (PRO) involvement around operations include meeting local

government needs assessment requests, establishing collection depots, improving materials processing, and conducting

robust and consistent education.

a. Collection and Recycling of USCL Materials

In this subsection, CAA details how it plans to support the collection and recycling of covered products that are included on

the Uniform Statewide Collection List (USCL).

Under ORS 459A.890, local governments and their service providers are entitled to be reimbursed or be provided advance

funding for, as appropriate, eligible expenses in several RMA program areas, including but not limited to: system expansions

and improvements (costs associated with the expansion and provision of recycling collection services); the transportation of

covered products over 50 miles; contamination reduction programming and periodic contamination evaluations outside of

comingled recycling processing facilities (CRPFs); and ensuring 10% post-consumer content in roll carts.

The collection and recycling section of the program plan addresses each of these areas in turn, and it also discusses CAA’s

start-up approach to address specific time sensitive tasks (previously interim coordination tasks).

Following the submission of this initial draft of the program plan, CAA will conduct further outreach and consultation with

local governments and service providers to:

Undertake the Oregon Recycling System Optimization Project (more details are provided below)

Enable the development of more accurate local government funding estimates and prioritization of disbursements

which cannot currently be done due to limited available information.

Develop a schedule for the disbursement of funding for local government service expansion requests as per RMA

requirements

Finalize the details of how various funding programs related to USCL materials will be administered

Administrative design principles have been developed to inform further consultation as detailed below.

Administrative Design Principles

Streamlined and expeditious processes for the disbursement of eligible expenses

Clear and accessible claims submission instructions and mechanisms (reliance on online submissions where possible)

Transparent information requirements all parties should utilize understandable similar source data in support of

funding requests

19

circularactionalliance.org

Standardized review criteria in support of prioritization and assessment of eligibility of claims (see proposed review

criteria below)

Coordination of funding program processes with local government budget cycles wherever possible

Streamlined dispute resolution processes

Appropriate accountability mechanisms to track reimbursements and any advance funding provided

For each compensation program, CAA proposes to post related policy documents, standardized registration forms, claims

submissions and other program documents on its stakeholder portal, for ease of access. These programs would also be

supported by CAA program staff dedicated to answering questions and guiding stakeholders through program

administrative processes.

i. System Expansions and Improvements

Providing financial and other assistance to local governments that need to expand recycling collection services is a critical

step in the implementation of this program plan and the execution of the RMA. The activities outlined below will help meet

a range of objectives and goals, including expanding overall opportunities to recycle, and help meet the plastics recycling

goal set out in the RMA.

Proposal for an Oregon Recycling System Optimization Project

2023 Department of Environmental Quality (DEQ) Needs Assessment Findings

Oregon DEQ released its initial RMA Local Government Needs Assessment in May 2023. While completing the needs

assessment survey was voluntary for local governments, eligibility for expansion funding from the PRO(s) in the first

program plan is contingent on completion of the needs assessment.

Two hundred forty-five local governments responded to the needs assessment survey (200 cities, 36 counties, and nine

additional county responses) with 92.2% of respondents indicating an interest in expanding recycling services.

To support program plan development, CAA consulted with a select number of local government representatives (see

Appendix D for more details) to gather more information about initial needs assessment requests and develop a better

understanding of existing recycling infrastructure in those jurisdictions.

This consultation process highlighted the different wasteshed infrastructure across the state, including a wide range of

different local government and service provider roles and responsibilities and variations in such recycling activities such as

contamination reduction activities, material flows, and current education and outreach efforts. This process underscored

the need for a second more detailed needs assessment process and continued outreach to local governments to further

develop the necessary components for RMA implementation.

The first needs assessment simply identified areas of potential interest in terms of service expansion. Local governments

checked general areas of interest to maintain eligibility for funding under the process, which may in some cases have

resulted in an inaccurate picture of needs in relation to existing recycling services. Information provided by local

20

circularactionalliance.org

governments was insufficient to prioritize funding requests in relation to RMA rule criteria (which had not been finalized at

the time of the needs assessment survey).

As anticipated in DEQ’s Internal Management Directive (IMD) related to the program plan submission, CAA is proposing to

conduct a follow up on DEQ's 2023 Needs Assessment by conducting an Oregon Recycling System Optimization Project

(ORSOP) between April and August 2024 to gather information necessary to further develop its estimates of required local

government funding for recycling system expansions and improvements and refine the schedule for processing funding

requests in accordance with RMA rule prioritization criteria.

Proposed Approach

Given the interrelationship between local government needs assessment requests and other areas of the program plan

pursuant to the RMA, CAA is proposing an integrated approach to the ORSOP. CAA will coordinate the outreach activities

required to develop more accurate estimates of service program expansion requests (ORSOP) with continued program

development of other local government compensation funding programs.

CAA proposes the following approach for engaging local governments and their service providers in the ORSOP:

1. Follow up outreach to all 2023 Needs Assessment respondents (details pending)

2. Engagement between CAA and local governments and service providers based on wastesheds (with additional

engagement as required for specific geographic areas). Consultation focuses on:

a. Understanding the unique conditions that may exist in each jurisdiction (i.e. local government

service provider franchise arrangements, nature of existing recycling services provided, etc.)

b. Consulting with local governments and service providers on the reimbursement process, review

criteria and administrative process that will be established to finalize and rollout service expansion

system funding

c. Confirm which permitted facilities and existing local government facilities would like to participate in

the PRO depot network

d. Coordinate needs assessment requests in the context of other local government compensation

programs such as transportation reimbursement (see relevant section below).

e. Identify primary contacts for each local government and service provider

f. Review anticipated processes for disbursement of education and outreach materials and the

provision of funding for contamination reduction activities

The ORSOP will enable the development of a schedule, prioritization, and cost estimates of local government service

expansion requests, as well as refined estimates of costs associated with reimbursements in other program areas.

21

circularactionalliance.org

General Process and Timelines for Prioritizing and Processing Service Expansion

Requests

Proposed Timeline

Under the RMA, producers are not obligated to become members of a PRO until the program starts on July 1, 2025. Given

the anticipated cost of local government infrastructure service expansions, CAA will not be in a position to fund service

expansion requests until it is generating revenue from obligated producers.

Actual local government service expansion disbursements, therefore, are anticipated to begin after the July 1, 2025,

program start date, with CAA prioritizing funding requests in accordance with RMA rule priorities. The general steps and

timeframe associated with implementation of this service expansion funding program is below. (This timeline can also be

reviewed in Appendix M, Preliminary Program Implementation Timeline.)

CAA Conducts ORSOP (April – August 2024)

CAA Program Plan is updated based on the ORSOP (September 2024). Updates will include:

o A more detailed schedule for implementing collection program expansion disbursements

o Revised estimates of local government expansion disbursements

o A formalized Administrative Process for Review and Approval of Expansion Disbursements.

o Prioritization of expansion disbursement requests

o Development of a 2025-2027 Schedule for Processing Expansion Disbursement Requests

CAA Program Plan Approved (November/December 2024)

CAA-Local government processing of 2025 Expansion Funding Requests (begins Spring 2025)

o Detailed CAA – local government negotiations

o Identification of individual local government/service provider funding amounts

Disbursement of 2025 Expansion Funding Requests (July – December 2025)

CAA-Local government processing of 2026 Expansion Funding Requests (begins Fall 2025)

o Detailed CAA – local government negotiations

o Identification of individual local government/service provider funding amounts

Disbursement of 2026 Expansion Funding Requests (January – December 2026)

CAA-Local government processing of 2027 Expansion Funding Requests (begins Fall 2026)

Detailed CAA – local government negotiations

o Identification of individual local government/service provider funding amounts

Disbursement of 2027 Expansion Funding Requests (January – December 2027)

22

circularactionalliance.org

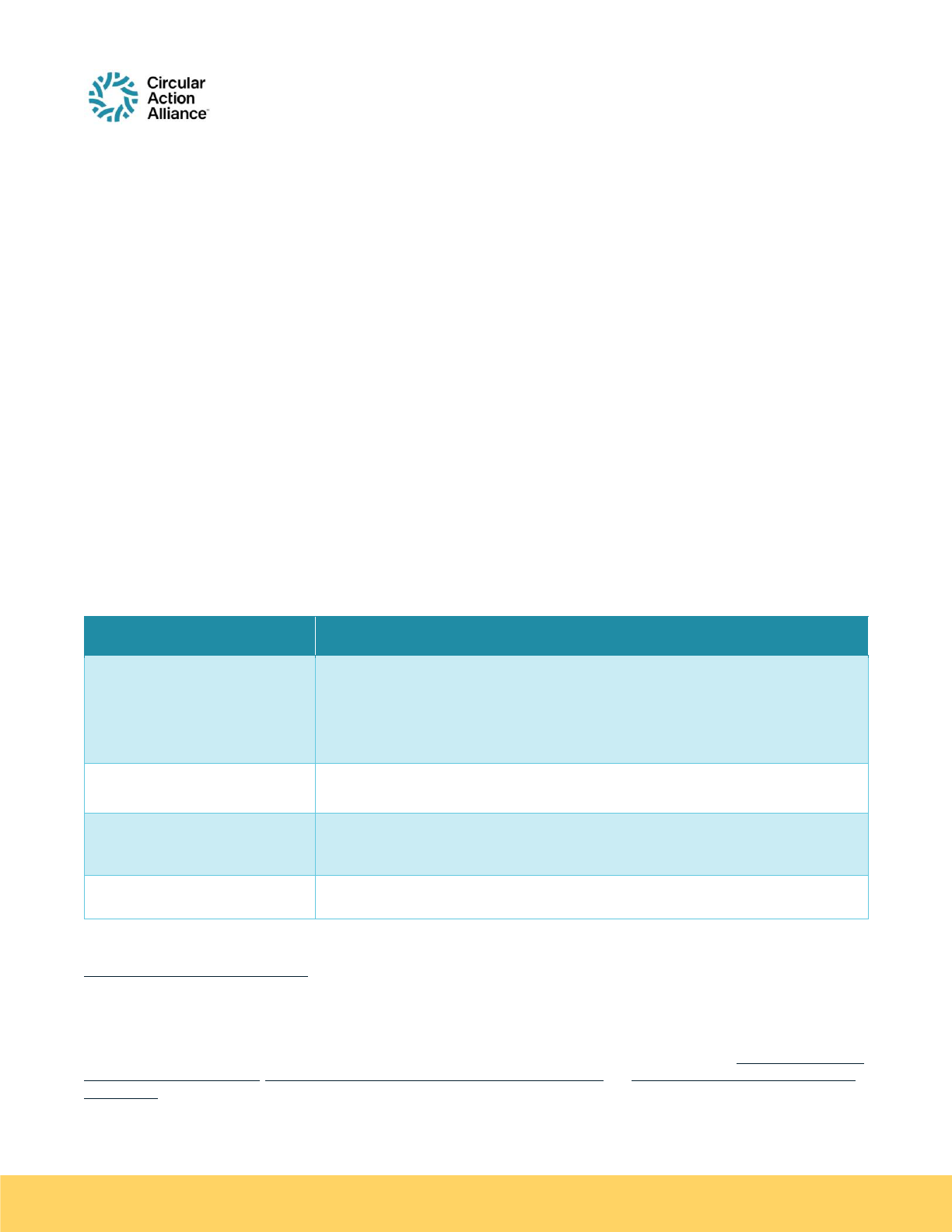

Initial Outline for Disbursement of Local Government System Expansions

Preliminary Esmated Funding for Local Government System Expansion

2025

$54 Million to $70 Million

2026

$143 Million to $186 Million

2027

$159 Million to $207 Million

Total Program Plan Funding

$356 Million to $463 Million

Table 1

Actual funding amounts for local government service expansion initiatives will be determined on a case-by-case basis

subject to RMA eligibility requirements as per a schedule for disbursements included in future program plan amendments.

For more information related to how CAA developed initial estimates see Appendix E.

Revised Local Government Funding Schedule

Following the ORSOP, CAA’s revised program plan will include a more detailed schedule for processing the disbursement of

system expansion funding requests. Where appropriate, CAA will schedule the funding of local government system

expansion on a geographic basis so that infrastructure improvements can be coordinated and support broader system

efficiencies.

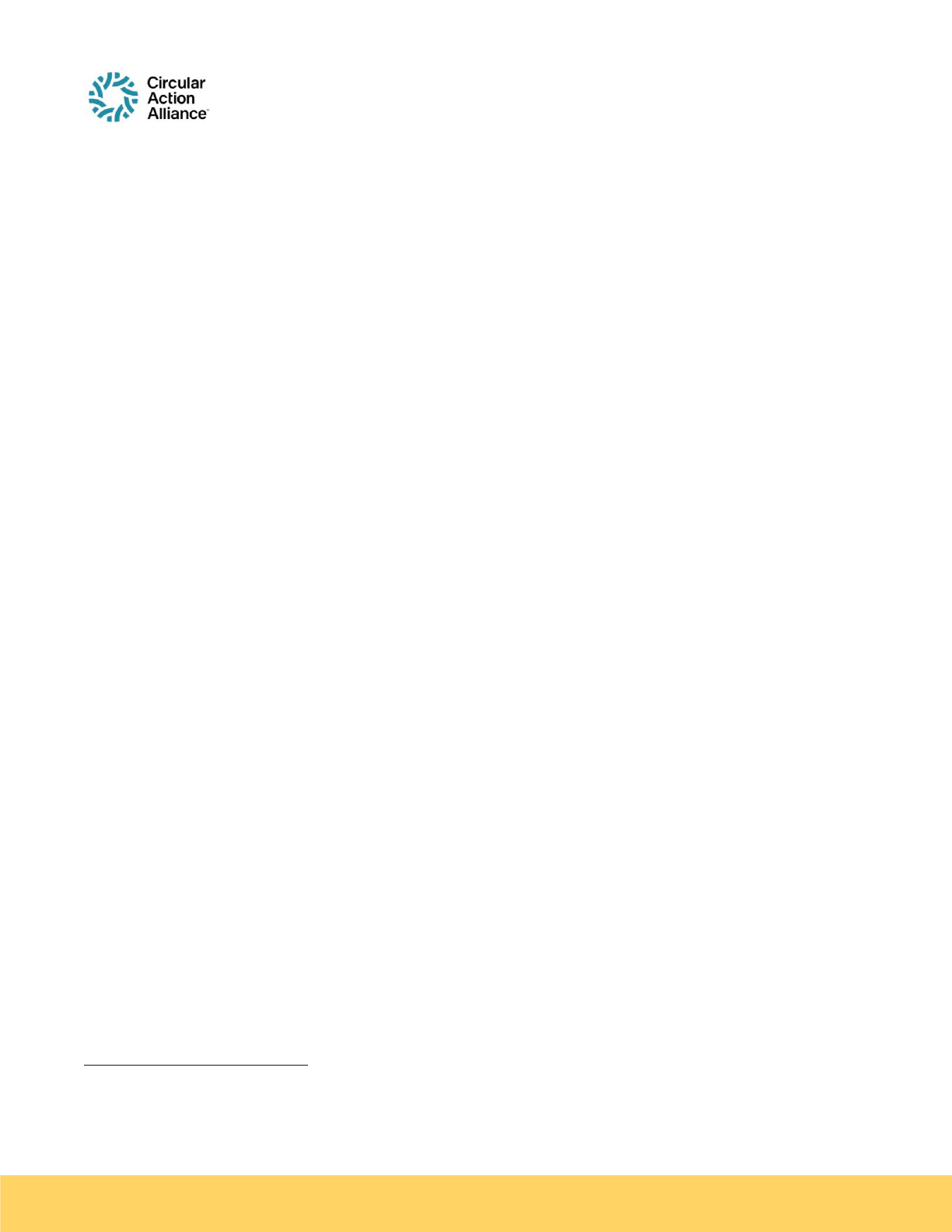

The proposed draft disbursement schedule to be included in the revised program plan could follow a format like the

following:

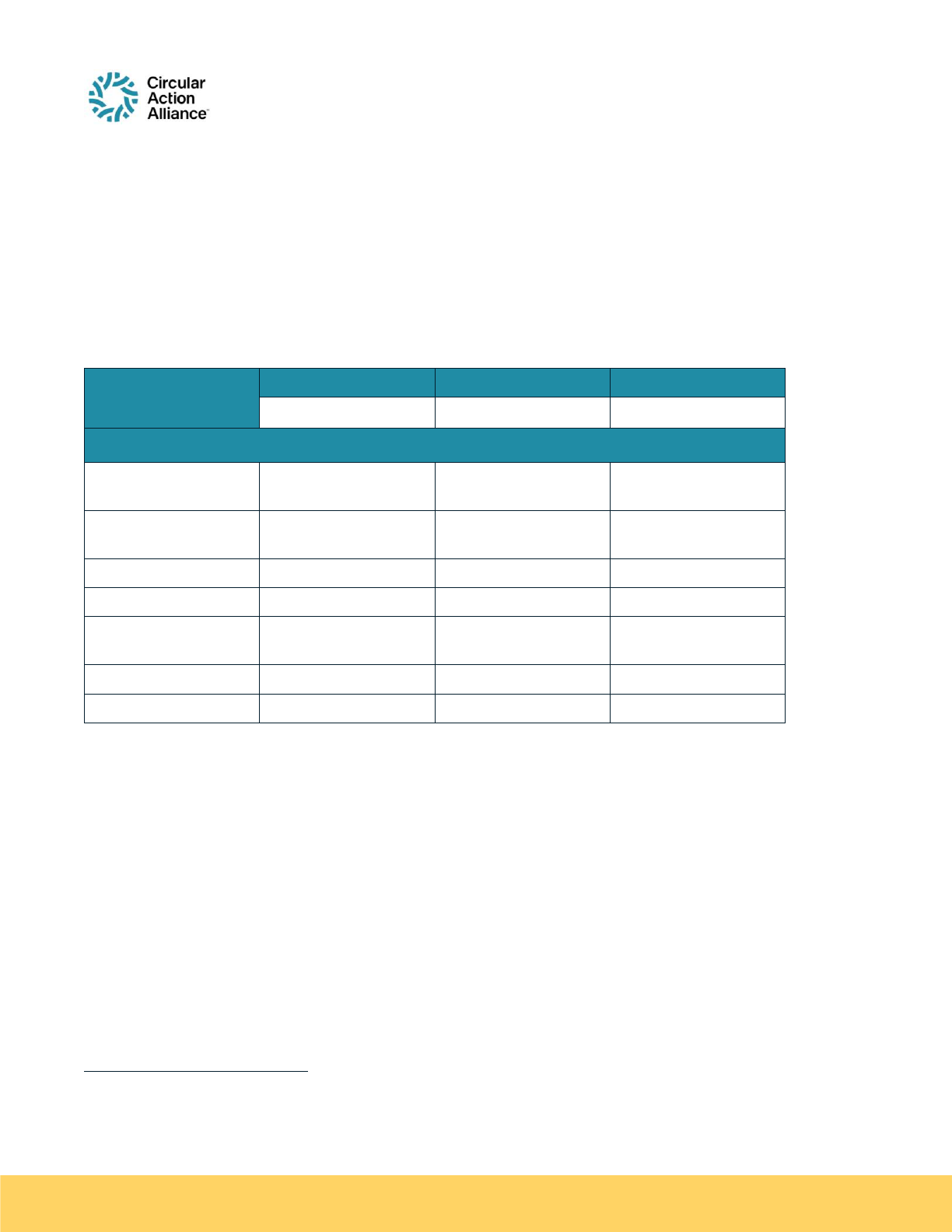

Local

Government

Type of Funding

Request

Reason for Priorizaon

Target Date for

Processing System

Funding Request

Target Date for

Funding

Disbursement

LG X

On-route Expansion

Required by OTR

September 2025

December 2025

LG Y

Depot

Populaon under 4,000

Oct 2025

Jan 2026

Table 2

CAA will consult with local governments to review optimal timing of funding disbursals to align with local government

budget policies.

Where prioritized local governments are not ready to process their funding requests in accordance with the proposed

Revised Program Plan funding schedule, CAA will work with those local governments to process service expansion requests

as soon as that local government is ready to engage in the processing exercise necessary to determine final disbursement

amounts.

23

circularactionalliance.org

Assessing Priority of Funding Requests

All PRO funding for expansions and provision of recycling services from July 2025 through to December 2027 will be

prioritized following RMA rule guidelines:

1. Local governments that are not, or will not be, able to provide the opportunity to recycle

2. Existing recycling depots to provide for the collection of any materials that were formerly collected on-route by

the local government or a local government’s service provider, as needed to ensure continuation of recycling

opportunities

3. Existing recycling depots to provide for the collection of any materials that are not currently or were not

formerly collected on-route by the local government or local government’s service provider

4. Local governments with populations less than 4,000, according to the Portland State University Population

Research Center’s most recent Population Estimate Report, or such other estimate approved by the Department

5. Local governments of any size that are looking to add new on-route or recycling depot service

6. All other local governments that are looking to expand existing on-route collection, recycling depots or both, in

order of ascending population

Where local government requests fall into multiple RMA rule prioritization categories, CAA will attempt to identify and

sequence in accordance with the most applicable rule criteria. As noted earlier, CAA will also attempt to assess local

government requests on a geographic or wasteshed basis to improve system efficiencies. Additional criteria that CAA

proposes to employ for evaluation are described below.

Evaluation of Funding Requests

CAA will use a standardized information-gathering mechanism to gather needed specifics for assessing and meeting funding

requests and to be able to gauge the requests against these evaluation criteria. This information may include:

1. Name of the project

2. Detailed description of the project

3. Financial request with detailed list of items to be acquired

4. Timeline for the project and funds to be disbursed

5. Who will be overseeing and undertaking the project

6. What is the projected impact on the intent of the RMA

7. Is the project consistent with industry best practices/guidelines

8. Will the project meet the performance standards outlined in RMA rules

Proposed Review Criteria

While RMA rules provide guidance on how to prioritize local government eligible funding requests, there are several

references in the RMA related to potential service expansion requests where further clarifications will be required to

determine whether a particular local government service expansion request is eligible for funding under the statute.

24

circularactionalliance.org

For example, service expansion requests related to expanded on-route collection services and the addition of recycling

reload facilities indicate that the recycling reload facility is an eligible expense if necessary. RMA rule requirements also

indicate that PRO funding for additional recycling depots is in relation to “as needed to provide convenient recycling

opportunities.” See OAR 340-090-0800(1)(A)(C). In the absence of additional review criteria, to address how RMA terms

such as “if necessary” or “as needed” should be interpreted, CAA is proposing program review criteria to clarify how needs

assessment funding requests will be assessed. Such criteria will also support other RMA requirements related to the

verification of funding amounts anticipated under the statute.

As part of the ORSOP, CAA will consult with local governments regarding funding eligibility protocols and the proposed

needs assessment review criteria outlined below:

1. Support for Existing Services and Infrastructure

Local governments and service providers have invested heavily in recycling infrastructure over decades to deliver recycling

services in conjunction with the delivery of other solid waste services that form the greater solid waste management

system. Where needed, improvements and additions will be considered, but existing infrastructure should remain the

foundation for services. Where consistent with other rule and funding assessment criteria, funding requests should support

and utilize existing recycling infrastructure.

2. Consistent with RMA Objectives

Funding requests must be qualified expenses under the statute, that are consistent with RMA objectives to minimize the

environmental impacts of producer packaging. Regarding local government infrastructure, requests should efficiently

support improved environmental outcomes related to both local government recycling and statewide packaging objectives.

3. Driving Efficiency and Effectiveness

Funding requests should improve current system efficiency and support cost-effective diversion. The funding should be

used both to improve the performance of existing recycling programs (e.g., increasing the recovery of materials that are

currently recycled) and add new materials in a cost-effective manner. Investments should create new capacity that meets

the newly anticipated volumes of recyclables under the RMA. Efficiency measurements (e.g., a “net cost per ton” diverted)

may be developed for considering applications for funding. It is recognized that any new tons added into the recycling

system will likely increase the total and net system costs.

4. Balancing Local Government and Statewide Needs

Local government funding requests should integrate well with statewide infrastructure. A balance is required between

funding to support State-wide system benefits and funding for local/regional funding needs and opportunities.

5. No Cross Subsidization or Duplication of Funding

There should be no cross subsidization between local government needs assessment funding and non-RMA solid waste

program funding. Funding provided by CAA for recycling programs will be dedicated to eligible recycling programs only.

Funding requests should also not duplicate funding provided through other RMA programs.

25

circularactionalliance.org

6. Accuracy and Transparency

Funding requests must be based on accurate and transparent information. CAA will work in good faith with local

governments and their services providers to document required information associated with various types of system

expansion service requests. (i.e., required information in relation to a request for expanded on-route collection).

Dispute Settlement Process relating to Service Expansion Funding Requests

Given the language of the RMA, there may be disagreements between CAA and local governments and their service

providers about the eligibility for certain types of funding requests. These disagreements may be more complex than typical

contractual disputes (which often involve disputes over the interpretation of contractual clauses) as they will likely involve

different legal interpretations of what reimbursement the statute requires and what qualifies as an eligible cost.

CAA proposes to utilize the ORSOP to identify and catalog the types of costs associated with the expansion and provision of

recycling collection service for covered products. CAA would propose to convene a working group comprised of

representatives from CAA, local government, and DEQ to attempt to mediate disagreements over service funding requests

between the approval of the second program plan and the start of the program plan on July 1, 2025. This process will

hopefully minimize potential disagreements between CAA and local governments prior to the processing of individual local

government service expansion requests once the program begins on July 1, 2025. In addition to resolving or narrowing

potential dispute issues, the working group could also align on the details of the dispute settlement process to be utilized

once more detailed CAA local governments negotiations related to service expansion requests are undertaken.

Accountability Mechanisms

Funding provided to local governments will need to be accompanied by accountability mechanisms to ensure that PRO

funding provided to local governments is allocated to its intended RMA purpose. In many cases, this may include advance

funding for capital items such as trucks or other capital items. As part of the ORSOP, CAA will consult with local

governments regarding the accountability reporting and conditions associated with the provision of funding in relation to

service expansion requests and different types of eligible funding categories. The details of proposed accountability

processes will be provided in the revised second draft of the program plan, anticipated in September 2024.

ii. Transportation Reimbursements

Under the RMA, the PRO is required to fund local government or their service provider costs of transporting covered

products from a recycling depot or recycling reload facility to a CRPF, processor, or responsible end market (REM).

DEQ rules establish methods for determining funding and reimbursement amounts which may include payments based on

zones. The rules require that:

Costs must be based on the actual costs of managing and transporting covered products that must be shipped more

than 50 miles

50-mile distance is the shortest driving distance to:

o the nearest CRPF with capacity to process the material, if the material is commingled

26

circularactionalliance.org

o the nearest processing or sorting facility that will prepare it for market or REM, if the material is collected

separately (e.g., glass) or is not fully commingled

o the nearest REM if the material is collected separately and in condition to be sent to an REM

Costs to receive, consolidate, load and transport covered products include but are not limited to purchasing and

maintaining equipment, signage (not already covered under RMA provisions), administrative costs including related

staffing costs

Transportation costs of covered products directly from a generator to a CRPF or REM are not eligible

In 2027, the PRO must also conduct a transportation study

The PRO program plan must include methods for calculating transportation costs

Payment methods may include rate schedules or zonal maps with periodic adjustments for fuel prices or other

variable factors

o Consultation with local governments and service providers required on payment methods

o Methods must include a voluntary option where PRO and local government/service provider may agree to

transfer some or all transportation responsibilities to PRO

Consultation Process

During the program plan development process, CAA consulted with a select number of local government service providers

on the design of the program for administering transportation disbursements under the RMA. These service providers are

all likely claimants for transportation reimbursement under the RMA and were selected in consultation with ORRA, which

represents haulers and other recycling businesses throughout the state.

The purpose of this pre-program plan consultation was to identify elements that need to be included in this funding

program and outline a general approach to administration. As with other RMA funding programs, CAA’s intention is to seek

feedback from affected parties throughout the state to support development of this RMA compensation program. Given

this requires outreach to the same parties involved in the ORSOP, CAA will coordinate consultation related to the

development of this funding program in tandem.

The proposed transportation reimbursement model, which CAA will seek feedback on in conjunction with the Oregon

Recycling System Optimization Project, is described below. Following further consultation and outreach CAA would finalize

transportation reimbursement policies and required forms and documents. These policy documents would be available

online, and CAA would propose to conduct webinars and stakeholder outreach prior to program plan implementation to

explain the claims submission process before the program start date.

CAA would begin processing claims from eligible funding recipients for any qualifying shipments made after the start of the

program on July 1, 2025.

27

circularactionalliance.org

Proposed Methods for Calculating Transportation Costs

General Model

CAA will calculate disbursements based on standardized rates per mile from eligible outbound facilities to the nearest CRPF

with capacity or end market, with some adjustment for loading and preparation of outbound loads:

A standardized rate per ton per mile, with different rates for different types of loads, would be utilized to calculate the

transportation reimbursement compensation for different facilities

The standard per mile rate would be used to calculate set transportation reimbursements for each eligible outbound

facility based on the application of the standard rate to the distance between eligible facilities and the nearest

processing facility or end market

Reimbursement rates would include a process to address fluctuations in fuel prices

Local governments can assign transportation eligibility funding rights to service providers, and eligible transporters would

register with CAA and enter into a transportation claims agreement. Functioning through an online portal, eligible applicants

would confirm eligibility for reimbursement for individual shipments with CAA prior to the shipment taking place. CAA

would confirm their shipment request and notify the receiving CRPF of the delivery. Once received the CRPF will confirm the

load was accepted and input final weights. Once that is complete, reimbursement would be disbursed to the party initiating

the shipment request. The program would include a dispute settlement process with specified timelines for contested

claims.

Although funding requests from service providers for facility upgrades and capital costs associated with preparation of

materials (excluding costs covered under expansion of services funding to local governments) may coincide with requests

for transportation cost reimbursement, CAA recommends managing funding requests for capital items (e.g. depot signage,

compaction equipment, etc.) separately from transportation claims.

Registration of Claimants

A process must be established for local governments to identify the recycling depots, recycling facilities and haulers eligible

for transportation reimbursements in their jurisdictions. At the time of this submission, DEQ informed CAA that it was

consulting with local governments on an authorization or designation process for local governments to utilize with respect

to all RMA local government compensation programs.

Eligible recipients of transportation funding, which could include both local governments and service providers, would enter

into a transportation claims agreement with CAA prior to receiving transportation reimbursements:

This agreement would include terms of payments including indemnification clauses that clarify each party’s liabilities

and obligations with respect to transportation of RMA materials including situations where a funding recipient was

utilizing a third party to transport covered products

CAA intends to consult with service providers and local governments on the content of a draft transportation claims

agreement template

CAA will facilitate the registration process and completion of transportation reimbursement claims agreements in time to

enable implementation by July 1, 2025.

28

circularactionalliance.org

Establishing Standard Rates

CAA will develop a draft recycling depot and recycling reload facility list for review by local governments and service

providers

A facility receiving rate of inbound shipments that need to be scaled, received, consolidated, stored, and reloaded and

all the associated administration and reporting would be paid a standard fee per ton managed

A transportation reimbursement rate for outbound shipments from each facility would be calculated based on a

standard per mile rate applied to the eligible distance and recorded weight received at the CRPF

Process for calculation of transportation rates for each facility would be reviewed including:

o The categories of shipments that would be subject to different standard transportation rates (i.e. material

type, destination)