Q3/FY2023 FINANCIAL RESULTS

ENDED DECEMBER 31, 2023

Atsushi Kitamura

Chief Financial Officer (CFO)

Astellas Pharma Inc.

February 5, 2024

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

2

In this material, statements made with respect to current plans, estimates, strategies and beliefs and other statements that

are not historical facts are forward-looking statements about the future performance of Astellas Pharma. These statements

are based on management’s current assumptions and beliefs in light of the information currently available to it and involve

known and unknown risks and uncertainties. A number of factors could cause actual results to differ materially from those

discussed in the forward-looking statements. Such factors include, but are not limited to: (i) changes in general economic

conditions and in laws and regulations, relating to pharmaceutical markets, (ii) currency exchange rate fluctuations, (iii)

delays in new product launches, (iv) the inability of Astellas to market existing and new products effectively, (v) the inability

of Astellas to continue to effectively research and develop products accepted by customers in highly competitive markets,

and (vi) infringements of Astellas’ intellectual property rights by third parties.

Information about pharmaceutical products (including products currently in development) which is included in this material

is not intended to constitute an advertisement or medical advice. Information about investigational compounds in

development does not imply established safety or efficacy of the compounds; there is no guarantee investigational

compounds will receive regulatory approval or become commercially available for the uses being investigated.

AGENDA

3

I

Q3/FY2023 Consolidated Financial Results

FY2023 Revised Forecasts

II

Initiatives for Sustainable Growth

Q3/FY2023 FINANCIAL RESULTS: OVERVIEW

4

Revenue increased YoY, however, behind the full-year forecast

XTANDI & XOSPATA: In line with the full-year forecast revised upward in Q2

PADCEV: In line with the full-year forecast revised significantly upward in Q2

Potential peak sales revised upward incorporating the robust results of EV-302 study

VEOZAH: Overall initiatives are progressing, however, demand trails internal expectations

Full-year forecast revised downward

IZERVAY: Encouraging first full quarter performance since launch, expect further growth

Cost items

SG&A and R&D expenses were on track

Operating profit

Core OP behind the full-year forecast mainly due to the performance of VEOZAH

Full-year forecast for revenue and operating profit revised downward incorporating VEOZAH’s current progress

Full-year forecast revised in Nov 2023, Exchange rate assumption: 140 yen/USD,152 yen/EUR

(billion yen)

Q3/FY22 Q3/FY23 Change

Change

(%)

FY23

FCST

Revenue

1,164.4

1,189.1 +24.7 +2.1% 1,608.0

Cost of sales

226.1

219.3 -6.8 -3.0%

% of revenue

19.4%

18.4% -1.0 ppt

SG&A expenses

471.0

547.0 +76.0 +16.1% 737.0

US XTANDI co-pro fee

138.2

146.2 +8.0 +5.8% 187.0

SG&A excl. the above

332.7

400.7 +68.0 +20.4% 555.0

R&D expenses

206.1

216.3 +10.3 +5.0% 290.0

Amortisation of intangible assets

29.2

66.2 +37.0 +126.8%

Gain on divestiture of intangible assets

0.2

9.7 +9.5 -

Core operating profit

233.7

149.6 -84.0 -36.0% 199.0

Other income

2.5

8.5 +6.0 +236.6%

Other expenses

54.9

84.0 +29.1 +52.9%

Operating profit

181.3

74.1 -107.2 -59.1% 123.0

Profit before tax

180.2

73.6 -106.6 -59.1% 121.0

Profit

144.8

50.3 -94.5 -65.3% 85.0

Q3/FY2023 FINANCIAL RESULTS

5

<Full basis>

+58.8 bil. yen

+10.2 bil. yen

FX impact (YoY)

+13.8 bil. yen

+26.1 bil. yen

+6.9 bil. yen

+19.2 bil. yen

Other expenses

• Organizational restructuring

cost on a global scale:

approx. 18.4 bil. yen

Full-year forecast revised in Nov 2023, Exchange rate assumption: 140 yen/USD,152 yen/EUR

+6.9 bil. yen

Note) Amortisation of IZERVAY’s

intangible assets started

from Q2

(billion yen)

Q3/FY2023 YTD

YoY FY2023 FCST

560.0

+48.1

(+9%)

719.8

Global sales are in line with the full-year forecast revised upward in Q2

~5% growth even excluding FX impact, still growing even 10+ years on the market

Expect to achieve the full-year forecast

Sales expanded in all regions

US: Approval of M0 CSPC additional indication based on EMBARK study in Nov 2023

Steady growth in demand excluding PAP (demand YoY +3%)

41.3

+5.0

(+14%)

55.2

Global sales are in line with the full-year forecast revised upward in Q2

Near double-digit growth even excluding FX impact

Expect to achieve the full-year forecast

6

XTANDI & XOSPATA: BUSINESS UPDATE

Full-year forecast revised in Nov 2023, Exchange rate assumption: 140 yen/USD,152 yen/EUR

M0: Non-metastatic, CSPC: Castration-sensitive prostate cancer, PAP: Patient Assistance Program

Performance in line with the full-year forecast upwardly revised in Q2, expect to achieve the full-year forecast

7

Update of potential peak sales

Updated sales forecast incorporating the robust results of EV-302

study which exceeded initial expectations

Upward revision of potential peak sales:

• Peak sales is disclosed as “in-market sales,” not Astellas revenue

• Indications in early clinical phase are not included (NMIBC and other solid tumors)

(Reference) Image of economic conditions with Pfizer

Intended for approx. 50:50 profit split globally

Pfizer Astellas

Americas*

Pfizer books sales

Receive 50% of gross profit

(recognize in product sales as

PADCEV related revenue)

Ex-Americas

Receive 50% of gross profit Astellas books sales

Note) Receipt/payment percentage and schemes vary by region (profit sharing or royalty payment)

(Latest forecast)

400 - 500 billion yen

(Previous forecast)

300 - 400 billion yen

PADCEV: BUSINESS UPDATE

(billion yen)

Q3/FY2023 YTD

YoY FY2023 FCST

55.6

+22.5

(+68%)

85.2

<US>

Performance in line with full-year forecast revised significantly upward

in Q2, driven by the penetration of 1L mUC based on EV-103 study (cis-

ineligible) approved in April 2023

Approval of 1L mUC additional indication based on EV-302 study (both

cis-eligible and ineligible) in Dec 2023 at an incredible speed, only two

weeks after the FDA filing acceptance

• Expect significant sales contribution in FY2024 and beyond, driven by

the robust data and further expansion of eligible patient population

<Europe>

Reimbursement started in 3 new countries including Spain, a total of 13

countries as of now. Expect further sales growth

Full-year forecast revised in Nov 2023, Exchange rate assumption: 140 yen/USD,152 yen/EUR

*Americas includes the US, Canada and Latin America, 1L: First line, mUC: Metastatic urothelial cancer, Cis: Cisplatin, FDA: Food and Drug Administration

Peak sales revised upward to 400 - 500 billion yen incorporating the robust results of EV-302 study

Latest progress & outlook

Aim for the upper end of 500 billion yen

Q3/FY2023 YTD FY2023 Revised FCST Factors for the downward revision

3.6 bil. yen 7.1 bil. yen

DTC activities have been effective, however, it is taking longer to impact the demand increase

Based on market research, HCP’s perception of the current payer coverage progress is

“insufficient to actively prescribe VEOZAH” which is impacting the uptake

As a result, full-year forecast has been revised downward by incorporating the above factors and

reassessing the timing and pace of demand ramp to delay which was expected particularly in Q4

Only US

($ basis)

$25M $50M

8

VEOZAH: BUSINESS UPDATE

<Latest progress>

Total lives covered (payer coverage) expanded to ~35%

Expect over 50% by the end of FY2023

Reach

DTC campaign has reached an estimated ~56M women

Awareness

Consumer:

HCP:

Activation

Consumer:

HCP:

<Future initiatives & outlook>

Sales force to continue driving rapid and widescale awareness of

VEOZAH and educate HCPs on the expanding payer coverage

VEOZAH TV spot during the Super Bowl in the US

In FY2024, expect % of lives covered (payer coverage) to increase and

continued momentum from commercial investments

Mid- to long-term and peak sales outlook will be reviewed based on the

progress of overcoming HCP’s perception that coverage is insufficient

Overall initiatives are progressing, however, demand trails internal expectations

Downward revision of full-year forecast, reassessed the timing and pace of the FY2023 demand ramp to delay

Market

Access

DTC

Impact*

Approval in Dec 2023, launched in 7 countries including Germany and UK

Update on Europe

Note) Approved as “VEOZA” in Europe,

Exchange rate assumption: 140 yen/USD,152 yen/EUR , *Market Research December 2023, DTC: Direct-to-consumer, HCP: Healthcare professional

53% increase (Sep: ~15% vs Dec: ~25%)

40% increase (Sep: ~50% vs Dec: ~70%)

70% of women reported “High Intent” to ask HCP

about VEOZAH (40% increase from Oct)

76% of HCP’s report they are “Extremely Willing”

to prescribe VEOZAH (19% increase from Sep)

9

IZERVAY: BUSINESS UPDATE

Encouraging first full quarter performance since launch in the US, expect significant growth in FY2024

(billion yen)

Q3/FY2023 YTD

FY2023 FCST

5.3 11.0

Note) Screenshot is from the US Disease education campaign and is intended for US audiences only

Exchange rate assumption: 140 yen/USD,152 yen/EUR, *Excluding clinical trial vials. The figure disclosed in Q2/FY2023 earnings (10K units) was inclusive of clinical trial vials

GA: Geographic atrophy, AMD: Age-related macular degeneration, AAO: American Academy of Ophthalmology

Encouraging performance despite being only the first full quarter

since launch, as well as before permanent J-Code and label update

17,000+* vials shipped and available in 920+ Retina accounts since

launch through Q3, representing ~70% of accounts

Accelerated growth in IZERVAY usage following the GATHER2 data

release at AAO 2023 (nonpromoted use)

Estimate market share in the Q3 period to be ~20% based on

reported volume shipments

Safety profile so far has been consistent with clinical trial results

Progress since launch

Expect significant growth in FY2024 driven by upcoming milestones;

• Received confirmation of permanent J-Code effective Apr 1 which will

be a driver of reimbursement confidence and accelerant of demand

• Anticipate approval of label update within FY2024

Future outlook

Branded campaign for IZERVAY:

• Achieved 55% brand awareness among GA patients post-launch

Disease awareness campaign for GA:

• Contributed to 56% awareness of GA among dry AMD patients

DTC activities to increase awareness (as of Dec 2023)

Disease awareness campaign

with two-time Emmy® Award-

winning actor Eric Stonestreet,

who shared his personal

connection with GA in a national

PR effort (askaboutGA.com

)

SG&A expenses increased YoY due to the impact of the acquisition of Iveric Bio and

the investment in VEOZAH, however, progress in line with expectations

Q3/FY2023 FINANCIAL RESULTS: COST ITEMS

10

Core basis: YoY comparison, ratio to revenue, and progress against FCST, for major cost items

Cost Items YoY change

Ratio to

Revenue

Progress

against FCST

Cost of sales -3.0%

18.4%

(-1.0 ppt YoY)

- Cost of sales ratio was as expected

SG&A

expenses

excl. US XTANDI

co-pro fee

+20.4%

(+14.6% excl.

FX impact)

33.7%

(+5.1 ppt YoY)

72.9%

YoY increase excl. FX impact: approx. +49.0 bil. yen

Impact of Iveric Bio acquisition (approx. +20.0 bil. yen. YoY)

Increase in VEOZAH-related costs (approx. +30.0 bil. yen YoY)

Reduction of mature products-related costs (approx. -6.0 bil. yen YoY)

R&D

expenses

+5.0%

(+1.6% excl.

FX impact)

18.2%

(+0.5 ppt YoY)

74.6% Impact of Iveric Bio acquisition: approx. +8.0 bil. yen

Full-year forecast revised in Nov 2023, Exchange rate assumption: 140 yen/USD,152 yen/EUR

(

billion yen

)

FY2023

FCST*

FY2023

Revised FCST

Change Main items of revision

Revenue 1,608.0

1,562,0 -46.0

Downward revision of VEOZAH: 53.3 bil. yen 7.1 bil. yen

(US only: $375M $50M)

SG&A expenses 737.0

731.0 -6.0

Review of VEOZAH investment timing aligned with reassessing

the timing and pace of demand ramp-up

R&D expenses 290.0

286.0 -4.0

Applied accounting treatment recognizing IZERVAY’s

production cost (R&D expenses) as inventory assets

Core operating profit 199.0

164.0 -35.0

Operating profit 123.0

83.0 -40.0

FY2023 REVISED FORECAST

11

<Full basis>

Revenue: Downward revision

VEOZAH: Full-year forecast revised downward incorporating current progress

No change has been made on exchange rates and other products’ full-year forecast

Core OP: Downward revision

Profit also revised downward aligned with VEOZAH’s downward revision

Partially mitigated by the review of cost items

*Revised in Nov 2023, Exchange rate assumption: 140 yen/USD,152 yen/EUR

AGENDA

12

I

Q3/FY2023 Consolidated Financial Results

FY2023 Revised Forecasts

II

Initiatives for Sustainable Growth

INITIATIVES FOR SUSTAINABLE GROWTH: OVERVIEW

13

XTANDI and Strategic products

enzalutamide / XTANDI : Approval of additional indication for M0 CSPC* (US)

enfortumab vedotin / PADCEV : Approval (US) and filing (Europe, Japan) of additional indication for 1L mUC

zolbetuximab : Complete response letter issued (US)

fezolinetant / VEOZAH : Approval (Europe), Phase 3 studies to start (Japan)

avacincaptad pegol / IZERVAY: Submission for label update (US)

Focus Area approach

Clinical studies ongoing:

Early data readout in Phase 1 studies expected in FY2023 for ASP1570, ASP2138 and ASP3082

Others

Open innovation initiatives:

Open labs in Tsukuba and Kashiwa-no-ha area, strategic collaboration with Mass General Brigham

VEOZAH: Approved as “VEOZA” in Europe

*with biochemical recurrence at high risk for metastasis

M0: Non-metastatic, CSPC: Castration-sensitive prostate cancer, 1L: First line, mUC: Metastatic urothelial cancer

14

XTANDI AND STRATEGIC PRODUCTS: KEY EVENTS EXPECTED IN FY2023

VEOZAH: Approved as “VEOZA” in Europe

*with biochemical recurrence at high risk for metastasis. M0: Non-metastatic, CSPC: Castration-sensitive prostate cancer, M1: Metastatic, TLR: Topline results, 1L: First line,

mUC: Metastatic urothelial cancer, CHMP: Committee for Medicinal Products for Human Use, HSCT: Hematopoietic stem cell transplant

Q1 (Apr-Jun) Q2 (Jul-Sep) Q3 (Oct-Dec) Q4 (Jan-Mar)

enzalutamide/

XTANDI

enfortumab

vedotin/

PADCEV

zolbetuximab

fezolinetant/

VEOZAH

avacincaptad

pegol/

I Z ERVAY

<Other updates>

fezolinetant / VEOZAH: Phase 3 studies in Japan (STARLIGHT 2 and STARLIGHT 3) to start in Q4

gilteritinib / XOSPATA: Development for post-HSCT maintenance acute myeloid lymphoma based on MORPHO study discontinued

May

Approval (US)

Aug

Acceptance

(M0 CSPC*; US)

As of Feb 2024

Aug

Approval (US)

Acceptance (Europe)

Jul

Acceptance (US, Europe, China)

Jun

Acceptance (Japan)

Sep

Acceptance

(M0 CSPC*; Europe, M1 CSPC; China)

Sep

EV-302 TLR

Sep

GATHER2 TLR

(24 month)

Oct

CHMP positive

opinion (Europe)

Nov

Approval

(M0 CSPC*; US)

Dec

Approval

(US)

Nov

Acceptance

(1L mUC; US)

Dec

Approval (Europe)

Jan

Complete response (US)

Jan

Acceptance

(1L mUC; Europe, Japan)

Jan

Submission

(Label update; US)

PROGRESS IN LATE-STAGE PIPELINE

15

VEOZAH: Approved as “VEOZA” in Europe

M0: Non-metastatic, CSPC: Castration-sensitive prostate cancer, BCR: Biochemical recurrence, GnRH: gonadotropin-releasing hormone, TLR: Topline results,

sBLA: Supplemental Biologics License Application, VMS: Vasomotor symptoms

4 regulatory approvals for new indication or region received during the quarter

Indication Region

M0 CSPC with BCR at high risk

for metastasis

US

First novel hormonal therapy for the indication

Approved for monotherapy as well as combination

with GnRH analog

Locally advanced or metastatic

urothelial cancer

(combination with pembrolizumab)

US

New treatment option to transform the current

standard of care for decades

Approval in a remarkably short period of time

• 3 months after TLR readout in EV-302 study

• 2 weeks after sBLA acceptance

Moderate to severe VMS

associated with menopause

Europe

First-in-class nonhormonal treatment option

Expansion of opportunities to address unmet

medical needs worldwide

Invasive aspergillosis and invasive

mucormycosis in pediatric patients

US

High unmet medical needs in pediatric patients

Extension of market exclusivity period by 6 months

granted

ZOLBETUXIMAB: LATEST STATUS

16

Addressing unresolved

deficiencies by CMO

Jan 4, 2024

A new PDUFA date will be identified upon FDA acceptance

Target: Q1 FY2024 (Apr-Jun)

<Action plan>

<Complete response letter (CRL) by FDA>

Unresolved deficiencies following pre-license inspection of a third-party manufacturing facility

FDA has not raised any concerns related to the clinical data, and is not requesting additional clinical studies

<Note>

Reviews of applications outside of the US are continuing as planned

Regulatory agencies around the world conduct their reviews independently, and the review decisions are based

on the different requirements and expectations of each regulatory agency

No other Astellas products are affected

FDA: Food and Drug Administration, CMO: Contract manufacturing organization, BLA: Biologics License Application, PDUFA: Prescription Drug User Fee Act

CRL issued

BLA

resubmission

Pre-license

inspection

17

PROGRESS IN FOCUS AREA APPROACH:

CURRENT STATUS OF PROJECTS IN CLINICAL TRIAL

*Not exhaustively listed. AAV: Adeno-associated virus, MTM1: Myotubularin 1, FDA: Food and Drug Administration, GAA: Acid alpha-glucosidase, DGK: Diacylglycerol kinase,

TSPAN8: Tetraspanin-8, IL-2: Interleukin-2, RPE: Retinal pigment epithelium, UDC: Universal donor cell, PPAR: Peroxisome proliferator-activated receptor,

PMM: Primary mitochondrial myopathies, DMD: Duchenne muscular dystrophy, KRAS: Kirsten rat sarcoma viral oncogene homologue

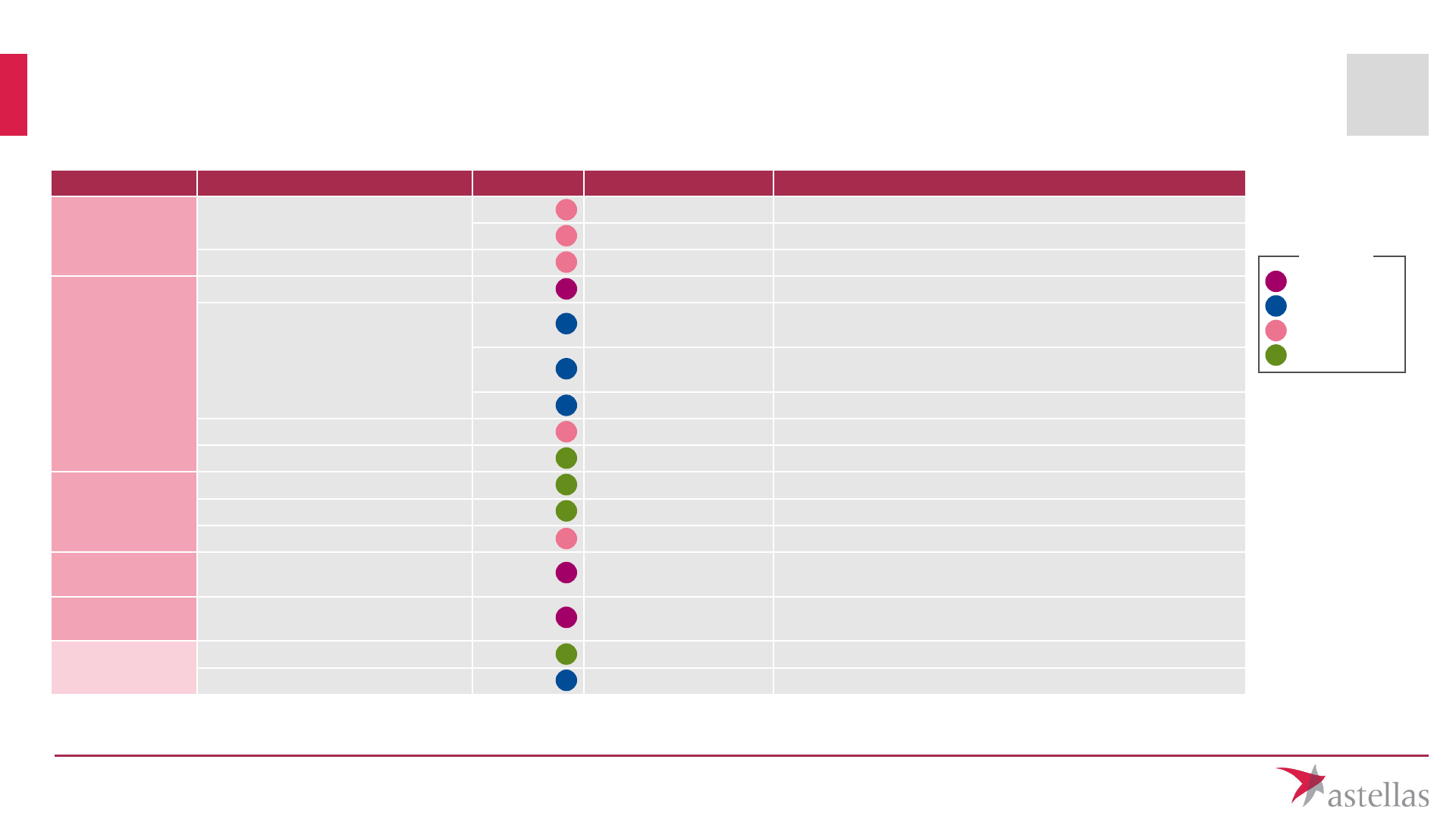

Primary Focus Biology/Modality/Technology* Project Mechanism of Action Current status

Genetic

Regulation

Gene replacement (AAV)

AT132 MTM1 gene ASPIRO study put on clinical hold by FDA in Sep 2021

AT845 GAA gene Phase 1 study ongoing

Gene regulation (AAV)

Immuno-

Oncology

Checkpoint ASP1570 DGKζ inhibitor Phase 1 study ongoing toward early data readout in FY2023

Bispecific immune cell engager

ASP2138

Anti-Claudin 18.2 and

anti-CD3

Phase 1 study ongoing toward early data readout in FY2023

ASP2074

Anti-TSPAN8 and

anti-CD3

Phase 1 study ongoing

ASP1002 Undisclosed Phase 1 study ongoing

Oncolytic virus (systemic) ASP1012 Leptin-IL-2 Phase 1 study under preparation to start in Q4/FY2023

Cancer cell therapy

Blindness &

Regeneration

Cell replacement ASP7317 RPE cells Phase 1b study ongoing

Cell replacement (UDC)

Gene regulation (AAV)

Mitochondria

Gene regulation & mitochondrial

biogenesis

ASP0367 PPARδ modulator

PMM: Phase 2/3 study ongoing

DMD: Next step under discussion

Targeted Protein

Degradation

Protein degradation ASP3082 KRAS G12D degrader Phase 1 study ongoing toward early data readout in FY2023

Primary Focus

Candidate

Immune modulating/regulatory cells

Tissue-specific immune regulation

Small molecule

Antibody

Gene

Cell

Modality

OPEN INNOVATION INITIATIVES

18

Advancing open innovation in life science ecosystems globally and accelerating early R&D

Activities at research stage Activities at early development stage

TME: Tumor microenvironment, TME iLab: TME imaging and interactive research for innovation

Open innovation hub for TME research

TME iLab

Focused on incorporating external innovation and co-

creation through collaborations with academia and other

companies, while contributing to life science ecosystems

Leverage open laboratories as part of these efforts:

Started activities of SakuLab

TM

-Tuskuba and TME iLab

in Tsukuba and Kashiwa-no-ha area

Located at Astellas’ Tsukuba Research Center

Available for academia and start-ups

SakuLab

TM

-Tsukuba

TM

Five-year strategic collaboration

with one of the leading biomedical

research organizations in US

Aim to advance translational

medicine and accelerate early

development of novel therapies

Initial focus in key areas of R&D investment for Astellas:

oncology, rare disease, cell and gene therapy

Expected to better understand diseases and modalities

and optimize clinical trials

Further reinforces Astellas' presence in the Greater

Boston innovation ecosystem

PROGRESS IN FY2023 AND FUTURE OUTLOOK

19

Achieved many key milestones including new product launches and additional indications in FY2023

Expecting Revenue and Profit to increase in FY2024 through contribution of VEOZAH, PADCEV and

IZERVAY as growth drivers

• VEOZAH: launch in US and Europe

• PADCEV (1L mUC): positive results

from EV-302 study, approval in US,

filing in Europe and Japan

• I Z E RVAY : launch in US, filing in

Europe, positive additional results

from GATHER2 study

• zolbetuximab: global filing

Major progress in FY2023

contributing to future growth

VEOZAH: Approved as “VEOZA” in Europe

1L: First line, mUC: Metastatic urothelial cancer

Revenue

Core OP

FY2023

FY2024

I Z E RVAY

PADCEV

zolbetuximab

VEOZAH

FY2025

Optimization of

cost structure

APPENDIX

Q3/FY2023: REVENUE BY REGION

21

(billion yen) Q3/FY2022 Q3/FY2023 Change (%)

Japan

204.5

211.0 +3.2%

United States

501.1

481.4 -3.9%

Established Markets

272.2

306.3 +12.5%

Greater China

65.2

67.3 +3.3%

International Markets

104.2

118.8 +14.0%

Established Markets: Europe, Canada, etc., Greater China: China, Hong Kong, Taiwan,

International Markets: Latin America, Middle East, Africa, Southeast Asia, South Asia, Russia, Korea, Australia, Export sales, etc.

22

Currency Q3/FY2022 Q3/FY2023 Change

USD 137 yen 143 yen +7 yen

EUR 141 yen 155 yen +15 yen

Average rate for the period

<Impact of exchange rate on financial results>

58.8 billion yen increase in revenue, 13.8 billion yen increase in core OP

Q3/FY2023 ACTUAL: FX RATE

23

Currency

Average rate

1 yen depreciation from assumption

Revenue Core OP

USD

Approx. +3.2 bil. yen Approx. +0.1 bil. yen

EUR

Approx. +1.4 bil. yen Approx. +0.6 bil. yen

FY2023 FORECAST: FX RATE & FX SENSITIVITY

Exchange rate

Average for the period

FY2023

Initial FCST

FY2023

Revised FCST

*

Change

USD 130 yen 140 yen +10 yen

EUR 140 yen 152 yen +12 yen

Estimated FX sensitivity (Q3 onwards) of FY2023 revised forecasts by 1 yen depreciation

Forecast rates Q3/FY2023 onwards: 140 yen/USD, 150 yen/EUR

*Disclosed in Nov 2023

24

(billion yen)

FY2022 end Dec 31, 2023

Total assets

2,456.5 3,368.7

Cash and cash equivalents

376.8 254.0

Total equity attributable to owners of the parent

Equity ratio (%)

1,508.0

61.4%

1,503.3

44.6%

(billion yen)

Q3/FY2022 Q3/FY2023

Cash flows from operating activities

212.2 100.5

Cash flows from investing activities

-61.8 -823.6

Free cash flows

150.4 -723.1

Cash flows from financing activities

-91.1 583.1

Increase/decrease in short-term borrowings and CP

-15.0 263.2

Proceeds from issuance of bonds and long-term borrowings

50.0 471.6

Acquisition of treasury shares

-10.6 -10.7

Dividends paid

-100.4 -116.7

As of end of December, Balance of bonds (Incl. CP) and borrowings: 871.0 billion yen

BALANCE SHEET & CASH FLOW HIGHLIGHTS

CP: Commercial Paper

MAIN INTANGIBLE ASSETS (AS OF DEC 31, 2023)

25

Bil. yen Foreign currency

*

AT132 15.3 USD 109M

AT845 10.2 USD 73M

Other gene therapy related program

**

92.5 USD 656M

Gene therapy related technology

**

68.1 USD 483M

VEOZAH 90.0 EUR 566M

EVRENZO 21.4 -

zolbetuximab 64.0 EUR 493M

IZERVAY (US)

702.6 USD 4,981M

IZERVAY (Ex-US)

155.2 USD 1,100M

* VEOZAH, zolbetuximab: foreign currency is a reference value based on the currency at the time of acquisition of the intangible asset

** Acquired during the acquisition of Audentes (now Astellas Gene Therapies)

26

14

16

22

24

25 25 25

26

27

30

32

34

36

38

40

42

50

60

70

0

1,000

2,000

3,000

4,000

5,000

6,000

0

20

40

60

80

100

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

FY23

FY24

FY25

Dividends

Core OP

Aiming for higher level of dividends increase during CSP2021 aligned with the robust profit growth forecast

Raise dividend level aligned

with profit / cashflow plan and

actual performance

throughout CSP2021 period

Flexibly execute share

buyback by excess cash

Top priority is investment

for business growth

2

1 3

*

Trend of Core OP and dividends

Core OP

(billion yen)

600

500

400

300

200

100

Dividends

(yen)

For illustrative purposes only

CAPITAL ALLOCATION

*Prior to FY2012, operating profit is in accordance with J-GAAP

CSP: Corporate Strategic Plan

27

Please refer to R&D pipeline list for details including target disease.

enfortumab vedotin

(MIBC)

gilteritinib

(Earlier-stage AML, pediatric use)

fezolinetant

(VMS due to menopause: China, Japan)

roxadustat

(Anemia associated with CKD, pediatric

use: Europe)

mirabegron

(Neurogenic detrusor overactivity,

pediatric use: Europe)

Phase 1 Phase 2 Phase 3

Others

Projects with Focus Area approach

XTANDI and Strategic products

enfortumab vedotin

(Other solid tumors)

zolbetuximab

(Pancreatic adenocarcinoma)

resamirigene bilparvovec/

AT132

(XLMTM)

avacincaptad pegol

(Stargardt disease)

bocidelpar/ASP0367

(Primary mitochondrial myopathies)

enfortumab vedotin

(NMIBC)

gilteritinib

(Newly diagnosed AML, HIC-ineligible)

ASP1570

ASP2138

ASP2074

ASP1002

ASP1012

ASP7317

bocidelpar/ASP0367

(Duchenne muscular dystrophy)

zocaglusagene nuzaparvovec/

AT845

ASP3082

abiraterone decanoate/

PRL-02/ASP5541

enzalutamide

(M0 CSPC*: Europe, M1 CSPC: China)

enfortumab vedotin

(mUC previously untreated: Europe, Japan;

mUC pretreated: China)

zolbetuximab

(Gastric and GEJ adenocarcinoma:

Japan, US, Europe, China)

avacincaptad pegol

(GA secondary to AMD: Europe)

peficitinib

(Rheumatoid arthritis: China)

Submitted/Filed

*with biochemical recurrence at high risk for metastasis. NMIBC: Non-muscle-invasive bladder cancer, AML: Acute myeloid leukemia, HIC: High-intensity chemotherapy,

XLMTM: X-linked myotubular myopathy, MIBC: Muscle-invasive bladder cancer, VMS: Vasomotor symptoms, CKD: Chronic kidney disease, M0: Non-metastatic, M1: Metastatic,

CSPC: Castration-sensitive prostate cancer, mUC: Metastatic urothelial cancer, GEJ: Gastroesophageal junction, GA: Geographic atrophy, AMD: Age-related macular degeneration

ROBUST PIPELINE OF ASTELLAS

28

Note: Phase 1 entry is defined as confirmation of IND open.

Phase transition is defined by approval of company decision body for entering to next clinical phase.

Filing is defined as submission of application to health authorities.

Discontinuation is defined by the decision of company decision body.

IND: Investigational New Drug

PROGRESS IN OVERALL PIPELINE

Phase 1 Entry to Approval since the Last Financial Results Announcement

Phase 1 Entry Phase 2 Entry Phase 3 Entry Filing Approval

enzalutamide

Nonmetastatic castration-

sensitive prostate cancer with

biochemical recurrence at high

risk for metastasis: US

enfortumab vedotin

Locally advanced or metastatic

urothelial cancer, previously

untreated (first line): US

fezolinetant

Moderate to severe vasomotor

symptoms associated with

menopause: Europe

isavuconazole

Invasive aspergillosis and

invasive mucormycosis in

pediatric patients: US

enfortumab vedotin

Locally advanced or

metastatic urothelial cancer,

previously untreated (first

line): Europe, Japan

fezolinetant

Vasomotor symptoms

associated with

menopause: Japan

29

(Red: Updates since the last financial results announcement)

Project / Product Indication Current status

enzalutamide/

XTANDI

M1 CSPC • NDA accepted in China in Sep 2023

M0 CSPC with BCR at high risk for metastasis • Approved in US in Nov 2023. Type II variation accepted in Europe in Sep 2023

enfortumab

vedotin/

PADCEV

Metastatic urothelial cancer

• Previously untreated (first line): Approved in US in Dec 2023. Type II variation/sNDA accepted

in Europe/Japan in Jan 2024

• Pretreated: BLA accepted in China in Mar 2023

Muscle-invasive bladder cancer • Phase 3 studies ongoing. Enrollment completed in Phase 3 EV-304 study

Non-muscle-invasive bladder cancer • Phase 1 study ongoing

Other solid tumors • Phase 2 study ongoing

gilteritinib/

XOSPATA

Relapsed and refractory AML • China: Phase 3 study stopped due to efficacy

AML, post-HSCT maintenance • Development based on Phase 3 MORPHO study discontinued

AML, newly diagnosed (HIC-eligible) • Phase 3 study ongoing (enrollment completed)

AML, newly diagnosed (HIC-ineligible) • Phase 1 study ongoing

AML, post-chemotherapy • Obtained topline results from Phase 2 GOSSAMER study

zolbetuximab

Gastric & GEJ adenocarcinoma

• NDA accepted in Japan in Jun 2023. BLA/MAA accepted in Europe and China in Jul 2023.

Received complete response letter in US in Jan 2024

Pancreatic adenocarcinoma • Phase 2 study ongoing

fezolinetant/

VEOZAH

VMS due to menopause

• Europe: Approved in Dec 2023

• China: Obtained topline results from Phase 3 MOONLIGHT 1 and MOONLIGHT 3 studies

• Japan: Phase 3 studies under preparation to start in Q4 FY2023

avacincaptad

pegol/

IZERVAY

GA secondary to AMD • MAA accepted in Europe in Aug 2023. sNDA for label update submitted in US in Jan 2024.

Stargardt disease • Phase 2b study ongoing

VEOZAH: Approved as “VEOZA” in Europe. M1: Metastatic, M0: Non-metastatic, CSPC: Castration-sensitive prostate cancer, BCR: Biochemical recurrence,

(s)NDA: (Supplemental) New Drug Application, BLA: Biologics License Application, AML: Acute myeloid leukemia, HSCT: Hematopoietic stem cell transplant, HIC: High-intensity chemotherapy,

GEJ: Gastroesophageal junction, MAA: Marketing Authorization Application, VMS: Vasomotor symptoms, GA: Geographic atrophy, AMD: Age-related macular degeneration

XTANDI AND STRATEGIC PRODUCTS: STATUS UPDATE

30

Initial

Diagnosis

PROSPER

M0 CRPC

AFFIRM

M1 CRPC

(2nd line+)

Localized Prostate Cancer Castration-Resistant Prostate Cancer

PREVAIL

M1 CRPC

(1st line)

M1 CSPC

newly-diagnosed

M1 CSPC

recurrent

Castration-Sensitive

Prostate Cancer

M0 CSPC

with BCR at high

risk for metastasis

ARCHES

EMBARK

Launched Launched

Launched

US/Europe/

Japan

China

• M1 CSPC: NDA accepted in Sep 2023

Launched

BCR: Biochemical recurrence, M1: Metastatic, M0: Non-metastatic, CSPC: Castration-sensitive prostate cancer, CRPC: Castration-resistant prostate cancer,

ENZA: enzalutamide, ADT: Androgen deprivation therapy, mono: Monotherapy

(Red: Updates since the last financial results announcement)

Local Therapy

Surgery, Radiation

or both

PSA

Recurrence

(BCR)

P3: EMBARK

NCT02319837

M0 CSPC

ENZA + ADT vs. placebo + ADT

vs. ENZA mono

n=1,068

Approved in US in Nov 2023

Type II variation accepted in Europe in Sep 2023

ENZALUTAMIDE (1/2): ANDROGEN RECEPTOR INHIBITOR

Launched (US)

31

Continued potential in earlier lines with consistent survival benefit and longer duration of treatment

Disease stage

Castration-sensitive (CSPC) Castration-resistant (CRPC)

M0 M1 M0

M1

(pre-chemo)

M1

(post-chemo)

Phase 3 study EMBARK ARCHES ENZAMET PROSPER PREVAIL AFFIRM

Control Placebo Placebo

Conventional

NSAA

Placebo Placebo Placebo

Primary

endpoint

MFS

HR 0.42

rPFS

HR 0.39

OS

HR 0.67

MFS

HR 0.29

rPFS

HR 0.17

OS

HR 0.71*

OS

HR 0.63

OS (Ongoing)

HR 0.66

HR 0.67

HR 0.73

HR 0.77

HR 0.63

DoT

32.4 months**

40.2 months

29.5 months

33.9 months

17.5 months

8.3 months

: Data obtained, *: Prespecified interim analysis, **: excluding treatment suspension period

Early stage Late stage

M0: Non-metastatic, M1: Metastatic, CSPC: Castration-sensitive prostate cancer, CRPC: Castration-resistant prostate cancer, NSAA: Non-steroidal antiandrogen,

HR: Hazard ratio, MFS: Metastasis-free survival, rPFS: Radiographic progression-free survival, OS: Overall survival, DoT: Duration of treatment

ENZALUTAMIDE (2/2): PHASE 3 STUDY DATA BY DISEASE STAGE

32

Stages 2 and 3

Stage 4

Clinical

studies

for EV

P2: EV-201

(Cohort 2)

Platinum-naïve

and Cis-ineligible

P3: EV-302

Platinum-eligible

vs. Chemo

Phase 1 or 2

Phase 3

P3: EV-301

vs. Chemo

P2: EV-201

(Cohort 1)

Patient

treatment

MIBC

mUC

Early stage - Disease stage of urothelial cancer - Late stage

RC-eligible

P3: KEYNOTE-905

/ EV-303

Cis-ineligible

vs. SoC (RC alone)

P3: KEYNOTE-B15

/ EV-304

Cis-eligible

vs. SoC (NAC + RC)

Platinum and

PD-1/L1 inhibitor

pretreated

PD-1/L1 inhibitor

pretreated

Previously

untreated

(first line)

EV mono

(i.v.)

Target

EV regimen

P2: EV-203

(Bridging study

in China)

EV+Pembro combo

(i.v.; perioperative)

sBLA approved

EV mono

(i.v.)

EV+Pembro

combo (i.v.)

Stages 0a-1

NMIBC

BCG-

unresponsive

P1: EV-104

EV mono

(intravesical)

P1b/2: EV-103

(Dose escalation

cohort & Cohort A)

Cis-ineligible

(Cohort K)

Cis-ineligible

EV + Pembro,

EV mono

(Cohorts H & L)

Cis-ineligible

EV mono (neoadjuvant

/perioperative) + RC

Approved

(AA)

sBLA (to convert

regular approval)

approved in US.

Approved in JP

and Europe

sBLA approved

(AA)

ADC: Antibody-drug conjugate, mUC: Metastatic urothelial cancer, NMIBC: Non-muscle-invasive bladder cancer, MIBC: Muscle-invasive bladder cancer,

BCG: Bacillus Calmette-Guerin, RC: Radical cystectomy, mono: Monotherapy, Pembro: Pembrolizumab, i.v.: Intravenous, Cis: Cisplatin, SoC; Standard of care,

NAC: Neoadjuvant chemotherapy, Chemo: Chemotherapy, sBLA: Supplemental Biologics License Application, AA: Accelerated Approval

BLA accepted

ENFORTUMAB VEDOTIN (EV) (1/4): NECTIN-4 TARGETED ADC

OVERALL UC PROGRAM

sBLA approved in US

(Red: Updates since the last financial results announcement)

33

P3: EV-301

NCT03474107

mUC, Platinum and PD-1/L1 inhibitor pretreated;

EV mono vs. Chemo

n=608

sBLA (to convert regular approval) approved in US in Jul 2021.

Approved in Japan in Sep 2021, in Europe in Apr 2022

P3: EV-302

NCT04223856

mUC, Previously untreated, Platinum-eligible;

EV + Pembro vs. Chemo

n=990

Approved in US in Dec 2023.

Type II variation/sNDA accepted in Europe/Japan in Jan 2024

P3: EV-303

/KEYNOTE-905

NCT03924895

MIBC, Cis-ineligible;

Pembro +/- EV (perioperative) + RC vs. RC alone

n=857 FSFT in Pembro + EV arm: Dec 2020

P3: EV-304

/KEYNOTE-B15

NCT04700124

MIBC, Cis-eligible; EV + Pembro (perioperative) + RC

vs. Chemo (neoadjuvant) + RC

n=784 Enrollment completed

P2: EV-201

NCT03219333

mUC, PD-1/L1 inhibitor pretreated; EV mono

Cohort 1: Platinum pretreated

Cohort 2: Platinum naïve and Cis-ineligible

n=219

Cohort 1: Approved (under the Accelerated Approval program)

Cohort 2: sBLA approved in US in Jul 2021

P1b/2: EV-103

NCT03288545

Cohorts A - G and K (mUC):

A-G: Combo with Pembro and other chemo

K: EV mono, EV + Pembro

Cohorts H, J and L (MIBC, Cis-ineligible, + RC):

H: EV mono (neoadjuvant)

J (optional): EV + Pembro (neoadjuvant)

L: EV mono (perioperative)

n=348

Dose Escalation/Cohort A and Cohort K: sBLA approved (under

the Accelerated Approval program) in US in Apr 2023.

Enrollment completed

P2: EV-203

NCT04995419

<Bridging study in China>

mUC, Platinum and PD-1/L1 inhibitor pretreated; EV mono

n=40 BLA accepted in China in Mar 2023

P1: EV-104

NCT05014139

NMIBC, High-risk BCG-unresponsive; Intravesical EV mono n=58 FSFT: Jan 2022

P2: EV-202

NCT04225117

HR+/HER2- breast cancer, Triple-negative breast cancer,

Squamous NSCLC, Non-

squamous NSCLC, Head and neck cancer,

Gastric adenocarcinoma or esophageal adenocarcinoma or GEJ

adenocarcinoma, Esophageal squamous cell carcinoma; EV mono

Head and neck squamous cell carcinoma; EV + Pembro

n=320

Enrollment completed for EV mono cohorts.

Initial topline results obtained in Jun 2022

For urothelial cancer

For other solid tumors

(Red: Updates since the last financial results announcement)

ENFORTUMAB VEDOTIN (EV) (2/4): CLINICAL STUDIES

mUC: Metastatic urothelial cancer, mono: Monotherapy, Chemo: Chemotherapy, (s)BLA: (Supplemental) Biologics License Application, Pembro: Pembrolizumab, sNDA: Supplemental

New Drug Application, MIBC: Muscle-invasive bladder cancer, Cis: Cisplatin, RC: Radical cystectomy, FSFT: First subject first treatment, NMIBC: Non-muscle-invasive bladder cancer,

BCG: Bacillus Calmette-Guerin, HR+: Hormone receptor positive, HER2-: HER2 negative, NSCLC: Non-small cell lung cancer, GEJ: Gastroesophageal junction

34

Disease

stage

MIBC mUC

Surgery eligible Previously untreated (first line) PD-1/L1 inhibitor pretreated

Cis-

eligible

Cis-

ineligible

Platinum eligible Cis-ineligible

Platinum naïve

& Cis

-ineligible

Platinum pretreated

Study phase Phase 3 Phase 3 Phase 3 Phase 1b/2 Phase 1b/2 Phase 2 Phase 2 Phase 3

Study No.

KN-B15

/ EV-304

KN-905

/ EV-303

EV-302

EV-103

Cohort K

EV-103

Cohort A

& Others

EV-201

Cohort 2

EV-201

Cohort 1

EV-301

No. of subjects 784 (2 arms) 857 (3 arms) 990 (2 arms) 76 73 45 89 125 608 (2 arms)

EV regimen

Combo w/

Pembro

(perioperative)

Combo w/

Pembro

(perioperative)

Combo w/ Pembro

Combo w/

Pembro

Mono

Combo w/

Pembro

Mono Mono Mono

Control

Chemo

(neoadjuvant)

SoC Chemo n/a n/a n/a n/a n/a Chemo

Primary

endpoint

pCR

&

EFS

pCR

&

EFS

PFS: HR 0.45

OS: HR 0.47

ORR

64%

(CR 11%)

ORR

45%

(CR 4%)

ORR

73% **

(CR 16% **)

ORR

51% **

(CR 22% **)

ORR

44%

(CR 12%)

OS

HR 0.70 *

OS (Ongoing) (Ongoing)

HR 0.47

(31.5 mos

vs.16.1 mos)

(Ongoing)

(21.7 mos)

(26.1 mos **)

(14.7 mos)

(12.4 mos **)

HR 0.70 *

(12.9 mos vs.9.0 mos)

PFS (Ongoing) (Ongoing)

HR 0.45

(12.5 mos

vs.6.3 mos)

(Ongoing)

(8.2 mos)

(12.7 mos **)

(5.8 mos)

(5.8 mos)

HR 0.62 *

(5.6 mos vs.3.7 mos)

ORR (Ongoing) (Ongoing)

67.7%

vs. 44.4%

(CR 29.1% vs. 12.5%)

64%

(CR 11%)

45%

(CR 4%)

73% **

(CR 16% **)

52%

(CR 20%)

44%

(CR 12%)

41%

vs.18% *

(CR 4.9%

vs.2.7%)

DoR (Ongoing) (Ongoing) (Ongoing) (Ongoing) 13.2 mos 22.1 mos ** 13.8 mos ** 7.6 mos

7.4 mos

vs. 8.1 mos *

: Data obtained, *: Prespecified interim analysis, **: Updated data

Early stage Late stage

(m)UC: (Metastatic) urothelial cancer, MIBC: Muscle-invasive bladder cancer, cis: Cisplatin, Pembro: Pembrolizumab, mono: Monotherapy, Chemo: Chemotherapy,

pCR: Pathologic complete response, EFS: Event-free survival, ORR: Objective response rate, CR: Complete response, OS: Overall survival, HR: Hazard ratio,

PFS: Progression-free survival, DoR: Duration of response

ENFORTUMAB VEDOTIN (EV) (3/4):

STUDY DATA BY DISEASE STAGE OF UC

35

The most significant growth driver is 1L mUC indication, which is expected to account for more than half of total sales

in the future

Success in NMIBC and other solid tumors will provide further growth potential

Patient segment

Pivotal study

(EV regimen)

Target filing

timing

Number of

eligible patients*

MIBC

Cis-ineligible

EV-303

(combo w/ Pembro)

FY2025 or later 10,000

Cis-eligible

EV-304

(combo w/ Pembro)

FY2025 or later 37,000

1L mUC

EV-302

EV-103 Cohorts

[Phase 1b/2 for AA in US]

(combo w/ Pembro)

Approved

Approved

[AA in US]

76,000

(incl. US,

Cis-ineligible:

8,000-9,000)

2L+

mUC

PD-1/L1

inhibitor

pretreated &

Cis-ineligible

EV-201 Cohort 2

(monotherapy)

Approved

1,600

(US, Cis-ineligible)

Platinum &

PD-1/L1

inhibitor

pretreated

EV-301

EV-201 Cohort 1

[Phase 2 for AA in US]

(monotherapy)

Approved 38,000

Patient segment

Study

(EV regimen)

NMIBC

High-risk

BCG-unresponsive

EV-104 [Phase 1]

(monotherapy,

intravesical)

Other solid tumors

EV-202 [Phase 2]

(monotherapy* /

combo w/ Pembro**)

<Already approved / pivotal phase> (Included in potential peak sales) <Early clinical phase> (Not included in potential peak sales)

*Monotherapy:

HR+/HER2- breast cancer,

Triple-negative breast cancer,

Squamous NSCLC,

Non-squamous NSCLC,

Head and neck cancer,

Gastric adenocarcinoma or esophageal adenocarcinoma or

GEJ adenocarcinoma,

Esophageal squamous cell carcinoma

**Combo w/ Pembro:

Head and neck squamous cell carcinoma

*Global, based on internal estimates

mUC: Metastatic urothelial cancer, MIBC: Muscle-invasive bladder, 1L: First line, 2L+: Second or later line, Cis: Cisplatin, Pembro: Pembrolizumab,

AA: Accelerated Approval, HR+: Hormone receptor positive, HER2-: HER2 negative, NSCLC: Non-small cell lung cancer, GEJ: Gastroesophageal junction

ENFORTUMAB VEDOTIN (EV) (4/4): FUTURE OUTLOOK

(Red: Updates since the last financial results announcement)

36

FLT3 mut+

AML

Low-intensity

chemo

Chemo

consolidation

Salvage therapy

Transplant

ADMIRAL

VICEROY

Maintenance

GOSSAMER

High-

intensity

induction

chemo

Maintenance

MORPHO

PASHA (HOVON)

PrE0905 (PrECOG)

Launched

China

• R/R AML: Conditional approval obtained in Jan 2021, based on ADMIRAL study data (full approval contingent on

COMMODORE study data) and launched in Apr 2021. Phase 3 COMMODORE study (including China and other countries)

stopped due to efficacy based on the planned interim analysis

FLT3 mut+: FLT3 mutation positive, AML: Acute myeloid leukemia, HIC: High-intensity chemotherapy, FSFT: First subject first treatment, HSCT: Hematopoietic stem cell transplant,

HOVON: The Haemato Oncology Foundation for Adults in the Netherlands, BMT-CTN: Blood and Marrow Transplant - Clinical Trial Network, R/R: Relapsed or refractory

GILTERITINIB: FLT3 INHIBITOR

Relapsed or refractory P3: ADMIRAL

NCT02421939

Monotherapy vs. salvage chemo

(2:1)

n=371 Launched in US, JP, and Europe

Newly diagnosed

(HIC-eligible)

P3: PASHA (HOVON)

NCT04027309

Combo with high intensity chemo

gilteritinib vs. midostaurin (1:1)

n=766 Enrollment completed (Sponsor: HOVON)

P2: PrE0905 (PrECOG)

NCT03836209

n=179 Enrollment completed (Sponsor: PrECOG, LLC.)

Post-HSCT maintenance P3: MORPHO

NCT02997202

Monotherapy vs. placebo (1:1) n=356 Development based on MORPHO study discontinued

Post-chemo maintenance P2: GOSSAMER

NCT02927262

Monotherapy vs. placebo (2:1) n=98 Topline results obtained in Aug 2021

Newly diagnosed

(HIC-ineligible)

P1: VICEROY

NCT05520567

Combo with venetoclax and

azacitidine

n=70 FSFT in Jan 2023

(Red: Updates since the last financial results announcement)

37

Gastric and GEJ adenocarcinoma

Target patient population:

HER2-, Claudin 18.2+ locally advanced and metastatic

gastric and GEJ adenocarcinoma

Metastatic gastric cancer is an area of significant unmet

need, especially in advanced stages with ~6% five-year

survival rate at Stage IV and treatment options are

limited

Target: Claudin 18.2

Claudin is a major structural component of tight junctions

and seals intercellular space in epithelial sheets

Broadly expressed in various cancer types

Prevalence of patients with high expression of

Claudin 18.2 is substantial: 38%

~60% of primary pancreatic adenocarcinomas;

~20% of these meet the eligibility criteria for the

ongoing Phase 2 study

Gastric and GEJ

adenocarcinoma

P3: SPOTLIGHT

NCT03504397

First line, Combo with mFOLFOX6, DB, vs. placebo n=566

NDA accepted in Japan in Jun 2023. BLA/MAA

accepted in Europe and China in Jul 2023. Received

complete response letter in US in Jan 2024

P3: GLOW

NCT03653507

First line, Combo with CAPOX, DB, vs. placebo n=507

P2: ILUSTRO

NCT03505320

Cohort 1: Third or later line, zolbetuximab monotherapy

Cohort 2: First line, Combo with mFOLFOX6

Cohort 3: Third or later line, Combo with pembrolizumab

Cohort 4: First line, Combo with mFOLFOX6 and nivolumab

Cohort 5: Perioperative, Combo with FLOT

n=143 FSFT: Sep 2018

Pancreatic

adenocarcinoma

P2

NCT03816163

First line, Combo with nab-paclitaxel and gemcitabine, open n=369 FSFT: May 2019

GEJ: Gastroesophageal junction, HER2-: HER2 negative, Claudin 18.2+: Claudin 18.2 positive, mFOLFOX6: 5-FU, leucovorin and oxaliplatin, DB: Double-blind,

CAPOX: Capecitabine and oxaliplatin, NDA: New Drug Application, BLA: Biologics License Application, MAA: Marketing Authorization Application,

FLOT: Fluorouracil, leucovorin, oxaliplatin and docetaxel, FSFT: First subject first treatment

ZOLBETUXIMAB: ANTI-CLAUDIN 18.2 MONOCLONAL ANTIBODY

(Red: Updates since the last financial results announcement)

38

P3: MOONLIGHT 1

NCT04234204

Moderate to severe VMS associated with menopause;

The first 12 weeks: DB, 30 mg vs. placebo (1:1)

The last 12 weeks: Active extension treatment period, 30 mg

n=302

Primary endpoints not met

(12w DB period topline results)

P3: MOONLIGHT 3

NCT04451226

VMS associated with menopause; open label, 30 mg for 52 weeks n=150 Topline results obtained in Sep 2022

VMS has a significant negative impact on QoL

Physical symptoms include hot flashes and night sweats, which can

impact sleep

.

Physical symptoms may lead to emotional impact including

embarrassment, irritability, anxiety, and sadness

Symptoms have a negative impact on multiple aspects of everyday life

1

Women’s Health Initiative (WHI) Study

2

Initial data analyses showed an association between chronic HRT use and

increased risk of cardiovascular disease and breast cancer

Since WHI’s findings, use of HRT has dropped

Although subsequent analysis of the WHI data have demonstrated that HRT is safe

and effective when initiated in the appropriate patient in the appropriate manner

(i.e. right time, formulation, dose and duration), prescriptions have not rebounded,

leaving some women with minimal options to satisfactorily manage their VMS

US and Europe

China

Japan

P3: STARLIGHT 2

NCT06206408

Mild to severe VMS associated with menopause;

12 weeks: DB, 2 doses vs. placebo (1:1:1)

n=390

Under preparation to start in Q4 FY2023

P3: STARLIGHT 3

NCT06206421

VMS associated with menopause;

52 weeks: DB, vs. placebo (1:1)

n=260

Under preparation to start in Q4 FY2023

P3: SKYLIGHT 1

NCT04003155

Moderate to severe VMS associated with menopause;

The first 12 weeks: DB, 30 mg and 45 mg vs. placebo (1:1:1)

The last 40 weeks: Active extension treatment period, 30 mg or 45 mg

n=527

Approved in US in May 2023.

Approved in Europe in Dec 2023

P3: SKYLIGHT 2

NCT04003142

n=501

P3: SKYLIGHT 4

NCT04003389

VMS associated with menopause;

52 weeks: DB, 30 mg and 45 mg vs. placebo (1:1:1)

n=1,831

P3b: DAYLIGHT

NCT05033886

Moderate to severe VMS associated with menopause, unsuitable for HRT;

24 weeks, DB, 45 mg vs. placebo (1:1)

n=453 Topline results obtained in Jun 2023

(Red: Updates since the last financial results announcement)

1: DelveInsight, Epidemiology Forecast, Jun 2018. 2: Data Source - IMS NPA (2000-2016), IMS NSP (2000-2016). (3 HTs and SSRI) NAMS 2015 Position Statement.

VMS: Vasomotor symptoms, QoL: Quality of life, HRT: Hormone replacement therapy, DB: Double-blind

FEZOLINETANT: NK3 RECEPTOR ANTAGONIST

39

Characteristics of ACP

Pegylated RNA aptamer (Chemically synthesized)

ACP inhibits complement C5, and slows inflammation and cell

death associated with development and progression of GA

GA secondary to AMD

P2/3: GATHER1

NCT02686658

Part 1: 1 mg, 2 mg vs. Sham (n=77)

Part 2: 2 mg, 4 mg vs. Sham (n=209)

n=286

MAA accepted in Europe in Aug 2023.

sNDA for label update submitted in

US in Jan 2024

P3: GATHER2

NCT04435366

2 mg vs. Sham n=448

Stargardt disease P2b

NCT03364153

vs. Sham n=120 FSFT: Jan 2018

Geographic atrophy (GA)

Advanced form of dry age-related macular degeneration

(AMD)

Globally, approximately 5 million people are estimated to

have GA at least in one eye

1

Approximately 75% of people living with GA in the US are

believed to be undiagnosed

2

Without timely treatment, an estimated 66% of people with

GA may become blind or severely visually impaired

3

AVACINCAPTAD PEGOL (ACP):

COMPLEMENT C5 INHIBITOR / PEGYLATED RNA APTAMER

(Red: Updates since the last financial results announcement)

1. Retina 37:819-835 (2017). 2. IQVIA Medical Claims (DX) data Jan ’20-Dec ’21: 24 Months. 3. JAMA Ophthalmol 139:743-750 (2021)

MAA: Marketing Authorization Application, sNDA: Supplemental New Drug Application, FSFT: First subject first treatment

40

FOCUS AREA APPROACH: KEY EVENTS EXPECTED IN FY2023

Primary Focus IND

Phase 1

Early data readout* Dosing resumption

Genetic Regulation

1 project AT845

Immuno-Oncology

2 projects

( ASP1012)

ASP1570

ASP2138

Blindness &

Regeneration

ASP7317

Targeted Protein

Degradation

1 project

(pan-KRAS)

ASP3082

Expecting Phase 1 entry in 4 projects and several progress in Phase 1 studies toward PoC judgment

*Dose escalation/monotherapy

PoC: Proof of concept, IND: Investigational New Drug

: Achieved

ON THE FOREFRONT OF

HEALTHCARE CHANGE