Important disclosures, including any required research certifications, are provided on the last page of this report.

Global

Credit

11 December 2023

Apple Inc. (AAPL US)

Maintaining a strong financial position

➢ FY23 Revenues decreased 3% y/y with lower revenues in all

segments except Services; EBITDA decreased 4% y/y

➢ Maintains a strong financial position with a net cash position of $51bn

➢ Outlook stable given the large and relatively stable revenues, the

continuous growth of services segment and the strong balance sheet

FICC Research Dept

Stefan Tudor, CFA

81-3-5555-8754

Daiwa Securities Co. Ltd

K

Credit Opinion

We evaluate the credit outlook as stable given Apple’s large and relatively stable revenues,

the continuous growth of services revenues and the strong balance sheet. In FY23, total

revenues decreased 3% y/y to $383.3bn as FX had a significant negative impact on

revenues. On a constant-currency basis, total revenues increased y/y despite the

challenging macroeconomic environment. The performance in emerging markets was

strong as revenues reached an all-time record in FY23, registering double-digit growth in

constant- currency.

Services segment continues to grow with FY23 revenues up 9.1% y/y. Revenue growth

was broad based with growth in advertising, cloud services and the App Store. There are a

few factors that continue to support the services growth. First, the installed base of active

devices continues to grow, reaching an all-time high for all major products categories and

geographic segments. Second, there is an increased customer engagement with more

than 1bn of paid subscriptions across services. Third, Apple continues to launch new

services and new offerings within the services. Services revenue growth is credit positive

as it helps diversify Apple’s product portfolio and increases the recurring revenue.

Apple maintains a strong financial position with a net cash position of $51bn. Apple

continues to return capital to shareholders through share repurchases and dividends but

we don’t expect significant deterioration in the credit metrics. We expect the financial policy

to remain conservative in line with the firm’s announced target of net zero cash position

over time.

Apple has an excellent liquidity profile with $162.1bn of cash and marketables on its

balance sheet as end of FY23. The liquidity profile is also supported by Apple’s high

capabilities to generate cash flows with $99.6bn of free operating cash flows in FY23.

Apple continues to have healthy profit margins with gross margins at 44.1% and EBITDA

margins at 32.8%.

FY23 Financial Highlights

Total revenues decreased 3% y/y to $383.3bn mainly due to lower sales of Mac and

iPhone, partially offset by higher sales of Services. FX had a negative impact on

revenues and the weakness in foreign currencies relative to the US dollar accounted for

more than the entire y/y revenue decrease.

- 2 -

Apple Inc. (AAPL US) 11 December 2023

iPhone revenues decreased 2% y/y to $200.6bn due to lower sales of non-Pro iPhone

models, partially offset by higher sales of Pro iPhone models. iPhone continues to be the

largest segment with a share of 52% in total revenues.

Mac revenues decreased 27% y/y to $29.4bn as the sales of laptops were lower y/y due to

challenging market conditions and a difficult comparison against the strong results a year

ago. In FY22, Apple experienced supply disruptions from factory shutdowns which was

followed by significant pent-up demand during the September quarter.

iPad revenues decreased 3% y/y to $28.3bn due to lower sales of iPad mini and iPad Air.

Wearables (Wearables, Home and Accessories) revenues decreased 3% y/y to $39.8bn

due to lower sales of Wearables and Accessories.

Services revenues increased 9.1% y/y to $85.2bn setting an all-time revenue record.

Services revenue growth was broad based with growth in advertising, cloud services and

the App Store. Services is the second largest segment with 22% share in total revenues.

On a geographical basis, Americas revenues decreased 4% y/y to $162.6bn due to lower

sales of iPhone and Mac, partially offset by higher sales of Services; Europe decreased

1% y/y to $94.3bn due to lower sales of Mac and Wearables, partially offset by higher

sales of iPhone and Services. The weakness of foreign currencies relative to the US dollar

accounted for more than the entire y/y decrease in Europe sales; Greater China decreased

2% y/y to $72.6bn due to lower sales of Mac and iPhone. The weakness of the Chinese

renminbi relative to the US dollar accounted for more than the entire decrease in Greater

China sales; Japan decreased 7% y/y to $24.3bn due to lower sales of iPhone, Wearables

and Mac. The weakness of the yen relative to US dollar accounted for more than the entire

y/y decrease in Japan sales; Rest of Asia increased 1% y/y to $29.6bn due to higher sales

of iPhone and Services, partially offset by lower sales of Mac and iPad. The weakness in

foreign currencies relative to the US dollar had a significantly unfavorable y/y impact on

Rest of Asia Pacific sales.

EBITDA decreased 4% y/y to $125.8bn due to lower revenues and higher operating

expenses. EBITDA margin decreased 30bps y/y to 32.8%.

Gross margin increased 80bps y/y to 44.1% driven by higher products gross margin,

partially offset by lower services gross margin. Products gross margin improved 20bps y/y

to 36.5% due to cost savings and a favorable product mix. Services gross margin

decreased 90bps y/y to 70.8% due to higher services costs and the negative FX impact.

Apple’s liquidity sources include cash holdings, cash generated by ongoing operations and

the access to debt markets. As end of September 2023, the balance of cash, cash

equivalents and marketable securities totaled $162.1bn.

Free operating cash flow (FOCF=operating cash flows - CapEx) decreased 11% y/y

to $99.6bn due to lower cash flow from operations and higher CapEx. Cash flow from

operations decreased 9.5% y/y to $110.5bn. CapEx increased 2.3% y/y to $11bn.

Total debt decreased 8% y/y to $111.1bn. When taking into consideration the cash

balance, Apple had a net cash position of $51bn as of end of September 2023. Apple

maintains its target of reaching a net cash neutral position over time.

In May 2023, Apple announced a new share repurchase program of up to $90bn and

raised its quarterly dividend from $0.23 to $0.24 per share beginning in May 2023. During

2023, Apple repurchased $76.6bn of its common stock and paid dividends and dividend

equivalents of $15bn.

- 3 -

Apple Inc. (AAPL US) 11 December 2023

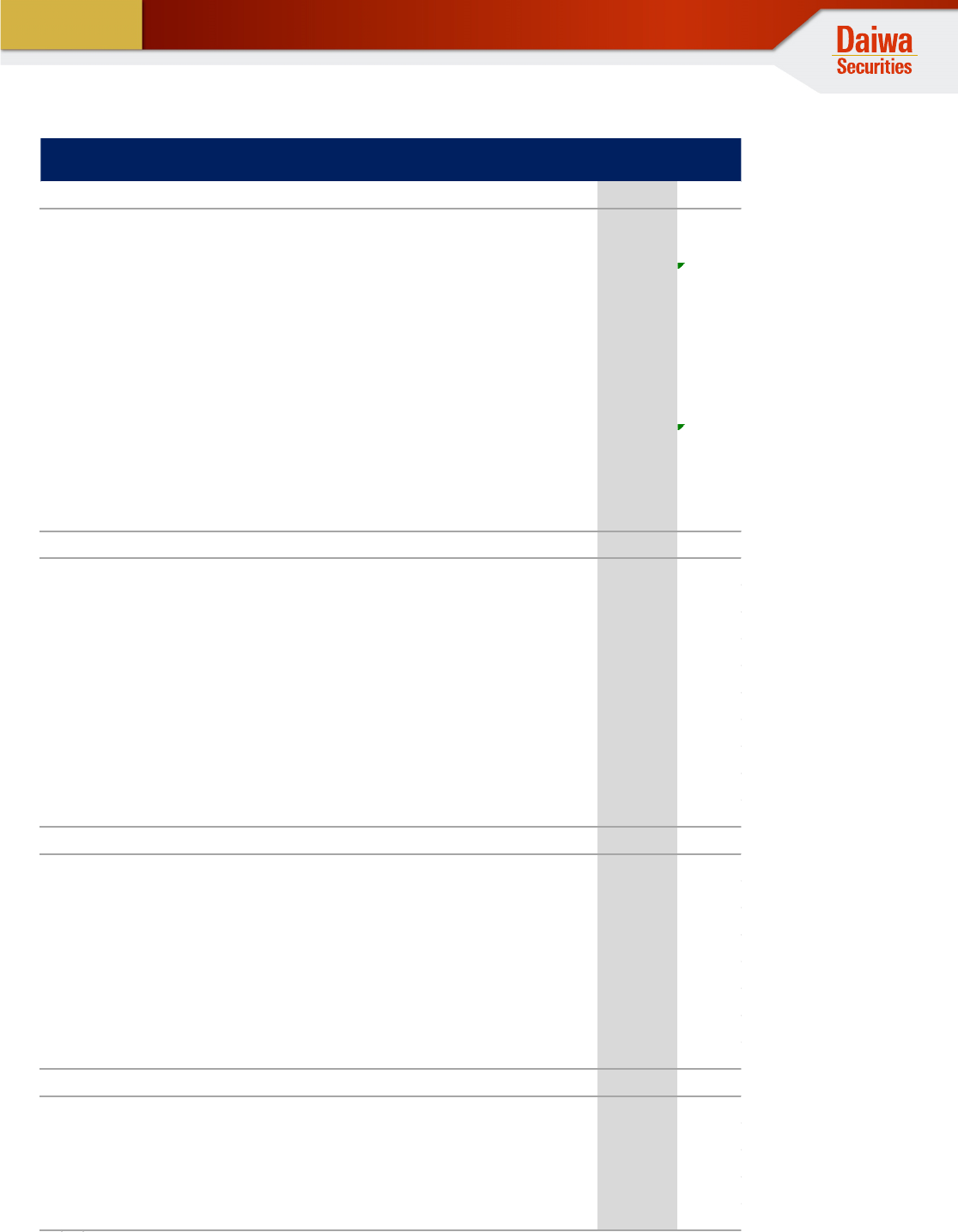

Chart 1: Financial results

Source: Company materials, Bloomberg; compiled by Daiwa

(*) Net Debt= total debt- cash- marketables

(**) Calculations are based on net income data for the last twelve month.

($m) FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Y/Y

Period End 09/28/2019 09/26/2020 09/25/2021 09/24/2022 09/30/2023

■

P/L

Revenues 260,174 274,515 365,817 394,328 383,285 -2.8%

Gross profit 98,392 104,956 152,836 170,782 169,148 -1.0%

Gross margin 37.8% 38.2% 41.8% 43.3% 44.1% 0.8

Operating expenses ▲ 34,462 ▲ 38,668 ▲ 43,887 ▲ 51,345 ▲ 54,847 6.8%

SG&A ▲ 18,245 ▲ 19,916 ▲ 21,973 ▲ 25,094 ▲ 24,932 -0.6%

R&D ▲ 16,217 ▲ 18,752 ▲ 21,914 ▲ 26,251 ▲ 29,915 14.0%

Operating Income 63,930 66,288 108,949 119,437 114,301 -4.3%

Pretax Income 65,737 67,091 109,207 119,103 113,736 -4.5%

Tax rate 15.9% 14.4% 13.3% 16.2% 14.7% ▲ 1.5

Net Income 55,256 57,411 94,680 99,803 96,995 -2.8%

EBITDA 76,477 77,344 120,233 130,541 125,820 -3.6%

EBITDA margin 29.4% 28.2% 32.9% 33.1% 32.8% ▲ 0.3

■

C/F

Cash from operations 69,391 80,674 104,038 122,151 110,543 -9.5%

Depreciation & Amortization 12,547 11,056 11,284 11,104 11,519 3.7%

Cash from investing 45,896 ▲4,289 ▲14,545 ▲22,354 3,705 ---

CapEx ▲10,495 ▲7,309 ▲11,085 ▲10,708 ▲10,959 2.3%

Cash from financing ▲90,976 ▲86,820 ▲93,353 ▲110,749 ▲108,488 -2.0%

Dividends paid ▲14,119 ▲14,081 ▲14,467 ▲14,841 ▲15,025 1.2%

Net stock repurchases ▲66,116 ▲71,478 ▲84,866 ▲89,402 ▲77,550 -13.3%

Free cash flow (FCF) 115,287 76,385 89,493 99,797 114,248 14.5%

Free operating cash flow (FOCF) 58,896 73,365 92,953 111,443 99,584 -10.6%

Net cash flow 24,311 ▲10,435 ▲3,860 ▲10,952 5,760 ---

■

B/S

Assets 338,516 323,888 351,002 352,755 352,583 0.0%

Current assets 162,819 143,713 134,836 135,405 143,566 6.0%

Cash&Marketables 205,898 191,830 190,516 169,109 162,099 -4.1%

Liabilities 248,028 258,549 287,912 302,083 290,437 -3.9%

Current liabilities 105,718 105,392 125,481 153,982 145,308 -5.6%

Total Debt 108,047 112,436 124,719 120,069 111,088 -7.5%

Net Debt(*) ▲ 97,851 ▲ 79,394 ▲ 65,797 ▲ 49,040 ▲ 51,011 4.0%

Equity 90,488 65,339 63,090 50,672 62,146 22.6%

■

Financial Ratios

Equity Ratio 26.7% 20.2% 18.0% 14.4% 17.6% 3.3

NetD/E ▲1.08 ▲1.22 ▲1.04 ▲0.97 ▲0.82 0.1

NetD/EBITDA ▲1.28 ▲1.03 ▲0.55 ▲0.38 ▲0.41 ▲ 0.0

ROA (**) 15.7% 17.3% 28.1% 28.4% 27.5% ▲ 0.9

ROE (**) 55.9% 73.7% 147.4% 175.5% 171.9% ▲ 3.5

- 4 -

Apple Inc. (AAPL US) 11 December 2023

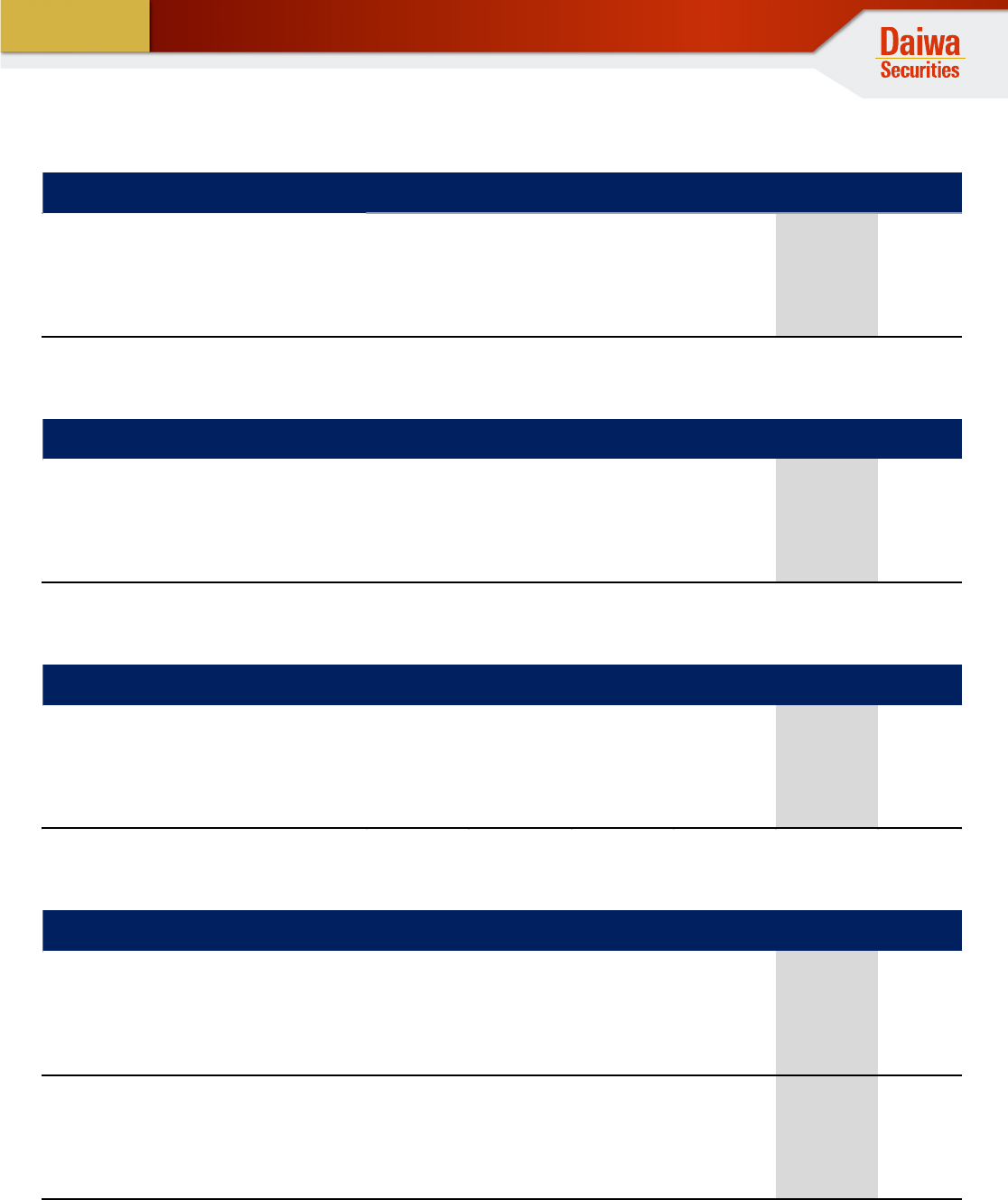

Chart 2: Revenues breakdown by products

Source: Company materials, Bloomberg; compiled by Daiwa.

Chart 3: Product share in total revenues

Source: Company materials, Bloomberg; compiled by Daiwa.

Chart 4: Revenues growth rates by product (y/y)

Source: Company materials, Bloomberg; compiled by Daiwa.

Chart 5: Revenues/ Operating Income breakdown by geographical segments

Source: Company materials, Bloomberg; compiled by Daiwa

Apple manages its business primarily on a geographic basis with five reportable segments:

(1) Americas, including both North & South America

(2) Europe, including European countries, India, the Middle East and Africa

(3) Greater China, including China, HK, Taiwan

(4) Japan

(5) Rest of Asia Pacific, including Australia, other Asian countries

($m) FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Y/Y

Period Ending 09/28/2019 09/26/2020 09/25/2021 09/24/2022 09/30/2023

Total Revenues 260,174 274,515 365,817 394,328 383,285 -2.8%

iPhone 142,381 137,781 191,973 205,489 200,583 -2.4%

Mac 25,740 28,622 35,190 40,177 29,357 -26.9%

iPad 21,280 23,724 31,862 29,292 28,300 -3.4%

Wearables, Home and Accessories 24,482 30,620 38,367 41,241 39,845 -3.4%

Services 46,291 53,768 68,425 78,129 85,200 9.1%

($m) FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Y/Y

3 Months Ending 09/28/2019 09/26/2020 09/25/2021 09/24/2022 09/30/2023 Change

Total Revenues 260,174 274,515 365,817 394,328 383,285

iPhone 55% 50% 52% 52% 52% 0.2

Mac 10% 10% 10% 10% 8% ▲ 2.5

iPad 8% 9% 9% 7% 7% ▲ 0.0

Wearables 9% 11% 10% 10% 10% ▲ 0.1

Services 18% 20% 19% 20% 22% 2.4

FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Y/Y

3 Months Ending 09/28/2019 09/26/2020 09/25/2021 09/24/2022 09/30/2023 Change

Total Revenues -2% 6% 33% 8% -3% ---

iPhone -14% -3% 39% 7% -2% ---

Mac 2% 11% 23% 14% -27% ---

iPad 16% 11% 34% -8% -3% ---

Wearables, Home and Accessories 41% 25% 25% 7% -3% ---

Services 16% 16% 27% 14% 9% ▲ 5.1

($m) FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Y/Y

3 Months Ending 09/28/2019 09/26/2020 09/25/2021 09/24/2022 09/30/2023

Revenue 260,174 274,515 365,817 394,328 383,285 -3%

Americas 116,914 124,556 153,306 169,658 162,560 -4%

Europe 60,288 68,640 89,307 95,118 94,294 -1%

Greater China 43,678 40,308 68,366 74,200 72,559 -2%

Japan 21,506 21,418 28,482 25,977 24,257 -7%

Rest of Asia Pacific 17,788 19,593 26,356 29,375 29,615 1%

Segment Operating Income 85,950 91,240 137,006 152,895 150,888 -1.3%

Americas 35,099 37,722 53,382 62,683 60,508 -3.5%

Europe 19,195 22,170 32,505 35,233 36,098 2.5%

Greater China 16,232 15,261 28,504 31,153 30,328 -2.6%

Japan 9,369 9,279 12,798 12,257 11,888 -3.0%

Rest of Asia Pacific 6,055 6,808 9,817 11,569 12,066 4.3%

- 5 -

Apple Inc. (AAPL US) 11 December 2023

IMPORTANT

This report is provided as a reference for making investment decisions and is not intended to be a solicitation for investment. Investment decisions should be

made at your own discretion and risk. Content herein is based on information available at the time the report was prepared and may be amended or otherwise

changed in the future without notice. We make no representations as to the accuracy or completeness. Daiwa Securities Co. Ltd. retains all rights related to the

content of this report, which may not be redistributed or otherwise transmitted without prior consent.

Ratings

Issues are rated 1, 2, 3, 4, or 5 as follows:

1: Outperform TOPIX/benchmark index by more than 15% over the next 12 months.

2: Outperform TOPIX/benchmark index by 5-15% over the next 12 months.

3: Out/underperform TOPIX/benchmark index by less than 5% over the next 12 months.

4: Underperform TOPIX/benchmark index by 5-15% over the next 12 months.

5: Underperform TOPIX/benchmark index by more than 15% over the next 12 months.

Benchmark index: TOPIX for Japan, S&P 500 for US, STOXX Europe 600 for Europe, HSI for Hong Kong, STI for Singapore, KOSPI for Korea, TWII for

Taiwan, and S&P/ASX 200 for Australia.

Target Prices

Daiwa Securities Co. Ltd. sets target prices based on its analysts’ earnings estimates for subject companies. Risks to target prices include, but are not limited

to, unexpected significant changes in subject companies’ earnings trends and the macroeconomic environment.

Disclosures related to Daiwa Securities

Please refer to https://drp.daiwa.co.jp/rp-daiwa/direct/reportDisclaimer/e_disclaimer.pdf for information on conflicts of interest for Daiwa Securities, securities

held by Daiwa Securities, companies for which Daiwa Securities or foreign affiliates of Daiwa Securities Group have acted as a lead underwriter, and other

disclosures concerning individual companies. If you need more information on this matter, please contact the Research Production Department of Daiwa

Securities.

Explanatory Document of Unregistered Credit Ratings

This report may use credit ratings assigned by rating agencies that are not registered with Japan’s Financial Services Agency pursuant to Article 66, Paragraph

27 of the Financial Instruments and Exchange Act. Please review the relevant disclaimer regarding credit ratings issued by such agencies at:

https://drp.daiwa.co.jp/rp-daiwa/direct/reportDisclaimer/credit_ratings.pdf. If you need more information on this matter, please contact the Research

Production Department of Daiwa Securities.

Notification items pursuant to Article 37 of the Financial Instruments and Exchange Law

(This Notification is only applicable to where report is distributed by Daiwa Securities Co. Ltd.)

If you decide to enter into a business arrangement with our company based on the information described in this report, we ask you to pay close attention to the

following items.

In addition to the purchase price of a financial instrument, our company will collect a trading commission* for each transaction as agreed beforehand with

you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the

commission for each transaction. In some cases, our company also may charge a maximum of ¥2 million per year as a standing proxy fee for our deposit of

your securities, if you are a non-resident.

For derivative and margin transactions etc., our company may require collateral or margin requirements in accordance with an agreement made beforehand

with you. Ordinarily in such cases, the amount of the transaction will be in excess of the required collateral or margin requirements**.

There is a risk that you will incur losses on your transactions due to changes in the market price of financial instruments based on fluctuations in interest

rates, exchange rates, stock prices, real estate prices, commodity prices, and others. In addition, depending on the content of the transaction, the loss could

exceed the amount of the collateral or margin requirements.

There may be a difference between bid price etc. and ask price etc. of OTC derivatives handled by our company.

Before engaging in any trading, please thoroughly confirm accounting and tax treatments regarding your trading in financial instruments with such experts as

certified public accountants.

* The amount of the trading commission cannot be stated here in advance because it will be determined between our company and you based on current

market conditions and the content of each transaction etc.

** The ratio of margin requirements etc. to the amount of the transaction cannot be stated here in advance because it will be determined between our company

and you based on current market conditions and the content of each transaction etc.

When making an actual transaction, please be sure to carefully read the materials presented to you prior to the execution of agreement, and to take

responsibility for your own decisions regarding the signing of the agreement with our company.

Corporate Name: Daiwa Securities Co. Ltd.

Registered: Financial Instruments Business Operator, Chief of Kanto Local Finance Bureau (Kin-sho) No.108

Memberships: Japan Securities Dealers Association, The Financial Futures Association of Japan, Japan Investment Advisers Association, Type II Financial

Instruments Firms Association, Japan Security Token Offering Association