Statement of

Mark A. Jones

President, Union Home Mortgage

On Behalf of the Mortgage Bankers Association

U.S. House of Representatives

Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

“Sink or Swim? A Deep Dive into the Current State of VA’s

Home Loan Program in a Competitive Market”

February 15, 2024

2:30 P.M.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

1

Chairman Van Orden, Ranking Member Levin, and members of the Subcommittee,

thank you for the opportunity to testify today on behalf of the Mortgage Bankers

Association (“MBA”).

1

My name is Mark Jones, and I am the President of Union Home Mortgage, a national

independent residential mortgage lender. I was previously the Co-founder and CEO of

AmeriFirst Home Mortgage, a privately held mortgage lender headquartered in

Kalamazoo, Michigan.

I am appearing today in my capacity as the current Chairman of the MBA. As a lender

with deep personal experience originating, securitizing, and servicing Department of

Veterans Affairs (VA) Home Loan Program mortgages, I am honored to be appearing

before this Subcommittee for the second time within the past two years.

MBA appreciates this Subcommittee’s focus on the topics outlined for discussion with

the VA and other important stakeholders at today’s hearing, namely the current state of

VA’s Home Loan Guaranty program – including a review of the agency’s procedures

governing mortgages, appraisals, refinancing, and foreclosures – and the Veterans’

Assistance Servicing Purchase (VASP) program, which is scheduled for release this

year.

MBA is pleased to offer recommendations designed to help improve various Home Loan

Program elements and ensure that our nation’s Veterans receive a high-quality

homebuying experience in a challenging, changing, and competitive mortgage market

environment. We are, of course, acutely aware that the VA may require additional

resources from Congress to implement some of these suggested program

improvements and changes.

1

The Mortgage Bankers Association (MBA) is the national association representing the real estate

finance industry, an industry that employs more than 300,000 people in virtually every community in the

country. Headquartered in Washington, D.C., the association works to ensure the continued strength of

the nation's residential and commercial real estate markets, to expand homeownership, and to extend

access to affordable housing to all Americans. MBA promotes fair and ethical lending practices and

fosters professional excellence among real estate finance employees through a wide range of educational

programs and a variety of publications. Its membership of more than 2,200 companies includes all

elements of real estate finance: independent mortgage banks, mortgage brokers, commercial banks,

thrifts, REITs, Wall Street conduits, life insurance companies, credit unions, and others in the mortgage

lending field. For additional information, visit MBA's website: www.mba.org.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

2

At the outset of my statement, I want to underscore that the MBA – and its many

individual member firms who originate and service VA loans – have a positive and

productive working relationship with the agency – one forged over many years of

partnership.

The VA Home Loan Program is one of the most significant benefits our nation’s heroes

earn through their sacrifice and service. MBA recognizes the need for making this

important program more accessible, operationally efficient, flexible, and competitive

against other loan options. This is particularly important during times of individual crisis

for Veterans and their families. We understand this work will involve reaching a

bipartisan consensus with the members of this Subcommittee, the agency, and all other

key market participants and advocates. MBA looks forward to playing a constructive role

as part of this ongoing dialogue.

The VA Mortgage Market

The VA Home Loan Program plays a vital role in increasing the availability of mortgage

credit for servicemembers, Veterans, and surviving spouses. By guaranteeing a portion

of the loan balance, the VA enables lenders to offer loans with more favorable terms,

such as no required down payment.

The VA share of total U.S. loan originations in the mortgage market comprises about

10%. VA originations totaled nearly 1.4 million loans in 2020 and, by contrast, just over

590,000 loans in 2022. VA home loans are offered by a wide variety of mortgage

lenders – both independent mortgage lenders and depository institutions – throughout

the country.

Loss Mitigation Tools

The following five charts help to place VA loan mortgage delinquencies, foreclosures,

and loan workouts in context relative to the broader U.S. mortgage market.

As displayed within the first two charts, there are approximately 50 million mortgage

loans outstanding in the U.S. Approximately 3.7 million loans outstanding are VA loans.

Of those 3.7 million VA loans, a little over 150,500 VA loans (4.07%) are delinquent as

of year-end 2023, and around 26,000 VA loans (0.70%) are in foreclosure as of year-

end 2023.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

3

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

4

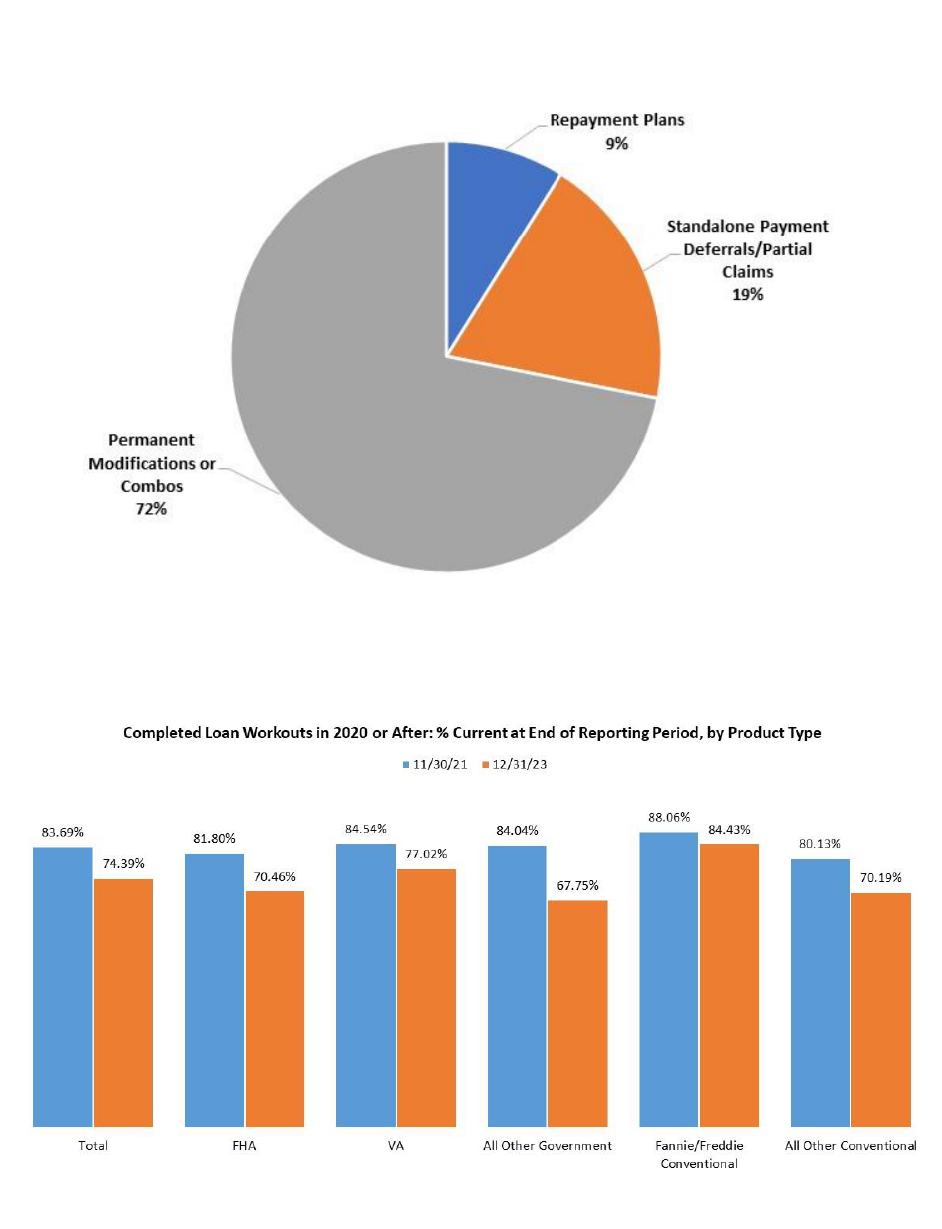

As of year-end 2023, approximately 3 million loans were in loan workouts completed in

2020 or after, with approximately 205,000 (or 6.85%) being VA loan workouts.

Workouts include modifications, partial claims, and repayment plans. In the chart that

follows, workouts that are paid off are excluded.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

5

Of the approximately 205,000 VA Loan workouts with a December 2023 payment due,

about 19% are partial claims.

Source: MBA’s Monthly Loan Monitoring Survey

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

6

Veterans’ Assistance Servicing Purchase (VASP) Program

MBA believes the current state of loss mitigation options requires urgent action. We

appreciate the dialogue VA has held with program stakeholders, but the time for a

public process for review and comment on VA’s new VASP program is necessary and

overdue – particularly since the agency will need to release those policy

recommendations quickly – and concurrently develop an appropriate implementation

timeline. Mortgage servicers stand ready to help the VA use VASP as one of its loss

mitigation tools to provide the relief needed to help Veterans stay in their homes.

In response to the dramatic increase in mortgage rates, MBA and several other

organizations wrote to the VA in January 2023 asking for an expansion of the VA’s

existing loss mitigation tools to address the mismatch between the mortgage note rates

that might need to be modified for Veterans in distress amidst rising market rates. One

consideration recommended at that time was for the VA to reconfigure and expand the

statutorily authorized refund program, which enables the VA to purchase delinquent

loans from servicers and change the terms of the original loans to reduce Veterans’

monthly payments.

The VA and all stakeholders would benefit from a transparent process that allows for

evaluation and input from a common starting point to identify any potential operational,

regulatory, and reputational risks that might pose a barrier to effectively helping

Veterans. A critical issue that needs careful consideration is the necessary time and

resources servicers will need to implement the VASP program.

VA Partial Claim Option

MBA also believes that VA borrowers facing temporary financial hardships should have

access to additional tools to resolve delinquency and avoid foreclosure. For example,

the partial claim options available to Federal Housing Administration (FHA) and Rural

Housing Service (USDA) borrowers are not currently found in the VA’s suite of loss

mitigation options. The COVID-19 Veterans’ assistance partial claim program expired in

October 2022.

A partial claim allows a Veteran borrower to either resume his/her regular payment or

achieve a sustainable level of payment reduction with a loan modification. Action by

Congress – such as language regarding a partial claim option contained within S. 3728,

recently introduced by Senate Veterans’ Affairs and Banking Committee Chairmen

Tester and Brown, respectively – would again make this essential option a reality.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

7

As the members of this Subcommittee are aware, MBA continues to call for

authorization of a permanent partial claim program as the industry’s preferred solution.

Mortgage servicers can deliver timely payment relief to Veterans, preserve affordable

homeownership, and prevent future crises with reliable access to a durable loss

mitigation framework that includes both a partial claim option and VASP.

A Broken Assumption Process

The assumption feature of VA loans can be beneficial under the right circumstances, as

it can provide a significant premium for the Veteran homeowner looking to sell their

home, while providing homebuyers with access to a below-market interest rate. In

practice, however, the required process for a homebuyer looking to assume an existing

VA loan has become broken over the years – largely because VA regulations have not

kept up with the market.

A proper assumption requires a VA loan servicer to complete a full underwriting of the

buyer that is assuming the loan in order to: (1) ensure the buyer has the ability to repay

and (2) protect taxpayers – and in some cases the Veteran who may remain liable on

the loan – from the cost of a default. A typical mortgage underwriting costs a lender

somewhere between $3,000 and $4,000 between application and closing. Since 1993

VA has only allowed lenders to charge a $300 flat fee to process an assumption – a fee

that has never been adjusted for inflation and was set during a time when neither a full

credit underwrite, nor licensed loan officer, were required elements (as they are now).

Simply stated, lenders lose thousands of dollars on each assumption transaction.

Additional frustrations with the process include the fact that while many assuming

parties must obtain a second mortgage to complete the transaction, VA provides little

guidance on acceptable forms of secondary financing. Many lenders are also unable to

offer a second-lien product, meaning borrowers must secure it from another source.

Finally, the lender is prohibited from making its own credit decision about a borrower it

will subsequently have to service – and bear credit risk against – as VA regulations

required the lender to approve any assuming party who meets the bare minimum

standards prescribed by VA. These standards can be lower than those that a lender

would choose to utilize to originate a VA purchase loan.

These broken economics predictably translate to frustration on both sides of the

transaction, including poor customer experiences and reduced value in VA servicing –

to the detriment of Veterans. As discussed by MBA for many years, VA can fix this

broken process by enabling the lender to at least recoup its costs in the transaction. We

hope VA elects to pursue this path, so that lenders have the flexibility to create better

outcomes for our Veterans.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

8

Appraisal Reform

We are grateful that now-current House Veterans’ Affairs Committee Chairman Mike

Bost’s prior appraisal modernization bill (H.R. 7735) was signed into law during the

117

th

Congress in late 2022 (now Public Law 117-308). I was privileged to testify before

this Subcommittee in May 2022 to discuss the implications of the legislation at that time,

as well as the need for VA to remain aligned with other programs so that more Veteran

homebuyers see their VA-backed offers accepted against conventional offers, cash

offers, or other types of financing.

Though market conditions have changed since I testified in 2022, the need for attention

on this topic remains. The still competitive and supply-constrained housing markets

across the country continue to favor sellers and, given the conditions that must be met

for VA loans to close, lenders report that many sellers give VA applicants low priority

when reviewing offers.

The enactment of PL 117-308 has resulted in many positive reforms. These have

included the expanded use of desktop appraisals in lieu of physical, “boots-on-the-

ground” appraisers, as well as proposed improvements to VA’s minimum property

requirements (MPRs) which have long been known to hold up transactions. In fact, MBA

submitted its comments to VA on MPRs just last week, joining several other trade

groups and stakeholders in encouraging VA to align its standards with those of the

housing GSEs – Fannie Mae and Freddie Mac.

One area that remains a major concern – and a topic which was not addressed by the

appraisal modernization statute – is VA’s unwillingness to delegate management of

appraiser rosters to lenders. Doing so would align the process with virtually every other

loan program. This remains a major contributor to the perception of appraiser shortages

in the VA space, as well as the actual heightened appraisal “turn-times” that make VA-

backed deals take longer to close.

MBA also encourages VA to lean into appraisal alternatives such as automated

valuation models (AVMs), where appropriate, as these can also reduce turn times,

minimize costs and friction, and improve the competitiveness of a VA-backed offer. To

that end, MBA, in partnership with the Mortgage Industry Standards Maintenance

Organization (MISMO®) has initiated a process to develop a common set of testing,

validation, and design standards for AVMs which comports with the recent interagency

proposed rule on AVMs and hopes to facilitate greater adoption of, and trust in, this type

of valuation methodology. We invite VA to join us in these efforts.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

9

While work remains to be done to streamline and evolve VA appraisal standards,

improvements have been made, and we thank both the VA and this Subcommittee for

their collective efforts to update this process and improve the strength of the VA home

loan benefit for Veterans across the country.

“Drafting Table” Policy Option

We encourage Congress to ensure the VA has the necessary resources to implement a

permanent public input process for the development of transformative policies before

they are required to be implemented. As we noted in our VASP comments, lack of a

process for formal stakeholder input has hampered the program’s development.

Consequently, MBA believes VA should adopt a “Drafting Table” process for interested

stakeholders – similar to the one used to great effect by FHA. This would expedite new

program initiatives by providing VA with constructive comments on the impact of

changes to a lender’s and servicer’s operations prior to implementation and

enforcement. Transparency and collaboration in policy development will ensure VA’s

mission goals are achieved, result in a more efficient mortgage program, and improve

positive outcomes for Veterans.

VA Funding Fees

As Congress considers multiple pieces of legislation that would expand or alter Veteran

benefits across a range of programs, MBA remains concerned about the repeated use

of VA home loan funding fee increases to pay for non-housing related Veterans’

benefits. MBA opposes legislation that increases or extends VA funding fees to offset

the costs associated with new and/or unrelated expenditures.

Simply stated, these funding fee increases and extensions implemented in recent years

– and being considered once again – are not in any way correlated with the actual credit

risks of Veteran homebuyers. If that were the case, the actual funding fee would be a

fraction of where it currently sits today, meaning that far more Veterans would be able to

qualify to purchase a home. Instead, that potential opportunity is out of reach for many

eligible Veterans. And those who can access the benefit are paying far more than they

should – in the midst of a housing affordability crisis – to help subsidize other federal

programs.

Testimony of Mark A. Jones

House Committee on Veterans’ Affairs

Subcommittee on Economic Opportunity

Oversight Hearing

February 15, 2024

10

These continued increases – and extensions of prior increases – severely threaten the

VA Home Loan Program. While any individual funding fee increase may be small, the

cumulative impact of the many hikes and extensions over the past decade is worrisome

and significant.

We urge Congress to work with the Biden Administration to ensure that VA funding fees

are set at levels commensurate with the risks associated with VA-guaranteed home

lending. Moreover, Congress should conduct appropriate oversight and analysis of past

funding fee increases – before simply defaulting to the practice of levying further

increases or extensions.

* * *

Conclusion

Once again, MBA appreciates the opportunity to comment on the many critical issues

that impact the efficacy of the VA Home Loan Program, including the need for potential

legislation to implement needed statutory changes. We value our partnership with VA

and our shared mission to help Veterans utilize their hard-earned benefit to achieve

homeownership.

Our association looks forward to working with the Subcommittee to forge practical

solutions – including, but not limited to, the development of legislation to make

permanent a VA partial claims option to help distressed borrowers. We also look

forward to working with Congress to help provide the VA with the resources necessary

to implement changes and improve the delivery of the Home Loan Program benefit to

our nation’s heroes.

I look forward to answering any questions you may have.