ANNUAL REPORT 2004

Our Shared Responsibilities

Citigroup’s goal is to be the most res-

pected global financial services company.

As a great institution with a unique and

proud history, we play an important role in

the global economy. Each member of the

Citigroup family has three Shared

Responsibilities:

We have a responsibility to OUR CLIENTS

We must put our clients first, provide superior advice,

products and services, and always act with the highest

level of integrity.

We have a responsibility to EACH OTHER

We must provide outstanding people the best oppor-

tunity to realize their potential. We must treat our

teammates with respect, champion our remarkable

diversity, share the responsibility for our successes,

and accept accountability for our failures.

We have a responsibility to OUR FRANCHISE

We must put Citigroup’s long-term interests ahead of

each unit’s short-term gains and provide superior

results for our shareholders. We must respect the

local culture and take an active role in the commu-

nities where we work and live. We must honor those

who came before us and extend our legacy for those

who will come after us.

Table of Contents

3

9

17

29

53

59

65

69

211

Letter of the President of the Management Board

of Bank Handlowy w Warszawie SA

3

9

17

29

53

59

65

69

211

The net profit of Bank Handlowy in 2004 amounted to

414 million zloty, which is an increase of 125 million zloty, or

43.6% over the same period in the previous year. We

attained very good revenues from interest and commission.

The increase in the net interest income of 150 million zloty

was achieved as a result of effective management of the

profit margin that took into account the rapidly developing

retail banking lending activities, an increase in deposits from

corporate customers and a larger debt instruments portfolio.

The increase in the net fee and commission income of 68

million zloty was achieved through commissions on

brokerage services, insurance products and fees for issuing

and using credit cards.

Thanks to an overall improvement in the macroeconomic

situation and stronger credit risk management, the quality of

the loan portfolio improved.

After a period of weak economic growth in many

sectors of the Polish economy the year 2004 should be

considered as a turning point. In the period preceding

Poland's accession to the EU, the rate of economic growth

increased to a level unseen since the middle of the nineteen-

nineties.

In 2004 the bank conducted its operations based on

its new and more effective coverage model.

One of the consequences of introducing this new customer

coverage model was an expansion of the products and

services offered to large and medium-sized companies.

The group of large corporations was covered by fully

personalised customer service.

4

Ladies and Gentlemen,

The year 2004 was a successful year

for the bank. We achieved our best

financial result since the merger of

Bank Handlowy with Citibank (Poland) SA, and managed to

confirm our leading position in many areas of commercial,

investment and retail banking.

The bank further strengthened its position as leader in

servicing international corporations and Poland's largest

companies. We are pleased to note that customers

appreciate the modern and extensive range of products and

services offered by us in transactional banking. The

economic growth, which facilitates the development of our

customers’ businesses, motivates us to introduce new

solutions in almost every quarter of the year.

In 2004 the UniKasa Utility Bill Payment Network (Sieæ

Obs³ugi P³atnoœci - SOP) underwent rapid growth. The high

level of interest in the UniKasa platform among Citigroup

entities gave rise to the first implementation of this system

outside Poland. A few of the first UniKasa bill payment points

were opened in Romania.

The bank strengthened its leading position among

participants on the FX, money and interest rate markets in

Poland. In 2004 the bank's FX market share increased to

23%. The bank also maintained its leading position on the

corporate bonds market with an almost 20% market share. It

is worth recalling that for many years the bank has remained

at the very top of companies operating on the primary

market for debt securities issued by companies and financial

institutions.

The year 2004 was also a successful year for the

Consumer Banking Sector: we retained our leading position

on the credit card market, noting a 14% increase in card

issues as compared to the end of 2003. The total number of

credit cards issued by our bank in 2004 exceeded 520,000.

We are the leading bank serving the most demanding

customers. Our CitiGold Wealth Management range of

products and services, introduced 2 years ago, continues to

hold the highest position on the market.

CitiFinancial, which offers cash loans to individual customers,

is doing very well, too. New branch offices are systematically

being opened throughout Poland. In 2004 the number of

outlets increased by 23, reaching a total number of 39 at the

end of 2004.

In 2004 the bank continued to promote its Citibank Online

(CBOL) internet platform.

The number of customers accessing their accounts over the

Internet amounted to 230,000, which constitutes a 56%

increase as compared to the end of 2003. This means that

over 65% of account holders at the bank access our banking

services via the Internet.

5

A positive accent ending last year was the European Quality

Award awarded to the bank. We are the first financial

institution on the Polish market to have received this title.

There are now new challenges ahead of us. The

macroeconomic environment helped us: Poland's economic

growth after its accession to the European Union - the

increase in GDP, stimulation of Polish exports, decreasing

unemployment and stable inflation have already given

results. Turnover on the Warsaw Stock Exchange, the second

largest in Europe in 2004 in terms of IPOs after the London

stock exchange, was a further signal that the chances for

growth by our customers in all segments, both retail and

corporate, are huge.

Our most important objective is to systematically increase

value for shareholders by ensuring a suitable return on

equity, and increasing the bank's share in key market

segments.

We intend to retain the bank's leading position in

corporate banking and in services for affluent individuals.

Areas of activities with great growth potential will be rapidly

developed, i.e. servicing large and mediumsized domestic

enterprises, servicing small business (the CitiBusiness

product offer) and cash loans for individual customers

(CitiFinancial). We are also counting on further growth in the

credit card segment.

In 2004 we worked intensively on our branch network

restructuring, designed to optimise operating costs and

facilitate access for our retail and corporate customers.

From a total number of 140 branch offices, 54 are corporate

branches and 86 are retail branches (11 of them are intended

to serve CitiGold Wealth Management customers).

In 2004 we took a decision to increase the functionality of

branches. Thanks to this a significant number of branches

hitherto servicing either corporate or retail customers only,

can now serve customers from both sectors.

Last year we completed the process of unifying the

bank's visual image. Currently both the retail and corporate

distribution networks operate under a common logo:

Our achievements were noted and appreciated by

prestigious financial institutions and the media. In 2004 we

were named the Best Employer among financial institutions

in the Newsweek Polska and Business Centre Club ranking.

The monthly magazine Global Finance considered us the Best

Bank on the FX Market in Poland, and the Best Bank in

Emerging Markets. Citibank Handlowy analysts were

recognized by Gazeta Bankowa for issuing the most accurate

macroeconomic forecasts. Our Brokerage House received an

award from the President of the Stock Exchange for taking

first place in the equity market turnover and for the largest

number of companies introduced into the stock market.

6

One of the bank's priorities for the next few years is the

development of its Regional Processing Centre in Olsztyn,

which provides clearing services for the bank and foreign

banks belonging to Citigroup in Central Europe.

Apart from concrete market shares, we are also interested in

ensuring that our environment perceives us as a model

corporation in Poland, with a high level of social

responsibility - a corporation with the highest moral and

ethical standards.

We will continue our mission to be a company that is

responsible to society by supporting cultural, educational

and charity work - both on a national scale, as well as at

community level - in particular through the Leopold

Kronenberg Foundation.

We are optimistically looking at our new challenges for 2005,

and we are well prepared to face them.

In inviting you to read our Report, I would like to thank our

customers and shareholders for the confidence placed in us,

the supervisory board for supporting the activities of the

bank's management board, and employees for their

commitment and professionalism.

S³awomir Sikora

President

of the Management

Board

7

The Polish economy in 2004

9

17

29

53

59

65

69

211

According to the estimates published by the Central Statistical

Office, the annual GDP growth in 2004 amounted to 5.4%. Such

significant growth was due to a very high GDP dynamic in the first

half of the year (6.5% year on year) followed by a weaker

performance in the second half. Consequently, GDP growth re-

mained at around 4.4% year on year, as the effects of Poland’s

entry into EU wore off.

On the demand side, the main growth factor was net exports (as per

national accounts) whereas the rate of increase of domestic

demand was slower than the GDP growth rate, and reached 4.9%

year on year throughout 2004. Gross investment increased sharply

by 14.1% year on year, however, fixed asset investment increased

by only 5.1% year on year. This, in turn, indicates that investment

growth was mainly caused by a rise in inventories. On the supply

side, the manufacturing sector was the main driver of economic

growth. Total industrial output grew by 13.1% year on year, and it is

worth noting that in the second half of the year this growth was

slower compared to the first half and amounted to 8.5% year on

year (17.7% year on year in the period from January to June).

Despite noticeable economic recovery, the situation in the labor

market improved very slowly. The registered unemployment rate

decreased only marginally on the previous year, down to 19.1% at

year end 2004 from 20% in the corresponding period of 2003,

when adjusted. Over the year, the number of jobless dropped by

276,100 and amounted to 2.99 million at the end of December. The

weakness of the falling trend in unemployment is partially

accounted for by strong growth in industrial productivity and by

likely employment growth in the grey economy.

Main macroeconomic trends

In 2004, the pace of economic growth significantly accelerated, in

particular in the run up to Poland’s accession to the EU. As exports

remained the main stimulator of economic growth, the current

account deficit improved markedly as a proportion of GDP. Despite

the favorable economic conditions, the situation in the labor market

saw only slight improvement and, in addition, a negative conse-

quence of EU accession was a significant increase in the inflation

rate.

10

In the first eleven months of 2004, the current account deficit

shrank significantly amounting to EUR 2.73 billion in comparison to

EUR 3.34 billion in the corresponding period of 2003 (preliminary

data of the National Bank of Poland). In relation to GDP, the eleven-

month rolling deficit dropped to around 1.8% in comparison with

the previous year’s 2.2% and remained at a safe level. This was

mainly caused by the improvement in the trade balance, a fall in the

deficit on commodity trade, and the deficit on services moved into

surplus. Such improvement was possible due to the very high rate

of increase of exports, fuelled by zloty depreciation in the pre-

accession period. Following Poland’s entry into the EU, export

growth was further stimulated by the removal of tariff barriers

between EU countries. Consequently, in the first eleven months of

2004 exports grew by 21.5% year on year and their growth was

superior to that of imports (19.5% year on year).

In 2004, the inflation growth rate accelerated sharply, with the

most significant increase reported in 2Q. This was due to factors

associated with Poland’s accession to the EU (such as price

increases due to increases in indirect tax rates and higher demand

by other EU countries for Polish food products) and strong increase

in raw materials prices, especially crude oil. Consequently, the

prices of consumption goods and services increased by 3.0%,

exceeding significantly the upper limit of NBP inflation target for

2004.

Strong growth was also reported in the prices of industrial output

which peaked in May and grew as much as 9.6% year on year.

Thereafter, their level decreased to reach 5.2% year on year at the

end of 2004. The primary reason for production price increases

was the price shock in mining and quarrying and – during the pre-

accession period – higher domestic demand, which allowed

manufacturers to widen margins earned on offered products.

The money supply, measured by the M3 aggregate, increased from

the beginning of the year by 9%, which continues to represent

a moderate increase in real terms (by 4.6% year on year). When

compared against the high pace of economic activity, this level

seems safe. Slow deposit growth in the first half of the year

gathered momentum in the second half. In 2004, total deposits

increased by 9.5% year on year against 5.6% year on year in 2003,

primarily reflecting deposit growth in social security funds (75.9%

over the year) and, to a lesser degree, that of local government

deposits (28.8%), deposits of non-monetary financial institutions

(27.4%) and corporate deposits (25.0%). Over the same period,

loans grew 4.0% year on year. Growth was reported in loans

granted to households (16.0%) and non-monetary financial

institutions (7.8%). Meanwhile, loans extended to non-commercial

institutions servicing households fell (by 6.4% year on year) and so

did loans to enterprises (5.3%).

The State Budget remained under control throughout 2004. The

budget deficit amounted to PLN 41.5 billion, representing 91.6% of

the full year 2004 budget deficit plan. The execution of the budget

was, therefore, significantly better than in prior years. The lower

deficit in the budget resulted from the higher than planned income,

in particular from indirect taxes and CIT. In addition, the increased

rate of economic growth accelerated inflows in comparison with the

previous year. At the same time budgeted expenditure was lower

than planned, mainly due to lower costs of debt service.

11

Despite positive economic trends, the Polish FX market was

dominated by the downward trend of the Zloty exchange rate in the

pre-accession period. The Zloty depreciated both in nominal and

real terms and the trend sustained later on. For eight months in

a row, the Zloty recorded the best performance among all the

currencies quoted in the world (appreciating some 25% against the

USD and 15% against Euro). This was due to a number of factors,

among which the key ones included political stability, attractive

interest rate differential, improving economic fundamentals, and

Poland’s accession to the European Union.

Capital market

In 2004, the situation on the Warsaw Stock Exchange (WSE) was

very favorable. The main stock exchange index, WIG, climbed from

20,820 points at year end 2003 to 26,636 points at year end 2004

(by 27.9%). The WIG20, an index of the most liquid stock

companies, grew 24.6%.

For the initial four months of 2004, the market followed an upward

trend. However, falling stock indices on the US exchanges in April

2004 triggered a price reduction on the WSE. Nevertheless,

in August 2004 came another wave of share price increases, which

took the WIG main stock exchange index to new record highs.

Money markets and FX markets

In 2004, the Monetary Policy Committee (“MPC”) raised interest

rates on three occasions, with the combined annual increase

amounting to 125 basis points. The upward trend of market rates

was reinforced by the factor, triggered by the Ministry of Finance,

of increasing Treasury yields, which affected the banking system’s

liquidity. Fearing that the State Budget may lose its liquidity after

Poland’s accession to EU, the Ministry expanded its liquidity

reserves. In consequence, liquidity was drained from the banking

system.

Towards the end of the year, the situation eased slightly. Influenced

by strong appreciation of the Polish currency and decreasing

inflationary pressure, the market began slowly to discount interest

rate cuts in 2005.

The first half of the year in the market for Treasury securities was

marked by substantial price volatility, dominated by downside

movements. The weakness of the Polish bond market was due to

a series of unfavorable events – an abrupt rise in inflation connect-

ed with Poland’s accession to EU, sales in international debt

securities markets and growing political risk originally caused by

discussions held over the Hausner plan and later associated with

the resignation of the government led by Prime Minister Miller

followed by the appointment of Marek Belka. In midyear, the trend

in the bond market reversed. Appreciating debt securities in base

markets, improving condition of the State Budget (higher inflows

attributable to economic recovery) and, most importantly, EU

accession combined with clear prospects for Poland’s euro zone

membership drew demand from foreign and then Polish investors.

At this point, it is also worth mentioning the specific mechanism

(akin to a ) which developed in the market –

appreciating debt securities attracted foreign investors and thus

strengthened the Polish currency. This, in turn, led to further

growth in bond prices.

erpetuum mobile

perpetum mobile

12

The successful initial public offering of PKO BP shares and the

flotation of a number of smaller companies were important events

in 2004. At year end 2003, the number of stock-listed companies

stood at 203. By the end of 2004, it had increased to 230. New

foreign companies debuted in the stock market. During 2004, their

number grew from 1 to 5. Total market capitalization noticeably

improved owing to the IPOs of newly-listed companies. At the end

of 2004, the market value of domestic companies reached PLN 214

billion (a 53.1% increase up from PLN 140 billion). Meanwhile, total

capitalization (inclusive of foreign companies) increased from PLN

167.7 billion to PLN 291.7 billion.

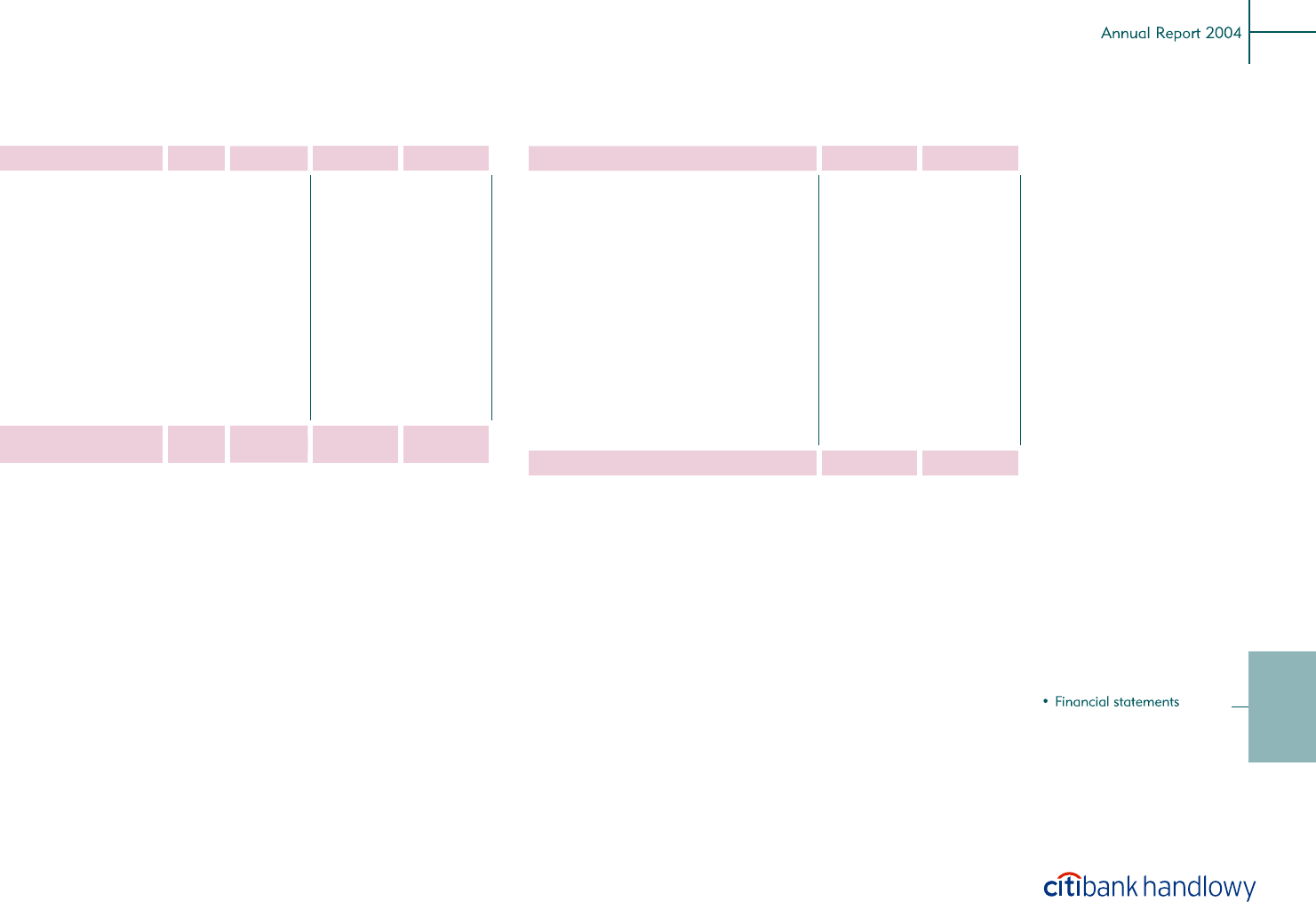

Index

Stock market indices as of 31 December

WIG

WIG-PL

WIG20

MIDWIG

TECHWIG

WIRR

NFI

Sector sub-indices

Banking

Construction

IT

Foodstuffs

Telecommunications

26,636.2

26,540.1

1,960.6

1,730.1

666.3

4,738.6

98.0

35,454.4

19,014.6

12,996.5

23,761.6

10,242.9

14,366.7

n/a

1,175.6

950.2

356.1

1,365.6

59.8

24,091.0

10,876.4

9,394.7

12,668.4

6,068.3

27.9

27.4

24.6

36.3

16.5

72.9

66.9

35.2

28.1

(3.3)

25.1

32.7

20,820.1

20,825.0

1,574.0

1,269.3

571.9

2,740.7

58.7

26,221.8

14,847.5

13,446.1

19,000.4

7,718.5

44.9

n/a

33.9

33.6

60.6

100.7

(1.8)

8.8

36.5

43.1

50.0

27.2

20032004 2002Change (%)

Change (%)

Source: WSE, Dom Maklerski Banku Handlowego SA

13

Increased index levels were positively correlated with the activity of

investors in the equity market. Turnover on the equity market

increased 65% from PLN 66.4 billion to PLN 109.8 billion,

continuing the upward trend initiated in 2003.

The turnover value in the bond market remained virtually

unchanged and amounted to PLN 7.82 billion in comparison to PLN

7.84 billion in 2003.

Index growth and the continuing bullish equity market had a ne-

gative impact on the volume of futures contracts.

In 2004, investors’ activity in the futures market was 15% lower

than in 2003, the record year for this market. The number of

concluded futures transactions fell from 8.5 million down to 7.2

million.

Meanwhile, the number of option transactions increased almost

fourfold. This attests to dynamically growing interest in new

instruments. In 2004 option transaction turnover volume amounted

to 157,000, whereas in the prior year the number of transactions

stood at 41,300.

Despite substantial turnover growth in the equity market and

improved economic conditions in the brokerage business, the

number of WSE brokers fell from 21 to 20. This did not contribute to

further turnover concentration. The share of the top five brokers in

equity turnover dropped in 2004 to 62.0% down from 64.2% in

2003.

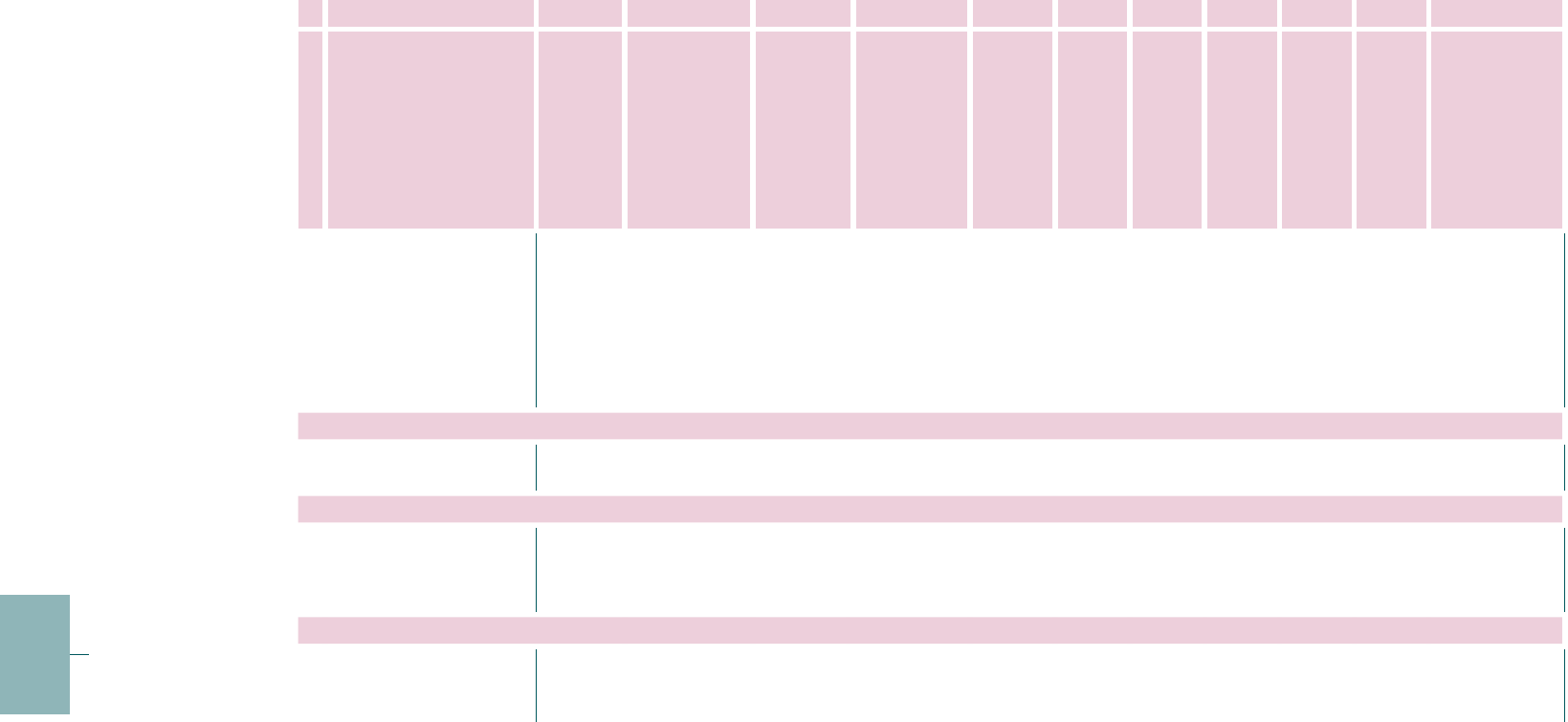

Equity (PLN million)

Bonds (PLN million)

Futures (volume)

Options (volume)

Number of brokers

109,775

7,820

7,218,250

157,504

20

47,729

3,986

6,349,530

0

24

65.2

(0.3)

(14.7)

281.4

66,443

7,840

8,461,206

41,294

21

39.2

96.7

33.3

n/a

2003 2001Change (%) Change (%)

Source: WSE, Dom Maklerski Banku Handlowego S.A.

Change (%)2004 2002

(21.2)

(21.7)

(15.1)

n/a

60,548

5,093

7,481,058

0

30

Equity and bond turnover, and derivative transaction volumes on WSE as of December 31

14

Banking sector

The banking sector’s net financial result for the year 2004

amounted to PLN 7.29 billion and was higher by 190% than in 2003.

Such a positive result of the banking industry reflects improved

economic conditions and, only to a small extent, is attributable to

one-off transactions of assets sales.

The sector’s profitability was primarily determined by improved

results on banking activity, reduced allowances to provisions and

growing participation in profits generated by subordinated entities

accounted for using the equity method. In 2004, the sector’s result

on banking activity grew by over PLN 2 billion in comparison with

2003, the net charges to provisions and revaluation were almost

PLN 2 billion lower than in 2003, whereas the participation in

profits generated by subordinated entities accounted for using the

equity method grew by over PLN 1 billion.

The sector’s result on banking activity in 2004 increased in relation

to the previous year by more than PLN 2.3 billion. This was

attributable to increases in net interest income, fees and

commissions and a slight increase in the result on financial

operations. On the other hand, income on shareholdings, other

securities and other financial instruments with variable income, and

the result on foreign exchange operations dropped in respect of

2003. In 2004, the banks’ interest expense increased in comparison

with 2003 as a result of interest rate increase. This growth,

however, was smaller than growth in interest income, which had

a positive impact on the banks’ net interest income.

In 2004, the growth of loans to individual customers was stable and

amounted to around 17% year on year. Nevertheless, the downward

trend of individual customers’ deposits continued (a 3% fall year on

year). This was mainly due to low attractiveness of bank placements

caused by low interest and tax on interest introduced in late 2001.

The portfolio of loans offered to economic entities decreased by

4%. Meanwhile, the situation in the market for corporate deposits

improved significantly and was reflected in a 24% increase.

15

Selected balance sheet data

and financial results of Bank

17

29

53

59

65

69

211

Financial results of the Bank in 2004

The net profit of the Bank in 2004 was PLN 414.2 million and was by

PLN 125.7 million, i.e. 43.6 % higher than in the corresponding

period of the previous year. The following were among the main

factors which contributed to the increase in the net profit of the

Bank:

• Reduction in net write-downs for specific provisions and

revaluation of financial assets, which amounted to a net charge of

PLN 8.8 million in comparison with a net charge of PLN 187.7

million in the corresponding period of the previous year (reducing

by 95.3%);

Profit and loss account

• Decrease in the charge for corporate income tax by PLN 66.6

million (35.0%) which amounted to PLN 123.7 million at the end of

2004;

• Increase in participation in net profits generated by subordinated

entities accounted for using the equity method up to PLN 61.9

million, i.e. by PLN 33.5 million (118.3%).

There were also factors that had a negative impact on net profit

due to:

• Decrease in profit on banking activity by PLN 30.9 million (1.6%),

• Increase in the Bank’s general expenses of PLN 144.5 million

(12.9%).

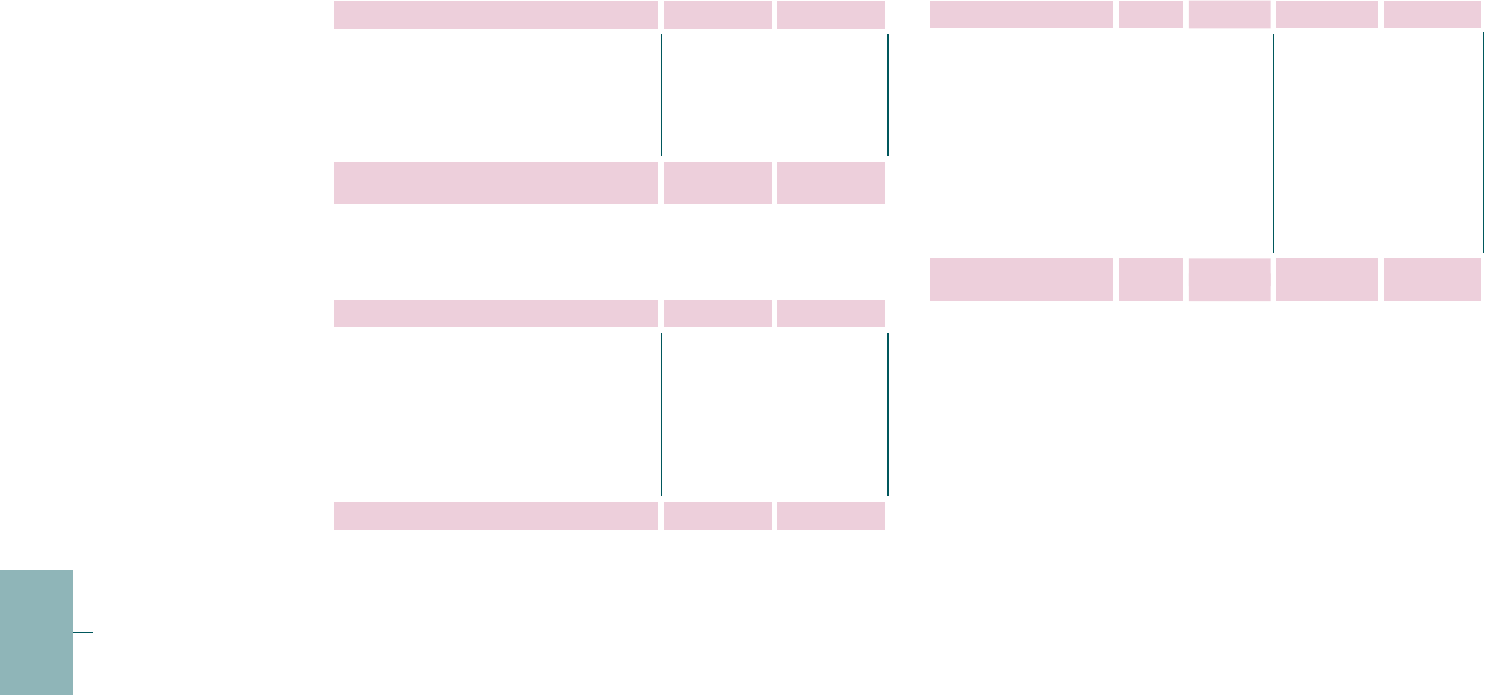

Summarized financial data of Bank Handlowy w Warszawie SA

in PLN million

Balance sheet total

Equity*

Loans**

Deposits**

Profit on banking activity

Net profit

Earnings per share or convertible bond (in PLN)

Dividend per share or convertible bond (in PLN) ***

Dividend payout ratio ****

Capital adequacy ratio

17,744.4

2,557.8

9,292.7

7,084.0

1,191.8

301.5

3.24

1.00

30.84%

13.7%

34,028.2

5,658.4

13,256.0

18,504.4

1,949.3

288.5

2.21

1.85

99.67%

16.0%

21,002.5

3,034.8

10,054.1

10,166.3

1,555.3

204.7

1.57

1.00

63.83%

15.6%

33,150.4

5,742.1

14,200.0

17,370.1

2,074.5

163.6

1.25

1.25

99.81%

21.2%

32,412.0

5,267.6

13,540.4

16,699.3

2,089.3

235.3

1.80

1.85

99.60%

18.5%

* Excluding net profit for the current period

** Non-financial and public sectors

*** Dividend per share of 2004 regards the proposed payment of a dividend from appropriation of 2004 profits and previous years’ profits

**** Calculation of dividend payout ratio of 2004 includes only dividend from appropriation of 2004 profits and net profit for the same period

20031998 2004

19,159.9

2,758.4

10,208.8

8,733.9

1,330.9

472.5

5.08

2.00

39.37%

14.5%

33,819.9

5,738.6

9,708.6

17,261.2

1,918.4

414.2

3.17

11.97

99.99%

19.3%

1999

2000 2001 2002

18

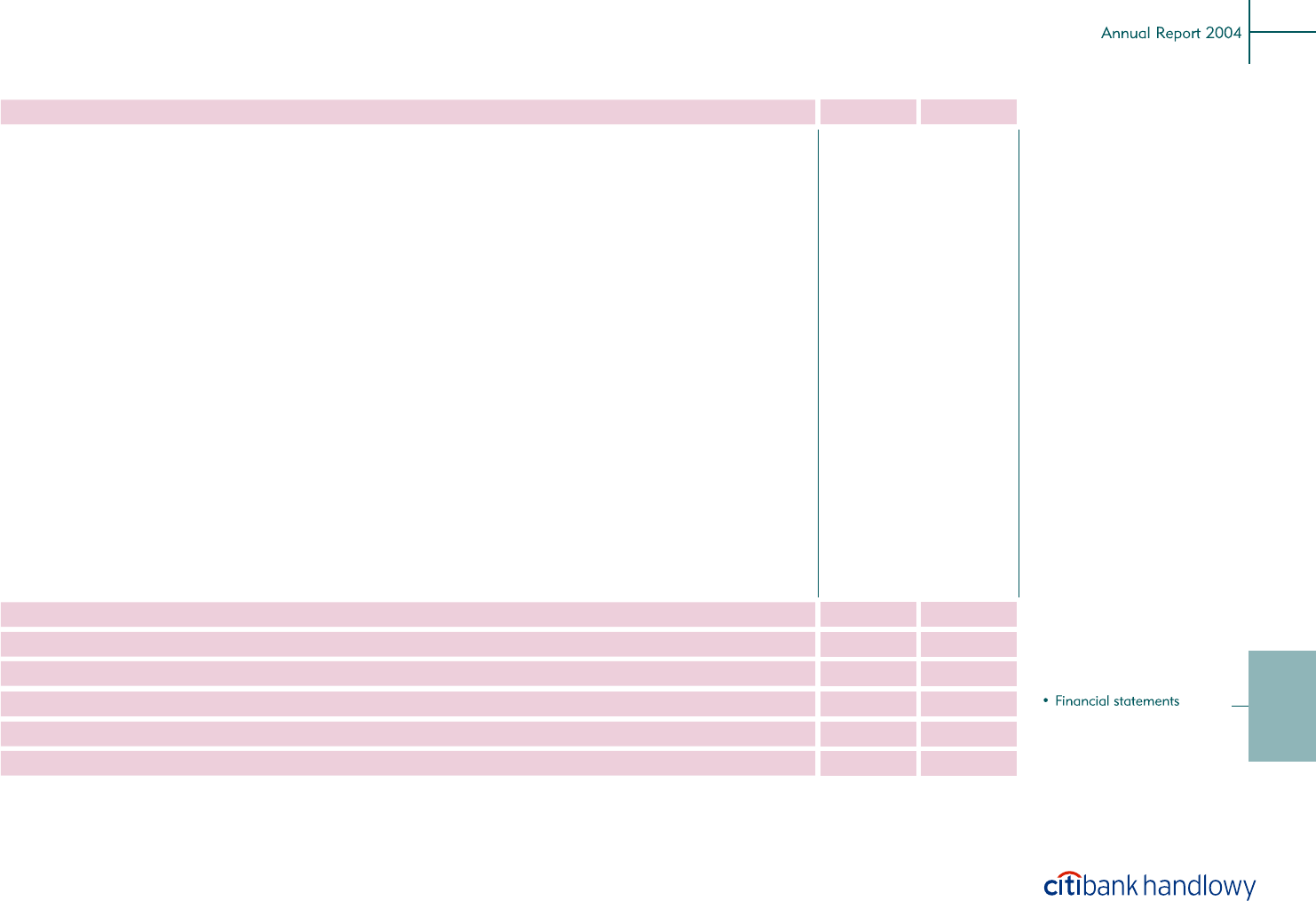

in PLN thousand

Profit and loss account

Interest income

Interest expense

Net interest income

Net fee and commission income

Income on shares, other securities and other financial instruments with variable income

Gains on financial operations

Foreign exchange profit

Profit on banking activity

Other operating income

Other operating expenses

General expenses

Depreciation and amortization

Goodwill amortization

Net charges to provisions and revaluation

Operating profit

Extraordinary items

Profit before taxation

Corporate income tax

Participation in net profit/(loss) of subordinated entities accounted for under the equity method

Net profit

266,860

(116,418)

150,442

68,313

(48,224)

(80,410)

(121,009)

(30,888)

12,236

(3,450)

(144,539)

13,266

—

178,947

25,572

—

25,572

66,616

33,533

125,721

1,653,161

(753,892)

899,269

590,464

16,526

51,765

360,352

1,918,376

90,101

(44,764)

(1,264,318)

(142,179)

(72,445)

(8,761)

476,010

—

476,010

(123,668)

61,872

414,214

1,386,301

(637,474)

748,827

522,151

64,750

132,175

481,361

1,949,264

77,865

(41,314)

(1,119,779)

(155,445)

(72,445)

(187,708)

450,438

—

450,438

(190,284)

28,339

288,493

Change Change (%)

19.3%

18.3%

20.1%

13.1%

(74.5%)

(60.8%)

(25.1%)

(1.6%)

15.7%

8.4%

12.9%

(8.5%)

—

95.3%

5.7%

—

5.7%

(35.0%)

118.3%

43.6%

2004 2003

19

In 2004, the Bank continued to pursue restructuring activities with

the aim to improve efficiency and increase profitability by lowering

the costs of operation. The most significant event during this period

related to further employment reduction. The changes in the

structure of employment followed the reorganization of individual

areas and the introduction of new technological and organizational

solutions. However, as a result of activities undertaken to adjust the

status and structure of employment to changes in strategies and

methods of operation of the Bank a significant number of employees

designated for reduction were redeployed to the fast growing

Consumer Sector of the Bank. As a consequence of this decision,

total severance cost amounted to PLN 33.0 million in 2004.

Expenses

Profit on banking activity

In 2004, the Bank reported a decrease in the profit on banking

activity by PLN 30.9 million, i.e. 1.6%. The following factors

contributed:

• increase in net interest income by PLN 150.4 million (i.e. 20.1%),

mainly as a result of higher interest income on debt securities due

to a marked increase in the portfolio of these securities;

• increase in net commission income by PLN 68.3 million (i.e.

13.1%), mainly due to commissions on insurance products, cash

management commissions, and payments for issuance and use of

payment and credit cards;

• decrease in gains on financial operations by PLN 80.4 million,

mainly due to lower gains on operations involving securities,

primarily shares and minority interests;

• decrease in net profit on foreign exchange by PLN 121.0 million,

mainly as a result of losses on foreign exchange differences

(revaluation).

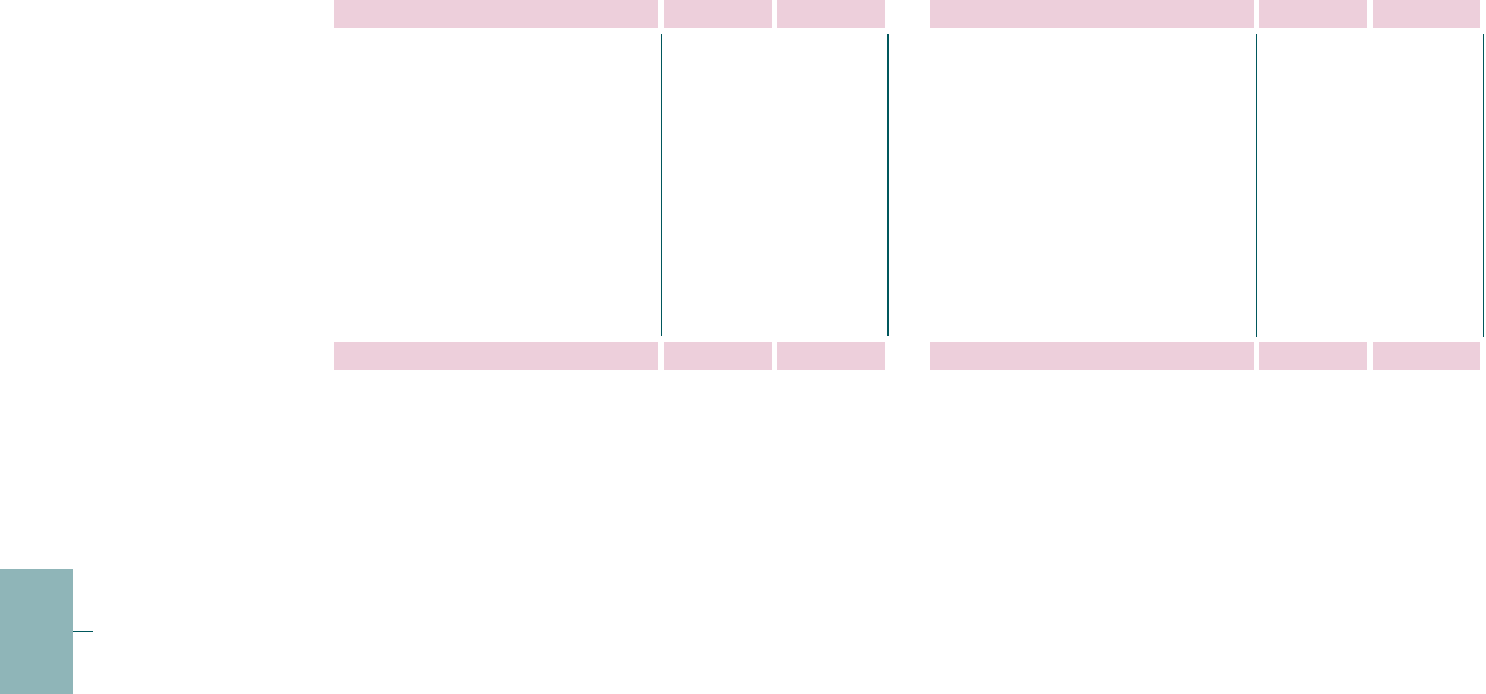

in PLN thousand

Expenses

Salaries

Social security and other benefits

Total personnel expenses

Administrative expenses

Taxes and fees

Contributions and payments to the Bank Guarantee Fund

Restructuring charge – personnel costs

Total general expenses

Depreciation

Total expenses

20,139

8,673

28,812

85,622

466

(3,409)

33,048

144,539

(13,266)

131,273

468,899

91,580

560,479

654,585

8,526

7,680

33,048

1,264,318

142,179

1,406,497

448,760

82,907

531,667

568,963

8,060

11,089

—

1,119,779

155,445

1,275,224

Change Change (%)

4.5%

10.5%

5.4%

15.0%

5.8%

(30.7%)

—

12.9%

(8.5%)

10.3%

2004 2003

20

Important factors which also affected the level of salaries were

agreements concerning the participation of the Bank’s employees in

incentive plans of Citigroup Inc. A provision of PLN 8.5 million was

created in 2004 for the respective future payments.

Other important factors affecting the level of expenses included:

• the opening of 23 new CitiFinancial branches (a fast growing sector

of the Consumer Bank) in 2004,

• the signing, in April 2004, of agreements with Citibank N.A. for the

provision of a number of administrative support services relating

to current Bank activity, which include consultation and advice in

the areas of management, finance, accounting, auditing etc., as

well as the maintenance of IT systems to service operational

activity. Information relating to the above mentioned agreements

is presented in the Additional Explanatory Notes.

In 2004, net write-downs on provisions and revaluation of financial

assets decreased by PLN 178.9 million (i.e. 95.2%) in comparison

with 2003. As a result of the review of the Bank’s loan portfolio

conducted in 2004 and the increase in specific provisions, the Bank

decided to reduce the general provision by PLN 136 million. The

remaining amount of the general provision is PLN 164 million and is

considered adequate to cover the credit risk relating to the

consumer portfolio and the credit exposure from the “watch”

category.

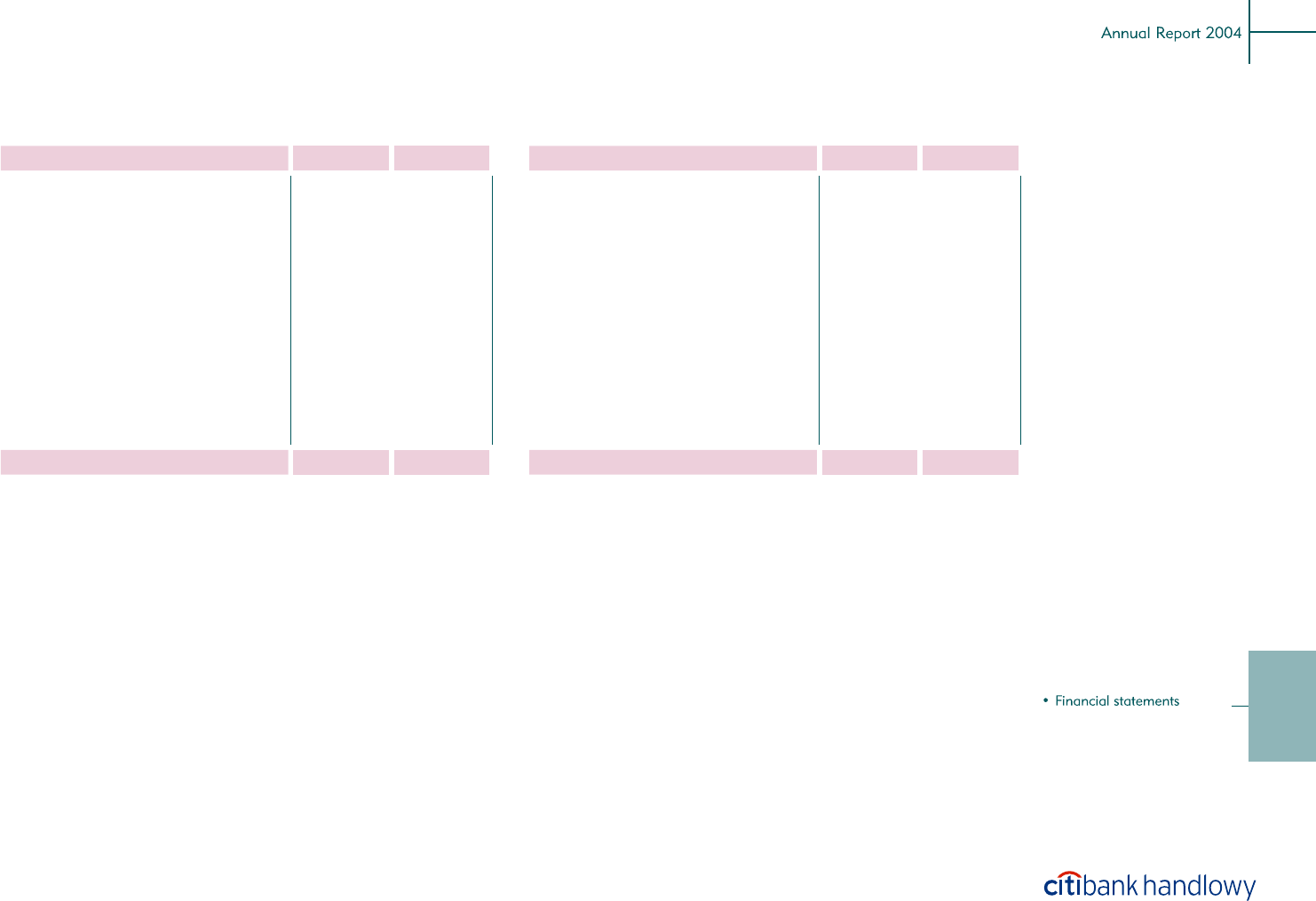

in PLN thousand Change Change (%)2004 2003

Net charges to provisions and revaluation

Specific provisions

- financial institutions

- non-financial sector

- subordinated loans

- other

- off-balance sheet contingent liabilities

Provision for general risk

Revaluation of financial assets

Total net charges to provisions and net revaluation

19,404

(38,736)

(195,470)

137,664

8,968

106,978

136,000

23,543

178,947

(148,946)

(10,712)

(318,628)

68,703

6,024

105,667

136,000

4,185

(8,761)

(168,350)

28,024

(123,158)

(68,961)

(2,944)

(1,311)

—

(19,358)

(187,708)

11.5%

(138.2%)

(158.7%)

199.6%

304.6%

8,160.0%

—

121.6%

95.3%

Provisions and revaluation of financial assets

21

The share of problem loans in the gross loan portfolio from non-

banking institutions amounted to 26.9% as of 31 December 2004 as

compared to 29.8% at year-end 2003. The significant share of

problem loans was mainly due to the decrease in the nominal value

of the total loans portfolio. However as of 31 December 2004, loans

classified as irregular decreased by 30.9% in comparison with the

same period of the previous year, in particular a significant

decrease by 66.5% was noted in loans classified in the “doubtful”

category.

In 2004, the Bank released specific provisions of PLN 68.7 million

on receivables from subordinated loans funding the operations of

special purpose investment vehicles Handlowy Investments S.A. and

Handlowy Investments S.a.r.l. following the current assessment of

the possibility of repayment of the above mentioned loans.

Accounting for subordinated entities

In 2004, the net profit of the Bank was increased by PLN 61.9

million from the valuation of significant shareholdings in

subordinated undertakings valued using the equity method. This

amount was disclosed in the profit and loss account in the item

“Participation in net profits (losses) of subordinated entities

accounted for using equity method” and comprised of valuations

of the following entities: Handlowy Inwestycje Sp. z o.o., Handlowy

Inwestycje II Sp. z o.o., Dom Maklerski Banku Handlowego SA,

Handlowy-Leasing S.A., Citileasing Sp. z o.o., Handlowy Zarz¹dzanie

Aktywami S.A., Towarzystwo Funduszy Inwestycyjnych BH SA,

Handlowy Investments S.A., Handlowy Inwestments II S.a.r.l., Bank

Rozwoju Cukrownictwa S.A., Polskie Pracownicze Towarzystwo

Emerytalne DIAMENT S.A., Handlowy-Heller S.A., KP Konsorcjum

Sp. z o.o. The largest part of this amount was the effect of valuation

of net assets of Citileasing Sp. z o.o. totaling PLN 25.8 million

and that of Dom Maklerski Banku Handlowego SA totaling PLN

18.5 million.

Ratio analysis

In general, changes in ratios of return on equity (ROE) and return

on assets reflected changes in net profit. The Bank currently has

a significant amount of excess capital which contributes to a re-

latively high capital adequacy ratio and, at the same time, explains

a relatively low ROE.

As of 31 December 2004, the Bank’s balance sheet total amounted

to PLN 33,819.9 million and was lower by 0.6% than a year before.

Balance Sheet

22

Return on owners’ equity (ROE)*

Return on assets (ROA)**

Net interest margin (NIM)***

Earnings per 1 share or convertible

bond (EPS), in PLN

Cost/Income****

6.9%

1.2%

2.6%

3.17

71.6%

4.8%

0.9%

2.3%

2.21

64.2%

* Net profit divided by average equity and retained earnings (including current period’s net profit)

calculated on a monthly basis; annualized ratio

** Net profit divided by average assets calculated on a monthly basis; annualized ratio

*** Net interest income divided by average assets calculated on a monthly basis; annualized ratio

**** Relation of the sum of total operating expenses, depreciation and other operating expenses

(excluding goodwill amortization) to the sum of the profit on banking activity and other

operating income (excluding goodwill amortization)

Profitability and cost efficiency ratios

2004 2003in PLN thousand

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

Balance Sheet

Cash, operations with the Central Bank

Due from the financial sector*

Due from the non-financial sector

Due from the public sector

Receivables subject to securities sale and repurchase agreements

Debt securities*

Equity investments*

Other financial assets

Intangible assets

- including: goodwill

Tangible fixed assets

Other assets

TOTAL ASSETS

(345,400)

(296,506)

(3,545,829)

(1,593)

4,608

3,460,765

54,266

480,228

(57,879)

(72,445)

(52,435)

91,491

(208,284)

841,114

8,418,278

9,707,041

1,538

293,209

7,303,033

513,987

4,105,123

1,237,133

1,171,200

711,710

687,766

33,819,932

1,186,514

8,714,784

13,252,870

3,131

288,601

3,842,268

459,721

3,624,895

1,295,012

1,243,645

764,145

596,275

34,028,216

(29.1%)

(3.4%)

(26.8%)

(50.9%)

1.6%

90.1%

11.8%

13.2%

(4.5%)

(5.8%)

(6.9%)

15.3%

(0.6%)

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

(40,427)

478,512

(1,309,604)

66,372

(62,244)

543,095

140,771

(230,614)

80,134

125,721

(208,284)

718

4,304,594

16,729,658

531,517

408,559

4,194,290

1,281,094

216,717

5,738,571

414,214

33,819,932

41,145

3,826,082

18,039,262

465,145

470,803

3,651,195

1,140,323

447,331

5,658,437

288,493

34,028,216

(98.3%)

12.5%

(7.3%)

14.3%

(13.2%)

14.9%

12.3%

(51.6%)

1.4%

43.6%

(0.6%)

Due to the Central Bank

Due to the financial sector

Due to the non-financial sector

Due to the public sector

Liabilities in respect of securities subject to sale and repurchase agreements

Other liabilities arising from financial instruments

Other liabilities

Provisions

Equity and retained earnings

Net profit

TOTAL LIABILITIES

* Subordinated loans funding investment vehicles and convertible bonds issued by Handlowy Investments – as of 31 December 2003 have been reclassified and are presented as equity investments.

23

Assets

Despite a substantial decline in the loan portfolio as a result of the

prudent lending policy pursued by the Bank, receivables due from

the non-financial sector remain the largest component of the

Bank’s assets. As of 31 December 2004, net credit exposure to non-

financial entities amounted to PLN 9,707.0 million, which

represented a reduction of exposure by 26.8% in comparison with

the corresponding period of the previous year.

In the twelve months of 2004, the Bank’s structure of assets

changed. Debt securities portfolio increased in the period by PLN

3,460.8 million (90.1%), mainly due to the growth in the portfolio of

treasury bonds and bills. The significant growth of the bond

portfolio was driven by the placement of liquid funds arising from

the reduction in the loans portfolio.

100%

24.9%

2.5%

28.7%

0.9%

21.6%

1.5%

19.9%

50%

0%

Cash, operations with the Central Bank

Share of main assets in the balance sheet total of the Bank

3.5%

25.5%

39.0%

0.8%

11.3%

1.4%

18.5%

Due from the financial sector

Due from the non-financial sector and public sector

Receivables subject to securities sale

and repurchase agreements

Debt Securities

Equity investments

Other assets

100%

50%

0%

31/12/2004 31/12/2003

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

Treasury bonds

NBP bonds

Treasury bills

Certificates of deposit and bonds issued by banks

Issued by other financial institutions

Issued by non-financial sector

TOTAL

3,622,978

(597)

157,664

44,100

(298)

(363,082)

3,460,765

6,263,335

384,287

303,770

160,727

—

190,914

7 303 033

2 640,357

384,884

146,106

116,627

298

553,996

3,842,268

137.2%

(0.2%)

107.9%

37.8%

—

(65.5%)

90.1%

Debt securities portfolio

24

sheet valuation of these instruments is presented in “Other

financial assets” on the asset side and “Other liabilities arising from

financial instruments” on the liabilities side of the balance sheet.

The Bank pursues a strategy of reducing its equity investments. In

2004 the Bank sold its entire share in IPC JV Sp. z o.o. as well as

part of its holding of shares in Pia Piasecki S.A. and Elektromonta¿

Poznañ S.A.. As a result of the valuation of strategic subsidiaries,

mainly Dom Maklerski Banku Handlowego SA, Citileasing Sp. z o.o,

Towarzystwo Funduszy Inwestycyjnych Banku Handlowego SA, the

value of equity investments portfolio increased by PLN 54.3 million

(11.8%). Detailed information on the above mentioned transactions

is presented in Additional Notes to Financial Statement.

Liabilities and equity

There were no significant changes in the structure of liabilities and

equity of the Bank in 2004, which to a large extent resulted from

the stability of the deposit base.

The main source of financing the Bank’s assets continued to be

from liabilities due to the non-financial sector. In comparison with

the end of 2003, this item fell by PLN 1,309.6 million (i.e. 7.3%),

inter alia due to the decrease in foreign currency liabilities resulting

from Polish zloty appreciation.

Liabilities due to banks, which represent the majority of liabilities

due to the financial sector, increased in the period from PLN 1,792.9

million to PLN 1,859.6 million, i.e. by PLN 66.7 million (3.7%).

An important item on both sides of the Bank’s balance sheet is the

significant share of unrealized profits/losses on derivative

operations which reflects the scale of off-balance sheet

purchase/sale operations carried out by the Bank. The balance

100%

51.0%

12.7%

1.2%

16.9%

18.2%

50%

0%

Due to the Central Bank and the financial sector

Share of main liabilities items in the balance sheet total of the Bank

11.4%

54.3%

1.4%

15.4%

17.5%

Due to the non-financial sector and the public sector

Liabilities in respect of securities subject to sale

and repurchase agreements

Other liabilities

Equity and earnings

100%

50%

0%

31/12/2004 31/12/2003

25

Equity and capital adequacy

Compared to 2003, the equity of the Bank increased by PLN 80.1

million (i.e. by 1.4%) as a result of:

• change in principles of recording repo/reverse repo transactions

of the sell-buy-back and buy-sell-back type on securities. The

positive effect of the introduced changes in accounting principles,

of PLN 46.0 million, was disclosed in equity as the correction of

the net profit/loss from previous years in the item of profit (loss)

from previous years.

• increase in the revaluation fund by PLN 32.8 million, caused by

a net increase in the value of debt securities available for sale.

• increase in reserve capital by PLN 1.3 million, inter alia, as a result

of distribution of net profit for 2003. The remaining part of the

profit, of PLN 241.7 million, was allocated for payment of dividend

to shareholders.

Other changes in the structure of equity occurred in the period

under discussion. These changes included:

• the transfer of PLN 498 thousand from the revaluation capital to

reserve capital in relation to sale of fixed assets, as a result of

which the revaluation reserve was utilized.

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

Authorized capital

Capital surplus

Reserve capital

Revaluation capital

General risk fund

Profit (loss) from previous years

Total equity

Core capital

Supplementary capital

Profit (loss) from previous years

—

—

1,288

32,863

—

45,983

80,134

1,288

32,863

45,983

522,638

3,044,585

1,726,561

19,651

390,000

35,136

5,738,571

5,683,784

19,651

35,136

522,638

3,044,585

1,725,273

(13,212)

390,000

(10,847)

5,658,437

5,682,496

(13,212)

(10,847)

—

—

0.1%

248.7%

—

423.9%

1.4%

0.0%

248.7%

423.9%

Equity

inter alia

26

In terms of total equity, the Bank ranked among the top players in

the sector. The level of capital was sufficient to guarantee financial

security to the institution and the deposits it accepts.

From 31 December 2003 to 31 December 2004 the ownership

structure of significant shareholders changed. This change was

attributable to the sale on 30 November 2004 by Citibank Overseas

Investment Corporation (COIC), a subsidiary of Citibank N.A., to

International Finance Associates B.V., based in Amsterdam,

a subsidiary of COIC, of 18,722,874 shares in the Bank, represent-

ing a 14.3% interest in the Bank’s authorized capital. As a result of

this transaction, the percentage share of COIC holdings in the

Bank’s authorized capital declined from 89.3% to 75%.

As of 31 December 2004, the capital adequacy ratio was 19.29%

and was higher than at the end of 2003 by 3.25%. The increase in

the ratio was mainly due to a reduction in the capital requirement

for credit risk by PLN 428.9 million which resulted from a reduction

in risk weighted assets and off-balance sheet commitments by PLN

5,361.6 million, to which the drop in the loan portfolio contributed to

a significant extent. The surplus of cash was primarily invested in

securities with a low risk weighting.

Moreover, the size of the capital adequacy ratio was also affected

by the increase in deduction of intangible assets (including

goodwill) from 60% in 2003 to 100% in 2004 from shareholders’

equity for calculation of the capital adequacy ratio.

Deductions, of which:

- goodwill

- other intangible fixed assets

- investments in subordinated

financial institutions

- financial assets revaluation reserve fund

Eligible capital

Risk-weighted off-balance sheet assets

and contingent liabilities (bank portfolio)

Total capital requirement, of which:

- capital requirement for credit risk

- capital requirement due to the excess

of credit concentration limit

- total capital requirement for market risks

- other capital requirements

Capital Adequacy Ratio

Balance sheet value of capital funds

1,708,617

1,171,200

65,933

480,854

(9,370)

4,029,954

14,737,211

1,670,944

1,178,977

198,444

191,315

102,208

19.29%

5,738,571

20,098,770

1,113,992

746,187

30,820

344,544

(7,559)

4,590,465

2,289,828

1,607,902

317,650

229,581

134,695

16.04%

5,704,457

Capital adequacy ratio

31/12/2004 31/12/2003

in PLN thousand

As of

27

Activities of Bank in 2004

29

53

59

65

69

211

Lending and other risk exposures

In 2004, the Bank reorganized its Corporate Banking Division, in

order to better position it in the various market segments. The

process of reorganization was completed in July.

Generally, the Bank’s lending policy includes active portfolio

management and precisely specified target market criteria, de-

signed to make it possible to control the credit exposure with

respect to a given industry or segment of customers. In addition,

individual borrowers are continuously monitored to detect deterio-

ration in the financial standing promptly and to apply the necessary

and timely corrective steps.

Lending

As of 31 December 2004, gross credit exposure to the non-financial

sector amounted to PLN 11,658 million, representing a decrease in

exposure by 23,4% compared to the same period of the previous

year. The decrease resulted from a combination of the Bank’s

prudent lending policy and the increased liquidity of numerous

segments of the economy, as well as the decrease in total value of

loans denominated in foreign currencies. High competition in the

banking sector and alternative ways of financing also impacted on

the size of the credit portfolio.

The largest part of the Bank’s loan portfolio, representing 74,6% of

the total, is the credit exposure to non-financial corporates.

Compared to 2003, loans to individuals grew significantly to PLN

1,946 million representing growth of almost 31%.

in PLN thousand Change Change (%)31/12/2004 31/12/2003

As of

Loans in PLN

Loans in foreign currency

Total

Loans to non-financial sector

Loans to financial sector

Loans to public sector

Total

Non-financial corporates

Non-bank financial entities

Individuals

Other non-financial entities

Public entities

Total

(1,134,320)

(2,421,468)

(3,555,788)

(3 427,018)

(127,410)

(1,360)

(3,555,788)

(3,880,486)

(127,410)

459,901

(6,433)

(1,360)

(3,555,788)

9,493,432

2,164,590

11,658,022

10,652,847

1,003,899

1,276

11,658,022

8,697,683

1,003,899

1,946,151

9,013

1,276

11,658,022

10,627,752

4,586,058

15,213,810

14,079,865

1,131,309

2,636

15,213,810

12,578,169

1,131,309

1,486,250

15,446

2,636

15,213,810

(10.7%)

(52.8%)

(23.4%)

(24.3%)

(11.3%)

(51.6%)

(23.4%)

(30.9%)

(11.3%)

30.9%

(41.6%)

(51.6%)

(23.4%)

Lending to non-bank customers (gross)

Loans excluding interest receivable.

30

During 2004, the currency structure of the loan portfolio slightly

changed as the result of strengthening of PLN against world

currencies. The share of foreign currency loans decreased

significantly to 19% in 2004 compared to 26% over the first half of

2004 and 30% in 2003. The Bank grants foreign currency loans to

customers who can provide a natural hedge against FX risk in the

form of foreign currency cash flows from exports, or to customers,

who in the Bank’s opinion, are able to absorb the risk of

depreciation of Polish currency.

The Bank monitors the concentration of its exposure on a regular

basis, seeking to avoid a portfolio concentrated in a limited group of

customers. As of 31 December 2004, the Bank’s portfolio of

exposure to non-bank entities did not include any exposure

exceeding the exposure concentration limits laid down by the law.

The largest exposure related to financing of a leasing company

owned by the Bank (Customer 1).

Loans classified as irregular as of 31 December 2004 dropped by

30.9% compared to 31 December 2003. In particular there was

a significant drop of 66.5% in loans classified as “Doubtful” which

were partially reclassified to “Watch” category. A significant part of

the “Doubtful” category was also repaid. At the same time, the

share of loans classified as “Watch” increased significantly up to

16,2%, which resulted from:

• Improved financial condition of certain enterprises previously

classified as irregular (reclassified to “Watch”);

• New regulations related to the classification of receivables and

creation of specific provisions.

Despite an improvement in the structure of classified exposures,

the Bank continued its policy of creating specific provisions,

increasing their level by almost 12% to PLN 1,688 million during

2004. At the same time, the Bank released PLN 136 million of

general risk provision, which at the end of 2003 amounted to PLN

164 million.

As a result of the changes in specific provisions and general risk

provision, the provisions to classified loans ratio increased from

40% as of 31 December 2003 to 59% as of 31 December 2004.

Quality of loan portfolio

Customer 1

Customer 2

Customer 3

Customer 4

Customer 5

Customer 6

Customer 7

Customer 8

Customer 9

Customer 10

Total 10

560,076

492,762

483,731

324,840

279,327

276,384

254,341

221,032

212,787

142,658

3,247,938

Total

exposure

Exposure concentration – non-bank customers

Balance sheet

exposure*

Off-balance

sheet exposure

502,258

29

75,742

122,769

198,425

127,672

0

1,294

158,028

6,020

1,192,237

57,818

492,733

407,989

202,071

80,902

148,712

254,341

219,738

54,759

136,638

2,055,701

* Does not include exposures to shares and other securities. Data for individual entities, excluding

exposures to entities related to a given customer.

in PLN

thousand

31

Off-balance sheet exposures

As of 31 December 2004, off-balance sheet exposure amounted to

PLN 11,762 million, which represented a decrease of 21,9% in

comparison with the same period of the previous year. Undrawn

credit lines represented 71% of total off-balance sheet exposure.

The amount of guarantees issued by the Bank decreased from PLN

3,020 million to PLN 2,351 million. Changes in letters of credit were

insignificant. The decrease in “Forward placements” mainly

reflected the significant value of above mentioned placement as of

31 December 2003. This was due to the Bank’s exposure to Citibank

Bahrain, a subsidiary of Citigroup. The exposure included two

forward placements of 350 and 500 million US dollar. These

placements were short term financial instruments at market price,

for the management of the Bank’s liquidity.

Change as from

31/12/2003

31/12/2004

31/12/2003

Specific provisions for receivables

- watch

- problem

General risk provision

Total provision

Index of provision coverage of problem loans

1,688,538

—

1,688,538

164,000

1,852,538

59.1%

in PLN thousand

1,505,931

—

1,505,931

300,000

1,805,931

39.8%

12.1%

—

12.1%

(45.3%)

2.6%

Provisions for non-bank loan portfolio

As of

Normal

Watch

Problem

- substandard

- doubtful

- loss

Total receivables from non-bank sector

Gross receivables from non-bank customers

by exposure quality

9,053,548

1,625,103

4,535,159

709,186

1,935,282

1,890,691

15 213 810

6,636,893

1,888,525

3,132,604

660,385

647,725

1,824,494

11,658,022

56.9%

16.2%

26.9%

5.7%

5.6%

15.7%

100.0%

59.5%

10.7%

29.8%

4.7%

12.7%

12.4%

100.0%

in PLN thousand

31/12/2004

Share %

31/12/2003

Indices of loan portfolio quality

Share %As of

in PLN thousand

32

External funding

As of the end of 2004, the total value of external funding of the

Bank was PLN 21,917 million and was higher by PLN 848 million

(3.7%) than as of the end of 2003. Liabilities to the non-financial

sector, which decreased by PLN 1,284 million (7.1%), were the main

factor changing the external funding of the Bank’s activities, which

mainly results from decreasing PLN equivalent of foreign currency

deposits.

Taking into account all sectors, the largest decrease in external

funding, as of the end of 2004, was in the group of individual

customers by PLN 487 million (8.2%), mainly in term deposits both

in PLN and foreign currency. This results from strong competition

from alternative offers of capital market investments. Despite the

decrease as of the end of 2004, the Bank still maintains its stable

position in the market for individual customers’ deposits.

The reason for the decrease of PLN 383 million (3.4%) in non-

financial entities deposits as of the end of 2004, compared to 2003,

was mainly sight deposits. During the year, the Bank noted

a significant increase in deposits made by corporate entities who,

as a result of economic improvement, placed their liquidity

surpluses in bank accounts.

By the end of the year, given the increased value of PLN and the

reduced liquidity of exporters,a decrease in deposits was observed.

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

Guarantees

Letters of credit issued

Third-part confirmed letters of credit

Committed loans

Forward placements

Other financing

Total

Provisions for off-balance sheet liabilities

Provision coverage index

(669,630)

7,736

139

319,506

(3,058,066)

104,286

(3,296,029)

(105,667)

2,351,306

168,073

17,108

8,353,739

121,359

751,277

11,762,862

39,352

0.33%

3,020,936

160,337

16,969

8,034,233

3,179,425

646,991

15,058,891

145,019

0.96%

(22.2%)

4.8%

0.8%

4.0%

(96.2%)

16.1%

(21.9%)

(72.9%)

Off-balance sheet exposures

33

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

Due to the Central Bank

Due to financial sector

Current

Long-term

- banking deposits

- received loans

- time deposits of non-bank institutions

Due to non-financial sector

Current

Long-term

Due to public sector

Current

Long-term

Sell-Buy-Backs

Total external funding

(40,098)

479,893

696,581

(216,688)

(13,087)

(98,507)

(105,094)

(1,284,916)

(454,763)

(830,153)

66,412

34,762

31,650

(62,147)

(840,856)

718

4,285,896

3,039,901

1,245,995

598,548

446,825

200,622

16,691,138

8,422,514

8,268,624

531,213

338,869

192,344

408,361

21,917,326

40,816

3,806,003

2,343,320

1,462,683

611,635

545,332

305,716

17,976,054

8,877,277

9,098,777

464,801

304,107

160,694

470,508

22,758,182

(98.2%)

12.6%

29.7%

(14.8%)

(2.1%)

(18.1%)

(34.4%)

(7.1%)

(5.1%)

(9.1%)

14.3%

11.4%

19.7%

(13.2%)

(3.7%)

External funding

Excluding interest payable.

34

Corporate funds management

The Bank has a rich, comprehensive and modern product offer

related to financial and transactional servicing of enterprises. Apart

from providing traditional services such as current accounts,

domestic and foreign transfers, deposits, and overdrafts, the Bank

also provides customers with more sophisticated transactional

banking products, particularly in the area of electronic and Internet

banking. Development of such activities is facilitated by access to

world-class Citigroup technological resources.

in PLN thousand Change Change (%)31/12/2004 31/12/2003As of

Individuals

Non-financial economic entities

Non-profit institutions

Non-bank financial institutions

Public sector

Suspense account liabilities

Total

Current

Long-term

Total

PLN

Foreign currency

Total

Liabilities towards:

(487,323)

(383,407)

(406,569)

445,146

66,411

(7,616)

(773,358)

130,246

(903,604)

(773,358)

(419,207)

(354,151)

(773,358)

5,489,847

10,749,745

424,038

2 247,722

531,212

27,510

19,470,074

10,808,488

8,661,586

19,470,074

14,508,306

4,961,768

19,470,074

5,977,170

11,133,152

830,607

1,802,576

464,801

35,126

20,243,432

10,678,242

9,565,190

20,243,432

14,927,513

5,315,919

20,243,432

(8.2%)

(3.4%)

(48.9%)

24.7%

14.3%

(21.7%)

(3.8%)

1.2%

(9.4%)

(3.8%)

(2.8%)

(6.7%)

(3.8%)

Liabilities to non-bank customers

Excluding interest payable.

Transaction servicing

The modern transactional banking offer is the result of continuous

efforts to provide services which meet the needs of the Bank's

customers in the most effective manner. Economic growth and new

business ideas of our customers stimulate the implementation of new

practical solutions.

Escrow Account is one of the new products implemented in 2004,

which has been included in the catalogue of bank accounts in the

Banking Law amended on 1 April 2004. Escrow Account provides an

additional level of security of transactions in the form of the

35

guaranteed manner of effecting payment instructions, precisely

defined in the Escrow Account Agreement and protecting the funds

in the account against third party claims.

Based on „SpeedCollect” - the mass payment processing platform,

which facilitates processing of the incoming payments, the product

team developed another solution called „SpeedCollect Plus”, which

supplements the missing data, that has not been recognized

automatically. Other Citigroup entities found the modernized

product very interesting, which resulted in the product

implementation for some of the global customers. The process of

implementation in other countries is continuing.

On 30 November 2004, the Bank established a relationship with the

Italian Bank Monte dei Paschi di Siena. As a result of this

relationship, the „Italian Desk” was established in Warsaw. The

project aims at acquiring customers trading with Polish or Italian

contractors and supporting their development with modern banking

solutions offered by the Bank.

In addition to product development, the Bank seeks to optimize

existing processes, starting from cost reduction. In 2003, the Bank

started to limit the number of printed hard copies of bank

statements. The implementation of electronic statements was one

of the process solutions. Such statements are identical with their

hard copies both in terms of appearance and content. Electronic

statements were well received by corporate customers. At the end

of June 2004, over 40% of total corporate customer statement

output was transmitted exclusively by electronic means. By the end

of 2004, approximately 60% of statements were transmitted

electronically. This service was rendered to over 12,000 customers.

Also, the Bank offers the possibility to save electronic statements

on CD's.

In 2004, the Bank continued its efforts to limit the number of hard

copy instructions delivered by the customers directly to the Bank's

branches and replace them with electronic communication. The

number of transactions ordered electronically increased from 95%

to 98% of the total volume of the transaction orders received by

the Bank. As a result, the number of hard copy instructions

decreased by several thousand a month.

At present, internet electronic banking systems are considered to

be the standard channels for servicing corporate customers with

respect to transactional banking products. The year 2004 was

characterized by a significant increase in their popularity. Several

changes have been introduced to both the traditional electronic

banking and internet banking system to enhance and improve their

performance. The most important was the introduction of CitiDirect

LITE - the new version of CitiDirect. CitiDirect LITE operates in

parallel to CitiDirect and focuses in particular on the Corporate

Banking Customers. As a result of the efforts taken to improve the

software operation and stability, the customers’ satisfaction has

increased.

In addition to new products and solutions, the Bank still strives for

acquiring customers for well-known products. The marketing of

Prepaid Payment Cards Visa Electron, where the Bank has been

maintaining its leading position may serve as an example. The Cards

are issued to corporate customers within loyalty and promotional

programs and in the form of Electronic Coupon. In 2004 the

number of customers using this product increased by 49%. By the

end of the year, the number of issued Prepaid Payment Cards

amounted to 127,000.

The Bank also actively acquires customers for Citibank Business

Debit Cards. The number of customers using Citibank Business

Debit Cards increased by 135% and the number of issued Cards

increased by 123%.

In 2004, the UniKasa Payment Servicing Network grew rapidly. The

number of UniKasa terminals increased by 1,200 compared to

December last year. In addition to the major national invoice

issuers, the creditors taking advantage of the network services also

36

include local companies, which has made the network even more

attractive. In December, the number of transactions concluded by

means of UniKasa Payment Servicing Network exceeded 300,000.

As Citigroup entities showed growing interest in UniKasa, for the

first time the network has been established abroad. In November

2004, a number of Payment Servicing Network terminals were

launched at gas stations in Romania. The service development team

entered into negotiations with other countries to arrange the 2005

UniKasa network implementation plan.

2004 saw further development of SpeedCollect, which is a basic

version of a mass payments servicing system. The system is offered

to cellular and cable telecom operators, cable TV providers,

distributors of gas and power supply and insurance companies.

Throughout 2004, SpeedCollect automatically processed over 130

million payments. In July, the elimination of paper-based

transaction servicing led to further automation and cost reduction.

A joint undertaking of the Bank and Poczta Polska resulted in

shorter post office payments transfer to the Bank, which now takes

only 2 business days. The launching of CitiConvert – an integrated

electronic report system - was one of the major projects influencing

the time and data quality of payments delivered to SpeedCollect

customers.

In 2004, the Bank played an active role on the market of servicing

payments by Direct Debit. Throughout 2004, the Bank processed

more than 4,76 million customer transactions, which in December

reached over 50% share of the Direct Debit market. The Bank was

able to retain this leading position thanks to participating in various

initiatives aimed at promoting direct debit among the Bank's

customers. The customers also highly appreciated the Bank's active

participation in the Coalition for Direct Debit, which organized and

carried out Direct Debit promotional campaign in the newspapers,

on the Internet and TV. As a result of the activities undertaken by

the Coalition, the Bank was awarded a prestigious prize of „Twój

Styl” - Alicja 2003. In addition, the Corporate Bank in cooperation

with the Consumer Bank introduced the possibility to activate

Direct Debit by individual customers via CitiPhone and

CitibankOnline.

In 2004, the Bank significantly enhanced and developed the

electronic platforms, through which trade finance products are

offered.

Due to a high level of interest shown by the Bank's customers, the

guarantee products offer was extended to include excise guarantee

which is an obligation contracted by the Bank towards the Customs

Office, upon the Bank customer’s order, representing a collateral

securing the payment of excise tax.

The Bank's guarantee offer was also extended to include the

standards required by PHARE, European Union and World Bank

programs and by the Customs Authorities.

A further innovation is the contract signed between the Bank and

the Agricultural Market Agency on cooperation in issuing and

servicing bank guarantees by the Bank in favor of the Agricultural

Market Agency, representing a security for proper performance of

financial obligations by the Agricultural Market Agency resulting

from the Common Agricultural Policy mechanisms.

In addition to guarantee products within trade finance products, the

Bank developed Supplier Finance – an option within factoring. The

financing mechanism involves the discount of receivables from the

selected group of suppliers of the given debtor, without the right to

recourse against the supplier. The Bank's entire risk is associated

with the debtor, who is also a borrower who, for the purpose of the

program, uses its credit line. The implementation of this product

enables the debtor to extend the payment dates and the supplier to

improve financial liquidity.

Trade Finance products

37

Commercial Revolving Loan is another new solution offered by the

Bank. It has been designed for financing the customer's operating

activity. The loan is secured with confirmed assignment of

receivables from selected local debtors. The main feature of the

product is the weekly adjustment of available credit line according

to the amount of submitted receivables. What is distinctive in this

product is the automation ensured by CitiConnect, which makes it

very user-friendly for the customer and efficient for the Bank.

Another advantage for the customer is the Bank's contact with

debtors, which makes the debtors more disciplined.

The following are the most important trade finance transactions

executed by the Bank in 2004:

• Framework agreement on issuing bank guarantees with a con-

struction company, for the amount of PLN 80 million;

• Payment guarantee issued within the syndicate of banks, upon

the request of the petroleum industry customer, for the total

amount of USD 96 million (the Bank's share was USD 48 million),

which secured proper performance of contractual obligations

towards suppliers;

• Letter of credit, constituting security for the amount of EUR 37.5

million, issued upon the request of the petroleum industry

customer and securing proper performance of contractual

obligations during the investment project;

• Launch of the export pre-financing programs for the shipyard

industry customer for the amount of USD 34.2 million for a foreign

shipowner in cooperation with KUKE and the State Treasury;

• Short-term financing of the tire industry customer distribution

network (over 80 distributors) based on Paylink Card (a tool

giving access to trade receivables next day after the invoice issue

date or its maturity, with the possibility to credit the debtor

automatically) for the total amount of PLN 34 million;

• Availment of the first tranche of a special purpose loan (short-

term financing of seasonal purchase) to the sugar industry for the

amount of PLN 30 million, the target amount is PLN 60 million;

• Availment of export prefinancing loan, for the total amount of

USD 87 million (the Bank's share was USD 29 million), granted by

the syndicate of banks to the shipyard industry for the

construction of 10 container ships in 3 years;

• Availment of export prefinancing loan for the amount of PLN 12

million to the machine-building industry;

• Supplier finance program for the construction industry for the

amount of PLN 10 million to cover 10 new suppliers.

Some of the aforementioned programs involve foreign trade

settlements, an area in which the Bank maintains its leading

position on the market. It is based on an extensive customer base