HATTON NATIONAL BANK PLC - ANNUAL REPORT 2010

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

www.hnb.lk

SRI LANKA IS GROWING; AND HNB IS AT THE

FOREFRONT OF THIS DRIVE, DELIVERING A

SPECTRUM OF SOLUTIONS THAT HELP DEVELOP

A NATION, ECONOMY AND ITS PEOPLE ON THE RISE.

OUR NATIONAL COMMITMENT HAS ALWAYS BEEN

TO CONVERT WORLD-CLASS FINANCIAL

SOLUTIONS TO PEOPLE FRIENDLY BANKING

PRODUCTS THAT HELP INDIVIDUALS AND

BUSINESS REALIZE THEIR PROMISE. OUR

UNDERSTANDING AND OUR RESPONSE TO

NATIONAL FINANCIAL NEEDS HAS BEEN

LONGSTANDING.

THIS IS WHAT TRULY MAKES US A NATIONAL BANK.

AND WE KNOW THERE IS NO BETTER TIME THAN

NOW, TO SHARE THE NATIONAL FOCUS AND GIVE

SRI LANKANS THE IMPETUS TO SURGE AHEAD.

CORPORATE

INFORMATION

NAME OF COMPANY

HATTON NATIONAL BANK PLC

LEGAL FORM

A public limited Company incorporated on 5th March 1970 under the Laws of

the Republic of Sri Lanka. The Company was re-registered under the Companies

Act No 7 of 2007 on 27th September, 2007. It is a Licensed Commercial Bank

under the Banking Act.

COMPANY REGISTRATION NUMBER

PQ 82 (previous PBS 613)

ACCOUNTING YEAR END

31st December

STOCK EXCHANGE LISTING

The ordinary shares and the Unsecured Subordinated Redeemable Debentures

of the Bank are listed on the Colombo Stock Exchange in Sri Lanka.

Global Depository Receipts of the Bank are listed on the

Luxembourg Stock Exchange.

REGISTERED OFFICE

No 479, T B Jayah Mawatha (Darley Road),

P O Box 837, Colombo 10, SRI LANKA

HEAD OFFICE

“HNB Towers”,

No 479, T B Jayah Mawatha (Darley Road),

P O Box 837, Colombo 10, SRI LANKA

Cable Address: HATNABANK

Telephone Nos 2664664, 2662772, 4764764

Fax Nos 2662814, 2662832 International – 2446523

Telex Nos 21259 Hatnbk Ce, 2166 Haynfx Ce

Swift : Bic Code – HBLILKLX

e-mail : [email protected]

Web : www.hnb.net

CREDIT RATINGS

The Bank has been assigned AA-(lka) national credit rating for implied

long term unsecured senior debt by Fitch Ratings Lanka Limited

ASSOCIATE COMPANIES

Delma Exchange 20.00%

Remittances and Foreign Currency Related Services

Browns Engineering (Pvt) Ltd 32.63%

Construction and Engineering

JOINT VENTURE COMPANIES

Acuity Partners (Pvt) Ltd 50.00%

Financial Services

SUBSIDIARY COMPANIES

HNB Assurance PLC 60.00%

Insurance Services

Sithma Development (Pvt) Ltd 100.00%

Property Development

Majan Exchange LLC 40.00%

Remittances and Foreign Currency Related Services

Commercial Interlink Services Inc 100.00%

(O/A of Delma Exchange Canada)

Remittances and Foreign Currency Related Services

AUDITORS

KPMG Ford, Rhodes, Thornton & Co.,

Chartered Accountants

No 32A, Sir Mohamed Macan Markar Mawatha,

Colombo 3,

Sri Lanka

INVESTOR INFORMATION

Institutional Investors, Stock Brokers and Security Analysts requiring nancial

information should contact the Senior DGM - Strategy & Compliance at:

“HNB Towers”, Level 16,

No 479, T B Jayah Mawatha (Darley Road),

Colombo 10,

Sri Lanka.

Telephone : 2662705, 2664705

Fax : 2662815

e-mail : nihalk[email protected]

BOARD OF DIRECTORS

Mr Rienzie T. Wijetilleke (Chairman)

Mr Rajendra Theagarajah (Managing Director / CEO)

Mr D H S Jayawardena

Mr M V Theagarajah

Mr R K Obeyesekere

Ms Pamela C. Cooray (Senior Director)

Mr Ranjeevan Seevaratnam

Mr N G Wickremeratne

Ms M A R C Cooray

BOARD SECRETARY

Ms Indrani Goonesekera

Attorney-at-Law & Notary Public

BOARD AUDIT COMMITTEE

Mr Ranjeevan Seevaratnam (Chairman)

Mr D H S Jayawardena

Ms Pamela C. Cooray

Mr N G Wickremeratne

BOARD NOMINATION COMMITTEE

Mr Rienzie T. Wijetilleke (Chairman)

Mr D H S Jayawardena

Mr M V Theagarajah

Mr R K Obeyesekere

BOARD REMUNERATION COMMITTEE

Ms Pamela C. Cooray (Chairperson)

Mr Rienzie T. Wijetilleke

Mr R K Obeyesekere

Mr N G Wickremeratne

BOARD INTEGRATED RISK MANAGEMENT COMMITTEE

Mr M V Theagarajah (Chairman)*

Mr Rienzie T. Wijetilleke*

Ms M A R C Cooray*

Mr Rajendra Theagarajah (Managing Director / CEO)**

Mr J D N Kekulawala – Senior DGM - Strategy & Compliance**

Mr D P N Rodrigo – DGM - Risk**

* Representatives of the Board

** Representatives of the Management

Designed & Produced by eMAGEWISE

®

Digital Plates by Imageline

Printed by Gunaratne Offset

VISION

OUR VALUES

MISSION

TO BE THE ACKNOWLEDGED LEADER

AND CHOSEN PARTNER IN PROVIDING

FINANCIAL SOLUTIONS THROUGH

INSPIRED PEOPLE

• TREASURE PROFESSIONAL & PERSONAL

INTEGRITY AT ALL TIMES

• DEMONSTRATE MUTUAL RESPECT IN

ALL OUR INTERACTIONS

• PASSIONATE ABOUT EVERYTHING WE DO

• COMMITTED TO BEING CUSTOMER CENTRIC

• COURAGE TO CHANGE, CHALLENGE

AND BE DIFFERENT

• DEMONSTRATE UNITY IN DIVERSITY

COMBINING ENTREPRENEURIAL SPIRIT

WITH EMPOWERED PEOPLE AND LEADING

EDGE TECHNOLOGY TO CONSTANTLY

EXCEED STAKEHOLDER EXPECTATIONS

Management Information

Financial Goals and Performance 2 • Financial Highlights 3 • Chairman’s

Message 4 • Chief Executive O cer’s Review 8 • Board of Directors 14 •

Corporate Management 16 • Senior Management 19 • Corporate Banking 22 •

Small And Medium Enterprises 23 • Personal Financial Services 24 •

Development Banking 27 • International Operations 29 • Treasury Operations

31 • Information Technology 32 • Marketing 33 • HNB Assurance PLC 35 •

Sithma Development (Pvt) Limited 36 • Exchange Houses 37 • Acuity Partners

(Pvt) Ltd 38 • Main Correspondents Worldwide 39 • Customer Centre Network

40 • Financial Review 42

Coporate Governance

Risk Management 48 • Corporate Governance 59 •

Statement of Internal Control 76

Sustainability Report

Chief Executive O cer’s Statement 80 • Report Parameters 82 •

Strategic Sustainability Review 84 • Customer Responsibility 94 •

Employee Responsibility 100 • Investor Responsibility 108 • Community

Responsibility 112 • Supplier Responsibility 119 • Environmental Responsibility

121 • Key Performance Indicators 126 • Independent Assurance Report 127 •

The Global Reporting Initiative (GRI) G3 128

Financial Information

Financial Calendar 139 • Annual Report of the Board of Directors on the A airs

of the Company 140 • Directors’ Interest in Contracts with the Bank 146 •

Remuneration Committee Report 150 • Nomination Committee Report 151 •

The Board Integrated Risk Management Committee Report 152 • Audit

Committee Report 153 • CEO’s and CFO’s Responsibility Statement 155 •

Directors’ Responsibility for Financial Reporting 156 • Independent Auditors’

Report 157 • Income Statement 158 • Balance Sheet 159 • Statement of

Changes in Equity 160 • Cash Flow Statement 161 • Notes to the Financial

Statements 164

Supplementary Information

Capital Adequacy 246 • Income Statement in US Dollars 249 • Balance Sheet in

US Dollars 250 • Analysis of Deposits 251 • Analysis of Advances 252 •

Province-wise Analysis of Deposits and Advances 253 • Sources and Utilisation

of Income 254 • Value Added Statement 255 • Quarterly Statistics 256 •

Ten Year Statistical Summary 257 • Ten Year Graphical Review 258 • Segmental

Analysis 259 • Share and Debenture Information 260 • Glossary 268 •

Notice of Meeting 270 • Form of Proxy - Voting 271 • Form of Proxy - Non

Voting 273 • Investor Feedback Form 275 • Corporate Information IBC

2 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

FINANCIAL GOALS

AND PERFORMANCE

2006 2007

2008 2009

2010

Medium Term

Goals

Results For the Year

Return on Average Assets (%)

1.2 1.4

1.3 1.6 1.5 Over 1.5

Return on Average Shareholders' Funds (%)

18.4 19.3

16.5 19.6 17.5 Over 20.0

Cost / Net Income Ratio (Excl. Financial VAT) (%) *

57.8 56.2

54.2 54.3 56.5 Below 50.0

Dividend per Share (Rs)

5.00 3.50

4.00 6.50 7.00 Over 4.00

Capital Adequacy

Tier 1 Capital Ratio (%) (Statutory Minimum Ratio Required is 5%)

10.23 10.32

9.25 11.10 10.99 9.00

Total Capital Ratio (%) (Statutory Minimum Ratio Required is 10%) 11.32 12.08 11.40 13.16

12.64 12.50

* Operating expenses consist of personnel expenses, premises equipment and establishment expenses, fee and commission expenses and other expenses.

Net income consists of net interest income, foreign exchange pro t, Fee and commission income, dividend income and other income.

GROSS

NPA RATIO

4.5%

MARKET

CAPITALISATION

Rs 76.5 Bn

+137%

DEPOSITS

Rs 234 Bn

+11.2%

PBT

Rs 6.7 Bn

+13.8%

ADVANCES

Rs 210 Bn

+18.5%

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 3

FINANCIAL

HIGHLIGHTS

Bank Group

Results For the Year

2010

Rs. Mn

2009

Rs. Mn

%

Change

2010

Rs. Mn

2009

Rs. Mn

%

Change

Income 35,582 39,358 - 9.6 38,105 41,301 - 7.7

Net pro t before income tax 6,731 5,918 + 13.7 7,252 6,167 + 17.6

Income tax on pro ts 2,267 1,566 + 44.8 2,365 1,613 + 46.6

Net pro t after taxation 4,464 4,352 + 2.6 4,887 4,553 + 7.3

Gross Dividends 1,648 1,533 + 7.5 1,678 1,556 + 7.9

Pro t available after appropriation 2,816 2,819 - 0.1 3,209 2,998 + 7.0

At the Year End

Shareholders' funds (Capital and Reserves) 27,274 23,900 + 14.1 29,978 26,374 + 13.7

Deposits from customers 234,071 210,507 + 11.2 233,881 210,363 + 11.2

Advances to customers including Leasing,

Bills of Exchange & Commercial paper (Gross) 210,068 177,229 + 18.5 208,070 174,476 + 19.3

Total Assets 313,913 280,289 + 12.0 323,258 287,208 + 12.6

Information per ordinary share

Earnings (Rs.) 18.84 18.47 + 2.0 20.20 19.03 + 6.1

Dividends (Rs.) 7.00 6.50 + 7.7

Dividend Yield (%) 1.75 3.82 - 54.2

Net asset value (Rs.) 114.61 101.37 + 13.1 125.97 110.83 + 13.7

Market value (Rs.) - Voting 399.90 170.25 + 134.9

Market value (Rs.) - Non voting 214.60 104.75 + 104.9

Ratios

Return on average shareholders' funds (%) 17.45 19.57 - 10.8

16.99

18.19 - 6.6

Price earning (Times) 21.23 9.22 + 130.3

19.80

8.95

+

121.3

Dividend cover (Times) 2.71 2.84 - 4.6

2.91

2.93

- 0.5

Capital Adequacy Ratios

Tier 1 (%) (Statutory minimum ratio required is 5%) 10.99 11.10 - 1.0 10.96 10.85

+ 1.0

Tier 1 & 2 (%) (Statutory minimum ratio required is 10%) 12.64 13.16 - 4.0 12.73 12.92

- 1.5

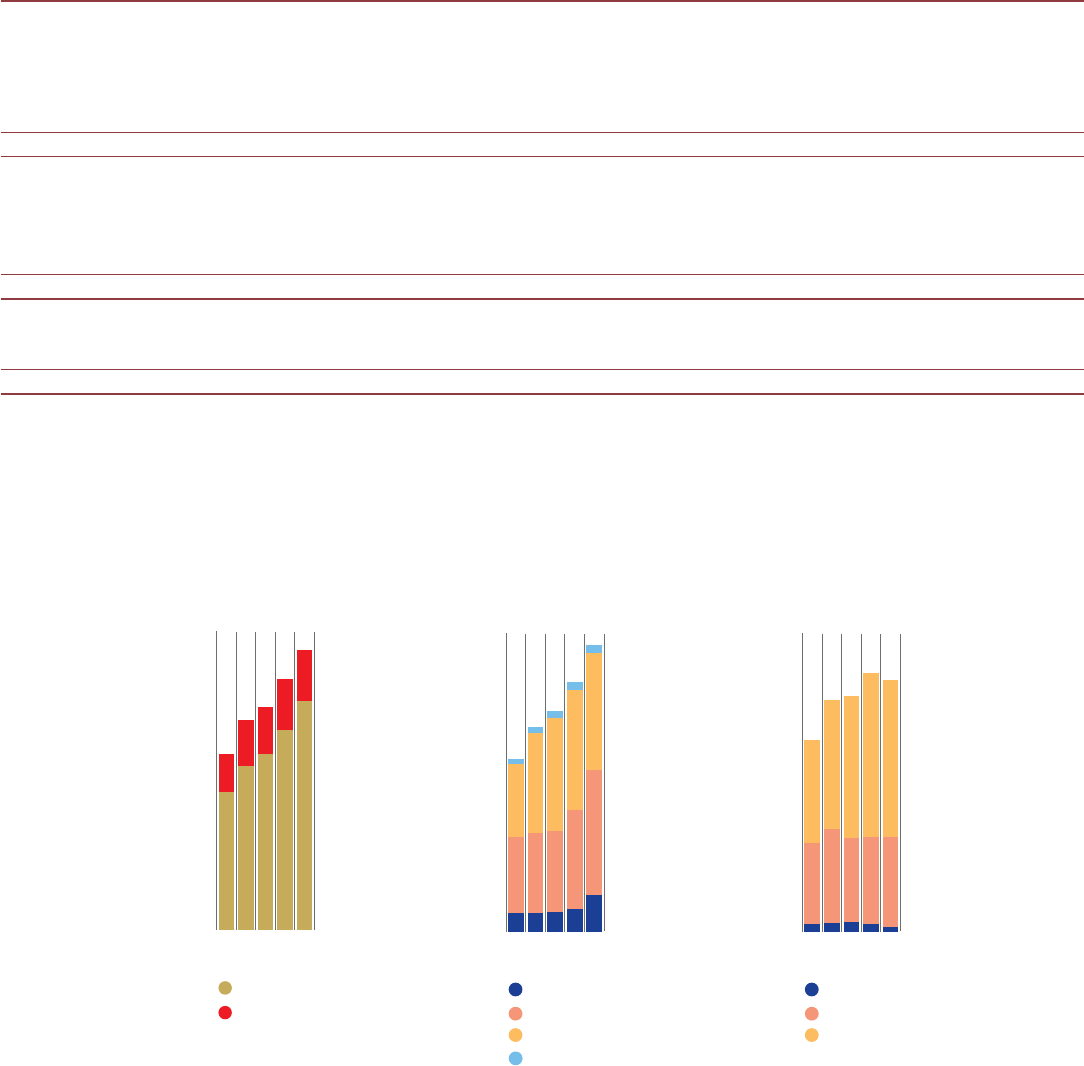

Net Prot

After Taxation

2006

2007

2008

2009

2010

Return on

Average Assets

Total

Deposits

Total

Advances

Shareholders’

Funds

0

1,000

2,000

3,000

4,000

5,000

Rs.Mn

2006

2007

2008

2009

2010

0.0

0.5

1.0

1.5

2.0

%

2006

2007

2008

2009

2010

0

50,000

100,000

150,000

200,000

250,000

Rs.Mn

2006

2007

2008

2009

2010

0

50,000

100,000

150,000

200,000

250,000

Rs.Mn

2006

2007

2008

2009

2010

0

5,000

10,000

15,000

20,000

25,000

30,000

Rs.Mn

4 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

MESSAGE

In the year 2010, our nation witnessed

an encouraging economic rebound.

It is without doubt that Sri Lanka is

on the throes of economic resurgence,

with surety of economic boom

evidenced through positive

indications prevalent in the year

2010.

It gives me great pleasure to welcome all of you, our

valued shareholders, to the forty second Annual

General Meeting of Hatton National Bank PLC and to

present to you the audited Financial Statements and

Annual Report for the year 2010. For Hatton National

Bank, the year 2010 has been yet another formidable

year. As a nancial institution that has a long history

and reputation as a corporate that works in the

national interest, your Bank has once again

substantiated its status as an integral element in the

CHAIRMAN’S

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 5

nation’s engine of growth. Our legacy by

far establishes us not only as a pioneer

but also a revolutionary force in shaping

the future of Sri Lanka’s economic and

commercial intent.

Sri Lanka’s economy rebounds post-con ict

In the year 2010, our nation witnessed an encouraging economic

rebound. It is without doubt that Sri Lanka is on the throes of

economic resurgence, with surety of economic boom evidenced

through positive indications prevalent in the year 2010. The

national economy grew by an estimated 8%, over and above the

growth expectations for the year 2010, with in ation at 6.9% and

unemployment down to 4.9%. Most encouragingly, the all island

poverty rate declined to 7.6% in 2010 from 15.2% in 2006. It is

indeed heartening to note that the Government is pursuing

economic growth in a manner that is inclusive of the rural

economy. Indeed, as Hatton National Bank has demonstrated

over the decades, growth can only be sustained through wealth

creation that is far reaching and equitable.

Fundamentals for a robust growth trajectory

Most importantly, the future outlook for the nation is brightened

by the strategic approach to national development adopted by

the Government of Sri Lanka, an approach that was amply

demonstrated by the government’s budgetary proposals for the

year 2010 / 2011. Pragmatism and a concerted strategic

approach are indeed the tools with which our nation can once

again rise above and overcome the drudgery of economic

underachievement that was imposed on us through three

decades of con ict. In the year 2010, the Government of Sri

Lanka demonstrated its will to put into action its vision for the

nation, through broad budgetary and economic proposals that

call for reform and reconstruction. Moreover, the Government

has perceptively understood and accepted that progressive and

sustainable national development can only be achieved through

private-public sector partnership. This I concur, is a robust and

sustainable foundation for the future, and is a call that must be

heeded by the nation’s business community to collaborate as

integral partners of national development. The national outlook

in the medium and long term, I believe, will be the outcome of

remedial steps undertaken through such a partnership. Indeed,

the private sector has the experience and far more success

stories as implementers of strategy. Thus, it is critical going

forward that we transfer this available expertise to realise more

potent outcomes through the collaboration of private initiatives

with public resources.

The late Sir Arthur C. Clarke shared with me this nugget of

wisdom once, “the private sector must not only do well but also

do good”. This statement truly resonates my sentiments on the

need for private-sector leadership for our nation’s future

development and prosperity. Of course, for national progress to

be realised, we as a nation must also accept that transparency

and governance in every institution – be it private or public

– must be upped to that of global standards. Bureaucracy has to

be curbed, with the public sector machinery becoming more

e cient and agile. The private sector needs to embrace positivity

and be corporates that truly demonstrate entrepreneurial spirit

and leadership.

Allocation of resources, of the State as well as the private sector,

to rural communities is imperative for equitable wealth creation,

wherein perceptible evidence of growth in rural Sri Lanka should

be the fulcrum of the drive for development. Whilst the

Government of Sri Lanka must be recognised and given due

credit for taking the appropriate measures towards controlling

in ation, stabilising the exchange rate and curbing domestic

interest rates, we need to accept that these measures will be

conducive for short and medium term progress. For long-term

economic stability, the creation of incremental wealth therefore,

is imperative. There is undoubtedly room for growth. The nation’s

critical sectors – tourism, construction, agriculture, health,

education, infrastructure and industry – are all presently under

capacity. As a nation we have enormous scope for capacity

building in a foray of sectors including those

mentioned above. Going forward, the

Government and the private sector need to

come together as partners to identify and

hone sector speci c growth strategies,

demarcating the most feasible opportunities

from a growth perspective and therein

invest decisively with the intention of

reaping long-term returns. Our forward

march as an economy too should be one

that imbues solidarity and friendship with

nations across the globe.

6 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

Consistency in regulation as a pivot for

strong economic growth

We have witnessed over the past few years tighter regulation

of the nancial services industry. With the adoption of global

standard Basel II by the nancial services sector, industry players

have progressed towards meeting risk and capital management

requirements to ensure adequate protection from overexposure

to lending, investment practices and challenges of the operating

environment. In addition, rigorous regulation and supervision by

the Central Bank of Sri Lanka have brought greater stability and

transparency to the sector. However, it is equally important that

the same ethical standards and levels of governance are applied

to Public Sector Financial Institutions (PSFIs), especially since

PSFIs enjoy a signi cant share of the nancial services sector and

all of us are part of the same playing eld.

Global trends indicate the need to self-assess values

Consumerism as a precept has given rise to overspending as

opposed to savings. Thus, the nations that were looked upon as

the leaders of the global economy are in fact nations that are

steeped in the concept of consumerism. As the past few years

have demonstrated, those economies that are fuelled by

consumerism have experienced a nancial fall-out that has been

marked as grave as the Great Depression. The global economic

crisis, though salvaged and reversed before reaching its climax,

was protracted and pervaded every nation designated as a

western economic icon due to inherent weaknesses in the

systems and processes that characterise these economies.

In retrospect, nations that are steeped in the value of savings,

desisted the domino e ect of the global nancial crisis. Thus,

I strongly believe that as a nation we need to self-assess our value

systems and be true to those values that have been our strength

in the past.

The role of your Bank

Hatton National Bank has always been a leader and proponent of

national priorities. In much the same way, it will continue to play

a catalyst role in achieving the economic objectives of this new

Sri Lanka. Through the conceptualisation of new products and

services that target growth sectors and which will contribute

towards the achievement of national priorities, the Bank will

continue to align its business strategy with the achievement and

implementation of national goals and strategies. It will continue

to accelerate its e orts towards socially mobilising rural Sri Lanka

with special focus on the people of the Northern and Eastern

provinces who need to be empowered towards the achievement

of self-sustenance. At Hatton National Bank we are con dent of

what our nation can achieve and committed towards playing a

vital role in achieving economic success.

Appreciations

I would like to take this opportunity to thank my fellow Directors

who have at all times extended their fullest support and shared

their valued expertise towards the betterment of the Bank. My

deep appreciation is extended to the Management and Sta for

their unstinted cooperation and for their tireless pursuit of the

Bank’s strategic expectations.

Our customers, who have stood by us for many decades have

truly demonstrated the meaning of loyalty. We are proud and

privileged to serve you. Thank you for placing your trust in us.

I would like to take this opportunity to thank His Excellency the

President and Minister of Finance Mahinda Rajapakse and o cials

at his Ministry, the Governor of the Central Bank of Sri Lanka,

Mr Ajith Nivard Cabraal and his o cials for their guidance and

continued support during the year.

CHAIRMAN’S

MESSAGE

Hatton National Bank has always

been a leader and proponent of national

priorities. In much the same way, it

will continue to play a catalyst role in

achieving the economic objectives

of this new Sri Lanka. Through the

conceptualisation of new products

and services that target growth sectors

and which will contribute towards the

achievement of national priorities, the

Bank will continue to align its business

strategy with the achievement and

implementation of national goals

and strategies.

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 7

Our shareholders have been the very pillars of strength upon

which we have built this Bank. I would like to thank you all for your

investment into this Bank, your belief in its potential is a re ection

of our passion to achieve.

We stay committed to serve all our stakeholders. On behalf of the

Board of Directors, I pledge that we will continue to add

shareholder value through the execution of prudent business

strategies whilst ensuring that we contribute towards the

achievement of national priorities.

Ladies and Gentlemen, having served HNB for a period of 34 years

of which the last 24 years was as your MD / CEO for 17 years and

7 years as the Chairman, I will be stepping down from the

Chairmanship as well as from the Board on the 31st March 2011.

I have watched with much satisfaction the great value addition

that has occurred to our organisation over this long period. This

has been mainly due to the prudent management, e ciency and

transparency displayed by your Board of Directors in

enthusiastically formulating and directing policy for the

organisation. As I bid goodbye to the Bank, I am quite pleased to

leave behind lasting memories of my long stay with an abundance

of hope and faith on the excellent prospects that HNB has for

further growth and rapid progress in the future.

Rienzie T. Wijetilleke

Chairman

Colombo, Sri Lanka

18th February 2011

8 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

Hatton National Bank, as a stalwart of national

banking heritage continued its progression as

a Bank that operates in the interests of the

nation. During the year, the Bank continued to

map its 3-year corporate strategy with the

national vision, in the process seeking,

identifying and strategising operational

pillars which re ect the Bank’s core

competencies and yield competitive

advantages.

Economic resurgence transcends challenges

The nancial year 2010 was essentially a year where challenges

were juxtaposed with optimism for the future. The nation’s

economy buoyed by con dence resurged commendably during

the year. The cessation of hostilities in 2009, and sound progress

towards reconstruction of lives and livelihoods in the primarily

a ected Northern and Eastern provinces of Sri Lanka catalysed

economic activity in an area which for over 3 decades had stood

OFFICER’S REVIEW

CHIEF EXECUTIVE

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 9

still in time. The progressive actions taken

by the Government of Sri Lanka to set in

motion greater economic activity, drawing

in communities and individuals to

contribute towards economic

development was the fundamental crux of

the economic gain in 2010. The optimism

displayed in 2009 for Sri Lanka’s future in a

post con ict era continued to be a

constant in the future sentiments for the

nation.

National vision mirrored in corporate strategy

Hatton National Bank, as a stalwart of national banking heritage

continued its progression as a Bank that operates in the interests of

the nation. During the year, the Bank continued to map its 3-year

corporate strategy with the national vision, in the process seeking,

identifying and strategising operational pillars which re ect the

Bank’s core competencies and yield competitive advantages. Hatton

National Bank followed a concerted drive in contributing towards

the national vision in tandem with the realisation of speci c

corporate objectives.

Financial and Operational performance

At Hatton National Bank, challenges have never been an

impediment to our growth. In 2010, as in the past, by strategising

proactively, setting the tone at the top, by integrating business focus

with needs of stakeholders and by being consistently transparent

through continuous disclosures, the Bank was able to augment its

operation to one of enhanced wealth creation.

Thus, agility and acceleration of strategy implementation paved the

way for greater growth in 2010. Despite the adversities, our nancial

performance proved to be robust with the Bank posting a pre tax

pro t of 6.73 Bn and post tax pro t of 4.46 Bn. The Group posted an

after tax pro t of Rs 4.89 Bn.

Solid contribution from core banking activities contributed towards

the expansion of nancial performance during the year. Group

performance was enhanced considerably during the year with a

majority of the subsidiaries posting commendable returns. The

Insurance subsidiary – HNB Assurance PLC - posted robust growth in

business and pro tability. Likewise, Sithma Development (Pvt) Ltd

(Sithma), performed exceptionally, posting a commendable

Rs 170.7 Mn after tax pro t in 2010. It was a milestone year for

Sithma which recouped its entire accumulated losses. Overseas

investments performed with promise; Majan Exchange (Oman)

performed well and is expected to break-even in the rst half of the

upcoming nancial year. Delma Exchange (UAE) continued to garner

a greater share of business through enhanced accessibility and

distribution. Delma Exchange (Canada) however proved to be an

operational challenge, largely due to the market context where the

presence of a large grey market for remittances limited the scope for

continuity. As a result, commercial operations of the subsidiary were

ceased in October 2010. Acuity Partners (Pvt) Ltd., which was newly

formed in 2008, as a Joint Venture with DFCC Bank incorporating the

businesses of stock brokering , xed income securities, corporate

nance and venture capital, posted excellent returns with a

consolidated after tax pro t of Rs 301 Mn. After the acquisition by

Acuity Partner ( Pvt) Ltd, Lanka Venture PLC was repositioned during

2010 , with the venture capital company’s main operational lines

focused towards healthcare and renewable energy; an initiative that

is directly in line with meeting national developmental priorities. The

Lanka Ventures Group posted commendable returns of Rs 102.6 Mn

(after tax) during the nine months to December 2010.

In last quarter of 2009, the Government of Sri Lanka instituted a

reduction in domestic interest rates amongst the State banks with a

view to precipitate post con ict development. In the rst quarter of

2010, the nancial services industry witnessed a pervasive reduction

of domestic interest rates as the Government looked to bolster and

accelerate the rate of investment. However, as consequence

nancial institutions grappled with the dilemma of balancing

re-pricing of assets whilst liabilities partly remained contracted to

pre-agreed rates. Whilst liability re-pricing

was a key concern for the Bank over the rst

half of the year, concentration on asset

re-pricing was a key area of focus over the

remaining quarters.

As a direct outcome of the interest rate

decline, the rst half of the nancial year was

characterised by declining asset and liability

books, due largely to sluggish domestic

credit growth, thus precipitating a dip in the

net interest income and a ecting the top

line targets for the year. However, in the

second half of 2010 domestic credit growth

witnessed a commendable recovery, placing

10 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

the Bank’s performance for the year in better light. In particular, the

expectations for 2011 remain high should the credit growth trend

continue with the same momentum witnessed during the last

quarter of 2010. From a macro perspective, the nancial services

industry as a whole was negatively a ected with credit growth at a

marginal 3.8% during the rst quarter of the year. Credit growth did

however, recover aggressively to end the year with a 22.6% growth.

A stable exchange rate scenario in 2010 saw the Sri Lankan Rupee

strengthen against the greenback. Despite the lack of a scenario of

exchange uctuations that normally sets the stage for exceptional

exchange income, the Bank remained one of the few in the industry

to achieve commendable foreign exchange income which re ected

12.5% growth over the previous year.

On a macro level, the year was de ned by commendable

achievements. Despite the challenges posed during the year and

the somewhat discouraging credit growth scenario during the rst

half of 2010, the Bank continued to execute its strategies for future

growth with urgency and priority with the intention to build

capacity in readiness for future growth. As such, the Bank’s plans to

increase accessibility were well executed with the opening of 19

customer centres and the commissioning of 40 additional

Automated Teller Machines (ATM), sustaining an equitable rural, semi

urban reach of the Bank’s services. The enhanced distribution

network is undoubtedly a platform for greater mobilisation of

services going forward and is a strategic initiative that is well aligned

with the national vision for rural empowerment.

As in previous years credit quality remained an area of critical focus.

The Bank worked tirelessly towards the achievement of a

signi cantly reduced Non Performing Advances portfolio (NPA). Its

strategies towards this end enabled the Bank to successfully

constrain NPAs to achieve a gross NPA below 5 percent for the year,

the lowest achieved in over a decade. The excellence in NPA

management placed the Bank well above the industry norm of 5.3%

for NPA. The Bank’s diligent and relentless pursuit of portfolio quality

continued to pay dividends in 2010 as in the previous nancial year.

However, in 2010 the cost to income ratio increased marginally to

56.5%, and remained below expectations. Cost to income remains a

critical area of concern, with the need to break through the 50%

psychological barrier imperative in the medium term.

During the year asset growth was managed through internal

sources, with primary dependence on the plough back of internally

generated pro ts. However, going forward, the Bank may objectively

consider external nancing options to add impetus to growth in the

medium term.

Risk management and governance took centre stage during the

nancial year, with the Bank placing due emphasis on the full

integration of BASEL II whilst being mindful of the recent

announcements on the requirements of the BASEL III road map. In

addition, the Bank is steadfastly pursuing preparations for the

adoption of Sri Lanka Accounting Standards 44 –“Financial

Instruments: Presentation” and Sri Lanka Accounting Standards 45

–“Financial Instruments: Recognition and Measurement”. The Bank

remains on target to adopt the Standards by January 2012.

Recognition of Excellence

In 2010, the Bank received numerous accolades as recognition for its

outstanding performance and service excellence. In this review,

I wish to make mention only of a few of these accolades as these

alone vividly portray the successes of the Bank in diverse areas of

operational and performance excellence

Hatton National Bank was the winner for the “Best Retail Bank in

Sri Lanka 2009” presented by “The Asian Banker” in The Asian Banker

Excellence in Retail Financial Services Awards 2010 for the third

consecutive year. Likewise, Euromoney Finance Magazine

recognised the Bank as the “Best Bank in Sri Lanka” at the Euromoney

Awards for Excellence 2010 for second consecutive year. The Bank

swept the prestigious Institute of Chartered Accountants of

Sri Lanka (ICASL) Annual Report Awards 2009 Competition

organised by the Institute of Chartered Accountants of Sri Lanka

winning four Gold Awards including the Cyril Gardiner Memorial

On a macro level, the year was de ned by

commendable achievements. Despite the

challenges posed during the year and the

somewhat discouraging credit growth

scenario during the rst half of 2010, the

Bank continued to execute its strategies for

future growth with urgency and priority

with the intention to build capacity in

readiness for future growth.

CHIEF EXECUTIVE

OFFICER’S REVIEW

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 11

Trophy for Overall Excellence and Edmond J Cooray Memorial

Trophy for Banking Sector Excellence for the second consecutive

year. It was the rst time in the history of ICASL Annual Report

Awards, that a participating institution won 4 gold awards in one

particular year and is indeed a feat that demonstrates the Bank’s

commitment to the highest levels of transparency and accuracy.

During the year, the Bank garnered further recognition by being

ranked First in Asia in terms of “Total Shareholder Return” in the last

ve years (2005-2009) under the category of ‘Small Cap Banks’

according to the Investor Audit Services of The Asian Banker.

These awards and accolades recognise the Bank for an array of

achievements – nancial performance, sustainability, business

model and strategy, and reporting initiatives - and therefore are a

sound representation of the Bank’s all round focus on achieving

excellence.

Future outlook

The Government’s budget proposals for 2011 placed the nancial

services sector on a strong footing for robust growth. The

Government proposed to abolish the bank debit tax so that

withdrawals from banks will not be liable for any tax, to reduce VAT

on nancial services to 12% from 20% and to implement a reduced

income tax structure on pro ts (with cap of 35% reducing to 28% )

of banking and nancial institutions applicable uniformly to all

o -shore and domestic banks as well as to nance companies,

leasing, insurance and other specialised banking and nancial

services. The Bank intends to reciprocate the Government’s gesture

of goodwill by ably leveraging its balance sheet towards the

national development agenda in particular, by taking longer term

tenor risk on project and development banking lending activity.

In moving forward, the Bank will continue to expand the distribution

network to bene t from the opportunities in post con ict Sri Lanka

whilst continually strengthening the Bank’s capital base.

In 2010 an industry-consolidated framework became reality and

going forward, it is hoped that the framework will be consistently

strengthened. It is the Bank’s intention to be involved from a

leadership standpoint in the future development of this initiative by

actively pursuing opportunities for growth through mergers and

acquisitions.

Appreciations

I would like to extend my sincere appreciation to the Governor of

the Central Bank of Sri Lanka and his able sta for their tremendous

support throughout this nancial year. My deepest gratitude to the

Chairman and my fellow Board of Directors for their continuous and

consistent support, encouragement, wisdom, input and guidance.

A special appreciation to my Chairman Mr Rienzie T. Wijetilleke for

his invaluable wisdom and advice which will be missed as he does

not intend seeking re- election to the Board of Directors at the forth

coming Annual General Meeting. To the HNB team, thank you for

your persistent perseverance and passion, you have been the

engine of our Bank’s success. We have many more great things to

achieve for the future, and I am con dent that we will leave Hatton

National Bank’s indelible mark on Sri Lanka’s future prosperity.

Rajendra Theagarajah

Managing Director / CEO

Colombo, Sri Lanka

18th February 2011

12 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

MANAGEMENT INFORMATION

EMPOWERING DELIVERY

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 13

Board of Directors 14

Corporate Management 16

Senior Management 19

14 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

BOARD

OF DIRECTORS

Mr Rienzie T. Wijetilleke

Chairman

Mr Rajendra Theagarajah

Managing Director / Chief Executive O cer

Mr R K Obeyesekere

Director

Mr D H S Jayawardena

Director

Mr M V Theagarajah

Director

Mr N G Wickremeratne

Director

Ms Pamela C. Cooray

Director

Mr Ranjeevan Seevaratnam

Director

Ms M A R C Cooray

Director

Ms Indrani Goonesekera

Board Secretary

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 15

Chairman

Mr Rienzie T. Wijetilleke

F.C.I.B. (London), F.I.B. (Sri Lanka)

Managing Director & Chief Executive O cer

from July 1988 to December 2004. He counts

over fty years as a practicing Banker, including

overseas assignments. Appointed Chairman in

March 2004. He is also the Chairman of HNB

Assurance PLC, Sithma Development (Private)

Ltd and Sunshine Holdings PLC and a Director

of Nawaloka Hospitals PLC, Ceylon Biscuits Ltd

and Mahaweli Reach Hotels PLC. He was

Chairman of HNB Stockbrokers (Pvt) Ltd (up to

3rd November 2008) and HNB Securities Ltd

(up to 4th November 2008). He was former

Chairman of the Colombo Stock Exchange.

Managing Director/

Chief Executive O cer

Mr Rajendra Theagarajah

F.C.M.A. (U.K.), F.C.A (Sri Lanka), M.B.A. (Cran eld),

F.I.B. (Hon) Sri Lanka

Appointed Director/General Manager/Chief

Executive O cer in December 2004. He was

appointed Managing Director in December

2005. Member of the Corporate Management

of HNB since 1997. He counts over 26 years in

Banking including overseas assignments. He is

a Director of HNB Assurance PLC, Acuity

Partners (Private) Ltd, Sithma Development

(Pvt) Ltd. He is the Chairman of Acuity

Securities Ltd, Acuity Stockbrokers (Pvt) Ltd

and Lanka Financial Services Bureau Ltd. He

was a past Chairman of Sri Lanka Banks’

Association (Guarantee) Ltd and Financial

Ombudsman Sri Lanka (Guarantee) Ltd and

Chairman of the Asian Bankers Association.

Member of the Sri Lanka Accounting &

Auditing Standards Monitoring Board, Ceylon

Chamber of Commerce and Chartered

Institute of Management Accountants

Governing Board Sri Lanka. Council Member of

the Institute of Directors of Sri Lanka.

Director

Mr D H S Jayawardena

Director since 1988. He is the Chairman of

Stassen Group of Companies, Aitken Spence

Group of Companies, Lanka Bell (Pvt) Ltd,

Periceyl (Pvt) Ltd, the Chairman and Chief

Executive O cer of Distilleries Company of Sri

Lanka PLC, Lanka Milk Foods (CWE) PLC,

Balangoda Plantations PLC, Madulsima

Plantations PLC and Browns Beach Hotels PLC

and the Chairman of the Ceylon Petroleum

Corporation. He is also the Consul-General for

Denmark in Sri Lanka. He was awarded the

Knight Cross of Dannebrog by Her Majesty the

Queen of Denmark.

Director

Mr M V Theagarajah

F.C.M.A. (U.K.), F.C.I.A.A., F.I. Mgt. (London)

Associated with the Bank since its inception

and a Director since 1979. He retired as

Chairman of the Browns Group of Companies

on 30th June 2006. He has over 45 years

experience in commerce, nance, industry and

management.

Director

Mr R K Obeyesekere

Director since 1998. He was former Deputy

Chairman - Sri Lanka Insurance Corporation.

He is a Director of Stassen Group of

Companies, Lanka Milk Foods (CWE) PLC,

Distilleries Company of Sri Lanka PLC,

Madulsima Plantations PLC and Lanka Dairies

(Pvt) Ltd.

Director

Ms Pamela C. Cooray

LL.B.

Appointed Director in April 2004. She was a

past Director of the Board of Investment of

Sri Lanka and Associated Battery

Manufacturers (Ceylon) Ltd.

Director

Mr Ranjeevan Seevaratnam

B.Sc (London), F.C.A. (England & Wales), F.C.A. (Sri Lanka)

Appointed Director in March 2007. Former

Partner of KPMG Ford Rhodes Thornton & Co

– Chartered Accountants. He is a Director of

Haycarb PLC, Dipped Products PLC, Diesel &

Motor Engineering PLC, Acme Printing &

Packaging PLC, Acme Packaging Solutions

(Pvt) Limited, Metecno Lanka (Pvt) Limited,

Classic Teas (Pvt) Limited, Tea Small Holders

Factories Limited, Green Farms Limited,

Hayleys MGT PLC, Tokyo Cement PLC, Nestle

Lanka PLC, Shaw Wallace & Hedges PLC, Shaw

Wallace Marketing Ltd, Lanka Aluminium

Industries PLC, Kelani Valley Plantations PLC,

Colombo Fort Land & Building Co PLC.

Director

Mr N G Wickremeratne

B.Sc University of Ceylon, Peradeniya, Sri Lanka

Appointed Director in July 2009. Former

Chairman of Hayleys PLC. and Chief Executive

of Dipped Products PLC from its inception to

2007. He is a Director of Finlays Colombo PLC.

He had chaired the Sri Lanka Association of

Manufacturers and Exporters of Rubber

Products, served as a Committee Member of

the Ceylon Chamber of Commerce and had

been its representative on the National Labour

Advisory Council. He is past President of the Sri

Lanka-France Business Council.

Director

Ms M A R C Cooray

B.A. (Hons,) University of Ceylon, Peradeniya, Sri Lanka

Msc. Strathclyde University, U.K.

Appointed Director in February 2010. She is a

retired Deputy Governor of the Central Bank of

Sri Lanka after a period of service of over 35

years. She is a Director of Ceylon Guardian

Investment Trust PLC and Ceylon Investment

PLC .

On release from the Central Bank, she had

served the Ministry of Finance in the capacity

of Director General Fiscal Policy and Economic

A airs Department for nearly 6 years,

represented the Government on the Boards of

DFCC Bank, Sri Lanka Institute of Information

Technology, Sri Lanka Telecom, Ceylon

Electricity Board, De La Rue Currency and

Security Print (Pvt) Ltd., Export Development

Board, National Housing and Development

Authority, and represented the Monetary

Board on West Coast Power (Pvt) Ltd.

She has served as the Vice Chairperson of the

Institute of Bankers of Sri Lanka for 5 years.

Board Secretary

Ms Indrani Goonesekera

Attorney-At-Law

Appointed Board Secretary in April 2001. She is

the Deputy General Manager (Legal) of the

Hatton National Bank PLC and is a member of

the Corporate Management of the Bank for

over 14 years. She is also the Board Secretary of

HNB Assurance PLC, Sithma Development (Pvt)

Ltd and was the Board Secretary of Acuity

Securities Limited (formerly HNB Securities

Limited) up to 31st December 2010).

16 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

CORPORATE

MANAGEMENT

Rajendra Theagarajah

M.B.A. (Cran eld), F.C.M.A.(UK), F.C.A. (Sri Lanka)

Managing Director / Chief Executive O cer

J D N Kekulawala

M.B.A. (Manchester), F.C.I.B.(London),

F.C.A.(England & Wales)

Senior Deputy General Manager

- Strategy & Compliance

Ms D C Cooke

F.C.A.(Sri Lanka)

Deputy General Manager

- Operations & Systems

A J Alles

M.B.A. - Finance (Stirling), A.I.B. (Sri Lanka)

Chief Operating O cer

J M J Perera

F.C.I.B. (London)

Senior Deputy General Manager - Business

Development & International Relations

C P Abeywickrema

B.Com. (Special) Sri Lanka

Deputy General Manager

- Marketing & Retail Banking

Ms I Goonesekera

Attorney-at-Law & Notary Public

Deputy General Manager (Legal ) /

Board Secretary

Ms I R D Thenabadu

F.C.I.B. (London), F.C.M.A.(UK)

Deputy General Manager

- Corporate Banking

J R P M Paiva

B.A. (Hons) Ceylon

Deputy General Manager

- Human Resources & Administration

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 17

Ms L L C C Thambiah

Deputy General Manager

- Network Management

P Sridharan

Assistant General Manager

- Personal Financial Services

M Asokan

F.C.A. (Sri Lanka), A.C.M.A. (UK),

C.I.S.A. (USA), C.I.A (USA)

Head of Internal Audit

P D Hennayake

M.B.A. (A.I.T) Thailand, P.G. Dip (Eng.), B.Sc. Eng.

(Hons) Moratuwa , C.Eng., M.I.E. (Sri Lanka)

Deputy General Manager - Services

D P N Rodrigo

M.B.A. (Cran eld), F.C.M.A.(UK), F.C.C.A.

Deputy General Manager - Risk

R H Abayasekara

Assistant General Manager - Correspondent

Banking & International Operations

A Ratnasabapathy

F.P.M.A.

Assistant General Manager

- Corporate Banking

A P L Fernando

M.B.A. (Colombo), F.I.B. (SL),

Dip. in Bank Mgmt. (IBSL)

Assistant General Manager - Recoveries

& Credit Quality Management

D A de Vas Gunasekara

A.C.A, F.C.M.A. (Sri Lanka)

Chief Financial O cer

18 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

CORPORATE

MANAGEMENT

D St E Fernando

Assistant General Manager - Operations

R M P Dayawansa

M.B.A. (Sri J.), F.I.B. (SL), F.C.I.M. (UK), F.S.L.I.M.

Assistant General Manager

- Specialised Financial Services

Ms K A L T Ranaweera

Attorney at Law, LL.M. (Cambridge),

Dip. in Int’l. A airs (BCIS)

Assistant General Manager

- Legal

N U Jumat

F.I.B. (Sri Lanka)

Assistant General Manager - Trade Services

R J Thambirajah

Assistant General Manager

- Network Management

Ms S Gnanapragasam

BSc. (Hons), F.C.M.A.(UK)

Assistant General Manager

- Treasury & Markets

Ms L C Cooray

Dip. in HR (IPMSL), I.P.M.A. - CP (USA)

Assistant General Manager

- Human Resources

S N Wijeratne

M.B.A. (Sri J.), B.Sc. (IT) - UK

Assistant General Manager

- Information Technology

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 19

SENIOR

MANAGEMENT

1 K L Wijesooriya

LL.B (Sri Lanka)

Chief Manager - Remittances

2 V Vijayakumar

M.Sc. (I.T.) UK, A.I.B. (SL), M.I.M.I.S. (Lond.),

A.M.I.A.P. (Lond.), M.A.A.T. (SL), M.B.C.S.

Chief Manager - IT Operations

3 B K Wijeratne

B.Sc. (Physical Science) Colombo

Chief Manager - Leasing

4 P G Wilson

B.Sc. (Kelaniya), Dip. in IT (N.I.B.M), M.C.S.E. - Security

Chief Manager - Network Infrastructure

5 S Sivalingam

A.C.I.B. (London)

Chief Manager - Procurement & Logistics

6 A Goonesekere

M.B.A. (Sri J.),F.C.A. (Sri Lanka), F.C.M.A. (Sri Lanka)

Chief Accountant

7 R B Warnakulasuriya

M.B.A. (Sri J.), B.Com. (Special) Kelaniya, M.A.A.T, A.I.C.M.

Chief Manager - Greater Colombo Region

8 V Ratnasabapathy

A.C.I.B. (London)

Chief Manager - Credit Risk

9 U N I Elapata

B.A. (Hons) - Uni. of Texas (Austin)

Chief Manager - Card Centre

10 Ms R Prabhakaran

A.I.B. (Sri Lanka)

Chief Manager - Treasury / International Operations

11 Ms N M C P Wettasinha

Attorney-at-Law & Notary Public

Senior Manager - Legal

12 S Udayakumar

D.B.A. (UK), B.Sc. (AM), M.C.M.I. (Lond), M.S.L.I.M, Dip. in Busi. Mgmt & Admin

(UK), M.C.P.M.(SL), Dip. in Sales Mgmt & Marketing (UK), A.I.T.D. (SL)

Deputy Regional Head - Greater Colombo Region

13 J T M Weeresinghe

Senior Manager - Credit Risk

14 Ms M K Rambukwella

M.B.A. (Sri J.), M. Sc. (Pera.), B.A. (Hons)- (Pera.)

A.C.I.M. (UK), M.S.L.I.M., A.M.I.T.D.(SL)

Senior Manager - Training & Development

15 A G Gomez

Senior Manager - Treasury

16 Ms K Balasubramaniam

LL.B (Sri Lanka)

Senior Manager - Human Resource Management

17 H J A Ferdinando

Senior Manager - Centralized Operations

18 L S C L R Fernando

A.I.B. (Sri Lanka)

Senior Manager - Central Region

19 N M Kulatunga

M.B.A. (Sri J), A.I.B. (Sri Lanka)

Senior Manager - Credit Administration

20 W J T Fernando

M.B.A. (Sri J), A.I.B. (Sri Lanka)

Senior Manager - North Western Region

21 D S L Ferdinando

Senior Manager - Corporate Account Relationship

22 A R Uduwela

M.B.A. (Sri J), B.Sc. Special (Pera.)

Senior Manager - City O ce

23 P H K S C Ranasinghe

B.Sc. (Eng.) Moratuwa, A.C.M.A. (UK)

Senior Manager - IT Strategy & Solutioning

24 W M C O Panditharatne

Senior Manager - Employee Remuneration & Bene ts

25 L S Sameera

C.Eng., M.B.C.S., C.I.T.P., M.C.S. (SL),C.M.A. (Australia)

Senior Manager - IT Software Development

26 R L Maheswaran

Senior Manager - Pettah

27 Ms G Arjuna

F.C.M.A. (UK)

Senior Manager - Personal Financial Services

28 N Y Liyanage

N.D.T. (Civil Eng.) - Moratuwa, P.G. Dip. in Project Mgmt. (Moratuwa),

A.M.I.E (Sri Lanka), M.S.S.E.(Sri Lanka)

Senior Manager - Premises & Engineering

29 P Parananthan

P.G. Exe. Dip. in Bank Mgmt. (IBSL)

Senior Manager - Pawning

30 A V Abeygunasekara

M.B.A. (Colombo), B.Sc. (Hons.) (Colombo), A.C.M.A. (UK)

Senior Manager - Treasury

31 B K Achan

M.Sc. (Bombay) B.Sc. (Hons) (Calcutta),C.A.I.I.B.(India)

Chief Representative O cer - Chennai

32 Kausar Ali

B.Com.

Chief Representative O cer - Karachi

20 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

MANAGEMENT DISCUSSION

DELIVERING STRATEGIES

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 21

Corporate Banking 22

Small And Medium Enterprises 23

Personal Financial Services 24

Development Banking 27

International Operations 29

Treasury Operations 31

Information Technology 32

Marketing 33

HNB Assurance PLC 35

Sithma Development (Pvt) Limited 36

Exchange Houses 37

Acuity Partners (Pvt) Ltd 38

Main Correspondents Worldwide 39

Customer Centre Network 40

Financial Review 42

22 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

As the year 2010 progressed, Sri Lanka’s economy

geared itself for a revival on the back of sound

economic policy and governmental stimuli

steering the nation towards greater prosperity.

The high interest rate scenario which has by large

been attributed for the lack of economic inertia

in the past, was reversed with interest rates

reduced to a six year low in the fourth quarter of

2010. However, despite the aura of future

economic con dence and expectations for

accelerated investment, the corporate banking

sector as an industry demonstrated slow growth

in the 1st half of the year. This trend is of course

expected to reverse in 2011 with the full impact

of interest rate cuts and other governmental

policy stimuli accelerating the rate of investment,

as was witnessed in the fourth quarter of 2010,

where precipitated growth pushed overall

performance upwards.

Whilst in the previous year the Bank has

opportunely utilised the year to revisit and

reinforce business processes, in 2010 the focus

lay on strengthening customer relations.

Extensive customer portfolio evaluations, market

and sector based analysis and strategic

development of key growth drivers were

emphasised upon as fundamental bases in

readiness for the future.

Corporate Banking

Despite the low appetite for corporate funding in

the rst half of 2010, the portfolio was

maintained and grown with aggressive recovery

strategies contributing to the maintenance of a

healthy portfolio. The depressed demand for

capital despite an increased interest in speci c

core sectors such as tourism, hospitality and

infrastructure contributed towards high market

liquidity. The lack of conversion of interest to

action remained a key concern during the year,

although expectation of these conversions to

investment in 2011 remains probable, especially

in light of the accelerated growth witnessed in

the nal quarter of the year under review. The

Bank continued to spearhead the entry of private

sector nancing into large-scale infrastructure

development projects such as utilities and road

development.

The Division actively facilitated capital for share

trading as interest in the share market grew

exponentially during the year whilst vehicle

nance also remained a key area of interest

especially with respect to nancing of vehicles

that are in the high-end price tier.

Project Finance

Project Financing continued to be focused on

renewable energy and power generation

projects during the year under review, as has

been the norm in the previous nancial year.

Continued interest in the sector has been

precipitated by the growing global, socio-

economic debate on the need for green energy,

and the Bank’s emphasis on garnering a greater

level of involvement in the energy sector,

speci cally as it has been recognised as a

strategic value driver, going forward.

In the latter half of the year 2010, as the tourism

industry gained momentum, a spike in tourism

sector related nancing opportunities arose and

have been undertaken for facilitation in 2011,

consequent to appraisal. The healthcare sector

remained bullish during the year with the Bank

nancing healthcare and hospital projects in the

Northern province, including the construction of

a full service hospital in Ja na.

New market development was judiciously

explored during the year with planned entry into

Bangladesh as a new market for project

nancing, subsequent to successful project

implementation in the Maldives and the African

continent in previous years.

Astute yet innovative strategies, a focus on quality,

enhanced monitoring, controls and continuous

prudent evaluations were the hallmark for

Corporate and Project Finance operations during

the year under review.

Small and Medium Industries (SMI)

Financing for the Small and Medium Industries

category gathered further momentum in 2010 with

renewed accessibility to enterprises in the Northern

and Eastern provinces as well. The Bank has viewed

this geographic area as a viable growth market for

decades, and consistent and sustained emphasis in

the development of this market through nancial

accessibility has led to the establishment of strong

relations with Small and Medium Industries (SMIs).

SMIs such as Agriculture including Tea and Fisheries,

Construction and Tourism demonstrated capacity

for growth and have been key areas where Hatton

National Bank actively facilitated capital investment

in view of the strategic importance of these sectors

to the national economy.

Future Outlook

In the short term, the Bank will look towards

capitalising on the growing interest of customers

on the Colombo Stock Exchange as a viable

investment tool. Thus, in 2011 the launch of margin

trading as a new product is under consideration.

The product will be fully developed with formalised

processes and will be o ered as a cohesive

corporate banking service.

In the medium term, focus will remain on the

growth of international markets as a key pillar for

future sustainability of the business. Thus, new

markets such as Bangladesh will continue to be

explored. On the domestic front, focus on the

above sectors as catalysts to economic recovery will

no doubt necessitate adequate nancial support.

The Bank plans to facilitate and meet these needs

especially in national priority sectors such as Dairy,

Agriculture, Tourism, Port & Aviation and Hospitality.

MANAGEMENT

DISCUSSION

Focus:

Fundamental bases

strengthened to

overcome industry

slack

CORPORATE

BANKING

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 23

From the inception of the Bank over a century

ago, Hatton National Bank’s focus on Small and

Medium Enterprises (SME) has been one

driven by the desire to grow and develop the

small scale entrepreneur. In 2010, the Bank

took this focus a step further, in full alignment

with the national vision to develop the SME

sector to be core contributors to national

wealth creation.

During the year, in recognition of the

importance of small and medium scale

entrepreneurs to the growth of Sri Lanka’s

national economy, the Bank proactively

positioned itself as the Small and Medium

Enterprise Development Partner through the

development of a nancial solution that meets

the full range of nancial needs of SMEs. This

sectoral product is expected to be launched in

the rst quarter of the upcoming nancial year.

Through the utilization of the product the

Bank is expected to, accelerate its reach to

SMEs in the rural pockets of Sri Lanka. Through

the o er of a full range of nancial solutions to

the SME sector, the Bank expects to engage

the sector e ectively in capacity building,

thereby ensuring not only its long-term

sustainability but also the sustainability of its

contribution to the national economy. The

Bank views its strong brand equity, branch

network and retail banking expertise as core

competencies for the future success of the

product.

Garnering experience and strength from its

operations in the sector, the Bank continued to

pursue a strategy of qualitative portfolio

management comprising mainly of improved

credit evaluation techniques and the utilisation

of a variety of risk management tools,

including credit scoring, to identify viable

ventures. Over the past ve years, the Bank’s

lending strategy has shifted primarily to

working capital nance and cash ow

management moving away from the

traditional security oriented lending. In line

with this move, the Bank advises customers to

undertake business planning in a systematic

manner, thereby assisting them in viable

business management.

Future Outlook

In the short term, the launch of the new SME

product in 2011 will energise the Bank’s

operations in the sector, sharpening the focus

and increasing the scope and scale of SME

services. It is expected that in the medium

term, SME will contribute signi cantly to the

Bank’s overall business performance whilst

acting as a catalyst in the economic

performance of the nation.

Focus:

Activating economic

development

through pro-active

partnerships

SMALL AND

MEDIUM

ENTERPRISES

24 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

Hatton National Bank from its inception has

been a Bank driven by the needs of its retail

customer base. The Bank’s retail banking

service and product portfolio is composed of a

wide spectrum of personal nancial services

that endeavour to meet every nancial need of

a retail customer. In 2010, the Bank persisted

with its two-fold strategy of retail banking

service penetration whilst preserving the

quality of the lending portfolio.

National well-being has been at the pinnacle

of Hatton National Bank’s concerns throughout

its operational history. Whilst in the past, the

Bank strived to cater to the people of Sri Lanka

– across every stratum of demography and

geography – through nancial solutions that

embraced people who had previously been

excluded as non-bankable, in 2010, the Bank

made headway in assisting the realisation of

the national strategy for reconstruction of the

Northern and Eastern provinces. Accelerated

penetration into the region with nancial

solutions and nancial literacy programmes

has enabled Hatton National Bank to truly

justify its market position as a leader and a

“partner in progress”.

The Bank’s national-focused strategy drew

international accolades in the year under

review. Hatton National Bank was recognised

for the third consecutive year as Sri Lanka’s

Best Retail Bank - winning the award for the

year 2009 in the ninth Asian Banker Excellence

in Retail Financial Services Awards Programme.

The Bank received the award at The Asian

Banker Excellence in Retail Financial Services

Awards 2010 ceremony, held in conjunction

with the region’s foremost retail banking event,

the Excellence in Retail Financial Services

Convention. The international Euromoney

Finance Magazine also recognised the Bank as

the “Best Bank in Sri Lanka” for the second

consecutive year at the Euromoney Awards for

Excellence 2010. The Bank’s role in acting as

the foundation of the banking industry

through pervasive personal nancial services

within the periphery of sustainable business

practice continued to be the bed-rock of its

success in the year under review.

Providing accessibility to every

customer across the nation

In the year 2010, the Bank accelerated its

network expansion to cater even to the most

remote villages across the nation. At the end of

the nancial year, 205 customer centres were

open for business, enabling people across the

nation to have access to a ordable nance

and nancial services. During the year, in

support of the national strategy for re-

integration of the Northern and Eastern

provinces and with a view to catalyse

economic activity in the Region, the Bank

focused its network expansion e orts on the

North-East whilst penetration into the less

accessible regions of the Southern and North

Western Provinces was also focussed on.

In line with the overall business strategy, the

Bank initiated a drive to upgrade the network

with customer centres enhanced to meet the

standard requirements of a Branch while

extension o ces were upgraded to operate as

separate business units, responsible for their

pro tability. The network upgrade has been

implemented during the year with a view to

enhance the customer service at every point

of customer access. With greater responsibility

meted out to extension o ces, the Bank

believes that the customers will be better

served with access to a larger portfolio of

services even in the most remote of locations.

In the medium term, Hatton National Bank will

execute an enhanced network strategy with

the intention of operating extended-hour

banking across all regions. This will entail the

operation of seven day banking branches,

Sunday banking centres, and the

commencement of specialist centres that

focus on a limited number of nancial services

for the retail customer.

One of the widest Automated Teller

Machine (ATM) penetrations in the

country

The Bank, during the year under review

furthered its strategy of greater accessibility

through the aggressive expansion of electronic

delivery channels, speci cally through

enhanced penetration of the ATM network.

With the commissioning of the 350th ATM in

2010, Hatton National Bank is widely regarded

as having one of the widest ATM penetrations

in Sri Lanka. The network caters not only to the

Bank’s own debit and credit card holders but

also provides accessibility to holders of Visa

and MasterCard credit and debit cards,

Maestro debit cards and Cirrus ATM cards.

The Bank currently maintains 287 on-site (at

customer centre premises), and 63 o -site

ATMs spread across the island. This number

also includes two “drive-thru” ATMs located at

the Bank’s Head O ce, “HNB Towers”, and at its

Priority Banking Centre. In the ATM expansion

process during the year, priority consideration

was given to the establishment of stand-alone

ATMs in a bid to enhance the accessibility and

service at strategic locations across the

country. During the year 2010, 40 new ATMs

were commissioned in total, out of which 27

locations are out of Colombo, at key public

places.

The ATM network was further upgraded during

the year with a view to providing a stable

backbone required to facilitate the aggressive

ATM expansion drive. An advanced ATM

monitoring system with the highest levels of

on-site security a ords customers the

reassurance of secure transactions. A 24-hour

customer help desk has also greatly improved

service levels by reducing response time. The

Focus:

Providing access to

nance to stimulate

national wealth

creation

PERSONAL

FINANCIAL

SERVICES

MANAGEMENT

DISCUSSION

HATTON NATIONAL BANK PLC ANNUAL REPORT 2010 25

introduction of several value additions to the

ATM services enabled the expansion of the

service o ering via electronic channels.

E-Banking as an alternate channel

for service delivery

Hatton National Bank recognises the need to

look beyond traditional delivery channels in

an era where consumers are gaining

sophistication in the manner in which they

transact and interact with service providers.

Whilst the Bank’s traditional brick and mortar

service delivery – the branch network, micro

banking infrastructure etc – reaches out to

the majority of the Bank’s customer base, a

growing demand for alternate delivery

channels has driven the growth of Bank’s

E-banking solutions. With the growth of

Internet and mobile telephony penetration in

Sri Lanka, this trend is expected to grow.

The Bank’s Internet Banking Service, “Virtual

Branch” was revamped during the year with

the introduction of a new User Interface to

facilitate a more user-friendly online

experience for customers. The migration of

the Internet Banking solution to “Finacle” – the

Bank’s core banking platform was completed

on schedule during the year, and has enabled

the Bank to o er a wider range of services via

its Virtual Branch. The migration has also

enhanced the service through lowered

transactions costs, greater exibility and

greater security in transactions.

The Virtual Branch continued to garner

increased tra c and transactions with over

154,000 nancial transactions exceeding

Rs 2.7 Bn completed during the year. The

usage of SMS and Mobile Banking evidenced

a growth of 32% during the year with over

1,500 transactions carried out monthly on

average at a total transaction value of Rs 3.2

Bn over the year.

Deposit Mobilisation

The year 2010 was a commendable year from

the perspective of Rupee deposit

mobilisation. The Bank witnessed sound

growth spurred primarily by savings, lifestyle

and products targeting minors. In 2010 the

Bank’s rupee deposit mobilisation drive

garnered a deposit base of approximately

Rs 25 Bn. Thus, Year on Year (YOY) deposit

growth was a commendable 15% from that

of 2009, a growth trend that is indicative of

the success of the Bank’s deposit mobilisation

strategy for the year.

Driven by Hatton National Bank’s agship

deposit mobilisation tool – HNB Pathum

Vimana- that has been the key stimulus for

savings mobilisation over the past 17 years,

the Bank’s savings base grew exceptionally in

the year under review. Pathum Vimana has

been an e ective means to rally low interest

cost savings accounts from across the nation.

It has e ectively enabled the Bank to expand

the savings deposits as a result of the

successful appeal of the Draw, and in the year

2010 Pathum Vimana stimulated a 23%

growth. Savings products – Singithi Kirikatiyo

and Singithi Lama – aimed at inculcating the

habit of thrift amongst children e ectively

drew in substantial deposits during the year.

The interest rate decline in the latter half of

the year, led to contracted returns from term

deposits which in the previous year had

already been experiencing sti ed growth due

to intense market competition. In 2010, Term

deposits contracted by 3%. However, the

impact of the contraction in Term Deposits

was considerably o set by the Bank’s ability

to strategically utilise the Pathum Vimana

Draw to convert existing Term Deposits to

Savings upon maturity, thus retaining the

deposits within the Bank.

Capital Savings performed commendably to

post a 64% growth. Capital Savings has been

a bene cial tool in attracting savings from the

more urban market and is a critical tool in

penetrating the Socio-Economic Class A and

B demographics even though the product is

less pro table to the Bank due to the relative

high cost of capital.

Foreign Currency deposits witnessed a

marginal decline in growth due to declining

interest rates. NRFC and RFC deposits were

marketed aggressively through the relaunch

of HNB Pathum Udanaya Draw as HNB World,

with greater brand appeal and reach to a

greater global audience.

Pawning

Pawning as a product has seen tremendous

growth in terms of its contribution to the

Bank’s bottom-line and has emerged as a

pivotal product in the retail-banking sector

from an industry perspective. In 2010, Hatton

National Bank retained its leadership position

as one of the top 3 in the Banking sector.

Deploying a strategy aimed at growing the

scale of the business through initiatives to

enhance the awareness of the product,

extended banking hours as well as improved

customer service in tandem with revisions to

the scale of advances to customers, the Bank

completed the nancial year with a

commendable performance contribution

from Pawning.

During 2010 the pawning portfolio witnessed

a signi cant increase aiding in the growth of

approximately Rs 6.05 Bn in business for the

year equivalent to 28% YOY growth from

2009. The rising prices of gold in the global

market continued to aid the growth of the

business in 2010.

In recognition of the strategic importance of

the product in the immediate and medium

term, the Bank carried out a series of strategic

evaluations comprising of a comprehensive

competitor and industry analysis, and

undertook primary research to e ectively

understand the needs of the customer in

relation to pawning. Drawing from these

insights to determine a concerted strategic

direction, the Bank aims to grow the pawning

business in the upcoming nancial year.

The Bank’s pawning portfolio retained its high

level of quality despite the aggressive

marketing of the product. The Bank’s strict

compliance and stance towards responsible

lending have ensured that the Bank persists in

strict quality evaluations prior to lending. Due

to keen focus on the quality of the portfolio,

the Bank continued to enjoy a Non

Performing Advances (NPA) ratio below 1%,

and has maintained minimal capital losses

during the year.

26 HATTON NATIONAL BANK PLC ANNUAL REPORT 2010

Leasing

Leasing as a product rebounded in the year

2010, stimulated by the Government’s

relaxation of duty on vehicle imports. The

market opportunity for the product grew

exponentially with the growth in the market

for new and reconditioned vehicles. As a

result in 2010, the Bank’s leasing products

performed commendably and recovered

from lackluster performance in the previous

nancial year. Witnessing a 49% overall

portfolio growth, the Bank experienced a

signi cant growth in new business as well.

Improved economic conditions realised an

increase in recoveries and overdue payments,

thereby improving the overall cash ows

during the year.

The Bank focused its marketing of the leasing

products mainly in the rural and outstation

areas across Sri Lanka with particular

emphasis on the Northern and Eastern

Provinces. Joint promotions with automotive

dealers and leasing fairs in key locations

constituted the crux of the marketing drive

whilst one on one campaigns with vehicle

importers were also carried out. With the

support of the Bank’s extensive distribution

network, Hatton National Bank retained its

leadership position amongst the

commercial banks. However, specialised

leasing and nance companies continued to

dominate the market and increased their

competitiveness in the marketplace. Going

forward, the Bank looks to implement key

strategies to maintain the momentum of

growth in the upcoming nancial year.

Housing Loans

The housing loan portfolio witnessed a

remarkable growth in the second half of the

year on the back of domestic interest rate

reductions and reversed the stagnation that

was evident in the rst half of the year. As a

result, by the end of the nancial year 2010,

the Bank disbursed Rs 5.1 Bn worth of

housing loans, which is a commendable 81%

growth over the previous year. The push was

possible through the twin e ects of the

interest rate reductions – which bene ted the

industry as a whole – and the positive

outcome of a concerted promotional drive,

which e ectively enhanced the appeal of the

Bank’s housing loan product “Shanthi”. The

NPA improved dramatically in the face of

measures undertaken in 2009 to contain the

growth of NPAs as a result of which the

portfolio quality improved during the year.