Interest Rate Volatility and

No-Arbitrage Affine Term Structure Models

∗

Scott Joslin

†

Anh Le

‡

This draft: April 3, 2016

Abstract

An important aspect of any dynamic model of volatility is the requirement that

volatility be positive. We show that for no-arbitrage affine term structure models, this

admissibility constraint gives rise to a tension in simultaneous fitting of the physical

and risk-neutral yields forecasts. In resolving this tension, the risk-neutral dynamics

is typically given more priority, thanks to its superior identification. Consequently,

the time-series dynamics are derived partly from the cross-sectional information; thus,

time-series yields forecasts are strongly influenced by the no-arbitrage constraints. We

find that this feature in turn underlies the well-known failure of these models with

stochastic volatility to explain the deviations from the Expectations Hypothesis observed

in the data.

∗

We thank Caio Almeida, Francisco Barillas, Riccardo Colacito, Hitesh Doshi, Greg Duffee, Michael

Gallmeyer, Bob Kimmel, Jacob Sagi, Ken Singleton, Anders Trolle and seminar participants at the

Banco de Espa˜na - Bank of Canada Workshop on Advances in Fixed Income Modeling, Emory Goizueta,

EPFL/Lausanne, Federal Reserve Bank of San Francisco, Federal Reserve Board, Gerzensee Asset Pricing

Meetings (evening sessions), the 2012 Annual SoFiE meeting, the 2013 China International Conference in

Finance, and University of Houston Bauer for helpful comments.

†

‡

1

1 Introduction

One of the key challenges for stochastic volatility models of the term structures, as observed by

Dai and Singleton (2002), is the “tension in matching simultaneously the historical properties

of the conditional means and variances of yields.” Similarly, Duffee (2002) notes that the

overall goodness of fit “is increased by giving up flexibility in forecasting to acquire flexibility

in fitting conditional variances.” Although the difficulty in matching both first and second

moments in affine term structure models has been a robust finding in the literature, the

exact mechanism that underlies this tension is not well understood. In this paper, we show

that the key element in understanding the tension between first and second moments is the

no-arbitrage restriction inducing the additional requirement to match first moments under

the risk-neutral distribution. Moreover, we show that precise inference about the risk-neutral

distribution has a number of important implications for stochastic volatility term structure

models.

The literature has largely attributed the failures of stochastic volatility term structure

models to match key properties in the data as the tension between the physical first and

second moments. To see the importance of the no-arbitrage constraints, consider, for example,

the deviations from the expectations hypothesis (EH). Campbell and Shiller (1991) show that

when the EH holds, a regression coefficient of φ

n

= 1 should be obtained in the regression

y

n−1,t+1

− y

n,t

= α

n

+ φ

n

y

n,t

− y

1,t

n − 1

+

n,t+1

, (1)

where

y

n,t

is the

n

-month yield at time

t

. However, in the data, the empirical

φ

n

coefficient

estimates are all negative and increasingly so with maturity. Dai and Singleton (2002)

(hereafter DS) show that no-arbitrage models with constant volatility are consistent with

the downward sloping pattern in the data. However, the no-arbitrage models with one or

two stochastic volatility factors are unable to match the pattern in the data. Their results

are replicated in Figure 1.

1

DS conjecture “the likelihood function seems to give substantial

weight to fitting volatility at the expense of matching [deviations from the EH]”.

We estimate stochastic volatility factor models that do not impose no arbitrage but fit

stochastic volatility of yields. In stark contrast to the no arbitrage models, the stochastic

volatility factor models can almost perfectly match the empirical patterns of bond risk

premia as characterized by regression coefficients. This finding clarifies that fitting stochastic

volatility is not an issue per se. Rather, it is the restrictiveness associated with the no-

arbitrage structure that underlies the well documented failure of the no arbitrage stochastic

volatility models to rationalize the deviations from the EH in the data.

The tension between first and second moments arises because of the fact that volatility

must be a positive process. This requires that forecasts of volatility must also be positive.

This introduces a tension between first and second moments. This type of tension, observed

by Dai and Singleton (2002) and Duffee (2002), is generally present in affine stochastic

volatility models, even when no arbitrage restrictions are not imposed. In a no arbitrage

1

See Section 5 for additional details on the data and our estimation.

2

1 2 3 4 5 6 7 8 9 10

ï3

ï2.5

ï2

ï1.5

ï1

ï0.5

0

0.5

1

Maturity

Data

A

1

(3)

A

0

(3)

A

2

(3)

F

1

(3)

F

2

(3)

Figure 1: Violations of the Expectations Hypothesis. This figures plots the coefficients

φ

n

from the Campbell-Shiller regression in (1). When risk premia are constant so that the

expectations hypothesis holds, the coefficients should be uniformly equal to one across all

maturities. The models

A

m

(3) are three factor no arbitrage models with

m

= 0

,

1, or 2

factors driving volatility. The models

F

m

(3) are three factor models that do not impose no

arbitrage with m = 1 or 2 factors driving volatility.

model, volatility must also be a positive process under the risk-neutral measure. This induces

an additional tension with risk-neutral first moments. This creates a three-way tension now

between first moments under the physical and risk-neutral measure and second moments.

The relative importance of these moments (and their role in the tension) are determined by

the precision with which they can be estimated.

At the heart of our result is the fact that the

Q

dynamics is estimated much more

precisely than its historical counterpart. Intuitively, although we have only one historical time

series with which to estimate physical forecasts, each observation of the yield curve directly

represents a term structure of risk neutral expectations of yields. Due to this asymmetry,

it is typically “costly” for standard objective functions to “give up” cross-sectional fits for

time-series fits in estimation. As a result, when faced with the “first moments” tension

– the trade-off between fitting time series and risk-neutral forecasts – standard objective

functions typically settle on a rather uneven resolution in which cross-sectional pricing errors

are highly optimized at the expense of fits to time series forecasts. The resulting impact on

the time series dynamics in turn deprives the estimated model of its ability to replicate the

CS regressions – meant to capture the times series properties of the data.

Our findings add to the recent discussion that suggests that no arbitrage restrictions are

completely or nearly irrelevant for the estimation of Gaussian dynamic term structure models

3

(DTSM).

2

Still left open by the existing literature is the question of whether the no arbitrage

restrictions are useful in the estimation of DTSMs with stochastic volatility. Our results show

that the answer to this question is a resounding yes – an answer that is surprising (given the

existing evidence regarding Gaussian DTSMs) but can now be intuitively explained in light

of our results. That is, the “first moments” tension essentially provides a channel through

which relatively more precise

Q

information will spill over and influence the estimation of the

P

dynamics. This channel does not exist in the context of Gaussian DTSMs in which the

admissibility constraint ensuring positive volatility is not needed.

Our findings also help clarify the nature of the relationship between the no arbitrage struc-

ture and volatility instruments extracted from the cross-section of bond yields documented

by several recent studies.

3

For example, we show that for the

A

1

(

N

) class of models (an

N

factor model with a single factor driving volatility), the cross-section of bonds will reveal

up to

N

linear combinations of yields, given by the

N

left eigenvectors of the risk neutral

feedback matrix (

K

Q

1

), that can serve as instruments for volatility. The no arbitrage structure

then essentially implies nothing more for the properties of volatility beyond the assumed one

factor structure and the admissibility conditions. Furthermore, we show that the estimates

of

K

Q

1

are very strongly identified and essentially invariant to volatility considerations. For a

variety of sampling and modeling choices, we show that the estimates of

K

Q

1

are virtually

identical across models with or without stochastic volatility.

4

This invariance implies the

striking conclusion that a Gaussian term structure model – with constant volatility – can

reveal which instruments would be admissible for a stochastic volatility model.

5

An elaborate

example illustrating this point is provided in Section 5.2.

Finally, our results help identify aspects of model specifications that may or may not have

any significant bearing on the model implied volatility outputs. For example, we show that

within the

A

1

(

N

) class of models, different specifications of the market prices of risks are

unlikely to significantly affect the identification of the volatility factor. To see this, recall

from the preceding paragraph that volatility instruments for an

A

1

(

N

) model are determined

by left eigenvectors of the risk neutral feedback matrix. Intuitively, since the market prices of

risks serve as the linkage between the

P

and

Q

measures, and since the

Q

dynamics is very

strongly identified, different forms of the market prices of risks are most likely to result in

different estimates for the

P

dynamics while leaving estimates of risk neutral feedback matrix

essentially intact. This thus implies that volatility instruments are likely identical across

these models with different risk price specifications. Our intuition is consistent with the

2

See, for example, Duffee (2011), Joslin, Singleton, and Zhu (2011), and Joslin, Le, and Singleton (2012).

3

For example, Collin-Dufresne, Goldstein, and Jones (2009) find an extracted volatility factor from the

cross-section of yields through a no arbitrage model to be negatively correlated with model-free estimates.

Jacobs and Karoui (2009) in contrast generally find volatility extracted from affine models are generally

positively related though in some cases they also find a negative correlation. Almeida, Graveline, and Joslin

(2011) also find a positive relationship.

4

In addition to our results, findings by Campbell (1986) and Joslin (2013b) also suggest that risk neutral

forecasts of yields are largely invariant to any volatility considerations.

5

A practical convenience of this result is that we can use the Gaussian model to generate very good

starting points for the

A

m

(

N

) models. In our estimation, these starting values take only a few minutes to

converge to their global estimates.

4

almost identical performances of volatility estimates implied by

A

1

(3) models with different

(completely affine and essentially affine) risk price specifications as reported in Jacobs and

Karoui (2009).

The rest of the paper is organized as follows. In Section 2, we provide the basic intuition

as to how the “first moments” tension arises. In Section 3, we lay out the general setup of

the term structure models with stochastic volatility that we subsequently consider. Section 4

empirically evaluates the admissibility restrictions under both the physical and risk neutral

measures. Section 5 provides a comparison between the stochastic volatility and pure gaussian

term structure models. Section 6 examines the impact of no arbitrage restrictions on various’

model performance statistics. Section 8 provides some extensions. Section 9 concludes.

2 Basic Intuition

In this section, we develop some basic intuition for our results before elaborating in more

detail both theoretically and empirically. We first describe three basic moments that a term

structure model should match. We then show how tensions arise in a no arbitrage term

structure model in matching those moments. In particular, we show that the presence of

stochastic volatility induces a tension between matching first moments under the historical

distribution (

P

) and the risk-neutral distribution (

Q

). This tension accentuates the difficulty

in matching first and second moments under the historical distribution.

2.1 Moments in a term structure model

A term structure model should match:

1. M

1

(P): the conditional first moments of yields under the historical distribution,

2. M

1

(Q): the conditional first moments of yields under the risk-neutral distribution, and

3. M

2

: the conditional second moments of yields.

6

A number of basic stylized facts are well-known about these moments (see, Piazzesi (2010)

or Dai and Singleton (2003), for example.) Empirically, the slope and curvature of the

yield curve (as well as the level to a slight extent) exhibit some amount of mean reversion.

Also, an upward sloping yield curve often predicts (slightly) lower interest rates in the

future.

M

1

(

P

) should capture these types of patterns. Recall that risk-neutral forecasts are

convexity-adjusted forward rates and therefore matching first moments under the risk-neutral

measure,

M

1

(

Q

), is closely related to the ability of the model to price bonds. The volatility

6

We make no distinction between second moments under the historical and risk-neutral distribution though

this is possible in some contexts. In Section 8.2 we discuss also the case where there is unspanned stochastic

volatility.

5

of yields is time-varying and persistent. Volatility is also related at least partially to the level

and shape of yield curve.

7

M

2

should deliver such features of volatility.

It is worth comparing that we could equivalently replace

M

1

(

Q

) with matching risk premia.

Dai and Singleton (2003) and others take this approach. In this context, the model should

match time-variation in expected excess returns found in the data such as the fact that

when yield curve is upward sloping, excess returns for holding long maturity bonds are on

average higher. Since excess returns are related to differences between actual and risk-neutral

forecasts (i.e. the expected excess return is the difference between an expected future spot

rate and a forward rate), such an approach is equivalent to our approach. As we explain

later, focusing on risk-neutral expectations has the benefit of isolating parameters which are

both estimated precisely and, importantly, invariant to the volatility specification.

2.2 The first moments tension

We now develop some intuition for how the “first moments” tension—that is a tension between

matching M

1

(P) and M

1

(Q)—arises.

Consider the affine class of models,

A

M

(

N

), formalized by Dai and Singleton (2000). Due

to the affine structure, the processes for the first

N

principle components of the yield curve

(e.g., level, slope, and curvature), denoted P, can be written as:

dP

t

=(K

0

+ K

1

P

t

)dt +

p

Σ

t

dB

t

, (2)

dP

t

=(K

Q

0

+ K

Q

1

P

t

)dt +

p

Σ

t

dB

Q

t

, (3)

where

B

t

,

B

Q

t

are standard Brownian motions under the historical measure,

P

, and the risk

neutral measure,

Q

, respectively. Σ

t

is the diffusion process of

P

t

, taking values as an

N ×N

positive semi-definite matrix:

8

Σ

t

= Σ

0

+ Σ

1

V

1,t

+ . . . + Σ

M

V

M,t

, and V

i,t

= α

i

+ β

i

· P

t

, (4)

where

V

i,t

’s are strictly positive volatility factors and conditions are imposed to maintain

positive semi-definite (psd) Σ

t

.

9

7

A rich body of literature has shown that the volatility of the yield curve is, at least partially, related to

the shape of the yield curve. For example, volatility of interest rates is usually high when interest rates are

high and when the yield curve exhibits higher curvature (see Cox, Ingersoll, and Ross (1985), Litterman,

Scheinkman, and Weiss (1991), and Longstaff and Schwartz (1992), among others).

8

Importantly, diffusion invariance implies that the diffusion, Σ

t

, is the same under both measures. Since Σ

t

is the same under both the historical and risk-neutral measures, it must be that the coefficients in (4) are the

same under both measures. A caveat applies that at a finite horizon, there may be difference in the coefficients

in (4). These arise because of differences in

E

t

[

V

t+∆t

] and

E

Q

t

[

V

t+∆t

]. Importantly, however, (

α

∆t

i

, β

∆t

i

) will

not depend on

P

or

Q

. This differences will manifest in differences in the other coefficients. That is, there

will be (Σ

∆t,Q

0

,

Σ

∆t,Q

1

, . . . ,

Σ

∆t,Q

M

) which will be different from (Σ

∆t,P

0

,

Σ

∆t,P

1

, . . . ,

Σ

∆t,P

M

). These differences will

not be important for our analysis. Even so, in typical applications, the time horizon is small (from daily to at

most one quarter), so even these differences will be minor. See also Section 4 and Appendix B.

9

Alternatively, one could express the diffusion as Σ

t

=

˜

Σ

0

+

˜

Σ

1

P

1,t

+

. . .

+

˜

Σ

N

P

N,t

. When the model

falls in the

A

M

(

N

) class, the matrices (

˜

Σ

1

, . . . ,

˜

Σ

N

) will lie in an

M

-dimensional subspaces, allowing the

representation in (4)

6

The one-factor structure of volatility

For the sake of clarity, let us first specialize to the case:

M

= 1. Due to the positivity of the

one volatility factor,

V

t

=

α

+

β · P

t

(where for simplicity we drop the indices in equation

(4)), forecasts of

V

t

at all horizons must remain positive. Thus, to avoid negative forecasts,

the (

N −

1) non-volatility factors must not be allowed to forecast

V

t

. This in turn requires

that the drift of V

t

must depend on only V

t

.

According to equation (2), the drift of

V

t

(ignoring constant) is given by

β

0

K

1

P

t

. For this

to depend only on

V

t

, and thus

β

0

P

t

, it must be the case that

β

0

K

1

is a multiple of

β

0

. That

is, β must be a left-eigenvector of K

1

. Equivalently, β must be an eigenvector of K

0

1

.

Likewise, applying similar logic under the risk-neutral measure, it must follow that

β

is a

left-eigenvector of

K

Q

1

. Thus, the volatility loading vector

β

must be a left eigenvector to both

the risk neutral feedback matrix,

K

Q

1

, and physical feedback matrix,

K

P

1

. This establishes a

tight connection between the physical and risk neutral yields forecasts since

K

P

1

and

K

Q

1

are

forced to share one common left eigenvector.

With this in mind, an unconstrained estimate of

K

P

1

, for example one obtained by fitting

P

to a VAR(1) analogous to (2), may not be optimal. The reason being, such an unconstrained

estimate might force

K

Q

1

to admit a left eigenvector of

K

1

as one of its own. Such an

imposition can result in poor cross-sectional fits. Likewise, an unconstrained estimate of

K

Q

1

can significantly impact the time series dynamics, by imposing one of its own left eigenvectors

upon

K

P

1

. By stapling the

P

and

Q

forecasts together, the common left eigenvector constraint

potentially triggers some tradeoff as the

P

and

Q

dynamics “compete” to match

M

1

(

P

) and

M

1

(Q).

More general settings

More generally, since the volatility factors

V

i,t

must remain positive, their conditional expec-

tations at all horizons must be positive. For given

β

i

’s, only some values of (

K

0

, K

1

) will

induce positive forecasts of

V

i,t

for all possible values of

P

t

.

10

This is the well-documented

tension between matching first and second moments (

M

1

(

P

) and

M

2

) seen in the literature.

We would like to choose a particular volatility instrument (

β

i

’s) to satisfy

M

2

, but the best

choice of β

i

’s to match M

2

may rule out the best choice of (K

0

, K

1

) to match M

1

(P).

Even within an affine factor model with stochastic volatility (that is, a factor model that

does not impose conditions for no arbitrage so that (2) applies but not (3)), this tension would

arise. That is, no arbitrage does not directly affect this tension. However, for no-arbitrage

affine term structure models, the above logic applies equally to both the

P

and

Q

measures.

As before, for a given choice of

β

i

’s, we will be restricted on the choice of (

K

Q

0

, K

Q

1

), so that

the drift of

V

i,t

under the risk-neutral measure guarantees that risk-neutral forecasts of

V

i,t

remain positive. Thus the no arbitrage structure adds a tension between

M

2

and

M

1

(

Q

).

That is, the best choice of

β

i

’s to match

M

2

may be incompatible with the best choice of

(K

Q

0

, K

Q

1

) to match M

1

(Q).

10

In the affine model we consider, the possible values of

P

t

will be an affine transformation of

R

M

+

×R

N−M

for some (M, N ).

7

This implies a three-way tension between

M

1

(

P

),

M

1

(

Q

), and

M

2

. When a model matches

M

2

and either

M

1

(

P

) or

M

1

(

Q

), it may not be possible to match the other first moment.

Since the risk-neutral dynamics are typically estimated very precisely, this can lead to a

difficulty matching M

1

(P) when M

2

is also matched.

3 Stochastic Volatility Term Structure Models

This section gives an overview of the stochastic volatility models that we consider. First, we

establish a general factor time-series model with stochastic volatility that does not impose

conditions for the absence of arbitrage. Within these models, arbitrary linear combinations of

yields serve as instruments for volatility. An important consideration here is the admissibility

conditions required to maintain a positive volatility process. Next, we show how no arbitrage

conditions imply constraints on the general factor model. A key result that we show is that

no arbitrage imposes that the volatility instrument is entirely determined by risk neutral

expectations. Finally, we investigate further the links between volatility and the cross-sectional

properties of the yield curve within the no arbitrage model. For simplicity, we focus in the

main text on the case of a single volatility factor under a continuous time setup; modifications

for discrete time processes and more technical details are described in Appendix B.

3.1 General admissibility conditions in latent factor models

We first review the conditions required for a well-defined positive volatility process within

a multi-factor setting. Following Dai and Singleton (2000), hereafter DS, we refer to these

conditions as admissibility conditions. Recall the

N

-factor

A

1

(

N

) process of DS. This process

has an

N

-dimensional state variable composed of a single volatility factor,

V

t

, and (

N −

1)

conditionally Gaussian state variables,

X

t

. The state variable

Z

t

= (

V

t

, X

0

t

)

0

follows the Itˆo

diffusion

d

V

t

X

t

= µ

Z,t

dt + Σ

Z,t

dB

P

t

, (5)

where

µ

Z,t

=

K

0V

K

0X

+

K

1V

K

1V X

K

1XV

K

1X

V

t

X

t

, and Σ

Z,t

Σ

0

Z,t

= Σ

0Z

+ Σ

1Z

V

t

, (6)

and

B

P

t

is a standard

N

-dimensional Brownian motion under the historical measure,

P

. Duffie,

Filipovic, and Schachermayer (2003) show that this is the most general affine process on

R

+

× R

N−1

.

In order to ensure that the volatility factor,

V

t

, remains positive, we need that when

V

t

is zero: (a) the expected change of

V

t

is non-negative, and (b) the volatility of

V

t

becomes

zero. Otherwise there would be a positive probability that

V

t

will become negative. Imposing

additionally the Feller condition for boundary non-attainment, our admissibility conditions

are then

K

1V X

= 0, Σ

0Z,11

= 0, and K

0V

≥

1

2

Σ

1Z,11

. (7)

8

A consequence of these conditions is that volatility must follow an autonomous process

under

P

since the conditional mean and variance of

V

t

depends only on

V

t

and not on

X

t

.

We now show how to embed the

A

1

(

N

) specification into generic term structure models

where no arbitrage is not imposed and re-interpret these admissibility constraints in terms of

conditions on the volatility instruments.

3.2 An A

1

(N) factor model without no arbitrage restrictions

We can extend the latent factor model of (5–6) to a factor model for yields by appending the

factor equation

y

t

= A

Z

+ B

Z

Z

t

, (8)

where (

A

Z

, B

Z

) are free matrices. Importantly, there are no cross-sectional restrictions that

tie the loadings (

A

Z

, B

Z

) together across the maturity spectrum. In this sense, this is a pure

factor model without no arbitrage restrictions.

Given the parameters of the model, we can replace the unobservable state variable with

observed yields through (8). Following Joslin, Singleton, and Zhu (2011), hereafter JSZ, we

can identify the model by observing that equation (8) implies

P

t

≡ W y

t

= (

W A

Z

)+(

W B

Z

)

Z

t

for any given loading matrix

W

such that

P

t

is of the same size as

Z

t

. Assuming

W B

Z

is

full rank,

11

this in turn allows us to replace the latent state variable Z

t

with P

t

:

dP

t

= (K

0

+ K

1

P

t

)dt +

p

Σ

0

+ Σ

1

V

t

dB

P

t

, (9)

where we can write V

t

(the first entry in Z

t

) as a linear function of P

t

: V

t

= α + β · P

t

.

Because the rotation from

Z

to

P

is affine, individual yields must be related to the yield

factors P

t

through:

12

y

t

= A + B P

t

. (10)

The admissibility conditions (7) map into:

β

0

K

1

= cβ

0

, (11)

where c is an arbitrary constant, and

β

0

Σ

0

β = 0, and β

0

K

0

≥

1

2

β

0

Σ

1

β. (12)

We will denote the stochastic volatility model in (9–10) by

F

1

(

N

). The model is parame-

terized by Θ

F

≡

(

K

0

, K

1

,

Σ

0

,

Σ

1

, α, β, A, B

) which is subject to the conditions in (12). Our

development shows that the

F

1

(

N

) model is the most general factor model with an underlying

affine A

1

(N) state variable.

11

This is overidentifying. For details, see JSZ. In the current case, this would rule out unspanned stochastic

volatility in the factor model. We extend our logic to the case of partially unspanned volatility in Section 8.

12

To maintain internal consistency, we impose that

W A

= 0 and

W B

=

I

N

, as in JSZ. This guarantees

that as we construct the yield factors by premultiplying

W

to the right hand side of the yield pricing equation

(10), we exactly recover P

t

.

9

We will refer to the first admissibility condition in (11) as condition

A

(

P

). This condition,

needed so that

V

t

is an autonomous process under

P

, can be restated as the requirement that

β

be a left eigenvector of

K

1

. With this requirement, choosing a

β

such that

V

t

matches

yields volatility (

M

2

) is equivalent to imposing a certain left eigenvector on the time series

feedback matrix

K

1

, which may hinder our ability to match the time series forecasts of bond

yields (

M

1

(

P

)). When it is not possible to choose

K

1

to match

M

1

(

P

) and

β

to match

M

2

in

the presence of

A

(

P

), a tension will arise. We refer to the tension between first and second

moments as the difficulty to match M

1

(P) and M

2

in the presence of the constraint A(P).

3.3 No arbitrage term structure models with stochastic volatility

The

A

1

(

N

) no arbitrage model of DS represents a special case of the

F

1

(

N

) model. That is,

when one imposes additional constraints to the parameter vector Θ

F

one will obtain a model

consistent with no arbitrage. In this section, we first review the standard formulation of the

A

1

(

N

) no arbitrage model. We then focus on the the effect of no arbitrage on the volatility

instrument through the restriction it implies on the loadings parameter β.

The latent factor specification of the A

1

(N) model

We now consider affine short rate models which take a latent variable

Z

t

with dynamics

given by (5–6) and append a short rate which is affine in a latent state variable. We consider

the general market prices of risk of Cheridito, Filipovic, and Kimmel (2007). Joslin (2013a)

shows that any such latent state term structure model can be drift normalized under

Q

so

that we have the short rate equation

r

t

= r

∞

+ ρ

V

V

t

+ ι · X

t

, (13)

where

ι

denotes a vector of ones,

ρ

V

is either +1 or -1, and the canonical risk-neutral dynamics

of Z

t

are given by

dZ

t

=

K

Q

0V

0

N−1×1

+

λ

Q

V

0

1×N−1

0

N−1×1

diag(λ

Q

X

)

Z

t

dt +

p

Σ

0Z

+ Σ

1Z

V

t

dB

Q

t

, (14)

where

λ

Q

X

is ordered. To ensure the absence of arbitrage, we impose the Feller condition that

K

Q

0V

≥

1

2

Σ

1Z,11

.

No arbitrage pricing then allows us to obtain the no arbitrage loadings that replace the

unconstrained version of (8) in the

F

1

(

N

) model with

y

t

=

A

Q

Z

+

B

Q

Z

Z

t

where

A

Q

Z

and

B

Q

Z

are dependent on the parameters underlying (13-14). From this, we again can rotate

Z

t

to

P

t

≡ W y

t

to obtain a yield pricing equation in terms of

P

t

:

y

t

=

A

+

BP

t

. This is a

constrained version of the yield pricing equation for the

F

1

(

N

) model in (10). In addition to

the time series dynamics in (9), we also obtain the dynamics of P under Q:

dP

t

= (K

Q

0

+ K

Q

1

P

t

)dt +

p

Σ

0

+ Σ

1

V

t

dB

Q

t

, (15)

with V

t

= α + β · P

t

.

10

Compared to the

F

1

(

N

) model, one clear distinction of the

A

1

(

N

) model is the role of

the

Q

dynamics (15) in determining yields loadings (

A

,

B

) and the volatility loadings

β

. We

provide an in-depth discussion of this dependence below. We first explain the impact of the

no arbitrage restrictions on the volatility loadings

β

. Next, we provide an intuitive illustration

as to how the no arbitrage restrictions will give rise to an intimate relation between the yields

loadings

B

and the volatility loadings

β

. This compares starkly with the

F

1

(

N

) models for

which B and β are completely independent.

Implications of the no arbitrage restrictions for the factor model

Ideally, we would like to characterize the no arbitrage model as restrictions on the parameter

vector Θ

F

in the

F

1

(

N

) model. In JSZ, they were able to succinctly characterize the parameter

restrictions of the no arbitrage model as a special case of the factor VAR model. In their case,

essentially the main restriction was that the factor loadings (

B

) belongs to an

N

-parameter

family characterized by the eigenvalues of the Q feedback matrix. In our current context of

stochastic volatility models, such a simple characterization is not possible because changing

the volatility parameters Σ

1Z

affects not only the volatility structure but also the loadings

B

Q

Z

.

13

This is because higher volatility implies higher convexity and thus higher bond prices

or lower yields. The fact that Σ

1Z

shows up both in volatility and in yields complicates a

clean characterization of the restrictions on Θ

F

that no arbitrage implies.

For this reason, we focus on a simpler but equally interesting question: what is the impact

of the no arbitrage restrictions on the volatility loadings β?

Recall from the previous subsection that for an

F

1

(

N

) model, the two main conditions

on

β

are : (1) matching second moments (

M

2

); and (2)

β

must be a left eigenvector of the

physical feedback matrix

K

1

that matches the first moments under

P

(

M

1

(

P

)). Turning to the

A

1

(

N

) model, these conditions are still applicable. Additionally, applying the admissibility

conditions (7) to the risk-neutral dynamics in (15) results in a set of constraints analogous to

(11):

β

0

K

Q

1

= cβ

0

, (16)

for an arbitrary number

c

. We will refer to the condition in (16) for the no arbitrage model

as the admissibility condition

A

(

Q

). This implies a third condition on

β

for the no arbitrage

model:

β

must be a left eigenvector of the risk neutral feedback matrix

K

Q

1

that matches the

first moments under Q (M

1

(Q)).

The impact of the no arbitrage restrictions on

β

depends on how strongly identifying the

third condition is compared to the first two. Should

K

Q

1

be very precisely estimated from the

data, the estimates of

β

for the

A

1

(

N

) models are strongly influenced by

A

(

Q

). Whence it is

possible that

β

estimates are different across the

F

1

(

N

) and

A

1

(

N

) models. To anticipate

our empirical results, we compare these restrictions in subsequent sections and indeed find

that the admissibility condition

A

(

Q

) (together with matching

M

1

(

Q

) and

M

2

) is essentially

13

In the Gaussian case, B

Q

Z

is only dependent on the eigenvalues of the risk-neutral feedback matrix, and

not on the volatility parameters.

11

the main restriction responsible for pinning down

β

in no arbitrage models whereas the direct

tension between first and second moments implied by A(P) has virtually no impact.

Why might

K

Q

1

be strongly pinned down in the data? Similar to JSZ, it can be shown

that the no-arbitrage restriction on K

Q

1

takes the following form:

K

Q

1

= (W B

Q

Z

)diag(λ

Q

)(W B

Q

Z

)

−1

(17)

where

λ

Q

= (

λ

Q

V

, λ

Q

X

0

)

0

. This follows from the rotation from

Z

whose dynamics is given by

(14) to

P

. Additionally, observe that the loadings

B

Q

Z

depend only on (

ρ

V

, λ

Q

,

Σ

1Z

). Since

ρ

V

is a normalization factor, it can be ignored. Σ

1Z

will affect the yield loadings through the

Jensen effects which are typically small and will be dominated by variation in risk neutral

expectations driven by

λ

Q

. Thus

B

Q

Z

will be well approximated by loadings obtained when

Σ

1Z

is set to zeros. These can be viewed as loadings from a Gaussian term structure model

which does not have a stochastic volatility effect. Up to this approximation, the risk-neutral

feedback matrix is essentially a non-linear function of its eigenvalues, which are typically

estimated with considerable precision (for example, see JSZ).

14

Combined, this implies that

K

Q

1

will be strongly identified in the data and thus

β

(up to scaling) is likely strongly affected

by the no arbitrage restrictions due to A(Q).

To relate to the results of JSZ, we make the above arguments relying on the approximation

that convexity effects are negligible. It is important to note that we can make our argument

more precise without resorting to approximations by a relatively more mechanical examination

of the above steps. In particular, we show in Appendix A that the volatility instrument

β

is in fact, up to a constant, completely determined by the (

N −

1) eigenvalues given in

λ

Q

X

.

Coupled with the observation that

λ

Q

X

is typically estimated with considerable precision, it is

clear that the volatility instruments are heavily affected by the no arbitrage restrictions.

The relation between yield loadings and the volatility instrument

An alternative way of understanding the impact of the no arbitrage restrictions on the

volatility instrument is through examining the linkage between yield loadings (

B

) and

β

.

To begin,

B

and

β

are clearly independent for the

F

1

(

N

) models since they are both free

parameters. Intuitively, for these models the yields loadings

B

are obtained from purely

cross-sectional information: regressions of yields on the pricing factors

P

whereas the volatility

loadings

β

is obtained purely from the time series information. In contrast, in the context

of an

A

1

(

N

) model, both

B

and

β

are influenced by

K

Q

1

. This common dependence on the

risk-neutral feedback matrix forces a potentially tight linkage between these two components.

For the sake of intuition, we consider below a simple example and show that for no arbitrage

models there is indeed an intimate relationship between B and β.

14

Intuitively,

λ

Q

governs the persistence of yield loadings along the

maturity

dimension. As shown by

Joslin, Le, and Singleton (2012), the estimates of the loadings (obtained, for example, by projecting individual

yields onto

P

t

) are typically very smooth functions of yield maturities. This relative smoothness in turn

should translate into small statistical errors associated with estimates of

λ

Q

. This intuition is confirmed by

examining the results of JSZ in which λ

Q

is estimated with considerable precision.

12

Let’s define the convexity-adjusted n-year forward rate on an one-year forward loan by:

f

t

(n) = E

Q

t

[

Z

t+n+1

t+n

r

s

ds]. (18)

In the spirit of Collin-Dufresne, Goldstein, and Jones (2008) we can write the following one

year ahead risk-neutral conditional expectation:

E

Q

t

V

t+1

f

t+1

(0)

f

t+1

(1)

= constant +

a

1

0 0

0 0 1

a

2

a

3

a

4

V

t

f

t

(0)

f

t

(1)

. (19)

The first row is due to the autonomous nature of

V

t

. The second row is the definition of

the forward rate in (18) for

n

= 1. The last row is obtained from the fact that in a three

factor affine model, (

V

t

,

f

t

(0),

f

t

(1)) are informationally equivalent to the three underlying

states at time

t

. From the last row and by applying the law of iterated expectation to (18),

we have:

f

t

(2) = constant + a

2

V

t

+ a

3

f

t

(0) + a

4

f

t

(1). (20)

This equation may be solved to give

V

t

in terms of

f

t

(0),

f

t

(1), and

f

t

(2). Furthermore, since

(18) gives

f

t+1

(2) =

E

Q

t+1

[

f

t+2

(1)] we can use (19) and (20) to express

E

Q

t

[

f

t+1

(2)] in terms of

f

t

(0),

f

t

(1), and

f

t

(2). Putting these together allows us to substitute

V

t

out from (19) and

obtain

E

Q

t

f

t+1

(0)

f

t+1

(1)

f

t+1

(2)

= constant +

0 1 0

0 0 1

α

1

α

2

α

3

f

t

(0)

f

t

(1)

f

t

(2)

. (21)

Simple calculations give

α

1

=

−a

1

a

3

,

α

2

=

a

3

− a

1

a

4

, and

α

3

=

a

4

+

a

1

. It follows from the

last row of (21) that:

f

t

(3) = constant + α

1

f

t

(0) + α

2

f

t

(1) + α

3

f

t

(2). (22)

Equation (22) reveals that if the forward rates can be empirically observed, the loadings

α

can in principle be pinned down simply by regressing

f

t

(3) on

f

t

(0),

f

t

(1), and

f

t

(2). Based

on the mappings from (

a

1

,

a

3

,

a

4

) to

α

, it follows that the regression implied by (22) will also

identify all the

a

coefficients, except for

a

2

. In the context of equation (20), it means that the

volatility factor is tightly linked to the forward loadings, up to a translation and scaling effect.

Since forwards and yields (and therefore yield portfolios) are simply rotated representations

of one another, this implies a close relationship between the volatility instrument and yields

loadings.

As is well known, yields and forwards at various maturities exhibit very high correlations.

The

R

2

’s obtained for cross-sectional regressions similar to (22) are typically close to 100%

with pricing errors in the range of a few basis points. Therefore we expect the standard errors

associated with

α

to be small and thus the volatility loadings

β

will be strongly identified

from cross-sectional loadings.

13

Repeated iterations of the above steps allow us to write any forward rate

f

t

(

n

) as a linear

function of (

f

(0)

t

, f

t

(1)

, f

t

(2)). Suppose that we use

J

+ 1 forwards in (

f

t

(0),

. . . f

t

(

J

)) in

estimation, then:

f

t

(0)

f

t

(1)

f

t

(2)

f

t

(3)

f

t

(4)

.

.

.

f

t

(J)

=

1 0 0

0 1 0

0 0 1

α

1

α

2

α

3

g

4

(α)

. . .

g

J

(α)

f

t

(0)

f

t

(1)

f

t

(2)

where (

g

4

, . . . , g

J

) represent the cross-sectional restrictions of no-arbitrage. This allows us to

think of the no-arbitrage restrictions as having two facets. First, it imposes a cross-section

to time series link through the fact that fixing

α

constrains what the volatility factor must

look like, through

a

3

and

a

4

. Second, it induces cross-sectional restrictions on the loadings

(g

4

, . . . g

J

), just as is seen with pure Gaussian term structure models.

4 Evaluating the Admissibility Restrictions

We have seen in Section 3 that in order to have a well-defined admissible volatility process,

we must have both

A

(

P

) and

A

(

Q

) which can be restated as that

β

must be a common left

eigenvector of the feedback matrices under

P

and

Q

. These admissibility restrictions are

helpful in providing guidance on potential volatility instruments. For example, although level

is known to be related to volatility, it is unlikely to be an admissible instrument for volatility

by itself. To see this, recall the well-known result (for example Campbell and Shiller (1991))

that the slope of the yield curve predicts future changes in the level of interest rates. Up to

the associated uncertainty of such statistical evidence, this suggests that the slope of the yield

curve predicts the level and thus also that the level of interest rates is not an autonomous

process.

We evaluate empirically how helpful each of the admissibility restrictions can be in

identifying the potential volatility instrument which in turn depends on the accuracy with

which the feedback matrices can be estimated. For example, if the physical (risk-neutral)

feedback matrix is strongly identified in the data, then the condition

A

(

P

) (

A

(

Q

)) must

provide helpful identifying information about

β

. As will be seen, our assessments are relatively

robust to the extent that we do not have to actually estimate the term structure models, nor

do we require that

M

2

be matched. Following Joslin, Le, and Singleton (2012) (hereafter JLS),

we use the monthly unsmoothed Fama Bliss zero yields with eleven maturities: 6–month,

one- out to ten-year. We start our sample in January 1973, due to the sparseness of longer

maturity yields prior to this period, and end in December 2007 to ensure our results are not

influenced by the financial crisis.

We note that the affine dynamics for

P

in (9) implies that the one month ahead conditional

14

expectation of P

t+∆

is affine in P

t

:

E

t

[P

t+∆

] = constant + e

K

1

∆

P

t

(23)

where ∆ = 1

/

12. Thus

P

t

, even when sampled monthly, follows a first order VAR. Importantly,

we can show that any left eigenvector of

K

1

must also be a left eigenvector of the one-month

ahead feedback matrix

e

K

1

∆

, denoted by

K

1,∆

.

15

In other words, the set of left eigenvectors

of the instantaneous feedback matrix

K

1

and the one-month ahead feedback matrix

K

1,∆

must be identical. As a result, we can equivalently restate

A

(

P

) as the requirement that the

volatility loading

β

be a left eigenvector of

K

1,∆

. Since our data are sampled at the monthly

interval, it is more convenient for us to focus on K

1,∆

in our empirical analysis.

Similarly, the affine dynamics in (15) under

Q

also implies a first order VAR for

P

t

sampled at the monthly frequency:

E

Q

t

[P

t+∆

] = constant + e

K

Q

1

∆

|{z}

K

Q

1,∆

P

t

. (24)

Applying similar logic, we can again restate

A

(

Q

) as the requirement that the volatility

loading β be a left eigenvector of the one-month ahead risk-neutral feedback matrix K

Q

1,∆

.

It is worth noting that for small ∆,

K

Q

1,∆

≈ I

+ ∆

K

Q

1

. So in some sense, we can view

K

Q

1

and

K

Q

1,∆

interchangeably. Importantly though, as the arguments above illustrate, our results

do not rely on this approximation.

4.1 Admissibility restrictions under P

We first consider the restriction

A

(

P

) which is present in both the

F

1

(

N

) and

A

1

(

N

) models.

This restriction guarantees that

V

t

is an autonomous process, which in turn is necessary for

volatility to be a positive process under

P

. This requires the volatility instrument,

β

, be a

left eigenvector of the one-month ahead physical feedback matrix

K

1,∆

. To the extent that

the conditional mean is strongly identified by the time-series, this condition will pin down

the admissible volatility instruments up to a sign choice and the choice of which of the

N

left

eigenvectors instruments volatility. However, in general even with a moderately long time

series, such as our thirty five year sample, inferences on the conditional means are not very

precise.

To gauge how strongly identified the volatility instrument is from the autonomy require-

ment under

P

, we implement the following exercise. First we estimate an unconstrained VAR

on the first three principal factors,

P

t

. Ignoring the intercepts, the estimates for our sample

15

To see this, assume that

β

is a left eigenvector of

K

1

with a corresponding eigenvalue

c

. Applying the

definition of left eigenvector,

β

0

K

1

=

cβ

0

, repeatedly, it follows that

β

0

K

n

1

=

c

n

β

0

or

β

is also a left eigenvector

of

K

n

1

for any

n

. Substitute these into

e

K

1

∆

=

P

∞

n=0

K

n

1

∆

n

/n

!, it implies that

β

0

e

K

1

∆

=

e

c∆

β

0

. Thus

β

is a

left eigenvector of e

K

1

∆

with the corresponding eigenvalue e

c∆

.

15

period are:

P

t+∆

= constant +

0.9902 −0.0092 −0.0472

0.0097 0.9548 −0.0802

−0.0021 0.0096 0.7991

| {z }

K

1,∆

P

t

+ noise. (25)

Then, for

each

potential volatility instrument

β · P

t

(as

β

roaming over all possible choices),

we re-estimate the VAR under the constraint that

β

is a left eigenvector of

K

1,∆

. The VAR

is easily estimated under this constraint after a change of variables so that the eigenvector

constraint becomes a zero constraint (compare the constraints in (7) and (12)). We then

conduct a likelihood ratio test of the unconstrained versus the constrained alternative and

compute the associated probability value (p-value). A p-value close to one indicates that the

evidence is consistent with such an instrument being consistent with

A

(

P

) while a p-value

close to zero indicates contradicting evidence.

16

In conducting this experiment, we do not

force

β ·P

t

to forecast volatility nor is

β

required to satisfy

A

(

Q

). In this sense, this exercise is

informative about the contribution of

A

(

P

) in shaping the volatility instrument independent

of both A(Q) and the requirement that M

2

be matched.

Since

β · P

t

and its scaled version,

cβ · P

t

, for any constant

c

, effectively give the same

volatility factor (and hence deliver the same p-values in our exercise), we scale so that all

elements of

β

sum up to one (the loading on PC1

β

(1) = 1

− β

(2)

− β

(3)). We plot the

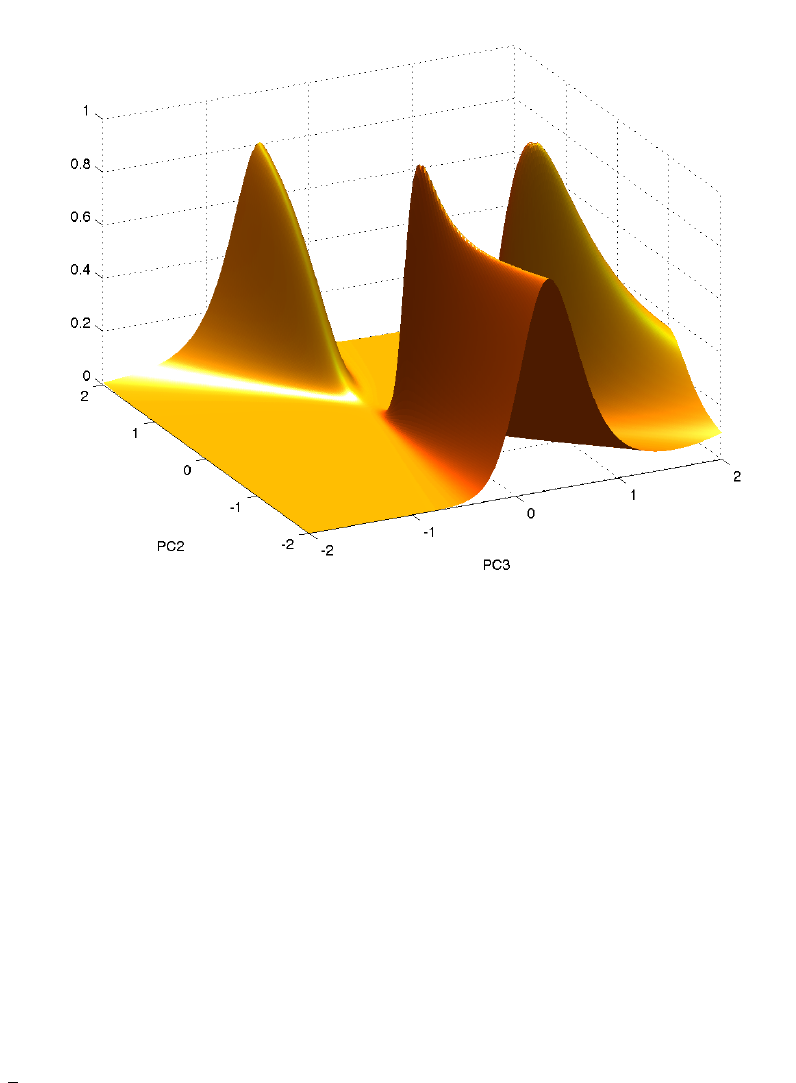

p-values against the corresponding pairs of loadings on PC2 and PC3 in Figure 2. For ease

of presentation, in this graph the three PCs are scaled to have in-sample variances of one.

We see that there are three peaks which correspond to the three left eigenvectors of the

maximum likelihood estimate of

K

1,∆

. When

β

is equal to one of these left eigenvectors (up to

scaling), the likelihood ratio test statistic must be zero and hence the corresponding p-value

must be one, by construction. As our intuition suggests, many, though not all, instruments

appear to potentially satisfy

A

(

P

) according to the metric that we are considering. Thus

we conclude that the admissibility requirement under the

P

measure in general still leaves a

great deal of flexibility in forming the volatility instrument.

4.2 Admissibility restrictions under Q

Turning to

A

(

Q

), to have a clean comparison, it is ideal if we can implement the same

regression approach applied to

A

(

P

) in the previous exercise. That is, we first run an

unconstrained regression using the Q forecasts:

E

Q

t

[P

t+∆

] = constant + K

Q

1,∆

P

t

+ noise (26)

to obtain an estimate of

K

Q

1,∆

. An important difference here with the

P

case in (25) is that

we now use

E

Q

t

[

P

t+∆

] instead of

P

t+1

on the left hand side in the regression. Next, for

16

We view this test as an approximation since it assumes volatility of the residuals is constant. However,

computations of p-values, accounting for heteroskedasticity of the errors, deliver very similar results.

16

Figure 2: Likelihood Ratio Tests of the Autonomy Restriction under

P

. This figure reports

the p-values of the likelihood ratio test of whether a particular linear combination of yields,

β · P

t

, is autonomous under

P

, plotted against the loadings of PC2 and PC3. The loading of

PC1 is one minus the loadings on PC2 and PC3 (

β

(1) = 1

− β

(2)

− β

(3)). PC1, PC2, and

PC3 are scaled to have in-sample variances of one.

each potential volatility instrument

β · P

t

, we re-estimate the regression in (26) under the

constraint that

β

is a left eigenvector of

K

Q

1,∆

. As is seen in the previous exercise, the resulting

likelihood ratios reveal whether or not the volatility instrument considered is consistent with

the admissibility constraint A(Q).

Although we do not strictly observe the risk neutral forecasts

E

Q

t

[

P

t+∆

] for stochastic

volatility models due to the presence of convexity effects, we use a model-free approach to

obtain very good approximation. The insight again is that risk-neutral expectations are, up

to convexity, observed as forward rates. The

n

-year forward rate that begins in one month,

f

∆,n

t

=

1

n

((n + ∆)y

n+∆,t

− ∆r

t

) is, up to convexity effects:

f

∆,n

t

≈ E

Q

t

[y

n,t+∆

] (27)

where

y

n,t

denotes

n

-year zero yield observed at time

t

. Thus we can use (27) to approximate

E

Q

t

[

y

n,t+∆

] whereby we simply ignore any convexity terms. This approximation is reasonable

17

for two reasons. First, Jensen terms are typically small. Second, notice that since our primary

interest is not in the level of expected-risk neutral changes but in their variation (as captured

by

K

Q

1,∆

), it is only changes in stochastic convexity effects that will violate this approximation.

Thus to the extent that changes in convexity effects are small this approximation will be

valid for inference of K

Q

1,∆

.

Using this method, we extract observations on

E

Q

t

[

y

n,t+∆

] from forward rates which we

can then convert into estimates of

E

Q

t

[

P

t+∆

] using the weighting matrix

W

. We denote this

approximation of E

Q

t

[P

t+∆

] by P

f

t

. Whence regression (26) translates into:

P

f

t

= constant + K

Q

1,∆

P

t

+ noise. (28)

Regression (28) draws a nice analogy to the time series VAR(1) of (25) that we use in

examining

A

(

P

). Importantly, as this regression can be implemented completely independently,

abstracting from any time series considerations, it serves as a stand-alone assessment of

A

(

Q

),

up to the validity of our convexity approximation approach. Notably, (28) makes clear the

(essentially) contemporaneous nature of the estimation of

K

Q

1,∆

. Since

P

t

explains virtually all

contemporaneous yields and forwards (and thus portfolios of forwards such as

P

f

t

), the

R

2

’s

of (28) are likely much higher than those for the time series VAR(1) at the monthly frequency.

Therefore we expect much stronger identification for

K

Q

1,∆

. Intuitively, although we observe

only a single time series under the historical measure with which to draw inferences, we

observe repeated term structures of risk-neutral expectations every month and this allows us

to draw much more precise inferences.

Figure 3 plots the p-values for this test of the restrictions of various instruments to be

autonomous under

Q

. In stark contrast to Figure 2 and in accordance with our intuition,

we see that the risk-neutral measure provides very strong evidence for which instruments

are able to be valid volatility instruments. Most potential volatility instruments are strongly

ruled out with p-values essentially at zero. Thus, our results here suggest that were it only

up to

A

(

P

) and

A

(

Q

) to decide which volatility instrument to use, the latter would almost

surely be the dominant force, with the remaining degrees of freedom being the sign choice and

choosing which of the

N

left eigenvectors of

K

Q

1,∆

is the volatility instrument. This evidence

suggests that the no arbitrage restrictions can potentially have very strong impact in shaping

volatility choices.

Left open by the model-free nature of our analysis in this section is, among other things,

the possibility that the defining property of the volatility factor (

β

should match

M

2

) can be

powerful enough that it might dominate

A

(

Q

) at identifying potential volatility instruments.

We take up an in depth examination of this possibility in the next section.

5 Comparison of Gaussian and Stochastic Volatility

Models

To understand the contribution of matching

M

2

on the identification of the volatility loadings

β

, we estimate and compare the (Gaussian)

A

0

(

N

) models with stochastic volatility models.

18

Figure 3: Likelihood Ratio Tests of the Autonomy Restriction under

Q

. This figure reports

the p-values of the likelihood ratio test of whether a particular linear combination of yields,

β · P

t

, is autonomous under

Q

, plotted against the loadings of PC2 and PC3. The loading of

PC1 is one minus the loadings on PC2 and PC3 (

β

(1) = 1

− β

(2)

− β

(3)). PC1, PC2, and

PC3 are scaled to have in-sample variances of one.

19

N = 4 N = 3

A

0

(N)

0.998 0.027 0.032 0.014 0.997 0.028 0.025

-0.007 0.957 -0.128 -0.042 -0.003 0.954 -0.098

-0.010 0.006 0.895 -0.080 -0.005 -0.002 0.928

-0.009 -0.009 -0.085 1.007

A

1

(N)

0.999 0.027 0.030 0.013 0.998 0.028 0.024

-0.005 0.959 -0.123 -0.037 -0.002 0.955 -0.097

-0.010 0.006 0.902 -0.075 -0.005 -0.000 0.931

-0.006 -0.007 -0.079 1.018

A

2

(N)

0.998 0.028 0.031 0.013 0.997 0.029 0.025

-0.005 0.956 -0.125 -0.040 -0.002 0.954 -0.099

-0.009 0.003 0.899 -0.077

-0.005 -0.002 0.929

-0.005 -0.012 -0.080 1.010

Regression

0.998 0.027 0.029 0.014 0.997 0.027 0.025

-0.008 0.957 -0.118 -0.041 -0.003 0.958 -0.098

-0.011 0.005 0.905 -0.077 -0.006 0.007 0.925

-0.016 -0.006 -0.065 0.987

Table 1: K

Q

1,∆

Estimates.

Clearly, matching

M

2

is relevant only in the latter and not the former. Since the

A

0

(

N

)

models are affine models, the one month ahead conditional expectation of yields portfolios

P

also take an affine form. Thus for both Gaussian and stochastic volatility models, we can

write:

E

Q

t

[

P

t+∆

] =

constant

+

K

Q

1,∆

P

t

under the risk neutral measure. Of particular interest

is the estimates of the monthly risk-neutral feedback matrix,

K

Q

1,∆

, implied by these models.

As we will show in this section, estimates of

K

Q

1,∆

are highly similar across these models.

This suggests that the role of stochastic volatility (matching

M

2

) is inconsequential for the

estimation of

K

Q

1,∆

. Thus identifying volatility instrument (

β

) is simply limited to making

the choice of which left eigenvector of

K

Q

1,∆

and its sign can best match

M

2

. We use the same

dataset as in the preceding section and note that all of our results remain fully robust for a

shortened sample period that excludes the Fed experiment regime.

5.1 Comparison of K

Q

1,∆

estimates

We estimate

A

M

(

N

) models, with

M

= 0

,

1

,

2 and

N

= 3

,

4, and then rotate the state

variables into low order yield PCs. For estimation, we assume these PCs are priced perfectly

while higher order PCs are observed with i.i.d. errors. JLS show that this assumption is

innocuous as it is likely to deliver estimates close to those obtained by Kalman filtering where

all yields portfolios are observed with errors. Estimation details and full parameter estimates

are deferred to Appendix C.

20

Table 1 reports the estimates of

K

Q

1,∆

implied by these models. Recall the defining property

of

K

Q

1,∆

given by equation (26) in which

K

Q

1,∆

is informative about how

P

t

forecasts

P

t+∆

under the risk neutral measure. Since for each

N

,

P

t

is characterized by the same loading

matrix

W

(that corresponds to the first

N

PCs of bond yields) across all models, it follows

that

K

Q

1,∆

estimates are directly comparable across all models with the same number of

factors

N

. Focusing first on the two models

A

0

(3) and

A

1

(3), the two estimates of

K

Q

1,∆

are

strikingly close: most entries are essentially identical up to the third decimal place. This

evidence indicates that the identification by the cross-sectional information (and possibly

other moments shared between the

A

0

(3) and

A

1

(3) models) for the parameter

K

Q

1,∆

seems

overwhelmingly stronger than the restrictions coming from matching

M

2

. Enriching the

volatility structure to

M

= 2 does not overturn this observation: the

K

Q

1,∆

estimate implied by

the A

2

(3) model remains essentially identical. Additionally, changing the number of factors

to

N

= 4 (results also reported Table 1) or

N

= 2 (results not reported) does not alter our

observation.

We have argued that variation in the one month ahead risk-neutral expectations, as

determined by

K

Q

1,∆

, is well approximated by the regression based estimate of (28). This

estimate can be further improved by simple steps that take into account the affine structure

of bond yields. Specifically up to convexity effects, the affine structure of bond yields implies

that:

˜

B

n+∆

= K

Q

1,∆

˜

B

n

+

˜

B

∆

where

˜

B

n

denotes the unannualized loadings of

n

-year zero yields on

P

t

. This suggests we

can recover

K

Q

1,∆

in two steps. First, we project yields of all maturities onto the states

P

t

to

recover the loadings

˜

B

n

.

17

Second, an estimate of

K

Q

1,∆

is obtained by projecting

˜

B

n+∆

−

˜

B

∆

onto

˜

B

n

(allowing for no intercepts).

18

As can be viewed from the last panel of Table 1, this

model free estimate of

K

Q

1,∆

come strikingly close to estimates obtained from the no arbitrage

models. This evidence suggests that the cross-sectional information

alone

is sufficient to pin

down the risk-neutral feedback matrix, and this identification is so strong that information

from other constraints imposed by the models seems irrelevant.

Given the estimates of

A

M

(

N

) models, we are able to confirm that the convexity effects

on yield loadings are negligible. Specifically, holding

N

fixed, varying

M

, and thereby varying

the degree of convexity effects due to the presence of stochastic volatility, is completely

inconsequential for the yield loadings implied by different models. Graphs (not reported) of

yield loadings on

P

t

plotted against the corresponding maturities (up to ten years) implied

by A

0

(N), A

1

(N), and A

2

(N) are virtually indistinguishable.

The observed invariance property of

K

Q

1,∆

estimates has a number of implications. First,

as stated previously, this allows us to pin down the potential volatility instruments using the

cross-section of yields due to the admissibility constraint. Essentially the volatility instrument

is free in terms of the sign but must be one of the left eigenvectors of

K

Q

1,∆

which can be

17

To obtain yields for the full range of maturities from the small set of maturities used in estimation, we

can use simple interpolation techniques such as the constant forward bootstrap or simply a cubic spline.

18

de los Rios (2013) develops a similar regression-based approach to obtain estimates of K

Q

1,∆

.

21

computed accurately from either the cross-sectional regression or from estimation of the

A

0

(

N

) model which has constant volatility and can be estimated quite quickly as shown in

JSZ.

This observation also shows that, in some regards, the estimation of the no arbitrage

A

1

(

N

) model is more tractable than estimate of the F

1

(

N

) model. In the case of the Gaussian

models the opposite holds: the factor model is trivial to estimate as it amounts to a set of

ordinary least squares regressions while the no arbitrage model is slightly more difficult to

estimate due to the non-linear constraints in the factor loadings. In the stochastic volatility

models, the admissibility conditions require a number of non-linear constraints in order

to ensure that volatility remains positive. The no arbitrage model essentially determines

the volatility instrument up to sign and choice of eigenvector. This actually simplifies the

estimation since it reduces the set of non-linear constraints that need to be imposed.

The observation that

K

Q

1,∆

estimates are nearly invariant across Gaussian and stochastic

volatility models leads us to the surprising conclusion that the

A

0

(

N

) model with

constant

volatility

allows us to essentially identify (up to choice of which eigenvector) the source of

stochastic volatility in the

A

1

(

N

) model. We provide an illustration of this point in the next

subsection.

5.2 Volatility information revealed by the Gaussian model