Guide to your

Home Insuance cover

Includes:

y Guide to your Boiler Emergency cover

y Guide to your Home Emergency cover

y Guide to your Family Legal Protection

In the event of an incident please call us immediately so we can help.

Claims:

0333 220 2035 Boiler/Home Emergency helpline: 0345 609 4375

These lines are open all day evey day.

Welcome to your Home Insurance cover

This booklet sets out the details of your Home Insurance with us, whether you insure one home under a single policy

or more than one home with a MultiCover policy.

Admiral MultiCover

Admiral MultiCover is designed to cover any number of homes, cars and vans under a single policy. The policy may

include just vehicles (also known as MultiCar), or a combination of vehicles and homes.

MultiCover is all about making things easier. It brings separate policies together under a standard 12-month policy

with a single renewal date and policy number.

You get a set of documents for each home, car or van you have insured. Please read these to make sure you are

familiar with all the terms of your policy.

The policy administrator

All policies must have a policy administrator.

Single policy

If your policy is for just your home, you will be the policy administrator.

The policy administrator is responsible for all payments, including any made by another person. If there is any overdue

amount which needs to be paid, we will contact the policy administrator.

MultiCover policy

Each home, car or van insured under the MultiCover policy will have its own individual policyholder. The policy

administrator will be one of the individual policyholders, and they will be our main point of contact.

If the policy administrator removes their own home or vehicle from the MultiCover policy, they must appoint one of

the other individual policyholders to take over as the policy administrator.

The policy administrator:

y

has access to all documents, information and personal information relating to the individual policies

y

can ask for another individual policyholder to become the policy administrator, and

y

can make changes to all the individual policies.

The policy administrator is responsible for all payments, whether those payments are made by individual

policyholders or any other person. If there is any overdue amount which needs to be paid, we will contact the

policy administrator.

The policy administrator is also responsible for making sure all individual policyholders have access to their policy

documents so they can check and amend the information if necessary.

For details of changes that individual policyholders and named drivers can make to MultiCover policies, please see

general condition 10.

Welcome to your Home Insurance cover (cont.)

When a new individual policy is added to a MultiCover policy, or a home, car or van is added to an individual policy,

the policy administrator gives to anyone who can make changes (as set out in general condition 10, Instructions)

permission to assess and confirm the suitability of the change. This person must consider the policy administrator’s

circumstances and agree to tell them about changes they make to a policy and provide further information if

necessary to confirm cover.

Your Home Insurance cover

This guide describes your Home Insurance cover. Please read it and the other policy documents carefully.

Your Home Insurance contract is made up of this policy booklet, your Home Proposal Confirmation or Home Renewal

Confirmation and your Home Policy Schedule.

This policy booklet provides all the information about your Home Insurance cover. Your Home Policy Schedule shows

the level of cover you have, any optional sections of cover you have chosen, your cover limits and excesses, and any

extra conditions that might apply.

Please read your policy documents carefully and let us know immediately if any of the information is incorrect. This is

important as the agreement to insure you is based on this information.

IMPORTANT

It is important that you tell us if any of the details on your Home Policy Schedule, Home Proposal

Confirmation or Home Renewal Confirmation are wrong, or if any of the information changes during the

period of insurance.

If you do not tell us about incorrect information or changes to details, we can:

y

refuse to pay your claim

y

reduce the amount of cover you have, or

y

declare your policy void (that is, treat it as if it had never existed).

Please see page 12 for full details of the changes you must tell us about.

Welcome to your Home Insurance cover (cont.)

Your contract of insurance has been arranged by us, EUI Limited of Ty Admiral, David Street, Cardiff, CF10 2EH. We are

authorised and regulated by the Financial Conduct Authority (FCA registration number 309378).

By taking out this cover you are entering into two separate agreements.

y

The first agreement is an intermediary agreement with us, EUI Limited. We are responsible for arranging and

managing your home insurance. That agreement, called ‘Your Agreement with EUI’, covers our services, fees and

charges. You are given a copy of this at the start of each period of insurance. It is also available on our website at

www.admiral.com.

y

The second agreement is the contract of insurance with the authorised insurer. The authorised insurer has

agreed to cover you, according to the terms and conditions in this document, against any liability, loss or damage

that arises in connection with your home during a period of insurance.

You only need to contact us about your insurance, and we will arrange everything with the authorised insurer on

your behalf.

Governing law

Unless we have agreed otherwise with you, this insurance is governed by English Law and all communications will be

in English.

Rights of third parties

The contract of insurance is between you and the authorised insurer. Nobody else has any rights relating to this

contract, including under the Contract (Rights of Third Parties) Act 1999.

Our authority

So that this document can be accepted as evidence of your contract of insurance, the authorised insurer has entered

into an agreement with us to allow an Authorised Underwriter of ours to issue this document on their behalf.

Guide to your Home Insuance cover

1

Contents

Guide to your Home Insurance cover

2 Your cover at a glance

4 Home Insurance definitions

8 Claims

12 Keeping your policy up to date

14 Section 1: Buildings

20 Section 2: Contents

29 Liability (I), (II), (III), (IV) and (V)

31 Section 3: Cover away from your home

33 Section 4: Pedal cycles

34 General exceptions to your Home Insurance cover

36 General conditions to your Home Insurance cover

41 Extra conditions that apply to your Home Insurance cover (endorsements)

Guide to your Boiler Emergency cover (Gold only) and Guide to your Home Emergency cover – optional policy

upgrade (included as standard on Platinum)

42 About your cover

Guide to your Family Legal Protection - optional policy upgrade (included as standard on Platinum)

53 About your Family Legal Protection

Comments and complaints

66 How to make a complaint

Privacy and security statement

67 Confidentiality and disclosure of your data

Guide to your Home Insuance cover

2

Your cover at a glance

Types of cover

Your Home Policy Schedule will show you the type of cover you have chosen.

The types of cover available with Home Insurance are listed below, with short explanations to help you understand

whether the cover is suitable for your needs.

General conditions and general exceptions always apply. Extra conditions only apply if they appear in your Home

Policy Schedule.

Buildings cover

This is suitable for customers who need cover for loss of or damage to buildings as a result of a cause listed in Section

1 (a buildings insured risk).

Contents cover

This is suitable for customers who need cover for loss of or damage to contents as a result of a cause listed in Section

2 (a contents insured risk).

Boiler Emergency cover

This is suitable for customers who need cover if their boiler or central heating completely breaks down, or they have

no hot water. The cover helps arrange and pay for emergency work to be carried out to make a temporary repair of

the damage.

Home Emergency cover

This is suitable for customers who need cover if specified events (set out in the ‘Guide to your Boiler Emergency cover

and Home Emergency cover’ on pages 42 to 52) cause an emergency (as defined on page 42) in their home. The cover

helps arrange and pay for work to be carried out to make a temporary repair of the damage.

Family Legal Protection

This is suitable for customers who need cover for the costs of appointing solicitors to deal with certain types of legal

disputes (as set out in this policy document).

Levels of cover

There are three levels of cover.

y

Admiral

y

Gold

y

Platinum

Each level has different features and benefits.

Duration of the cover

The duration of cover for buildings and contents, and any upgrades you have chosen, is shown in your Home Policy

Schedule and will not be more than 12 months. This cover will automatically be renewed unless:

y

you are no longer entitled to the cover, or

y

you tell us that you do not want to renew the cover.

Guide to your Home Insuance cover

3

Your cover at a glance (cont.)

Boiler Emergency cover is included as a standard benefit on Gold and so will automatically renew with the cover for

buildings and contents.

Family Legal Protection cover and Home Emergency cover apply for up to 12 months from the date you added them

to your policy until your policy is renewed or cancelled. This cover will automatically be renewed when your policy

is renewed.

Your level of cover

We know that everyone’s home insurance needs are different, so we offer three levels of cover for you to choose from

– Admiral, Gold and Platinum. Each level of cover provides a different package of policy benefits as standard.

You can change your level of cover but cannot mix and match levels. For example, you can’t choose Platinum cover for

buildings and Gold cover for contents.

If you have more than one home, you can choose different levels of cover for each home. For example, you can choose

a Platinum buildings and contents policy for one home and a Gold contents policy for the other.

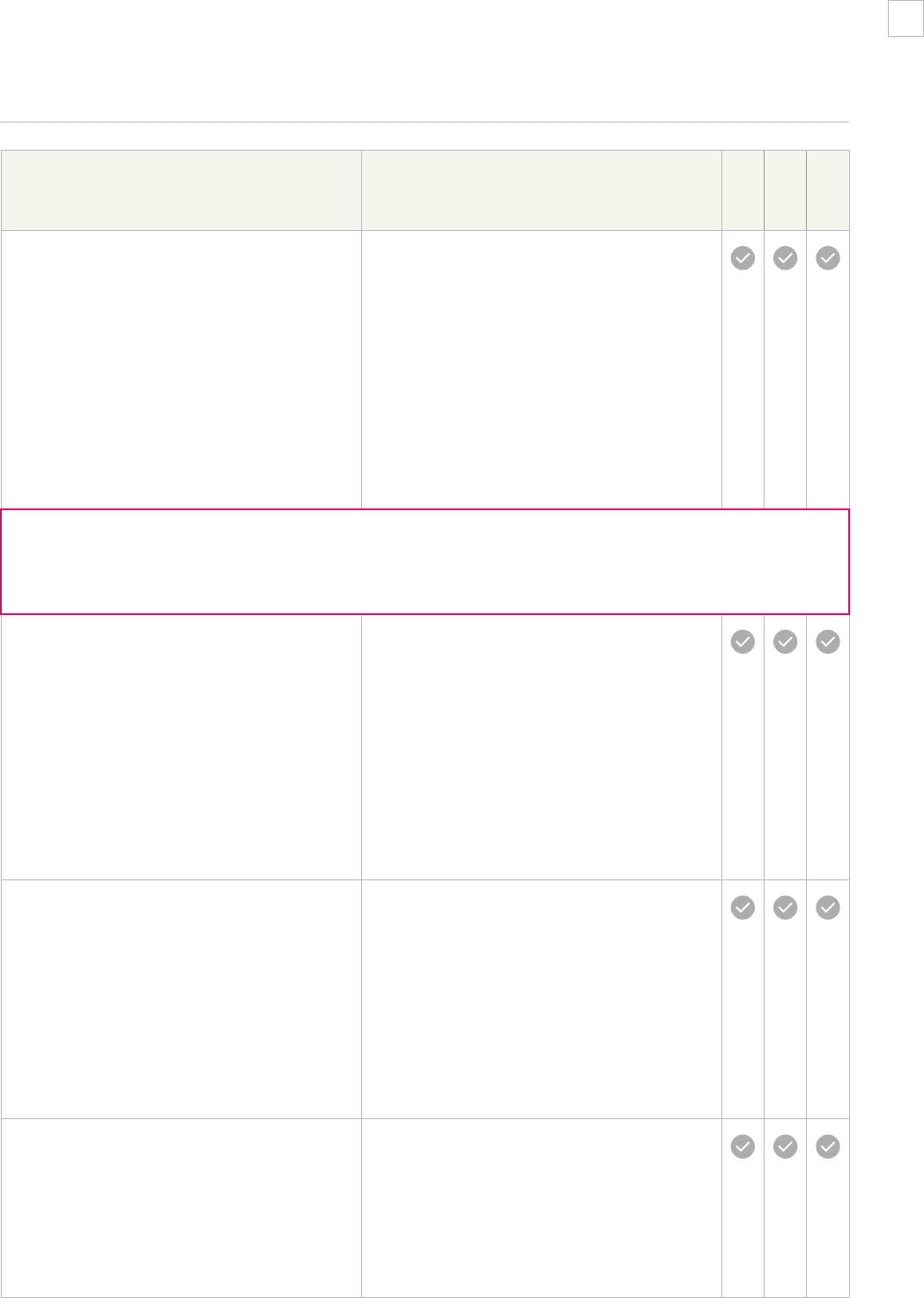

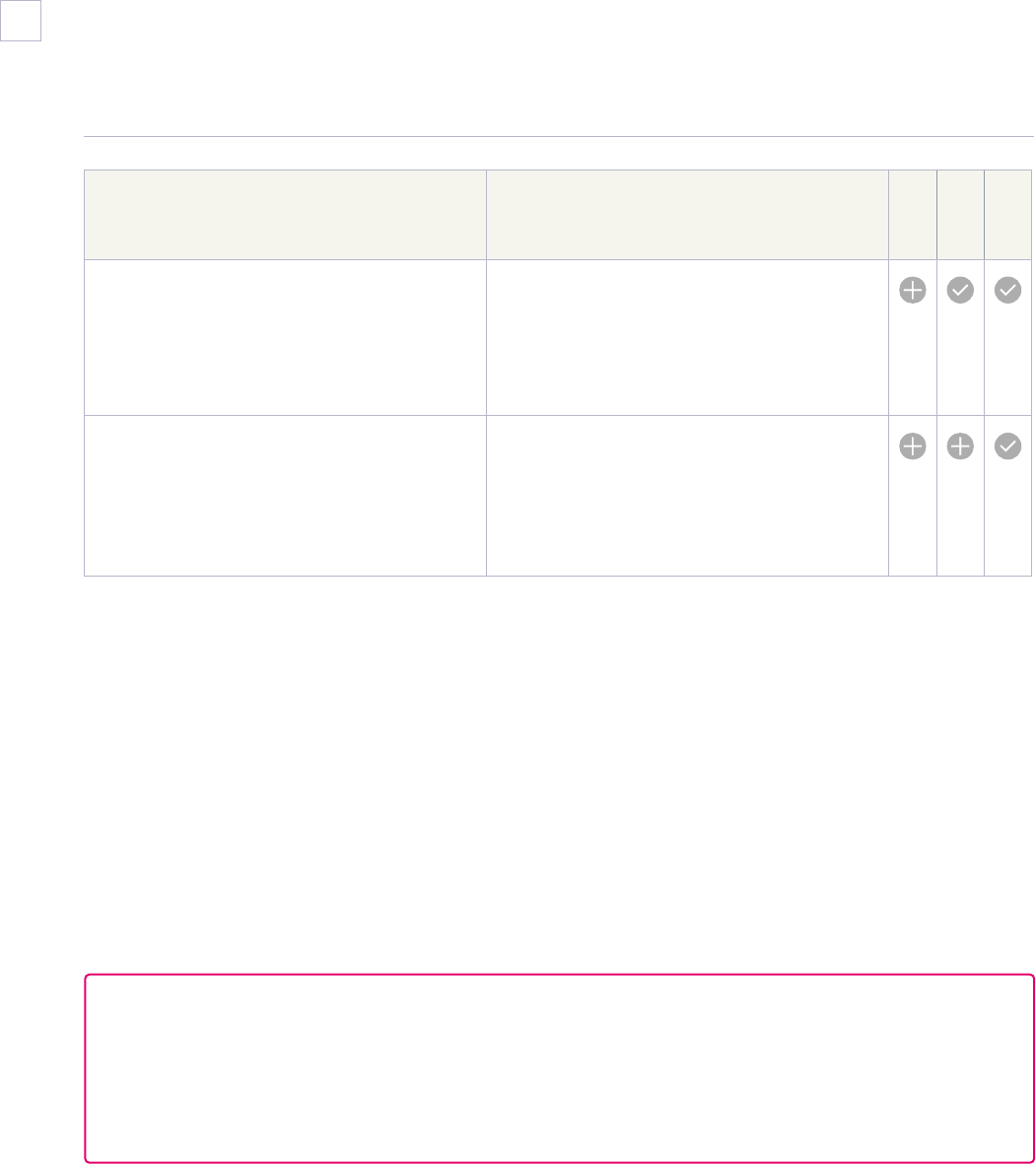

How your policy works

Within the policy sections, we’ve included a guide to show whether certain policy benefits are included as standard,

optional, or not available with the level of cover you have chosen. The tables in the policy sections indicate this with

the following symbols.

Included

Optional

Not Included

Below is an example of how the tables in individual sections will be set out.

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

This part of the tables gives detailed

information on the insurance provided and

must be read with ‘What is not covered’ (to

the right).

This part of the table specifies what is not

included in your policy.

Your Home Policy Schedule will show the level of cover you have, any optional cover you have chosen, your cover

limits and excesses, and any extra conditions that might apply.

IMPORTANT

General conditions and general exceptions, set out on pages 34 to 40, apply to all sections of your policy.

Guide to your Home Insuance cover

4

Home Insurance definitions

When the following words appear in bold in this policy booklet, they will have the meaning shown below.

Accidental breakage

Sudden, unexpected and visible breakage which has not been caused deliberately.

Accidental damage

Sudden, unexpected and visible loss or damage which has not been caused deliberately.

Authorised insurer

Admiral Insurance (Gibraltar) Limited, 2Aa 2nd Floor, Leisure Island Business Centre, 23 Ocean Village Promenade,

Gibraltar, GX11 1AA. Admiral Insurance (Gibraltar) Limited underwrites this policy (meaning they provide the

insurance cover).

Admiral Insurance (Gibraltar) Limited is licensed and regulated by the Gibraltar Financial Services Commission under

the Financial Services (Insurance Companies) Act 1987 of Gibraltar.

Buildings

Your home and its permanent fixtures and fittings, including the following.

y

Central-heating systems, fuel-storage tanks, drains, permanently connected pipes and cables, service tanks and

septic tanks

y

Permanently installed wind turbines, solar panels, electric-vehicle charging points, ground-source-heating pumps,

air-source-heating pumps, hot tubs and swimming pools

y

Drives, decking, boundary hedges, fences, garden walls, gates, hard tennis courts, paths, patios and terraces

Business equipment

Any item that is used mainly for your or your family’s profession, business, trade or employment, or belongs to

your employer.

Business purposes

Activities you carry out at your home in connection with your or your employer’s business, trade or profession.

These activities include, but are not limited to:

y

meeting business visitors

y

providing a service

y

selling or manufacturing products, and

y

storing stock that is intended to be sold or used for manufacturing or providing a service.

Using your home to carry out office work is not considered to be a business purpose.

Contents

Household goods, high-risk items and personal belongings which you or your family own or are legally responsible

for, including tenant’s fixtures and fittings, aerials and satellite dishes, domestic gardening equipment and domestic

motorised vehicles, but not including the following.

y

Any living creature or garden plants

y

Pedal cycles

y

Securities (financial certificates such as shares and bonds), money, credit cards, certificates and documents

y

Landlord’s fixtures and fittings

Guide to your Home Insuance cover

5

Home Insurance definitions (cont.)

y

Any part of the buildings

y

Business equipment

y

Motorised vehicles

Domestic motorised vehicles

Ride-on lawnmowers used in the boundaries of the home, electrically powered mobility carriages, electric

wheelchairs and golf trolleys controlled by a person on foot.

EUI Limited

EUI Limited, Ty Admiral, David Street, Cardiff, CF10 2EH. EUI Limited is authorised and regulated by the Financial

Conduct Authority (FCA registration number 309378). EUI Limited arrange and manage this policy.

Excess

The amount you must pay towards any claim. Your excesses are shown in your Home Policy Schedule.

Family

Your husband, wife or partner, children, foster children, parents, and any other relative who permanently lives with

you at your home address.

Heave

The ground beneath the buildings moving upwards as a result of the soil expanding.

High-risk items

The following personal belongings owned by you and your family.

y

Any collectible articles which are rare or unusual

y

Musical instruments or audio-visual, photographic or sporting equipment

y

Computers, laptops, mobiles phones, tablets and electronic notebooks

y

Jewellery, watches, pearls, precious metals or precious stones

y

Pictures, prints or works of art

y

Stamp, coin or other collections

Home

The main buildings you live in and their outbuildings, all of which are within the boundaries of the address shown in

your policy documents and are used for private and domestic purposes only. If more than one home is insured, each

will have its own policy documents.

Landslip

Sloping ground collapsing or sliding downwards.

Money

Current legal tender (bank notes and coins currently accepted as payment), cheques, postal or money orders, postage

stamps, savings stamps, savings certificates or bonds, travel tickets, luncheon vouchers, phone cards, mobile-phone

vouchers, reward vouchers and tokens, or gift cards and tokens, held for personal or charitable purposes.

Guide to your Home Insuance cover

6

Home Insurance definitions (cont.)

Motorised vehicle

Any vehicle that is electrically or mechanically powered or assisted, and its keys, parts or accessories. This includes

(but is not limited to) the following.

y

Quad bikes, e-scooters, caravans, trailers, aircraft and watercraft, whether or not they are licensed to be used on

the road

y

Electrically assisted pedal cycles, electric wheelchairs or mobility scooters that must be licensed to be used on

the road

Outbuildings

Permanent and immovable structures that are within the boundaries of the address shown in your policy documents,

are used for private and domestic purposes only, and cannot be lived in. Examples of outbuildings include:

y

garages

y

sheds

y

summerhouses, and

y

greenhouses.

Structures that are not permanent or can be moved, such as mobile homes, caravans or motor homes, are

not covered.

Period of insurance

The length of time you are covered by this insurance, as shown in your current policy documents.

Personal possessions

Portable items which belong to you or your family and are designed to be worn or carried, including golf trolleys

controlled by a person on foot and wheelchairs or mobility scooters that do not need to be licensed to be used on

the road.

Policy documents

Your policy documents are as follows.

y

The most recent version of your Home Policy Schedule. This shows the sections of the policy you have chosen,

the limits and excesses that apply if you make a claim, and any extra conditions (endorsements) that apply

y

The most recent version of your Home Proposal Confirmation or Home Renewal Confirmation. These show the

details you provided when you took out the insurance

y

This policy booklet and all amendments set out in the documents we send you at renewal

Specified item

High-risk items which are worth more than the ‘Unspecified item limit’ and which you have chosen to insure. These

items are listed in your policy documents.

Settlement

The ground moving downwards as a result of the soil being compressed by the weight of the buildings within 10 years

of them being built.

Guide to your Home Insuance cover

7

Home Insurance definitions (cont.)

Storm

Wind with gusts of at least 55mph, heavy rainfall at a rate of at least 25mm per hour, snow to a depth of at least 30cm

in 24 hours, or hail that causes damage to hard surfaces or breaks glass.

These extreme weather conditions can cause damage to even well-maintained homes. However, damage caused to

homes that have not been well-maintained, or caused by normal weather or wear and tear, is not covered. Please see

general exception 10, gradual causes.

Subsidence

The ground beneath the buildings moving downwards, other than by settlement.

Territorial limits

Great Britain, Northern Ireland, the Isle of Man and the Channel Islands.

Unoccupied

When your home is not lived in by you or a member of your family or does not contain enough furniture for normal

living purposes. By ‘lived in’ we mean that you or a member of your family regularly sleep there overnight and

carry out day-to-day activities such as cooking and bathing in the property. Unless we have agreed otherwise in

advance, your home will be classed as unoccupied if you exceed the ‘Days unoccupied limit’ shown in your Home

Policy Schedule.

IMPORTANT

If you know that the home is going to be unoccupied for longer than the ‘Days unoccupied limit’ you must tell

us beforehand so you are not left without cover.

We

EUI Limited.

You

Anyone named as policyholder or joint policyholder on the most recent policy documents.

Guide to your Home Insuance cover

8

Claims

Making a claim

Your Home Policy Schedule shows the sections of the policy you have chosen.

To make a Home Insurance claim you can:

y

call our Claims Department on 0333 220 2035

y

call from abroad on +44 2920 601 294, or

y

go through ‘My Account’ on our website.

If you want to make a claim for a Boiler Emergency or Home Emergency, or Family Legal Protection, see the relevant

sections of this booklet.

Am I covered?

Check your current policy documents and ‘Guide to your Home Insurance cover’ to see your level of cover and make

sure your lost or damaged property is insured. Also check if any extra conditions (endorsements) or limits apply to

your current policy and the excess you will have to pay.

What else do I need to do?

If your claim relates to any theft or attempted theft, or loss of or damage to your property as a result of civil

commotion, a malicious act, riot, strikes or vandalism, you must report the matter to the police and get a crime

reference number from them.

What information do I need to provide when making a claim?

y

Your personal details, including your policy number, so we can confirm your identity

y

The date and time of the incident that caused the loss or damage, and details of that incident

y

Details of the loss or damage, including the value (if you know this)

y

Details of any person responsible for the incident and any injured person, the contact details for any witness and

the crime reference number (if appropriate)

If you claim for something under this policy which is also covered by other insurance, you must give us full details of

the other policy. We will only pay our share of any claim.

What happens next?

We will try to settle your claim as quickly as possible. We may appoint a firm of loss adjusters to act on our behalf to

assess your claim. A claim may take longer to settle if a lot of people have been affected at once (for example, due to

civil commotion, storm or flood). Complicated claims such as subsidence claims may also take more time to settle.

Your responsibilities

As well as the individual sections you are covered under, it is important that you also read the general conditions on

page 36 and the general exceptions on page 34.

You must pay the excess shown in your policy documents for each claim we accept.

Fraud

Insurance fraud (for example, providing false or misleading information in connection with a claim) is a crime. It

increases premiums for everyone, and we are committed to protecting our customers against fraud and its effects.

We will take action to detect and prevent fraud. The action could include reporting the matter to the police. Please

see general condition 9 on page 39 for more information.

Guide to your Home Insuance cover

9

Claims (cont.)

Basis for settling claims

We may ask you for more information to support your claim, such as:

y

original receipts, invoices or valuations dated before the item was insured, and

y

instruction booklets, photographs or details of where and when an item was purchased.

Do not get rid of a damaged item (unless it could cause harm) as it could help us settle your claim faster. If you do not

provide everything we need, it could mean we do not pay your claim or we reduce the amount you can claim for.

IMPORTANT

Please check your Home Policy Schedule as you may need to pay more than one excess for a claim.

Compulsory buildings excess and compulsory contents excess

These excesses apply for all buildings or contents claims, unless they are replaced by the claims cause excess

(see below).

Claims cause excess

If a claim was caused by one of the claims causes listed in your Home Policy Schedule, we will charge either

the compulsory excess or the claims cause excess, whichever is more.

Voluntary excess

This is the excess you chose when arranging cover. You can choose a voluntary excess to be added to the

compulsory excess (or claims cause excess). You will need to pay the total before we will settle your claim.

The excess that will apply

If the item your claim relates to is insured under both section 1 (Buildings) and one or more section for

contents (sections 2, 3 and 4), the excess we apply when we settle the claim will be based on the overall

nature of your claim. If the overall nature of your claim is both buildings and contents, the higher excess will

always apply.

Your claim may also be covered under Boiler Emergency cover or Home Emergency cover (if you have chosen

these options). For example, a leak from your toilet could be covered under Home Emergency cover, where no

excess applies. Please check your Boiler Emergency cover or Home Emergency cover.

How we will settle your claim

Section 1 (Buildings)

We will decide how to settle your claim. We will either pay the cost of rebuilding, repairing or replacing any damaged

part of the buildings covered under this policy, or pay you a cash settlement for the same amount it would have cost

us to use our chosen supplier for a necessary repair or replacement. The cash settlement may be less than the cost of

rebuilding, repairing or replacing the damaged part.

If we decide not to rebuild or repair the damage, we will pay either:

y

the amount by which the property has reduced in value because of the damage, or

y

the estimated cost of repair, whichever is lower.

Guide to your Home Insuance cover

10

Claims (cont.)

We will not take any amount off the claim payment to account for wear and tear, as long as:

y

your buildings were in a good state of repair when the damage happened, and

y

the necessary work is carried out as soon as reasonably possible.

Section 2 (Contents), Section 3 (Cover away from your home) and Section 4 (Pedal cycles)

We will decide to either:

y

repair the item

y

restore the item (for example, use professional cleaners for carpets)

y

pay the cost of repairing the item

y

replace the item as new, or

y

pay in cash or vouchers up to the amount we could repair, restore or replace the item for.

The most we will pay under any one contents section is the contents sum insured shown in your Home Policy

Schedule, unless the particular section states a maximum limit that will apply.

We will not reduce the sum insured after a claim, as long as all replacements and repairs are made.

All sections

If you do not tell us about any mistakes in or changes to the details in your policy documents, we may reduce the

claims settlement proportionately, as set out in the example below, or even refuse to pay your claim at all.

For example, if the details you provided when arranging cover are incorrect, meaning the premium you paid was only

75% of what it should have been, we will pay no more than 75% of your claim.

IMPORTANT

When your claim is settled, we may take ownership of your damaged property and keep any salvage (what is

left of any damaged items).

Each individual item from a matching set or suite of items (such as a bathroom suite, a fitted kitchen, an area

of wall tiles, floor coverings or a furniture set) is considered to be a single item. We will not pay for the other

items in the set, unless ‘Matching items’ is shown in your policy documents.

If we ask you to, you must give us the undamaged parts of the set or suite when the claim is settled.

Guide to your Home Insuance cover

11

Claims (cont.)

Our responsibilities

We will not pay for any reduction in the market value of your home as a result of rebuilding, repairing or replacing any

damaged part of your buildings due to an incident covered under this policy.

We will not reduce the sum insured after a claim, as long as all necessary work has been carried out.

We will not pay any extra cost to change, extend or improve your buildings in any way.

Our liability under Section 1 (Buildings) and Section 2 (Contents) is limited to the maximum amount shown on your

policy documents for each period of insurance, no matter how many claims are made.

IMPORTANT

High-risk items

Any high-risk item or collection valued at more than the ‘Unspecified item limit’ must be shown on your Home

Policy Schedule as a specified item.

We will not pay more than the ‘Unspecified item limit’ for any single high-risk item or collection not

shown on your Home Policy Schedule. Please contact us if you need to add a specified item to your Home

Policy Schedule.

Guide to your Home Insuance cover

12

Your policy documents show the information you have given us. It is important that you tell us if any of the

information is wrong or if the details change during the period of insurance.

If any details need to be corrected or changed, we will work out any difference in premium from the date you should

have told us about the correction or change (even if this was in a previous period of insurance).

For example, if you change address, make alterations to your property or are convicted of a crime, this could also

mean that:

y

the terms of your insurance cover will change, or

y

we are no longer able to provide cover.

IMPORTANT

If you do not tell us about any corrections or changes, this could mean that we do not pay your claim, we

reduce the amount you can claim for, or we declare your policy void (consider it to have never existed).

You must keep the following details up to date during the period of insurance.

1. Please tell us about the following beforehand.

y

If you are changing address

y

If your home will be unoccupied for longer than the ‘Days unoccupied limit’ shown on your policy documents

y

If you plan to rent out your home or use it as a holiday home

y

If the number of lodgers or paying guests in your home changes (if a number is shown in your policy documents)

y

If you intend to use your home for business purposes

y

If you intend to do any building work or renovations inside or outside the property (except routine maintenance

and decorating)

y

If the number of bedrooms or bathrooms in your home will change (if a number is shown in your policy documents)

y

If the property will no longer be your home address

2. Please tell us immediately if any of the following happen.

y

You or anyone living with you is convicted of, has been charged with or waiting to hear about being charged for a

criminal offence

y

The condition of your home deteriorates so as to increase the risk of loss or damage

y

The value of your contents, specified items, personal possessions or pedal cycles increases or any specified items

need to be shown in your policy documents

y

The value of your high-risk items increases above the ‘Total high risk items limit’ shown in your policy documents

y

You need to add, remove or change your joint policyholder

y

You stop using your intruder alarm (if your policy documents show that you have one)

Keeping your policy up to date

Guide to your Home Insuance cover

13

Keeping your policy up to date (cont.) Keeping your policy up to date (cont.)

3. Please tell us about the following when you renew your insurance.

y

Any changes to the details in your policy documents

y

If you or anyone living with you has been declared bankrupt or, in Scotland, sequestrated (if ‘declared bankrupt or

received an IVA’ is shown in your policy documents)

y

If you or anyone living with you has entered into an IVA (Individual Voluntary Agreement) or trust deed to pay off

debts from a credit agreement (if ‘declared bankrupt or received an IVA’ is shown in your policy documents).

Adequate protection for contents

At the start of the policy and at each renewal you must make sure that the cover you have for contents is enough to

cover the total value of all your contents as new, and tell us about any changes that may affect your cover.

Inflation protection

If a ‘Contents Total’ is shown in your Home Proposal Confirmation we will increase it in line with inflation (according

to the consumer durables section of the Retail Price Index, or any other suitable index) when we set your

renewal premium.

Adequate protection for buildings

At the start of the policy and at each renewal you must make sure that the cover you have for buildings is enough

to cover the ‘Rebuild cost’ of your buildings (as shown in your Home Proposal Confirmation), and tell us about any

changes that affect this.

Inflation protection

If a ‘Rebuild cost’ is shown in your Home Proposal Confirmation we will increase it in line with the House

Rebuilding Cost Index of the Royal Institute of Chartered Surveyors, or any other suitable index, when we set your

renewal premium.

IMPORTANT

Personal possessions, specified items and pedal cycles are not index linked, meaning that their value does

not automatically increase at renewal. It is important you check the personal possessions limit and the

value for any specified items and pedal cycles listed in your Home Policy Schedule to make sure you have

enough cover.

Guide to your Home Insuance cover

14

Section 1: Buildings

This section only applies if it is shown in your Home Policy Schedule.

Please check your Home Policy Schedule for details of your level of cover, the cover limits and details of the excess

that will apply to each claim.

Causes 1 to 13 in the table below (the buildings insured risks) are included as standard with all levels of cover.

What is covered What is not covered

1) Fire, lightning, explosion or earthquake. Loss or damage caused by:

y

cigarette or tobacco burns, or

y

scorching, melting, warping or other forms of heat

damage caused without flames.

2) Smoke. Loss or damage caused by smog, air pollution, volcanic ash,

or agricultural or industrial work.

3) Riot and civil commotion.

4) Collision involving any:

y

vehicle

y

aircraft (including flying objects) and anything falling

from them, or

y

animal.

Loss or damage caused by pets or pests (see general

exception 21, Pests).

Loss or damage caused by a drone flown by you or your

family.

5) Falling trees and branches. Loss or damage caused during tree maintenance.

Loss of or damage to hedges, gates or fences.

The cost of removing fallen trees or branches that have not

caused damage to the buildings.

The cost of removing any part of the tree remaining below

ground, or of restoring the site.

6) Falling television and radio aerials (including satellite

dishes), and their fittings and masts.

Loss of or damage to hedges, gates or fences, or to the

aerials, fittings, satellite dishes and masts themselves.

(These items may be covered under Section 2, Contents.)

7) Storm and Flood.

IMPORTANT

Please check your policy documents for the Claims Cause

Excess for flood.

Please see the definition of storm, the general exceptions

and general condition 3 in this booklet.

Loss or damage caused to any:

y

gate, fence or hedge, or

y

unfinished alterations or extensions.

Loss or damage caused by gradually rising ground-water

levels.

Loss or damage caused by subsidence, heave or landslip

resulting from storm or flood.

Loss or damage that happens gradually through wear and

tear or due to a lack of maintenance.

Guide to your Home Insuance cover

15

Section 1: Buildings (cont.)

What is covered What is not covered

8) Theft and attempted theft.

For guidance on what steps to take after a theft or

attempted theft, see General Condition 2, Claims

Procedure.

Loss or damage caused by you, your family, or any other person

lawfully in your home, unless force and violence was used to

enter your home.

Loss or damage while your home is lived in by anyone other

than you or your family, unless force and violence was used to

enter your home.

Loss or damage while your home is unoccupied.

9) Vandalism and malicious acts.

10) Water escaping from any:

y

fixed water tank

y

water pipe

y

fixed central-heating system, or

y

domestic appliance.

IMPORTANT

Please check your policy documents for the Claims Cause

Excess for escape of water.

Loss or damage caused to the fixed domestic-water or

central-heating system, or the domestic appliance itself, or to

any drains and pipes.

Loss or damage caused by:

y

water overflowing as a result of any taps being left on

(this may be covered under ‘Buildings accidental damage’)

y

faulty, failed or inadequate grout or sealant, or

y

water escaping from external pipes that are above ground

Loss or damage caused to solid floors by infill materials

settling, swelling or shrinking due to the escape of water.

Loss or damage caused by subsidence, heave or landslip

resulting from the escape of water.

Loss or damage caused while your home is unoccupied.

11) Accidental damage to underground drains, pipes,

cables and tanks.

The cost of clearing blockages from pipes and drains if there

is no damage to the pipe or drain itself.

12) Oil escaping from any:

y

fixed central-heating oil tank, or

y

domestic heating appliance.

Loss or damage caused by oil escaping from a:

y

plastic single-skin storage tank that does not meet

current pollution regulations in your area or is outside its

manufacturer’s guarantee, or

y

de-commissioned or abandoned oil tank.

Loss or damage caused as a result of necessary repairs or

maintenance work identified in the most recent inspection of

the oil tank and pipes not being carried out.

Loss or damage caused:

y

to the fixed central-heating oil tank or heating appliance

itself

y

by oil escaping from external pipes that are above ground,

or

y

while your home is unoccupied.

Guide to your Home Insuance cover

16

Section 1: Buildings (cont.)

What is covered What is not covered

13) Subsidence, heave and landslip.

IMPORTANT

Please check your policy documents for the Claims Cause

Excess for subsidence.

Loss or damage caused by:

y

settlement, consolidation (soil changing in volume

because of a change in pressure), shrinkage or ground

being compacted

y

thermal movement (expansion and contraction caused by

heat and cold)

y

the action chemicals have on or with any materials

forming part of the buildings

y

coastal or river erosion, or

y

demolition or structural changes or repairs to your home.

Loss of or damage to solid floor slabs or from them moving,

unless the foundations of the home (not including its

outbuildings) are damaged at the same time and by the same

cause.

Loss of or damage to any part of the buildings unless the

home is damaged at the same time and by the same cause.

Loss or damage that is covered under a guarantee or an NHBC

Certificate.

Loss of or damage to hedges, gates or fences.

The following policy benefits are only available if they are included with the level of cover you have chosen. Please

check your Home Policy Schedule to confirm your level of cover, and the most we will pay for any one claim.

Included

Optional

Not Included

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Locks and keys

Replacing and installing locks and keys to:

y

the external doors of your home, and

y

safes in your home,

if the keys are lost or stolen.

This cover is included under both Section 1

(Buildings) and Section 2 (Contents). If both

sections are in force, we will only pay under

one section.

Guide to your Home Insuance cover

17

Section 1: Buildings (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Site clearance and building fees

When dealing with a claim for loss or damage

due to a buildings insured risk, we will pay the

following.

y

Architects’, surveyors’ and consulting

engineers’ fees

y

Legal fees

y

The cost of clearing debris from the site

y

The cost of demolishing or supporting the

buildings

y

The cost of keeping to government or local-

authority requirements

Any fees for preparing your claim.

Any costs you agree without our permission.

Alternative accommodation and loss of rent

If your home is not fit to be lived in due to loss or

damage resulting from a buildings insured risk, or

following a compulsory evacuation of your home

by a local authority or emergency services, we will

pay the following.

y

The reasonable cost of temporary

accommodation for you, your family and your

pets, while your home is being repaired

y

Any ground rent you still have to pay

y

The amount of rent you would have received

under a contract if your home were let,

including short-term lettings

Any costs you agree without our permission.

Any costs that arise once your home is fit to be

lived in again.

Any costs that arise after the local authority or

emergency services confirm you can return to your

home.

Any costs associated with keeping livestock.

IMPORTANT

By ‘reasonable cost’ we mean that the amount we pay for temporary accommodation will take account of all of the

circumstances of the claim, including your needs, the length of time the temporary accommodation is needed for, and the

cost of other suitable accommodation available locally.

Emergency access

Damage caused to your buildings or garden as a

result of emergency services having to force entry

into your property due to a medical emergency or

to prevent damage to your property.

Frost damage to plumbing

Damage to any part of the pipes and plumbing

inside your home as a result of freezing.

Loss of or damage to:

y

plumbing that is outside or in an outbuilding,

or

y

the fixed domestic-water or central-heating

system itself as a result of something other

than freezing.

Loss or damage arising while your home is

unoccupied.

Guide to your Home Insuance cover

18

Section 1: Buildings (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Property owner’s liability

Amounts you or your family legally have to pay, as

owners of your home, for causing accidental death

or injury.

Amounts you or your family legally have to pay,

as owners of your home, for accidental loss of or

damage to property.

Amounts you or your family legally have to pay, as

the previous owners of any private property, under

Section 3 of the Defective Premises Act 1972 or

Section 5 of the Defective Premises (Northern

Ireland) Order 1975.

There is no excess for claims for property owner’s

liability.

The death of or injury to you, your family or

anyone else permanently living with you, including

your domestic staff.

Damage to property which you, your family or

anyone else permanently living with you, including

your domestic staff, own or are responsible for.

Any liability resulting directly or indirectly from

you or your family being treated for or passing on

any disease or virus.

Liability arising from any profession, business,

trade or employment.

Liability due to you owning or using a lift or any

motorised vehicle.

Liability arising if you own and live in your home

(that is, you are the owner-occupier) and have

claimed under occupier’s liability cover (Section 2,

Contents).

IMPORTANT

If you are the owner-occupier of your home, to be adequately covered you need occupier’s liability cover under Section 2,

Contents. If you have contents cover, Occupier’s Liability will be shown in your policy documents.

Sale of home

If you sell your home, and between the date

you exchange contracts and the date the sale

completes the buildings are damaged due to any

buildings insured risk, cover will be provided for

the person buying your home.

Loss or damage occurring more than 90 days before

the sale completes.

Trace and access

The cost of removing and replacing any part of

the buildings to find the source of a water or oil

leak from any tank, pipe, or fixed water or heating

system if the buildings are damaged due to

any buildings insured risk, or by frost damage to

your plumbing.

Loss of or damage to your tanks, pipes, fixed water

or heating systems themselves.

Matching items

If part of:

y

a bathroom suite

y

a fitted kitchen,

y

a floor covering, or

y

an area of wall tiles

is damaged beyond repair, and we cannot find a

replacement for that part, we will pay for repairing

or replacing the whole suite, the complete floor

covering or all the wall tiles.

Loss of or damage to floor coverings in adjoining

rooms or clearly identifiable separate areas.

Guide to your Home Insuance cover

19

Section 1: Buildings (cont.)

Buildings accidental breakage and accidental damage

Your Home Policy Schedule will show the level of cover you have and any optional cover that you have chosen.

Included

Optional

Not Included

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

I) Accidental breakage of glass and sanitary

fixtures

The accidental breakage of:

y

fitted glass in windows, doors, fan lights, skylights

and solar panels

y

sanitary fixtures (washbasins, sinks, toilets, shower

trays, shower screens, baths and bidets), or

y

ceramic hobs which form part of a fitted kitchen.

Loss or damage to window frames, solar-panel

frames, door frames or casements.

II) Buildings accidental damage

Accidental damage to your buildings.

Loss or damage caused by:

y

water entering the home (this may be

covered under causes 7 and 10 in Section 1,

Buildings)

y

electrical breakdown or failure

y

subsidence, heave, landslip, thermal

movement, settlement or shrinkage, or

y

the action chemicals have on or with any

materials forming part of the buildings.

Loss or damage which is specifically not covered

under Section 1, Buildings.

Any cost of maintenance and normal decorating.

The following exclusions apply to accidental breakage of glass and sanitary fixtures and accidental damage to

buildings.

We will not pay for damage caused:

y

as a result of alterations or extensions to the buildings

y

by demolition

y

by any paying guest or tenant

y

by pets, through chewing, scratching, tearing, fouling or vomiting

y

while your home is unoccupied

y

by pests (see general exception 21, Pests), or

y

by a drone being flown by you or your family.

IMPORTANT

An excess will apply to any claims for accidental breakage or accidental damage. The details of the excess

are shown in your policy documents. Also see your policy documents for details of ‘Cover and Limits’. For

example, if you claim for accidental damage to locks, the limit of cover for locks will apply.

Guide to your Home Insuance cover

20

Section 2: Contents

This section only applies if shown in your policy documents.

Please check your Home Policy Schedule for details of your level of cover, the cover limits and the excess that will

apply to each claim.

Causes 1 to 12 in the table below (the contents insured risks) are included as standard with all levels of cover.

What is covered What is not covered

1) Fire, lightning, explosion and earthquake. Loss or damage caused by:

y

cigarette or tobacco burns, or

y

scorching, melting, warping or other forms of heat

damage caused without flames.

2) Smoke. Loss or damage caused by smog, air pollution, volcanic ash,

or agricultural or industrial work.

3) Riot and civil commotion.

4) Collision involving any:

y

vehicle

y

aircraft (including flying objects) and anything falling

from them, or

y

animals.

Loss or damage caused by pets or pests (see general

exception 21, Pests).

Loss or damage caused by a drone being flown by you or

your family.

5) Falling trees and branches. Loss or damage to the trees or branches themselves.

6) Falling television and radio aerials (including satellite

dishes), and their fittings and masts.

Loss or damage to the aerials, fittings, satellite dishes and

masts themselves.

(These items may be covered under (I), accidental damage to

audio visual equipment.)

7) Storm and flood.

IMPORTANT

Please check your policy documents for the Claims Cause

Excess for flood.

Please see the definition of storm, the general exceptions

and general condition 3 in this booklet.

Loss or damage caused by gradually rising ground-water

levels.

Loss or damage caused to radio or television aerials or

satellite dishes.

Loss or damage that happens gradually through wear and

tear or due to a lack of maintenance.

Guide to your Home Insuance cover

21

Section 2: Contents (cont.)

What is covered What is not covered

8) Theft and attempted theft.

For guidance on what steps to take after a theft or

attempted theft, see General Condition 2, Claims Procedure.

Loss or damage to contents in your outbuildings, or kept in

the open on the land your home stands on.

(This may be covered under ‘Theft from garages and

outbuildings’ or ‘Contents in your garden’ (or both) if you

chose these options.)

Loss or damage caused by you, your family, or any other

person lawfully in your home, unless force and violence was

used to enter your home.

Loss or damage while your home is being lived in by anyone

other than you or your family, unless force and violence was

used to enter your home.

Loss or damage while your home is unoccupied.

9) Vandalism and malicious acts. Loss or damage caused by you, your family, or any other

person lawfully in your home, including through a dedicated

home-sharing website, unless force and violence was used to

enter your home.

Loss or damage while your home is:

y

let out or lent, unless force and violence was used to

enter your home, or

y

unoccupied.

10) Water escaping from any:

y

fixed water tanks

y

water pipes

y

fixed central-heating system, or

y

domestic appliance.

IMPORTANT

Please check your policy documents for the Claims Cause

Excess for escape of water.

Loss or damage caused by:

y

water overflowing as a result of any taps being left

on (this may be covered under ‘Contents accidental

damage’)

y

faulty, failed or inadequate grout or sealant, or

y

water escaping from external pipes that are above

ground

Loss or damage caused while your home is unoccupied.

Guide to your Home Insuance cover

22

Section 2: Contents (cont.)

What is covered What is not covered

11) Oil escaping from any:

y

fixed central-heating oil tank, or

y

domestic heating appliance.

Loss or damage caused while your home is unoccupied.

12) Subsidence, heave and landslip. Loss or damage caused by:

y

settlement, consolidation (soil changing in volume

because of a change in pressure), shrinkage or ground

being compacted

y

thermal movement (expansion and contraction caused

by heat and cold)

y

coastal or river erosion, or

y

demolition or structural changes or repairs to your home.

The following policy benefits are only available if they are included with the level of cover you have chosen. Please

check your Home Policy Schedule to confirm your level of cover and the most we will pay for any one claim.

Included

Optional

Not Included

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Loss of metered water and oil

The cost of metered water or domestic-heating

oil lost following accidental damage to pipes and

equipment which provide services to your home.

Loss or damage that arises while your home is

unoccupied.

Money

Loss of or damage to money in your home.

Theft, unless force and violence was used to enter

or leave your home.

Loss of, damage to or theft of money in your

garden or outbuildings.

Credit cards

The unauthorised use of a charge, credit or debit

card that has been stolen from your home.

Unauthorised use of the card by:

y

you, your family or any other person lawfully

in your home, or

y

anyone else, unless force and violence was used

to enter your home.

Locks and keys

Replacing and installing locks and keys to:

y

the external doors of your home, and

y

safes in your home

if the keys are lost or stolen.

This cover is provided under both Section 1

(Buildings) and Section 2 (Contents). If both sections

are in force, we will only pay under one section.

Claims covered by a separate buildings policy you

have to cover theft or loss of keys.

Guide to your Home Insuance cover

23

Section 2: Contents (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Alternative accommodation

If your home is not fit for you to live in due to

loss or damage to contents resulting from any

contents insured risk, we will pay either:

y

the reasonable cost of temporary

accommodation for you, your family and your

pets while your home is being repaired or,

y

any rent which you, as the tenant, remain

legally responsible for paying.

We will also pay for the temporary storage of your

contents if they are at risk.

Any costs you agree without our permission.

Any costs that arise once your home is fit for you

to live in again.

Costs for any person who is not a member of your

family.

Any costs associated with keeping livestock.

IMPORTANT

By ‘reasonable cost’ we mean that the amount we pay for temporary accommodation will take account of all of the

circumstances of the claim, including your needs, the length of time the temporary accommodation is needed for, and the cost

of other suitable accommodation available locally.

Digital downloads

Loss of or damage to legally downloaded content

that you have bought and stored on your home

entertainment equipment.

The cost of remaking a film, tape or disc.

Rewriting the information on your home

entertainment equipment.

Files that can be retrieved from elsewhere.

Claims where you cannot provide proof of purchase

and confirmation from the download provider that

they cannot restore your lost files.

Loss of or damage to the entertainment

equipment itself, unless covered under another

section of this policy.

Freezer food

Loss of or damage to food in a freezer in your

home after a sudden rise or fall in temperature or

as a result of contamination from refrigerant or

refrigerant fumes.

Loss or damage:

y

due to the plug being accidentally removed or

the appliance being switched off by mistake, or

y

following any planned interruption to your

supply carried out by an electricity provider.

Loss or damage if the refrigeration unit of the

appliance is over 10 years old.

Loss or damage while your home is unoccupied.

Celebration cover

The sum insured for contents will be increased by

the amount shown in your policy documents for

14 days either side of the date of a special event, a

religious festival, your wedding day or the birth of

your child, to cover gifts and food bought for the

celebration.

Guide to your Home Insuance cover

24

Section 2: Contents (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Garden plants

Damage to trees, shrubs, plants and lawns while in

the open on the land your home stands on.

Loss or damage caused:

y

by you, your family, or any other person

lawfully in your home, or

y

while your home is unoccupied

y

by storm or flood, or

y

by oil escaping.

Office equipment

Loss of or damage to office equipment belonging

to you or your family, and used at home or

outbuildings for office work, as a result of any

contents insured risk.

By office equipment we mean: computers,

keyboards, monitors, printers, fax machines,

photocopiers, landline phones (not mobile phones)

and office furniture. It does not include any trade

items held in stock.

Loss of or damage to electronic storage media, discs,

records, diskettes or tapes.

Loss or damage caused while your home is

unoccupied.

Theft from unlocked outbuildings.

Contents temporarily away from home

Loss of or damage to contents, due to any

contents insured risk, while they are temporarily

away from your home, either in a family member’s

home or in a purpose-built storage facility,

anywhere in the world, for up to 90 days.

Loss or damage while the contents are:

y

being transported

y

stored in a caravan or temporary structure.

Loss or damage by deception.

Loss of or damage to:

y

sports equipment, or

y

any contents not previously kept in your home.

Items in a bank

Loss of or damage to contents while they are being

stored in a bank or building society safe deposit

within the territorial limits.

Contents that are being removed from or being

transported to the bank or safe deposit.

Deeds and documents

Loss of or damage to title deeds and documents

which prove that you or your family own your

home or property, while they are held in a bank,

building society or solicitor’s strong room or kept

in your home.

Deeds and documents held for any professional,

business, trade or employment purposes.

Any loss or damage arising outside the territorial

limits.

Securities (financial certificates such as shares and

bonds).

Theft from garages and outbuildings

Theft or attempted theft of your or your family’s

contents (including sporting equipment) which are

kept locked in your outbuildings on the land your

home stands on.

For theft or attempted theft of your office

equipment, please see the office equipment cover

above.

Loss or damage caused:

y

by you, your family, or any other person

lawfully in your home, or

y

while your home is unoccupied.

Money, credit cards and high-risk items.

Theft from greenhouses.

Guide to your Home Insuance cover

25

Section 2: Contents (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Contents in your garden

Loss of or damage to your or your family’s

contents while they are kept in the open, or in a

locked vehicle, on the land that your home stands

on.

If your contents are away from your home, please

see Section 3 (Cover away from your home).

Loss or damage caused:

y

by you, your family, or any other person

lawfully in your home, or

y

while your home is unoccupied.

High-risk items, pedal cycles, or money.

Loss or damage due to cause 7, storm and flood.

Loss or damage caused by theft or attempted

theft from an unattended motor vehicle, unless:

y

all windows were closed

y

all doors were locked

y

the boot was locked, and

y

the items were hidden from view in the boot,

a closed glove compartment, or a concealed

luggage compartment.

Visitors’ belongings

Loss of or damage to contents belonging to

visitors, while they are in your home, due to any

contents insured risk.

y

Loss or damage to money.

Household removal and temporary storage

Accidental damage to contents while they are

being moved, by a professional removals company,

to your new home, or to temporary storage or a

furniture storage unit, including while being stored

there for up to seven days.

Loss or damage to:

y

money, high-risk items, deeds and

documents, or

y

china, glass, earthenware or other fragile

items, unless they were packed by professional

packers.

New purchases

Newly bought high-risk items that you have not

yet told us about, for up to 15 days from the date

they were bought.

Contents at university

Loss of or damage to your or your family’s

contents, due to any contents insured risk, while

they are temporarily in student accommodation

while you or the family member are in full-time

education anywhere in the world.

Loss or damage caused:

y

while the contents are being moved, carried or

worn, or

y

while the student accommodation is

unoccupied.

Loss or damage caused by theft or attempted

theft, unless there are signs that force and violence

was used to enter the student accommodation.

Contents in a nursing home

Loss of or damage to your or your family’s

contents while they are temporarily removed

from your home and kept in your or your family’s

allocated room within a nursing home.

Loss or damage while:

y

the contents are being moved, carried or

worn, or

y

your room is unoccupied.

Loss or damage caused by theft or attempted theft,

unless there are signs that force and violence was

used to enter the room.

Guide to your Home Insuance cover

26

Section 2: Contents (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Domestic staff’s belongings

Loss of or damage to contents that belong to your

domestic staff and are kept in your home.

Fatal injury benefit

We will pay the amount shown in your policy

documents if you or a member of your family

dies as the result of a fire or criminal assault in

your home.

There is no excess for claims for fatal injury

benefit.

Your or your family member’s death if it:

y

happens more than 12 months after the fire or

assault, or

y

is a result of any incident outside the

territorial limits.

Matching items

We will pay for undamaged items in a matching set

if a part is damaged beyond repair and we cannot

find a replacement.

Loss or damage to floor coverings in adjoining

rooms or clearly identifiable separate areas.

Specified items

A specified item is any high-risk item that exceeds the ‘Unspecified item limit’ and therefore must be listed on your

Home Policy Schedule. Please tell us if any high-risk item with a value of more than the ‘Unspecified item limit’ needs

to be shown in your policy documents.

Included

Optional

Not Included

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

Specified items

Loss or damage caused to specified items by any

contents insured risk.

Any amount over the ‘Unspecified item limit’ for

any item or collection not mentioned in your

policy documents.

Any amount over the value shown for each item

in the ‘Specified Items’ table in your policy

documents.

Accidental damage to specified items, unless

accidental damage for the relevant item is shown

in your policy documents.

Guide to your Home Insuance cover

27

Section 2: Contents (cont.)

IMPORTANT

Collections

If you want to insure a collection (for example, a stamp or coin collection) worth more in total than the

‘Unspecified item limit’, it must be shown as a specified item in your Home Policy Schedule.

Unspecified item limit

This limit is shown in your Home Policy Schedule under the ‘Specified Items’ table. All high-risk items above

this limit must be shown in your latest policy documents. If they’re not, we will not pay more than the

‘Unspecified item limit’ for them.

Total high-risk items limit

We will not pay more than the ‘Total high risk items limit’ shown in your Home Policy Schedule for all your

high-risk items, specified and unspecified.

Cover for items away from the home

Please see Section 3, ‘Cover away from your home’.

Inflation

The value of specified items often changes independently of inflation. We do not index link the value of your

specified items, meaning that their value does not automatically increase at renewal. You must make sure

that specified items are always insured for the correct amounts.

Contents accidental damage

Your Home Policy Schedule will show the level of cover you have and any optional cover you have chosen.

Included

Optional

Not Included

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

(I) Audio-visual equipment

Accidental damage, in your home, to the following

electrical items that are not portable.

y

Television sets, DVD players, radios, personal

computers (including accessories), games

consoles and other audio-visual equipment.

Loss of or damage to portable items, including:

y

handheld games consoles, radio transmitters,

hearing aids, cameras, video cameras and

satellite navigation systems, and

y

software or downloaded content, records

and discs (including CDs, DVDs and computer

games).

Loss or damage caused by dismantling, adjusting

or repairing any equipment, through misuse, or

by failing to use the equipment in line with the

manufacturer’s instructions.

Accidental damage to mobile phones, laptops,

tablets or notebooks, unless ‘Accidental damage

(III) Contents’ appears on your policy documents.

Guide to your Home Insuance cover

28

Section 2: Contents (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

(II) Mirrors or glass

Accidental breakage of mirrors, fixed glass in

furniture, pictures, ornaments, plate-glass tops

to furniture and ceramic hobs on freestanding

cookers in your home.

Loss of or damage to fixtures and fittings. These

may be covered under Section 1, Buildings.

(III) Contents

Accidental damage to or loss of contents in your

home.

Loss of or damage to food, drink, plants, corneal or

contact lenses, money, securities, pedal cycles and

clothing.

Loss or damage caused to the inside of watches

and clocks.

The following exclusions apply to contents accidental damage (I) (II) and (III).

We will not pay for loss or damage:

y

due to electronic or electrical breakdown

y

that happens outside your home

y

caused by a paying guest or tenant in your home

y

caused by pets, through chewing, scratching, tearing, fouling or vomiting

y

caused while your home is unoccupied

y

caused by pests (see general exception 21, Pests), or

y

caused by a drone being flown by you or your family.

IMPORTANT

An excess will apply to any claim for accidental damage. Details of the excess are shown in your

policy documents.

Limits of cover apply to accidental damage. Please see your policy documents for details of ‘Cover and Limits’.

Guide to your Home Insuance cover

29

Section 2: Contents (cont.)

Liability

The following policy benefits are only available if they are included within your level of cover. Please check your Home

Policy Schedule to confirm your level of cover, and the most we will pay for any one claim. There is no excess for

claims for liability.

Included

Optional

Not Included

What is covered

In any one period of insurance we will pay damages,

including any associated defence costs and expenses

we have agreed to, for the following.

What is not covered

The exclusions below apply to the whole of this

section.

ADMIRAL

GOLD

PLATINUM

( I) Occupier’s liability

Your or your family’s liability to the public as

occupier (but not owner) of your home.

Any liability for death of or physical injury to you,

your family or anyone else permanently living with

you, including your domestic staff, unless covered

under liability (IV).

Any liability if you are the owner-occupier of your

home and have claimed under Property Owner’s

liability cover.

Any liability resulting from you or your family

owning or occupying any land or building other

than your home, unless covered under liability (III)

and liability (V).

Any liability resulting from you or your family

owning or using:

y

a motorised vehicle

y

a caravan that is being towed, or

y

a watercraft, hovercraft or aircraft (including

drones).

Any liability resulting from you or your family’s

profession, business, trade or employment.

Any liability resulting directly or indirectly from

you or your family being treated for or passing on

any disease or virus.

Any liability resulting from any living creature

other than cats and dogs you or your family own

or are legally responsible for (except any dog

defined as dangerous or allowed to be dangerously

out of control under the Dangerous Dogs Act 1991

or the Dangerous Dogs (Northern Ireland) Order

1991, or any subsequent law).

Any liability resulting from you or your family

taking part in any sporting activity including

racing, hunting and polo.

Any liability resulting from the use of firearms or

any other weapon.

Cont...

( II) Personal liability

Your or your family’s liability after an accident

that happened during the period of insurance,

within the territorial limits, and caused the

following.

y

Death, disease, illness or physical injury to a

person

y

Damage to physical property that you, your

family or anyone else permanently living with

you, including your domestic staff, do not own

and are not responsible for

(III) Tenant’s liability

Your or your family’s liability as a result of damage

caused to your landlord’s fixtures and fittings by:

y

buildings insured risks 6, 7, 8, 10 and 11

y

accidental breakage of glass, sanitary fixtures

or built-in ceramic hobs in a fitted kitchen, or

y

accidental damage to mirrors and glass.

(IV) Employer’s liability

Your or your family’s liability as a result of

accidental bodily injury, illness or disease of any

person you or your family employ as domestic

staff under a contract of employment.

(The accidental bodily injury, illness, or disease

must have been caused during the period of

insurance and while the person was carrying out

work they are employed to do.)

Guide to your Home Insuance cover

30

Section 2: Contents (cont.)

What is covered What is not covered

ADMIRAL

GOLD

PLATINUM

(V) Liability as occupier of temporary

accommodation

Your or your family’s liability which arises from an

incident that happened while you were living in

temporary accommodation (as agreed by us under

Section 2) and caused the following.

y

Death, disease, illness or physical injury to

anyone other than you, your family or anyone

else permanently living with you, including

your domestic staff

y

Damage to physical property that you, your

family or anyone else permanently living with

you, including your domestic staff, do not own

and are not responsible for

(Cont.)

Any liability for damages, legal costs or other costs

awarded by any court, tribunal or other body with

no jurisdiction (authority) in Great Britain and

Northern Ireland.

Any liability arising from The Party Wall etc Act

1996.

Any liability for fines, penalties, liquidated

damages (an estimate of unknown or hard-to-

define losses), aggravated damages (damages

to provide compensation for mental distress or

hurt feelings), punitive or exemplary damages

(damages to punish or make an example of the

person), or any damages resulting from multiplying

compensation.

IMPORTANT

You must not admit that an incident was your fault.

Guide to your Home Insuance cover

31

Section 3: Cover away from your home

This section is only available if you have contents cover. The compulsory contents excess and voluntary excess (if you

have chosen one) apply to this section.

Your Home Policy Schedule will show the level of cover you have and any optional cover you have chosen.

Included

Optional

Not Included

What is covered What is not covered

The exclusions below apply to the whole of this

section.

ADMIRAL

GOLD

PLATINUM

1) Personal possessions

Up to the amount shown under ‘Personal

possessions limit’ on your policy documents

(The limit for money shown in your policy

documents also applies to personal possessions

covered under this Section 3.)

Loss of or damage to:

y

any personal possessions and high-risk items

lost or damaged in your home or on the land

that your home stands on, or

y

high-risk items worth more than the

‘Unspecified item limit’.

Loss of or damage to property which has been

outside the territorial limits for more than 60

days in a row, unless taken on an ‘operational tour’

(a military tour of duty for which an operational

allowance is paid to you).

Loss of or damage to:

y

plants or any living creature

y

corneal or contact lenses

y

lottery or raffle tickets, credit cards, securities

or documents

y

domestic appliances

y

business equipment, or

y

remote-controlled models or sporting

equipment while being used.

Loss of or damage to the inside of watches and

clocks.

Loss of or damage to items that are not with you