Destination:

One Million New Jobs

GLOBAL SME FINANCE FACILITY PROGRESS REPORT

2012-2015

“With SMEs being an important driver

of employment and development, it is

essential that SMEs are given the access

to finance and the technical assistance to

enable them to play this key role. DFID has

been a strong supporter of this innovative

blended finance initiative which leverages

IFC’s extensive experience in blended

finance, its broad network of financial

institution partners and its expertise

in providing the technical assistance

needed to maximise the impact of SME

finance. DFID is especially supportive

of the initiative’s eorts in fragile and

conflict aected states and welcome’s the

initiative’s successes in some of the more

fragile countries of the world.”

— Rachel Turner, DFID Director for International Finance

“SMEs are crucial for

inclusive growth, jobs

and innovation. We are

happy to partner with

IFC, DFID and others in

the Global SME Finance

Facility and look forward

to a strong increase in SME

loan portfolios with local

banks.”

— Peter Le Poole, Senior Policy

Advisor Financial Sector

Development, Ministry of Foreign

Aairs, Netherlands

ACRONYMS & DEFINITIONS

DFID Department for International Development

DFI Development Finance Institutions

DRC Democratic Republic of Congo

EIB European Investment Bank

ETI Ecobank Transnational International

FCAS Fragile and Conflict-Aected States

FIG Financial Institutions Group

GPFI Global Partnership for Financial Inclusion

HBL Habib Bank Limited

IDA International Development Association**

IFC International Finance Corporation

IFI International Financial Institutions

M&E Monitoring and Evaluation

MIS Management Information System

MSME Micro, small and medium enterprises

MTR Mid-Term Review

ODA Ocial Development Assistance

RMG Ready Made Garments

RSF Risk-Sharing Facility

SDG Sustainable Development Goals

SME Small and medium enterprise

VSE Very small enterprise

WEDF Women Entrepreneurship Development Fund

Table of Contents

i Acronyms & Definitions

1 Letter from Nena Stoiljkovic

2 Destination: One Million

New Jobs

4 Inside the SME Financing Gap

6 Where We Operate

8 The Facility Works Through an

Ecosystem Approach

10 The Facility In Action

18 Already Creating Jobs and

Improving Lives

21 Addendum: List of Projects

i

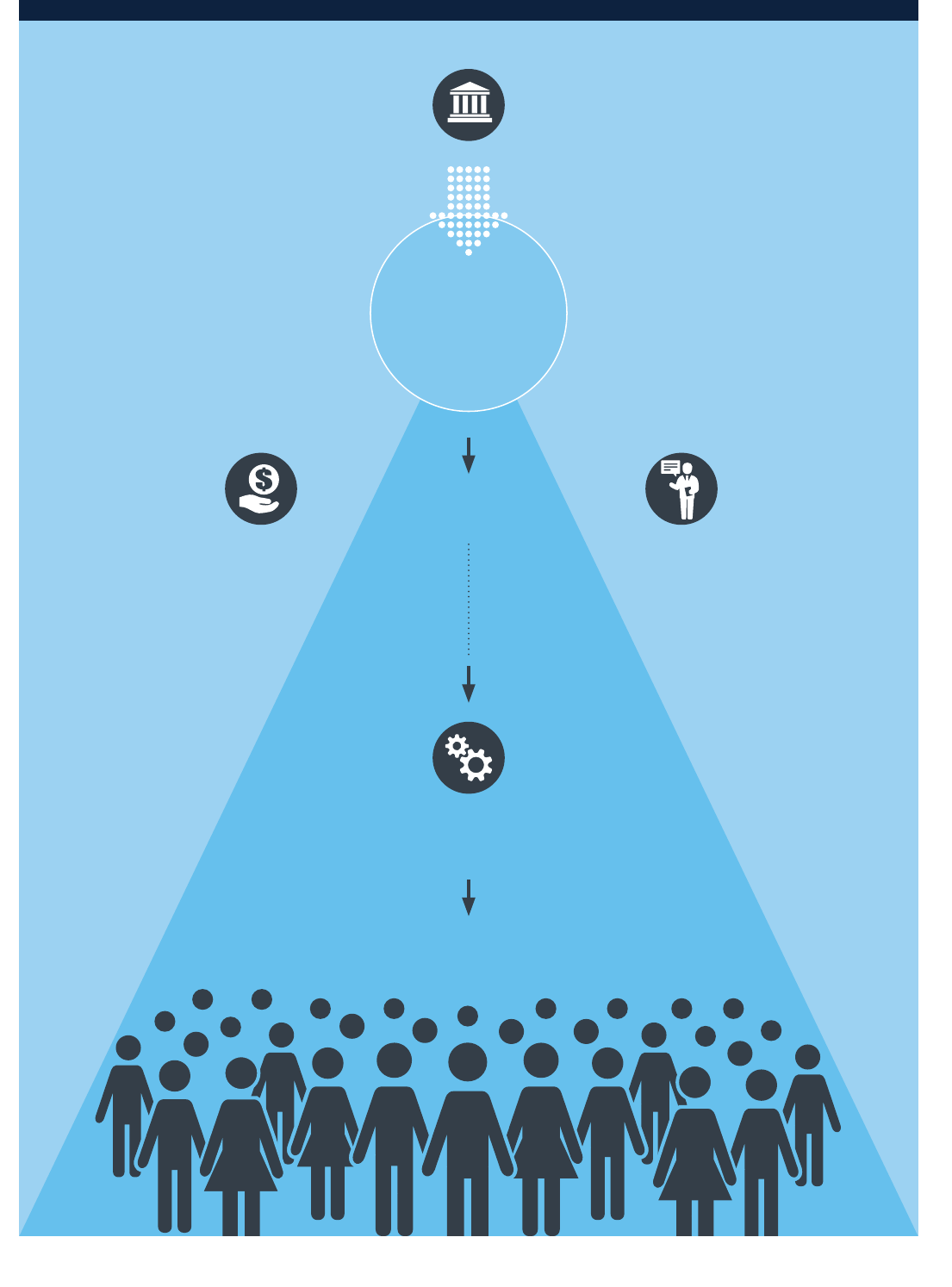

From:

• International Financial

Institutions / Development

Finance Institutions

• Donors

Investment Services

(for financial institutions)

• Loans

• Risk-Sharing Facilities

Advisory Services

• Capacity Building for

Financial Institutions

• Financial Infrastructure

Funding

Facility Activities

Lending is Increased to SMEs

(by financial institutions)

SMEs grow and create jobs

Global

SME Finance

Facility

ii

Dear Friends,

In 2009 the leaders of the G20 countries put supporting access to finance

for Small and Medium Enterprises (SMEs) at the forefront of the global

development agenda as a means of driving economic growth and fostering

job creation. SMEs account for a significant share of employment and GDP

around the world, and they produce about two-thirds of all formal-sector jobs

in emerging markets. Yet these firms face pervasive challenges in accessing

finance, which is a critical lever for running and growing a successful business.

The Global SME Finance Facility was established in 2012 as multi-stakeholder

initiative focused on strengthening the ability of financial institutions to

better meet the financial needs of SMEs. For the last four years, the Facility

has partnered with the UK Department for International Development, the

European Investment Bank and the Netherlands Ministry of Foreign Aairs.

It has been able to leverage the power of these partnerships across some of

the most challenging markets to support nearly 100 SME Finance projects

through investment and advisory solutions that accelerate SMEs’ access to

finance in tough markets.

The Facility is particularly embracing its goal to support the creation of one

million jobs over ten years. We are proud that the Facility’s support has

already enabled its financial institution clients to facilitate US$ 6.4 billion in

over 67 thousand new SME loans, which are estimated to have helped SMEs

create over 414,000 jobs.

This key initiative, with support from its donors and partners, provides

unparalleled flexibility in terms of the range of investment instruments and

advisory services that it oers to its clients. It also plays a critical role in IFC’s

ability to leverage development assistance funds to mitigate risks and catalyze

private sector investments through blended finance instruments.

With the strong support of our partners, the Global SME Finance Facility will

continue implementing successful models for expanding SME finance, and we

fully expect to continue to report impressive results in the years to come.

Nena Stoiljkovic

Vice President, Global Client Services

1

Destination:

One Million New Jobs

T

he Global SME Finance Facility is a blended finance partnership focused on helping to

close the financing gap faced by SMEs in emerging markets. By playing a catalytic role

in increasing access to finance for SMEs, it aims to contribute to the creation of a

million jobs in the SME sector. The Facility focuses on supporting the most underserved

SME segments, such as SMEs in fragile countries, very small enterprises, and women-owned SMEs.

A global partnership to close the SME Financing Gap.

Established in response to a G-20 call for more innovative

approaches to financing SMEs, the Facility provides

funding, risk mitigation and advisory assistance to financial

institutions to help them expand lending to SMEs in

challenging markets and segments. In addition, the Facility

provides advice to governments to improve the financial

infrastructure, enabling financing to flow more eciently

to SMEs.

First four years of progress. The Facility has

demonstrated in its first four years the power of its

multi-pronged approach and its partnership model. Since

its creation in 2012, the Facility has supported 56 financial

institution clients who have lent over $6 billion through

more than 67 thousand new loans to SMEs. We estimate

that to date the Facility contributed to 414,000 new jobs

created through such lending.

Joining forces to accomplish more than any single

resource can. Managed by IFC, the Facility blends

commercial financing from IFC and the European

Investment Bank with donor funding from the UK

Department for International Development (DFID) and

the Netherlands.DFID provided the initial funding for the

Facility with US$ 120 million for investment and advisory

services. Subsequently, the Netherlands committed US$

27 million for investment and advisory services in IDA

countries, and the European Investment Bank committed

US$ 100 million for risk-sharing facilities.

Blended finance refers

to the strategic use of

donor funds to attract

private capital towards

investments that have a

high development impact.

2

ADDRESSING THE ENTIRE FINANCE

ECOSYSTEM.

Funding and/or guarantees are provided to commercial

banks and microfinance institutions to help expand their

lending to SMEs that would otherwise be considered

too risky.

As Banks work to understand the risks and manage the

costs of moving into new segments, the Facility also

provides IFC advisory services to help establish the new

products, processes and risk management systems that

will make their eorts sustainable.

Where credit information and the policy environment

are not conducive to expanding SME lending, the Facility

steps in to provide advice from the World Bank to improve

financial infrastructure that will ease the conditions for

banks to lend to SMEs.

With the support of its partners, the Facility will continue

providing investment and advisory services to institutions

committed to expanding SME lending, and it looks forward

to achieving its ultimate goal of facilitating disbursement

of US$ 8 billion in SME loans and creating one million new

jobs by 2019.

Global SME Finance Facility

2012 – 2015 Highlights

Ninety-

Nine

Investment and

Advisory Projects

56

WORKING WITH

financial

institutions

27

low-income

countries

ACTIVE IN

CONTRIBUTING TO

414,000

new jobs created

Building

financial

infrastructure in13 countries

RESULTING IN

$6.4 billion

incremental growth

in new SME loans

AND

67,539

new loans to SMEs

3

Recent studies estimate that over 90 percent of net job

creation in emerging markets is attributed to SMEs with

fewer than 250 employees. Small firms with under 100

employees contribute more than three-quarters of these

net new jobs, while young SMEs create new jobs at a

faster rate than older ones**. Moreover, research shows

that SMEs play a bigger role in low income and fragile

countries than more auent countries.

Because of this, expansion of the SME sector is critical to

boosting employment and reducing poverty in low income

countries. Yet SME owners in these markets face

significant challenges in building their businesses, from the

high cost of doing business and the pervasiveness of the

informal economy, to a lack of supporting infrastructure

and skilled capacity. However, at the top the list of

challenges for SMEs in most emerging markets is a severe

lack of access to finance, which can greatly limit their

ability to invest in growing their businesses and hiring

additional employees.

The dierence between the amount of financing SMEs

need and the amount they are able to obtain from formal

financial institutions is known as the Financing Gap. As

of 2011, the SME Financing Gap in emerging markets was

estimated at US$ 900 billion to US$ 1.1 trillion. Closing

the SME finance gap will accelerate the formation of new

SMEs and help existing ones thrive.

Women-owned SMEs. Approximately 31–38 percent

(8–10 million) of formal SMEs in developing economies are

owned fully or partly by women. These firms have access

to high-quality financial services to even a lesser degree

than SMEs owned by men, and they cite access to finance

as a major constraint more often than male business

owners. Women-owned SMEs are less likely to obtain

funding because they tend to be smaller and less formal,

and they often face socio-cultural norms and sometimes

legal constraints that makes it more dicult for women to

own and pledge assets as collateral to access finance.

The Facility is committed to working with its clients to

devote increased attention to this market segment and

its unmet demand for financial services. However, many

Facility clients are institutions that are just starting to

focus on SME banking. They need to put in place basic

SME products, risk management policies, marketing

and market research capabilities, and assign and train

specialized SME-focused sta before they can focus

on reaching specific segments, such as women-owned

enterprises. Currently, about 1/3 of the Facility projects

have a dedicated component focusing on supporting

women-owned SMEs.

As of December 2015, the Facility programs have enabled

financial institutions to ramp up lending to women-owned

SMEs with 7,270 loans, worth over US$370 million. We

expect these results to significantly increase in the coming

years as the Facility clients develop sustainable and

profitable SME business lines needed to reach women-led

businesses.

Very Small enterprises (VSEs). VSEs comprise firms too

large to be reached through micro lending approaches, yet

too small for most banks to find attractive. Very small

enterprises represent 54–68 percent

***

of formal SMEs.

These firms do not have strong, tangible collateral to oer

as backing for loans, and their lack of credit records and

financial history makes it dicult for financial institutions

to analyze and assess their credit risk. Additionally, VSEs

typically require smaller loans, which can be costly to service.

* Small and Medium Sized Enterprises (SMEs). To qualify as an SME a firm must meet at least two of the following three characteristics:

10 to 300 employees, $100,000 to < $15 Million in assests, $100,000 to < $15 Million in annual sales, SME loans typically are between $10,000 and $1 million.

** SMEs, Age, and Jobs, Policy Research Working Paper, World Bank Group’s Development Economics Global Indicators Group 7493, November 2015, p. 18"

*** IFC Enterprise Finance Gap Database (2011)

Inside the SME

*

Financing Gap

4

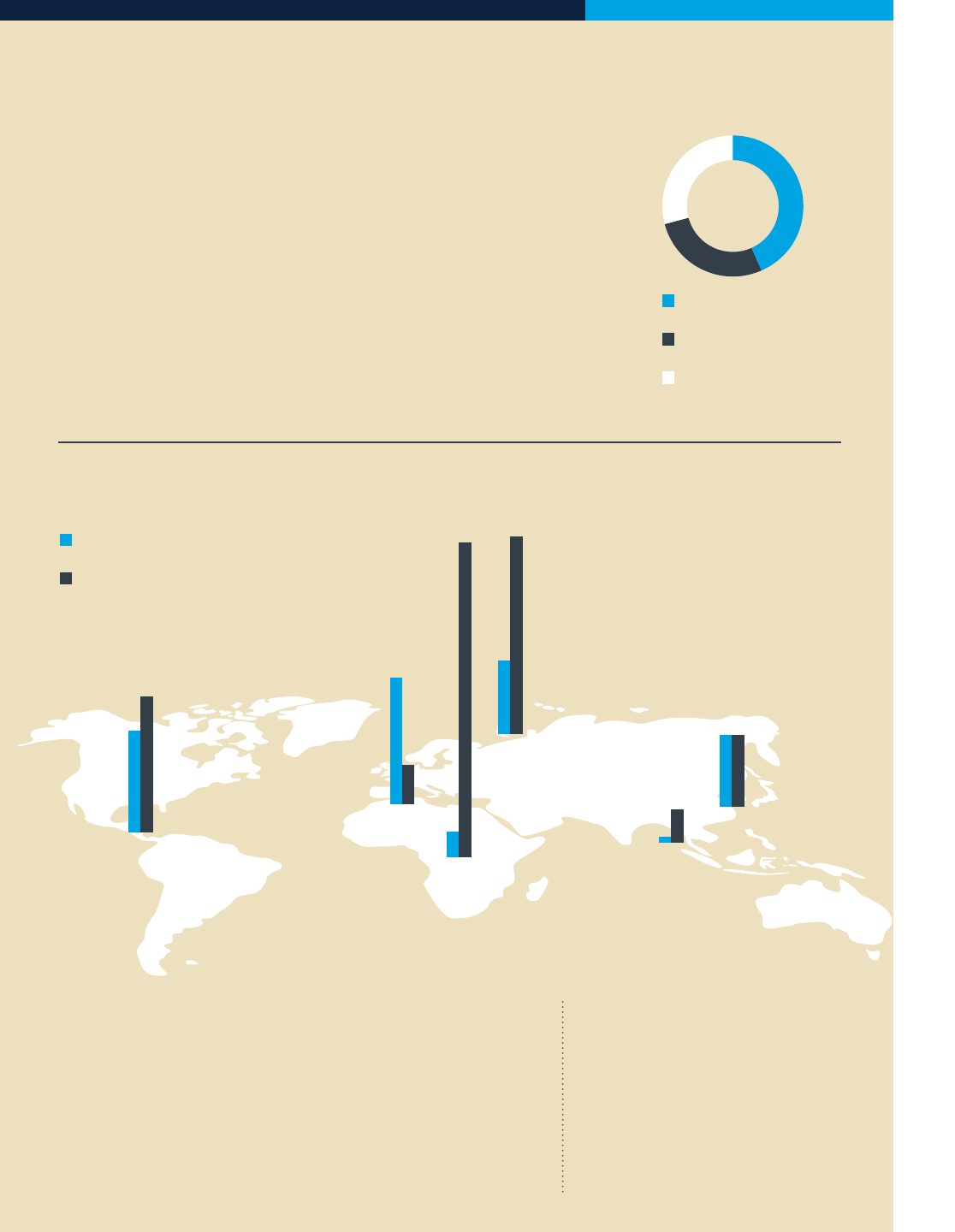

A One Trillion Financing Gap*

Medium Enterprises

29 – 36 percent

Small Enterprises

19 – 23 percent

Very Small Enterprises

19 – 24 percent

Finance

Gap

Amount of Total Credit Gap

In USD$

Percent of Unserved Formal SMEs

Varies Per Region

$80.09B

73.64%

Sub-

Saharan

Africa

$170.06B

47.67%

Central

Asia and

Eastern

Europe

Latin

America

$235.29B

32.92%

South

Asia

$14.88B

8.10%

East

Asia

$167.52B

17.49%

Middle

East and

North

Africa

$294.15B

9.57%

The financing gap data refers to formal SMEs

only. In regions with a large number of micro and

informal businesses, the total financing gap is

much larger.

Although the definition may vary by region and the

size of the market, VSEs are typically defined as

companies with between 5 and 25 employees and

annual turnover below US$ 0.12 million.

*IFC Enterprise Finance Gap Database (2011),

https://www.smefinanceforum.org/data-sites/ifc-

enterprise-finance-gap

And Disproportionately Aects Women

57-71 percent of women-owned SMEs in developing economies are

either unserved or under-served, totaling 5.3-6.6 million SMEs

US$ 260-320 billion in unmet financing needs of women-owned

businesses, representing a large opportunity for financial institutions

Total Gap

US$ 900 Billon

– US$ 1.1 Trillion

= 26 – 32 percent of

current outstanding

SME credit

Aects 55 – 68 percent of formal SMEs developing

countries representing 13 – 20 million firms

5

These factors contribute to the perception among

financial institutions that SMEs are riskier clients, and that

they increase the transaction costs of the commercial

banks and microfinance institutions that serve them.

Furthermore, the financial institutions in these countries

typically are just beginning to focus on SME banking. Basic

SME products, appropriate SME risk management policies,

tailored marketing and market research capabilities, and

trained specialized SME-focused sta are not yet in place.

As a result of these challenges, SMEs in IDA and FCAS

countries in particular have the most limited options for

accessing banking products that meet their financing

needs. In IDA and IDA blend countries alone, about 4.7

million SMEs are estimated to be financially unserved or

under-served, and financial institutions in these markets

need substantial support in building sustainable SME

banking models.

* The World Bank Group’s Fragile, Conflict and Violence Group annually releases the Harmonized List of Fragile Situations.

http://www.worldbank.org/en/topic/fragilityconflictviolence/brief/harmonized-list-of-fragile-situations

** The World Bank’s International Development Association (IDA) is one of the largest sources of assistance for the world’s 77poorest countries, 39 of which are in Africa, and is the

single largest source of donor funds for basic social services in these countries. Eligibility for IDA classification depends a country’s relative poverty, defined as GNI per capita below an

established threshold and updated annually ($1,215 in fiscal year 2016). Blend countries: IDA-eligible but also creditworthy for some IBRD borrowing. http://ida.worldbank.org/

15

FCAS Countries

reached

Targeting sectors vital to

rebuilding markets and

assisting recovery

CURRENT PROJECTS:

80%

are in IDA

countries

35%

are in FCAS

countries

20%

are in IDA-blend

countries

Where We Operate

Zeroing in on Fragile and Conflict Situations and

Poverty Economies: Acknowledging the need for

increasing SMEs’ access to finance in the most dicult

markets, the Facility has prioritized its activities in

the poorest countries as defined by the World Bank’s

International Development Association (IDA), and in

countries with Fragile and Conflict Situations (FCAS).*

The Facility’s ecosystem approach also allows the IFC to

have a larger footprint in IDA and FCAS countries. Global

SME Finance Facility has contributed over half of all IFC’s

Financial Institutions Group’s MSME Finance investments

in FCAS globally, and over 90 percent of the investments in

Africa FCAS.

Financial institutions in FCAS and IDA countries

face the greatest SME finance challenges. Financial

institutions in these markets operate in volatile and

unpredictable business environments, troubled by

heightened political instability, a dicult investment

climate, and a weak financial infrastructure that makes

eective assessment of SME credit risk dicult. In

addition, SMEs in these countries have limited financial

history and formal business records, possess few fixed

assets for collateral, and require smaller loans.

6

Solomon

Islands

Micronesia, FS

Marshall Islands

Kiribati

Tuvalu

Samoa

Tonga

Vanuatu

7

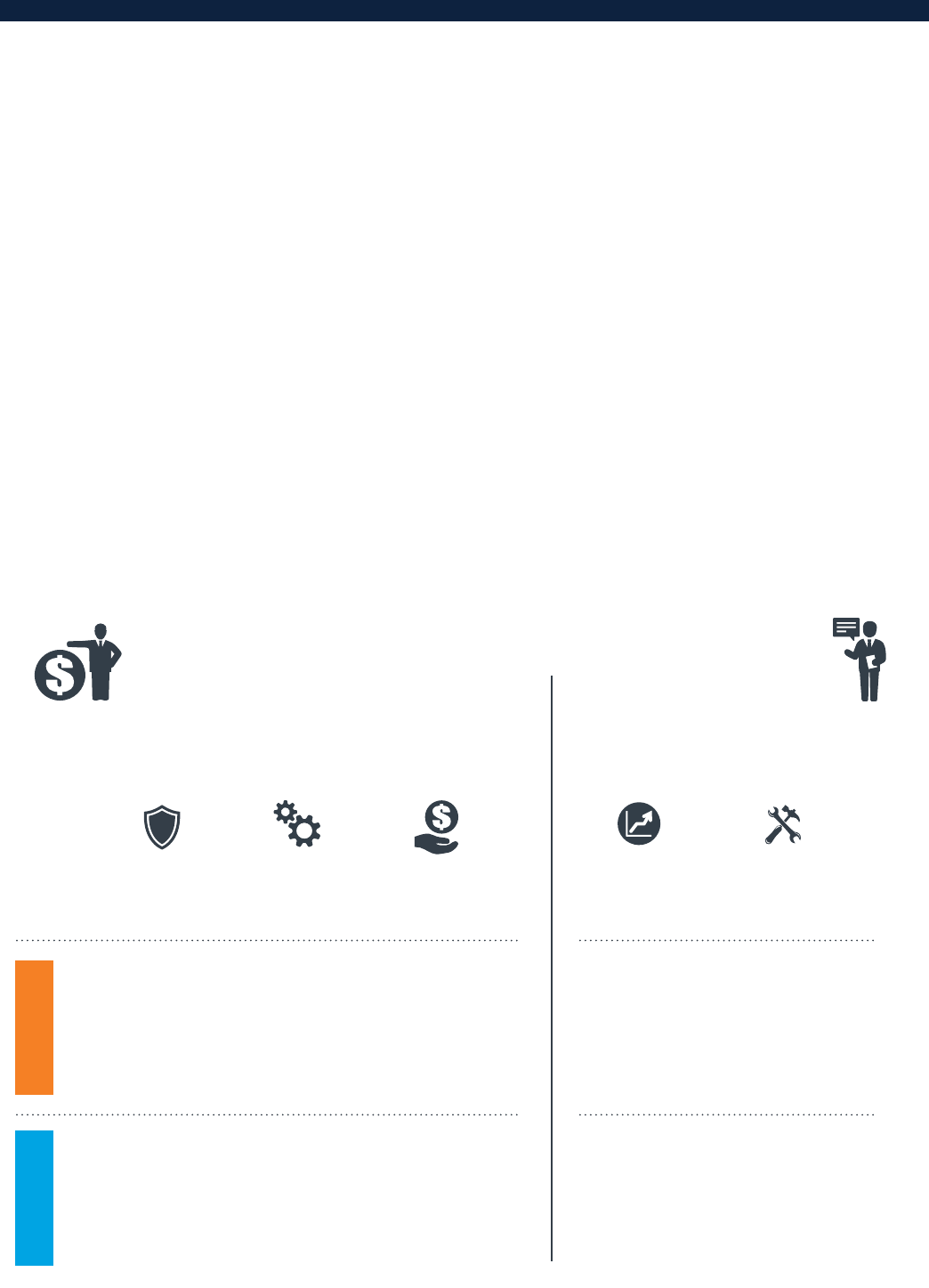

The Facility Works

Through an “Ecosystem” Approach

C

omplex challenges addressed at multiple levels. Given the range of challenges

facing SMEs, addressing the SME finance gap in a sustainable and scalable manner

requires a comprehensive approach. This includes integrated, multi-tiered solutions

that span the ecosystem of financing.

The Facility provides Investment and Advisory solutions,

crafted to the needs of each country and partner

institution. These projects are implemented through IFC’s

global network, comprised of 106 IFC country oces,

215 field and 73 HQ-based FIG Investment sta, 83 field

and 17 HQ-based FIG Advisory sta, and 765 Financial

Institutions clients.

INVESTMENT SERVICES

Blended funds from IFC, donors and other investors.

Performance incentives available for all investments.

ADVISORY SERVICES

Risk Sharing

Guarantees cover

a portion of losses

on loans to SMEs

Lowers risks

to financial

institutions of

moving into SME

markets

Senior or

Subordinated

Loans

Credit lines

designated for

on-lending to

underserved

SME segments,

including Women-

owned SMEs

Encourages

increased lending

to SMEs

Performance-

Based

Rebates

Flexible

rebates linked to

meeting specific

performance

targets related

to growing SME

portfolios

Incentives to

financial

institutions for

investments in

ramping up lending

to under-served

segments

Advisory Services

for Financial

Institutions

Capacity building

tailored to the

needs of banks

and microfinance

institutions

Strengthens

FIs institutional

capacity to better

serve SMEs

Financial

Infrastructure

Projects

Technical advisory

services for

establishing credit

bureaus, and

secured collateral

registries

Facilitates SME

lending by

strengthening

countries' financial

infrastructure

MECHANISMPURPOSE

8

Global SME Finance Facility

Activity 2012-2015

BLENDED FINANCE

INVESTMENT PROJECTS

TOTAL PROJECT SIZE

US$ 899 million

US$ 62 million in donor funding

ADVISORY PROJECTS

TOTAL PROJECT SIZE

US$ 97 million

US$ 41 million in donor funding

n 9 projects

completed

n 66 in

implementation

n 24 in pre-

implementation

IFC Blended Finance Facilities

Global SME

Finance Facility

The Women

Entrepreneurs

Opportunity

Facility (WEOF)

The Global

Agriculture

and Food

Security

Program (GAFSP)

MENA SME

Finance Facility

Climate related

Facilities

Blended Finance across IFC

TOTAL PROJECT SIZE

$996 million

leveraging US$ 103 million

in donor funding

99

34 investment projects

65 advisory projects

TOTAL

PROJECTS

18

13

56

Financial and financial in countries

Institutions infrastructure

projects

Since 1996, IFC has approved nearly US$ 407 million in

concessional funds for investment and advisory projects

in the climate, agriculture and SME sectors, leveraging

more than US$ 4 billion. By blending donor funds from its

partners alongside IFC’s own capital, IFC has been able

to undertake high-risk, high-impact projects that have

strong potential to improve lives and reduce poverty,

and catalyze investments in areas where market barriers

would otherwise stand in the way.

In 2012 IFC approved a blended finance policy, including

a rigorous governance structure led by a blended finance

committee.

The blended finance solutions, such as those provided by

the Global SME Finance Facility, are indicative of IFC’s role

in “turning billions into trillions” - the World Bank’s call for

action to mobilize, redirect and unlock trillions of dollars of

private capital needed to achieve the 2030 United Nation’s

Sustainable Development Goals (SDGs).Estimates for total

annual investment in developing countries that is needed

to achieve the 2030 SDGs range from $3.3 trillion to $4.5

trillion. Current Ocial Development Assistance (ODA)

falls far short of these demands, leaving an annual gap of

US$ 2.3 trillion.

9

Project Example: Access to financing

accelerates in Nigeria — particularly for

women-owned SMEs

The Facility is supporting Access Bank

Nigeria in expanding its lending to smaller

SMEs, with a special focus on women and

women-owned SMEs. We provided Access Bank

Nigeria with a loan, an RSF and advisory services to

support scaling up its SME lending and its Banking

on Women model. IFC helped the bank develop a

value proposition tailored to women needs, with a

special focus on helping the Bank incorporate full

banking services for women, including personal,

micro, SME and corporate banking solutions. The

project is expected to demonstrate to other financial

institutions in Nigeria the viability of lending to

women owned SMEs, and is expected to significantly

increase the finance options available to these firms.

The financing package, along with the performance-

based incentive and advisory services, already has

encouraged the bank to double its annual growth rate

target for the women-owned SME lending portfolio.

LOANS

Funding to financial institutions, including dedicated credit

lines for reaching specific SME segments such as women-

owned SMEs. Status: 18 loan projects.

Project Example: Loans grow Very Small

Enterprises in the DRC

The Facility is supporting Advans DRC, a microfinance

bank, in upscaling its lending to Very Small Enterprises

(VSEs). VSEs are too large to be serviced through

RISKSHARING FACILITIES RSF

Risk mitigation instruments that encourage financial

institutions to move into a new market and pursue SME

segments perceived to be higher risk.

Status: 16 RSF projects.

Project Example: Risk-sharing facilities

increase SME lending in West and Central

Africa

The Facility is supporting Ecobank Transnational

International Ltd (ETI) to increase its SME lending

in 8 FCAS countries in Africa. These countries face

persistent political instability, weak financial

infrastructure and a poor investment climate creating

a particularly dicult business and SME-financing

environment. With the support of the RSF that covers

a portfolio of up to US$ 110 million in loans to SMEs, ETI

is expanding its SME lending across eight subsidiaries

in West and Central Africa.

This RSF, along with a performance incentive, is

motivating ETI aliates in Burundi, Chad, Côte

d’Ivoire, the Democratic Republic of Congo, the

Republic of Congo, Guinea, Mali and Togo to take on

greater risk and increase their outreach to otherwise

unserved SME segments. ETI aliates are expected

to provide SME loans to over 5,000 SME borrowers.

Once the eectiveness of this outreach has been

demonstrated, ETI expects to scale up SME lending

across its entire network, including in other fragile

and conflict-aicted states.

The Facility in Action

Investment Services

10

traditional microfinance approaches and yet are too

small for banks to find attractive. They face more

challenges in accessing credit than micro enterprises

in the local market.

Historically focused on micro lending, Advans has

benefited from the Facility’s support to provide larger

loans to VSEs. The facility provided Advans with a loan

and a performance incentive linked to pre-agreed

stretch targets. The blended finance approach has

incentivized Advans to increase its lending to VSEs by

mitigating some of the higher risks of lending to them.

With the support of the loan, Advans plans to more

than triple its volume of outstanding MSME loans.

Mr. Matebo is a distributor for a leading beverage

company in DRC, Bracongo. He sells to shops

and restaurants as well as retail. With Facility

funding, Advans was able to provide Charles

Matelo Mutebo with a loan to finance the

construction of a new storage depot and grow his

drinks distributorship enterprise.

A new enclosed storage depot will provide Mr.

Matebo with needed security for his product. The

Facility enabled Advans to lend Mr. Matebo the

US$ 40,000 needed to build the depot, as well

as additional storage rental units. Even while

construction proceeds, Mr. Matebo is renting out

income-producing extra storage units, and he

is regularly repaying his loan. Looking forward,

he is preparing to increase his inventory and is

considering the next steps to grow his business.

11

PERFORMANCE INCENTIVES FOR

INVESTMENTS

Performance incentives are embedded in loans and RSFs,

and are linked to pre-defined performance targets.

Incentives are tailored to the structure of each investment,

and they reward financial institutions for setting and

meeting more ambitious SME lending targets, encouraging

them to rapidly reach and serve most SMEs. Status: All

loans and RSF projects include performance incentives.

Project Example: Performance incentives

spur life-saving loans in Bangladesh

The Ready-Made Garments (RMG) sector is the major

driver of Bangladesh’s growth, making Bangladesh

the second largest RMG producer in the world after

China. While the RMG sector in Bangladesh provides

employment for millions of people, most of whom are

women from poor backgrounds, the country has a

poor record of working conditions and worker safety,

as well as deficient factory infrastructure. The Facility

is supporting local banks to provide loans to small

garment factories, for the specific purpose of funding

capital improvements essential to worker safety.

The Facility support for four Bangladeshi banks —

City Bank, Eastern Bank, Prime Bank and United

Commercial Bank — is enabling small garment

factories to invest in structural, electrical, and fire

safety standard improvements. The Facility support

includes a performance incentive embedded into a

loan from IFC that specifically encourages banks to

give loans to smaller garment factories, which face

the most diculties in accessing finance. The program

estimates that this eort may help almost 500,000

workers, including about 400,000 women, benefit

from a safer work environment.

THE FACILITY IN ACTION: INVESTMENT SERVICES CONTINUED

Project Example: Incentives increase lending

to women entrepreneurs

in India

With support from the Facility, IFC provided

India’s Yes Bank with a loan featuring

an embedded performance incentive

to motivate the bank to scale up its lending to

SME borrowers in low income states (LIS) and in

underserved North East states (NES), including

women-owned SMEs in these disenfranchised regions.

The incentive, conditioned on Yes Bank meeting

stretch targets for reaching these markets, has

been successful in achieving a significant increase in

lending to women-owned SMEs. The bank refined its

strategy for reaching women-owned SMEs, and as a

result of this eort, the bank has decided to launch

a country-wide program to become a flagship lender

to women in India. By helping one of the largest and

most dynamic banks in India see the opportunity

within the women’s market, our support has spurred

Yes Bank to strive to become a market leader in the

gender space.

12

13

ADVISORY SERVICES FOR

FINANCIAL INSTITUTIONS

Under the Facility, IFC leverages its regional SME Finance

Advisory Services Specialists to help financial institutions

improve their SME lending operations, including building

eective business models, developing appropriate products

and services, optimizing channels for delivery, increasing

eciency, and training sta to more ably identify, evaluate

and serve SME clients. Additional advisory services are

geared to helping financial institutions develop non-

financial services for SMEs, such as training, mentoring

and networking for business owners. Status: 47 advisory

service projects.

Project Example: Advisory services help

Kenya’s NIC Bank reach more SMEs

The Global SME Finance Facility is providing advisory

services to help Kenya’s NIC Bank strengthen its

capacity to sustainably serve SMEs. The program aims

to help the bank identify gaps in its existing SME

banking operations, and revise its SME strategies,

structures and processes. The project’s goal is to triple

the NIC’s volume of SME lending over three years. IFC

also has an investment in NIC Bank to help it expand

SME banking operations.

Project Example: Advisory services support

financing for women-owned SMEs in

Bangladesh

As a component of a wider SME-financing

Advisory Services for IDLC Finance Ltd.,

the Facility helped IDLC build a Women in

Business program and develop a range of products and

services specifically for women-owned SMEs. IDLC’s

Purnota products provide a comprehensive solution

for women-owned businesses to grow, including

loans, business facilitation services, training,

insurance, digital marketing, and other services to

women-owned businesses. This was the first time

any financial institution in Bangladesh launched a

comprehensive financial services program focused on

The Facility in Action

Advisory Services

“Our focus will be to

deepen our presence

and oerings in the retail

and SME segments, and

increase our footprint in

the region.”

— John Gachora, NIC Group Managing Director, Kenya

14

the women’s segment. With the help of this product,

IDLC expects to grow its portfolio to more than two

thousand women entrepreneurs over one year.

Project Example: In Pakistan, advisory

services transform SME lending capacity

The Facility has provided advisory services to Bank

Alfalah to help the bank redesign its SME business

model and improve its credit underwriting process.

With this support Bank Alfalah has created a

specialized SME business unit it introduced tailored

delivery models for SMEs, invested in its Management

Information System (MIS) to improve SME lending

operational eciency, and entirely revamped the SME

product line. Additionally, Bank Alfalah developed

a non-financial advisory services (NFS) for SMEs,

including the development of the SME Toolkit, and has

become the first bank in Pakistan to have a structured

NFS oering as part of its SME business model.

THE FACILITY IN ACTION: ADVISORY SERVCIES CONTINUED

“Our new non-financial

advisory services will add

significant value to SMEs

in managing their business

… and enable economic

progress.”

— Atif Bajwa, President and Chief Executive Ocer,

Bank Alfalah, Pakistan

15

STRENGTHENING STATES’

FINANCIAL INFRASTRUCTURES

The Facility also supports the building and/or

strengthening of secured collateral registries and

credit bureaus. Establishing proven credit histories and

expanding the types of assets entrepreneurs can use as

collateral have the potential to increase SME lending

dramatically. A robust financial infrastructure is expected

to especially benefit SMEs owned by women, who

generally have less access to land and property, currently

the preferred collateral for most financial institutions.

Status: 18 financial infrastructure projects in 13

countries.

Project Example: Advisory services improve

Liberia’s collateral registry

In Liberia, the Facility is supporting the development

of a collateral registry, including the appropriate

legal, regulatory and institutional framework

for secured transactions for movable collateral

lending. The collateral registry allows SMEs that

do not have access to traditional collateral, such as

land or real estate property, to register moveable

assets as collateral in order to access loans from the

participating financial institutions. These moveable

assets can be a car, a motorcycle, crops, agricultural

equipment, accounts receivable, etc. Despite being

launched in 2014 during the Ebola crisis, the movable

collateral registry is already making it possible for

farmers and entrepreneurs to borrow money against

such assets.

Project Example: Advisory services establish

a credit registry in Afghanistan

The Facility is supporting Afghanistan’s eorts to

establish credit information sharing systems to

provide lenders with information to make ecient

risk assessments of potential borrowers, and create a

secured lending framework that includes a collateral

registry for movable property to provide lenders with

the ability to eectively use borrowers’ property as

collateral. While the new Registry in Afghanistan is

still in a nascent stage, it is expected to significantly

improve access to finance for micro, small and

medium enterprises (MSMEs).

Global SME Finance Facility

works closely with the

World Bank’s Finance and

Markets Group, which leads

the implementation of the

financial infrastructure

projects.

16

THE PROMISE OF FINANCIAL INFRASTRUCTURE

The successful implementation of financial infrastructure project can have

a dramatic impact on increasing access to finance for SMEs. The IFC’s work in strengthening financial infrastructure

in China is a compelling example of the far-reaching impact a well-functioning secured collateral registry can have on

lowering the costs of credit and increasing access to finance to SMEs.

With IFC’s support, which took place prior to the Facility, China established a solid secured transactions system that

has resulted in a sustainable flow of additional credit to the SME sector. China created a security interest registry

for account receivables in October 2007. Three and half years later, the registry's data reported a cumulative US$

3.58 trillion accounts receivable financing, including USD$ 1.09 trillion in SME lending to over 68 thousand SME

borrowers. Sixty-three percent of SMEs that obtained new loans using accounts receivable had female ownership,

while 20 percent are majority-owned by women.

An example of a successful

Financial Infrastructure project

that makes a dierence.

17

Already Creating Jobs and

Improving Lives

I

nitial results, for the Facility are strong, and demonstrate that by leveraging the capital from

our partners along with IFC’s banking relationships globally, we can address the Financing

Gap more eectively than any single international financial institution, development finance

institution, or donor could alone.

Number and volume of loans: The Global SME Finance

Facility can report substantial progress towards achieving

our 2019 goal of facilitating the disbursement of US$ 8

billion in SME loans to 200,000 small and medium

enterprises, as well as creating one million jobs. The

Facility Investment and Advisory support has helped

its clients to provide US$ 6.4 billion in over 67 thousand

new SME loans. These results are expected to increase

significantly as projects reach a more advanced stage

of implementation, and all the supported financial

institutions, credit bureaus and collateral registries

start reporting results.

Supporting Job Creation: Since measuring job creation is

a key goal of the Facility, the Monitoring and Evaluation

(M&E) team has focused on developing an econometric

model to assess the Facility impact on the growth of SMEs,

and job creation in the SME sector. This data-driven

research model has yielded the conclusion that SMEs

receiving a loan from financial institutions supported by

the Facility added approximately 414,000 new jobs by the

end of 2015. Additionally, the findings of the jobs

extrapolation model indicate that the SMEs accessing

loans from our clients are likely to create more jobs than

other SMEs in the same markets. With additional data

collected every year, we will continue to refine this model.

Impact

FACILITATED INCREMENTAL GROWTH IN SME LENDING*

Number of loans

Target: 100,000

Actual:

67,539

Jobs

Target: 1,000,000

Actual:

414,000

Volume of loans

Target: 8 B

Actual:

6.4

billion

* Results are based on data reported by the Facility clients as of December 2015

18

Leveraging donor funds for investment projects: The

Facility aimed to leverage each donor dollar with eight

dollars in commercial financing through investments in 15

financial institutions. As of March 2016, the Facility

leverages the donors’ funds at a rate of one to 14.5 and

provides investment services to 32 banks and microfinance

institutions.

Mid-Term Review. In 2015, the Facility underwent a

formal Mid-Term Review (MTR). The evaluators concluded

that the Facility:

• Eectively deployed its funding to countries with less

developed financial markets at a rate that is higher

than other comparable portfolios within development

finance institutions.

• Eectively contributed to increases in lending to SMEs

by its partner financial institutions. The Facility will

likely surpass its targets with regard to the number

of firms reached, as well as the value of SME lending

facilitated, including targets in fragile states.

• Is on track to meeting its ultimate goal of supporting

the creation of one million jobs by the year 2019.

The MTR also noted that reaching women has been more

challenging because of the dicult markets in which the

Facility operates. Financial institutions in these countries

lack a rigorous reporting capacity to disaggregate portfolio

data based on the gender of SME owner. Additionally, in

many of these markets fewer SMEs are owned by women.

Finally, financial institutions in many markets where

the Facility works have nascent SME lending businesses,

requiring the Facility to help financial institutions build

their SME lending fundamentals before focusing on

increasing their reach to specific market segments such as

women-owned SMEs.

19

20

Addendum

List of Projects

Projects in Africa

BURUNDI

Ecobank Burundi RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding its SME lending,

with a particular focus on reaching more small firms, which

are some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

KCB Burundi SME Advisory

This project supports Kenya Commercial Bank (KCB)

Burundi in expanding its SME banking business. The

advisory services will focus on market research and

segmentation, developing a SME strategy, business model

and a customer value proposition, as well as developing

appropriate SME products, services and delivery channels.

The Advisory will also include, strengthening the bank’s

credit operations and SME credit risk management

practices, policies and tools, and sta training.

Pre-Implementation* Stage • PFI Advisory

Secured Transactions, Burundi

The project aims to increase access to credit for businesses

in Burundi by developing an appropriate legal, regulatory

and institutional framework for movable assets-based

lending. The project introduces an innovative approach to

the development of an electronic centralized collateral

registry by integrating it with the development of a credit

information registry. This approach increases eciency

and provides more comprehensive information coverage

for financial institutions and users.

Pre-Implementation Stage • Financial Infrastructure

CHAD

Ecobank Tchad RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding its SME lending,

with a particular focus on reaching more small firms, which

are some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

CONGO

Credit du Congo RSF

The project consists of a Risk Sharing Facility to Credit du

Congo for developing a targeted approach to providing

finance to SMEs in key value chains that can serve as

sub-contractors to Total Exploration and Production

Congo. The RSF will help Credit du Congo manage its risk

exposure to SMEs and increase its reach to this new

business segment.

Implementation Stage • Risk-Sharing Facility

* on hold

21

Ecobank Congo RSF

The project consists of an RSF and a performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding its SME lending,

with a particular focus on reaching more small firms, which

are some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

COTE D’IVOIRE

Advans Cote d’Ivoire Loan

The project consists of a senior loan in local currency to

fund the SME lending expansion of Advans Côte d’Ivoire, a

Greenfield microfinance bank. The project includes a

performance incentive to motivate the bank to scale its

SME lending capacity to reach more small enterprises,

while maintaining portfolio quality.

Implementation Stage • Loan

BICICI RSF

The project consists of a Risk Sharing Facility for a portfolio

of short- and medium-term loans to SMEs, which will be

originated and serviced by Banque Internationale pour le

Commerce et l’Industrie de la Côte d’Ivoire (BICICI). The

RSF will support BICICI eorts to downscale its lending to

large corporate enterprises by developing an SME business

line. The RSF includes a performance incentive to motivate

a quick ramp-up in lending to new SMEs.

Implementation Stage • Risk-Sharing Facility

Ecobank Cote d’Ivoire RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding its SME lending,

with a particular focus on reaching more small firms, which

are some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

SocGen Cote d’Ivoire RSF

The project consists of an RSF for Société Générale des

Banques Côte d’Ivoire (SGBCI) to enable the bank to enter

into the SME segment. With the support of the RSF and

the embedded performance incentive, the bank is expected

to increase its lending to SMEs in the education, health and

agrifinance sectors, as well as to women-owned SMEs.

These SME segments are perceived as higher risk, and as a

result they have limited access to finance.

Implementation Stage • Risk-Sharing Facility

SIB Cote d’Ivoire RSF

The project includes a Risk-Sharing Facility to support

Société Ivoirienne de Banques (SIB) eorts to expand and

develop its SME banking. The project includes a

performance incentive to motivate SIB to significantly

increase its reach to smaller SMEs, agri businesses and

SMEs owned by women. The Global SME Finance Facility is

collaborating with the Global Agriculture and Food

Security Program(GAFSP) on this investment.

Implementation Stage • Risk-Sharing Facility

Bank of Africa SME Advisory

The project will support Bank of Africa (BoA) in increasing

its outreach to SMEs. The Advisory will focus on developing

a SME strategy; improving BoA’s SME sector market

knowledge and segmentation; strengthening its

organizational structure, risk management framework and

sales channels; and training SME sta.

Pre-Implementation* Stage • PFI Advisory

DEMOCRATIC REPUBLIC OF CONGO

Advans DRC Loan

The project includes a senior loan to Advans Bank Congo

(Advans DRC) to support the bank in expanding its services

in the regions outside of Kinshasa that are severely

underserved. The project will also support Advans DRC in

upscaling its lending to Very Small Enterprises, which face

more challenges in accessing credit than micro enterprises

in the local market. The project includes a performance

PROJECTS CONTINUED

* on hold

22

incentive linked to stretch targets related to the growth

rate and the quality of Advans’ SME portfolio.

Implementation Stage • Loan

Ecobank DRC RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in an expansion of its SME

lending, with a particular focus on reaching more small

firms, which are some of the most underserved firms in

these markets.

Implementation Stage • Risk-Sharing Facility

Rawbank Loan

The project consists of a senior loan to Rawbank to expand

its lending activities to SMEs, including women-owned

SMEs. The project also includes a performance incentive

linked to stretch targets to motivate the bank to increase

its outreach to the SME segment, and specifically to women-

owned SMEs. The incentive will provide a strong motivation

for Rawbank to move beyond its current SME lending

capacity to reach more SMEs and women-owned SMEs.

Pre-Implementation* Stage • Loan

Raw Bank SME Advisory

The project focuses on improving Rawbank’s overall risk

management framework, and strengthening its capacity

to sustainably serve its SME clients. The Advisory includes

a review of the existing risk management framework, the

roll out of a revised risk management procedures and

sta training.

Implementation Stage • PFI Advisory

GHANA

UT Bank Ghana SME Advisory

The project focused on strengthening UT Bank Ghana’s

capacity to serve MSME customers, including the women

in business segment. The Advisory included enhancing the

bank’s credit risk management framework, institutional

capacity building, and sta training.

Completed Stage • PFI Advisory

* on hold

23

GUINEA

BICIGUI RSF

The project consists of an RSF for a portfolio of short- and

medium-term loans to SMEs originated and serviced by

Banque Internationale pour le Commerce et l’Industrie de

la Guinée (BICIGUI), the Guinean aliate of BNP Paribas.

The RSF together with a performance incentive will

motivate BICIGUI to target smaller businesses, which are

less sophisticated, more dicult to reach, and have higher

perceived risk.

Implementation Stage • Risk-Sharing Facility

Ecobank Guinea RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding its SME lending,

with a particular focus on reaching more small firms, which

are some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

KENYA

Chase Bank Loan

The project consists of a senior loan, 50 percent of which is

earmarked for on-lending to women-owned SMEs. A

performance incentive serves to motivate the bank to

significantly grow its SME portfolio, and specifically expand

lending to women-owned SMEs. The incentive motivates

the bank to shift resources to focus on SMEs and women-

owned businesses beyond what it would have done

otherwise. The Global SME Finance Facility is collaborating

with the Women’s Entrepreneurship Opportunity Facility

(WEOF) on this investment.

Implementation Stage • Loan

Cooperative Bank Loan

The project consists of a senior loan to provide

Cooperative Bank Kenya (Coop Bank) with long-term

funding to support increased lending to SMEs, including

women-owned enterprises. A performance incentive is

provided to motivate the bank to focus on growing its SME

portfolio, and specifically to increase its reach to women-

owned SMEs. The Global SME Finance Facility is

collaborating with the Women’s Entrepreneurship

Opportunity Facility (WEOF) on this investment.

Implementation Stage • Loan

DTB Kenya RSF

The project consists of a Risk Sharing Facility to help the

Diamond Trust Bank of Kenya (DTBK) expand its SME

lending program to include financing for Very Small

Enterprises (VSEs). The RSF includes a performance

incentive to support the bank in growing its SME lending

portfolio and to increase its reach to women-owned

businesses.

Implementation Stage • Risk-Sharing Facility

Medical Credit Fund Loan

The project consists of a subordinated loan to support the

Medical Credit Fund (MCF) in increasing access to finance

for healthcare SMEs, improving the quality of healthcare

services and business practices through technical

assistance, and catalyzing financing from the banking

sector for SMEs operating in the healthcare sector.

Pre-Implementation Stage • Loan

Gulf African Bank SME Advisory

The project focuses on building Gulf African Bank’s

capacity to serve the SME segment, including women-

owned SMEs. The Advisory included refining the SME

segmentation and Islamic Finance products and services;

reengineering the relationship manager role and

enhancing the SME coverage model. Advisory support also

focused on reviewing and redesigning the SME credit

management process and developing products for

women-owned SMEs.

Implementation Stage • PFI Advisory

PROJECTS CONTINUED

24

Equity Bank SME Risk Management Advisory

The project aims to strengthen Equity Bank’s institutional

capacity to serve the SME market segment. The Advisory

focused on improving its credit and risk management

framework; improving risk analytics; enhancing MIS

capabilities; developing credit scoring tools to improve

eciency in loan processing; and delivering credit training

for the bank sta.

Completed • PFI Advisory

NIC Kenya SME Advisory

The project aims to strengthen NIC Bank capacity to

sustainably serve SMEs. The Advisory will include refining

NIC’s SME segmentation model to include both asset and

liability data; augmenting the current SME banking

products; redesigning the credit-scoring model and credit

management processes; and strengthening the bank’s

SME credit recovery processes.

Implementation Stage • PFI Advisory

LIBERIA

Access Bank Liberia SME Advisory

The project supports Access Bank Liberia in developing a

SME business line. The technical assistance focuses on

strengthening its SME credit operations, risk management

and internal controls, as well as sta capacity building and

training in SME lending. The project enabled Access Bank

Liberia to remain operational and continue to serve it is

clients during the Ebola crisis.

Completed • PFI Advisory

Secured Transactions, Liberia

The project focuses on increasing access to credit to SMEs

by developing an appropriate legal, regulatory and

institutional framework for secured-transactions and

movable collateral lending. The Advisory includes drafting

regulations that support the implementation of the

secured transactions law and designing and developing the

collateral registry. The project is also developing an

awareness program on the benefits of the reform.

Implementation Stage • Financial Infrastructure

25

MALAWI

Secured Transactions, Malawi

The project focuses on increasing access to credit for

businesses in Malawi by developing an appropriate legal,

regulatory and institutional framework for movable

assets-based lending. The project will include developing a

secured transactions legal and regulatory framework,

designing a web-based centralized collateral registry for

security interests in movable property, and building the

local capacity to maximize the benefits of the new Secured

Transactions system.

Implementation Stage • Financial Infrastructure

MALI

Ecobank Mali RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding its SME lending,

with a particular focus on reaching more small firms, which

are some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

MOZAMBIQUE

Millennium BIM Loan

The project consists of a loan to Millennium Banco

Internacional de Moçambique (BIM) to support the bank’s

lending activities to SMEs. The transaction includes a

performance-incentive to motivate the bank to meet its

stretch targets for reaching under-served SME segments,

including small enterprises and SMEs in rural areas.

Pre-Implementation* Stage • Loan

ABC Bank SME Advisory

The project focuses on developing and growing the SME

banking business of Bank ABC Mozambique. The project

focuses on enhancing the bank’s operating eciency, risk

management capacity building, and sta development, as

well as on strengthening SME loan process, developing a

credit scoring system, and developing appropriate

products and services for SMEs.

Completed • PFI Advisory

NIGERIA

Access Bank RSF

The project includes an RSF for Access Bank Nigeria for a

portfolio of mostly women-owned distributors of the

National Bottling Company. The RSF and the performance

incentive embedded in this transaction will encourage

Access Bank to expand its lending to a new and riskier

market segment of small distributors, while helping the

bank mitigate its risk, gain greater confidence, and acquire

more experience in serving this segment.

Implementation Stage • Risk-Sharing Facility

Access Bank Loan

The project includes a loan to support Access Bank

Nigeria’s lending program to SMEs, with a specific focus on

reaching more women-owned SMEs. The transaction

includes a performance incentive to motivate the bank to

scale up its lending to women-owned SMEs and to build a

more sustainable business line.

Implementation Stage • Loan

Access Bank Women SME Advisory

The project supported Access Bank Nigeria in developing a

value proposition for women by incorporating full banking

services for women, such as personal, SME and corporate

banking solutions. The Advisory focused on developing

tailored products that suit the needs of women customers

— including women-owned SMEs. The project also

supported the bank in strengthening its SME processes

and procedures, and provided training for Bank sta.

Completed • PFI Advisory

PROJECTS CONTINUED

* Project on hold due to country conditions

26

Diamond Bank SME Advisory

The project supports Diamond Bank Nigeria eorts to

increase access to finance to SMEs, with a specific focus on

SMEs operating in the agricultural sector. The Advisory

helped Diamond Bank develop a strategy, a product oering,

and risk management tools for the agricultural sector, and

develop a financing model to demonstrate the viability of

lending to agri SMEs, including value chain financing.

Completed • PFI Advisory

Diamond Bank SCF Advisory

The project will support Diamond Bank Nigeria to

sustainably increase financing to SMEs operating within its

corporate- customer supply chain. The Advisory will identify

and leverage internal and external opportunities for supply

chain finance in various sectors. Activities will focus on

market sizing to identify potential anchor firms from current

corporate clients with large supplier/distributor

opportunities; developing a tailored product plan and sales

approach; and enhancing credit processes, risk management

criteria, and an early warning system framework.

Pre-Implementation* Stage • PFI Advisory

FCMB SME Advisory

The project focused on improving FCMB Nigeria’s

operating eciency to better serve SMEs; improving the

bank’s SME operations; and developing tailored products

and services for SMEs. Additionally, the Advisory included

enhancing FCMB’s IT and MIS platforms to ensure that it

captures the information needed to monitor SMEs, as well

as comprehensive SME training for bank sta.

Completed • PFI Advisory

FCMB SEF Advisory

The project will provide technical assistance support to

FCMB to expand its energy eciency and renewable

energy SME lending program. The Advisory will consist of a

market assessment to identify key opportunities, and a

review of FCMB’s current portfolio to identify key target

clients. Additionally the project will include training for

FCMB sta, support for marketing events, pipeline

development, and risk assessment.

Pre-Implementation* Stage • PFI Advisory

* on hold

27

Skye Bank SME Advisory

This project aims to support Skye Bank in scaling its

lending to SMEs. The Advisory includes market

segmentation and product development, improving the

delivery channels, streamlining credit management

processes and procedures, and training for the bank sta.

Implementation Stage • PFI Advisory

Credit Bureau, Nigeria

The project provides advice and technical support to the

Central Bank of Nigeria (CBN) on the regulatory and

legislative regime governing credit reporting, data

protection and other relevant legislation. The Advisory is

also supporting CBN in developing an appropriate

supervision and oversight role, sta training, and designing

an awareness campaign about credit reporting.

Implementation Stage • Financial Infrastructure

Secured Transactions, Nigeria

The project focuses on improving the secured transactions

legal regime in Nigeria, and the development and launch of

the electronic centralized collateral registry for security

interests in movable property. The Advisory includes

supporting Central Bank of Nigeria (CBN) in drafting and

implementing regulations related to secured transactions

and collateral regimes; assisting the CBN in the design and

establishment of a collateral registry; and developing a

communications strategy to accelerate the

implementation of the reforms.

Implementation Stage • Financial Infrastructure

RWANDA

AB Rwanda SME Advisory

This project provides management and capacity building

services to AB Bank Rwanda, a Greenfield microfinance

bank in Rwanda. The advisory services focus on supporting

AB Bank Rwanda in scaling up its activities to serve very

small enterprises and SMEs (including developing SME

products), and setting up appropriate processes and

procedures to ensure a quality SME portfolio.

Implementation Stage • PFI Advisory

SIERRA LEONE

Secured Transactions, Sierra Leone

The project focuses on increasing access to finance for

MSMEs by developing a secured transaction platform in

Sierra Leone. The project will include supporting the

development of secured transactions and a collateral

registry law, developing criteria on collateral eligibility and

credit classification, developing the electronic collateral

registry, a communication and awareness campaign, as

well as training for public and private stakeholders.

Implementation Stage • Financial Infrastructure

TANZANIA

CRDB Bank Loan

The project consists of a debt and guarantee facility to

support CRDB’s strategic focus on SMEs, including an

increased focus on reaching WSMEs. The investment will

incentivize the bank to grow its focus on women-owned

SMEs at a faster rate. The project also includes advisory

services to more eectively support this segment.

Implementation Stage • Loan

DTB Tanzania Loan

The project consists of a subordinated loan to help

Diamond Trust Bank (DTB) Tanzania implement its SME

loan portfolio growth strategy, and to support its

expansion outside major cities to severely under-served

provinces. The loan together with a performance incentive

will also encourage DTB to ramp up its Banking on Women

pilot program, and to develop a deeper engagement with

women-owned SMEs.

Implementation Stage • Loan

PROJECTS CONTINUED

28

CRDB SME Advisory

The project supports CRDB in enhancing its SME banking

capacity by focusing on segmentation for targeted

products and services, and development, customization

and rollout of SME products and delivery channels. The

Advisory is also focusing on risk management, as well as

support for key SME segments such as agrifinance and

trade finance procedures.

Implementation Stage • PFI Advisory

TOGO

Ecobank Togo RSF

The project consists of an RSF and performance incentive

for eight Ecobank Transnational Inc. (ETI) aliates in

Burundi, Chad, DRC, Côte d’Ivoire, Guinea, Mali, Togo and

the Republic of Congo. The RSF provides a risk mitigation

mechanism to support ETI in expanding SME lending, with

a particular focus on reaching more small firms, which are

some of the most underserved firms in these markets.

Implementation Stage • Risk-Sharing Facility

UGANDA

DTB Uganda Loan

The project consists of a subordinated loan to help

Diamond Trust Bank (DTB) Uganda implement its SME

loan portfolio growth strategy, and support its expansion

outside major cities to severely under-served provinces.

The loan together with a performance incentive will also

encourage DTB to ramp up its Banking on Women pilot

program and develop a deeper engagement with women-

owned SMEs.

Implementation Stage • Loan

ZAMBIA

Secured Transactions, Zambia

The project focuses on developing a secured transactions

legal and regulatory framework in Zambia. The Advisory

will include developing a legal framework to support

implementation of a modern system of financing secured

by movable assets and designing a web-based centralized

collateral registry for security interests in movable property.

The project will also focus on building local capacity to

maximize the benefits of the new Secured Transactions

system, including a public awareness campaign,

stakeholder training, and training to financial institutions.

Implementation Stage • Financial Infrastructure

Projects in South Asia

BANGLADESH

Ready Made Garments (RMG) Bangladesh Loan

Bangladesh RMG program is a comprehensive sectoral

program for strengthening the fire and safety

infrastructure in the RMG sector in Bangladesh. The

project includes loans and performance incentives to

support four local banks (City Bank, Eastern Bank, Prime

Bank, and UCB) in providing financing for small RMG

factories, specifically for investing in improving structural,

electrical, and fire safety standards in accordance with

international safety standards.

Implementation Stage • Loan

29

BRAC Bank SEF Advisory

The project focuses on supporting BRAC Bank eorts to

grow its SME banking portfolio and introducing

Sustainable Energy Finance (SEF). This is to be achieved by

strengthening BRAC’s systems, processes, policies and

products. The project will develop an SME credit scoring

model, and subsequently will focus on credit policy,

process re-engineering, collections and performance

management. The Advisory will also support the bank in

developing and launching an SEF product, and train the

sta to develop internal capacity for SEF operations.

Implementation Stage • PFI Advisory

City Bank SME Advisory

The project is supporting City Bank's eorts to grow its

SME portfolio, with a focus on automation of the loan

origination process, upgrading the MIS platform, and

implementing a data warehouse. Additionally the Advisory is

focusing on risk management, automation of the collections

process, implementation of a customer management

program, and improving sta capacity through training.

Implementation Stage • PFI Advisory

Eastern Bank SME Advisory

The project focuses on improving the capacity of Eastern

Bank Limited (EBL) to expand its services to underserved

SMEs. The Advisory focuses on refining the bank’s

understanding of the SME segment, defining specific

target customer segments, aligning products and

marketing strategies with target segments, and creating a

sales eectiveness program. The Project will also include

support for designing non-financial services for SMEs.

Implementation Stage • PFI Advisory

IDLC SME Advisory

The project delivers technical assistance to IDLC Finance

Limited to develop its SME finance service oering. The

Advisory focuses on enhancing IDLC’s SME banking

capacity, as well as developing a credit-scoring model, and

standardized and automated credit process workflows.

The project is also supporting IDLC in developing a

“Women in Business” program and providing non-financial

services to SMEs.

Implementation Stage • PFI Advisory

Financial Infrastructure, Bangladesh

This project supports increasing the level of SME finance in

Bangladesh through strengthening the secured lending and

movable collateral legal/regulatory framework, and the

establishment of the secured lending registry. The Advisory

will also include supporting the establishment of a collateral

registry, as well as awareness and capacity building activities.

Implementation Stage • Financial Infrastructure

INDIA*

Fullerton Loan

The project consists of a loan to Fullerton India Credit

Company Ltd., a third of which is for on-lending to SMEs

in Low-Income States (LIS). The project utilizes a

performance incentive to motivate the company to shift

resources and expand its lending to underserved small

enterprises in LIS. Lending to this market is largely

untested by Fullerton, and serving this segment is

considered to be higher risk

Implementation Stage • Loan

PROJECTS CONTINUED

* projects approved as of May 2015

30

YES Bank Loan

The project involves a financing package to Yes Bank to

support its SME portfolio growth in India’s Low Income

States (LIS) as well as North Eastern States (NES). The

project has a specific focus on supporting Yes Bank eorts

to increase its reach to women-owned SMEs. The loan will

incentivize Yes Bank to develop a commercially viable SME

lending business in LIS. The incentive is also expected to

motivate the bank to significantly increase its lending to

women-owned SMEs.

Implementation Stage • Loan

India MSME Finance Umbrella Advisory

This umbrella project focuses on supporting financial

institutions’ eorts to increase their outreach to the SME

sector by helping them improve their business model and

management practices. The projects will include tailored

technical assistance to address the specific performance

constraints at each institution. This will include a

combination of the following interventions: business

model and strategy, product and channel innovation,

customer management, risk management, non-financial

services, and SME training and capacity building.

Pre-Implementation Stage • PFI Advisory

India VSE Advisory Umbrella

This umbrella will provide a comprehensive suite of

advisory support to MFIs and Fintech firms to achieve their

chosen route of institutional transformation (e.g.,

transformation into a Small Finance Bank or a Payment

Bank). These advisory projects will help clients expand

financial services to their clients in low-income segments

or financially excluded areas. The main areas of technical

advisory are related to MSME product development (with

a special focus on women borrowers), operating model

design, development of alternative delivery channels, and

facilitation of study visits and knowledge exchange sessions.

Pre-Implementation Stage • PFI Advisory

Maanaveeya SME Advisory

The project assists Maanaveeya in building and growing a

profitable agricultural SME portfolio. The Advisory includes

improving and strengthening its organizational capabilities

to understand agri-value chains; enhancing the capacity of

Maanaveeya’s partner institutions to adequately support

agri-value chains; increasing Maanaveeya’s value-chain

lending program; and expanding the agri-value chain

customer base.

Implementation Stage • PFI Advisory

SIDBI Bank SME Advisory

The project supports SIDBI in increasing access to finance

opportunities for MSMEs. The project focuses on three

segments within the SME sector: early-stage enterprises,

enterprises operating in the services sector, and enterprises

operating in the manufacturing sector. The advisory

program will support SIDBI in developing new products,

strengthening its risk management and credit processes,

designing a formal credit assessment scorecard for early

stage enterprises, and expanding its market outreach.

Implementation Stage • PFI Advisory

Utkarsh Upscaling Advisory

The project supports Utkarsh, a non-banking finance

company operating primarily in India’s low-income states,

in its eort to transform into a bank. The Advisory includes

the development of a detailed strategy and roll-out plan

for the transformation, as well as strengthening Utkarsh

enterprise business loans to expand its product to very

small enterprises (VSEs). The project will also focus on

developing a women-owned small business program and

receiving the Employer of Choice for Women Certification.

Subproject under the India VSE Advisory Umbrella.

Implementation Stage • PFI Advisory

31

Collateral Registries, India

The project focuses on supporting the Central Registry of

Securitization Asset Reconstruction and Security Interest

(CERSAI) in expanding to include movable collateral. The

Advisory includes supporting the development of a

business plan and strategy for CERSAI to include dierent

types of collateral, engaging across a range of stakeholders,

and supporting the review and amendment of the legal

and regulatory framework.

Implementation Stage • Financial Infrastructure

Credit Bureau, India

This project focuses on integrating alternative data

sources into the credit reporting system, and encouraging

greater reporting and usage specifically for the SME sector.

The sectoral interventions include market assessment and

sector-level research, review of the existing legal and

regulatory framework, capacity building for financial

institutions, and awareness raising about the benefits of

credit reports and the importance of credit bureaus.

Implementation Stage • Financial Infrastructure

NEPAL

Secured Transactions, Nepal

The project aims to facilitate greater access to finance for

underserved segments in Nepal, by strengthening the legal

and institutional frameworks for secured transactions and

credit reporting. The project includes strengthening the